Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION PURSUANT TO - TD Holdings, Inc. | f10k2014ex32i_chinacommer.htm |

| EX-32.2 - CERTIFICATION PURSUANT TO - TD Holdings, Inc. | f10k2014ex32ii_chinacommer.htm |

| EX-31.2 - CERTIFICATION OF THE CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 - TD Holdings, Inc. | f10k2014ex31ii_chinacommer.htm |

| EXCEL - IDEA: XBRL DOCUMENT - TD Holdings, Inc. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION OF THE CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 - TD Holdings, Inc. | f10k2014ex31i_chinacommer.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-36055

China Commercial Credit, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 45-4077653 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

No. 1688, Yunli Road, Tongli Wujiang, Jiangsu Province People’s Republic of China |

215200 | |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number: (86-0512) 6396-0022

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered | |

| Common stock, par value $.001 | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2014, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $44 million based on the closing price of $3.72 for the registrant’s common stock as reported on the NASDAQ Capital Market.

As of April 7, 2015, there were 12,255,062 shares of the Company’s common stock issued and outstanding.

China Commercial Credit, Inc.

Annual Report on Form 10-K

For the fiscal year ended December 31, 2014

TABLE OF CONTENTS

| Note Regarding Forward-Looking Statements | 3 | |

| PART I | ||

| Item 1. | Description of Business | 4 |

| Item 1A. | Risk Factors | 29 |

| Item 1B. | Unresolved Staff Comments | 49 |

| Item 2. | Description of Property | 49 |

| Item 3. | Legal Proceedings | 50 |

| Item 4. | Mine Safety Disclosure | 50 |

| PART II | ||

| Item 5. | Market for Common Equity and Related Stockholder Matters | 51 |

| Item 6. | Selected Financial Data | 51 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 52 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8. | Financial Statements | 64 |

| Item 9. | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | 64 |

| Item 9A. | Controls and Procedures | 64 |

| Item 9B. | Other Information | 66 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 66 |

| Item 11. | Executive Compensation | 70 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 73 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 73 |

| Item 14. | Principal Accountant Fees and Services | 74 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 74 |

All references to “we,” “us,” “our,” “CCC,” “Company,” “Registrant” or similar terms used in this report refer to China Commercial Credit, Inc., a Delaware corporation (“CCC”), including its consolidated subsidiaries and variable interest entities (“VIE”), unless the context otherwise indicates. We conduct our business through three operating entities, Wujiang Luxiang Rural Microcredit Co., Ltd., a PRC company with limited liability by stock (“Wujiang Luxiang”), which is a VIE controlled by Wujiang Luxiang Information Technology Consulting Co., Ltd (“WFOE”) a wholly-owned subsidiary of ours, through a series of contractual arrangements, and Pride Financial Leasing (Suzhou) Co. Ltd (“PFL”), our wholly-owned indirect subsidiary.

“PRC” or “China” refers to the People’s Republic of China, excluding, for the purpose of this report, Taiwan, Hong Kong and Macau. “RMB” or “Renminbi” refers to the legal currency of China and “$”, “US$” or “U.S. Dollars” refers to the legal currency of the United States.

| 2 |

Note Regarding Forward-Looking Statements

The information contained in this Annual Report on Form 10-K includes some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our company and our management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition and results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained herein are based on current expectations and beliefs concerning future developments and the potential effects on us. Future developments actually affecting us may not be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Examples are statements regarding future developments with respect to the following:

| ● | Our ability to satisfy the inquiry from NASDAQ in order to have our common stock resume trading and listing on NASDAQ; | |

| ● | Our ability to improve internal controls and procedures; | |

| ● | Our ability to develop and market our microcredit lending and guarantee business in the future; | |

| ● | Our ability to effectively control the lending risk and collect from default borrowers;

| |

| ● | Our ability to make timely adjustment to ensure adequate loan loss and financial guarantee provisions;

| |

| ● | Inflation and fluctuations in foreign currency exchange rates; | |

| ● | Our on-going ability to obtain all mandatory and voluntary government and other industry certifications, approvals, and/or licenses to conduct our business; | |

| ● | Development of a liquid trading market for our securities; and | |

| ● | The costs we may incur in the future from complying with current and future governmental regulations and the impact of any changes in the regulations on our operations. |

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to changes in our expectations.

We qualify all of our forward-looking statements by these cautionary statements. The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

| 3 |

PART I

| Item 1. | Description of Business. |

General

China Commercial Credit, Inc., is a financial services firm operating in China. Our mission is to fill the significant void in the market place by offering lending, financial guarantee and financial leasing products and services to a target market which has been significantly under-served by the traditional Chinese financial community. Our current operations consist of providing direct loans, loan guarantees and financial leasing services to small-to-medium sized businesses (“SMEs”), farmers and individuals in the city of Wujiang, Jiangsu Province.

Our loan and loan guarantee business is conducted through Wujiang Luxiang, a fully licensed microcredit company which we control through our subsidiaries and certain contractual arrangements. Our financial leasing business is conducted through PFL, our wholly owned subsidiary. Historically, many SMEs and farmers have been borrowing at high interest rates from unregulated and often illegal lenders, referred to as “underground” lenders, to finance their operations and growth, contrary to the preferences of Chinese banking authorities. Such high interest rate borrowing makes it difficult for businesses to grow, and also exacerbates China’s concerns about inflation. By operating through licensed and regulated businesses, we seek to bridge the gap between Chinese state-owned and commercial banks that have not traditionally served the capital needs of SMEs and higher interest rate “underground” lenders.

Jiangsu, which is an eastern coastal province, has among the highest population density in China and is home to many of the world’s leading exporters of electronic equipment, chemicals and textiles. As a result, the city of Wujiang ranks as one of the most economically successful cities in China. The SMEs, both in Jiangsu and other provinces in China, have historically been an under-served segment of the Chinese banking market. Due to the significant demand from SMEs, the number of microcredit companies in China is increasing rapidly. According to the People’s Bank of China (the “PBOC”), there were approximately 8,791 microcredit companies in China with a total outstanding loan balance of over $149.5 billion (RMB942.0 billion) as of the end of 2014.

Since Wujiang Luxiang’s inception in October 2008, it has developed a large number of borrowers in Wujiang City. All of our loans are made from our sole office, located in Wujiang City. As of December 31, 2014, we have built an $86.5 million portfolio of direct loans to 190 borrowers and a total of $21.9 million in loan guarantees for 23 borrowers.

During 2014, the microcredit companies in Wujiang area went through the most difficult time since their inceptions in 2008. Three of them went bankrupt while the remainder are struggling with high default rates due to the poor economic condition, especially the slow-down in the textile industry. The operations of Wujiang Luxiang were also affected. For the years ended December 31, 2014, we had a loss of $23 million and a net loss of $27 million compared to net revenue of $12.5 million and net income of $7.7 million in 2013, a decrease of 284% and 450%, respectively. As a result of the deteriorating economic condition, we experienced a substantial increase in the amount of default loans in both our direct lending and guarantee business. The amount of underlying loans we guaranteed has been reduced by 63.5 % to $21,794,663 as of December 31, 2014 compared to $ 59,692,091 as of December 31, 2013. As the rate of fees and commissions generated from the guarantee business has been decreasing, the Company decided that the revenue does not justify the default risks involved in the guarantee business, and therefore expects to further reduce the traditional guarantee business and hold off on pursuing the guarantee business to be provided via the Kaixindai Financing Services Jiangsu Co. Ltd (“Kaixindai”) platform as previously planned. Management may actively resume the guarantee business in the future if economic conditions improve.

Our financial leasing services are anticipated to be provided to a diverse base of customers, including textile and other manufacturing companies, railroads, port facilities, local bus, and rail companies and municipal governments. Customers will include existing clients of Wujiang Luxiang in addition to new clients. PFL, our wholly owned subsidiary, plans to provide leases on both new and used manufacturing equipment, medical devices, transportation vehicles and industrial equipment, purchased both domestically and from foreign suppliers, to meet its customer’s needs. As of the date of this Annual Report, PFL entered into two financial leasing agreements for an aggregate of $5.61 million in lease receivables. We do not currently have further funds to deploy in the financial leasing business and plan to hold off expansion of the leasing business until the economic environment improves.

| 4 |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, (the “JOBS Act”) and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies, that are not emerging growth companies, including, but not limited to, (1) presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in our initial public offering, (2) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (3) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, stockholders may have less information then they might otherwise have.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We elected to opt out of such extended transition period and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

We could remain an emerging growth company for up to five years, or until the earliest of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months, or (3) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Corporate Structure

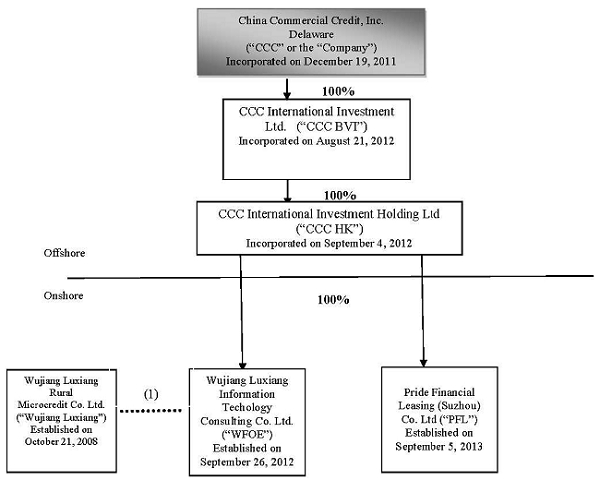

China Commercial Credit, Inc. is a holding company that was incorporated under the laws of the State of Delaware on December 19, 2011. The Company, through its indirect wholly-owned subsidiary, Wujiang Luxiang Information Technology Consulting Co. Ltd. (“WFOE”), a limited liability company formed under the laws of the PRC on September 26, 2012, controls Wujiang Luxiang, a company established under the laws of the PRC on October 21, 2008, through a series of contractual arrangements. CCC International Investment Ltd. (“CCC BVI”), a company incorporated under the laws of the British Virgin Islands (“BVI”) on August 21, 2012, is wholly owned by the Company. CCC BVI wholly owns CCC International Investment Holding Ltd. (“CCC HK”), a company incorporated under the laws of the Hong Kong S.A.R. of the PRC on September 4, 2012. WFOE is wholly owned by CCC HK. On September 5, 2013, CCC HK incorporated PFL a wholly owned subsidiary, to start our financial leasing business.

On April 11, 2015, WFOE delivered a notice of termination to Pride Information Technology Co. Ltd. (“Pride Online”), a domestic entity established on February 19, 2014 and 100% owned by Mr. Qin to terminate the VIE agreements by and among the parties. The Company entered into the VIE agreements with Pride Online in order to provide WFOE absolute control over the economic interest in Pride Online. As a result of the termination notice, the contractual arrangements by and among the Company, Mr. Qin and Pride Online will terminate as of May 11, 2015 and WFOE will no longer control Pride Online.

| 5 |

The following diagram illustrates our corporate structure as of the date of this Annual Report:

(1) Pursuant to a series of contractual arrangements, WFOE effectively controls and manages the business activities of Wujiang Luxiang.

Contractual Arrangements between WFOE and Wujiang Luxiang

There are no PRC state, provincial or local laws, rules and regulations prohibiting or restricting direct foreign equity ownership in companies engaged in rural microcredit business. However, the provincial authorities regulate microcredit companies through strict licensing requirements and approval procedures. Direct controlling foreign ownership in a for-profit microcredit company has never been approved by competent Jiangsu government authorities. Based on the current position taken by the competent Jiangsu government authorities, direct foreign controlling ownership of a for-profit rural microcredit company will not be approved in the foreseeable future.

As such, neither we nor our subsidiaries own any equity interest in Wujiang Luxiang. Instead, we control and receive the economic benefits of Wujiang Luxiang’s business operation through a series of contractual arrangements. WFOE, Wujiang Luxiang and its shareholders entered into a series of contractual arrangements, also known as VIE Agreements, on September 26, 2012. The VIE agreements are designed to provide WFOE with the power, rights and obligations equivalent in all material respects to those it would possess as the sole equity holder of Wujiang Luxiang, including absolute control rights and the rights to the assets, property and revenue of Wujiang Luxiang. Based on a legal opinion issued by Dacheng Law Offices to WFOE, the VIE agreements constitute valid and binding obligations of the parties to such agreements, and are enforceable and valid in accordance with the laws of the PRC.

According to the Exclusive Business Cooperation Agreement, Wujiang Luxiang is obligated to pay service fees to WFOE approximately equal to the net income of Wujiang Luxiang.

| 6 |

Each of the VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Wujiang Luxiang and WFOE, WFOE provides Wujiang Luxiang with technical support, consulting services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, Wujiang Luxiang granted an irrevocable and exclusive option to WFOE to purchase from Wujiang Luxiang, any or all of Wujiang Luxiang’s assets at the lowest purchase price permitted under the PRC laws. WFOE may exercise, at its sole discretion, the option to purchase equity interests of Wujiang Luxiang from Wujiang Luxiang Shareholders permitted by PRC laws. Should WFOE exercise such option, the parties shall enter into a separate asset transfer or similar agreement. For services rendered to Wujiang Luxiang by WFOE under this agreement, WFOE is entitled to collect a service fee calculated based on the time of services rendered multiplied by the corresponding rate, the plus amount of the services fees or ratio decided by the board of directors of WFOE based on the value of services rendered by WFOE and the actual income of Wujiang Luxiang from time to time, which is approximately equal to the net income of Wujiang Luxiang.

The Exclusive Business Cooperation Agreement shall remain in effect for ten years unless it is terminated by WFOE with 30-day prior notice. Wujiang Luxiang does not have the right to terminate the agreement unilaterally. WFOE may unilaterally extend the term of this agreement with prior written notice.

The sole director and president of WFOE, Mr. Ling, is currently managing Wujiang Luxiang pursuant to the terms of the Exclusive Business Cooperation Agreement. WFOE has absolute authority relating to the management of Wujiang Luxiang, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. The Exclusive Business Cooperation Agreement does not prohibit related party transactions. The audit committee of CCC is required to review and approve in advance any related party transactions, including transactions involving WFOE or Wujiang Luxiang.

Share Pledge Agreement

Under the Share Pledge Agreement between the Wujiang Shareholders and WFOE, the 12 Wujiang Shareholders pledged all of their equity interests in Wujiang Luxiang to WFOE to guarantee the performance of Wujiang Luxiang’s obligations under the Exclusive Business Cooperation Agreement. Under the terms of the agreement, in the event that Wujiang Luxiang or its shareholders breach their respective contractual obligations under the Exclusive Business Cooperation Agreement, WFOE, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends generated by the pledged equity interests. The Wujiang Shareholders also agreed that upon occurrence of any event of default, as set forth in the Share Pledge Agreement, WFOE is entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. The Wujiang Shareholders further agree not to dispose of the pledged equity interests or take any actions that would prejudice WFOE’s interest.

The Share Pledge Agreement shall be effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Wujiang Luxiang. WFOE shall cancel or terminate the Share Pledge Agreement upon Wujiang Luxiang’s full payment of fees payable under the Exclusive Business Cooperation Agreement.

Exclusive Option Agreement

Under the Exclusive Option Agreement, the Wujiang Shareholders irrevocably granted WFOE (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in Wujiang Luxiang. The option price is equal to the capital paid in by the Wujiang Shareholders subject to any appraisal or restrictions required by applicable PRC laws and regulations. As of the date of this report, if WFOE exercised such option, the total option price that would be paid to all of the Wujiang Shareholders would be $44,063,863, which is the aggregate registered capital of Wujiang Luxiang. The option purchase price shall increase in case the Wujiang Shareholders make additional capital contributions to Wujiang Luxiang, including when the registered capital is increased upon Wujiang Luxiang receiving the proceeds from our initial public offering.

| 7 |

The agreement remains effective for a term of ten years and may be renewed at WFOE’s election.

Power of Attorney

Under the Power of Attorney, the Wujiang Shareholders authorize WFOE to act on their behalf as their exclusive agent and attorney with respect to all rights as shareholders, including but not limited to: (a) attending shareholders' meetings; (b) exercising all the shareholder's rights, including voting, that shareholders are entitled to under the laws of China and the Articles of Association, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of Wujiang Luxiang.

Although it is not explicitly stipulated in the Power of Attorney, the term of the Power of Attorney shall be the same as the term of that of the Exclusive Option Agreement.

This Power of Attorney is coupled with an interest and shall be irrevocable and continuously valid from the date of execution of this Power of Attorney, so long as the Wujiang Shareholder is a shareholder of Company.

Timely Reporting Agreement

To ensure Wujiang Luxiang promptly provides all of the information that WFOE and the Company need to file various reports with the SEC, a Timely Reporting Agreement was entered between Wujiang Luxiang and the Company.

Under the Timely Reporting Agreement, Wujiang Luxiang agrees that it is obligated to make its officers and directors available to the Company and promptly provide all information required by the Company so that the Company can file all necessary SEC and other regulatory reports as required.

Although it is not explicitly stipulated in the Timely Reporting Agreement, the parties agreed its term shall be the same as that of the Exclusive Business Cooperation Agreement.

Our Business

General

We have three business lines, lending, guarantee and financial leasing.

For our lending and guarantee services, we generally provide direct loans and guarantee services, to borrowers located within City of Wujiang, Jiangsu Province of China. In our direct loan business, we provide short-term loans to the borrowers and generate interest income. In our guarantee business, we act as a guarantor to borrowers applying for short-term direct loans with other lenders and generate fee income. Our clients in both the direct loan and guarantee businesses are primarily SMEs, farmers and individuals who generally use the proceeds of the loans for business related purposes. We are not dependent on any one borrower in either our direct loan or guarantee business.

We fund our lending and guarantee operations by using our registered capital, drawing down from the line of credit we have with state-owned or commercial banks, and using cash generated from our operations. We currently have only one line of credit agreement with Agricultural Bank of China, the amount we are allowed to finance through debt financing is limited at 50% of our net capital. As of December 31, 2014, we have borrowed approximately $11.3 million (RMB 70 million) from Agricultural Bank of China and there is still another $ 4.7 million (RMB 30 million available under the line of credit. This line of credit was granted to Wujiang Luxiang since its inception in 2008 as a provincial government's measure to support rural microcredit company's operations. The total line of credit decreased from RMB 150 million to RMB 100 million during 2014 due to PBOC’s tightened monetary policy. Interest rates under this line of credit vary, but have been no more than 110% of the PBOC benchmark interest rate (the "PBOC Rate").

| 8 |

On September 5, 2013, we formed PFL to start our financial leasing business. PFL is licensed by SAIC to provide leasing services in all of the Chinese provinces. PFL offers financial leases on machinery and equipment, public transportation vehicles, and medical devices to municipal government agencies, public transportation agencies, hospitals and SMEs in Jiangsu Province and other provinces. As of December 31, 2014, PFL incurred two finance lease transactions with total lease receivables of $4.87 million.

Our Services

Direct Loans

We provide direct loans to borrowers with terms not exceeding one year. During 2014 and 2013 the average principal loan amount we provided was approximately $336,000 and $429,000, respectively. The interest rate we charge on a specific direct loan depends on a number of factors, including the type of borrower and whether the loan is secured or unsecured. We also take into account the quality of the collateral or guarantee given and the term of the loan.

Interest on our loans is usually payable monthly and averaged 14.19% and 14.50% for our direct loan portfolio for the twelve months ended December 31, 2014 and 2013 respectively. Under certain Jiangsu banking regulations, since August 2012, we are allowed to charge an interest rate within the range of 0.9 times and 3 times PBOC Rate. As of December 31, 2014, the PBOC Rate was set at 6% per annum for one-year term loans and 5.6% for six-month term loans. During the fiscal year ended 2014, the average interest rate we charged to SMEs was 2.3 times the PBOC Rate or 14.19% for one-year term loans and 12.5% for six-month term loans. The interest on loans to farmers is subsidized by the Jiangsu government and usually results in farmers paying a rate lower than that of loans to SME’s. A portion of the difference between the lower rate charged to farmers and the rate charged to SME’s is remitted to us annually by the government as a government incentive. It is within the provincial government's discretion as to the amount of incentive to be remitted to us. The revenue we generated from such government incentive has always been less than 5% of our gross revenue since Wujiang Luxiang's inception.

We offer both secured and unsecured direct loans. As of December 31, 2014, there were 190 direct loans outstanding, with a total aggregate outstanding balance of approximately $86.5 million and interest rates ranging from 9.6% to 17.2% and original terms of the loans ranging from 1 month to 12 months, none of which were unsecured loans. The following table sets forth a summary of our direct loan portfolio as of December 31, 2014 and 2013:

| Total Outstanding Balance as of 12/31/2014 | Percentage of the Total Loan Portfolio as of 12/31/2014 | Total Outstanding Balance as of 12/31/2013 | Percentage of the Total Loan Portfolio as of 12/31/2013 | |||||||||||||

| Guarantee-backed loans | 75,059,359 | 91.4 | % | 81,485,918 | 90.3 | % | ||||||||||

| Pledge assets-backed loans | 6,368,940 | 7.76 | % | 7,326,834 | 8.2 | % | ||||||||||

| Collateral-backed loans | 650,830 | 0.79 | 1,390,661 | 1.5 | % | |||||||||||

| Total: | 82,079,129 | 100 | % | 90,203,413 | 100 | % | ||||||||||

| 9 |

All our loans are secured. We offer three types of secured loans:

| ● | loans guaranteed by a third party, referred to in China as “guarantee-backed loans”; |

| ● | loans secured by real property, referred to in China as “collateral-backed loans”; and |

| ● | loans secured by personal property, referred to in China as “pledge-backed loans”. |

| ● | Guarantee-backed loans |

In the case of guarantee-backed loans, the third party guarantor and the borrower are jointly and severally liable for the repayment of the loan. The third party guarantor, whether being an individual or legal entity, must be creditworthy. We do not require any asset from the borrower as collateral for such guarantee-backed loans.

| ● | Collateral-backed loans |

In the case of collateral-backed loans, the borrowers provide land use rights or building ownership as collateral for the loan.

For loans secured by land use rights, the principal amount we grant is no more than 50-70% of the value of the land use rights. The percentage varies depending on the liquidity of the land use rights. For loans secured by building ownership, the principal amount we grant can be up to 100% of the value of the building. We engage independent appraisal firms to determine the value of the land use rights or the building.

Prior to funding a direct loan secured by land use rights or building ownership, we register our security interest in the collateral with the appropriate government authority. In the event the borrower defaults, we take legal actions including legal proceedings against the default borrower and enforcement action resulting in the court’s sale of the asset through an auction.

| ● | Pledge-backed loans |

In the case of pledge-backed loans, the borrowers pledge negotiable instruments as collateral for the loan. The maximum principal amount of pledge-backed loans we extend is generally within 90% of the value of the pledged negotiable instrument.

We will take physical possession of the negotiable instrument at the time the loan is made and do not need to register such security interest with any government authority. If the borrower defaults, we can acquire ownership of the negotiable instrument upon the borrower’s consent. If the borrower refuses to settle the outstanding balance amicably by rendering ownership to the pledged instrument to us, we will then initiate legal proceedings in which the court will be required to enforce transfer of the ownership.

We require the business owners or individual shareholders of business borrowers to be jointly and severally liable for the repayment of the loan. In addition, we also require either a guarantee from a third party or certain assets as collateral.

Guarantee Services

For a fee, we also provide guarantees to third party lenders on behalf of borrowers applying for loans with such other lenders. Our guarantee is a commitment by us to repay the loan to the lender if the borrower defaults. We, as the third party guarantor, are jointly and severally liable with the borrower for the repayment of the full amount of the loan. We have cooperation agreements with six state-owned and commercial banks pursuant to which we are accepted as a guarantor.

In order for us to agree to act as a guarantor, a borrower must provide a counter-guarantor to us or acceptable collateral to the third party lender such as land use rights, building ownership, or a negotiable instrument. In addition, the borrower must deposit cash with us in an amount equal to the amount we are required to deposit with the third party lender which is usually 10% to 20% of the principal amount of the loan. If the borrower defaults and we pay the lender on the borrower’s behalf, we will first recover from the cash deposit the borrower provided us and then demand the counter-guarantor make payment to us or recover the payment from the sale proceeds of the collateral asset.

| 10 |

In exchange for our guarantee, the borrowers pay us guarantee fees. We charge a per annum guarantee fee ranging from 1.56% to 1.80% of the principal amount of the underlying loan. The guarantee fees are payable in full when the guarantee is made. The criteria in determining the guarantee fee paid by the borrower are summarized in the following table:

| Types of Security Interest | New Client | Previous or Existing Client | ||

| Land Use Rights or Building Ownership | 1.68% of the principal amount of the underlying loan multiplied by the number of years of the guarantee |

1.56% of the principal amount of the underlying loan multiplied by the number of years of the guarantee | ||

| Counter-Guarantor | 1.80 % of the principal amount of the underlying loan multiplied by the number of years of the guarantee |

1.62 % of the principal amount of the underlying loan multiplied by the number of years of the guarantee |

In addition to the fee income, we earn interest on the refundable cash deposits provided to us by the borrowers. Such cash deposits are required to be made to our bank account when we approve the guarantee application. After the expiration of the guarantee term, such cash deposits, without interest, will be refunded to the borrower once we receive a notice from the third party lender confirming termination of our guarantee obligation.

As of December 31, 2014, we have provided guarantees for a total of $21.9 million underlying loans to approximately 23 borrowers.

Due to a substantial increase in the amount of default loans in the loan guarantee business, the amount of underlying loans we guaranteed has been reduced by 63.1% as of December 31, 2014 compared to as of December 31, 2013. As the rate of fees and commissions generated from the guarantee business has been decreasing, the Company has decided that the revenue does not justify the default risks involved, and therefore expects to further reduce the traditional guarantee business and hold off on pursuing the guarantee business to be provided via the Kaixindai Financing Services Jiangsu Co. Ltd (“Kaixindai”) platform as previously planned. Management may actively resume the guarantee business in the future if economic conditions improve.

Financial Leasing Services

On September 5, 2013, we formed PFL, a wholly owned subsidiary, to start our financial leasing business. PFL is licensed by SAIC to provide leasing services in all of the Chinese provinces. PFL plans to offer financial leases on machinery and equipment, public transportation vehicles, and medical devices to municipal government agencies, public transportation agencies, hospitals and SMEs in Jiangsu Province and other provinces. As of the date of this annual report, PFL entered into two financial leasing agreements for an aggregate of $5.61 million in loan receivables. We do not currently have further funds to deploy in the financial leasing business.

We had used substantially all of the net proceeds from the follow-on public offering closed in May 2014 to increase the registered capital of PFL and corresponding financing leasing capacity. Currently, PFL is approved to have a registered capital of $50 million. We were required to contribute 15% of the $50 million by December 4, 2013. In 2014, we orally obtained an extension from the relevant government authority to delay the initial contribution without any monetary penalty. In October 2014, approximately $5.7 million (RMB 30.7 million) of the net proceeds raised in our follow-on public offering closed in May 2014 was transferred to PFL to increase its registered capital.

Due to the short history of China’s financial leasing industry, there are certain gaps in relevant PRC law. There is no nation-wide uniform equipment title registration process and system in China and each municipality adopts different procedures. As such, our ownership interest on the leased property may be threatened. In addition, there is no guidance on the reserve requirement for financial leasing companies. We have followed the same “Five-Tier Principal” in our measurement of reserve for the financial leasing business except at different reserve rates. We will have reserve rates of 1.5%, 3%, 30%, 60% and 100% for the leases categorized as “pass”, “special-mention”, “substantial”, “doubtful” and “loss”, respectively. We believe such reserve should be sufficient to cover potential loan loss in the first few years of PFL’s operations. We may adjust these rates as we roll out our operations.

| 11 |

Loan/Guarantee Application, Review and Approval Process

We have a standard process with regard to how a loan or guarantee application is reviewed, processed and approved. The same process applies to both applications for direct loans and for guarantees.

The application process starts with an inquiry from potential borrowers to our Loan Officer. The Loan Officer has the discretion whether to accept the inquirer as an applicant. If accepted, the Loan Officer assists in the preparation of an application package and implements a field visit of the applicant.

The application package usually includes the following items in order for it to be considered:

| ● | Summary of the desired loan/guaranty: general description of the borrower, use of proceeds, amount, term of the loan, guarantee, collateral or counter-guarantee to be provided.

|

| ● | Identity information: if the borrower is a legal entity, we require articles of incorporation, business license, state and local tax registration certificates, copies of the personal identification cards of all the shareholders and the legal representative; if the borrower is an individual, we require copies of personal identification cards of all the borrowers.

|

| ● | Banking relationship documents: including loan application with banks or other lenders, permission to open bank accounts, and credit record.

|

| ● | Financial reports such as prior three years’ financial statements, interim financial reports, and recent tax returns.

|

| ● | Business operation documents including samples of sales contracts or customer contracts, and utility bills over the past few months.

|

| ● | Consents: if the borrower is an entity, board or shareholder consent for the loan. |

| 12 |

The flow chart below summarizes the loan/guarantee application, review and approval process.

The reviews during steps 1, 2, 3 and 4 are deemed Level One review. The Loan Review Committee’s review is deemed Level Two review. The General Manager’s final review is the Level Three review. Typically it takes one to two weeks to complete our review.

Loan Extension and Renewal

In our direct loan business, if a borrower has difficulty repaying the principal amount and/or accrued interest in full at the maturity date due to a temporary situation, the borrower may choose to either apply for an extension of the term or a renewal of the loan. The extension or renewal applications are reviewed in accordance with the same loan application, review and approval process outlined above. In our guarantee business, we generally do not extend the guarantee period.

| 13 |

Loan Extension

We will generally approve loan extensions for borrowers who have made timely interest payments, are capable of paying the balance and have loans secured by sufficient collateral or guaranteed by an acceptable guarantor. The term of the loan extensions we grant is generally no longer than the term of the original loan and we only agree to extend a loan one time. If the loan extension application is not approved prior to the original maturity date of the loan, it will be transferred to the collection department and labeled as a default loan. As of December 31, 2014 and 2013, extended loans constituted 5.36% and 0.18% of our total outstanding direct loan balance, respectively. During 2014, the Company approved extension to certain default customers who demonstrated a strong likelihood to repay or already paid part of this outstanding principal and interest. Management believes that extending the term of the default loans instead of suing the borrowers will give the borrowers a better chance to recover during the extended term and thus make the repayment. We treated these extended loans according to their original terms in our loan loss reserve provision calculation.

Loan Renewal

Many of our borrowers repay their loans and re-borrow at a later date, being referred to as a “loan renewal”. We consider a renewed loan a new loan, not a loan extension, despite our previous relationship with the borrower. Prior to the maturity date of the loan, the borrower may choose to apply to renew the loan. In order for the loan renewal application to be approved, the borrower must agree to repay the existing loan’s principal amount and accrued interest in full before the renewal application is approved. Although we do not have a specific clean-up period policy, we do require that the period of time between repayment of the existing loan and the funding of the new loan to be 2-10 days. As of December 31, 2014 and 2013 renewed loans constituted 86.9% and 68.70% of our total outstanding direct loan balance, respectively.

Collection Procedure

We have standard collection procedures in our direct loan business. We call every borrower approximately 15 days prior to the maturity date to remind them that if we do not receive the repayment in full on the maturity date, we will send a written collection notice within 7 days after the maturity date. The Loan Officer will frequently call and make on-site visits to a borrower upon a loan going into default. Within 90 days after the default, our legal counsel will send warning letters to the default borrower. If the outstanding amount cannot be collected within 180 days after the maturity date and the parties could not reach an agreement on a specific repayment plan, we will initiate legal proceedings in the court.

We apply the same collection procedure in our guarantee business. The only difference is that we will collect from both the borrowers (including recovery from the cash deposit the borrowers deposit with us) and the counter-guarantor or pursue recovery from the collateral.

We will apply the same collection procedure in our financial leasing business.

Description of Our Financial Leasing Business

Target Customers

PFL plans to serve a diverse base of customers, including textile and other manufacturing companies, railroads, port facilities, local bus and rail companies and municipal governments. Customers will include existing clients of the Company in addition to new clients. PFL plans to initially offer leases to four primary customer categories, first in Jiangsu Province and then in other provinces in China:

(1) Municipal Governments - Municipal governments throughout China have begun to realize the benefits of leasing equipment utilized to manage and run China’s large newly developed infrastructure. PFL believes this is an opportunity for substantial growth of its leasing business, especially as a result of the Company’s strong and long-term relationship with Wujiang and other Jiangsu municipal government agencies.

| 14 |

(2) Public Transportation Agencies - PFL plans to lease transportation vehicles to public transportation agencies which would replace existing municipally and regionally owned buses, subway cars, and trains. For example, PFL has been engaged in discussions with a local transportation authority to provide leases for the replacement of existing buses on several city bus routes.

(3) Hospitals - The Company has existing relationships with several local hospitals that are potential customers to lease medical devices, such as x-ray equipment. Since healthcare and medical technologies are constantly improving, frequently making existing medical technology and equipment obsolete, hospitals and other healthcare facilities are increasingly interested in leasing versus purchasing more modern equipment. The switch from one-time cash purchases to leasing will allow hospitals to preserve more of their working capital for other purposes, such as building upgrades, education and training programs and/or the leasing of additional equipment and devices.

(4) SMEs - PFL plans to lease a variety of industrial equipment and machinery to local SMEs in Jiangsu Province and beyond. Potential customers include local manufacturing businesses, mining companies, farmers and individuals. PFL initially targeted the Company’s existing SME lending clients since it has a relationship with these customers and understands their operational and credit history and financing needs.

As PFL’s business develops further, we expect to provide leases to customers in other sectors as opportunities arise. PFL, although not required by government mandate, will only lease to businesses that are within the sectors encouraged by the Chinese national industry development and planning policy and environmentally friendly businesses.

The two customers whom PFL provided financial leasing to during 2014 are local SMEs in the manufacturing industry. They are existing borrowers in our lending business. They paid off the outstanding principal and interest of their loans before the Company provided the financial leasing to them.

Leased Equipment

PFL plans to provide leases on both new and used manufacturing equipment, medical devices, transportation vehicles and industrial equipment, purchased both domestically and from foreign suppliers to meet its customer’s needs. PFL may attempt to import technologically advanced transportation vehicles, engines, other vehicular components, industrial equipment and machinery identified by its lessees. PFL anticipates its potential customers will have strong demand for imported technologically advanced equipment and machinery and expects to lease these to its customers at a significant premium due to the real and perceived technical and superior performance and durability characteristics of these imported products.

PFL leased manufacturing equipment to the two current customers.

Lease Underwriting

PFL underwrites the leases via a 3-step process:

(1) A potential customer applies to PFL for a lease on certain equipment that the customer has already identified from a seller;

(2) PFL performs a detailed legal and credit analysis to determine the potential customer’s creditworthiness and ability to make the lease payments; and

(3) If the application is approved, PFL will purchase the asset from the seller, take ownership of such asset, and then lease it to the customer/lessee. Sometimes PFL will require a third party guarantor, who must be pre-approved by PFL, who will guaranty the monthly payment obligations of the lessee.

The underwriting process takes approximately 2 weeks.

| 15 |

Lease Terms

The terms and conditions of the lease will generally include following:

(1) A lease term ranging between 3 and 10 years.

(2) The lessee will be required to pay 30% of the purchase price to the seller and PFL will pay 70% of the purchase price (which will be the lease value) to the seller.

(3) The lessee will pay a deposit equal to 10% of the lease value to PFL and PFL will finance the remaining 90%

(4) The lessee will pay a one-time servicing fee equal to 1% of the total lease value multiplied by the number of years of the lease (for example, a four-year lease requires a 4% service fee.

(5) The lessee will make amortized lease payments consisting of principal and interest (generally at the interest rate of 12%), which will be due monthly or quarterly.

(6) Lessees must (i) operate the leased equipment and perform minimum maintenance in accordance with the manufacturer’s instructions during the entire term of the lease; (ii) insure the equipment against property and casualty loss; and (iii) make all scheduled lease and interest payment regardless of the performance of the equipment.

(7) At the end of the lease term, the lessee will have the option to purchase the leased asset for its residual value. We expect to enter into our boiler plate lease contracts with lessees. Pursuant to the terms of these lease agreements, lessee shall either pay RMB 1,000 (approximately $160) to acquire or automatically acquire the title of the leased assets at the end of the lease term. The buy-back purchase price of RMB 1,000 shall be paid along with the last installment of the rent.

Collateral and Default Assumptions

Some of PFL’s initial target customers are our direct loan customers. We are very familiar with these businesses and individuals and their growth prospects, credit worthiness, management teams, and profitability. We will take advantage of this knowledge and lease to creditworthy customers only, thereby potentially reducing defaults and bad debt expense. When evaluating potential customers with which we do not have a pre-existing relationship, we will utilize our prior experience in the risk assessment of lending clients to timely evaluate a new customer’s creditworthiness.

PFL may require a third party guarantor to reduce financial exposure in the event of a default. PFL may choose to work with a third party to assist with the repossession, storage and sale of the leased equipment in the event of lease defaults.

Risk Management

Credit Risk

As a microcredit lender, credit risk is the most significant risk for our business. In our direct loan business, we suffer financial loss when a borrower defaults and full collection cannot be achieved. In our guarantee business, in the event the borrower defaults in its payment obligation and we pay the lender on behalf of the borrower, we suffer financial loss when we cannot recover the full amount of the payment we paid to the lender (after collection from the cash deposit provided by the borrower) from the counter guarantor or the sale proceeds of the collateral. In our financial leasing business, we suffer financial loss when a lessee defaults while we are unable to lease the equipment at the same or better leasing terms in a timely manner.

| 16 |

Risk Assessment

We apply the same risk assessment approach and procedures for direct lending, guarantee as well as financial leasing activities. We have a dedicated Risk Department which assesses and evaluates the credit risks through in-house research and analysis. We follow the methodology and procedure outlined in our risk assessment guidelines. According to our risk assessment guidelines, the basic principle is that the bench mark ratio multiplied by the financial risk quotient and non-financial risk quotient and the result is the comprehensive risk ratio. The financial risk quotient takes into consideration 16 factors in three categories, i.e. leverage, profitability and growth. The non-financial risk quotient takes into consideration 12 factors in four categories, i.e. industry risk, enterprise risk, management risk and other risks. In summary, our Risk Department assesses the credit risks based on the payment ability of the underlying obligors, transaction structure as well as the industry of borrower and the general economic condition of the market in which we operate.

Risk Control

In our direct lending business, we assess, monitor and control the credit risks both before and after the loan is extended.

As discussed above, we assess the risks through the loan application, review and approval process. Our Risk Department quantifies the risks related to a loan application in a risk assessment report by classifying the loan into one of three categories. A loan with a score of less than 0.35 points is deemed to be a low-risk loan. A loan with a score of between 0.35 and 0.5 points is considered a medium-risk loan. A loan with a score higher than 0.5 points will be classified as a high-risk loan. We have higher requirements for the collateral and require the guarantor to be of higher payment capacity for loans labeled as higher risk.

After the loan or guarantee application is approved, we continue to monitor the credit risk. Our Loan Officers collect the borrower’s financial statements at the end of each quarter and conduct periodic field trips to the borrower’s facilities to observe its operation, sales, ability to make timely repayments, etc. Based on the Loan Officer’s report, the comprehensive risk ratio of each loan is reviewed on a quarterly basis and adjustments are made to the ratio as necessary, according to the borrower’s operational and financial position and other factors outlined above. We label each outstanding loan as “Good”, “Maintenance” or “Contraction”. For “Good” loans, we may extend further credit. For “Maintenance” loans, we will maintain the current credit level. For “Contraction” loans, we may reduce credit to the borrower.

We will apply the same risk control procedure for the financial leasing business.

Liquidity Risk

Liquidity risk is the risk to a bank's earnings and capital arising from its inability to timely meet obligations when they come due without incurring unacceptable losses. As a microcredit company, we are prohibited by PRC banking regulations to accept deposits from the public. Our funding sources include our registered capital, draw-down ability from any lines of credit we have with state-owned or commercial banks as well as cash generated from our operations. Liquidity risk in our operation is therefore limited. We monitor the repayment of loans drawn from the line of credit with Agricultural Bank of China, the only line of credit we currently have.

Allowance for Loan Loss

Reserve for Direct Loan

In our direct loan business, we apply three loan loss reserve measurements:

| ● | Measurement 1- The Specific Reserve: |

In determining our loan loss reserve, we follow the guidelines for the specific reserve set forth in “The Guidance on Provisioning for Loan Losses” (the “Provision Guidance”) issued by PBOC.

| 17 |

Specific reserves are funds set aside based on the anticipated level of loss of each loan after categorizing the loan according to the risks. Such specific reserves are to be used to cover specific losses. According to the “Five-Tier Principle” set forth in the Provision Guidance, the loans are categorized as “pass”, “special-mention”, “substantial”, “doubtful” or “loss”. The definition and provision rate for each category is set forth below.

| Tier | Definition | Reserve Rate | ||

| Pass | Loans for which borrowers are expected to honor the terms of the contracts, and there is no reason to doubt their ability to repay the principal and accrued interest in full and on a timely basis. | 0% | ||

| Special-mention | Loans for which borrowers are currently able to repay the principal and accrued interest in full, although the repayment of loans might be adversely affected by some factors. | 2% | ||

| Substantial | Loans for which borrowers’ ability to repay the principal and accrued interest in full is apparently in question and borrowers cannot depend on the revenues generated from ordinary operations to repay the principal and accrued interest in full. Lender may suffer some losses even though the underlying obligation is guaranteed by a third party or collateralized by certain assets. | 25% | ||

| Doubtful | Loans for which borrowers are unable to repay principal and accrued interest in full. Lender will suffer significant losses even though the underlying obligation is guaranteed by a third party or collateralized by certain assets. | 50% | ||

| Loss | Principal and accrued interest cannot be recovered or only a small portion can be recovered after taking all possible measures and resorting to necessary legal procedures. | 100% |

| ● | Measurement 2 - The General Reserve: |

General reserves are funds set aside based on certain percentage of the total outstanding balance and to be used to cover unidentified probable loan loss. The General Reserve is required to be no less than 1% of total outstanding balance. We use 1% of total outstanding balance in our calculation for the General Reserve.

| ● | Measurement 3 - Special Reserve |

Special reserves are funds set aside covering losses due to risks related to a particular country, region, industry or type of loans. The reserve rate could be decided based on management estimates of loan collectability.

We had no Special Reserves for 2013 due to the short-term and microcredit nature of our loans and our low loss rate. For the fiscal year ended December 31, 2013, our reserve measurements indicate the aggregate amount calculated based on General Reserve is higher than the amount calculated based on the Specific Reserve. For the fiscal year ended December 31, 2014, we utilized Special Reserve and Five-Tiers Principal in estimating the loan loss as it is higher than the amount calculated based on the General Reserve. We review the loss reserve on a quarterly basis.

In February and March 2015, the Company revisited the classification of its loan portfolios within its rating system to test the adequacy of the allowances calculated thereby. As a result of such testing, the Company decided to reclassify certain loans into different categories. The Company reviewed the profile, financial condition and other relevant information and documents of each customer in the lending businesses. For customers with several loans with different due dates, if one loan was past due, the Company decided to reclassify all of this customer's loans as past due (even the other loans that were not mature yet). For extended loans, the Company re-evaluated the customer's repayment ability in a more cautions manner and reclassified the loans of customers without very strong financial condition into the past due category. These reclassifications affected numerous customer accounts.

As of December 31, 2014 and 2013 the total outstanding direct loan balance was $82,079,129 and $90,203,413 and the loan loss reserve $ 24,490,721 and $1,375,948, respectively.

| 18 |

Reserve for the Guarantee Services.

In our guarantee business, we are required to set aside reserves consisting of no less than 1% of the total outstanding balance of loans we guaranteed at the end of fiscal year and 50% of the income generated by our guarantee business during the fiscal year to cover probable losses. The reserve of 50% of the income is applicable only to commission income. Since it is our standard practice to receive the guarantee fee in full in advance when the guarantee is made, we did not think we were exposed to any risk with regard to receipt of such income. Therefore we did not set aside the reserve based on the 50% of the commission income.

We follow the same “Five-Tier Principal” in our measurement of reserve for the guarantee business. For the fiscal year ended December 31, 2013, our reserve measurements indicate the aggregate amount calculated based on Five-Tier Principal is lower than the amount calculated based on the statutory requirement of 1% of the total outstanding guarantee portfolio, as such, the reserve we made for the guarantee business was 1% of the total outstanding guarantee portfolio. For the fiscal year ended December 31, 2014, our reserve measurements indicate the aggregate amount calculated based on Five-Tier Principal is higher than the amount calculated based on the statutory requirement of 1% of the total outstanding guarantee portfolio, as such, the reserve we made for the guarantee business was the aggregate amount calculated based on Five-Tier Principal. We review the loss reserve on a quarterly basis.

In February and March 2015, the Company revisited the classification of its guarantee portfolios within its rating system to test the adequacy of the allowances calculated thereby. As a result of such testing, the Company decided to reclassify certain guarantees into different categories. The Company reviewed the profile, financial condition and other relevant information and documents of each customer in the guarantee businesses. For customers with several guarantees with different due dates, if one guaranteed loan was past due, the Company decided to reclassify all of this customer's guaranteed loans as past due (even the other loans that were not mature yet). These reclassifications affected numerous customer accounts.

As of December 31, 2014 and 2013, the total outstanding balance we guaranteed was $21,794,663 and $56,692,091 and the accrual for financial guarantee services was $5,546,128 and $588,740 respectively.

Reserve for the Financial Leasing Services

We plan to follow the same “Five-Tier Principal” in our measurement of reserve for the financial leasing business except at different reserve rates. We will have reserve rates of 1.5%, 3%, 30%, 60% and 100% for the leases categorized as “pass”, “special-mention”, “substantial”, “doubtful” and “loss”, respectively.

Business Strategy

As we anticipate the economic condition will remain challenging in the next 12 months, the Company plans to aggressively collect the default loans and guarantees with all available legal remedies. The Company also plans to closely monitor the trend in the microfinance industry and may explore microfinance products and services other than lending, guarantee and financial leasing to SMEs.

When the economic condition substantially improves in the future, we intend to implement three primary strategies to expand and grow the size of our Company: (i) increase our lending capacity through the cash generated from operations and through increases in our registered capital by additional equity and/or debt financing, (ii) implementation of our financial leasing business plan in Jiangsu province and other Chinese provinces, and (iii) potential acquisitions of similar microcredit companies in Jiangsu Province, China.

Organic growth will occur through expansion of our direct loan and guarantee services directed at SMEs and farmers. Our existing direct loan and guarantee services could also be expanded by increasing our registered capital base with proceeds of future financings. The lending capacity of Wujiang Luxiang is limited to the aggregate of its registered capital, any proceeds from borrowings and profits generated from operation, subject to certain statutory reserve deductions required under the PRC laws and regulation. According to a policy named “Opinions Regarding Further Pushing Forward the Reform of Rural Microcredit Companies,” Su Zheng Ban Fa (2011) No. 8 (“Jiangsu Document No. 8”), the maximum obligation Wujiang Luxiang is allowed to provide guarantees for is three times its net capital. As of December 31, 2014, the registered capital of Wujiang Luxiang was approximately $53 million. Under PRC laws, the registered capital refers to the total amount of equity investment made by the shareholders. Once the registered capital is established, it cannot be used for purposes beyond the approved business scope of that entity. Because our target market has been historically underserved by the state-owned and commercial banks in China, we believe there will be a continued high demand for our services and we will be able to attract a steady flow of borrowers.

| 19 |

Also, we believe that we may have the opportunity to acquire other microcredit companies of similar size and scope in Jiangsu province, China. As a result of such acquisitions, we may expand our geographic coverage by obtaining requisite licenses to conduct business in other cities in Jiangsu province. We intend to actively pursue acquisition opportunities as they arise, although we currently do not have any written or oral binding agreements, arrangements or understandings with any acquisition target and there can be no assurance that we will be able to locate any target or negotiate definitive agreements with them.

Competition for Our Lending and Guarantee Business

The number of microcredit companies in China is increasing rapidly. According to data compiled by PBOC and released on its website, as of December 2014, there were approximately 8,791 microcredit companies in China. The total loan balance from microcredit companies stood at $ 149.5 billion (RMB 942.0 billion), and new loans issued to microcredit companies in the year of 2014 hit $19.4 billion (RMB 122.8 billion). In Jiangsu province, there are about 631 microcredit companies with total paid-in capital of $14.74 billion (RMB 92.91 Billion) and a total outstanding balance of $18.19 billion (RMB 114.6 billion) as of December 31, 2014, according to PBOC.

According to the data from Central Bank of China, our major competitors in the city of Wujiang as of the end of December 31, 2014 are listed below (in million Dollars). The total loan portfolio of microcredit companies in Wujiang area for the year ended December 31, 2014 is $864.19 million, a 16% decrease from year ended December 31, 2013. The guarantee portfolio for the year ended December 31, 2014 is $136.2 million, a 66.7% decrease from year ended December 31, 2013. Due to the poor economic condition in the Wujiang area, especially the slow-down in the local textile industry, three of the below microcredit companies went bankrupt during 2014 while the remainder are struggling with high default rates.

| Entities | Direct Loan Portfolio | Guarantee Portfolio | Total Portfolio | |||

| Dongfang | 133.39 | 46.36 | 179.75 | |||

| Sunan | 78.11 | 0 | 78.11 | |||

| Sushang | 85.00 | 15.15 | 100.15 | |||

| Wujiang luxiang | 76.92 | 20.46 | 97.39 | |||

| Jinguo | 96.95 | 24.10 | 121.05 | |||

| Wuyue | 86.70 | 11.41 | 98.12 | |||

| Lili | 100.10 | 0 | 100.10 | |||

| Tenglv | 25.71 | 0 | 25.71 | |||

| Tongli | 35.56 | 0 | 35.56 | |||

| Fenghu | 46.31 | 8.54 | 54.86 | |||

| Jinxin | 37.13 | 10.17 | 47.30 | |||

| songling | 13.39 | 0 | 13.39 | |||

| Kaifeng | 25.13 | 0 | 25.13 | |||

| Keji | 23.74 | 0 | 23.74 | |||

| Total | 864.19 | 136.20 | 1,000.42 |

| 20 |

Competitive Strengths for Our Lending and Guarantee Business

We believe there are several key factors that will continue to differentiate us from other microcredit companies in the city of Wujiang.

| ● | Experienced Management Team. We have a senior management team that has time-tested, hands-on experience with a high degree of market knowledge and a thorough understanding of the lending industry in China. Members of our management team have an average of 25 years of previous banking, accounting or other relevant experience. We believe that our management’s significant experience in the lending industry and our efficient underwriting process allow us to more carefully determine to whom to lend to and how to structure the loans. |

| ● | Stable Relationship with State-Owned Banks and Commercial Banks. We have established relationships with local branches of the state-owned and provincial commercial banks. We currently have a credit facility agreement in the amount of approximately $16.2 million (RMB 100 million), approximately $4.7million (RMB 30) of which is currently available, with Agricultural Bank of China pursuant to which it extended a line of credit to us. We also have established guarantee cooperation relationships with China Construction Bank, Agricultural Bank of China, Bank of Communications, China CITIC Bank Agriculture Commercial Bank and Jiangsu Bank pursuant to which these banks previously have agreed to accept us as a guarantor for third party loans. Although there is no written agreement or understanding between these banks and us with regard to the referral of lending business, we believe that the reputation of our management team will enable us to maintain and develop good relationships with the local branches of these state owned and commercial banks. |

| ● | Early Entrance and Good Reputation. We are one of the first microcredit companies approved in the city of Wujiang region. We have strong brand recognition among the small borrowers in the city of Wujiang, which we believe should create a steady flow of business from borrowers. |

| ● | Stable Borrower Base. Our early entrance into the micro credit market has resulted in our creating a sizeable market share. We have been able to retain a stable borrower base with recurring borrowing needs and good repayment histories. |

We believe we have the following competitive strengths compared to the local branches of state-owned banks and commercial banks which are permitted to extend credit to microcredit borrowers.

| ● | Fast Service. We are able to close loans more quickly than traditional Chinese banks due to our efficient yet comprehensive underwriting process and a less bureaucratic environment, which is important to SMEs, farmers and individuals. |

| ● | Favorable Interest Rates to Borrowers with Good Track Records. We offer favorable interest rates to borrowers who have good repayment histories with us, especially to the borrowers who provide real property as collateral. SMEs appear more willing to establish and maintain good relationship with us than with the local branches of the state-owned and commercial banks which may not provide the same level of services to SMEs. |

| ● | A Greater Willingness to Lend to SMEs. We are focused on providing credit to SMEs, farmers and individuals in the city of Wujiang. With our extensive knowledge and experience working with local SMEs, farmers and individuals, we are better equipped to attract such borrowers and maintain a long-standing relationship with them. |

Competition for Our Financial Leasing Business

As one of the few leasing companies in Jiangsu Province, PFL enjoys little competition in Jiangsu province at this time. In fact, very few companies have received a leasing business license, and the companies that have licenses are mostly selling to a smaller and narrower customer base. However, in China, we compete with a number of international, national, regional and local banks and finance companies, financial leasing companies and equipment manufacturers that lease or finance the sale of their own products.

Due to the Company’s strong relationships with local business owners and government agencies and its expertise in evaluating the financial health of local businesses, PFL believes it is in a strong position to grow its leasing business in Jiangsu Province once it has the financial means. However, we currently do not have further funds to deploy in the financial leasing business.

| 21 |

Competitive Strengths for Our Financial Leasing Business

We believe we could thrive in the financial leasing business even with future competition in Jiangsu province due to following competitive advantages:

| ● | Substantial experience in identifying potential lessees. Our financial and industrial lending experience in the local Jiangsu marketplace and our relationships with local business owners will enable us to identify potential leasing customers, and knowledge of these customers will allow us to more accurately anticipate and serve their financial leasing needs. |

| ● | An early entrant to financial leasing segment in the Jiangsu region. As one of the few leasing companies in Jiangsu province, PFL enjoys little competition and we believe that being an early entrant will enable us to develop brand recognition and customer loyalty. |

| ● | Strong relationships with local and regional government agencies. As a result of our relationships with local and regional government agencies, PFL may be afforded access to participate in projects sponsored by those government and public transportation agencies. |

| ● | Local government support. PFL has been afforded certain tax benefits and incentives by the government. PFL will be exempted from Jiangsu provincial income tax for the first five years, followed by a provincial income tax rate at half of normal tax rates for the following five years. PFL will also receive a registered capital bonus payment from the Wujiang city government equivalent to 2% of the actually contributed registered capital. |

| ● | Our status as a NASDAQ listed company. We believe we have a marketing advantage over other financial leasing companies due to our status as a NASDAQ listed company. |

Applicable Government Regulations

Our operations are subject to extensive and complex state, provincial and local laws, rules and regulations including but not limited:

| ● | PRC Company Law and its implementation rules;

|

| ● | Wholly Foreign-Owned Enterprise Law and its implementation rules;

|

| ● | Guidance on Microcredit Company Pilot (Yin Jian Fa [2008]23) (the “Circular 23”) issued by the CBRC and the PBOC on May 4, 2008 and effective on May 4, 2008;

|

| ● | Reply to Certain Issues on Microcredit Company Organization Yin Jian Fa [2006] 246 issued by the CBRC on September 20, 2006 and effective on September 20, 2006;

|

| ● | Guidance on Great Promotion to Rural Microcredit Business of the Banking Industry (Yin Jian Fa [2007] 67) issued by the CBRC on August 6, 2007 and effective on August 6 ,2007;

|

| ● | Circular on Implementing the “Accounting Rule for Financial Enterprise” to Microcredit Company (Cai Jin [2008]185) issued by Ministry of Finance on December 24, 2008 and effective on December 24, 2008;

|

| ● | Circular on Relevant Policies for Rural Bank, Loan Company, Rural Mutual Cooperative and Microcredit Company (Yin Fa [2008]137) issued by the PBOC and the CBRC on April 24, 2008 and effective on April 24, 2008;

|