Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TEXAS CAPITAL BANCSHARES INC/TX | a04232015-8k.htm |

| EX-99.1 - EXHIBIT 99.1 - TEXAS CAPITAL BANCSHARES INC/TX | a0423-2015exhibit991.htm |

April 22, 2015 TCBI Q1 2015 Earnings

Certain matters discussed on this call may contain “forward-looking statements” as defined in federal securities laws, which are subject to risks and uncertainties and are based on Texas Capital’s current estimates or expectations of future events or future results. These statements are not historical in nature and can generally be identified by such words as “believe,” “expect,” “estimate,” “anticipate,” “plan,” “may,” “will,” “intend” and similar expressions. A number of factors, many of which are beyond Texas Capital’s control, could cause actual results to differ materially from future results expressed or implied by our forward-looking statements. These risks and uncertainties include the risk of adverse impacts from general economic conditions, the effects of recent declines in oil and gas prices on our customers, competition, changes in interest rates and exposure to regulatory and legislative changes. These and other factors that could cause results to differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties that may affect Texas Capital’s business, can be found in our Annual Report on Form 10-K and other filings made by Texas Capital with the Securities and Exchange Commission. Forward-looking statements speak only as of the date of this call. Texas Capital is under no obligation, and expressly disclaims any obligation, to update, alter or revise its forward-looking statements, whether as a result of new information, future events or otherwise. 2

Opening Remarks & Financial Highlights 3 Core Earnings Power Strong Balanced Growth Credit Quality • Exceptional growth in traditional LHI balances despite highly competitive C&I market • Growth in mortgage finance loans (MFLs) with impact from refinance activity • Continued significant growth in demand and total deposits • Asset sensitivity position increased with extended duration of low-cost funding • Growth in total loans continues to produce strong net revenue • Operating leverage improving with growth, even with continued build-out • Business model focused on organic growth continues to demonstrate ability to produce high returns on invested capital • Credit metrics remain strong but with increase in NPAs; $1.9 million related to energy • NCOs at 12 bps in Q1-2015, none related to energy • High allowance coverage ratios • Provision driven by application of methodology; increase related to growth in core LHI and anticipated downgrades in energy credits Operating Results Net Income $35.1 million EPS $0.70 ROE SPACE 9.82% Total Loans $16.2 billion Total Deposits $14.1 billion +13.4% LQ +11.4% LQ

Net Interest Income & Margin 4 • Net interest income growth of 2% from Q4-2014 and 20% from Q1-2014 • MFL growth benefits NII with small negative to NIM • Traditional LHI spreads continue to show only modest erosion with competitive pressure • Impact of liquidity build significantly reduces NIM, but no adverse impact on NII • Two fewer days in Q1-2015; $.04 impact on EPS Earning Asset & Margin Trends Quarterly Change NII ($MM) NIM (%) $127.6 Q4 2014 3.56% .3 Increase in liquidity (.28) (2.3) Decrease in LHI loan yields (.06) (.6) Decrease in MF loan yields (.02) (.7) Mix shift of MF loans/total loans (.02) (2.9) Decrease in day count for Q1 − 8.7 Increase in earning assets − (.1) Other .04 $130.0 Q1 2015 3.22% $10.7 $11.7 $12.8 $13.3 $14.1 $0.4 $0.2 $0.4 $0.9 $2.3 4.24% 4.08% 4.01% 3.91% 3.82% 3.99% 3.87% 3.77% 3.56% 3.22% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 P or tf ol io B al an ce s ($ B ) Loans Other Earning Assets Total Loan Spread NIM

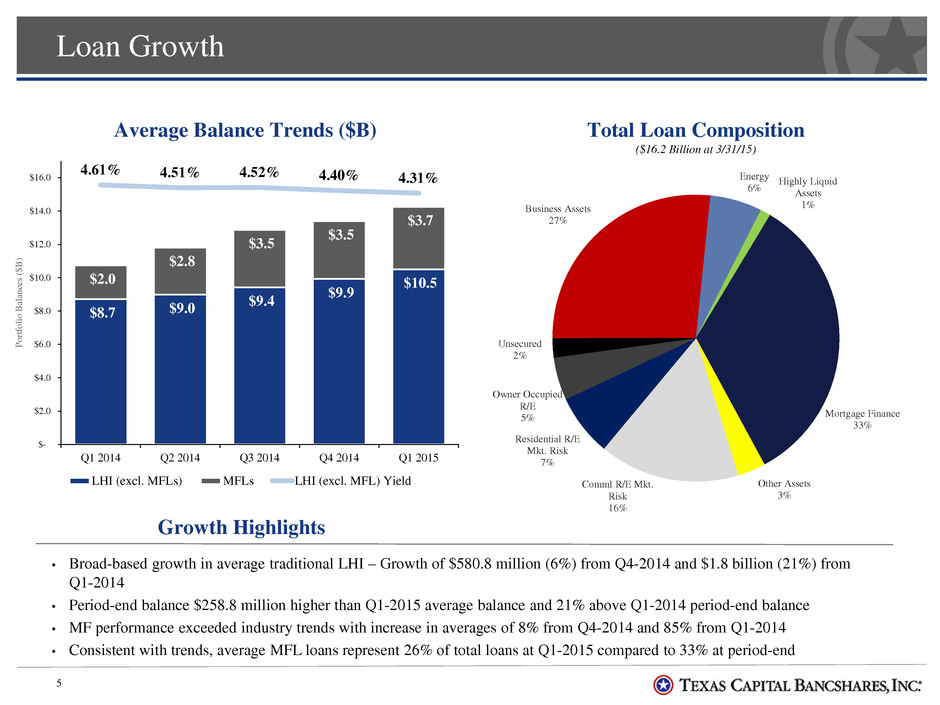

Loan Growth 5 • Broad-based growth in average traditional LHI – Growth of $580.8 million (6%) from Q4-2014 and $1.8 billion (21%) from Q1-2014 • Period-end balance $258.8 million higher than Q1-2015 average balance and 21% above Q1-2014 period-end balance • MF performance exceeded industry trends with increase in averages of 8% from Q4-2014 and 85% from Q1-2014 • Consistent with trends, average MFL loans represent 26% of total loans at Q1-2015 compared to 33% at period-end Growth Highlights Average Balance Trends ($B) Total Loan Composition ($16.2 Billion at 3/31/15) Business Assets 27% Energy 6% Highly Liquid Assets 1% Mortgage Finance 33% Other Assets 3% Comml R/E Mkt. Risk 16% Residential R/E Mkt. Risk 7% Owner Occupied R/E 5% Unsecured 2% $8.7 $9.0 $9.4 $9.9 $10.5 $2.0 $2.8 $3.5 $3.5 $3.7 4.61% 4.51% 4.52% 4.40% 4.31% -5.00% -3.00% -1.00% 1.00% 3.00% 5.00% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 P or tf ol io B al an ce s ($ B ) LHI (excl. MFLs) MFLs LHI (excl. MFL) Yield

Deposit Growth 6 Average Balance Trends ($B) Funding Costs • Core funding costs – deposits and borrowed funds – flat at 17 bps • Deposit growth consistent with strategic opportunity to build deposit base • Minor benefit to NII • Impact on NIM consistent with objectives, and will fluctuate from quarter to quarter based on levels of liquidity assets and loan mix • Significant increase in asset sensitivity and duration of low-cost funding Growth Highlights 0.17% 0.17% 0.16% 0.17% 0.17% 0.30% 0.31% 0.28% 0.28% 0.26% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Avg Cost of Deposits Total Funding Costs $6.1 $6.3 $6.9 $7.4 $8.0 $3.4 $3.6 $4.7 $5.0 $5.6 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 D ep os it B al an ce s ($ B ) Interest-Bearing Deposits DDAs

Non-interest Expense 7 • Efficiency Ratio at less than 55% in Q1-2015, even with seasonal impact from benefit costs ($.03 EPS impact), as well as two fewer days ($.04 EPS impact) • Continued focus on managing growth in NIE • Effective utilization of professional resources and reduction in legal expense • Linked quarter net decrease in incentive expense linked to performance and change in stock price Efficiency Ratio Trends Expense Highlights Non-interest expense ($MM) Increase/ (Decrease) Q4 2014 $74.1 Salaries and employee benefits – seasonal impact of FICA, etc. 2.3 Salaries and employee benefits – performance based incentives, LTI and annual incentive pool (1.9) Legal & other professional – effective use of professional services; legal reduced and varies by quarter .3 Salaries and employee benefits – continued build out .8 FDIC assessment .9 Q1 2015 $76.5 Quarterly Change 58.4% 55.4% 52.8% 53.4% 53.8% 54.3% 55.3% 55.6% 55.8% 62.2% 60.9% 60.3% 60.9% 48.0% 50.0% 52.0% 54.0% 56.0% 58.0% 60.0% 62.0% 64.0% Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Texas Capital Texas Peers* Top 100* * Peer data through Q4-2014 from SNL Datasource

Performance Summary - Quarterly 8 (in thousands) Q1 2015 Q4 2014 Q3 2014 Q2 2014 Q1 2014 Net interest income $ 130,009 $ 127,582 $ 125,661 $ 115,407 $ 108,315 Non-interest income 12,267 11,226 10,396 10,533 10,356 Net revenue 142,276 138,808 136,057 125,940 118,671 Provision for credit losses 11,000 6,500 6,500 4,000 5,000 Non-interest expense 76,517 74,117 71,915 69,765 69,317 Income before income taxes 54,759 58,191 57,642 52,175 44,354 Income tax expense 19,709 20,357 20,810 18,754 16,089 Net income 35,050 37,834 36,832 33,421 28,265 Preferred stock dividends 2,438 2,437 2,438 2,437 2,438 Net income available to common shareholders $ 32,612 $ 35,397 $ 34,394 $ 30,984 $ 25,827 Diluted EPS $ .70 $ .78 $ .78 $ .71 $ .60 Net interest margin 3.22% 3.56% 3.77% 3.87% 3.99% ROA .84% 1.03% 1.07% 1.08% 1.01% ROE 9.82% 11.41% 12.11% 11.38% 10.20% Efficiency 53.8% 53.4% 52.9% 55.4% 58.4%

2015 Outlook 9 Business Driver 2015 Outlook v. 2014 Results Changes since January 21, 2015 Average LHI Low to mid teens percent growth Increased from low teens percent growth Average LHI – Mortgage Finance High single to low double-digit percent growth Increased from flat to single-digit percent growth Average Deposits Low 20’s percent growth Increased from mid to high teens percent growth Net Interest Income Low double-digit percent growth, with continued low interest rates and impact of days in Q1 − Net Interest Margin 3.40% to 3.50%, excluding effect of continued liquidity build Clarified to exclude effect of liquidity build Net Charge-Offs Less than 0.25%; could include some higher provisioning Provided additional guidance on provisioning NIE Low to mid-teens percent growth − Efficiency Ratio Mid-fifties, includes continued development of product extension and regulatory compliance costs, with improvement expected in 2nd half of 2015 − Diluted shares 2015 will include full effect of 2014 common equity offerings −

Asset Quality 10 • Total credit cost of $11.0 million for Q1-2015, compared to $5.0 million in Q1-2014 and $6.5 million in Q4-2014 • NCOs $3.1 million, or 12 bps, in Q1-2015 compared to 10 bps in Q1-2014 and 5 bps in Q4-2014 • Increase in non-accruals primarily related to non-energy C&I; NPA ratio still at low levels • No net charge-offs related to energy; energy NPAs at $1.9 million for Q1-2015 Asset Quality Highlights Non-accrual loans Q1 2015 Commercial $ 59,152 Construction – Real estate 8,983 Consumer – Equipment leases 172 Total non-accrual loans 68,307 Non-accrual loans as % of loans excluding MF .63% Non-accrual loans as % of total loans .42% OREO 605 Total Non-accruals + OREO $ 68,912 Non-accrual loans + OREO as % of loans excluding MF + OREO .64% Reserve to non-accrual loans 1.6x 0.58% 0.10% 0.07% 0.07% 0.12% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2011 2012 2013 2014 2015 NCO / Average Traditional LHI ALLL/ Trad’l LHI 1.26% 1.10% 1.03% .99% 1.00%

EPS Growth 11 EPS Growth (5-yr CAGR of 27%) $1.00 $1.98 $3.00 $2.72 $0.60 $0.70 $0.71 $0.78 $0.78 $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 2010 2011 2012 2013 2014 YTD Q1-2015 YTD $2.88 Note: Q1-2015 includes the full quarter impact of the common stock offering completed in Q4-2014, resulting in a $0.03 decrease as compared to Q4-2014 Stock Offerings 2,300,000 common shares August $150 million preferred March 1,875,000 January 2,523,128 November common shares

Closing Comments • Strong traditional LHI growth experienced in Q1-2015 affirms our confidence in the guidance for the remainder of 2015, despite limitations on CRE and Builder Finance growth rates and uncertainty related to energy • Continue to have critical focus on maintaining strong credit quality • Significant mortgage finance growth in Q1-2015 with record ending balance; Q1-2015 included meaningful impact from refinance activity • Continued success in building liquidity which had a significant impact on NIM, but not net interest income in Q1-2015 • Remain highly asset sensitive based on how we run our business; better positioned to take advantage of increases in short-term rates 12

Q&A 13

Appendix 14

Average Balances, Yields & Rates - Quarterly 15 (in thousands) Q1 2015 Q4 2014 Q1 2014 Avg. Bal. Yield Rate Avg. Bal. Yield Rate Avg. Bal. Yield Rate Assets Securities $ 39,930 3.78% $ 42,515 3.80% $ 57,581 4.18% Liquidity assets 2,210,864 .25% 882,001 .25% 304,042 .27% Loans held for investment, mortgage finance 3,746,938 2.99% 3,471,737 3.06% 2,027,264 3.36% Loans held for investment 10,502,172 4.31% 9,921,323 4.40% 8,717,969 4.61% Total loans, net of reserve 14,148,068 3.99% 13,296,921 4.08% 10,657,547 4.41% Total earning assets 16,398,867 3.49% 14,221,437 3.85% 11,019,170 4.29% Total assets $16,857,892 $14,631,072 $11,401,368 Liabilities and Stockholders’ Equity Total interest bearing deposits $ 8,044,876 .28% $ 7,405,436 .28% $ 6,105,214 .27% Other borrowings 1,172,675 .16% 251,449 .19% 293,012 .24% Total long-term debt 399,406 4.88% 399,406 4.84% 341,073 4.87% Total interest bearing liabilities 9,616,957 .46% 8,056,291 .50% 6,739,299 .50% Demand deposits 5,592,124 5,047,876 3,381,501 Stockholders’ equity 1,496,172 1,380,646 1,177,054 Total liabilities and stockholders’ equity $16,857,892 .26% $14,631,072 .28% $11,401,368 .30% Net interest margin 3.22% 3.56% 3.99% Total deposits and borrowed funds $14,809,675 .17% $12,704,761 .17% $ 9,779,727 .17% Loan spread 3.82% 3.91% 4.24%

Average Balance Sheet - Quarterly 16 (in thousands) QTD Average Q1/Q4 % Change YOY % Change Q1 2015 Q4 2014 Q1 2014 Total assets $16,857,892 $14,631,072 $11,401,368 15% 48% Loans held for investment 10,502,172 9,921,323 8,717,969 6% 20% Loans held for investment, mortgage finance 3,746,938 3,471,737 2,027,264 8% 85% Total loans 14,249,110 13,393,060 10,745,233 6% 33% Liquidity assets 2,210,864 882,001 304,042 151% 627% Demand deposits 5,592,124 5,047,876 3,381,501 11% 65% Total deposits 13,637,000 12,453,312 9,486,715 10% 44% Stockholders’ equity 1,496,172 1,380,646 1,177,054 8% 27%

Period End Balance Sheet 17 (in thousands) Period End Q1/Q4 % Change YOY % Change Q1 2015 Q4 2014 Q1 2014 Total assets $17,325,458 $15,899,946 $12,147,070 9% 43% Loans held for investment 10,760,978 10,154,887 8,928,325 6% 21% Loans held for investment, mortgage finance 5,408,750 4,102,125 2,688,044 32% 101% Total loans 16,169,728 14,257,012 11,616,369 13% 39% Liquidity assets 734,495 1,233,990 146,205 (40)% 402% Demand deposits 6,050,817 5,011,619 3,451,294 21% 75% Total deposits 14,122,306 12,673,300 9,729,128 11% 45% Stockholders’ equity 1,517,958 1,484,190 1,230,131 2% 23%