Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Colfax CORP | q12015earningspressrelease.htm |

| 8-K - 8-K - Colfax CORP | cfx8-kxq12015earnings.htm |

FIRST QUARTER 2015 | EARNINGS CONFERENCE CALL

2 FORWARD-LOOKING STATEMENTS The following information contains forward-looking statements, including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning Colfax's plans, objectives, expectations and intentions and other statements that are not historical or current facts. Forward-looking statements are based on Colfax's current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Factors that could cause Colfax's results to differ materially from current expectations include, but are not limited to, factors detailed in Colfax's reports filed with the U.S. Securities and Exchange Commission including its 2014 Annual Report on Form 10-K under the caption “Risk Factors”. In addition, these statements are based on a number of assumptions that are subject to change. This presentation speaks only as of this date. Colfax disclaims any duty to update the information herein.

Q1 2015 RESULTS

4 Q1 2015 HIGHLIGHTS • Adjusted net income of $44.5 million ($0.36 per share) compared to $51.6 million ($0.43 per share) in Q1 2014 • Net sales of $911.1 million, a decrease of 13.6% from Q1 2014 net sales of $1,054.3 million (an organic decline of 12.3%) • Adjusted operating income of $81.2 million compared to $94.1 million in Q1 2014 • First quarter gas- and fluid-handling orders of $446.9 million compared to orders of $583.4 million in Q1 2014, a decrease of 23.4% (an organic decline of 14.5%) • Gas- and fluid-handling backlog of $1.351 billion at period end

GAS AND FLUID HANDLING

6 GAS AND FLUID HANDLING Q1 2015 HIGHLIGHTS • Net sales of $422.2 million compared to net sales of $573.9 million in Q1 2014, a decrease of 26.4% (an organic decline of 17.2%) • Adjusted segment operating income of $36.3 million and adjusted segment operating income margin of 8.6% • First quarter orders of $446.9 million compared to orders of $583.4 million in Q1 2014, a decrease of 23.4% (an organic decline of 14.5%) • Backlog of $1.351 billion at period end

7 ORDERS AND BACKLOG ORDERS BACKLOG Note: Dollars in millions (unaudited). $1.59B Q1 Existing Businesses (14.5)% Acquisitions —% FX Translation (8.9)% Total Decline (23.4)% $1.40B $1.35B

8 GEOGRAPHIC EXPOSURE 2015 REVENUE REVENUE AFTERMARKET REVENUE 2015 Note: Dollars in millions (unaudited). Q1 Existing Businesses (17.2)% Acquisitions —% FX Translation (9.2)% Total Decline (26.4)% ▪ Foremarket ▪ Aftermarket ▪ Developed Economies ▪ Emerging Markets 34% 66% 42% 58%

9 Q1 2015 SALES AND ORDERS BY END MARKET SALES: $422.2 million Total Decline Organic (Decline) Growth Power Generation (34.4)% (28.6)% Oil, Gas & Petrochemical (31.9)% (18.8)% Marine (17.4)% (3.3)% Mining (6.4)% 4.3% General Industrial & Other (16.8)% (7.3)% Total (26.4)% (17.2)% ORDERS: $446.9 million Total (Decline) Growth Organic (Decline) Growth Power Generation (42.8)% (37.5)% Oil, Gas & Petrochemical 7.9% 19.7% Marine (13.5)% 2.1% Mining (18.6)% (7.3)% General Industrial & Other (15.6)% (5.9)% Total (23.4)% (14.5)%

10 POWER GENERATION MARKET PERSPECTIVE SALES & ORDERS DECLINE • Served by both Howden and Colfax Fluid Handling • Declines due to tailing off of China SCR and timing of new- build projects • Continued strong investment levels in new capacity in Southeast Asia 2015 SALES SPLIT 2015 ORDERS SPLIT HIGHLIGHTS Q1 2015 vs. Q1 2014 Total Organic Sales (34.4)% (28.6)% Orders (42.8)% (37.5)% 36% 32%

11 OIL, GAS & PETROCHEMICAL MARKET PERSPECTIVE SALES & ORDERS (DECLINE) GROWTH • Served by both Howden and Colfax Fluid Handling • Period over period comparisons are difficult due to the timing of large projects • Received follow-on compressor orders in Middle East and orders for multiple Russian downstream projects 2015 SALES SPLIT 2015 ORDERS SPLIT HIGHLIGHTS Q1 2015 vs. Q1 2014 Total Organic Sales (31.9)% (18.8)% Orders 7.9% 19.7% 18% 22%

12 MARINE MARKET PERSPECTIVE SALES & ORDERS (DECLINE) GROWTH • Primarily served by Colfax Fluid Handling • Defense spending increase partially offset by declines from commercial ship building and offshore vessels for the oil & gas sector 2015 SALES SPLIT 2015 ORDERS SPLIT HIGHLIGHTS Note: Marine market comprised of commercial marine and government, or defense, customers Q1 2015 vs. Q1 2014 Total Organic Sales (17.4)% (3.3)% Orders (13.5)% 2.1% 11% 12%

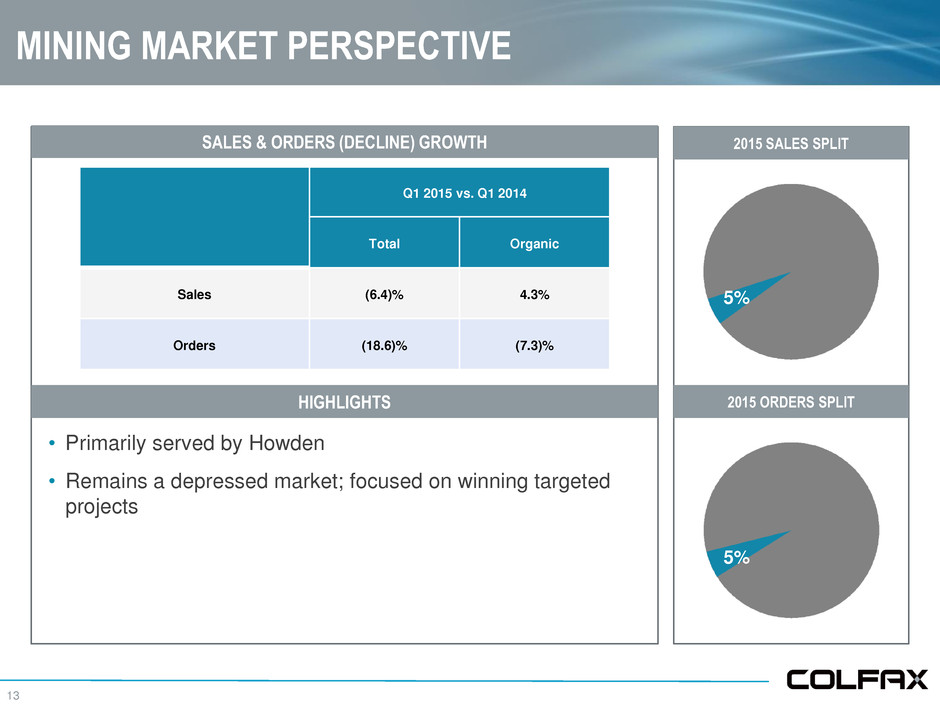

13 MINING MARKET PERSPECTIVE SALES & ORDERS (DECLINE) GROWTH • Primarily served by Howden • Remains a depressed market; focused on winning targeted projects 2015 SALES SPLIT 2015 ORDERS SPLIT HIGHLIGHTS Q1 2015 vs. Q1 2014 Total Organic Sales (6.4)% 4.3% Orders (18.6)% (7.3)% 5% 5%

14 GENERAL INDUSTRIAL & OTHER MARKET PERSPECTIVE SALES & ORDERS DECLINE • Includes both Howden and Colfax Fluid Handling • Volatile quarter to quarter due to large orders • Increased pump orders in Q1 2015 and continued expansion into new industrial applications suggests potential for modest growth in 2015 2015 SALES SPLIT 2015 ORDERS SPLIT HIGHLIGHTS Q1 2015 vs. Q1 2014 Total Organic Sales (16.8)% (7.3)% Orders (15.6)% (5.9)% 30% 29%

FABRICATION TECHNOLOGY

16 FABRICATION TECHNOLOGY HIGHLIGHTS • Net sales of $488.9 million compared to net sales of $480.4 million in Q1 2014, an increase of 1.8% (an organic decline of 6.4%) • Adjusted segment operating income of $57.3 million and adjusted segment operating income margin of 11.7% •Improvement of 50 basis points over Q1 2014

17 GEOGRAPHIC EXPOSURE 2015 REVENUE REVENUE REVENUE 2015 Note: Dollars in millions (unaudited). ▪ Consumables ▪ Equipment 75% 25% ▪ Developed Economies ▪ Emerging Markets 46% 54% Q1 Volume (4.0)% Price/ Mix (2.4)% Acquisitions 21.6% FX Translation (13.4)% Total Growth 1.8%

RESULTS OF OPERATIONS

19 INCOME STATEMENT SUMMARY (unaudited) Refer to Appendix for Non-GAAP reconciliation and footnotes. Note: Dollars in millions, except per share amounts. Three Months Ended March 27, 2015 March 28, 2014 Net sales $ 911.1 $ 1,054.3 Gross profit $ 294.4 $ 325.6 % of sales 32.3 % 30.9 % SG&A expense $ 213.2 $ 231.6 % of sales 23.4 % 22.0 % Adjusted operating income $ 81.2 $ 94.1 % of sales 8.9 % 8.9 % Adjusted net income $ 44.5 $ 51.6 % of sales 4.9 % 4.9 % Adjusted net income per share $ 0.36 $ 0.43

APPENDIX

21 DISCLAIMER Colfax has provided financial information that has not been prepared in accordance with GAAP. These non-GAAP financial measures are adjusted net income, adjusted net income per share, adjusted operating income, organic sales growth (decline) and organic order growth (decline). Adjusted net income, adjusted net income per share and adjusted operating income exclude restructuring and other related charges. Adjusted net income and adjusted net income per share for the first quarter of 2014 exclude the preferred stock conversion inducement payment. The effective tax rates used to calculate adjusted net income and adjusted net income per share are 29.5% and 27.0% for the first quarters of 2015 and 2014, respectively. Organic sales growth (decline) and organic order growth (decline) exclude the impact of acquisitions and foreign exchange rate fluctuations. These non-GAAP financial measures assist Colfax in comparing its operating performance on a consistent basis because, among other things, they remove the impact of restructuring and other related charges and the preferred stock conversion inducement payment. Sales and order information by end market are estimates. We periodically update our customer groupings order to refine these estimates.

22 NON-GAAP RECONCILIATION (unaudited) (1) The effective tax rates used to calculate adjusted net income and adjusted net income per share are 29.5% and 27.0% for the first quarters of 2015 and 2014, respectively. (2) Adjusted net income per share for periods prior to February 12, 2014, was calculated under the if-converted method in accordance with GAAP. On February 12, 2014, the Series A Perpetual Convertible Preferred Stock were converted to Common stock and the Company paid a $19.6 million conversion inducement to the holders of the Series A Perpetual Convertible Preferred Stock. _____________________ Note: Dollars in thousands, except per share amounts. Three Months Ended March 27, 2015 March 28, 2014 Adjusted Net Income Net income attributable to Colfax Corporation $ 52,056 $ 46,790 Restructuring and other related charges 3,753 6,312 Tax adjustment(1) (11,262 ) (1,488 ) Adjusted net income $ 44,547 $ 51,614 Adjusted net income margin 4.9 % 4.9 % Adjusted Net Income Per Share Net income available to Colfax Corporation common shareholders $ 52,056 $ 24,877 Restructuring and other related charges 3,753 6,312 Preferred stock conversion inducement payment(2) — 19,565 Tax adjustment(1) (11,262 ) (1,488 ) Adjusted net income available to Colfax Corporation common shareholders 44,547 49,266 Dividends on preferred stock(2) — 2,348 $ 44,547 $ 51,614 Weighted-average shares outstanding - diluted 125,092,635 119,832,595 Adjusted net income per share $ 0.36 $ 0.43 Net income per share — diluted (in accordance with GAAP) $ 0.42 $ 0.22

23 NON-GAAP RECONCILIATION (unaudited) _____________________ Note: Dollars in thousands. Three Months Ended March 27, 2015 Three Months Ended March 28, 2014 Gas and Fluid Handling Fabrication Technology Corporate and Other Total Colfax Corporation Gas and Fluid Handling Fabrication Technology Corporate and Other Total Colfax Corporation Net sales $ 422,209 $ 488,861 $ — $ 911,070 $ 573,949 $ 480,382 $ — $ 1,054,331 Operating income (loss) 33,612 8.0 % 56,238 11.5 % (12,397 ) 77,453 8.5 % 53,098 9.3 % 50,451 10.5 % (15,811 ) 87,738 8.3 % Restructuring and other related charges 2,645 1,108 — 3,753 2,900 3,412 — 6,312 Adjusted operating income (loss) $ 36,257 8.6 % $ 57,346 11.7 % $ (12,397 ) $ 81,206 8.9 % $ 55,998 9.8 % $ 53,863 11.2 % $ (15,811 ) $ 94,050 8.9 %

24 CHANGE IN SALES, ORDERS AND BACKLOG (unaudited) _____________________ Note: Dollars in millions. (1) Represents the incremental sales as a result of our acquisition of Victor Technologies Holdings, Inc. Net Sales Orders Backlog at Period End $ % $ % $ % As of and for the three months ended March 28, 2014 $ 1,054.3 $ 583.4 $ 1,592.0 Components of Change: Existing Businesses (129.3 ) (12.3 )% (84.7 ) (14.5 )% (27.6 ) (1.7 )% Acquisition(1) 103.9 9.9 % — — % — — % Foreign Currency Translation (117.8 ) (11.2 )% (51.8 ) (8.9 )% (213.5 ) (13.4 )% Total (143.2 ) (13.6 )% (136.5 ) (23.4 )% (241.1 ) (15.1 )% As of and for the three months ended March 27, 2015 $ 911.1 $ 446.9 $ 1,350.9