Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IBERIABANK CORP | d914559d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - IBERIABANK CORP | d914559dex991.htm |

MAKING

THE MOST OF IT 1Q15 Earnings Conference Call

Supplemental Presentation

Exhibit 99.2

April 22, 2015 |

| Safe

Harbor And Legend 2

To the extent that statements in this press release and the accompanying PowerPoint presentation

relate to future plans, objectives, financial results or performance of IBERIABANK Corporation, these

statements are deemed to be forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements, which are based on management’s

current information, estimates and assumptions and the current economic environment, are

generally identified by the use of the words “plan”, “believe”, “expect”,

“intend”, “anticipate”, “estimate”, “project” or similar

expressions. The Company’s actual strategies, results and financial condition in future

periods may differ materially from those currently expected due to various risks and

uncertainties. Forward-looking statements are subject to numerous assumptions, risks and

uncertainties that change over time and could cause actual results or financial condition to

differ materially from those expressed in or implied by such statements. Consequently, no

forward-looking statement can be guaranteed. In connection with the proposed merger with Georgia Commerce Bancshares, Inc., IBERIABANK

Corporation has filed a Registration Statement on Form S-4 that contains a proxy

statement/prospectus. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE PROXY

STATEMENT/ PROSPECTUS REGARDING THE PROPOSED TRANSACTION BECAUSE SUCH DOCUMENTS WILL

CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the proxy

statement/prospectus and other documents containing information about the pending transaction

with Georgia Commerce Bancshares, Inc., without charge, at the SEC’s website at

http://www.sec.gov. Copies of the proxy statement /prospectus and the SEC filing that is

incorporated by reference in the proxy statement/prospectus may also be obtained for free from

the IBERIABANK Corporation website, www.iberiabank.com, under the heading “Investor

Information”. This communication is not a solicitation of any vote or approval, is not an offer to purchase shares

of common stock of Georgia Commerce Bancshares, Inc., nor is it an offer to sell shares of

IBERIABANK Corporation common stock which may be issued in the proposed merger. The

issuance of IBERIABANK Corporation common stock in any proposed merger would have to be

registered under the Securities Act of 1933, as amended, and such IBERIABANK Corporation common

stock would be offered only by means of a prospectus complying with the Securities Act of 1933,

as amended. |

•

Reported EPS of $0.75 (down $0.32 from 4Q14) and non-GAAP operating EPS of $0.95

(down $0.10 from 4Q14) •

Tax

equivalent

net

interest

income

increased

$1.1

million,

or

1%

from

4Q14,

while

average

earning

assets

increased $312 million, or 2%

•

Completed

the

acquisitions

of

Florida

Bank

Group

and

Old

Florida

during

the

quarter.

Converted

Florida

Bank

Group

over

the

weekend

of

March

13th.

Anticipate

conversions

of

Old

Florida

Bank

and

New

Traditions

Bank

during 2Q15

•

Pending shareholder approval, anticipate closing of Georgia Commerce Bancshares,

Inc. acquisition on May 31, 2015 and converting and integrating within the

next 70 days •

Legacy loan growth:

•

Legacy deposit growth:

•

Net

interest

margin

increased

one

basis

point

to

3.54%,

slightly

above

management’s

expectations

•

Significant operating influences:

•

Seasonality

•

Timing

•

Non-recurring expense

•

Energy-related provisions

Overview

Introductory Comments –

First Quarter 2015

$181

million

since

December

31,

2014

(+7%

annualized),

including

$69

million

of

commercial and $112 million of small business and consumer

Energy-related

loans

down

$61

million

or

7%

and

indirect

loans

down

$30

million

or

8%

Growth in the legacy loan portfolio was commercial 38%, small business 22%,

consumer 25%, and mortgage 14%

$351 million since December 31, 2014 (+11% annualized)

$212 million increase in legacy non-interest bearing deposits (+27%

annualized) 3 |

Overview

Energy Update

Our overall outlook on our energy portfolio is generally consistent with

views

expressed

at

our

February

27,

2015

Analyst-Investor

Day

•

What we are seeing now:

•

Access to the capital markets has

recently increased for many E&P

companies

•

Oil prices have increased

significantly

•

Total outstandings down $61 million or

6.7%

•

We are approximately 40% of the way

through spring redeterminations. All

clients are within their borrowing

bases.

•

In the portfolio at quarter-end:

•

One $40,000 loan on non-

accrual; no others classified or

worse

•

Only one loan, with less than $4

million outstanding, was rated

Special Mention

4 |

Overview

Non-Performing Assets Trends

$ in millions

NPA determination based on regulatory guidance for Acquired portfolios

1Q15 includes $14 million of bank-related properties reclassified to OREO

Energy loans

classified as non-

performing assets at

March 31, 2015

totaled only $40,000

Legacy includes

Increase due to

two legacy

credits (not

energy-related)

Prior Period NPAs

Acquired during 1Q15

Transfer from Covered

Components of 1Q15 Non-Covered Acquired

5 |

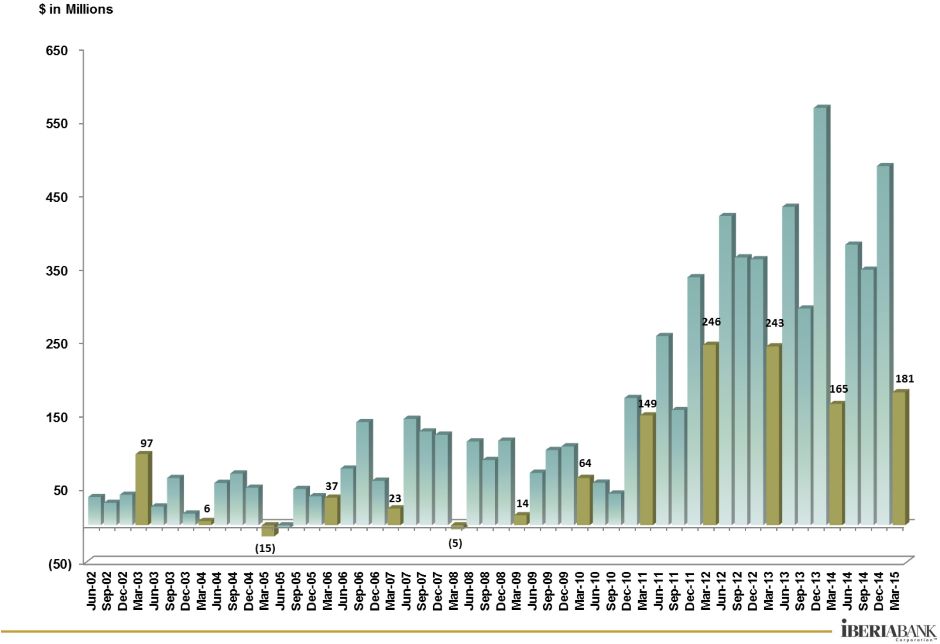

6

Seasonal Influences

Quarterly Organic Loan Growth

•

The first quarter of each year tends to exhibit slower loan

growth than other quarters due to seasonal factors

•

1Q15 net organic loan growth of $181 million, or +7%

annualized growth; includes $61 million decline in energy

loans and $30 million decline in indirect auto loans

•

1Q15 organic growth consistent with historical seasonal

trends

•

Anticipated run-rate decline of indirect auto portfolio is

approximately $45 million per quarter |

Excludes acquired deposits

Seasonal Influences

Deposit Growth

$ in millions

•

Increase of $2.1

billion, or 17%, in

1Q15

•

Deposits acquired

from Florida Bank

Group and Old

Florida acquisitions

equated to $1.8

billion

•

$669 million (+21%)

growth in total non-

interest bearing

deposits for 1Q15,

including $457

million of acquired

non-interest bearing

deposits

Total Deposit Growth

Very strong

transaction account

growth in 4Q12

7 |

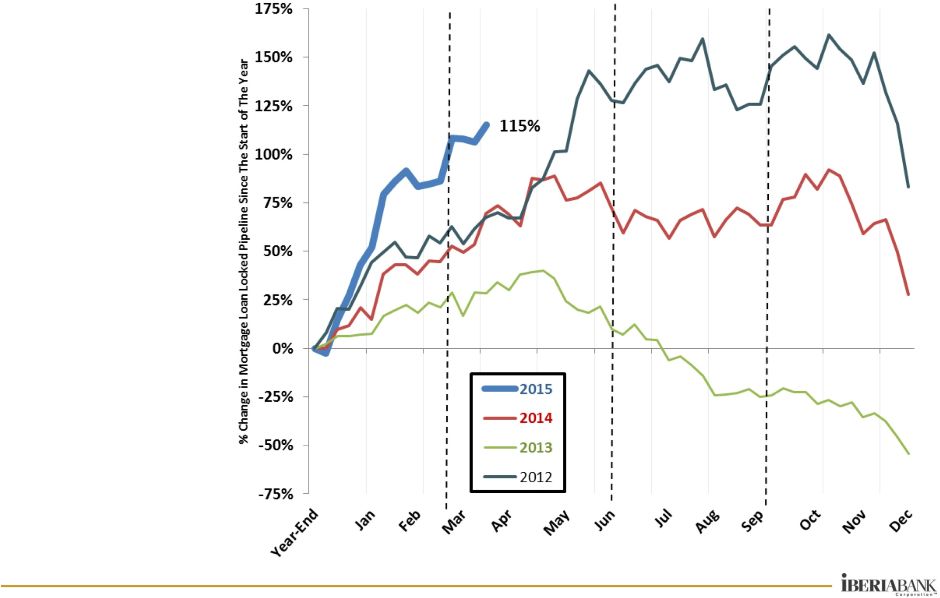

Financial Results

Weekly Locked Mortgage Pipeline Trends

•

Seasonal rebound

commences at the

start of each year

through spring

months into early

summer

•

Increased

production due to a

combination of

favorable rate

environment and

improved recruiting

in key markets

•

Weekly locked

pipeline was $317

million at April 17,

2015, up 9% since

March 31, 2015

and over two times

the level at

December 31,

2014

8 |

9

Acquisitions

Update

•

HQ:

Tampa, Florida

•

Offices:

13 in Florida

•

Assets:

$571 million

•

Loans:

$319 million

•

Deposits:

$404 million

•

Collars:

$56.79 & $76.83

•

% Pro Forma IBKC: 3%

•

Announced: 10/3/14

•

Days to Fed Approval

Total Days

•

HQ:

Orlando, Florida

•

Offices:

14 in Florida

•

Assets:

$1.4 billion

•

Loans:

$1.1 billion

•

Deposits:

$1.2 billion

•

Collars:

$57.31 & $70.05

•

% Pro Forma IBKC: 7%

•

Announced: 10/27/14

•

Days to Fed Approval

Total Days

•

HQ:

Atlanta, Georgia

•

Offices:

9 in Georgia

•

Assets:

$1.0 billion

•

Loans:

$746 million

•

Deposits:

$858 million

•

Collars:

$58.69 & $71.73

•

% Pro Forma IBKC: 5%

•

Announced: 12/8/14

•

Days to Fed Approval

Total Days

Old Florida

Georgia Commerce

Florida Bank Group.

Unaudited Balance Sheet Information as of December 31, 2014

15

13

161

121

34

46

201

95

26

200

+ Days to Close

+ Days to Convert

+ Days to Close

+ Days to Convert

+ Days to Close

+ Days to Convert

133

79 |

Financial Results

Influences to 1Q15 EPS

•

Seasonal influences impact first quarter results and tend to significantly diminish

over the remainder of the year

•

Timing influences impact current results and should be recouped over next two

years •

The Company considers the non-recurring influences to be one-time in

nature •

Aggregate pre-tax impact equal to $9.0 million

•

Aggregate after-tax EPS impact equal to $0.18 per share

$ in Millions

Fewer Business Days

$2.2

FDIC Recovery

$1.5

Benefits Payment

$0.6

Payroll Taxes

$2.1

Service Charges

$0.9

Title Income

$0.9

Card Income

$0.8

Pre-Tax Impact

$6.9

$1.5

$0.6

EPS (After-Tax)

0.14

$

0.03

$

0.01

$

Seasonality

Timing

Non-Recurring

10 |

Financial Results

Non-Interest Income –

1Q15 Components

•

Operating non-

interest income

increased $1.8

million, or 4%, on

a linked quarter

basis

•

Non-operating

income of $0.4

million mainly

from gains on

sales of

investments

11 |

•

Mortgage non-interest income of $18.0 million

was $4.4 million higher than 4Q14 driven by:

•

$6.4 million higher market value

adjustment (positive $5.2 million

recognized in 1Q15 versus negative $1.2

million in 4Q14)

•

$1.7 million lower gains on lower sales

volume (-12%) and lower margins

•

$0.1 million lower servicing income.

Financial Results

Mortgage Income

12 |

•

Operating non-

interest expense

increased $6.8

million, or 6%, on

a linked-quarter

basis

•

Non-operating

expense of $10.4

million includes:

•

$9.3 million of

merger-related

expense

•

$0.6 million in

impairment of

long-lived

assets

•

$0.4 million of

professional

fees

Financial Results

Non-Interest Expense –

1Q15 Components

13 |

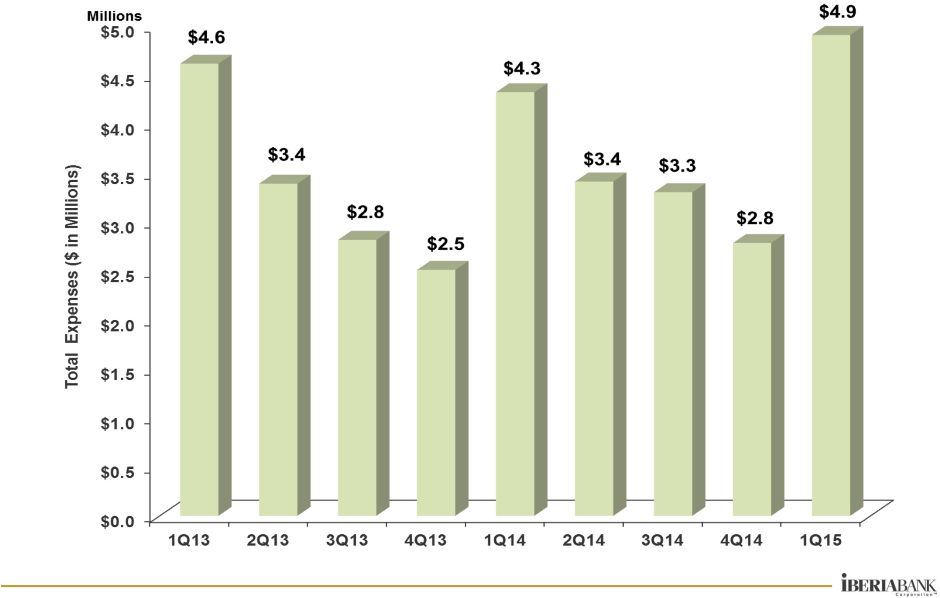

Seasonal Influences

Checking NSF Related Charges

Influenced by impact of

Teche acquisition completed

in May 2014

1Q15 results include one month operating results from Florida Bank Group

acquisition 14 |

Seasonal Influences

Payroll Taxes

2Q14 results influenced by impact of Teche Holding Company acquisition completed

in May 2014 and First Private Holdings, Inc. acquisition completed in June 2014

1Q15 results include one month operating results from Florida Bank Group

acquisition 15 |

Seasonal Influences

Retirement Contributions

1Q15 results include one month operating results from Florida Bank Group

acquisition 16 |

17

Capital

Preliminary Results and Anticipated Changes

•

1Q15 Capital ratios fully

reflect BASEL III

presentation

•

50% phase-out of trust

preferred securities is

reflected in updated

ratios

•

Change in risk-weighted

assets mainly driven by

change in risk-weighting

for commercial real-

estate, past due and

non-accrual loans and

addition of off-balance

sheet loan commitments

to risk-weighted asset

calculation

•

Net risk weighted assets increased approximately $509 million, or 4%,

between calculations

BASEL III

Prior

Common Equity Tier 1 (CET1) ratio

9.79%

N/A

N/A

bps

N/A

Tier 1 Leverage

9.04%

9.42%

(38)

bps

N/A

Tier 1 Risk Based

10.19%

11.02%

(83)

bps

N/A

Total Risk Based

11.62%

12.09%

(47)

bps

N/A

BASEL III

Prior

Change

Common Equity Tier 1 (CET1) ratio

9.55%

N/A

N/A

bps

6.50%

Tier 1 Leverage

8.48%

8.54%

(6)

bps

5.00%

Tier 1 Risk Based

9.55%

9.99%

(44)

bps

8.00%

Total Risk Based

10.59%

11.07%

(48)

bps

10.00%

IBERIABANK Corporation Capital Ratios

Well

Capitalized

Minimum

IBERIABANK and Subsidiaries Capital Ratios

Change

March 31, 2015

March 31, 2015

Well

Capitalized

Minimum |

Appendix

18 |

19

Appendix

Performance Metrics –

Quarterly Trends

3/31/2014

6/30/2014

9/30/2014

12/31/2014

3/31/2015

Net Income ($ in thousands)

22,336

$

16,217

$

30,893

$

35,936

$

25,126

$

-30%

Per Share Data:

Fully Diluted Earnings

0.75

$

0.53

$

0.92

$

1.07

$

0.75

$

-31%

Operating Earnings (Non-GAAP)

0.73

0.89

1.04

1.05

0.95

-10%

Pre-provision Operating Earnings (Non-GAAP)

0.78

0.99

1.15

1.17

1.05

-11%

Tangible Book Value

37.56

37.28

37.81

39.08

39.26

0%

Key Ratios:

Return on Average Assets

0.68%

0.46%

0.79%

0.91%

0.64%

(27)

bps

Return on Average Common Equity

5.82%

3.99%

6.79%

7.79%

5.40%

(239)

bps

Return on Average Tangible Common Equity (Non-GAAP)

8.35%

5.88%

10.10%

11.46%

7.93%

(353)

bps

Net Interest Margin (TE)

(1)

3.54%

3.49%

3.49%

3.53%

3.54%

1

bps

Tangible Operating Efficiency Ratio (TE)

(1)

(Non-GAAP)

73.5%

69.8%

65.1%

65.7%

68.5%

282

bps

Tangible Common Equity Ratio (Non-GAAP)

8.60%

8.43%

8.45%

8.59%

8.62%

3

bps

Tier 1 Leverage Ratio

(2)

9.61%

10.00%

9.21%

9.36%

9.04%

(32)

bps

Common Equity Tier 1 (CET1) Ratio

(2)

9.79%

Total Risk Based Capital Ratio

(2)

12.68%

12.40%

12.40%

12.30%

11.62%

(68)

bps

Net Charge-Offs to Average Loans

(3)

0.05%

0.04%

0.09%

0.06%

0.06%

0

bps

Non-performing Assets to Total Assets

(3)

0.49%

0.53%

0.46%

0.41%

0.55%

14

bps

(1)

Fully taxable equivalent basis.

(2)

March 31, 2015 Captial Ratios reflect full implementation of Basel III capital

requirements, excluding the impact of the (3)

Excluding FDIC Covered Assets and Acquired Assets.

Linked Quarter

%/Basis Point

Change

For Quarter Ended:

•

Average earning

assets up $0.3

billion (+2%)

•

T/E net interest

income up $1

million (+1%)

•

Provision for loan

losses of $5 million:

•

Legacy net charge-

offs: $1.6 million

(annualized 0.06%

of average loans)

•

Covered and

acquired net

charge-offs: $0.2

million (annualized

0.04% of average

loans)

•

Legacy provision

for loan losses:

$4.2 million

Old Florida Bancshares, Inc. acquisition. Prior periods have not been restated to

reflect BASEL III implementation. |

20

Appendix

Performance Metrics –

Yields and Costs

12/31/2014

3/31/2015

Investment Securities

2.24%

2.22%

(2)

bps

Covered Loans, net of loss share receivable

3.57%

3.82%

25

bps

Legacy Loans, net

3.94%

3.90%

(4)

bps

Non-Covered Acquired Loans, net

6.94%

6.91%

(3)

bps

Loans & Loss Share Receivable

4.32%

4.33%

1

bps

Mortgage Loans Held For Sale

3.95%

4.55%

60

bps

Other Earning Assets

0.80%

0.81%

1

bps

Total Earning Assets

3.88%

3.90%

2

bps

Interest-bearing Deposits

0.41%

0.40%

(1)

bps

Short-Term Borrowings

0.19%

0.19%

(0)

bps

Long-Term Borrowings

2.73%

2.91%

18

bps

Total Interest-bearing Liabilities

0.48%

0.49%

1

bps

Net Interest Spread

3.41%

3.41%

0

bps

Net Interest Margin

3.53%

3.54%

1

bps

(1)

Earning asset yields are shown on a fully taxable-equivalent basis.

For Quarter Ended:

Linked Quarter

Basis Point

Change |

Appendix

Non-GAAP Cash Margin

•

Adjustments represent accounting

impacts of purchase discounts on

acquired loans and related accretion

as well as the indemnification asset

and related amortization on the

covered portfolio

Balances, as

Reported

Adjustments

As Adjusted

1Q14

Average Balance

$12,088,186

$16,847

$12,105,029

Income

104,408

(2,517)

101,890

Rate

3.54%

-0.09%

3.45%

2Q14

Average Balance

12,687,971

30,318

12,718,289

Income

109,273

392

109,665

Rate

3.49%

0.01%

3.50%

3Q14

Average Balance

13,990,358

44,149

14,034,507

Income

121,751

(4,170)

117,581

Rate

3.49%

-0.13%

3.36%

4Q14

Average Balance

14,144,762

54,669

14,199,431

Income

124,680

(6,076)

118,603

Rate

3.53%

-0.18%

3.35%

1Q15

Average Balance

14,456,891

67,056

14,523,947

Income

125,804

(8,969)

116,835

Rate

3.54%

-0.30%

3.28%

$ in millions

21 |

22

Appendix

Non-Interest Income Trends

•

Mortgage income increased $4.4 million, or +32%

•

Title income decreased $0.9 million, or -16%

•

Service charges decreased $0.9 million, or -9% due to

seasonal influences

•

Credit card fee income decreased $0.8 million, or -24%

1Q15 compared to 4Q14:

1Q15 includes one-month of Florida Bank Group results

Non-interest Income ($000s)

1Q14

2Q14

3Q14

4Q14

1Q15

$ Change

%

Change

Service Charges on Deposit Accounts

7,012

$

8,203

$

10,205

$

10,153

$

9,262

$

(891)

$

-9%

ATM / Debit Card Fee Income

2,467

2,937

3,287

3,331

3,275

(56)

-2%

BOLI Proceeds and CSV Income

934

934

1,047

1,050

1,092

42

4%

Mortgage Income

10,133

13,755

14,263

13,646

18,023

4,377

32%

Title Revenue

4,167

5,262

5,577

5,486

4,629

(857)

-16%

Broker Commissions

4,048

5,479

5,297

3,960

4,162

202

5%

Other Noninterest Income

5,129

7,182

6,854

9,071

8,067

(1,005)

-11%

Noninterest income excluding non-operating income

33,890

43,752

46,530

46,697

48,510

1,812

4%

Gain (Loss) on Sale of Investments, Net

19

8

582

164

389

225

138%

Other Non-operating income

1,772

1

-

211

-

(211)

-100%

Total Non-interest Income

35,681

$

43,761

$

47,112

$

47,072

$

48,899

$

1,827

$

4%

1Q15 vs. 4Q14

Originations up 8%

Sale volume decreased 5%

Refinancings declined from 36% to 24% of

production

Margins 10% lower in 1Q15

Pipeline of $278 million at quarter-end,

double the pipeline level at December 31,

2014. At April 17, 2015, the locked

pipeline was $317 million, or +9%, over

March 31, 2015 |

23

Appendix

Non-Interest Expense Trends

•

Non-interest expenses excluding non-operating items up

$6.8 million, or 6%, as compared to 4Q14

•

Total expenses up $14.0 million, or 12%, in 1Q15

•

Severance expense down $0.1 million

•

Impairment of long-lived assets down $0.5 million

•

Merger-related expense increased $7.3 million, related

primarily to Florida Bank Group and Old Florida

transactions

•

Tangible Operating Efficiency Ratio of 68.5%, up from

65.7% in 4Q14

Linked quarter changes in operating expense:

1Q15 includes one-month of Florida Bank Group results

2.1

0.9

(0.9)

(0.7)

$0.7 mil

Non-interest Expense ($000s)

1Q14

2Q14

3Q14

4Q14

1Q15

$ Change

% Change

Mortgage Commissions

2,215

$

3,481

$

3,912

$

4,045

$

4,085

$

40

$

1%

Hospitalization Expense

3,944

3,661

4,611

4,606

5,181

575

12%

Other Salaries and Benefits

53,582

55,921

54,898

56,784

62,091

5,307

9%

Salaries and Employee Benefits

59,741

$

63,063

$

63,421

$

65,435

$

71,357

$

5,922

$

9%

Credit/Loan Related

3,560

3,093

4,569

2,483

4,183

1,700

68%

Occupancy and Equipment

13,775

13,918

14,580

14,526

16,055

1,529

11%

Amortization of Acquisition Intangibles

1,218

1,347

1,623

1,618

1,525

(93)

-6%

All Other Non-interest Expense

27,134

28,567

29,523

31,899

29,667

(2,232)

-7%

Nonint. Exp. (Ex-Non-Operating Exp.)

105,428

$

109,988

$

113,717

$

115,961

$

122,787

$

6,826

$

6%

Severance

119

5,466

1,226

139

41

(98)

-71%

Occupancy and Branch Closure Costs

17

14

-

-

-

-

100%

Storm-related expenses

184

4

1

2

20

18

760%

Impairment of Long-lived Assets, net of gains on sales

541

1,241

4,213

1,078

579

(499)

-46%

Provision for FDIC clawback liability

-

-

(797)

-

-

-

0%

Termination of Debit Card Rewards Program

(22)

-

-

-

-

-

0%

Consulting and Professional

-

-

-

-

430

430

100%

Merger-Related Expenses

967

10,419

1,752

1,955

9,296

7,341

376%

Total Non-interest Expense

107,234

$

127,132

$

120,112

$

119,135

$

133,153

$

14,017

$

12%

Tangible Efficiency Ratio -

excl Nonop-Exp

73.5%

69.8%

65.1%

65.7%

68.5%

1Q15 vs. 4Q14

1.4

1.3

0.7

Total Florida Bank Group expenses

Payroll taxes

Occupancy and equipment expense

Provision for unfunded commitment

Marketing and business development

Benefits expense

Professional services

OREO costs, net |

24

Appendix

Non-Operating Items (Non-GAAP)

Non-operating expenses equal to $10.4 million pre-tax, or $0.21 EPS after-tax:

•

1Q15 Merger related expense of $9.3 million pre-tax, or $0.18 EPS after-tax

•

Net impairment expense of $0.6 million pre-tax or $0.01, EPS after-tax

•

Other non-operating items expense of $0.5 million pre-tax, or $0.01 after-tax

Pre-tax

After-tax

(2)

Per share

Pre-tax

After-tax

(2)

Per share

Pre-tax

After-tax

(2)

Per share

Net Income (Loss) (GAAP)

30,752

$

22,336

$

0.75

$

46,122

$

35,936

$

1.07

$

36,205

$

25,126

$

0.75

$

Non-interest income adjustments

Gain on sale of investments and other non-interest income

(1,791)

(1,692)

(0.06)

(374)

(243)

(0.01)

(389)

(252)

(0.01)

Non-interest expense adjustments

Merger-related expenses

967

629

0.02

1,955

1,496

0.04

9,296

6,139

0.18

Severance expenses

119

78

0.00

139

91

0.00

41

27

0.00

(Gain) Loss on sale of long-lived assets, net of impairment

541

352

0.01

1,078

701

0.02

579

376

0.01

Other non-operating non-interest expense

179

116

0.00

2

1

(0.00)

450

292

0.01

Total non-interest expense adjustments

1,806

1,175

0.03

3,174

2,289

0.07

10,366

6,834

0.21

Income tax benefits

-

-

-

-

(2,959)

(0.09)

-

-

-

Operating earnings (Non-GAAP)

(3)

30,767

21,819

0.73

48,922

35,023

1.05

46,182

31,708

0.95

Covered and acquired impaired (reversal of) provision for loan losses

108

70

0.00

1,497

973

0.03

1,169

760

0.02

Other (reversal of) provision for loan losses

1,995

1,297

0.04

4,998

3,249

0.08

4,176

2,715

0.08

Pre-provision operating earnings (Non-GAAP)

(3)

32,870

$

23,186

$

0.78

$

55,417

$

39,245

$

1.17

$

51,527

$

35,183

$

1.05

$

(1) Per share amounts may not appear to foot due to rounding.

(2) After-tax amounts estimated based on a 35% marginal tax rate.

RECONCILIATION

OF

NON-GAAP

FINANCIAL

MEASURES

(1)

(dollars in thousands)

For The Quarter Ended

March 31, 2014

December 31, 2014

March 31, 2015

Dollar Amount

Dollar Amount

Dollar Amount |

| 25

Appendix

Market Highlights For 1Q15

•

Competitive pressure remains strong for high quality commercial and

business banking clients in terms of both pricing and structure

•

Birmingham, Houston, New Orleans, Memphis and Baton Rouge

showed strong commercial loan originations

•

Total commitments originated during 1Q15 of $960 million with 37%

fixed rate and 63% floating rate

•

Commercial loans originated and funded in 1Q15 totaled $405 million

with a mix of 20% fixed and 80% floating ($584 million in commercial

loan commitments during the quarter)

•

Strong commercial pipeline in excess of $800 million at quarter-end

•

Legacy period-end core deposit increase of $338 million, with non-

interest bearing deposits up $212 million |

| 26

Overview

Small Business and Retail –

1Q15 Progress

•

Small Business legacy loan growth of $39 million, or +5%, on a linked-quarter

basis •

Consumer Direct & Mortgage legacy loan growth of $105 million, or +5%, on a

linked quarter basis

•

Credit Card legacy loan growth of ($0.6 million), or -1%, on a linked quarter

basis •

Expected seasonal decline. Experienced a similar decline during 1Q14

•

Checking account growth:

•

Small Business checking accounts increased 10% year-over-year and an

annualized 11% on a linked quarter basis

•

Consumer checking accounts decreased 3% year-over-year but increased an

annualized 1% on a linked quarter basis, primarily due to the expected

attrition from the Teche Holding Company portfolio that we converted last

year •

Continued

focus

on

productivity

and

efficiency

of

the

delivery

network

–

opened

one

branch in 1Q15, did not close any branches in 1Q15, converted 12

branches and

consolidated one branch into an existing IBKC branch related to the Florida Bank

Group acquisition and 15 branches related to the Old Florida

acquisition. •

Acceptance and usage of digital delivery continues to increase among our client

base: •

Released Online Appointment Setting |

27

Appendix

Loan Growth

$ in millions

1st Quarter 2015:

•

Since YE 2009:

•

•

$181 million legacy

loan growth, or

+2% (+7%

annualized)

$5.7 billion legacy

loan growth, or

+139% (+27%

annualized)

The FDIC

covered loan

portfolio declined

85%, or $1.4

billion (16%

annualized rate) |

28

Appendix

Loan Growth and Originations 1Q15 –Top Markets

$ in millions

Loan commitments and originations include renewals

$ in millions

•

$181 million in legacy loan growth for 1Q15

•

Top 5 markets represent 88% of legacy growth

•

$1.0 billion in total funded and unfunded

loan commitments |

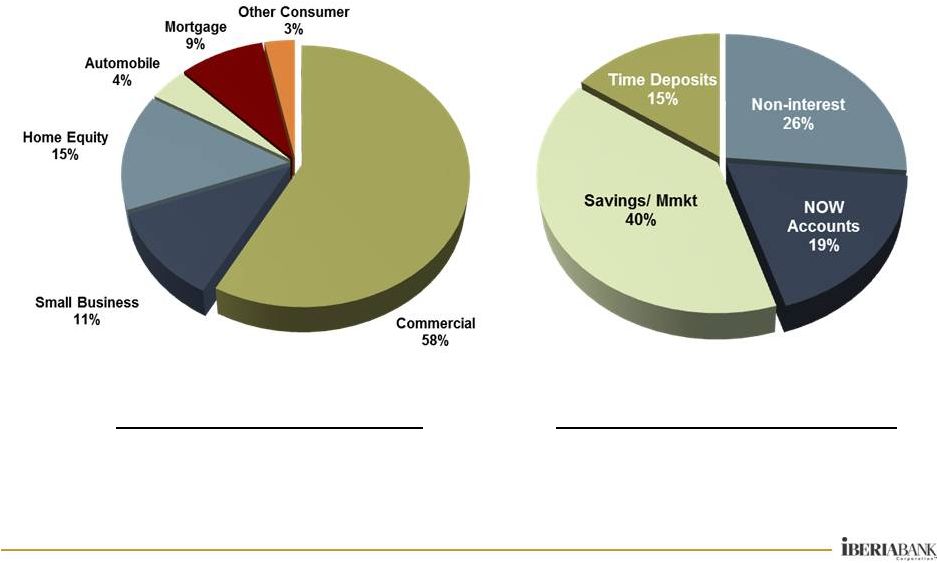

Appendix

Loan And Deposit Mix

Deposits at March 31, 2015

$14.7 Billion

Loans at March 31, 2015

$12.9 Billion

29 |

Appendix

Non-Interest Bearing Deposits

% of Total

Deposits

Non-interest-bearing deposits at period-end

$ in billions

30

•

Houston

•

Lafayette

•

Sarasota

•

Naples

•

NE Arkansas

•

$669 million of

incremental non-

interest-bearing

deposit growth, or

+21%, in 1Q15

•

$457 million increase

related to acquired

deposits from Florida

Bank Group and Old

Florida

•

Top 1Q15 legacy

non-interest-bearing

deposit growth

markets include: |

Appendix

Deposits Costs

•

Our deposit

costs declined

greater than

peers

•

A portion of the

lower costs were

due to improved

mix of deposits

•

Non-interest-

bearing deposits

grew from 11%

of total deposits

in 2010 to 26%

of total deposits

in 1Q15

31 |

32

Appendix

Legacy Portfolio

Asset Quality Summary

(Excludes FDIC covered assets and all acquired loans)

•

NPAs equated to

0.55% of total assets,

up 14 bps compared to

4Q14. Includes $14

million of bank-related

properties

•

$91 million in classified

loans (up $12 million

from 4Q14)

•

Legacy net charge-offs

of $1.6 million, or an

annualized rate of

0.06% of average

loans

($ thousands)

3/31/2014

12/31/2014

3/31/2015

Non-accrual Loans

32,983

$

34,970

$

60,064

$

82%

72%

OREO

26,204

21,243

21,654

-17%

2%

Accruing Loans 90+ Days Past Due

269

754

239

-11%

-68%

Non-performing Assets

59,456

56,967

81,957

38%

44%

Note: NPAs excluding Former Bank Properties

50,453

45,411

68,353

35%

51%

Past Due Loans (excluding non-accrual loans)

11,453

30,321

17,845

56%

-41%

Classified Loans

64,476

78,890

91,248

42%

16%

Non-performing Assets/Assets

0.49%

0.41%

0.55%

6

bps

14

bps

NPAs/(Loans + OREO)

0.70%

0.59%

0.83%

13

bps

24

bps

Classified Assets/Total Assets

0.53%

0.57%

0.61%

8

bps

4

bps

Past Dues Loans/Loans

0.14%

0.31%

0.18%

4

bps

(13)

bps

Provision For Loan Losses

1,995

$

4,998

$

4,176

$

109%

-16%

Net Charge-Offs/(Recoveries)

1,014

1,538

1,578

56%

3%

Provision Less Net Charge-Offs

981

$

3,460

$

2,598

$

165%

-25%

Net Charge-Offs/Average Loans

0.05%

0.06%

0.06%

1

bps

0

bps

Allowance For Loan Losses/Loans

0.81%

0.79%

0.80%

(1)

bps

1

bps

Allowance For Credit Losses/Loans

0.94%

0.91%

0.93%

(1)

bps

2

bps

For Quarter Ended:

% or Basis Point Change

Year/Year

Qtr/Qtr |

33

Appendix

Asset Quality Portfolio Trends

($thousands)

Non-accruals

229,962

$

169,686

$

195,371

$

-15%

15%

OREO & Foreclosed

93,165

53,947

53,194

-43%

-1%

90+ Days Past Due

981

1,708

5,642

475%

230%

Non-performing Assets

324,108

$

225,341

$

254,207

$

-22%

13%

NPAs/Assets

2.39%

1.43%

1.41%

(98)

bps

(2)

bps

NPAs/(Loans + OREO)

3.33%

1.96%

1.97%

(136)

bps

1

bps

LLR/Loans

1.40%

1.14%

1.00%

(40)

bps

(14)

bps

ACL/Loans

1.52%

1.24%

1.10%

(42)

bps

(14)

bps

Net Charge-Offs/Loans

0.03%

0.06%

0.06%

3

bps

(0)

bps

Past Dues:

30-89 Days Past Due

43,905

$

51,141

$

32,835

$

-25%

-36%

90+ days Past Due

981

1,708

5,642

475%

230%

Total 30+ Past Dues

44,886

$

52,849

$

38,477

$

-14%

-27%

% Loans

0.47%

0.46%

0.30%

(17)

bps

(16)

bps

Total Portfolio

% or Basis Point Change

1Q14

4Q14

1Q15

Year/Year

Qtr/Qtr |

Appendix

Capital Markets and Wealth Management

•

ICP revenues +6%

compared to 4Q14

•

IWA revenues +5%

compared to 4Q14

•

IFS revenues +4%

compared to 4Q14

•

IWA assets under

management

increased $75 million

(+6%) to $1.4 billion

on March 31, 2015

34 |

35

Appendix

Expected Quarterly Re-pricing Schedule

$ in millions

Note: Amounts exclude re-pricing of assets and liabilities from prior

quarters Excludes FDIC loans and receivable, non-accrual loans and market value

adjustments 2Q15

3Q15

4Q15

1Q16

2Q16

Cash Equivalents

Balance

763.5

$

-

$

-

$

-

$

-

$

Rate

0.52%

0.00%

0.00%

0.00%

0.00%

Investments

Balance

159.9

$

76.2

$

76.1

$

58.9

$

63.1

$

Rate

1.70%

3.05%

3.14%

2.96%

2.97%

Fixed Rate Loans

Balance

472.0

$

413.9

$

379.8

$

353.3

$

351.2

$

Rate

5.12%

4.99%

4.97%

4.94%

4.90%

Variable Rate Loans

Balance

5,847.9

$

98.0

$

61.4

$

48.2

$

37.7

$

Rate

3.30%

3.18%

3.58%

3.49%

3.95%

Time Deposits

Balance

731.9

$

400.9

$

328.3

$

259.2

$

189.7

$

Rate

0.49%

0.74%

0.75%

0.89%

1.00%

Repos/ST Debt

Balance

544.1

$

49.3

$

10.0

$

-

$

-

$

Rate

0.19%

0.23%

0.29%

0.00%

0.00%

Borrowed Funds

Balance

127.0

$

3.4

$

1.9

$

1.9

$

12.0

$

Rate

3.27%

4.30%

4.40%

4.40%

4.11% |

36

Appendix

Interest Rate Risk Simulation

Source: Bancware model, as of March 31, 2015

* Assumes instantaneous and parallel shift in interest rates based on static

balance sheet •

Asset sensitive from an interest rate risk position

•

The degree of asset sensitivity is a function of the reaction of

competitors to changes in deposit pricing

•

Forward curve has a positive impact over 12 months

Base

Blue

Forward

Change In:

-200 bp*

-100 bp*

Case

+100 bp*

+200 bp*

Chip

Curve

Net Interest

Income

-3.6%

-2.1%

0.0%

4.8%

9.5%

1.7%

1.0%

Economic

Value of

Equity

-5.3%

-9.8%

0.0%

12.9%

23.3%

-0.3%

-0.2% |

Georgia Commerce

Bancshares, Inc.

•

Announced December 8, 2014

•

New market acquisition of a Georgia-based commercial

bank headquartered in Atlanta, Georgia

•

Adds

nine

branches

in

Georgia

–

all

offices

are

in

the

Atlanta, MSA

As of December 31, 2014:

•

Total Loans:

$746 million

•

Total Assets:

$1,020 million

•

Total Deposits:

$858 million

•

Total Equity:

$104 million common stock

•

Tax-free, stock-for-stock exchange

•

Fixed exchange ratio of 0.6134 share of IBKC common

stock for each Georgia Commerce Bancshares, Inc. share

within collars and floating exchange ratios outside of

collars

(1)

$189

million

for

total

equity

(2)

outstanding based on IBKC’s

closing price of $65.21 on December 5, 2014

$40.00 per Georgia Commerce common share

outstanding

(2)

Estimated $5 million in cash liquidation value of all options

outstanding

(3)

Approximately 1.6% accretive to EPS in 2016 and 5%

accretive in 2017

TBVS dilution of approximately 1.8% at consummation

TBVS breakeven in approximately three and one-half years

IRR in excess of 20%

Equity

(2)

Including Options

(3)

•

•

(1)

The agreement provides for a fixed exchange ratio with pricing collars that fix the

value received by Georgia Commerce’s shareholders if the weighted average

trading price of IBERIABANK Corporation’s common stock were to decline

below $58.69 per share, or exceed $71.73 per share, over a specified period.

(2)

Includes exercise of outstanding warrants and no exercise of stock options currently

outstanding. (3)

Assumes all stock options outstanding are cashed out at consummation.

37

Appendix

181%

196%

186%

202%

Shareholders’

Aggregate Value

Price / Total Book:

Price / Tangible Book:

•

•

•

•

•

•

• |

|