Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMERICA INC /NEW/ | cma-20150331xform8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - COMERICA INC /NEW/ | cma-20150331ex991.htm |

Comerica Incorporated First Quarter 2015Financial Review April 17, 2015 2 Safe Harbor Statement Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities LitigationReform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,”“outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,”“outcome,” “continue,” “remain,” “maintain,” “on course,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words andsimilar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as theyrelate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated onthe beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of thispresentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives ofComerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures ofeconomic performance, including statements of profitability, business segments and subsidiaries, estimates of credit trends and global stability.Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks anduncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual resultscould differ materially from those discussed. Factors that could cause or contribute to such differences are changes in general economic, politicalor industry conditions; changes in monetary and fiscal policies, including changes in interest rates; changes in regulation or oversight; Comerica'sability to maintain adequate sources of funding and liquidity; the effects of more stringent capital or liquidity requirements; declines or otherchanges in the businesses or industries of Comerica's customers, including the energy industry; operational difficulties, failure of technologyinfrastructure or information security incidents; reliance on other companies to provide certain key components of business infrastructure; factorsimpacting noninterest expenses which are beyond Comerica's control; changes in the financial markets, including fluctuations in interest rates andtheir impact on deposit pricing; changes in Comerica's credit rating; unfavorable developments concerning credit quality; the interdependence offinancial service companies; the implementation of Comerica's strategies and business initiatives; Comerica's ability to utilize technology toefficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financialinstitutions within Comerica's markets; changes in customer behavior; any future strategic acquisitions or divestitures; management's ability tomaintain and expand customer relationships; management's ability to retain key officers and employees; the impact of legal and regulatoryproceedings or determinations; the effectiveness of methods of reducing risk exposures; the effects of terrorist activities and other hostilities; theeffects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes, fires, droughts and floods; changes in accountingstandards and the critical nature of Comerica's accounting policies. Comerica cautions that the foregoing list of factors is not exclusive. Fordiscussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and ExchangeCommission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the yearended December 31, 2014. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to updateforward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements aremade. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor forforward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

3 Financial Summary $ in millions, except per share data ● n/a – not applicable ● 1Basel III capital rules (standardized approach) became effective for Comerica on 1/1/15. The ratio reflects transitional treatment for certain regulatory deductions and adjustments. Capitalratios for prior periods are based on Basel I rules. ● 2See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures. ● 3Estimated ● 4Including the $44MM impact of accounting presentation of a card program. 1Q15 4Q14 1Q14 Diluted income per common share $0.73 $0.80 $0.73 Net interest income $413 $415 $410 Loan accretion 3 9 12 Provision for credit losses 14 2 9 Noninterest income4 256 225 208 Noninterest expenses4 460 419 406 Net income 134 149 139 Total average loans $48,151 $47,361 $45,075 Total average deposits 56,990 57,760 52,770 Basel III common equity Tier 1 capital ratio1 10.43%3 n/a n/a Tier 1 common capital ratio1,2 n/a 10.50% 10.58% Average diluted shares (millions) 182 184 187 4 First Quarter 2015 Results $ in millions, except per share data ● n/m – not meaningful ● 1Q15 compared to 4Q14 ● 1Excluding the $44MM impact of accounting presentation of a card program. The Corporation believes this information will assist investors, regulators, management and others in comparing results to prior quarters. ● 2EPS based on diluted income per share. ● 3See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures. ● 4Shares repurchased under the equity repurchase program. 1Q15 Change From4Q14 1Q14Total average loans 48,151 790 3,076 Total average deposits 56,990 (770) 4,220 Net interest income 413 (2) 3 Loan accretion 3 (6) (9) Provision for credit losses 14 12 5 Noninterest income 256 n/m n/m Excl. impact of acct. presentation1 212 (13) 4 Noninterest expenses 460 n/m n/m Excl. impact of acct. presentation1 416 (3) 10 Net income 134 (15) (5) Earnings per share (EPS)2 0.73 (0.07) -- Tangible Book Value Per Share3 38.47 0.75 1.97 Shares repurchased4 1.4MM shares or $59MM Key QoQ Performance Drivers Strong average loan growth across all markets & most businesses Net interest income relatively stable Credit quality remains strong Excluding $44MM impact of change in accounting presentation of a card program: • Noninterest income lower due to lower derivative activity & commercial lending fees • Expenses decline with lower occupancy expense offset by seasonally higher compensation Share repurchases4, combined with dividends, returned $95 million to shareholders

5 Diverse Footprint Drives Growth $ in billions 10.4 11.0 11.1 11.3 11.5 1Q14 2Q14 3Q14 4Q14 1Q15 Average Loans 10.9 10.7 10.6 10.8 11.1 1Q14 2Q14 3Q14 4Q14 1Q15 Average Deposits 14.8 15.4 15.5 15.8 16.2 1Q14 2Q14 3Q14 4Q14 1Q15 Average Loans 14.8 15.4 16.4 18.0 16.8 1Q14 2Q14 3Q14 4Q14 1Q15 Average Deposits 13.5 13.5 13.3 13.2 13.3 1Q14 2Q14 3Q14 4Q14 1Q15 Average Loans 20.6 20.7 21.2 21.6 21.7 1Q14 2Q14 3Q14 4Q14 1Q15 Average Deposits +11% +1% +9% +14% +5% -2% +2% +2% +3% -7% +1% +1% 6 Broad-based Loan GrowthLoan Yields Relatively Stable 1Q15 compared to 4Q14 ● 1Utilization of commercial commitments as a percentage of total commercial commitments at period-end. Total Loans($ in billions) 45.1 46.7 47.2 47.4 48.2 48.6 49.1 3.39 3.31 3.22 3.22 3.19 1Q14 2Q14 3Q14 4Q14 1Q15 4Q14 1Q15 Loan Yields Average Balances Period-end Total average loans increased $790MM, or 2%+ $208MM Energy+ $178MM Tech. & Life Sciences+ $145MM National Dealer+ $135MM General Middle Market+ $ 52MM Small BusinessPeriod-end loans grew $479MM Commitments stable at $56.6B Line utilization1 of 50%, up from 49% Loan pipeline increasedLoan yields:- 5 bps lower accretion+6 bps 4Q14 lease residual charge- 3 bps lower nonaccrual interest & prepayment fees- 1 bps other loan portfolio dynamics

7 Average Deposits Decline Following Robust 4Q14Period-end Balances Relatively Stable 1Interest costs on interest-bearing deposits ● 21Q15 compared to 4Q14 ● 3At 3/31/15 Average Balances Period-end Strong Deposit Base($ in billions) 52.8 53.4 55.2 57.8 57.0 57.5 57.6 0.15 0.15 0.15 0.15 0.15 1Q14 2Q14 3Q14 4Q14 1Q15 4Q14 1Q15 Deposit Rates1 Total average deposits decreased $770MM2: Noninterest-bearing deposits decreased $807MM to $26.7B Interest-bearing deposits stable at $30.3B About 2/3 of total deposits are commercial Loan to Deposit Ratio3 of 85% 8 Securities Portfolio At 3/31/15 ● 1Estimated as of 3/31/15. Excludes auction rate securities (ARS). ● 2Net unrealized pre-tax gain on the available-for-sale (AFS) portfolio. Securities Portfolio: Duration of 3.6 years1 • Extends to 4.5 years under a 200 bps instantaneous rate increase1 Net unrealized pre-tax gain of $128MM2 Net unamortized premium of $45MM GNMA about 27% of MBS portfolio Purchased ~$500MM in Treasury Securities (late in 4Q14) 8.9 9.0 9.0 9.0 9.1 9.2 9.3 9.3 9.4 9.4 9.4 9.9 10.1 10.1 2.42 2.35 2.29 2.27 2.26 1Q14 2Q14 3Q14 4Q14 1Q15 4Q14 1Q15 Other (Incl. Treasury Securities)Mortgage-backed Securities (MBS)MBS Yield Securities Portfolio($ in billions) Average Balances Period-end

9 Net Interest Income Relatively StableLoan Volume Offset by 2 Fewer Days in 1Q15 11Q15 compared to 4Q14 ● 2For standard model assumptions see slide #16. Estimate is based on simulation modeling analysis. 12 10 3 9 3 410 416 414 415 413 2.77 2.78 2.67 2.57 2.64 1Q14 2Q14 3Q14 4Q14 1Q15 Accretion NIM Net Interest Income($ in millions) Net Interest Income and Rate NIM1: $415MM 4Q14 2.57% -7-6-4 +7+6 Loan impacts:Two fewer days in 1Q15Loan accretionLower prepayment fees &nonaccrual interest Lease residual value adj. (4Q)Loan growth ---0.04-0.02 +0.05-- +2 Securities impacts -0.01 +1 Deposit impacts -- -1 Lower balances at the Fed +0.09 $413MM 1Q15 2.64% +200 bps rate rise = ~$220MM2 Estimated increase to net interest income over 12 months 10 Continued Strong Credit QualityProvision of $14MM At 3/31/15 ● 1Criticized loans are consistent with regulatory defined Special Mention, Substandard, Doubtful and Loss loan classifications. ● 2Loans related to energy at 3/31/15 included approximately $3.6B of loans in our Energy business line & approximately $750MM loans in other businesses that have a sizable portion of their revenue related to energy or could be otherwise disproportionately negatively impacted by prolonged low oil and gas prices. 2,139 2,188 2,094 1,893 2,067 0.76 0.75 0.75 0.62 0.59 1Q14 2Q14 3Q14 4Q14 1Q15 NPAs as a Percentage of Total Loans + ORE Net Loan Charge-offs($ in millions) Criticized Loans1($ in millions) 594 591 592 594 601 1.8 1.7 1.7 2.1 2.2 1Q14 2Q14 3Q14 4Q14 1Q15 NPL Coverage 12 9 3 1 8 10 8 3 1 7 1Q14 2Q14 3Q14 4Q14 1Q15 NCO Ratio Closely monitoring Energy business line, as well as energy-related exposure2 At this point in the cycle, energy portfolio continues to perform well Increased reserve allocation for energy exposure (including qualitative component) Energy (In basis points) Allowance for Loan Losses($ in millions)

11 Noninterest IncomeImpacted by a Change in Accounting Presentation of a Card Program 1Q15 compared to 4Q14 ● Excluding the impact of a change in accounting presentation of a card program, noninterest income would have decreased by $13MM. 44208 220 215 225 256 1Q14 2Q14 3Q14 4Q14 1Q15 Impact of change in accountingpresentation of a card program Noninterest Income ($ in millions) Noninterest income: +$44MM Impact of a change in accounting presentation of a card program (previously presented revenues net of expenses) - $7MM Customer Derivative Income, reflecting a few large transactions in 4Q14 - $4MM Commercial Lending Fees, reflecting a seasonal decline post robust year-end activity 12 Noninterest ExpensesImpacted by a Change in Accounting Presentation of a Card Program 1Q15 compared to 4Q14 ● Excluding the impact of accounting presentation of a card program, noninterest expenses would have decreased by $3MM. Noninterest expenses: +$44MM Impact of a change in accounting presentation of a card program - $8MM Occupancy expense, primarily reflecting a real estate optimization charge taken in 4Q14 & several discrete 1Q15 items - $3MM Consulting expense +$8MM Salaries & benefits expense: + Annual stock compensation + Seasonally higher payroll taxes+ Pension- 2 Fewer days - Seasonally lower healthcare 44406 404 397 419 460 1Q14 2Q14 3Q14 4Q14 1Q15 Impact of change in accountingpresentation of a card program Noninterest Expenses($ in millions)

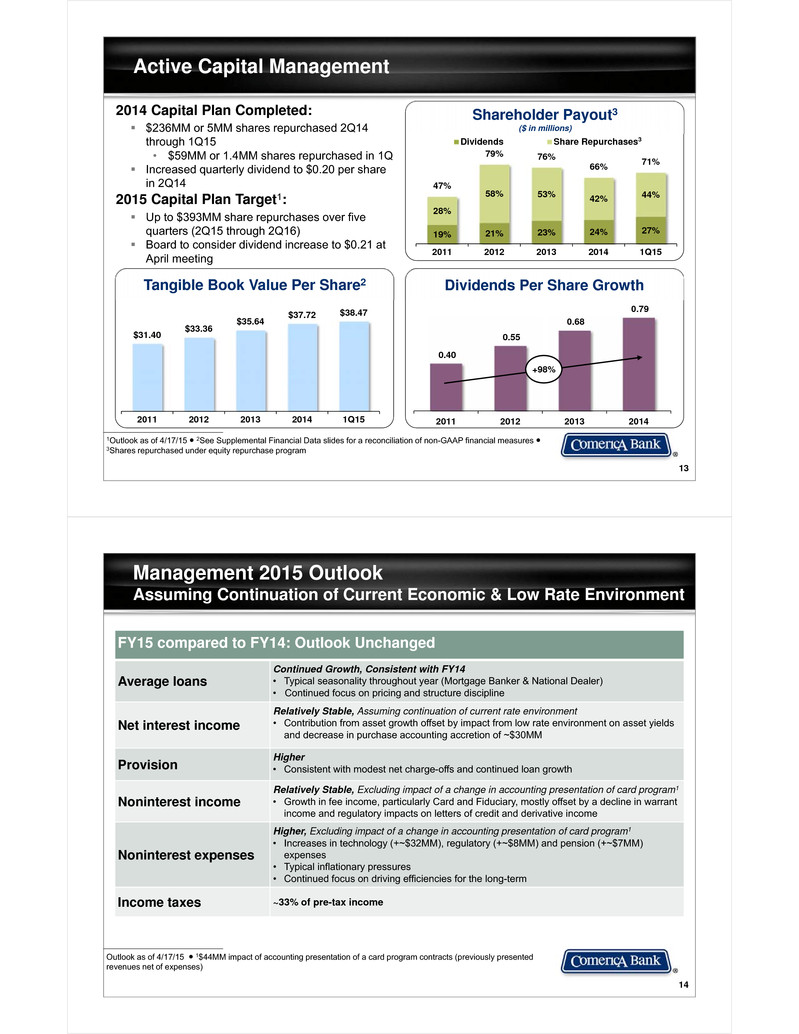

13 19% 21% 23% 24% 27% 28% 58% 53% 42% 44%47% 79% 76% 66% 71% 2011 2012 2013 2014 1Q15 Dividends Share Repurchases Active Capital Management 1Outlook as of 4/17/15 ● 2See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures ●3Shares repurchased under equity repurchase program Shareholder Payout3($ in millions)2014 Capital Plan Completed: $236MM or 5MM shares repurchased 2Q14 through 1Q15 • $59MM or 1.4MM shares repurchased in 1Q Increased quarterly dividend to $0.20 per share in 2Q14 2015 Capital Plan Target1: Up to $393MM share repurchases over five quarters (2Q15 through 2Q16) Board to consider dividend increase to $0.21 at April meeting Dividends Per Share Growth 0.40 0.55 0.68 0.79 2011 2012 2013 2014 +98% 3 $31.40 $33.36 $35.64 $37.72 $38.47 2011 2012 2013 2014 1Q15 Tangible Book Value Per Share2 14 Management 2015 OutlookAssuming Continuation of Current Economic & Low Rate Environment Outlook as of 4/17/15 ● 1$44MM impact of accounting presentation of a card program contracts (previously presented revenues net of expenses) FY15 compared to FY14: Outlook Unchanged Average loans Continued Growth, Consistent with FY14 • Typical seasonality throughout year (Mortgage Banker & National Dealer)• Continued focus on pricing and structure discipline Net interest income Relatively Stable, Assuming continuation of current rate environment• Contribution from asset growth offset by impact from low rate environment on asset yields and decrease in purchase accounting accretion of ~$30MM Provision Higher• Consistent with modest net charge-offs and continued loan growth Noninterest income Relatively Stable, Excluding impact of a change in accounting presentation of card program1• Growth in fee income, particularly Card and Fiduciary, mostly offset by a decline in warrant income and regulatory impacts on letters of credit and derivative income Noninterest expenses Higher, Excluding impact of a change in accounting presentation of card program1• Increases in technology (+~$32MM), regulatory (+~$8MM) and pension (+~$7MM) expenses• Typical inflationary pressures• Continued focus on driving efficiencies for the long-term Income taxes ~33% of pre-tax income

Appendix 16 Interest Rate SensitivityRemain Well Positioned for Rising Rates At 3/31/15 ● For methodology see the Company’s Form 10K, as filed with the SEC and as updated by this slide. Estimates are based on simulation modeling analysis. Estimated Net Interest Income: Annual (12 month) SensitivitiesBased on Various AssumptionsAdditional Scenarios are Relative to 1Q15 Standard Model($ in millions) ~110 ~190 ~200 ~210 ~220 ~260 ~320 Up 100bps Addl. $3BDepositDecline Addl.20%Increasein Beta Addl. $1BDepositDecline 1Q15StandardModel Addl.~3%LoanGrowth Up 300bps 0.1 Interest Rates 200 bps gradual, non-parallel rise Loan Balances Modest increase Deposit Balances Modest decrease Deposit Pricing (Beta) Historical price movements with short-term rates Securities Portfolio Increased for LCR compliance Loan Spreads Held at current levels MBS Prepayments Third-party projections and historical experience Hedging (Swaps) No additions modeled Standard Model Assumptions

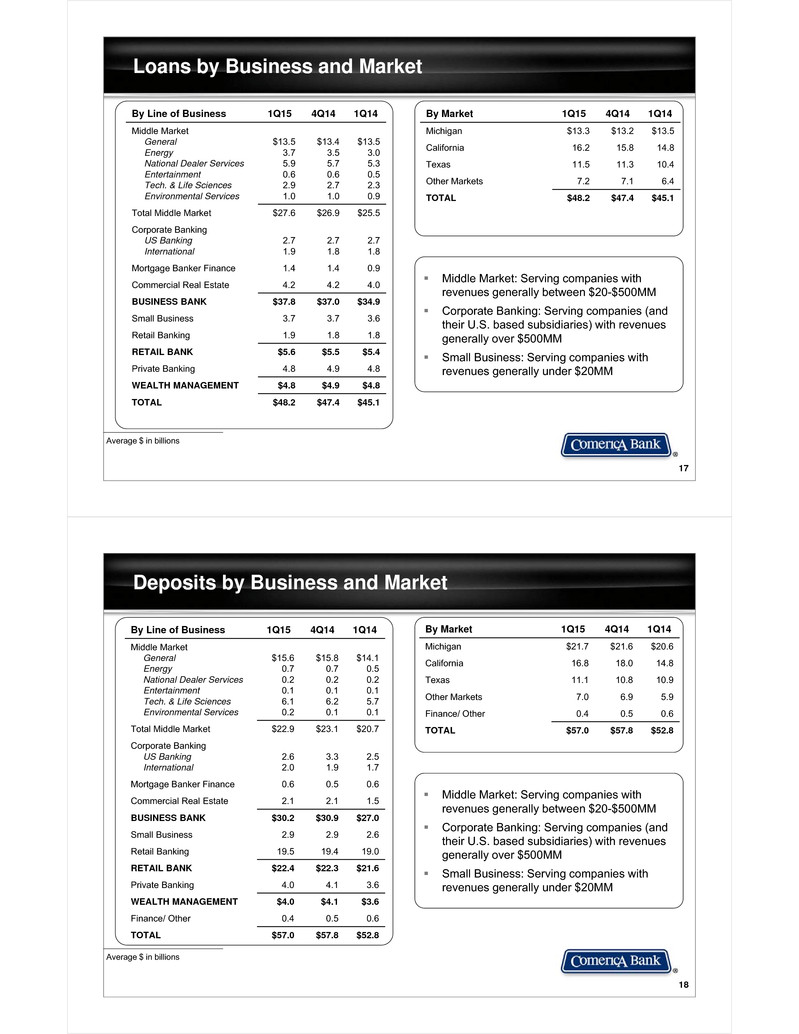

17 Loans by Business and Market Average $ in billions Middle Market: Serving companies with revenues generally between $20-$500MM Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM Small Business: Serving companies with revenues generally under $20MM By Line of Business 1Q15 4Q14 1Q14 Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services $13.53.75.90.62.91.0 $13.43.55.70.62.71.0 $13.53.05.30.52.30.9 Total Middle Market $27.6 $26.9 $25.5 Corporate BankingUS BankingInternational 2.71.9 2.71.8 2.71.8 Mortgage Banker Finance 1.4 1.4 0.9 Commercial Real Estate 4.2 4.2 4.0 BUSINESS BANK $37.8 $37.0 $34.9 Small Business 3.7 3.7 3.6 Retail Banking 1.9 1.8 1.8 RETAIL BANK $5.6 $5.5 $5.4 Private Banking 4.8 4.9 4.8 WEALTH MANAGEMENT $4.8 $4.9 $4.8 TOTAL $48.2 $47.4 $45.1 By Market 1Q15 4Q14 1Q14 Michigan $13.3 $13.2 $13.5 California 16.2 15.8 14.8 Texas 11.5 11.3 10.4 Other Markets 7.2 7.1 6.4 TOTAL $48.2 $47.4 $45.1 18 Deposits by Business and Market Average $ in billions Middle Market: Serving companies with revenues generally between $20-$500MM Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM Small Business: Serving companies with revenues generally under $20MM By Line of Business 1Q15 4Q14 1Q14 Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services $15.60.70.20.16.10.2 $15.80.70.20.16.20.1 $14.10.50.20.15.70.1 Total Middle Market $22.9 $23.1 $20.7 Corporate BankingUS BankingInternational 2.62.0 3.31.9 2.51.7 Mortgage Banker Finance 0.6 0.5 0.6 Commercial Real Estate 2.1 2.1 1.5 BUSINESS BANK $30.2 $30.9 $27.0 Small Business 2.9 2.9 2.6 Retail Banking 19.5 19.4 19.0 RETAIL BANK $22.4 $22.3 $21.6 Private Banking 4.0 4.1 3.6 WEALTH MANAGEMENT $4.0 $4.1 $3.6 Finance/ Other 0.4 0.5 0.6 TOTAL $57.0 $57.8 $52.8 By Market 1Q15 4Q14 1Q14 Michigan $21.7 $21.6 $20.6 California 16.8 18.0 14.8 Texas 11.1 10.8 10.9 Other Markets 7.0 6.9 5.9 Finance/ Other 0.4 0.5 0.6 TOTAL $57.0 $57.8 $52.8

19 Energy Line of Business At 3/31/15 Granular portfolio: ~200 customers 30+ years experience with strong performance through cycles $3.6B in loans at period-end 3/31/15, unchanged from 12/31/14 Utilization rate of 50% (vs 49% at 12/31/14) ~95% of loans have security Semi-annual borrowing base re-determinations about 45% complete at 4/15/15 Average Loans($ in millions) 1,81 1 1,65 6 1,46 9 1,32 7 1,29 6 1,14 9 1,19 6 1,26 9 1,42 3 1,45 6 1,63 5 1,94 7 2,30 5 2,45 2 2,64 1 2,85 1 3,00 2 2,95 1 2,89 5 2,75 2 2,98 2 3,23 6 3,33 2 3,49 2 3,70 0 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 0 0 0 0 36 69 19 10 13 6 0 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 20141Q15 Strong Credit Quality(In basis points) Energy Net Charge-offs to Avg. Energy Loans Exploration & Production 70%Midstream15% Service15% Natural Gas 10% Oil42% Mixed18% Diverse Customer Base(Based on period-end outstandings) 20 Mortgage Banker Finance At 3/31/15 40+ years’ experience with reputation for consistent, reliable approach Provide short-term warehouse financing: bridge from origination of residential mortgage until sale into end market Extensive backroom provides collateral monitoring and customer service Focus on full banking relationships Average Deposits($ in millions) 360 481 52 3 551 6 37 513 372 399 4 41 454 49 7 62 5 645 665 643 566 565 516 516 526 55 5 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 425 707 943 1 ,101 566 61 4 923 1,53 5 1,48 3 1,50 7 1,99 6 2,09 4 1,73 7 1,81 5 1,60 5 1,10 9 886 1,31 9 1,59 5 1,39 7 1,39 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 Average Loans($ in millions)

21 National Dealer Services At 3/31/15 ● 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans) Toyota/Lexus15% Honda/Acura 13% Ford 8% GM 9% Chrysler 9% Mercedes 3% Nissan/ Infiniti 8%Other European 11% Other Asian 13% Other111% Franchise Distribution(Based on period-end loan outstandings) Geographic DispersionCalifornia 62% Texas 9%Michigan 18% Other 11% Average Loans($ in billions) 65+ years of Floor Plan lending, with 20+ years on a national basis Top tier strategy Focus on “Mega Dealer” (five or more dealerships in group) Strong credit quality Robust monitoring of company inventory and performance 1.9 1.7 1.3 1.5 1.9 2.3 2.3 2.5 2.8 3.1 2.9 3.2 3.2 3.5 3.2 3.4 3.5 3.8 3.6 3.1 3.4 3.8 4.3 4.3 4.6 4.9 5.1 4.9 5.3 5.3 5.7 5.5 5.7 5.9 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 Floor Plan 22 Technology and Life Sciences At 3/31/15 20+ year history Products and services tailored to meet the needs of emerging companies throughout their lifecycle Strong relationships with top-tier investors National business headquartered in Palo Alto, CA, operating from 14 offices in the U.S. and Toronto Top notch relationship managers with extensive industry expertise Average Loans($ in billions) 1.1 1.1 1.1 1.2 1.2 1.2 1. 3 1.5 1.6 1.7 1 .8 1.9 2.0 1.9 2.0 2. 1 2.3 2. 5 2.6 2.7 2 .9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 3.3 3.4 3.3 3.5 3. 7 4.1 4.2 4.4 4 .7 5.1 5.2 5.2 5.0 5.0 5.1 5.2 5 .7 5.6 5.9 6 .2 6.1 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 Average Deposits($ in billions)

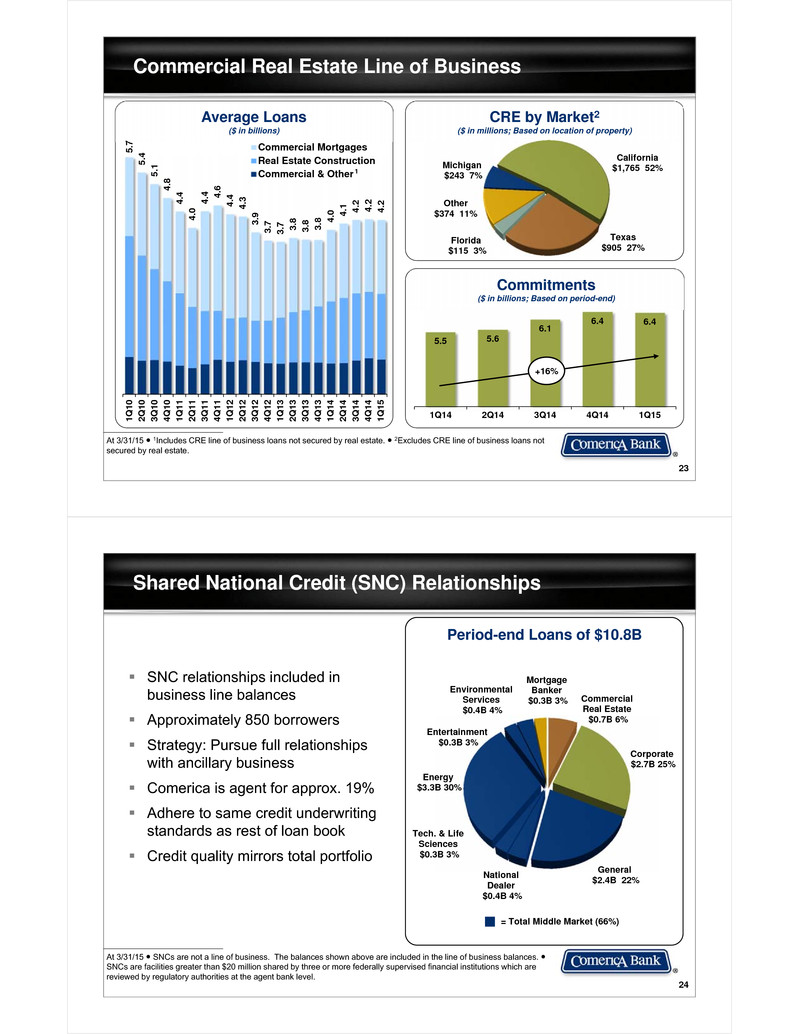

23 Commercial Real Estate Line of Business At 3/31/15 ● 1Includes CRE line of business loans not secured by real estate. ● 2Excludes CRE line of business loans not secured by real estate. 5.7 5.4 5.1 4.8 4.4 4.0 4.4 4.6 4.4 4.3 3.9 3.7 3.7 3.8 3.8 3.8 4 .0 4.1 4.2 4.2 4.2 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 Commercial MortgagesReal Estate ConstructionCommercial & Other Average Loans($ in billions) 5.5 5.6 6.1 6.4 6.4 1Q14 2Q14 3Q14 4Q14 1Q15 Commitments($ in billions; Based on period-end) +16% 1 Michigan$243 7% California$1,765 52% Texas$905 27%Florida$115 3% Other$374 11% CRE by Market2($ in millions; Based on location of property) 24 Shared National Credit (SNC) Relationships At 3/31/15 ● SNCs are not a line of business. The balances shown above are included in the line of business balances. ●SNCs are facilities greater than $20 million shared by three or more federally supervised financial institutions which are reviewed by regulatory authorities at the agent bank level. SNC relationships included in business line balances Approximately 850 borrowers Strategy: Pursue full relationships with ancillary business Comerica is agent for approx. 19% Adhere to same credit underwriting standards as rest of loan book Credit quality mirrors total portfolio Period-end Loans of $10.8B Commercial Real Estate$0.7B 6% Corporate $2.7B 25% General$2.4B 22%National Dealer $0.4B 4% Energy$3.3B 30% Entertainment$0.3B 3% Tech. & Life Sciences$0.3B 3% Environmental Services $0.4B 4% Mortgage Banker$0.3B 3% = Total Middle Market (66%)

25 Government Card ProgramsGenerate Valuable Retail Deposits At 3/31/15 ● 1Source: the Nilson Report July 2014, based on 2013 data ● 2Based on a 2014 survey conducted by KRC Research ● 3Source: U.S. Department of the Treasury ● 4Source: Social Security Administration 720 948 1,221 1,444 1,592 2011 2012 2013 2014 YTD 2015 US Treasury ProgramState Card Programs Growing Average Noninterest-Bearing Deposits($ in millions) #1 prepaid card issuer in US1 State/ Local government benefit programs:• 49 distinct programs US Treasury DirectExpress Program:• Exclusive provider of prepaid debit cards since 2008; contract extended to January 2020• ~80k new accounts per month• 95% of Direct Express card holders report they are satisfied2• Eliminating monthly benefit checks, resulting in significant taxpayer savings3 # of Social Security Beneficiaries4(in millions) 25 30 35 40 45 50 55 60 1970 1975 1980 1985 1990 1995 2000 2005 2010 Key Facts 26 Funding and Maturity Profile At 3/31/15 ● 1Face value at maturity. ● 2$300MM of subordinated notes mature on 5/1/2015. ~$7B unencumbered securities Loan to deposit ratio of 85% Access to wholesale debt markets Federal Home Loan Bank of Dallas• $-0- outstanding • $5B borrowing capacity Fed funds/ Repo markets Brokered deposits Multiple Funding Sources Debt Profile by Maturity1($ in millions) 600 650 500 350 400 2015 2016 2017 2019 2020+ Subordinated Notes Senior Notes Equity$7.5B 11% Interest-Bearing Deposits$30.2B 45% Noninterest-Bearing Deposits$27.4B 40% Wholesale Debt $2.8B 4% Funding ProfileAt March 31, 2015 2

27 Holding Company Debt Rating As of 4/7/15 ● Source: SNL Financial ● Debt Ratings are not a recommendation to buy, sell, or hold securities Senior Unsecured/Long-Term Issuer Rating S&P Moody’s Fitch BB&T A- A2 A+ BOK Financial A- A2 A Comerica A- A3 A M&T Bank A- A3 A- KeyCorp BBB+ Baa1 A- Fifth Third BBB+ Baa1 A SunTrust BBB+ Baa1 BBB+ Huntington BBB Baa1 A- Regions Financial BBB Ba1 BBB Zions Bancorporation BBB- Ba1 BBB- First Horizon National Corp BB+ Baa3 BBB- Synovus Financial Corp BB- Ba3 BB+ Wells Fargo & Company A+ A2 AA- U.S. Bancorp A+ A1 AA- JP Morgan A A3 A+ PNC Financial Services Group A- A3 A+ Bank of America A- Baa2 A Pee r Ba nks Larg e Ba nks Supplemental Financial DataReconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in millions) The Tier 1 common capital ratio removes preferred stock and qualifying trust preferred securities from Tier 1 capital as defined by and calculated in conformity with Basel I risk-based capital rules in effect through 12/31/14. Effective 1/1/15, regulatory capital components and risk-weighted assets are defined by and calculated in conformity with Basel III risk-based capital rules. The tangible common equity ratio removes preferred stock and the effect of intangible assets from capital and the effect of intangible assets from total assets. Tangible common equity per share of common stock removes the effect of intangible assets from common shareholders equity per share of common stock.The Corporation believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of common equity and to compare against other companies in the industry.1Tier 1 Capital and risk-weighted assets as defined by Basel I risk-based capital rules.n/a – not applicable. 3/31/15 12/31/14 3/31/14 12/31/13 12/31/12 12/31/11 Tier 1 and Tier 1 common capital1Risk-weighted assets1Tier 1 and Tier 1 common capital ratio n/an/an/a 7,16968,27310.50% 6,96265,78810.58% 6,89564,82510.64% 6,70566,11510.14% Common shareholders’ equityLess: GoodwillLess: Other intangible assets $7,50063515 $7,40263515 $7,28363516 $7,15063517 $6,93963522 $6,86563532Tangible common equity $6,850 $6,752 $6,632 $6,498 $6,282 $6,198Total assetsLess: GoodwillLess: Other intangible assets $69,33663515 $69,19063515 $65,68163516 $65,22463517 $65,06663522 $61,00563532Tangible assets $68,686 $68,540 $65,030 $64,572 $64,409 $60,338Common equity ratio 10.82% 10.70% 11.09% 10.97% 10.67% 11.26%Tangible common equity ratio 9.97 9.85 10.20 10.07 9.76 10.27 Common shareholders’ equity $7,500 $7,402 $7,283 $7,150 $6,939 $6,865Tangible common equity $6,850 $6,752 $6,632 $6,498 $6,282 $6,198Shares of common stock outstanding (in millions) 178 179 182 182 188 197 Common shareholders’ equity per share of common stock $42.12 $41.35 $40.09 $39.22 $36.86 $34.79Tangible common equity per share of common stock 38.47 37.72 36.50 35.64 33.36 31.40 28