Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Strategic Storage Growth Trust, Inc. | d911418d8k.htm |

| Exhibit 99.1

|

STRATEGIC Strage Growth Trust, Inc. LEASE-UP EXPANSION DEVELOPMENT/REDEVELOPMENT

2014

Year

End

Results

&

Acquisi7on

Update

|

|

Disclaimer and Risk Factors Disclaimers CAUTIONARY NOTE REGARDING FORWARD--?LOOKING STATEMENTS

Certain

statements

contained

in

this

material,

other

than

historical

facts,

may

be

considered

forward--?looking

statements

within

the

meaning

of

Sec=on

27A

of

the

Securi=es

Act

of

1933,

as

amended

(the

“Securi=es

Act”)

and

Sec=on

21E

of

the

Securi=es

Exchange

Act

of

1934,

as

amended

(the

“Exchange

Act”) .

We

intend

for

all

such

forward

looking

statements

to

be

covered

by

the

applicable

safe

harbor

provisions

for

forward--?looking

statements

contained

in

Sec=on

27A

of

the

Securi=es

Act

and

Sec=on

21E

of

the

Exchange

Act,

as

applicable.

Such

statements

include,

in

par=cular,

statements

about

our

plans,

strategies,

and

prospects

and

are

subject

to

certain

risks

and

uncertain=es,

including

known

and

unknown

risks,

which

could

cause

actual

results

to

differ

materially

from

those

projected

or

an=cipated.

Therefore,

such

statements

are

not

intended

to

be

a

guarantee

of

our

performance

in

future

periods.

Such

forward--?looking

statements

can

generally

be

iden=fied

by

our

use

of

forward--?looking

terminology

such

as

“may,”

“will,”

“expect,”

“intend,”

“an=cipate,”

“es=mate,”

“believe,”

“con=nue,”

or

other

similar

words.

Readers

are

cau=oned

not

to

place

undue

reliance

on

these

forward--?looking

statements,

which

speak

only

as

of

the

date

of

this

material.

We

cannot

guarantee

the

accuracy

of

any

such

forward

looking

statements

contained

in

this

material,

and

we

do

not

intend

to

publicly

update

or

revise

any

forward--?looking

statements,

whether

as

a

result

of

new

informa=on,

future

events,

or

otherwise.

Any

such

forward--?looking

statements

are

subject

to

risks,

uncertain=es,

and

other

factors

and

are

based

on

a

number

of

assump=ons

involving

judgments

with

respect

to,

among

other

things,

future

economic,

compe==ve,

and

market

condi=ons,

all

of

which

are

difficult

or

impossible

to

predict

accurately.

To

the

extent

that

our

assump=ons

differ

from

actual

results,

our

ability

to

meet

such

forward--?looking

statements,

including

our

ability

to

generate

posi=ve

cash

flow

from

opera=ons

and

provide

distribu=ons

to

stockholders,

and

our

ability

to

find

suitable

investment

proper=es,

may

be

significantly

hindered.

All

forward--?looking

statements

should

be

read

in

light

of

the

risks

iden=fied

in

our

prospectus

and/or

private

placement

memorandum

and

supplements

thereto.

Risk

Factors

–

Strategic

Storage

Growth

Trust

(SSGT)

? No

public

market

currently

exists

for

shares

of

our

common

stock

and

we

may

not

list

our

shares

on

a

na=onal

securi=es

exchange

before

three

to

?ve

years

aYer

comple=on

of

this

o?ering,

if

at

all;

therefore,

it

may

be

di?cult

to

sell

your

shares.

If

you

sell

your

shares,

it

will

likely

be

at

a

substan=al

discount.

Our

charter

does

not

require

us

to

pursue

a

liquidity

transac=on

at

any

=me.

? We

cannot

assure

you

if

or

when

we

will

make

cash

distribu=ons.

We

may

pay

distribu=ons

from

sources

other

than

our

cash

?ows

from

opera=ons,

including

from

the

net

proceeds

from

our

o?erings.

We

are

not

prohibited

from

undertaking

such

ac=vi=es

by

our

charter,

bylaws

or

investment

policies,

and

we

may

use

an

unlimited

amount

from

any

source

to

pay

our

distribu=ons,

and

it

is

likely

that

we

will

use

o?ering

proceeds

to

fund

a

majority

of

our

ini=al

distribu=ons.

Paying

distribu=ons

from

the

proceeds

of

this

o?ering

may

nega=vely

impact

our

ability

to

make

investments

and

reduce

your

basis

in

our

stock.

? This

is

an

ini=al

public

o?ering;

we

have

li_le

prior

opera=ng

history,

and

the

prior

performance

of

real

estate

programs

sponsored

by

a?liates

of

our

sponsor

may

not

be

indica=ve

of

our

future

results.

? This

is

a

“best

efforts”

offering.

If

we

are

unable

to

raise

substan=al

funds

in

this

offering,

we

may

not

be

able

to

invest

in

a

diverse

por`olio

of

real

estate

and

real

estate--?related

investments,

and

the

value

of

your

investment

may

fluctuate

more

widely

with

the

performance

of

specific

investments.

? We

are

a

“blind

pool”

because

we

have

not

iden=fied

any

proper=es

to

acquire

with

the

net

proceeds

from

this

offering.

As

a

result,

you

will

not

be

able

to

evaluate

the

economic

merits

of

our

future

investments

prior

to

their

purchase.

We

may

be

unable

to

invest

the

net

proceeds

from

this

offering

on

acceptable

terms

to

investors,

or

at

all.

? There

are

substan=al

con?icts

of

interest

among

us

and

our

sponsor,

advisor,

property

manager

and

dealer

manager.

? Our

advisor

will

face

con?icts

of

interest

rela=ng

to

the

purchase

of

proper=es,

including

con?icts

with

our

sponsor

and

Strategic

Storage

Trust

II,

Inc.,

and

such

con?icts

may

not

be

resolved

in

our

favor,

which

could

adversely

a?ect

our

investment

opportuni=es.

? We

have

no

employees

and

must

depend

on

our

advisor

to

select

investments

and

conduct

our

opera=ons,

and

there

is

no

guarantee

that

our

advisor

will

devote

adequate

=me

or

resources

to

us.

? We

will

pay

substan=al

fees

and

expenses

to

our

advisor,

its

a?liates

and

par=cipa=ng

broker--?dealers

for

the

services

they

provide

to

us,

which

will

reduce

cash

available

for

investment

and

distribu=on.

We

may

be

required

to

pay

our

advisor

a

signi?cant

distribu=on

if

our

advisory

agreement

is

involuntarily

terminated.

? We

may

incur

substan=al

debt,

which

could

hinder

our

ability

to

pay

distribu=ons

to

our

stockholders

or

could

decrease

the

value

of

your

investment.

? We

may

fail

to

qualify

as

a

REIT,

which

could

adversely

a?ect

our

opera=ons

and

our

ability

to

make

distribu=ons.

2

? Our

board

of

directors

may

change

any

of

our

investment

objec=ves

without

your

consent.

|

|

Disclaimer

and

Risk

Factors

Other

Informa=on

–

SSGT

? An

investment

in

shares

of

SSGT

is

not

suitable

for

all

investors.

An

investment

in

shares

of

SSGT

involves

significant

risks

and

is

only

suitable

for

persons

who

have

adequate

financial

means,

desire

a

rela=vely

long--?term

investment

and

will

not

need

immediate

liquidity

from

their

investment.

Investors

should

only

purchase

shares

if

they

can

afford

a

complete

loss

of

their

investment.

Generally,

a

purchaser

of

shares

must

have,

excluding

the

value

of

a

purchaser’s

home,

furnishings

and

automobiles,

either:

? A

net

worth

of

at

least

$250,000,

or

? A

gross

annual

income

of

at

least

$70,000

and

a

net

worth

of

at

least

$70,000.

? Please

see

the

prospectus

for

a

full

descrip=on

of

suitability

standards.

Residents

of

Alabama,

Iowa,

Kansas,

Kentucky,

Maine,

Massachuse_s,

Missouri,

Nebraska,

New

Jersey,

New

Mexico,

North

Dakota,

Ohio,

Oregon,

Pennsylvania,

Tennessee

and

Vermont

should

consult

the

prospectus

for

details

regarding

the

more

stringent

suitability

standards

that

apply

to

them

based

on

their

states

of

residence.

3

|

|

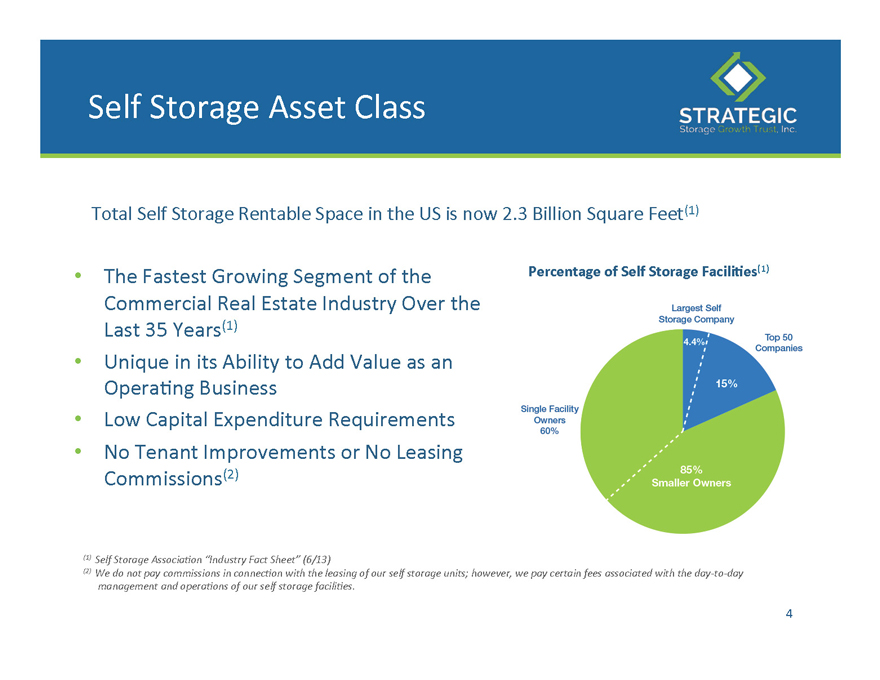

Self

Storage

Asset

Class

Total

Self

Storage

Rentable

Space

in

the

US

is

now

2.3

Billion

Square

Feet(1)

? The

Fastest

Growing

Segment

of

the

Percentage

of

Self

Storage

Facili7es(1)

Commercial

Real

Estate

Industry

Over

the

Last

35

Years(1)

? Unique

in

its

Ability

to

Add

Value

as

an

Opera=ng

Business

? Low

Capital

Expenditure

Requirements

? No

Tenant

Improvements

or

No

Leasing

Commissions(2)

(1)

Self

Storage

Associa2on

“Industry

Fact

Sheet”

(6/13)

(2)

We

do

not

pay

commissions

in

connec2on

with

the

leasing

of

our

self

storage

units;

however,

we

pay

certain

fees

associated

with

the

day--?to--?day

management

and

opera2ons

of

our

self

storage

facili2es.

4

|

|

Self

Storage

Asset

Class

Driven

by

People

in

Transi7on

? Change

in

marital

status

? Birth

? Inheritance

? Military

enlistment

? Baby

boomers

? Job

reloca=on

? Business

expansion

or

contrac=on

? Micro

business

Nearly 10% of U.S. households currently rent a self storage unit, up from 1 in 17 in 1995.*

*

Self

Storage

Associa2on

“Industry

Fact

Sheet”

(11/13)

5

|

|

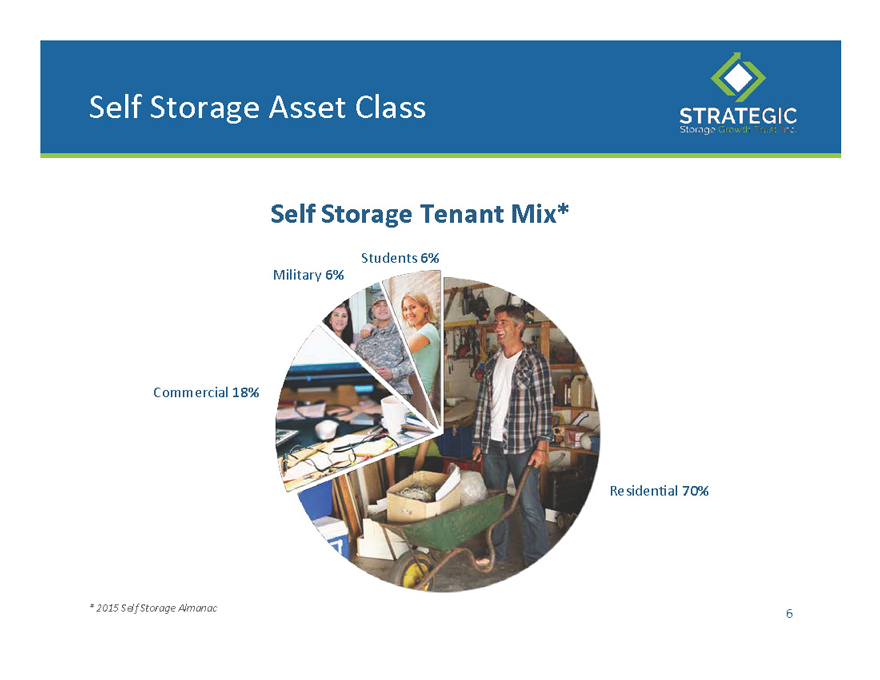

Self

Storage

Asset

Class

Self

Storage

Tenant

Mix*

Students

6%

Military

6%

Commercial

18%

Residen=al

70%

| * |

|

2015

Self

Storage

Almanac

6

|

|

Strategic

Storage

Growth

Trust,

Inc.

Opportunis7c

REIT

? Goal

of

Mee=ng

Future

Income

Needs

?Protec=on

Against

In?a=on

(Due

to

month

to

month

rents)

?Greater

Capital

Apprecia=on

Poten=al

This

property

is

not

owned

by

Strategic

Storage

Growth

Trust,

Inc.

This

property

was

acquired

by

another

program

sponsored

by

our

sponsor

or

its

a?liates.

The

property

is

only

shown

to

indicate

what

we

expect

our

acquisi2ons

to

look

like

aTer

we

have

converted

them

to

the

SmartStop®

brand.

7

|

|

Investment

Strategy

DEVELOP

REDEVELOP

/

EXPANSION

LEASE--?UP

These

proper2es

are

not

owned

by

Strategic

Storage

Growth

Trust,

Inc.

These

proper2es

were

acquired

by

another

program

sponsored

by

our

sponsor

or

its

a?liates.

These

proper2es

are

only

shown

to

indicate

what

we

expect

our

acquisi2ons

to

look

like

aTer

we

have

converted

them

to

the

SmartStop®

brand.

| 8 |

|

|

|

Investment

Strategy

Development

Brampton,

Ontario

? Ground

Up

from

Vacant

Land

? Low

Cap

Rate

Environment

promotes

building

? Market

Speci?c

? Higher

Return

Poten=al

This

property

is

not

owned

by

Strategic

Storage

Growth

Trust,

Inc.

This

property

was

acquired

by

another

program

sponsored

by

our

sponsor

or

its

a?liates.

The

property

is

only

shown

to

indicate

what

we

expect

our

acquisi2ons

to

look

like

aTer

we

have

converted

them

to

the

SmartStop®

brand.

9

|

|

Investment

Strategy

Mississauga,

Ontario

Redevelopment/Expansion

? Conversion

to

Repurpose

an

Exis=ng

Building

–

Typically

an

Industrial

Building

? Addi=onal

Rentable

Square

Feet

to

an

Exis=ng

Self

Storage

Facility

This

property

is

not

owned

by

Strategic

Storage

Growth

Trust,

Inc.

This

property

was

acquired

by

another

program

sponsored

by

our

sponsor

or

its

a?liates.

The

property

is

only

shown

to

indicate

what

we

expect

our

acquisi2ons

to

look

like

aTer

we

have

converted

them

to

the

SmartStop®

brand.

10

|

|

Investment

Strategy

Lease--?Up

? and

Open

Exis=ng

Self

Storage

Facility

Built

? Stabiliza=on

Has

Not

Yet

Reached

? Boost

Occupancy

Exis=ng

Management

Unable

to

? Makes

a

Di?erence!

Management

and

Marke=ng

SmartStop®

Self

Storage

--?

Sharpsburg,

GA

This

property

is

not

owned

by

Strategic

Storage

Growth

Trust,

Inc.

This

property

was

acquired

by

another

program

sponsored

by

our

sponsor

or

its

a?liates.

The

property

is

only

shown

to

indicate

what

we

expect

our

acquisi2ons

to

look

like

aTer

we

have

converted

them

to

the

SmartStop®

brand.

11

|

|

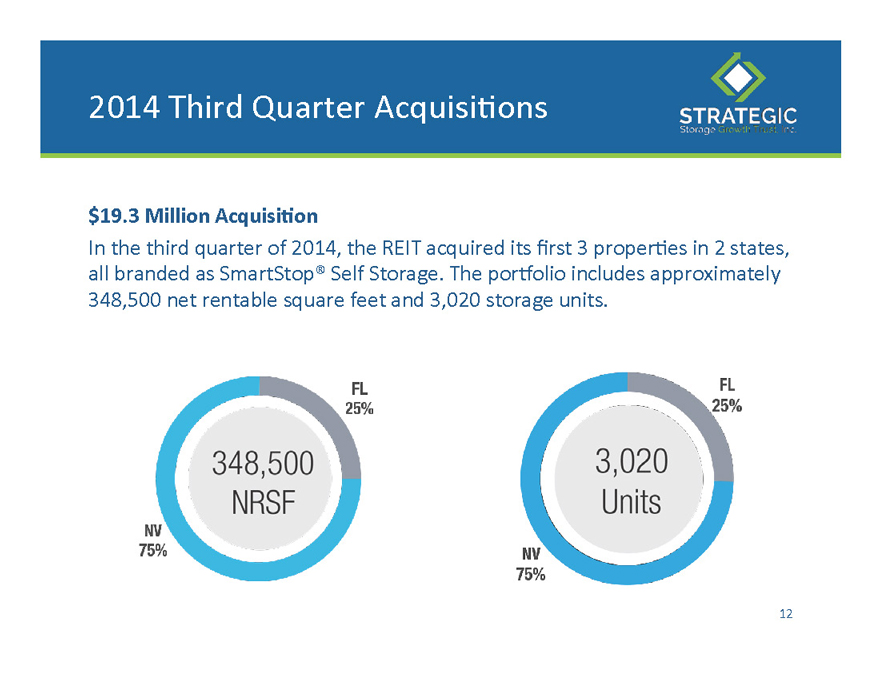

2014

Third

Quarter

Acquisi=ons

$19.3

Million

Acquisi7on

In

the

third

quarter

of

2014,

the

REIT

acquired

its

?rst

3

proper=es

in

2

states,

all

branded

as

SmartStop®

Self

Storage.

The

por`olio

includes

approximately

348,500

net

rentable

square

feet

and

3,020

storage

units.

12

|

|

Third

Quarter

Acquisi=ons

Ft.

Pierce

–

Florida

770

Units

88,400

NRSF

13

|

|

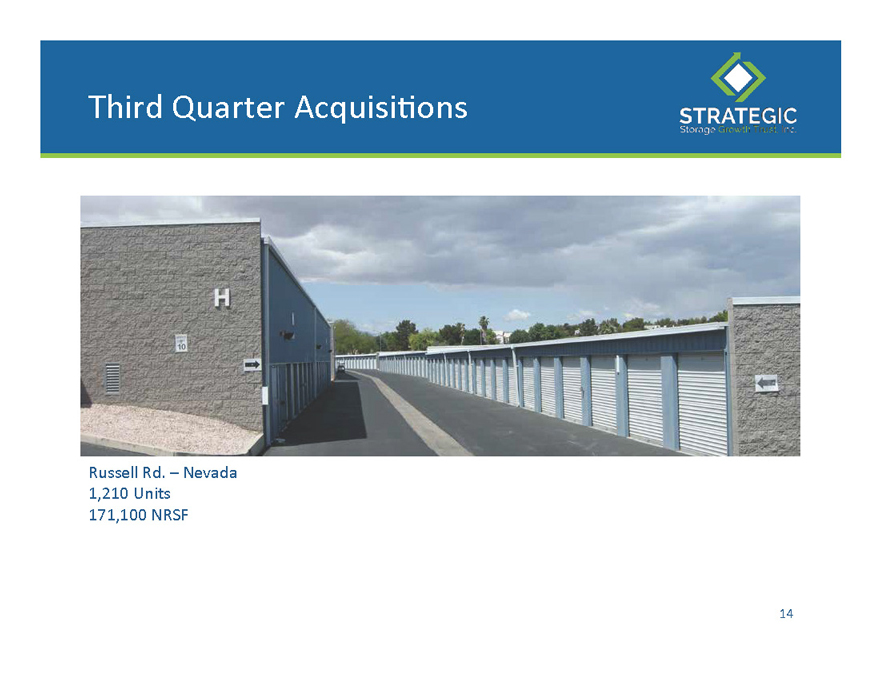

Third

Quarter

Acquisi=ons

Russell

Rd.

–

Nevada

1,210

Units

171,100

NRSF

14

|

|

Third

Quarter

Acquisi=ons

Jones

Blvd.

–

Nevada

1,040

Units

89,000

NRSF

15

|

|

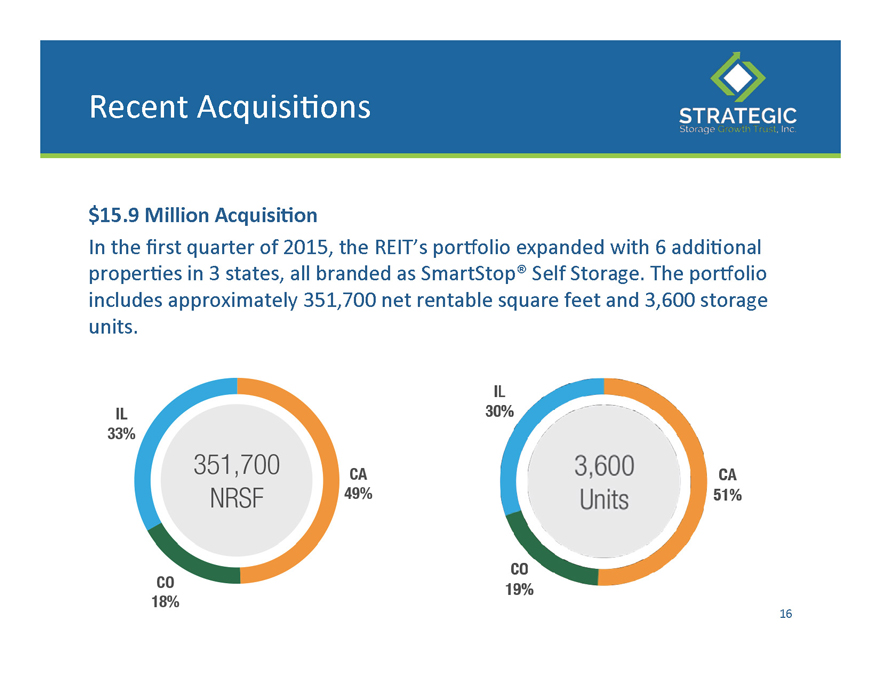

Recent

Acquisi=ons

$15.9

Million

Acquisi7on

In

the

first

quarter

of

2015,

the

REIT’s

por`olio

expanded

with

6

addi=onal

proper=es

in

3

states,

all

branded

as

SmartStop®

Self

Storage.

The

por`olio

includes

approximately

351,700

net

rentable

square

feet

and

3,600

storage

units.

16

|

|

Recent

Acquisi=ons

Elgin,

IL

Airport

Rd,

CO

Azusa,

CA

Romeoville,

IL

410

Units

680

Units

660

Units

680

Units

49,600

NRSF

61,800

NRSF

64,400

NRSF

66,700

NRSF

Riverside,

CA

Stockton,

CA

610

Units

560

Units

60,100

NRSF

49,100

NRSF

17

|

|

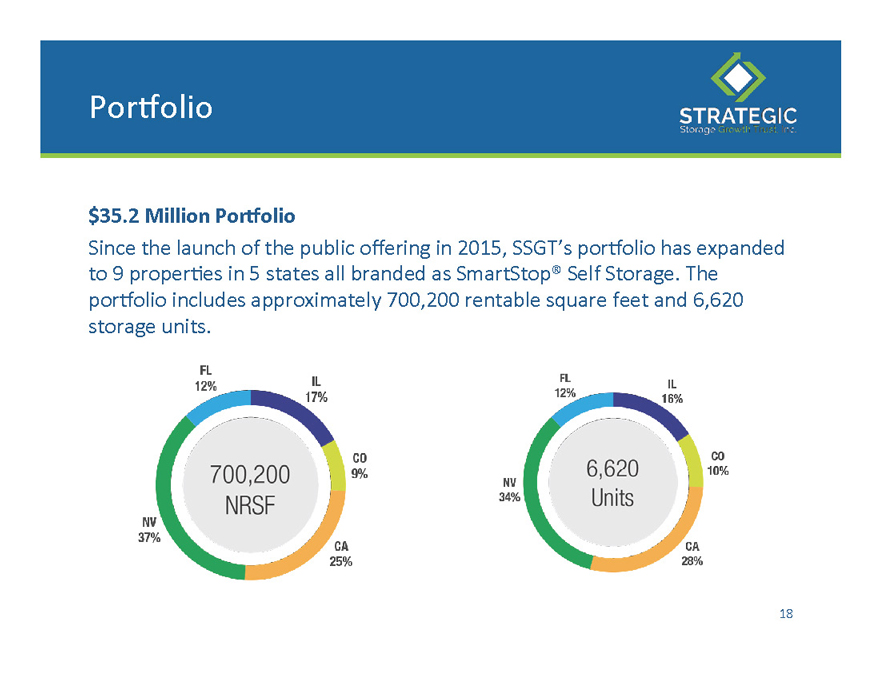

Por`olio

$35.2

Million

Porbolio

Since

the

launch

of

the

public

offering

in

2015,

SSGT’s

por`olio

has

expanded

to

9

proper=es

in

5

states

all

branded

as

SmartStop®

Self

Storage.

The

por`olio

includes

approximately

700,200

rentable

square

feet

and

6,620

storage

units.

18

|

|

Publicly

Traded

Self

Storage

Companies

(NYSE:

PSA)

(NYSE:

EXR)

(NYSE:

CUBE)

(NYSE:

SSS)

(NYSE:

UHAL)

Public

Non--?Traded

Self

Storage

REITs

19

|

|

Questions?