Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EARTHSTONE ENERGY INC | este-8k_20150414.htm |

Investor Presentation April 2015 Exhibit 99.1

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about oil and gas pricing assumptions, future operations, estimates of reserve and production volumes, estimates of capital expenditures, expansion of production and reserves, future growth potential, possible acquisitions, and the ability to raise future capital. Forward-looking statements are based on expectations and assumptions and analyses made by Earthstone Energy, Inc. (“Earthstone”) in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform with expectations is subject to a number of risks and uncertainties, including adverse changes in oil and gas prices or protracted periods of low oil and gas prices; problems that may arise in the integration of the businesses involved with the transactions generally described on Page 4; that the transactions may involve additional and unexpected costs; the risks of the oil and gas industry (for example, operational risks in exploring for, developing and producing crude oil and natural gas; risks and uncertainties involving geology of oil and gas deposits); the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to future production, costs and expenses; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; health, safety and environmental risks and risks related to weather; inability of management to execute its plans to meet its goals; shortages of drilling equipment, oil field personnel and services; unavailability of gathering systems, pipelines and processing facilities; the possibility that government policies may change; and that foreign production rates may change. Earthstone’s annual report on Form 10-K for the year ended December 31, 2014 and other Securities and Exchange Commission (“SEC”) filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. Earthstone undertakes no obligation to revise or update publicly any forward-looking statements except as required by law.

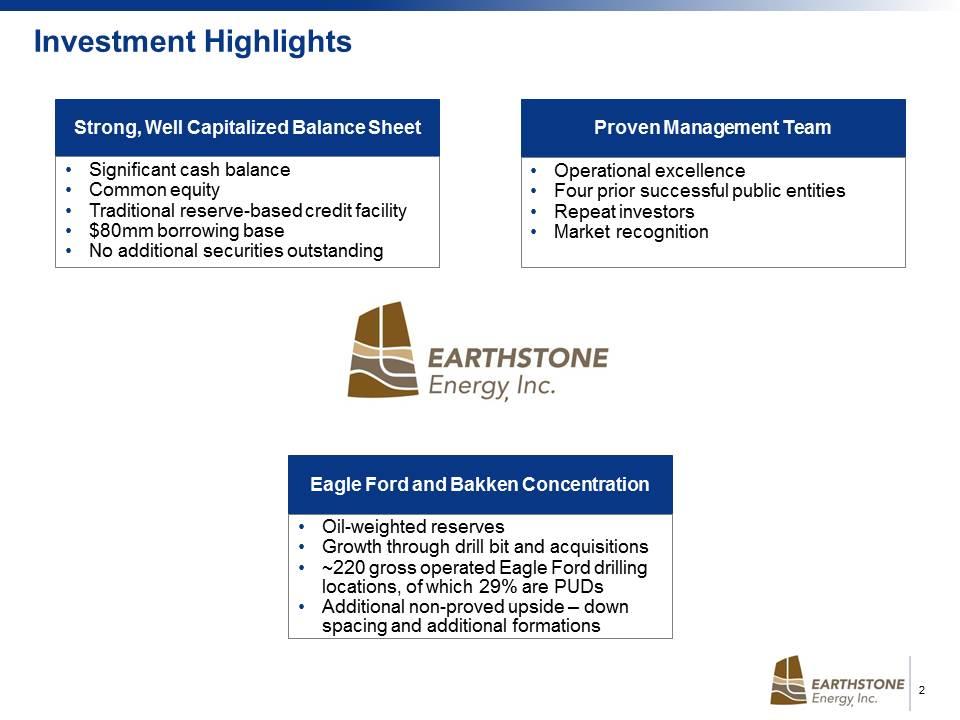

Investment Highlights Eagle Ford and Bakken Concentration Oil-weighted reserves Growth through drill bit and acquisitions ~220 gross operated Eagle Ford drilling locations, of which 29% are PUDs Additional non-proved upside – down spacing and additional formations Strong, Well Capitalized Balance Sheet Significant cash balance Common equity Traditional reserve-based credit facility $80mm borrowing base No additional securities outstanding Proven Management Team Operational excellence Four prior successful public entities Repeat investors Market recognition

Management & Directors Management Position Years of Experience Frank Lodzinski President and CEO 43 Robert Anderson EVP, Corporate Development and Engineering 28 Steve Collins EVP, Completions and Operations 26 Chris Cottrell EVP, Land and Marketing 31 Tim Merrifield EVP, Geological and Geophysical 35 Francis Mury EVP, Drilling and Development 40 Ray Singleton EVP, Northern Region 37 Neil Cohen VP, Finance, and Treasurer 11 Bret Wonson VP, Accounting 13 Directors Affiliation Frank Lodzinski Earthstone Jay Joliat Outside Director Ray Singleton Earthstone Douglas Swanson Jr. EnCap Brad Thielemann EnCap Zachary Urban Vlasic Robert Zorich EnCap

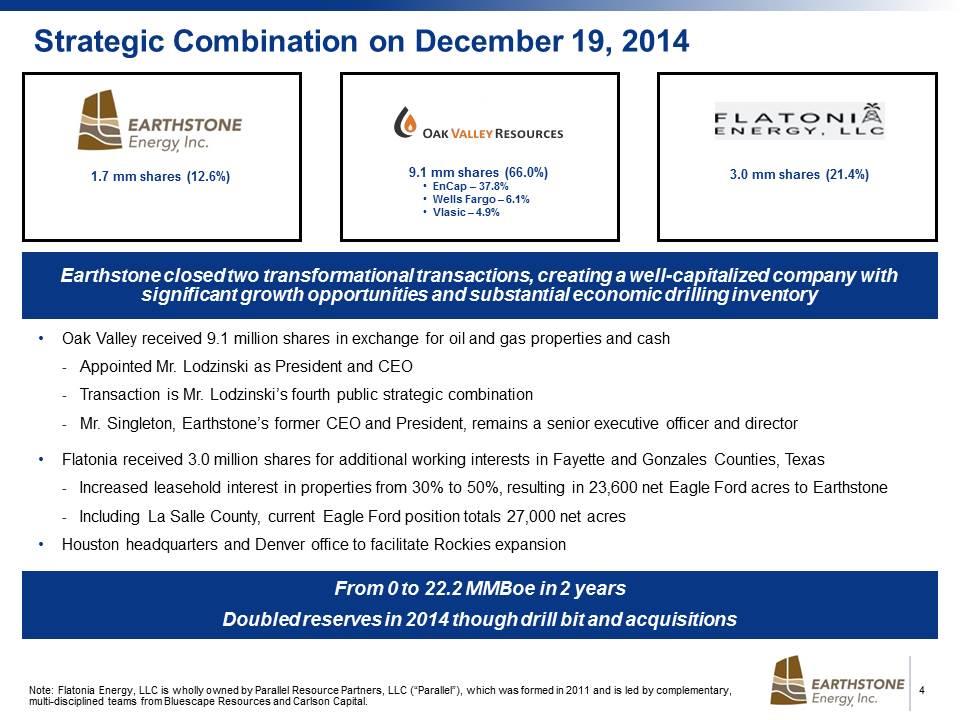

Strategic Combination on December 19, 2014 Earthstone closed two transformational transactions, creating a well-capitalized company with significant growth opportunities and substantial economic drilling inventory Oak Valley received 9.1 million shares in exchange for oil and gas properties and cash Appointed Mr. Lodzinski as President and CEO Transaction is Mr. Lodzinski’s fourth public strategic combination Mr. Singleton, Earthstone’s former CEO and President, remains a senior executive officer and director Flatonia received 3.0 million shares for additional working interests in Fayette and Gonzales Counties, Texas Increased leasehold interest in properties from 30% to 50%, resulting in 23,600 net Eagle Ford acres to Earthstone Including La Salle County, current Eagle Ford position totals 27,000 net acres Houston headquarters and Denver office to facilitate Rockies expansion From 0 to 22.2 MMBoe in 2 years Doubled reserves in 2014 though drill bit and acquisitions 1.7 mm shares (12.6%) 9.1 mm shares (66.0%) EnCap – 37.8% Wells Fargo – 6.1% Vlasic – 4.9% 3.0 mm shares (21.4%) Note: Flatonia Energy, LLC is wholly owned by Parallel Resource Partners, LLC (“Parallel”), which was formed in 2011 and is led by complementary, multi-disciplined teams from Bluescape Resources and Carlson Capital.

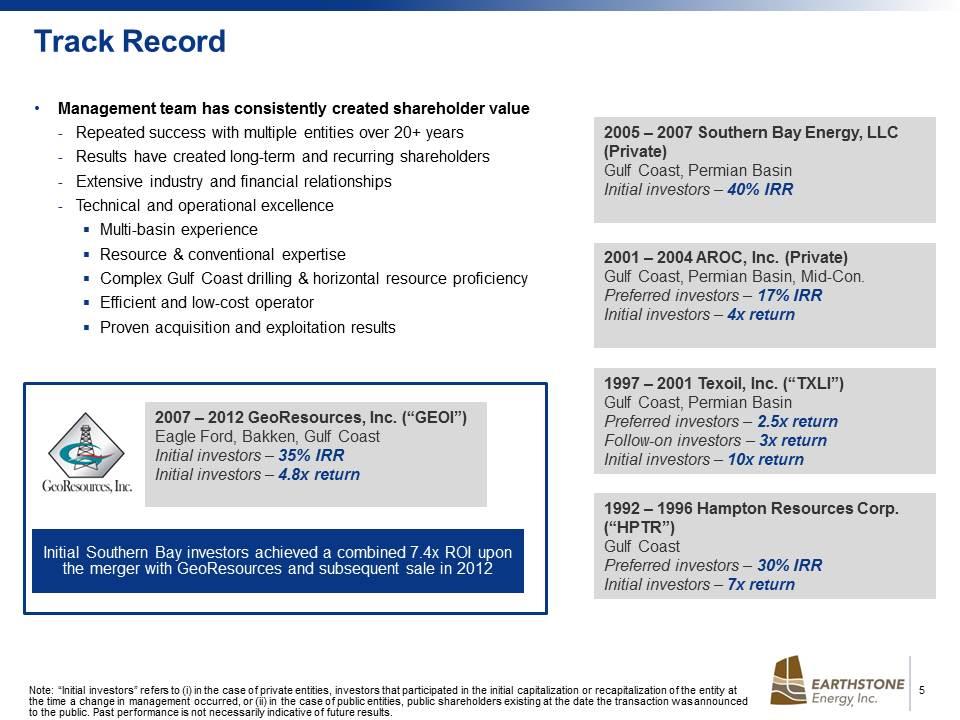

Track Record 2001 – 2004 AROC, Inc. (Private) Gulf Coast, Permian Basin, Mid-Con. Preferred investors – 17% IRR Initial investors – 4x return 2005 – 2007 Southern Bay Energy, LLC (Private) Gulf Coast, Permian Basin Initial investors – 40% IRR 1997 – 2001 Texoil, Inc. (“TXLI”) Gulf Coast, Permian Basin Preferred investors – 2.5x return Follow-on investors – 3x return Initial investors – 10x return 1992 – 1996 Hampton Resources Corp. (“HPTR”) Gulf Coast Preferred investors – 30% IRR Initial investors – 7x return Management team has consistently created shareholder value Repeated success with multiple entities over 20+ years Results have created long-term and recurring shareholders Extensive industry and financial relationships Technical and operational excellence Multi-basin experience Resource & conventional expertise Complex Gulf Coast drilling & horizontal resource proficiency Efficient and low-cost operator Proven acquisition and exploitation results 2007 – 2012 GeoResources, Inc. (“GEOI”) Eagle Ford, Bakken, Gulf Coast Initial investors – 35% IRR Initial investors – 4.8x return Initial Southern Bay investors achieved a combined 7.4x ROI upon the merger with GeoResources and subsequent sale in 2012 Note: “Initial investors” refers to (i) in the case of private entities, investors that participated in the initial capitalization or recapitalization of the entity at the time a change in management occurred, or (ii) in the case of public entities, public shareholders existing at the date the transaction was announced to the public. Past performance is not necessarily indicative of future results.

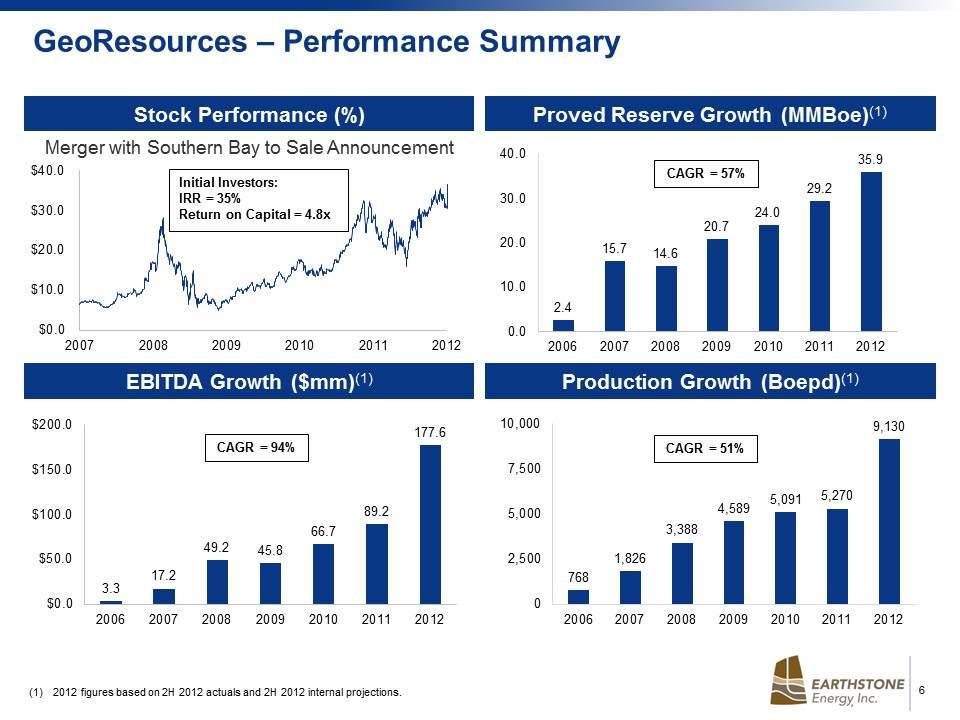

GeoResources – Performance Summary Proved Reserve Growth (MMBoe)(1) Stock Performance (%) Production Growth (Boepd)(1) EBITDA Growth ($mm)(1) Merger with Southern Bay to Sale Announcement 2012 figures based on 2H 2012 actuals and 2H 2012 internal projections. CAGR = 94%

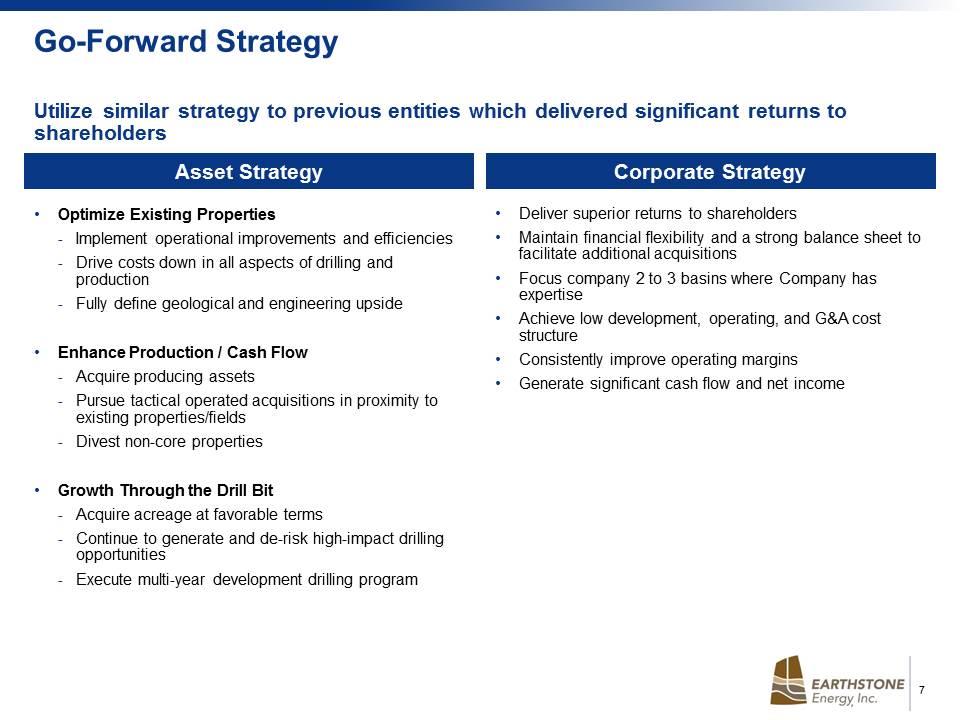

Go-Forward Strategy Utilize similar strategy to previous entities which delivered significant returns to shareholders Corporate Strategy Asset Strategy Optimize Existing Properties Implement operational improvements and efficiencies Drive costs down in all aspects of drilling and production Fully define geological and engineering upside Enhance Production / Cash Flow Acquire producing assets Pursue tactical operated acquisitions in proximity to existing properties/fields Divest non-core properties Growth Through the Drill Bit Acquire acreage at favorable terms Continue to generate and de-risk high-impact drilling opportunities Execute multi-year development drilling program Deliver superior returns to shareholders Maintain financial flexibility and a strong balance sheet to facilitate additional acquisitions Focus company 2 to 3 basins where Company has expertise Achieve low development, operating, and G&A cost structure Consistently improve operating margins Generate significant cash flow and net income

Asset Overview

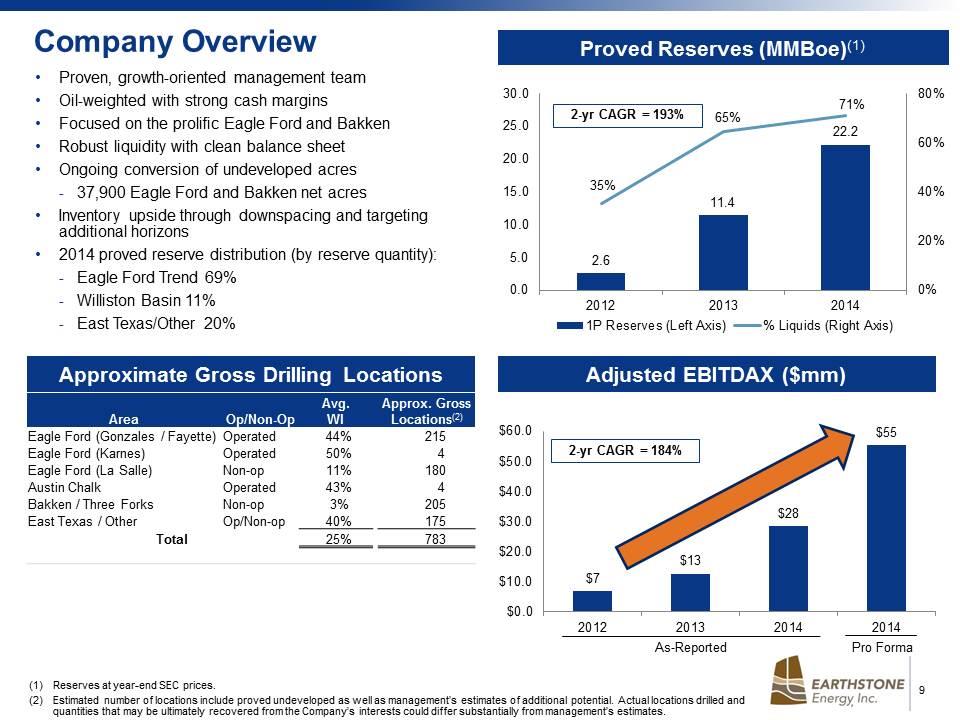

Company Overview Proven, growth-oriented management team Oil-weighted with strong cash margins Focused on the prolific Eagle Ford and Bakken Robust liquidity with clean balance sheet Ongoing conversion of undeveloped acres 37,900 Eagle Ford and Bakken net acres Inventory upside through downspacing and targeting additional horizons 2014 proved reserve distribution (by reserve quantity): Eagle Ford Trend 69% Williston Basin 11% East Texas/Other 20% As-Reported Pro Forma Proved Reserves (MMBoe)(1) Adjusted EBITDAX ($mm) Approximate Gross Drilling Locations Area Op/Non-Op Avg. WI Approx. Gross Locations(2) Eagle Ford (Gonzales / Fayette) Operated 44% 215 Eagle Ford (Karnes) Operated 50% 4 Eagle Ford (La Salle) Non-op 11% 180 Austin Chalk Operated 43% 4 Bakken / Three Forks Non-op 3% 205 East Texas / Other Op/Non-op 40% 175 Total 25% 783 Reserves at year-end SEC prices. Estimated number of locations include proved undeveloped as well as management’s estimates of additional potential. Actual locations drilled and quantities that may be ultimately recovered from the Company’s interests could differ substantially from management’s estimates.

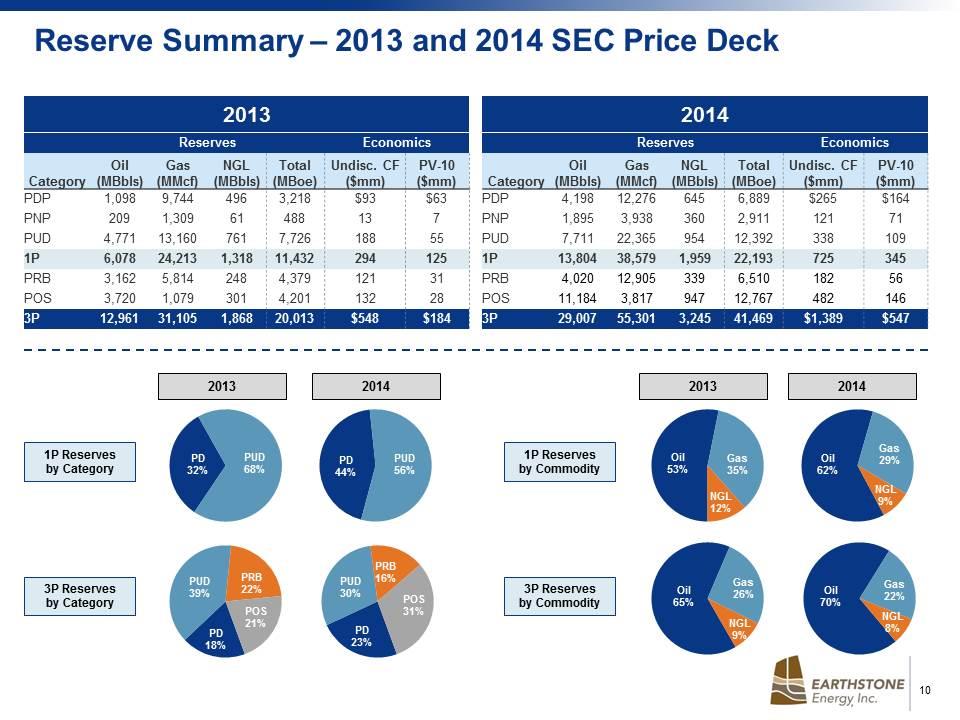

Reserve Summary – 2013 and 2014 SEC Price Deck 1P Reserves by Category 2013 2014 3P Reserves by Category 1P Reserves by Commodity 2013 2014 3P Reserves by Commodity 2013 2014 Reserves Economics Category Oil (MBbls) Gas (MMcf) NGL (MBbls) Total (MBoe) Undisc. CF ($mm) PV-10 ($mm) PDP 1,098 9,744 496 3,218 $93 $63 PNP 209 1,309 61 488 13 7 PUD 4,771 13,160 761 7,726 188 55 1P 6,078 24,213 1,318 11,432 294 125 PRB 3,162 5,814 248 4,379 121 31 POS 3,720 1,079 301 4,201 132 28 3P 12,961 31,105 1,868 20,013 $548 $184 Reserves Economics Category Oil (MBbls) Gas (MMcf) NGL (MBbls) Total (MBoe) Undisc. CF ($mm) PV-10 ($mm) PDP 4,198 12,276 645 6,889 $265 $164 PNP 1,895 3,938 360 2,911 121 71 PUD 7,711 22,365 954 12,392 338 109 1P 13,804 38,579 1,959 22,193 725 345 PRB 4,020 12,905 339 6,510 182 56 POS 11,184 3,817 947 12,767 482 146 3P 29,007 55,301 3,245 41,469 $1,389 $547

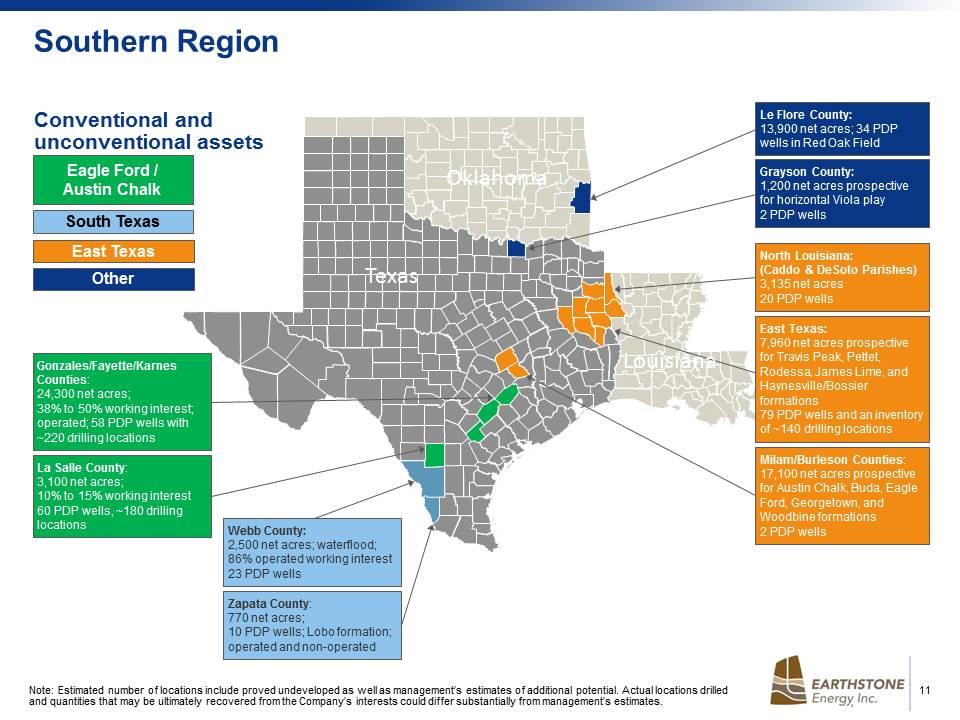

Southern Region Conventional and unconventional assets Texas Oklahoma Louisiana South Texas East Texas Other Eagle Ford / Austin Chalk Zapata County: 770 net acres; 10 PDP wells; Lobo formation; operated and non-operated Webb County: 2,500 net acres; waterflood; 86% operated working interest 23 PDP wells La Salle County: 3,100 net acres; 10% to 15% working interest 60 PDP wells, ~180 drilling locations Gonzales/Fayette/Karnes Counties: 24,300 net acres; 38% to 50% working interest; operated; 58 PDP wells with ~220 drilling locations Grayson County: 1,200 net acres prospective for horizontal Viola play 2 PDP wells Le Flore County: 13,900 net acres; 34 PDP wells in Red Oak Field North Louisiana: (Caddo & DeSoto Parishes) 3,135 net acres 20 PDP wells East Texas: 7,960 net acres prospective for Travis Peak, Pettet, Rodessa, James Lime, and Haynesville/Bossier formations 79 PDP wells and an inventory of ~140 drilling locations Milam/Burleson Counties: 17,100 net acres prospective for Austin Chalk, Buda, Eagle Ford, Georgetown, and Woodbine formations 2 PDP wells Note: Estimated number of locations include proved undeveloped as well as management’s estimates of additional potential. Actual locations drilled and quantities that may be ultimately recovered from the Company’s interests could differ substantially from management’s estimates.

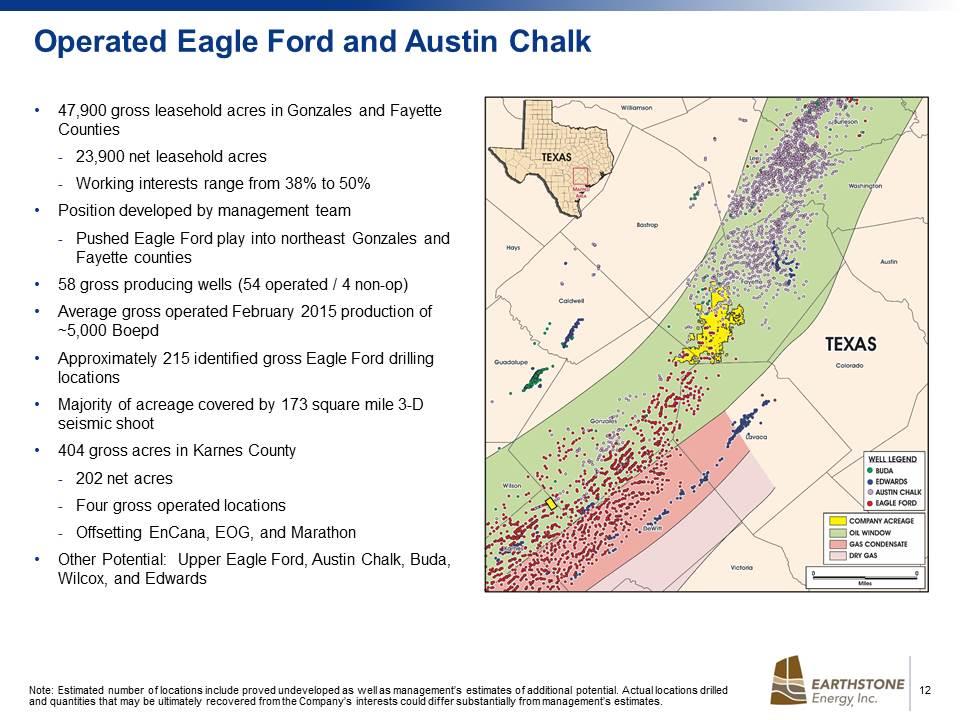

Operated Eagle Ford and Austin Chalk 47,900 gross leasehold acres in Gonzales and Fayette Counties 23,900 net leasehold acres Working interests range from 38% to 50% Position developed by management team Pushed Eagle Ford play into northeast Gonzales and Fayette counties 58 gross producing wells (54 operated / 4 non-op) Average gross operated February 2015 production of ~5,000 Boepd Approximately 215 identified gross Eagle Ford drilling locations Majority of acreage covered by 173 square mile 3-D seismic shoot 404 gross acres in Karnes County 202 net acres Four gross operated locations Offsetting EnCana, EOG, and Marathon Other Potential: Upper Eagle Ford, Austin Chalk, Buda, Wilcox, and Edwards Note: Estimated number of locations include proved undeveloped as well as management’s estimates of additional potential. Actual locations drilled and quantities that may be ultimately recovered from the Company’s interests could differ substantially from management’s estimates.

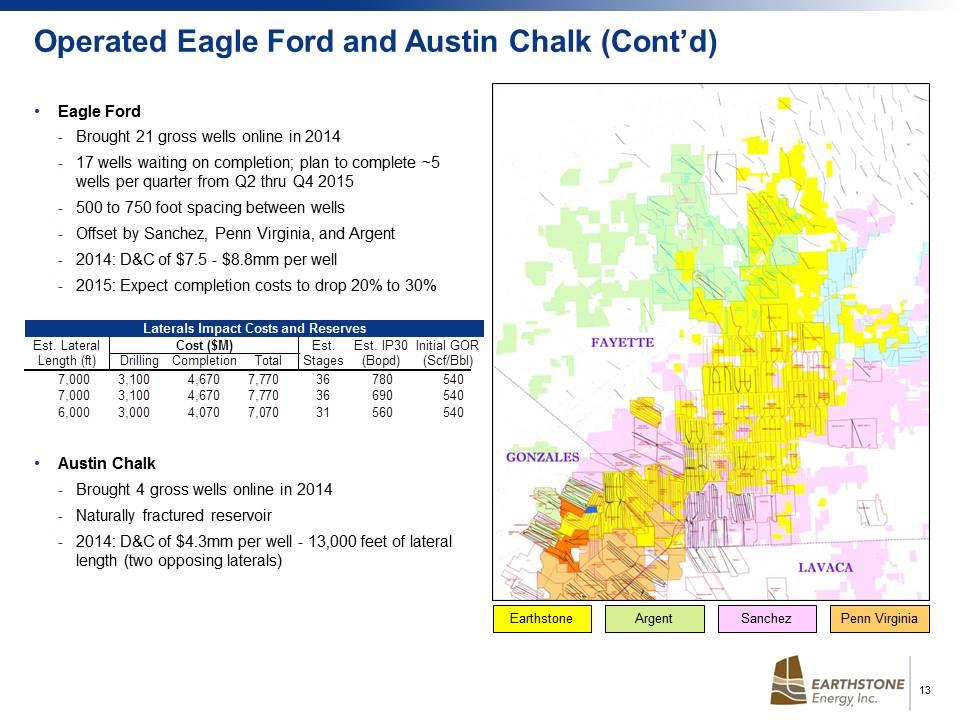

Operated Eagle Ford and Austin Chalk (Cont’d) Eagle Ford Brought 21 gross wells online in 2014 17 wells waiting on completion; plan to complete ~5 wells per quarter from Q2 thru Q4 2015 500 to 750 foot spacing between wells Offset by Sanchez, Penn Virginia, and Argent 2014: D&C of $7.5 - $8.8mm per well 2015: Expect completion costs to drop 20% to 30% Austin Chalk Brought 4 gross wells online in 2014 Naturally fractured reservoir 2014: D&C of $4.3mm per well - 13,000 feet of lateral length (two opposing laterals) Earthstone Sanchez Penn Virginia Argent

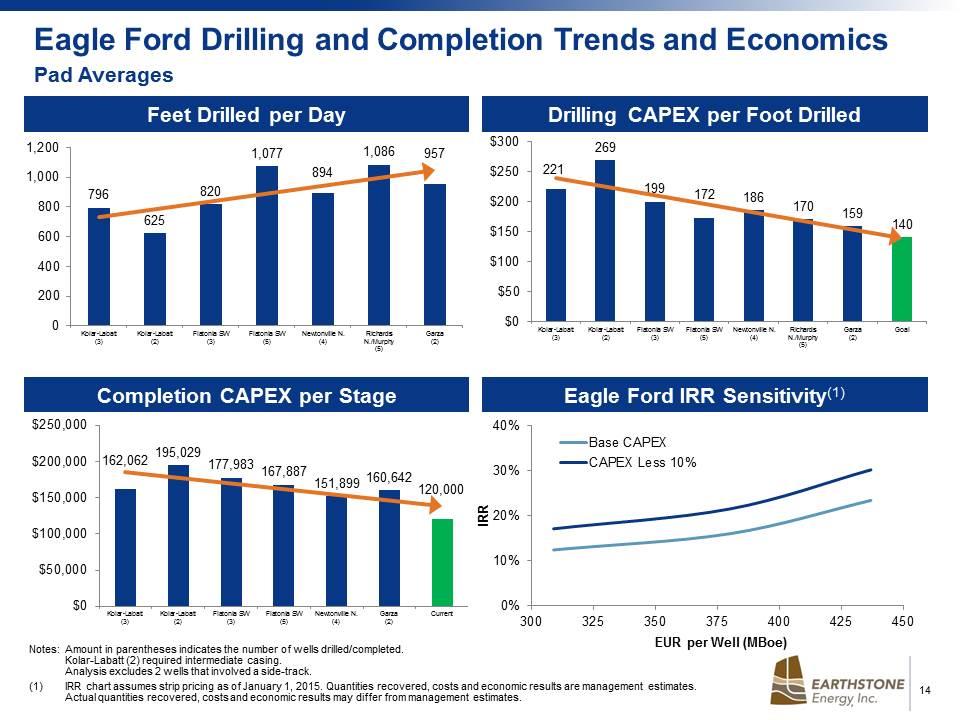

Eagle Ford Drilling and Completion Trends and Economics Pad Averages Notes:Amount in parentheses indicates the number of wells drilled/completed. Kolar-Labatt (2) required intermediate casing. Analysis excludes 2 wells that involved a side-track. IRR chart assumes strip pricing as of January 1, 2015. Quantities recovered, costs and economic results are management estimates. Actual quantities recovered, costs and economic results may differ from management estimates. Feet Drilled per Day Drilling CAPEX per Foot Drilled Completion CAPEX per Stage Eagle Ford IRR Sensitivity(1)

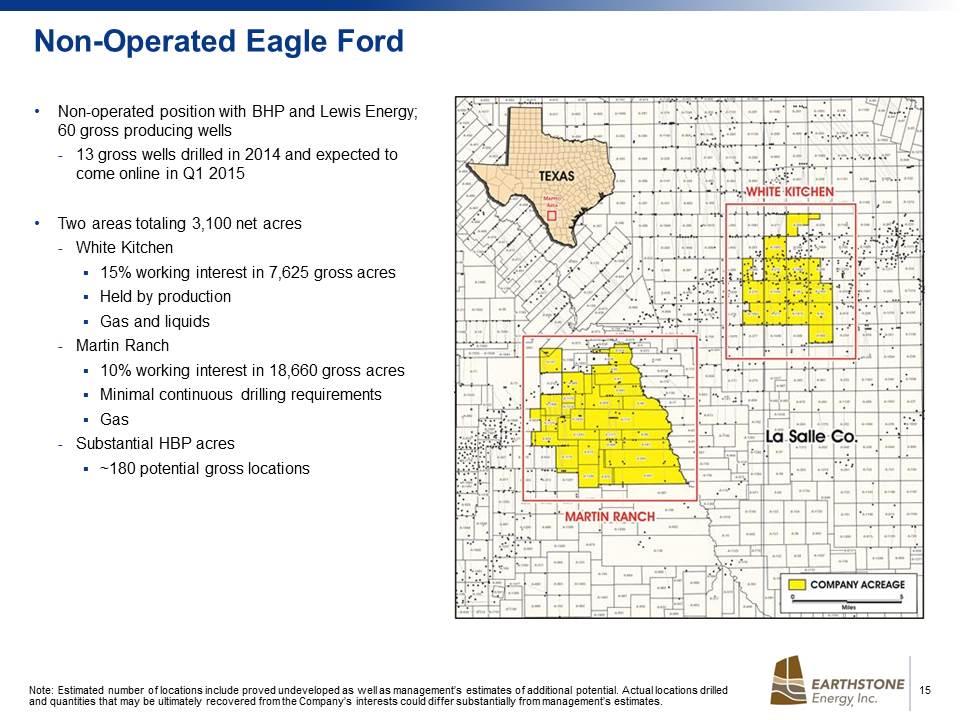

Non-operated position with BHP and Lewis Energy; 60 gross producing wells 13 gross wells drilled in 2014 and expected to come online in Q1 2015 Two areas totaling 3,100 net acres White Kitchen 15% working interest in 7,625 gross acres Held by production Gas and liquids Martin Ranch 10% working interest in 18,660 gross acres Minimal continuous drilling requirements Gas Substantial HBP acres ~180 potential gross locations Non-Operated Eagle Ford Note: Estimated number of locations include proved undeveloped as well as management’s estimates of additional potential. Actual locations drilled and quantities that may be ultimately recovered from the Company’s interests could differ substantially from management’s estimates.

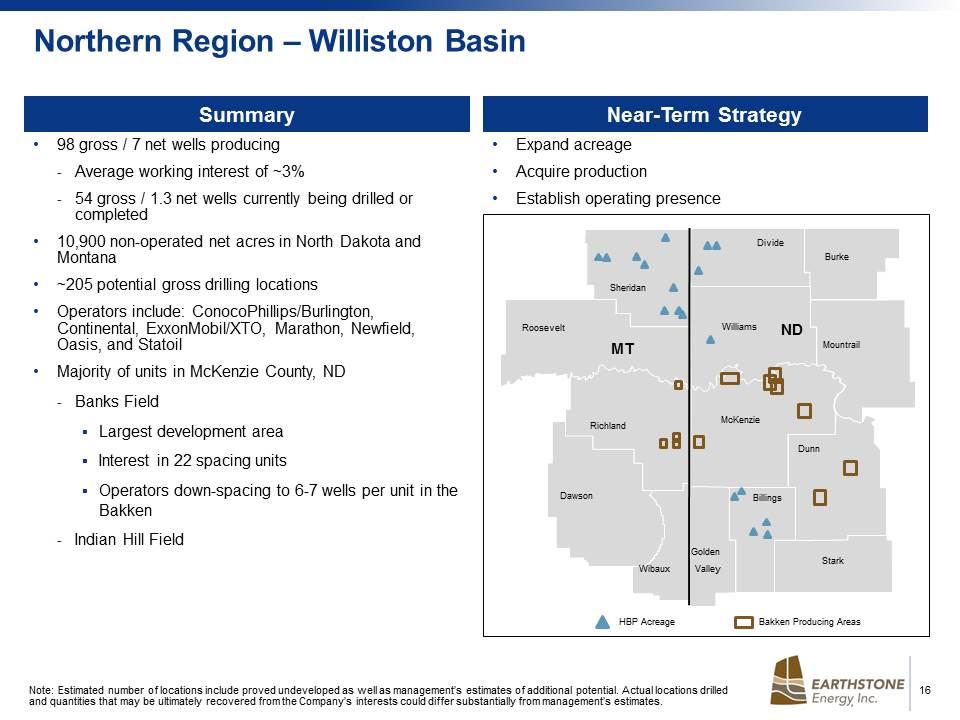

Northern Region – Williston Basin Expand acreage Acquire production Establish operating presence 98 gross / 7 net wells producing Average working interest of ~3% 54 gross / 1.3 net wells currently being drilled or completed 10,900 non-operated net acres in North Dakota and Montana ~205 potential gross drilling locations Operators include: ConocoPhillips/Burlington, Continental, ExxonMobil/XTO, Marathon, Newfield, Oasis, and Statoil Majority of units in McKenzie County, ND Banks Field Largest development area Interest in 22 spacing units Operators down-spacing to 6-7 wells per unit in the Bakken Indian Hill Field Near-Term Strategy Summary Sheridan Wibaux Dawson Richland Roosevelt Divide Dunn Mountrail Billings McKenzie Burke Golden Valley Williams Stark HBP Acreage Bakken Producing Areas ND MT Note: Estimated number of locations include proved undeveloped as well as management’s estimates of additional potential. Actual locations drilled and quantities that may be ultimately recovered from the Company’s interests could differ substantially from management’s estimates.

Capital Expenditures and Financial Overview

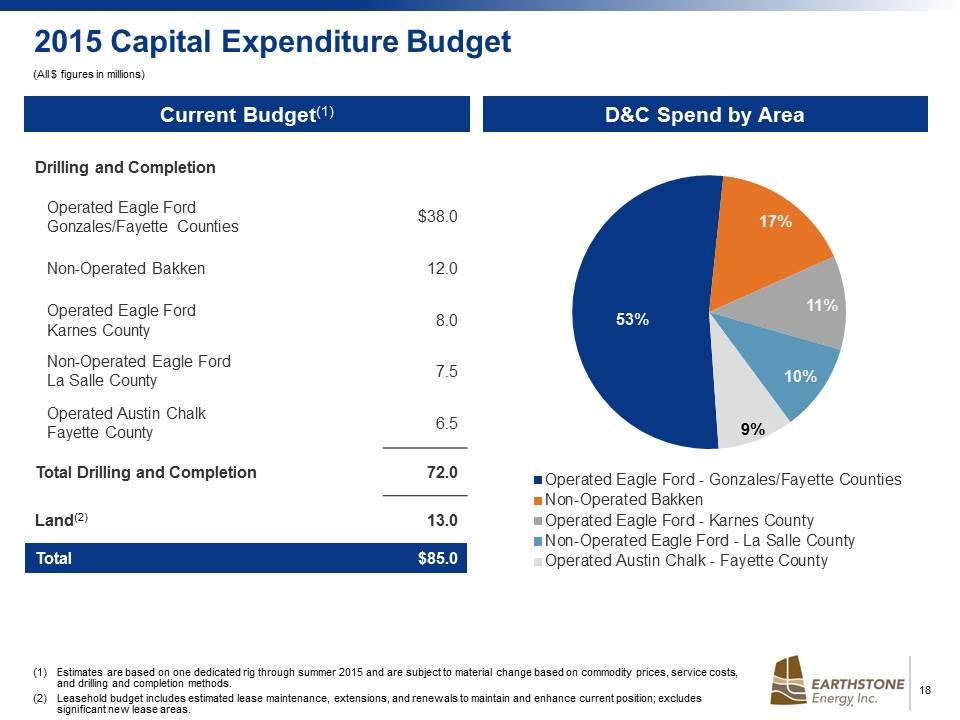

2015 Capital Expenditure Budget Drilling and Completion Operated Eagle Ford Gonzales/Fayette Counties $38.0 Non-Operated Bakken 12.0 Operated Eagle Ford Karnes County 8.0 Non-Operated Eagle Ford La Salle County 7.5 Operated Austin Chalk Fayette County 6.5 Total Drilling and Completion 72.0 Land(2) 13.0 Total $85.0 Estimates are based on one dedicated rig through summer 2015 and are subject to material change based on commodity prices, service costs, and drilling and completion methods. Leasehold budget includes estimated lease maintenance, extensions, and renewals to maintain and enhance current position; excludes significant new lease areas. D&C Spend by Area Current Budget(1) (All $ figures in millions)

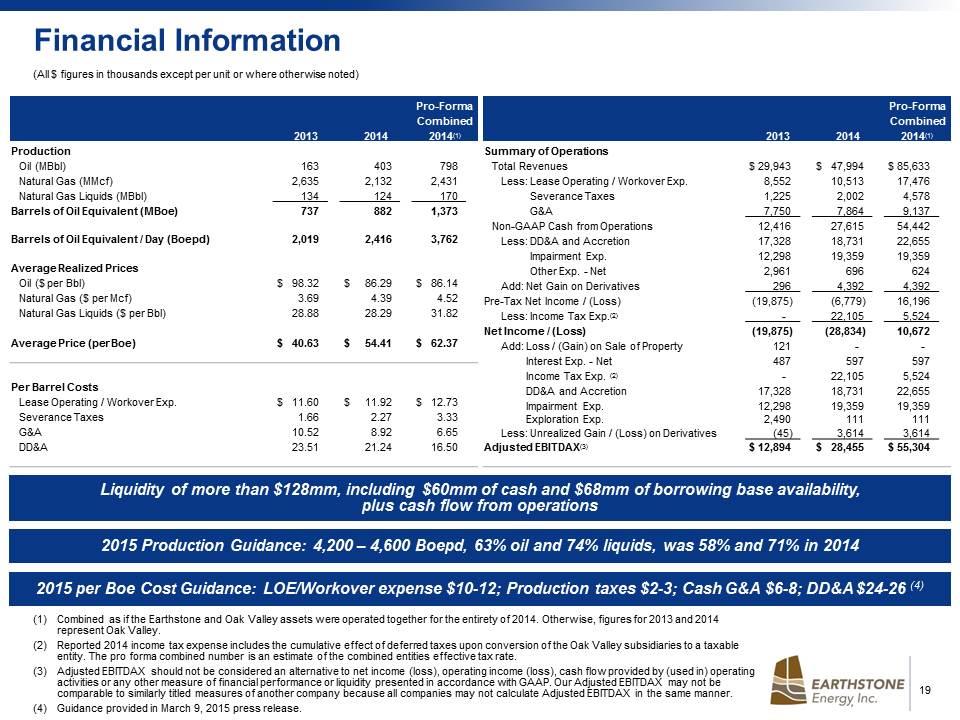

Financial Information Combined as if the Earthstone and Oak Valley assets were operated together for the entirety of 2014. Otherwise, figures for 2013 and 2014 represent Oak Valley. Reported 2014 income tax expense includes the cumulative effect of deferred taxes upon conversion of the Oak Valley subsidiaries to a taxable entity. The pro forma combined number is an estimate of the combined entities effective tax rate. Adjusted EBITDAX should not be considered an alternative to net income (loss), operating income (loss), cash flow provided by (used in) operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Our Adjusted EBITDAX may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDAX in the same manner. Guidance provided in March 9, 2015 press release. (All $ figures in thousands except per unit or where otherwise noted) Pro-Forma Combined 2013 2014 2014(1) Summary of Operations Total Revenues $ 29,943 $ 47,994 $ 85,633 Less: Lease Operating / Workover Exp. 8,552 10,513 17,476 Less: Severance Taxes 1,225 2,002 4,578 Less: G&A 7,750 7,864 9,137 Non-GAAP Cash from Operations 12,416 27,615 54,442 Less: DD&A and Accretion 17,328 18,731 22,655 Less: Impairment Exp. 12,298 19,359 19,359 Less: Other Exp. - Net 2,961 696 624 Add: Net Gain on Derivatives 296 4,392 4,392 Pre-Tax Net Income / (Loss) (19,875) (6,779) 16,196 Less: Income Tax Exp.(2) - 22,105 5,524 Net Income / (Loss) (19,875) (28,834) 10,672 Add: Loss / (Gain) on Sale of Property 121 - - Add: Interest Exp. - Net 487 597 597 Add: Income Tax Exp. (2) - 22,105 5,524 Add: DD&A and Accretion 17,328 18,731 22,655 Add: Impairment Exp. 12,298 19,359 19,359 Add: Exploration Exp. 2,490 111 111 Less: Unrealized Gain / (Loss) on Derivatives (45) 3,614 3,614 Adjusted EBITDAX(3) $ 12,894 $ 28,455 $ 55,304 Pro-Forma Combined 2013 2014 2014(1) Production Oil (MBbl) 163 403 798 Natural Gas (MMcf) 2,635 2,132 2,431 Natural Gas Liquids (MBbl) 134 124 170 Barrels of Oil Equivalent (MBoe) 737 882 1,373 Barrels of Oil Equivalent / Day (Boepd) 2,019 2,416 3,762 Average Realized Prices Oil ($ per Bbl) $ 98.32 $ 86.29 $ 86.14 Natural Gas ($ per Mcf) 3.69 4.39 4.52 Natural Gas Liquids ($ per Bbl) 28.88 28.29 31.82 Average Price (per Boe) $ 40.63 $ 54.41 $ 62.37 Per Barrel Costs Lease Operating / Workover Exp. $ 11.60 $ 11.92 $ 12.73 Severance Taxes 1.66 2.27 3.33 G&A 10.52 8.92 6.65 DD&A 23.51 21.24 16.50 2015 Production Guidance: 4,200 – 4,600 Boepd, 63% oil and 74% liquids, was 58% and 71% in 2014 2015 per Boe Cost Guidance: LOE/Workover expense $10-12; Production taxes $2-3; Cash G&A $6-8; DD&A $24-26 (4) Liquidity of more than $128mm, including $60mm of cash and $68mm of borrowing base availability, plus cash flow from operations

Frank Lodzinski President and CEO Robert Anderson EVP, Corporate Development and Engineering Neil Cohen VP, Finance, and Treasurer Corporate Headquarters Houston 1400 Woodloch Forest Drive | Suite 300 | The Woodlands, TX 77380 | (281) 298-4246 Denver 633 17th Street | Suite 2320 | Denver, CO 80202 | (303) 296-3076 Website www.earthstoneenergy.com Contact Information