Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bank of New York Mellon Corp | form8-k_earningsxapril22.htm |

| EX-99.3 - EXHIBIT 99.3 - Bank of New York Mellon Corp | ex993_keyfacts1q15.htm |

| EX-99.1 - EXHIBIT 99.1 - Bank of New York Mellon Corp | ex991_earningsrelease1q15.htm |

| EX-99.2 - EXHIBIT 99.2 - Bank of New York Mellon Corp | ex992_quarterlytrends1q15.htm |

BNY Mellon First Quarter 2015 Financial Highlights April 22, 2015

2 First Quarter 2015 – Financial Highlights Cautionary Statement A number of statements in our presentations, the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate”, “forecast”, “project”, “anticipate”, “target”, “expect”, “intend”, “continue”, “seek”, “believe”, “plan”, “goal”, “could”, “should”, “may”, “will”, “strategy”, “opportunities”, “trends” and words of similar meaning signify forward-looking statements. These statements relate to, among other things, The Bank of New York Mellon Corporation’s (the “Corporation”) expectations regarding: our capital plans, estimated capital ratios and expectations regarding those ratios; preliminary business metrics; and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, estimates, intentions, targets, opportunities and initiatives. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual results may differ materially from those expressed or implied as a result of the factors described under “Forward Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014 (the “2014 Annual Report”), and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of April 22, 2015, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. Non-GAAP Measures: In this presentation we may discuss some non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP adjusted measures are contained in the Corporation’s reports filed with the SEC, including the 2014 Annual Report and the Corporation's Earnings Release for the quarter ended March 31, 2015, included as an exhibit to our Current Report on Form 8-K filed on April 22, 2015 (the “Earnings Release”), available at www.bnymellon.com/investorrelations.

3 First Quarter 2015 – Financial Highlights First Quarter 2015 Financial Highlights • Earnings per common share of $0.67 • Earnings per common share +18% year-over-year • Total revenue +6% year-over-year; +4% year-over-year on an adjusted basis1 • Total expense (1%) year-over-year, (23%) sequentially • (2%) year-over-year; (1%) sequentially on an adjusted basis1 • Generated over 500 bps of positive operating leverage year-over-year on an adjusted basis1 • Executing on capital plan and return of value to common shareholders • Return on tangible common equity1 of 20%; 20% on an adjusted basis • Repurchased 10.3 million common shares for $400 million in 1Q15 and 56.5 million common shares for $2.1 billion over the last five quarters, ending 1Q15; declared common stock dividend of $0.17 per share • As previously announced, Board of Directors approved the repurchase of up to $3.1 billion of common stock through 2Q162 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. 2 $700 million of this amount is contingent on prior issuance of $1 billion of qualifying preferred stock.

4 First Quarter 2015 – Financial Highlights First Quarter 2015 Key Performance Drivers • Earnings per common share of $0.67, +18%, driven by foreign exchange and other trading revenue and expense control • Investment management and performance fees +1%, or +6% on a constant currency basis (Non-GAAP)1, driven by higher equity market values, the impact of the Cutwater Asset Management acquisition and strategic initiatives, partially offset by lower performance fees • Investment services fees +3% reflecting net new business, largely driven by Global Collateral Services and securities lending, and higher market values, partially offset by the unfavorable impact of a stronger U.S. dollar • Market-sensitive revenue driven by volume and volatility • Foreign Exchange +67% driven by higher volumes and volatility, as well as higher Depositary Receipts-related activity • Securities Lending +13% driven by volume • Net interest revenue unchanged reflecting a larger balance sheet and lower asset yields • Provision for credit losses was $2 million in 1Q15 versus a credit of $18 million in 1Q14 • Noninterest expense1 (2%) reflecting lower expenses in all categories, except sub-custodian which is volume-related and other expense which includes the impact of the new EU Single Resolution Fund • Effective tax rate of 24.4% in 1Q15; includes a 2.0% benefit related to the tax impact of consolidated investment management funds 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: All comparisons are 1Q15 vs. 1Q14 unless otherwise stated.

5 First Quarter 2015 – Financial Highlights Summary Financial Results for First Quarter 2015 Growth vs. $ in millions, except per share data 1Q15 4Q14 1Q14 1Q14 4Q14 Revenue $ 3,851 $ 3,689 $ 3,647 6 % 4 % Expenses $ 2,700 $ 3,524 $ 2,739 (1 )% (23 )% Income before income taxes $ 1,149 $ 164 $ 926 24 % N/M Pre-tax operating margin 30 % 4 % 25 % EPS $ 0.67 $ 0.18 $ 0.57 18 % N/M Return on Tangible Common Equity1 20.3 % 5.9 % 17.6 % 1 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: Provision for credit losses was $2 million in 1Q15 versus a credit of $18 million in 1Q14 and a provision of $1 million in 4Q14. N/M - not meaningful

6 First Quarter 2015 – Financial Highlights Summary Financial Results for First Quarter 2015 (Non-GAAP)1 Growth vs. $ in millions, except per share data 1Q15 4Q14 1Q14 1Q14 4Q14 Revenue $ 3,761 $ 3,665 $ 3,627 4% 3 % Expenses $ 2,637 $ 2,651 $ 2,681 (2)% (1 )% Operating leverage 533 bps 315 bps Income before income taxes $ 1,122 $ 1,013 $ 964 16 % 11 % Pre-tax operating margin 30 % 28 % 27 % EPS $ 0.67 $ 0.58 $ 0.57 18 % 16 % Return on Tangible Common Equity 20.2 % 16.3 % 17.3 % 1 Represent Non-GAAP measures. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. bps - basis points

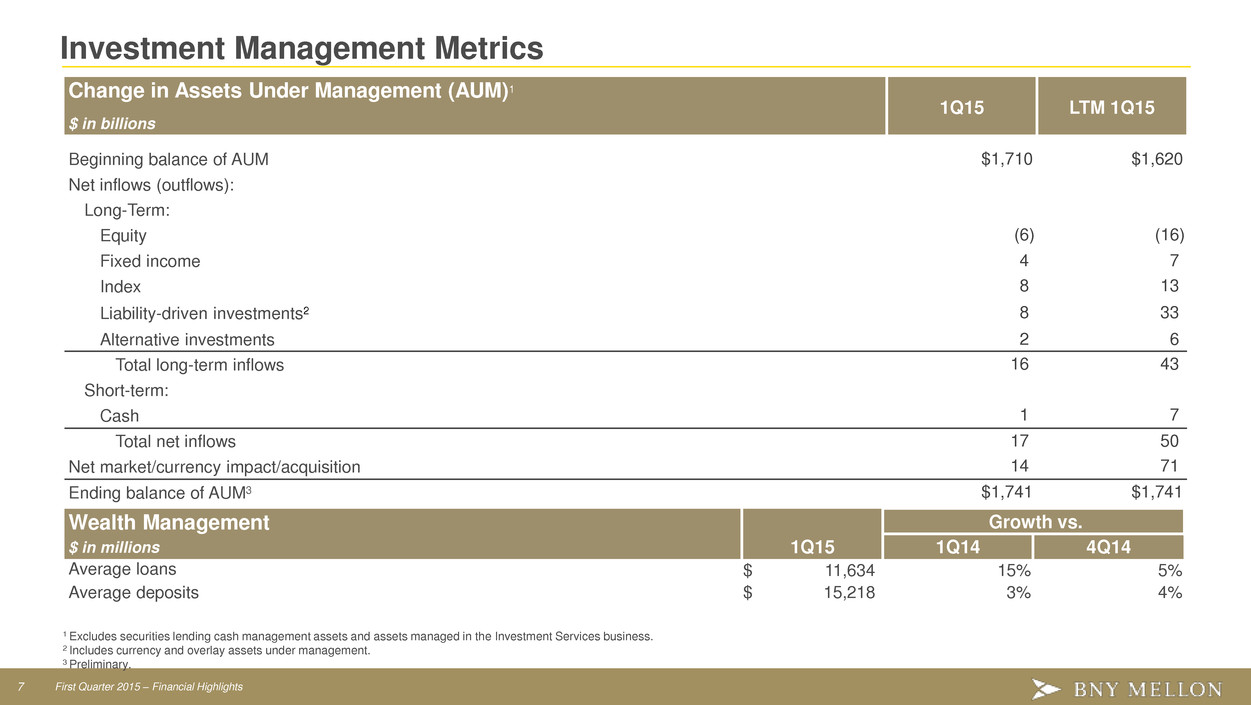

7 First Quarter 2015 – Financial Highlights Investment Management Metrics Change in Assets Under Management (AUM)1 $ in billions 1Q15 LTM 1Q15 Beginning balance of AUM $1,710 $1,620 Net inflows (outflows): Long-Term: Equity (6 ) (16 ) Fixed income 4 7 Index 8 13 Liability-driven investments2 8 33 Alternative investments 2 6 Total long-term inflows 16 43 Short-term: Cash 1 7 Total net inflows 17 50 Net market/currency impact/acquisition 14 71 Ending balance of AUM3 $1,741 $1,741 Wealth Management Growth vs. $ in millions 1Q15 1Q14 4Q14 Average loans $ 11,634 15 % 5 % Average deposits $ 15,218 3 % 4 % 1 Excludes securities lending cash management assets and assets managed in the Investment Services business. 2 Includes currency and overlay assets under management. 3 Preliminary.

8 First Quarter 2015 – Financial Highlights Investment Management . Growth vs. Drivers ($ in millions) 1Q15 1Q14 4Q14 Investment management and performance fees $ 850 1 % (4 )% Investment management fees YoY: +7% on a constant currency basis (Non-GAAP)3, driven by higher equity market values, the impact of the Cutwater acquisition and strategic initiatives QoQ: Fewer days in 1Q15 and unfavorable impact of stronger U.S. dollar, partially offset by the impact of the Cutwater acquisition Performance fees YoY: ($5MM) QoQ: ($29MM) Seasonality Other revenue YoY: $31MM: Higher seed capital gains QoQ: $40MM: Higher seed capital gains and reduced losses on hedging activities within a boutique Net interest revenue Higher loan and deposit levels Noninterest expense YoY: Higher compensation and purchased services expenses resulting from the Cutwater acquisition and investments in strategic initiatives and higher incentive expense, partially offset by favorable impact of stronger U.S. dollar QoQ: Lower litigation, legal and distribution and servicing expenses and favorable impact of stronger U.S. dollar, partially offset by higher incentive expense and the impact of the Cutwater acquisition Distribution and servicing 39 (3 ) (3 ) Other1 47 N/M N/M Net interest revenue 74 6 7 Total Revenue $ 1,010 4 % 1 % Noninterest expense (ex. amortization of intangible assets and (recovery) related to investment management funds, net of incentives) $ 721 3 % (1 )% Income before taxes (ex. amortization of intangible assets and (recovery) related to investment management funds, net of incentives) $ 289 6 % 7 % Amortization of intangible assets 25 (19 ) (17 ) (Recovery) related to investment management funds, net of incentives — N/M N/M Income before taxes $ 264 7 % 10 % Pre-tax operating margin 26 % 71 bps 212 bps Adjusted pre-tax operating margin2,3 34 % (12) bps 157 bps 1 Total fee and other revenue includes the impact of the consolidated investment management funds, net of noncontrolling interests. Additionally, other revenue includes asset servicing, treasury services, foreign exchange and other trading revenue and investment and other income. 2 Excludes the net negative impact of money market fee waivers, amortization of intangible assets and the charge (recovery) related to investment management funds, net of incentives, and is net of distribution and servicing expense. 3 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. N/M - not meaningful bps – basis points

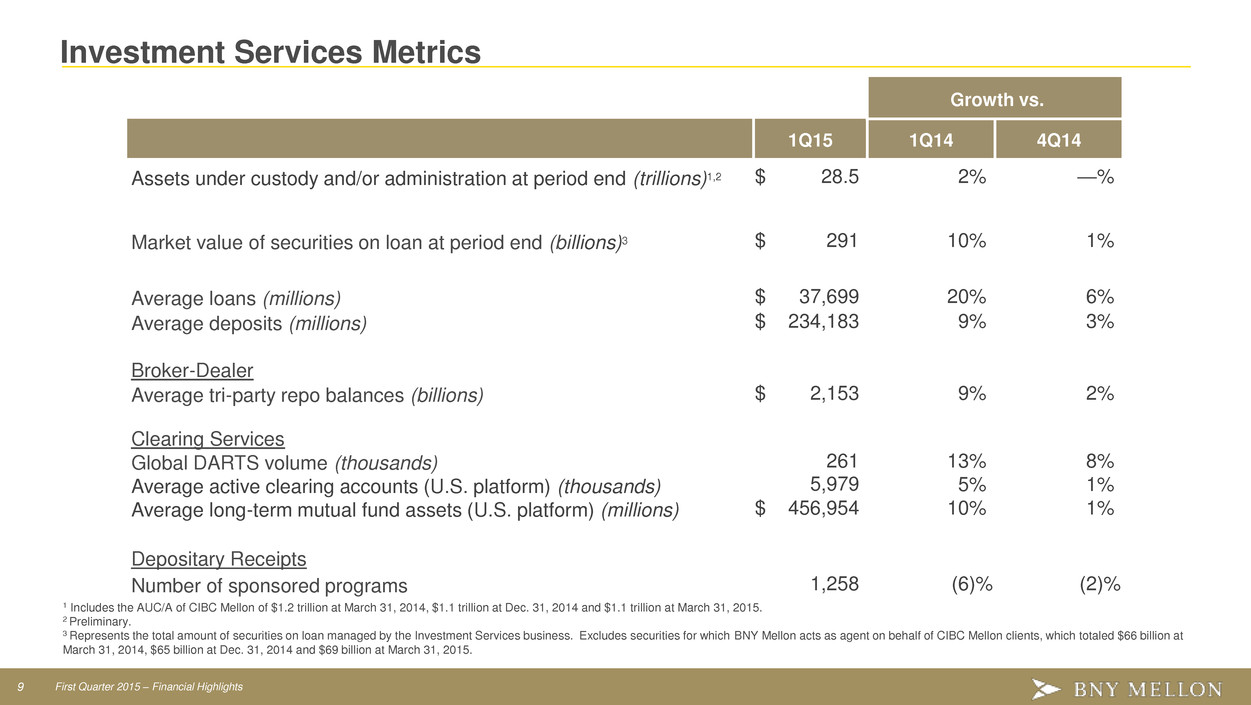

9 First Quarter 2015 – Financial Highlights Investment Services Metrics Growth vs. 1Q15 1Q14 4Q14 Assets under custody and/or administration at period end (trillions)1,2 $ 28.5 2 % — % Market value of securities on loan at period end (billions)3 $ 291 10 % 1 % Average loans (millions) $ 37,699 20 % 6 % Average deposits (millions) $ 234,183 9 % 3 % Broker-Dealer Average tri-party repo balances (billions) $ 2,153 9 % 2 % Clearing Services Global DARTS volume (thousands) 261 13 % 8 % Average active clearing accounts (U.S. platform) (thousands) 5,979 5 % 1 % Average long-term mutual fund assets (U.S. platform) (millions) $ 456,954 10 % 1 % Depositary Receipts Number of sponsored programs 1,258 (6 )% (2 )% 1 Includes the AUC/A of CIBC Mellon of $1.2 trillion at March 31, 2014, $1.1 trillion at Dec. 31, 2014 and $1.1 trillion at March 31, 2015. 2 Preliminary. 3 Represents the total amount of securities on loan managed by the Investment Services business. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $66 billion at March 31, 2014, $65 billion at Dec. 31, 2014 and $69 billion at March 31, 2015.

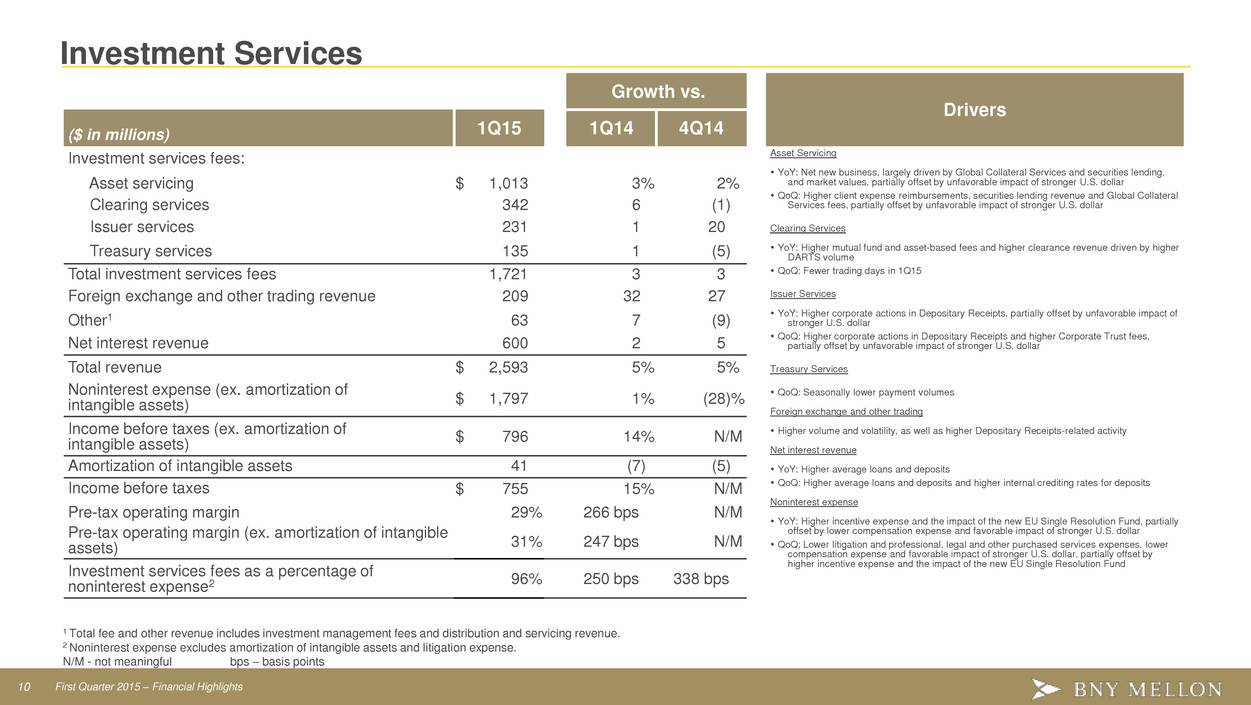

10 First Quarter 2015 – Financial Highlights Investment Services Growth vs. Drivers ($ in millions) 1Q15 1Q14 4Q14 Investment services fees: Asset Servicing YoY: Net new business, largely driven by Global Collateral Services and securities lending, and market values, partially offset by unfavorable impact of stronger U.S. dollar QoQ: Higher client expense reimbursements, securities lending revenue and Global Collateral Services fees, partially offset by unfavorable impact of stronger U.S. dollar Clearing Services YoY: Higher mutual fund and asset-based fees and higher clearance revenue driven by higher DARTS volume QoQ: Fewer trading days in 1Q15 Issuer Services YoY: Higher corporate actions in Depositary Receipts, partially offset by unfavorable impact of stronger U.S. dollar QoQ: Higher corporate actions in Depositary Receipts and higher Corporate Trust fees, partially offset by unfavorable impact of stronger U.S. dollar Treasury Services QoQ: Seasonally lower payment volumes Foreign exchange and other trading Higher volume and volatility, as well as higher Depositary Receipts-related activity Net interest revenue YoY: Higher average loans and deposits QoQ: Higher average loans and deposits and higher internal crediting rates for deposits Noninterest expense YoY: Higher incentive expense and the impact of the new EU Single Resolution Fund, partially offset by lower compensation expense and favorable impact of stronger U.S. dollar QoQ: Lower litigation and professional, legal and other purchased services expenses, lower compensation expense and favorable impact of stronger U.S. dollar, partially offset by higher incentive expense and the impact of the new EU Single Resolution Fund Asset servicing $ 1,013 3 % 2 % Clearing services 342 6 (1 ) Issuer services 231 1 20 Treasury services 135 1 (5 ) Total investment services fees 1,721 3 3 Foreign exchange and other trading revenue 209 32 27 Other1 63 7 (9 ) Net interest revenue 600 2 5 Total revenue $ 2,593 5 % 5 % Noninterest expense (ex. amortization of intangible assets) $ 1,797 1 % (28 )% Income before taxes (ex. amortization of intangible assets) $ 796 14 % N/M Amortization of intangible assets 41 (7 ) (5 ) Income before taxes $ 755 15 % N/M Pre-tax operating margin 29 % 266 bps N/M Pre-tax operating margin (ex. amortization of intangible assets) 31 % 247 bps N/M Investment services fees as a percentage of noninterest expense2 96 % 250 bps 338 bps 1 Total fee and other revenue includes investment management fees and distribution and servicing revenue. 2 Noninterest expense excludes amortization of intangible assets and litigation expense. N/M - not meaningful bps – basis points

11 First Quarter 2015 – Financial Highlights Fee and Other Revenue Growth vs. Drivers ($ in millions) 1Q15 1Q14 4Q14 Asset servicing1 $ 1,038 3 % 2 % Asset Servicing YoY: Net new business, largely driven by Global Collateral Services and securities lending, and market values, partially offset by unfavorable impact of stronger U.S. dollar QoQ: Higher client expense reimbursements, securities lending revenue, and Global Collateral Services fees, partially offset by unfavorable impact of stronger U.S. dollar Clearing Services YoY: Higher mutual fund and asset-based fees and higher clearance revenue driven by higher DARTS volume QoQ: Fewer trading days in 1Q15 Issuer Services YoY: Higher corporate actions in Depositary Receipts, partially offset by unfavorable impact of stronger U.S. dollar QoQ: Higher corporate actions in Depositary Receipts and higher Corporate Trust fees, partially offset by unfavorable impact of stronger U.S. dollar Treasury Services QoQ: Seasonally lower payment volumes Investment Management and Performance Fees YoY: +6% on a constant currency basis (Non-GAAP)2, driven by higher equity market values, the impact of the Cutwater acquisition and strategic initiatives, partially offset by lower performance fees QoQ: Seasonally lower performance fees, fewer days in 1Q15 and unfavorable impact of stronger U.S. dollar, partially offset by the impact of the Cutwater acquisition Foreign Exchange & Other Trading Revenue YoY: Higher volumes and volatility, higher Depositary Receipts-related activity and higher fixed income trading revenue QoQ: Higher volumes and volatility, higher Depositary Receipts-related activity, higher fixed income trading revenue and reduced losses on hedging activities within an Investment Management boutique Clearing services 344 6 (1 ) Issuer services 232 1 20 Treasury services 137 1 (6 ) Total investment services fees 1,751 3 3 Investment management and performance fees 854 1 (4 ) Foreign exchange and other trading revenue 229 68 52 Distribution and servicing 41 (5 ) (5 ) Financing-related fees 40 5 (7 ) Investment and other income 63 N/M N/M Total fee revenue 2,978 4 3 Net securities gains 24 N/M N/M Total fee and other revenue - GAAP $ 3,002 4 % 2 % 1 Asset servicing fees include securities lending revenue of $43 million in 1Q15, $38 million in 1Q14, and $37 million in 4Q14. 2 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. N/M - not meaningful

12 First Quarter 2015 – Financial Highlights Net Interest Revenue Growth vs. Drivers ($ in millions) 1Q15 1Q14 4Q14 Net interest revenue (non-FTE) $ 728 — % 2 % Net Interest Revenue YoY: Increase in deposits drove growth in securities portfolio and offset impact of lower yields QoQ: Change in the mix of assets, partially offset by fewer days in 1Q15. Lower hedging losses in 1Q15 were primarily offset by lower accretion and higher amortization Net interest revenue (FTE) - Non-GAAP 743 — 2 Net interest margin (FTE) 0.97 % (8) bps 6 bps Selected Average Balances: Cash/interbank investments $ 123,642 (3 )% (12 )% Trading account securities 3,046 (42 ) (22 ) Securities 123,476 23 5 Loans 57,935 12 2 Interest-earning assets 308,099 8 (3 ) Interest-bearing deposits 159,520 4 (2 ) Noninterest-bearing deposits 89,592 10 5 FTE – fully taxable equivalent bps – basis points

13 First Quarter 2015 – Financial Highlights Noninterest Expense Growth vs. Drivers ($ in millions) 1Q15 1Q14 4Q14 Staff $ 1,485 (2 )% 5 % YoY: Lower expenses in all categories, except sub- custodian which is volume-related and other expense which includes the impact of the new EU Single Resolution Fund. These lower expenses primarily reflect the favorable impact of a stronger U.S. dollar and the benefit of the business improvement process which focuses on reducing structural costs Total staff expense primarily reflects favorable impact of stronger U.S. dollar, the curtailment gain related to the U.S. pension plan and lower headcount. The decrease was partially offset by higher incentive expense reflecting better performance, a lower adjustment for the finalization of the annual incentive awards and the impact of vesting of long-term stock awards for retirement eligible employees Headcount primarily driven by streamlining actions, partially offset by acquisitions in 1Q15 Professional, legal and other purchased services 302 (3 ) (23 ) Software and equipment 228 (4 ) (3 ) Net occupancy 151 (2 ) 1 Distribution and servicing 98 (8 ) (4 ) Sub-custodian 70 3 — Business development 61 (5 ) (19 ) Other 242 9 15 Amortization of intangible assets 66 (12 ) (10 ) M&I, litigation and restructuring charges (3 ) N/M N/M Total noninterest expense – GAAP $ 2,700 (1 )% (23 )% Total noninterest expense excluding amortization of intangible assets, M&I, litigation and restructuring charges and the (recovery) related to investment management funds, net of incentives – Non-GAAP1 $ 2,637 (2 )% (1 )% Full-time employees 50,500 (900) 200 1 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. N/M - not meaningful

14 First Quarter 2015 – Financial Highlights Capital Ratios Highlights 3/31/15 12/31/14 Regulatory capital ratios:1,2,3 Capital ratios remain strong Advanced Approach ratios were impacted by increases in operational risk RWA 1Q15: Net CET1 increased $192 million Repurchased 10.3 million common shares for $400 million in 1Q15 and 56.5 million common shares for $2.1 billion over the last five quarters, ending 1Q15 In 1Q15, declared a quarterly dividend of $0.17 per common share Compliant with U.S. Liquidity Coverage Ratio (LCR)5 CET1 ratio 10.0 % 11.2 % Tier 1 capital ratio 10.8 12.2 Total (Tier 1 plus Tier 2) capital ratio 11.1 12.5 Leverage capital ratio 5.6 5.6 Selected regulatory capital ratios - fully phased-in - Non-GAAP:1,2,4 Estimated CET1: Standardized approach 9.5 % 10.6 % Advanced approach 9.1 9.8 Estimated Supplementary leverage ratio ("SLR")4 4.5 % 4.4 % Note: See corresponding footnotes on Page 19 of the Appendix. RWA - risk-weighted assets

APPENDIX

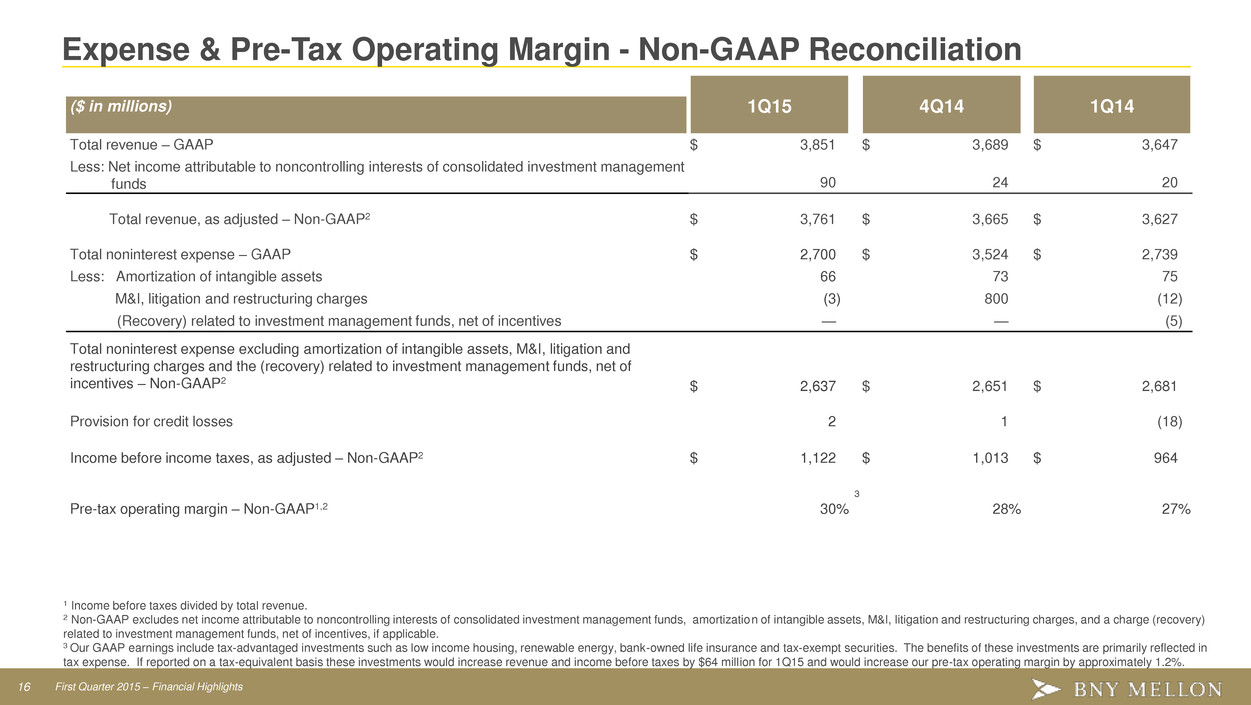

16 First Quarter 2015 – Financial Highlights Expense & Pre-Tax Operating Margin - Non-GAAP Reconciliation 1Q15 4Q14 1Q14 ($ in millions) Total revenue – GAAP $ 3,851 $ 3,689 $ 3,647 Less: Net income attributable to noncontrolling interests of consolidated investment management funds 90 24 20 Total revenue, as adjusted – Non-GAAP2 $ 3,761 $ 3,665 $ 3,627 Total noninterest expense – GAAP $ 2,700 $ 3,524 $ 2,739 Less: Amortization of intangible assets 66 73 75 M&I, litigation and restructuring charges (3 ) 800 (12 ) (Recovery) related to investment management funds, net of incentives — — (5 ) Total noninterest expense excluding amortization of intangible assets, M&I, litigation and restructuring charges and the (recovery) related to investment management funds, net of incentives – Non-GAAP2 $ 2,637 $ 2,651 $ 2,681 Provision for credit losses 2 1 (18 ) Income before income taxes, as adjusted – Non-GAAP2 $ 1,122 $ 1,013 $ 964 Pre-tax operating margin – Non-GAAP1,2 30 % 3 28 % 27 % 1 Income before taxes divided by total revenue. 2 Non-GAAP excludes net income attributable to noncontrolling interests of consolidated investment management funds, amortization of intangible assets, M&I, litigation and restructuring charges, and a charge (recovery) related to investment management funds, net of incentives, if applicable. 3 Our GAAP earnings include tax-advantaged investments such as low income housing, renewable energy, bank-owned life insurance and tax-exempt securities. The benefits of these investments are primarily reflected in tax expense. If reported on a tax-equivalent basis these investments would increase revenue and income before taxes by $64 million for 1Q15 and would increase our pre-tax operating margin by approximately 1.2%.

17 First Quarter 2015 – Financial Highlights Return on Tangible Common Equity Reconciliation 1Q15 4Q14 1Q14 ($ in millions) Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $ 766 $ 209 $ 661 Add: Amortization of intangible assets, net of tax 43 47 49 Net income applicable to common shareholders of The Bank of New York Mellon Corporation excluding amortization of intangible assets – Non-GAAP 809 256 710 Less: Benefit primarily related to a tax carryback claim — 150 — Add: M&I, litigation and restructuring charges (2 ) 608 (7 ) (Recovery) related to investment management funds, net of incentives — — (4 ) Net income applicable to common shareholders of The Bank of New York Mellon Corporation, as adjusted – Non-GAAP2 $ 807 $ 714 $ 699 Average common shareholders’ equity $ 35,486 $ 36,859 $ 36,289 Less: Average goodwill 17,756 17,924 18,072 Average intangible Assets 4,088 4,174 4,422 Add: Deferred tax liability – tax deductible goodwill1 1,362 1,340 1,306 Deferred tax liability – intangible assets1 1,200 1,216 1,259 Average tangible common shareholders’ equity - Non-GAAP $ 16,204 $ 17,317 $ 16,360 Return on tangible common equity – Non-GAAP2,3 20.3 % 5.9 % 17.6 % Return on tangible common equity – Non-GAAP adjusted2,3 20.2 % 16.3 % 17.3 % 1 Deferred tax liabilities are based on fully phased-in Basel III rules. 2 Non-GAAP excludes amortization of intangible assets, the benefit primarily related to a tax carryback claim, M&I, litigation and restructuring charges, and a charge (recovery) related to investment management funds, net of incentives, if applicable. 3 Annualized.

18 First Quarter 2015 – Financial Highlights Earnings Per Share & GAAP Revenue Reconciliation Earnings per share Growth vs. ($ in dollars) 1Q15 4Q14 1Q14 1Q14 4Q14 GAAP results $ 0.67 $ 0.18 $ 0.57 Add: Litigation and restructuring charges — 0.53 — Less: Benefit primarily related to a tax carryback claim — 0.13 — Non-GAAP results $ 0.67 $ 0.58 $ 0.57 18 % 16 % Revenue - GAAP ($ in millions) 1Q15 1Q14 4Q14 Asset servicing1 $ 1,038 $ 1,009 $ 1,019 Clearing services 344 325 347 Issuer services 232 229 193 Treasury services 137 136 145 Total investment services fees 1,751 1,699 1,704 Investment management and performance fees 854 843 885 Foreign exchange and other trading revenue 229 136 151 Distribution and servicing 41 43 43 Financing-related fees 40 38 43 Investment and other income 63 102 78 Total fee revenue 2,978 2,861 2,904 Net securities gains 24 22 31 Total fee and other revenue - GAAP $ 3,002 $ 2,883 $ 2,935 Income from consolidated investment management funds 121 36 42 Net interest revenue 728 728 712 Total revenue - GAAP $ 3,851 $ 3,647 $ 3,689 1 Asset servicing fees include securities lending revenue of $38 million in 1Q14, $46 million in 2Q14, $37 million in 3Q14, $37 million in 4Q14 and $43 million in 1Q15.

19 First Quarter 2015 – Financial Highlights Capital Ratio Footnotes 1 March 31, 2015 consolidated regulatory capital ratios are preliminary. Please reference slides 20 and 21. See the “Capital Ratios” section in the Earnings Release for additional detail. 2 Risk-based capital ratios at Dec. 31, 2014 and March 31, 2015 include the net impact of the total consolidated assets of certain consolidated investment management funds in risk-weighted assets. 3 At Dec. 31, 2014, the CET1, Tier 1 and Total risk-based consolidated regulatory capital ratios determined under the transitional Standardized Approach were 15.0%, 16.3% and 16.9%, and were calculated based on Basel III components of capital, as phased-in, and asset risk-weightings using Basel I-based requirements. At March 31, 2015, the CET1, Tier 1 and Total risk-based consolidated regulatory capital ratios determined under the transitional Basel III Standardized Approach were 10.7%, 11.6% and 12.0%. 4 Please reference slides 20 and 21. See the “Capital Ratios” section in the Earnings Release for additional detail. 5 The U.S. LCR rules became effective Jan. 1, 2015 and require BNY Mellon to meet an LCR of 80%, increasing annually by 10% increments until fully phased-in on Jan. 1, 2017, at which time we will be required to meet an LCR of 100%. Our estimated LCR on a consolidated basis is compliant with the fully phased-in requirements of the U.S. LCR as of March 31, 2015 based on our current understanding of the U.S. LCR rules. Note: In 1Q15, BNY Mellon implemented the Basel III Standardized Approach under the final rules released by the Board of Governors of the Federal Reserve System (the “Federal Reserve”) on July 2, 2013 (the “Final Capital Rules”). The transitional capital ratios were negatively impacted by the phase-in requirements for 2015.

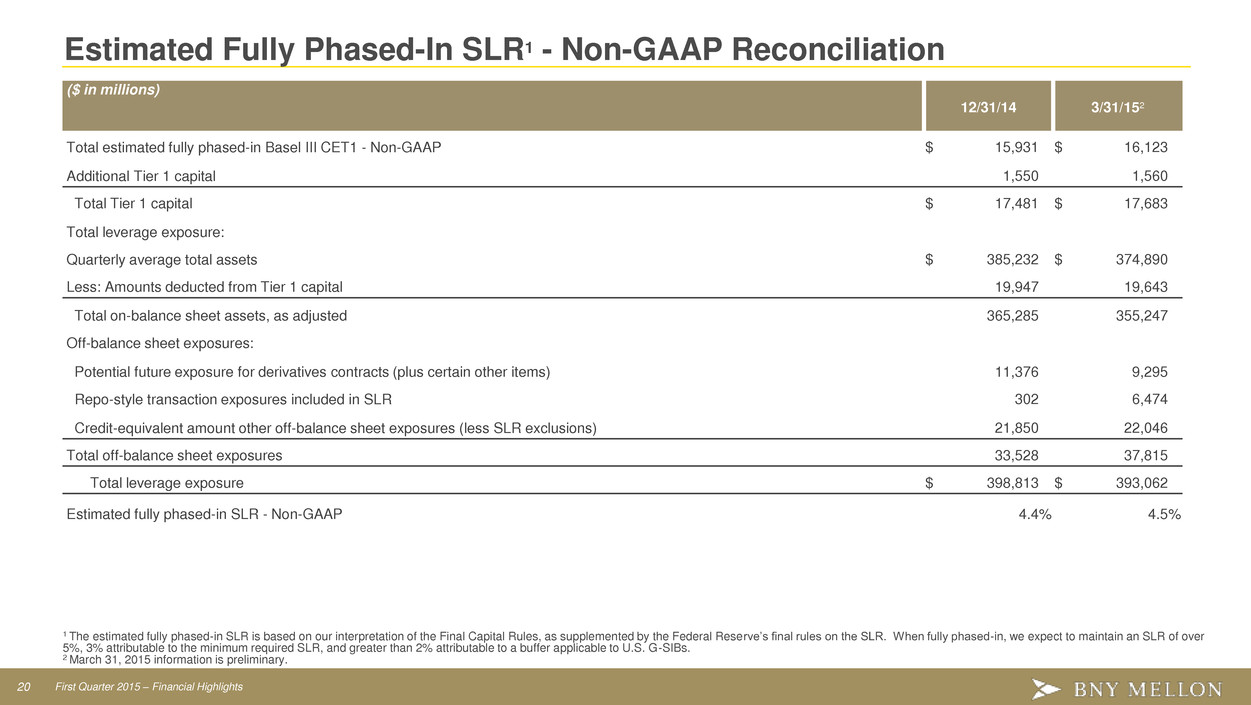

20 First Quarter 2015 – Financial Highlights Estimated Fully Phased-In SLR1 - Non-GAAP Reconciliation ($ in millions) 12/31/14 3/31/152 Total estimated fully phased-in Basel III CET1 - Non-GAAP $ 15,931 $ 16,123 Additional Tier 1 capital 1,550 1,560 Total Tier 1 capital $ 17,481 $ 17,683 Total leverage exposure: Quarterly average total assets $ 385,232 $ 374,890 Less: Amounts deducted from Tier 1 capital 19,947 19,643 Total on-balance sheet assets, as adjusted 365,285 355,247 Off-balance sheet exposures: Potential future exposure for derivatives contracts (plus certain other items) 11,376 9,295 Repo-style transaction exposures included in SLR 302 6,474 Credit-equivalent amount other off-balance sheet exposures (less SLR exclusions) 21,850 22,046 Total off-balance sheet exposures 33,528 37,815 Total leverage exposure $ 398,813 $ 393,062 Estimated fully phased-in SLR - Non-GAAP 4.4 % 4.5 % 1 The estimated fully phased-in SLR is based on our interpretation of the Final Capital Rules, as supplemented by the Federal Reserve’s final rules on the SLR. When fully phased-in, we expect to maintain an SLR of over 5%, 3% attributable to the minimum required SLR, and greater than 2% attributable to a buffer applicable to U.S. G-SIBs. 2 March 31, 2015 information is preliminary.

21 First Quarter 2015 – Financial Highlights Estimated Fully Phased-In Basel III CET1 Ratio - Non-GAAP1,2 1 Regulatory capital ratios for March 31, 2015 are preliminary. 2 Risk-based capital ratios at Dec. 31, 2014 and March 31, 2015 include the net impact of the total consolidated assets of certain consolidated investment management funds in risk-weighted assets. ($ in millions) 3/31/15 Total estimated fully phased-in Basel III CET1 - Non-GAAP - End of period $ 16,123 Under the Standardized Approach: Estimated fully phased-in Basel III risk-weighted assets - Non-GAAP $ 169,673 Estimated fully phased-in Basel III CET1 ratio – Non-GAAP3 9.5 % Under the Advanced Approach: Estimated fully phased-in Basel III risk-weighted assets - Non-GAAP $ 176,680 Estimated fully phased-in Basel III CET1 ratio – Non-GAAP3 9.1 %

22 First Quarter 2015 – Financial Highlights Pre-Tax Operating Margin – Investment Management Reconciliation 1Q15 4Q14 1Q14 ($ in millions) Income before income taxes – GAAP $ 264 $ 239 $ 246 Add: Amortization of intangible assets 25 30 31 Money market fee waivers 34 34 35 (Recovery) related to investment management funds, net of incentives — — (5 ) Income before income taxes excluding amortization of intangible assets, money market fee waivers and the (recovery) related to investment management funds, net of incentives – Non-GAAP $ 323 $ 303 $ 307 Total revenue – GAAP $ 1,010 $ 998 $ 970 Less: Distribution and servicing expense 97 102 106 Money market fee waivers benefiting distribution and servicing expense 38 36 38 Add: Money market fee waivers impacting total revenue 72 70 73 Total revenue net of distribution and servicing expense and excluding money market fee waivers - Non- GAAP $ 947 $ 930 $ 899 Pre-tax operating margin1 26 % 24 % 25 % Pre-tax operating margin excluding amortization of intangible assets, money market fee waivers, the (recovery) related to investment management funds, net of incentives and net of distribution and servicing expense – Non-GAAP1 34 % 32 % 34 % 1 Income before taxes divided by total revenue.

23 First Quarter 2015 – Financial Highlights Investment Management and Performance Fees - Non-GAAP Investment management and performance fees - Consolidated Growth vs. ($ in millions) 1Q15 1Q14 1Q14 Investment management and performance fees - GAAP $ 854 $ 843 1 % Impact of changes in foreign currency exchange rates — (40 ) Investment management and performance fees, as adjusted - Non-GAAP $ 854 $ 803 6 % Investment management fees - Investment Management business Growth vs. ($ in millions) 1Q15 1Q14 1Q14 Investment management fees - GAAP $ 835 $ 824 1 % Impact of changes in foreign currency exchange rates — (40 ) Investment management fees, as adjusted - Non-GAAP $ 835 $ 784 7 %