Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - HWN, INC. | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - HWN, INC. | exhibit31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - HWN, INC. | exhibit32-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - HWN, INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

(Mark One)

[ X ] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended February 28, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ________to _________

Commission file number: 000-53461

MANTRA VENTURE GROUP LTD.

(Exact name of registrant as specified in its charter)

| British Columbia | 26-0592672 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

#562 – 800 15355 24th

Avenue

Surrey, British Columbia, Canada V4A 2H9

(Address of

principal executive offices) (zip code)

(604) 560-1503

(Registrant’s telephone number,

including area code)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [ X ]

No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [ X ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [ X ] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [ X ].

As of April 20, 2015, there were 71,377,692 shares of registrant’s common stock outstanding.

MANTRA VENTURE GROUP LTD.

INDEX

PART I – FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS |

The unaudited interim consolidated financial statements of Mantra Venture Group Ltd. (“we”, “us”, “our” and “our company”) follow. All currency references in this report are in US dollars unless otherwise noted.

MANTRA VENTURE GROUP LTD.

Consolidated balance sheets

(Expressed in U.S. dollars)

| February 28, | May 31, | |||||

| 2015 | 2014 | |||||

| $ | $ | |||||

| (unaudited) | ||||||

| ASSETS | ||||||

| Current assets | ||||||

| Cash | 67,735 | 931,886 | ||||

| Amounts receivable | 40,147 | 163,591 | ||||

| Deferred finance costs | 9,030 | – | ||||

| Prepaid expenses and deposits | 199,725 | 504,697 | ||||

| Total current assets | 316,637 | 1,600,174 | ||||

| Restricted cash | 20,702 | 27,374 | ||||

| Property and equipment, net | 100,977 | 94,231 | ||||

| Intangible assets, net | 55,743 | 29,547 | ||||

| Total assets | 494,059 | 1,751,326 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities | 589,057 | 715,053 | ||||

| Due to related parties | 77,851 | 159,994 | ||||

| Loans payable | 189,870 | 204,176 | ||||

| Obligations under capital lease | 19,151 | 8,246 | ||||

| Convertible debentures (net of discount of $250,971) | 175,882 | 164,660 | ||||

| Derivative liability | 160,370 | – | ||||

| Total current liabilities | 1,212,181 | 1,252,129 | ||||

| Obligations under capital lease | – | 19,856 | ||||

| Convertible debentures (net of discount of $nil and $175,360 respectively) | – | 16,640 | ||||

| Total liabilities | 1,212,181 | 1,288,625 | ||||

| Stockholders’ equity (deficit) | ||||||

| Mantra Venture Group Ltd. stockholders’ equity (deficit) | ||||||

| Preferred

stock Authorized: 20,000,000 shares, par value $0.00001 Issued and outstanding: Nil shares |

– | – | ||||

| Common

stock Authorized: 100,000,000 shares, par value $0.00001 Issued and outstanding: 71,377,692 (May 31, 2014 – 69,157,322) shares |

715 | 692 | ||||

| Additional paid-in capital | 10,396,957 | 9,679,880 | ||||

| Subscriptions receivable | – | (1,791 | ) | |||

| Common stock subscribed | 74,742 | 216,391 | ||||

| Accumulated deficit | (11,012,752 | ) | (9,314,295 | ) | ||

| Total Mantra Venture Group Ltd. stockholders’ equity (deficit) | (540,338 | ) | 580,877 | |||

| Non-controlling interest | (177,784 | ) | (118,176 | ) | ||

| Total stockholders’ equity (deficit) | (718,122 | ) | 462,701 | |||

| Total liabilities and stockholders’ equity (deficit) | 494,059 | 1,751,326 |

MANTRA VENTURE GROUP LTD.

Consolidated statements of

operations

(Expressed in U.S. dollars)

(unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||

| February 28, | February 28, | |||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||

| $ | $ | $ | $ | |||||||||

| Revenue | 39,116 | 16,858 | 116,912 | 165,262 | ||||||||

| Cost of goods sold | – | – | – | – | ||||||||

| Gross profit | 39,116 | 16,858 | 116,912 | 165,262 | ||||||||

| Operating expenses | ||||||||||||

| Business development | 5,903 | 81 | 21,836 | 8,743 | ||||||||

| Consulting and advisory | 135,735 | 24,893 | 395,319 | 121,837 | ||||||||

| Depreciation and amortization | 6,846 | 5,048 | 26,896 | 17,706 | ||||||||

| Foreign exchange gain | (3,397 | ) | (19,588 | ) | (50,385 | ) | (37,407 | ) | ||||

| General and administrative | 26,363 | 11,150 | 110,362 | 56,172 | ||||||||

| License fees | – | – | 45,941 | 40,000 | ||||||||

| Management fees | 76,957 | 45,564 | 192,956 | 138,512 | ||||||||

| Professional fees | 35,786 | 33,231 | 105,552 | 114,017 | ||||||||

| Public listing costs | 3,855 | 5,706 | 34,922 | 12,821 | ||||||||

| Rent | 17,878 | 15,821 | 51,423 | 39,740 | ||||||||

| Research and development | 55,196 | 91,918 | 622,605 | 234,521 | ||||||||

| Shareholder communications and awareness | – | – | – | 7,382 | ||||||||

| Supplies | 4,732 | – | 21,809 | – | ||||||||

| Travel and promotion | 22,278 | 1,178 | 155,995 | 52,086 | ||||||||

| Wages and benefits | 9,505 | 3,551 | 29,513 | 17,787 | ||||||||

| Total operating expenses | 397,637 | 218,553 | 1,764,744 | 823,917 | ||||||||

| Loss before other income (expense) | (358,521 | ) | (201,695 | ) | (1,647,832 | ) | (658,655 | ) | ||||

| Other income (expense) | ||||||||||||

| Accretion of discounts on convertible debentures | (27,563 | ) | (434 | ) | (49,391 | ) | (9,448 | ) | ||||

| Gain on settlement of debt | – | – | 1,759 | – | ||||||||

| Loss on change in fair value of derivatives | (35,370 | ) | – | (35,370 | ) | – | ||||||

| Interest expense | (9,261 | ) | (13,162 | ) | (27,231 | ) | (43,043 | ) | ||||

| Total other income (expense) | (72,194 | ) | (13,596 | ) | (110,233 | ) | (52,491 | ) | ||||

| Net loss for the period | (430,715 | ) | (215,291 | ) | (1,758,065 | ) | (711,146 | ) | ||||

| Less: net loss attributable to the non-controlling interest | 18,523 | 16,686 | 59,608 | 41,586 | ||||||||

| Net loss attributable to Mantra Venture Group Ltd. | (412,192 | ) | (198,605 | ) | (1,698,457 | ) | (669,560 | ) | ||||

| Net

loss per share attributable to Mantra Venture Group Ltd. common

shareholders, basic and diluted |

(0.01 | ) | – | (0.02 | ) | (0.01 | ) | |||||

| Weighted average number of shares outstanding used in the

calculation of net loss attributable to Mantra Venture Group Ltd. per common share |

71,33,248 | 57,410,721 | 70,789,507 | 56,893,646 | ||||||||

(The accompanying notes are an integral part of these consolidated financial statements)

MANTRA VENTURE GROUP LTD.

Consolidated statements of

cash flows

(Expressed in U.S. dollars)

(unaudited)

| Nine Months | Nine Months | |||||

| Ended | Ended | |||||

| February 28, | February 28, | |||||

| 2015 | 2014 | |||||

| $ | $ | |||||

| Operating activities | ||||||

| Net loss | (1,758,065 | ) | (711,146 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||

| Change in fair value of derivative liability | 35,370 | – | ||||

| Amortization of finance costs | 470 | – | ||||

| Accretion of discounts on convertible debentures | 49,391 | 9,448 | ||||

| Depreciation and amortization | 26,896 | 17,706 | ||||

| Foreign exchange gain | (8,342 | ) | (12,076 | ) | ||

| Gain on settlement of debt | (1,759 | ) | – | |||

| Stock-based compensation | 323,455 | 38,200 | ||||

| Changes in operating assets and liabilities: | ||||||

| Amounts receivable | 123,445 | (8,581 | ) | |||

| Prepaid expenses and deposits | 304,972 | 29,058 | ||||

| Accounts payable and accrued liabilities | (124,238 | ) | 211,438 | |||

| Due to related parties | (82,143 | ) | (18,217 | ) | ||

| Net cash used in operating activities | (1,110,548 | ) | (444,170 | ) | ||

| Investing activities | ||||||

| Purchase of property and equipment | (28,295 | ) | (1,481 | ) | ||

| Investment in intangible assets | (31,543 | ) | – | |||

| Net cash used in investing activities | (59,838 | ) | (1,481 | ) | ||

| Financing activities | ||||||

| Bank overdraft | – | 2,776 | ||||

| Repayment of capital lease obligations | (8,243 | ) | (5,306 | ) | ||

| Repayment of loans payable | (54,809 | ) | (23,889 | ) | ||

| Proceeds from issuance of convertible debentures | 125,000 | 192,000 | ||||

| Finance costs | (9,500 | ) | – | |||

| Proceeds from issuance of common stock and subscriptions received | 253,787 | 254,683 | ||||

| Net cash provided by financing activities | 306,235 | 420,264 | ||||

| Change in cash | (864,151 | ) | (25,387 | ) | ||

| Cash, beginning of period | 931,886 | 25,387 | ||||

| Cash, end of period | 67,735 | – | ||||

| Non-cash investing and financing activities: | ||||||

| Common stock issued to relieve common stock subscribed | 112,625 | – | ||||

| Common stock issued to settle debt | 9,019 | – | ||||

| Supplemental disclosures: | ||||||

| Interest paid | 8,048 | 12,787 | ||||

| Income taxes paid | – | – |

(The accompanying notes are an integral part of these consolidated financial statements)

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

February 28, 2015

(Expressed in U.S. dollars)

(unaudited)

| 1. |

Basis of Presentation |

Mantra Venture Group Ltd. (the “Company”) was incorporated in the State of Nevada on January 22, 2007 to acquire and commercially exploit various new energy related technologies through licenses and purchases. On December 8, 2008, the Company continued its corporate jurisdiction out of the State of Nevada and into the province of British Columbia, Canada. The Company is in the business of developing and providing energy alternatives. The Company also provides marketing and graphic design services to help companies optimize their environmental awareness presence through the eyes of government, industry and the general public.

The accompanying unaudited consolidated interim financial statements of the Company should be read in conjunction with the consolidated financial statements and accompanying notes filed with the U.S. Securities and Exchange Commission in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2014. In the opinion of management, the accompanying financial statements reflect all adjustments of a recurring nature considered necessary to present fairly the Company’s financial position and the results of its operations and its cash flows for the periods shown.

The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ materially from those estimates. The results of operations and cash flows for the periods shown are not necessarily indicative of the results to be expected for the full year.

These unaudited consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has yet to acquire commercially exploitable energy related technology, and is unlikely to generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of management to raise additional equity capital through private and public offerings of its common stock, and the attainment of profitable operations. At February 28, 2015, the Company has accumulated losses of $11,012,752. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Management requires additional funds over the next twelve months to fully implement its business plan. Management is currently seeking additional financing through the sale of equity and from borrowings from private lenders to cover its operating expenditures. There can be no certainty that these sources will provide the additional funds required for the next twelve months.

| 2. |

Significant Accounting Policies |

| (a) |

Principles of Consolidation |

These unaudited consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States. These unaudited consolidated financial statements include the accounts of the Company and its subsidiaries, Carbon Commodity Corporation, Climate ESCO Ltd., Mantra Energy Alternatives Ltd., Mantra China Inc., Mantra China Limited, Mantra Media Corp., Mantra NextGen Power Inc., and Mantra Wind Inc. All the subsidiaries are wholly-owned with the exception of Climate ESCO Ltd., which is 65% owned and Mantra Energy Alternatives Ltd., which is 89% owned. All inter-company balances and transactions have been eliminated.

| (b) |

Recent Accounting Pronouncements |

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

| (c) |

Fair Value Measurements |

The Company measures and discloses the estimated fair value of financial assets and liabilities using the fair value hierarchy prescribed by US generally accepted accounting principles. The fair value hierarchy has three levels, which are based on reliable available inputs of observable data. The hierarchy requires the use of observable market data when available. The three-level hierarchy is defined as follows:

Level 1 – quoted prices for identical

instruments in active markets;

Level 2 – quoted prices for similar

instruments in active markets; quoted prices for identical or similar

instruments in markets that are not active; and model derived valuations in

which significant inputs and significant value drivers are observable in active

markets; and

Level 3 – fair value measurements derived from valuation

techniques in which one or more significant inputs or significant value drivers

are unobservable.

Financial instruments consist principally of cash and cash equivalents, accounts receivable, restricted cash, accounts payable, loans payable and convertible debentures. Derivative liabilities are determined based on “Level 3” inputs, which are significant and unobservable and have the lowest priority. There were no transfers into or out of “Level 3” during the nine months ended February 28, 2015 and 2014. The recorded values of all other financial instruments approximate their current fair values because of their nature and respective relatively short maturity dates or durations.

Fair value estimates are made at a specific point in time, based on relevant market information and information about the financial statement. These estimates are subjective in nature and involve uncertainties and matters of significant judgment and therefore cannot be determined with precision. Changes in assumptions could significantly affect the estimates. See Note 10 for additional information.

| (d) |

Derivative Liabilities |

The Company accounts for derivative instruments in accordance with ASC Topic 815, Derivatives and Hedging and all derivative instruments are reflected as either assets or liabilities at fair value in the balance sheet. The Company uses estimates of fair value to value its derivative instruments. Fair value is defined as the price to sell an asset or transfer a liability in an orderly transaction between willing and able market participants. In general, the Company’s policy in estimating fair values is to first look at observable market prices for identical assets and liabilities in active markets, where available. When these are not available, other inputs are used to model fair value such as prices of similar instruments, yield curves, volatilities, prepayment speeds, default rates and credit spreads, relying first on observable data from active markets. Depending on the availability of observable inputs and prices, different valuation models could produce materially different fair value estimates. The values presented may not represent future fair values and may not be realizable. The Company categorizes its fair value estimates in accordance with ASC 820 based on the hierarchical framework associated with the three levels of price transparency utilized in measuring financial instruments at fair value as discussed above. As at February 28, 2015 and 2014, the Company had a $160,370 and $Nil derivative liability, respectively.

| 3. |

Restricted Cash |

Restricted cash represents cash pledged as security for the Company’s credit cards.

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

| 4. |

Property and Equipment |

| February 28, | May 31, | ||||||||||||

| 2015 | 2014 | ||||||||||||

| Accumulated | Net carrying | Net carrying | |||||||||||

| Cost | depreciation | value | value | ||||||||||

| $ | $ | $ | $ | ||||||||||

| Furniture and equipment | 2,496 | 333 | 2,163 | – | |||||||||

| Computer | 5,341 | 4,160 | 1,181 | 2,821 | |||||||||

| Research equipment | 138,013 | 67,038 | 70,975 | 51,030 | |||||||||

| Vehicles under capital lease | 68,340 | 41,682 | 26,658 | 40,380 | |||||||||

| 214,190 | 113,213 | 100,977 | 94,231 |

| 5. |

Intangible Assets |

| February 28, | May 31, | ||||||||||||

| 2015 | 2014 | ||||||||||||

| Accumulated | Net carrying | Net carrying | |||||||||||

| Cost | amortization | value | value | ||||||||||

| $ | $ | $ | $ | ||||||||||

| Patents | 58,628 | 2,885 | 55,743 | 29,547 |

Estimated Future Amortization Expense:

| $ | ||||

| For year ended May 31, 2015 | 774 | |||

| For year ended May 31, 2016 | 3,235 | |||

| For year ended May 31, 2017 | 3,235 | |||

| For year ended May 31, 2018 | 3,235 | |||

| For year ended May 31, 2019 | 3,235 |

| 6. |

Related Party Transactions |

| (a) |

During the nine months ended February 28, 2015, the Company incurred management fees of $124,997 (2014 - $92,263) and rent of $Nil (2014 - $13,500) to the President of the Company. | |

| (b) |

During the nine months ended February 28, 2015, the Company incurred management fees of $42,264 (2014 - $46,197) to the spouse of the President of the Company. | |

| (c) |

During the nine months ended February 28, 2015, the Company incurred research and development fees of $57,859(2014 - $43,552) to a director of the Company. | |

| (d) |

On December 9, 2014, the Company granted 200,000 stock options exercisable at $0.20 per share for a period of two years to a director. The Company recorded the fair value of the vested portion of the options of $25,695 as management fees. | |

| (e) |

As at February 28, 2015, the Company owed a total of $59,140 (May 31, 2014 - $124,857) to the President of the Company and his spouse, and a company controlled by the President of the Company, which is non-interest bearing, unsecured, and due on demand. |

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

| (f) |

As at February 28, 2015, the Company owed $18,711(May 31, 2014- $21,518) to an officer and a director of the Company, which is non-interest bearing, unsecured, and due on demand. |

| 7. |

Loans Payable |

| (a) |

As at February 28, 2015, the amount of $50,653 (Cdn$63,300) (May 31, 2014 - $58,251 (Cdn$63,300)) is owed to a non-related party, which is non-interest bearing, unsecured, and due on demand. | |

| (b) |

As at February 28, 2015, the amount of $17,500 (May 31, 2014 - $17,500) is owed to a non-related party, which is non-interest bearing, unsecured, and due on demand. | |

| (c) |

As at February 28, 2015, the amount of $15,000 (May 31, 2014 - $15,000) is owed to a non-related party, which is non-interest bearing, unsecured, and due on demand. | |

| (d) |

As at February 28, 2015, the amount of $15,120 (Cdn$18,895) (May 31, 2014 – $17,387 (Cdn$18,895)) is owed to a non-related party, which is non-interest bearing, unsecured, and due on demand. | |

| (e) |

As at February 28, 2015, the amounts of $7,500 and $29,607 (Cdn$37,000) (May 31, 2014 - $7,500 and $34,048 (Cdn$37,000)) are owed to a non-related party, which are non-interest bearing, unsecured, and due on demand. | |

| (f) |

As at February 28, 2015, the amount of $4,490 (May 31, 2013- $4,490) is owed to a non-related party which is non- interest bearing, unsecured, and due on demand. | |

| (g) |

In March 2012, the Company received $50,000 for the subscription of 10,000,000 shares of the Company’s common stock. During the year ended May 31, 2013, the Company and the subscriber agreed that the shares would not be issued and that the subscription would be returned. The subscription has been reclassified as a non-interest bearing demand loan until the funds are refunded to the subscriber. |

| 8. |

Obligations Under Capital Lease |

On each of July 31, 2012 and December 21, 2012, the Company entered an agreement to lease a vehicle for three years each. The vehicle leases are classified as a capital leases. The following is a schedule by years of future minimum lease payments under capital leases together with the present value of the net minimum lease payments as of February 28, 2015:

| Year ending May 31: | $ | |||

| 2015 | 2,524 | |||

| 2016 | 18,161 | |||

| Net minimum lease payments | 20,685 | |||

| Less: amount representing interest payments | (1,534 | ) | ||

| Present value of net minimum lease payments | 19,151 | |||

| Less: current portion | (19,151 | ) | ||

| Long-term portion | – |

At the end of both leases, the Company has the option to purchase the vehicles for $9,000 each.

| 9. |

Convertible Debentures |

| (a) |

In October 2008, the Company issued three convertible debentures for total proceeds of $250,000 which bear interest at 10% per annum, are unsecured, and due one year from date of issuance. The unpaid amount of principal and accrued interest can be converted at any time at the holder’s option into 625,000 shares of the Company’s common stock at a price of $0.40 per share. The Company also issued 250,000 detachable, non-transferable share purchase warrants. Each share purchase warrant entitles the holder to purchase one additional share of the Company’s common stock for a period of two years from the date of issuance at an exercise price of $0.50 per share. |

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

|

In accordance with ASC 470-20, “Debt with Conversion and Other Options”, the Company determined that the convertible debentures contained no embedded beneficial conversion feature as the convertible debentures were issued with a conversion price higher than the fair market value of the Company’s common shares at the time of issuance. | ||

|

In accordance with ASC 470-20, the Company allocated the proceeds of issuance between the convertible debt and the detachable share purchase warrants based on their relative fair values. Accordingly, the Company recognized the fair value of the share purchase warrants of $45,930 as additional paid-in capital and an equivalent discount against the convertible debentures. The Company had recorded accretion expense of $45,930, increasing the carrying value of the convertible debentures to $250,000. | ||

Subsequent to issuance the Company entered into settlement agreements with two of the debenture holders with an aggregate principal amount of $200,000. The third debenture of $50,000 remains outstanding as issued at February 28, 2015. |

||

|

On January 19, 2012, the Company entered into a settlement agreement with one of the debenture holders to settle a $50,000 convertible debenture and $122,535 in accounts payable and accrued interest with the debt holder. Pursuant to the agreement, the debt holder agreed to reduce the debt to Cdn$100,000 on the condition that the Company pays the amount of Cdn$2,500 per month for 40 months, beginning March 1, 2012 and continuing on the first day of each month thereafter. At February 28, 2015, the debenture was fully repaid pursuant to the terms of the settlement agreement. | ||

|

On July 18, 2012, the Company entered into a settlement agreement with the $150,000 debenture holder. Pursuant to the settlement agreement, the lender agreed to extend the due date until April 11, 2013 and the Company agreed to pay $43,890 of accrued interest within five days of the agreement (paid), pay the accruing interest on a monthly basis (paid), and pay a $10,000 premium in addition to the $150,000 principal outstanding on April 11, 2013. On April 29, 2013, the Company entered into an amended settlement agreement whereby the lender agreed to extend the due date to September 15, 2013 and the Company agreed to pay $6,836 of interest for the period from April 1 to September 15, 2013 upon execution of the agreement (paid) and granted the lender 100,000 stock options exercisable at $0.12 per share for a period of two years. | ||

|

On November 15, 2013, the Company entered into a second settlement agreement amendment. Pursuant to the second amendment, on November 15, 2013, the Company agreed to pay interest of $4,438 (paid) and commencing February 1, 2014, the Company would make monthly payments of $10,000 on the outstanding principal and interest. | ||

|

The Company evaluated the modifications and determined that the creditor did not grant a concession. In addition, as the present value of the amended future cash flows had a difference of less than 10% of the cash flows of the original debt, it was determined that the original and new debt instruments are not substantially different. As a result, the modification was not treated as an extinguishment of the debt and no gain or loss was recognized. The Company recorded the fair value of $12,901 for the stock options as additional paid-in capital and a discount. During the year ended May 31, 2014, the Company repaid $40,000 of the debenture. As at May 31, 2014, the Company had accreted $12,901 of the discount bring the carrying value of the convertible debenture to $114,661. During the nine months ended February 28, 2015, the Company repaid $54,808, decreasing the carrying value to $59,853. | ||

| (b) |

On August 19, 2013, the Company issued a convertible debenture for total proceeds of $10,000, which bears interest at 10% per annum, is unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $10,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $10,000. As at February 28, 2015, the carrying value of the convertible promissory note was $5,828. | |

| (c) |

On September 11, 2013, the Company issued a convertible debenture for total proceeds of $58,000, which bears interest at 10% per annum, is unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $58,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $58,000. As at February 28, 2015, the carrying value of the convertible promissory note was $19,715. |

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

| (d) |

On October 18, 2013, the Company issued a convertible debenture for total proceeds of $94,000, which bears interest at 10% per annum, is unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $94,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $94,000. As at February 28, 2015, the carrying value of the convertible promissory note was $22,323. | |

| (e) |

On December 27, 2013, the Company issued three convertible debentures for total proceeds of $15,000, which bear interest at 10% per annum, are unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion features of $15,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $15,000. As at February 28, 2015, the carrying value of the convertible promissory note was $7,725. | |

| (f) |

On February 4, 2014, the Company issued a convertible debenture for total proceeds of $15,000, which bears interest at 10% per annum, is unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $15,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $15,000. As at February 28, 2015, the carrying value of the convertible promissory note was $4,249. | |

| (g) |

On February 17, 2015, the Company issued a convertible note in the principal amount of $125,000. The note has a cash redemption premium of 130% of the principal amount in the first 90 days following the execution date, of 135% for days 90-120 following the execution date, and 140% after the 120th day. After 140 days, cash redemption is only available upon approval by the holder. The note bears interest at 12% per annum and is convertible into common shares of the Company at the lower of (i) 42% discount to the lowest trading price during the previous 20 trading days to the date of conversion or (ii) 42% discount to the lowest trading price during the previous 20 trading days before the date the note was executed. | |

|

The embedded conversion option qualifies for derivative accounting and bifurcation under ASC 815-15 Derivatives and Hedging. The initial fair value of the conversion feature of $160,244 resulted in a discount to the note payable of $125,000 and the recognition of a loss on derivatives of $35,244. During the nine months ended February 28, 2015, the Company recorded accretion of $6,189, increasing the carrying value of the note to $6,189. |

| 10. |

Derivative Liabilities |

The embedded conversion option of the convertible debenture described in Note 9(g) contains a conversion feature that qualifies for embedded derivative classification. The fair value of the liability will be re-measured at the end of every reporting period and the change in fair value will be reported in the statement of operations as a gain or loss on derivative financial instruments.

Upon the issuance of the convertible note payable described in Note 9(g), the Company concluded that it only has sufficient shares to satisfy the conversion of some, but not all, of the outstanding convertible notes, warrants and options. The Company elected to reclassify contracts from equity with the earliest inception date first. As a result none of the Company’s previously outstanding convertible instruments qualified for derivative reclassification, however, any convertible securities issued after the election would qualify for treatment as derivative liabilities. The Company reassesses the classification of the instruments at each balance sheet date. If the classification changes as a result of events during the period, the contract is reclassified as of the date of the event that caused the reclassification.

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

The table below sets forth a summary of changes in the fair value of the Company’s Level 3 financial liabilities:

| February 28, | ||||

| 2015 | ||||

| Balance at the beginning of period | $ | – | ||

| Addition of new derivative liabilities (embedded conversion options) | 160,244 | |||

| Change in fair value of embedded conversion option | 126 | |||

| Balance at the end of the period | $ | 160,370 |

The following table summarizes the change in fair value of derivatives:

| February 28, | February 28, | ||||||

| 2015 | 2014 | ||||||

| Fair value of derivative liabilities in excess of note proceeds received | $ | (35,244 | ) | $ | – | ||

| Change in fair value of derivative liabilities during period | (126 | ) | – | ||||

| Change in fair value of derivatives | $ | (35,370 | ) | $ | – |

The Company uses Level 2 inputs for its valuation methodology for the embedded conversion option liabilities as their fair values were determined by using the Black-Scholes option pricing model based on various assumptions. The model incorporates the price of a share of the Company’s common stock (as quoted on the Over the Counter Bulletin Board), volatility, risk free rate, dividend rate and estimated life. Significant changes in any of these inputs in isolation would result in a significant change in the fair value measurement. As required, these are classified based on the lowest level of input that is significant to the fair value measurement. The following table shows the assumptions used in the calculations:

| Expected | Expected | ||||||||||||

| Expected | Risk-free Interest | Dividend | Life (in | ||||||||||

| Volatility | Rate | Yield | years) | ||||||||||

| At issuance | 124% | 0.07% | 0% | 0.50 | |||||||||

| At February 28, 2015 | 129% | 0.07% | 0% | 0.47 |

| 11. |

Common Stock |

| (a) |

At February 28, 2015, the Company had received proceeds of $2,080 at $0.08 per unit for subscriptions for 26,000 units. Each unit consisted of one share of common stock and one-half of one share purchase warrant. Each whole share purchase warrant is exercisable at $0.20 per common share for a period of two years or five business days after the Company’s common stock trades at least one time per day on the FINRA Over-the-Counter Bulletin Board at a price at or above $0.40 per share for seven consecutive trading days. At May 31, 2014, the proceeds of $100,000 were included in common stock subscribed. | |

| (b) |

As at February 28, 2015 the Company’s subsidiary, Mantra Energy Alternatives Ltd., had received subscriptions for 67,000 shares of common stock at Cdn$1.00 per share for proceeds of $66,277 (Cdn$67,000), which is included in common stock subscribed, net of the non-controlling interest portion of $7,231. |

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

| (c) |

As at February 28, 2015, the Company’s subsidiary, Climate ESCO Ltd., had received subscriptions for 210,000 shares of common stock at $0.10 per share for proceeds of $21,000, which is included in common stock subscribed, net of the non-controlling interest portion of $7,384. |

Stock transactions during the nine months ended February 28, 2015:

| (d) |

On June 4, 2014, the Company issued 333,333 units at $0.30 per unit for proceeds of $100,000 included in common stock subscribed at May 31, 2014. Each unit consists of one share of common stock and one share purchase warrant. Each share purchase warrant is exercisable at $0.80 per common share for a period of three years or five business days after the Company’s common stock trades at least one time per day on the FINRA Over-the-Counter Bulletin Board at a price at or above $1.60 per share for seven consecutive trading days. | |

| (e) |

On June 4, 2014, the Company issued 240,000 shares for proceeds of $61,625 upon the exercise of warrants. At May 31, 2014, the proceeds of $32,625 were included in common stock subscribed. | |

| (f) |

On June 4, 2014, the Company issued 500,000 shares with a fair value of $270,000 to a consultant for services. As at May 31, 2014, the Company recorded the fair value of the 500,000 shares issuable of $270,000 as $5 of subscriptions receivable and $269,995 as additional paid in capital. | |

| (g) |

On July 11, 2014, the Company issued 200,000 units at $0.30 per unit for proceeds of $60,000. Each unit consists of one share of common stock and one share purchase warrant. Each share purchase warrant is exercisable at $0.80 per common share for a period of three years or five business days after the Company’s common stock trades at least one time per day on the FINRA Over-the-Counter Bulletin Board at a price at or above $1.60 per share for seven consecutive trading days. | |

| (h) |

On June 30, and July 17, 2014, the Company issued 40,000 common shares with a fair value of $20,000 pursuant a consulting agreement. | |

| (i) |

On July 10, 2014, the Company issued 60,037 common shares for the conversion of $5,000 of loans payable and $4,019 of accrued interest by a lender. At May 31, 2014, the shares were included in common stock subscribed. | |

| (j) |

On August 22, 2014 the Company entered into an agreement with one consultant to procure investor relations services. Pursuant to the agreement the Company issued 12,000 shares of common stock to the consultant with a fair value of $5,880. | |

| (k) |

On August 25, 2014 the Company issued 150,000 common shares to a director of the Company in exercise of options at an exercise price of $0.02 per share for aggregate proceeds of $3,000. | |

| (l) |

On September 9, 2014, the Company entered into a consulting agreement with a two month term with a consultant. Pursuant to the agreement, the Company issued 12,500 common shares with a fair value of $6,375 on September 15, 2014 and 12,500 common shares with a fair value of $5,000 on October 15, 2014. | |

| (m) |

On October 15, 2014, the Company entered into a consulting agreement with a consultant. Pursuant to the agreement, the Company issued 10,000 common shares with a fair value of $4,500 on October 15, 2014. | |

| (n) |

On November 5, 2014, the Company issued 150,000 units at $0.40 per unit for proceeds of $60,000. Each unit consists of one share of common stock and one share purchase warrant. Each share purchase warrant is exercisable at $0.60 per common share for a period of two years or 30 business days after the Company’s common stock trades at least one time per day on the FINRA Over-the-Counter Bulletin Board at a price at or above $0.90 per share for five consecutive trading days. | |

| (o) |

On February 24, 2015, the Company issued 500,000 units at $0.20 per unit for proceeds of $100,000. Each unit consists of one share of common stock and one share purchase warrant. Each share purchase warrant is exercisable at $0.60 per common share for a period of two years or 30 business days after the Company’s common stock trades at least one time per day on the FINRA Over-the-Counter Bulletin Board at a price at or above $0.90 per share for seven consecutive trading days. |

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

| 12. |

Share Purchase Warrants |

The following table summarizes the continuity of share purchase warrants:

| Weighted average | |||||||

| Number of | exercise price | ||||||

| warrants | $ | ||||||

| Balance, May 31, 2014 | 9,818,402 | 0.29 | |||||

| Issued | 1,183,333 | 0.69 | |||||

| Exercised | (240,000 | ) | 0.26 | ||||

| Expired | (5,503,402 | ) | 0.23 | ||||

| Balance, February 28, 2015 | 5,258,333 | 0.44 |

As at February 28, 2015, the following share purchase warrants were outstanding:

| Exercise | ||||||||

| Number of | price | |||||||

| warrants | $ | Expiry date |

||||||

| 150,000 | 0.60 |

November 18, 2016 |

||||||

| 500,000 | 0.60 |

February 27, 2017 |

||||||

| 333,333 | 0.80 |

June 4, 2017 |

||||||

| 200,000 | 0.80 |

July 11, 2017 |

||||||

| 4,075,000 | 0.37 |

April 10, 2019 |

||||||

| 5,258,333 |

| 13. |

Stock Options |

On June 1, 2014, the Company granted 150,000 stock options exercisable at $0.02 per share for a period of two years to a director. The Company recorded the fair value of the options of $94,600 as research and development fees.

On July 17, 2014, the Company granted 200,000 stock options exercisable at $0.30 per share for a period of two years to two consultants. The options vest 25% every six months following the date of grant. The Company recorded the fair value of the vested portion of the options of $16,900 as consulting fees.

On August 1, 2014, the Company granted 100,000 stock options each to two consultants. The options are exercisable at $0.10 per share for a period of two years. The Company recorded the fair value of the options of $88,900 as consulting fees.

On November 1, 2014, the Company granted 100,000 stock options each to two employees. The options are exercisable at $0.20 per share for a period of two years. The Company recorded the fair value of the options of $55,600 as consulting fees.

On December 9, 2014, the Company granted 200,000 stock options exercisable at $0.20 per share for a period of two years to a director. The options vest 25% on the date of grant and 25% every four months following the date of grant. The Company recorded the fair value of the vested portion of the options of $25,695 as management fees.

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

The following table summarizes the continuity of the Company’s stock options:

| Weighted | Weighted average | Aggregate | |||||||||||

| average | remaining | intrinsic | |||||||||||

| Number | exercise price | contractual life | value | ||||||||||

| of options | $ | (years) | $ | ||||||||||

| Outstanding, May 31, 2014 | 675,000 | 0.17 | |||||||||||

| Granted | 950,000 | 0.17 | |||||||||||

| Exercised | (150,000 | ) | 0.20 | ||||||||||

| Outstanding, February 28, 2015 | 1,475,000 | 0.17 | 1.33 | 103,623 | |||||||||

| Exercisable, February 28, 2015 | 1,175,000 | 0.20 | 1.20 | 96,138 |

A summary of the changes of the Company’s non-vested stock options is presented below:

| Weighted Average | |||||||

| Number of | Grant Date | ||||||

| Non-vested stock options | Options | Fair Value | |||||

| $ | |||||||

| Non-vested at May 31, 2014 | – | – | |||||

| Granted | 950,000 | 0.38 | |||||

| Vested | (650,000 | ) | 0.40 | ||||

| Non-vested at February 28, 2015 | 300,000 | 0.32 |

As at February 28, 2015, there was $30,255 of unrecognized compensation cost related to non-vested stock option agreements. This cost is expected to be recognized over a weighted average period of 1.08 years.

Additional information regarding stock options as of February 28, 2015 is as follows:

| Exercise | ||||||||

| Number of | price | |||||||

| options | $ | Expiry date |

||||||

| 200,000 | 0.10 |

May 7, 2015 |

||||||

| 300,000 | 0.20 |

July 1, 2015 |

||||||

| 175,000 | 0.20 |

April 28, 2015 |

||||||

| 200,000 | 0.30 |

July 17, 2016 |

||||||

| 200,000 | 0.10 |

August 1, 2016 |

||||||

| 200,000 | 0.20 |

November 1, 2016 |

||||||

| 200,000 | 0.20 |

December 9, 2016 |

||||||

| 1,475,000 |

The fair values for stock options granted have been estimated using the Black-Scholes option pricing model assuming no expected dividends and the following weighted average assumptions:

| February 28, | February 28, | ||||||

| 2015 | 2014 | ||||||

| Risk-free Interest rate | 0.52% | 0.34% | |||||

| Expected life (in years) | 1.98 | 2.0 | |||||

| Expected volatility | 111% | 169% |

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

During the nine month period ended February 28, 2015, the Company recorded stock-based compensation of $281,695 (2014 - $38,200) for stock options granted.

The weighted average fair value of the stock options granted for the nine month period ended February 28, 2015, was $0.42 (2014 - $0.13) per option.

| 14. |

Commitments and Contingencies |

| (a) |

On September 2, 2009, the Company entered into an agreement with a company to acquire a worldwide, exclusive license for the Mixed Reactant Flow-By Fuel Cell technology. The term of the agreement is for twenty years or the expiry of the last patent licensed under the agreement, whichever is later. The Company agreed to pay the licensor the following license fees: |

| • | an initial license fee of Cdn$10,000 payable in two installments: Cdn$5,000 upon execution of the agreement (paid) and Cdn$5,000 within thirty days of September 2, 2009 (paid); | |

| • | a further license fee of Cdn$15,000 (paid) to be paid within ninety days of September 2, 2009; and | |

| • | an annual license fee, payable annually on the anniversary of the date of the agreement as follows: |

| September 1, 2010 |

Cdn$10,000 (paid) | ||

| September 1, 2011 |

Cdn$20,000 (accrued) | ||

| September 1, 2012 |

Cdn$30,000 (accrued) | ||

| September 1, 2013 |

Cdn$40,000 (accrued) | ||

| September 1, 2014 |

Cdn$50,000 (accrued) | ||

| and each successive anniversary |

|

The Company is to pay the licensor a royalty calculated as 2% of the gross revenue and 15% of any and all consideration directly or indirectly received by the Company from the grant of any sublicense rights. The Company will pay interest at a rate of 1% per month on any amounts past due. In addition, the Company is responsible for the timely payment of all future costs relating to patent expenses and any new or useful art, process, machine, manufacture or composition of matter arising out of any licensor improvements or joint improvements licensed under this agreement and identified by the licensor as potentially patentable. The Company must also invest a minimum of Cdn$250,000 in research and development directly associated with the technology. | ||

| (b) |

On May 23, 2012, a former employee of the Company delivered a Notice of Application seeking judgment against the Company for approximately $55,000. The hearing of that Application took place on July 31, 2012, at which time the former employee obtained judgment in the approximate amount of $55,000. The Company did not defend the amount of the judgment and the amount is included in accounts payable, but claims a complete set-off on the basis that the former employee retains 1,000,000 shares of common stock of the Company as security for payment of the outstanding consulting fees owed to him. On August 31, 2012, the Company commenced a separate action against the former employee seeking a return of the 1,000,000 shares of common stock and a stay of execution of the judgment. That application is pending and has not yet been heard or determined by the court. The payment of the judgment claim of approximately $55,000 is dependent upon whether the former employee will first return the 1,000,000 shares of common stock noted above. The probable outcome of the Company’s claim for the return of the shares cannot yet be determined. | |

| (c) |

On March 25, 2014, the Company entered into an agreement with a research and development firm who will design, engineer, and build an ERC Energy Demonstration unit for an estimated Cdn$360,000 over a period of approximately 24 weeks. The Company paid the initial deposit of Cdn$190,000, which will be applied to the last two invoices of the project. |

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

February 28, 2015

(Expressed in U.S.

dollars)

(unaudited)

| (d) |

On May 7, 2014, the Company entered into a two year office space lease commencing July 1, 2014. Pursuant to the lease, the Company is required to pay Cdn$2,683 plus taxes per month. In addition, on June 1, 2014, the Company entered into a two year office space lease commencing June 1, 2014. Pursuant to the lease, the Company is required to pay Cdn$1,240 plus taxes per month. The following is a schedule by years of future minimum lease payments under capital leases together with the present value of the minimum lease payments as of February 28, 2015: |

| Twelve month periods ending February 28: | $ | |||

| 2015 | 37,669 | |||

| 2016 | 11,565 | |||

| 49,234 |

| (e) |

On November 1, 2014, the Company’s subsidiary entered into an employment agreement. Pursuant to the agreement, the employee will perform services for a term of one year for base remuneration of $80,000 per annum. In addition, the Company granted to the employee 100,000 stock options exercisable at a price of $0.20 per share. These options are non-transferrable, vest immediately, and expire upon the earlier of 24 months, or upon termination of the employment agreements. | |

| (f) |

On November 1, 2014, the Company’s subsidiary entered into an employment agreement. Pursuant to the agreement, the employee will perform services for a term of one year for base remuneration of $86,000 per annum. In addition, the Company granted to the employee 100,000 stock options exercisable at a price of $0.20 per share. These options are non-transferrable, vest immediately, and expire upon the earlier of 24 months, or upon termination of the employment agreements. |

| 15. |

Subsequent Event |

| (a) |

On March 17, 2015, the Company granted 100,000 stock options each to three directors. The options are exercisable at $0.20 per share for a period of two years. The options vest as follows: |

| • | 75,000 options vested immediately; | |

| • | 75,000 options vest on July 17, 2015; | |

| • | 75,000 options vest on November 17, 2015; and | |

| • | 75,000 options vest on March 17, 2016. |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This Management's Discussion and Analysis of Financial Condition and Results of Operations includes a number of forward-looking statements that reflect Management's current views with respect to future events and financial performance. You can identify these statements by forward-looking words such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate” and “continue,” or similar words. Those statements include statements regarding the intent, belief or current expectations of us and members of our management team as well as the assumptions on which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risk and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the Securities and Exchange Commission. Important factors currently known to Management could cause actual results to differ materially from those in forward-looking statements. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in the future operating results over time. We believe that our assumptions are based upon reasonable data derived from and known about our business and operations. No assurances are made that actual results of operations or the results of our future activities will not differ materially from our assumptions. Factors that could cause differences include, but are not limited to, expected market demand for our products, fluctuations in pricing for materials, and competition.

Our unaudited consolidated financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States generally accepted accounting principles. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this quarterly report.

In this quarterly report, unless otherwise specified, all dollar amounts are expressed in United States dollars. All references to "US$" refer to United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this quarterly report, the terms “we”, “us”, “our” and “our company” mean Mantra Venture Group Ltd. and our wholly owned subsidiaries Carbon Commodity Corporation, Mantra China Inc., Mantra China Limited, Mantra Media Corp., Mantra NextGen Power Inc., and Mantra Wind Inc., as well as our majority owned subsidiary Climate ESCO Ltd. and Mantra Energy Alternatives Ltd., unless otherwise indicated.

Business Overview

We were incorporated in Nevada on January 22, 2007. On December 8, 2008 we continued our corporate jurisdiction out of the state of Nevada and into the Province of British Columbia, Canada. Our principal offices are located at 1562 128th Street, Surrey, British Columbia, V4A 3T7 Our Lab space is located at #202 3590 W41st Avenue, Vancouver, British Columbia V6N 3E6. Our telephone number is (604) 560-1503. Our fiscal year end is May 31.

We are building a portfolio of companies and technologies that mitigate negative environmental and health consequences that arise from the production of energy and the consumption of resources.

Our mission is to develop and commercialize alternative energy technologies and services to enable the sustainable consumption, production and management of resources on residential, commercial and industrial scales. We plan to develop or acquire technologies and services which include electrical power system monitoring technology, wind farm electricity generation, online retail of environmental sustainability solutions through a carbon reduction marketplace, and media solutions to promote awareness of corporate actions that support the environment. To carry out our business strategy we intend to acquire or license from third parties technologies that require further development before they can be brought to market. We also intend to develop such technologies ourselves, and we anticipate that to complete commercialization of some technologies we will enter into joint ventures, partnerships, or other strategic relationships with third parties who have expertise that we may require. We also plan to enter into formal relationships with consultants, contractors, retailers and manufacturers who specialize in the areas of environmental sustainability in order to carry out our online retail strategy.

We own a technology for the electro-reduction of carbon dioxide and have the exclusive global license for a mixed-reactant fuel cell. Since our inception, we have incurred operational losses and we have completed several rounds of financing to fund our operations.

We carry on our business through our subsidiary, Mantra Energy Alternatives Ltd. (“MEA”), through which we identify, acquire, develop and market technologies related to alternative energy production, greenhouse gas emissions reduction and resource consumption reduction.

We also have a number of inactive subsidiaries which we plan to engage in various business activities in the future.

Collaboration with Alstom (Switzerland) Ltd.

On June 24, 2013, MEA entered into an agreement with Alstom (Switzerland) Ltd. concerning the joint research and development projects relating to (1) a pilot plant for the conversion of carbon dioxide to formate at a Lafarge cement plant (the “Lafarge pilot project”); and (2) the development of processes for the conversion of carbon dioxide to other valuable chemicals.

Pursuant to the agreement with Alstom, MEA and Alstom will co-operate in one or more research and development projects related to MEA’s ERC technology. Prospective projects will be associated with the development of technologies and processes for the conversion of CO2 to chemical products and the investigation of the feasibility of scale-up and commercialization of these processes. Prior to undertaking any research and development project under the agreement, MEA and Alstom will mutually agree to special terms and conditions governing the purpose, aims and objectives of any such project, including technical descriptions, the designation of work phases and project managers, and the allocation of responsibilities and costs between the parties. The commencement of any work phase for any project will be at the sole discretion of Alstom.

Lafarge Pilot Project and Carbon Dioxide to Alternative Products

The agreement with Alstom will remain valid for the later of five years or the completion of the last active project, and may be extended at any time by the written agreement of both parties. The first joint research and development project under the agreement is the Lafarge pilot project, which plans for the design, construction, and installation of a pilot plant for the conversion of 100 kg/day carbon dioxide to formate, followed by a commercialization scale-up study. Alstom’s contribution to the Lafarge pilot plant project will be approximately Cdn$250,000 for in-kind services. A second integrated research and development project will study carbon dioxide conversion to alternative chemical products by electrochemical reduction, with a focus on catalyst materials and lifetime. Alstom has contributed approximately $430,750 for Phases 1 and 2 of the alternative products project, and has committed to $180,375 for Phase 3. Alstom's planned, but not committed, contribution is estimated at $35,375 for Phase 4, and the final amount for Phase 5 is yet to be determined. Mantra and Alstom are actively seeking external funding to support the execution of the projects.

Electro Reduction of Carbon Dioxide (“ERC”)

On November 2, 2007, MEA entered into a technology assignment agreement with 0798465 BC Ltd. whereby we acquired 100% ownership in and to a certain chemical process for the electro-reduction of carbon dioxide as embodied by and described in the following patent cooperation treaty application:

| Country |

Application

Number |

File Date |

Status |

| Patent Cooperation Treaty (PCT) |

W02207 | 10/13/2006 | PCT |

As of the date of this quarterly report, we have been awarded the following patents:

| Country | Patent Number | Patent Date | Name of Patent |

| India | 251493 | March 20, 2012 | “An Electrochemical Process for Reducing of Carbon Dioxide” |

| China |

ZL 2006 8 0037810.8 |

May 8, 2013 |

“Continuous Co-Current

Electrochemical Reduction of Carbon Dioxide” |

| Australia | 2012202601 | May 1, 2014 | “Continuous Co-Current Electrochemical Reduction of Carbon Dioxide” |

The reactor at the core of the chemical process, referred to as the electrochemical reduction of carbon dioxide (CO2), or ERC, has been proven functional through small scale prototype trials. ERC offers a possible solution to reduce the impact of CO2 on Earth’s environment by converting CO2 of fuel cells. Powered by electricity, the ERC process combines captured carbon dioxide with water to produce materials, such as formic acid, formate salts, oxalic acid and methanol, that are conventionally obtained from the thermo-chemical processing of fossil fuels. However, while thermo-chemical reactions must be driven at relatively high temperatures that are normally obtained by burning fossil fuels, ERC operates at near ambient conditions and is driven by electric energy that can be taken from an electric power grid supplied by hydro, wind, solar or nuclear energy. into chemicals with a broad range of commercial applications, including a fuel for a next generation

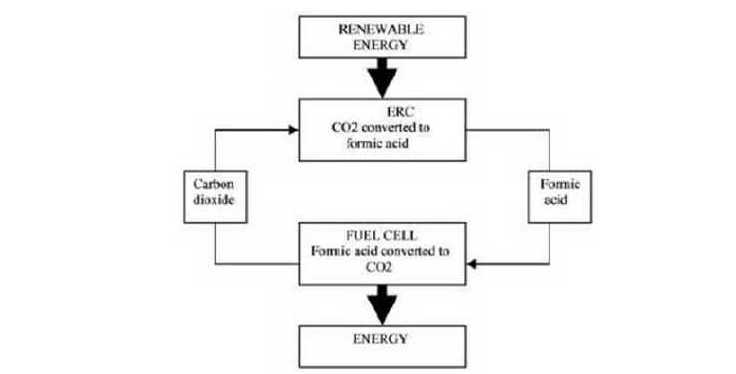

In fuel cells, liquid fuels are indirectly burned with air to form carbon dioxide and water, while generating electricity. This process is known as electrochemical combustion or electro-oxidation. The complementary nature of ERC and electro-oxidation makes it possible to use ERC in a regenerative fuel cell cycle, where carbon dioxide is converted to a fuel that is consumed in a fuel cell to regenerate carbon dioxide. As shown in the figure, the net energy input required in this cycle could be supplied from a renewable or non-fossil fuel source.

ERC has been shown to produce a range of compounds, including formic acid, formate salts, oxalic acid, and methanol. The efficiency for generation of each compound depends on the experimental conditions, most importantly the material of the cathode, which catalyzes the electrochemical reactions.

Until appropriate cathodes are found, some products of CO2 reduction (methanol, for instance) are obtained at efficiencies too low for practical use. Other products can be generated on known cathodes with high current yields that could support valuable practical processes. For example, formic acid has been obtained on tin cathodes with current yields above 80%. Formate salts and sodium bicarbonate are obtained at similarly high yields.

ERC Development to Date

Since the technology was acquired in 2008, ERC has been developed in several contracted laboratories, including Kemetco Research Inc., Powertech Labs Inc., and Tekion (Canada) Inc. In early 2013, Mantra established its own internal research and development labs and has since built a team of five Ph.D. engineers and four technical support staff to carry out the technology development.

Having improved the product selectivity, energy efficiency, and overall economics of the ERC process at the bench scale, Mantra is currently in the process of designing a pilot plant for the conversion of 100 kg/day of CO2 from industrial emissions into formic acid and formate salts. This plant will be installed at the site of the Lafarge cement plant in Richmond, British Columbia. It will serve as a technical and economical validation of the industrial process, and will be followed by the development of the first large-scale pre-commercial plant, which will likely be on the scale of converting 10 tonnes/day of CO2.

We anticipate that commercialization of ERC will require us to develop reactors capable of processing not less than 100 tons of CO2 per day; however, there is no guarantee that we will successfully produce reactors of that size. Production of commercially viable ERC reactors will depend on continued research and development, successful testing of pilot-scale ERC reactors, and securing of additional financing.

Applications for Formic Acid and Formate Salts

Formic acid and formate salts have a variety of applications in industry. Formic acid’s uses include in animal feed preservation, leather tanning, textiles production, and industrial cleaning and de-scaling. Formate salts are used as environmentally benign de-icing agents, in oil well drilling, and as heat exchange fluids. Because these chemicals are conventionally produced from natural gas, their displacement with ERC-derived formic acid/formate salts will eliminate CO2 emissions associated with their production and degradation.

Established and Emerging Market for ERC and By-Products:

The technology behind ERC can be applied to any scale commercial venture that outputs CO2 into the atmosphere. We anticipate that, once fully commercialized, we will be able to offer ERC as a CO2 management system to various industries, including steel, power generation and lumber.

The ERC products formic acid and its salts (such as potassium formate) have a market value of greater than $1,000 per pure tonne in North American and European markets, and existing applications include feedstock preservatives, de-icing solutions, and heat transfer fluids, among others. Approximately 720,000 tonnes of formic acid were produced in 2009. The market for formic acid has experienced continual growth and demand over the past several years, mainly attributed to European and developing country demand for formic acid in silage, rising raw materials, energy and logistics costs, as well as animal feed preservative and Asian demand for formic acid in leather, rubber, food and pharmaceutical industries.

However, if the ERC process reaches market acceptance as a way to deal with CO2 emissions from industry facilities, it will likely lead to supply of formic acid in excess of current market demand. We have identified several potential future applications for formic acid, which may lead to an expansion in current market demand. The application we have identified and are currently focusing on is steel pickling.

Results of Operations for the Three Month Periods Ended February 28, 2015 and February 28, 2014.

The following summary of our results of operations should be read in conjunction with our consolidated financial statements for the quarters ended February 28, 2015 and 2014, which are included herein.

Our operating results for three month periods ended February 28, 2015 and 2014 are summarized as follows:

| Difference Between | |||||||||

| Three Month Period | |||||||||

| Ended | |||||||||

| Three Months | Three Months | February 28, 2015 | |||||||

| Ended | Ended | and | |||||||

| February 28, 2015 | February 28, 2014 | February 28, 2014 | |||||||

| ($) | ($) | ($) | |||||||

| Revenue | $ | 39,116 | $ | 16,858 $ | 22,258 | ||||

| Operating expenses |

$ | 397,637 | $ | 218,553 $ | 179,084 | ||||

| Other income (expense) |

$ | (72,194 | ) | $ | (13,596 | ) $ | (58,598 | ) | |

| Net loss | $ | (430,715 | ) | $ | (215,291 | ) $ | (215,424 | ) |

Revenues

For the three months ended February 28, 2015, we generated $39,116 in revenue compared to revenue of $16,858 generated during the same period in 2014. This is a result of new projects during the three months ended February 28, 2015, compared to the three months ended February 28, 2014.

Expenses

Our operating expenses for the three month periods ended February 28, 2015 and February 28, 2014 are summarized as follows:

| Three Months Ended | ||||||

| February 28, | February 28, | |||||

| 2015 | 2014 | |||||

| ($) | ($) | |||||

| Business development | $ | 5,903 | $ | 81 | ||

| Consulting and advisory | $ | 135,735 | $ | 24,893 | ||

| Depreciation and amortization | $ | 6,846 | $ | 5,048 | ||

| Foreign exchange gain | $ | (3,397 | ) | $ | (19,588 | ) |

| General and administrative | $ | 26,363 | $ | 11,150 | ||

| Management fees | $ | 76,957 | $ | 45,564 | ||

| Professional fees | $ | 35,786 | $ | 33,231 | ||

| Public listing costs | $ | 3,855 | $ | 5,706 | ||

| Rent | $ | 17,878 | $ | 15,821 | ||

| Research and development | $ | 55,196 | $ | 91,918 | ||

| Supplies | $ | 4,732 | $ | Nil | ||

| Travel and promotion | $ | 22,278 | $ | 1,178 | ||

| Wages and benefits | $ | 9,505 | $ | 3,551 | ||

For the three months ended February 28, 2015, we incurred total operating expenses of $397,637, compared to total operating expenses for the three months ended February 28, 2014 of $218,553. The $179,084 increase in operating expense during 2014 is primarily due to an increase of $110,842 of expenses for consulting and advisory services as a result of our launching the detailed engineering phase of the Lafarge pilot project, along with a $31,393 increase in management fees expenses due to hiring additional employees for the execution of Phase 2 of the alternative products project and a $21,100 increase in travel and promotion expenses related to attendance at various trade shows in Europe, which was partially offset by a $36,722 decrease in research and development as we have more operations and less research.

Net Loss

For the three months ended February 28, 2015, we incurred a net loss of $430,715, compared to a net loss of $215,291 for the same period in 2014.

Results of Operations for the Nine Month Periods Ended February 28, 2015 and February 28, 2014.

The following summary of our results of operations should be read in conjunction with our consolidated financial statements for the nine month period ended February 28, 2015 and 2014, which are included herein.

Our operating results for the nine month periods ended February 28, 2015 and February 28, 2014 are summarized as follows:

| Difference Between | |||||||||

| Nine Month Period | |||||||||

| Ended | |||||||||

| Nine Months | Nine Months | February 28, 2015 | |||||||

| Ended | Ended | and | |||||||

| February 28, 2015 | February 28, 2014 | February 28, 2014 | |||||||

| ($) | ($) | ($) | |||||||

| Revenue | $ | 116,912 | $ | 165,262 $ | (48,350 | ) | |||

| Operating expenses |

$ | 1,764,744 | $ | 823,917 $ | 940,827 | ||||

| Other income (expense) |

$ | (110,233 | ) | $ | (52,491 | ) $ | (57,742 | ) | |

| Net loss | $ | (1,758,065 | ) | $ | (711,146 | ) $ | (1,046,919 | ) |

Revenues

For the nine months ended February 28, 2015, we generated $116,912 in revenue compared to revenue of $165,262 generated during the same period in 2014. We completed the previous phase of our current project in September 2014. We did not start the next phase of the project until the beginning of January 2015. As a result of this downtime, revenue decreased during the nine months ended February 28, 2015, compared to the nine months ended February 28, 2014.

Expenses

Our operating expenses for the nine month periods ended February 28, 2015 and February 28, 2014 are summarized as follows:

| Nine Months Ended | ||||||

| February 28, | February 28, | |||||

| 2015 | 2014 | |||||

| ($) | ($) | |||||

| Business development | $ | 21,836 | $ | 8,743 | ||

| Consulting and advisory | $ | 395,319 | $ | 121,837 | ||

| Depreciation and amortization | $ | 26,896 | $ | 17,706 | ||

| Foreign exchange loss (gain) | $ | (50,385 | ) | $ | (37,407 | ) |

| General and administrative | $ | 110,362 | $ | 56,172 | ||

| License fees | $ | 45,941 | $ | 40,000 | ||

| Management fees | $ | 192,956 | $ | 138,512 | ||

| Professional fees | $ | 105,552 | $ | 114,017 | ||

| Public listing costs | $ | 34,922 | $ | 12,821 | ||

| Rent | $ | 51,423 | $ | 39,740 | ||

| Research and development | $ | 622,605 | $ | 234,521 | ||

| Shareholder communications and awareness | $ | – | $ | 7,382 | ||

| Supplies | $ | 21,809 | $ | – | ||

| Travel and promotion | $ | 155,995 | $ | 52,086 | ||

| Wages and benefits | $ | 29,513 | $ | 17,787 | ||

For the nine months ended February 28, 2015, we incurred total operating expenses of $1,764,744, compared to total operating expenses for the nine months ended February 28, 2014 of $823,917. The $940,827 increase in operating expense is primarily due to a $388,084 increase in research and development expenses as a result of having hired additional employees performing research and development to accelerate the commercialization of our two technologies, an increase of $273,482 related to consulting and advisory services as a result of our launching the detailed engineering phase of the Lafarge pilot project, an $103,909 increase in travel and promotion expenses related to proposed projects in Europe and grant proposals, an increase of $54,444 in management fees as a result of recording $25,695 of stock-based compensation relating to a grant of stock options to a director and an increase in management fees paid to the President, and an increase of $54,190 in general and administrative expenses due to hiring of additional administrative staff. Labor costs are allocated based on the services provided by the employee. Employees performing research and development are classified as research and development costs, employees performing administrative functions are charged to general and administrative expense and salaries to management performing management services are classified as management fees.

Net Loss

For the nine months ended February 28, 2015, we incurred a net loss of $1,758,065, compared to a net loss of $711,146 for the same period in 2014.

Liquidity and Capital Resources

Working Capital

| At | At | |||||

| February 28, | May 31, | |||||

| 2015 | 2014 | |||||

| Current Assets | $ | 316,636 | $ | 1,600,174 | ||

| Current Liabilities | $ | 1,212,181 | $ | 1,252,129 | ||

| Working Capital (Deficit) | $ | (895,545 | ) | $ | 348,045 |

Cash Flows

| Nine Months | Nine Months | |||||

| Ended | Ended | |||||

| February 28, | February 28, | |||||

| 2015 | 2014 | |||||

| Net Cash Used In Operating Activities | $ | (1,110,548 | ) | $ | (444,170 | ) |

| Net Cash Used In Investing Activities | $ | (59,838 | ) | $ | (1,481 | ) |

| Net Cash Provided by Financing Activities | $ | 306,235 | $ | 420,264 | ||

| Change In Cash | $ | (864,151 | ) | $ | (25,387 | ) |