Attached files

| file | filename |

|---|---|

| EX-2.1 - SHARE EXCHANGE AGREEMENT - China Teletech Holding Inc | f8k041715a1ex2i_chinatele.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - China Teletech Holding Inc | f8k041715a1ex21i_chinatele.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment No. 1 to

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 17, 2015

CHINA TELETECH HOLDING, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Florida | 333-130937 | 59-3565377 | ||

| (State

or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS

Employer Identification No.) |

|

Bao’an District, Guanlan Area, Xintian, Jun’xin Industrial Zone Building No. 9, 10, Shenzhen, Guangdong, China |

| (Address, including zip code, of principal executive offices) |

Registrant’s telephone number, including area code (850) 521-1000

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

EXPLANATORY NOTE

This Form 8-K/A is filed as an amendment (“Amendment No. 1”) to the Current Report on Form 8-K filed by China Teletech Holding, Inc. (the “Company”) under items 1.01, 2.01, 2.02, 3.02, 5.01, 5.02, 5.06, and 9.01, on January 29, 2015 (the “Original 8-K”). Amendment No. 1 is being filed to update certain information in response to an SEC Comment Letter dated February 25, 2015.

| Item 1.01 | Entry into a Material Definitive Agreement. |

See Item 2.01, below, regarding the discussion of a Share Exchange Agreement dated as of January 28, 2015 (the “Share Exchange Agreement”), which was entered into by and among China Teletech Holding Inc., a Florida corporation (“China Teletech” or the “Company”), Shenzhen Jinke Energy Development Co., Ltd., a company organized under the laws of the People’s Republic of China (“Jinke”), and Guangyuan Liu, the holder of 97% of the equity interest of Jinke (the “Jinke Shareholder”), pursuant to which China Teletech acquired 51% of the issued and outstanding equity securities of Jinke (the “Share Exchange”). In connection with the Share Exchange, the cooperation agreement dated June 30, 2014 into which Jinke and the Company previously entered was terminated and superseded in its entirety by the Share Exchange Agreement.

Reference is made to Item 2.01 for a description of the Share Exchange Agreement and the transactions contemplated thereunder. The descriptions of the Share Exchange Agreement are qualified in their entirety by reference to the complete text of the Share Exchange Agreement, which are attached hereto as Exhibit 2.1, and are incorporated by reference herein. You are urged to read the entire Share Exchange Agreement and the other exhibits attached hereto.

The preceding summaries of the Share Exchange Agreement are qualified in their entirety by reference to the complete text of the Share Exchange Agreement, which is attached hereto as Exhibit 2.1 and incorporated by reference herein. You are urged to read the entire Share Exchange Agreement attached hereto.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

OVERVIEW

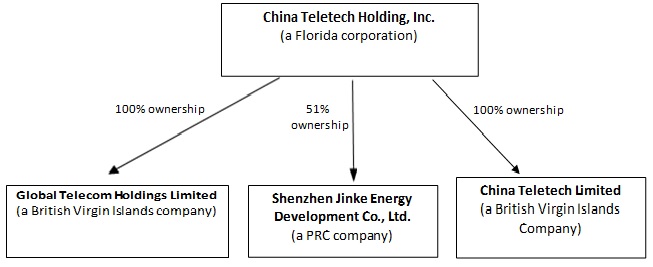

As used in this report, unless otherwise indicated, the terms “we” and the “Company” refer to China Teletech Holding Inc., a Florida corporation, its wholly-owned subsidiary Global Telecom Holdings Limited (“Global Telecom”) and 51%-owned subsidiary Jinke.

HISTORY

We were incorporated as Avalon Development Enterprises, Inc. on March 29, 1999, under the laws of the State of Florida. From inception until January 2007, we engaged in the business of acquiring commercial property and expanding into building cleaning, maintenance services, and equipment leasing as supporting ancillary services and sources of revenue. On January 10, 2007, the Company, Global Telecom Holdings, Ltd., a British Virgin Islands company ("GTHL"), and the shareholders of GTHL, entered into a share exchange agreement, pursuant to which the Company issued 39,817,500 shares of its restricted common stock to the shareholders of GTHL in exchange for all of the issued and outstanding capital stock of GTHL. Following the transaction on March 27, 2007, GTHL became our wholly-owned subsidiary and we changed our name to Guangzhou Global Telecom Holdings, Inc. and succeeded to the business of GTHL.

In 2007, we established four subsidiaries; namely, Zhengzhou Global Telecom Equipment Limited ("ZGTE"), Macau Global Telecom Company Limited ("MGT"), Huantong Telecom Hongkong Holding Limited ("HTHKH"), and Huantong Telecom Singapore Company PTE Limited ("HTS") with capital of RMB 500,000, Macau Dollar 300,000, Hong Kong Dollar 100 and Singapore Dollar 200,000, respectively. Simultaneously, we established a subsidiary; namely, Guangzhou Huantong Telecom Technology and Consultant Services, Ltd ("GHTTCS") with capital of RMB 8,155,730. Pursuant to a Stock Purchase Agreement dated April 9, 2008 and July 29, 2008, respectively, the Company acquired 50% of the issued and outstanding shares in the capital of Beijing Lihe Jiahua Technology and Trading Company Ltd ("BLJ") and 51% of the issued and outstanding shares in Guangzhou Renwoxing Telecom Co., Ltd. ("GRT"), a limited liability company incorporated in China. Pursuant to the terms of the Stock Purchase Agreements, the Shareholders agreed to sell and transfer the proportion of the shares to the Company for a purchase consideration of US$300,000 and US$291,833 respectively.

In 2009 and 2010, the Company disposed of its subsidiaries CHTTCS, ZGTE, MGT and BLJ due to their loss in operations. HTHKH and HTS were not able to commence operations since its inception, so the Company deregistered them in 2010.

Acquisition of China Teletech Limited

On March 30, 2012, the Company completed a share exchange transaction with China Teletech Limited, a British Virgin Islands corporation ("CTL"), by entering into a share exchange agreement with CTL and the former shareholders of CTL, dated March 30, 2012.

CTL is a British Virgin Islands Company, incorporated on January 30, 2008 under the British Virgin Islands Business Act 2004. Its primary business operations were concluded through two wholly owned subsidiaries located in China, namely, (a) Shenzhen Rongxin Investment Co., Ltd. ("Shenzhen Rongxin") and (b) Guangzhou Rongxin Science and Technology Limited ("Guangzhou Rongxin").

Pursuant to the agreement, we acquired all the outstanding capital stock of CTL from the former shareholders of CTL in exchange for the issuance of 40,000,000 shares of our common stock. The shares issued to the former shareholders of CTL constituted approximately 68.34% of our issued and outstanding shares of common stock as of an immediately after the commutation of the share exchange transaction. As a result of the share exchange, CTL became our wholly owned subsidiary and Dong Liu and Yuan Zhao, the former shareholders of CTL, became our principal shareholders.

In connection with the share exchange, Yankuan Li resigned as our Chief Financial Officer, Secretary and Chairman of the Board of Directors, effective as of March 30, 2012. Also effective upon closing of the share exchange, Dong Liu, Yuan Zhao, Yau Kwong Lee and Kwok Ming Wai Andrew were appointed as our directors. Ms. Yankuan Li remained President, Chief Executive Officer and a member of the board of directors of the Company. As of result of the merger, the Company believed that it could enjoy a greater management and capital resources and have a greater network and business opportunities. The Company expected to be able to expand its telecommunications business in Guangzhou and Shenzhen cities in China.

Sale of the Company's Wholly-Owned Subsidiary, Guangzhou Global Telecommunication Company Limited

On June 30, 2012, we entered into a Sales and Purchase Agreement with Mr. Zhu Sui Hui ("Mr. Hui ") pursuant to which we sold all the capital stock of Guangzhou Global Telecommunication Company Limited ("GGT"), our wholly-owned subsidiary, to Mr. Hui for RMB 5,000, or approximately $800. Both parties agreed unconditionally to waive the current accounts payable or receivable balances between the Company (and its subsidiaries) and Guangzhou Global Telecommunication Company Limited. GGT was engaged in the trading and distribution of cellular phones and accessories, prepaid calling cards, and rechargeable store-value cards.

Sale of the Company's Subsidiary, Global Telecom Holdings Limited

On June 30, 2013, the Company’s subsidiary, Global Telecom Holdings Limited, entered into an agreement with an independent third party to dispose of its 51% owned subsidiary Guangzhou Renwoxing Telecom Co., Limited for a cash consideration of US$3,232.

| 2 |

Deregistration of the Company’s Wholly-Owned Subsidiary, Guangzhou Rongxin.

On December 30, 2013, the Company had its subsidiary, Guangzhou Rongxin, deregistered due to ceased operations.

Disposition of the Company’s variable interest entity, S henzhen Rongxin Investment Co., Ltd.

On September 30, 2012, China Teletech, Limited entered into an agreement with a related party – Liu Yong, brother of Mr. Liu Dong, the Company’s former Chairman, to dispose of the variable interest entity Shenzhen Rongxin for a cash consideration of US$1,579.

Following the deregistration of the company’s subsidiaries, Guangzhou Rongxin and Guangzhou Rongxin, the company was a shell company with no operations until the Company entered into the Share Exchange Agreement with Jinke.

On January 28, 2015, China Teletech closed the Share Exchange, described below, pursuant to which Jinke became a 51% owned subsidiary.

The Company’s registration with the State of Florida lapsed on September 27, 2013 for failure to make its annual payment and file its annual reports with the State. The lapse occurred due to administrative error. As of April 15, 2015, the Company has paid the required fees and reinstated its registration with the State of Florida. No material negative impact on the operations of the Company has been identified to-date.

CORPORATE STRUCTURE

The corporate structure of the Company subsequent to the consummation of the Share Exchange is illustrated as follows:

The address of our principal executive offices and corporate offices Bao’an District, Guanlan Area, Xintian, Jun’xin Industrial Zone Building No. 9, 10, Shenzhen, Guangdong, China. Our telephone number is (850) 521-1000.

PRINCIPAL TERMS OF THE SHARE EXCHANGE

On January 28, 2015, the Company, Jinke and the Jinke Shareholder entered into a Share Exchange Agreement pursuant to which the Company agreed to issue an aggregate of 20,000,000 shares of its common stock, $0.001 par value per share (the “Common Stock”) to the Jinke Shareholder in exchange for 51% of the issued and outstanding securities of Jinke.

Both the Company and Jinke believed that the acquisition transaction is in the best interest of their respective shareholders. The Company believed that the acquisition would enhance the value of the Company through the acquisition of a majority equity interest in Jinke’s viable business, and Jinke believed that such transaction would afford Jinke access to the U.S. capital market and other possible financial resources. Prior to the execution of the Cooperation Agreement, no material relationship between the company and its affiliates, on the one hand, and Shenzhen Jinke Energy Development Co. Ltd and their affiliates, on the other,. Jinke was introduced to the Company by Ms. Chen Xiaoqiao, a PRC resident, who is a mutual business contact of Ms. Li Yankuan, the Company’s CEO and Mr. Liu Guangyuan, Jinke’s former owner. For her role in this, Ms. Chen received 1,000,000 shares of the Company’s common stock subsequent to the closing of the acquisition. Other than the foregoing, no third party played a material role in arranging or facilitating the acquisition.

Of the 20,000,000 shares to be issued by the Company, 16,000,000 were issued on October 6, 2014 and delivered prior to closing, and 4,000,000 were to be issued and delivered at closing. The Share Exchange closed on January 28, 2015. As promptly as practicable after closing, Jinke and the Jinke Shareholder agreed to obtain confirmation from the relevant PRC governmental authorities of the change in registration of ownership of Jinke to reflect the transfer of the 51% equity interest to the Company. The Company is currently processing the registration of the Company’s 51% equity interest in Jinke with the relevant PRC governmental authorities. Because the Company is a non-PRC shareholder of Jinke, it must take steps to register its foreign ownership.

| 3 |

The Company and Jinke had previously entered into a certain Cooperation Agreement on June 30, 2014. The Cooperation Agreement was superseded and replaced by the Share Exchange Agreement by and between the Company and Jinke, dated as of January 28, 2015. The parties decided to change from an asset purchase to a share purchase primarily due to the difficulty in ascertaining Jinke’s assets to be acquired based on the percentages as set forth in the previous Cooperation Agreement. In connection with the Share Exchange, the cooperation agreement dated June 30, 2014 into which Jinke and the Company previously entered, and which was first disclosed on the Company’s current report on Form 8-K filed August 8, 2014, was terminated and superseded in its entirety by the Share Exchange Agreement. The transactions contemplated by the Share Exchange were intended to be a “tax-free” reorganization pursuant to the provisions of Sections 351 and/or 368(a) of the Internal Revenue Code of 1986, as amended.

In connection with the Share Exchange, Mr. Guangyuan Liu was appointed a director of the Company, and Ms. Yankuan Li was appointed a director of Jinke. Immediately following the Share Exchange, Mr. Liu beneficially owned 15.97% of the issued and outstanding common stock of the Company, which includes shares held by Mr. Liu’s son, Liu Jiexun. However, of the 20,000,000 shares beneficially owned, 4,000,000 have not yet been issued.

Jinke is required, by the PRC government regulations discussed above, to complete and submit application documents for the purpose of establishing a joint venture from the local cooperation departments of foreign trade and economy. Jinke is now in the process of submitting these application documents.

BUSINESS

Prior to our acquisition with Jinke, we were a shell company with no operations. Additionally, there was no operation at the Company’s wholly-owned subsidiary, Global Telecom Holdings Limited, before the Share Exchange. We are currently a holding company with substantially all of our operations located in the PRC through our 51% equity ownership of Jinke. Through Jinke, we are now primarily a manufacturer of lithium-ion polymer batteries.

Established in 2006, Jinke develops and manufactures lithium-ion polymer batteries with approximately different models and specifications for a range of products. Our manufacturing facility is located in Guangdong, China, and our products are sold and distributed both domestically and internationally; approximately 48% of revenue is derived from our international sales network, with customers in North America, South Asia, the Middle East, Europe and Central America.

Industry

Rapid advancements in electronic technology in recent years have expanded the number and sophistication of battery-powered devices, which in turn have come to require increasingly higher levels of energy. This has stimulated consumer demand for higher-energy batteries capable of delivering longer period of service between recharges or battery replacement.

High energy density and long achievable cycle life are important characteristics of rechargeable battery technologies. Energy density refers to the total electrical energy per unit volume stored in a battery. High energy density batteries generally are longer lasting power sources providing longer operating time and necessitating fewer battery recharges. Greater energy density will permit the use of batteries of a given weight or volume for a longer time period. Long cycle life is a preferred feature of a rechargeable battery because it allows the user to charge and recharge many times before noticing a difference in performance. Long achievable cycle life, particularly in combination with high energy density, is desirable for applications requiring frequent battery recharges.

We believe that China has become one of the biggest producers of lithium batteries. Production plants of lithium batteries in China cluster in such provinces as Guangdong, Jiangsu, Zhejiang and Tianjin. We believe that the global lithium market underwent more significant development in 2013 than in 2012, and as such the demand for lithium batteries has increased. Additionally, China will be developing the alternative-energy automobile market as an emerging market of strategic importance, and thus we believe that lithium battery-powered automobiles will provide a bigger growth opportunity for lithium battery producers. At the same time, in markets such as electric bicycles, aerospace, and defense and military fields, lithium batteries have wide applications and thus the development of such markets may translate into good prospects for lithium battery producers.

Products

Lithium-ion batteries

Our primary source of revenue is our lithium-ion batteries, which we design and manufacture on an OEM-basis for our customers. In contrast to non-rechargeable batteries, such as those comprised of nickel cadmium or nickel-metal hydride, our lithium-ion rechargeable batteries have a higher energy density, a longer lifespan and can be recharged and reused up to 500 times. Additionally, unlike other rechargeable batteries, lithium batteries have no memory effect, meaning they can be recharged without being completely discharged, making charging quicker and more convenient, and giving lithium batteries a longer battery life than other rechargeable options. Although more expensive to manufacture than other battery options, lithium batteries are recyclable: oxidized lithium is non-toxic and can be safely extracted for use in new lithium batteries.

We generally categorize the lithium-ion batteries we produce as follows:

| ● | “small”-size batteries primarily used in digital consumer electronics products such as notebook PCs, cameras, portable media players, navigational tools and medical instruments. | |

| ● | “large”-size batteries, or high power polymer batteries, primarily used in remote-control vehicles, electrical tools and emergency power supplies. | |

| ● | “Paper” or “micro” batteries primarily used in portable devices such as smart cards, wireless devices and packaging solutions. |

| 4 |

After sales services

We offer comprehensive after-sales services to our customers to maintain their satisfaction with our products. Our professional service technicians provide 24-hour customer service relating to product quality insurance, distribution logistics, financing, and R&D improvements.

Strategy:

We intend to focus on enhancing the performance of our existing products and diversify our product line to achieve growth and capture market share. We also intend to implement a growth strategy through strategic acquisitions. Our goals are:

| ● | Improving existing battery products; |

| ● | Developing and commercializing cutting edge battery products to replace older technologies; |

| ● | Acquiring more high-tech equipment, so as to target customers seeking cutting-edge technologies that have the potential to generate higher profit margins. |

| ● | Vertically integrating our business with the manufacture of products that utilize our battery solutions; and |

| ● | Achieving cost efficiencies and economies of scale. |

We are continually developing new battery products to expand our market reach. Products in development include series connection batteries, parallel connection batteries, batteries for medical devices, high voltage batteries with voltages of 3.85v-4.35v, which higher voltages can turn on machines more quickly. Our manufacturing capability has matured, is ISO 9001 certified.

Paper batteries

Paper batteries are composed of carbon nanotubes that flank a sheet of cellulose-based spacer. They are flexible, ultra-thin and, unlike conventional chemical batteries that contain corrosive materials, relatively environmentally friendly. Due to their light and thin construction, paper batteries can be used in portable devices such as smart cards, wireless devices and packaging solutions. Paper batteries are able to utilize electrolytes in the blood and therefore are ideal for use in disposable medical devices such as transdermal pharmaceutical and cosmetic patches as well as implantable medical devices like pacemakers.

Jinke primarily manufactures its paper batteries for use in smartcards, but these batteries have the potential to be used in a range of thin digital devices. Current challenges to the development of paper battery segment are high production costs of the carbon nanotubes and the low shear strength of the paper component, which limits the battery’s durability.

Raw Materials

The primary raw materials used in our products are Lithium cobaltate, graphite, aluminium plastic film, electrolytes, and separators.

During the fiscal year 2014, Jinke’s top five principal suppliers are all based in China, and includes, Hunan Bingbing New Material Ltd., Shenzheng Sinuo Development Ltd., Xinxiang Zhongke Technology Ltd., Rishang Youse Trade (Shanghai) Ltd., Huizhou Tianjiaolilai Development Ltd.

| 5 |

We depend on a limited number of suppliers for certain key raw materials and components used in manufacturing and developing our power systems. We have undertaken efforts to diversify our supplier base for certain key raw materials and components. We plan to continue to diversify our supplier base for certain materials and components in the future, as appropriate. We generally purchase raw materials pursuant to purchase orders placed from time to time.

Manufacturing

Our manufacturing operations are conducted in the Junxin Industrial Zone, Shenzhen, Guangdong, China. We have a total of 6 production lines in an approximately 11,531 sq. meter facility. We provide OEM manufacturing, design and labeling services.

Our design and manufacture of lithium polymer battery is ISO 9001 certified. We have received several accreditations, including The International Organization for Standardization (ISO) 9001: 2008, Certificate of Conformity by Guangzhou Testing and Inspection Institute for Household Electrical Appliances, PONY Testing International Group, and Underwriters Laboratories Inc. (UL), attesting to our quality design, manufacture, manufacturing safety, controls, procedures and environmental performance.

Major Customers

Jinke had approximately RMB 23,000,000 worth of sales in 2013 and approximately RMB 15,000,000 in the first nine months of 2014 from its top five customers combined.

Based upon total sales, include the following customers are greater than 10%: Shanghai Sand Information Technology System Co., Ltd, Dahao Information Technology (Weihai) Co., Ltd, Shenzhen Shunmeng Science and Technology Co., Ltd, Shenzhen Daitian, Electronic Science and Technology Co., Ltd, and Suqian Zhongmao Battery Co., Ltd.

Sales to our customers are based primarily on purchase orders we receive, generally on a quarterly basis, rather than firm, long-term purchase commitments from our customers. These customers have been Jinke’s customers for two or three years. Generally, the customers will send quarterly sales orders for Jinke to fulfill. We also employ a rigorous customer screening policy to optimize the collectability and duration of each customer relationship. Before filling an order, Jinke evaluates each purchase order for the customer’s financial condition and potential market share.

Sales and Marketing

Our consolidated advertising and marketing efforts will be focused on building our business with middle and upper tier customers. Our sales force makes up a significant portion of our current marketing expenses. Approximately 80% of our revenue is derived from our in-house sales force, and approximately 20% is derived from contractors.

Research and Development

We spent approximately RMB 4-5 million in each of the last two years. Generally, 30% of the research and development cost is passed on to our customers. For example, in the event that we do not have a product model that meets a customer’s specifications, we will develop a new model to meet their needs. Where any intellectual property developed for new model is to be owned by Jinke, approximately 30% of development costs is passed on to customers. Where any intellectual property developed for the new model is to be owned by the customer, approximately 40% of development costs is passed on to such customer.

Competition

We face competition from many other battery manufacturers, many of which have significantly greater name recognition and financial, technical, manufacturing, personnel and other resources than we have. We compete against other lithium-ion polymer battery producers, as well as manufacturers of all different types of (rechargeable and non-rechargeable) batteries. Our primary competitors are the following: Hong Kong Highpower Technology, Inc., Mbell Technology Groups, Shenzhen SJY Energy Technology Co., Ltd, and Shenzheng Mottcell Battery Technology Co., Ltd. These primary competitors have production equipment that is more high-end than Jinke’s, and therefore can produce more sophisticated products. However, we believe that Jinke has a competitive advantage over these competitors because Jinke is able to cover a larger market base, in both B2B and B2C markets.

| 6 |

Seasonality

The battery market is subject to some seasonal variation. In the Chinese market, April to July are weaker months, as well as the weeks leading up to the Chinese New Year.

Intellectual Property

We rely on a combination of patent and trade secret protection and other unpatented proprietary information to protect our intellectual property rights and to maintain and enhance our competitiveness in the battery industry. We hold eight (8) patents in China relating to our products, expiring in 2021 and 2022. One of the patents is held by Liu Guangyuan and another company employee, serial number ZL 2011 2 0185568.7. There is no contract between the Company on the one hand, and Liu Guangyuan and this other company employee on the other hand, for the use of this patent by the Company. We believe there is limited risk in losing access to these patents since Liu Guangyuan, one of the patent-holders has ownership stake in the Company and is unlikely to prohibit the company’s use of this patent. All of these patents are utility patents that cover our batteries and their production methods, battery testing devices, as well as battery components. Additionally, we have eight (8) patents applications pending in China. We also have one registered trademark in China, which include “Golden Energy” and its Chinese equivalent, expiring on September 27, 2020.

PRC Government Regulations

We require a number of approvals, licenses and certificates in order to operate our business. Our principal approvals, licenses and certificates are set forth below.

Business License

Any company that conducts business in the PRC must have a business license that covers the scope of the business in which such company is engaged. Following the Share Exchange, we conduct our business through our operating subsidiary, Jinke. Each of our operating subsidiaries holds a business license that covers its present business. Prior to expanding our business beyond the scope covered by our business licenses, we are required to apply and receive approvals from the relevant PRC authorities (if applicable, based on the new business in which we intend to engage) and conduct modification registration formalities with the competent administration of industry and commerce. Companies that operate outside the scope of their licenses can be subjected to a fine of not more than RMB20,000, if such operations do not violate the PRC Criminal Law, or a fine of not less than RMB20,000 but no more than RMB200,000 if such operations violate the PRC Criminal Law, or a fine of not less than RMB50,000 but not more than RMB500,000 if the such operations harm human health, have serious hidden hazards to safety, threaten public safety or destroy environmental resources. Other penalties can include disgorgement of income and being ordered to cease operations. We have a Business License issued on January 16, 2006 by Shenzhen Administration for Industry and Commerce, and the scope of the licnse is manufacturing, R&D, sales of polymer li-ion batteries, electronic products (MP3, MP4) and related components, import and export of goods and technology.

We also hold a Certificate of High Technology Enterprise, expiring on July 21, 2016.

Environmental Regulations

The major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution. We aim to comply with environmental laws and regulations and have acquired an Approval Permit of Manufacturing Project Environmental Impact from the Shenzhen Bao’an District Environmental Protection and Water Affairs Bureau, which is valid until September 15, 2015, and renewable on an annual basis. Additionally, on July 22, 2011, we were issued a permit of waste water disposal into Junzibu River for the waste water generated in our manufacture process.

If we fail to comply with the provisions of the permits, we could be subject to fines, criminal charges or other sanctions by regulators, including the suspension or termination of our manufacturing operations.

| 7 |

Our operating subsidiaries have received certifications from the relevant PRC government agencies in charge of environmental protection, which indicate that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We have committed significant attention and efforts to quality and environmental protection during our production process. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws. We do not believe the existence of these environmental laws, as currently written and interpreted, will materially hinder or adversely affect our business operations; however, there can be no assurances of future events or changes in laws, or the interpretation of laws, governing our industry. Failure to comply with PRC environmental protection laws and regulations may subject us to fines up to RMB1,000,000, the exact amount of which is determined on a case by case basis, or disrupt our operations and the construction of our new facility, result in the shutdown of our operations temporarily or permanently, which may materially and adversely affect our business, results of operations and financial condition.

During the year ended December 31, 2013, we expended approximately RMB300,000 related to our compliance with environmental regulations.

Patent Protection in China

The PRC’s intellectual property protection regime is consistent with those of other modern industrialized countries. The PRC has domestic laws for the protection of rights in copyrights, patents, trademarks and trade secrets. The PRC is also a signatory to most of the world’s major intellectual property conventions, including:

| ● | Convention establishing the World Intellectual Property Organization (WIPO Convention) (June 4, 1980); |

| ● | Paris Convention for the Protection of Industrial Property (March 19, 1985); |

| ● | Patent Cooperation Treaty (January 1, 1994); and |

| ● | The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) (November 11, 2001). |

Patents in the PRC are governed by the China Patent Law and its Implementing Regulations, each of which went into effect in 1985. Amended versions of the China Patent Law and its Implementing Regulations came into effect in 2001 and 2003, respectively.

The PRC is signatory to the Paris Convention for the Protection of Industrial Property, in accordance with which any person who has duly filed an application for a patent in one signatory country shall enjoy, for the purposes of filing in the other countries, a right of priority during the period fixed in the convention (12 months for inventions and utility models, and 6 months for industrial designs).

The Patent Law covers three kinds of patents, i.e., patents for inventions, utility models and designs respectively. The Chinese patent system adopts the principle of first to file. This means that, where more than one person files a patent application for the same invention, a patent can only be granted to the person who first filed the application. Consistent with international practice, the PRC only allows the patenting of inventions or utility models that possess the characteristics of novelty, inventiveness and practical applicability. For a design to be patentable, it should not be identical with or similar to any design which, before the date of filing, has been publicly disclosed in publications in the country or abroad or has been publicly used in the country, and should not be in conflict with any prior right of another.

PRC law provides that anyone wishing to exploit the patent of another must conclude a written licensing contract with the patent holder and pay the patent holder a fee. One rather broad exception to this, however, is that, where a party possesses the means to exploit a patent but cannot obtain a license from the patent holder on reasonable terms and in reasonable period of time, the PRC State Intellectual Property Office, or SIPO, is authorized to grant a compulsory license. A compulsory license can also be granted where a national emergency or any extraordinary state of affairs occurs or where the public interest so requires. SIPO, however, has not granted any compulsory license up to now. The patent holder may appeal such decision within three months from receiving notification by filing a suit in a people’s court.

| 8 |

PRC law defines patent infringement as the exploitation of a patent without the authorization of the patent holder. A patent holder who believes his patent is being infringed may file a civil suit or file a complaint with a PRC local Intellectual Property Administrative Authority, which may order the infringer to stop the infringing acts. Preliminary injunction may be issued by the People’s Court upon the patentee’s or the interested parties’ request before instituting any legal proceedings or during the proceedings. Evidence preservation and property preservation measures are also available both before and during the litigation. Damages in the case of patent infringement is calculated as either the loss suffered by the patent holder arising from the infringement or the benefit gained by the infringer from the infringement. If it is difficult to ascertain damages in this manner, damages may be reasonably determined in an amount ranging from one to more times of the license fee under a contractual license. The infringing party may be also fined by Administration of Patent Management in an amount of up to three times the unlawful income earned by such infringing party. If there is no unlawful income so earned, the infringing party may be fined in an amount of up to RMB500,000, or approximately $81,981.

Product Liability and Consumers Protection

Product liability claims may arise if the products sold have any harmful effect on the consumers. The injured party may make a claim for damages or compensation. The General Principles of the Civil Law of the PRC, which became effective in January 1987, state that manufacturers and sellers of defective products causing property damage or injury shall incur civil liabilities for such damage or injuries.

The Product Quality Law of the PRC was enacted in 1993 and amended in 2000 to strengthen the quality control of products and protect consumers’ rights and interests. Under this law, manufacturers and distributors who produce or sell defective products may be subject to confiscation of earnings from such sales, revocation of business licenses and imposition of fines, and in severe circumstances, may be subject to criminal liability.

The Law of the PRC on the Protection of the Rights and Interests of Consumers was promulgated on October 31, 1993 and became effective on January 1, 1994 to protect consumers’ rights when they purchase or use goods or services. All business operators must comply with this law when they manufacture or sell goods and/or provide services to customers.

The Tort Law of the PRC effective on July 1, 2010 requires that when the product defect endangers people’s life or property, the injured party may hold the producer or the seller liable in tort and require that it remove obstacles, eliminate danger, or take other action. The Tort Law also requires that when a product is found to be defective after it is put into circulation, the producer and the seller shall give timely warnings, recall the defective product, or take other remedial measures.

Employment Laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, and social insurance, housing funds and other welfare. These include local labor laws and regulations, which may require substantial resources for compliance.

China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract. The National Labor Contract Law has enhanced rights for the nation’s workers, including permitting open-ended labor contracts and severance payments. The legislation requires employers to provide written contracts to their workers, restricts the use of temporary labor and makes it harder for employers to lay off employees. It also requires that employees with fixed-term contracts be entitled to an indefinite-term contract after a fixed-term contract is renewed once or the employee has worked for the employer for a consecutive ten-year period.

| 9 |

Tax

Pursuant to the Provisional Regulation of China on Value Added Tax and their implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay VAT at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to a portion of or all the refund of VAT that it has already paid or borne.

Foreign Currency Exchange

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations promulgated by the State Council, as amended on August 5, 2008, or the Foreign Exchange Regulations. Under the Foreign Exchange Regulations, the Renminbi is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investments, loans, repatriation of investments and investments in securities outside of China, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce, the SAFE and the State Reform and Development Commission.

Dividend Distributions

Under applicable PRC regulations, enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, enterprises in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year as its statutory general reserves until the accumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

Jinke would have been able to distribute as dividends in 2013 and 2014 to the Company as Jinke’s 51% equity owner. But Jinke experienced operating loss in 2013 and the first nine months of 2014, therefore, no dividend was distributed. If Jinke did not experience operating loss in 2013, and in 2014, Jinke would have provided 50% of its profit to its shareholders on a pro rata basis. Therefore, the company, as Jinke’s 51% equity owner, would have received 51% of the 50% profit distributed as dividend.

Properties

Our manufacturing operations are conducted in the Junxin Industrial Zone, Shenzhen, China. We have a total of 6 production lines in an approximately 11,531 sq. meter facility. The manufacturing facilities are leased and will not expire until 2017.

We believe that our current facilities are adequate and suitable for our operations.

Employees

As of January 1, 2015, we had 290 employees, all of whom are full time. None of our employees are covered by a collective bargaining agreement. We have not experienced any work stoppages and we consider our relations with our employees to be good.

Legal Proceedings

On October 9, 2014, Dong Liu, the Chairman of the Board of Directors of the Company, commenced an action individually and on behalf of the Company, against Yankuan Li, the Company’s President, Chief Executive Officer and director, Jiewen Li, Yuan Zhao, a director of the Company, and Jane Yu, the Company’s Chief Financial Officer and Secretary. In this action, Dong Liu v. Yankuan Li et al., New York County Supreme Court, Index No. 653084/2014 , Dong Liu asserted claims sounding in fraud, civil conspiracy to commit fraud, breach of fiduciary duty and unjust enrichment.

Mr. Liu never served the complaint on the individual defendants. Instead, on November 3, 2014, Dong Liu, by order to show cause, moved for a temporary restraining order and preliminary injunction to enjoin the Company from proceeding with a merger with Jinke, granting Dong Liu unfettered access to the Company’s books and records and permitting him to serve the individual defendants by a method other than those permitted by the New York State Civil Practice and Laws or the Hague Convention on Service Abroad of Judicial and Extrajudicial Documents in Civil and Commercial Matters. On November 6, 2014, the New York Supreme Court denied the temporary restraining order and set up a briefing schedule to determine the preliminary injunction.

On February 18, 2015, the court issued a decision denying Dong Liu’s motion for a preliminary injunction and granting the defendants’ motion by dismissing the complaint without prejudice. Since that time, plaintiff has made no effort to re-plead the case or challenge the ruling. Under New York court rules, plaintiff’s time to re-argue the motion or serve notice to appeal has expired.

Except as described above, Jinke is not involved in any material legal proceedings outside of the ordinary course of its business.

| 10 |

RISK FACTORS

In addition to the other information contained and referred to in this report, you should consider carefully the following factors when evaluating our business. Any of these risks, or the occurrence of any of the events described in these risk factors, could cause our actual future results, performance or achievements to be materially different from or could materially adversely affect our business, financial condition or results of operations. In addition, other risks or uncertainties not presently known to us or that we currently do not deem material could arise, any of which could also materially adversely affect us.

RISKS RELATED TO OUR BUSINESS

Our business depends in large part on the growth in demand for portable electronic devices.

Many of our battery products are used to power various portable electronic devices. Therefore, the demand for our batteries is substantially tied to the market demand for portable electronic devices. A growth in the demand for portable electronic devices will be essential to the expansion of our business. Our results of operations may be adversely affected by decreases in the general level of economic activity. Decreases in consumer spending that may result from the current global economic downturn may weaken demand for items that use our battery products. A decrease in the demand for portable electronic devices would likely have a material adverse effect on our results of operations. We are unable to predict the duration and severity of the current disruption in financial markets and the global adverse economic conditions and the effect such events might have on our business.

Our success depends on the success of manufacturers of the end applications that use our battery products.

Because our products are designed to be used in other products, our success depends on whether end application manufacturers will incorporate our batteries in their products. Although we strive to produce high quality battery products, there is no guarantee that end application manufacturers will accept our products. Our failure to gain acceptance of our products from these manufacturers could result in a material adverse effect on our results of operations.

Additionally, even if a manufacturer decides to use our batteries, the manufacturer may not be able to market and sell its products successfully. The manufacturer’s inability to market and sell its products successfully could materially and adversely affect our business and prospects because this manufacturer may not order new products from us. Therefore, our business, financial condition, results of operations and future success would be materially and adversely affected.

We are and will continue to be subject to declining average selling prices of consumer electronic devices, which may harm our results of operations.

Portable consumer electronic devices, such as cellular phones, DVD players, laptop computers and tablets are subject to rapid declines in average selling prices due to rapidly evolving technologies, industry standards and consumer preferences. Therefore, electronic device manufacturers expect suppliers, such as our company, to cut their costs and lower the price of their products to lessen the negative impact on the electronic device manufacturer’s own profit margins. As a result, we have previously reduced the price of some of our battery products and expect to continue to face market-driven downward pricing pressures in the future. Our results of operations will suffer if we are unable to offset any declines in the average selling prices of our products by developing new or enhanced products with higher selling prices or gross profit margins, increasing our sales volumes or reducing our production costs.

Our success is highly dependent on continually developing new and advanced products, technologies, and processes and failure to do so may cause us to lose our competitiveness in the battery industry and may cause our profits to decline.

To remain competitive in the battery industry, it is important to continually develop new and advanced products, technologies, and processes. There is no assurance that competitors’ new products, technologies, and processes will not render our existing products obsolete or non-competitive. Alternately, changes in legislative, regulatory or industry requirements or in competitive technologies may render certain of our products obsolete or less attractive. Our competitiveness in the battery market therefore relies upon our ability to enhance our current products, introduce new products, and develop and implement new technologies and processes. We predominately manufacture and market Li-polymer batteries. If our competitors develop alternative products with more enhanced features than our products, our financial condition and results of operations would be materially and adversely affected.

| 11 |

The research and development of new products and technologies is costly and time consuming, and there are no assurances that our research and development of new products will either be successful or completed within anticipated timeframes, if at all. Our failure to technologically evolve and/or develop new or enhanced products may cause us to lose competitiveness in the battery market and may cause our profits to decline. In addition, in order to compete effectively in the battery industry, we must be able to launch new products to meet our customers’ demands in a timely manner. However, we cannot provide assurance that we will be able to install and certify any equipment needed to produce new products in a timely manner, or that the transitioning of our manufacturing facility and resources to full production under any new product programs will not impact production rates or other operational efficiency measures at our manufacturing facility. In addition, new product introductions and applications are risky, and may suffer from a lack of market acceptance, delay in related product development and failure of new products to operate properly. Any failure by us successfully to launch new products, or a failure by our customers to accept such products, could adversely affect our operating results.

We have historically depended on a limited number of customers for a significant portion of our revenues and this dependence is likely to continue

We have historically depended on a limited number of customers for a significant portion of our net sales. Our top five customers accounted for approximately 73.67% and 45.51% of our net sales for the year ended December 31, 2013 and the nine months ended September 30, 2014, respectively. One customer, Shanghai Sand Information Technology System Co., Ltd., accounted for 25.63% and 23.85% of our net sales for the year ended December 31, 2013 and the nine months ended September 30, 2014, respectively. We anticipate that a limited number of customers will continue to contribute to a significant portion of our net sales in the future. Maintaining the relationships with these significant customers is vital to the expansion and success of our business, as the loss of a major customer could expose us to risk of substantial losses. Our sales and revenue could decline and our results of operations could be materially adversely affected if one or more of these significant customers stops or reduces its purchasing of our products, or if we fail to expand our customer base for our products.

Significant order cancellations, reductions or delays by our customers could materially adversely affect our business.

Our sales are typically made pursuant to individual purchase orders, and although we have a long term relationship with many of our customers, we generally do not formalize any long-term supply arrangements with our customers, but instead work with our customers to develop nonbinding forecasts of future requirements. Based on these forecasts, we make commitments regarding the level of business that we will seek and accept, the timing of production schedules and the levels and utilization of personnel and other resources. A variety of conditions, both specific to each customer and generally affecting each customer’s industry, may cause customers to cancel, reduce or delay orders that were either previously made or anticipated. Generally, customers may cancel, reduce or delay purchase orders and commitments without penalty, except for payment for services rendered or products competed and, in certain circumstances, payment for materials purchased and charges associated with such cancellation, reduction or delay. Significant or numerous order cancellations, reductions or delays by our customers could have a material adverse effect on our business, financial condition or results of operations.

Substantial defaults by our customers on accounts receivable or the loss of significant customers could have a material adverse effect on our business.

A substantial portion of our working capital consists of accounts receivable from customers. Six (6) customers represented more than of 10% of our accounts receivable as of December 31, 2013. If customers responsible for a significant amount of accounts receivable were to become insolvent or otherwise unable to pay for products and services, or to make payments in a timely manner, our business, results of operations or financial condition could be materially adversely affected. An economic or industry downturn could materially adversely affect the servicing of these accounts receivable, which could result in longer payment cycles, increased collection costs and defaults in excess of management’s expectations. A significant deterioration in our ability to collect on accounts receivable could also impact the cost or availability of financing available to us.

| 12 |

A change in our product mix may cause our results of operations to differ substantially from the anticipated results in any particular period.

Our overall profitability may not meet expectations if our products, customers or geographic mix are substantially different than anticipated. Our profit margins vary among our battery and new materials products, our customers and the geographic markets in which we sell our products. Consequently, if our mix of any of these is substantially different from what is anticipated in any particular period, our profitability could be lower than anticipated.

Certain disruptions in supply of and changes in the competitive environment for raw materials integral to our products may adversely affect our profitability.

We use a broad range of materials and supplies, including metals, chemicals and other electronic components in our products. A significant disruption in the supply of these materials could decrease production and shipping levels, materially increase our operating costs and materially adversely affect our profit margins. Shortages of materials or interruptions in transportation systems, labor strikes, work stoppages, war, acts of terrorism or other interruptions to or difficulties in the employment of labor or transportation in the markets in which we purchase materials, components and supplies for the production of our products, in each case may adversely affect our ability to maintain production of our products and sustain profitability. If we were to experience a significant or prolonged shortage of critical components from any of our suppliers and could not procure the components from other sources, we would be unable to meet our production schedules for some of our key products and to ship such products to our customers in timely fashion, which would adversely affect our sales, margins and customer relations.

Our future operating results may be affected by fluctuations in costs of raw materials, such as lithium.

Our principal raw material is lithium, which is available from a limited number of suppliers in China. The price of lithium was volatile during 2012 and 2013 and could be volatile again. The price of lithium decreased approximately 10% over the course of 2012 and 2013. The prices of lithium and other raw materials used to make our batteries increase and decrease due to factors beyond our control, including general economic conditions, domestic and worldwide demand, labor costs or problems, competition, import duties, tariffs, energy costs, currency exchange rates and those other factors described under “Certain disruptions in supply of and changes in the competitive environment for raw materials integral to our products may adversely affect our profitability.” In an environment of increasing prices for lithium and other raw materials, competitive conditions may impact how much of the price increases we can pass on to our customers and to the extent we are unable to pass on future price increases in our raw materials to our customers, our financial results could be adversely affected.

Our operations would be materially adversely affected if third-party carriers were unable to transport our products on a timely basis.

All of our products are shipped through third party carriers. If a strike or other event prevented or disrupted these carriers from transporting our products, other carriers may be unavailable or may not have the capacity to deliver our products to our customers. If adequate third party sources to ship our products are unavailable at any time, our business would be materially adversely affected.

We may not be able to increase our manufacturing output in order to maintain our competitiveness in the battery industry.

We believe that our ability to provide cost-effective products represents a significant competitive advantage over our competitors. In order to continue providing such cost-effective products, we must maximize the efficiency of our production processes and increase our manufacturing output to a level that will enable us to reduce the unit production cost of our products. Our ability to increase our manufacturing output is subject to certain significant limitations, including:

| ● | Our ability raise capital to acquire additional raw materials and expand our manufacturing facilities; |

| ● | Delays and cost overruns, due to increases in raw material prices and problems with equipment vendors; |

| 13 |

| ● | Delays or denial of required approvals and certifications by relevant government authorities; |

| ● | Diversion of significant management attention and other resources; and |

| ● | Failure to execute our expansion plan effectively. |

If we are not able to increase our manufacturing output and reduce our unit production costs, we may be unable to maintain our competitive position in the battery industry. Moreover, even if expand our manufacturing output, we may not be able to generate sufficient customer demand for our products to support our increased production output.

The market for our products and services is very competitive and, if we cannot effectively compete, our business will be harmed.

The market for our products and services is very competitive and subject to rapid technological change. Many of our competitors are larger and have significantly greater assets, name recognition and financial, personnel and other resources than we have. As a result, our competitors may be in a stronger position to respond quickly to potential acquisitions and other market opportunities, new or emerging technologies and changes in customer requirements. We cannot assure that we will be able to maintain or increase our market share against the emergence of these or other sources of competition. Failure to maintain and enhance our competitive position could materially adversely affect our business and prospects.

Our business may be adversely affected by a global economic downturn, in addition to the continuing uncertainties in the financial markets.

The global economy experienced a pronounced economic downturn in previous years. Global financial markets have and may in the future experience disruptions, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, and uncertainty about economic stability. There is no assurance that there will not be deterioration in the global economy in the future, the global financial markets and consumer confidence. If economic conditions deteriorate, our business and results of operations could be materially and adversely affected.

Additionally, sales of consumer items such as portable electronic devices, have slowed in previous years and there have been adverse changes in employment levels, job growth, consumer confidence and interest rates. Our future results of operations may experience substantial fluctuations from period to period as a consequence of these factors, and such conditions and other factors affecting consumer spending may affect the timing of orders. Thus, any economic downturns generally would have a material adverse effect on our business, cash flows, financial condition and results of operations.

Moreover, the inability of our customers and suppliers to access capital efficiently, or at all, may have other adverse effects on our financial condition. For example, financial difficulties experienced by our customers or suppliers could result in product delays; increase accounts receivable defaults; and increase our inventory exposure. The inability of our customers to borrow money to fund purchases of our products reduces the demand for our products and services and may adversely affect our results from operations and cash flow. These risks may increase if our customers and suppliers do not adequately manage their business or do not properly disclose their financial condition to us.

Although we believe we have adequate liquidity and capital resources to fund our operations internally, in light of current market conditions, our inability to access the capital markets on favorable terms, or at all, may adversely affect our financial performance. The inability to obtain adequate financing from debt or capital sources could force us to self-fund strategic initiatives or even forego certain opportunities, which in turn could potentially harm our performance.

| 14 |

Maintaining and expanding our manufacturing operations requires significant capital expenditures, and our inability or failure to maintain and expand our operations would have a material adverse impact on our market share and ability to generate revenue.

We had capital expenditures of approximately RMB4 million and RMB2 million in the years ended December 31, 2013 and 2012, respectively. We may incur significant additional capital expenditures as a result of our expansion of our operations into our new production factory, as well as unanticipated events, regulatory changes and other events that impact our business. If we are unable or fail to adequately maintain our manufacturing capacity or quality control processes or adequately expand our production capabilities, we could lose customers and there could be a material adverse impact on our market share and our ability to generate revenue.

Warranty claims, product liability claims and product recalls could harm our business, results of operations and financial condition.

Our business inherently exposes us to potential warranty and product liability claims, in the event that our products fail to perform as expected or such failure of our products results, or is alleged to result, in bodily injury or property damage (or both). Such claims may arise despite our quality controls, proper testing and instruction for use of our products, either due to a defect during manufacturing or due to the individual’s improper use of the product. In addition, if any of our designed products are or are alleged to be defective, then we may be required to participate in a recall of them.

Existing PRC laws and regulations do not require us to maintain third party liability insurance to cover product liability claims. Although we have obtained products liability insurance, if a warranty or product liability claim is brought against us, regardless of merit or eventual outcome, or a recall of one of our products is required, such claim or recall may result in damage to our reputation, breach of contracts with our customers, decreased demand for our products, costly litigation, additional product recalls, loss of revenue, and the inability to commercialize some products. Additionally, our insurance policy imposes a ceiling for maximum coverage and high deductibles and we may be unable to obtain sufficient amounts from our policy to cover a product liability claim. We may not be able to obtain any insurance coverage for certain types of product liability claims, as our policy excludes coverage of certain types of claims. In such cases, we may still incur substantial costs related to a product liability claim, which could adversely affect our results of operations.

Manufacturing or use of our battery products may cause accidents, which could result in significant production interruption, delay or claims for substantial damages.

Our batteries, especially lithium batteries, can pose certain safety risks, including the risk of fire. While we implement stringent safety procedures at all stages of battery production that minimize such risks, accidents may still occur. Any accident, regardless of where it occurs, may result in significant production interruption, delays or claims for substantial damages caused by personal injuries or property damages.

We cannot guarantee the protection of our intellectual property rights and if infringement of our intellectual property rights occurs, including counterfeiting of our products, our reputation and business may be adversely affected.

To protect the reputation of our products, we have sought to file or register intellectual property, as appropriate, in the PRC where we have our primary business presence. As of December 31, 2013, we have registered one trademark as used on our battery products. There is no assurance that there will not be any infringement of our brand name or other registered trademarks or counterfeiting of our products in the future, in China or elsewhere. Should any such infringement and/or counterfeiting occur, our reputation and business may be adversely affected. We may also incur significant expenses and substantial amounts of time and effort to enforce our trademark rights in the future. Such diversion of our resources may adversely affect our existing business and future expansion plans.

| 15 |

As of December 31, 2013, we held 8 Chinese patents and had 8 Chinese patent applications pending. We believe that obtaining patents and enforcing other proprietary protections for our technologies and products have been and will continue to be very important in enabling us to compete effectively. However, there can be no assurance that our pending patent applications will issue, or that we will be able to obtain any new patents, in China or elsewhere, or that our or our licensors’ patents and proprietary rights will not be challenged or circumvented, or that these patents will provide us with any meaningful competitive advantages. Furthermore, there can be no assurance that others will not independently develop similar products or will not design around any patents that have been or may be issued to us or our licensors. Failure to obtain patents in certain foreign countries may materially adversely affect our ability to compete effectively in those international markets. If a sufficiently broad patent were to be issued from a competing application in China or elsewhere, it could have a material adverse effect upon our intellectual property position in that particular market.

In addition, our rights to use the licensed proprietary technologies of our licensors depends on the timely and complete payment for such rights pursuant to license agreements between the parties; failure to adhere to the terms of these agreements could result in the loss of such rights and could materially and adversely affect our business.

If our products are alleged to or found to conflict with patents that have been or may be granted to competitors or others, our reputation and business may be adversely affected.

Rapid technological developments in the battery industry and the competitive nature of the battery products market make the patent position of battery manufacturers subject to numerous uncertainties related to complex legal and factual issues. Consequently, although we either own or hold licenses to certain patents in the PRC, and are currently processing several additional patent applications in the PRC, it is possible that no patents will issue from any pending applications or that claims allowed in any existing or future patents issued or licensed to us will be challenged, invalidated, or circumvented, or that any rights granted there under will not provide us adequate protection. As a result, we may be required to participate in interference or infringement proceedings to determine the priority of certain inventions or may be required to commence litigation to protect our rights, which could result in substantial costs. Further, other parties could bring legal actions against us claiming damages and seeking to enjoin manufacturing and marketing of our products for allegedly conflicting with patents held by them. Any such litigation could result in substantial cost to us and diversion of effort by our management and technical personnel. If any such actions are successful, in addition to any potential liability for damages, we could be required to obtain a license in order to continue to manufacture or market the affected products. There can be no assurance that we would prevail in any such action or that any license required under any such patent would be made available on acceptable terms, if at all. Failure to obtain needed patents, licenses or proprietary information held by others may have a material adverse effect on our business. In addition, if we were to become involved in such litigation, it could consume a substantial portion of our time and resources. Also, with respect to licensed technology, there can be no assurance that the licensor of the technology will have the resources, financial or otherwise, or desire to defend against any challenges to the rights of such licensor to its patents.

We rely on trade secret protections through confidentiality agreements with our employees, customers and other parties; the breach of such agreements could adversely affect our business and results of operations.

We rely on trade secrets, which we seek to protect, in part, through confidentiality and non-disclosure agreements with our employees, customers and other parties. There can be no assurance that these agreements will not be breached, that we would have adequate remedies for any such breach or that our trade secrets will not otherwise become known to or independently developed by competitors. To the extent that consultants, key employees or other third parties apply technological information independently developed by them or by others to our proposed projects, disputes may arise as to the proprietary rights to such information that may not be resolved in our favor. We may be involved from time to time in litigation to determine the enforceability, scope and validity of our proprietary rights. Any such litigation could result in substantial cost and diversion of effort by our management and technical personnel.

The failure to manage growth effectively could have an adverse effect on our employee efficiency, product quality, working capital levels, and results of operations.

Any significant growth in the market for our products or our entry into new markets may require and expansion of our employee base for managerial, operational, financial, and other purposes. As of January 1, 2015, we had approximately 290 full-time employees. During any growth, we may face problems related to our operational and financial systems and controls, including quality control and delivery and service capacities. We would also need to continue to expand, train and manage our employee base. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees.

| 16 |

Aside from increased difficulties in the management of human resources, we may also encounter working capital issues, as we will need increased liquidity to finance the purchase of raw materials and supplies, development of new products, and the hiring of additional employees. For effective growth management, we will be required to continue improving our operations, management, and financial systems and control. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on our profitability. We cannot assure investors that we will be able to timely and effectively meet that demand and maintain the quality standards required by our existing and potential customers.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and operational and technical expertise of certain key personnel. Each of the named executive officers performs key functions in the operation of our business. The loss of a significant number of these employees could have a material adverse effect upon our business, financial condition, and results of operations.

We are dependent on a technically trained workforce and an inability to retain or effectively recruit such employees could have a material adverse effect on our business, financial condition and results of operations.

We must attract, recruit and retain a sizeable workforce of technically competent employees to develop and manufacture our products and provide service support. Our ability to implement effectively our business strategy will depend upon, among other factors, the successful recruitment and retention of additional highly skilled and experienced engineering and other technical and marketing personnel. There is significant competition for technologically qualified personnel in our business and we may not be successful in recruiting or retaining sufficient qualified personnel consistent with our operational needs.

Our planned expansion into new and existing international markets poses additional risks and could fail, which could cost us valuable resources and affect our results of operations.

We are expanding sales of our products into new and existing international markets including developing and developed countries, such as Europe and the Americas. These markets are untested for our products and we face risks in expanding the business overseas, which include differences in regulatory product testing requirements, intellectual property protection (including patents and trademarks), taxation policy, legal systems and rules, marketing costs, fluctuations in currency exchange rates and changes in political and economic conditions.

Adverse capital and credit market conditions may significantly affect our ability to meet liquidity needs, access to capital and cost of capital.

The capital and credit markets have previously experienced extreme volatility and disruption, including, among other things, extreme volatility in securities prices, severely diminished liquidity and credit availability, ratings downgrades of certain investments and declining valuations of others. Governments have taken unprecedented actions intended to address extreme market conditions that have included severely restricted credit and declines in real estate values. In some cases, the markets have exerted downward pressure on availability of liquidity and credit capacity for certain issuers. While historically these conditions have not impaired our ability to utilize our current credit facilities and finance our operations, there can be no assurance that there will not be deterioration in financial markets and confidence in major economies such that our ability to access credit markets and finance our operations might be impaired. Without sufficient liquidity, we may be forced to curtail our operations and any planned expansion. Adverse market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to operate and grow our business. As such, we may be forced to delay raising capital or bear an unattractive cost of capital which could decrease our profitability and significantly reduce our financial flexibility. The tightening of credit in financial markets could adversely affect the ability of our customers to obtain financing for purchases of our products and could result in a decrease in or cancellation of orders for our products. Our results of operations, financial condition, cash flows and capital position could be materially adversely affected by disruptions in the financial markets.