Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - AVINTIV Inc. | d806629dex232.htm |

| EX-23.1 - EX-23.1 - AVINTIV Inc. | d806629dex231.htm |

| EX-23.3 - EX-23.3 - AVINTIV Inc. | d806629dex233.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 27, 2015.

Registration No. 333-201995

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PGI Specialty Materials, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 2221 | 27-4132779 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

9335 Harris Corners Parkway, Suite 300

Charlotte, North Carolina 28269

(704) 697-5100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

April Miller Boise

Senior Vice President, General Counsel,

Head of Global Mergers & Acquisitions

and Secretary

PGI Specialty Materials, Inc.

9335 Harris Corners Parkway, Suite 300

Charlotte, North Carolina 28269

(704) 697-5100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Igor Fert, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 Telephone: (212) 455-2000 Facsimile: (212) 455-2502 |

Michael Kaplan, Esq. Richard D. Truesdell, Jr., Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 Phone: (212) 450-4000 Fax: (212) 701-5800 |

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after the Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title Of Each Class Of Securities To Be Registered |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Common Stock, par value $0.01 per share |

$100,000,000 | $11,620 | ||

|

| ||||

| (1) | Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

| (2) | Includes shares of common stock subject to the underwriters’ option to purchase additional shares of common stock. |

| (3) | Previously paid |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated April 27, 2015.

Shares

PGI Specialty Materials, Inc.

Common Stock

This is an initial public offering of shares of common stock of PGI Specialty Materials, Inc.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . PGI Specialty Materials, Inc. intends to list the common stock on The New York Stock Exchange (the “NYSE”) under the symbol “ .”

After the completion of this offering, affiliates of The Blackstone Group L.P. will continue to own a majority of the voting power of all outstanding shares of the common stock. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of the NYSE. See “Principal Stockholders.”

We have granted the underwriters a 30-day option to purchase up to additional shares at the initial public offering price less the underwriting discount and commissions.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 27 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2015.

| BofA Merrill Lynch | Citigroup | |||

| Goldman, Sachs & Co. | Jefferies | RBC Capital Markets | ||

Prospectus dated , 2015.

Table of Contents

Unless otherwise indicated or the context otherwise requires, financial data in this prospectus reflects the consolidated business and operations of PGI Specialty Materials, Inc. and its consolidated subsidiaries.

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor the underwriters take responsibility for, nor can provide any assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

MARKET, RANKING AND OTHER INDUSTRY DATA

The data included in this prospectus regarding the markets and the industry in which we operate, including the size of certain markets and our position and the position of our competitors within these markets, are based on reports of government agencies, independent industry sources (including a report prepared for us by Smithers Information Ltd., an independent third-party market research firm, and information obtained from Nonwovens Industry) and our own estimates relying on our management’s knowledge and experience in the markets in which we operate. Our management’s knowledge and experience, in turn, are based on information obtained from our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. We believe these reports, sources and estimates to be accurate as of their respective dates. However, this information may prove to be inaccurate because of the method by which we obtained some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Unless otherwise specified in this prospectus, all references to market size and our market positions are based on our pro forma net sales for the specified periods.

Although we believe market, ranking and other industry data included in this prospectus is generally reliable, we cannot guarantee the accuracy and completeness of the information and have not independently verified it. We have not independently verified any of the data from other third party sources, nor have we ascertained the underlying assumptions relied upon therein. As a result, you should be aware that market, ranking and other industry data included in this prospectus, and our estimates and beliefs based on that data, may not be reliable. Neither we nor the underwriters can guarantee the accuracy or completeness of any such information contained in this prospectus. While we are not aware of any misstatements regarding the industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors,” “Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

This prospectus contains some of our trademarks, trade names and service marks, including the following: APEX, Chicopee, Chix, Chux, Durawipe, Fiberweb, KAMI, Masslinn, PGI, Polymer Group, Inc., Providência, REEMAY, Spinlace, S-Tex, TYPAR and Worxwell. Each one of these trademarks, trade names or service marks is either (i) our registered trademark, (ii) a trademark for which we have a pending application, (iii) a trade name or service mark for which we claim common law rights or (iv) a registered trademark or application for registration which we have been licensed by a third party to use.

Solely for convenience, the trademarks, service marks, and trade names referred to in this prospectus are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, and trade names. This prospectus contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners.

As used in this prospectus, unless otherwise noted or the context otherwise requires:

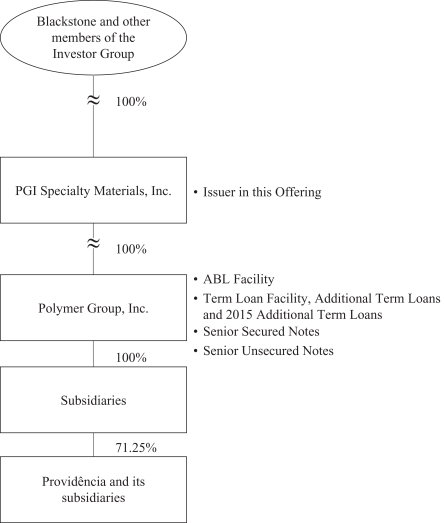

| • | references to the “Issuer” are to PGI Specialty Materials, Inc., exclusive of its subsidiaries; |

| • | references to “we,” “us,” “our,” “PGI,” and “the Company” are to PGI Specialty Materials, Inc. and its subsidiaries; |

| • | references to “PGI Group” are to Polymer Group, Inc., an indirect subsidiary of the Issuer, exclusive of its subsidiaries; |

ii

Table of Contents

| • | references to “Holdings” are to Scorpio Acquisition Corporation, the direct subsidiary of the Issuer, exclusive of its subsidiaries; |

| • | references to “Blackstone” and the “Sponsor” are to certain investment funds affiliated with Blackstone Capital Partners V L.P.; |

| • | references to the “Investor Group” are, collectively, to Blackstone and the management investors (as defined below); |

| • | references to the “management investors” are to certain members of our management team and employees who have made investments in the Issuer; |

| • | references to “Providência” are to Companhia Providência Indústria e Comércio, a Brazilian corporation (sociedade anônima); |

| • | references to “Acquisition Co.” are to our wholly-owned subsidiary, PGI Polímeros do Brasil S.A., a Brazilian corporation (sociedade anônima); |

| • | references to the “Providência Acquisition” are to the acquisition of approximately 71.25% of the outstanding capital stock of Providência by Acquisition Co.; |

| • | references to “Providência Refinancing” are to the borrowings under the Incremental Amendment (as defined below), the Senior Unsecured Notes (as defined below) and the use of proceeds therefrom; |

| • | references to the “Mandatory Tender Offer” are to the mandatory tender offer registration request filed by Acquisition Co., our wholly-owned subsidiary, with the Securities Commission of Brazil (Comissão de Valores Mobiliários or “CVM”) in order to launch as required by Brazilian law, after the CVM’s approval, a tender offer to acquire the remaining approximately 28.75% of the outstanding capital stock of Providência that is currently held by minority shareholders; |

| • | references to “Fiberweb” are to Fiberweb Limited (formerly known as Fiberweb plc); |

| • | references to the “Fiberweb Acquisition” are to the completion of the acquisition of the entire issued ordinary share capital of Fiberweb, the borrowings under the Bridge Facilities and the use of proceeds therefrom; |

| • | references to the “Fiberweb Refinancing” are to the Equity Contribution (as defined below), the borrowings under the Term Loans (as defined below) and the use of proceeds therefrom; |

| • | references to “Terram Geosynthetics” are to Terram Geosynthetics Private Limited, a joint venture we acquired as part of the Fiberweb Acquisition in which we maintain a 65% interest; |

| • | references to the “ABL Facility” are to the Credit Agreement, dated as of January 28, 2011, among Holdings, PGI Group, as lead borrower, the lenders from time to time party thereto, Citibank, N.A., as administrative agent and collateral agent, Morgan Stanley Senior Funding, Inc., as syndication agent, Barclays Bank PLC and RBC Capital Markets, as co-documentation agents, and Citigroup Global Markets Inc., Morgan Stanley Senior Funding, Inc., Barclays Capital Inc. and RBC Capital Markets LLC, as joint lead arrangers and joint book runners, as further amended or supplemented from time to time; |

| • | references to the “Secured Bridge Facility” are to the $268.0 million secured bridge credit facility, dated as of September 17, 2013, among PGI Group, Holdings, the lenders from time to time party thereto, Citicorp North America, Inc., as administrative agent, Barclays Bank PLC, as syndication agent and Citigroup Global Markets Inc. and Barclays Bank PLC, as joint lead arrangers and joint bookrunners, as further amended or supplemented from time to time; |

| • | references to the “Unsecured Bridge Facility” are to the $50.0 million unsecured bridge credit facility, dated as of November 26, 2013, among PGI Group, Holdings, the lenders from time to time party thereto, Citicorp North America, Inc., as administrative agent, Barclays Bank PLC, as syndication |

iii

Table of Contents

| agent and Citigroup Global Markets Inc. and Barclays Bank PLC, as joint lead arrangers and joint bookrunners, as further amended or supplemented from time to time; |

| • | references to the “Bridge Facilities” are to the Secured Bridge Facility and the Unsecured Bridge Facility, collectively; |

| • | references to the “Term Loans” are to the $295.0 million of term loans outstanding pursuant to the Senior Secured Credit Agreement (the “Term Loan Facility”), dated as of December 19, 2013, among PGI Group, Holdings, the lenders from time to time party thereto, Citicorp North America, Inc., as administrative agent, Barclays Bank PLC, as syndication agent, RBC Capital Markets and HSBC Bank USA, N.A., as co-documentation agents, Citigroup Global Markets Inc. and Barclays Bank PLC, as joint lead arrangers and Citigroup Global Markets Inc., Barclays Bank PLC, RBC Capital Markets and HSBC Securities (USA) Inc., as joint bookrunners, as further amended or supplemented from time to time; |

| • | references to “Additional Term Loans” are to the $415.0 million of incremental term loans outstanding pursuant to an incremental term loan amendment, dated as of June 10, 2014 (the “Incremental Amendment”), to our existing Term Loan Facility; |

| • | references to “2015 Additional Term Loans” are to the $283.0 million of incremental term loans outstanding pursuant to the second incremental term loan amendment, dated as of April 17, 2015 (the “Second Incremental Amendment”); |

| • | references to “Equity Contribution” are to an equity investment by the Sponsor of approximately $30.7 million in the Issuer, the proceeds of which were contributed as a capital contribution to Holdings, which in turn contributed such proceeds to PGI Group as a capital contribution; |

| • | references to “pro forma” give pro forma effect to the Providência Acquisition and the Providência Refinancing and the Offering (as defined herein), for the period indicated; |

| • | references to the “Senior Unsecured Notes” are to the $210.0 million aggregate principal amount of 6.875% senior unsecured notes due 2019 issued by PGI Group on June 11, 2014; |

| • | references to the “Senior Secured Notes” are to the $560.0 million aggregate principal amount of 7.75% notes due 2019 issued by PGI Group on January 13, 2011; |

| • | reference to “spunmelt” are to spunmelt technology, which uses thermoplastic polymers that are melt-spun to manufacture continuous-filament products; |

| • | references to “Smithers Pira” are to Smithers Information Ltd., a market research firm. All information included herein that is attributed to Smithers Pira is based on Smithers Pira Consultancy Report: Global Nonwovens Market Study, dated October 30, 2014; |

| • | references to “nonwovens industry” are to industry size, as measured by either volume (in metric tons) or value (in U.S. dollars), based on information by Smithers Pira. The nonwovens industry, as defined by Smithers Pira, encompasses nonwovens used for various products that serve the hygiene, healthcare filtration, dryer sheets, industrial and wipes applications. The industry also includes geocomposites products, which are an adjacent technology used in industrial applications that can utilize nonwovens; |

| • | references to “Nonwovens Industry” are to the information publicly available at http://www.nonwovens-industry.com, a website dedicated to the worldwide business of nonwovens; |

| • | references to “markets” or “regions” generally refers to the four geographic regions in which we operate: North America, South America, Europe (including our India operations), and Asia; |

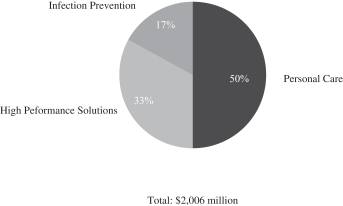

| • | references to “applications” generally are to the various customer end-use applications which our products serve. While our products serve a diverse range of applications, for convenience, we group these applications into three primary categories: Personal Care, Infection Prevention and High Performance Solutions. Personal Care includes hygiene applications (such as baby diapers, adult |

iv

Table of Contents

| incontinence products, and feminine hygiene products), personal care wipes, and fabric-softening dryer sheets. Infection Prevention includes healthcare applications (such as surgical gowns and drapes, face masks and wound care products), filtration products (including blood filters, pool and spa filters, and Hepa filtration), and disinfectant wipes (including patient care wipes and hard surface disinfectant wipes). High Performance Solutions includes building, construction and geosynthetics (including house wrap, road underlayment and industrial cable wrap), along with air filtration, home and bedding and industrial wiping applications, among others; |

| • | references to our market positions or rank are, except as otherwise indicated, based on our pro forma net sales; and |

| • | references to the “underwriters” are to the firms listed on the cover page of this prospectus. |

On January 28, 2011, pursuant to an Agreement and Plan of Merger, dated as of October 4, 2010, we were acquired by affiliates of Blackstone, along with certain members of our management (the “Merger”). Periods prior to January 28, 2011 reflect the financial position, results of operations, and changes in financial position of the Company prior to the Merger (the “Predecessor”). The fiscal year ended December 31, 2011 reflects the financial position, results of operations, and changes in financial position of the Company after the Merger (the “Successor”). The Successor had no operating activities between its November 22, 2010 inception date and the closing date of the Merger. The audited financial statements of the Successor for the period from November 22, 2010 to January 2, 2011, and as of January 2, 2011, have been omitted from this prospectus because we believe the Successor qualified as a “business combination related shell company” within the meaning of relevant SEC guidance during such period, as it was formed for the sole purpose of completing the Merger and did not have any assets as of January 2, 2011.

The Merger was recorded using the acquisition method of accounting in accordance with the accounting guidance for business combinations and non-controlling interest. The guidance prescribes that the purchase price be allocated to assets acquired and liabilities assumed based on the estimated fair market value of such assets and liabilities at the date of acquisition. As a result, periods prior to the Merger are not comparable to subsequent periods due to the difference in the basis of presentation of purchase accounting as compared to historical cost.

The audited financial statements of Fiberweb as of and for the years ended December 31, 2012, 2011 and 2010 and the unaudited interim financial statements as of and for the nine months ended September 30, 2013 included in this prospectus have been prepared in pounds sterling and in accordance with applicable International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). IFRS differs in certain significant respects from U.S. Generally Accepted Accounting Principles (“GAAP”).

The audited financial statements of Providência as of and for the years ended December 31, 2013 and 2012 and the unaudited condensed interim financial statements as of and for the three months ended March 31, 2014 included in this prospectus have been prepared in Brazilian reals and in accordance with applicable IFRS as issued by the IASB. IFRS differs in certain significant respects from GAAP. See “Unaudited Pro Forma Condensed Combined Financial Information” for a discussion of significant differences between IFRS and GAAP as they relate to Providência.

The Company’s fiscal year is based on a 52 week period ending on the Saturday closest to each December 31. The one month ended January 28, 2011 for the Predecessor contains four weeks. The fiscal year ended December 31, 2011 for the Successor contains 48 weeks. The fiscal years ended December 29, 2012 and December 28, 2013 for the Successor contain operating results for 52 weeks. References herein to “2011,” “2012,” and “2013” generally refer to fiscal 2011, fiscal 2012 and fiscal 2013, respectively, unless the context indicates otherwise. In fiscal year 2014, the Company changed its year-end date to December 31. The Company’s 2014 fiscal year commenced on December 29, 2013 and concluded on December 31, 2014.

v

Table of Contents

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete, and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the section entitled “Risk Factors” and the consolidated financial statements and the notes thereto, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of certain factors such as those set forth in “Risk Factors” and “Forward-Looking Statements.” When making an investment decision, you should also read the discussion under “Basis of Presentation” for the definition of certain terms used in this prospectus and a description of certain transactions and other matters described in this prospectus.

Company Overview

We are a leading global innovator and manufacturer of specialty materials for use in a broad range of products that make the world safer, cleaner and healthier. We design and manufacture versatile high performance materials that can be engineered to possess specific value-added characteristics, including absorbency, tensile strength, softness and barrier properties. We serve customers focused on personal care, infection prevention, and high performance solutions, where our products are critical components used in a broad array of consumer and commercial products. For personal care applications, we supply specialty materials essential to the performance and feel of disposable baby diapers, feminine hygiene products, adult incontinence products, personal wipes and fabric softening dryer sheets. For infection prevention applications, our materials are utilized in products designed to ensure a clean environment, including disinfectant wipes, surgical gowns and drapes, face masks, wound care sponges, and water, air and blood filters. For high performance solutions, we supply protective house wrap, industrial cable wrap, construction and agricultural geosynthetics, as well as components for home and bedding products, industrial cleaning wipes, and various other applications.

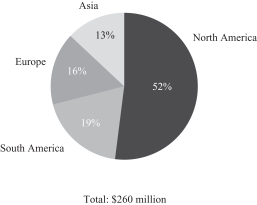

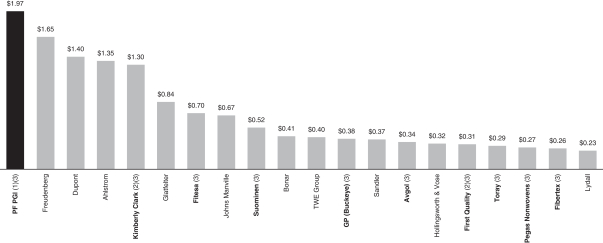

We primarily manufacture nonwovens, which are fabric-like, value-added materials produced from polypropylene and other resins, along with natural and synthetic fibers and other components. The total nonwovens industry size is estimated to be worth in excess of $30 billion globally in 2013 and is expected to grow at a compounded annual growth rate (“CAGR”) by volume of 6.6% from 2013 to 2018, according to Smithers Pira.

We are the largest global manufacturer of nonwovens based on our 2013 pro forma net sales, according to Nonwovens Industry. Over the past five years, we have undertaken a series of investments and acquisitions, including the Fiberweb Acquisition in November 2013 and the Providência Acquisition in June 2014, that have expanded our global presence, increased our product portfolio and broadened our technology base. As a result, we estimate that we generated approximately 70% of our 2014 pro forma net sales from applications for which we believe we have either the #1 or #2 position as measured by pro forma net sales or volume. We believe we have one of the largest global platforms in the nonwovens industry, with 22 manufacturing and converting facilities in 14 countries, including a significant presence in high-growth emerging markets such as South America and Asia. We have manufacturing capabilities in each of North America, South America, Europe and Asia, which we believe is a competitive advantage in serving our multi-national, blue-chip customers. Our manufacturing facilities are strategically located near the production facilities of many of our key customers in order to increase our effectiveness in addressing regional demand for our products, many of which do not ship economically over long distances.

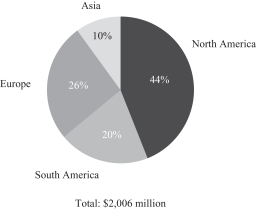

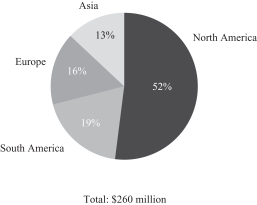

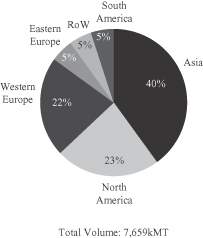

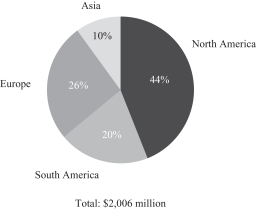

For the fiscal year ended December 31, 2014, on a pro forma basis, we generated net sales of $2,006 million, and net loss attributable to PGI Specialty Materials, Inc. of $121 million. For the year ended December 31, 2014, we generated pro forma Adjusted EBITDA of $260 million. For information about how we calculate

1

Table of Contents

Adjusted EBITDA, please see “Summary Historical and Pro Forma Condensed Combined Financial Information.” Our sales are geographically diversified, with 44% of our pro forma net sales generated in North America, 20% generated in South America, 26% generated in Europe and 10% generated in Asia, each for the year ended December 31, 2014.

Segment Overview

We manage our business through four reportable operating segments organized by geographic region: North America, South America, Europe and Asia. Each of our regional manufacturing facilities has a diverse range of capabilities and technologies to serve local demand trends and our customers’ specific requirements, which vary by region. Consequently, each of our regions serves a unique mix of customer applications; however, certain of our applications and customers are consistent across our regions. We believe that our ability to provide consistent, high-quality products across a variety of geographies is a strong competitive advantage in serving our global customers. In addition, our geographic breadth and broad range of applications reduce exposure to any one region, manufacturing facility, application, or customer.

North America

Our North America segment includes five manufacturing and converting facilities in the United States, one in Canada and one in Mexico. Our North America segment includes a broad array of product technologies, including our proprietary Reemay, Spinlace, Apex and TYPAR technologies, that collectively serve a wide spectrum of product applications. Within personal care, we believe we are a leading manufacturer of nonwovens for hygiene applications, such as baby diapers and feminine hygiene products, and substrates for fabric-softening dryer sheets, based on pro forma volume. Within infection prevention, we believe we are the largest provider of substrates for household cleaning wipes, based on pro forma volume, and a leading supplier of specialty materials for use in various medical garments, such as surgical gowns and drapes. Within high performance solutions, we believe we are the largest provider of filtration media for pool and spa filters, as well as the #1 provider of protective house wrap in Canada, based on pro forma volume, and the #2 provider in the United States.

South America

Our South America segment includes two manufacturing facilities in Brazil, one in Argentina and one in Colombia. This footprint enables us to efficiently serve the Caribbean and Central America, the Andean Community (CAN) and the Southern Common Market (MERCOSUR) economic trade zones. All of our facilities in the region utilize leading-edge spunmelt technology and specialize in serving personal care applications, such as baby diapers and feminine hygiene products. We believe consumer adoption of these products is expected to grow rapidly with disposable incomes rising towards the levels of developed economies. We believe we are the leading provider of nonwovens for personal care applications in South America, based on pro forma volume. Within high performance solutions, we also serve certain specialty agriculture and industrial customers in this region.

Europe

Our Europe segment includes two manufacturing facilities in the United Kingdom, two in France, and one in each of Germany, Italy, Spain and the Netherlands. Our Europe segment also includes our India joint venture with one manufacturing facility located in India. Our European segment includes our most diverse set of technologies, such as our proprietary S-tex spunmelt and hydroentanglement technologies, and serves a broad array of personal care, infection prevention and high performance solutions applications. We believe we are the leading global provider of industrial cable wrap and have significant positions in geosynthetics for civil engineering, landscape and military use. We also have meaningful positions in hygiene applications, such as baby diapers and adult incontinence products, and healthcare products, such as surgical drapes, blood filtration and face masks.

2

Table of Contents

Asia

Our Asia segment consists of two manufacturing facilities in China. Infection prevention applications currently represent approximately 60% of our pro forma net sales in Asia, with personal care applications accounting for 31% and high performance solutions applications accounting for the remaining 9%, for the fiscal year ended December 31, 2014. Our Asia region is the primary manufacturing base for servicing our global healthcare customers. For these applications, we supply our specialty materials to regional converters in Asia who cut and sew our products into finished goods for sale primarily in Europe and North America. In addition, we plan to utilize our leading-edge spunmelt technologies to participate in the rapid growth expected in the Asia region from rising disposable incomes and consumer adoption of personal care products.

|

2014 Pro Forma Net Sales by Geography |

2014 Pro Forma Adjusted EBITDA by Geography(1)(2) | |

|

| |

| (1) | For information about how we calculate pro forma Adjusted EBITDA, please see “Summary Historical and Pro Forma Condensed Combined Financial Information.” |

| (2) | Percentages in chart are presented before unallocated corporate expenses. |

Overview of Key Applications

We design and manufacture specialty materials, which are critical components used in various personal care, infection prevention and high performance solutions products that make the world safer, cleaner and healthier. Our customers include global manufacturers such as Procter & Gamble (diapers, feminine sanitary protection and dryer sheets), Kimberly-Clark (diapers, surgical drapes and face masks) and Cardinal Health (surgical drapes and medical accessories) and a number of regional manufacturers.

3

Table of Contents

While we manufacture specialty materials both for disposable applications (such as hygiene, healthcare, wipes and filtration) and durable applications (such as house wrap and geosynthetics), we believe we are an industry leader in serving disposable applications as measured by pro forma net sales or volume—which we believe are attractive due to the recurring nature of product sales, long-term secular growth trends driven by higher global incomes, and lower cyclicality with macroeconomic cycles. Disposable applications represented approximately 74% of our pro forma net sales in 2014.

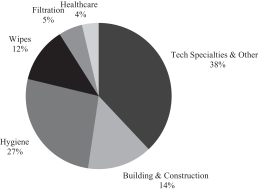

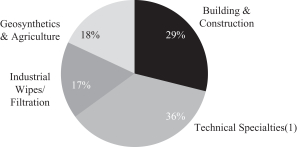

| 2014 Pro Forma Net Sales by Application |

|

The table below outlines our key product applications and related industry metrics.

| Key Applications |

% of 2014 Pro Forma Net Sales(1) |

Representative End Products |

Representative |

Product Application Estimated 2013 Size |

Product Application Projected Volume Growth 2013-2018(3) | |||||||

| (dollars in millions) | ||||||||||||

| Personal Care |

50% | Hygiene | Baby diapers, feminine hygiene products, adult incontinence products, and training pants | Kimberly-Clark, Procter & Gamble, SCA |

$8,549 | 6.3% | ||||||

| Dryer Sheets/Personal Wipes |

Dryer sheets and Personal wipes | Procter & Gamble, SC Johnson |

$1,689 | 5.1% | ||||||||

| Infection Prevention | 17% | Healthcare |

Surgical gowns and drapes, disposable surgical packs, face masks, shoe covers and wound care sponges and dressings |

Cardinal Healthcare, Halyard Health, Medline |

$1,148 | 5.1% | ||||||

| Filtration |

Air, water and blood filters |

3M, Pall | $541 | 6.6% | ||||||||

| Disinfectant Wipes |

Patient care & skin disinfectant wipes, hard surface wipes, sanitizer-compatible wipes |

Clorox, SC Johnson, Sysco | $387 | 7.0% | ||||||||

4

Table of Contents

| Key Applications |

% of 2014 Pro Forma Net Sales(1) |

Representative End Products |

Representative |

Product Application Estimated 2013 Size |

Product Application Projected Volume Growth 2013-2018(3) | |||||||

| (dollars in millions) | ||||||||||||

| High Performance Solutions |

33% | Building & Construction/ Geosynthetics & Agriculture |

House wrap, cable wrap, road underlayment liners, geo cells, tree protection | Regional Home-builders, CanSave, GAF, Suprema |

$4,058 | 7.4% | ||||||

| Industrial Wipes |

Auto/aero wipes, graphic arts, industrial general purpose wipes |

3M, Cintas | $849 | 7.0% | ||||||||

| Filtration |

Air, structure, and liquid filters, pool and spa filters |

Meissner, PALL | $2,309 | 6.6% | ||||||||

| Technical specialties and other |

Furniture and bedding, composites, other industrial applications |

Hanes, Simmons | $13,540 | 7.0% | ||||||||

Source: Smithers Pira.

| (1) | Gives pro forma effect to the Providência Acquisition, as if it had occurred on December 29, 2013. |

| (2) | Represents key industry participants in the applications indicated. Certain of such participants are not PGI customers. |

| (3) | Represents Smithers Pira’s projected compounded annual growth rate in volumes for global nonwoven demand for the indicated product applications from 2013 to 2018. |

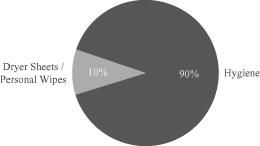

Personal Care

We manufacture specialty materials that are essential to the performance and feel of hygiene, dryer sheets and personal wipes applications. For hygiene applications, our products are engineered to provide critical performance characteristics including superior absorbency, barrier properties, strength, fit and softness in baby diapers, feminine hygiene products, adult incontinence products and training pants. Our broad product offering and global manufacturing base provides hygiene customers with a full range of these specialized components for their manufacturing facilities around the globe. We believe we are the leading global manufacturer of nonwovens for hygiene applications, based on pro forma volume.

To serve fabric-softening dryer sheet applications we sell products made with our proprietary Reemay technology that provides superior heat resistance and scent retention, which are critical to product performance and customer demands. We believe we are the primary supplier of these products to the two largest dryer sheet manufacturers in the United States.

Within wipes applications, our products serve as the key substrate for facial wipes and other personal cleansing wipes. Wipes producers rely on our specialty materials to enhance the durability, softness and liquid dispensability of their products.

5

Table of Contents

We frequently partner with industry leaders to jointly develop innovative products to meet changing consumer demands. We believe our ability to serve global manufacturers and provide specialty material consistently across geographical regions differentiates us from our competition.

| 2014 Personal Care Pro Forma Net Sales by Application |

|

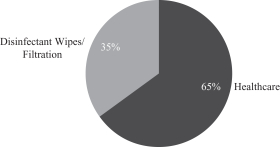

Infection Prevention

Our specialty materials are integral to many healthcare products that ensure a sterile environment by enhancing key performance characteristics such as barrier performance, breathability, strength and softness. Our healthcare products are used for the manufacture of disposable surgical packs, surgical gowns and drapes, face masks, shoe covers and wound care sponges. For these applications, our customers predominantly convert our specialty materials into their products in lower labor cost countries, such as China, for export to Western markets. We believe that our high-quality nonwoven manufacturing capabilities in China, strategically located near the manufacturing and converting operations of our customers, combined with our global position, provide a competitive advantage in serving these customers. We believe we are the leading global supplier of nonwovens for healthcare applications, based on pro forma volume.

We also provide substrates with superior absorbency, strength, softness or abrasiveness, durability and liquid dispensability for use in hard surface disinfectant wipes, patient care wipes and other infection prevention wipes. Our infection prevention wipes products include our Chicopee-branded converted wipes sold into foodservice channels to sanitize eating surfaces, as well as substrates sold to leading consumer products companies for conversion into hard surface disinfectant wipes for consumer use. We believe we are the leading North American supplier of materials for use in consumer disinfectant wipes, based on pro forma volume.

6

Table of Contents

Additionally, our specialty materials are critical to many filtration applications including blood, water and air filtration. We believe there are significant opportunities to expand our existing business in the areas of air filtration for HVAC applications, HEPA air filtration, as well as blood and water filtration.

| 2014 Infection Prevention Pro Forma Net Sales by Application |

|

High Performance Solutions

Numerous industrial and other applications make use of our specialty materials due to our ability to engineer characteristics such as strength and durability, barrier protection, breathability and insulation properties. High performance solutions applications include protective house wrap, industrial cable wrap, geosynthetics, products for agricultural uses, industrial wipes and various other specialty materials used in home furnishings and bedding, road underlayment, liners and railroad materials.

We believe we are a leading supplier of house wrap to home-builders in the United States and Canada. House wrap is a protective layer used to prevent moisture-related damage and enhance energy efficiency. Through our Typar brand, we believe that we are the #1 provider of house wrap in Canada, based on pro forma volume, and the #2 provider in the United States. As this application is linked both to new construction and renovation spending, we expect continued growth in this segment to the extent the housing market recovery continues.

We believe that we are also a leading supplier of industrial cable wrap in Europe. Cable wrap is a protective cover used for pipelines and cables to prevent damage to these critical infrastructure assets. In addition, we believe we are the leading provider of nonwoven substrates for pool and spa filtration applications in North America through our proprietary Reemay-branded technology based on pro forma volume.

Geosynthetics products include various specialty materials used to improve the performance and mitigate the environmental impact of civil engineering and construction projects. Geosynthetics also include products for military, forestry, agriculture and landscaping applications. Key brands in this category include Terram, Tubex, DefenCell and Agryl.

Our high performance solutions also include converted wipes sold under our Chicopee brand name for use in automotive, graphics arts and cleanroom wipes, materials for household and bedding applications, industrial filtration media and various other technical products.

7

Table of Contents

| 2014 High Performance Solutions Pro Forma Net Sales by Category |

|

| (1) | Includes materials for protective apparel, furniture and bedding, composites and other industrial durable and infrastructure applications. |

Our Competitive Strengths

Global Leader with Strong Competitive Positions

We are a leading global supplier of specialty materials and the largest global manufacturer of nonwovens based on our 2013 pro forma net sales, according to Nonwovens Industry. The nonwovens industry has experienced significant consolidation in recent years, including our own acquisitions of Fiberweb and Providência, which we believe has improved our competitive position and enhanced our opportunities for growth across each of our geographic regions.

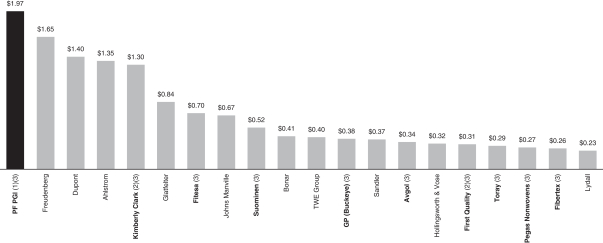

| 2013 Nonwovens Sales (in billions of $) |

|

Source: Nonwovens Industry.

| (1) | Includes $1.2 billion of revenue from PGI, $398 million of revenue from Fiberweb, and $360 million of revenue from Providência. |

| (2) | Production is primarily for internal consumption. |

| (3) | Represents companies primarily focused on nonwovens for disposable applications, such as hygiene, healthcare and wipes. |

8

Table of Contents

We estimate that we generated approximately 70% of our 2014 pro forma net sales from applications for which we believe we have either the #1 or #2 position as measured by pro forma net sales or volume. Specifically, we believe that we are an industry leader in serving disposable applications as measured by pro forma net sales or volume, which accounted for approximately 70% of our 2014 pro forma net sales. We also believe we are the leading global supplier of nonwovens for applications in personal care and healthcare, based on pro forma volume.

In addition, we believe that we have leading positions in a number of niche applications. We believe that we hold a leading position in pool and spa filtration in the United States through our Reemay branded products, which are sold to filter manufacturers. We also believe that we are the leading manufacturer of substrates for dryer sheets in the United States. Through our Typar brand, we believe that we are the #1 provider of house wrap in Canada, based on pro forma volume, and the #2 provider in the United States. As we continue to evolve to higher value specialty materials, we believe there is meaningful opportunity to grow in each of the key applications which we serve: personal care, infection prevention and high performance solutions. We believe that our innovative and differentiated technology platforms position us well to gain share in these applications as we work to broaden the use of our products.

Our market positions in numerous applications are a reflection of our differentiated technologies, customer service and global footprint. These capabilities enable us to effectively serve global customers, such as Procter & Gamble and Cardinal Health, who are among the industry leaders in their respective product applications. Our marketing and research and development teams collaborate closely with customers to develop new products through the application of new technologies, as well as meet our customers’ stringent product qualifications and process standards. These factors encourage customer loyalty, leading to an average relationship length of approximately 15 years with our key customers.

Attractive Long-Term Industry Growth Outlook Driven by Socio-Economic Trends

According to Smithers Pira, global demand for nonwovens is projected to grow at a CAGR of 6.6% by volume from 2013 to 2018 driven by several socio-economic trends, including overall population growth, a growing middle class in emerging markets, an aging population, increasing health standards, product innovation and agricultural efficiency. These trends favorably impact the various applications which we serve. For example, population growth and rising incomes impact the consumption of personal care products, such as baby diapers and wipes. In addition, increasing life expectancy and an aging population in many developed countries present a growing opportunity for adult incontinence and healthcare products. For example, the market for adult incontinence products, which uses up to 60% more of our specialty materials than baby diapers, was estimated at $2.4 billion in 2013 and is expected to grow to $3.4 billion in 2018. Increasingly stringent health standards and consumer focus on infection prevention are also driving greater consumption of disposable medical gowns, drapes, face masks, sanitary wipes and disinfectant wipes. Our specialty materials also serve a number of attractive niche applications, such as house wrap, industrial cable wrap and geosynthetics, which could benefit from a recovery in construction spending.

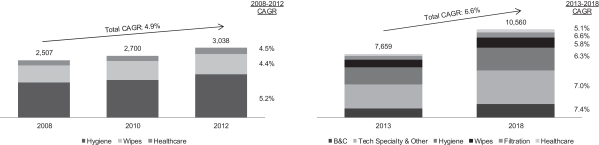

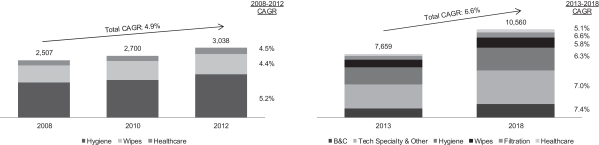

Our specialty materials are primarily used to manufacture disposable products, which accounted for approximately 74% of our pro forma net sales for the fiscal year ended December 31, 2014. We believe disposable products, such as baby diapers and medical gowns, have attractive long-term growth trends and are less cyclical than durable products, strengthening our financial profile through economic cycles (as demonstrated in the table below by the sale volumes of disposable products from 2008 to 2012). We believe that this resilience, combined with the diversification of our revenues across regions and applications, enhance our long-term financial profile and mitigates the risk of disruptions within any region, application, facility or customer.

9

Table of Contents

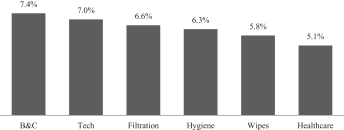

| Historical Disposable Application Growth | Expected Nonwoven Application Growth

|

Source: Smithers Pira.

| (1) | Wipes end market comprises personal wipes, dryer sheets, disinfectant wipes and industrial wipes. |

| (2) | Filtration end market includes medical and industrial filtration applications. |

Significant Exposure to Attractive Emerging Markets

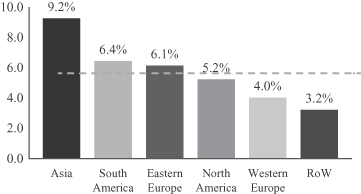

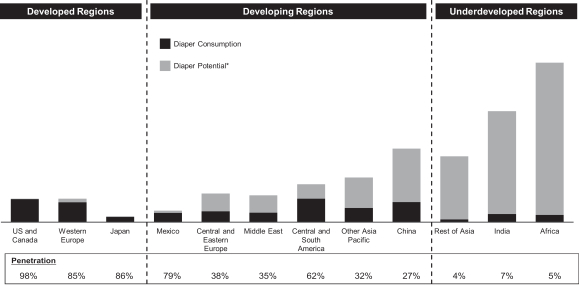

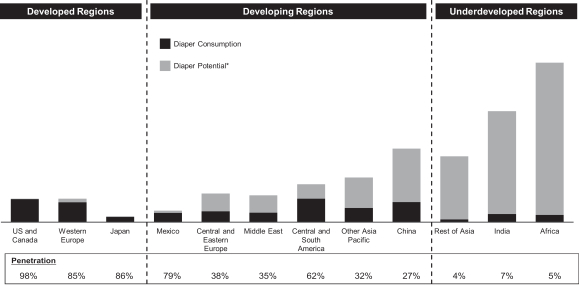

We believe that emerging markets represent a significant long-term secular growth opportunity for our specialty materials, especially in personal care applications. In many emerging markets, penetration rates for personal care products that utilize specialty nonwoven materials, such as disposable baby diapers, are significantly lower relative to developed markets. For example, the penetration of baby diapers is only 27% in China and 62% in Central and South America, compared to 98% in the United States and Canada, according to Price Hanna Consultants estimates. We believe growth will be driven by increasing disposable product penetration resulting from rising per capita incomes as well as population growth. According to Smithers Pira, total nonwovens volume demand in South America and Asia is projected to grow at a CAGR of 6.4% and 9.2%, respectively, from 2013 to 2018.

10

Table of Contents

The chart below contrasts the high penetration rates in developed regions in diaper consumption with the significantly lower current penetration rates seen in developing markets, which present a sizable growth opportunity. According to Smithers Pira, a 1% increase in the penetration rate of disposable diapers in China in 2013 would result in approximately $30 million of incremental materials market value, assuming current product design and pricing. Additionally, under-developed regions, such as India, Africa, and other emerging markets in Asia, represent additional longer-term growth opportunities.

| 2012 Actual and Estimated Potential Diaper Consumption by Region (in Billions of Diapers) |

|

Source: Price Hanna Consultants estimates.

| * | Represents potential market size if these regions achieve a penetration rate of 100%. Actual future penetration rates will vary. |

We believe that we are well-positioned to capitalize on this anticipated demand. The Providência Acquisition strengthened our presence in South America, providing us with the #1 nonwovens position in the region, based on pro forma volume, and two attractive manufacturing assets in Brazil to complement our existing production facilities in Colombia and Argentina. Pro forma for the Providência Acquisition, we are the leading manufacturer of nonwovens for hygiene and medical products in the region. Additionally, recent capacity expansions in Nanhai, China (expected to be completed in 2015) and Suzhou, China (completed in mid-2013) have enhanced our manufacturing capabilities in Asia. In 2014, we derived approximately 30% of our pro forma net sales and 32% of our Adjusted EBITDA from our South America and Asia segments.

Scalable Cost Structure and Operational Excellence To Drive Margin Expansion

Our scalable global infrastructure and focus on operational excellence position us to reduce our costs and increase our operating margins as we expand both organically and through acquisitions. We have increased our gross profit margin and Adjusted EBITDA margin from 15.5% and 11.8%, respectively, in 2011 on a stand alone basis to 17.9% and 13.0%, respectively, for the year ended December 31, 2014, on a pro forma basis. We have achieved this margin expansion through a combination of annual productivity and cost saving initiatives as well as realization of cost synergies associated with our recent acquisitions. For example, as of December 31, 2014, we have fully implemented initiatives at Fiberweb accounting for approximately $39.2 million of annualized

11

Table of Contents

savings (above our initial estimates of $28 million) and we continue to pursue initiatives aimed at achieving additional savings. Likewise, we have also identified initiatives that are estimated to generate meaningful synergies in connection with the Providência Acquisition.

In addition to executing on the identified acquisition synergies, we have recently implemented a robust business excellence program designed to generate annual productivity savings, achieve a low-cost position and prolong the useful life of our assets through product and process innovation. These initiatives have included continuous improvement programs focused on procurement, manufacturing, and distribution costs, facility consolidation and optimization, and optimization of our fixed cost structure. For example, in 2012, we restructured our global operations in order to consolidate our global footprint, align resources and capabilities with future growth opportunities, and provide a more efficient structure to serve existing customers. We believe we have the opportunity to continue to accelerate our annual productivity savings, which would serve to offset inflation in our business and benefit our margins.

Strong Free Cash Flow Generation

For the years ended December 29, 2012, December 28, 2013 and December 31, 2014, we have consistently generated strong free cash flow, which we define as Adjusted EBITDA minus capital expenditures, of $78.0 million, $155.8 million and $177.5 million, respectively. For the same periods, our net cash provided by operating activities was $75.5 million, $16.9 million and $49.1 million, respectively. Our strong cash flow generation has benefited from pass-through pricing mechanisms in many of our customer contracts, which allow us to pass through increases in certain raw material costs by changing our prices, thereby mitigating the potential impact of fluctuations in raw material costs on our profitability.

Our cash flow generation also benefits from our disciplined approach to capital investments. We believe our maintenance capital requirements (defined as investments required to maintain current production capabilities) range from 2.0% to 2.5% of our annual net sales, enabling us to deploy a meaningful portion of our capital investments toward projects designed to expand our capacity and/or capabilities or to reduce our operating costs. For instance, over the past five years, we have commercialized four new state-of-the-art spunmelt lines to expand our capacity to meet growing demand as well as realize their lower relative production cost per unit and their ability to produce lower basis weight products suited for certain hygiene applications. Additionally, we have invested in commercializing proprietary technologies, such as our Spinlace and Arium platforms, that provide differentiated product capability and cost performance. Our cash flow generation in the future may also benefit from our significant net operating losses, which were $284.1 million for the year ended December 31, 2014 and may result in reduced U.S. tax payments in the future.

Successful Track Record of Value-Enhancing Acquisitions

We have completed two significant acquisitions, Providência and Fiberweb, which enhanced our competitive position by expanding our capabilities in existing regions (like the US and Europe) and new regions (such as Brazil). These acquisitions also enhanced our technology positions in several new applications, such as filtration, where we believe there are significant growth opportunities. Additionally, given our scalable global infrastructure, we believe these acquisitions will result in meaningful cost savings and enhance our operating margins.

The Providência Acquisition was completed in June 2014 and strengthened our competitive position in North and South America. With three well-invested manufacturing facilities (two in Brazil and one in the United States) focused on hygiene applications, Providência’s operations were highly complementary with our existing operations. In particular, as a result of the acquisition, we are the largest producer of nonwovens in South

12

Table of Contents

America, with facilities in Brazil, Argentina and Colombia that enable us to cost-effectively serve customers across the continent. We have begun the integration of Providência into our existing regional operations and expect to generate meaningful cost savings from the elimination of duplicative costs, implementation of best practices, and by leveraging our enhanced scale.

The Fiberweb Acquisition was completed in November 2013. With operations in North America and Europe, Fiberweb improved our capabilities in several existing applications (such as hygiene and healthcare) but also meaningfully expanded our positions in several complementary applications, such as filtration, dryer sheets and house wrap. Fiberweb also provided access to several new technologies such as S-Tex (hygiene) and Nano fiber (filtration), which offer differentiated products to address our customers’ needs for innovation and customized solutions. Fiberweb has been fully integrated into our European and North American regions and we believe will generate significant cost savings, in excess of our initial estimates. As of December 31, 2014, we have fully implemented initiatives at Fiberweb accounting for approximately $39.2 million of annualized savings (above our initial estimates of $28 million).

Experienced Management Team

Our senior management team has extensive industry and operational experience and has been instrumental in developing and executing our growth strategy. Our nine person senior management team has an average of over 20 years of experience, including significant experience with specialty materials and similar businesses, and has successfully integrated numerous acquisitions. Our Chief Executive Officer, J. Joel Hackney Jr., who joined us in 2013 after holding a variety of senior executive roles with General Electric, Nortel and Avaya, has 21 years of relevant experience, including significant experience with leading global organizations and executing organic and acquisition-driven growth programs. Since mid-2012, we have successfully implemented an enhanced business strategy designed to significantly expand our business, both organically and through acquisitions, and to improve our cost structure and capital efficiency. We believe the proven abilities of our senior management team will allow us to continue to execute on our strategy, grow our global business, and deliver value to our stakeholders.

Our Strategy

Our mission is to provide superior products and services to enable our customers to create a safer, cleaner and healthier world. By leveraging our global team and broad portfolio of assets and technologies, we engineer customized solutions to meet our customers’ needs. We are focused on supplying consistent high quality products from our global manufacturing footprint, supported by knowledgeable local sales and technical service teams. We believe that our global presence and breadth of application expertise (further enhanced by the recent acquisitions of Fiberweb and Providência) provide a strong foundation for us to grow with our existing customers across the globe as well as for enhanced access to new customers across an array of highly specialized applications. As a result, we strive to grow our revenues consistent with the demand growth of the applications which we serve, while enhancing our operating efficiencies to improve our margins. To accomplish our mission and drive continued success, we are focused on the following strategies:

Support Continued Growth of Our Existing Customers Globally

We will invest to support the continued growth of our existing customers across the globe. As previously discussed, many of our customers’ products benefit from attractive growth trends and, consequently, our customers demand an increasing amount of our specialty materials. We will seek to enhance our competitive positions by providing cutting edge innovations, high quality and cost-effective products, and dedicated customer service. We will do so through initiatives to expand the production capacity of our current asset base as well as prudent capital investments to expand our capabilities. Many of our customers are increasingly growing their business globally, and we believe we are well positioned to gain share with these customers given our global presence and ability to reliably deliver consistent products across the globe.

13

Table of Contents

Further Strengthen our Positions in Emerging Markets

We intend to establish stronger positions in emerging markets through partnerships with new customers, as well as by accelerating growth with existing accounts where we are viewed as a strategic supplier. For example, the Providência Acquisition enhanced our position in South America, particularly Brazil, where we are now the leading supplier of hygiene products to a broad and long standing customer base. Additionally, in China, we have recently made significant capital investments in new production capacity designed to meet the growing demand for our products. In 2014, we generated 30% of our net sales and 32% of our Adjusted EBITDA in South America and Asia, respectively, on a pro forma basis. We believe there will be significant growth in our existing markets in South America and Asia. Additionally, in the future, we believe there may be growth opportunities in currently under-developed regions, where current penetration rates for many of the applications we serve are lower compared to other regions. As these emerging markets develop, we will continue to make careful, disciplined investments to expand our global capabilities and operations.

Pursue Growth in Complementary Businesses

We intend to use our industry expertise and capabilities to pursue growth opportunities in complementary products that share one or more key characteristics with our core businesses, including customers, products, manufacturing technologies or supply chain. We will prioritize opportunities in higher value applications with greater product differentiation, higher margins and lower capital intensity. For example, the Fiberweb Acquisition resulted in a significant improvement in our standing in several complementary applications, including filtration, dryer sheets and house wrap. By leveraging Fiberweb’s position and certain of our existing technologies and capabilities, we believe there may be opportunities to expand in these adjacent applications. We may pursue these opportunities organically or through targeted acquisitions depending on the specific industry dynamics and required capabilities.

Drive Business Excellence to Pursue Economic Leadership and Enhance Margins

Our success is dependent upon our ability to offer an attractive value proposition to our customers and to maximize customer satisfaction through our innovation, product quality and reliability. Consequently, we will seek to use our global platform and capabilities to offer solutions which maximize customers’ value and streamline their operations. We will also seek to improve our supply chain management to improve our cost position. We will seek to accelerate our business excellence initiatives to generate recurring annual productivity savings to offset inflation, enable reinvestment in growth, and improve our margins. These initiatives are focused on procurement savings, manufacturing yield optimization, lean initiatives, preventative maintenance and logistics savings. Over the past three years, we have increased our gross profit margin and Adjusted EBITDA margin from 15.5% and 11.8%, respectively, in 2011 on a stand alone basis to 17.9% and 13.0%, respectively, for the year ended December 31, 2014, on a pro forma basis. Through the realization of acquisition-related cost savings and our business excellence initiatives, we plan to continue to pursue improved cost positions and operating margins in the future.

Opportunistically Pursue Value-Enhancing Acquisitions

The nonwovens industry has experienced significant consolidation in recent years, including our acquisitions of Fiberweb and Providência. However, the industry remains relatively fragmented with many smaller regional players. In the future, we will continue to opportunistically evaluate potential acquisitions that enhance our business. We will prioritize transactions that complement our existing businesses, offer a potential for meaningful cost savings, enhance our capabilities in complementary products or regions or improve our growth profile by leveraging our existing customer relationships, technologies, global manufacturing and distribution network, and expertise in engineered materials.

14

Table of Contents

Develop and Attract Top Talent

We strive to attract and develop the best talent in the industry. We work as a team to make a positive impact to our organization, our customers and suppliers, and the community. We believe that our history of growth and innovation coupled with our strong global position will highlight the Company as an attractive career opportunity for talented business leaders. Over the past several years, we have redesigned our global organization structure and significantly enhanced the senior leadership team adding resources and capabilities in several key areas to address our strategic growth priorities.

Recent Acquisitions

We have recently completed two significant acquisitions. On June 11, 2014, Acquisition Co., our wholly-owned subsidiary, completed the acquisition of approximately 71.25% of the outstanding capital stock of Providência and on November 15, 2013, PGI Acquisition Limited, our indirect wholly-owned subsidiary, completed the acquisition of the entire issued ordinary share capital of Fiberweb. As required by Brazilian law, we intend to launch, subject to CVM approval, the Mandatory Tender Offer to acquire the remaining outstanding capital stock of Providência from the minority shareholders. See “Business—Expansion and Optimization—Providência Acquisition.”

Providência is a leading manufacturer of spunmelt nonwoven products based in Brazil, with a presence throughout the Americas, offering nonwoven fabrics under the KAMI brand. Its products are primarily used in hygienic and personal care applications, such as disposable diapers, sanitary pads, cleansing tissues and adult incontinence products. Providência operates state-of-the-art spunmelt technology, utilizing 13 Reicofil lines situated in three sites in North and South America. Providência was founded in 1963 and is based in São José dos Pinhais, Brazil. Following the completion of the Providência acquisition, Herminio Vicente Smania de Freitas joined PGI as President—South America & Global Hygiene. He continues to serve as chief executive officer of Providência.

The Providência Acquisition strengthened our competitive position in North and South America. With three well-invested manufacturing facilities (two in Brazil and one in the United States) focused on hygiene applications, Providência’s operations were highly complementary with our existing operations. In particular, as a result of the acquisition, we became the largest producer of nonwovens in South America, with facilities in Brazil, Argentina and Colombia that enable us to cost-effectively serve customers across the continent. We have begun the integration of Providência into our existing regional operations and expect to generate meaningful cost savings from the elimination of duplicative costs, implementation of best practices, and by leveraging our enhanced scale.

Fiberweb is one of the largest global manufacturers of specialized technical fabrics with eight production sites in six countries. Fiberweb creates specialty materials that are found in many critical applications, including hygiene and healthcare, as well as house wrap, filtration, dryer sheets, and several other specialized niche applications. In each area, Fiberweb helps its customers meet a range of technical challenges from precise filtration to reducing the energy demands of housing.

With operations in North America and Europe, Fiberweb improved our capabilities in several existing applications (such as hygiene and healthcare) but also meaningfully expanded our positions in several complementary applications, such as filtration, dryer sheets, and house wrap. Fiberweb also provided access to several new technologies such as S-Tex (hygiene) and Nano fiber (filtration), which offer differentiated products to address our customers’ needs for innovation and customized solutions. Fiberweb has been fully integrated into our European and North American regions and we believe will generate significant cost savings, in excess of our initial estimates. As of December 31, 2014, we have fully implemented initiatives at Fiberweb accounting for approximately $39.2 million of annualized savings (above our initial estimates of $28 million).

15

Table of Contents

Recent Developments

Dounor Acquisition

On March 25, 2015, we announced that PGI France Holdings SAS, our wholly-owned subsidiary, entered into an agreement to acquire Dounor SAS (“Dounor”), a French manufacturer of materials used in hygiene, healthcare and industrial applications. The acquisition of Dounor was completed on April 17, 2015 using the proceeds from borrowings under an incremental amendment (the “Second Incremental Amendment”) to the Company’s existing Term Loan Facility.

Term Loan Facility Amendment

On April 17, 2015, PGI Group entered into the Second Incremental Amendment. Pursuant to the Second Incremental Amendment, PGI Group obtained $283.0 million of commitments for incremental term loans (the “2015 Additional Term Loans”). A portion of the proceeds of the 2015 Additional Term Loans were used to fund the consideration due in respect of the previously announced acquisition of Dounor. The remaining proceeds are expected to be used to redeem $200.0 million outstanding principal amount of the PGI Group’s outstanding Senior Secured Notes, to pay related fees and expenses (including the redemption premium) and for general corporate purposes.

Redemption of Senior Secured Notes

On April 8, 2015, PGI Group issued a conditional notice of its election to redeem $200.0 million of the outstanding principal amount of its Senior Secured Notes. The Senior Secured Notes are expected to be redeemed on May 8, 2015 (the “Redemption Date”) at a redemption price of 103.875% of the principal amount thereof, plus accrued and unpaid interest on the Senior Secured Notes to, but excluding, the Redemption Date.

Risks Related to Our Business

Investing in our common stock involves substantial risks, and our ability to successfully operate our business and execute our growth plan is subject to numerous risks. Some of the more significant challenges and risks include the following:

| • | the specialized markets in which we sell our products are highly competitive and we may therefore have difficulty growing our business and maintaining profit margins; |

| • | we must continue to invest significant resources in developing innovative products in order to maintain a competitive edge in the highly specialized markets in which we operate; |

| • | increases in prices for raw materials and energy, as well as a reduction of our selling prices to customers could reduce our profit margins; |

| • | a material disruption at one of our manufacturing facilities could prevent us from meeting customer demand, reduce our sales or negatively affect our results of operation and financial condition; |

| • | we rely on a limited number of suppliers to provide raw materials, significant machinery and components used in our production facilities. A material interruption in supply or delivery could prevent or limit our ability to accept and fill orders for our products; |

| • | we generate most of our revenue from the sale of manufactured products that are used in a wide variety of consumer and industrial applications and the potential for product liability exposure could be significant; |

| • | goodwill and other identifiable intangible assets represent a significant portion of our total assets, and we may never realize the full value of our intangible assets; |

| • | our substantial indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under our indebtedness; |

16

Table of Contents

| • | affiliates of our Sponsor control us and have the ability to elect all of the members of our Board of Directors; the Sponsor’s interests may conflict with ours or yours in the future; and |

| • | other factors set forth under “Risk Factors” in this prospectus. |

Corporate Information

PGI Specialty Materials, Inc. was incorporated under the laws of the State of Delaware in November 22, 2010. PGI Specialty Materials, Inc.’s only material asset is the equity of Holdings, sole equityholder of PGI Group, through which we conduct our operations. Our principal executive office is located at 9335 Harris Corners Parkway, Suite 300, Charlotte, North Carolina. Our telephone number is (704) 697-5100.

Our Sponsor

Blackstone (NYSE: BX) is one of the world’s leading investment firms. Blackstone’s asset management businesses, with approximately $310 billion in assets under management as of March 31, 2015, include investment vehicles focused on private equity, real estate, public debt and equity, non-investment grade credit, real assets and secondary funds, all on a global basis. Blackstone also provides various financial advisory services, including financial and strategic advisory, restructuring and reorganization advisory and fund placement services.

Immediately after the offering of our common stock, affiliates of Blackstone will beneficially own approximately % of our common stock or approximately % if the underwriters exercise in full their option to purchase additional shares.

17

Table of Contents

| Common stock offered by us |

shares. |

| Option to purchase additional shares |

The underwriters have an option to purchase up to additional shares of our common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Common stock outstanding after giving effect to this offering |

shares ( shares if the underwriters exercise their option to purchase additional shares in full). |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting estimated underwriting discounts and estimated offering expenses payable by us, will be approximately $ , based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus. |

| We intend to use the net proceeds from this offering to redeem $ aggregate principal amount of the Senior Secured Notes and to pay a $ million one-time Advisory Agreement termination fee to our Sponsor, with any remaining balance to be used for general corporate purposes. See “Use of Proceeds.” |

| Dividend policy |

We have no current plans to pay dividends on our common stock. Any decision to declare and pay dividends in the future will be made at the sole discretion of our Board of Directors and will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions in the agreements governing our indebtedness and other obligations, and other factors that our Board of Directors may deem relevant. |

| Risk factors |

See “Risk Factors” for a discussion of risks you should carefully consider before deciding to invest in our common stock. |

| Proposed NYSE trading symbol |

“ ” |

The number of shares of our common stock to be outstanding immediately after the consummation of this offering is based on shares of common stock outstanding as of , and excludes:

| • | shares of common stock issuable upon the exercise of options to purchase shares outstanding as of , at a weighted average exercise of $ per share; |

| • | shares of common stock issuable pursuant to restricted stock units as of , ; and |

| • | shares of common stock reserved for future issuance following this offering under our equity plans. |

18

Table of Contents

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus:

| • | assumes (1) no exercise of the underwriters’ option to purchase additional shares and (2) an initial public offering price of $ per share, which is the mid-point of the range set forth on the cover page of this prospectus; |

| • | reflects a for one stock split of our common stock, to be effected prior to the consummation of this offering; and |

| • | assumes the filing and effectiveness of our amended and restated certificate of incorporation immediately prior to the consummation of this offering. |

19

Table of Contents

SUMMARY HISTORICAL AND PRO FORMA CONDENSED COMBINED

FINANCIAL INFORMATION