Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PERRIGO Co plc | fy15responsetooffer8-k42115.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - PERRIGO Co plc | exhibit9918-kannouncement4.htm |

April 2015 Perrigo: Creating Superior Value for Shareholders Exhibit 99.2

1 Forward – Looking Statements The directors of Perrigo accept responsibility for the information contained in this presentation. To the best of the knowledge and belief of the directors of Perrigo (who have taken all reasonable care to ensure such is the case), the information contained in this presentation is in accordance with the facts and does not omit anything likely to affect the import of such information. A person interested in 1% or more of any class of relevant securities of Perrigo or Mylan may have disclosure obligations under Rule 8.3 of the Irish Takeover Rules. A disclosure table, giving details of the companies in whose "relevant securities" "dealings" should be disclosed can be found on the Irish Takeover Panel's website at www.irishtakeoverpanel.ie. "Interests in securities" arise, in summary, when a person has long economic exposure, whether conditional or absolute, to changes in the price of securities. In particular, a person will be treated as having an "interest" by virtue of the ownership or control of securities, or by virtue of any option in respect of, or derivative referenced to, securities. Terms in quotation marks are defined in the Irish Takeover Rules, which can be found on the Irish Takeover Panel's website. If you are in any doubt as to whether you are required to disclose a "dealing" under Rule 8, please consult the Irish Takeover Panel's website at www.irishtakeoverpanel.ie or contact the Irish Takeover Panel on telephone number +353 1 678 9020; fax number +353 1 678 9289. The adjusted EPS guidance for calendar year 2015 provided by Perrigo in this presentation constitutes a profit forecast for the purposes of the Irish Takeover Rules. This profit forecast will be reported on by Perrigo's reporting accountants and financial advisors in accordance with Rule 28.3 of the Irish Takeover Rules at the relevant time. Other than the reference to the aforementioned guidance provided by Perrigo for calendar year 2015, nothing in this presentation is intended to be a profit forecast or asset valuation and no statement in presentation announcement, other than aforementioned profit forecast, should be interpreted to mean that the earnings per Perrigo share for the current or future financial periods will necessarily be greater than those for the relevant preceding financial period. This Presentation contains non-GAAP measures. The reconciliation of those measures to the most comparable GAAP measures is included at the end of this presentation. A copy of this presentation, including the reconciliations, is available on our website at www.perrigo.com. Non-GAAP guidance for calendar 2015 excludes amortization of intangibles, restructuring, unusual litigation charges, along with transaction and financing costs related to the Omega acquisition. At this time, a reconciliation to GAAP earnings per share guidance for calendar 2015 is not available without unreasonable effort. The Company expects that the unavailable reconciling items, which primarily include the amortization of intangibles and non-cash charges related to Omega, along with other expenses not related to our core operations, which may be related to the integration of Omega, the Company’s change in fiscal year and a recent indication of interest for the acquisition of the Company, could significantly impact its financial results.

2 Call Agenda checkbld Situation Overview checkbld Financial Results & Outlook checkbld Perrigo’s Value Proposition head2right Diversified Franchises head2right Durable Global Base head2right New Product Pipeline head2right Plus: Rx-to-OTC Switches head2right Plus: Expansive M&A head2right Plus: Tysabri® Upside checkbld Continuing to Deliver Durable and Consistent Growth

3 Perrigo Rejects Unsolicited Proposal from Mylan checkbld On April 6, 2015, Perrigo received an unsolicited proposal from Mylan to acquire all outstanding shares of Perrigo for $205.00 per share. checkbld Perrigo’s Board of Directors concluded that the proposal substantially undervalues the Company and its future growth prospects and is not in the best interest of Perrigo’s shareholders. checkbld Perrigo’s Board believes the Company has a strong, independent future and that the proposal would deny shareholders the full benefits of Perrigo’s durable competitive position and compelling growth strategy.

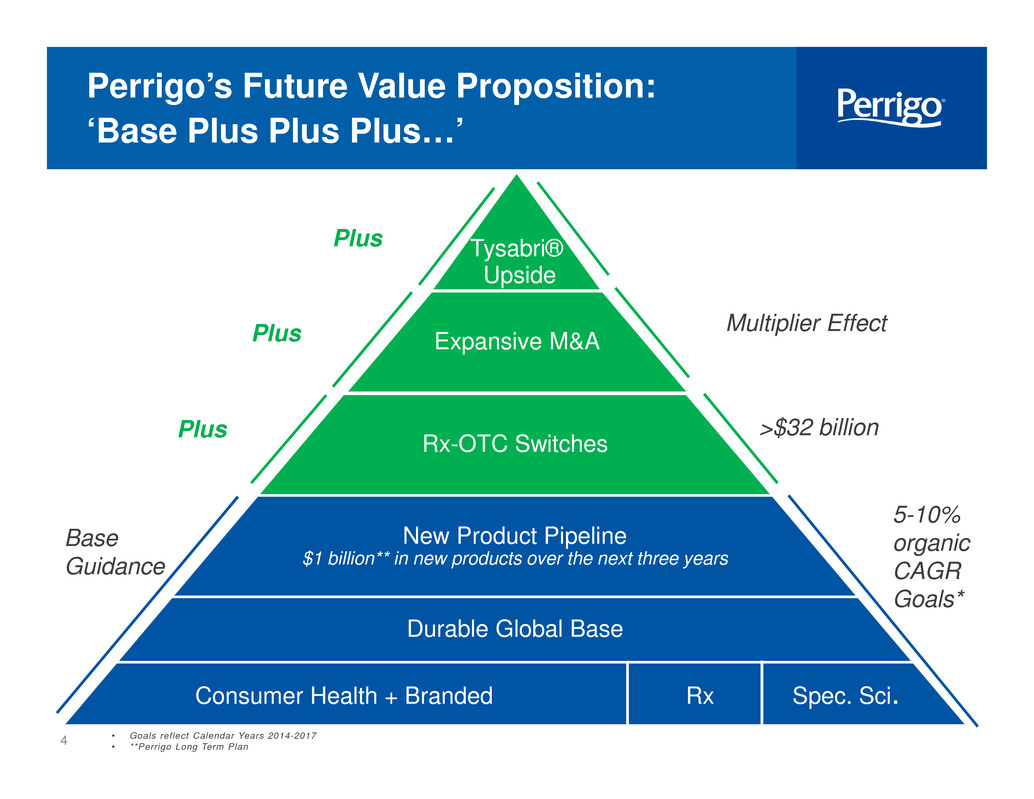

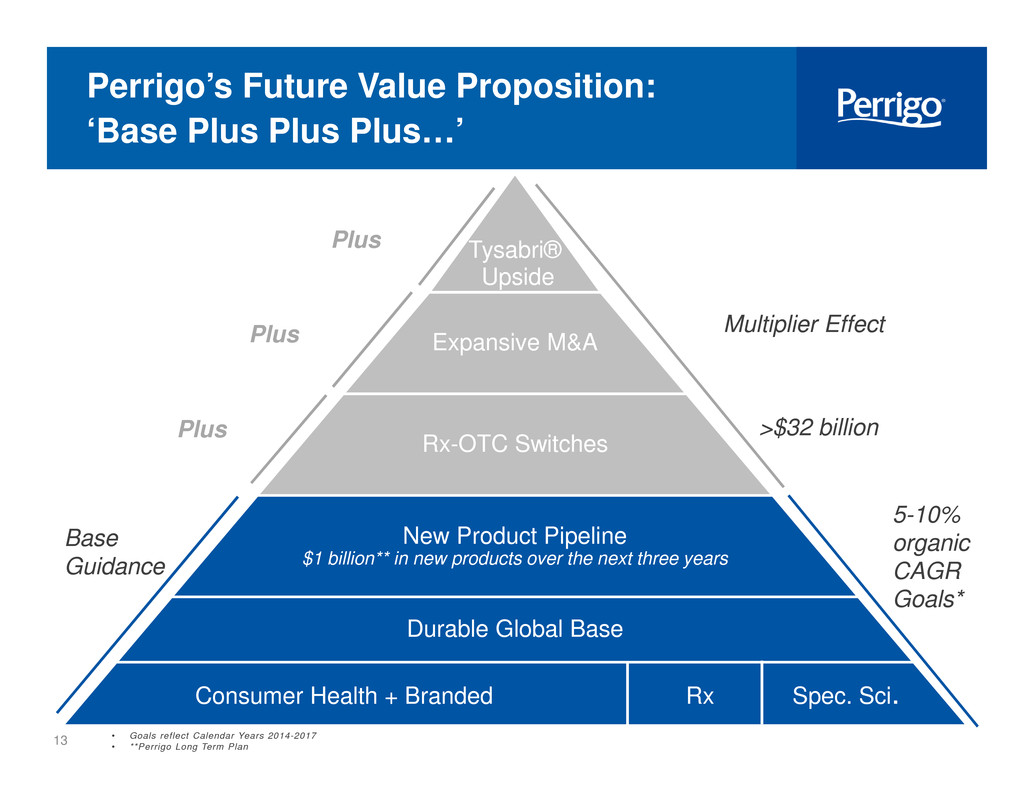

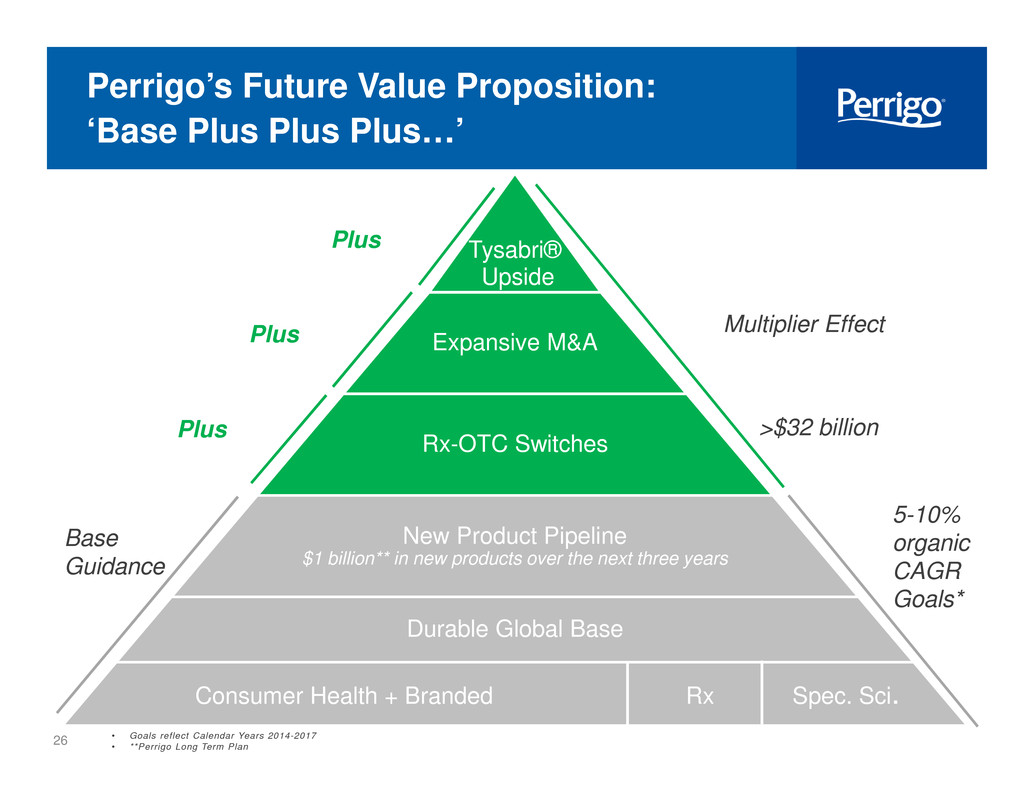

4 Perrigo’s Future Value Proposition: ‘Base Plus Plus Plus…’ New Product Pipeline $1 billion** in new products over the next three years Durable Global Base Consumer Health + Branded Rx Spec. Sci. Base Guidance Tysabri® Upside 5-10% organic CAGR Goals* • Goals reflect Calendar Years 2014-2017 • **Perrigo Long Term Plan >$32 billionRx-OTC SwitchesPlus Expansive M&A Multiplier EffectPlus i i Plus

April 2015 Judy Brown Perrigo CFO

6 Fiscal Year 2015 Q3 Financial Results Exceeded our adjusted net income guidance on net sales of over $1 billion New product sales of $81 million, primarily driven by Rx launches Highlighted by record third quarter net sales, adjusted net income, adjusted margins and operating cash flow Immediately following end of quarter, closed Omega acquisition, creating a top 5 global OTC company U.S. OTC net sales up approx. +3% Adjusted Gross margins +90 bps Net Sales + 13% Successful launches of GRx versions of Androgel® 1% and Clobex spray CHC Nutritionals Rx Adj. operating income increased to $18M VMS sales impacted by market dynamics

7 Calendar Year 2015 Consolidated Guidance Calendar Year 2014 (Recast) Calendar Year 2015 Guidance* Net Sales $4.17B $5.4B - $5.7B(9 months of Omega) Adjusted DSG&A as % of Net Sales**┼ 12.9% ~17.5% Adjusted R&D as % of Net Sales**┼ 3.9% ~3.5% Adjusted Operating Margin┼ 27.1% ~27% Capital Expenditures $142M $125M - $155M Interest Expense $110M ~$170M Adjusted Effective Tax Rate┼ 17.3% ~17% Adjusted Diluted EPS┼ $6.27/share $7.50 - $8.00/share Adjusted Diluted Shares Outstanding┼± 135M 144M * Includes only 9 months for Omega acquisition translated at €1:$1.09 ** Percentages are +/- 75 basis points ┼See Appendix for reconciliation of CY 2014 Non-GAAP measures to GAAP ±Quarterly Diluted Shares Outstanding is 147M for Q2 –Q4 CY 2015

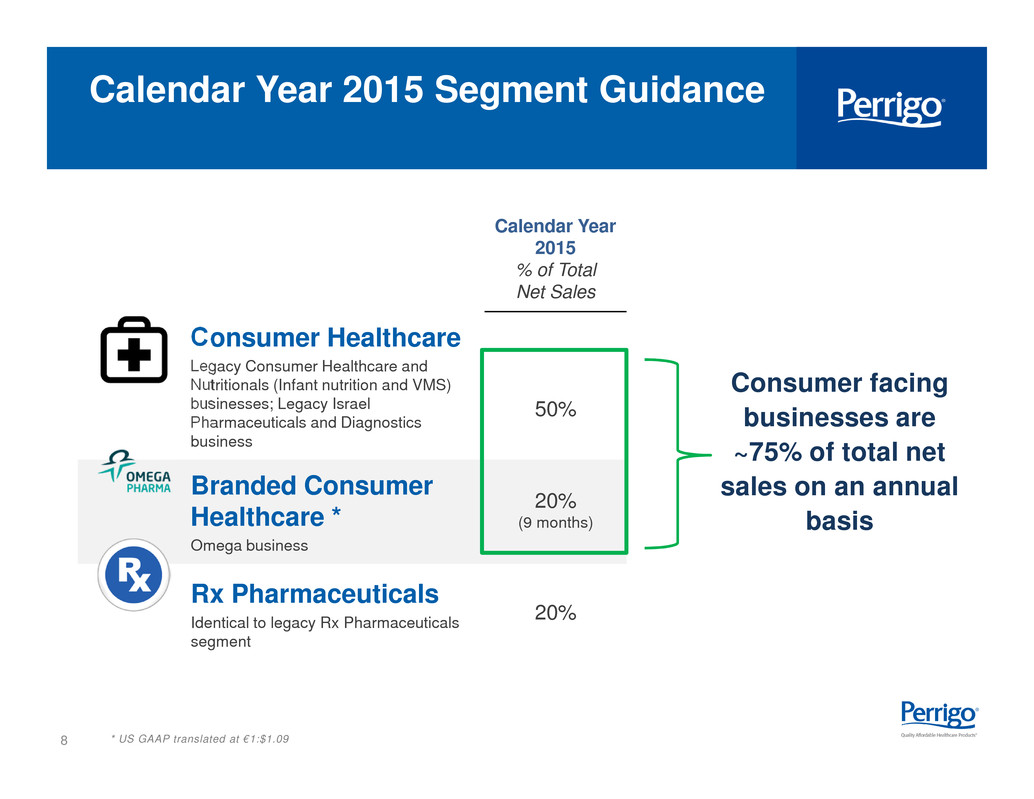

8 Calendar Year 2015 % of Total Net Sales Consumer Healthcare Legacy Consumer Healthcare and Nutritionals (Infant nutrition and VMS) businesses; Legacy Israel Pharmaceuticals and Diagnostics business 50% Branded Consumer Healthcare * Omega business 20% (9 months) Rx Pharmaceuticals Identical to legacy Rx Pharmaceuticals segment 20% * US GAAP translated at €1:$1.09 Calendar Year 2015 Segment Guidance Consumer facing businesses are ~75% of total net sales on an annual basis

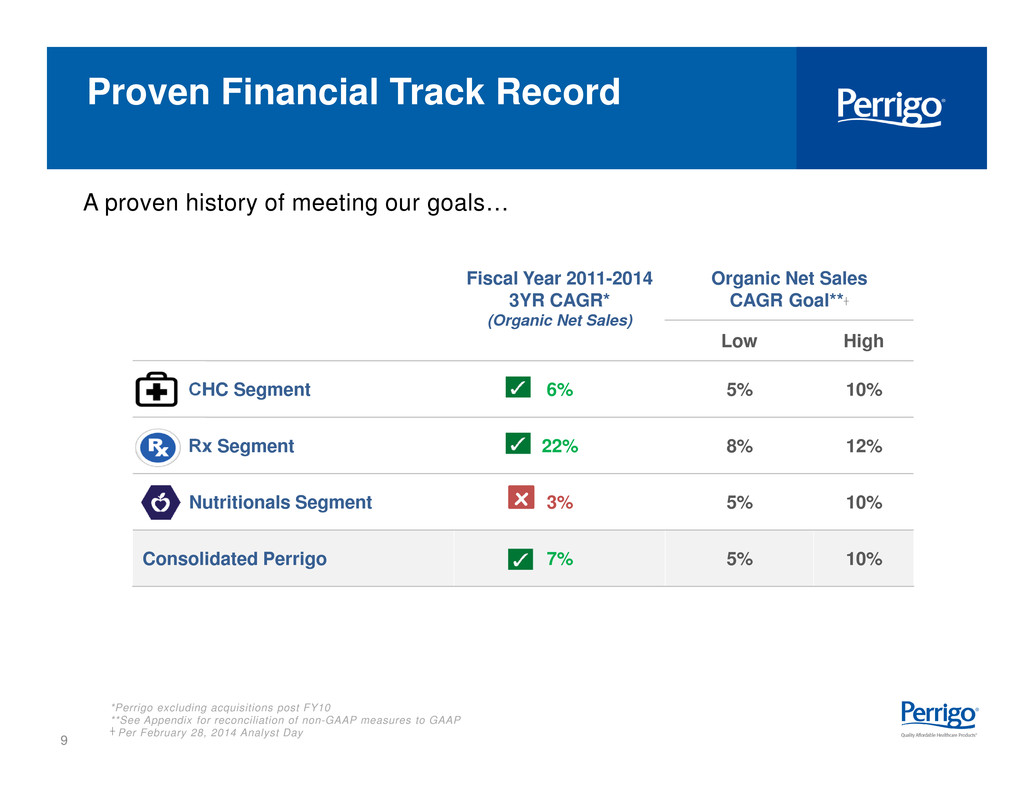

9 Fiscal Year 2011-2014 3YR CAGR* (Organic Net Sales) Organic Net Sales CAGR Goal**┼ Low High CHC Segment 6% 5% 10% Rx Segment 22% 8% 12% Nutritionals Segment 3% 5% 10% Consolidated Perrigo 7% 5% 10% x *Perrigo excluding acquisitions post FY10 **See Appendix for reconciliation of non-GAAP measures to GAAP ┼ Per February 28, 2014 Analyst Day A proven history of meeting our goals… Proven Financial Track Record

10 Fiscal Year 2011-2014 3YR CAGR* (Organic Net Sales) Consolidated Perrigo 7% * Perrigo excluding acquisitions post FY10 A proven history of meeting our goals… Calendar Year 2014-2017 3YR CAGR Goal (Organic Net Sales) Consolidated Perrigo 5-10% Proven Financial Track Record … and the ability to keep delivering

11 EBITDA Expansion and Cash Flow Generation Delivers Long-Term Value checkbld Annual operating cash flow of $1.2B provides significant liquidity to support growth opportunities – ~$0.8B of cash on hand post close of Omega checkbld Opportunity for rapid deleveraging through EBITDA generation and debt pay down – ~$5.6B of balance sheet debt post close of Omega – Leverage ratio declines rapidly by calendar year end 2015 checkbld Cash generation PLUS EBITDA expansion drives debt capacity for M&A Cash Balance* CY 2015 CY 2016 CY 2017 CY 2018 CY 2019 *Illustrative cash balance after capital expenditures, debt service and dividend payments $1.5B

April 2015 Joe Papa Perrigo CEO

13 Perrigo’s Future Value Proposition: ‘Base Plus Plus Plus…’ New Product Pipeline $1 billion** in new products over the next three years Durable Global Base Consumer Health + Branded Rx Spec. Sci. Base Guidance Tysabri® Upside 5-10% organic CAGR Goals* >$32 billionRx-OTC SwitchesPlus Expansive M&A Multiplier EffectPlus Plus • Goals reflect Calendar Years 2014-2017 • **Perrigo Long Term Plan

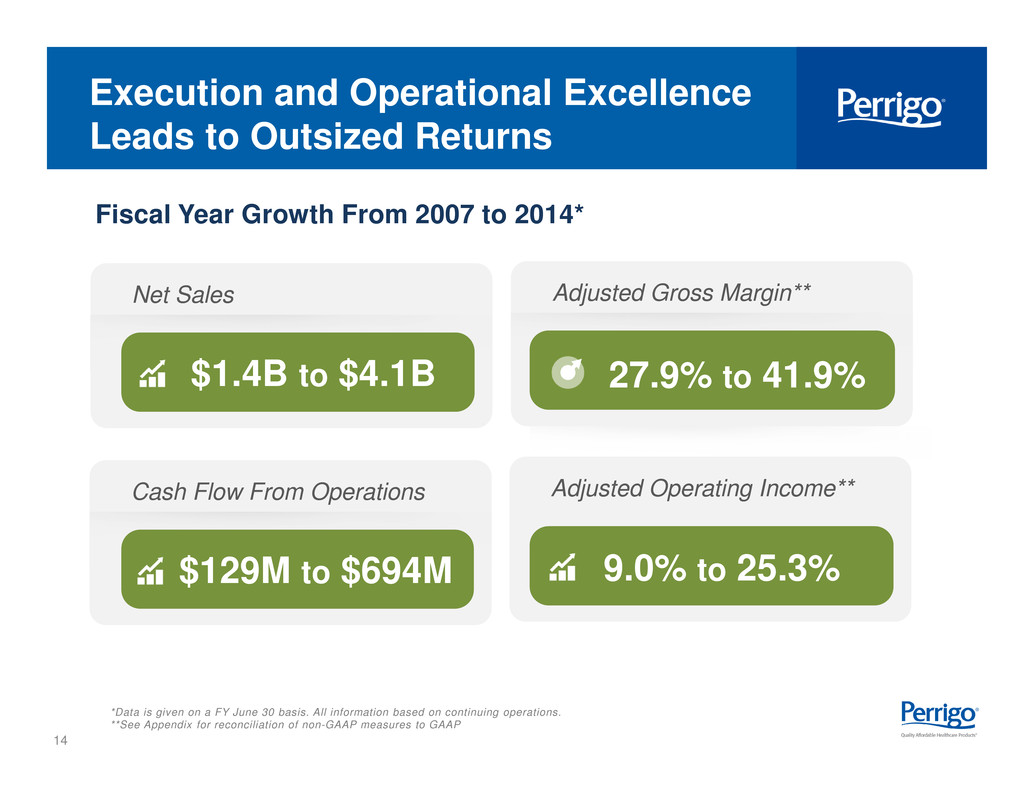

14 Execution and Operational Excellence Leads to Outsized Returns Fiscal Year Growth From 2007 to 2014* *Data is given on a FY June 30 basis. All information based on continuing operations. **See Appendix for reconciliation of non-GAAP measures to GAAP Net Sales $1.4B to $4.1B Cash Flow From Operations $129M to $694M Adjusted Gross Margin** 27.9% to 41.9% Adjusted Operating Income** 9.0% to 25.3%

15 Unique Business Model Creates High Barriers to Entry Pharmaceutical Supply ChainFMCG Pharmaceutical FMCG* Supply Chain A leading manufacturer and developer of high quality pharmaceutical products in hundreds of dosage forms CHC and NUT products are marketed for ease of consumer self selection, providing retailers a full ‘turn key’ offering Vast, highly complex, integrated supply chain which allows for custom packaging, promotion and inventory management on behalf of diverse customers *FMCG = Fast Moving Consumer Goods The unique combination of expertise, specialization and technology make us a powerhouse focusing on serving the customers

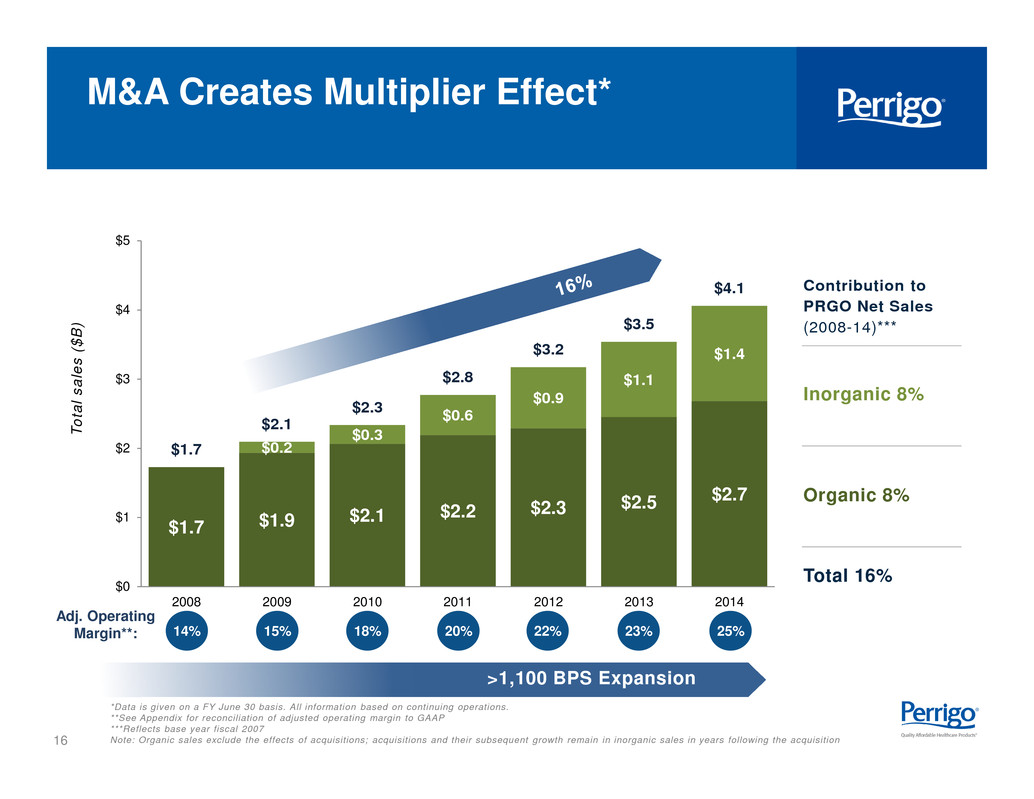

16 $1.7 $1.9 $2.1 $2.2 $2.3 $2.5 $2.7 $0.2 $0.3 $0.6 $0.9 $1.1 $1.4 $1.7 $2.1 $2.3 $2.8 $3.2 $3.5 $4.1 $0 $1 $2 $3 $4 $5 2008 2009 2010 2011 2012 2013 2014 M&A Creates Multiplier Effect* *Data is given on a FY June 30 basis. All information based on continuing operations. **See Appendix for reconciliation of adjusted operating margin to GAAP ***Reflects base year fiscal 2007 Note: Organic sales exclude the effects of acquisitions; acquisitions and their subsequent growth remain in inorganic sales in years following the acquisition T o t a l s a l e s ( $ B ) 14% 15% 18% 20% 22% 23% Adj. Operating Margin**: Contribution to PRGO Net Sales (2008-14)*** Inorganic 8% Organic 8% Total 16% >1,100 BPS Expansion 25%

17 $0 $100 $200 $300 $400 $500 $600 $700 Management Delivers Exceptional Performance… FOCUS ON GROSS AND OPERATING MARGIN EXPANSION 5- Year CAGR: Net Sales: 15% Op. Cash Flow: 22% Adj. Op. Margin: 12% -See Appendix for reconciliation of adjusted operating margin to GAAP. Data is given on a FY June 30 basis. All information based on continuing operations $2,006 $2,268 $2,755 $3,173 $3,540 $4,061 14.6% 18.0% 19.6% 21.6% 22.8% 25.3% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 FY2009 FY2010 FY2011 FY2012 FY2013 FY2014 Net Sales, Cash Flow & Adjusted Operating Margin Annual Revenue Operating Cash Flow Adjusted Operating Margin in millions Net Sal s Operating Cash Flow Adjusted Operating Margin

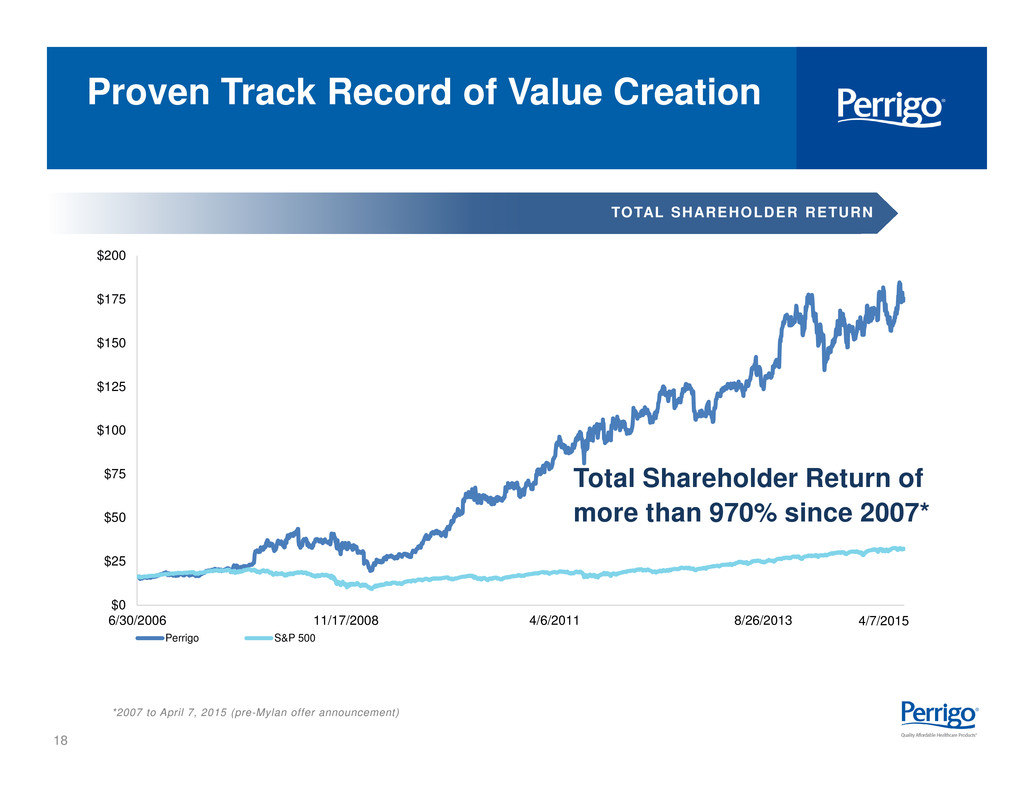

18 $0 $25 $50 $75 $100 $125 $150 $175 $200 6/30/2006 11/17/2008 4/6/2011 8/26/2013 Perrigo S&P 500 Proven Track Record of Value Creation Total Shareholder Return of more than 970% since 2007* *2007 to April 7, 2015 (pre-Mylan offer announcement) TOTAL SHAREHOLDER RETURN 4/7/2015

19 Well-Positioned to Capitalize on the Megatrends Driving Global OTC Growth Demographics will drive increased OTC utilization Fewer people to fund healthcare, driving the need for greater efficiency OTC delivers greater healthcare efficiency and value Store brand proposition further enhances OTC’s efficiency and value More products will switch from Rx to OTC status 1 2 3 4 5

20 Consumer Healthcare (Legacy CHC + NUT) ANDA Pipeline >$3.6B in National Brand Sales $1 Billion* in Total New Products Over the Next Three Years *Perrigo Long Term Plan

21 *Note: Brand Value per Symphony Health at WAC C Y 1 5 - 1 7 Brand Value > $3.5B New Product Opportunities >30 • 31 ANDAs Pending FDA Approval • 7 Paragraph IV Litigations • 9 Projects in Clinical Studies Diversified Rx Franchise and Strong Pipeline Drive Excess Returns Products CY14 Sales (%) Cumulative (%) Product 1 5 % 5 % Product 2 4 % 9 % * * * * * * * * * Top 10 Products 34 % 34 % 11 – 20 Products 19 % 53 % All Other 47 % 100 % TOP 100 PRODUCTS

22 Core Competencies Drive Unique Business Model Quality excellence across 31 global sites New product pipeline / innovation: 160 filings awaiting regulatory approval No. 1 position: Consumer (SB), Infant formula (SB), Extended topicals (GRx), Animal health (SB) Expansive, ROIC-focused M&A Long-standing customer relationships Continued commitment to R&D and delivery of new products to market Critical Mass: +50B dosages per year Superior global supply chain, distribution platform and vertical integration capabilities Mass Customization: 6K unique formulas comprising Approximately 23K SKUs Irish Tax Domicile

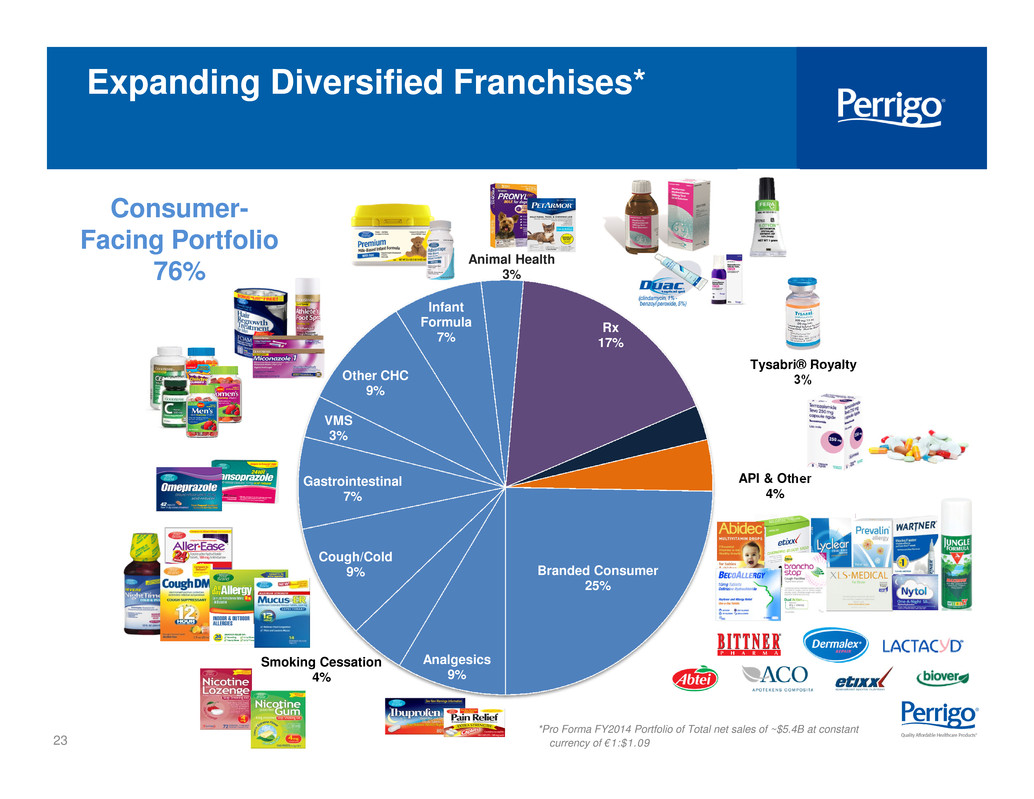

23 Analgesics 9% Smoking Cessation 4% Cough/Cold 9% Gastrointestinal 7% VMS 3% Other CHC 9% Infant Formula 7% Animal Health 3% Rx 17% Tysabri® Royalty 3% API & Other 4% Branded Consumer 25% Expanding Diversified Franchises* *Pro Forma FY2014 Portfolio of Total net sales of ~$5.4B at constant currency of €1:$1.09 Consumer- Facing Portfolio 76%

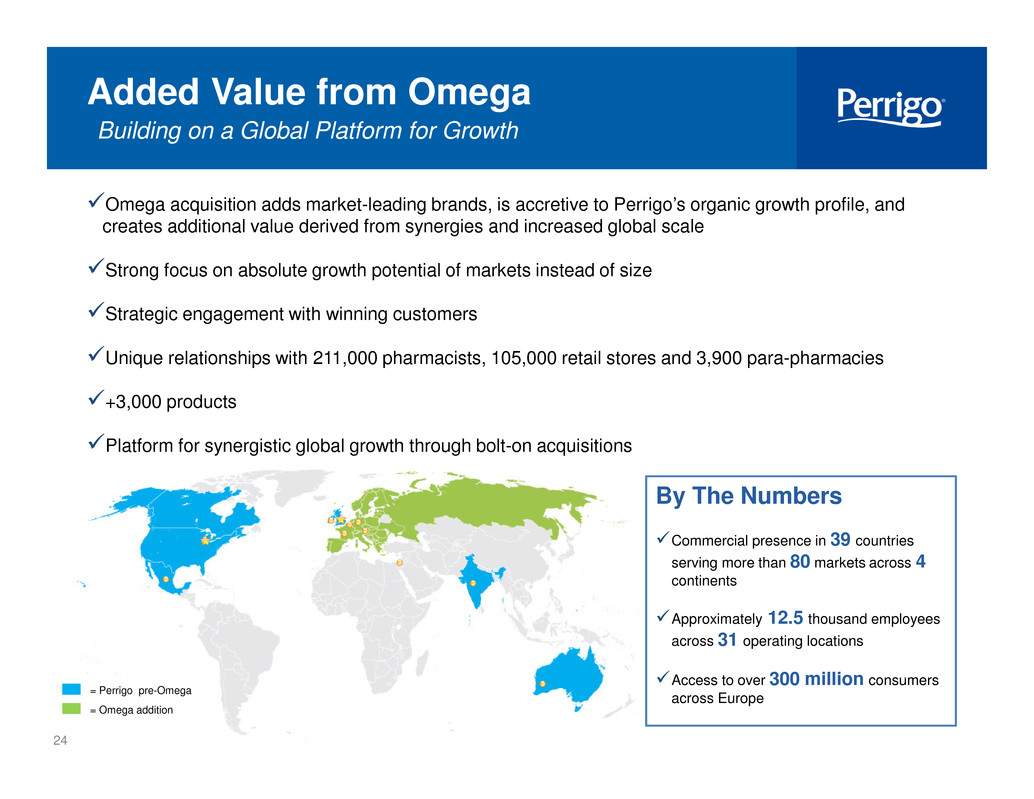

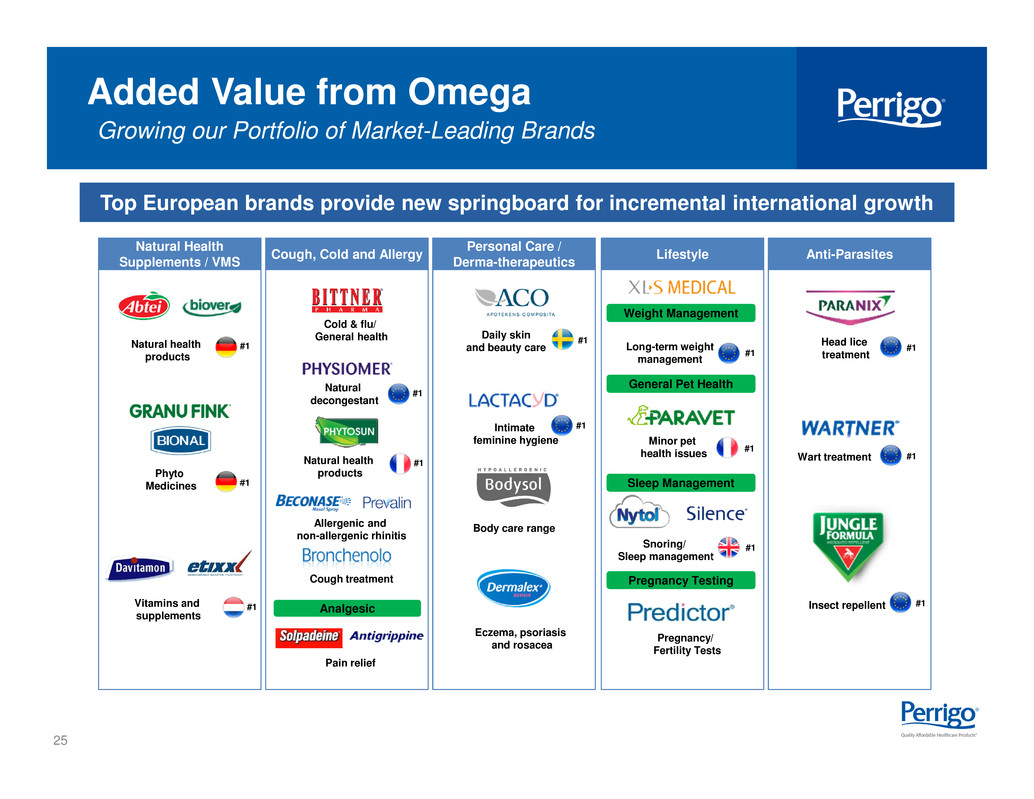

24 checkbldOmega acquisition adds market-leading brands, is accretive to Perrigo’s organic growth profile, and creates additional value derived from synergies and increased global scale checkbldStrong focus on absolute growth potential of markets instead of size checkbldStrategic engagement with winning customers checkbldUnique relationships with 211,000 pharmacists, 105,000 retail stores and 3,900 para-pharmacies checkbld+3,000 products checkbldPlatform for synergistic global growth through bolt-on acquisitions Added Value from Omega Building on a Global Platform for Growth By The Numbers checkbldCommercial presence in 39 countries serving more than 80 markets across 4 continents checkbldApproximately 12.5 thousand employees across 31 operating locations checkbldAccess to over 300 million consumers across Europe= Perrigo pre-Omega = Omega addition

25 Added Value from Omega Growing our Portfolio of Market-Leading Brands Top European brands provide new springboard for incremental international growth Anti-Parasites #1 #1 #1Head lice treatment Wart treatment Insect repellentAnalgesic Cough, Cold and Allergy #1 #1 Cold & flu/ General health Natural decongestant Natural health products Allergenic and non-allergenic rhinitis Cough treatment Pain relief Long-term weight management Weight Management Lifestyle General Pet Health Sleep Management Pregnancy Testing #1 #1 Minor pet health issues Snoring/ Sleep management Pregnancy/ Fertility Tests #1 Natural Health Supplements / VMS #1 #1 #1 Natural health products Phyto Medicines Vitamins and supplements Intimate feminine hygiene Personal Care / Derma-therapeutics #1 #1 Daily skin and beauty care Body care range Eczema, psoriasis and rosacea

26 Perrigo’s Future Value Proposition: ‘Base Plus Plus Plus…’ New Product Pipeline $1 billion** in new products over the next three years Durable Global Base Consumer Health + Branded Rx Spec. Sci. Base Guidance Tysabri® Upside 5-10% organic CAGR Goals* >$32 billionRx-OTC SwitchesPlus Expansive M&A Multiplier EffectPlus Plus • Goals reflect Calendar Years 2014-2017 • **Perrigo Long Term Plan

27 Past Rx-to-OTC Switch Economics Brand Rx Sales Prior to Switch OTC Brand Sales Prilosec® $3.6B $750M Nexium® $6.1B $300M (<1 yr) Prevacid® $2.0B $201M Brand Rx Sales Prior to Switch OTC Brand Sales Claritin® $1.8B $700M Zyrtec® $1.8B $550M Allegra® $687M $358M Brand Rx Sales Prior to Switch OTC Brand Sales Nasacort® $240M $150M Flonase® $2.9B Recent Switch Nasonex® $1.2B Future Switch Sources: IMS 2015, Wolters Kluwer Health 2006, IRI MULO 2015 $6.1B Nexium Prilosec $2.0B Prevacid $3.6B $0.7B Allegra $1.8B Claritin $1.8B Zyrtec Proton Pump Inhibitors Non-Sedating Antihistamines Nasals – In Process of Switching $2.9B$1.2B $0.24B GRx Fluticasone All other Increasing Consumer Access to Quality Affordable Healthcare®

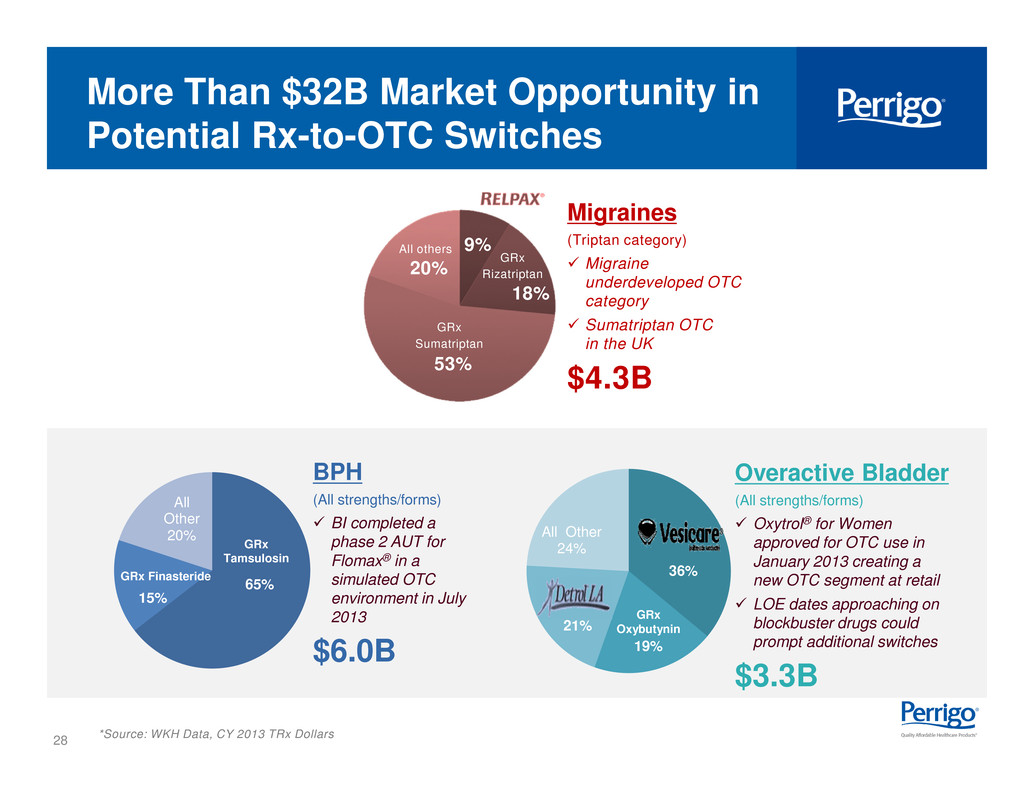

28 65% 15% All Other 20% GRx Tamsulosin More Than $32B Market Opportunity in Potential Rx-to-OTC Switches *Source: WKH Data, CY 2013 TRx Dollars BPH (All strengths/forms) checkbld BI completed a phase 2 AUT for Flomax® in a simulated OTC environment in July 2013 $6.0B Overactive Bladder (All strengths/forms) checkbld Oxytrol® for Women approved for OTC use in January 2013 creating a new OTC segment at retail checkbld LOE dates approaching on blockbuster drugs could prompt additional switches $3.3B GRx Finasteride 36% 19% 21% All Other 24% GRx Oxybutynin Migraines (Triptan category) checkbld Migraine underdeveloped OTC category checkbld Sumatriptan OTC in the UK $4.3B 18% GRx Rizatriptan 53% GRx Sumatriptan 9% 20% All others

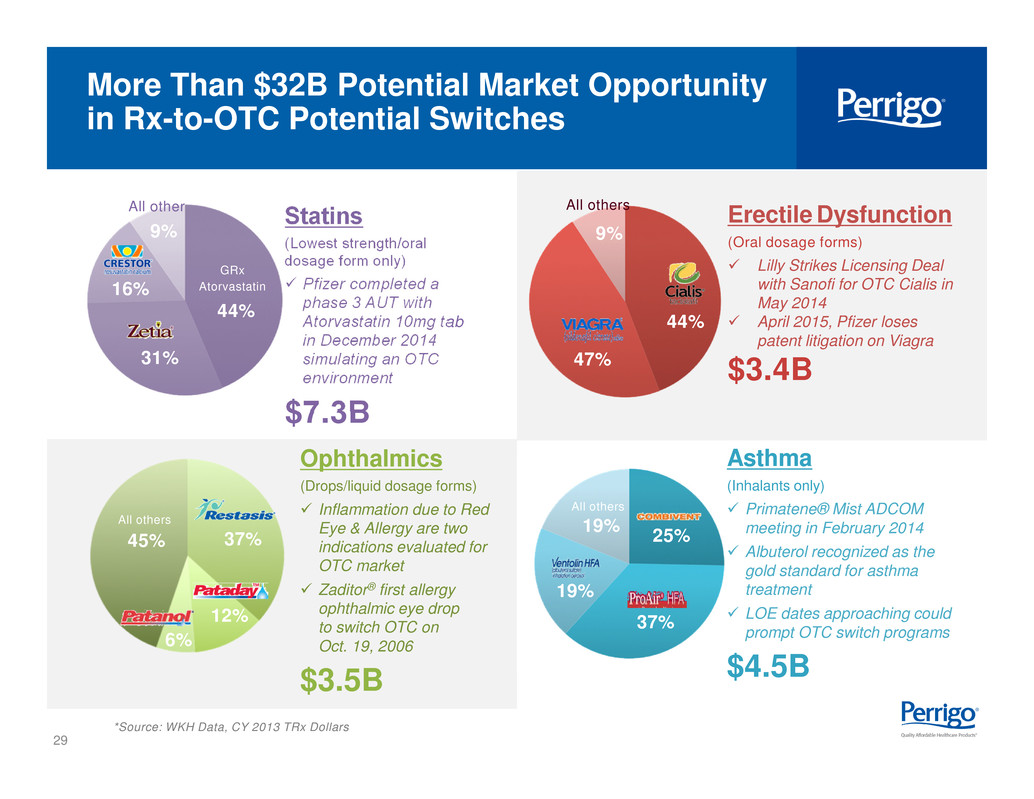

29 *Source: WKH Data, CY 2013 TRx Dollars Erectile Dysfunction (Oral dosage forms) checkbld Lilly Strikes Licensing Deal with Sanofi for OTC Cialis in May 2014 checkbld April 2015, Pfizer loses patent litigation on Viagra $3.4B Ophthalmics (Drops/liquid dosage forms) checkbld Inflammation due to Red Eye & Allergy are two indications evaluated for OTC market checkbld Zaditor® first allergy ophthalmic eye drop to switch OTC on Oct. 19, 2006 $3.5B Asthma (Inhalants only) checkbld Primatene® Mist ADCOM meeting in February 2014 checkbld Albuterol recognized as the gold standard for asthma treatment checkbld LOE dates approaching could prompt OTC switch programs $4.5B 18% GRx Rizatriptan 53% GRx Sumatriptan 9% 20% All others 37% 25% 19% 19% All others 47% 44% 9% All others 6% 12% 37% All others 45% More Than $32B Potential Market Opportunity in Rx-to-OTC Potential Switches Statins (Lowest strength/oral dosage form only) checkbld Pfizer completed a phase 3 AUT with Atorvastatin 10mg tab in December 2014 simulating an OTC environment $7.3B 44% 31% 16% 9% GRx Atorvastatin All other

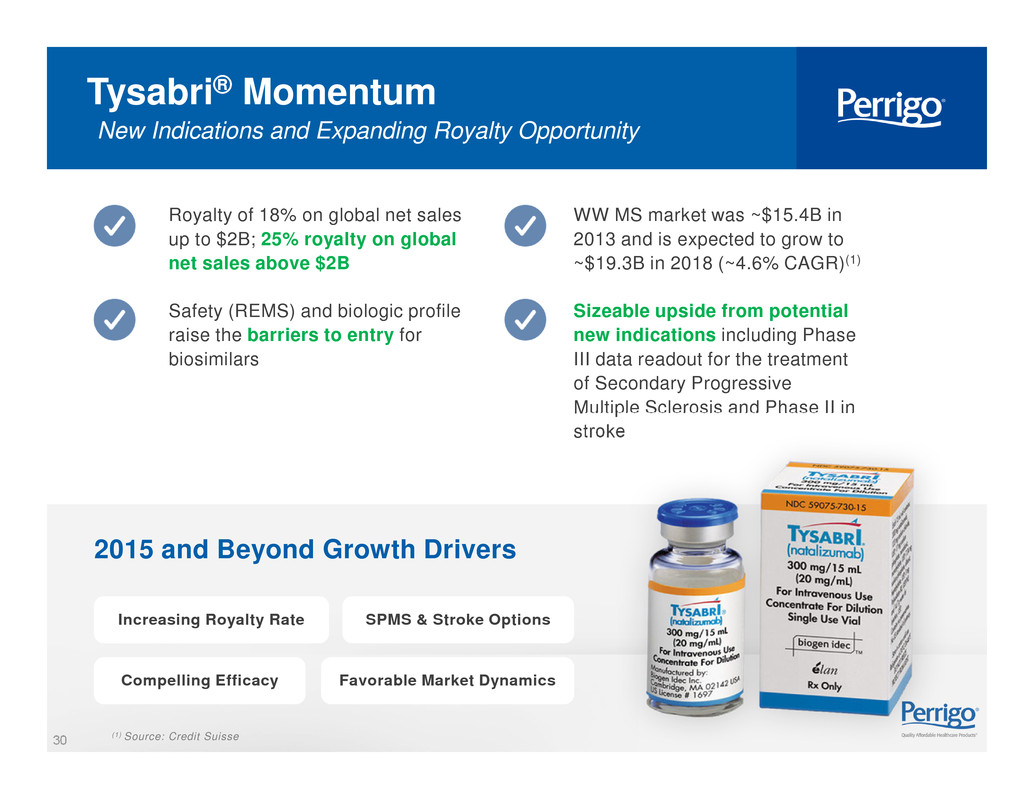

30 Increasing Royalty Rate WW MS market was ~$15.4B in 2013 and is expected to grow to ~$19.3B in 2018 (~4.6% CAGR)(1) Sizeable upside from potential new indications including Phase III data readout for the treatment of Secondary Progressive Multiple Sclerosis and Phase II in stroke 2015 and Beyond Growth Drivers Royalty of 18% on global net sales up to $2B; 25% royalty on global net sales above $2B Safety (REMS) and biologic profile raise the barriers to entry for biosimilars Compelling Efficacy SPMS & Stroke Options Favorable Market Dynamics Tysabri® Momentum New Indications and Expanding Royalty Opportunity (1) Source: Credit Suisse

31 Well-Positioned for Inorganic Opportunities Global Platform Diversified Franchises Cash-flow and EBITDA Expansion Yields Expansive M&A Opportunity + = + Strong Position to Immediately Benefit from M&A

32 Perrigo’s Future Value Proposition: ‘Base Plus Plus Plus…’ Approach Growth Rate 5-10% three-year organic net sales CAGR Limited Patent Cliff Risk Deep Pipeline Upside + + + + Enhancing Shareholder Value Base Plus Plus Plus… = Durable and Diversified Business Experienced and Accomplished Management Team

33 APPENDIX

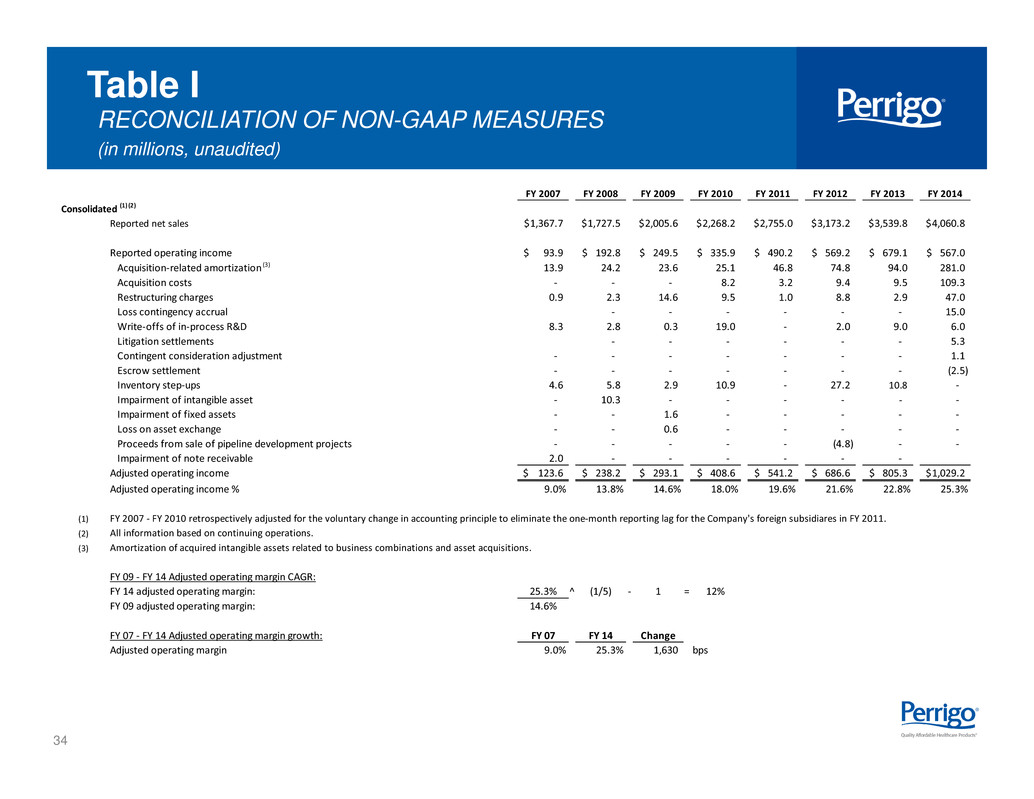

34 Table I RECONCILIATION OF NON-GAAP MEASURES (in millions, unaudited) FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 Consolidated (1) (2) Reported net sales 1,367.7$ 1,727.5$ 2,005.6$ 2,268.2$ 2,755.0$ 3,173.2$ 3,539.8$ 4,060.8$ Reported operating income 93.9$ 192.8$ 249.5$ 335.9$ 490.2$ 569.2$ 679.1$ 567.0$ Acquisition-related amortization (3) 13.9 24.2 23.6 25.1 46.8 74.8 94.0 281.0 Acquisition costs - - - 8.2 3.2 9.4 9.5 109.3 Restructuring charges 0.9 2.3 14.6 9.5 1.0 8.8 2.9 47.0 Loss contingency accrual - - - - - - 15.0 Write-offs of in-process R&D 8.3 2.8 0.3 19.0 - 2.0 9.0 6.0 Litigation settlements - - - - - - 5.3 Contingent consideration adjustment - - - - - - - 1.1 Escrow settlement - - - - - - - (2.5) Inventory step-ups 4.6 5.8 2.9 10.9 - 27.2 10.8 - Impairment of intangible asset - 10.3 - - - - - - Impairment of fixed assets - - 1.6 - - - - - Loss on asset exchange - - 0.6 - - - - - Proceeds from sale of pipeline development projects - - - - - (4.8) - - Impairment of note receivable 2.0 - - - - - - Adjusted operating income 123.6$ 238.2$ 293.1$ 408.6$ 541.2$ 686.6$ 805.3$ 1,029.2$ Adjusted operating income % 9.0% 13.8% 14.6% 18.0% 19.6% 21.6% 22.8% 25.3% (1) FY 2007 - FY 2010 retrospectively adjusted for the voluntary change in accounting principle to eliminate the one-month reporting lag for the Company's foreign subsidiares in FY 2011. (2) All information based on continuing operations. (3) Amortization of acquired intangible assets related to business combinations and asset acquisitions. FY 09 - FY 14 Adjusted operating margin CAGR: FY 14 adjusted operating margin: 25.3% ^ (1/5) - 1 = 12% FY 09 adjusted operating margin: 14.6% FY 07 - FY 14 Adjusted operating margin growth: FY 07 FY 14 Change Adjusted operating margin 9.0% 25.3% 1,630 bps

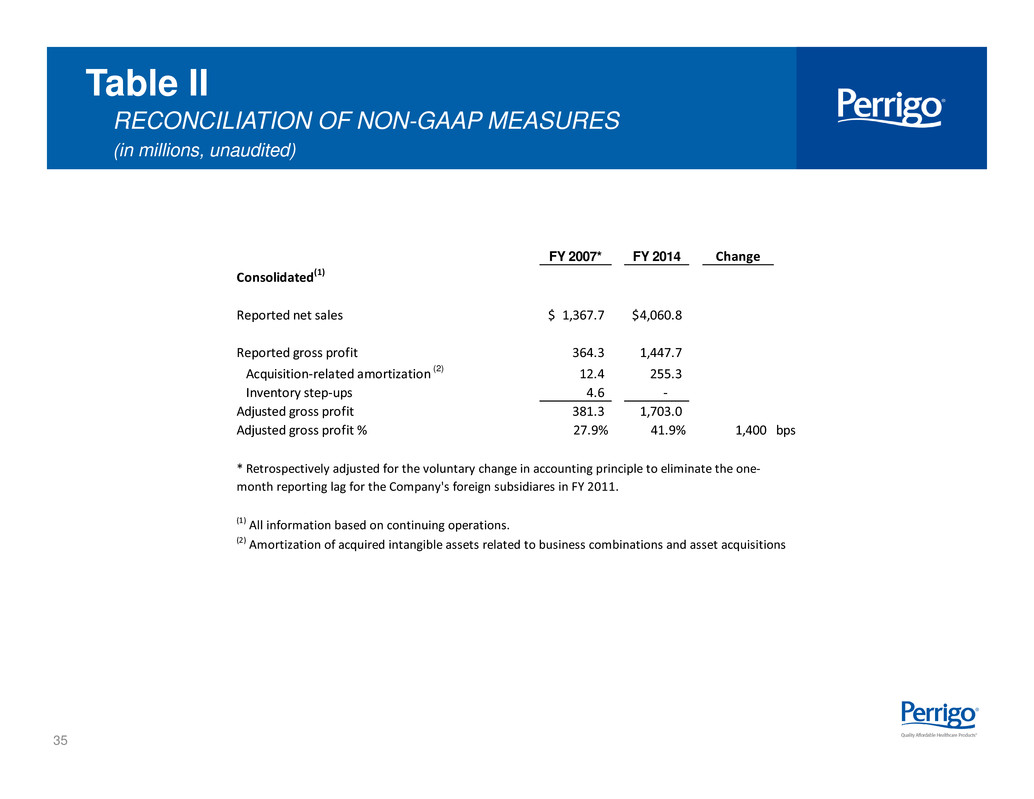

35 Table II RECONCILIATION OF NON-GAAP MEASURES (in millions, unaudited) FY 2007* FY 2014 Change Consolidated(1) Reported net sales 1,367.7$ 4,060.8$ Reported gross profit 364.3 1,447.7 Acquisition-related amortization (2) 12.4 255.3 Inventory step-ups 4.6 - Adjusted gross profit 381.3 1,703.0 Adjusted gross profit % 27.9% 41.9% 1,400 bps (1) All information based on continuing operations. (2) Amortization of acquired intangible assets related to business combinations and asset acquisitions * Retrospectively adjusted for the voluntary change in accounting principle to eliminate the one- month reporting lag for the Company's foreign subsidiares in FY 2011.

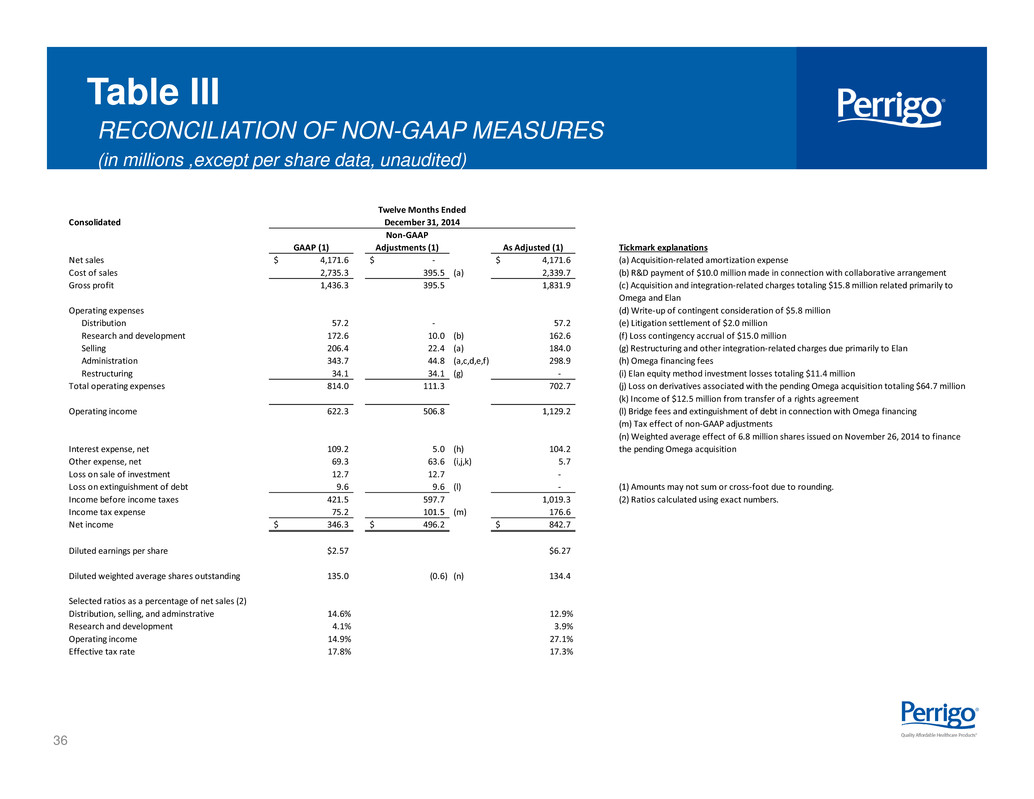

36 Table III RECONCILIATION OF NON-GAAP MEASURES (in millions ,except per share data, unaudited) Consolidated GAAP (1) Non-GAAP Adjustments (1) As Adjusted (1) Tickmark explanations Net sales 4,171.6$ -$ 4,171.6$ (a) Acquisition-related amortization expense Cost of sales 2,735.3 395.5 (a) 2,339.7 (b) R&D payment of $10.0 million made in connection with collaborative arrangement Gross profit 1,436.3 395.5 1,831.9 Operating expenses (d) Write-up of contingent consideration of $5.8 million Distribution 57.2 - 57.2 (e) Litigation settlement of $2.0 million Research and development 172.6 10.0 (b) 162.6 (f) Loss contingency accrual of $15.0 million Selling 206.4 22.4 (a) 184.0 (g) Restructuring and other integration-related charges due primarily to Elan Administration 343.7 44.8 (a,c,d,e,f) 298.9 (h) Omega financing fees Restructuring 34.1 34.1 (g) - (i) Elan equity method investment losses totaling $11.4 million Total operating expenses 814.0 111.3 702.7 (j) Loss on derivatives associated with the pending Omega acquisition totaling $64.7 million (k) Income of $12.5 million from transfer of a rights agreement Operating income 622.3 506.8 1,129.2 (l) Bridge fees and extinguishment of debt in connection with Omega financing (m) Tax effect of non-GAAP adjustments Interest expense, net 109.2 5.0 (h) 104.2 (n) Weighted average effect of 6.8 million shares issued on November 26, 2014 to finance the pending Omega acquisition Other expense, net 69.3 63.6 (i,j,k) 5.7 Loss on sale of investment 12.7 12.7 - Loss on extinguishment of debt 9.6 9.6 (l) - (1) Amounts may not sum or cross-foot due to rounding. Income before income taxes 421.5 597.7 1,019.3 (2) Ratios calculated using exact numbers. Income tax expense 75.2 101.5 (m) 176.6 Net income 346.3$ 496.2$ 842.7$ Diluted earnings per share $2.57 $6.27 Diluted weighted average shares outstanding 135.0 (0.6) (n) 134.4 Selected ratios as a percentage of net sales (2) Distribution, selling, and adminstrative 14.6% 12.9% Research and development 4.1% 3.9% Operating income 14.9% 27.1% Effective tax rate 17.8% 17.3% (c) Acquisition and integration-related charges totaling $15.8 million related primarily to Omega and Elan Twelve Months Ended December 31, 2014

37 Table IV RECONCILIATION OF NON-GAAP MEASURES (in millions, except per share data, unaudited) Consolidated GAAP Non-GAAP Adjustments As Adjusted GAAP (1) Non-GAAP Adjustments (1) As Adjusted (1) GAAP Adjusted Adjusted (1) Net sales 1,049.1$ -$ 1,049.1$ 1,004.2$ -$ 1,004.2$ 4% 4% Cost of sales 670.3 101.0 (a) 569.3 689.2 101.2 (a) 588.0 -3% -3% Gross profit 378.8 101.0 479.8 315.0 101.2 416.2 20% 15% Operating expenses Distribution 14.7 - 14.7 13.9 - 13.9 6% 6% Research and development 35.4 - 35.4 44.7 - 44.7 -21% -21% Selling 48.8 5.6 (a) 43.2 52.5 5.5 (a) 47.0 -7% -8% Administration 79.6 5.6 (a,b,c) 74.0 81.1 11.1 (a,h,i,j) 70.0 -2% 6% Restructuring 1.1 1.1 (d) - 19.5 19.5 (d) - -94% 0% Total operating expenses 179.6 12.3 167.3 211.7 36.1 175.6 -15% -5% Operating income 199.2 113.3 312.5 103.3 137.3 240.6 93% 30% Interest expense, net 43.3 18.7 (e) 24.6 26.2 — 26.2 66% -6% Other expense, net 258.6 258.5 (e,m) 0.1 14.4 14.5 (k,l) (0.1) NM -159% Income (loss) before income taxes (102.7) 390.5 287.8 62.7 151.8 214.5 -264% 34% Income tax expense (benefit) (7.8) 47.1 (f) 39.3 14.6 23.8 (f) 38.3 -153% 3% Net income (loss) (94.9)$ 343.4$ 248.5$ 48.1$ 128.0$ 176.2$ -297% 41% Diluted earnings per share (0.67)$ 1.85$ 0.36$ 1.31$ -286% 41% Diluted weighted average shares outstanding 140.8 6.3 (g) 134.5 134.3 134.3 5% 0% Selected ratios as a percentage of net sales (2) Gross profit 36.1% 45.7% 31.4% 41.4% Operating expenses 17.1% 15.9% 21.1% 17.5% Operating income 19.0% 29.8% 10.3% 24.0% (1) Amounts may not sum or cross-foot due to rounding (f) Tax effect of non-GAAP adjustments (2) Ratios as a % to net sales may not calculate due to rounding (g) Weighted average effect of 6.8 million shares issued on November 26, 2014 to finance the Omega acquisition NM - Calculations are not meaningful (h) Elan transaction costs of $3.2 million (a) Acquisition-related amortization (i) Write-up of contingent consideration of $5.8 million (b) Omega acquisition and integration-related expenses totaling $2.0 million (j) Litigation settlement of $2.0 million (c) Increase in litigation accrual of $2.0 million (k) Losses on Elan equity method investments (d) Restructuring and other integration-related charges (l) Loss on sale of investments (e) Omega financing fees (m) Loss on derivatives associated with the Omega acquisition totaling $258.2 million March 28, 2015 March 29, 2014 Three Months Ended % Change Three Months Ended

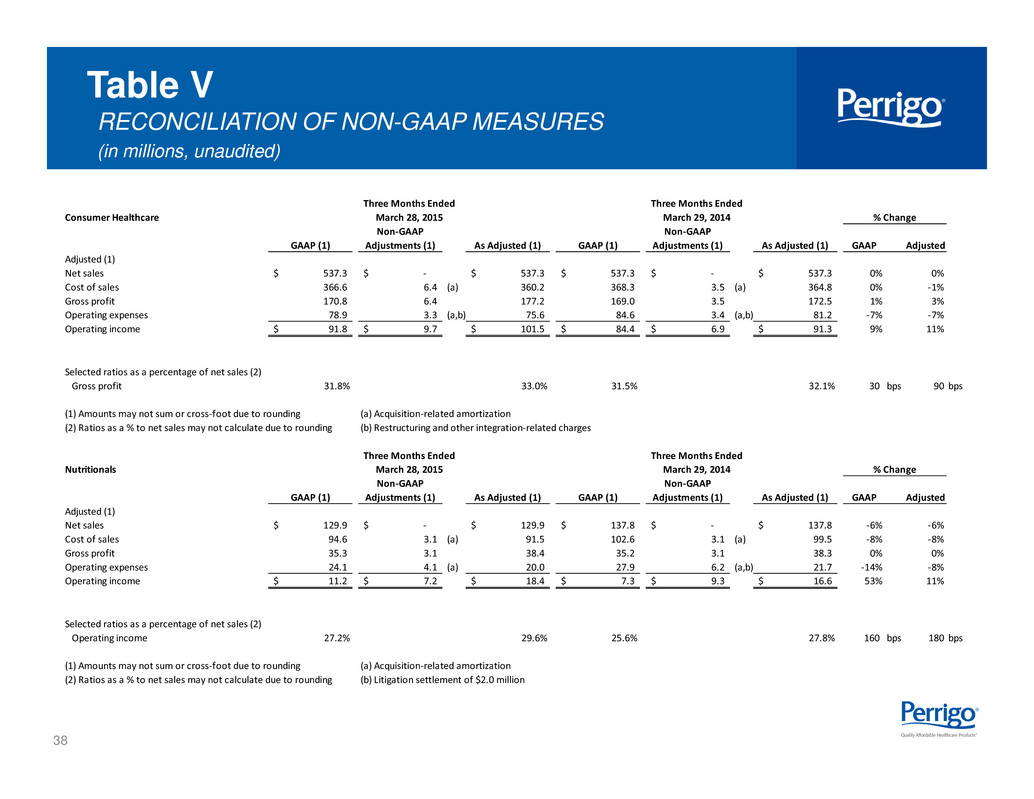

38 Table V RECONCILIATION OF NON-GAAP MEASURES (in millions, unaudited) Consumer Healthcare GAAP (1) Non-GAAP Adjustments (1) As Adjusted (1) GAAP (1) Non-GAAP Adjustments (1) As Adjusted (1) GAAP Adjusted Adjusted (1) Net sales 537.3$ -$ 537.3$ 537.3$ -$ 537.3$ 0% 0% Cost of sales 366.6 6.4 (a) 360.2 368.3 3.5 (a) 364.8 0% -1% Gross profit 170.8 6.4 177.2 169.0 3.5 172.5 1% 3% Operating expenses 78.9 3.3 (a,b) 75.6 84.6 3.4 (a,b) 81.2 -7% -7% Operating income 91.8$ 9.7$ 101.5$ 84.4$ 6.9$ 91.3$ 9% 11% Selected ratios as a percentage of net sales (2) Gross profit 31.8% 33.0% 31.5% 32.1% 30 bps 90 bps (1) Amounts may not sum or cross-foot due to rounding (a) Acquisition-related amortization (2) Ratios as a % to net sales may not calculate due to rounding (b) Restructuring and other integration-related charges Nutritionals GAAP (1) Non-GAAP Adjustments (1) As Adjusted (1) GAAP (1) Non-GAAP Adjustments (1) As Adjusted (1) GAAP Adjusted Adjusted (1) Net sales 129.9$ -$ 129.9$ 137.8$ -$ 137.8$ -6% -6% Cost of sales 94.6 3.1 (a) 91.5 102.6 3.1 (a) 99.5 -8% -8% Gross profit 35.3 3.1 38.4 35.2 3.1 38.3 0% 0% Operating expenses 24.1 4.1 (a) 20.0 27.9 6.2 (a,b) 21.7 -14% -8% Operating income 11.2$ 7.2$ 18.4$ 7.3$ 9.3$ 16.6$ 53% 11% Selected ratios as a percentage of net sales (2) Operating income 27.2% 29.6% 25.6% 27.8% 160 bps 180 bps (1) Amounts may not sum or cross-foot due to rounding (a) Acquisition-related amortization (2) Ratios as a % to net sales may not calculate due to rounding (b) Litigation settlement of $2.0 million March 28, 2015 March 29, 2014 % Change Three Months Ended Three Months Ended Three Months Ended Three Months Ended March 28, 2015 March 29, 2014 % Change

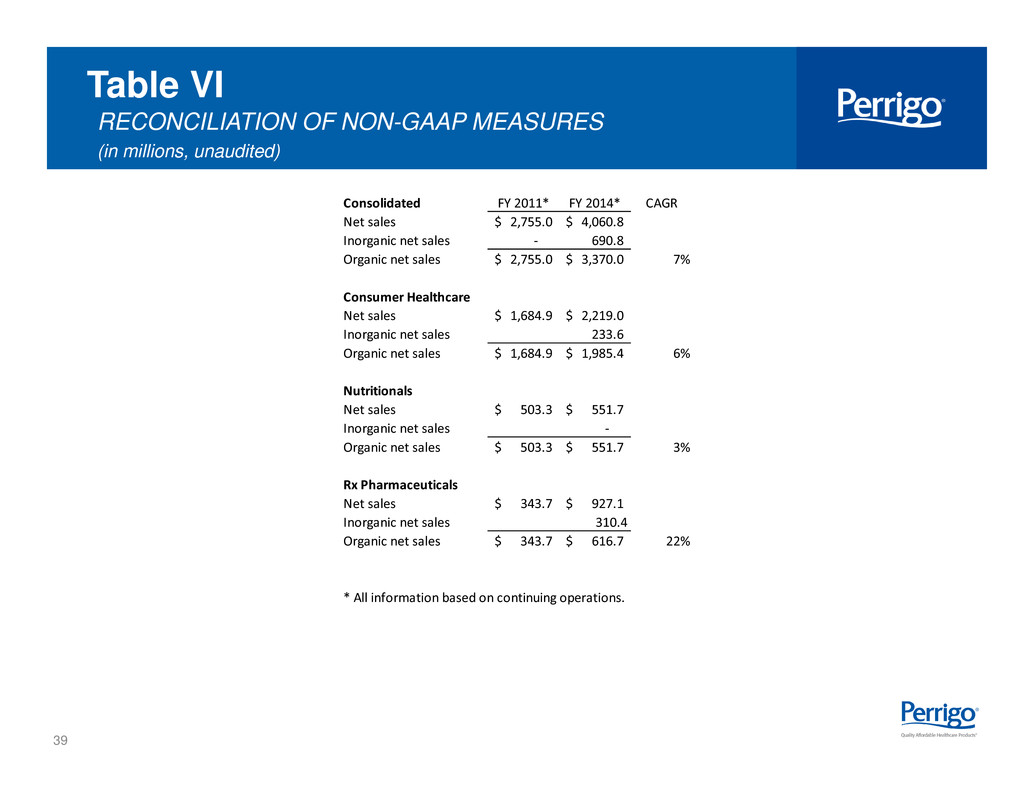

39 Table VI RECONCILIATION OF NON-GAAP MEASURES (in millions, unaudited) Consolidated FY 2011* FY 2014* CAGR Net sales 2,755.0$ 4,060.8$ Inorganic net sales - 690.8 Organic net sales 2,755.0$ 3,370.0$ 7% Consumer Healthcare Net sales 1,684.9$ 2,219.0$ Inorganic net sales 233.6 Organic net sales 1,684.9$ 1,985.4$ 6% Nutritionals Net sales 503.3$ 551.7$ Inorganic net sales - Organic net sales 503.3$ 551.7$ 3% Rx Pharmaceuticals Net sales 343.7$ 927.1$ Inorganic net sales 310.4 Organic net sales 343.7$ 616.7$ 22% * All information based on continuing operations.