Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - WELLS FARGO & COMPANY/MN | wfc1qer4-14x2015exx991.htm |

| 8-K - 8-K - WELLS FARGO & COMPANY/MN | wfc1qer4-14x2015form8xk.htm |

1Q15 Quarterly Supplement April 14, 2015 © 2015 Wells Fargo & Company. All rights reserved.

Wells Fargo 1Q15 Supplement 1 Appendix Pages 20-29 - Non-strategic/liquidating loan portfolio 21 - Real estate 1-4 family first mortgage portfolio 22 - Real estate 1-4 family junior lien mortgage portfolio 23 - Consumer credit card portfolio 24 - Auto portfolios 25 - Student lending portfolio 26 Common Equity Tier 1 under Basel III (General Approach and Standardized Approach with Transition Requirements) 27 Common Equity Tier 1 under Basel III (Advanced Approach, fully phased-in) 28 Forward-looking statements and additional information 29 Table of contents 1Q15 Results - 1Q15 Highlights Page 2 - Year-over-year results 3 - 1Q15 Revenue diversification 4 - Balance Sheet and credit overview (linked quarter) 5 - Income Statement overview (linked quarter) 6 - Loans 7 - Broad-based, year-over-year loan growth 8 - Deposits 9 - Net interest income 10 - Noninterest income 11 - Noninterest expense and efficiency ratio 12 - Community Banking 13 - Wholesale Banking 14 - Wealth, Brokerage and Retirement 15 - Credit quality 16 - Capital position 17 - Capital return 18 - Summary 19

Wells Fargo 1Q15 Supplement 2 5,893 5,726 5,729 5,709 5,804 1Q14 2Q14 3Q14 4Q14 1Q15 1Q15 Highlights Earnings of $5.8 billion, down $89 million, or 2% year-over-year (YoY), and up $95 million, or 2% linked quarter (LQ) Diluted earnings per common share of $1.04, down 1% YoY and up 2% LQ Revenue up 3% YoY and down 1% LQ - Net interest income up 3% YoY and down 2% LQ - Noninterest income up 3% YoY and stable LQ Strong balance sheet - Average loans up 2% LQ and up 7% annualized, LQ - Average deposits up 2% LQ and up 9% annualized, LQ - Credit quality remained strong with net charge- offs of 33 bps of average loans - Strong capital position • Common Equity Tier 1 ratio under Basel III (Advanced Approach, fully phased-in) of 10.53% at 3/31/15 (1) • Returned $3.3 billion to shareholders through common stock dividends and net share repurchases - Strong liquidity position • Already compliant with domestic, fully phased-in LCR • 18% of total assets in cash, fed funds sold and short-term investments, up from 16% in 1Q14 Wells Fargo Net Income ($ in millions) (1) 1Q15 capital ratios are preliminary estimates. See pages 27-28 for additional information regarding common equity ratios. Estimated based on final rules adopted July 2, 2013, by the Federal Reserve Board establishing a new comprehensive capital framework for U.S. banking organizations that would implement the Basel III capital framework and certain provisions of the Dodd-Frank Act. Diluted earnings per common share $1.05 $1.01 $1.02 $1.02 $1.04

Wells Fargo 1Q15 Supplement 3 $5.9 $5.8 1Q14 1Q15 Year-over-year results (1) Pre-tax pre-provision profit (PTPP) is total revenue less noninterest expense. Management believes PTPP is a useful financial measure because it enables investors and others to assess the Company’s ability to generate capital to cover credit losses through a credit cycle. Pre-tax Pre-provision Profit (1) ($ in billions) Net Income ($ in billions, except EPS) Diluted earnings per common share Period-end Loans ($ in billions) Period-end Deposits ($ in billions) Ending Common Shares Outstanding (shares in millions) $8.7 $8.8 1Q14 1Q15 994.2 1,087.0 100.4 109.7$1,094.6 $1,196.7 1Q14 1Q15 Core Deposits 748.4 802.6 78.0 58.6 $826.4 $861.2 1Q14 1Q15 Core Loans Non-strategic/liquidating loans Revenue ($ in billions) $1.05 $1.04 $20.6 $21.3 1Q14 1Q15 5,265.7 5,162.9 1Q14 1Q15

Wells Fargo 1Q15 Supplement 4 Balanced Spread and Fee Income Diversified Fee Generation Deposit Service Charges 12% Card Fees 9% Total Mortgage Banking 15% Insurance 4% Net Gains from Trading 4% (1) Other noninterest income includes lease income, life insurance investment income and all other noninterest income. 1Q15 Revenue diversification Total Trust & Investment Fees 35% Total Other Fees 10% Net Gains from Equity Inv. 4% Brokerage advisory, commissions and other Mortgage Orig./ Sales, net Mortgage Servicing, net Trust and investment management Investment banking Charges and fees on loans Merchant processing 1% Cash network 1% CRE brokerage commissions 1% Letters of credit Card fees Deposit service charges Other noninterest income (1) Net gains from trading Insurance 48%52% Net Interest Income Noninterest Income All other fees Net gains from equity investments Other Noninterest Income (1) 4% Net Gains on Debt Securities 3% Net gains on debt securities $21.3 billion 12% 23% 8% 4%9% 3% 2% 2% 5% 10% 4% 4% 3% 4%4% $10.3 billion

Wells Fargo 1Q15 Supplement 5 Balance Sheet and credit overview (linked quarter) Loans Core loans (1) increased $914 million on commercial loan growth Non-strategic/liquidating portfolio (1) decreased $2.2 billion Short-term investments/ Fed funds sold Up $32.9 billion on growth in deposits Investment securities Up $11.8 billion as gross purchases of ~$23 billion were partially offset by run-off and maturities Deposits Up $28.4 billion on strong consumer and small business growth, as well as higher mortgage escrow balances Short-term borrowings Up $14.2 billion on higher repurchase agreement balances across the sales and trading platform to support trading asset growth and client financing activity Common stock repurchases Common shares outstanding down 7.4 million as share repurchases were partially offset by annual employee benefit plan issuances Entered into a $750 million forward repurchase transaction for an additional 14.0 million shares, which settled in early April 2015 Credit Provision expense of $608 million, up $123 million on lower reserve release - Net charge-offs of $708 million, or 33 bps, down $27 million on continued improvement in consumer credit - $100 million reserve release (2) vs. $250 million in 4Q14 on continued strong credit performance Period-end balances. All comparisons are 1Q15 compared with 4Q14. (1) See pages 7 and 21 for additional information regarding core loans and the non-strategic/liquidating portfolio, which is comprised of Pick-a-Pay, liquidating home equity, legacy WFF indirect auto, legacy WFF debt consolidation, Education Finance-government guaranteed, and legacy Wachovia commercial & industrial, commercial real estate, and other PCI loan portfolios. (2) Provision expense minus net charge-offs.

Wells Fargo 1Q15 Supplement 6 Income Statement overview (linked quarter) Total revenue Revenue of $21.3 billion, down $165 million Net interest income NII down $194 million reflecting two fewer days in the quarter, and lower income from variable sources NIM down 9 bps to 2.95% driven by deposit growth and lower variable income Noninterest income Noninterest income up $29 million - Service charges on deposit accounts down $26 million and card fees down $54 million reflecting seasonality - Trust and investment fees down $28 million on lower investment banking fees - Mortgage banking up $32 million on higher production revenue reflecting an 11% increase in originations and higher gain on sale - Insurance up $48 million on seasonally higher crop insurance premiums - Market sensitive revenue (1) up $319 million on higher trading gains and an increase in net gains from debt securities - Other income down $221 million from 4Q14 which included a $217 million gain on the sale of government guaranteed student loans Noninterest expense Noninterest expense down $140 million - Personnel expense up $369 million; included $688 million in seasonally higher incentive compensation and employee benefits expense, partially offset by lower salaries expense on two fewer days in the quarter - Equipment expense down $87 million from typically higher 4Q14 - Outside professional services down $252 million from typically higher 4Q14 Income tax Tax expense down $240 million 28.2% effective income tax rate included $359 million of discrete tax benefits related to the resolution of various federal and state prior period matters All comparisons are 1Q15 compared with 4Q14. (1) Consists of net gains from trading activities, debt securities and equity investments.

Wells Fargo 1Q15 Supplement 7 Loans Period-end Core loans grew $54.2 billion, or 7%, YoY and were up $914 million LQ - Commercial loans up $899 million LQ driven by growth in real estate construction and lease financing • Oil and gas loans of $18.5 billion were up $65 million LQ - Consumer loans up $15 million LQ as growth in nonconforming mortgage, auto, security-based lending and student was largely offset by lower junior lien and seasonally lower credit card Non-strategic/liquidating loans (1) down $19.4 billion YoY and $2.2 billion LQ Average Total average loans of $863.3 billion up $39.5 billion YoY and $13.8 billion LQ on broad-based growth in 4Q14 Total average loan yield of 4.19%, down 8 bps LQ on lower PCI loan resolutions and loan fees - Core loan yield excluding the non-strategic/ liquidating portfolio was down 7 bps (1) See page 21 for additional information regarding the non-strategic/liquidating portfolio, which is comprised of Pick-a-Pay, liquidating home equity, legacy WFF indirect auto, legacy WFF debt consolidation, Education Finance-government guaranteed, and legacy Wachovia commercial & industrial, commercial real estate, and other PCI loan portfolios. At the end of 2Q14, $9.7 billion in Education Finance-government guaranteed loans were transferred to loans held for sale. Period–end Loans Outstanding ($ in billions) (1) Total average loan yield 748.4 763.6 775.8 801.8 802.6 78.0 65.3 63.1 60.8 58.6 826.4 828.9 838.9 862.6 861.2 1Q14 2Q14 3Q14 4Q14 1Q15 Core loans Non-strategic/liquidating loans 4.29% 4.28% 4.29% 4.27% 4.19%

Wells Fargo 1Q15 Supplement 8 210 220 230 240 250 260 270 280 1Q14 1Q15 Commercial and Industrial 10 14 18 22 26 30 1Q14 1Q15 Credit Card 24 29 34 39 44 49 54 59 1Q14 1Q15 Automobile 150 160 170 180 190 200 210 220 1Q14 1Q15 Core 1-4 Family First Mortgage (1) Broad-based, year-over-year loan growth Nonconforming mortgage growth Disciplined origination activity New account growth and 4Q14 portfolio acquisition ($ in billions) Broad-based growth Period-end balances. (1) Please see page 22 for additional information.

Wells Fargo 1Q15 Supplement 9 Deposits Average Deposits up $97.5 billion, or 9%, YoY and $25.0 billion, or 2%, LQ Average deposit cost of 9 bps, flat LQ and down 2 bps YoY Core deposits (1) of $1.1 trillion up $89.4 billion, or 9%, YoY and up $27.2 billion, or 3%, LQ - Average retail core deposits up 6% YoY on both existing and new customer account balance growth, and up 10% annualized, LQ Period-end Total period-end deposits of $1.2 trillion up $102.1 billion, or 9%, YoY and up $28.4 billion, or 2%, LQ Primary consumer checking customers (2) up 5.7% YoY Primary small business and business banking checking customers (2) up 5.5% YoY Average Deposits and Rates ($ in billions) Average deposit cost Period-end Deposits ($ in billions) (1) Core deposits are noninterest-bearing deposits, interest-bearing checking, savings certificates, certain market rate and other savings, and certain foreign deposits (Eurodollar sweep balances). (2) Data as of February 2015, comparisons with February 2014; customers who actively use their checking account with transactions such as debit card purchases, online bill payments, and direct deposits. 1,094.6 1,168.3 1,196.7 1Q14 4Q14 1Q15 793.2 825.7 849.2 284.1 324.1 325.6 1,077.3 1,149.8 1,174.8 1Q14 4Q14 1Q15 Noninterest-bearing deposits Interest-bearing deposits 0.11% 0.09% 0.09%

Wells Fargo 1Q15 Supplement 10 10,832 11,016 11,163 11,418 11,228 1Q14 2Q14 3Q14 4Q14 1Q15 Net interest income (TE) (1) up $396 million YoY on earning asset growth Net interest income (TE) (1) down $190 million LQ on two fewer days in the quarter and lower variable income Average earning assets up $37.4 billion, or 2%, LQ - Investment securities up $19.3 billion - Loans up $13.8 billion - Short-term investments/fed funds sold up $7.6 billion - Trading assets up $2.6 billion - Mortgages and loans held for sale down $5.9 billion NIM of 2.95% down 9 bps from 4Q14 on: - Customer-driven deposit growth = (5) bps - Variable income = (3) bps - Liquidity-related activity = (1) bps - Balance sheet repricing, growth and mix = 0 bps Net interest income Net Interest Income (TE) (1) ($ in millions) Net Interest Margin (NIM) (1) Tax-equivalent net interest income is based on the federal statutory rate of 35% for the periods presented. Net interest income was $10,615 million, $10,791 million, $10,941 million, $11,180 million and $10,986 million for 1Q14, 2Q14, 3Q14, 4Q14 and 1Q15 respectively. 3.20% 3.15% 3.06% 3.04% 2.95%

Wells Fargo 1Q15 Supplement 11 Noninterest income Deposit service charges down $26 million LQ on seasonality Trust and investment fees down $28 million, or 1%, LQ as lower investment banking was partially offset by higher asset-based fees and retail brokerage transaction revenue Card fees down $54 million on seasonality Other fees down $46 million on lower CRE brokerage commissions and letter of credit fees Mortgage banking up $32 million on higher origination volumes and gain on sale Insurance up $48 million on seasonally higher crop insurance premiums Trading gains up $229 million on $177 million higher customer accommodation trading reflecting better markets in high grade, high yield and RMBS as well as 1Q seasonality - $58 million in deferred compensation investment income (P&L neutral) vs. $53 million in 4Q14 Gains on sale of debt securities up $92 million All other income down $221 million from 4Q14 which included a $217 million gain on the sale of government guaranteed student loans vs vs ($ in millions) 1Q15 4Q14 1Q14 Noninterest income Service charges on deposit accounts $ 1,215 (2) % - Trust and investment fees Brokerage advisory, commissions and other fees 2,380 2 6 Trust and investment management 852 - 1 Investment banking 445 (15) 36 Card fees 871 (6) 11 Other fees 1,078 (4) 3 Mortgage banking 1,547 2 2 Insurance 430 13 - Net gains from trading activities 408 n.m. (6) Net gains on debt securities 278 49 n.m. Net gains from equity investments 370 (1) (56) Lease income 132 4 (1) Life insurance investment income 145 - 10 All other 141 (61) n.m. Total noninterest income $ 10,292 - % 3 10,010 10,275 10,272 10,263 10,292 1Q14 2Q14 3Q14 4Q14 1Q15

Wells Fargo 1Q15 Supplement 12 Noninterest expense and efficiency ratio (1) Noninterest expense down $140 million LQ - Personnel expense up $369 million • Salaries down $87 million due to two fewer days • Commission and incentive compensation up $103 million as $236 million in annual equity awards to retirement-eligible employees was partially offset by lower revenue-based incentive compensation • Employee benefits expense up $353 million on $452 million in seasonally higher payroll taxes and 401(k) matching expenses o $62 million in deferred compensation expense vs. $81 million in 4Q14 - Equipment expense down $87 million from a 4Q14 that included annual license renewals - Outside professional services (2) down $252 million from elevated 4Q14 levels - Other expense (2) down $154 million • Travel and entertainment down $58 million • Advertising expense down $77 million on seasonality • Insurance expense up $80 million on seasonally higher crop insurance commissions 1Q15 efficiency ratio of 58.8% Expect to operate within targeted efficiency ratio range of 55%-59% for full year 2015 Efficiency Ratio (1) Efficiency ratio defined as noninterest expense divided by total revenue (net interest income plus noninterest income). Noninterest expense and our efficiency ratio may be affected by a variety of factors, including business and economic cyclicality, seasonality, changes in our business composition and operating environment, growth in our business and/or acquisitions, and unexpected expenses relating to, among other things, litigation and regulatory matters. (2) The sum of Outside professional services expense and Other expense equals Other noninterest expense in the Consolidated Statement of Income, pages 19 and 20 of the press release. vs vs ($ in millions) 1Q15 4Q14 1Q14 Noninterest expense Salaries $ 3,851 (2) % 3 Commission and incentive compensation 2,685 4 11 Employee benefits 1,477 31 8 Equipment 494 (15) 1 Net occupancy 723 (1) (3) Core deposit and other intangibles 312 (8) (9) FDIC and other deposit assessments 248 7 2 Outside professional services (2) 548 (32) (2) Other (2) 2,169 (7) 5 Total noninterest expense $ 12,507 (1) % 5 11,948 12,194 12,248 12,647 12,507 1Q14 2Q14 3Q14 4Q14 1Q15 57.9% 57.9% 57.7% 59.0% 58.8%

Wells Fargo 1Q15 Supplement 13 Community Banking Net income of $3.7 billion, down 5% YoY and up 7% LQ Regional Banking (1) Primary consumer checking customers (2) up 5.7% YoY Primary small business and business banking checking customers (2) up 5.5% YoY Retail bank cross-sell of 6.13 (3) products per household Consumer Lending Credit card penetration (1)(4) rose to 41.8%, up from 41.5% in 4Q14 and 38.0% in 1Q14 Consumer auto originations of $7.1 billion, up 6% LQ on seasonality and down 10% YoY reflecting continued underwriting discipline Mortgage originations of $49 billion, up 11% LQ and 36% YoY - 55% of originations were for refinance, compared with 40% in 4Q14 - 2.06% gain on sale ratio (5) - Application pipeline at its highest level since 2Q13 (1) Metrics reported on a one-month lag from reported quarter-end; for example 1Q15 data as of February 2015 compared with February 2014. (2) Customers who actively use their checking account with transactions such as debit card purchases, online bill payments, and direct deposit. (3) February 2015 Retail Bank household cross-sell ratio includes the impact of the sale of government guaranteed student loans in 4Q14. (4) Household penetration as of February 2015 and defined as the percentage of Retail Bank households that have a credit card with Wells Fargo. (5) Net gains on mortgage loan origination/or sales activities less repurchase reserve build/release divided by total originations. vs vs ($ in millions) 1Q15 4Q14 1Q14 Net interest income $ 7,561 - % 4 Noninterest income 5,223 (1) (2) Provision for credit losses 617 19 47 Noninterest expense 7,064 (3) 4 Income tax expense 1,364 (12) (1) Segment net income $ 3,665 7 % (5) ($ in billions) Avg loans, net $ 506.4 1 - Avg core deposits 668.9 2 7 vs vs ($ in billions) 1Q15 4Q14 1Q14 Consumer Lending Credit card payment volumes (POS) $ 15.4 (8) % 16 Credit card penetration (1)(4) 41.8 % 26 bps 383 Home Lending Applications $ 93 41 % 55 Application pipeline 44 69 63 Originations 49 11 36 Gain on sale ratio (5) 2.06 % 26 bps 45 1Q15 4Q14 1Q14 Regional Banking Primary consumer checking customers (1)(2) 5.7 % 5.2 5.1 Primary business checking customers (1)(2) 5.5 5.4 5.1 Retail Bank household cross-sell (1)(3) 6.13 6.17 6.17

Wells Fargo 1Q15 Supplement 14 Wholesale Banking Net income of $1.8 billion, up 3% YoY and down 9% LQ Net interest income down 6% LQ reflecting lower loan resolution income as well as two fewer days in the quarter Noninterest income up 1% LQ on higher trading gains and seasonally higher insurance Noninterest expense up 3% LQ on seasonally higher personnel costs Cross-sell Cross-sell of 7.2 products per relationship (1), stable LQ Treasury Management Commercial card spend volume (2) of $6.0 billion up 12% YoY Treasury management revenue up 3% LQ and 11% YoY reflecting new product sales and repricing Investment Banking U.S. investment banking market share of 4.9% (3) up LQ reflecting continued improvement in equity capital markets and investment grade originations despite a flat U.S. market Asset Management Total AUM up $13 billion YoY, including a $9 billion increase in fixed income AUM reflecting net client inflows and favorable market conditions (1) Cross-sell reported on a one-quarter lag. (2) Includes commercial card volume for the entire company. (3) Source: Dealogic U.S. investment banking fee market share. vs vs ($ in millions) 1Q15 4Q14 1Q14 Net interest income $ 2,921 (6) % 1 Noninterest income 2,991 1 11 Reversal of provision for credit losses (6) (85) (94) Noninterest expense 3,409 3 6 Income tax expense 706 (11) (1) Segment net income $ 1,797 (9) % 3 ($ in billions) Avg loans, net $ 337.6 3 12 Avg core deposits 303.4 4 17 vs vs ($ in billions) 1Q15 4Q14 1Q14 Key Metrics: Cross-sell (1) 7.2 - % - Commercial card spend volume (2) $ 6.0 - 12 Total AUM $ 492.7 (1) % 3 Advantage Funds AUM 236.7 (3) 1

Wells Fargo 1Q15 Supplement 15 Wealth, Brokerage and Retirement Record net income of $561 million, up 18% YoY and up 9% LQ Net interest income up 2% LQ; average loans up 4% and average core deposits up 3% Noninterest income up 3% LQ primarily driven by higher asset-based fees and brokerage transaction revenue Noninterest expense up 1% LQ as seasonally higher personnel expenses were partially offset by lower other expenses Retail Brokerage Managed account assets of $435 billion, up 3% LQ and 12% YoY driven by net flows and market performance Wealth Management Wealth Management client assets flat LQ and up 4% YoY Retirement IRA assets up 2% LQ and 6% YoY Institutional Retirement plan assets up 2% LQ and 3% YoY (3) (1) Includes deposits. (2) Data as of February 2015. (3) Year-over-year percentage changes reflect revision of prior periods to conform with current period classification of Institutional Retirement Plan assets. vs vs ($ in millions) 1Q15 4Q14 1Q14 Net interest income $ 861 2 % 12 Noninterest income 2,872 3 6 Reversal of provision for credit losses (3) n.m. (63) Noninterest expense 2,831 1 4 Income tax expense 344 10 19 Segment net income $ 561 9 % 18 ($ in billions) Avg loans, net $ 56.9 4 14 Avg core deposits 161.4 3 3 vs vs ($ in billions, except where noted) 1Q15 4Q14 1Q14 Key Metrics: WBR Client Assets (1) ($ in trillions) $ 1.7 1 % 4 Cross-sell (2) 10.44 - - Retail Brokerage Financial Advisors 15,134 - - Managed account assets $ 435 3 12 Client assets (1) ($ in trillions) 1.4 1 4 Wealth Management Client assets (1) 226 - 4 Retirement IRA Assets 365 2 6 Institutional Retirement Plan Assets (3) 347 2 3

Wells Fargo 1Q15 Supplement 16 Credit quality Provision expense of $608 million, up $123 million from 4Q14 on lower reserve release (1) Net charge-offs of $708 million, down $27 million, or 4%, LQ 0.33% net charge-off rate - Commercial losses of 4 bps, up 1 bp LQ on lower recoveries - Consumer losses of 60 bps, down 3 bps LQ NPAs declined $618 million LQ - $338 million decline in nonaccrual loans - $280 million decrease in foreclosed assets Reserve release (1) of $100 million, down $150 million LQ Allowance for credit losses as of 3/31/15 contemplated the inherent credit losses associated with our oil and gas exposures Allowance for credit losses = $13.0 billion - Allowance covered 4.5x annualized 1Q15 net charge-offs - Future allowance levels may increase or decrease based on a variety of factors, including loan growth, portfolio performance and general economic conditions (1) Provision expense minus net charge-offs. Provision Expense and Net Charge-offs ($ in billions) Nonperforming Assets ($ in billions) 14.7 14.0 13.4 12.9 12.5 3.4 3.0 2.8 2.6 2.3 18.1 17.0 16.2 15.5 14.8 1Q14 2Q14 3Q14 4Q14 1Q15 Nonaccrual loans Foreclosed assets 0.3 0.2 0.4 0.5 0.6 0.8 0.7 0.7 0.7 0.7 0.41% 0.35% 0.32% 0.34% 0.33% 1Q14 2Q14 3Q14 4Q14 1Q15 Provision Expense Net Charge-offs Net charge-off rate

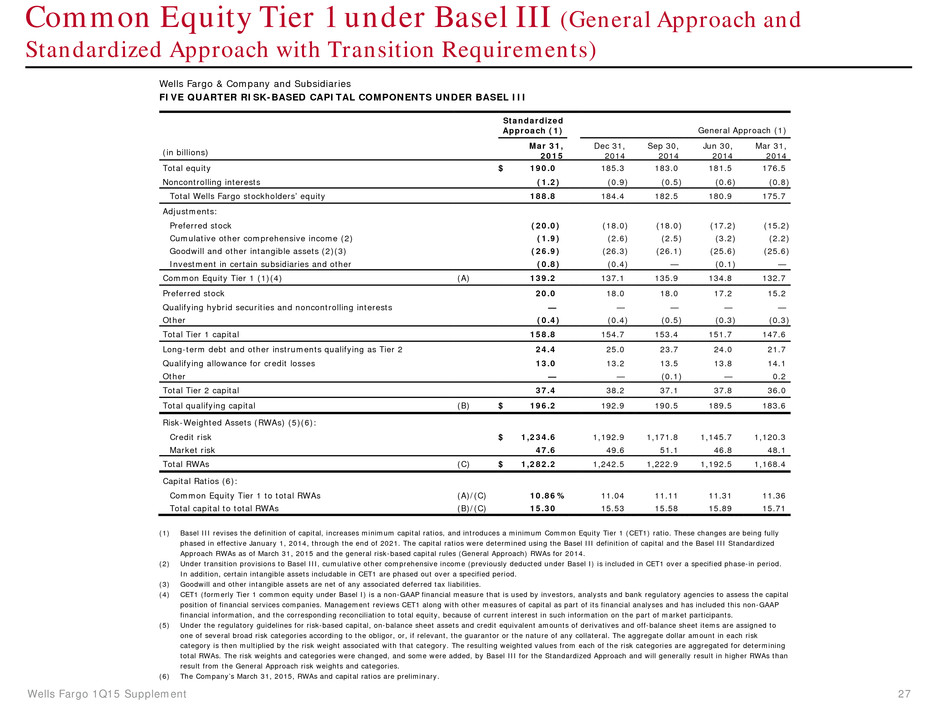

Wells Fargo 1Q15 Supplement 17 Capital remained strong Common Equity Tier 1 ratio under Basel III (Standardized Approach with Transition Requirements) of 10.86% Common Equity Tier 1 ratio under Basel III (Advanced Approach, fully phased-in) of 10.53% at 3/31/15 (1) Approval to use Advanced Approaches for capital requirements granted from the FRB and OCC starting in 2Q15 - Approval did not include stipulations requiring increases to current Advanced Approach risk-weighted assets (RWA) Capital position See pages 27-28 for additional information regarding capital ratios. 1Q15 capital ratios are preliminary estimates. (1) Estimated based on final rules adopted July 2, 2013, by the Federal Reserve Board establishing a new comprehensive capital framework for U.S. banking organizations that would implement the Basel III capital framework and certain provisions of the Dodd-Frank Act. 10.53% 1.49% 1.77% Basel III, Advanced Approach, Fully Phased-in (1) As of 3/31/15 13.79% Tier 2 Capital / Subordinated Debt Tier 1 Capital / Preferred Common Equity Tier 1

Wells Fargo 1Q15 Supplement 18 Our strong capital levels allowed us to continue to return capital to shareholders - Returned $3.3 billion to shareholders in 1Q15 No objection from the Federal Reserve to our 2015 Capital Plan - Included a proposed dividend rate of $0.375 per common share for 2Q15, subject to Board approval Capital return (1) Dividend payout ratio means the ratio of (i) common stock dividends, divided by (ii) net income applicable to common stock. (2) Net payout ratio means the ratio of (i) common stock dividends and share repurchases less issuances and stock compensation-related items, divided by (ii) net income applicable to common stock. Payout Ratios Period-end common shares outstanding down 7.4 million LQ - Purchased 48.4 million common shares - Issued 41.0 million common shares through employee benefit plans Entered into a $750 million forward repurchase transaction for an additional 14.0 million shares, which settled in early April 2015 (1) (2) 28% 34% 34% 34% 33% 26% 66% 66% 72% 61% 1Q14 2Q14 3Q14 4Q14 1Q15 Dividend Payout Ratio Net Payout Ratio 9 (16) (35) (45) (7) (50) (40) (30) (20) (10) - 10 20 1Q14 2Q14 3Q14 4Q14 1Q15 Net Change in Ending Common Shares Outstanding (shares in millions)

Wells Fargo 1Q15 Supplement 19 Summary 1Q15 Solid earnings of $5.8 billion, down $89 million, or 2% from 1Q14 - Diluted EPS of $1.04, down 1% Solid returns - ROA = 1.38% - ROE = 13.17% Strong loan and deposit growth - Period-end loans up $34.8 billion, or 4%, YoY with core loans up $54.2 billion, or 7%, on broad-based growth - Period-end deposits up $102.1 billion, or 9%, YoY Diversified and high quality loan portfolio - Credit quality remained strong with net charge-offs of 0.33% (annualized), down from 0.41% a year ago - Maintained our risk and pricing discipline Strong capital levels while returning $3.3 billion to shareholders through common stock dividends and net share repurchases in 1Q15 Strong liquidity position - Compliant with domestic, fully phased-in LCR - 18% of total assets in cash, fed funds sold and short-term investments

Appendix

Wells Fargo 1Q15 Supplement 21 (1) Net of purchase accounting adjustments. (2) At the end of 2Q14, $9.7 billion in Education Finance-government guaranteed loans were transferred to loans held for sale. -$112.8 Non-strategic/liquidating loan portfolio -$12.7 -$132.2 -$2.2 -$2.3 -$2.2 ($ in billions) 1Q15 4Q14 3Q14 2Q14 1Q14 4Q08 Pick-a-Pay mortgage (1) $ 43.7 45.0 46.4 48.0 49.5 95.3 Liquidating home equity 2.7 2.9 3.1 3.3 3.5 10.3 Legacy WFF indirect auto - - 0.1 0.1 0.1 18.2 Legacy WFF debt consolidation 11.1 11.4 11.8 12.2 12.6 25.3 Education Finance - gov't guaranteed (2) - - - - 10.2 20.5 Legacy WB C&I and CRE PCI loans (1) 0.7 1.1 1.5 1.5 1.7 18.7 Legacy WB other PCI loans (1) 0.4 0.4 0.2 0.2 0.4 2.5 Total $ 58.6 60.8 63.1 65.3 78.0 190.8

Wells Fargo 1Q15 Supplement 22 Real estate 1-4 family first mortgage portfolio Core first lien up $1.4 billion, or 1%, reflecting nonconforming mortgage originations - Nonconforming mortgage loans increased $4.7 billion to $115.2 billion (2) - First lien home equity lines of $16.7 billion, down $263 million Strong core first lien credit performance - Nonaccrual loans down $42 million, or 3 bps, LQ - Net charge-offs up $3 million LQ to 7 bps Pick-a-Pay non-PCI portfolio - Loans of $22.7 billion down 3% LQ driven by loans paid-in-full - Nonaccrual loans decreased $101 million, or 4%, LQ - Net charge-offs of $8 million, or 15 bps, down $1 million LQ on improved portfolio performance and lower severities - Current average LTV of 62% (3) (1) Non-strategic and liquidating loan portfolios primarily consist of Pick-a-Pay and PCI loans acquired from Wachovia and certain portfolios from legacy Wells Fargo Home Equity and Wells Fargo Financial. (2) Nonconforming mortgages originated post February 2009. (3) The current loan-to-value (LTV) ratio is calculated as the net carrying value divided by the collateral value. ($ in millions) 1Q15 4Q14 Real estate 1-4 family first mortgage: Core portfolio $ 210,287 208,851 Non-strategic and liquidating loan portfolios (1) 54,926 56,535 Total real estate 1-4 family first mortgage portfolio 265,213 265,386 Nonaccrual loans $ 3,678 3,720 as % of loans 1.75 % 1.78 Net charge-offs $ 35 32 as % of average loans 0.07 % 0.06 Nonaccrual loans $ 4,667 4,863 as % of loans 8.50 % 8.60 Net charge-offs $ 48 56 as % of average loans 0.35 % 0.39 Core first lien mortgage Non-strategic and liquidating first lien mortgage portfolio

Wells Fargo 1Q15 Supplement 23 Real estate 1-4 family junior lien mortgage portfolio Junior lien mortgage loans down 3% LQ as high quality new originations were more than offset by paydowns Core junior nonaccruals down $46 million, or 3%, LQ Core junior net charge-offs of $106 million, or 77 bps, down $5 million LQ (1) Non-strategic and liquidating loan portfolios primarily consist of PCI loans acquired from Wachovia and certain portfolios from legacy Wells Fargo Home Equity and Wells Fargo Financial. ($ in millions) 1Q15 4Q14 Real estate 1-4 family junior mortgage: Core portfolio $ 54,941 56,631 Non-strategic and liquidating loan portfolios (1) 2,898 3,086 Total real estate 1-4 family junior mortgage portfolio 57,839 59,717 Nonaccrual loans $ 1,676 1,722 as % of loans 3.05 % 3.04 Net charge-offs $ 106 111 as % of average loans 0.77 % 0.77 Nonaccrual loans $ 122 126 as % of loans 4.21 % 4.08 Net charge-offs $ 17 23 as % of average loans 2.30 % 2.87 Core junior lien mortgage Non-strategic and liquidating junior lien mortgage portfolio

Wells Fargo 1Q15 Supplement 24 Consumer credit card portfolio Credit card outstandings down 3% LQ on seasonality, but up 15% YoY reflecting new account growth and growth in private label and co-brand outstandings driven by the card portfolio acquisition in 4Q14 - Credit card household penetration (2) of 41.8%, up 26 bps LQ and 383 bps YoY reflecting the card portfolio acquisition in 4Q14 and continued new account growth - Purchase dollar volume down 8% LQ and POS transactions down 6% LQ on 4Q14 seasonal spending - Purchase dollar volume up 16% YoY and POS transactions up 19% YoY reflecting growth in the account base, as well as the card portfolio acquisition in 4Q14 Net charge-offs up $18 million, or 22 bps, LQ on seasonality and up $8 million YoY on portfolio growth (1) Includes consumer credit card as well as certain co-brand and private label relationship new account openings. The 4Q14 new accounts have been revised to conform with this basis of presentation. (2) Household penetration as of February 2015 and defined as the percentage of Retail Bank households that have a credit card with Wells Fargo. ($ in millions) 1Q15 4Q14 Credit card outstandings $ 30,078 31,119 Net charge-offs 239 221 as % of avg loans 3.19 % 2.97 Key Metrics: Purchase volume $ 15,410 16,839 POS transactions (millions) 224 239 New accounts (1) 729,283 553,804 Penetration (2) 41.8 % 41.5

Wells Fargo 1Q15 Supplement 25 Auto portfolios (1) Consumer Portfolio Auto outstandings of $56.3 billion up 1% LQ and 7% YoY - 1Q15 originations of $7.1 billion up 6% LQ on seasonality and down 10% YoY reflecting continued underwriting discipline Nonaccrual loans declined $4 million LQ and $28 million YoY Net charge-offs were down $31 million LQ reflecting seasonality, and down $11 million YoY - March Manheim index of 124.5 up 1% LQ and stable YoY 30+ days past due decreased $367 million, or 68 bps, LQ reflecting seasonality and increased $228 million, or 31 bps, YoY Commercial Portfolio Loans of $9.0 billion stable LQ and up 6% YoY (1) The consumer auto portfolio includes the liquidating legacy Wells Fargo Financial indirect portfolio of $23 million. ($ in millions) 1Q15 4Q14 Auto outstandings $ 53,336 52,672 Nonaccrual loans 129 131 as % of loans 0.24 % 0.25 Net charge-offs $ 99 128 as % of avg loans 0.76 % 0.96 30+ days past due $ 964 1,325 as % of loans 1.81 % 2.52 Auto outstandings $ 3,003 3,068 Nonaccrual loans 4 6 as % of loans 0.13 % 0.18 Net charge-offs $ 2 4 as % of avg loans 0.28 % 0.46 30+ days past due $ 10 16 as % of loans 0.33 % 0.52 Commercial Auto outstandings $ 8,962 8,973 Nonaccrual loans 17 17 as % of loans 0.19 % 0.19 Net charge-offs $ - - as % of avg loans n.m. % n.m. Indirect Consumer Direct Consumer

Wells Fargo 1Q15 Supplement 26 Student lending portfolio Private Portfolio $12.2 billion private loan outstandings up 2% LQ and 4% YoY - Average FICO of 754 and 80% of the total outstandings have been co-signed Net charge-offs decreased $5 million LQ due to seasonality of repayment 30+ days past due decreased $25 million LQ on seasonality Government Portfolio Transferred to held for sale at the end of 2Q14 - $8.3 billion sold in 4Q14 - $0.7 billion remains in held for sale ($ in millions) 1Q15 4Q14 Private Portfolio Private outstandings $ 12,169 11,936 Net charge-offs 33 38 as % of avg loans 1.09 % 1.27 30 days past due $ 228 253 as % of loans 1.87 % 2.12

Wells Fargo 1Q15 Supplement 27 Common Equity Tier 1 under Basel III (General Approach and Standardized Approach with Transition Requirements) Wells Fargo & Company and Subsidiaries FIVE QUARTER RISK-BASED CAPITAL COMPONENTS UNDER BASEL III Standardized Approach (1) General Approach (1) (in billions) Mar 31, 2015 Dec 31, 2014 Sep 30, 2014 Jun 30, 2014 Mar 31, 2014 Total equity $ 190.0 185.3 183.0 181.5 176.5 Noncontrolling interests (1.2 ) (0.9 ) (0.5 ) (0.6 ) (0.8 ) Total Wells Fargo stockholders’ equity 188.8 184.4 182.5 180.9 175.7 Adjustments: Preferred stock (20.0 ) (18.0 ) (18.0 ) (17.2 ) (15.2 ) Cumulative other comprehensive income (2) (1.9 ) (2.6 ) (2.5 ) (3.2 ) (2.2 ) Goodwill and other intangible assets (2)(3) (26.9 ) (26.3 ) (26.1 ) (25.6 ) (25.6 ) Investment in certain subsidiaries and other (0.8 ) (0.4 ) — (0.1 ) — Common Equity Tier 1 (1)(4) (A) 139.2 137.1 135.9 134.8 132.7 Preferred stock 20.0 18.0 18.0 17.2 15.2 Qualifying hybrid securities and noncontrolling interests — — — — — Other (0.4 ) (0.4 ) (0.5 ) (0.3 ) (0.3 ) Total Tier 1 capital 158.8 154.7 153.4 151.7 147.6 Long-term debt and other instruments qualifying as Tier 2 24.4 25.0 23.7 24.0 21.7 Qualifying allowance for credit losses 13.0 13.2 13.5 13.8 14.1 Other — — (0.1 ) — 0.2 Total Tier 2 capital 37.4 38.2 37.1 37.8 36.0 Total qualifying capital (B) $ 196.2 192.9 190.5 189.5 183.6 Risk-Weighted Assets (RWAs) (5)(6): Credit risk $ 1,234.6 1,192.9 1,171.8 1,145.7 1,120.3 Market risk 47.6 49.6 51.1 46.8 48.1 Total RWAs (C) $ 1,282.2 1,242.5 1,222.9 1,192.5 1,168.4 Capital Ratios (6): Common Equity Tier 1 to total RWAs (A)/(C) 10.86 % 11.04 11.11 11.31 11.36 Total capital to total RWAs (B)/(C) 15.30 15.53 15.58 15.89 15.71 (1) Basel III revises the definition of capital, increases minimum capital ratios, and introduces a minimum Common Equity Tier 1 (CET1) ratio. These changes are being fully phased in effective January 1, 2014, through the end of 2021. The capital ratios were determined using the Basel III definition of capital and the Basel III Standardized Approach RWAs as of March 31, 2015 and the general risk-based capital rules (General Approach) RWAs for 2014. (2) Under transition provisions to Basel III, cumulative other comprehensive income (previously deducted under Basel I) is included in CET1 over a specified phase-in period. In addition, certain intangible assets includable in CET1 are phased out over a specified period. (3) Goodwill and other intangible assets are net of any associated deferred tax liabilities. (4) CET1 (formerly Tier 1 common equity under Basel I) is a non-GAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies. Management reviews CET1 along with other measures of capital as part of its financial analyses and has included this non-GAAP financial information, and the corresponding reconciliation to total equity, because of current interest in such information on the part of market participants. (5) Under the regulatory guidelines for risk-based capital, on-balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items are assigned to one of several broad risk categories according to the obligor, or, if relevant, the guarantor or the nature of any collateral. The aggregate dollar amount in each risk category is then multiplied by the risk weight associated with that category. The resulting weighted values from each of the risk categories are aggregated for determining total RWAs. The risk weights and categories were changed, and some were added, by Basel III for the Standardized Approach and will generally result in higher RWAs than result from the General Approach risk weights and categories. (6) The Company’s March 31, 2015, RWAs and capital ratios are preliminary.

Wells Fargo 1Q15 Supplement 28 Common Equity Tier 1 under Basel III (Advanced Approach, fully phased-in) Wells Fargo & Company and Subsidiaries COMMON EQUITY TIER 1 UNDER BASEL III (ADVANCED APPROACH, FULLY PHASED-IN) (1)(2) (in billions) Mar 31, 2015 Common Equity Tier 1 (transition amount) under Basel III $ 139.2 Adjustments from transition amount to fully phased-in under Basel III (3): Cumulative other comprehensive income 1.9 Other (2.0 ) Total adjustments (0.1 ) Common Equity Tier 1 (fully phased-in) under Basel III (C) $ 139.1 Total RWAs anticipated under Basel III (4)(5) (D) $ 1,320.3 Common Equity Tier 1 to total RWAs anticipated under Basel III (Advanced Approach, fully phased-in) (5) (C)/(D) 10.53 % (1) CET1 is a non-GAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies. Management reviews CET1 along with other measures of capital as part of its financial analyses and has included this non-GAAP financial information, and the corresponding reconciliation to total equity, because of current interest in such information on the part of market participants. (2) The Basel III CET1 and RWAs are estimated based on the Basel III capital rules adopted July 2, 2013, by the FRB. The rules establish a new comprehensive capital framework for U.S. banking organizations that implement the Basel III capital framework and certain provisions of the Dodd-Frank Act. The rules are being phased in effective January 1, 2014 through the end of 2021. (3) Assumes cumulative other comprehensive income is fully phased in and certain other intangible assets are fully phased out under Basel III capital rules. (4) The final Basel III capital rules provide for two capital frameworks: the Standardized Approach intended to replace Basel I, and the Advanced Approach applicable to certain institutions. Under the final rules, we will be subject to the lower of our CET1 ratio calculated under the Standardized Approach and under the Advanced Approach in the assessment of our capital adequacy. While the amount of RWAs determined under the Standardized and Advanced Approaches has been converging, management’s estimate of RWAs as of March 31, 2015, is based on the Advanced Approach, which is currently estimated to be higher than RWAs under the Standardized Approach, resulting in a lower CET1 compared with the Standardized Approach. Basel III capital rules adopted by the Federal Reserve Board incorporate different classification of assets, with risk weights based on Wells Fargo’s internal models, along with adjustments to address a combination of credit/counterparty, operational and market risks, and other Basel III elements. (5) The Company’s March 31, 2015, RWAs and capital ratio are preliminary.

Wells Fargo 1Q15 Supplement 29 Forward-looking statements and additional information Forward-looking statements: This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, we may make forward-looking statements in our other documents filed or furnished with the SEC, and our management may make forward- looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements include, but are not limited to, statements we make about: (i) the future operating or financial performance of the Company, including our outlook for future growth; (ii) our noninterest expense and efficiency ratio; (iii) future credit quality and performance, including our expectations regarding future loan losses and allowance levels; (iv) the appropriateness of the allowance for credit losses; (v) our expectations regarding net interest income and net interest margin; (vi) loan growth or the reduction or mitigation of risk in our loan portfolios; (vii) future capital levels and our estimated Common Equity Tier 1 ratio under Basel III capital standards; (viii) the performance of our mortgage business and any related exposures; (ix) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; (x) future common stock dividends, common share repurchases and other uses of capital; (xi) our targeted range for return on assets and return on equity; (xii) the outcome of contingencies, such as legal proceedings; and (xiii) the Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on forward- looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For more information about factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements” discussion in Wells Fargo’s press release announcing our first quarter 2015 results and in our most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014. Purchased credit-impaired loan portfolio: Loans that were acquired from Wachovia that were considered credit impaired were written down at acquisition date in purchase accounting to an amount estimated to be collectible and the related allowance for loan losses was not carried over to Wells Fargo’s allowance. In addition, such purchased credit-impaired loans are not classified as nonaccrual or nonperforming, and are not included in loans that were contractually 90+ days past due and still accruing. Any losses on such loans are charged against the nonaccretable difference established in purchase accounting and are not reported as charge-offs (until such difference is fully utilized). As a result of accounting for purchased loans with evidence of credit deterioration, certain ratios of the combined company are not comparable to a portfolio that does not include purchased credit-impaired loans. In certain cases, the purchased credit-impaired loans may affect portfolio credit ratios and trends. Management believes that the presentation of information adjusted to exclude the purchased credit-impaired loans provides useful disclosure regarding the credit quality of the non-impaired loan portfolio. Accordingly, certain of the loan balances and credit ratios in this document have been adjusted to exclude the purchased credit-impaired loans. References in this document to impaired loans mean the purchased credit-impaired loans. Please see page 31 of the press release announcing our 1Q15 results for additional information regarding the purchased credit-impaired loans.