Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORTHERN TRUST CORP | d913706d8k.htm |

northerntrust.com

©

2015 Northern Trust Corporation

N O R T H E R N T R U S T C O R P O R A T I O N

2015 Annual

Meeting of

Stockholders

April 21, 2015

Frederick H. Waddell

Chairman &

Chief Executive Officer

EXHIBIT 99.1 |

2

Northern Trust Corporation 2015 Annual Meeting of Stockholders

Forward Looking Statement

This presentation may include forward-looking statements concerning Northern

Trust’s financial results and outlook, capital adequacy, dividend

policy, anticipated expense levels and technology spending, risk management

policies, contingent liabilities, strategic initiatives, industry

trends,

and

expectations

regarding

the

impact

of

recent

legislation.

Forward-looking

statements are typically identified by words or phrases such as

“believe”, “expect”, “anticipate”,

“intend”, “estimate”, “project”, “likely”,

“may increase”, “plan”, “goal”, “target”, “strategy”, and

similar expressions or future or conditional verbs such as “may”,

“will”, “should”, “would”, and

“could”.

Forward-looking statements are Northern Trust’s current estimates or

expectations of future events or future results, and involve risks and

uncertainties that are difficult to predict. These statements are based on

assumptions about many important factors, including the factors discussed

in Northern Trust’s most recent annual report on Form 10-K and other filings

with the U.S. Securities and Exchange Commission, all of which are available on

Northern Trust’s website.

We caution you not to place undue reliance on any forward-looking statement as

actual results may differ materially from those expressed or implied by

forward-looking statements. Northern Trust assumes no obligation to

update its forward-looking statements. |

3

Northern Trust Corporation 2015 Annual Meeting of Stockholders

2014 Financial Performance

Solid fee growth driven by strong

new business and improving

markets

Higher net interest income driven

by growth in client deposits

Achieved positive operating

leverage

Net income and earnings per

share up 11% versus 2013

Improved our return on common

equity to 10.0% in 2014 from 9.5%

in 2013

($MM, Except EPS)

Trust, Inv. & Other Servicing Fees

Foreign Exchange Trading Income

Other Non-Interest Income

Net Interest Income

Total Revenues

Non-Interest Expenses

Provision for Credit Losses

Pre-Tax Income

Taxes

Net Income

Earnings per Share

Return on Common Equity

$2,833

210

283

1,005

$4,331

3,135

6

$1,190

378

$812

$3.32

10.0%

2014

+9%

-14%

-6%

+8%

+6%

+5%

-70%

+11%

+10%

+11%

+11%

2014

vs. 2013 |

4

Northern Trust Corporation 2015 Annual Meeting of Stockholders

First Quarter 2015 Financial Performance

Solid revenue growth continued

into the first quarter

Maintained expense discipline

Net income and earnings per share

were up 27% and 25%,

respectively, versus the prior year

Return on common equity of 11.3%

1Q15

1Q15

vs. 1Q14

Trust, Inv. & Other Servicing Fees

Foreign Exchange Trading Income

Other Non-Interest Income

Net Interest Income

Total Revenues

Non-Interest Expenses

Provision for Credit Losses

Pre-Tax Income

Taxes

Net Income

Earnings per Share

Return on Common Equity

$727

72

75

261

1,135

789

(4)

350

119

$231

$0.94

11.3%

+7%

+43%

+15%

+6%

+9%

+3%

NM

+30%

+36%

+27%

+25%

($MM, Except EPS) |

5

Northern Trust Corporation 2015 Annual Meeting of Stockholders

Returning Capital to Shareholders

1

2015 figure represents the planned dividend action included in Northern

Trust’s 2015 Capital Plan. The Board of Directors will consider formal

approval of the increase at its regular April meeting. Quarterly Dividend Paid

per Common Share 1

Declared $311.7 million in dividends

and repurchased $480.7 million of our

common stock in 2014

The Federal Reserve did not object to

Northern Trust’s 2015 capital plan,

including:

a planned increase in our dividend to

$0.36 per share, and

the repurchase of up to $675 million

of common stock through June 2016

$0.23

$0.25

$0.28

$0.28

$0.28

$0.28

$0.30

$0.31

$0.33

$0.36

4Q06

4Q07

4Q08

4Q09

4Q10

4Q11

4Q12

4Q13

4Q14

2015 |

6

Northern Trust Corporation 2015 Annual Meeting of Stockholders

Improving Profitability & Returns

Focus on enhancing productivity

and efficiency has contributed to

the continued improvement in the

profitability and returns of the

business over the last four years

We achieved a return on equity

of 10.0% in 2014, within our target

range

of

10%

-

15%

We are focused on achieving

continued improvement through

profitable growth

Pre-tax Margin

Return on Equity

8.6%

9.3%

9.5%

10.0%

11.3%

23.4%

25.5%

26.3%

27.5%

30.9%

2011

2012

2013

2014

1Q 2015 |

7

Northern Trust Corporation 2015 Annual Meeting of Stockholders

Wealth

Management

Leading advisor to

the affluent market

A Highly Focused Business Model

As of March 31, 2015

Corporate &

Institutional Services

Global provider of

investment services for

institutional investors

Integrated Global Operating Platform

Banking

$107 billion

in assets

Asset

Servicing

$6.1 trillion

in AUC

Asset

Management

$960 billion

in AUM

Individuals

Families

Family offices

Foundations

Endowments

Privately held

businesses

Pensions

Sovereign entities

Fund managers

Foundations &

endowments

Insurance companies |

8

Northern Trust Corporation 2015 Annual Meeting of Stockholders

A Recognized Market Leader

One of the Nation’s Top 10

Wealth Managers

—

Barron’s 2014

Best Private Bank in the U.S.

—

Financial Times Group, 2014

(6th Consecutive Year)

Best Firm for Family Office and

Philanthropy Services

—

Euromoney, 2014

Global Custodian of the Year

—

Central Banking Awards 2014

Hedge Fund Administrator of the Year

—

Americas Awards, Custody Risk Magazine, 2014

Best European ETF Administrator

—

ETF Express Global Awards 2015

World’s Most Admired

Companies

—

Fortune Magazine, 2015

(9

th

consecutive

year)

Best Banks in America

—

Forbes, 2015

World’s Most Ethical Companies

—

Ethisphere Institute, 2015

13

th

Largest

Manager

of

Worldwide Institutional Assets

12

th

Largest

Asset

Manager

Worldwide

—

Pensions & Investments 2014

Best Fixed Income Indexer

Manager of the Year

—

Institutional Investor Magazine (2014)

Best Place to Work in Money Management

(2nd consecutive year) |

9

Northern Trust Corporation 2015 Annual Meeting of Stockholders

Accelerating our Growth

Engineered Equity

Separate Accounts

Commingled Funds

New York & Houston

Australia |

10

Northern Trust Corporation 2015 Annual Meeting of Stockholders

Enabling Faster, More Profitable Growth

As of March 31, 2015

Manila

Opened

2014

FTE

216

Bangalore

Opened

2005

FTE

3,490

Limerick

Opened

2006

FTE

501

Tempe

Targeted

2015

Our portfolio of strategic investments includes initiatives such as further building out

our global location strategy. |

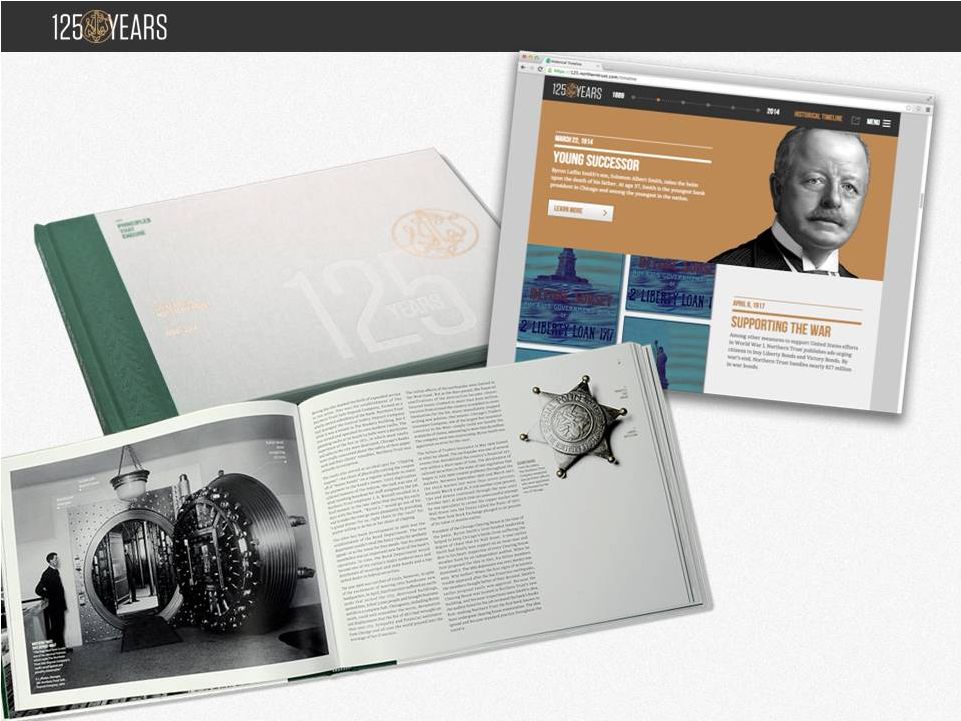

125

TH

ANNIVERSARY

CELEBRATION |

12

|

Headquarters |

13

|

Client

Communications |

Partner Celebrations

Around the World |

Communities

$1.25

million to charities

125,000

volunteer hours |

16

|

Media Highlights

Northern Trust preps

for another 125 years

Northern Trust celebrates

125 years in Chicago

Helping Northern Trust

Grow --

And Change |

17

|

Thank

you,

our

shareholders. |

|