UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2015

CYPRESS SEMICONDUCTOR CORPORATION

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| 1– 10079 | 94-2885898 | |

| (Commission File Number) |

(IRS Employer Identification Number) |

198 Champion Court San Jose, California 95134-1599

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (408) 943-2600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Compensatory Arrangements of Certain Officers

2015 Performance-based Restricted Stock (“PARS”) Program

On March 3, 2015, the Compensation Committee of Cypress Semiconductor Corporation (the “Company” or “Cypress”) approved the issuance of certain performance-based and service-based restricted stock units to the Company’s Named Executive Officers, who are listed in the compensation tables of the Company’s Proxy Statement filed with the Securities and Exchange Commission on April 1, 2015, under the Company’s 2015 Performance Accelerated Restricted Stock, or PARS, Program (the “2015 PARS Program”).

In response to shareholder feedback, the Company is continuing to evolve our PARS Program to make a majority of equity grants performance-based and based on transparent metrics for shareholders, and to lengthen the time period over which performance-based and service-based awards vest. For 2015, we have significantly streamlined and revised the PARS Program, such that:

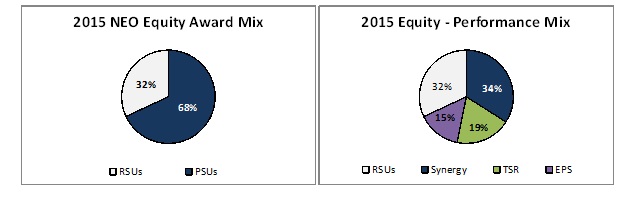

| • | Approximately 68% of the 2015 grants are in the form of performance-based restricted stock units (“PSUs”) which vest based on achievement of three performance milestones: |

| • | Cypress’s total shareholder return (“TSR”) relative to the Company’s peer group in each of the next three years; |

| • | Achievement of synergy (cost savings) goals related to the merger with Spansion Inc. in each of the next three years; and |

| • | Achievement of earnings per share (“EPS”) goals in each of the next three years. |

| • | The remaining approximately 32% of the 2015 grants are in the form of restricted stock units (“RSUs”) which vest based on continued employment with the Company over three years. |

The percentages above and the charts below show the mix of awards between performance and service-based as well as the mix between the various performance milestones for the Named Executive Officers, other than for Mr. McCranie who received only RSU grants for 2015.

Additionally, approximately 57% of the PSUs for the Named Executive Officers are eligible to vest two or more years after the date of grant.

Each of the performance milestones are described in greater detail below.

TSR Milestones

TSR will be measured relative to the Company’s compensation peer group for each of three performance periods. As we are in the process of transitioning to a longer performance measurement period, a series of one, two and three year periods will be used to phase-in the awards.

In each performance period, Cypress’s TSR must be above the 25th percentile of the peer group before any Named Executive Officer will earn any PSUs. If Cypress’s TSR is at the 65th percentile of the peer group, executives will have the potential to earn the target number of PSUs. If Cypress’s TSR is at the

2

90th percentile or higher, executives will have the potential to earn the maximum number of PSUs (200% of target). The number of PSUs earned will be linearly interpolated between the indicated performance levels. Importantly, if Cypress’s TSR is negative, the number of PSUs earned (if any) will be reduced by 50%.

Synergy Milestones

Company-specific synergy (cost savings related to the Spansion transaction) performance goals have been defined for each of 2015, 2016 and 2017. Synergy achievement will be reported with the Company’s financial results for the respective periods. Similar to the TSR milestones, the Company must achieve a threshold level of synergy performance before any Named Executive Officer will earn any PSUs. If synergy goals are achieved at target levels, executives will have the potential to earn the targeted number of PSUs. The number of PSUs earned will be linearly interpolated for synergy performance achieved between threshold and target, and target to maximum. The maximum number of PSUs which may be earned for the synergy performance goals is 200% of target.

EPS Milestones

Company-specific EPS performance goals have been defined for each of 2015, 2016 and 2017. Similar to the TSR and synergy milestones, the Company must achieve a threshold level of EPS performance before any Named Executive Officer will earn any PSUs. If EPS goals are achieved at target levels, executives will have the potential to earn the targeted number of PSUs. The number of PSUs earned will be linearly interpolated for EPS performance achieved between threshold and target, and target to maximum. The maximum number of PSUs which may be earned for the EPS performance goals is 200% of target.

The table below summarizes the total grants made to each Named Executive Officer under our 2015 PARS Program:

| Performance-based PSUs | ||||||||||||||||||||||

| Name | Title | Service- vested RSUs |

TSR Milestone |

Synergy Milestone |

EPS Milestone |

2015 Total Grant |

||||||||||||||||

| T.J. Rodgers | President and Chief Executive Officer | 180,000 | 108,000 | 192,000 | 84,000 | 564,000 | ||||||||||||||||

| Thad Trent | Executive Vice President, Finance & Administration, Chief Financial Officer |

60,000 | 36,000 | 64,000 | 28,000 | 188,000 | ||||||||||||||||

| J. Daniel McCranie | Executive Vice President, Sales & Applications | 160,000 | N/A | N/A | N/A | 160,000 | ||||||||||||||||

| Paul D. Keswick | Executive Vice President, Marketing & IT | 90,000 | 54,000 | 96,000 | 42,000 | 282,000 | ||||||||||||||||

| Dana C. Nazarian | Executive Vice President, Memory Products Division | 90,000 | 54,000 | 96,000 | 42,000 | 282,000 | ||||||||||||||||

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: April 27, 2015 | CYPRESS SEMICONDUCTOR CORPORATION | |||||

| By: | /s/ Thad Trent | |||||

| Name: | Thad Trent | |||||

| Title: | Executive Vice President, Finance and Administration and Chief Financial Officer | |||||

4