Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d910244d8k.htm |

Annual Meeting of Shareholders

April 14, 2015

Please refer to earnings release dated January 21, 2015

and 10-K dated February 25, 2015 for further information,

including full results reported on a U.S. GAAP basis.

Exhibit 99.1

©

Fifth Third Bank | All Rights Reserved

|

2

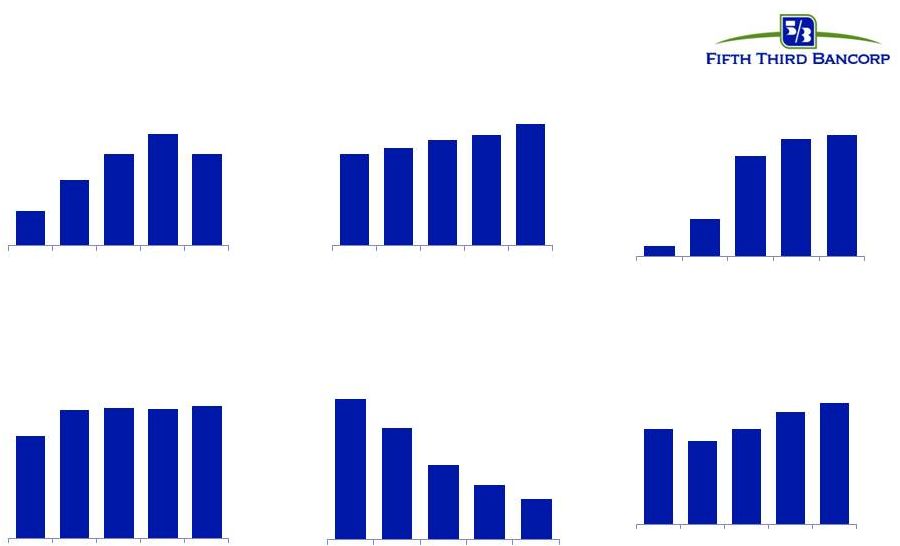

2014 performance at a glance

Diluted Earnings Per Share

Strong long-term earnings growth

Nonperforming asset ratio

Problem assets at lowest

levels since before crisis

Tier

1

common

ratio

2

ALLL / NPLs

Maintaining prudent reserve stance

Solid capital ratios;

above targets and requirements

1

Includes dividends declared and share repurchases. 2013 is net of the issuance of

shares valued at $398MM related to the Series G preferred stock conversion

on July 1, 2013. 2012, 2013, and 2014 also include repurchases of shares in

the amount of after-tax gains on the sale of Vantiv shares.

2

Non-GAAP measure; see Reg. G reconciliation in appendix.

Book value per share

Creating value and sustaining

momentum in results

Total

payout

ratio

1

~$1.1B

1

payout to common

shareholders in 2014

©

Fifth Third Bank | All Rights Reserved

2010

2011

2012

2013

2014

2010

2011

2012

2013

2014

2010

2011

2012

2013

2014

2010

2011

2012

2013

2014

2010

2011

2012

2013

2014

2010

2011

2012

2013

2014

$0.63

$1.18

$1.66

$2.02

$1.66

$13.06

$13.92

$15.10

$15.85

$17.35

6%

24%

63%

74%

76%

179%

157%

180%

211%

228%

2.79%

2.23%

1.49%

1.10%

0.82%

7.5%

9.4%

9.5%

9.5%

9.7% |

3

ABOVE MARKET

GROWTH

TOP-TIER

EQUITY

RETURNS

SOUND RISK

MANAGEMENT

Where we focus

to create value for our shareholders

©

Fifth Third Bank | All Rights Reserved

›

Run core businesses to take share

›

Deliver on our value proposition

›

Expand markets we serve

›

Thoughtful deployment of capital

›

Manage to less volatile, more

sustainable earnings growth

›

Continuous improvements in scale,

efficiency, and productivity

›

Balanced business portfolio

›

Balance sheet management

›

Credit risk management

›

Regulatory compliance |

4

Operating environment update

›

Tepid economic growth

›

Regulation eliminates certain

businesses and constrains future

innovation

›

Changing customer behavior

›

Interest rates

›

Fee regulation

›

Compliance costs

›

Capital and liquidity regulation

›

Future regulatory uncertainty

›

At a favorable point in the credit

cycle

ABOVE MARKET

GROWTH

TOP-TIER

EQUITY

RETURNS

SOUND RISK

MANAGEMENT

©

Fifth Third Bank | All Rights Reserved

|

5

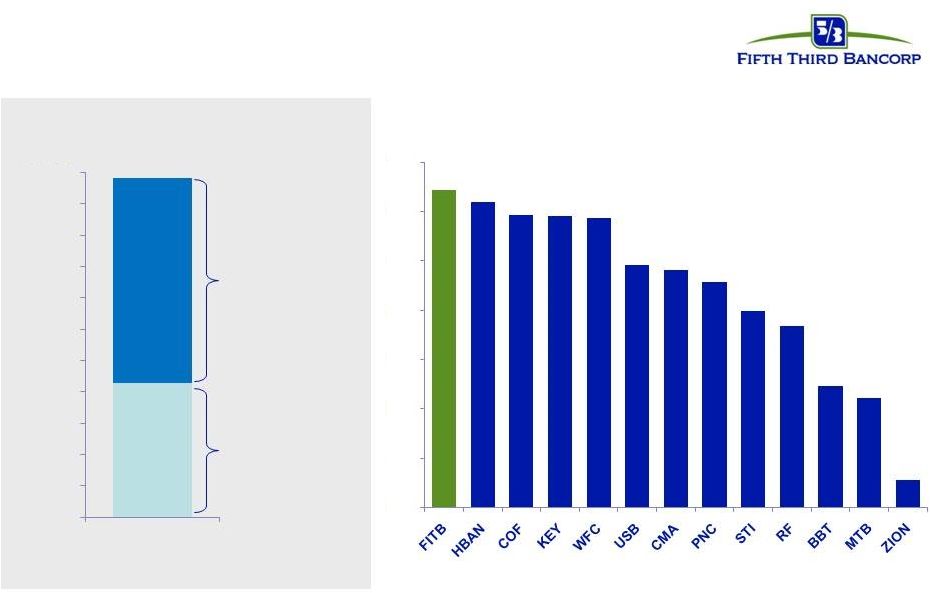

Strong capital return to shareholders

2014 total payout yield (regional peers)

~$1.1 billion in capital returned to

common shareholders

$654MM common

stock repurchases

$427MM common

dividends declared

Increased common stock dividend

and continued active share repurchase program

Source: SNL Financial.

Total payout yield equals dividend yield plus shares repurchased

($) / reported market cap at 12/31/14.

©

Fifth Third Bank | All Rights Reserved

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

$1,100

2014 Payouts

($MM)

6.4%

6.2%

5.9%

5.9%

5.9%

4.9%

4.8%

4.6%

4.0%

3.7%

2.5%

2.2%

0.6%

0%

1%

2%

3%

4%

5%

6%

7% |

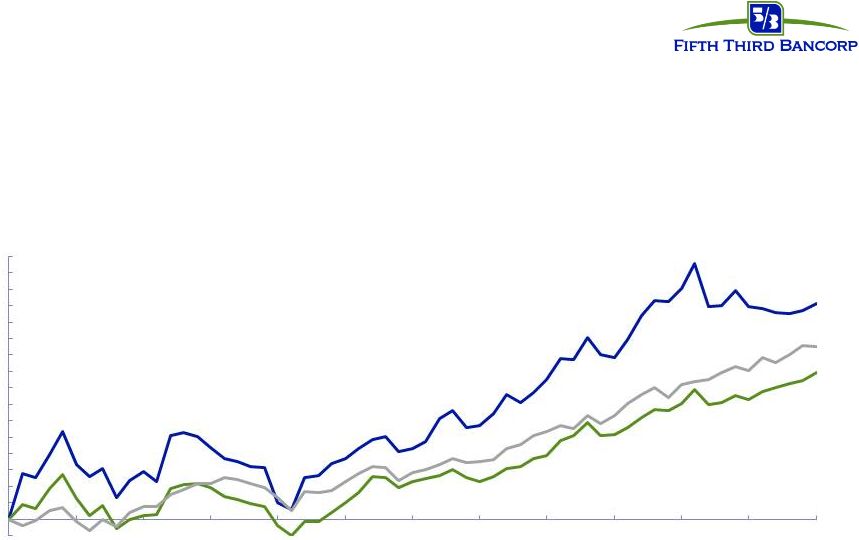

6

Performance track-record

Total Shareholder Return

Fifth

Third

(FITB)

vs.

S&P

Banks

Index

(BIX)

and S&P 500 Index (SPX)

5 years

2009-2014

BIX

89%

FITB

130%

SPX

104%

1

The S&P Banks Composite is a capitalization-weighted index of all the

stocks in the S&P 500 that are involved in the business of

banking. Source: Bloomberg; refer to 10-K dated February 25, 2015 for

additional views of total shareholder return. ©

Fifth Third Bank | All Rights Reserved

(10%)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

110%

120%

130%

140%

150%

160%

12/09

5/10

10/10

3/11

8/11

1/12

6/12

11/12

4/13

9/13

2/14

7/14

12/14

1 |

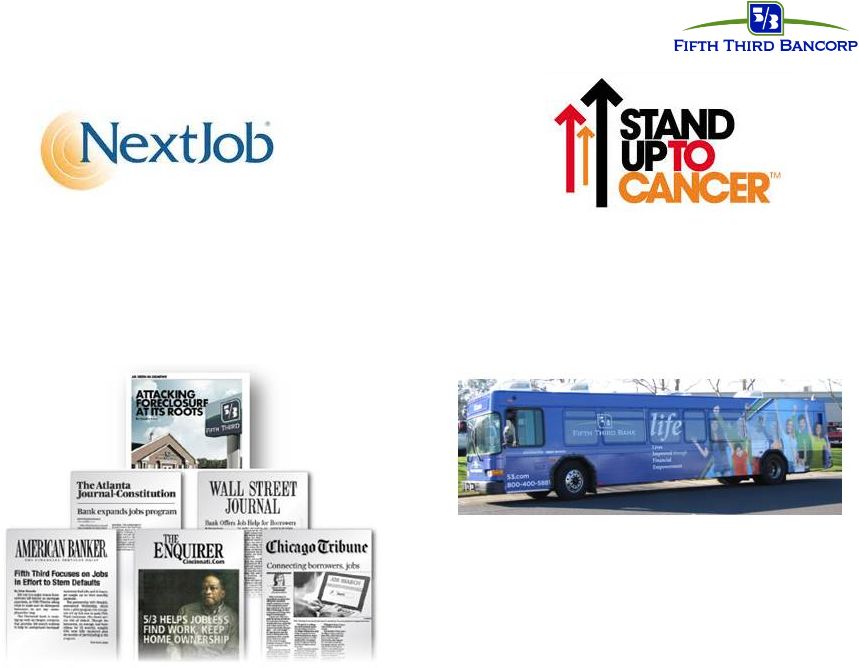

7

Looking at banking differently

Homeowner Reemployment Program

•

Directing donations toward cancer

research with every qualifying purchase

made using a Fifth Third SU2C debit or

credit card

•

Fifth Third’s Financial Empowerment

Mobiles have been on the road since

2004 bringing valuable services to low-

and moderate-income community

members.

©

Fifth Third Bank | All Rights Reserved

•

First in the industry to offer job search

assistance to unemployed mortgage

borrowers

•

Winner of BAI-Finacle Global Banking

Innovation Award in Societal and

Community Impact |

8

Accolades

Fifth Third Private Bank ranked #25 on

list of top Wealth Management Firms

Fifth Third ranked third

nationally in the U.S. Treasury’s

SSBCI lending

Fifth Third Recognized as

Green Power Partner and

as a member of EPA’s

Green Power Leadership Club

2014 Disability Matters honoree,

presented by Springboard

Consulting LLC

Significant national and local recognition across diverse areas

Business Practices •

Employment •

Green Initiatives •

Customer Service •

Philanthropy

©

Fifth Third Bank | All Rights Reserved

|

©

Fifth Third Bank | All Rights Reserved

|

10

Cautionary statement

©

Fifth Third Bank | All Rights Reserved

This report contains statements that we believe are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule

3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future

performance or business. They usually can be identified by the use of forward-looking language

such as “will likely result,” “may,” “are expected to,” “is

anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as

“believes,” “plans,” “trend,” “objective,”

“continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,”

“should,” “could,” “might,” “can,” or similar verbs. You

should not place undue reliance on these statements, as they are subject to risks and

uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our

Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should

keep in mind these risks and uncertainties, as well as any cautionary statements we may make.

Moreover, you should treat these statements as speaking only as of the date they are made and

based only on information then actually known to us. There are a number of important factors that could cause future results to differ materially from

historical performance and these forward- looking statements. Factors that might cause such

a difference include, but are not limited to: (1) general economic conditions and weakening in

the economy, specifically the real estate market, either nationally or in the states in which Fifth Third, one or more acquired

entities and/or the combined company do business, are less favorable than expected; (2) deteriorating

credit quality; (3) political developments, wars or other hostilities may disrupt or increase

volatility in securities markets or other economic conditions; (4) changes in the interest rate

environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan

loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate

sources of funding and liquidity; (7) maintaining capital requirements and adequate sources of

funding and liquidity may limit Fifth Third’s operations and potential growth; (8) changes and

trends in capital markets; (9) problems encountered by larger or similar financial institutions may

adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among

depository institutions increase significantly; (11) effects of critical accounting policies and

judgments; (12) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board

(FASB) or other regulatory agencies; (13) legislative or regulatory changes or actions, or significant

litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined

company or the businesses in which Fifth Third, one or more acquired entities and/or the

combined company are engaged, including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (14) ability to maintain

favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16)

ability to attract and retain key personnel; (17) ability to receive dividends from its

subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth

Third; (19) effects of accounting or financial results of one or more acquired entities; (20)

difficulties from Fifth Third’s investment in, relationship with, and nature of the

operations of Vantiv, LLC; (21) loss of income from any sale or potential sale of businesses that could

have an adverse effect on Fifth Third’s earnings and future growth; (22) ability to secure

confidential information and deliver products and services through the use of computer systems

and telecommunications networks; and (23) the impact of reputational risk created by these

developments on such matters as business generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these forward-looking

statements.

|

11

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

2014

2013

2012

2011

2010

Total Bancorp shareholders' equity (U.S. GAAP)

$15,626

$14,589

$13,716

$13,201

$14,051

Goodwill and certain other intangibles

(2,476)

(2,492)

(2,499)

(2,514)

(2,546)

Unrealized gains

(429)

(82)

(375)

(470)

(314)

Qualifying trust preferred securities

60

60

810

2,248

2,763

Other

(17)

19

33

38

11

Tier I capital

12,764

12,094

11,685

12,503

13,965

Less:

Preferred stock

(1,331)

(1,034)

(398)

(398)

(3,654)

Qualifying trust preferred securities

(60)

(60)

(810)

(2,248)

(2,763)

Qualifying noncontrolling interest in consolidated subsidiaries

(1)

(37)

(48)

(50)

(30)

Tier I common equity (a)

11,372

10,963

10,429

9,807

7,518

Risk-weighted assets, determined in accordance with

prescribed regulatory requirements (b)

117,878

115,969

109,301

104,219

100,561

Ratio:

Tier I common equity (a) / (b)

9.65%

9.45%

9.54%

9.41%

7.48%

For the Year Ended

©

Fifth Third Bank | All Rights Reserved

|