Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - CITY NATIONAL CORP | a2224324zex-31_2.htm |

| EX-31.1 - EX-31.1 - CITY NATIONAL CORP | a2224324zex-31_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

PART IV

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 1-10521

CITY NATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware (State of incorporation) |

95-2568550 (I.R.S. Employer Identification No.) |

|

City National Plaza 555 South Flower Street, Los Angeles, California, 90071 (Address of principal executive offices) (Zip Code) |

||

Registrant's telephone number, including area code (213) 673-7700 |

||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

|

Name of each exchange on which registered |

|

|---|---|---|

| Common Stock, $1.00 par value | New York Stock Exchange | |

Depositary Shares, each representing a 1/40th interest in a share of 5.50% Non-Cumulative Perpetual Preferred Stock, Series C |

New York Stock Exchange |

|

Depositary Shares, each representing a 1/40th interest in a share of 6.750% Fixed Rate/Floating Rate Non-Cumulative Preferred Stock Series D |

New York Stock Exchange |

No securities are registered pursuant to Section 12(g) of the Act

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý |

Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2014, the aggregate market value of the registrant's common stock ("Common Stock") held by non-affiliates of the registrant was approximately $3,564,827,934 based on the June 30, 2014 closing sale price of Common Stock of $75.76 per share as reported on the New York Stock Exchange.

As of January 30, 2015, there were 55,290,225 shares of Common Stock outstanding (including unvested restricted shares).

City National Corporation (the "Company") is filing this Amendment No. 1 on Form 10-K/A (the "Amendment") to amend our Annual Report on Form 10-K for the year ended December 31, 2014, originally filed with the Securities and Exchange Commission (the "SEC") on February 27, 2015 (the "Original Form 10-K"), to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year-end. We are filing this Amendment to include Part III information in our Original Form 10-K because a definitive proxy statement containing such information will not be filed by the Company within 120 days after the end of the fiscal year covered by the Original Form 10-K. The reference on the cover of the Original Form 10-K to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Form 10-K is hereby deleted.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), Part III, Items 10 through 14 of the Original Form 10-K are hereby amended and restated in their entirety, and Part IV, Item 15 of the Original Form 10-K is hereby amended and restated in its entirety, with the only changes being the filing of new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 by our principal executive officer and principal financial officer, with paragraphs 3, 4 and 5 omitted as no financial statements are contained within this amendment. This Amendment does not amend or otherwise update any other information in the Original Form 10-K. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K and with our filings with the SEC subsequent to the Original Form 10-K.

City National Corporation

Form 10-K/A

(Amendment No. 1)

For the Fiscal Year Ended December 31, 2014

1

Item 10. Directors, Executive Officers and Corporate Governance

Board of Directors

Our Board of Directors (the "Board") consists of eleven members. The Compensation, Nominating and Governance Committee (the "CN&G Committee") identifies, screens and recommends to the Board candidates for membership on the Board on the basis of candidate guidelines established by the CN&G Committee and approved by the Board as well as those qualifications for directors set forth in our Corporate Governance Guidelines. These criteria and factors include whether the candidate (i) has demonstrated notable or significant achievements in business, education, or public service; (ii) has the requisite intelligence, education and experience to make a significant contribution to the membership of the Board; (iii) will serve as a significant and active resource for referrals and business development for the Company; (iv) will assist in achieving a mix of Board members that represents a diversity of skills, background, viewpoints, experiences, industry knowledge and community contacts, including with respect to age, gender, demographics, race and specialized experience; and (v) has the highest ethical standards, a strong sense of professionalism and dedication to serving the interests of all the stockholders and will be available to the Board in the fulfillment of director duties. In addition to the particular experiences, qualifications, attributes and skills discussed with respect to each director below, the CN&G Committee determined that all of the members of the Board satisfied or met the foregoing criteria and factors.

Name

|

Age | Principal Occupation and Other Directorships/Qualifications | Director of City National Bank Since |

Director of City National Corporation Since |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Russell Goldsmith(1) |

65 |

Chief Executive Officer of City National Corporation and Chairman of the Board and Chief Executive Officer, City National Bank since October 1995. Chairman of the Board of City National Corporation since October 2013 and Vice Chairman from October 1995 to October 2013. President of City National Corporation since May 2005. Representative of the Twelfth District to the Federal Reserve's Federal Advisory Council from 2008 through 2011 and Vice President of that entity for 2010 and 2011. Director of Wynn Resorts, Limited from May 2008 to December 2012. |

1978 |

1979 |

||||||||

|

Mr. Goldsmith contributes to the Board his broad knowledge of the banking, legal and entertainment industries; a deep understanding of the Company and its personnel, clients, and communities, as well as its operations, strategy, value proposition and history; and strong management and leadership skills from his extensive experience as a community, business and industry leader, including his service as the former Chairman and Chief Executive Officer of Republic Pictures, as Vice Chairman of the San Diego Padres, as an attorney, and on other public company boards. |

|||||||||||

2

Name

|

Age | Principal Occupation and Other Directorships/Qualifications | Director of City National Bank Since |

Director of City National Corporation Since |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Bram Goldsmith(1) |

92 | Chairman Emeritus of the Board, City National Corporation, since October 2013. Chairman of the Board, City National Corporation, for more than the past five years and until October 2013. |

1964 | 1969 | ||||||||

|

Mr. Goldsmith contributes to the Board his many years of experience as a successful real estate developer and as a leader of both the banking industry and the Company. He brings to the Board his unique perspective as one of the earliest clients and one of the earliest stockholders of the Bank, his 50 years as a director of the Company, his service as the Chairman of the Company since 1975, and as the Chief Executive Officer of the Company from 1975 to 1995. |

|||||||||||

Mohamad Ali |

44 |

President and Chief Executive Officer, Carbonite, Inc., an online backup and recovery solutions provider, from December 4, 2014 to the present. Chief Strategy Officer, Hewlett Packard, a multi-national information technology corporation, from August 2012 to December 2014. Chief Executive Officer, Workforce Optimization Division, Aspect Software, a global leader in customer engagement solutions, from April 2012 to August 2012. Senior VP, Corporate Development and Strategy and President, Avaya Client Services, Avaya Corporation, July 2009 to April 2012. |

2013 |

2013 |

||||||||

|

Mr. Ali contributes to the Board a global strategic perspective on trends in the technology industry and significant experience and specific knowledge and insights regarding the Massachusetts and Silicon Valley technology communities. Mr. Ali has extensive experience managing and leading the strategic development of technology companies and business units of major corporations, including IBM, Hewlett Packard and Avaya and has significant experience leading the acquisition of numerous technology companies and assessing investment risk from various vantage points. |

|||||||||||

3

Name

|

Age | Principal Occupation and Other Directorships/Qualifications | Director of City National Bank Since |

Director of City National Corporation Since |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Richard L. Bloch |

85 | President, Piñon Farm, Inc., an agricultural company, for more than the past five years. |

1974 | 1979 | ||||||||

|

Mr. Bloch contributes to the Board his entrepreneurial skills and abilities as an experienced business leader in the real estate and entertainment industries and as a public servant, with extensive knowledge of and contacts in the San Diego community and a broad-based understanding of the Company from his years of service on the Company's Board. |

|||||||||||

Kenneth L. Coleman |

72 |

Chairman, Saama Technologies, Inc., a business analytics services company, since January 2013. Non-executive Chairman of the Board, MIPS Technologies, a technology provider, from November 2010 to February 2013 and Director from January 1998 to February 2013. Director United Online, Inc. since September 2001. Non-executive Chairman of the Board, Accelrys, Inc., a software provider, from February 2006 to December 2011 and Director since May 2003. |

2003 |

2003 |

||||||||

|

Mr. Coleman contributes to the Board his highly successful executive and entrepreneurial experience in the computer and technology industry, knowledge about the Northern California economy, extensive experience in human resources, strong skills in evaluating business issues and making strategic business judgments, and understanding the impact of science and technology on consumers, companies and the economy. Mr. Coleman also has unique experience in the management of the Information Technology function to ensure that it maximizes its impact on the enterprise. |

|||||||||||

4

Name

|

Age | Principal Occupation and Other Directorships/Qualifications | Director of City National Bank Since |

Director of City National Corporation Since |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Clifford Gilbert-Lurie |

60 | Partner, Ziffren Brittenham LLP, a law firm, for more than the past five years. |

2014 | 2014 | ||||||||

|

Mr. Gilbert-Lurie contributes to the Board his extensive experience as a leading entertainment lawyer with deep knowledge of the entertainment, media, digital and technologies businesses and sophisticated experience in evaluating business issues, negotiating contracts, advising clients, resolving disputes and making strategic decisions involving the entertainment and media businesses. |

|||||||||||

Ashok Israni |

67 |

President and Chairman, Pacifica Companies, a real estate development and investment firm, and a private real estate investor, for more than the past five years. |

2007 |

2007 |

||||||||

|

Mr. Israni contributes to the Board his significant knowledge of real estate development and investment, his in-depth knowledge of the economy in San Diego and Southern California, a broad understanding of the real estate economy in California and around the world, and the ability to analyze complex business problems and develop creative solutions arising from his substantial success as an entrepreneur. |

|||||||||||

Bruce Rosenblum |

57 |

President, Legendary Television and Digital Media, an entertainment company, since June 2013. President, Warner Bros. Television Group, an entertainment company, from September 2005 to May 2013. Chairman and Chief Executive Officer, Academy of Television Arts & Sciences, since January 2012. |

2007 |

2007 |

||||||||

|

Mr. Rosenblum contributes to the Board his significant achievement and experience in the entertainment business and knowledge regarding the entertainment industry and clients, as well as skills in evaluating business and legal issues, handling personnel, compensation and operational matters and strategic planning. |

|||||||||||

5

Name

|

Age | Principal Occupation and Other Directorships/Qualifications | Director of City National Bank Since |

Director of City National Corporation Since |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Peter M. Thomas |

65 | Managing Partner, Thomas & Mack Co., LLC, a commercial real estate development company, for more than the past five years. From 1992 to 1995, President and Chief Operating Officer of Bank of America-Nevada; and from 1982 to 1992, President and Chief Operating Officer of Valley Bank of Nevada. Director of Boyd Gaming Corporation since April 2004. |

2003 | 2003 | ||||||||

|

Mr. Thomas contributes to the Board his extensive experience in the banking, finance and commercial real estate industries, including service on other public company boards, as well as strong management skills, financial sophistication and expertise, and the ability to make strategic decisions and provide valuable insight into the Nevada economy and competitive landscape. |

|||||||||||

Robert H. Tuttle |

71 |

Co-managing Partner, Tuttle-Click Automotive Group, an automotive dealer, since November 2009 and from 1989 to July 2005. From July 2005 to February 2009, U.S. Ambassador to the Court of St. James's, London, England. From 1988 to 1989, Assistant to the President and Director of Presidential Personnel, The White House, from 1985 to 1988, Deputy Assistant to the President and Director of Presidential Personnel, The White House, and from 1982 to 1985, Special Assistant to the President, The White House. Director, City National Corporation from 2002 to 2005 and Arizona Bank from 1989 to 1998. From 1994 to 1998, Chairman of the Executive Committee of Arizona Bank. |

2010 |

2010 |

||||||||

|

Mr. Tuttle contributes to the Board his experience as a business leader, former bank director and distinguished public servant, with extensive knowledge of international relations and markets, strong relationships within the global community and the perspective and insight as the Chief Executive Officer of a large automotive group as well as a deep understanding of the Orange County economy. Mr. Tuttle has extensive experience with human resources, business operations, sales, service and marketing, and the ability to make complex, sophisticated decisions. |

|||||||||||

6

Name

|

Age | Principal Occupation and Other Directorships/Qualifications | Director of City National Bank Since |

Director of City National Corporation Since |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Christopher J. Warmuth |

61 | Executive Vice President, City National Corporation and President, City National Bank since May 2005. Chief Credit Officer, City National Bank from June 2002 to May 2005. |

2005 | 2005 | ||||||||

|

Mr. Warmuth contributes to the Board his broad based knowledge of the banking and real estate industries, an in-depth understanding of the Company, its businesses and operations, including credit policy and risk management; and valuable and strategic insight into the Company's challenges and opportunities. |

|||||||||||

- (1)

- Russell Goldsmith is the son of Bram Goldsmith.

7

We are committed to maintaining the highest standards of business conduct and corporate governance. We regularly review our governance practices and update them, as appropriate, based upon applicable state law, New York Stock Exchange ("NYSE") rules and listing standards, SEC regulations, and market and best practices. Our corporate governance program includes robust risk management and compliance policies, practices and programs.

Corporate Governance Guidelines, Codes of Conduct and Committee Charters

Our Corporate Governance Guidelines establish significant corporate governance policies and practices for our Company. Our codes of conduct are comprised of our Code of Ethics for Senior Financial Officers and our Principles of Business Conduct and Ethics (collectively, "Codes of Conduct") for our directors, officers and colleagues. Each standing committee of our Board operates pursuant to a written charter which states each committee's functions and duties. Each committee's charter is reviewed, revised, as appropriate, and reaffirmed annually. Further information regarding certain of our Board committees is set forth below.

Please visit our website at www.cnb.com/investor-relations/corporate-governance ("Corporate Governance Web Page") to view our Corporate Governance Guidelines, Codes of Conduct and committee charters as well as additional information about our Board, committees and corporate governance. We will post on this website any amendments to the Corporate Governance Guidelines, Codes of Conduct or committee charters, and any waivers of the Codes of Conduct for directors and executive officers. There were no waivers in 2014.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act requires directors and executive officers of the Company and persons who own more than 10% of the Company's common stock ("10% Owners") to file reports of initial ownership of the Company's common stock and subsequent changes in ownership with the SEC and to provide us with copies of such reports. Based solely on a review of the copies of such reports and written representations furnished to us by reporting persons that no other reports were required to be filed during 2014, the Company's directors, officers and 10% Owners complied with all Section 16(a) filing requirements in a timely manner in 2014.

Executive Officers

Information relating to the executive officers of the Company is presented in Part I of the Original Form 10-K under the caption "Executive Officers of the Registrant."

Committees of the Board

The Board has established a CN&G Committee, an Audit & Risk Committee, a Wealth Management & Fiduciary Committee, a Community Reinvestment Act Committee and a Special Matters Committee. Each member of the CN&G Committee and Audit & Risk Committee is an independent

8

director as defined by the requirements of the NYSE and our independence standards. The Committee memberships as of the date of this Amendment are set forth below.

| |

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Name

|

Audit & Risk Committee |

CN&G Committee |

Special Matters Committee |

Wealth Management & Fiduciary Committee |

Community Reinvestment Act Committee |

|||||

Mohamad Ali |

ü(1) | |||||||||

Richard L. Bloch |

ü | Chair(1) | ||||||||

Kenneth L. Coleman |

ü | Chair | ||||||||

Clifford Gilbert-Lurie |

ü(1) | |||||||||

Bram Goldsmith |

ü | |||||||||

Russell Goldsmith |

Chair(1) | |||||||||

Ashok Israni(1) |

ü | |||||||||

Bruce Rosenblum |

Chair(1) | ü | ||||||||

Peter M. Thomas |

ü | ü | Chair(1) | |||||||

Robert H. Tuttle |

ü | ü(1) | ||||||||

Christopher J. Warmuth |

ü | ü | ||||||||

- (1)

- Mohamad Ali was appointed to the Wealth Management Committee effective April 23, 2014. Richard L. Bloch was appointed Chairman of the CN&G Committee effective April 23, 2014. Clifford Gilbert-Lurie was appointed to the Board and the Wealth Management Committee effective June 18, 2014. Russell Goldsmith was appointed Chairman of the Special Matters Committee effective April 23, 2014. Ashok Israni served on the Wealth Management Committee until April 23, 2014. Bruce Rosenblum was appointed Chairman of the Audit & Risk Committee effective April 23, 2014. Peter Thomas was appointed Chairman of the Wealth Management & Fiduciary Committee effective April 23, 2014. Robert Tuttle was appointed to the Special Matters Committee effective April 23, 2014.

Audit & Risk Committee

The Company's separately designated Audit & Risk Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board has appointed Mr. Bloch, Mr. Rosenblum and Mr. Thomas to serve as members of the Audit & Risk Committee. Mr. Rosenblum serves as chairman of the committee. Each member of the Audit & Risk Committee is an independent director as defined by the requirements of the NYSE and our independence standards, and is "financially literate" within the meaning of the NYSE listing standards as determined by the Board in its business judgment. The Board has designated Mr. Thomas as the Audit & Risk Committee "Audit Committee Financial Expert" as defined by the SEC. Under the Corporate Governance Guidelines, Committee members are expected to not serve simultaneously on the audit committees of more than two other public companies, unless the Board determines that such service is (i) not otherwise prohibited and (ii) will not impair the effectiveness and ability to serve effectively on the Audit & Risk Committee. The Committee also functions as the Audit & Risk Committee of City National Bank (the "Bank") and the Trust Audit Committee with audit oversight responsibility for audit, risk and compliance related wealth management and fiduciary activities of the Company.

Contacting the Board of Directors

Individuals can contact the Board, any Committee, or select Board members (including the independent directors as a group) by sending an email to bdofdirectors@cnb.com or by writing to: Board of Directors, Attention: Corporate Secretary, City National Corporation, 555 S. Flower Street, 18th Floor, Los Angeles, California 90071. This contact information is also provided on the Company's Corporate Governance Web Page. The Audit & Risk Committee has also established procedures for the receipt, retention and treatment of so-called "Whistleblower" complaints regarding accounting and auditing matters or actual or potential corporate fraud or violation of applicable law, which procedures are stated on the Company's Corporate Governance Web Page.

9

Item 11. Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes our executive compensation program and the 2014 compensation decisions made for our named executive officers ("NEOs") identified in the Summary Compensation Table following this Compensation Discussion and Analysis.

Executive Summary

Very Strong Fiscal 2014 Performance

The Company delivered very strong financial performance in 2014 and in the fourth quarter of 2014, the Company reported its 87th consecutive profitable quarter. The Company achieved record levels of assets, loans and deposits. The Company's performance reflects the strength of its executive and leadership team and its approximately 3,570 colleagues. They have driven growth through, among other things, increasingly broad product and service offerings, an expanding geographic base, strategic acquisitions and exceptional financial solutions and client service. The Company's strong results for 2014 include the following highlights:

- •

- Consolidated net income attributable to City National Corporation increased 11% to $255.8 million from $230.0 million in

2013. Earnings per share were $4.26, compared with $3.99 per share in 2013.

- •

- Fully taxable-equivalent net interest income for 2014 was $886.7 million.

- •

- Period-end deposit balances grew to a new Company record of $28.11 billion at December 31, 2014. Average deposits

increased 11% from 2013, reaching $26.68 billion, and average core deposits increased by 12%. Average core deposits accounted for 98% of deposit balances at year end.

- •

- Period-end loan balances grew to a new Company record of $20.34 billion at December 31, 2014. Average loans increased to

$18.45 billion for 2014, up 17% from 2013, with average commercial loans and commercial real estate mortgage loans increasing 19% year over year. These figures exclude loans covered by FDIC

loss-sharing agreements.

- •

- Total assets grew to a new Company record of $32.61 billion as of December 31, 2014.

- •

- Assets under management or administration were $60.82 billion as of December 31, 2014.

- •

- Credit quality (excluding loans and other real estate owned, covered by FDIC loss-sharing agreements) continued to improve. Net recoveries for 2014 were $15.4 million. Nonperforming assets decreased to $52.9 million at December 31, 2014 from $81.3 million at December 31, 2013. In light of strong credit quality and significant recoveries, the Company did not record any provision for credit losses in 2014, and released $14.0 million from its loan-loss reserves.

2014 Performance Compensation Program

We strive to maintain compensation programs that reflect strong governance practices and consistency with our pay for performance philosophy. We set challenging targets under our incentive programs, including our net income target for the CEO's annual bonus plan and the net operating income target that is used to set incentives for the other NEOs. Because our targets are intended to be challenging, our strong performance in 2014 resulted in payments well below the maximum achievable. Our CEO received a bonus equal to 101% of target and our NEOs received bonuses that in the aggregate amounted to 123% of target.

With respect to long-term incentives, there were no changes to our CEO's compensation for 2014 performance. There were no changes in 2014 to the long-term incentives for our other NEOs, other than the mix of equity vehicles granted. Equity awards in 2014 consisted of a mix of 50% restricted stock and 50% stock options.

10

In July 2014, the CN&G Committee and our CEO entered into an amendment to our CEO's employment agreement. The amendment extended the term of our CEO's employment agreement to July 15, 2017 and revised the long-term incentive compensation structure for our CEO effective beginning in 2015. The amendment, which is described below under Employment Agreements, was intended to increase the tie between our CEO's compensation and the Company's long-term performance. On January 22, 2015, the Company entered into an Agreement and Plan of Merger (the "Merger Agreement") with Royal Bank of Canada, a Canadian chartered bank ("Royal Bank of Canada") and RBC USA Holdco Corporation, a Delaware corporation and wholly owned subsidiary of Royal Bank of Canada ("Holdco"), pursuant to which the Company will merge with and into Holdco with Holdco surviving the merger as a wholly owned subsidiary of Royal Bank of Canada (the "Merger"). The transactions contemplated by the Merger Agreement will be a "change in control" for purposes of the Company's compensation and benefit plans described below.

Strong Compensation and Corporate Governance Practices

The following are highlights of our strong compensation practices and corporate governance framework, which reinforces our pay for performance culture:

- •

- A Majority of Our CEO's Compensation is Performance Based and Tied to Multiple Performance

Metrics. A majority of our CEO's compensation is performance based. Our CEO's compensation is tied to multiple performance metrics to ensure that compensation is measured in

relation to different aspects of Company performance, including growth, delivery of stockholder value and performance against peers. This also ensures that our CEO is motivated by overall Company

performance rather than a single metric.

- •

- No Excessive

Perquisites. Our NEOs do not receive excessive perquisites and it is our policy to limit perquisites.

- •

- No Pension or Supplemental Retirement

Plan. We do not provide our NEOs with pension or supplemental retirement plan benefits.

- •

- Prohibition of

Pledging. Our policies on trading prohibit pledging of Company stock by our employees and directors.

- •

- Prohibition of

Hedging. Our policies on trading prohibit hedging and other speculative trading in Company stock.

- •

- Stock Ownership

Requirements. Our NEOs are required to hold a multiple of their salary in Company stock pursuant to our stock ownership requirements,

further aligning their interests with our stockholders' interests. See Stock Ownership Requirements below for more information.

- •

- No Repricing or Discounted Stock

Options. The Company's 2008 Omnibus Plan ("2008 Plan") prohibits the repricing of any outstanding stock options or the use of discounted

stock options.

- •

- Clawback. Pursuant to his employment agreement, our CEO's incentives are subject to

forfeiture and recoupment if based on materially inaccurate financial statements or any other materially inaccurate performance metric criteria.

- •

- Double Trigger and No Tax

Gross-up. Our CEO's employment agreement requires a termination of employment in addition to a change in control before change in

control benefits are triggered, and there is no golden parachute excise tax gross-up.

- •

- Compensation Plan Risk Assessment. The CN&G Committee retains and consults with an independent compensation consultant to collaborate with our senior risk officers to conduct an annual risk-based review of all of the Company's employee incentive plans.

11

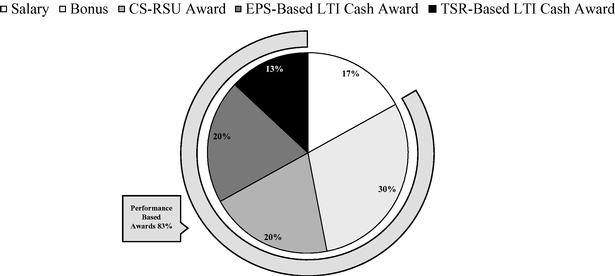

Consistent with our pay for performance philosophy, our CEO's target compensation mix is designed to be heavily weighted towards performance based compensation. As depicted in the chart below, 83% of our CEO's target compensation is provided in the form of performance based variable compensation, the value of which is tied to the Company's performance. Variable compensation consists of four components, which is further described below: bonus; cash-settled restricted stock unit ("cash-settled RSU") awards; an earnings-per-share based long-term incentive cash award ("EPS-Based LTI Cash Award"); and a total shareholder return ("TSR")-based long-term incentive cash award ("TSR-Based LTI Cash Award").

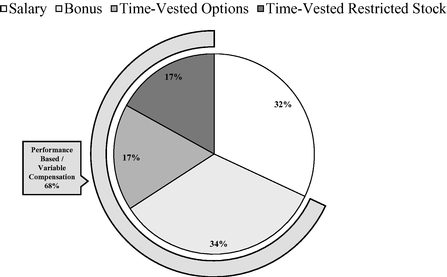

The target compensation of our other NEOs is also weighted towards performance based/variable compensation. On average, 68% of their compensation is performance based/variable compensation, including 17% of the target compensation that is tied to time-vested restricted stock, the value of which moves up and down with our stock price.

Average Other NEOs—Target Compensation Mix

12

CEO Compensation and Performance Alignment

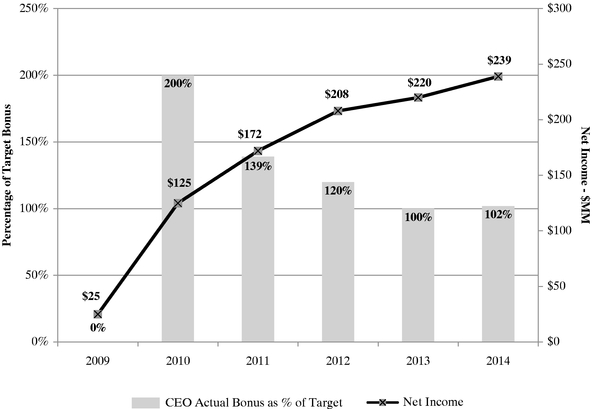

Our CEO's annual incentive award under the Variable Bonus Plan ("Variable Bonus Plan") is based on a net income performance goal. As such, in years where net income performance is substantially below our internal goals, our CEO receives little or no annual incentive payout. Notably, as reflected in the graph below, our CEO received $0 actual bonus for performance year 2009 despite the Company maintaining positive net income in 2009 during the worst financial crisis in the United States in the last 70 years.

The net income goal under the Variable Bonus Plan is intended to be challenging. In fiscal 2014, the net income target was set 7% higher than in 2013. Accordingly, even though 2014 was a year of exceptional financial results, this challenging target resulted in the 2014 Variable Bonus Plan payout remaining nearly flat from 2013 to 2014. Accordingly, the CEO's actual bonus as a percentage of target increased by less than 2% from the prior year. In fact, for the third year in a row, our CEO's bonus payment as a percentage of target has either decreased or remained essentially flat since 2011, despite the fact that our net income has risen by 39% over this time-frame to record levels for the Company.

As a result of the aggressive net income goal set by the CN&G Committee for fiscal year 2014, our CEO's annual earned bonus remained relatively unchanged, increasing by approximately $32,000 relative to the year prior.

CEO Actual Bonus as Percentage of Target vs. Net Income

13

Response to 2014 Advisory Vote on Executive Compensation

The Company's 2014 annual meeting of stockholders included a non-binding advisory vote on executive compensation. Approximately 87% of the votes cast at the 2014 annual meeting were in favor of the compensation earned by our NEOs. Consistent with the Company's long standing active and open dialogue with its institutional investors, following the filing of our 2014 proxy statement, the Company and its representatives contacted many of our largest institutional stockholders, representing approximately 54% of our outstanding shares (representing the top 30 stockholders), to discuss governance issues of importance to our investors and to answer questions about our compensation programs for our NEOs. Based on the generally favorable responses from our stockholders and the support reflected by the votes ultimately cast at the 2014 annual meeting, the CN&G Committee determined to continue our NEO compensation program in its current form.

Our Compensation Philosophy

Our executive compensation programs are vital to achieving our objective to become the most recommended financial provider and to build sustainable long-term growth in stockholder value. We design our compensation programs based on a pay for performance philosophy to reward our NEOs both for recent performance and to motivate them to achieve strong future performance for the Company and long-term value for our stockholders. As a result, our compensation program for our NEOs is guided by the following principles:

- •

- Challenge and motivate our executives, their teams and the entire organization to achieve results that support our business and

financial strategies.

- •

- Design our compensation plans and programs to encourage sustained and consistent performance while incorporating checks, balances and

controls to promote a culture of risk management consistent with our value proposition, and to discourage executives from taking unnecessary and excessive risks that threaten the value of our Company.

- •

- Align our NEOs' interests with the interests of our stockholders by including equity and other long-term awards in our compensation

package together with stock ownership requirements to motivate our NEOs to create long-term stockholder value.

- •

- Attract, motivate, retain, and reward our executives by providing a competitive total compensation opportunity.

Role of our Compensation Committee

Our CN&G Committee is comprised of independent directors and is responsible for reviewing and approving our director and executive compensation plans, policies and programs, including compensation awarded to our CEO and other NEOs. Recommendations regarding the compensation of our NEOs, other than our CEO, are presented by management to the CN&G Committee. The CN&G Committee has the sole authority to retain and terminate any compensation consultant directly assisting it in the evaluation of director, CEO or senior executive compensation. The CN&G Committee also has the sole authority to approve fees and other engagement terms. In its absolute discretion, the CN&G Committee may also seek advice and assistance from internal or external legal, accounting or other advisors. The CN&G Committee may also form and delegate authority to subcommittees when appropriate.

The compensation of the President of the Bank and CFO is reviewed by our CEO before presentation to the CN&G Committee. The compensation of our other NEOs and executives is reviewed by our Strategy and Planning Committee, comprised of our Chairman Emeritus of the Board, CEO, CFO and President of the Bank, prior to submission to the CN&G Committee. Our CEO's compensation is determined under the terms of his employment agreement based on achievement of previously established performance goals. The CN&G Committee makes the final decision as to compensation of each of our

14

NEOs and other executives. Each material action of the CN&G Committee is reported to the full Board at its regular meetings.

Role of Compensation Consultants.

In 2014, the CN&G Committee retained the services of Frederic W. Cook, LLP ("F.W. Cook") as its independent consultant to advise on the amendment to our CEO's employment agreement, to provide advice and recommendations on senior executive compensation, including an analysis of peer companies used by the Company in computing TSR for our CEO's TSR-Based LTI Cash Award. F.W. Cook generally assists the CN&G Committee with its review of management's recommendations regarding senior executive compensation, including by providing an independent assessment of the recommendation and the underlying data. The CN&G Committee also retained the services of F.W. Cook to work with the Company's senior risk officers to conduct a comprehensive risk review of the Company's incentive compensation plans. See below under Risk Management.

Our management team retains separate compensation consultants. In 2014, we utilized the services of Semler Brossy Consulting Group ("Semler Brossy") and Towers Watson. We retained Semler Brossy to analyze and provide recommendations with regard to the peer companies used by the Company in computing TSR for our CEO's TSR-Based LTI Cash Award and to advise on the amendment to our CEO's employment agreement. We utilized Towers Watson to provide surveys of competitive pay practices. Towers Watson also prepared specific change in control calculations included in the disclosure set forth below in Potential Payments Upon Termination or Change in Control. The CN&G Committee evaluated the independence of each of these compensation consultants in accordance with SEC rules, and determined that their work did not create any conflicts of interest.

Role of Internal Comparison and Use of Market Comparison Data

We seek to establish compensation levels that are consistent with the external competitive market and also reflective of the internal value of each position based on our strategies and business goals. Our compensation programs achieve a balance between fixed and variable pay and result in our executives having more pay at risk than non-executive colleagues. As a part of our decision-making process for executive compensation, we internally compare executives' respective roles and their performance. We look at the relative level of complexity and significant differences among the executives' job positions, the position of each job in the Company's hierarchy, the internal reporting relationship of each job position and the added value of each job to the Company and then calibrate the total compensation for each executive appropriately.

We annually assess the compensation level for executive positions by analyzing market data that is reflective of our talent market. We obtain this data both from published surveys and, as needed, customized surveys, generally analyzing data from companies between one-half to two times our asset size across the banking and financial services sectors. We use this data to evaluate the market position of our executive compensation levels and to recommend changes to executive salaries. We generally evaluate the compensation of our NEOs, other than our CEO, to confirm that we are within a competitive range of the 50th percentile of surveyed companies. However, an individual NEO's pay may differ from this overall competitive positioning strategy due to an individual's performance, experience level, scope of responsibility, unique skills and talents, and the competitive market for the officer's position. Each NEO's current and prior compensation is considered in setting future compensation. The process for setting our CEO's compensation differs as our CEO's compensation terms are set forth in an employment agreement entered into in 2010, as further amended in 2014. In setting CEO compensation, our CN&G Committee considered several factors, including, but not limited to, comparable market data, the proven track record and experience level of our CEO, and the exceptional leadership qualities and highly specialized skills and competencies of our CEO that would not only be favorable but critical to the success of the Company.

15

2014 Compensation Elements

The Company's executive compensation program provides a mix of direct cash and equity compensation and participation in Company-sponsored benefit plans generally available to other colleagues. As described below, the elements of direct compensation include base salary, an annual cash incentive award, and long-term incentive compensation awards. Pursuant to his employment agreement, as amended, the long-term incentive compensation awards made in 2014 to our CEO are a mix of approximately 37.5% EPS-Based LTI Cash Awards and 37.5% cash-settled RSUs, and 25% TSR-Based LTI Cash Awards. The long-term incentive compensation grants made in 2014 to our NEOs (other than our CEO) are a mix of 50% options and 50% restricted stock.

| |

||||||

|---|---|---|---|---|---|---|

| Pay Element |

Description/Objective |

Performance Criteria |

Vesting Period |

|||

|

|

||||||

Annual Compensation |

||||||

Base Salary |

• Fixed annual cash amount • Compensates NEOs for services during year and forms foundation for other reward vehicles |

• Reviewed annually • Increases for NEOs other than CEO are based on competitive market data, company performance and individual performance • CEO base salary set by the terms of his employment agreement |

N/A | |||

Annual Cash Incentive Award |

• Paid in cash • Award targets for NEOs other than CEO established as percentage of base salary based on NEO's level of responsibility and market competitiveness • CEO award target determined pursuant to the terms of his employment agreement • CN&G Committee determines final award based on Company and/or staff division performance, and individual performance |

• Reviewed annually • Performance criteria for NEOs other than CEO established annually by CN&G Committee and the Strategy and Planning Committee • CEO performance criteria established annually by the CN&G Committee |

• Payout determined and awarded after end of fiscal year |

|||

16

| |

||||||

|---|---|---|---|---|---|---|

| Pay Element |

Description/Objective |

Performance Criteria |

Vesting Period |

|||

|

|

||||||

Long-Term Incentive Compensation |

||||||

EPS-Based Long-Term Incentive Cash Award (CEO Only) |

• Cash award based on EPS performance over three years for initial award and over four or five years for supplemental award • Aligns executive interests with stockholders' interests • Emphasizes performance-based culture • Reduces stockholder dilution through use of cash • Retention tool |

• Compares the Company's cumulative actual diluted EPS for the performance period to the sum of the separate annual target EPS performance goals set by the CN&G Committee at approximately the start of each year during the relevant performance period • Target award value is payable at achievement of 100% or more of cumulative target EPS for initial three-year period scaling down to 60% if 75% of cumulative target EPS achieved • Supplemental award of 33.33%-50% of target can be earned in year four or five if performance exceeds target by at least 5%-7.5% |

• Third anniversary of the grant date for initial award • Fourth or fifth anniversary of grant date for supplemental award |

|||

TSR-Based Long-Term Incentive Cash Award (CEO Only) |

• Cash award based on three-year TSR performance • Aligns executive interests with stockholders' interests • Emphasizes performance-based culture • Reduces stockholder dilution through use of cash • Retention tool |

• Compares the Company's three-year TSR performance relative to the TSR Peers (as described below) • Award amount payable is calculated based on the Company's three-year TSR percentile ranking versus peers |

• Third anniversary of the grant date |

|||

17

| |

||||||

|---|---|---|---|---|---|---|

| Pay Element |

Description/Objective |

Performance Criteria |

Vesting Period |

|||

Restricted Stock and Cash-Settled RSUs |

• Restricted Stock converts 1-for-1 to shares of common stock (Available to NEOs other than CEO) • Cash-settled RSU value paid in cash at vesting (available only to CEO) • Aligns executive interests with stockholders' interests • Emphasizes performance-based culture • Includes dividends/dividend equivalents • Retention tool |

• Amount of CEO annual cash-settled RSU award is subject to achievement of 60% or more of the annual cash incentive award performance goal |

• Typically vest 25% per year beginning on the 2nd anniversary of grant date |

|||

Stock Options (NEOs other than CEO) |

• Ten year term • Exercise price set at closing stock price on date of grant • Aligns executive interests with stockholders' interests • Value realized only if stock price rises above exercise price • Retention tool |

• Amount of options granted is based on individual performance • Ultimate value of award is based on stock price appreciation |

• Vest 25% per year beginning on the 1st anniversary of the grant date |

|||

|

|

||||||

Plans and Programs |

||||||

Deferred Compensation |

• Voluntary • Provides flexibility for an executive to manage individual tax liability • No Company match other than profit sharing make-up contribution • CEO's former SERP benefit converted to CNC Stock Fund balance |

N/A | • Compensation is deferred into accounts that earn a market return based on a variety of investment options • CNC Stock Fund balance payable solely in shares of our common stock, on the first day of the month following termination of CEO's employment for any reason |

|||

18

| |

||||||

|---|---|---|---|---|---|---|

| Pay Element |

Description/Objective |

Performance Criteria |

Vesting Period |

|||

Benefit Programs |

• Company 401(k) Plan with Company match and profit sharing • Company health insurance • Change in control plans (see 2014 Nonqualified Deferred Compensation and see Potential Payments Upon Termination or Change in Control) |

• Profit sharing contribution based on annual growth in net profits year over year, capped at 8% of net profits less matching contributions |

N/A | |||

Perquisites |

• Limited personal benefits |

N/A | N/A | |||

2014 Compensation Actions for NEOs

CEO Compensation

2014 Annual Base Salary

Our CEO's base salary is fixed at $980,000 for the term of his employment agreement.

2014 Performance-Based Annual Cash Incentive Compensation

Our CEO's annual cash incentive award ("Annual Incentive Award") for 2014 performance was awarded pursuant to the Variable Bonus Plan and his employment agreement. The Variable Bonus Plan is designed to permit the tax deductibility of annual incentive awards for our CEO and the next three most highly compensated executive officers (other than our CFO) as of the end of the year. In 2014, the CN&G Committee approved net income as the financial criteria under the Variable Bonus Plan for our CEO, and set the performance goal at $236 million with a target cash incentive award of $1,715,000 (175% of base salary). The net income goal was developed from the Company's budgeting process and reflected the Company's financial and other business goals approved by the Board. The payout range for the Annual Incentive Award is expressed as a percentage of base salary based on the percentage of achievement of the performance goal, as follows:

Net Income Goal Achievement

|

Bonus Percentage of Target |

Bonus Percentage of Base Salary |

|||||

|---|---|---|---|---|---|---|---|

<70% |

0 | % | 0 | % | |||

70% |

15 | % | 26 | % | |||

100% |

100 | % | 175 | % | |||

154% |

200 | % | 350 | % | |||

In 2014, 101.5% of the net income goal was achieved by the Company. In accordance with his employment agreement and the Variable Bonus Plan, the CN&G Committee approved the payment to our CEO of an incentive bonus of $1,746,759. This award reflects payment of 101.9% of the target award and 178% of base salary. This award reflects the solid growth in our Company's 2014 net income under the leadership of our CEO and illustrates our organization's commitment to its stated objective to pay for performance.

19

2014 Long-Term Incentive Compensation

Annual Incentive Cash-Settled RSU Award. The size of the cash-settled RSU award granted to the CEO in 2014 was based on the level of achievement of the performance goal established for our CEO's 2013 Annual Incentive Award. Specifically, the CN&G Committee established 2013 net income of $220 million as the performance goal applicable to our CEO's Annual Incentive Award for 2013 performance. While the target level of the 2014 cash-settled RSU award value was $1,125,000, the amount actually awarded was based on the degree to which the Company achieved the 2013 net income goal:

Net Income Goal Achievement

|

Grant of 2014 Target Annual Cash-Settled RSU Award |

|||

|---|---|---|---|---|

60% or more |

100 | % | ||

50% to below 60% |

75 | % | ||

40% to below 50% |

50 | % | ||

Less than 40% |

0 | % | ||

In 2014, the Company granted 100% of the target annual incentive cash-settled RSU award to our CEO due to the achievement of 100% of the 2013 net income goal. This award vests equally over four years beginning on the second anniversary of the grant date. Vesting for the cash-settled RSU award may be accelerated under certain circumstances, including death, disability, termination without cause or for good reason, the CEO's termination after expiration of his employment agreement currently in effect, or a change in control. These circumstances are further described below under Potential Payments Upon Termination or Change in Control.

2014 EPS-Based LTI Cash Award. Our CEO is eligible for an annual long-term incentive cash award based on diluted earnings per share ("EPS") for the 2014-2016 performance period. The CN&G Committee considers an EPS-based award an important complement to the annual bonus, which is based on net income. While the annual bonus rewards net income growth, an EPS-based award is intended to ensure that such growth is not achieved at the expense of stockholder value.

The target EPS-Based LTI Cash Award is $1,125,000. Actual payment is determined by comparing the Company's cumulative actual EPS for the performance period to the sum of the three separate annual target EPS performance goals set by the CN&G Committee at approximately the start of each year. The EPS target set by the CN&G Committee each year is developed from the Company's budgeting process and reflects rigorous performance goals approved by the CN&G Committee and the Board, taking into account historical performance, current and expected economic conditions, and the Company's operating and investment plans. The CN&G Committee believes these additional performance conditions strengthen the linkage between compensation earned and the value delivered to our stockholders. In addition, this award reduces share utilization and dilution to our stockholders by settling the award in cash instead of stock.

The following table shows the percentage of the target EPS-Based LTI Cash Award payable based on percentage achievement of the performance goal. The target award value is payable at achievement of 100% or more of cumulative target EPS for 2014-2016, scaling down to 60% if 75% of cumulative target EPS is achieved. If less than 75% of the EPS goal is achieved, then no amount is paid.

EPS Goal Achievement

|

EPS Percentage of Target Award Payable |

|||

|---|---|---|---|---|

100% or more |

100 | % | ||

75% |

60 | % | ||

Less than 75% |

0 | % | ||

20

The EPS-Based LTI Cash Award has also been structured to give the CEO an opportunity to earn an additional award, but only if long-term EPS performance is significantly above target. Above target payout requires, however, above target performance for a longer time period than three years—either four or five years.

Specifically, an additional award is payable if cumulative actual EPS is at least 105% of cumulative target EPS for the performance period. At 105% achievement, the additional award is an additional 33.33% of the target award ($375,000), scaling up to an additional 50% of the target award ($562,500) if actual cumulative EPS is 107.5% or more of the cumulative target award. It should be emphasized that the additional award requires achievement significantly in excess of target—no additional award is payable unless target is exceeded by at least 5%.

The additional award can be entirely earned for the 2014-2017 performance period if 107.5% of the target is met. To the extent the entire award is not earned for the 2014-2017 performance period, the unearned amount can still be earned if cumulative performance for the 2014-2018 performance period is high enough. For example, if cumulative EPS is 105% of target for 2014-2017, this would result in an additional award of $375,000. While the remaining $187,500 can be earned if 2014-2018 cumulative EPS is 107.5%, it should be noted that the 2014-2018 earnout is based on cumulative performance, so it will require superior performance in 2018 to achieve the maximum award. By way of example (the following numbers are illustrative only and do not represent projections with respect to future EPS), if the EPS target for each of the years from 2014-2017 were $4, the 105% threshold would require cumulative EPS to be $16.80 (105% of $16). By way of illustration, suppose that cumulative EPS were $16.80 for 2014-2017. In that case, if the EPS target for 2018 were again $4, the 107.5% achievement level would only be met for 2014-2018 if actual EPS for 2018 were $4.70 (117.5% of target) because the actual EPS in 2018 would have to be very significantly above 107.5% to make up for prior years. In effect, the payout curve in 2018 is significantly steeper than the payout curve for 2014-2017 because of the need to perform better than the 2014-2017 average to get any additional payout.

In general, the payment of amounts earned, if any, under the EPS-Based LTI Cash Award for a performance period is contingent on employment through the end of the applicable performance period. Vesting for the EPS-Based LTI Cash Award may be accelerated under certain circumstances, including death, disability, termination without cause or for good reason, the CEO's termination after the expiration of his employment agreement currently in effect, or a change in control. Other than in the case of a change in control, accelerated vesting does not modify the performance requirements previously described. These circumstances are further described below under Potential Payments Upon Termination or Change in Control.

In 2014, the Company's diluted EPS was $4.26, which was 101.4% of the 2014 target EPS goal of $4.20 set by the CN&G Committee in February 2014. In 2013, the Company's diluted EPS was $3.99, which was slightly below the 2013 target EPS goal of $4.01 set by the CN&G Committee in February 2013. In 2012, the Company's diluted EPS was $3.83, which was 109% of the target EPS goal of $3.51.

As a result of achieving a three-year diluted EPS total of $12.08, which was 103.1% of the target three-year EPS goal of $11.72 for 2012-2014, 100% of the 2012-2014 EPS-Based LTI cash award was earned in 2014. This resulted in a payout of $1,125,000 to our CEO.

2014 TSR-Based LTI Cash Award. Our CEO is eligible for an annual long-term incentive cash award based on a comparison of the Company's three-year TSR for the July 1, 2014 through June 30, 2017 performance period relative to the SNL Bank Index, with a target award value of $750,000. The value of the award is determined by comparing the percentile ranking of the Company's TSR on the last day of the performance period to the TSRs measured as of such date for the companies (excluding the Company) ranked as the 11th through 50th of the largest banks in the SNL Bank Index as measured by assets (the "TSR Peers"). The Company ranks at approximately the 63rd percentile in assets and the 58th percentile in market capitalization of the TSR Peers as of December 31, 2014.

21

The TSR Peers as of December 31, 2014 are as follows:

| Associated Banc-Corp | First Niagara Financial Group, Inc. | Signature Bank | ||

| BankUnited, Inc. | First Republic Bank | Susquehanna Bancshares, Inc. | ||

| BB&T Corporation | FirstMerit Corporation | SVB Financial Group | ||

| BOK Financial Corporation | Fulton Financial Corporation | Synovus Financial Corp. | ||

| Citizens Financial Group, Inc. | Hancock Holding Company | TCF Financial Corporation | ||

| Comerica Incorporated | Huntington Bancshares Incorporated | Texas Capital Bancshares, Inc. | ||

| Commerce Bancshares, Inc. | KeyCorp | UMB Financial Corporation | ||

| Cullen/Frost Bankers, Inc. | M&T Bank Corporation | Umpqua Holdings Corporation | ||

| East West Bancorp, Inc. | Northern Trust Corporation | Valley National Bancorp | ||

| F.N.B. Corporation | PacWest Bancorp | Webster Financial Corporation | ||

| Fifth Third Bancorp | People's United Financial, Inc. | Wintrust Financial Corporation | ||

| First Citizens BancShares, Inc. | Popular, Inc. | Zions Bancorporation | ||

| First Horizon National Corporation | Prosperity Bancshares, Inc. | |||

| First National of Nebraska, Inc. | Regions Financial Corporation |

The TSR-Based LTI Cash Award pays the target award value at 50th percentile performance and pays above target award value for at least 75th percentile performance, with a range for threshold to maximum performance from $0 to $1,125,000. The TSR-Based LTI Cash Award links pay to Company stock-price performance as compared to its peers and, as compared to the prior use of stock options, reduces share utilization and dilution to our stockholders through cash settlement. The award amount payable is calculated based on the Company's three-year TSR percentile ranking versus the TSR Peers as follows:

TSR Percentile

|

Deemed Value ($) | |||

|---|---|---|---|---|

Below 25% |

0 | |||

25% to below 50% |

375,000 | |||

50% to below 75% |

750,000 | |||

75% to below 90% |

1,000,000 | |||

90% and above |

1,125,000 | |||

Clawback. If the Annual Incentive Award, cash-settled RSU award, EPS-Based LTI Cash Award or TSR-Based LTI Cash Award is or was based on materially inaccurate financial statements or any other materially inaccurate performance metric criteria, the excess compensation is subject to forfeiture and recoupment.

Other Named Executive Officers

2014 Annual Base Salary

During its 2014 annual compensation review, the CN&G Committee approved merit increases in the base salaries of the NEOs based on Company and individual performance to the following amounts, effective March 2014. Increases were generally based on the NEO's overall performance as well as the NEO's position relative to median market survey data.

Named Executive

|

2013 Base Salary ($) |

2014 Base Salary ($) |

|||||

|---|---|---|---|---|---|---|---|

Christopher J. Warmuth |

600,000 | 626,000 | |||||

Christopher J. Carey |

565,000 | 589,000 | |||||

Brian Fitzmaurice |

448,000 | 466,000 | |||||

Michael B. Cahill |

468,000 | 488,000 | |||||

2014 Annual Cash Incentive Compensation

The Annual Incentive Award for 2014 performance was awarded under the Executive Management Incentive Compensation Plan ("Executive Plan") for our CFO and under the Variable Bonus Plan for our

22

other NEOs. The CN&G Committee designated Christopher J. Warmuth, Brian Fitzmaurice and Michael B. Cahill as participants in the Variable Bonus Plan for 2014. Mr. Carey, our CFO, participated in the Executive Plan. The CN&G Committee used the funding formulas and performance factors under the Executive Plan as the basis for its determination of the awards to the participants under the Variable Bonus Plan.

Awards under the Variable Bonus Plan and Executive Plan are determined based on Company performance, individual performance and the performance of each executive's area of responsibility. Under these plans, management sets a financial goal for net operating income ("NOI") which is reviewed and approved by the CN&G Committee. Actual performance is measured against the NOI goal to determine award amounts. NOI is calculated as net income available to common stockholders, excluding unusual corporate gains or losses (net of tax) to prevent either unearned enrichment or unjust penalties for incentive plan participants. In 2014, the NOI performance goal was $236 million with funding capped at 150% of the target bonus for achievement of 127% or more of the NOI performance goal. If less than 85% of the NOI performance goal is achieved, there is no funding of the Company performance component for any participant in the Executive Plan.

Financial goals were also set for each line division of the Company as part of setting internal financial and strategic goals, and goals with significant division and/or Company-wide impact were also set for heads of the staff divisions. Mr. Carey and Mr. Warmuth have responsibility for the performance of the entire organization, and funding of awards to them is based 100% on the Company's performance relative to the NOI performance goal. Mr. Fitzmaurice and Mr. Cahill are each responsible for a staff division, and funding of awards to them is based 60% on the Company's performance relative to the NOI performance goal and 40% based on an evaluation of their respective annual division and/or individual performance. In order for the division portion of the Plan to fund, at least 65% of the Company NOI performance goal must be achieved, and at least 85% of the division performance objectives must be achieved. Funding and payment of the awards is subject to an individual performance modifier which can result in an upward or downward adjustment by as much as 20%.

The target and maximum permissible payouts expressed as a percentage of base salary for the NEOs for 2014 were as follows. The maximum payment percentage is a function of each NEO's (1) individual target annual incentive award, (2) the maximum financial component payable at 150% of target and (3) the maximum upward adjustment of 20% for individual performance.

Named Executive

|

Target | Maximum | |||||

|---|---|---|---|---|---|---|---|

Christopher J. Warmuth |

125 | % | 225 | % | |||

Christopher J. Carey |

125 | % | 225 | % | |||

Brian Fitzmaurice |

100 | % | 180 | % | |||

Michael B. Cahill |

90 | % | 162 | % | |||

For 2014, 101.5% of the Company's NOI performance goal was achieved. The Company performance component was funded at 103% for each participant in the Executive Plan. To determine the award amount for each NEO, the CN&G Committee considered the Company's 2014 strong financial performance, as well as each of the NEOs' contribution to that performance, and the performance of each of them against their division and/or individual goals, as appropriate. The CN&G Committee approved the funding of the awards to each NEO at the percentage amount set forth below. The bonuses paid to each

23

executive reflected the following percentage of the maximum bonus that the executive could have received under the applicable bonus plan for the Company's 2014 performance:

Named Executive

|

Percentage of Maximum Bonus |

|||

|---|---|---|---|---|

Christopher J. Warmuth |

69 | % | ||

Christopher J. Carey |

69 | % | ||

Brian Fitzmaurice |

68 | % | ||

Michael B. Cahill |

68 | % | ||

The actual incentive award amounts for each NEO are set forth below in the Summary Compensation Table. The awards reflect the evaluation of each NEO's individual performance as well as an evaluation of his overall contributions to the Company's strong performance for 2014.

In order to maximize the deductibility of the compensation and incentive payments to the NEOs, the requirements of Section 162(m) of the Internal Revenue Code of 1936, as amended (the "Code") were taken into account in the structure of the Variable Bonus Plan. At the start of 2014, the CN&G Committee reviewed and approved revenue as the financial criteria under the Variable Bonus Plan to determine whether the maximum permissible incentive for 2014 could be funded for each of Mr. Warmuth, Mr. Fitzmaurice, and Mr. Cahill, and set the performance goal at $950 million. In each case, these awards could then be reduced, but not increased, at the sole discretion of the Committee. The 2014 revenue goal was achieved.

2014 Long-Term Incentive Compensation

The CN&G Committee approves awards for long-term incentive compensation for the NEOs at the same time as annual cash compensation to ensure the CN&G Committee considers all elements of proposed compensation concurrently. In granting long-term compensation to the NEOs, the CN&G Committee follows a methodology including establishing the total dollar value of the award taking into account expectations for the executive's future contribution to the Company's long-term success, its strategic business plan and the role of the executive, individual performance, market data, internal parity, prudent corporate level expense management and consistency in equity award policies and practices.

In 2014, the CN&G Committee approved the grant of a mix of options and restricted stock. The CN&G Committee continues to believe that equity based awards should constitute a core element of long-term compensation. The long-term compensation grants made in 2014 to our NEOs (other than our CEO) are a mix of approximately 50% options and 50% restricted stock. The restricted stock vests 25% per year beginning on the second anniversary of the grant date. Options vest 25% per year beginning on the first anniversary of the grant date.

The following table sets forth the grants of equity based awards to the NEOs in 2014. It provides the number of shares of stock options and restricted stock granted to each NEO as part of their annual equity based award. The value of each award reflects the significance of the individual's responsibilities, their attractiveness to competitors, and the retention value of their previous equity awards. These awards were granted under the 2008 Plan.

Named Executive

|

Stock Options | Restricted Stock |

|||||

|---|---|---|---|---|---|---|---|

Christopher J. Warmuth |

28,646 | 7,481 | |||||

Christopher J. Carey |

26,042 | 6,801 | |||||

Brian Fitzmaurice |

7,813 | 2,040 | |||||

Michael B. Cahill |

7,813 | 2,040 | |||||

24

Stock Ownership Requirements

Our stock award program requires our NEOs to own a specific minimum amount of our common stock consistent with our stated principle to align our NEOs' interests with our stockholders' interests. The amount of common stock our NEOs must own varies depending upon the NEO's position and is computed as a multiple of annual base salary. Stock ownership requirements are phased in over five years with the first phase of the requirement becoming applicable three years from hire date or change in officer position. As of April 13, 2015, each NEO met and exceeded the applicable stock ownership requirements. The stock ownership requirements currently applicable to the NEOs are listed below:

Named Executive

|

Stock Ownership Requirement as % of Base Salary |

|||

|---|---|---|---|---|

Russell Goldsmith |

500 | % | ||

Christopher J. Warmuth |

350 | % | ||

Christopher J. Carey |

350 | % | ||

Brian Fitzmaurice |

150 | % | ||

Michael B. Cahill |

150 | % | ||

Ownership may be achieved in several ways including shares owned directly, vested RSUs, stock held in our Profit Sharing Plan, units in the CNC Stock Fund, 50% of the gain on in-the-money exercisable stock options and 50% of unvested restricted stock and RSUs. The higher of the actual spot date price or the one year simple moving average price for the Company's stock may be used in determining compliance with these ownership requirements.

Restrictions on Hedging and Pledging

Our Securities Trading Policy, which applies to all of our employees and directors, prohibits the pledge of Company stock and has for many years included a prohibition on hedging or speculative trading in Company stock.

Employment Agreements

Other than our CEO, the NEOs do not have employment agreements. Russell Goldsmith serves as Chairman of the Board, CEO and President of the Company and Chairman of the Board and CEO of the Bank. The Company entered into an employment agreement with Mr. Goldsmith on June 24, 2010 for a term of four years commencing July 16, 2010 which was subsequently amended in March 2012. The Company entered into an additional mutually agreed upon amendment to Mr. Goldsmith's employment agreement on July 14, 2014 (the "2014 amendment") which extended the term of the employment agreement to July 15, 2017 and modified the structure of Mr. Goldsmith's long-term compensation effective in 2015.

The 2014 amendment modifies the performance target and the target award value of the annual incentive cash-settled RSU award. Mr. Goldsmith is entitled to an annual incentive cash-settled RSU award with a target award value of $1,225,000 if the Company's net income goal for the fiscal year in which the award is granted is achieved at 75% of target or above, scaling down based on the percentage of the target net income goal achieved. The award is forfeited in its entirety if less than 50% of the target net income goal is achieved. In lieu of the annual EPS-Based LTI Cash Award, the 2014 amendment provides for a long-term incentive cash award with a target award value of $1,325,000 based on the Company's performance relative to Peer Banks (as defined in the 2014 amendment) for a three-year performance measurement period as measured by (1) growth in cumulative actual diluted earnings per share, (2) return on tangible equity, (3) net charge-offs to total loans, and (4) nonperforming assets to total loans. Mr. Goldsmith is entitled to the maximum award value of $579,687.50 for each performance segment only

25

if the Company's performance is at the 75th percentile or above relative to the Peer Banks, scaling down based on the Company's percentile rank relative to the Peer Banks. No payout will be made for a particular performance segment if the Company's performance for such performance segment is below the 35th percentile. The 2014 amendment also modifies the potential award value at the target, maximum and threshold levels for the TSR-Based LTI Cash Award. The TSR-Based LTI Cash Award pays the target award value of $1,000,000 at 50th percentile performance and pays above target award value for at least 75th percentile performance, with a range for threshold to maximum performance of $0 to $1,750,000. The award will be earned based on the Company's performance relative to Peer Banks for a three-year performance measurement period beginning on July 1 of the year of grant. No payout will be made for a TSR-Based LTI Cash Award if the Company's performance is below the 25th percentile.

Our CEO's employment agreement does not provide for a golden parachute excise tax gross-up and requires a termination of employment in addition to a change in control before change in control benefits are triggered. See Potential Payments Upon Termination or Change in Control for further information regarding the rights of our CEO and the Company in various termination scenarios and upon a change in control of the Company.

Termination of Employment and Change in Control Plans and Agreements

The rights and obligations of our CEO and the Company upon a change in control are governed by the terms of his employment agreement, as amended, which provides benefits in the event of a change in control of the Company ("CEO CIC Agreement"). Change in control payments, benefits and rights are set forth in the Strategy & Planning Committee Change in Control Severance Plan ("S&P Plan") for Christopher J. Carey and Christopher J. Warmuth, and in the Executive Committee Change in Control Severance Plan ("EC Plan," and together with the S&P Plan, the "CIC Plans") for Brian Fitzmaurice and Michael B. Cahill.

The CIC Plans and the CEO CIC Agreement are designed to promote stability and continuity of management despite the risk of job loss in the event of termination due to a change in control, and are consistent with market practices. The CIC Plans and CEO CIC Agreement provide that following a defined change in control event, cash severance payments are paid upon involuntary termination for any reason, other than cause, death or disability, or upon termination for "good reason," within 12 months (36 months for the CEO) of the occurrence of a change in control. The CIC Plans (but not the CEO CIC Agreement) also provide that a termination for "good reason" includes a voluntary termination of employment during the 30-day period immediately preceding the first anniversary of the change in control. The CEO CIC Agreement provides that following a change of control, the CEO will be employed for the greater of three years or the remaining term of his employment agreement. This structure provides for transition in the event of a change in control and provides an incentive for the NEOs to remain with the successor organization after a change in control.

Information regarding applicable payments under these agreements for the NEOs is provided below under Potential Payments Upon Termination or Change in Control.

Executive Compensation Tax and Accounting Considerations