Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Kiwibox.Com, Inc. | kiwb123114exh31_2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Kiwibox.Com, Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Kiwibox.Com, Inc. | kiwb123114exh31_1.htm |

| EX-32.01 - EXHIBIT 32.01 - Kiwibox.Com, Inc. | kiwb123114exh32_1.htm |

| EX-32.02 - EXHIBIT 32.02 - Kiwibox.Com, Inc. | kiwb123114exh32_2.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year ended December 31, 2014

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES AND EXCHANGE OF 1934

For the Transition Period From to

Commission File No. 33-20432

KIWIBOX.COM, INC.

(formerly known as Magnitude Information Systems, Inc.)

Exact Name of Registrant as Specified in its Charter

DELAWARE 75-2228828 _____

State or Other Jurisdiction of IRS Employer

Incorporation or Organization Identification Number

330 W. 42nd Street, #3210, New York, New York 10036

Address of Principal Executive Offices Zip Code

(347-836-4727

Registrants Telephone Number, Including Area Code

Securities Registered Pursuant to Section 12(b) of the Act:

NONE

Title of Each Class Name of Each Exchange on Which Registered

NONE NONE

Securities Registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

The Registrant’s revenues for the fiscal year ended December 31, 2014 were $36,755.

Common stock, par value $.0001 per share (“Common Stock”), was the only class of voting stock of the Registrant outstanding on April 15, 2015. Based on the closing price of the Common Stock on the OTC Electronic Bulletin Board as reported on April 15, 2015, the aggregate market value of the shares of the Common Stock held by persons other than officers, directors and persons known to the Registrant to be the beneficial owners (as the term is defined under the rules of the Securities and Exchange Commission) of more than five percent of the Common Stock on April 15, 2015, was approximately $6,836,931. By the foregoing statements, the Registrant does not intend to imply that any of the officers, directors, or beneficial owners are affiliates of the registrant or that the aggregate market value, as computed pursuant to rules of the Securities and Exchange Commission, is in any way indicative of the amount which could be obtained for such shares of Common Stock.

As of April 15, 2015 683,693,060 shares of Common Stock, $.0001 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: SEE EXHIBIT INDEX

| 1 |

KIWIBOX.COM, INC.

CONTENTS

| PART I. | |||

| Page | |||

| Item 1. | Business | 3 | |

| Item 1A. | Risk Factors | 6 | |

| Item 2. | Properties | 9 | |

| Item 3. | Legal Proceedings | 9 | |

| Item 4. | Submission of Matters to a Vote of Security Holders | 9 | |

| PART II. | |||

| Item 5. | Market for Registrant's Common Equity and Related Shareholder Matters | 10 | |

| Item 6. | Selected Financial Data | 10 | |

Item 7. |

Management’s' Discussion and Analysis of Financial Condition and Results of Operations | 11 | |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risks | 14 | |

| Item 8. | Financial Statements | 14 | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 14 | |

| Item 9A. | Control and Procedures | 14 | |

| Item 9B. | Other Information | 16 | |

| PART III. | |||

| Item 10. | Directors and Executive Officers of the Registrant | 17 | |

| Item 11. | Executive Compensation | 18 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | 21 | |

| Item`13. | Certain Relationships and Related Transactions | 23 | |

| Item 14. | Principal Accountant Fees and Services | 23 | |

| PART IV. | |||

| Item 15. | Exhibits | 25 | |

| Signatures | 26 | ||

| Exhibit Index | 27 | ||

| 2 |

PART I

ITEM 1: BUSINESS

Section 1.1 The Company

Kiwibox.Com, Inc. (the “Company”) was incorporated as a Delaware corporation on April 19, 1988 under the name Fortunistics, Inc. On November 18, 1998, the Company changed its name to Magnitude Information Systems, Inc. On December 31, 2009, the Company changed its name to Kiwibox.Com, Inc.

On August 16, 2007 the Company acquired all outstanding shares of Kiwibox Media, Inc., a social media network dedicated to young adults.

The Company, its subsidiary Magnitude, Inc. and Kiwibox Media Inc. were separate legal entities until December 31, 2009, with Kiwibox Media, Inc. being a wholly owned subsidiary. The 1% of Magnitude, Inc. not owned by the Company constituted a minority interest which was valued at $0. On December 31, 2009, the two subsidiaries Magnitude, Inc. and Kiwibox Media, Inc. merged into the Company.

On September 30, 2011, Kiwibox.com acquired the German based social network Kwick! (see Note 1 of the Financial Statements). On December 18, 2013 the company sold 80% of its ownership interest in Kwick! (see Note 1 of the Financial Statements).

The Company is currently subject to the reporting requirements of Section 13 of the Securities Exchange Act of 1934. The Company has the authority to issue an aggregate of One Billion Four Hundred Million (1,400,000,000) Common Shares, par value $.0001, following an increase from 700,000,000 shares, authorized by the Company on January 29, 2009, with authorization to issue up to Three Million (3,000,000) “blank check” Preferred Shares, par value $.001, of which at December 31, 2011, Two Thousand Five Hundred (2,500) were designated as Cumulative Preferred Shares, par value $.001; Three Hundred Thousand (300,000) were designated as Series A Senior Convertible Preferred Stock, par value $0.001; Three Hundred Fifty Thousand (350,000) were designated as Series B Senior Convertible Preferred Stock, par value $0.001; One Hundred Twenty Thousand (120,000) were designated as Series C Senior Convertible Preferred Stock, par value $0.001; Five Hundred Thousand (500,000) were designated as Series D Senior Convertible Preferred Stock, par value $0.001; Five Hundred Thousand (500,000) were designated as Series E Senior Convertible Preferred Stock, par value $0.001, and Forty-Three Thousand Six Hundred Ten (43,610) were designated Series G Senior Convertible Preferred Stock

As of December 31, 2014, there were outstanding 683,693,060 Common Shares, 1 Cumulative Preferred Share, and 85,890 Convertible Preferred Shares.

Description of Business

Overview

On December 31, 2009 Magnitude Information Systems, Inc. changed its name to Kiwibox.Com, Inc.

We own and operate “Kiwibox.com”, a social networking website. Initially launched in 1999, Kiwibox.com is an online social networking community. Kiwibox has a regional-based advertising-system that allows target-group-optimized ads for advertisers and sponsors.

Kiwibox Operations

Kiwibox.com is a social network for young adults all around the world for web based - and mobile usage. A community to find new friends and to meet new people online and in the real world. Kiwibox continues to follow the mobile trend by updating its mobile applications to keep members engaged across its multiple platforms. Unlike traditional social networking sites such as MySpace and Facebook, Kiwibox combines "magazine" content and social networking technology in its website, creating attractive topics for its membership to peruse and enjoy. Kiwibox provides advertisers with a superior, worry-free advertising platform with Profile targeted technology to reach Webbrowser based and mobile Apps Customers.

The Company has successfully integrated Pixunity, a photo-sharing apploication, to the US market and will continue to add enhancement features throughout the year. At the same time we continue to increase our market presence. Our promotional teams, both inside and outside of New York City, continue to develop partnerships with event organizers and businesses along the West Coast of the United States and plan further expansion of these types of market alliances thoughout 2015.

| 3 |

Our operating expenses, not including stock-based compensation, are at a level of approximately $100,000 per month. (see sections “Loans and Notes Payable”).

Kiwibox shall continue to rely upon its advertising agreement with Triple Double U (”TDU”), an exclusive German online advertising agency, which agreements have been negotiated by out former subsidiary, Germany-based Kwick, for the Kiwibox network for web and mobile advertisements. Integrated last year, this “Ads-Delivery” program has resulted in an increase in advertising revenue during fiscal year 2014.

Overall, we have equipped our entire Kiwibox.com website with the newest state-of-the-art advertising features which enable sponsors to self-direct their message to specific target audiences based on gender, age, geographic region, education, and interests. Included in this array of features is our “search and be found” function, incorporating Search-Engine optimization with privacy options that improves search results. We focused our developed in 2013 and further enhanced during 2014 to facilitate friends’ searches and establish networks of users on a global basis.

Potential Revenue Streams and Marketing Strategy

Currently we generate the majority of our revenue from advertising/sponsorships. We anticipate revenue growth from increased membership activity and our revitalized website as we continue to implement new marketing strategies. Our software and networking technologies we incorporated during the last 2 years now permit our mobile devices to accept and receive direct advertising. Our social networks permit us to work with potential advertisers to identify the right member groups for direct target advertising, a marketing channel that is readily accessible to our social media community.

Our continuing membership growth is fueled by infiltrating our users into local event venues where they participate and simultaneously communicate with our social network via the regular deployment of our cutting-edge App updates. As a result, the Kiwibox network enjoys continuing user sign-ups and continuing loyalty of users to our social network. Due to our long-time experience with our German affiliate, the KWICK! Community (“Kwick”), we were able to fulfill the front-end and back-end needs for this remarkable growth!

Community means social network – and thrives on membership networking. Our new website is based on the latest web technology which makes it easier for users to stay connected and to interact with each other. Most importantly, our website features permit our community members to stay informed in “real” time about events and parties in areas we are targeting through our promotional teams.

The results of our year-long marketing efforts clearly shows the following positive trends in the growth of our community at December 31, 2014:

· Active Members – Our Kiwibox.com website has 3.54 Million Active Members as of December 31st 2014, an increase of approximately 32 % over fiscal year 2013. Active users are those which have logged in to Kiwibox.com during the last 30 days.

· New Registrations – We had 517,178 new registrations for the quarter ended December 31, 2014, an increase of approximately 105% over third quarter results. New registrations represent a participant’s initial registration on our Kiwibox.com website as a new member: we averaged 8,000 new user registrations per day during this 4th quarter 2014!

· Unique Visitors- – For the quarter ended December 31, 2014, we had 5.07 Million Unique Visitors to our Kiwibox.com website, an increase of approximately 3% over third quarter results. Unique Visitors refers to the number of distinct individuals requesting pages from our Kiwibox.com website during a specific period, regardless of how often they visit. Visits refers to the number of times our Kiwibox.com website is visited, no matter how many visitors make up those visits.

· Page Impressions – We had 483.4 Million Page Impressions during the last quarter of 2014, an increase of approximately 1 % over the prior quarter. Generally, Page Views refer to a number of pages which are viewed or clicked on our Kiwibox.com website during 2014.

· Guestbook Entries – For the quarter ended December 31, 2014, Kiwibox.com had 143.3 Million Guestbook Entries, an increase of approximately 386% from the previous quarter. A Guestbook is a logging system that permits visitors to our Kiwibox.com website to leave a public comment.

| 4 |

· Blog Entries – Our Kiwibox.com website members and visitors entered 95.4 Million Blog Entries during the last quarter of 2014, an approximate 264% increase over the prior quarter. A Blog Entry is a message entered in our Kiwibox.com.

Market Position

The Kiwibox Network is in a unique position because it combines the excitement of a dating community with the benefits and accessibility of a real social network. The Kiwibox Network encourages members to explore local events in their area, connect with other members and enjoy the additional member exclusive benefits the social network is offering, such as games, blogging, chatting, picture-sharing and online-flirting. This community behavior binds users to the platform and is the base for our viral marketing.

Safety

Kiwibox.com has developed an effective monitoring model which assists in maintaining a safe site for our member base, combining both technology based systems and user moderation. Users communicate and share information in an environment where they feel both secure and at ease. Members of the Kiwibox team monitor forums and groups daily to ensure the content is appropriate.

In addition to our monitoring system, the Kiwibox.com platform is equipped with advanced technology safety features. This includes the private sphere configuration of users, contact blocs for larger age differentials, anti-spam protection and intelligent self-learning user-scoring feature. In addition to this, Kiwibox.com has implemented state of the art security features such as former Attorney General Andrew M. Cuomo’s hash value database in order to block images of illegal sexual content.. With the combination of human moderation and advanced technology, users are afforded a safe and secure site.

Competition

Our primary competitors are other online social networks, including Facebook, Instagram, Tinder and tumblr. Facebook is widely considered as the industry leaders, however, recently statistics and strategic announcements have indicated a shift in the target audience from teens and college students to a much broader and more adult demographic, because of their international focus. We plan to distinguish ourselves by targeting the US-market and by combining the social-network advantages with user generated content – from users to users, while stressing the community feeling. As these other social networks have made changes to their websites we have been able to capitalize on the disenfranchised users and bring them into our online community.

Technology Development

The Company attaches great importance to its innovative technology developments and continues to follow the top social network market leaders with technology upgrades, providing its users with an alternative social networking opportunity.

The Kiwibox Network is focusing on the fast growing mobile usage phenomenon, being online with friends everytime and everywhere. The Kiwibox Network released multiple updates in the 4th quarter for its iOS and Android Applications. At present, more than 700,000 company Apps are installed in our social media marketplace. Our entire Event page was redesigned during the last quarter of 2014, targeted to generate income based on direct advertisement sales with partners and not through the Banner Ads market. In 2015, Kiwibox plans to optimize the Ads-Sales by organizing a department dedicated to target group based editorial and exclusive Ads-Sales.

Intellectual Property

The Kiwibox.com web and mobile software and other related intellectual property rights are important assets. We hold the Internet domain names Kiwibox.com, Kiwibox.net, Kiwibox.org, as well as other country-code top level domains and feature-based domains like 4kiwi.com.

Governmental Regulations

Our Kiwibox website operations are subject to state, federal and international laws, rules and regulations that cover on-line business, privacy policies, consumer protection and product marketing. The Kiwibox website business is subject to state, federal and international laws, rules and regulations applicable to online commerce, including user privacy policies, product pricing policies, website content and general consumer protection laws. Various laws, rules and regulations have been adopted, and probably will be adopted in the future, that apply to the Internet, including available online content, privacy concerns, online marketing, “spam” and unsolicited commercial email, taxation issues, and regulations that effect and monitor the quality of products and services.

| 5 |

A portion of these laws, rules and regulations that concern the Internet and its uses have been only recently adopted. Courts and administrative agencies have not yet fully interpreted these legal requirements as to their application and scope. Accordingly, our Kiwibox website business is subject to the uncertainties of future interpretations and application of these legal requirements. The application and interpretation of these legal requirements or the passage of new and/or revised laws, rules and regulations could reduce the demand for Kiwibox website services, increase its operational costs, and expose it to potential liability. Any such events could have a material adverse effect upon our Kiwibox website business and financial condition. Our failure, or that of our business partners, to accurately predict and anticipate the interpretation or application of these laws, rules and regulations, whether now in force or adopted in the future, could have a detrimental impact on our operations, create negative publicity for us and expose us to potential liability.

State and federal agencies are applying consumer protection laws to regulate the on-line use, collection and dissemination of personal information and website content. These laws require us to implement programs to notify our website users of our privacy and security programs. Consumer protection laws will require us to obtain the consent of our website users if we want to collect and use certain portions of their personal information. We are currently voluntarily working in partnership with the New York State Attorney General’s office and have incorporated hash value technology into our website.

The Federal Trade Commission (“FTC”) is the lead federal agency monitoring Internet websites and their content. State attorneys general have become active monitors of the Internet at the local State level. These governmental bodies may investigate or bring enforcement actions against website operators they deem in violation of applicable consumer protection laws. We believe that our Kiwibox website’s collection and dissemination of information programs, including our privacy policies, do and will continue to comply with existing laws. However, a decision by a federal or state agency that any of our Kiwibox website’s business practices do not meet applicable legal standards could result in liability and have a material adverse effect on our business and financial condition.

Employees

Currently, we have 4 employees.

ITEM 1.A: Risks Related to Our Business

Early Stage Company; Generation of Revenues

Kiwibox.Com, Inc. (“Kiwibox” or “the Company”) can be considered an early stage company and investors cannot reasonably assume that we will ever be profitable. As an early stage company, we are likely to continue to have financial difficulties for the foreseeable future. We may successfully re-develop our website operations and generate additional revenues but still be unable to achieve profitability. Kiwibox had devoted substantial funds to develop its website, but investors should be aware that there can be no assurance that Kiwibox will ever achieve revenues that exceed its operational costs. We may not obtain the funding necessary to provide Kiwibox with the working capital necessary to continue to develop and market its website. Moreover, the Kiwibox.com website may not receive sufficient internet traffic to increase revenues or achieve profitability.

Doubt Raised About our Ability to Continue as a Going Concern.

Our financial statements have been presented on the basis that we will remain a going concern and that our assets will increase and that we will satisfy our liabilities in the normal course of our business. Kiwibox has had minimal revenues and/or has incurred operating losses during the fiscal years ended December 31, 2010, 2011, 2012, 2013 and 2014. Our independent auditors have concluded that these factors create an uncertainty about our ability to continue as a going concern. Our ability to continue as a going concern is dependent, among other factors, on our continued success in raising capital.

Need for Additional Capital; Short-Term Viability of Company

Our operations require immediate investment of equity capital or loans to continue to operate. If we can not secure funds in the short-term, we will be required to close our entire business operations and our website.

| 6 |

Assuming we can receive a current investment or loans to fund our immediate operational needs, our Kiwibox website business’s future capital requirements will depend on many factors, including the degree to which teenagers use the kiwibox.com Website and the degree to which Kiwibox is able to generate revenues from users of its site. We expect to require additional financing before we achieve a profitable level of operations; however, there is no assurance that such funding will be available on acceptable terms, or at all. If we elect to sell equity to raise additional funds, there is no assurance that additional equity can be sold on terms favorable to the Company and to its existing shareholders, with the result that existing shareholders may incur substantial dilution. Without the necessary funding, we may be required to delay, reduce or terminate some or all of our Kiwibox website business or our efforts to obtain additional funding.

No Formal Feasibility and Market Research Plan

We have collected data and statistics concerning the potential market for the Kiwibox.com website and the costs of marketing our services. We have relied principally on the judgment and conclusions of our management, based on their respective knowledge and experiences. We have not performed any formal marketing study that confirms any absolute demand for the services we are providing on our Kiwibox.com website.

Unpredictability of Future Revenues; Potential Downturns in Operating Results

Due to Kiwibox’s minimal revenues since inception and the uncertainty of revenues that may be generated through potential partners and alliances, we are currently unable to forecast our future revenues with accuracy. Our current and future operational costs are based primarily on our marketing and website development plans and our estimates of future revenues. Our potential advertising and joint marketing sales results are difficult to forecast at this stage. It will be difficult for us to realign our operational expenses should future revenue forecasts not materialize which would require that we curtail or cease certain aspects of our operations. Accordingly, if our future revenues are insufficient to fund our planned operations, such a shortfall could have an immediate adverse effect on our business, prospects, financial condition and results of operations.

We may experience cyclical downturns in our future operating results due to various factors, many of which are beyond our control. Some of the factors that could impact our operating results include: (a) our ability to attract and retain new members to our Kiwibox.com website; (b) new developments by our competitor websites; (c) advertising and product price competition; (d) our ability to develop enhancements to our website, upgrade its internet functionality and services; (e) our ability to attract and retain necessary personnel; (f) difficulties with our software or hardware equipment, including any interruptions in the development and maintenance of our internet equipment and related infrastructure systems related to our Kiwibox.com website; (g) the future impact of governmental rules, regulations and laws, and; (h) general economic conditions.

Website and Service Development Risks

The continuing development of our Kiwibox.com website is a highly complex technical process. We are continuing the process of designing and implementing a wide array of feature and contents enhancements in order to remain competitive in our teen marketplace. If we are unable to develop and introduce new services or enhancements to our website in a timely manner in response to changing market conditions or customer requirements, our business, prospects, operating results and financial condition could be materially adversely affected.

Limited Senior Management Team; Potential Problems with Expanding Personnel

We have a limited number of senior management personnel, planning, developing and managing our website business. We have expanded our website operations to accommodate potential growth in our membership and marketplace. We could experience significant pressure on our financial resources and management personnel as a result of the current expansion. In order to manage this expansion, we may be required to adopt new

| 7 |

operating procedures, develop new advertising and marketing plans, financial controls and procedures and policies to supervise a growing employee population. We will also be required to attract, retain and properly administer the expansion of our employee population. Investors should be aware that we may not be able to adequately manage all of these new developments in our expansion, in which case our operations, business prospects, operating results and financial condition could be materially adversely affected.

Competition

Our website business in the young adult and teen marketplace is highly competitive. We can give no assurances that our website business will effectively compete with the more established teen websites currently operating in this marketplace.

Many of our competitors have significantly greater financial resources, established brand names and significantly larger membership and customer bases and we expect our competition to only intensify.

Dependence on Management

The Kiwibox.com website’s success will be substantially dependent on the continued services and on the performance of our current senior management. We will also be dependent upon our ability to retain and provide incentives for our management team. The loss of services of any one or more of our senior management team could have a material adverse affect on our operating results, business prospects and financial condition.

Our success will be dependent, in large part, on the services of our principal officers and employees. The loss of any of these individuals could have a material adverse effect on our business or results of operations. We do not maintain “key-man” life insurance policies on the lives of our officers to compensate us in the event of their deaths.

Except for issues that require shareholder approval, investors should be aware that they will have no vote on our operations, business developments or any management issues, including expansion, website enhancements or personnel decisions. You should not invest in our company unless you understand that all business and operational decisions are made by our management.

Creation of Brand Awareness

It will be crucial to the economic success of our Kiwibox.com website that we promote and establish brand awareness. A successful brand awareness campaign will tend to decrease our marketing expenses over time. If we are not able to adequately establish our brand in our marketplace, our operating results, market growth and financial condition could be materially adversely affected.

Potential for Defects in our Products and Services

Our Kiwibox.com website, its functionality, product offerings and services may contain defects or problems yet undetected. Such defects or problems could delay the launch of our new Kiwibox.com website, generate negative public comment and inhibit marketplace acceptance, any one or more of which could have a material adverse affect on our operating results and financial condition.

Penny Stock Regulation

Our common shares are subject to the “penny stock rules” that require broker-dealers who sell our shares to make specific disclosures before selling to certain persons. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risk associated therewith as well as the written consent of the purchaser of such

| 8 |

security prior to engaging in a penny stock transaction. These penny stock restrictions will continue to apply as long as the Company’s common stock continues to trade at market prices below $5.00. Investors should be aware that the regulations on penny stocks may significantly restrict the ability of any purchaser of our common shares to sell his or her Company common shares in the market.

Absence of Dividends

We have not paid any dividends on our common stock and we are not likely to do so in the foreseeable future. We presently intend to retain earnings for use in growing our business. We may pay for some of our future expansion through debt financing, in which case lenders traditionally prohibit the payment of any such dividends. We also are prohibited from paying dividends on our common stock before we have paid all dividends accrued on our preferred stock, which accruals amounted to $735,655 at December 31, 2014. Investors should be aware, therefore, that the Company intends to re-invest any earnings back into our business for the foreseeable future and that they should have no expectations of receiving any dividends on the common shares they may purchase.

ITEM 2: Description of Properties

We maintain offices for our Kiwibox operations at 330 W. 42nd Street, New York, New York 10036, for approximately 990 square feet. The lease requires initial minimum monthly rentals of $3,833 plus tenants’ share of utility/cam/property tax charges which average approximately $291 per month.

ITEM 3: LEGAL PROCEEDINGS

At the time of this report, the Company is not a party to any material legal proceedings.

ITEM 4: SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

| 9 |

PART II

ITEM 5: MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED

SHAREHOLDER MATTERS

(a) Market Information

The Company’s common stock currently trades on the Electronic Bulletin Board of the OTC market, under the symbol KIWB. The following table sets forth, for the calendar quarters indicated, and for the last three years, the high and low sales prices for the Company’s common stock.

| OTC-BB | |||||||

| Low/Bid | High/Ask | ||||||

| 2012 | |||||||

| First Quarter …………….. | $ | 0.03 |

$ | 0.05 | |||

| Second Quarter ………….. | 0.02 | 0.04 | |||||

| Third Quarter..................... | 0.01 | 0.02 | |||||

| Fourth Quarter................... | 0.01 | 0.02 | |||||

| 2013 | |||||||

| First Quarter …………….. | $ | 0.003 |

$ | 0.01 | |||

| Second Quarter ………….. | 0.00 | 0.01 | |||||

| Third Quarter..................... | 0.003 | 0.01 | |||||

| Fourth Quarter................... | 0.003 | 0.01 | |||||

| 2014 | |||||||

| First Quarter …………….. | $ | 0.002 |

$ | 0.006 | |||

| Second Quarter ………….. | 0.002 | 0.005 | |||||

| Third Quarter..................... | 0.002 | 0.009 | |||||

| Fourth Quarter................... | 0.001 | 0.004 | |||||

(b) Shareholders

As of April 15, 2015, there were approximately 356 shareholders of record for the Company’s Common Stock. The number of record holders does not include shareholders whose securities are held in street names.

(c) Dividends

The Company has not declared or paid, nor has it any present intention to pay, cash dividends on its Common stock. The Company is obliged to pay cash dividends on its outstanding convertible preferred stock and, under certain circumstances, on its outstanding cumulative preferred stock. See "DESCRIPTION OF CAPITAL STOCK" - "The Series A Stock", "The Series B Stock", "The Series C Stock", "The Series D Stock", the “Series E Stock”, and "The Series G Stock", below.

ITEM 6: Selected Financial Data

Except for historical information, the Company's reports to the Securities and Exchange Commission on Form 10-K and Form 10-Q and periodic press releases, as well as other public documents and statements, contain "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ

| 10 |

materially from those expressed or implied by the statements. These risks and uncertainties include general economic and business conditions, development and market acceptance of the Company’s products, current dependence on the willingness of investors to continue to fund operations of the Company and other risks and uncertainties identified in the Company's reports to the Securities and Exchange Commission, periodic press releases, or other public documents or statements.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to republish or revise forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrences of unanticipated events.

The selected financial information presented below under the captions "Statement of Operations" and "Balance Sheet" for the years ended December 31, 2010 through 2014 is derived from the financial statements of the Company and should be read in conjunction with the financial statements and notes thereto.

The financial data are those of Kiwibox.Com, Inc. (f/k/a Magnitude Information Systems, Inc.) including the operations of Magnitude, Inc. and, starting with August 16, 2007, the date of acquisition, the operations of KiwiBox Media, Inc through December 31, 2009, the date these entities were merged into Kiwibox.Com, Inc. All inter-company accounts and transactions have been eliminated in consolidation through December 31, 2009.

Balance Sheet

| December 31, | |||||

2014

|

2013

|

2012 | 2011 | 2010 | |

| Total assets | $ 309,294 | $ 157,366 | $ 6,877,123 | $ 8,243,931 | $ 166,436 |

| Current liabilities | 30,894,601 | 26,017,383 | 25,910,042 | 16,326,319 | 6,181,044 |

| Long-term debt | - | - | - | - | - |

| Working capital | (30,608,081) | (25,887,308) | (25,475,653) | (15,505,560) | (6,145,931) |

| Stockholders’ equity (impairment) |

$(30,585,307) |

(25,860,017) |

$(19,032,919) |

(8,211,778) |

(6,014,608) |

Statement of Operations

| For the Year Ended December 31, | |||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |||

| Total revenues | $ 36,755 | $934,219 | $ 1,469,705 | $ 599,615 | $ 2,039 | ||

| Operating loss | (1,181,252) | (7,404,934) | (1,671,156) | (1,500,610) | (1,181,626) | ||

| Net loss | (4,674,027) | (6,953,532) | (14,010,332) | (5,900,537) | (3,972,372) | ||

| Net loss after dividends on preferred shares | (4,725,290) | (7,004,795) | (14,061,595) | (5,951,800) | (4,023,635) | ||

| Net loss per common share | $ (0.007) | $ (0.01) | $ (0.022) | $ (0.011) | $ (0.008) | ||

| Number of shares used in computing per share data | 683,693,060 | 680,961,142 | 650,715,901 | 522,090,046 | 494,315,316 | ||

ITEM 7: MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

CAUTIONARY STATEMENT PURSUANT TO "SAFE HARBOR" PROVISIONS OF SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934

| 11 |

The information in this annual report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such Act provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about their businesses so long as they identify these statements as forward looking and provide meaningful cautionary statements identifying important factors that could cause actual results to differ from the projected results. All statements other than those statements of historical fact made in this report are forward looking. In particular, the statements herein regarding industry prospects and future results of operations or financial position are forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Our actual results may differ significantly from management’s expectations.

The following discussion and analysis should be read in conjunction with the consolidated financial statements of Kiwibox.Com, Inc., included herewith. This discussion should not be construed to imply that the results discussed herein will necessarily continue into the future, or that any conclusion reached herein will necessarily be indicative of actual operating results in the future. Such discussion represents only the best present assessment of our management.

Description of Business

Kiwibox is in a unique position because it combines the excitement of a dating community with the benefits and accessibility of a real social network. The Kiwibox network encourages members to explore local events in their area, connect with other members and enjoy the additional member exclusive benefits the Kiwibox social network is offering.

Based on its market surveys, the Company’s business plan focused on increasing its regional membership during 2014. These efforts in the New York City membership market have resulted in an increased membership growth during 2014. The Company intends to continue its marketing efforts in this region through a series of street promotion and event organizing in 2015. The Company has developed a number of partnerships with event organizers and businesses along the east coast of the United States and plans further expansion of these types of market alliances.

The Company attaches great importance to its innovative technology developments and continues to follow the top social network market leaders with technology upgrades, providing its users with an alternative social networking opportunity in the web and through mobile apps. Kiwibox was one of the first social networks that integrated its mobile-apps for social mobile advertising in its mobile-apps, to account for the fast growing movement to mobile applications from fixed site usage. We are continuing to optimize this website and develop mobile applications to keep these users engaged across multiple platforms. At present, more than 500,000 company Apps are installed in our network for our community and our market. Kiwibox plans to release various monthly updates for its existing Apps and another two new mobile Apps by the end of the year. We plan to integrate in-App shopping to be less dependent on the advertisement market.

Our continuing membership growth is fueled by infiltrating our users into local event venues where they participate and simultaneously communicate with our social network via the regular deployment of our cutting-edge App updates. As a result, the Kiwibox network enjoys continuing user sign-ups and continuing loyalty of users to our social network. Due to our long-time experience with our German affiliate, the KWICK! Community (“Kwick”), we were able to fulfill the front-end and back-end needs for this remarkable growth.

Our former subsidiary, Kwick, has negotiated with Triple Double U (“TDU”) – an exclusive German online advertisement company – an exclusive online advertisement agreement for the Kiwibox network for web and mobile advertisements. This “Ads-Delivery” has been transferred to and integrated into the Kiwibox platform in January 2014.

| 12 |

While the disposition of our former subsidiary Kwick has resulted in a loss of overall advertising revenue, this new agreement has resulted in an increase in advertising revenue in 2014 for the parent company’s operations. The Company attaches great importance to its technology developments and continues to follow the top social network market leaders with technology upgrades, providing its users with an alternative social networking opportunity.

Currently we generate the majority of our revenue from advertising/sponsorships. We anticipate continued revenue growth from increased membership activity and our revitalized website as we continue to implement new marketing strategies. Our software and networking technologies, primarily incorporated during 2013, now permit our mobile devices to accept and receive direct advertising through our exclusive online advertising agreement with TDU. Kiwibox has constructed a new revenue stream through its members mobile devices based on the delivery of our Kiwibox original, editorial content, supported with the new advertisement-profiles. Overall, we have equipped the entire website with the newest state-of-the-art advertising features which enable sponsors to self-direct their message to specific target audiences based on gender, age, geographic region, education, and interests.

Community means social network – and Kiwibox thrives on its membership networking. Our new website is based on the latest web technology which makes it easier for users to stay connected and to interact with each other. Most importantly, our website features permit our community members to stay informed in “real” time about events and parties in areas we are targeting through our promotional teams.

The operating expenses, not including stock-based compensation, remained at a level of approximately $100,000 per month. We are currently receiving funding at these levels from existing investors (see sections

“Loans and Notes Payable”).

Results of Operations for the Twelve Months Ended December 31, 2014 Compared to the Twelve Months Ended December 31, 2013

Our website presence is not yet supported by a volume of active members-users that would provide a basis for significant growth in advertising revenues. For the year ended December 31, 2014, total revenues amounted to $36,755 compared to $934,219 in 2013. Revenues in 2013 were derived almost entirely from the Kwick! operations, which were acquired on September 30, 2011. The Company deconsolidated the operations of Kwick! in December 2013.

Gross Profit amounted to $5,349 after considering $31,406 costs of revenue. After deducting selling, general and administrative expenses of $1,186,600 compared to the $7,746,830 (which included $6,138,210 impairment of goodwill) recorded in 2013, the Company realized an operating loss of $1,181,251 compared to an operating loss of $7,404,934 in 2013. After deducting the prior year impairment of goodwill, the disposition of the former subsidiary Kwick is the main reason for the large decrease in operating expenses. For the year 2015 management expects operating expenses to remain steady and an expected increase in revenues due to new mobile advertising, this will start a process of putting the company on a path towards eventually eliminating the erosion of shareholder value.

The major item included in non-operating income and expenses was a charge of $2,444,269 accounting for the intrinsic value of the beneficial conversion feature associated with convertible debt. We also had a gain of $30,075 in connection with changes in the valuation of derivative liabilities, In 2013, included in non-operating income and expenses was a charge of $2,307,402 accounting for the intrinsic value of the beneficial conversion feature associated with convertible debt and a gain of $4,036,848 in connection with changes in the valuation of derivative liabilities, and a $253,557 loss on the deconsolidation of Kwick. In 2014, the year concluded with a net loss of $4,674,027. After accounting for dividends accrued on outstanding preferred stock which totaled $51,263 the net loss applicable to common shareholders was $4,725,290 or $0.007 per share, compared to a loss of $7,004,795 or $0.01 per share for the previous year.

| 13 |

Liquidity and Capital Resources

We have financed our business with new debt and equity capital since our cash flow is insufficient to provide the working capital necessary to fund our parent operations. In addition, we received $1,275,001 from short-term loans for continuing operations. We have an urgent need for working capital to fund our operations. If we are unable to immediately receive new equity investments or obtain loans, we will not be able to fund our operations and we will be required to close our business.

Our deficit in working capital amounted to $30,608,081 at December 31, 2014, as compared to $25,887,308 at December 31, 2013. Stockholders’ equity showed an impairment of $30,585,307 at the end of the year, compared to an impairment of $25,860,017 at the beginning of the year. The cash flows used by operations totaled $(1,277,811) and was brought about primarily due to operating losses. We have no bank indebtedness at December 31, 2014. Our other indebtedness, excluding the other current liabilities described below, consisted of certain notes and loans aggregating $11,667,229, derivative conversion liabilities of $14,482,427 and advances from related parties of $65,909. The position “Obligations to be settled in stock” of $276,568 includes $130,568 for common shares and options accrued for certain officers and directors pursuant to their respective employment and remuneration agreements, and $146,000 for stock and warrants due under consulting agreements. Current liabilities also include $735,655 accrued unpaid dividends on outstanding preferred stock. Such dividends will be paid only if and when capital surplus and cash-flow from operations are sufficient to cover the outstanding amounts without thereby unduly impacting the Company’s ability to continue operating and growing its business.

Our current cash reserves and net cash flow from operations expected during the near future will be insufficient to fund our operations and website development and marketing plan over the next twelve months. We expect to fund these requirements with further investments in form of debt or equity capital and are in discussions with potential investors. There can be no assurance, however, that we will be able to identify financing sources, or if we do, whether the terms of such financing will be acceptable or commercially reasonable.

Absent the receipt of immediate equity investment or loans, we will be compelled to close our business operations. Absent the receipt of sufficient funds, our website development, results of operations and financial condition could be subject to material adverse consequences. There can be no assurance that we will find alternative funding for the working capital required to finance on-going operations.

ITEM 7 A: Quantitative and Qualitative Disclosures about Market Risk

The Company is subject to certain market risks, for changes in financial market conditions. The Company does not undertake any special actions to limit those exposures. We do not have a significant interest rate risk because the interest on all our debt obligations is based on fixed rates in accordance with the terms of such indebtedness.

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company's Financial Statements and Notes to Financial Statements are attached hereto as Exhibit A and incorporated herein by reference.

ITEM 9: CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING AND FINANCIAL DISCLOSURE

There have been no changes in or disagreements with the Registrant’s independent auditors during the last two years.

| ITEM 9A: | MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING |

Item 9A(T). Evaluation of Disclosure Controls and Procedures

| 14 |

In connection with the preparation of the Company’s Annual Report on Form 10-K, an evaluation was carried out by our management, with participation of our Chief Executive Officer and Chief Financial Officer, of the effectiveness of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (“Exchange Act”) as of December 31, 2014. Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed and submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified, and that such information is accumulated and communicated to management, included the Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

During our evaluation of disclosure controls and procedures as of December 31, 2014, conducted as part of the Company’s annual audit and preparation of our annual financial statements, several deficiencies were identified which viewed in the aggregate, represent a material weakness. As a result of this material weakness, described more fully below, our Chief Executive Officer and Chief Financial Officer concluded that, as of December 31, 2014, the Company’s disclosure controls and procedures were ineffective.

The Company instituted and is continuing to implement corrective actions with respect to the deficiencies in our disclosure controls and procedures.

Management’s Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) under the Exchange Act. The Company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of the Company’s financial reporting and the preparation of consolidated financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness in future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management has conducted, with the participation of the Chief Executive Officer and Chief Financial Officer, an evaluation of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2014. Management’s assessment of internal control over financial reporting was conducted using the criteria set forth in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) and SEC guidance on conducting such assessments.

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. Based on management’s assessment over financial reporting, management believes as of December 31, 2014, the Company’s internal control over financial reporting was not effective due to the following deficiencies:

1. The Company’s control environment did not have adequate segregation of duties and lacked adequate accounting resources to address non routine and complex transactions and financial reporting matters on a timely basis, primarily due to a lack of resources.

2. The Company had only a part time chief financial officer performing all accounting related duties on site, presenting the risk that the reporting of these non routine and complex transactions during the preparation of our future financial statements and disclosures may not be accomplished in a timely manner. In September of 2012 the Company hired an additional comptroller to review and assist the Chief Financial Officer.

Company management believes that notwithstanding the above identified deficiencies that constitute our material weakness, that the consolidated financial statements fairly present, in all material respects, the Company’s consolidated balance sheets as of December 31, 2014 and 2013 and the related consolidated statements of operations, stockholders’ equity, and cash flows for the years ended December 31, 2014 and 2013, in conformity with generally accepted accounting principles.

This annual report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this annual report.

| 15 |

Remediation of Material Weaknesses in Internal Control over Financial Reporting

The Company commenced efforts to address the material weakness in its internal control over financial reporting and its control environment through the following actions:

- We will continue to seek qualified fulltime or part-time employees and third party consultants to supplement our financial personnel when and if additional resources become available;

- We will continue to institute a more stringent approval process for financial transactions, and

- We will continue to perform additional procedures and analysis for significant transactions as a mitigating control in the control environment due to segregation of duties issues.

Changes in Internal Control over Financial Reporting

Other than described above, there have been no changes in the Company’s internal control over financial reporting during the most recently completed fiscal year ended December 31, 2014, that have materially affected or are reasonably likely to materially affect the Company’s internal control over financial reporting.

ITEM 9B: OTHER INFORMATION

None.

| 16 |

PART III

ITEM 10: DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL

PERSONS

The names of all directors and executive officers of the Company are as follows:

| Name | Positions | Term Served (Expires) |

| Andre Scholz | Director President, Chief Executive Officer Chief Technology Officer |

May 13, 2009 to present August 1, 2010 to present May 13, 2009 to present |

| Joseph J. Tomasek | Director | Feb. 11, 1999 to present |

| Craig S. Cody | Chief Financial Officer | May 1, 2010 to present |

Andre Scholz, Age 37 – Director, Chief Technology Officer. Andre Scholz has more than 16 years business experience in Internet, telecommunication technology and IT security. He holds an advanced degree from the University of Stuttgart and Konstanz in electronic engineering. Mr. Scholz is a consultant and well known technical expert for numerous social networks, communities and high-traffic sites, active around the world. He brings a wealth of social network and internet knowledge to Kiwibox. Mr. Scholz was co-founder of various internet exchange points and manages them until now. Since 1996 he is Managing Director of a carrier and Internet Service Provider in Stuttgart, Germany and since 2002 he is CEO of the Interscholz company group, Leonberg, Germany, which places private investments in and is managing and operating various companies.

Craig S. Cody, Age 52 – Chief Financial Officer. Effective as of May 4, 2010, Registrant promoted Craig S. Cody to serve as its Chief Financial Officer. Mr. Cody, a licensed Certified Public Accountant, had previously served as the Comptroller for the Registrant. In addition to managing an independent accounting and financial services business in New York for a diverse group of clients, he brings extensive management experience derived in the public sector. Mr. Cody holds a B.S. Degree in Accounting from the State University of New York.

Joseph J. Tomasek, Age 68 - Director. Mr. Tomasek was appointed a director in February 2000. Mr. Tomasek also serves as our General Counsel and coordinates our legal affairs in such role. In addition to serving in these Company positions, Mr. Tomasek represents U.S. and international clients in corporate and securities law matters. Mr. Tomasek received his Juris Doctor and Bachelor of Arts Degrees from Seton Hall University and a Certificate d'Etudes in European Studies from the University of Strasbourg, France. Mr. Tomasek is a member of the Bars of the States of New Jersey, and New York.

Family Relationships

There are no family relationships between any of the directors or executive officers.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

The Company knows of no person, who at any time during the period from the date at which it filed its annual report on Form 10-K for the year ended December 31, 2014 to the present, was a director, officer, beneficial owner of more than ten percent of any class of equity securities of the Company (a "Reporting Person"), that failed to file on a timely basis any reports required to be furnished pursuant to Section 16(a), except for the annual statements of beneficial ownership of securities on Form 5 for the officers and directors of the Company which were filed late.

| 17 |

ITEM 11: EXECUTIVE COMPENSATION

2014 SUMMARY COMPENSATION TABLE

The following table sets forth certain compensation information for: (i) the person who served as the Chief Executive Officer of the Company during the year ended December 31, 2014, regardless of the compensation level, and (ii) each of our other executive officers, serving as an executive officer at any time since 2012, as well as the most highly compensated employees who did not serve as executive officers since 2012. Compensation information is shown for the fiscal years ended December 31, 2014, 2013 and 2012:

(1)

Name and Principal Position (a) |

Year (b) |

Salary ($) (c) |

Bonus ($) (d) |

Stock Awards ($) (e) |

Option Awards ($) (f) |

Non-Equity Incentive Plan Compensation ($) (g) |

Non-Qualified Deferred Compensation Earnings ($) (h) |

All Other Compen sation ($) (i) |

Total ($) |

Andre Scholz Chief Executive Officer, President, Director |

2014 2013 2012

|

220,000 200,000 200,000

|

-- 2,000 2,500

|

5,400 8,040 30,600

|

- - -

|

- - -

|

- - -

|

- - - |

225,400 210,040 233,100 |

Joseph J. Tomasek, Esq., Director and General Legal Counsel

|

2014 2013 2012

|

13,500 - - |

- 1,250 2,500 |

- - - |

11,880 11,880 11,880

|

- - - |

- - - |

34,288 33,708 60,000

|

59,668 46,838 74,380

|

Craig S Cody Chief Financial Officer

|

2014 2013 2012

|

74,500 73,500 91,000

|

- 1,250 2,500 |

- - - |

- - - |

- - - |

- - - |

3,500 17,500 5,000

|

78,000 92,250 98,500 |

| All executive officers and named significant employees and directors as a group | 2014 2013 2012

|

308,000 273,500 291,000

|

- 4,500 7,500 |

5,400 8,040 30,600

|

11,880 11,880 11,880 |

- - - |

- - - |

37,788 51,208 65,000

|

363,068 349,128 405,980 |

Andre Scholz 2014-2012: Andre Scholz joined the Company in May 2009, as our Chief Technology Officer and as a director. On August 1, 2010 Mr. Scholz took over as President and Chief Executive Officer. During 2014, we paid Mr. Scholz $220,000 as salary. He also has accrued 1,200,000 common shares, earning 100,000 common shares every month. These shares were accrued for and valued at $5,400. These shares had not been issued at December 31, 2014. During 2013, we paid Mr. Scholz $200,000 as salary. He also has accrued 1,200,000 common shares, earning 100,000 common shares every month. These shares were accrued for and valued at $8,040. During 2012, we paid Mr. Scholtz $200,000 as salary. He also has accrued 1,200,000 common shares, earning 100,000 common shares every month. These shares were for and valued at $36,000.

| 18 |

He also had accrued 500,000 common shares as a signing bonus and has been earning 100,000 common shares every month, beginning with May 15, 2009.

The terms of his consulting /employment agreement are included in our filing on Form 8-K of May 22, 2009 which is incorporated herein by reference to that filing. On November 21, 2014 the terms of his consulting agreement were extended through December 31, 2015. On January 1, 2014 the terms of his consulting agreement were extended through December 31, 2014 with no changes to the terms. In December 2013 the terms of his contract was updated to $220,000 annually.

Joseph J. Tomasek 2014-2012: During fiscal years 2014, 2013, and 2012, the Company incurred or paid $47,788, $33,708, $60,000 and $60,000, respectively, to Mr. Tomasek for legal services rendered to the Company. In 2014 Mr. Tomasek earned options for 1,200,000 restricted shares, valued at $11,880 pursuant to the Black-Scholes valuation formula. In 2013 Mr. Tomasek earned options for 1,200,000 restricted shares, valued at $11,880 pursuant to the Black-Scholes valuation formula. In 2012 Mr. Tomasek earned options for 1,200,000 restricted shares, valued at $11,880 pursuant to the Black-Scholes valuation formula. These options are earned at the rate of 100,000 options per month, beginning with April 2009.

Craig S Cody 2014- 2012: During the year 2014, Mr. Cody earned $78,000. During the year 2013, Mr. Cody earned $92,250. During the year 2012, Mr. Cody earned $98,500.

Stock Options:

No stock options were granted during 2012, 2013 or 2014 pursuant to the Company’s 1997 Stock Option Plan and 2000 Stock Incentive Plan, to any executive officers, directors, employees or to any beneficial owners of more than 10 percent of any class of equity securities of the Company. In addition, there were no stock options or warrants exercised by any officer, director, employee or any beneficial owners of more than 10 percent of any class of equity securities of the Company during 2012, 2013 or 2014.

1997 Stock Option Plan:

The Company’s 1997 Stock Option Plan, as filed with Information Statement pursuant to Section 14(c) with the Commission on July 1, 1997, and with Registration Statement on Form S-8 with the Commission on September 8, 1997, is hereby incorporated by reference.

2000 Stock Incentive Plan:

The Company’s 2000 Stock Incentive Plan, as filed with the Commission as an exhibit to the quarterly report on Form 10-QSB for the period ended March 31, 2000, is hereby incorporated by reference.

Options Granted Outside of Stock Option Plans:

During 2014, one director who also serves as the Company’s general counsel earned 1,200,000 five-year stock options, exercisable at $0.05 per common share.

Outstanding Equity Awards at Fiscal Year-End Table

The following table provides certain information regarding unexercised options to purchase common stock, stock options that have not vested, and equity-incentive plan awards outstanding at December 31, 2014, for each of the persons covered under our Summary Compensation Table.

| 19 |

Name and Principal Position |

Number of Securities Underlying Unexercised Options Exercisable |

Number of Securities Underlying Unexercised Options Unexercisable |

Equity Incentive Plan Awards No. of Underlying Unexercised Unearned Options |

Option Exercise Price |

Option Expiration Date |

No. of Shares or Units of Stock that have not vested |

Market Value of Shares or Units of Stock that have not vested |

Equity Incentive Awards, Shares, Units Or other Rights that have not vested |

Equity Incentive Plan Awards: Market or Payout value of Unearned Shares,Units or other rights that have not vested |

Joseph J. Tomasek, Director and General Legal Counsel |

4,500,000

|

-

|

-

|

$0.05

|

03/31/15 to 9/30/18 |

- | - | - | - |

Option Exercises and Stock Vested Table: None

Pension Benefits Table: None

Nonqualified Deferred Compensation Table: None

Pre-requisites Table: None

Compensation of Directors:

We did not pay any compensation to any of our directors for services rendered as directors during fiscal years 2014, 2013 and 2012

During 2014, 2013 and 2012, one outside director of the Company who also serves as the Company’s general and securities counsel, incurred or was paid an aggregate of $56,484, $46,838 and $74,380 respectively, for legal services.

CORPORATE GOVERNANCE AND CODE OF ETHICS

The Company has always been committed to good corporate governance. In furtherance of this commitment, during 2002 the Board of Directors expanded the duties of the Company’s Audit Committee by increasing the Committee's duties specifically to include responsibility and oversight of corporate governance matters and adherence to the Company’s Code of Ethics. A copy of the Corporate Code of Ethics and Conduct had been included as an exhibit to the Company’s report on Form 10-KSB for the year ended December 31, 2002.

Board Committees

AUDIT COMMITTEE

The Company has appointed an Audit Committee in accordance with the provisions of the Sarbanes-Oxley Act of 2002. The Audit Committee is currently comprised of the entire board of directors.

| 20 |

COMPENSATION AND NOMINATING COMMITTEES

Our board of directors intends to appoint such persons and form such committees as are required to meet the corporate governance requirements imposed by the national securities exchanges. Therefore, we intend that a majority of our directors will eventually be independent directors. Additionally, our board of directors is expected to appoint a nominating committee and a compensation committee, and to adopt charters relative to each such committee. Until further determination by the Board, the full Board of Directors will undertake the duties of the compensation committee and nominating committee.

ITEM 12: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

The following table sets forth information known to us with respect to the beneficial ownership of Common Stock held of record as of December 31, 2014, by (1) all persons who are owners of 5% or more of our Common Stock, (2) each of our named executive officers (see “Summary Compensation Table”), (3) each director, and (4) all of our executive officers and directors as a group. Each of the stockholders can be reached at our principal executive offices located at 330 West42nd Street, Suite 3210, New York, New York 10036.

| Title of Class* | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Class | |||||||

| Directors and Executive Officers: | ||||||||||

| Common Stock | Andre Scholz | 8,400,000 | (2) | 1.22 | % | |||||

| Pres./CEO/Director | ||||||||||

| Joseph Tomasek | 9,930,500 | (3) | 1.45 | % | ||||||

| Director | ||||||||||

| Craig Cody | 1,250,000 | (4) | 0.18 | % | ||||||

| Chief Financial Officer | ||||||||||

| All Directors and Officers as a Group: | 19,580,500 | 2.9 | % | |||||||

| as a Group (3 persons) | ||||||||||

| Beneficial owners of more than 5% of Common Stock (exclusive of officers and directors): | ||||||||||

| Discover Advisory Company | 68,300,937 | (5) | 9.99 | % | ||||||

| c/o Horymor Trust Corp. Ltd. | ||||||||||

| 50 Shirley Street / P.O.Box N-341, | ||||||||||

| Nassau | ||||||||||

| Cambridge Services Inc. | 68,300,937 | (6) | 9.99 | % | ||||||

| c/o TSZ Treuhandgesellschaft | ||||||||||

| Sauter & Co. | ||||||||||

| Suedstr. 11, CH-8034 Zurich, Switzerland | ||||||||||

| Markus Winkler 330 West 42nd New York, NY 10036 | 68,300,937 | (7) | 9.99 | % | ||||||

* The Company also has issued and outstanding as of December 31, 2014, 85,890 shares of its Senior Convertible Preferred Stock, with concentrations in excess of 10% for one or more of the holders of such stock, however, none of such shares bear any voting rights.

| (1) | For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of Common Stock which such person has the right to acquire within 60 days of March 1, 2015. For purposes of computing the percentage of outstanding shares of Common Stock held by each person or group of persons named above, any shares of Common Stock which such person has the right to acquire within such date, whether by exercise of stock options or warrants or conversions of other securities, are deemed to be outstanding and to be beneficially owned by the person holding such option, warrant or convertible security for purposes of computing such person’s percentage ownership but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Except as indicated in the footnote to this table and pursuant to applicable community property laws, the Company believes based on information supplied by such persons, that the persons named in this table have sole voting and investment power with respect to all shares of Common Stock which they beneficially own. (2) Consists of 7,600,000hares 400,000 shares accrued but not yet issued along with 400,000 shares issued in December 2014 (3) Includes 4,500,000 stock options and 500,000 warrants.. (4) Includes 500,000 warrants and 250,000 shares. (5) Includes 33,300,937 shares issuable upon conversion of convertible debt. Karen Buehler has investment and voting control of Discover Advisory Company. (6) Includes 37,171,829 shares issuable upon conversion of convertible debt. Victor Sauter has investment control of Cambridge Services Inc. (7) Includes 2,300,937 shares issuable upon conversion of convertible debt of Kreuzfeld, Ltd. and VGZ (Vermoegenssverwaltungsgesellschaft) both of which Markus Winkler has investment and voting control.

|

| 21 |

All Directors of the Company hold office until the next annual meeting of the shareholders and until successors have been elected and qualified. Executive Officers of the Company are appointed by the Board of Directors at meetings of the Company’s Directors and hold office until they resign or are removed from office.

Family Relationships

There are no family relationships between any of the directors or executive officers.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

The Company knows of no person, who at any time during the year ended December 31, 2014, was a director, officer, or beneficial owner of more than ten percent of any class of equity securities of the Company (a "Reporting Person"), that failed to file on a timely basis any reports required to be furnished pursuant to Section 16(a).

| 22 |

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During the year ended December 31, 2014 and 2013 one outside director of the Company who also serves as the Company’s general and securities counsel, incurred an aggregate $44,604 and $33,708, respectively, for each period for legal services. The director also received 100,000 common stock options per month during the year ended December 31, 2014, valued at $11,880. The director also received 100,000 common stock options per month during the year ended December 31, 2013, valued at $11,880. The balance due to this director at December 31, 2014 and 2013 was $10,552 and $9,620, respectively.

For the year ended December 31, 2014 and 2013 we incurred an aggregate $450,446 and $513,591, respectively, to companies controlled by the Chief Executive Officer of the Company, for website hosting, website development and technical advisory services, server farm installations and IT equipment purchases. The officer also earned 100,000 common shares per month during the year ended December 31, 2014 under a consulting agreement, valued at $5,400. During 2014, The officer received $220,000 in November 2014 for prepaid consulting fees towards 2015 under the terms of a consulting agreement. The balance due to this officer and/or his affiliated companies at December 31, 2014 and 2013 was $65,909 and $23,992, respectively.

During 2014 and 2013, approximately 10% of the Company’s voting stock was beneficially held by Discovery Advisory Company, located in the Bahamas, and Cambridge Services Inc., Kreuzfeld, Ltd. and Vermoegensverwaltungs-Gesellschaft Zurich Ltd. (VGZ) of Switzerland. Discovery Advisory Company, Cambridge Services Inc., Kreuzfeld, Ltd. and VGZ are major creditors, having advanced operating capital against issuance by the Company of convertible promissory notes during 2013 and 2014. During the year ended December 31, 2013, VGZ converted $409,200 of debt.

During the year ended December 31, 2014, Cambridge Services Inc. advanced an additional $720,000, Discovery Advisory Company advanced $485,000 and Kreuzfeld, Ltd advanced $70,000. During the year ended December 31, 2013, Cambridge Services Inc. advanced $1,085,000 and Kreuzfeld, Ltd. advanced $60,000. At December 31, 2014, $3,706,722 and $3,080,060 of such notes were outstanding and owed to Discovery Advisory Company and Cambridge Services Inc, respectively and $3,634,959 and $771,958 owed to Kreuzfeld, Ltd. and VGZ, respectively.

During 2014, the Company loaned $30,000 to its former Subsidiary Kwick. At December 31, 2014 the full $30,000 was outstanding. Additionally, the Company through an advertising agreement with Triple Double U (TDU) has an ”Ads-Delivery” program whereby revenue is received through the former subsidiary Kwick. This revenue in 2014 amounted to $36,703. At December 31, 2014 $28,146 in A/R was outstanding.

The Company, through its former subsidiary, Kwick, was formally a party to a service agreement with JAUMO GmbH, Germany, a company partially owned by the former officers of Kwick. Kwick recognized approximately $93,174 in service revenue from this entity in the year ended December 31, 2013.

During 2013, a shareholder loaned Kwick $899,794 plus accrued interest of $19,849. These loans carry an interest rate of 6% and are payable on demand. A portion of this loan was used to pay off a bank line of credit. The balance was eliminated upon deconsolidation of the Company’s Kwick subsidiary.

ITEM 14: PRINCIPAL ACCOUNTANT FEES AND SERVICES

| 23 |

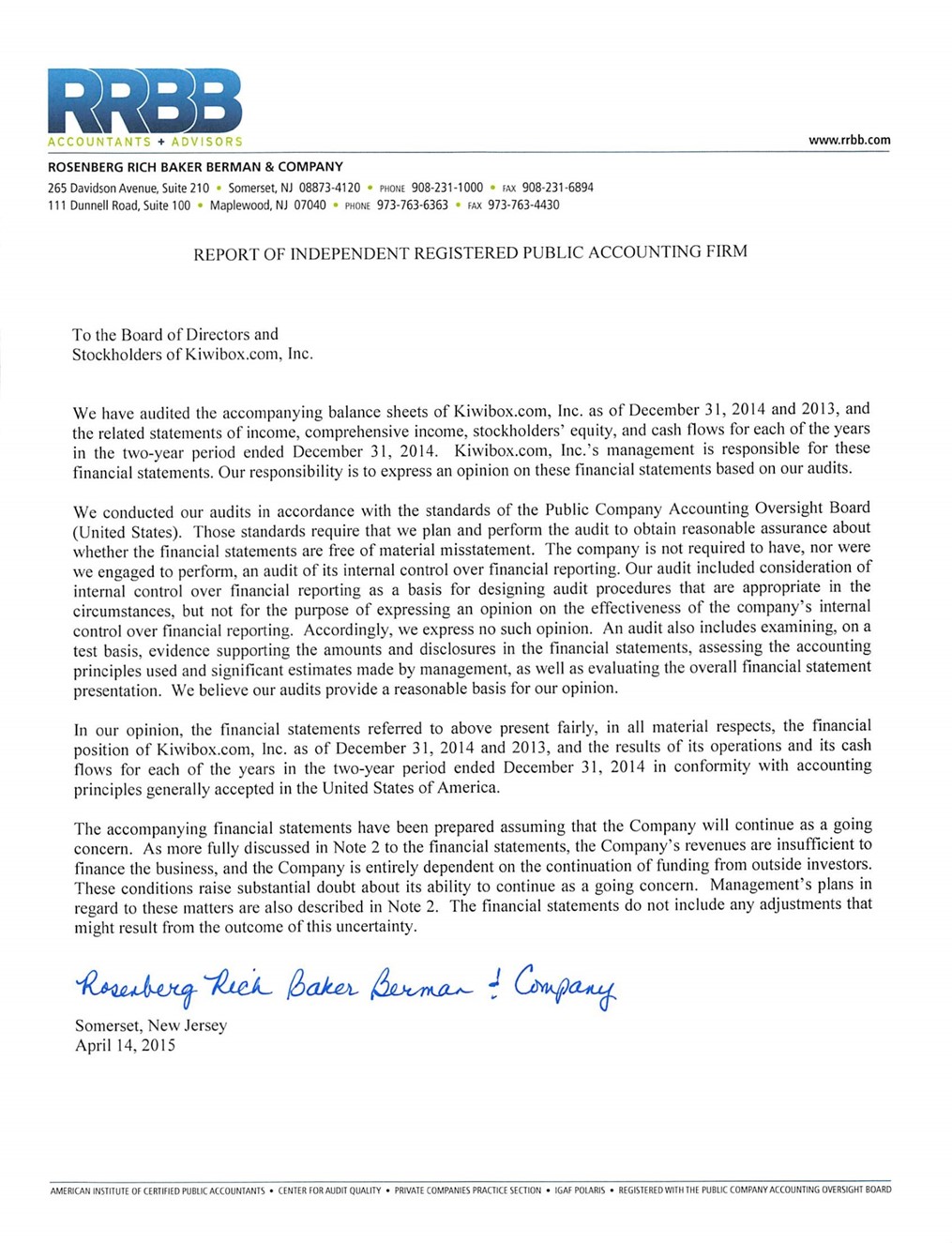

AUDIT FEES

Rosenberg Rich Baker Berman & Company ("Rosenberg") billed us in the aggregate amount of $46,680 and $52,925 for professional services rendered for their audit of our annual financial statements and their reviews of the financial statements included in our Forms 10-K and 10-Q for the years ended December 31, 2014, and December 31, 2013, respectively.

AUDIT-RELATED FEES

Rosenberg did not bill us for, nor perform professional services rendered for assurance and related services that were reasonably related to the performance of audit or review of the Company's financial statements for the fiscal years ended December 31, 2014, and December 31, 2013.

TAX FEES

Rosenberg billed us in the aggregate amount of $0, and $0 for professional services rendered for tax related services for the fiscal years ended December 31, 2014 and December 31, 2013, respectively.

ALL OTHER FEES

The aggregate fees billed by Rosenberg for services rendered to the Company during the last two fiscal years, other than as reported above, were $0 and $0, respectively.

TRANSFER AGENT

The transfer agent for the Company is Securities Transfer Corporation, located at 2591 Dallas Parkway, Suite 102, Frisco, Texas 75034.

ANNUAL REPORT

The Company intends to continue its practice of furnishing annual reports to its shareholders containing financial statements audited by independent certified public accountants.

| 24 |

PART IV

ITEM 15: EXHIBITS AND REPORTS ON FORM 8-K

(a) Exhibits

The Exhibits that are filed with this report or that are incorporated by reference are set forth in the Exhibit Index attached hereto.

(b) Reports on Form 8-K

During the fourth quarter in 2014, the Company filed the following reports on Form 8-K:

On October 9, 2014 the Company released a press release disclosing certain statistical accomplishments achieved during the third quarter 2014.

| 25 |

SIGNATURES

In accordance with Section 13 or 15(d) of the Securities Exchange Act, the Registrant has caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.