Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DAVITA INC. | d912695d8k.htm |

| EX-5.7 - EX-5.7 - DAVITA INC. | d912695dex57.htm |

| EX-4.1 - EX-4.1 - DAVITA INC. | d912695dex41.htm |

| EX-5.4 - EX-5.4 - DAVITA INC. | d912695dex54.htm |

| EX-5.1 - EX-5.1 - DAVITA INC. | d912695dex51.htm |

| EX-5.9 - EX-5.9 - DAVITA INC. | d912695dex59.htm |

| EX-5.3 - EX-5.3 - DAVITA INC. | d912695dex53.htm |

| EX-5.2 - EX-5.2 - DAVITA INC. | d912695dex52.htm |

| EX-5.6 - EX-5.6 - DAVITA INC. | d912695dex56.htm |

| EX-5.5 - EX-5.5 - DAVITA INC. | d912695dex55.htm |

| EX-5.8 - EX-5.8 - DAVITA INC. | d912695dex58.htm |

| EX-5.14 - EX-5.14 - DAVITA INC. | d912695dex514.htm |

| EX-99.1 - EX-99.1 - DAVITA INC. | d912695dex991.htm |

| EX-5.13 - EX-5.13 - DAVITA INC. | d912695dex513.htm |

| EX-5.10 - EX-5.10 - DAVITA INC. | d912695dex510.htm |

| EX-5.12 - EX-5.12 - DAVITA INC. | d912695dex512.htm |

Exhibit 5.11

April 17, 2015

DaVita HealthCare Partners Inc.

2000 16th Street

Denver, Colorado 80202

| Re: | $1,500,000,000 5.000% Senior Notes due 2025 |

Ladies and Gentlemen:

We have acted as special New Mexico counsel to Medical Group Holding Company, LLC, a New Mexico limited liability company (the “Subsidiary”) and wholly owned subsidiary of DaVita HealthCare Partners, Inc. (“DaVita”), in connection with the issuance by DaVita of $1,500,000,000 of 5.000% Senior Notes due 2025 (the “Notes”) under an indenture dated as of April 17, 2015 (the “Indenture”), among DaVita, the subsidiary guarantors named therein, including the Subsidiary (together, the “Guarantors”) and The Bank of New York Mellon Trust Company, N.A. (the “Trustee”), and the issuance by the Guarantors of the related guarantees of the Notes (the “Guarantees”).

This opinion letter is being delivered in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act of 1933, as amended (the “Act”).

In rendering the opinions expressed below, we have examined and relied upon a copy of the form of Note, the form of the notation of Guarantee and the Indenture. In connection with the opinions contained in this letter, we have also reviewed the following documents:

(i) The Certificate of Formation of the Subsidiary as filed in the office of and certified by the New Mexico Public Regulation Commission on February 23, 2007 and the Amended and Restated Operating Agreement of the Subsidiary dated September 7, 2012;

(ii). The resolution of the sole Member and Manager of the Subsidiary dated as of April 13, 2015; and

(iii) The Certificate of Good Standing issued by the Secretary of State of New Mexico dated March 23, 2015 certifying the good standing of the Subsidiary.

We have also examined originals, or copies of originals certified or otherwise identified to our satisfaction, of such agreements, documents, certificates and statements of governmental officials and of officers and representatives of the Subsidiary, and have examined such questions of law and have satisfied ourselves as to such matters of fact, as we have considered relevant and necessary as a basis for the opinions expressed below. The opinion expressed in paragraph 1 below as to the existence and good standing of the Subsidiary in the State of New Mexico is based solely upon the certificates referred to in paragraph (iii) above. As to all questions of fact, material to the opinions set forth herein, we have relied with your permission solely upon the certificates or other comparable documents of officers and representatives of the Subsidiary. We are generally not familiar with the Subsidiary’s business, records, transactions or activities. Our

knowledge of the Subsidiary’s businesses, records, transactions and activities is limited to the matters that have been brought to our attention by the officers of the Subsidiary in connection with the preparation of this letter or by those company records and agreements that were disclosed to us by the Subsidiary in response to our inquiries. While nothing has come to our attention that has led us to conclude that such information, taken as a whole, is materially inaccurate, we make no representation concerning the scope or adequacy of such review or such inquiries or concerning the accuracy or completeness of the responses to such inquiries.

We have assumed the authenticity and completeness of all documents, instruments and certificates submitted to us as originals, the genuineness of all signatures, the legal capacity of all persons signatory thereto and the conformity with the original documents of any copies thereof submitted to us for examination. We have also assumed (a) that the Indenture and the Guarantees (the “Documents”) have been duly authorized, executed and delivered by the parties thereto other than the Subsidiary; (b) that the Documents constitute legally valid and binding obligations of the parties thereto, enforceable against each of them in accordance with their respective terms; and (c) the status of the Documents as legally valid and binding obligations of the parties is not affected by any breaches of, or defaults under, agreements or instruments, or violations of statutes, rules and regulations or court or governmental orders.

Based on the foregoing, and subject to the qualifications, assumptions and limitations set forth in this letter we are of the opinion that:

1. The Subsidiary is a New Mexico limited liability company validly existing and in good standing under the laws of the State of New Mexico.

2. The Subsidiary has the requisite limited liability company power and authority to execute, deliver and perform its obligations under the Indenture and the Guarantees.

3. The Indenture has been duly authorized, executed and delivered by the Subsidiary and the Guarantee executed by the Subsidiary has been duly authorized, executed and delivered by the Subsidiary.

This letter is limited to the laws of the State of New Mexico. We express no opinion and make no statement as to the laws, rules or regulations of any other jurisdiction or any state securities or blue sky laws. The opinions contained in this letter relate to applicable New Mexico law as of the date of this letter, and we assume no obligation to revise or supplement this opinion due to any change in the law by legislative action, judicial decision or otherwise. We do not render any opinion with respect to any matters other than those expressly set forth above.

The opinions contained herein are solely for the benefit of the addressee.

With respect to each document, instrument or agreement referred to in or otherwise relevant to the opinions set forth herein (each, an “Instrument”), we have assumed, to the extent relevant to the opinions set forth herein, that (a) each party to such Instrument (if not a natural person) was duly organized or formed, as the case may be, and was at all relevant times and is validly existing and in good standing under the laws of its jurisdiction of organization or formation, as the case may be, and had at all relevant times and has full right, power and

2

authority to execute, deliver and perform its obligations under such Instrument, (b) such Instrument has been duly authorized, executed and delivered by each party thereto, and (c) such Instrument was at all relevant times and is a valid, binding and enforceable agreement or obligation, as the case may be, of, each party thereto; provided, that we make no such assumption insofar as any of the foregoing matters relate to the Subsidiary and is expressly covered by our opinion set forth in paragraphs 1 and 3 above.

We hereby consent to the filing of this opinion letter as an exhibit to DaVita’s Current Report relating to the Notes and the Guarantees and to all references to our firm included in or made a part of DaVita’s Registration Statement on Form S-3 under the Act, filed with the Securities and Exchange Commission on April 14, 2015 (File No. 333-203394). In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Act.

| Very truly yours, |

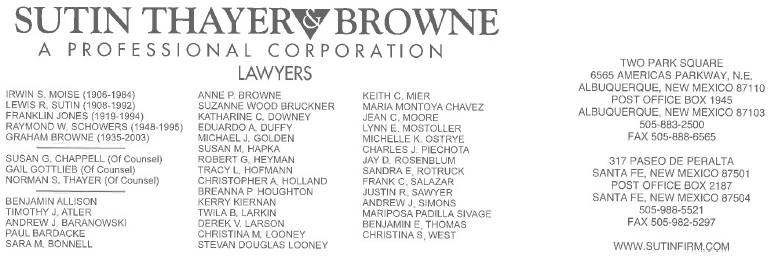

| /s/ Sutin Thayer & Browne, |

| A Professional Corporation |

| Sutin Thayer & Browne, |

| A Professional Corporation |

3