Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - China Teletech Holding Inc | Financial_Report.xls |

| EX-21.1 - JURISDICTION OF INCORPORATION - China Teletech Holding Inc | f10k2014ex21i_chinateletech.htm |

| EX-31.1 - CERTIFICATION - China Teletech Holding Inc | f10k2014ex31i_chinateletech.htm |

| EX-32.1 - CERTIFICATION - China Teletech Holding Inc | f10k2014ex32i_chinateletech.htm |

| EX-31.2 - CERTIFICATION - China Teletech Holding Inc | f10k2014ex31ii_chinateletech.htm |

| EX-32.2 - CERTIFICATION - China Teletech Holding Inc | f10k2014ex32ii_chinateletech.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 333-130937

CHINA TELETECH HOLDING, INC.

(Exact name of registrant as specified in its charter)

| Florida | 59-3565377 | |

| State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization | Identification No.) | |

| Bao’an District, Guanlan Area, Xintian, Jun’xin Industrial Zone Building No. 9, 10, Shenzhen, Guangdong, China | N/A | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code (850) 521-1000

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T ( 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K ( 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |

| (Do not check if a smaller reporting company) | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter, June 30, 2014: $568,443.82.

As of April 13, 2015, the registrant had 147,213,776 shares of its common stock outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

Following the acquisition of Shenzhen Jinke Energy Development Co., Ltd. in January 2015, China Teletech Holding, Inc. ("we" or the "Company") is a manufacture of lithium-ion polymer batteries.

CORPORATE HISTORY AND STRUCTURE

We were incorporated as Avalon Development Enterprises, Inc. on March 29, 1999, under the laws of the State of Florida. From inception until January 2007, we engaged in the business of acquiring commercial property and expanding into building cleaning, maintenance services, and equipment leasing as supporting ancillary services and sources of revenue. On January 10, 2007, the Company, Global Telecom Holdings, Ltd., a British Virgin Islands company ("GTHL"), and the shareholders of GTHL, entered into a share exchange agreement, pursuant to which the Company issued 39,817,500 shares of its restricted common stock to the shareholders of GTHL in exchange for all of the issued and outstanding capital stock of GTHL. Following the transaction on March 27, 2007, GTHL became our wholly-owned subsidiary and we changed our name to Guangzhou Global Telecom Holdings, Inc. and succeeded to the business of GTHL.

In 2007, we established four subsidiaries; namely, Zhengzhou Global Telecom Equipment Limited ("ZGTE"), Macau Global Telecom Company Limited ("MGT"), Huantong Telecom Hongkong Holding Limited ("HTHKH"), and Huantong Telecom Singapore Company PTE Limited ("HTS") with capital of RMB 500,000, Macau Dollar 300,000, Hong Kong Dollar 100 and Singapore Dollar 200,000, respectively. Simultaneously, we established a subsidiary; namely, Guangzhou Huantong Telecom Technology and Consultant Services, Ltd ("GHTTCS") with capital of RMB 8,155,730. Pursuant to a Stock Purchase Agreement dated April 9, 2008 and July 29, 2008, respectively, the Company acquired 50% of the issued and outstanding shares in the capital of Beijing Lihe Jiahua Technology and Trading Company Ltd ("BLJ") and 51% of the issued and outstanding shares in Guangzhou Renwoxing Telecom Co., Ltd. ("GRT"), a limited liability company incorporated in China. Pursuant to the terms of the Stock Purchase Agreements, the Shareholders agreed to sell and transfer the proportion of the shares to the Company for a purchase consideration of US$300,000 and US$291,833 respectively.

In 2009 and 2010, the Company disposed of its subsidiaries CHTTCS, ZGTE, MGT and BLJ due to their loss in operations. HTHKH and HTS were not able to commence operations since its inception, so the Company deregistered them in 2010.

The Company’s registration with the State of Florida lapsed on September 27, 2013 for failure to make its annual payment and file its annual reports with the State. The lapse occurred due to administrative error. As of April 15, 2015, the Company has paid the required fees and reinstated its registration with the State of Florida. No material negative impact on the operations of the Company has been identified to-date.

Acquisition of China Teletech Limited

On March 30, 2012, the Company completed a share exchange transaction with China Teletech Limited, a British Virgin Islands corporation ("CTL"), by entering into a share exchange agreement with CTL and the former shareholders of CTL, dated March 30, 2012.

CTL is a British Virgin Islands Company, incorporated on January 30, 2008 under the British Virgin Islands Business Act 2004. Its primary business operations were concluded through two wholly owned subsidiaries located in China, namely, (a) Shenzhen Rongxin Investment Co., Ltd. ("Shenzhen Rongxin") and (b) Guangzhou Rongxin Science and Technology Limited ("Guangzhou Rongxin").

Pursuant to the agreement, we acquired all the outstanding capital stock of CTL from the former shareholders of CTL in exchange for the issuance of 40,000,000 shares of our common stock. The shares issued to the former shareholders of CTL constituted approximately 68.34% of our issued and outstanding shares of common stock as of an immediately after the commutation of the share exchange transaction. As a result of the share exchange, CTL became our wholly owned subsidiary and Dong Liu and Yuan Zhao, the former shareholders of CTL, became our principal shareholders.

In connection with the share exchange, Yankuan Li resigned as our Chief Financial Officer, Secretary and Chairman of the Board of Directors, effective as of March 30, 2012. Also effective upon closing of the share exchange, Dong Liu, Yuan Zhao, Yau Kwong Lee and Kwok Ming Wai Andrew were appointed as our directors. Ms. Yankuan Li remained President, Chief Executive Officer and a member of the board of directors of the Company. As of result of the merger, the Company believed that it could enjoy a greater management and capital resources and have a greater network and business opportunities. The Company expected to be able to expand its telecommunications business in Guangzhou and Shenzhen cities in China.

| 1 |

Sale of the Company's Wholly-Owned Subsidiary, Guangzhou Global Telecommunication Company Limited

On June 30, 2012, we entered into a Sales and Purchase Agreement with Mr. Zhu Sui Hui ("Mr. Hui") pursuant to which we sold all the capital stock of Guangzhou Global Telecommunication Company Limited ("GGT"), our wholly-owned subsidiary, to Mr. Hui for RMB 5,000, or approximately $800. Both parties agreed unconditionally to waive the current accounts payable or receivable balances between the Company (and its subsidiaries) and Guangzhou Global Telecommunication Company Limited. GGT was engaged in the trading and distribution of cellular phones and accessories, prepaid calling cards, and rechargeable store-value cards.

Sale of the Company's Subsidiary, Global Telecom Holdings Limited

On June 30, 2013, the Company’s subsidiary, Global Telecom Holdings Limited, entered into an agreement with an independent third party to dispose of its 51% owned subsidiary Guangzhou Renwoxing Telecom Co., Limited for a cash consideration of US$3,232.

Deregistration of the Company’s Wholly-Owned Subsidiaries, Guangzhou Rongxin Science and Technology Limited

On December 30, 2013, the Company had its subsidiary, Guangzhou Rongxin, deregistered due to ceased operations.

Disposition of the Company’s variable interest entity, Shenzhen Rongxin Investment Co., Ltd.

On September 30, 2012, China Teletech, Limited entered into an agreement with a related party, Liu Yong, brother of Mr. Liu Dong, the Company’s former Chairman, to dispose of the variable interest entity Shenzhen Rongxin for a cash consideration of US$1,579.

Following the deregistration of the Company’s subsidiary, Guangzhou Rongxin, the Company was a shell company with no operations until the Company entered into the Share Exchange Agreement with Jinke.

Share Exchange with Jinke

On January 28, 2015, the Company entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with Shenzhen Jinke Energy Development Co., Ltd., a company organized under the laws of the People’s Republic of China (“Jinke”), and Guangyuan Liu, the holder of 97% of the equity interest of Jinke (the “Jinke Shareholder”), pursuant to which China Teletech acquired 51% of the issued and outstanding equity securities of Jinke (the “Share Exchange”). Both the Company and Jinke believed that the acquisition transaction is in the best interest of their respective shareholders. The Company believed that the acquisition would enhance the value of the Company through the acquisition of a majority equity interest in Jinke’s viable business, and Jinke believes that such transaction will afford Jinke access to the U.S. capital market and other possible financial resources. Prior to the execution of the Cooperation Agreement, no material relationship between the company and its affiliates, on the one hand, and Shenzhen Jinke Energy Development Co. Ltd and their affiliates, on the other,. Jinke was introduced to the Company by Ms. Chen Xiaoqiao, a PRC resident, who is a mutual business contact of Ms. Li Yankuan, the Company’s CEO and Mr. Liu Guangyuan, Jinke’s former owner. For her role in this, Ms. Chen received 1,000,000 shares of the Company’s common stock subsequent to the closing of the acquisition. Other than the foregoing, no third party played a material role in arranging or facilitating the acquisition.

The Company and Jinke had previously entered into a certain Cooperation Agreement on June 30, 2014. The Cooperation Agreement was superseded and replaced by the Share Exchange Agreement by and between the Company and Jinke, dated as of January 28, 2015. The parties decided to change from an asset purchase to a share purchase primarily due to the difficulty in ascertaining Jinke’s assets to be acquired based on the percentages as set forth in the previous Cooperation Agreement. In connection with the Share Exchange, the cooperation agreement dated June 30, 2014 into which Jinke and the Company previously entered, and which was first disclosed on the Company’s current report on Form 8-K filed August 8, 2014, was terminated and superseded in its entirety by the Share Exchange Agreement.

Pursuant to the Share Exchange Agreement, the Company agreed to issue an aggregate of 20,000,000 shares of its common stock, $0.001 par value per share (the “Common Stock”) to the Jinke Shareholder in exchange for 51% of the issued and outstanding securities of Jinke. Of the 20,000,000 shares to be issued by the Company, 16,000,000 were issued on October 6, 2014 and delivered to the Jinke Shareholder and his designee prior to closing and 4,000,000 were to be issued and delivered at closing. The Share Exchange closed on January 28, 2015. As promptly as practicable after closing, Jinke and the Jinke Shareholder agreed to obtain confirmation from the relevant PRC governmental authorities of the change in registration of ownership of Jinke to reflect the transfer of the 51% equity interest to the Company. As of the date of this report, the Company is still in the process of registering the transfer with the relevant PRC governmental authorities. Additionally, the Company is in the process of issuing the 4,000,000 shares due to Mr. Liu at closing.

The transactions contemplated by the Share Exchange were intended to be a “tax-free” reorganization pursuant to the provisions of Sections 351 and/or 368(a) of the Internal Revenue Code of 1986, as amended.

In connection with the Share Exchange, Mr. Guangyuan Liu was appointed a director of the Company, and Ms. Yankuan Li was appointed a director of Jinke. Immediately following the Share Exchange, Mr. Liu beneficially owns 10.87% of the issued and outstanding common stock of the Company, which includes shares held by Mr. Liu’s son, Liu Jiexun.

| 2 |

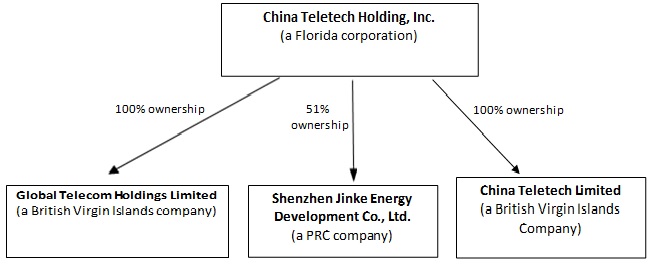

The corporate structure of the Company subsequent to the consummation of the Share Exchange is illustrated as follows:

The address of our principal executive offices and corporate offices is Bao’an District, Guanlan Area, Xintian, Jun’xin Industrial Zone Building No. 9, 10, Shenzhen, Guangdong, China. Our telephone number is (850) 521-1000.

BUSINESS

Prior to our acquisition of Jinke, we were a shell company with no operations prior to the Share Exchange. Additionally, there was no operation at the Company’s wholly-owned subsidiaries, Global Telecom Holdings Limited and China Teletech Limited, before the Share Exchange. We are currently a holding company with substantially all of our operations located in the PRC through our 51% equity ownership of Jinke. Through Jinke, we are now primarily a manufacturer of lithium-ion polymer batteries.

Established in 2006, Jinke develops and manufactures lithium-ion polymer batteries with approximately different models and specifications for a range of products. Our manufacturing facility is located in Guangdong, China, and our products are sold and distributed both domestically and internationally; approximately 48% of revenue is derived from our international sales network, with customers in North America, South Asia, the Middle East, Europe and Central America.

We currently operate our business through our subsidiary, Jinke. Jinke is located in Junxin Industrial Zone, Shenzhen, China. It is primarily engaged in the manufacturing and design of batteries, including lithion-ion polymer batteries.

Industry

Rapid advancements in electronic technology in recent years have expanded the number and sophistication of battery-powered devices, which in turn have come to require increasingly higher levels of energy. This has stimulated consumer demand for higher-energy batteries capable of delivering longer period of service between recharges or battery replacement.

High energy density and long achievable cycle life are important characteristics of rechargeable battery technologies. Energy density refers to the total electrical energy per unit volume stored in a battery. High energy density batteries generally are longer lasting power sources providing longer operating time and necessitating fewer battery recharges. Greater energy density will permit the use of batteries of a given weight or volume for a longer time period. Long cycle life is a preferred feature of a rechargeable battery because it allows the user to charge and recharge many times before noticing a difference in performance. Long achievable cycle life, particularly in combination with high energy density, is desirable for applications requiring frequent battery recharges.

We believe that China has become one of the biggest producers of lithium batteries. Production plants of lithium batteries in China cluster in such provinces as Guangdong, Jiangsu, Zhejiang and Tianjin. We believe that the global lithium market underwent more significant development in 2013 than in 2012, and as such the demand for lithium batteries has increased. Additionally, China will be developing the alternative-energy automobile market as an emerging market of strategic importance, and thus we believe that lithium battery-powered automobiles will provide a bigger growth opportunity for lithium battery producers. At the same time, in markets such as electric bicycles, aerospace, and defense and military fields, lithium batteries have wide applications and thus the development of such markets may translate into good prospects for lithium battery producers.

| 3 |

Products

Lithium-ion batteries

Our primary source of revenue is our lithium-ion batteries, which we design and manufacture on an OEM-basis for our customers. In contrast to non-rechargeable batteries, such as those comprised of nickel cadmium or nickel-metal hydride, our lithium-ion rechargeable batteries have a higher energy density, a longer lifespan and can be recharged and reused up to 500 times. Additionally, unlike other rechargeable batteries, lithium batteries have no memory effect, meaning they can be recharged without being completely discharged, making charging quicker and more convenient, and giving lithium batteries a longer battery life than other rechargeable options. Although more expensive to manufacture than other battery options, lithium batteries are recyclable: oxidized lithium is non-toxic and can be safely extracted for use in new lithium batteries.

We generally categorize the lithium-ion batteries we produce as follows:

| ● | “small”-size batteries primarily used in digital consumer electronics products such as notebook PCs, cameras, portable media players, navigational tools and medical instruments. |

| ● | “large”-size batteries, or high power polymer batteries, primarily used in remote-control vehicles, electrical tools and emergency power supplies. |

| ● | “Paper” or “micro” batteries primarily used in portable devices such as smart cards, wireless devices and packaging solutions. |

After sales services

We offer comprehensive after-sales services to our customers to maintain their satisfaction with our products. Our professional service technicians provide 24-hour customer service relating to product quality insurance, distribution logistics, financing, and R&D improvements.

Strategy:

We intend to focus on enhancing the performance of our existing products and diversify our product line to achieve growth and capture market share. We also intend to implement a growth strategy through strategic acquisitions. Our goals are:

| ● | Improving existing battery products; |

| ● | Developing and commercializing cutting edge battery products to replace older technologies; |

| ● | Acquiring more high-tech equipment, so as to target customers seeking cutting-edge technologies that have the potential to generate higher profit margins. |

| ● | Vertically integrating our business with the manufacture of products that utilize our battery solutions; and |

| ● | Achieving cost efficiencies and economies of scale. |

We are continually developing new battery products to expand our market reach. Products in development include series connection batteries, parallel connection batteries, batteries for medical devices, high voltage batteries with voltages of 3.85v-4.35v, which higher voltages can turn on machines more quickly. Our manufacturing capability has matured, is ISO 9001 certified.

Paper batteries

Paper batteries are composed of carbon nanotubes that flank a sheet of cellulose-based spacer. They are flexible, ultra-thin and, unlike conventional chemical batteries that contain corrosive materials, relatively environmentally friendly. Due to their light and thin construction, paper batteries can be used in portable devices such as smart cards, wireless devices and packaging solutions. Paper batteries are able to utilize electrolytes in the blood and therefore are ideal for use in disposable medical devices such as transdermal pharmaceutical and cosmetic patches as well as implantable medical devices like pacemakers.

Jinke primarily manufactures its paper batteries for use in smartcards, but these batteries have the potential to be used in a range of thin digital devices. Current challenges to the development of paper battery segment are high production costs of the carbon nanotubes and the low shear strength of the paper component, which limits the battery’s durability.

| 4 |

Raw Materials

The primary raw materials used in our products are Lithium cobaltate, graphite, aluminium plastic film, electrolytes, and separators.

During the fiscal year 2014, Jinke’s top five principal suppliers are all based inproperty China, and includes, Hunan Bingbing New Material Ltd., Shenzheng Sinuo Development Ltd., Xinxiang Zhongke Technology Ltd., Rishang Youse Trade (Shanghai) Ltd., Huizhou Tianjiaolilai Development Ltd.

We depend on a limited number of suppliers for certain key raw materials and components used in manufacturing and developing our power systems. We have undertaken efforts to diversify our supplier base for certain key raw materials and components. We plan to continue to diversify our supplier base for certain materials and components in the future, as appropriate. We generally purchase raw materials pursuant to purchase orders placed from time to time.

Manufacturing

Our manufacturing operations are conducted in the Junxin Industrial Zone, Shenzhen, Guangdong, China. We have a total of 6 production lines in an approximately 11,531 sq. meter facility. We provide OEM manufacturing, design and labeling services.

Our design and manufacture of lithium polymer battery is ISO 9001 certified. We have received several accreditations, including The International Organization for Standardization (ISO) 9001: 2008, Certificate of Conformity by Guangzhou Testing and Inspection Institute for Household Electrical Appliances, PONY Testing International Group, and Underwriters Laboratories Inc. (UL), attesting to our quality design, manufacture, manufacturing safety, controls, procedures and environmental performance.

Major Customers

Jinke had approximately RMB 23,000,000 worth of sales in 2013 and approximately RMB 17,000,000 worth of sales in 2014 from its top five customers combined.

The following customers represented over 10% of total sales: Shanghai Sand Information Technology System Co., Ltd, Dahao Information Technology (Weihai) Co., Ltd, Shenzhen Shunmeng Science and Technology Co., Ltd, Shenzhen Daitian, Electronic Science and Technology Co., Ltd, and Suqian Zhongmao Battery Co., Ltd.

Sales to our customers are based primarily on purchase orders we receive, generally on a quarterly basis, rather than firm, long-term purchase commitments from our customers. These customers have been Jinke’s customers for two or three years. Generally, the customers will send quarterly sales orders for Jinke to fulfill. We also employ a rigorous customer screening policy to optimize the collectability and duration of each customer relationship. Before filling an order, Jinke evaluates each purchase order for the customer’s financial condition and potential market share.

Sales and Marketing

Our consolidated advertising and marketing efforts will be focused on building our business with middle and upper tier customers. Our sales force makes up a significant portion of our current marketing expenses. Approximately 80% of our revenue is derived from our in-house sales force, and approximately 20% is derived from contractors.

Research and Development

We spent approximately RMB 4-5 million in each of the last two years. Generally, 30% of the research and development cost is passed on to our customers. For example, in the event that we do not have a product model that meets a customer’s specifications, we will develop a new model to meet their needs. Where any intellectual property developed for new model is to be owned by Jinke, approximately 30% of development costs is passed on to customers. Where any intellectual property developed for the new model is to be owned by the customer, approximately 40% of development costs is passed on to such customer.

Competition

We face competition from many other battery manufacturers, many of which have significantly greater name recognition and financial, technical, manufacturing, personnel and other resources than we have. We compete against other lithium-ion polymer battery producers, as well as manufacturers of all different types of (rechargeable and non-rechargeable) batteries. Our primary competitors are the following: Hong Kong Highpower Technology, Inc., Mbell Technology Groups, Shenzhen SJY Energy Technology Co., Ltd, and Shenzheng Mottcell Battery Technology Co., Ltd. These primary competitors have production equipment that is more high-end than Jinke’s, and therefore can produce more sophisticated products. However, we believe that Jinke has a competitive advantage over these competitors because Jinke is able to cover a larger market base, in both B2B and B2C markets.

| 5 |

Seasonality

The battery market is subject to some seasonal variation. In the Chinese market, April to July are weaker months, as well as the weeks leading up to the Chinese New Year.

Intellectual Property

We rely on a combination of patent and trade secret protection and other unpatented proprietary information to protect our intellectual property rights and to maintain and enhance our competitiveness in the battery industry. We hold eight (8) patents in China relating to our products, expiring in 2021 and 2022. One of the patents is held by Liu Guangyuan and another company employee, serial number ZL 2011 2 0185568.7; there is no contract between the Company on the one hand, and Liu Guangyuan and this other company employee on the other hand, for the use of this patent by the Company. We believe there is limited risk in losing access to these patents since Liu Guangyuan, one of the patent-holders has ownership stake in the Company and is unlikely to prohibit the company’s use of this patent. All of these patents are utility patents that cover our batteries and their production methods, battery testing devices, as well as battery components. Additionally, we have eight (8) patents applications pending in China. We also have one registered trademark in China, which includes “Golden Energy” and its Chinese equivalent, expiring on September 27, 2020.

Government Approval and Regulation

PRC Government Regulations

We require a number of approvals, licenses and certificates in order to operate our business. Our principal approvals, licenses and certificates are set forth below.

Business License

Any company that conducts business in the PRC must have a business license that covers the scope of the business in which such company is engaged. Following the Share Exchange, we conduct our business through our operating subsidiary, Jinke. Each of our operating subsidiaries holds a business license that covers its present business. Prior to expanding our business beyond the scope covered by our business licenses, we are required to apply and receive approvals from the relevant PRC authorities (if applicable, based on the new business in which we intend to engage) and conduct modification registration formalities with the competent administration of industry and commerce. Companies that operate outside the scope of their licenses can be subjected to a fine of not more than RMB20,000, if such operations do not violate the PRC Criminal Law, or a fine of not less than RMB20,000 but no more than RMB200,000 if such operations violate the PRC Criminal Law, or a fine of not less than RMB50,000 but not more than RMB500,000 if the such operations harm human health, have serious hidden hazards to safety, threaten public safety or destroy environmental resources. Other penalties can include disgorgement of income and being ordered to cease operations. We have a Business License issued on January 16, 2006 by Shenzhen Administration for Industry and Commerce, and the scope of the licnse is manufacturing, R&D, sales of polymer li-ion batteries, electronic products (MP3, MP4) and related components, import and export of goods and technology.

We also hold a Certificate of High Technology Enterprise, expiring on July 21, 2016.

Environmental Regulations

The major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution. We aim to comply with environmental laws and regulations and have acquired an Approval Permit of Manufacturing Project Environmental Impact from the Shenzhen Bao’an District Environmental Protection and Water Affairs Bureau, which is valid until September 15, 2015, and renewable on an annual basis. Additionally, on July 22, 2011, we were issued a permit of waste water disposal into Junzibu River for the waste water generated in our manufacture process.

If we fail to comply with the provisions of the permits, we could be subject to fines, criminal charges or other sanctions by regulators, including the suspension or termination of our manufacturing operations.

| 6 |

Our operating subsidiaries have received certifications from the relevant PRC government agencies in charge of environmental protection, which indicate that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We have committed significant attention and efforts to quality and environmental protection during our production process. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws. We do not believe the existence of these environmental laws, as currently written and interpreted, will materially hinder or adversely affect our business operations; however, there can be no assurances of future events or changes in laws, or the interpretation of laws, governing our industry. Failure to comply with PRC environmental protection laws and regulations may subject us to fines up to RMB1,000,000, the exact amount of which is determined on a case by case basis, or disrupt our operations and the construction of our new facility, result in the shutdown of our operations temporarily or permanently, which may materially and adversely affect our business, results of operations and financial condition.

During the year ended December 31, 2014, we expended approximately RMB 600,000 related to our compliance with environmental regulations.

Patent Protection in China

The PRC’s intellectual property protection regime is consistent with those of other modern industrialized countries. The PRC has domestic laws for the protection of rights in copyrights, patents, trademarks and trade secrets. The PRC is also a signatory to most of the world’s major intellectual property conventions, including:

| ● | Convention establishing the World Intellectual Property Organization (WIPO Convention) (June 4, 1980); |

| ● | Paris Convention for the Protection of Industrial Property (March 19, 1985); |

| ● | Patent Cooperation Treaty (January 1, 1994); and |

| ● | The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) (November 11, 2001). |

Patents in the PRC are governed by the China Patent Law and its Implementing Regulations, each of which went into effect in 1985. Amended versions of the China Patent Law and its Implementing Regulations came into effect in 2001 and 2003, respectively.

The PRC is signatory to the Paris Convention for the Protection of Industrial Property, in accordance with which any person who has duly filed an application for a patent in one signatory country shall enjoy, for the purposes of filing in the other countries, a right of priority during the period fixed in the convention (12 months for inventions and utility models, and 6 months for industrial designs).

The Patent Law covers three kinds of patents, i.e., patents for inventions, utility models and designs respectively. The Chinese patent system adopts the principle of first to file. This means that, where more than one person files a patent application for the same invention, a patent can only be granted to the person who first filed the application. Consistent with international practice, the PRC only allows the patenting of inventions or utility models that possess the characteristics of novelty, inventiveness and practical applicability. For a design to be patentable, it should not be identical with or similar to any design which, before the date of filing, has been publicly disclosed in publications in the country or abroad or has been publicly used in the country, and should not be in conflict with any prior right of another.

PRC law provides that anyone wishing to exploit the patent of another must conclude a written licensing contract with the patent holder and pay the patent holder a fee. One rather broad exception to this, however, is that, where a party possesses the means to exploit a patent but cannot obtain a license from the patent holder on reasonable terms and in reasonable period of time, the PRC State Intellectual Property Office, or SIPO, is authorized to grant a compulsory license. A compulsory license can also be granted where a national emergency or any extraordinary state of affairs occurs or where the public interest so requires. SIPO, however, has not granted any compulsory license up to now. The patent holder may appeal such decision within three months from receiving notification by filing a suit in a people’s court.

PRC law defines patent infringement as the exploitation of a patent without the authorization of the patent holder. A patent holder who believes his patent is being infringed may file a civil suit or file a complaint with a PRC local Intellectual Property Administrative Authority, which may order the infringer to stop the infringing acts. Preliminary injunction may be issued by the People’s Court upon the patentee’s or the interested parties’ request before instituting any legal proceedings or during the proceedings. Evidence preservation and property preservation measures are also available both before and during the litigation. Damages in the case of patent infringement is calculated as either the loss suffered by the patent holder arising from the infringement or the benefit gained by the infringer from the infringement. If it is difficult to ascertain damages in this manner, damages may be reasonably determined in an amount ranging from one to more times of the license fee under a contractual license. The infringing party may be also fined by Administration of Patent Management in an amount of up to three times the unlawful income earned by such infringing party. If there is no unlawful income so earned, the infringing party may be fined in an amount of up to RMB500,000, or approximately $81,981.

| 7 |

Product Liability and Consumers Protection

Product liability claims may arise if the products sold have any harmful effect on the consumers. The injured party may make a claim for damages or compensation. The General Principles of the Civil Law of the PRC, which became effective in January 1987, state that manufacturers and sellers of defective products causing property damage or injury shall incur civil liabilities for such damage or injuries.

The Product Quality Law of the PRC was enacted in 1993 and amended in 2000 to strengthen the quality control of products and protect consumers’ rights and interests. Under this law, manufacturers and distributors who produce or sell defective products may be subject to confiscation of earnings from such sales, revocation of business licenses and imposition of fines, and in severe circumstances, may be subject to criminal liability.

The Law of the PRC on the Protection of the Rights and Interests of Consumers was promulgated on October 31, 1993 and became effective on January 1, 1994 to protect consumers’ rights when they purchase or use goods or services. All business operators must comply with this law when they manufacture or sell goods and/or provide services to customers.

The Tort Law of the PRC effective on July 1, 2010 requires that when the product defect endangers people’s life or property, the injured party may hold the producer or the seller liable in tort and require that it remove obstacles, eliminate danger, or take other action. The Tort Law also requires that when a product is found to be defective after it is put into circulation, the producer and the seller shall give timely warnings, recall the defective product, or take other remedial measures.

Employment Laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, and social insurance, housing funds and other welfare. These include local labor laws and regulations, which may require substantial resources for compliance.

China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract. The National Labor Contract Law has enhanced rights for the nation’s workers, including permitting open-ended labor contracts and severance payments. The legislation requires employers to provide written contracts to their workers, restricts the use of temporary labor and makes it harder for employers to lay off employees. It also requires that employees with fixed-term contracts be entitled to an indefinite-term contract after a fixed-term contract is renewed once or the employee has worked for the employer for a consecutive ten-year period.

Tax

Pursuant to the Provisional Regulation of China on Value Added Tax and their implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay VAT at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to a portion of or all the refund of VAT that it has already paid or borne.

Foreign Currency Exchange

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations promulgated by the State Council, as amended on August 5, 2008, or the Foreign Exchange Regulations. Under the Foreign Exchange Regulations, the Renminbi is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investments, loans, repatriation of investments and investments in securities outside of China, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce, the SAFE and the State Reform and Development Commission.

| 8 |

Dividend Distributions

Under applicable PRC regulations, enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, enterprises in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year as its statutory general reserves until the accumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

Jinke would have been able to distribute as dividends in 2013 and 2014 to the Company as Jinke’s 51% equity owner. But Jinke experienced operating loss in 2013 and the first nine months of 2014, therefore, no dividend was distributed. If Jinke did not experience operating loss in 2013, and in 2014, Jinke would have provided 50% of its profit to its shareholders on a pro rata basis. Therefore, the company, as Jinke’s 51% equity owner, would have received 51% of the 50% profit distributed as dividend.

Employees

As of April 13, 2015, we have 290 full-time employees.

Not applicable because we are a smaller reporting company.

Item 1B. Unresolved Staff Comments.

Not applicable because we are a smaller reporting company.

Our manufacturing operations are conducted in the Junxin Industrial Zone, Shenzhen, China. We have a total of 6 production lines in an approximately 11,531 sq. meter facility. The manufacturing facilities are leased and will not expire until March 31, 2017. The Company does not own the land where its manufacturing facilities are located, but it rents it from the local SASAC, State-owned Assets Supervision and Administration Commission. The land use right issued authorizes the land for industrial use.

We believe that our current facilities are adequate and suitable for our operations.

We have not been involved in any material legal proceedings, other than the ordinary litigation incidental to our business; except for the following:

Dong Liu (individually and on behalf of China Teletech Holdings, Inc. v. Yankuan Li, Jiewen Li, Zhou Yuan, Jane Yu, John Doe #1-10, New York County Supreme Court, Index No. 653084/2014. Dong Liu, the former Chairman of the Board of Directors of the Company, individually and on behalf of the Company, commenced the action on October 9, 2015 against Yankuan Li, the Company’s President, Chief Executive Officer and director, Jiewen Li, Yuan Zhao, a director of the Company, and Jane Yu, the Company’s Chief Financial Officer and Secretary, asserting claims sounding in fraud, civil conspiracy to commit fraud, breach of fiduciary duty and unjust enrichment. Dong Liu never served the complaint on the individual defendants. Instead, he moved by order to show cause on November 3, 2014, for a temporary restraining order and preliminary injunction to enjoin the Company from proceeding with a merger with Jinke, granting Dong Liu unfettered access to the Company’s books and records and permitting him to serve the individual defendants by a method other than those permitted by the New York State Civil Practice and Laws or the Hague Convention on Service Abroad of Judicial and Extrajudicial Documents in Civil and Commercial Matters. On November 6, 2014, the New York Supreme Court denied the temporary restraining order and set up a briefing schedule to determine the preliminary injunction. On February 18, 2015, the court issued a decision denying Dong Liu’s motion for a preliminary injunction and granting the defendants’ motion by dismissing the complaint without prejudice. Since that time, plaintiff has made no effort to re-plead the case or challenge the ruling. Under New York court rules, plaintiff’s time to re-argue the motion or serve notice to appeal has expired.

Other than as disclosed above, there are no proceedings in which any of our directors, officers or any of their respective affiliates, or any beneficial stockholder of more than five percent of our voting securities, is an adverse party or has a material interest adverse to our interest.

Item 4. Mine Safety Disclosures.

Not applicable.

| 9 |

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock trades on the OTC Pink Markets under the symbol "CNCT". The OTCPink is a quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter ("OTC") equity securities. An OTC equity security generally is any equity that is not listed or traded on a national securities exchange.

Price Range of Common Stock

The following table shows, for the periods indicated, the high and low bid prices per share of our common stock as reported by the OTCPink quotation service. These bid prices represent prices quoted by broker-dealers on the OTCPink quotation service. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions.

| High | Low | |||||||

| Fiscal Year 2013 | ||||||||

| First quarter ended March 31, 2013 | $ | 0.01 | $ | 0.47 | ||||

| Second quarter ended June 30, 20113 | $ | 0.01 | $ | 0.07 | ||||

| Third quarter ended September 30, 2013 | $ | 0.01 | $ | 0.06 | ||||

| Fourth quarter ended December 31, 2013 | $ | 0.01 | $ | 0.02 | ||||

| Fiscal Year 2014 | ||||||||

| First quarter ended March 31, 2014 | $ | 0.01 | $ | 0.01 | ||||

| Second quarter ended June 30, 2014 | $ | 0.01 | $ | 0.01 | ||||

| Third quarter ended September 30, 2014 | $ | 0.03 | $ | 0.01 | ||||

| Fourth quarter ended December 31, 2014 | $ | 0.01 | $ | 0.00 | ||||

Approximate Number of Equity Security Holders

As of April 13, 2015 there were approximately 84 stockholders of record.

Dividends

Holders of our common stock are entitled to receive dividends if, as and when declared by the Board of Directors out of funds legally available therefore. We have never declared or paid any dividends on our common stock. We intend to retain any future earnings for use in the operation and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our common stock to our stockholders for the foreseeable future.

Jinke would have been able to distribute as dividends in 2013 and 2014 to the Company as Jinke’s 51% equity owner. But Jinke experienced operating loss in 2013 and the first nine months of 2014, therefore, no dividend was distributed. If Jinke did not experience operating loss in 2013, and in 2014, Jinke would have provided 50% of its profit to its shareholders on a pro rata basis. Therefore, the company, as Jinke’s 51% equity owner, would have received 51% of the 50% profit distributed as dividend.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have in effect any compensation plans under which our equity securities are authorized for issuance.

Item 6. Selected Financial Data.

Not applicable because we are a smaller reporting company.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of the results of operations and financial condition of the Company for the years December 31, 2014 and 2013 shall be read in conjunction with its financial statements and notes. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results of the timing of events could differ materially from those projected in these forward-looking statements as a result of a number of factors, including those set forth under the heading Risk Factors herein. We use words such as "anticipate," "estimate," "plan," "project," "continuing," "ongoing," "expect," "believe," "intend," "may," "will," "should," "could," and similar expressions to identify forward-looking statements.

| 10 |

Company Overview

As a result of the Share Exchange, we are a high-tech enterprise specializing in the R&D, production and marketing of polymer Li-ion batteries. We have a research and development team led by PhD and MS-level experts, and we possesses advanced production equipment and the state-of-the-art technologies. Currently, Jinke boasts approximately 11,531 square meters of workshop, with a daily production of all models of polymer Li-ion batteries over 50,000. Approximately 70% of our products are sold in China, and approximately 30% are sold overseas to Central Asia, U.S. and European markets.

The polymer Li-ion battery produced by our company has passed the international safety certification such as SGS, CE, ROHS. They are widely applied to portable DVD, notebook PC, mobile phone, Bluetooth product, MP3, MP4, PDA, digital camera, digital video camera, digital learning machine, electronic dictionary and other digital products as well as model plane, electric tool, electric toy and electric bikes. Our management systems of design, R&D, production and service are established in accordance with the ISO9001 standard. They ensure all stages in polymer Li-ion battery production comply with the international standard so as to guarantee our products’ stable performance, reliable quality and effective cost.

During 2012-2013, we invested around $500,000 in improving equipment such as coating applicators, and roller press machines that will improve our efficiency and production capacity. The equipment has been installed and have improved the quality of our products, as well as increased our production capacity by 100%.

Going Concern

The yearly consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the discharge of liabilities in the normal course of business for the foreseeable future.

As of December 31, 2014, the Company has an accumulated loss of $10,498,618 due to the fact that the Company incurred losses over the past several years. The loss was mainly due to the investment in equipment, and R&D. We have also invested a significant amount, RMB 260,000, in building our own sales and marketing network.

These losses have affected the Company’s ability to pay PRC government tax and outstanding loans. So far no tax payment has been in arrears. The balance of related party loans as of December 31, 2014 and 2013 was approximately $7.1 million and $5.0 million respectively, which accounted for 60.4% and 50.4% of total assets as of December 31, 2014 and 2013, respectively. The Company has significantly relied on related party loans to meet the liquidity and capital resource requirements. The table below provides a description of our related party loans outstanding as of December 31, 2014 and 2013:

| December 31, | December 31, | |||||||

| Due to related parties | 2014 | 2013 | ||||||

| Ms. Li, Yankuan | $ | 223,769 | $ | 234,711 | ||||

| Mr. Liu, Guangyuan | 6,908,010 | 4,810,131 | ||||||

| Total due to related parties | $ | 7,131,779 | $ | 5,044,842 | ||||

Mr. Guangyuan Liu, the non-controlling equity interest owner of Jinke, has provided interest free unsecured loans to the Company. There is no due date on these loans.

Ms. Yankuan Li, Chief Executive Officer and Director of the Company, made advances to the Company to help fund the Company’s prior operations. These advances are unsecured and interest free. There is no due date for repayment.

The table below provides a description of the short-term loans we have as of December 31, 2014 and 2013:

| Due Date | Interest Rate | Collateral | December 31, 2014 | December 31, 2013 | ||||||||||||||

| Zhuhai Huarun Bank | 5/30/2015 | 8.70% | Guangyuan, Huang Fenxian, and a Company under common control | 912,275 | 900,105 | |||||||||||||

| Pingan Bank | 5/20/2015 | 8.10% | Liu Guangyuan's personal real estate | 969,292 | 1,309,243 | |||||||||||||

| China Construction Bank-Nonghua Branch | 5/8/2015 | 7.80% | Guaranteed by Huang Fenxian | 488,719 | 245,483 | |||||||||||||

| Total | $ | 2,370,286 | $ | 2,454,831 | ||||||||||||||

| 11 |

Results of Operations

Results of Operation for the year ended December 31, 2014 compared with the year ended December 31, 2013

Total Revenue

During the year ended December 31, 2014, we generated $4,296,084 in revenue, as compared to $5,036,674 for the year ended December 31, 2013, representing a decrease of $740,590 or approximately 14.7%. The lower sales amount for the year ended December 31, 2014 was mainly due to the performing of customer screening process. As a result, the number of customers decreased.

Gross Profit

The gross profit was $117,358 for the year ended December 31, 2014, as compared to $525,224 for the year ended December 31, 2013, representing $407,866, or 77.7% increase. The gross profit margin decreased from 10.43% to 2.7%. The decrease in gross profits margin was mainly due to the increase of cost of goods sold.

Expenses

Our general and administrative expenses ("G&A expenses") were $766,907 during the year ended December 31, 2014, as compared to $695,104 during the year ended December 31, 2013, representing an increase of $71,803, or 10.3%. The increase in G&A expenses was mainly due to employing R&D staffs to develop new products.

Net Income

Net loss of $867,474 was recorded during the year ended December 31, 2014 as compared to net loss of $295,070 during the year ended December 31, 2013. The increase of net loss was mainly due to investment in R&D and building the Company’s sales & marketing network.

| 12 |

Liquidity and Capital Resources

Cash used in operating activities was $2,353,858 during the year ended December 31, 2014, as compared to cash used in operating activities was $1,609,342 during the year ended December 31, 2013. Cash used in operating activities for the year ended December 31, 2014 was mainly resulted from net loss attributable to the Company $907,474, added adjustments of depreciation and amortization $78,225, non-cash equity-based compensation $288,000 and non-controlling interest $13,978, net increase in current liabilities (accrued liabilities and other payables) $333,839, and net increase in current assets (other receivables, amounts due from a related party, purchase deposit and inventories) $2,160,426. Cash used in operating activities during year 2013 was mainly resulted from net loss attributable to the Company $295,278, added adjustments of depreciation and amortization $73,438, non-cash equity-based compensation $70,000 and non-controlling interest $15,875, increase in current assets (other receivables, amounts due from related parties, purchase deposit, inventories and tax payables) $1,228,057, and decrease in current liabilities (accrued liabilities and other payables) $245,000. The increase of cash used in operating activities in 2014 compared to that in 2013 was mainly due to the increase of purchase of equipment and R&D expenses.

Cash flows provided by investing activities were $754,015 for the year ended December 31, 2014, as compared to $147,214 used in the year 2013. Cash used in investing activities during the year 2014 was resulted from net cash inflow from decrease of deposits $771,521 and purchase of equipment $17,506. Cash used in investing activities during the year 2013 was resulted from purchase of equipment $25,993 and net cash outflow from increase of deposits $121,221.

Cash provided by financing activities was $1,731,628 for the fiscal year ended December 31, 2014 as compared to cash flows provided by financing activities was $1,613,748 for the fiscal year ended December 31, 2013. Cash provided by financing activities in the year 2014 was resulted from proceeds from loans from related parties. Cash provided by financing activities in the year 2013 was resulted from bank loans and loan from related parties.

Critical Accounting Policies

Our significant accounting policies are summarized in Notes 2 of our financial statements included in this quarter report on Form 10-K for the year ended December 31, 2014. Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States ("GAAP"). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

Recent Accounting Pronouncements

Please refer to Note (v) to Consolidated Financial Statements for the years ended December 31, 2014 and 2013.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as "special purpose entities" (SPEs).

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Not applicable because we are a smaller reporting company.

| 13 |

Item 8. Financial Statements and Supplementary Data.

CHINA TELETECH HOLDING, INC.

audited consolidated Financial statements

December 31, 2014 and 2013

(STATED IN U.S. DOLLARS)

| 14 |

CHINA TELETECH HOLDING, INC.

| F-1 |

| To: | The Board of Directors and Stockholders of China Teletech Holding, Inc. |

Report of Independent Registered Public Accounting Firm

We have audited the accompanying consolidated balance sheets of China Teletech Holding, Inc. ("the Company") as of December 31, 2014 and 2013, and the related consolidated statements of operations, comprehensive (loss) income, stockholders' equity, and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of China Teletech Holding, Inc. as of December 31, 2014 and 2013, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 12 to the consolidated financial statements, the Company has incurred substantial losses which raise substantial doubt about its ability to continue as a going concern. These consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| San Mateo, California | /s/ WWC, P.C. | |

| April 15, 2015 | Certified Public Accountants |

| F-2 |

AUDITED CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2014 AND 2013

(Stated in US Dollars)

| 12/31/2014 | 12/31/2013 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 253,278 | $ | 539,946 | ||||

| Accounts receivable, net | 3,831,500 | 2,121,907 | ||||||

| Inventories | 4,391,212 | 4,448,776 | ||||||

| Other receivables and prepaid expenses | - | 19,639 | ||||||

| Advances to suppliers | 2,929,594 | 2,401,558 | ||||||

| Total current assets | 11,405,584 | 9,531,826 | ||||||

| Non-current assets | ||||||||

| Property, plant and equipment, net | 300,002 | 358,354 | ||||||

| Other assets | 108,440 | 125,049 | ||||||

| 408,442 | 483,403 | |||||||

| TOTAL ASSETS | $ | 11,814,026 | $ | 10,015,229 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities | ||||||||

| Short-term loans | $ | 2,370,286 | $ | 2,454,831 | ||||

| Notes payable | 496,864 | 239,592 | ||||||

| Accounts payable | 3,629,151 | 2,608,767 | ||||||

| Other payables | 30,220 | 13,092 | ||||||

| Advances from customers | 929,250 | 1,630,534 | ||||||

| Taxes payable | 5,161 | 7,550 | ||||||

| Due to related parties | 7,131,779 | 5,044,842 | ||||||

| Total current liabilities | 14,592,711 | 11,999,208 | ||||||

| TOTAL LIABILITIES | 14,592,711 | 11,999,208 |

See Notes to Consolidated Financial Statements and Accountants’ Report

| F-3 |

CHINA TELETECH HOLDING, INC.

AUDITED CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2014 AND 2013

(Stated in US Dollars)

| 12/31/2014 | 12/31/2013 | |||||||

| EQUITY | ||||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Common stock: 1,000,000,000 authorized, par value $0.01, 147,213,776 and 122,413,776 shares issued and outstanding at December 31, 2014 and 2013 | 1,472,138 | 1,184,138 | ||||||

| Additional paid-in capital | 8,123,754 | 8,123,754 | ||||||

| Accumulated other comprehensive (loss) | (634,598 | ) | (445,388 | ) | ||||

| Accumulated deficit | (10,538,618 | ) | (9,989,089 | ) | ||||

| TOTAL STOCKHOLDERS' EQUITY | (1,577,324 | ) | (1,126,585 | ) | ||||

| Non-controlling interest | (1,201,361 | ) | (857,394 | ) | ||||

| TOTAL EQUITY | (2,778,685 | ) | (1,983,979 | ) | ||||

| TOTAL LIABILITIES AND EQUITY | $ | 11,814,026 | $ | 10,015,229 |

See Notes to Consolidated Financial Statements and Accountants’ Report

| F-4 |

AUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS AND

COMPREHENSIVE (LOSS)

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

(Stated in US Dollars)

| 12/31/2014 | 12/31/2013 | |||||||

| Sales | $ | 4,296,084 | $ | 5,036,674 | ||||

| Cost of sales | 4,178,726 | 4,511,450 | ||||||

| Gross profit | 117,358 | 525,224 | ||||||

| Selling, general and administrative expenses | 806,907 | 695,104 | ||||||

| Loss from operations | (689,549 | ) | (169,880 | ) | ||||

| Other income and (expenses) | ||||||||

| Interest income | 931 | 25,174 | ||||||

| Other expense | (165,228 | ) | - | |||||

| Interest expense | (53,628 | ) | (150,348 | ) | ||||

| Other income and (expense), net | (217,925 | ) | (125,174 | ) | ||||

| Income (loss) before income taxes | (907,474 | ) | (295,054 | ) | ||||

| Income taxes | - | 224 | ||||||

| Net loss | $ | (907,474 | ) | $ | (295,278 | ) | ||

| less: Loss attributable to Non-controlling interest | (357,945 | ) | (147,325 | ) | ||||

| Net loss attributable to China Teletech Holding, Inc. | $ | (549,529 | ) | $ | (147,953 | ) | ||

| Basic and diluted income (loss) per common share | ||||||||

| Basic | $ | - | $ | - | ||||

| Diluted | $ | - | $ | - | ||||

| Weighted average common shares outstanding: | ||||||||

| Basic | 124,360,023 | 105,197,283 | ||||||

| Diluted | 124,360,023 | 105,197,283 |

See Notes to Consolidated Financial Statements and Accountants’ Report

| F-5 |

CHINA TELETECH HOLDING, INC.

AUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS AND

COMPREHENSIVE (LOSS)

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

(Stated in US Dollars)

| 12/31/2014 | 12/31/2013 | |||||||

| Net income loss attributable to China Teletech Holding, Inc. | $ | (549,529 | ) | $ | (147,953 | ) | ||

| Net income loss attributable to Non-controlling interest | $ | (357,945 | ) | $ | (147,325 | ) | ||

| Other comprehensive income: | ||||||||

| Foreign currency translation (loss) gain - China Teletech Holding, Inc. | (189,210 | ) | 16,532 | |||||

| Foreign currency translation gain – Non-controlling interest | 13,978 | 15,875 | ||||||

| Comprehensive loss China Teletech | $ | (738,739 | ) | $ | (131,421 | ) | ||

Comprehensive loss Non-controlling interest | $ | (343,967 | ) | $ | (131,450 | ) |

See Notes to Consolidated Financial Statements and Accountants’ Report

| F-6 |

AUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

(Stated in US Dollars)

| 12/31/2014 | 12/31/2013 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (907,474 | ) | $ | (295,278 | ) | ||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||

| Non-cash equity-based compensation | 288,000 | 70,000 | ||||||

| Depreciation and amortization | 78,225 | 73,438 | ||||||

| Non-controlling interest | 13,978 | 15,875 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Decrease/(Increase) in Accounts receivable | (1,709,593 | ) | (575,059 | ) | ||||

| Decrease/(Increase) in Inventories | 57,564 | (226,996 | ) | |||||

| Decrease/(Increase) in Advance to suppliers | (528,036 | ) | (509,427 | ) | ||||

| Decrease/(Increase) in Other receivable | 19,639 | 83,425 | ||||||

| Increase/(Decrease) in Accounts payable and other payables | 1,035,123 | (892,974 | ) | |||||

| Increase/(Decrease) in Customer deposits | (701,284 | ) | 647,654 | |||||

| Net cash used in operating activities | (2,353,858 | ) | (1,609,342 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Purchase of equipment | (17,506 | ) | (25,993 | ) | ||||

| Payment for deposits | 771,521 | (121,221 | ) | |||||

| Net cash provided by (used in) investing activities | 754,015 | (147,214 | ) | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from loans | - | 1,126,383 | ||||||

| Repayment of loans | (84,545 | ) | 247,774 | |||||

| Proceeds from issuances of notes | 257,272 | 239,591 | ||||||

| Loans from/(repayment to) related parties | 1,558,901 | - | ||||||

| Net cash provided by financing activities | 1,731,628 | 1,613,748 | ||||||

| Net Increase/(Decrease) in Cash & cash equivalents for the year | 131,785 | (142,808 | ) | |||||

| Effect of currency translation changes on Cash & equivalents | (418,453 | ) | (587,281 | ) | ||||

| Cash and equivalents, beginning of year | 539,946 | 1,270,035 | ||||||

| Cash and equivalents, end of year | $ | 253,278 | $ | 539,946 | ||||

| SUPPLEMENTARY DISCLOSURES: | ||||||||

| Interest received | $ | 931 | $ | 25,174 | ||||

| Interest paid | $ | 165,228 | $ | 150,364 | ||||

| Income tax paid | $ | - | $ | - |

See Notes to Consolidated Financial Statements and Accountants’ Report

| F-7 |

AUDITED CONSOLIDATED STATEMENTS OF CHANGE OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

(Stated in US Dollars)

| Total number of shares | Common stock | Additional paid in capital | Accumulated other comprehensive (loss) | Accumulated deficit | Total stockholders’ equity | Non-controlling interest | Total equity | |||||||||||||||||||||||||

| Balance at January 1, 2013 | 62,813,776 | 628,138 | 5,283,805 | (401,572 | ) | (6,851,558 | ) | (1,341,187 | ) | - | (1,341,187 | ) | ||||||||||||||||||||

| Recapitalization via reverse takeover by Shenzhen Jinke | 20,000,000 | 200,000 | 2,247,949 | (60,339 | ) | (2,989,786 | ) | (602,176 | ) | (725,944 | ) | (1,328,120 | ) | |||||||||||||||||||

| Conversion of debt retroactively restated | 4,600,000 | 46,000 | - | - | - | 46,000 | - | 46,000 | ||||||||||||||||||||||||

| Shares to be issued | (4,000,000 | ) | (40,000 | ) | 400,000 | - | - | - | - | - | ||||||||||||||||||||||

| Issuance of shares | 28,000,000 | 280,000 | 520,000 | - | - | 800,000 | - | 800,000 | ||||||||||||||||||||||||

| Issuance of share based compensation | 7,000,000 | 70,000 | 32,000 | - | - | 102,000 | - | 102,000 | ||||||||||||||||||||||||

| Net loss | - | - | - | - | (295,070 | ) | (295,070 | ) | - | (295,070 | ) | |||||||||||||||||||||

| Non-controlling interest | - | - | - | - | 147,325 | 147,325 | (147,325 | ) | - | |||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | 16,523 | - | 16,523 | 15,875 | 32,398 | ||||||||||||||||||||||||

| Balance at December 31, 2013 | 118,413,776 | 1,184,138 | 8,123,754 | (445,388 | ) | (9,989,089 | ) | (1,126,585 | ) | (857,394 | ) | (1,983,979 | ) | |||||||||||||||||||

| Balance at January 1, 2014 | 118,413,776 | 1,184,138 | 8,123,754 | (445,388 | ) | (9,989,089 | ) | (1,126,585 | ) | (857,394 | ) | (1,983,979 | ) | |||||||||||||||||||

| Issuance of share based compensation | 28,800,000 | 288,000 | - | - | - | 288,000 | - | 288,000 | ||||||||||||||||||||||||

| Net loss | - | - | - | - | (907,474 | ) | (907,474 | ) | - | (907,474 | ) | |||||||||||||||||||||

| Non-controlling interest | - | - | - | - | 357,945 | 357,945 | (357,945 | ) | - | |||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | (189,210 | ) | - | (189,210 | ) | 13,978 | (175,232 | ) | |||||||||||||||||||||

| Balance at December 31, 2014 | 147,213,776 | 1,472,138 | 8,123,754 | (634,598 | ) | (10,538,618 | ) | (1,577,324 | ) | (1,201,361 | ) | (2,778,685 | ) | |||||||||||||||||||

See Notes to Consolidated Financial Statements an Accountants’ Report

| F-8 |

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

As of December 31, 2014 and 2013

| 1. | ORGANIZATION AND PRINCIPAL ACTIVITIES |

China Teletech Holding, Inc. (the “Company”) formerly known as Avalon Development Enterprise, Inc. was incorporated in the State of Florida, United States (an OTCBB Company) on March 29, 1999.

On June 30, 2014, the Company entered into a cooperation agreement (the “Agreement”) with Shenzhen Jinke Energy Development Co., Ltd. (“SJD”). Pursuant to the Agreement, the Company will purchase, in an aggregate, 51% of all the outstanding capital of SJD in exchange for 20 million newly issued shares of the Company’s common stock. The Company filed Form 8-K with the U.S Securities and Exchange Commission on August 8, 2014 detailing the transaction; the Agreement was filed as an exhibit to the Form 8-K. As of December 31, 2014, 16 million shares of the 20 million shares have been issued, and 4 million shares are pending issuance.

The Company has accounted for the transaction with SJD as reverse takeover and recapitalization of the Company; accordingly, the legal acquirer is the accounting acquiree and the legal acquirer is the accounting acquirer. As a result of this transaction, the Company is deemed to be a continuation of the business of SJD. Accordingly, the financial data included in the accompanying consolidated financial statements for all periods prior to June 30, 2014 is that of the accounting acquirer (SJD). The historical stockholders’ equity of the accounting acquirer prior to the share exchange has been retroactively restated as if the share exchange transaction occurred as of the beginning of the first period presented.

The Company’s primary operations are carried out through its operating subsidiary SJD. SJD manufactures and distributes lithium-ion polymer batteries, micro batteries, and smart cards.

For comparability, the auditors restate prior year’s (2013) financial statements of the company. The difference between the beginning balance of 2013 and the ending balance of 2012 is due to the change of organization structure. The company disposed a subsidiary named “Renwoxing” and disregistry a subsidiary named Guangzhou Rongxin Science and Technology Limited. The Company has accounted for the transaction with SJD as reverse takeover and recapitalization of the Company. Then the difference is come from the different retained earnings and minority interest between SJD and the two prior subsidiaries of the company.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| (a) | Method of Accounting |

The Company maintains its general ledger and journals with the accrual method of accounting for financial reporting purposes. The financial statements and notes are representations of management. Accounting policies adopted by the Company conform to generally accepted accounting principles in the United States of America and have been consistently applied in the presentation of financial statements.

| (b) | Consolidation |

The consolidated financial statements include the accounts of China Teletech Holdings, Inc. and its three wholly and partially owned subsidiaries. The consolidated financial statements were compiled in accordance with generally accepted accounting principles of the United States of America. All significant inter-company accounts and transactions have been eliminated in consolidation.

| F-9 |

CHINA TELETECH HOLDING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

As of December 31, 2014 and 2013

As of December 31, 2014, the Company’s condensed consolidated financial statements included the accounts of the subsidiaries below:

| Name of Company | Place of Incorporation | Attributable Equity Interest % | Registered Capital | ||||

| China Teletech Limited | BVI | 100% | USD 10 | ||||

| Global Telecom Holdings Limited BVI | BVI | 100% | HKD 7,800 | ||||

| Shenzhen Jinke Energy Development Co., Ltd. | PRC | 51% | RMB 10,000,000 |

| (c) | Economic and Political Risks |

The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic, legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, restriction on international remittances, and rates and methods of taxation, among other things.

| (d) | Use of Estimates |

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting years. These accounts and estimates include, but are not limited to, the estimation on useful lives of property, plant and equipment. Actual results could differ from those estimates.

| (e) | Cash and Cash Equivalents |

The Company considers all cash and other highly liquid investments with initial maturities of three months or less to be cash equivalents.

As of December 31, 2014 and 2013, substantially all of the Company’s cash and cash equivalents were held by major financial institutions located in PRC, which management believes are of high credit quality.

| (f) | Accounts Receivable |