Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - SPECTRUM MANAGEMENT HOLDING COMPANY, LLC | d910919dex311.htm |

| EX-31.2 - EX-31.2 - SPECTRUM MANAGEMENT HOLDING COMPANY, LLC | d910919dex312.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission file number 001-33335

TIME WARNER CABLE INC.

(Exact name of registrant as specified in its charter)

| Delaware | 84-1496755 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

60 Columbus Circle

New York, New York 10023

(Address of principal executive offices) (Zip Code)

(212) 364-8200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.01 | New York Stock Exchange | |

| 5.750% Notes due 2031 | New York Stock Exchange | |

| 5.250% Notes due 2042 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ | Accelerated filer ¨ | |||||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of the close of business on February 11, 2015, there were 280,900,337 shares of the registrant’s Common Stock outstanding. The aggregate market value of the registrant’s voting and non-voting common equity securities held by non-affiliates of the registrant (based upon the closing price of such shares on the New York Stock Exchange on June 30, 2014) was approximately $41.1 billion.

DOCUMENTS INCORPORATED BY REFERENCE

None

EXPLANATORY NOTE

On February 13, 2015, Time Warner Cable Inc. (together with its subsidiaries, “TWC” or the “Company”) filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (the “Original Form 10-K”). This Amendment No. 1 on Form 10-K/A (the “Form 10-K/A”) amends Part III, Items 10 through 14 of the Original Form 10-K to include information previously omitted from the Original Form 10-K in reliance on General Instructions G(3) to Form 10-K. TWC is filing this Form 10-K/A because it will not file its definitive proxy statement within 120 days after the end of its fiscal year ended December 31, 2014.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), certifications by TWC’s principal executive officer and principal financial officer are filed as exhibits to this Form 10-K/A under Item 15 of Part IV hereof.

Except as described above, this Form 10-K/A does not modify or update disclosure in, or exhibits to, the Original Form 10-K. Furthermore, this Form 10-K/A does not change any previously reported financial results, nor does it reflect events occurring after the date of the Original Form 10-K. Information not affected by this Form 10-K/A remains unchanged and reflects the disclosures made at the time the Original Form 10-K was filed.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Executive Officers.

For information relating to the Company’s executive officers, please see “Executive Officers of the Company” in Part I of the Original Form 10-K.

Directors.

Set forth below are the principal occupation and certain other information, as of April 15, 2015, about each of the twelve directors currently serving on the Company’s Board of Directors (the “Board”).

| Name |

Age | Principal Occupation During the Past Five Years | ||||

| Carole Black

|

71 | Former President and Chief Executive Officer, Lifetime Entertainment Services. Ms. Black served as the President and Chief Executive Officer of Lifetime Entertainment Services, a multi-media brand for women, including Lifetime Network, Lifetime Movie Network, Lifetime Real Women Network, Lifetime Online and Lifetime Home Entertainment, from March 1999 to March 2005. Prior to that, Ms. Black served as the President and General Manager of NBC4, Los Angeles, a commercial television station, from 1994 to 1999, and in various marketing-related positions at The Walt Disney Company, a media and entertainment company, from 1986 to 1993. Ms. Black has served as a director since July 2006 and also served as director of Herbalife, Ltd. from 2011 through April 2014.

Ms. Black has broad experience as the former president and chief executive officer of a large media and entertainment company, and her extensive experience in television programming, marketing and cable, media and entertainment business provides her with a strong understanding of the Company’s business and its competitive environment. | ||||

1

| Name |

Age | Principal Occupation During the Past Five Years | ||||

| Thomas H. Castro

|

60 | President and Chief Executive Officer, El Dorado Capital, LLC. Mr. Castro is the founder of El Dorado Capital, LLC, a private equity investment firm, and has served as its President and Chief Executive Officer since December 2008. He is also the founder of IMB Development Corporation, a private equity investment firm, and has served as its Managing Director since January 2012. Previously, he was the co-founder and Chief Executive Officer of Border Media Partners, LLC, a radio broadcasting company that primarily targets Hispanic listeners in Texas, from 2002 to 2007 and its Vice Chairman through 2008. Prior to that, Mr. Castro, an entrepreneur, owned and operated other radio stations and founded a company that exported oil field equipment to Mexico. Mr. Castro has served as a director since July 2006.

These experiences have provided Mr. Castro with significant operating, financial, advertising and regulatory experience as well as an in-depth understanding of the Company’s business and industry. In addition, through his entrepreneurial experience and community work, Mr. Castro brings an appreciation and awareness of issues important to the Hispanic community, an increasingly important customer base for the Company. | ||||

| David C. Chang

|

73 | Professor Emeritus, Polytechnic Institute of New York University and Chairman and Chief Executive Officer, The Global Maximum Educational Opportunities, Inc. Dr. Chang co-founded The Global Maximum Educational Opportunities, Inc. (“G-MEO”), which provides study abroad programs in China for U.S. undergraduate students, in 2011 and became its Chairman and Chief Executive Officer in August 2013. He also became Professor Emeritus of Polytechnic Institute of New York University (formerly known as Polytechnic University) in July 2013, after having served as its Chancellor from July 2005 and its President and a Professor of Electrical and Computer Engineering from 1994. Prior to that, he was Dean of the College of Engineering and Applied Sciences at Arizona State University. Dr. Chang has served as a director since March 2003 and served as an independent director of American Television and Communications Corporation (a predecessor of the Company) from 1986 to 1992. He is also a director of AXT, Inc.

Dr. Chang has significant technology and managerial experience as well as historical perspective and understanding of the Company through his longstanding board service, first as a director of American Television and Communications Corporation and then as a director of the Company. | ||||

| James E. Copeland, Jr.

|

70 | Former Chief Executive Officer of Deloitte & Touche USA LLP and Deloitte Touche Tohmatsu Limited and Former Global Scholar, Robinson School of Business, Georgia State University. Mr. Copeland served as a Global Scholar at the Robinson School of Business at Georgia State University from 2003 through 2007. Prior to that, Mr. Copeland served as the Chief Executive Officer of Deloitte & Touche USA LLP, a public accounting firm, and Deloitte Touche Tohmatsu Limited, its global parent, from 1999 to May 2003. Prior to that, Mr. Copeland served in various positions at Deloitte & Touche and its predecessors from 1967. Mr. Copeland has served as a director since July 2006 and is also a director of ConocoPhillips and Equifax, Inc.

Mr. Copeland has substantial accounting, regulatory and business experience from his distinguished career in the accounting profession. He has extensive technical accounting expertise as well as experience managing a leading accounting firm and working with regulators to develop and apply accounting policy. In addition, Mr. Copeland has experience serving on audit committees of other public companies. | ||||

2

| Name |

Age | Principal Occupation During the Past Five Years | ||||

| Peter R. Haje

|

80 | Legal and Business Consultant and Private Investor. Mr. Haje has served as a legal and business consultant and private investor since he retired from service as an executive officer of Time Warner in January 2000. Prior to that, he served as the Executive Vice President and General Counsel of Time Warner from October 1990, adding the title of Secretary in May 1993. He also served as the Executive Vice President and General Counsel of Time Warner Entertainment Company, L.P. (“TWE”), a former subsidiary of the Company, from June 1992 until 1999. Prior to his service to Time Warner, Mr. Haje was a partner of the law firm of Paul, Weiss, Rifkind, Wharton & Garrison LLP for more than 20 years. Mr. Haje has served as a director since July 2006 and as the lead director from March 2009 to May 2012.

Mr. Haje has substantial experience guiding various aspects of corporate legal and executive compensation matters as well as in the cable, media and entertainment industry from his service as the chief legal officer at Time Warner and as a member of a premier law firm. Mr. Haje also has significant historical perspective and knowledge of the Company through his long service at Time Warner. | ||||

| Donna A. James

|

57 | Consultant, Business Advisor and Managing Director, Lardon & Associates LLC. Ms. James has served as a consultant, business advisor and managing director of Lardon & Associates LLC, a business and executive advisory services firm, since April 2006. Prior to that, Ms. James served as President of Nationwide Strategic Investments, a division of Nationwide Mutual Insurance Company (“Nationwide Mutual”), a financial services and insurance company, from 2003, and as Executive Vice President and Chief Administrative Officer of Nationwide Mutual from 2000. Ms. James also served as Chair of the National Women’s Business Council, an appointment by President Obama, from October 2010 to May 2013. Ms. James has served as a director since March 2009 and is also a director of L Brands, Inc. (formerly known as Limited Brands, Inc.) and Marathon Petroleum Corporation. Ms. James previously served as a director of CNO Financial Group, Inc. from 2007 until May 2011 and Coca-Cola Enterprises Inc. from 2005 until April 2012.

Ms. James has significant finance, accounting and human resources experience. In addition, Ms. James’s service on other public company boards contributes to her knowledge of public company matters, including corporate governance and public affairs. | ||||

| Don Logan

|

71 | Investor. Mr. Logan served as the Chairman of the Company’s Board of Directors from February 2006 until March 2009. He currently invests in a variety of media, entertainment and sports entities. He served as Chairman of Time Warner’s Media & Communications Group from July 2002 through December 2005. Prior to assuming that position, he was Chairman and Chief Executive Officer of Time Inc., then Time Warner’s publishing subsidiary, from 1994 to July 2002 and was its President and Chief Operating Officer from 1992 to 1994. Prior to that, Mr. Logan held various executive positions with Southern Progress Corporation, which was acquired by Time Inc. in 1985. Mr. Logan has served as a director since March 2003.

Mr. Logan has substantial business, finance and accounting experience as well as extensive knowledge of the media and entertainment industry. In addition, Mr. Logan oversaw Time Warner’s investment in the Company as Chairman of Time Warner’s Media and Communications Group, and he has a deep understanding of the Company’s business. | ||||

3

| Name |

Age |

Principal Occupation During the Past Five Years | ||||

| Robert D. Marcus

|

49 | Chairman and Chief Executive Officer of the Company. Mr. Marcus has served as the Company’s Chairman and Chief Executive Officer since January 1, 2014. Prior to that, Mr. Marcus served as the Company’s President and Chief Operating Officer from December 2010 and Senior Executive Vice President and Chief Financial Officer from January 2008 to December 2010, having served as Senior Executive Vice President from August 2005. Mr. Marcus joined the Company from Time Warner, where he had served as Senior Vice President, Mergers and Acquisitions from 2002 and as Vice President of Mergers and Acquisitions from 1998. Mr. Marcus has served as a director since July 2013 and is also a director of Equifax, Inc.

Mr. Marcus has substantial business, legal, finance and accounting experience developed through his career at the Company and Time Warner. As a result of his experience, Mr. Marcus possesses a deep understanding of the Company’s business and the cable industry. | ||||

| N.J. Nicholas, Jr.

|

75 | Investor. Mr. Nicholas is an investor. From 1964 until 1992, Mr. Nicholas held various positions at Time Inc. and Time Warner. He was named President of Time Inc. in 1986 and served as Co-Chief Executive Officer of Time Warner from 1990 to 1992. Mr. Nicholas has served as a director since March 2003 and as lead director since March 2012. He is also a director of Boston Scientific Corporation. Mr. Nicholas served as a director of Xerox Corporation from 1987 until May 2012.

Mr. Nicholas has substantial executive experience as well as extensive experience in the media and entertainment field developed through his nearly 30 years at Time Warner and Time Inc. Mr. Nicholas also possesses valuable corporate governance experience from his longstanding service on other public company boards. | ||||

| Wayne H. Pace

|

68 | Former Executive Vice President and Chief Financial Officer, Time Warner. Mr. Pace served as Executive Vice President and Chief Financial Officer of Time Warner from November 2001 through December 2007, and served as Executive Vice President and Chief Financial Officer of TWE from November 2001 until October 2004. He was Vice Chairman and Chief Financial and Administrative Officer of Turner Broadcasting System, Inc., a cable programming subsidiary of Time Warner (“TBS”), from March 2001 to November 2001 and held various other executive positions at TBS, including Chief Financial Officer, from 1993 to 2001. Prior to that, Mr. Pace was an audit partner with Price Waterhouse, now PricewaterhouseCoopers LLP, an international accounting firm. Mr. Pace has served as a director since March 2003.

Mr. Pace has substantial business, finance and accounting experience developed during his nearly fifteen years with Time Warner and TBS and, prior to that, Price Waterhouse. Mr. Pace also brings an extensive knowledge of the Company’s business and financial condition to the Board. | ||||

4

| Name |

Age |

Principal Occupation During the Past Five Years | ||||

| Edward D. Shirley

|

58 | Former President and Chief Executive Officer, Bacardi Limited. Mr. Shirley served as the President and Chief Executive Officer of Bacardi Limited, a spirits company, from March 2012 to April 2014. Prior to that, he served as Vice Chairman of Global Beauty and Grooming, a business unit of The Procter & Gamble Company, a consumer goods company (“Procter & Gamble”), from July 2008 through June 2011 and as Vice Chair on Special Assignment from July 2011 through December 2011. Prior to that, he served as Group President, North America of Procter & Gamble from April 2006 and held several senior executive positions with The Gillette Company, a consumer goods company, which was acquired by Procter & Gamble in 2005. Mr. Shirley has served as a director since March 2009.

Mr. Shirley has substantial executive and marketing experience developed as President and Chief Executive Officer of large consumer products companies and during more than 30 years as a senior executive at Procter & Gamble and The Gillette Company. The Company operates in an extremely competitive industry, and Mr. Shirley brings valuable marketing experience and perspective to the Board. | ||||

|

John E. Sununu

|

|

50 |

|

Former U.S. Senator, New Hampshire. Senator Sununu has served as a Senior Policy Advisor for Akin Gump Strauss Hauer & Feld LLP, a law firm, since July 2010. He served as a U.S. Senator from New Hampshire from January 2003 to 2009. He was a member of the Committees on Banking, Commerce, Finance and Foreign Relations, and he was appointed the Congressional Representative to the United Nations General Assembly. Prior to his election to the Senate, he represented New Hampshire’s First District in the U.S. House of Representatives from 1997 to 2003. Prior to serving in Congress, he served as the Chief Financial Officer of Teletrol Systems, Inc., a manufacturer of building control systems, from 1993 to 1996. Senator Sununu has served as a director since March 2009 and is also a director of Boston Scientific Corporation.

Senator Sununu has significant legislative, regulatory and financial experience. The Company’s business is subject to extensive regulation, and Senator Sununu provides legislative and regulatory insight. He also possesses corporate governance experience from his service on another public company board. | ||

In addition to the qualifications identified above, several of the directors have substantial experience in the cable, media and entertainment industries, including Messrs. Castro, Chang, Haje, Logan, Marcus, Nicholas and Pace and Ms. Black. Messrs. Haje, Logan, Marcus, Nicholas and Pace all share a deep understanding of the Company’s business developed through their prior service at Time Warner. Ms. Black served as the President and Chief Executive Officer of Lifetime Entertainment Services, a multi-media brand for women, for six years, where she oversaw all aspects of programming and marketing. Mr. Castro co-founded a radio broadcasting company that primarily targets the Hispanic community, an increasingly important focus for distributing the Company’s services. In addition to Dr. Chang’s technological and management experience, he has a long history serving as a director of the Company and its predecessors.

Each of the directors also has significant experience as a senior officer of a major corporation or a comparable position in government or academia. Mr. Shirley served as the President and Chief Executive Officer of Bacardi Limited, and also has a long service history with The Procter & Gamble Company and The Gillette Company and brings his marketing and managerial experience to the Board. Several of the directors also have extensive finance and accounting experience, including Messrs. Copeland, Marcus, Nicholas and Pace, Senator Sununu and Ms. James. Messrs. Copeland and Nicholas and Ms. James also have valuable experience serving on the audit committees of other public companies. Several of the directors have extensive legislative or regulatory experience, including Senator Sununu and Messrs. Castro, Copeland and Marcus and Ms. James, through their experience in highly-regulated industries.

While backgrounds of all of the directors contribute a diversity of experience and opinion to the Board, Messrs. Castro and Chang and Mses. Black and James also bring ethnic and gender diversity.

5

Information about the Audit Committee.

The Audit Committee of the Board of Directors assists the Board in fulfilling its responsibilities in connection with the Company’s (i) independent auditors, (ii) internal auditors, (iii) financial statements, (iv) earnings releases and guidance and (v) the Company’s compliance program, internal controls and risk management. The members of the Audit Committee are Donna James, who serves as the Chair, Thomas Castro, James Copeland, Jr. and Wayne Pace. Among other things, the Audit Committee complies with all NYSE and legal requirements and consists entirely of Independent Directors (as defined below). The Board has determined that each member of the Audit Committee qualifies as an audit committee financial expert under the rules of the Securities and Exchange Commission (“SEC”) implementing section 407 of the Sarbanes-Oxley Act of 2002 and meets the independence and experience requirements of the NYSE and the federal securities laws.

Section 16(a) Beneficial Ownership Reporting Compliance.

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than ten-percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such forms furnished to the Company, or written representations that no Forms 5 were required, the Company believes that during 2014, its officers, directors and greater than ten-percent beneficial owners complied with all applicable Section 16(a) filing requirements, except that a Form 4 filed on behalf of Mr. Stern, a named executive officer, on August 13, 2014 to report an award of restricted stock units was filed eight days late.

Codes of Conduct.

For information relating to the Company’s Codes of Conduct that apply to the Company’s principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions, please see Part III of the Original Form 10-K.

Item 11. Executive Compensation.

Executive Compensation.

Compensation Discussion and Analysis

This discussion describes the Company’s compensation philosophy, principles and practices for 2014 for those of its executive officers named in the Summary Compensation Table below—Messrs. Marcus, Jain, Minson, Lawrence-Apfelbaum and Stern (collectively, the “named executive officers”)—and explains how they were applied to determine these executives’ 2014 compensation.

Overview:

Executive Compensation Program

The Company’s executive compensation program is designed to attract, retain, motivate and reward leaders who create value for the Company and its stockholders. The Company seeks to:

|

Pay-for- Performance Orientation |

•

• |

pay for performance by rewarding executives for leadership excellence and sustained financial and operating performance in line with the Company’s strategic goals; and

align executives’ interests and risk orientation with the Company’s business goals and the interests of the Company’s stockholders. | ||||

The Company’s standard executive compensation program consists of:

| • | annual salary; |

| • | annual cash bonus dependent in 2014 on performance against certain financial and operational metrics; and |

| • | equity awards, a significant portion of which are subject to complete forfeiture if performance-based vesting conditions are not met. |

The Company believes that the program has played a key role in the Company’s operating and financial success, which in turn has helped drive strong operating results and total stockholder return.

6

Special 2014 Compensation Considerations and Programs

While the Company believes that its standard executive compensation program appropriately incentivizes executives to achieve the Company’s goals and aligns the executives’ interests with those of the Company’s stockholders in most circumstances, the extraordinary events that occurred in late 2013 and early 2014 prompted Management (as defined below) and the Compensation Committee of the Board to consider whether its standard executive compensation program alone would be sufficient to support all of the Company’s business priorities in the near and longer term.

In January 2014, after months of market speculation and attendant share-price appreciation, Charter Communications, Inc. (“Charter”) made an unsolicited proposal to acquire the Company, followed in February 2014 by formal notice to the Company that, among other things, Charter was nominating a slate of thirteen independent candidates for election to TWC’s Board of Directors at the Company’s 2014 annual meeting of stockholders. Then, on February 12, 2014, the Company entered into a Merger Agreement with Comcast Corporation (“Comcast”) pursuant to which the Company would become a wholly owned subsidiary of Comcast (the “Comcast merger”). Accordingly, the Compensation Committee needed to consider not only appropriate compensation and incentives to encourage the executive officers to meet the Company’s ambitious financial and operational goals (discussed below), but also whether the compensation program structure of the past few years would be effective, especially in light of the need to motivate and retain executives during a potentially prolonged period of uncertainty between the announcement of the Comcast merger and its closing. The Company also needed to incorporate into its planning the possibility that the Comcast merger would not close, which would underscore the importance of retaining the management team during the pendency of the Comcast merger as well as providing appropriate long-term incentives that would be perceived as retaining their intended value and achieve their intended goals under those circumstances.

As a result, as discussed in more detail below, the Committee made certain changes to the compensation program in 2014 that were designed to support stockholder alignment and the pay-for-performance orientation of the program while also addressing the importance of motivating and retaining talent against the backdrop of the pending Comcast merger. Specifically, the Compensation Committee approved an enhanced cash bonus opportunity based on the Company’s ambitious 2014 performance objectives and advanced certain anticipated annual equity awards into 2014:

| • | Enhanced Cash Bonus Opportunity. To further incentivize employees to achieve the Company’s operating and financial goals despite the potential distractions and additional responsibilities associated with the pending Comcast merger, the Company established a supplemental bonus opportunity (the “Supplemental Bonus Program”) for all approximately 15,000 employees who participated in the Company’s regular 2014 annual cash incentive program, including the named executive officers, that effectively increased each participant’s target bonus opportunity by 50% and was based on the achievement of financial and operational goals established under the regular 2014 annual bonus program, payable upon the closing, or abandonment, of the Comcast merger; and |

| • | Retention Equity Awards. To further support employee retention, the Compensation Committee approved advancing into 2014 the Company’s equity awards that would otherwise have been made in 2015 and 2016 for the approximately 1,800 equity-award eligible employees, including the executive officers, while, importantly, retaining significant vesting attributes of the awards as if they had been made in 2015 and 2016 (the “retention equity awards”). |

The lengthy regulatory review process – and the ultimate termination of the Comcast merger – underscores the importance and effectiveness of the Company’s 2014 compensation planning and programs. The Company’s executive team remains in place and – as evidenced by the Company’s 2014 operating and financial results – was intently focused on achieving the Company’s short and long-term goals despite the uncertainty and challenges during the pendency of the transaction. In addition, the retention equity awards remain subject to their time-based vesting schedules and, consistent with its intent when the retention equity awards were made, the Compensation Committee made no new equity awards to the named executive officers in 2015.

These special programs are discussed in more detail below under “2014 Short-Term Incentive Program—Annual Cash Bonus—Supplemental Bonus Program” and “2014 Long-Term Incentive Program—Equity-Based Awards—Merger-Related Retention Equity Awards.”

7

2014 Highlights

Company Performance

In January 2014, the Company announced a three-year plan to revitalize its residential services by refocusing on growing its customer base, investing in reliability and customer service and enhancing its products and to drive growth in business services by expanding its network, augmenting the sales force and increasing productivity. During 2014, the Company made significant operational and financial progress against the plan’s goals even as it sought regulatory approval and conducted integration planning for the Comcast merger. In addition to the 2014 accomplishments, the Company, led by its executive officers, has created significant stockholder value over the past several years:

Significant Operational Improvement

and Solid Financial Performance

In 2014, the Company:

| • | Engineered and executed a profound subscriber turnaround—adding 150,000 residential customer relationships and 373,000 residential triple-play customers in 2014. |

| • | Increased revenue 3.1% during 2014 to $22.8 billion as a result of revenue growth in all its segments, including growth of 22.8% in business services revenue, 10.4% in residential high-speed data revenue and 10.6% in advertising revenue; total revenue has grown 15.9% over the last three fiscal years. |

| • | Significantly improved customer experience through various initiatives, including: |

| • | Completing the “TWC Maxx” all-digital conversions in New York City and Los Angeles, and the roll out of Internet speed increases in New York City, Los Angeles and Austin, ahead of schedule. |

| • | Investing in the Company’s network and new set-top boxes and modems. |

| • | Improved customer service, including record “on-time” performance with technicians arriving at more than 97% of customer appointments within an industry-leading one-hour appointment window during the fourth quarter of 2014, improved self-help tools and reductions in “rework” and trouble calls. |

| • | Enhanced video, data and voice products such as an improved cloud-based video set-top box guide, increased capability and availability of the TWC TV app, more WiFi hotspots and free unlimited calling to Mexico, Hong Kong and China. |

| • | Expanded the Company’s business services reach and opportunity by adding nearly 70,000 commercial buildings to the Company’s network. |

Significant Return of Capital

| • | Started paying a quarterly dividend on shares of the Company’s common stock (“Common Stock”) in March 2010; increased it by 20% in 2011, 17% in 2012, 16% in 2013 and 15% in 2014 (dividend yield of 2.3% as of January 29, 2014, the date the most recent increase was approved). |

| • | Paid $857 million in dividends in 2014; $3.5 billion in aggregate quarterly dividend payments through 2014. |

| • | Repurchased $208 million of Common Stock in 2014, aggregating $7.7 billion since the repurchase program started in November 2010, representing approximately 26% of the Common Stock then outstanding, while maintaining the Company’s leverage ratio in its target range. The repurchase program was suspended in connection with the entry into the Merger Agreement in February 2014. |

8

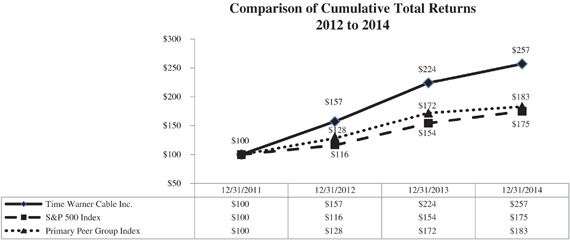

Impressive Total Stockholder Return

| • | Delivered 15% stockholder return in 2014 and significant total return to stockholders over the longer term: 157% three-year cumulative total return and 319% five-year cumulative total return through December 31, 2014. |

This chart compares the performance of the Company’s Common Stock with the performance of the S&P 500 Index and an index comprised of the companies included in the Primary Peer Group (as defined and listed below) over the last three fiscal years. The chart assumes $100 was invested on December 31, 2011 and reflects reinvestment of regular dividends and distributions on a monthly basis and quarterly market capitalization weighting. Source: Capital IQ, a Standard & Poor’s business.

In achieving these results, the executive officers effectively balanced the advancement of the Company’s ambitious operating and financial goals with the challenges of the then-pending Comcast merger, including complying with the requests of regulators reviewing the proposed transaction and planning for post-closing integration.

Executive Compensation Principles and Practices

Compensation Practices Checklist

The Company and the Compensation Committee regularly monitor best practices and emerging trends in executive compensation. In addition, from time to time, the Company communicates with significant institutional stockholders and

9

other interested constituencies to discuss the design and operation of its executive compensation and governance programs. The current practices reflect the enhancements that the Company has made over the years to strengthen its compensation practices.

The listing below identifies compensation practices that are (and, where noteworthy, are not) incorporated into the Company’s compensation programs and, to the extent relevant, provides the location of the discussion of the practice in this Form 10-K/A.

| Compensation Practice | TWC’s Compensation Practices |

Discussion in this Form 10-K/A | ||||

| Stock ownership requirements with a retention component and hedging restrictions | YES | Compensation Discussion & Analysis (“CD&A”)—“Ownership and Retention Requirements; Hedging Policy” | ||||

| Multiple performance metrics for the annual incentive program | YES | CD&A—“2014 Short-Term Incentive Program—Annual Cash Bonus” | ||||

| Clawback capabilities | YES | “Employment Agreements” | ||||

| Change in control “double-trigger” for equity award vesting acceleration and severance benefits | YES | “Potential Payments upon a Change in Control” | ||||

| Limits on executive annual incentive compensation (bonuses capped notwithstanding performance better than maximum range) | YES | CD&A—“2014 Short-Term Incentive Program—Annual Cash Bonus” | ||||

| Performance-based vesting conditions for long-term equity incentive awards (“LTI”); awards are forfeited if conditions are not met | YES | CD&A—“2014 Long-Term Incentive Program—Equity-Based Awards” | ||||

| Pay tallies used to assist in compensation decisions | YES | CD&A—“The Use of Pay Tallies” | ||||

| Limits on Pension Plan benefits (eligible compensation capped at $350,000 per year) | YES | “Pension Plans” | ||||

| Restrictive covenants and non-compete protections | YES | “Employment Agreements” | ||||

| Peer-of-peer analysis | YES | CD&A—“The Role of Competitive Comparisons” | ||||

| Competitive employment market analysis | YES | CD&A—“The Role of Competitive Comparisons” | ||||

| Limited number of perquisites | YES | CD&A—“Perquisites” | ||||

| “Golden parachute” tax gross-ups | NO | n.a. | ||||

| Above market or guaranteed earnings in non-qualified deferred compensation program | NO | n.a. | ||||

| Supplemental executive health benefits | NO | n.a. | ||||

| Repricing of stock options without express stockholder approval | NO | n.a. | ||||

| Executive officers with pledged TWC Common Stock | NONE | “Security Ownership” |

The Company’s Executive Compensation Structure Reflects its Key Compensation Principles

The core elements of the Company’s executive compensation program are intended to focus the Company’s named executive officers on different but complementary aspects of the Company’s financial, operational and strategic goals:

| • | Annual Base Salary: The base salary paid to the Company’s named executive officers and other employees is intended to focus the recipient on his or her day-to-day duties. | |||

|

Consistency between Principles and Design

|

• | Short-Term Performance-Based Incentive: The Company’s annual cash bonus program is designed to motivate the executive officers to meet and exceed Company operating and financial goals and, in the case of other employees, to make individual contributions to the Company’s strategic and operational objectives. For additional information, see “—2014 Short-Term Incentive Program—Annual Cash Bonus.” | ||

| • | Long-Term Performance-Based Incentive: The Company’s LTI program is designed to retain participants and motivate them to meet and exceed the Company’s goals that are likely to result in long-term value creation for stockholders. For additional information, including about the performance-based vesting conditions, see “—2014 Long-Term Incentive Program—Equity-Based Awards.” | |||

10

In establishing its executive compensation programs, the Company is guided by the following key principles:

| Principle | Compensation Goal | Compensation Practice | ||

| Pay for performance | Provide an appropriate level of performance-based compensation tied to the achievement of Company financial and operational performance goals. | The compensation structure has a mix of base salary and variable or performance-based awards. For 2014, 89% of the CEO’s target total direct compensation and at least 75% of each of the other named executive officers’ target total direct compensation was variable and performance-based. As in prior years, 60% of each executive officer’s 2014 annual LTI awards were subject to a financial performance-based vesting condition. | ||

| Align executives’ interests with stockholders’ | Deliver equity compensation to align executives’ interests with those of stockholders. | Equity awards comprised 50% or more of each executive officer’s target total direct compensation. The 2014 annual LTI program consisted of Company restricted stock units (“RSUs”) that vest over a period of time and a portion of which are generally contingent on Company performance. In addition, each of the Company’s senior officers, including the named executive officers, is subject to stock ownership requirements and compensation recoupment. | ||

| Balance incentives | Focus executives on both short-term and long-term objectives. | The Company believes its mix of short-term and long-term incentives, with a larger proportion of long-term incentives, encourages focus on both long-term strategic objectives and shorter-term business objectives without introducing excessive risk. | ||

| Encourage appropriate risk-taking | Encourage neither excessive risk-taking nor inappropriate conservatism in decisionmaking. |

11

| Principle | Compensation Goal | Compensation Practice | ||

| Compensate competitively | Consider the competitive marketplace for talent inside and outside the Company’s industry to attract and retain talented executives in light of the risk of losing (and the difficulty of replacing) the relevant executive. | Total target and actual compensation are established to be externally competitive and internally equitable. | ||

| Consider internal equity | Seek to ensure comparable compensation for executives with comparable roles and organizational value. |

2014 Executive Compensation Decisions

General Factors Considered in Determining Annual Compensation Levels

The Compensation Committee has generally reviewed each named executive officer’s target compensation annually, although, in recent years, changes have been made only in the case of entry into a new or extended employment agreement or when the executive’s role or responsibilities change. The following factors, among others, are considered in determining compensation:

| • | executive-specific items, such as the compensation previously provided to the executive, the executive’s performance and potential, the importance of retaining the executive, the executive’s role and tenure in the role and the executive’s importance to succession planning; |

| • | the value and structure of compensation provided to individuals in similar positions at peer companies to ensure competitiveness and within the Company, to ensure internal equity; |

| • | whether the proposed compensation is consistent with the Company’s compensation philosophy and key compensation principles, each as described above; |

| • | the Company’s overall performance; and |

| • | stockholder return. |

2014 Base Salary and Target Incentive Compensation Determinations

Each named executive officer’s 2014 target total direct compensation (“TDC”) is set out below. Target TDC is comprised of annual base salary, target annual cash bonus (short-term incentive) and target annual LTI. As noted below, the Compensation Committee, working with its independent consultant, reviewed a wide range of information in setting TDC and structuring these compensation packages.

The TDC discussion and charts below do not include the impact of the Supplemental Bonus Program or retention equity awards, which were intended as one-time programs designed to address the Company’s specific and immediate needs during the pendency of the Comcast merger. These merger-related special programs are discussed in detail below under “2014 Short-Term Incentive Program—Annual Cash Bonus—Supplemental Bonus Program” and “2014 Long-Term Incentive Program—Equity-Based Awards—Merger-Related Retention Equity Awards.”

12

2014 Target Total Direct Compensation

| Name |

Base Salary |

Target Annual Bonus |

Target LTI |

Target Total | ||||

| Robert D. Marcus |

$ 1,500,000 | $ 5,000,000 | $ 7,500,000 | $ 14,000,000 | ||||

| Dinesh C. Jain |

$ 1,000,000 | $ 2,500,000 | $ 4,000,000 | $ 7,500,000 | ||||

| Arthur T. Minson, Jr. |

$ 900,000 | $ 1,350,000 | $ 3,250,000 | $ 5,500,000 | ||||

| Marc Lawrence-Apfelbaum |

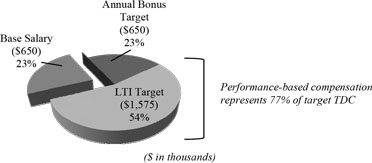

$ 650,000 | $ 650,000 | $ 1,575,000 | $ 2,875,000 | ||||

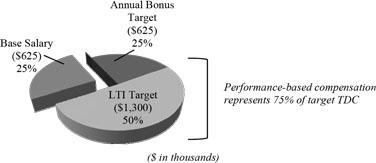

| Peter C. Stern(1) |

$ 625,000 | $ 625,000 | $ 1,300,000 | $ 2,550,000 |

| (1) | Mr. Stern’s 2014 annual base salary and target annual bonus are prorated to reflect increases for 2014 approved by the Compensation Committee in July 2014, as discussed below. |

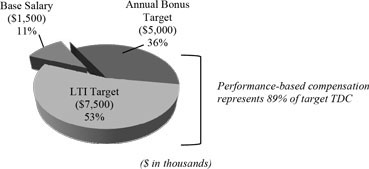

Mr. Marcus. Mr. Marcus became the Company’s Chairman and Chief Executive Officer on January 1, 2014. In July 2013, in conjunction with the Board’s decision to appoint Mr. Marcus to the positions of Chairman and Chief Executive Officer effective upon the retirement of Glenn A. Britt from those positions, the Company and Mr. Marcus entered into a new employment agreement that, among other things, established the compensation for his new role. See “—Employment Agreements—Robert D. Marcus.” In connection with its compensation decisions under that agreement, the Compensation Committee considered the Company’s key compensation principles, the importance of Mr. Marcus’s position as well as compensation levels for chief executive officer positions in the Primary Peer Group, Secondary Peer Group (as defined and listed below) and general survey data and decided to increase Mr. Marcus’s annual base salary, target annual bonus and target LTI value commencing in 2014 upon his service as Chairman and Chief Executive Officer. In light of its review, the Compensation Committee established the following 2014 TDC for Mr. Marcus: (a) an annual base salary of $1,500,000; (b) an annual discretionary cash bonus with a target amount of $5,000,000; and (c) annual LTI with a target value of $7,500,000. These new targets served to further weight Mr. Marcus’s pay mix toward performance-based and long-term incentives, which the Compensation Committee considered appropriate in light of Mr. Marcus’s responsibilities and role at the Company.

Robert D. Marcus

2014

Target Direct Compensation

Total: $14,000,000

In reviewing Mr. Marcus’s compensation, the Compensation Committee noted that Mr. Marcus’s target TDC was below the median for chief executive officers in the Primary Peer Group, and below that of Glenn A. Britt, the Company’s former Chief Executive Officer. The Compensation Committee also determined that it was appropriate to continue to weight Mr. Marcus’s TDC most heavily (89%) toward performance-based compensation in the belief that this compensation structure would best focus Mr. Marcus on achieving the Company’s strategic and business objectives. In addition, pursuant to the terms of his 2013 employment agreement and in connection with his appointment as Chairman and Chief Executive Officer, Mr. Marcus received a special LTI award in 2014 with a grant value of approximately $2,000,000, which was awarded in the form of RSUs, consistent with the form of the annual LTI awards made to the other executive officers in 2014.

13

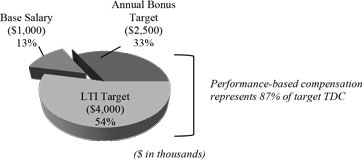

Mr. Jain. Mr. Jain joined the Company as Chief Operating Officer in January 2014. In determining the appropriate compensation for Mr. Jain, the Compensation Committee considered the Company’s key compensation principles, compensation for chief operating officers, and similar senior management positions, in the Primary Peer Group, Secondary Peer Group, general survey data and internal comparisons and the Company’s desire to attract and retain a cable executive of Mr. Jain’s stature, experience and reputation to lead its operations. In light of its review, the Compensation Committee established the following target TDC for Mr. Jain: (a) an annual base salary of $1,000,000; (b) an annual discretionary cash bonus with a target amount of $2,500,000; and (c) annual LTI with a target value of $4,000,000.

Dinesh C. Jain

2014

Target Direct Compensation

Total: $7,500,000

In setting Mr. Jain’s compensation, the Compensation Committee noted that his target TDC was slightly below the median for comparable executive officer positions in the Primary Peer Group and above the median for chief operating officers in general survey data. The Compensation Committee also determined that it was appropriate to weight his TDC most heavily (87%) toward performance-based compensation.

Mr. Jain was previously employed by Insight Communications Company, Inc. (“Insight”), which was acquired by the Company in 2012. In connection with the acquisition and the subsequent termination of Mr. Jain’s employment by Insight, Mr. Jain was entitled to certain related severance benefits and, in 2014, received a total of $742,283 of salary continuation and bonus payments from the Company. These severance benefits were not taken into account in the Compensation Committee’s TDC determination when Mr. Jain was hired for his current role as the Company’s Chief Operating Officer. See “—Employment Agreements—Dinesh C. Jain.”

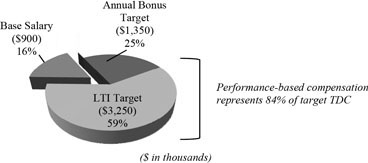

Mr. Minson. Mr. Minson joined the Company as Executive Vice President and Chief Financial Officer in May 2013. In determining the appropriate compensation for Mr. Minson, the Compensation Committee considered the Company’s key compensation principles, compensation for chief financial officers in the Primary Peer Group, Secondary Peer Group, general survey data, internal comparisons and the Company’s desire to attract and retain an executive of Mr. Minson’s stature, experience, especially in related industries, and reputation. In light of its review, the Compensation Committee established the following target TDC for Mr. Minson: (a) an annual base salary of $900,000; (b) an annual discretionary cash bonus with a target amount of $1,350,000; and (c) annual LTI with a target value of $3,250,000.

14

Arthur T. Minson, Jr.

2014

Target Direct Compensation

Total: $5,500,000

In setting Mr. Minson’s compensation, the Compensation Committee noted that his target TDC was above the median for chief financial officers in the Primary Peer Group, which the Committee considered appropriate in light of his past experience at the Company and in related industries. The Compensation Committee also determined that it was appropriate to weight his TDC most heavily (84%) toward performance-based compensation. See “—Employment Agreements—Arthur T. Minson, Jr.”

Mr. Lawrence-Apfelbaum. In 2012, the Compensation Committee reviewed Mr. Lawrence-Apfelbaum’s compensation in connection with the renegotiation of his employment agreement. For 2014, the Compensation Committee reviewed this compensation in light of the Company’s key compensation principles, comparisons to comparable general counsel and other positions in the Primary Peer Group, Secondary Peer Group and general survey data and the importance of his continuing role at the Company. In light of its review, the Compensation Committee determined it would be appropriate to maintain the following target TDC for Mr. Lawrence-Apfelbaum: (a) an annual base salary of $650,000; (b) an annual discretionary cash bonus with a target amount of $650,000; and (c) annual LTI with a target value of $1,575,000.

Marc Lawrence-Apfelbaum

2014

Target Direct Compensation

Total: $2,875,000

In setting Mr. Lawrence-Apfelbaum’s compensation, the Compensation Committee noted that his 2014 target TDC was below the median of the most comparable positions within the Primary Peer Group. The Compensation Committee also determined that it was appropriate to continue to weight Mr. Lawrence-Apfelbaum’s target TDC most heavily (77%) toward performance-based compensation. See “—Employment Agreements—Marc Lawrence-Apfelbaum.”

15

Mr. Stern. In October 2013 and again in July 2014, the Compensation Committee reviewed 2014 compensation for Mr. Stern and considered the Company’s key compensation principles, compensation for similar positions based on internal comparisons and general survey data in light of the absence of comparable information in the Primary Peer Group and Secondary Peer Group. In October 2013, the Compensation Committee made no change to Mr. Stern’s target TDC for 2014. In July 2014, the Compensation Committee determined to increase Mr. Stern’s target TDC by 10% to reflect an increase in Mr. Stern’s responsibilities, internal and market compensation practices, his experience and the importance of his position and retaining him in that position. In light of its review, the Compensation Committee determined to make the following target TDC changes for Mr. Stern, which were prorated for 2014 as reflected in the table above and the chart below: (a) increase his annual base salary from $600,000 to $650,000; (b) increase the target amount of his annual discretionary cash bonus from $600,000 to $650,000; and (c) increase the annual target value of his LTI from $1,300,000 to $1,450,000 (with no adjustment made to his 2014 annual LTI award).

Peter C. Stern

2014

Target Direct Compensation

Total: $2,550,000

In setting Mr. Stern’s compensation, the Compensation Committee noted that his 2014 target TDC was reflective of his diverse and important responsibilities. The Compensation Committee also determined that it was appropriate to continue to weight Mr. Stern’s target TDC most heavily (75%) toward performance-based compensation. See “—Employment Agreements—Peter C. Stern.”

2014 Short-Term Incentive Program—Annual Cash Bonus

The Company’s annual cash bonus payments to the named executive officers for 2014 were based on three components:

| • | the 2014 Time Warner Cable Annual Incentive Plan (the “2014 AIP”), based 50% on a Profit Participation Program (“Profit Participation Program”) tied to Company financial performance and 50% on a new Operational Performance Incentive (“OPI”) feature introduced for 2014 tied to achievement of specified operational and financial goals; |

| • | a residential video subscriber additions bonus opportunity equal to 5% of the 2014 AIP target bonus in the event of a net increase in residential video subscribers in any 2014 fiscal quarter (the “Residential Video Subscriber Additions Bonus”); and |

| • | a special Supplemental Bonus Program award opportunity approved as an additional incentive in connection with the Comcast merger, that served to increase the target bonus opportunity by 50% (see “—Supplemental Bonus Program,” below). |

Unlike past years in which the named executive officers’ cash incentive was based predominantly on the Company’s financial performance, the Compensation Committee believed that the 2014 mix of financial and operational goals would align executives with

16

the Company’s ambitious three-year plan to revitalize its residential services, expand and improve its network and drive growth in business services to lead to longer-term shareholder returns.

2014 Profit Participation Program. Management proposed the use of Operating Income to determine Company financial performance under the 2014 Profit Participation Program component of the AIP, which accounted for 50% of the 2014 AIP opportunity. In adopting Management’s proposal for the 2014 Profit Participation Program component, the Compensation Committee indicated that it believed that Operating Income would be an important indicator of the overall operational strength and performance of the Company’s business in 2014, including the ability to provide cash flows to service debt, pay dividends, repurchase shares and prudently invest in new growth opportunities.

The following threshold and maximum goals were established for the Profit Participation Program component of the 2014 AIP based upon a review of the prior year’s Operating Income results, the Company’s 2014 budget and other factors:

Profit Participation Program

for Named Executive Officers

(50% of 2014 AIP Opportunity)

| 2014 Profit Participation Program—Financial Metric |

Threshold Award (50% of target) |

Maximum Award (150% of target) |

||||||

| (in millions) | ||||||||

| Operating Income |

$ | 4,500 | $ | 5,100 | ||||

The Compensation Committee determined that the threshold Operating Income goal set an appropriate level of performance to earn an award under the Profit Participation Program component of the 2014 AIP. If the Company failed to meet the threshold level, no bonus payment would be made under this component of the 2014 AIP. Similarly, the maximum goal was considered to present very significant challenges and was not likely to be attained. If the Company exceeded the maximum goal, the Company financial performance “score” under the Profit Participation Program component would be 150%.

If the Company’s Operating Income after required adjustments (“adjusted Operating Income”) was above the threshold but below the maximum goal, the Compensation Committee would determine the Profit Participation Program score in its discretion, but using as its starting point the “straight line interpolation” of the Company’s performance against the threshold and maximum goals. For example, if the Company’s adjusted Operating Income results were exactly at the midpoint between the threshold and maximum goals, the straight line interpolation would be 100%, the midpoint between 50% and 150%.

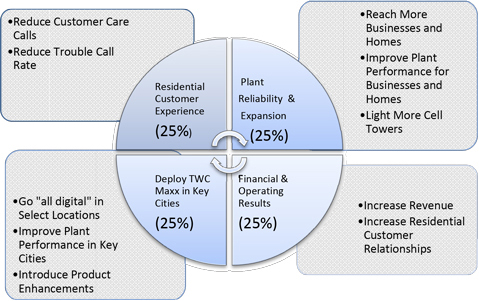

2014 Operational Performance Incentive. Management proposed a broad set of metrics for the executive officers, including the named executive officers, under the 2014 OPI, which together accounted for 50% of the total 2014 AIP opportunity. These metrics were intended to motivate the named executive officers to drive performance in four key performance areas, each carrying equal weight of 25% under the OPI (i.e., 12.5% of the total 2014 AIP opportunity): (i) residential customer experience, (ii) plant reliability and expansion, (iii) completion of the upgrades in key cities designated as “TWC Maxx” and (iv) financial and operating results. The key metrics within each of these areas are set out below.

17

Operational Performance Incentive

for Named Executive Officers

(50% of 2014 AIP Opportunity)

In adopting Management’s proposal for the OPI portion of the 2014 AIP, the Compensation Committee believed that the four principal performance areas and their underlying components would be reflective of the Company’s success in achieving several key objectives: enhancing the customer experience, investing in plant and products to revitalize its residential business, continuing to expand its business services operations, and driving sustainable top-line growth. While each metric within the performance areas was assigned a weighting and a threshold and maximum to help evaluate the level of accomplishment, none of the metrics was in itself material to the ultimate performance evaluation.

| • | The Residential Customer Experience metrics of reducing call volume and “trouble calls” (i.e., truck rolls following a customer interaction) were thought to be important indicators of whether TWC customers are generally having a positive experience. |

| • | The Plant Reliability and Expansion metrics were thought to support the Company’s objective of efficiently and economically investing in its physical infrastructure to ensure a quality customer experience and support growth in its business service and residential segments. |

| • | The TWC Maxx deployment metrics were selected to support the Company’s roll out of an enhanced residential customer experience, which is also intended to provide the Company with a meaningful competitive advantage in key operating areas. |

| • | The Financial and Operating Results selected by the Committee were thought to be important indicators of business performance: residential customer relationships to gauge the Company’s success in attracting and retaining customers and revenue to gauge the Company’s success in maintaining pricing discipline. |

Reflecting the fact that many of the 2014 OPI goals were interrelated and interdependent, the Committee determined to have all the Company’s executive officers share the same goals. This was also intended to foster collaboration and cooperation among executive team members.

As under the Profit Participation component of the 2014 AIP, the Compensation Committee would determine a performance “score” for each metric within the four key areas using a scale on which a designated outcome could represent minimally satisfactory results and a score of 150% would represent truly exceptional results.

Residential Video Subscriber Additions Bonus. In light of negative residential video subscriber trends, the Compensation Committee developed the Residential Video Subscriber Additions Bonus opportunity to encourage employee focus on quarterly residential video subscriber net additions. Under the 2014 AIP, an additional bonus of 5% of the target bonus opportunity would have been payable based on the achievement of a net increase in residential video subscribers in any fiscal quarter of 2014. This additional

18

5% bonus opportunity would be payable to any AIP-eligible employee, including the executive officers. The payment of this bonus could have permitted an individual’s total 2014 cash bonus to exceed 150% of the target opportunity. The Company failed to meet the performance threshold for payment of the Residential Video Subscriber Additions Bonus.

Supplemental Bonus Program. As noted above, to further incentivize employees to maintain focus on achieving the Company’s operating goals while also engaging in a complicated and time-consuming integration planning process during the pendency of the Comcast merger, the Company established a special Supplemental Bonus Program for all participants in the 2014 AIP (approximately 15,000 employees), including the named executive officers. The Supplemental Bonus Program provided a 50% increase to each participant’s target bonus opportunity under the 2014 AIP, subject to an aggregate Supplemental Bonus Program payment limit of $100 million for all AIP-eligible employees. Furthermore, the Supplemental Bonus Program was based on the same performance goals and subject to the same limits (including a payout cap) established under the 2014 AIP. Pursuant to its terms, the Supplemental Bonus Program payments were to be made upon the completion or termination of the Comcast merger and would not have been made had the 2014 AIP performance thresholds not been met.

The Compensation Committee believed that meaningfully increasing the size of the potential cash bonus opportunity under the 2014 AIP by 50% for the general employee population, as well as the named executive officers, was an essential component of the 2014 incentive compensation package to motivate and reward participants in light of the Company’s ambitious goals and its circumstances. The Compensation Committee believed that mirroring the 2014 AIP financial and operational goals in the Supplemental Bonus Program reinforced the criticality of achieving, and exceeding, the operating performance objectives despite the potential Comcast merger distractions and additional responsibilities. In addition, the timing of the payment of the bonus would also serve to reinforce the retention of senior management through the closing, or abandonment, of the Comcast merger.

2014 Annual Incentive Plan Performance Determination. In connection with its determination of annual bonus payments, the Compensation Committee reviewed the Company’s results under the Profit Participation Program, the OPI and the Residential Video Subscriber Additions Bonus. The Profit Participation Program and the Residential Video Subscriber Additions Bonus applied similarly to all bonus-eligible employees, while the 2014 OPI goals described above applied to the executive officers. Management determined the OPI metrics and goals for the other bonus-eligible employees cascading down, as applicable, from the executive officers, based on the participants’ roles within the Company. The Company did not achieve the quarterly net residential video subscriber gain required to receive the Residential Video Subscriber Additions Bonus.

Profit Participation Program. As mandated by the terms of the Profit Participation Program component of the 2014 AIP, Operating Income was adjusted to reflect identified items, such as merger-related and restructuring costs, and other items that affect Operating Income but that are beyond the control of management or otherwise not indicative of management’s performance. For 2014, these mandatory adjustments had the net impact of increasing Operating Income for 2014 AIP purposes by $147 million in aggregate, predominantly for merger-related expenses, resulting in adjusted Operating Income, for compensation purposes, of $4,779 million.

Since this adjusted Operating Income exceeded the threshold performance, the Compensation Committee noted the straight-line interpolation between the threshold and maximum target levels. This interpolation yielded an initial “score” of 96%, which the Compensation Committee used as the starting point for its final determination of performance under the 2014 Profit Participation Program component.

Pursuant to the Profit Participation Program, in evaluating performance, the Compensation Committee considered, among other factors:

| • | the quality of the Company’s 2014 financial performance; |

| • | the Company’s performance relative to its budget; |

| • | the Company’s growth as compared with 2013 results; |

| • | the Company’s performance relative to that of other cable operators; |

| • | Management’s recommendation for the Company financial performance score; and |

| • | the external business environment and market conditions. |

19

After deliberation, the Compensation Committee established a Profit Participation Program “score” of 96%, based on the straight-line interpolation. This determination reflected the Compensation Committee’s view of the Company’s accomplishments during the year (as outlined above under “2014 Highlights: Company Performance”), especially in light of the efforts, demands and distractions arising from the Comcast merger, including complying with the requests of federal, state and local regulators reviewing the proposed transaction and planning for post-closing integration.

Operational Performance Incentive Plan. The Compensation Committee reviewed each of the four principal areas established under the 2014 OPI and considered management’s progress, as reviewed by the Company’s internal auditor, against the metrics and goals associated with each of these areas. Based on its review, the Committee established the following scores:

| • | Residential customer experience score – 124%. This score was based on management’s impressive success in reducing the number of trouble calls (i.e., truck rolls) during 2014, exceeding expectations, and the Company’s reduction in the number of customer care phone calls during the year. The Committee considered the impact of growth in customer relationships and the expansion of the TWC Maxx program on the service call experience, but determined not to adjust the score from the straight line interpolation. |

| • | Plant reliability and expansion score – 122%. This score was based on exceeding expectations with respect to improving plant reliability and performance and expanding residential service opportunities. However, the score was negatively impacted by achieving a lower level of success in building business services line extensions and cell towers despite adding more than $1 billion in business services opportunity. |

| • | TWC Maxx Deployment – 117%. This score was based on management having successfully completed the migration to “all-digital” in Los Angeles and having deployed its TWC Maxx Internet speed increases in New York and Los Angeles as planned, and improving plant performance in these key locations, along with Austin, Texas, to a level above expectations. The Committee did not adjust the score to reflect the successful increase of Internet speeds in Austin, Texas to TWC Maxx levels ahead of schedule. |

| • | Financial and operating performance score – 102%. This score was based on strong growth in residential customer relationships during 2014 (net additions of 150,000), as well as revenue growth of 3.1% during 2014. |

In each case, the Company’s performance exceeded the threshold performance established under the OPI. Accordingly, the Compensation Committee noted the straight-line interpolation between the threshold and maximum target levels in each case in which such goals had been established. This interpolation yielded initial “scores,” which the Compensation Committee used as the starting point for its final determination of performance under the 2014 OPI. After deliberation, the Compensation Committee established an aggregate 2014 OPI “score” of 116%, based on the unadjusted straight-line interpolation of each applicable component and the appropriately weighted aggregate of each of the four principal areas, as shown in the table below. This determination reflected the Compensation Committee’s view of the Company’s accomplishments during the year (as outlined above and under “2014 Highlights: Company Performance”) to set the foundation for achievements under the long-term plan and in light of the difficult competitive environment and the distractions of the Comcast merger regulatory review process and planning for post-closing integration.

The table below sets out each of the threshold/maximum interpolated scores for each of the Profit Participation Program and the OPI components of the 2014 annual bonus program and the ultimate scores assigned by the Compensation Committee for use in the bonus determinations.

20

| 2014 Company Performance |

Percentage Allocation |

X | Threshold/ Maximum Interpolation |

= | Final Score |

|||||||||||

| Profit Participation Program |

||||||||||||||||

| (50% of 2014 annual bonus target payment) |

50 | % | 96 | % | 48 | % | ||||||||||

| Operational Performance Incentive |

||||||||||||||||

| (50% of 2014 annual bonus target payment) |

||||||||||||||||

| Residential customer experience |

12.5 | % | 124 | % | 15.5 | % | ||||||||||

| Plant reliability and expansion |

12.5 | % | 122 | % | 15.25 | % | ||||||||||

| TWC Maxx deployment |

12.5 | % | 117 | % | 14.5 | % | ||||||||||

| Financial and operating performance |

12.5 | % | 102 | % | 12.75 | % | ||||||||||

| Total weighted aggregate score |

50 | % | 116 | % | 58 | % | ||||||||||

| Weighted Aggregate Annual Bonus Score |

100 | % | 106 | % | 106 | % | ||||||||||

2014 Annual Incentive Plan and Supplemental Bonus Payments.

The table below indicates the total amount awarded to each named executive officer under the 2014 annual bonus programs, including the (a) 2014 AIP and (b) Supplemental Bonus Program, based on a 106% overall performance score, alongside each officer’s aggregate annual bonus target under the 2014 AIP and Supplemental Bonus Program. The named executive officers were paid a portion of these annual bonus awards before the end of the first quarter of 2015 and, consistent with the terms of the Supplemental Bonus Program, will be paid the balance in April 2015 as a result of the abandonment of the Comcast merger. These bonus amounts are also included under the heading “Non-Equity Incentive Plan Compensation” in the Summary Compensation Table below.

| Executive Officer |

2014 Annual Bonus Award |

Target 2014 AIP and Supplemental Bonus(2) |

||||||||||||||

| 2014 AIP | Supplemental Bonus Program |

Total 2014 Annual Bonus Award(1) |

||||||||||||||

| Robert D. Marcus |

$ | 5,300,000 | $ | 2,650,000 | $ | 7,950,000 | $ | 7,500,000 | ||||||||

| Dinesh Jain |

$ | 2,650,000 | $ | 1,325,000 | $ | 3,975,000 | $ | 3,750,000 | ||||||||

| Arthur T. Minson, Jr. |

$ | 1,431,000 | $ | 715,500 | $ | 2,146,500 | $ | 2,025,000 | ||||||||

| Marc Lawrence-Apfelbaum |

$ | 689,000 | $ | 344,500 | $ | 1,033,500 | $ | 975,000 | ||||||||

| Peter C. Stern |

$ | 662,500 | $ | 331,250 | $ | 993,750 | $ | 937,500 | ||||||||

| (1) | Aggregate of amounts awarded under the 2014 AIP and Supplemental Bonus Program. |

| (2) | The 2014 AIP bonus target for each of the named executive officers is set forth in the table above titled “2014 Target Total Direct Compensation.” The Supplemental Bonus Program effectively increased each AIP participant’s bonus target by 50%. |

Section 162(m) Compliance. In order to structure the short-term incentive awards as potentially deductible amounts under Section 162(m) of the Internal Revenue Code (“Section 162(m)”), additional conditions and limitations on awards were imposed under the Time Warner Cable Inc. 2012 Annual Bonus Plan (the “162(m) Bonus Plan”), which was approved by the Company’s stockholders in May 2012. Pursuant to the 162(m) Bonus Plan, a subcommittee of the Compensation Committee, whose members are “outside directors” as defined in Section 162(m) (the “Subcommittee”), established objective performance criteria for 2014 that determined the maximum bonus pool from which the named executive officers’ bonuses can be paid and a percentage allocation of the pool for each named executive officer. Under the objective criteria established by the Subcommittee, an aggregate 2014 maximum bonus pool was established equal to 7.5% of the amount by which the Company’s 2014 Operating Income before depreciation of tangible assets and amortization of intangible assets (as adjusted) of at least $8.15 billion exceeded $6.723 billion. Each annual bonus payment was subject in all cases to a 162(m) Bonus Plan cap equal to the lesser of (i) 250% of the officer’s annual bonus target and (ii) $15 million, in addition to an overall cap under the annual bonus program of 150% of the individual’s target annual bonus (as increased by the Supplemental Bonus Program opportunity). In awarding 2014 bonuses to each named executive officer, the Subcommittee exercised its discretion to reduce the maximum amount available for each executive officer under the 162(m) Bonus Plan’s pool. The basis for this exercise of negative discretion was the Company’s performance score under the Profit Participation Program and the operational performance under the OPI as described above.

2014 Long-Term Incentive Program—Equity-Based Awards

As the Compensation Committee considered the 2014 LTI program, it also realized that additional retention incentives would be essential in light of the possible protracted regulatory review process that is typical for significant mergers in the cable industry and various uncertainties related to the Comcast merger. As a result, in addition to the standard annual LTI awards, it approved advancing into 2014 equity awards that would have otherwise been made in 2015 and 2016 as special retention equity awards.

21

2014 Standard Annual Equity Awards. The Company’s 2014 Annual LTI program consisted of RSUs awarded under the Company’s 2011 Stock Incentive Plan (the “Stock Plan”), 60% of which was subject to complete forfeiture if specified performance-based vesting conditions were not satisfied. The 2014 annual LTI program represented a change from the Company’s practices in recent years, which had also included stock options as part of its standard mix. The Compensation Committee believed that granting RSUs with a combination of performance-based and service-based vesting would provide the best mix of LTI vehicles to motivate key executives to drive business results against the Company’s goals and retain the senior management team during the pendency of the Comcast merger and better aligned executives’ interests with those of the Company’s stockholders. In addition, the Compensation Committee was aware that stock options, which had historically been granted with a ten-year term, might not have, or be perceived to have, the opportunity to reach their full anticipated value in light of the various circumstances related to the Comcast merger. As a result, stock options were not considered to be as effective as RSUs in achieving all of the Company’s business and compensation objectives under the circumstances.

2014 Equity Awards—Determinations. The number of RSUs awarded to each named executive officer in connection with the 2014 LTI program and the retention equity awards, described below, was determined by reference to the target LTI value for such executive and the average closing price of the Company’s Common Stock over a ten-day period prior to the date of grant selected in advance by the Compensation Committee.

2014 Standard Annual Equity Awards—Performance-Based Conditions and Other Terms. Consistent with the Company’s LTI programs since 2011, 60% of the value of the 2014 annual LTI award to each executive officer was subject to complete forfeiture if the Company failed to satisfy specified performance goals. For 2014, the Compensation Committee established a one-year measurement period for this performance-based vesting condition and set 2014 Operating Income (as adjusted) of $4.5 billion (the threshold performance level under the Profit Participation Program under the 2014 AIP) as the 2014 LTI award performance threshold. The Compensation Committee believed that utilizing this one-year performance threshold for 60% of the target value of the 2014 annual LTI awards was appropriate in light of general market practice, the inherent performance aspects of equity awards, the types of vehicles and mix used by the peer groups and the challenges associated with setting multi-year performance goals, particularly in light of the pending Comcast merger. In conjunction with the determination of the performance score under the 2014 Profit Participation Program component of the annual bonus program in early 2015, the Compensation Committee certified the satisfaction of the one-year performance condition, which permitted the awards to vest on their designated time-based vesting schedules, as described below.