Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SPORTS FIELD HOLDINGS, INC. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - SPORTS FIELD HOLDINGS, INC. | f10k2014ex32i_sportsfield.htm |

| EX-32.2 - CERTIFICATION - SPORTS FIELD HOLDINGS, INC. | f10k2014ex32ii_sportsfield.htm |

| EX-31.2 - CERTIFICATION - SPORTS FIELD HOLDINGS, INC. | f10k2014ex31ii_sportsfield.htm |

| EX-31.1 - CERTIFICATION - SPORTS FIELD HOLDINGS, INC. | f10k2014ex31i_sportsfield.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2014

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-50302

SPORTS FIELD HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 27-4841391 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

4320 Winfield Road, Suite 200

Warrenville, IL 60555

(Address of principal executive offices)

978-914-7570

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $0.00001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ☐ | Non-accelerated filer | ☐ | ||

| Accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The registrant cannot provide the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2014 because the registrants stock was not yet traded. As of April 15, 2015, the registrant had 13,555,275 shares of its common stock, par value $0.00001 per share, outstanding.

Documents Incorporated By Reference: None.

TABLE OF CONTENTS

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Included in this Annual Report on Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

| 3 |

Sports Field Holdings, Inc. (the “Company” or “Sports Field”) through its wholly owned subsidiary Sports Field Engineering, Inc. (“SportsField Engineering”), is a product development, engineering and design-build construction company, engaged in the design, engineering, constructing, and construction management of athletic facilities, and sports complexes.

According to the Synthetic Turf Council, in 2012, over 1000 new synthetic turf athletic fields were installed. We believe synthetic turf fields have become the field of choice for public and private schools, municipal parks and recreation departments, non-profit and for profit sports venue businesses, residential and commercial landscaping and golf related venues. We believe this is due to the spiraling costs associated with maintaining natural grass athletic fields and the demand for increased playing time, durability of the playing surface and the ability to play on that surface in any weather conditions.

As synthetic turf athletic fields and synthetic turf have truly become the viable alternative to natural grass fields, there are a number of technical and environmental issues that have arisen through the evolution of the development of turf and the systems designed around its installation. Sports Field has focused on addressing the main technical issues that still remain with synthetic turf athletic fields and synthetic turf.

Since its inception Sports Field has completed a variety of projects from the engineer, design and build of entire football stadiums to the installation of a specialized lacrosse field. Our team has also designed, engineered and installed baseball stadiums, soccer fields, indoor soccer facilities, softball fields for private sports venues, public and private high schools and public and private universities.

Lines of Business

Sports Field, has two primary lines of business which are all integral parts of the organization’s overall business model.

Sports Field, through its wholly owned subsidiary, SportsField Engineering, Inc., is a product development and design-build construction company, engaged in the design, constructing, and construction management of athletic facilities, and sports complexes.

Construction management of sports facilities and synthetic turf sales are the two primary lines of business. These lines of business can be categorized as design, development, and manufacturing of sports surfacing products and associated pre-engineered construction systems.

Sports facilities construction and construction management represent approximately 20% of the company’s gross revenue. Approximately 80% of the company’s gross revenues are from surfacing products and systems sales.

Target Markets

Our main target market is the more than 50,000 colleges, universities, high schools and primary schools in the United States with athletic programs, both public and private. Municipal parks and recreations departments also represent a potential significant market for the Company.

Additionally, we target private club sports associations and independent athletic training facilities inclusive of all major sports, including; football, soccer, baseball, softball, lacrosse, field hockey, rugby, as well as track and field.

We also intend to market our unique design-build services to public youth sports leagues and all semi-professional and professional sports leagues.

| 4 |

Products and Services

We manufacture (through a third-party manufacturer) and sell our own proprietary, synthetic turf products, including, a high-end synthetic turf system, based on surface heat reduction which incorporates a proprietary, third-party pre-engineered structural base system, and our proprietary infill matrix called Organite, an eco-safe infill alternative that is lead-free. The Company also provides design and engineering services, as well as construction management for the development and building of athletic facilities at colleges, universities, high schools and primary schools, both public and private. In addition, these services are offered to municipalities, the Federal Aviation Administration (“FAA”), private businesses, as well as the residential and commercial landscaping market, the golf industry and golf-related venues such as driving ranges, practice putting greens, and the miniature golf market.

Products and Usage

Base Construction

Conventional free-draining stone bases incorporate an inherent engineering conflict - drainage capacity vs. grade stability. In addition, the infiltration rate of the stone base cannot be accurately measured or predicted and degrades over time. To address these issues, we utilize vertical-to-horizontal drainage technology, using a third party’s pre-engineered structural base system. Our drainage methodology eliminates the engineering conflicts, practically eliminates invasive excavation, greatly reducing material import and export. Further, it is not susceptible to variances in sub-soil conditions and it is calculable, predictable and constant over time as to drainage capacity and infiltration rate, providing a predictable and constant profile for “G-Max” reduction. G-Max is a measurement of how much force the surface will absorb, the higher the G-Max rating the less absorption of force by the surface.

| 5 |

Shock Attenuation

The National Football League’s (the “NFL”) recent attention to head injuries is reflected in its adoption of new standards for impact forces. New NFL guidelines require that NFL fields have a G-MAX value that is not greater than 100 (based on the “Clegg” method of calculating G-MAX). We believe that this criterion will eventually trickle-down and apply to all sports surfaces, and all artificial turf fields will have to maintain a G-Max below 115 (indoor) and 125 (outdoor) (Clegg) for the life of the product. In managements’ experience, many of the most popular turf systems use sand as the majority component of infill material, mixed with crumb rubber, or ground up discarded automobile tires, that are known to contain lead, chromium and other toxic heavy metals. Sand has a significantly higher specific gravity than rubber. As a result, the sand separates and falls to the bottom of the infill matrix where it compacts over time. This compacting of sand results in such a field’s G-MAX value increasing, usually to well above the maximum allowable G-Max for NFL Fields. For this reason, we have created an eco-friendly infilled artificial turf system. Sports Field’s synthetic turf system combines the predictable G-Max enhancing pre-engineered structural base panel system with a high-mass turf configuration and eco-friendly infill to provide a surface system that is guaranteed to never exceed 100 G-Max (Clegg) for the life of the product.

Heat Reduction

Artificial turf produces a higher temperature ambient above the playing surface due to absorption of solar energy (electromagnetic radiation). The reflectivity or albedo of an artificial turf system, including the infill, is generally lower than natural grass (darker colors absorb more electromagnetic radiation) due to the exposure of dark infill. Further, artificial turf and rubber infill do not naturally contain and hold moisture, to provide evaporative cooling, as natural grass and soils do. Given a specific material (in this case, PE fiber or recycled tire rubber), the darker the color of the material, the more electromagnetic radiation will be absorbed and subsequently re-radiated to the ambient above the playing surface. The darker the area of the playing surface, the more elevated the temperatures to which athletes are exposed during play.

Additionally, because artificial turfs tend to “lay-over” and expose more surface area directly to the sun’s radiation, insolation (solar radiation energy received) can increase, dramatically. In hot, dry (less cloudy/low humidity) climates, and especially in southern latitudes, the preponderance of exposed black (rubber) material is likely to create an unhealthy, excessively hot, playing condition. Not only is the air temperature above the surface excessive, but also the surface temperature of the black rubber can actually be dangerous to touch.

| 6 |

To address these concerns, Sports Field created Replicated Grass, which boasts minimal exposed infill and is the coolest infilled artificial turf possible (for any chosen color of grass fiber) and the albedo of the alternative infill is much higher (cooler) because of its tan color. Additionally, the organic infill can hold water to extend evaporative cooling. In addition, the superior memory of the 360-micron monofilament decreases insolation, by significantly reducing “lay-over”, (lay-over or “matting” is the failure of the synthetic grass filaments to remember their desired vertical configuration and, instead, to assume a horizontal alignment by breaking sharply at the point of exit from the infill. When the filaments are in a horizontal position the angle of exposure to the sun’s rays is greatly reduced, maximizing the absorption of heat-energy, a process known as insolation). Available testing indicates a 35 degree Fahrenheit decrease in surface temperature in full sun conditions, as compared with the leading competitor.

Athletic Performance

Sports Field’s product, Replicated Grass™, was created so that athlete are able to “run on the grass - not on the infill.” Consequently, we design the surface with more synthetic turf blades of grass (almost two and a half times as much as the leading competitor) and much less infill. Our shorter tuft-height and higher face-weight combine to produce a surface with almost three times the blade-density of leading competitors. The result is a surface with increased infill stability because if the infill can be displaced, there is no way to maintain consistent performance characteristics. Because our infill is so stable and does not displace under normal use, there is no change in performance characteristics over time and the infill does not require grooming or replacement on a regular basis. Our dynamic design affords athletes natural “ball-action”, or “ball roll”, and “natural foot-feel”, or “foot action”.

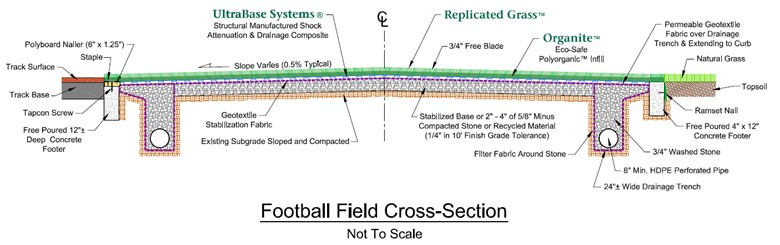

Below is an illustration of a typical installation design:

Sustainability and Disposal Procedures

We believe every artificial turf field will eventually require replacement in 10 to 20 years. Each one of these full-sized fields typically contains approximately 225,000 pounds of recycled-tire rubber, 25,000 pounds of synthetic grass filament fibers, which contain undetermined levels of heavy metals and 15,000 pounds of urethane coating. In addition, a majority of the fields contain more than 500,000 pounds of sand containing silica, which may also contain fungi and mold and, unfortunately, cannot be separated from the rubber. Many states define these products (or are likely to in the near future) as ‘special waste’ or as hazardous waste, which requires special handling. For example, Connecticut no longer permits the landfilling of waste tire rubber.

| 7 |

When removed turf requires special handling and disposal sites, as almost all turf of conventional design will require, the cost, including OSHA and Environmental Protection Agency compliant removal, transportation and special hazards disposal fees, will likely exceed $100,000. In many cases, the disposal costs and fees alone will exceed that amount by a significant margin. Consideration of the ecological effects, which affect the eventual disposal costs of all components of a proposed artificial turf installation, is an important determination of the financial viability of a project from the outset. The recyclability and environmentally friendly nature of turf components must be factored into the total project cost in order to avoid burdening the next generation of users with the failure to consider the cost of ignoring the problem.

Environmentally friendly, ecologically-safe, recyclable infill, filament yarn and coating materials are available and we are using them in our current products. We believe our products perform, in all respects, as well or better than the ecologically-challenged products traditionally considered. The inclusion of ecologically friendly materials can be accomplished with no additional present cost. Some companies produce fields with potentially toxic materials, such as lead that cannot be recycled. Many older fields are subject to being declared hazardous waste and may need costly special handling for disposal. The inclusion of ecologically friendly materials assures significant reduction in future cost, while minimizing environmental, ecological and health risks.

Competition

The competitive landscape with respect to manufacturing is very well-established, with seven companies selling the majority of synthetic turf products. Based on management’s experience and knowledge of the synthetic turf industry, Field Turf is the leading manufacturer of synthetic turf athletic fields and synthetic turf products, with what we believe is roughly 60% of the overall market and is one of the only companies operating in this space that we characterize as a true manufacturer. ShawSports, Astroturf, LLC, Sprint Turf, Pro Grass, A-Turf, and Hellas Construction are all purveyors of synthetic turf athletic fields with varying degrees of manufacturing and assembly. We estimate that these six companies account for approximately 30% of synthetic turf athletic field sales. There remains over 20 other distributors, and to varying degrees manufacturers and assemblers, of synthetic turf products that account for the remaining 10% of the synthetic turf athletic fields market. These applications run the entire gamut of synthetic turf from residential and commercial landscaping, to golf applications, parks and recreation, private parks, airports, highway medians, downhill skiing, and other applications.

The competitive landscape from an installation and construction perspective looks very different when compared to the landscape of the manufacturing side of the industry. In regard to installation and construction of artificial turf fields and athletic facilities, the industry is very much fragmented. There are no clear national leaders from the perspective of facilities construction. The bulk of the construction is provided by local or regional general contracting firms that specialize in certain phases of synthetic turf athletic fields and facility construction, but, to our knowledge, none that offer a true turn-key operation, to include their own in-house engineering staff. Sports Field offers full service design and engineering services, with forensic studies of athletic facilities to properly prepare and recommend custom specifications based on specific circumstances unique to every facility. In addition, the Company will provide full service turn-key construction services for the facility depending on a client’s needs, or simply provide project management services for a particular project.

Sales and Marketing

The Company has received many of its jobs through referral by virtue of its track record on previous jobs and the reputation of management. Sports Field currently has a sales team comprised of both internal and external sales staff. There are 3 salaried salesmen working internally dedicated specifically to SFE sales, there are also 3 contracted groups of sales professionals working as 3rd party sales representation, who are compensated strictly on commission and fees. Finally, we have representation from a future Hall of Fame retired NFL player who is also compensated on a commission only basis. These professionals maintain high level contacts with the NFL, Major League Baseball, professional soccer leagues, and major universities and colleges. These contacts have introduced the Company to NFL owners, professional athletes, college presidents and athletic directors, head coaches and other important industry contacts. Currently, there are 14 individuals actively promoting SportsField Engineering to our customer base.

| 8 |

Our commission-based sales force is active through the United States and will continue to call on relationships with these contacts. The efforts of this group comprise a major component of the Company’s sales and marketing initiatives and these contacts in the professional and collegiate sports industries represent a significant asset as the Company looks to continue its growth.

The Company has engaged in targeted and innovative direct marketing to athletic directors, school business managers, college and high school athletic programs, high school football coaches, landscape architects, engineering firms, and municipal parks and recreation departments. This plan has its focus on our innovative products and construction methodologies.

We are currently engaged in a brand analysis campaign to maximize our exposure to the markets we intend to serve. Our plan includes a new brand development phase and roll out through every form of market communication. It also includes the automation of our sales process through the adoption of a new CRM and mobile sales tools, engaging the market with the use of technology through our high level professional sales team.

These tools in addition to marketing our brand ambassadors, user referrals and trade show participation will carry us forward in our rapid growth acceleration phase.

Growth Strategy

Our growth strategy will center around our national marketing campaign and is designed to secure contracts in every major region of the United States, establishing Sports Field as the premier provider of a unique turn-key service that includes design and engineering expertise, along with what we believe to be the leading patent pending turf systems and drainage products available in the industry. We believe that the marriage of civil engineering and material science, combined with a turn-key all-inclusive, single interface service for the client will clearly distinguish Sports Field from its competitors and establish the Company as the leading provider of services and products to the athletic facilities construction industry.

By securing contracts and establishing Sports Field in major regions of the country, the Company will seek to leverage those relationships and successful contracts to aggressively market to all potential clients in these regions. Utilizing its network of regional contractors and service providers, Sports Field plans to establish territorial relationships with these providers that will allow the Company to aggressively market to major regions of the country managing these regional contractors and providers to facilitate expansion of the Company’s unique business model throughout the United States.

Intellectual Property Rights

Trademarks:

We do not maintain registered trademarks at this time, however, we believe we have certain common law rights with respect to the prior and continued usage of the names “Replicated Grass” and “Organite”.

Replicated Grass is our signature synthetic turf product. We believe this turf has the highest face weight in the industry, which allows athletes to run on the blades of grass, not on the infill. The high density fibers eliminate infill migration and improve stability.

Organite is our Eco-Friendly infill product that consists of Zeolite (Porous stone products which retains 55% of its weight in water to provide evaporative cooling effect), Walnut Shell (Non-Allergenic Organic Shells that absorb and release water as well as improve GMAX scores) and EPDM (a virgin rubber product used to coat roof tops has extreme UV resistance and no known carcinogens).

| 9 |

Service Mark:

The Company’s service mark is “Bringing Science to the Surface” which stands for the Company’s commitment to research and development.

Employees

We have 3 full time employees, additionally, the Company employs 15 independent contractors including fourteen contract employees for sales and one for accounting services. None of our employees are represented by a labor union.

DESCRIPTION OF PROPERTY

Our principal office is located at 4320 Winfield Road, Suite 200, Warrenville, IL 60555, additionally, we have an office at 176 East Main Street, Suite 7, Westborough, MA 01581. These total approximately 2,000 sq. ft. office space rented at a rate of $2,915. This space is utilized for office purposes and it is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our business activities. We do not foresee any significant difficulties in obtaining additional facilities if deemed necessary.

Legal Proceedings

On May 5, 2014, Sports Field was named as a defendant in a civil lawsuit in the Circuit Court of the Seventh Judicial Circuit in Sangamon County, Illinois (“the Court”). Sallenger Incorporated (“Sallenger”), as plaintiff, is making certain claims against the Company in connection with a mechanics lien and for unjust enrichment. The matter was settled on December 18, 2014. The Company agreed to pay Sallenger a total of $210,000, with $50,000 upfront and $16,000 per month for ten months thereafter.

Other than as mentioned above, there are no material proceedings to which any director or officer, or any associate of any such director or officer, is a party that is adverse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. No director or executive officer has been a director or executive officer of any business which has filed a bankruptcy petition or had a bankruptcy petition filed against it during the past ten years. No current director or executive officer has been convicted of a criminal offense or is the subject of a pending criminal proceeding during the past ten years. No current director or executive officer has been the subject of any order, judgment or decree of any court permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities during the past ten years. No current director or officer has been found by a court to have violated a federal or state securities or commodities law during the past ten years.

Our Corporate History

We were incorporated on February 8, 2011, as Anglesea Enterprises, Inc. Initially our activities consisted of providing marketing and web-related services to small businesses including the design and development of original websites, creative writing and graphics, virtual tours, audio/visual services, marketing analysis and search engine optimization. On June 16, 2014, Anglesea Enterprises, Inc. (“Anglesea”), Anglesea Enterprises Acquisition Corp (“Merger Sub”), Sports Field Holdings, Inc., a privately-held Nevada corporation headquartered in Illinois (“Sports Field Private Co”) Leslie Toups and Edward Mass Jr., as individuals (the “Majority Shareholders”), entered into an Acquisition Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which the Merger Sub was merged with and into Anglesea, with Sports Field Private Co surviving as a wholly-owned subsidiary of Anglesea (the “Merger”). Anglesea acquired, through a reverse triangular merger, all of the outstanding capital stock of Sports Field Private Co in exchange for issuing Sports Field Private Co’s shareholders that certain amount of shares of Anglesea’s common stock.

Upon completion of the Merger, on June 16, 2014, Anglesea merged with Sports Field Private Co in a short-form merger transaction (the “Short Form Merger”) under Nevada law. Upon completion of the Short Form Merger, the Company became the parent company of the Sport Field Private Co’s wholly owned subsidiaries, Sports Field Contractors LLC, SportsField Engineering, Inc. and Athletic Construction Enterprises, Inc. In connection with the Short Form Merger, Anglesea changed its name to Sports Field Holdings, Inc on June, 16 2014.

| 10 |

Where You Can Find More Information

Our website address is www.spotsfieldengineering.com. We do not intend our website address to be an active link or to otherwise incorporate by reference the contents of the website into this Report. The public may read and copy any materials the Company files with the U.S. Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0030. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

RISK FACTORS

RISKS RELATING TO OUR INDUSTRY

THE INSTALLATION OF SYNTHETIC TURF IS A HIGHLY COMPETITIVE INDUSTRY.

The installation of synthetic turf is a highly competitive and highly fragmented industry. Competing companies may be able to beat our bids for the more desirable projects. As a result, we may be forced to lower bids on projects to compete effectively, which would then lower the fees we can generate. We may compete for the management and installation of synthetic turf with many entities, including nationally recognized companies. Many competitors may have substantially greater financial resources than we do. In addition, certain competitors may be willing to accept lower fees for their services.

THE SUCCESS OF OUR BUSINESS IS SIGNIFICANTLY RELATED TO GENERAL ECONOMIC CONDITIONS AND, ACCORDINGLY, OUR BUSINESS COULD BE HARMED BY THE ECONOMIC SLOWDOWN AND DOWNTURN IN FINANCING OF PUBLIC WORKS CONTRACTS.

Our business is closely tied to general economic conditions. As a result, our economic performance and the ability to implement our business strategies may be affected by changes in national and local economic conditions. During an economic downturn funding for public contracts tends to decrease significantly thereby limiting the growth and opportunities available for new and established businesses in the synthetic turf industry. An economic downturn may limit the number of projects that we are able to bid on and limit the opportunities we have to penetrate the synthetic turf industry, stunting the Company’s growth prospects and having a material adverse effect on our business.

IF WE ARE UNABLE TO OBTAIN RAW MATERIALS IN A TIMELY MANNER OR IF THE PRICE OF RAW MATERIALS INCREASES SIGNIFICANTLY, PRODUCTION TIME AND PRODUCT COSTS COULD INCREASE, WHICH MAY ADVERSELY AFFECT OUR BUSINESS.

The third party manufacture of our products depends on raw materials derived from petrochemicals such as yarn, backing and infill. If the prices of these raw materials rise significantly, we may be unable to pass on the increased cost to our customers. Our results of operations could be adversely affected if we are unable to obtain adequate supplies of raw materials in a timely manner or at reasonable cost. In addition, from time to time, we may need to reject raw materials that do not meet our specifications, resulting in potential delays or declines in output. Furthermore, problems with our raw materials may give rise to compatibility or performance issues in our products, which could lead to an increase in customer returns or product warranty claims. Errors or defects may arise from raw materials supplied by third parties that are beyond our detection or control, which could lead to additional customer returns or product warranty claims that may adversely affect our business and results of operations.

| 11 |

WE MUST ANTICIPATE AND RESPOND TO RAPID TECHNOLOGICAL CHANGE.

The market for our products and services is characterized by technological developments and evolving industry standards. These factors will require us to continually improve the performance and features of our products and services and to introduce new products and services, particularly in response to offerings from our competitors, as quickly as possible. As a result, we might be required to expend substantial funds for and commit significant resources to the conduct of continuing product development. We may not be successful in developing and marketing new products and services that respond to competitive and technological developments, customer requirements, or new design and production techniques. Any significant delays in product development or introduction could have a material adverse effect on our operations.

WE RELY UPON THIRD-PARTY MANUFACTURERS AND SUPPLIERS, WHICH PUTS US AT RISK FOR THIRD-PARTY BUSINESS INTERRUPTIONS.

Success for our business depends in part on our ability to retain third party manufacturers and suppliers to provide subparts for our products and materials for the services we provide. Although in several cases we do hold long term contracts with important manufacturers, and suppliers, third-parties may not perform as we expect. If manufacturers and suppliers fail to perform, our ability to market products and to generate revenue would be adversely affected. Our failure to deliver products and services in a timely manner could lead to customer dissatisfaction and damage to our reputation, cause customers to cancel contracts and to stop doing business with us.

LOWER THAN EXPECTED DEMAND FOR OUR PRODUCTS AND SERVICES WILL IMPAIR OUR BUSINESS AND COULD MATERIALLY ADVERSELY AFFECT OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

Currently there are approximately 7,000 synthetic turf fields installed in the U.S. and approximately 1,000 new fields installed every year, according to the Synthetic Turf Council. Given that there are approximately 50,000 colleges and high schools in the U.S. with athletic programs, in so far as athletic fields are concerned, at some point in the future saturation will slow the growth of the industry. If we meet a lower demand for our products and services than we are expecting, our business, results of operations and financial condition are likely to be materially adversely affected. Moreover, overall demand for synthetic turf products and services in general may grow slowly or decrease in upcoming quarters and years because of unfavorable general economic conditions, decreased spending by schools and municipalities in need of synthetic turf products or otherwise. This may reflect a saturation of the market for synthetic turf. To the extent that there is a slowdown in the overall market for synthetic turf, our business, results of operations and financial condition are likely to be materially adversely affected.

WE MAY BE SUBJECT TO THE RISK OF SUBSTANTIAL ENVIRONMENTAL LIABILITY AND LIMITATIONS ON OUR OPERATIONS BROUGHT ABOUT BY THE REQUIREMENTS OF ENVIRONMENTAL LAWS AND REGULATIONS

Sports Field may be subject to various federal, state and local environmental, health and safety laws and regulations concerning issues such as, wastewater discharges, solid and hazardous materials and waste handling and disposal, landfill operation and closure. There have been a number of ecological concerns that have arisen from the creation of synthetic turf and the evolution of the synthetic turf industry. One of the biggest concerns to surface most recently is the amount of lead in some of the products used in the manufacture and installation of synthetic turf and synthetic turf systems such as crumb rubber. Crumb rubber is rubber used from recycled tires and used as an infill product in most synthetic turf athletic fields in the U.S. and has shown to contain levels of lead that many argue could potentially be harmful to humans. In addition, many of the yarns used to make synthetic turf blades contain levels of lead that are also coming into question as to potential health hazards. Due to the many concerns that are now arising regarding the levels of lead contained in many synthetic turf products, the disposal of old synthetic turf fields may become an issue with municipal land-fills and could in fact add significant costs to the disposal of these worn out fields. It is possible that these old fields could be declared hazardous materials in the future by municipal land-fills, which would add enormous costs to the disposal of such products and the cost to dispose of these materials could in fact be as much as the original cost to purchase and install such fields. While Sports Field believes that it is and will continue to manufacture products in compliance with all applicable environmental laws and regulations, the risks of substantial additional costs and liabilities related to compliance with such laws and regulations are an inherent part of our business.

| 12 |

RISKS RELATED TO OUR COMPANY

We are not YET profitable and may never be profitable.

Since inception through December 31, 2014, Sports Field has raised approximately $5,000,000 in capital. During this same period, we have recorded net accumulated losses totaling $6,931,361. As of December 31, 2014, we had working capital of $242,668. Our net losses for the two most recent fiscal years ended December 31, 2014 and 2013 have been $3,832,856 and $2,886,807, respectively. Our ability to achieve profitability depends upon many factors, including the ability to develop and commercialize products. There can be no assurance that we will ever achieve profitable operations.

We have received a going concern opinion from our auditors.

As reflected in the financial statements, the Company has a cash balance of $523,492 and working capital of $242,668. Furthermore, the Company had a net loss and net cash used in operations of $3,832,856 and $2,971,653, respectively, for the year ended December 31, 2014 and an accumulated deficit totaling $6,931,361. Accordingly, these factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue its operations as a going concern is dependent on Management's plans, which include the raising of capital through debt and/or equity markets with some additional funding from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements.

We have a limited operating history.

We have been in existence for approximately four years. Our limited operating history means that there is a high degree of uncertainty in our ability to: (i) develop and commercialize our products; (ii) achieve market acceptance of our products; or (iii) respond to competition. Additionally, even if we do implement our business plan, we may not be successful. No assurances can be given as to exactly when, if at all, we will be able to recognize profits high enough to sustain our business. We face all the risks inherent in a new business, including the expenses, difficulties, complications, and delays frequently encountered in connection with conducting operations, including capital requirements. Given our limited operating history, we may be unable to effectively implement our business plan which could materially harm our business or cause us to cease operations.

WE NEED ADDITIONAL CAPITAL TO DEVELOP OUR BUSINESS.

The development of our services will require the commitment of substantial resources to implement our business plan. In addition, substantial expenditures will be required to enable us to complete projects in the future. Currently, we have no established bank-financing arrangements. Therefore, it is likely we would need to seek additional financing through subsequent future private offerings of our equity securities, or through strategic partnerships and other arrangements with corporate partners.

We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us. The sale of additional equity securities will result in dilution to our stockholders. The occurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. If adequate additional financing is not available on acceptable terms, we may not be able to implement our business development plan or continue our business operations.

WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS, RESULTING IN THE FAILURE TO GENERATE REVENUE.

In order to maximize potential growth in our current and potential markets, we believe that we must expand our marketing operations and eventually, begin to manufacture our principal product ourselves. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

In order to achieve the above mentioned targets, the general strategies of our company are to maintain and search for hard-working employees who have innovative initiatives, while at the same time, keep a close eye on any and all expanding opportunities.

| 13 |

WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the U.S. Securities and Exchange Commission (the “SEC”). We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

WE CANNOT BE CERTAIN THAT ANY PATENTS WILL BE ISSUED WITH RESPECT TO OUR CURRENT OR POTENTIAL PATENT APPLICATIONS.

As of the date hereof, we have filed two patent applications. We do not know whether any of our patent applications will result in the issuance of patents or whether the examination process will require us to narrow the scope of our claims. To the extent any of our applications proceed to issuance as a patent, any such future patent may be opposed, contested, circumvented, designed around by a third party or found to be invalid or unenforceable. The process of seeking patent protection can be lengthy and expensive. Some of our technology may not covered by any patent or patent application.

WE HAVE NOT REGISTERED OUR TRADEMARKS AND THUS MAY BE SUBJECT TO CLAIMS OF INFRINGEMENT OR HAVE DIFFICULTY PREVENTING OTHERS FROM USING OUR MARKS.

We have not obtained federal registration of any of the trademarks we use in our business, or our name or logo. Currently, we are asserting common law protection by holding the certain marks out to the public as the property of Sports Field. However, no assurance can be given that this common low assertion will be effective to prevent others from using the marks concurrently or in other locations. In the event someone asserts ownership to a mark, we may incur legal costs to enforce any unauthorized use of the marks or defend ourselves against any claims.

WE MAY SUFFER LOSSES IF OUR REPUTATION IS HARMED.

Our ability to attract and retain customers and employees may be adversely affected to the extent our reputation is damaged. If we fail, or appear to fail, to deal with various issues that may give rise to reputational risk, we could harm our business prospects. These issues include, but are not limited to, appropriately dealing with potential conflicts of interest, legal and regulatory requirements, ethical issues, money-laundering, privacy, record-keeping, sales and trading practices, and the proper identification of the legal, reputational, credit, liquidity, and market risks inherent in our business. Failure to appropriately address these issues could also give rise to additional legal risk to us, which could, in turn, increase the size and number of claims and damages asserted against us or subject us to regulatory enforcement actions, fines, and penalties.

WE DEPEND ON OUR KEY MANAGEMENT PERSONNEL AND THE LOSS OF THEIR SERVICES COULD ADVERSELY AFFECT OUR BUSINESS.

We place substantial reliance upon the efforts and abilities of Jeromy Olson, our Chief Executive Officer.. Though no individual is indispensable, the loss of the services of Mr. Olson could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the life of Mr. Olson.

IF

WE FAIL TO ESTABLISH AND MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS

ACCURATELY OR TO PREVENT FRAUD. ANY INABILITY TO REPORT AND FILE OUR FINANCIAL RESULTS ACCURATELY AND TIMELY COULD HARM OUR REPUTATION

AND ADVERSELY IMPACT THE TRADING PRICE OF OUR COMMON STOCK. Effective

internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial

reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment

existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control

deficiencies may adversely affect our financial condition, results of operation and access to capital. We

currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements

and application of US GAAP and SEC disclosure requirements. Additionally, there is a lack of formal process and timeline for closing

the books and records at the end of each reporting period and such weaknesses restrict the Company’s ability to timely gather,

analyze and report information relative to the financial statements. Because

of the Company’s limited resources, there are limited controls over information processing. There is inadequate segregation

of duties consistent with control objectives. Our Company’s management is composed of a small number of individuals resulting

in a situation where limitations on segregation of duties exist. In order to remedy this situation we would need to hire additional

staff. Currently, the Company is unable to hire additional staff to facilitate greater segregation of duties but will reassess

its capabilities on a quarterly basis. RISKS

RELATED TO OUR COMMON STOCK OUR

SHARES OF COMMON STOCK HAVE LIMITED TRADING AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR

SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE Our shares of common stock have limited

trading in the market. There can be no assurance that there will be an active market for our shares of common stock either now

or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management

might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated.

Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the

business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares

of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a

broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees,

taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the

use of such shares of common stock as collateral for any loans. WE

MAY BE SUBJECT TO PENNY STOCK RULES WHICH WILL MAKE THE SHARES OF OUR COMMON STOCK MORE DIFFICULT TO SELL. We

may be subject now and in the future to the SEC’s “penny stock” rules if our shares of common stock sell below

$5.00 per share. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker-dealers

to deliver a standardized risk disclosure document prepared by the SEC which provides information about penny stocks and the nature

and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations

for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market

value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson

compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given

to the customer in writing before or with the customer’s confirmation. In

addition, the penny stock rules require that prior to a transaction the broker dealer must make a special written determination

that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction.

The penny stock rules are burdensome and may reduce purchases of any offerings and reduce the trading activity for shares of our

common stock. As long as our shares of common stock are subject to the penny stock rules, the holders of such shares of common

stock may find it more difficult to sell their securities. SALES

OF OUR CURRENTLY ISSUED AND OUTSTANDING STOCK MAY BECOME FREELY TRADABLE PURSUANT TO RULE 144 AND MAY DILUTE THE MARKET FOR YOUR

SHARES AND HAVE A DEPRESSIVE EFFECT ON THE PRICE OF THE SHARES OF OUR COMMON STOCK A

substantial majority of our outstanding shares of common stock are “restricted securities” within the meaning of Rule

144 under the Securities Act. As restricted shares, these shares may be resold only pursuant to an effective registration statement

or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable

state securities laws. Rule 144 provides in essence that an Affiliate (as such term is defined in Rule 144(a)(1)) of an issuer

who has held restricted securities for a period of at least six months (one year after filing Form 10 information with the SEC

for shell companies and former shell companies) may, under certain conditions, sell every three months, in brokerage transactions,

a number of shares that does not exceed the greater of 1% of a company’s outstanding shares of common stock or the average

weekly trading volume during the four calendar weeks prior to the sale (the four calendar week rule does not apply to companies

quoted on the OTC Bulletin Board). Rule 144 also permits, under certain circumstances, the sale of securities, without any limitation,

by a person who is not an Affiliate of the Company and who has satisfied a one-year holding period. A sale under Rule 144 or under

any other exemption from the Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have

a depressive effect upon the price of our shares of common stock in any active market that may develop. YOU

WILL EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST BECAUSE OF THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK AND

OUR PREFERRED STOCK. In

the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership

interests of our present stockholders. We are currently authorized to issue an aggregate of 270,000,000 shares of capital stock

consisting of 250,000,000 shares of common stock, par value $0.00001 and 20,000,000 shares of blank check preferred stock, par

value $0.00001. We

may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock

in connection with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital

raising purposes, or for other business purposes. The future issuance of any such additional shares of our common stock or other

securities may create downward pressure on the trading price of our common stock. There can be no assurance that we will not be

required to issue additional shares, warrants or other convertible securities in the future in conjunction with hiring or retaining

employees or consultants, future acquisitions, future sales of our securities for capital raising purposes or for other business

purposes, including at a price (or exercise prices) below the price at which shares of our common stock are trading. WE

DO NOT EXPECT TO PAY DIVIDENDS AND INVESTORS SHOULD NOT BUY OUR COMMON STOCK EXPECTING TO RECEIVE DIVIDENDS. We

have not paid any dividends on our common stock in the past, and do not anticipate that we will declare or pay any dividends in

the foreseeable future. Consequently, shareholders will only realize an economic gain on their investment in our common stock

if the price appreciates. Because we do not pay dividends, and there may be limited trading, investors may not have any manner

to liquidate or receive any payment on their investment. Therefore, our failure to pay dividends may cause investors to not see

any return on investment even if we are successful in our business operations. In addition, because we do not pay dividends we

may have trouble raising additional funds, which could affect our ability to expand our business operations. Item

1B. Unresolved Staff Comments. Not

applicable. Our principal office is located at 4320 Winfield

Road, Suite 200, Warrenville, IL 60555, additionally we have a second office at 176 East Main Street, Suite 7, Westborough, MA

01581, these offices total 2,000 sq. ft. of office space rented at a rate of $2,915. This space is utilized for office purposes

and it is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our business

activities. We do not foresee any significant difficulties in obtaining additional facilities if deemed necessary. Other than

as mentioned above, there are no material proceedings to which any director or officer, or any associate of any such director

or officer, is a party that is adverse to our Company or any of our subsidiaries or has a material interest adverse to our Company

or any of our subsidiaries. No director or executive officer has been a director or executive officer of any business which has

filed a bankruptcy petition or had a bankruptcy petition filed against it during the past ten years. Item

4. Mine Safety Disclosures. Not applicable. Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. (a)

Market Information Our

shares of Common Stock are quoted on the OTCQB under the symbol “SFHI.” The OTCQB is a quotation service that displays

real-time quotes, last-sale prices, and volume information in over-the-counter (“OTC”) equity securities. An OTCQB

equity security is not listed or traded on a national securities exchange. The

following table sets forth the high and low bid price for our common stock for each quarter during the 2014 fiscal year. The prices

reflect inter-dealer quotations, do not include retail mark-ups, markdowns or commissions and do not necessarily reflect actual

transactions. 1.50 *The

Company did not begin trading until the Third Quarter of 2014. (b)

Holders of Common Equity As of April 15, 2015, there were

139 stockholders of record. An additional number of stockholders are beneficial holders of our Common Stock in “street name”

through banks, brokers and other financial institutions that are the record holders. (c)

Dividend Information We

have not paid any cash dividends to our shareholders. The declaration of any future cash dividends is at the discretion of our

board of directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic

conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future,

but rather to reinvest earnings, if any, in our business operations. (d)

Securities Authorized for Issuance under Equity Compensation Plans There are no outstanding options to purchase our securities.

However we intend to implement a 2015 Employee Stock Option Incentive Plan during the 2015 fiscal year. Option

Plan 14 15 16 17

Fiscal 2014:

Third Quarter (July 1 – September 30)

$

$ 1.50

Fourth Quarter (October 1 – December 31)

$ 1.50

$ 1.50

We currently do not have a Stock Option Plan, however, we intend to implement a 2015 Employee Stock Option Incentive Plan during the 2015 fiscal year. Such stock options may be awarded to management, employees, members of the Company’s Board of Directors and consultants of the Company.

Item 6. Selected Financial Data.

Not applicable.

| 18 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This annual report on Form 10-K and other reports filed by Sports Field Holdings, Inc. (the “Company”) from time to time with the SEC (collectively, the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used in the Filings, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors, including the risks relating to the Company’s business, industry, and the Company’s operations and results of operations. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’s judgment in its application. There are also areas in which management’s judgment in selecting any available alternative would not produce a materially different result. The following discussion should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this report.

Business Overview

Sports Field Holdings, Inc. is a product development, engineering, manufacturing and construction company that designs and builds athletic facilities, as well as supplies its own proprietary high - end synthetic turf products to the sports industry.

| 19 |

According to the Synthetic Turf Council, in 2012, over 1000 new synthetic turf athletic fields were installed. We believe synthetic turf fields have become the field of choice for public and private schools, municipal parks and recreation departments, non-profit and for profit sports venue businesses, residential and commercial landscaping and golf related venues due to the spiraling costs associated with maintaining natural grass athletic fields and the demand for increased playing time, durability of the playing surface and the ability to play on that surface in any weather conditions.

As synthetic turf athletic fields and synthetic turf have truly become the viable alternative to natural grass fields, there are a number of technical issues that have arisen through the evolution of the development of turf and the systems designed around its installation. Sports Field has focused on addressing the main technical issues that still remain with synthetic turf athletic fields and synthetic turf.

Since its inception in 2011 through the present, Sports Field has completed a total of 23 contracts. These contracts encompass a variety of projects from the engineer, design and build of entire football stadiums such as Sacred Heart Griffin High School, in Springfield, Illinois, to the installation of a specialized lacrosse field at Fairfield University, in Fairfield, Connecticut. We have also designed, engineered and installed baseball stadiums, soccer fields, indoor soccer facilities, softball fields for private sports venues, public and private high schools and public and private universities.

Results of Operations

Summary of Statements of Operations for the Years Ended December 31, 2014 and 2013:

| Years Ended | ||||||||

| December 31, 2014 | December 31, 2013 | |||||||

| Revenue | $ | 1,228,188 | $ | 1,260,391 | ||||

| Gross profit (loss) | $ | (488,323 | ) | $ | 142,187 | |||

| Operating expenses | $ | 3,303,136 | $ | 2,883,817 | ||||

| Loss from operations | $ | 3,791,459 | $ | 2,741,630 | ||||

| Other expenses | $ | 41,397 | $ | 145,177 | ||||

| Net loss | $ | 3,832,856 | $ | 2,886,807 | ||||

| Loss per common share – basic and diluted | $ | 0.29 | $ | 0.32 | ||||

Revenue

Revenue was $1,228,188 for the year ended December 31, 2014, as compared to $1,260,391 for the year ended December 31, 2013, a decrease of $32,203. An increase in the size of the contracts during the year ended December 31, 2014 as compared to prior year was offset by a decrease in the number of contracts during the year ended December 31, 2014 as compared to prior year.

Gross Profit (Loss)

Gross profit (loss) decreased from a gross profit of $142,187 during the year ended December 31, 2013, to a gross loss of $(488,323) during the year ended December 31, 2014 due to two completed jobs and one job in progress during the year ended December 31, 2014 that have incurred more labor costs and shipping costs than originally estimated. Consequently, the Company incurred losses on the completed jobs and has an estimated loss on the one job in progress. In addition, in 2014, the Company accepted jobs at discounted pricing in order to gain new product presence in the marketplace.

| 20 |

Operating Expenses

Operating expenses for the year ended December 31, 2014 were $3,303,136 as compared to $2,883,817 for the year ended December 31, 2013, an increase of $419,319. The increase is attributable to the increase in professional fees in relation to the Company going public and keeping current with its public filings. In addition, the Company invested resources into a professional sales team in March 2014 in an effort to increase future revenues. The aforementioned increases were partially offset by a decrease in stock-based compensation from $1,263,000 for the year ended December 31, 2013 as compared to $1,010,000 for the year ended December 31, 2014.

As predicted, operating expenses for 2014 were accelerated due to the acquisition of a professional sales team. Given the average lead time for sales of nine months, the revenues from sales were not adequate to offset these increased operating costs. These revenues will not be realized until the first quarter of 2015.

Other Expenses

Other expenses for the year ended December 31, 2014 were $41,397, as compared to $145,177 for the year ended December 31, 2013. The decrease is attributable to the conversion of all of the Company’s promissory notes into common stock in January 2014 and the transfer of most of the Company’s financed equipment to Jeremy Strawn as per the Separation Agreement in May 2014.

Net Loss

The net loss for the year ended December 31, 2014 was $3,832,856, or a basic and diluted loss per share of $0.29, as compared to a net loss of $2,886,807, or basic and diluted loss per share of $0.32, for the year ended December 31, 2013. The net losses incurred for the years ended December 31, 2014 and 2013 were attributable to the costs of the Company going public, the development of infrastructure within the Company, the completion of several jobs at discounted rates in order to gain new product presence in the marketplace and the cost incurred for restructuring and the hiring of a new management team.

Liquidity and Capital Resources

The following table summarizes total current assets, liabilities and working capital at December 31, 2014, compared to December 31, 2013:

| December 31, 2014 | December 31, 2013 | Increase/ (Decrease) | ||||||||||

| Current Assets | $ | 657,587 | $ | 109,806 | $ | 547,781 | ||||||

| Current Liabilities | $ | 414,919 | $ | 1,740,381 | $ | (1,325,462 | ) | |||||

| Working Capital (Deficit) | $ | 242,668 | $ | (1,630,575 | ) | $ | 1,873,243 | |||||

At December 31, 2014, we had working capital of $242,668, as compared to a working capital deficit of $(1,630,575), at December 31, 2013, an increase of $1,873,243. The increase is primarily attributable to the approximate $4.3 million in net proceeds received during the private placement of common stock through Spartan Capital in 2014 and was partially offset by professional fees and other costs associated with the Company going public and keeping current with its public filings and continued operating losses in 2014.

Net Cash

Net cash used in operating activities for the year ended December 31, 2014 and 2013 was $2,971,653 and $353,228, respectively. The increase in the net cash used for operating activities was attributable to the increase in the net loss for the year ended December 31, 2014 of $3,832,856 as compared to the net loss for the year ended December 31, 2013 of $2,886,807 and the use of some of the proceeds received during the private placement of common stock through Spartan Capital to become current with its accounts payable.

Net cash used in investing activities during the year ended December 31, 2014 was $419,944 compared to $282,154 for the 2013 comparable period. The increase in cash used in investing activities was attributable to the cost of the going public process, which was partially mitigated by increased capital purchases in the prior year.

Financings

Net cash provided by financing activities for the year ended December 31, 2014 and 2013 was $3,914,614 and $635,857, respectively. During the year ended December 31, 2014, the Company received approximately $4.3 million in net proceeds received during the private placement of common stock through Spartan Capital and repaid $391,183 in promissory notes. During the year ended December 31, 2013, the Company received $650,000 through the issuance of convertible promissory notes.

| 21 |

Going Concern

As reflected in the accompanying financial statements, the Company has a cash balance of $523,492 and working capital of $242,668. Furthermore, the Company had a net loss and net cash used in operations of $3,832,856 and $2,971,653, respectively, for the year ended December 31, 2014 and an accumulated deficit totaling $6,931,361. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue its operations as a going concern is dependent on Management's plans, which include the raising of capital through debt and/or equity markets with some additional funding from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements.

The Company will require additional funding to finance the growth of its current and expected future operations as well as to achieve its strategic objectives. The Company believes its current available cash along with anticipated revenues may be insufficient to meet its cash needs for the near future. There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all.

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

Off-Balance Sheet Arrangements

As of December 31, 2014 and December 31, 2013, the Company had no off-balance sheet arrangements.

Critical Accounting Policies

We believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this “Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

Revenue and Cost Recognition

Revenues from construction contracts are included in contract revenue in the consolidated statements of operations and are recognized under the percentage-of-completion accounting method. The percent complete is measured by the cost incurred to date compared to the estimated total cost of each project. This method is used as management considers expended cost to be the best available measure of progress on these contracts, the majority of which are completed within one year, but may occasionally extend beyond one year. Inherent uncertainties in estimating costs make it at least reasonably possible that the estimates used will change within the near term and over the life of the contracts.

Contract costs include all direct material and labor costs and those indirect costs related to contract performance and completion. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined. General and administrative costs are charged to expense as incurred.

Changes in job performance, job conditions and estimated profitability, including those arising from contract penalty provisions and final contract settlements, may result in revisions to costs and income. Such revisions are recognized in the period in which they are determined.

| 22 |

Costs and estimated earnings in excess of billings are comprised principally of revenue recognized on contracts (on the percentage-of-completion method) for which billings had not been presented to customers because the amount were not billable under the contract terms at the balance sheet date. In accordance with the contract terms, any unbilled receivables at period end will be billed subsequently. Amounts are billed based on contractual terms. Billings in excess of costs and estimated earnings represent billings in excess of revenues recognized.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

The Company’s significant estimates and assumptions include accounts receivable allowance for doubtful accounts, percentage of completion revenue recognition method, the useful life of fixed assets and assumptions used in the fair value of stock-based compensation. Those significant accounting estimates or assumptions bear the risk of change due to the fact that there are uncertainties attached to those estimates or assumptions, and certain estimates or assumptions are difficult to measure or value.

Management bases its estimates on historical experience and on various assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources.

Management regularly reviews its estimates utilizing currently available information, changes in facts and circumstances, historical experience and reasonable assumptions. After such reviews, and if deemed appropriate, those estimates are adjusted accordingly. Actual results could differ from those estimates.

Property and Equipment

Property, plant and equipment are carried at cost less accumulated depreciation and amortization. Depreciation and amortization are calculated using the straight-line method over the estimated useful lives of the assets, which generally range from 3 to 5 years. Gains and losses from the retirement or disposition of property and equipment are included in operations in the period incurred. Maintenance and repairs are expensed as incurred.

Stock-Based Compensation

All stock-based payments to employees and to nonemployee directors for their services as directors, including any grants of restricted stock and stock options, are measured at fair value on the grant date and recognized in the statements of operations as compensation or other expense over the relevant service period. Stock-based payments to nonemployees are recognized as an expense over the period of performance. Such payments are measured at fair value at the earlier of the date a performance commitment is reached or the date performance is completed. In addition, for awards that vest immediately and are non-forfeitable the measurement date is the date the award is issued.

Fair Value of Financial Instruments

Accounting Standards Codification subtopic 825-10, “Financial Instruments” (“ASC 825-10”) requires disclosure of the fair value of certain financial instruments. The carrying value of cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities, and short-term borrowings, as reflected in the balance sheets, approximate fair value because of the short-term maturity of these instruments. All other significant financial assets, financial liabilities and equity instruments of the Company are either recognized or disclosed in the financial statements together with other information relevant for making a reasonable assessment of future cash flows, interest rate risk and credit risk. Where practicable the fair values of financial assets and financial liabilities have been determined and disclosed; otherwise, only available information pertinent to fair value has been disclosed.

| 23 |

Recent Accounting Pronouncements