Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JUNIPER NETWORKS INC | d914450d8k.htm |

| EX-99.1 - EX-99.1 - JUNIPER NETWORKS INC | d914450dex991.htm |

Exhibit 99.2

Juniper Networks, Inc.

1133 Innovation Way

Sunnyvale, CA 94089

April 23, 2015

CFO Commentary on First Quarter 2015 Financial Results

Related Information

The following commentary is provided by management and should be referenced in conjunction with Juniper Networks’ first quarter 2015 financial results press release available on its Investor Relations website at http://investor.juniper.net/investor-relations/default.aspx. These remarks represent management’s current views on the Company’s financial and operational performance and outlook and are provided to give investors and analysts further insight into our performance in advance of the earnings call webcast.

Q1 2015 Financial Results

GAAP

| (in millions, except per share amounts and percentages) | Q1’15 | Q4’14 | Q1’14 | Q/Q Change | Y/Y Change | |||||||||||||||

| Revenue |

$ | 1,067.4 | $ | 1,101.6 | $ | 1,170.1 | (3 | )% | (9 | )% | ||||||||||

| Product |

764.1 | 794.0 | 876.0 | (4 | )% | (13 | )% | |||||||||||||

| Service |

303.3 | 307.6 | 294.1 | (1 | )% | 3 | % | |||||||||||||

| Gross margin % |

62.1 | % | 61.3 | % | 61.5 | % | 0.8 | pts | 0.6 | pts | ||||||||||

| Research and development |

248.7 | 233.5 | 264.0 | 7 | % | (6 | )% | |||||||||||||

| Sales and marketing |

225.8 | 243.0 | 273.4 | (7 | )% | (17 | )% | |||||||||||||

| General and administrative |

55.2 | 40.6 | 74.9 | 36 | % | (26 | )% | |||||||||||||

| Restructuring and other charges |

1.4 | 9.8 | 114.0 | (86 | )% | (99 | )% | |||||||||||||

| Impairment of goodwill |

— | 850.0 | — | (100 | )% | N/A | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expense |

531.1 | 1,376.9 | 726.3 | (61 | )% | (27 | )% | |||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Operating margin % |

12.3 | % | (63.7 | )% | (0.5 | )% | 76.0 | pts | 12.8 | pts | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

$ | 80.2 | $ | (769.6 | ) | $ | 110.6 | (110 | )% | (27 | )% | |||||||||

|

|

|

|

|

|

|

|||||||||||||||

| EPS (Diluted) |

$ | 0.19 | $ | (1.81 | ) | $ | 0.22 | (110 | )% | (14 | )% | |||||||||

|

|

|

|

|

|

|

|||||||||||||||

Non-GAAP

| (in millions, except per share amounts and percentages) | Q2’15 Guidance | Q1’15 | Q4’14 | Q1’14 | Q/Q Change | Y/Y Change | ||||||||||||||||

| Revenue(*) |

$1,090 - $1,120 | $ | 1,067.4 | $ | 1,101.6 | $ | 1,137.1 | (3 | )% | (6 | )% | |||||||||||

| Product(*) |

764.1 | 794.0 | 858.4 | (4 | )% | (11 | )% | |||||||||||||||

| Service(*) |

303.3 | 307.6 | 278.7 | (1 | )% | 9 | % | |||||||||||||||

| Gross margin % |

64% +/- 0.5% | 63.1 | % | 64.1 | % | 63.5 | % | (1.0 | )pts | (0.4 | )pts | |||||||||||

| Research and development |

216.8 | 199.4 | 228.8 | 9 | % | (5 | )% | |||||||||||||||

| Sales and marketing |

212.8 | 226.3 | 255.6 | (6 | )% | (17 | )% | |||||||||||||||

| General and administrative |

47.1 | 39.2 | 57.5 | 20 | % | (18 | )% | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Total operating expense |

$475 +/- $5 | 476.7 | 464.9 | 541.9 | 3 | % | (12 | )% | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Operating margin % |

21% (mdpt. of rev.) | 18.5 | % | 21.9 | % | 17.2 | % | (3.4 | )pts | 1.3 | pts | |||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

$ | 131.6 | $ | 179.3 | $ | 142.6 | (27 | )% | (8 | )% | ||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| EPS (Diluted) |

$0.38 - $0.42 | $ | 0.32 | $ | 0.41 | $ | 0.29 | (22 | )% | 10 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| (*) | Q1’14 revenues have been normalized for the sale of Junos Pulse. |

The following CFO Commentary is on a non-GAAP basis and the reconciliations to GAAP can be found at the end of this document. Also, prior year revenue has been normalized for the sale of Junos Pulse.

Overview

For the first quarter of 2015, we delivered good year-over-year non-GAAP operating margin and earnings per share expansion, reflecting continued management of our cost structure and significant reduction in our share count, while driving innovation and remaining focused on our growth strategy. We exceeded our revenue guidance range due to slightly better demand from our Cloud, Cable and European Service Providers, which points to the strength in the continued diversification of our customer base.

Our underlying demand metrics were healthy this quarter with an increase in both total and product deferred revenue and a book-to-bill greater than 1.

We continued to deliver on our capital return program. In the quarter, we repurchased $400 million of shares and we are reaffirming our commitment to repurchase a total of $1.0 billion of shares from January through June 2015. Additionally, in the quarter we completed a $600 million bond offering enabling us to execute on our total capital return of $4.1 billion to shareholders through 2016.

Revenue

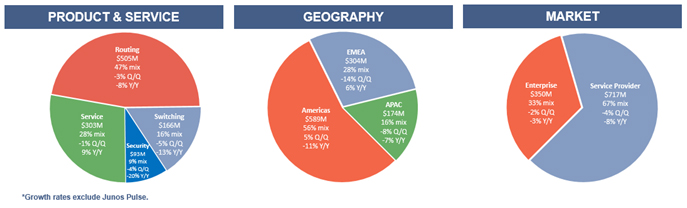

Product & Service

| • | Routing product revenue: $505 million, down 8% year-over-year and a 3% decline from the prior quarter. As expected, the year-over-year decline was due to continued softness from large US Carriers partially offset by an increase in Enterprise globally and Service Providers in EMEA. Sequentially, the decrease was due to the anticipated decline from Service Providers in EMEA and APAC, offset by a moderate improvement from US Carriers, Cloud, and Cable Providers. |

| • | Switching product revenue: $166 million, a decrease of 13% year-over-year, primarily due to declines in campus and branch offset by a modest increase in data center. Quarter-over-quarter, switching product revenue decreased 5% due to normal seasonality in our Enterprise business partially offset by strength from Cloud and Cable Providers. |

| • | Security product revenue: $93 million, down 20% year-over-year and 4% sequentially. Our Screen OS and other legacy products declined 54% year-over-year and 23% quarter-over-quarter. The SRX Platform and Security Software were flat sequentially and down 11% year-over-year. The lower revenue from the prior year is due to fewer Service Provider deployments in the Americas and APAC, partially offset by growth in High-End SRX from Cloud Providers in the Americas. |

| • | Service revenue: $303 million, up 9% year-over-year and down 1% quarter-over-quarter. The year-over-year increase in service revenue was primarily driven by new service contracts and strong contract renewals. The sequential decline is in line with typical seasonality. |

Geography

| • | Americas: $589 million, down 11% year-over-year and up 5% quarter-over-quarter. As expected, the year-over-year decrease was primarily due to US Carriers partially offset by Cloud Providers. The sequential increase was driven by Cloud and Cable providers and Enterprise customers. |

| • | EMEA: $304 million, up 6% year-over-year and down 14% from the prior quarter. The increase from the prior year was due to growth from Services Providers in Germany, Sweden and the Middle East. The sequential decline was across both Service Providers and Enterprise. |

| • | APAC: $174 million, down 7% year-over-year due to revenue declines in China, Japan, and Australia. The 8% decrease quarter-over-quarter was due to declines in Korea, Australia, and China. |

Market

| • | Service Provider: $717 million, down 8% year-over-year and 4% from the prior quarter. Year-over-year declines in the Americas and APAC were offset by strength in EMEA across routing, switching and security. Quarter-over-quarter strength in the Americas from Cloud and Cable Providers was offset by declines in EMEA and APAC. |

| • | Enterprise: $350 million, down 3% from the prior year and 2% from last quarter. The year-over-year and sequential declines were primarily due to lower switching product revenue in the Americas and EMEA and lower security product revenue in EMEA and APAC. Enterprise routing increased year-over-year in all three geographies. Overall, in Enterprise we saw improved momentum in the data center across routing, switching and security. |

Gross Margins

| • | Non-GAAP gross margins: 63.1%, compared to 63.5% a year ago and 64.1% last quarter. As a reminder, for the first quarter of 2015 we guided to a lower gross margin level, than our long range model as a result of the combination of expected lower volumes and higher variable costs. |

| • | Non-GAAP product gross margins: 63.9%, down nine tenths of a point from a year ago and four tenths of a point from last quarter due to mix and lower volume. While the pricing environment is consistently competitive, we remain focused on innovation and continued improvements to our cost structure. |

| • | Non-GAAP service gross margins: 61.3%, up 1.6 points from a year ago and down 2.3 points quarter-over-quarter. The year-over-year increase was due to operational improvements and lower costs, while the sequential decline was due to lower revenue, the impact of seasonally higher variable labor costs such as FICA tax-related expense, and the reset of variable compensation. |

Operating Expenses

| • | Non-GAAP operating expenses: $477 million, within our guidance range, down $65 million or 12% year-over-year. This reflects the continued management of our cost structure primarily due to year-over-year headcount reductions of 8% and a decrease in real estate square footage of 13%. Non-GAAP operating expenses increased sequentially, as expected, due to typical first quarter employee-related variable expenses. |

Operating Margin

| • | Non-GAAP operating margins: 18.5%, an improvement of 1.3 points year-over-year despite lower revenue. This reflects our continued focus on cost management. |

Tax Rate

| • | Non-GAAP tax rate: 26.9%, compared to 20.9% last quarter. This change is primarily due to the $13 million one-time benefit in the prior quarter for the federal R&D tax credit. |

Diluted Earnings Per Share

| • | Non-GAAP diluted earnings per share: $0.32, increased $0.03 year-over-year primarily due to the positive impact from cost reductions and reduced share count offset by lower revenue and gross margins. The sequential decrease of $0.09 was due to lower revenue and gross margins, an increase in the tax rate, and higher operating expenses partially offset by a positive impact from reduced share count. |

Balance Sheet, Cash Flow, and Capital Return

| (in millions) | Q1’15 | Q4’14 | Q3’14 | Q2’14 | Q1’14 | |||||||||||||||

| Cash(1) |

$ | 3,450.6 | $ | 3,104.9 | $ | 3,321.0 | $ | 3,960.4 | $ | 3,478.7 | ||||||||||

| Debt |

1,948.6 | 1,349.0 | 1,348.9 | 1,348.9 | 1,348.9 | |||||||||||||||

| Net cash and investments |

1,502.0 | 1,755.9 | 1,972.1 | 2,611.5 | 2,129.8 | |||||||||||||||

| Operating cash flow(4) |

219.3 | 284.9 | (69.7 | ) | 423.6 | (2) | 124.6 | |||||||||||||

| Share repurchases |

400.0 | 500.0 | 850.0 | (3) | — | 900.0 | (3) | |||||||||||||

| Dividends |

$ | 40.8 | $ | 42.2 | $ | 43.8 | $ | — | $ | — | ||||||||||

| Diluted shares |

414.2 | 432.4 | 454.8 | 476.5 | 496.5 | |||||||||||||||

| (1) | Cash includes cash, cash equivalents, and investments. |

| (2) | Includes $75 million from a patent litigation settlement. |

| (3) | Represents a $1.2 billion accelerated share repurchase of which $900 million of shares and $300 million of shares were delivered in first and third quarter of 2014, respectively. |

| (4) | Certain prior period amounts have been reclassified to conform to the current period presentation. |

Balance Sheet

| • | Cash: $3.5 billion, with 20% held onshore. |

| • | Debt: $1.9 billion, including the $600 million bond offering completed in the quarter. We continue to maintain investment grade credit ratings of BBB/Baa2 by S&P and Moody’s. We believe that our debt also has well staggered maturities. |

| • | Net cash and investments: $1.5 billion. A decline of $254 million quarter-over-quarter primarily due to share repurchases and dividend payments totaling $441 million offset by cash flow from operations of $219 million. |

Cash Flow

| • | Cash flow from operations: Cash flow from operations was $219 million, down from $285 million from the prior quarter primarily due to payments for incentive compensation. |

Capital Return

| • | We continue to deliver on our commitments to shareholders and execute on our capital return plan. |

| • | We repurchased $400 million of shares in the quarter. |

| • | Since the beginning of 2014, we repurchased and retired approximately 114 million shares. |

| • | Diluted share count declined 17% year-over-year. |

| • | We are reaffirming our commitment to return a total of $4.1 billion to shareholders through 2016. |

| • | A quarterly dividend of $0.10 per share was paid in March with the intent to grow it over time. |

| • | The Board approved a dividend of $0.10 per share for the second quarter of 2015. |

Other Financial Metrics

| (in millions, except product book-to-bill, days sales outstanding (“DSO”), and headcount) | Q1’15 | Q4’14 | Q3’14 | Q2’14 | Q1’14 | |||||||||||||||

| Product book-to-bill |

>1 | >1 | 1 | 1 | <1 | |||||||||||||||

| DSO |

43 | 49 | 49 | 41 | 46 | |||||||||||||||

| Depreciation and amortization |

$ | 46.0 | $ | 42.5 | $ | 44.3 | $ | 45.3 | $ | 46.1 | ||||||||||

| Capital expenditures |

$ | 44.2 | $ | 51.9 | $ | 42.4 | $ | 41.2 | $ | 57.4 | ||||||||||

| Headcount |

8,772 | 8,806 | 9,059 | 9,083 | 9,573 | |||||||||||||||

Demand metrics

| • | Product book-to-bill was greater than 1. |

| • | Total deferred revenue was $1,175 million up $21 million year-over-year and $99 million quarter-over-quarter. |

| • | Product deferred revenue was $253 million up $22 million year-over-year and $28 million sequentially. |

DSO

| • | DSO: 43 days, compared to 49 days from the prior quarter, a decline of 6 days. The sequential decline was primarily due to better shipment linearity and collections in the quarter. |

Headcount

| • | 8,772, a decline of 801 employees or 8% year-over-year. |

Outlook

These metrics are provided on a non-GAAP basis, except for revenue and share count.

The Company continues to see the long-term demand drivers as healthy and is confident in its innovation pipeline. Juniper expects to return to its historical pattern of higher revenue in the second half of 2015 versus the first half of the year.

Juniper Networks estimates that for the quarter ending June 30, 2015:

| • | Revenues will be in the range of $1,090 million to $1,120 million. |

| • | Non-GAAP gross margin will be approximately 64%, plus or minus 0.5%. |

| • | Non-GAAP operating expenses will be $475 million, plus or minus $5 million. |

| • | Non-GAAP operating margin will be roughly 21% at the midpoint of revenue guidance. |

| • | Non-GAAP net income per share will range between $0.38 and $0.42 on a diluted basis. This assumes a share count of 395 million and a non-GAAP tax rate flat from the first quarter, assuming no renewal of the R&D tax credit for 2015. |

Forward-Looking Statements

Statements in this CFO Commentary and related conference call concerning Juniper Networks’ business, economic and market outlook, future financial and operating results, capital return program, and overall future prospects are forward looking statements that involve a number of uncertainties and risks. Actual results or events could differ materially from those anticipated in those forward-looking statements as a result of certain factors, including: general economic and political conditions globally or regionally; business and economic conditions in the networking industry; changes in overall technology spending and spending by communication service providers and major customers; the network capacity requirements of communication service providers; contractual terms that may result in the deferral of revenue; increases in and the effect of competition; the timing of orders and their fulfillment; manufacturing and supply chain constraints; ability to establish and maintain relationships with distributors, resellers and other partners; variations in the expected mix of products sold; changes in customer mix; changes in geography mix; customer and industry analyst perceptions of Juniper Networks and its technology, products and future prospects; delays in scheduled product availability; market acceptance of Juniper Networks products and services; rapid technological and market change; adoption of regulations or standards affecting Juniper Networks products, services or the networking industry; the ability to successfully acquire, integrate and manage businesses and technologies; product defects, returns or vulnerabilities; the ability to recruit and retain key personnel; significant effects of tax legislation and judicial or administrative interpretation of tax regulations; currency fluctuations; litigation settlements and resolutions; the potential impact of activities related to the execution of capital return and product rationalization; and other factors listed in Juniper Networks’ most recent report on Form 10-K filed with the Securities and Exchange Commission (“SEC”). All statements contained in this CFO Commentary and related conference call are made only as of the date set forth at the beginning of this document. Juniper Networks undertakes no obligation to update the information contained in this document or the related conference call in the event facts or circumstances subsequently change after the date of this document.

Use of Non-GAAP Financial Measures

This CFO Commentary contains references to the following non-GAAP financial measures: product gross margin as a percentage of product revenue; service gross margin as a percentage of service revenue; gross margin as a percentage of revenue; research and development expense; sales and marketing expense; general and administrative expense; operating expense; operating income; operating margin; income tax rate; net income; and net income per share. For important commentary on why Juniper Networks considers non-GAAP information a useful view of the company’s financial results, please see the press release furnished with our Form 8-K filed today with the SEC. With respect to future financial guidance provided on a non-GAAP basis, we have excluded estimates for amortization of intangible assets, share-based compensation expenses, acquisition-related charges, restructuring and other charges, impairment charges, professional services related to non-routine stockholder matters, litigation settlement and resolution charges, gain or loss on equity investments, retroactive impact of certain tax settlements, non-recurring income tax adjustments, valuation allowance on deferred tax assets, and income tax effect of non-GAAP exclusions. These measures are not presented in accordance with, nor are they a substitute for U.S. generally accepted accounting principles or GAAP. In addition, these measures may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. The non-GAAP financial measures used in this CFO Commentary should not be considered in isolation from measures of financial performance prepared in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, many of the adjustments to our GAAP financial measures reflect the exclusion of items that are recurring and will be reflected in our financial results for the foreseeable future.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis due to the high variability and low visibility with respect to the charges which are excluded from these non-GAAP measures.

Juniper Networks, Inc.

GAAP to Non-GAAP Reconciliations

Revenue by Product & Service Ex-Junos Pulse

| Revenue, As Reported (in millions, except percentages) | ||||||||||||||||||||||||||||||||||||

| Q1’14 | Q2’14 | Q3’14 | Q4’14 | Q1’15 | Q/Q | Y/Y | ||||||||||||||||||||||||||||||

| Routing |

$ | 549.8 | $ | 617.8 | $ | 533.2 | $ | 523.1 | $ | 504.8 | $ | (18.3 | ) | (3 | )% | $ | (45.0 | ) | (8 | )% | ||||||||||||||||

| Switching |

192.0 | 199.8 | 155.0 | 174.4 | 166.5 | (7.9 | ) | (5 | )% | (25.5 | ) | (13 | )% | |||||||||||||||||||||||

| Security |

134.2 | 111.6 | 121.3 | 96.5 | 92.8 | (3.7 | ) | (4 | )% | (41.4 | ) | (31 | )% | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Product |

876.0 | 929.2 | 809.5 | 794.0 | 764.1 | (29.9 | ) | (4 | )% | (111.9 | ) | (13 | )% | |||||||||||||||||||||||

| Service |

294.1 | 300.3 | 316.4 | 307.6 | 303.3 | (4.3 | ) | (1 | )% | 9.2 | 3 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total |

$ | 1,170.1 | $ | 1,229.5 | $ | 1,125.9 | $ | 1,101.6 | $ | 1,067.4 | $ | (34.2 | ) | (3 | )% | $ | (102.7 | ) | (9 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Revenue, Ex-Junos Pulse (in millions, except percentages) |

||||||||||||||||||||||||||||||||||||

| Q1’14 | Q2’14 | Q3’14 | Q4’14 | Q1’15 | Q/Q | Y/Y | ||||||||||||||||||||||||||||||

| Routing |

$ | 549.8 | $ | 617.8 | $ | 533.2 | $ | 523.1 | $ | 504.8 | $ | (18.3 | ) | (3 | )% | $ | (45.0 | ) | (8 | )% | ||||||||||||||||

| Switching |

192.0 | 199.8 | 155.0 | 174.4 | 166.5 | (7.9 | ) | (5 | )% | (25.5 | ) | (13 | )% | |||||||||||||||||||||||

| Security |

116.6 | 95.7 | 105.9 | 96.5 | 92.8 | (3.7 | ) | (4 | )% | (23.8 | ) | (20 | )% | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Product |

858.4 | 913.3 | 794.1 | 794.0 | 764.1 | (29.9 | ) | (4 | )% | (94.3 | ) | (11 | )% | |||||||||||||||||||||||

| Service |

278.7 | 284.8 | 301.2 | 307.6 | 303.3 | (4.3 | ) | (1 | )% | 24.6 | 9 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total |

$ | 1,137.1 | $ | 1,198.1 | $ | 1,095.3 | $ | 1,101.6 | $ | 1,067.4 | $ | (34.2 | ) | (3 | )% | $ | (69.7 | ) | (6 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Security Products: Quarterly Revenue Trend

| (in millions) | Q1’14(*) | Q2’14(*) | Q3’14(*) | Q4’14(*) | Q1’15 | |||||||||||||||

| SRX Platform and Security Software |

$ | 91.3 | $ | 78.0 | $ | 87.6 | $ | 81.4 | $ | 81.1 | ||||||||||

| Screen OS and Other Legacy |

25.3 | 17.7 | 18.3 | 15.1 | 11.7 | |||||||||||||||

| Junos Pulse |

17.6 | 15.9 | 15.4 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total product revenue |

$ | 134.2 | $ | 111.6 | $ | 121.3 | $ | 96.5 | $ | 92.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (*) | Certain prior period amounts have been reclassified to conform to the current period presentation. |

Juniper Networks, Inc.

GAAP to Non-GAAP Reconciliations

Revenue by Geography Ex-Junos Pulse

| Revenue, As Reported (in millions, except percentages) | ||||||||||||||||||||||||||||||||||||

| Q1’14 | Q2’14 | Q3’14 | Q4’14 | Q1’15 | Q/Q | Y/Y | ||||||||||||||||||||||||||||||

| Americas |

$ | 681.5 | $ | 711.0 | $ | 678.3 | $ | 559.5 | $ | 589.0 | $ | 29.5 | 5 | % | $ | (92.5 | ) | (14 | )% | |||||||||||||||||

| EMEA |

295.7 | 324.8 | 290.5 | 352.3 | 303.8 | (48.5 | ) | (14 | )% | 8.1 | 3 | % | ||||||||||||||||||||||||

| APAC |

192.9 | 193.7 | 157.1 | 189.8 | 174.6 | (15.2 | ) | (8 | )% | (18.3 | ) | (9 | )% | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total |

$ | 1,170.1 | $ | 1,229.5 | $ | 1,125.9 | $ | 1,101.6 | $ | 1,067.4 | $ | (34.2 | ) | (3 | )% | $ | (102.7 | ) | (9 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Revenue, Ex-Junos Pulse (in millions, except percentages) |

||||||||||||||||||||||||||||||||||||

| Q1’14 | Q2’14 | Q3’14 | Q4’14 | Q1’15 | Q/Q | Y/Y | ||||||||||||||||||||||||||||||

| Americas |

$ | 662.7 | $ | 693.9 | $ | 662.2 | $ | 559.5 | $ | 589.0 | $ | 29.5 | 5 | % | $ | (73.7 | ) | (11 | )% | |||||||||||||||||

| EMEA |

286.7 | 315.3 | 280.6 | 352.3 | 303.8 | (48.5 | ) | (14 | )% | 17.1 | 6 | % | ||||||||||||||||||||||||

| APAC |

187.7 | 188.9 | 152.5 | 189.8 | 174.6 | (15.2 | ) | (8 | )% | (13.1 | ) | (7 | )% | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total |

$ | 1,137.1 | $ | 1,198.1 | $ | 1,095.3 | $ | 1,101.6 | $ | 1,067.4 | $ | (34.2 | ) | (3 | )% | $ | (69.7 | ) | (6 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Revenue by Market Ex-Junos Pulse

| Revenue, As Reported (in millions, except percentages) | ||||||||||||||||||||||||||||||||||||

| Q1’14 | Q2’14 | Q3’14 | Q4’14 | Q1’15 | Q/Q | Y/Y | ||||||||||||||||||||||||||||||

| SP |

$ | 782.7 | $ | 831.8 | $ | 741.5 | $ | 744.4 | $ | 717.0 | $ | (27.4 | ) | (4 | )% | $ | (65.7 | ) | (8 | )% | ||||||||||||||||

| Enterprise |

387.4 | 397.7 | 384.4 | 357.2 | 350.4 | (6.8 | ) | (2 | )% | (37.0 | ) | (10 | )% | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total |

$ | 1,170.1 | $ | 1,229.5 | $ | 1,125.9 | $ | 1,101.6 | $ | 1,067.4 | $ | (34.2 | ) | (3 | )% | $ | (102.7 | ) | (9 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Revenue, Ex-Junos Pulse (in millions, except percentages) |

||||||||||||||||||||||||||||||||||||

| Q1’14 | Q2’14 | Q3’14 | Q4’14 | Q1’15 | Q/Q | Y/Y | ||||||||||||||||||||||||||||||

| SP |

$ | 777.4 | $ | 827.5 | $ | 733.8 | $ | 744.4 | $ | 717.0 | $ | (27.4 | ) | (4 | )% | $ | (60.4 | ) | (8 | )% | ||||||||||||||||

| Enterprise |

359.7 | 370.6 | 361.5 | 357.2 | 350.4 | (6.8 | ) | (2 | )% | (9.3 | ) | (3 | )% | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total |

$ | 1,137.1 | $ | 1,198.1 | $ | 1,095.3 | $ | 1,101.6 | $ | 1,067.4 | $ | (34.2 | ) | (3 | )% | $ | (69.7 | ) | (6 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Juniper Networks, Inc.

GAAP to Non-GAAP Reconciliations

| Q1’15 | Q4’14 | Q1’14 | ||||||||||

| GAAP gross margin - Product |

$ | 480.9 | $ | 483.1 | $ | 549.4 | ||||||

| GAAP product gross margin % of product revenue |

62.9 | % | 60.8 | % | 62.7 | % | ||||||

| Share-based compensation expense |

1.7 | 1.1 | 1.3 | |||||||||

| Share-based payroll tax expense |

0.1 | — | 0.3 | |||||||||

| Amortization of purchased intangible assets |

5.2 | 7.2 | 8.2 | |||||||||

| Restructuring and other charges |

— | 19.4 | 8.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP gross margin - Product |

$ | 487.9 | $ | 510.8 | $ | 567.6 | ||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP product gross margin % of product revenue |

63.9 | % | 64.3 | % | 64.8 | % | ||||||

| GAAP gross margin - Service |

$ | 182.0 | $ | 192.0 | $ | 170.7 | ||||||

| GAAP service gross margin % of service revenue |

60.0 | % | 62.4 | % | 58.0 | % | ||||||

| Share-based compensation expense |

3.4 | 3.5 | 4.0 | |||||||||

| Share-based payroll tax expense |

0.4 | 0.2 | 1.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP gross margin - Service |

$ | 185.8 | $ | 195.7 | $ | 175.7 | ||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP service gross margin % of service revenue |

61.3 | % | 63.6 | % | 59.7 | % | ||||||

| GAAP gross margin |

$ | 662.9 | $ | 675.1 | $ | 720.1 | ||||||

| GAAP gross margin % of revenue |

62.1 | % | 61.3 | % | 61.5 | % | ||||||

| Share-based compensation expense |

5.1 | 4.6 | 5.3 | |||||||||

| Share-based payroll tax expense |

0.5 | 0.2 | 1.3 | |||||||||

| Amortization of purchased intangible assets |

5.2 | 7.2 | 8.2 | |||||||||

| Restructuring and other charges |

— | 19.4 | 8.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP gross margin |

$ | 673.7 | $ | 706.5 | $ | 743.3 | ||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP gross margin % of revenue |

63.1 | % | 64.1 | % | 63.5 | % | ||||||

| GAAP research and development expense |

$ | 248.7 | $ | 233.5 | $ | 264.0 | ||||||

| Share-based compensation expense |

(30.7 | ) | (33.7 | ) | (32.1 | ) | ||||||

| Share-based payroll tax expense |

(1.2 | ) | (0.4 | ) | (3.1 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP research and development expense |

$ | 216.8 | $ | 199.4 | $ | 228.8 | ||||||

|

|

|

|

|

|

|

|||||||

| GAAP sales and marketing expense |

$ | 225.8 | $ | 243.0 | $ | 273.4 | ||||||

| Share-based compensation expense |

(5.8 | ) | (15.3 | ) | (14.6 | ) | ||||||

| Share-based payroll tax expense |

(0.8 | ) | (0.4 | ) | (2.2 | ) | ||||||

| Amortization of purchased intangible assets |

(6.4 | ) | (1.0 | ) | (1.0 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP sales and marketing expense |

$ | 212.8 | $ | 226.3 | $ | 255.6 | ||||||

|

|

|

|

|

|

|

|||||||

| GAAP general and administrative expense |

$ | 55.2 | $ | 40.6 | $ | 74.9 | ||||||

| Share-based compensation expense |

(4.4 | ) | (1.0 | ) | (8.8 | ) | ||||||

| Share-based payroll tax expense |

(0.4 | ) | (0.1 | ) | (0.4 | ) | ||||||

| Amortization of purchased intangible assets |

(0.3 | ) | (0.3 | ) | (0.3 | ) | ||||||

| Acquisition-related charges |

— | — | (0.6 | ) | ||||||||

| Professional services related to non-routine stockholder matters |

(3.0 | ) | — | (7.3 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP general and administrative expense |

$ | 47.1 | $ | 39.2 | $ | 57.5 | ||||||

|

|

|

|

|

|

|

|||||||

Juniper Networks, Inc.

GAAP to Non-GAAP Reconciliations

| Q1’15 | Q4’14 | Q1’14 | ||||||||||

| GAAP operating expense |

$ | 531.1 | $ | 1,376.9 | $ | 726.3 | ||||||

| Share-based compensation expense |

(40.9 | ) | (50.0 | ) | (55.5 | ) | ||||||

| Share-based payroll tax expense |

(2.4 | ) | (0.9 | ) | (5.7 | ) | ||||||

| Amortization of purchased intangible assets |

(6.7 | ) | (1.3 | ) | (1.3 | ) | ||||||

| Restructuring and other charges |

(1.4 | ) | (9.8 | ) | (114.0 | ) | ||||||

| Impairment of goodwill |

— | (850.0 | ) | — | ||||||||

| Acquisition-related charges |

— | — | (0.6 | ) | ||||||||

| Professional services related to non-routine stockholder matters |

(3.0 | ) | — | (7.3 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP operating expense |

$ | 476.7 | $ | 464.9 | $ | 541.9 | ||||||

|

|

|

|

|

|

|

|||||||

| GAAP operating income (loss) |

$ | 131.8 | $ | (701.8 | ) | $ | (6.2 | ) | ||||

| GAAP operating margin |

12.3 | % | (63.7 | )% | (0.5 | )% | ||||||

| Share-based compensation expense |

46.0 | 54.6 | 60.8 | |||||||||

| Share-based payroll tax expense |

2.9 | 1.1 | 7.0 | |||||||||

| Amortization of purchased intangible assets |

11.9 | 8.5 | 9.5 | |||||||||

| Restructuring and other charges |

1.4 | 29.2 | 122.4 | |||||||||

| Impairment of goodwill |

— | 850.0 | — | |||||||||

| Acquisition-related charges |

— | — | 0.6 | |||||||||

| Professional services related to non-routine stockholder matters |

3.0 | — | 7.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP operating income |

$ | 197.0 | $ | 241.6 | $ | 201.4 | ||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP operating margin |

18.5 | % | 21.9 | % | 17.2 | % | ||||||

| GAAP income (loss) tax provision |

$ | 35.8 | $ | 75.2 | $ | 37.4 | ||||||

| GAAP income (loss) tax rate |

30.9 | % | (10.8 | )% | 25.3 | % | ||||||

| Income tax effect of non-GAAP exclusions |

12.7 | (27.7 | ) | 11.6 | ||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP provision for income tax |

$ | 48.5 | $ | 47.5 | $ | 49.0 | ||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP income tax rate |

26.9 | % | 20.9 | % | 25.6 | % | ||||||

| GAAP net income (loss) |

$ | 80.2 | $ | (769.6 | ) | $ | 110.6 | |||||

| Share-based compensation expense |

46.0 | 54.6 | 60.8 | |||||||||

| Share-based payroll tax expense |

2.9 | 1.1 | 7.0 | |||||||||

| Amortization of purchased intangible assets |

11.9 | 8.5 | 9.5 | |||||||||

| Restructuring and other charges |

1.4 | 29.2 | 122.4 | |||||||||

| Impairment of goodwill |

— | 850.0 | — | |||||||||

| Acquisition-related charges |

— | — | 0.6 | |||||||||

| Professional services related to non-routine stockholder matters |

3.0 | — | 7.3 | |||||||||

| Gain on equity investments |

— | (0.6 | ) | (164.0 | ) | |||||||

| Gain on sale of Junos Pulse |

— | (19.6 | ) | — | ||||||||

| Other |

(1.1 | ) | (2.0 | ) | — | |||||||

| Income tax effect of non-GAAP exclusions |

(12.7 | ) | 27.7 | (11.6 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP net income |

$ | 131.6 | $ | 179.3 | $ | 142.6 | ||||||

|

|

|

|

|

|

|

|||||||

|

|

||||||||||||

|

|

|

|

|

|

|

|||||||

| GAAP diluted net income (loss) per share |

$ | 0.19 | $ | (1.81 | ) | $ | 0.22 | |||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP diluted net income per share |

$ | 0.32 | $ | 0.41 | $ | 0.29 | ||||||

|

|

|

|

|

|

|

|||||||

| Shares used in computing GAAP diluted net income (loss) per share |

414.2 | 426.1 | 496.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Shares used in computing Non-GAAP diluted net income per share |

414.2 | 432.4 | 496.5 | |||||||||

|

|

|

|

|

|

|

|||||||