Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PARK NATIONAL CORP /OH/ | prk-20150427x8xk.htm |

ANNUAL MEETING OF SHAREHOLDERS April 27, 2015 1

Safe Harbor Statement Park cautions that any forward-looking statements contained in this presentation or made by management of Park are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include, without limitation: Park's ability to execute our business plan successfully and within the expected timeframe; general economic and financial market conditions, specifically in the real estate markets and the credit markets, either nationally or in the states in which Park and our subsidiaries do business, may experience a slowing or reversal of the current economic expansion in addition to continuing residual effects of recessionary conditions and an uneven spread of positive impacts of recovery on the economy and our counterparties, including adverse impacts on demand for loan, deposit and other financial services, delinquencies, defaults and counterparty ability to meet credit and other obligations; changes in interest rates and prices may adversely impact the value of securities, loans, deposits and other financial instruments and the interest rate sensitivity of our consolidated balance sheet as well as reduce interest margins; changes in consumer spending, borrowing and saving habits, whether due to changing business and economic conditions, legislative and regulatory initiatives, or other factors; changes in customers', suppliers' and other counterparties' performance and creditworthiness; asset/liability repricing risks and liquidity risks; our liquidity requirements could be adversely affected by changes to regulations governing bank capital and liquidity standards as well as by changes in our assets and liabilities; competitive factors among financial services organizations could increase significantly, including product and pricing pressures, changes to third-party relationships and our ability to attract, develop and retain qualified bank professionals; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; the nature, timing and effect of changes in banking regulations or other regulatory or legislative requirements affecting the respective businesses of Park and our subsidiaries, including changes in laws and regulations concerning taxes, pensions, bankruptcy, consumer protection, accounting, banking, securities and other aspects of the financial services industry, specifically the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), as well as future regulations which will be adopted by the relevant regulatory agencies, including the Consumer Financial Protection Bureau, to implement the Dodd-Frank Act's provisions, the Budget Control Act of 2011, the American Taxpayer Relief Act of 2012 and the Basel III regulatory capital reforms; the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board, the SEC, the Public Company Accounting Oversight Board and other regulatory agencies, and the accuracy of our assumptions and estimates used to prepare our financial statements; the effect of trade, monetary, fiscal and other governmental policies of the U.S. federal government, including money supply and interest rate policies of the Federal Reserve; disruption in the liquidity and other functioning of U.S. financial markets; the impact on financial markets and the economy of any changes in the credit ratings of the U.S. Treasury obligations and other U.S. government-backed debt, as well as issues surrounding the levels of U.S. and European government debt and concerns regarding the creditworthiness of certain sovereign governments, supranationals and financial institutions in Europe; unfavorable resolution of legal proceedings or other claims and regulatory and other governmental examinations or other inquiries; the adequacy of our risk management program; the ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors and other service providers, including as a result of cyber attacks; demand for loans in the respective market areas served by Park and our subsidiaries; and other risk factors relating to the banking industry as detailed from time to time in Park's reports filed with the SEC including those described in "Item 1A. Risk Factors" of Part I of Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2014. Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law. 2

Park National Corporation Profile (as of March 31, 2015) • 11 Community Bank Divisions • 2 Specialty Finance Companies • One non-bank workout subsidiary • 29 Ohio counties • 116 bank offices • 6 specialty finance offices • 1,799 FTEs 3

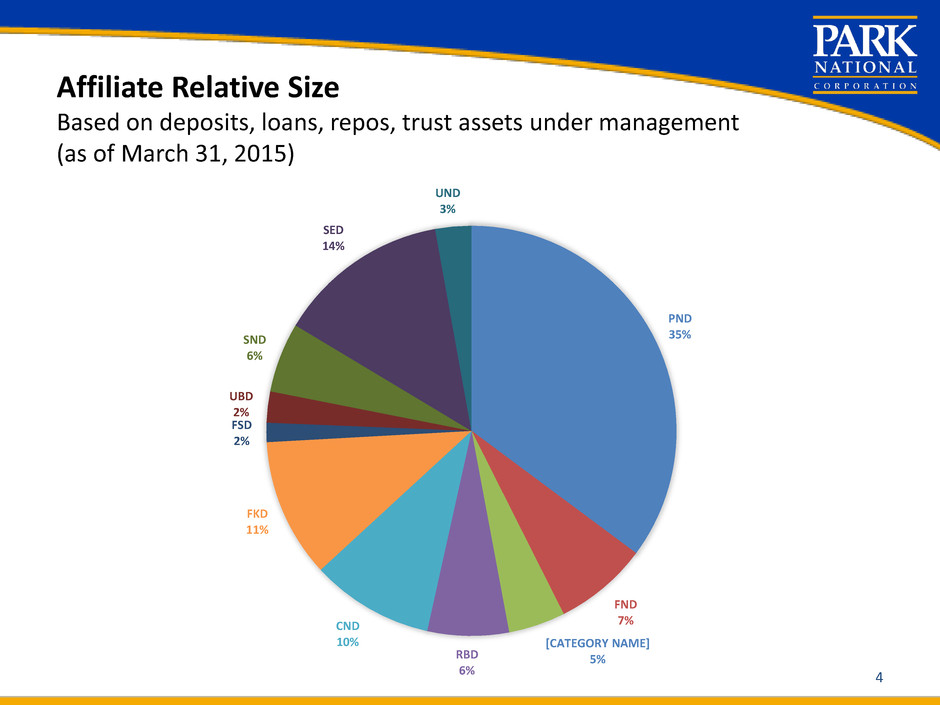

Affiliate Relative Size Based on deposits, loans, repos, trust assets under management (as of March 31, 2015) PND 35% FND 7% [CATEGORY NAME] 5% RBD 6% CND 10% FKD 11% FSD 2% UBD 2% SND 6% SED 14% UND 3% 4

Park National Corporation Consolidated Statements of Income Source: Company Filings 5 (in thousands) Dec. 31, 2013 Dec. 31, 2014 Mar. 31, 2014 Mar. 31, 2015 Net interest income $221,025 $225,044 $54,480 $55,535 Provision for (recovery of) loan losses 3,415 (7,333) (2,225) 1,632 Net interest income after provision for (recovery of) loan losses $217,610 $232,377 $56,705 $53,903 Non interest income 73,277 75,549 16,648 18,873 Non interest expense 181,515 187,510 45,779 45,720 Income before income taxes $109,372 $120,416 $27,574 $27,056 Income taxes 32,503 36,459 7,997 8,012 Net income $76,869 $83,957 $19,577 $19,044 Note: Prior period results were updated to reflect the January 1, 2015 adoption of Accounting Standards Update (ASU) 2014-01, Accounting for Investments in Qualified Affordable Housing Projects. The adoption of this ASU required retrospective application.

Net Income by Operating Segment Source: Company Filings 6 (in thousands) Dec. 31, 2013 Dec. 31, 2014 Mar. 31, 2014 Mar. 31, 2015 The Park National Bank $ 75,236 $ 82,907 $ 19,565 $19,159 Guardian Financial Services Company 2,888 1,175 604 281 PRK Parent Company (1,397) (5,050) (904) (694) Ohio-based operations $ 76,727 $ 79,032 $ 19,265 $ 18,746 SE Property Holdings, LLC 142 4,925 312 298 Total PRK $ 76,869 $ 83,957 $ 19,577 $ 19,044

Park National Corporation Consolidated Balance Sheets Source: Company Filings 7 (in millions) Dec. 31, 2013 Dec. 31, 2014 Mar. 31, 2015 Cash & cash equivalents $ 147 $ 238 $ 580 Investment securities 1,424 1,501 1,457 Loans 4,620 4,829 4,831 Allowance for loan losses (59) (54) (55) Other assets 506 487 491 Total assets $ 6,638 $ 7,001 $ 7,304 Non-interest bearing deposits $ 1,194 1,269 1,262 Interest bearing deposits 3,596 3,859 4,254 Total deposits $ 4,790 5,128 5,516 Total borrowings 1,133 1,108 1,019 Other liabilities 63 68 62 Stockholders’ equity 652 697 707 Total liabilities & stockholders’ equity $ 6,638 $ 7,001 $ 7,304

PRK Comparison to Peers Ratios at December 31 for each year Source: Company Filings and Sandler O’Neill, using SNL data of $3 billion to $10 billion bank holding companies PRK Price to Book % Peer Group Price to Book Value % PRK Price to Tangible Book Value % Peer Group Price to Tangible Book Value % PRK Price to Earnings Peer Group Price to Earnings PRK Dividend Yield Peer Group Dividend Yield 2014 195% 133% 218% 169% 16.2 16.3 4.3 2.0 2013 201% 136% 226% 178% 16.9 17.9 4.4 1.8 2012 153% 118% 172% 146% 13.2 13.8 5.8 2.8 2011 156% 109% 176% 135% 13.1 14.7 5.8 2.4 2010 177% 127% 202% 155% 21.1 17.8 5.2 2.1 2009 141% 105% 163% 140% 12.2 16.9 6.4 2.5 2008 183% 135% 217% 211% 14.6 15.7 5.3 2.9 2007 155% 138% 207% 206% 11.9 13.2 5.8 3.3 2006 242% 206% 280% 291% 14.7 17.1 3.8 2.3 2005 259% 204% 296% 268% 15.5 15.5 3.6 2.3 8

Total Return Performance Park National Corporation The total return stock performance graph depicts the yearly percentage change in Park’s cumulative total shareholder return over the latest 5-year fiscal periods. Calculations include the reinvestment of dividends and are indexed to the base year’s measurement point (closing price on last trading day before the beginning of the registrant’s fifth preceding fiscal year). Source: SNL 50 75 100 125 150 175 200 225 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 In d e x V a lu e Total Return Performance Park National Corporation NYSE MKT Composite NASDAQ Bank Stocks SNL Financial Bank and Thrift 9

Dividends Paid Dividends Paid Bank Division (counties in italics) 2010-2014 (5 years) 2005-2014 (10 years) Park National Bank (Licking & Franklin) $ 36,316,577 $ 88,767,123 First-Knox National Bank (Knox, Holmes & Morrow) 23,330,619 48,307,098 Security National Bank (Clark, Champaign, Fayette, Greene, Madison, & Warren) 10,960,866 24,992,854 Second National Bank (Darke & Mercer) 3,074,563 6,669,591 Century National Bank (Muskingum, Perry, Athens, Hocking, Coshocton & Tuscarawas) 2,457,160 5,365,205 Richland Bank (Richland) 1,298,459 2,702,115 United Bank, N.A. (Marion & Crawford) 1,135,658 2,885,711 Unity National Bank (Miami) 1,081,927 2,139,663 Fairfield National Bank (Fairfield) 860,309 1,671,966 Park National Bank of SW Ohio & Northern Kentucky (Hamilton, Butler & Clermont) 537,744 1,202,649 Farmers Bank (Ashland) 282,085 625,157 Other (Counties outside of PRK footprint) 63,076,698 196,364,555 Other (held by brokers) 156,549,334 198,585,314 $ 300,962,000 $ 580,279,000 Note: The table above presents the amount of dividends that have been paid to shareholders residing in the counties in which our divisions operate. 10

The Park National Bank Fiduciary Income and Asset Trends Source: Company Filings 11 14.0 15.0 16.0 17.0 18.0 19.0 20.0 3.00 3.50 4.00 4.50 12/31/2011 12/31/2012 12/31/2013 12/31/2014 (I n co m e in m ill io n s) (A sse ts in b ill io n s) Trust Assets (market value) (left Y axis) Fiduciary Income (right Y axis)

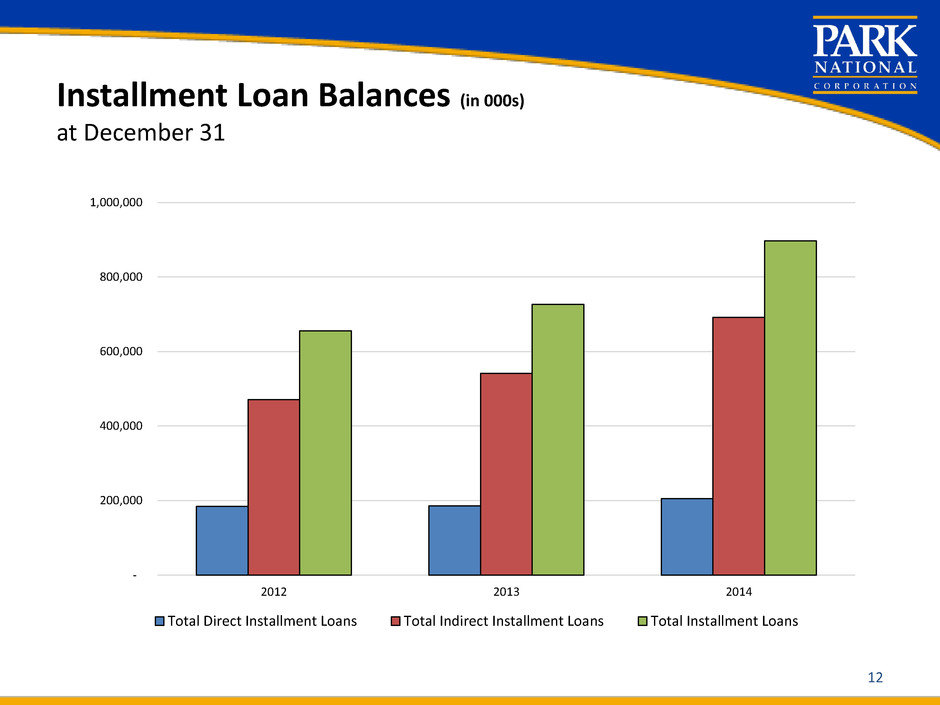

Installment Loan Balances (in 000s) at December 31 - 200,000 400,000 600,000 800,000 1,000,000 2012 2013 2014 Total Direct Installment Loans Total Indirect Installment Loans Total Installment Loans 12

Real Estate Loan Balances (in 000s) at December 31 1,000,000 1,050,000 1,100,000 1,150,000 1,200,000 1,250,000 2012 2013 2014 Real Estate Loans 13

Park National Corporation Nonperforming Assets Source: BHC Performance Report and Company Filings Peers include all bank holding companies nationwide with total assets between $3.0 and $10.0 billion Note: The Texas Ratio is calculated as total nonperforming assets divided by the sum of tangible common equity plus the allowance for loan losses. 14 (in thousands) Dec. 31, 2013 Dec. 31, 2014 Mar. 31, 2015 Total nonperforming loans $ 155,640 $ 119,288 $ 114,304 Other real estate owned (OREO) 34,636 22,605 26,337 Total nonperforming assets $ 190,276 $ 141,893 $ 140,641 Percentage of nonperforming loans to loans (PRK) 3.37% 2.47% 2.37% Percentage of nonperforming assets to loans + OREO (PRK) 4.09% 2.92% 2.90% Texas Ratio (PRK) 29.78% 20.85% 20.25% Peer Group Information Percentage of nonperforming loans to loans (Peer Group) 1.71% 1.14% Percentage of nonperforming assets to loans + OREO (Peer Group) 2.71% 1.94%

Vision Bank/SE Property Holdings, LLC Nonperforming Assets Source: Company Filings 15 (in thousands) Dec. 31, 2013 Dec. 31, 2014 Mar. 31, 2015 Nonaccrual loans $ 36,108 $ 22,916 $ 18,486 Accruing TDRs - 97 96 Loans past due 90 days or more (still accruing) - - - Total nonperforming loans $ 36,108 $ 23,013 $ 18,582 OREO 23,224 11,918 16,114 OREO – PNB participated - 3,175 5,615 Total nonperforming assets $ 59,332 $ 38,106 $ 40,311 PNB participations - Vision Bank nonperforming loans 12,304 8,359 5,959 Total Legacy Vision Bank nonperforming assets $ 71,636 $ 46,465 $ 46,269

22 16

Transactions Mobile Banking App vs. In-Person Transactions 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Mobile Banking Transactions 17 2,100,000 2,150,000 2,200,000 2,250,000 2,300,000 2,350,000 2,400,000 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 In-Person Transactions

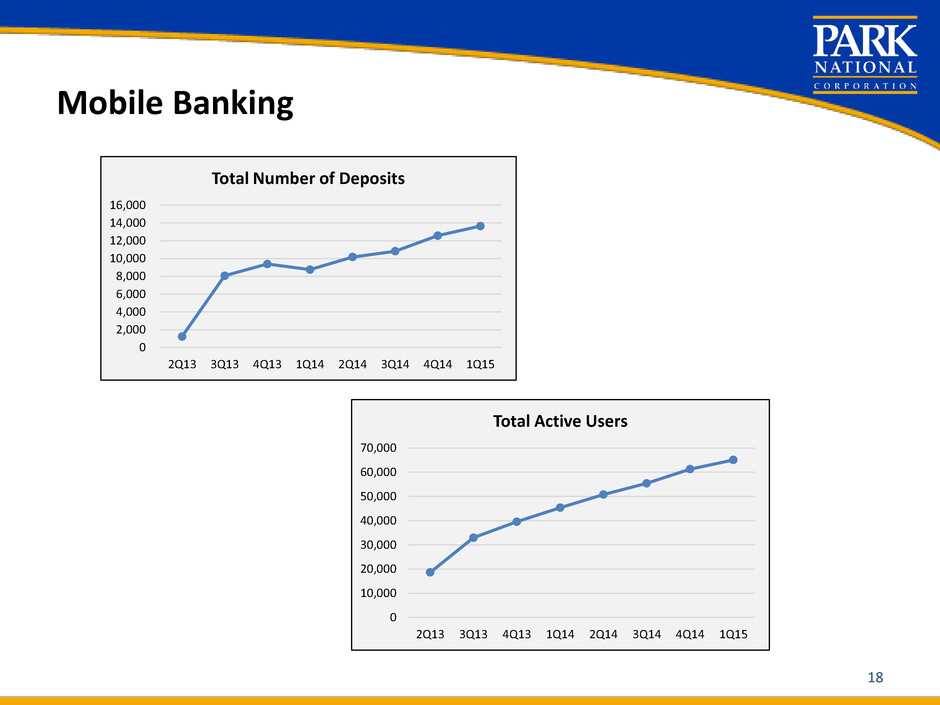

Mobile Banking 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Total Active Users 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Total Number of Deposits 18

Net Promoter Score Comparison of Results Financial Industry Includes direct banks, credit unions, community banks, regional banks and national banks. Average score for community banks is based on Bain/Research Now US Survey, 2013. 17 46 83 0 10 20 30 40 50 60 70 80 90 Financial Industry Average Community Bank Average PRK Affiliate Average World Class Companies 19

Net Promoter Score Source: 2014 Satmetrix, Net Promoter Industry Benchmarks PRK data as of 12/31/14 0 10 20 30 40 50 60 70 80 90 Banking: USAA Insurance: State Farm Tech: Apple iPhone Online Services: Amazon Online Services: Zappos Retail Stores: Costco Travel: Southwest Airlines PRK World Class Companies World Class Companies 20

The Park National Bank The bank of choice Headquarter Counties – Deposits (in thousands) Source: FDIC, June 30, 2014 Bank Division Year Joined Park Hdqtr. Co. Deposits as of 6/30/14 Total County Deposits as of 6/30/14 % of 2014 Market Share % of 2013 Market Share 2014 Headquarter County Market Share Rank 2013 Headquarter County Market Share Rank Park National 1908 $1,239,220 $2,115,889 58.57% 58.27% 1 1 Fairfield National 1985 401,853 1,875,451 21.43% 20.00% 1 1 Richland Bank 1987 485,952 1,715,231 28.33% 28.05% 1 1 Century National 1990 393,326 1,275,756 30.83% 31.27% 1 1 First-Knox National 1997 430,599 756,899 56.89% 56.80% 1 1 Second National 2000 247,829 1,038,191 23.87% 23.39% 2 2 Security National 2001 456,238 1,447,778 31.51% 32.12% 1 1 Seven largest OH divisions $3,655,017 $10,225,195 35.75% 35.30% Other OH divisions – headquarter counties 534,419 4,854,888 11.01% 11.50% Total OH divisions – headquarter counties $4,189,436 $15,080,083 27.78% 27.80% Remaining Ohio bank deposits $840,951 Total Ohio bank deposits $5,030,387 21

2014 PRK Agenda A. Grow consolidated net income; maintain dividend at historic rate B. Produce PRK ROAE in the upper quintile relative to peers C. Continued reduction of SEPH nonperforming assets D. Reduce PNB nonperforming assets E. Grow quality loans; expand relationships with existing customers F. Maintain or improve all regulatory ratings G. Resolve overcrowded conditions in operations centers H. Analyze and review M&A opportunities 22

2015 PRK Agenda A. Consolidated Net Income => $85 million B. Maintain common dividend at historic rate C. Perform in upper quintile of $3-$10 billion bank holding company peer group D. Reduce SEPH troubled assets to $20 million by 12/31/2015 E. Maintain or improve all regulatory ratings F. Maintain => 85% of key risk indicators in green condition G. Establish and/or maintain contact with M&A prospects; review M&A possibilities as they emerge 23

ANNUAL MEETING OF SHAREHOLDERS April 27, 2015 24