Attached files

U.S. Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

| [X] | Annual Report Under Section 13 or 15(d) of The Securities Exchange Act of 1934 for the Fiscal Year Ended December 31, 2014 |

| [ ] | Transition Report Under Section 13 or 15(d) of The Securities Exchange Act of 1934 for the Transition Period from _______ to _______ |

Commission File Number: 1-10559

CHINA FRUITS CORP.

(Exact name of small business issuer as specified in its charter)

| Nevada | 90-0315096 |

| (State or other jurisdiction of | (IRS Employer Identification No.) |

| incorporation or organization) |

Bldg. 3 Sec. 7, 188 Nan Si Huan Xi Rd.

Fengtai Dist. Beijing, P. R. China

(Address of principal executive offices)

+86 (10) 6792-8610

(Issuer's telephone number)

Securities registered under Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| None | Not Applicable |

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $.001par value

(Title of Class)

| (1) |

Indicate by check mark if the registrant is a well-know seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ x ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [ x ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ x ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

Yes [ x ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this Chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy of information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K.

Yes [ ] No [ x ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ |

| Non-accelerated filer | ☐(Do not check if a smaller reporting company) |

| Accelerated filer | ☐ |

| Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the exchange act).

Yes [ ] No [ x ]

The Registrant’s revenues for its fiscal year ended December 31, 2014 were $32,635,446.

The aggregate market value of the voting stock on April 13, 2015 (consisting of Common Stock, $0.001 par value per share) held by non-affiliates was approximately $3,480,867 based upon the most recent sales price ($0.072) for such Common Stock. On April 13, 2015, there were 52,225,394 shares of our Common Stock issued and outstanding, of which approximately 48,345,379 shares were held by non-affiliates.

Number of shares of common stock, par value $.001, outstanding as of April 15, 2015: 52,225,394

Number of shares of preferred stock outstanding as of April 15, 2015:

Series A, par value $.001 - 13,150

Series B, par value $.001 - 12,100,000

DOCUMENTS INCORPORATED BY REFERENCE

None

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

The discussion contained in this 10-K under the Securities Exchange Act of 1934, as amended, contains forward-looking statements that involve risks and uncertainties. The issuer's actual results could differ significantly from those discussed herein. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as "anticipate," "expect," "intend," "plan," "will," "we believe," "the Company believes," "management believes" and similar language, including those set forth in the discussions under "Notes to Financial Statements" and "Management's Discussion and Analysis or Plan of Operation" as well as those discussed elsewhere in this Form 10-K. We base our forward-looking statements on information currently available to us, and we assume no obligation to update them. Statements contained in this Form 10-K that are not historical facts are forward-looking statements that are subject to the "safe harbor" created by the Private Securities Litigation Reform Act of 1995.

| (2) |

| (3) |

ITEM 1. BUSINESS

History

As used herein the terms "We", the "Company", "CHFR", the "Registrant," or the "Issuer" refers to China Fruits Corporation, its subsidiary and predecessors, unless indicated otherwise. We were incorporated in the State of Delaware on January 6, 1993, as Vaxcel, Inc. On December 19, 2000, we changed our name to eLocity Networks Corporation. On August 6, 2002, we changed our name to Diversified Financial Resources Corporation. In May 2006, our board decided to redomicile from the State of Delaware to the State of Nevada. Their decision was approved by the holders of a majority of the voting rights and common stock. On August 18, 2006, we changed our name to China Fruits Corporation.

As of April 1, 2006, we entered into a Plan of Exchange (the “Agreement”), between and among us, Jiang Xi Tai Na Guo Ye You Xian Gong Si, a corporation organized and existing under the laws of the Peoples’ Republic of China (“PRC”), which changed its corporate name to Jiangxi Taina Nanfeng Orange Co., Ltd. in February of 2007 (collectively referred to herein as “Tai Na”), the shareholders of Tai Na (the “Tai Na Shareholders”) and our Majority Shareholder.

Pursuant to the terms of the Agreement, two simultaneous transactions were consummated at closing, as follows: (i) our Majority Shareholder delivered 13,150 of our convertible Series A preferred shares and 12,100,000 non-convertible Series B preferred shares to the Tai Na Shareholders in exchange for total payments of $500,000 in cash and (ii) we issued to the Tai Na Shareholders an amount equal to 30,000,000 new investment shares of our common stock pursuant to Regulation S under the Securities Act of 1933, as amended, in exchange for all of their shares of registered capital of Tai Na. Upon completion of the exchange, Tai Na became our wholly-owned subsidiary. All of these conditions to closing have been met, and we, Tai Na, the Tai Na Shareholders and our Majority Shareholders declared the exchange transaction consummated on May 31, 2006. The transaction was treated for accounting purposes as a capital transaction and recapitalization by the accounting acquirer and as a re-organization by the accounting acquiree.

Business Description of the Issuer

Since the reverse merger was consummated, we have continued operations of Tai Na, a company located in Nan Feng County, Jiang Xi Province, a well-known agricultural area for tangerines plantation in China, which is primarily engaged in manufacturing, trading and distributing fresh tangerines and other fresh fruits in China and oversea markets. In 2008, we incorporated a wholly-owned subsidiary, Tai Na International Fruits (Beijing) Co. Ltd. (“Tai Na Beijing”) in Beijing, China and relocated the corporate headquarters to Beijing. The headquarters office currently consists of approximately 17,700 square feet for daily operations, which are adequate not only for our current operations, but also for our growth in the near future. We believe that having headquarters in Beijing has a positive effect on our corporate image and the implementation of our marketing strategies.

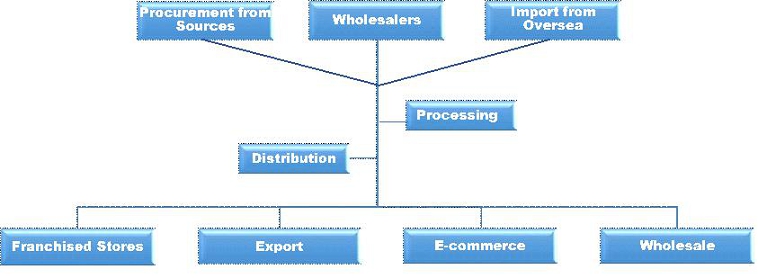

We have been focused on the industry related to fresh fruits business since 2005 and devoted to operating franchise retail stores since 2007. After almost a decade of experience in manufacturing, trading and distributing fresh fruits in the domestic and oversea markets, we are building up a sophisticated business model integrating farmers, plantation alliances, wholesalers, franchised stores, export channels and e-commerce, which effectively shortens fresh fruits distribution process from the plantation to consumers due to the following:

Business Model of China Fruits Corp.

Stable supplies

Our signature tangerines are from Nan Feng County, China, an agricultural county in China famous for high-quality tangerines for centuries attributable to particular natural resources at that area. Nanfeng tangerines were selected solely for Chinese royals in the past and became very popular in the market during recent decades. Since our wholly-owned subsidiary, Jiangxi Taina Nanfeng Orange Co., Ltd. is considered as one of biggest enterprises in Nan Feng County, we have a strong long-term relationship with the local government anda high reputation amongst local farmers. Therefore, approximately 30% of Nan Feng County tangerines have been processed in our manufacturing facility and distributed through our sales network.

In addition to Nanfeng tangerines, our products sold in the franchised stores include other popular fresh fruits, such as grapes, pears, kiwi, and so on. In order to ensure the stability of supplies for these fruits, we establish alliances with different fruit plantations, each of which are closely monitored by our own staff. Periodic checks are carried out on the plantations directly by us. Therefore, we are able to obtain instant information about our supplies sources, including growing environment, fruits quality and output. Our onsite staff also assist in facilitating the shipping process during the seasons. We believe it is cost efficient for us to make alliances with different fruit plantations and will seek for alliance opportunities with more fruit plantations in 2015.

Efficient process

Our manufacture facility in Nan Feng County includes a set of temperature and humidity auto-control equipment with capacity of 1,500 tons to effectively maintain the quality of our tangerines. We also have two automatic product lines for fruit selection, the hourly process capacity of which is 10 ton/hour and 15 ton/hour, respectively. During the year of 2014, our total production was 17,000 tons. We expect the production capacity will reach 34,000 tons in 2015 due to the improvement of production efficiency.

Since 2012, we have established a systematic logistics center to support the expanding retail network.We believe a sound warehouse and logistics center will help us to improve efficiency and reduce operating expenses. Especially for fresh fruits, the prompt handling and delivery is significant to reduce loss from spoilage. Our warehouse and logistic space is located in Beijing with approximately 26,700 square feet to store, select, pack and deliver fresh fruits. After the full operation of the logistics center, we believe both operating expenses and cost of goods sold will be reduced due to large-scale purchases and delivery.

In addition, with the support from the local government in Nan Feng County, we utilized an area of 98,505 square feet to establish an Express Export Zone (“EEZ”) to speed up the process of exporting fresh tangerines and other fresh fruits. The government departments including Customs, Inspections and Clearing have setup a satellite office onsite to facilitate the process. We believe the setup of this EEZ is good for us to improve our operating efficiencies and also serves as a bridge connecting local enterprises to the world and benefits our local economy. EEZ also provides us with a platform and opportunity to develop our logistics business for international trading. Therefore, we invested approximately $325,024 (RMB 2,000,000) in August 2014 to setup a new subsidiary called Nanfeng Taina Logistic Co. Ltd. (“Taina Logistic”), which is wholly-owned by Jiangxi Taina Nanfeng Orange Co., Ltd. and is engaged in shipping, warehousing, assorting agriculture products and packing. We believe the business in Taina Logistic will provide a revenue stream for Jiangxi Taina Nanfeng Orange Co., Ltd. during the slow seasons, which normally are the second and third quarter of each year.

Expanding Sales Network

The last and important section of our business model is our sales network, which determines the ratio of our inventory turnover and the efficiency of our working capital. We have been devoted to establish a systematic and efficient sales network for years. In 2015, our sales network cover franchised retail stores, export, e-commerce and wholesale.

| · | Increasing Franchised Retail Stores |

The franchised retail stores build up the direct channel between the end users and us, which facilitates the process from our manufacture plants to the markets, benefits us in adjusting our business strategies when market changes. We provide the stores with our standard management systems, supplies, as well as renovation to unify store display, color and sign pursuant to the franchise requirements. The fresh fruits sold in the stores include our own products as well as the products from our alliance plantations. By the end of 2014, the number of our franchised retail stores reached 64, increasing by approximately 814% compared to 7 stores in 2013, meeting our expectations for 2014. Such expansion was accomplished via acquisitions, franchise sales or direct setups. There are 44 stores within Beijing area, of which 2 stores are wholly owned by us under direct management, and 42 stores are managed by franchisees. The remaining 20 stores are located in different provinces including Hebei, Jiangxi, Yunnan and Zhejiang, all of which are managed by franchisees.

In addition, we entered into an acquisition agreement on February 28, 2014 with Baojia Guoye Co. Ltd. (“Baojia”), a corporation existing and organized under the laws of China, pursuant to which we paid cash of $162,512 (RMB 1,000,000) to acquire Baojia’s three retail stores in Hangzhou, Zhejiang Province, China. As of the date of this report, the acquisition transaction is not closed since the transfer of business registrations and related licenses has not been completed. Thus, the accounts for these three retail stores were not included in the consolidated financial statements as of December 31, 2014.

In order to efficiently and systematically manage our franchised retail stores throughout China, we plan to incorporate regional franchise management companies, all of which will be wholly-owned and managed directly by Tai Na Beijing. The regional franchise management companies serve as a hub to cover all stores within the region, which significantly reduce the spoilage rate due to long distance transportation and improve logistic efficiency. The first two regional franchise management companies are located in Nanchang and Hangzhou. Both cities have leading positions amongst Tier II cities in China with great potential to have a boom in local economy. They will be our next target markets to expand our franchised retail stores after Beijing area. As of December 31, 2014, there are 7 stores in Hangzhou area and 5 stores in Nanchang area. We estimate that the number of retailed stores in 2015 will reach 20 and 10 in Hangzhou and Nanchang, respectively. The total number of retailed stores throughout China is expected to be 135 in 2015.

We will periodically evaluate the operations in the existing stores and replace those in poor performance with new stores. We believe we are able to expand our market shares through an effective and efficient franchise retail network. We expect more market shares via brand recognition in the near future.

| · | Forming New BVI Subsidiary for export |

Our revenue from fresh fruits export was a key component of our revenues, which was approximately $22 million, or 67% of total revenues in 2014. In order to simplify the procedures of import and export, our Board of Directors authorized and approved to setup a new subsidiary called US-China Fruits Company Limited (“US-China Fruits”) under the laws of British Virgin Islands in June of 2014, of which we have 99.99% ownership. The articles of incorporation of US-China Fruits was filed on June 16, 2014. The switch from current exporting system to new system involving US-China Fruits was not completed; thus, there were no activities in US-China Fruits as of December 31, 2014. We believe the new subsidiary will facilitate the export process and increase the efficiency when we develop oversea markets.

| · | Developing E-commerce Market |

E-commerce overcomes the geographic barrier and provides us with a powerful access to the non-China markets. Currently all of our e-commerce business is conducted by a related party, and we are the exclusive supplier for all the fruits sold online. We plan to integrate this section into our corporate structure in 2015. According to our strategic plans, we will develop our online fruit stores on the popular e-commerce platforms associated with Alibaba, and further expand our fruit e-commerce business to the leading business-to-consumer platforms like Taobao.com, Tmall.com, JD.com, and Yhd.com, and other major group-buying websites. Working with these well-developed e-commerce platforms, we expect to establish our competitive niche with respect to high quality, wide range of variety and efficient delivery.

Eventually, we will develop an “Online Distribution and Franchise” system in order to build a comprehensive vertical fruit e-commerce platform with major fruit participants, operators and industry bodies. We believe e-commerce market will share the same significance as traditional markets in the near future. Our goal is to combine e-commerce with our growing retail stores network to introduce an “online to offline” business model for our clients. Such integration will increase our brand recognition and market shares in fruit e-commerce business.

When our business model is running efficiently, we believe all components within our model will be benefited and profitable, and, as a result, our business will obtain a rapid growth rate in 2015.

Simultaneously with expanding our infrastructure, we have attempted to enhance our brand recognition by hosting certain social events. During the first quarter of 2014, we launched the “Taina® Miss Fruit” Beauty Contest, the first national fruit-themed beauty contest in China that is aimed to advocate the fruit culture and healthy lifestyle in China’s growing urban population. In November 2014, we co-sponsored “Nanfeng Tangerines Promotion Conference” at China National Convention Center, Beijing, which was hosted by China Entry-Exit Inspection and Quarantine Associates and the local government of Nan Feng County. As a recent move to enhance our retail fruit store brand name, Taina®, we believe the social events will set a stage for us to present cross marketing opportunities in fruit planting, distributing, and retailing.

| (4) |

Overview of Our Market Area

China's citrus industry currently experiences transition from quantity concentration to quality concentration, from production only to diversified business segments covering pre-production to post-production. According to China Citrus Industry Development Report (2013), citrus production in China has the following features:

| * | Planting area for citrus fruit and its output have been at the first place in the World for several years. In 2012, the planting area for citrus fruit in China was approximately 2.3 million hectares and its output was approximately 31.7 million tons, which was 24.98% and 24.56% of the World, respectively, compared to global citrus planting area of approximately 9.2 million hectares and global citrus output of approximately 129 million tons. |

| * |

Planting area for citrus fruit was also at the first place amongst various fruit in China; its output was at the second place, less than the output of apples. In China, the planting area for all kinds of fruit was 121.4 million hectares, 19.0% of which was planting citrus fruit; the total fruit output was 151.0 million tons, 21.0% of which was citrus fruit. Compared to the planting area of 32.7 thousand hectares and 177.9 thousand hectares in 1952 and 1978, respectively, the planting area for citrus fruit increased 70 times and 12 times in 2012. Compared to the output of 206.6 thousand tons and 382.7 thousand tons in 1952 and 1978, respectively, the output increased 152 times and 82 times in 2012.

|

| * |

Increase in global fresh fruit trading. According to the data from Global Trading Information Services Co. (“GTI”), global fresh fruit trading revenues were $120.4 billion, increased by 11% compared to the trading revenues in 2010. China was at the seventh place with respect to fruit export, which was $2.3 billion, increased by 18.5% compared to the previous year. China was at the ninth place with respect to fruit import, which was $2.35 billion, increased by 58% compared to the previous year.

|

| * |

Increase in fruit revenues. The total revenues generated from fruit industry in China was approximately $100 billion (RMB 629.1 billion) in 2012, increased by approximately $11.4 billion (RMB 72.1 billion), or 12.9%, compared to 2011. It was approximately 13.4% of total agricultural revenues. In the past decade, the revenues from the fruit industry have been increasing with the expansion in production capacity. The fruit revenues in 2012 were 4 times the fruit revenues in 2003. The average increasing rate of fruit revenues was 14.87% per year in the past decade. The fruit industry becomes a significant portion of modern agriculture in China.

|

| * |

Preference to fresh fruits. 95% of citrus products in China are consumed as fresh fruit. Fruit manufacturing is not popular in China, most of which is for export only. In addition, the orange juices on Chinese markets are primarily made from concentrated or non-concentrated juices imported from Brazil and the United States. As a result of the improved life quality in China and the awareness of health, the consumption of fresh fruit has changed from the enjoyable goods to be the necessity for life. The consumption habit also changes from seasonal consumption to be daily consumption.

|

In general, citrus output increased tremendously in China in the past decades due to the increases in numbers of plantations. However, compared to the world's market, the citrus industry in China is undeveloped in terms of quality, output, manufacture and efficiency. There are four barriers in China's citrus industry: a) small manufacturing magnitude, primarily based on household; b) lack of technology input, primarily based on nature growth; c) undeveloped commercial systems, particularly in storage and transportation; d) no clear segments in the industry, particular in household base. It is a long-term goal to rid us of all these barriers. After China entered the World Trade Organization ("WTO") in 2001, the sales channels for citrus products should be facilitated due to the open markets. In the long run, the export of Chinese citrus will increase constantly, for both fresh fruits and processed products.

Marketing Strategies

Expanding Retail Fruit Stores Network

We believe franchise retail stores will benefit us in our business expansion and brand recognition. We identify middle-size stores currently profitable and persuade them to join our franchise. Those stores are better than the brand-new stores because they have certain operating history and customers base. We provide the stores with our standard management systems, supplies, as well as renovation to unify store display, color, and sign pursuant to the franchise requirements. The franchised retail stores will help build a direct channel between the end users and us, which will facilitate the process of moving product from our manufacture plants to the markets, and benefit us in adjusting our business strategies when markets change. By the end of 2014, the number of our franchised retail stores reached 64, increasing by approximately 814% compared to 7 stores in 2013, exceeding our expectation in 2014. Such expansion was accomplished via acquisitions, franchise sales or direct setups. There are 44 stores within Beijing area, of which 2 stores are wholly owned by us under direct management, and 42 stores are managed by franchisees. The remaining 20 stores are located in different provinces including Hebei, Jiangxi, Yunnan and Zhejiang, all of which are managed by franchisees.

Expanding Logistic Center

We believe a sound warehouse and logistics center will help us to improve efficiency and reduce operating expenses. Especially for fresh fruits, the prompt handling and delivery is significant to reduce loss from spoilage. Therefore, we focus on establishing a systematic logistics center to support the expanding retail network. On March 3, 2012, we entered into a five-year lease agreement for warehouse and logistic space of approximately 26,700 square feet to store, select, pack and deliver fresh fruits. After the full operation of the logistics center, we believe both operating expenses and cost of goods sold will be reduced due to large-scale purchases and delivery.

| (5) |

Improving Management Systems

We have run retail fruit stores since 2007, experiencing economic boom and financial crises, from which we summarize three key success factors, including good location, prompt delivery system and sophisticated leader. If good location is predetermined, prompt delivery and sophisticated leader will be significantly related to our management system. We will standardize our operating system; provide our employees with clear indicators in connection with sales skill, products display, storage, delivery, and marketing promotion. We will set up different modules to evaluate the store performance and employee performance. We believe an effective operating system will improve efficiency and encourage our employees.

In addition, we plan to incorporate regional franchise management companies in 2015 to efficiently and systematically manage our franchised retail stores throughout China. The regional franchise management companies serve as a hub to cover all stores within the region, which significantly reduce the spoilage rate due to long distance transportation and improve logistic efficiency.

Seeking for Opportunities to Develop International Markets

Our signature tangerines, known as "Nanfeng tangerine", was selected solely for Chinese royals in the past and became very popular in the market during recent decades for their high quality, attributable to the particular natural resources in Nan Feng County. Currently, we primarily market in China and hold a leading position in the Chinese market. However, this position has been challenged since China’s participation in WTO in 2001. We believe the open-market policies will lower the barriers to entry, in both Chinese markets and global markets. WTO membership brought with it the opportunity to take advantage of new market access opportunities and new protections now available to China under the rules-based system of the WTO. In order to develop our international markets, we have set up a department in charge of oversea markets since 2010, which included 15 full-time employees as of December 31, 2014. Our target markets include Europe, Middle-east, and Southeast Asia. In 2014, our revenues generated from international markets were approximately $22 million, or 67% of total revenues, including approximately $5 million from Thailand, approximately $4.6 million from Myanmar, approximately $4.5 million from Kyrgyzstan, approximately $3.2 million from Kazakhstan and approximately $1.6 million from Dubai. We believe there is great growth potential in international markets and we will keep looking for the opportunities oversea.

Seeking for Strategic partners

For Nanfeng tangerine, other fresh fruit and certain related products, we intend to make alliances with third parties, which will be good for us with respect to the followings:

• Enhance manufacturing capacities;

• Setup franchised retail stores in our target markets located in North China, East China and South China;

• Diversify the fresh fruit sold in the franchise stores;

• Expand the sales network;

• Increase sales revenue; and

• Successfully build brand identity.

Enhancing Manufacture Capacity

We own our primarily facility in Nan Feng County which consists of a total land area of 755,228 square feet, including manufacturing plants of 340,570 square feet and office buildings of 19,267 square feet. In order to effectively maintain the quality of tangerine, we have a set of temperature and humidity auto-control equipment with capacity of 1,500 tons. We also have two automatic production lines for fruits selection, the hourly process capacity of which is 10 ton/hour and 15 ton/hour, respectively. During the year of 2014, our total production was 17,000 tons. We expect the production capacity will reach 34,000 tons in 2015 due to the improvement of production efficiency.

Seeking for Supports from local government

We have been focused within our industry since 2005 and we believe we have obtained a solid reputation and a good working relationship with the local government due to our continuous contributions to the local economy. During 2012, with the support from our local government, we utilized an area of 98,505 square feet to establish an Express Export Zone (“EEZ”) to speed up the process of exporting fresh tangerines and other fresh fruits. The government departments including Customs, Inspections and Clearing have setup a satellite office onsite to facilitate the process. We believe the setup of this EEZ is good for us to improve our operating efficiencies and also serves as a bridge connecting local enterprises to the world and benefits our local economy. In order to encourage our efforts on modern agricultural development, we obtained the grants in amount of $278,780 and $409,160 from the local government in 2014 and 2013, respectively.

Increasing Expenses in Marketing

We have selected Beijing as our target market since 2008. We plan to increase the marketing expenses on advertising to support our franchise retail stores in Beijing and build up the Beijing market as a showcase for our franchise retail business. Beijing is heart of North China, which has significant effects on the market in North China as a whole. The success in Beijing market is critical for us to develop the market in North China. We divide the Chinese market into three parts: North China, East China and South China. If our business model in North China succeeds, we will repeat it in East China and South China. In 2015, we will pick Nanchang and Hangzhou as our next target markets to expand our franchised retail stores after Beijing area. Both cities have leading positions amongst Tier II cities in China with great potential to have a boom in local economy. As of December 31, 2014, there are 7 stores in Hangzhou area and 5 stores in Nanchang area. We estimate that the number of retail stores in 2015 will reach 20 and 10 in Hangzhou and Nanchang, respectively. The total number of retailed stores throughout China is expected to be 135 in 2015.

In addition, we retain professional consultants to integrate our marketing strategies. We believe their expertise will benefit us in connection with target markets definition, corporate image, brand identity and media preference.

Competition

The domestic and international markets for the citrus industry are intensely competitive and require us to compete against some companies possessing greater financial, marketing and other resources than ours. These include firms that compete in multiple geographic areas as well as firms that are primarily local in their operation. Competitive products include different fruits planted in domestic market and those imported from Southeast Asia, Japan, Taiwan, Europe, US and Canada. Competitive factors impacting our business include pricing, advertising, sales promotions, product innovation, increased efficiency in production techniques, the introduction of new packaging, and brand/trademark development and protection.

Our competitive strengths include good quality with a high level of consumer acceptance; a national distribution network; sophisticated marketing capabilities; and a talented group of dedicated employees. However, we cannot be certain that efforts in marketing will be successful.

Government Regulation

The production, distribution and sale in the Chinese market of our products are subject to the PRC State Food, Drug, and Cosmetic Act, state consumer protection laws, the Occupational Safety and Health Act, various environmental statutes; and various other state and local statutes and regulations applicable to the production, transportation, sale, safety, advertising, labeling and ingredients of such products.

Employees

We have to make a rational allocation and use of personnel to match our business growth. As of December 31, 2014, we had 60 full-time employees, of which 27persons are specialized in franchising management, export trading and purchasing, 10 persons graduated with master degree or higher.

| (6) |

ITEM 1A. RISK FACTORS

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or future results. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deems to be immaterial also may materially adversely affect our business, financial condition or results of operations.

We rely on our strategic partners for a significant portion of our business. If we are unable to maintain good relationships with our strategic partners, our business could suffer

For Nanfeng tangerine, other fresh fruit and certain related products, we intend to make alliance with third parties in connection with the followings:

• Enhance manufacturing capacities;

• Setup franchised retail stores in our target markets located in North China, East China and South China;

• Diversify the fresh fruit sold in the franchise stores;

• Expand the sales network;

• Increase sales revenue; and

• Successfully build brand identity.

We cannot assure that we will be able to enter into alliance agreements with partners on terms favorable to us, or at all, and any future agreement may expose us to risks that our partner might fail to fulfill its obligations and delay commercialization of our products. We also could become involved in disputes with partners, which could lead to delays in or terminations of our development and commercialization programs and time consuming and expensive litigation or arbitration. Our inability to enter into additional collaborative arrangements with other partners, or our failure to maintain such arrangements, would limit the number of product candidates which we could develop and ultimately, decrease our sources of any future revenues.

Increase in cost, disruption of supply or shortage of raw materials could harm our business.

The output of tangerine significantly relies on the local climate. A shortage of tangerines would increase our operating costs and could reduce our profitability. Increases in the prices of our finished products resulting from higher raw material costs could affect affordability in some markets and reduce our sales. An increase in the cost or a sustained interruption in the supply or shortage of the tangerine that may be caused by natural disasters could negatively impact our net revenues and profits.

Adverse weather conditions could reduce the demand for our products.

The sales of our products are influenced to some extent by weather conditions in the markets in which we operate. Unusually cold weather during the summer months may have a temporary effect on the demand for our products and contribute to lower sales, which could have an adverse effect on our results of operations for those periods.

If we are unable to maintain brand identity and product quality, our business may suffer.

Our success depends on our ability to maintain brand identity for our "Nan Feng Tangerine". We cannot assure you, however, that additional expenditures and our renewed commitment to advertising and marketing will have the desired impact on our products' brand image and on consumer preferences. Product quality issues, real or imagined, or allegations of product contamination, could tarnish the image of the affected brands and may cause consumers to choose other products.

Changes in accounting standards and taxation requirements could affect our financial results.

New accounting standards or pronouncements that may become applicable to us from time to time, or changes in the interpretation of existing standards and pronouncements, could have a significant effect on our reported results for the affected periods. We are also subject to income tax in China in which we generate net operating revenues. In addition, our products are subject to sales and value-added taxes in China. Increases in income tax rates could reduce our after-tax income from affected jurisdictions, while increases in indirect taxes could affect our products' affordability and therefore reduce demand for our products.

| (7) |

If we are not able to achieve our overall long term goals, the value of an investment in us could be negatively affected.

We have established and publicly announced certain long-term growth objectives. These objectives were based on our evaluation of our growth prospects, which are generally based on the increase in our investment, and on an assessment of potential level or mix of product sales. There can be no assurance that we will achieve the required volume or revenue growth or mix of products necessary to achieve our growth objectives.

Our assets are located in China and its revenues are derived from its operations in China which is a planned economy.

In terms of industry regulations and policies, the economy of China has been transitioning from a planned economy to market oriented economy. Although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reforms, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in China are still owned by the Chinese government. For example, all lands are state owned and are leased to business entities or individuals through governmental granting of State-owned Land Use Rights. The granting process is typically based on government policies at the time of granting and it could be lengthy and complex. This process may adversely affect our future manufacturing expansions. The Chinese government also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency and providing preferential treatment to particular industries or companies. Uncertainties may arise with changing of governmental policies and measures. At present, our development of research and development technologies and products is subject to approvals from the relevant government authorities in China. Such governmental approval processes are typically lengthy and complex, and never certain to be obtained.

Political and economic risks

China is a developing country with a young market economic system overshadowed by the state. Its political and economic systems are very different from the more developed countries and are still in the stage of change. China also faces many social, economic and political challenges that may produce major shocks and instabilities and even crises, in both its domestic arena and in its relationship with other countries, including but not limited to the United States. Such shocks, instabilities and crises may in turn significantly and adversely affect our performance.

Risks related to interpretation of China laws and regulations which involves significant uncertainties

China’s legal system is based on written statutes and their interpretation by the Supreme People’s Court. Prior court decisions may be cited for reference but have limited value as precedents. Since 1979, the Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. In addition, as the Chinese legal system develops, we cannot assure that changes in such laws and regulations, and their interpretation or their enforcement will not have a material adverse effect on our business operations.

Fluctuations in the exchange rate could have a material adverse effect upon our business.

We conduct our business in the Renminbi. The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. On July 21, 2005, the PRC government changed its decade old policy of pegging its currency to the U.S. currency. Under the current policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximately 6.5% appreciation of the Renminbi against the U.S. dollar between July 21, 2005 and August 31, 2007. However, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the RMB against the U.S. dollar. To the extent our future revenues are denominated in currencies other the United States dollars, we would be subject to increased risks relating to foreign currency exchange rate fluctuations which could have a material adverse affect on our financial condition and operating results since our operating results are reported in United States dollars and significant changes in the exchange rate could materially impact our reported earnings.

| (8) |

Declining economic conditions could negatively impact our business

Our operations are affected by local, national and worldwide economic conditions. Markets in the United States and elsewhere have been experiencing extreme volatility and disruption for more than three years, due in part to the financial stresses affecting the liquidity of the banking system and the financial markets generally. In recent years, this volatility and disruption has reached unprecedented levels. The consequences of a potential or prolonged recession may include a lower level of economic activity and uncertainty regarding energy prices and the capital and commodity markets. While the ultimate outcome and impact of the current economic conditions cannot be predicted, a lower level of economic activity might result in a decline in energy consumption, which may adversely affect the price of oil, liquidity and future growth. Instability in the financial markets, as a result of recession or otherwise, also may affect the cost of capital and our ability to raise capital.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on United States or other foreign laws against us, our management or the experts named in this current report.

We conduct substantially all of our operations in China and substantially all of our assets are located in China. In addition, most of our senior executive officers reside within China. As a result, it may not be possible to effect service of process within the United States or elsewhere outside of China upon our senior executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. Moreover, our PRC counsel has advised us that the PRC does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of judgment of courts.

To date, we have not paid any cash dividends and no cash dividends will be paid in the foreseeable future.

We do not anticipate paying cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. Even if the funds are legally available for distribution, we may nevertheless decide not to pay any dividends. We intend to retain all earnings from our operations.

The application of the "penny stock" rules could adversely affect the market price of our common stock and increase your transaction costs to sell those shares.

As long as the trading price of our common shares is below $5 per share, the open-market trading of our common shares will be subject to the "penny stock" rules. The "penny stock" rules impose additional sales practice requirements on broker-dealers who sell securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of securities and have received the purchaser's written consent to the transaction before the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the broker-dealer must deliver, before the transaction, a disclosure schedule prescribed by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information on the limited market in penny stocks. These additional burdens imposed on broker-dealers may restrict the ability or decrease the willingness of broker-dealers to sell our common shares, and may result in decreased liquidity for our common shares and increased transaction costs for sales and purchases of our common shares as compared to other securities.

Our common shares are thinly traded and, you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

Our common shares have historically been sporadically or "thinly-traded" on the “Over-the-Counter Bulletin Board”, meaning that the number of persons interested in purchasing our common shares at or near bid prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company with a small and thinly traded “float” that could lead to wide fluctuations in our share price. The price at which you purchase our common stock may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

The market for our common shares is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable to a number of factors. First, as noted above, our common shares are sporadically and/or thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative or "risky" investment due to our level of revenues or profits to date and uncertainty of future market acceptance for our current and potential products. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer. The following factors may add to the volatility in the price of our common shares: actual or anticipated variations in our quarterly or annual operating results; adverse outcomes, additions or departures of our key personnel, as well as other items discussed under this "Risk Factors" section, as well as elsewhere in this Annual Report. Many of these factors are beyond our control and may decrease the market price of our common shares, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common shares will be at any time, including as to whether our common shares will sustain their current market prices, or as to what effect that the sale of shares or the availability of common shares for sale at any time will have on the prevailing market price.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

| (9) |

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources.

Our corporate actions are substantially controlled by a single stockholder.

Chen, Quan Long currently owns approximately 100% of our outstanding Series A and B Preferred shares, representing a majority of our voting power. This stockholder could exert substantial influence over matters such as electing directors and approving mergers or other business combination transactions. In addition, because of the percentage of ownership and voting concentration in the principal stockholder, elections of our board of directors will generally be within the control of this stockholder. While all of our shareholders are entitled to vote on matters submitted to our shareholders for approval, the concentration of shares and voting control presently lies with this principal stockholder. As such, it would be extremely difficult for shareholders to propose and have approved proposals not supported by the Chen, Quan Long. There can be no assurances that matters voted upon by the Chen, Quan Long will be viewed favorably by all shareholders of our company.

We may need additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our shareholders.

We may require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If our resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities could result in additional dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

PRC laws and regulations governing our business are uncertain. If we are found to be in violation, we could be subject to sanctions. In addition, changes in such PRC laws and regulations may materially and adversely affect our business.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including, but not limited to, the laws and regulations governing our business. We are considered a foreign person or foreign invested enterprise under PRC law. As a result, we are subject to PRC law limitations on foreign ownership of Chinese companies. These laws and regulations are relatively new and may be subject to change, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

The PRC government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new PRC laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future PRC laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations.

| (10) |

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We are headquartered in Beijing, PRC with office space of approximately17,700 square feet for daily operations, which is under a three-year lease agreement due on August 17, 2017. On March 3, 2012, we entered into a five-year lease agreement for warehouse and logistic space of approximately 26,700 square feet to store, select, pack and deliver fresh fruits. The logistics center includes office space of approximately 8,800 square feet. We believe the new warehouse and logistics center is adequate for our current operations.

We also lease two stores in Beijing area for retail business under our direct management. The total store area is approximately1,722 square feet with annual rental payment of approximately $140,000.

Our main operation is located in the Fu Xi Technology & Industry Park, Nan Feng County, Jiang Xi Province, People’s Republic of China, with a total land area of 755,228 square feet, including manufacturing plants with total area of 340,570 square feet and office buildings with total area of 19,267 square feet. This space is adequate for our present operations. No other businesses operate from this office.

There is no private ownership of land in China; all land ownership is held by the government of China, its agencies and collectives. Land use rights are obtained from government for periods ranging from 50 to 70 years, and are typically renewable. Land use rights can be transferred upon approval by the land administrative authorities of China (State Land Administration Bureau) upon payment of the required transfer fee.

ITEM 3. LEGAL PROCEEDINGS

We may be subject to, from time to time, various legal proceedings relating to claims arising out of our operations in the ordinary course of our business. We are not currently a party to any legal proceedings, the adverse outcome of which, individually or in the aggregate, would have a material adverse effect on the business, financial condition, or results of operations of the Company.

ITEM 4. (REMOVED AND RESERVED)

| (11) |

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Trading Market for Common Equity

Our common stock is quoted on the Over-the-Counter Bulletin Board under the symbol, CHFR. Trading of our common stock in the over-the-counter market has been limited and sporadic and the quotations set forth below are not necessarily indicative of actual market conditions. Further, these prices reflect inter-dealer prices without retail mark-up, mark-down, or commission, and may not necessarily reflect actual transactions. The following tables set forth the high and low sale prices for our common stock as reported on the Over-the-Counter Bulletin Board for the periods indicated.

| Interim Period | Low | High | |||

| Interim Period ended April 15, 2015 | $ | 0.09 | $ | 0.18 | |

| Fiscal 2014 | |||||

| Quarter ended March 31, 2014 | $ | 0.015 | $ | 0.0399 | |

| Quarter ended June 30, 2014 | $ | 0.04 | $ | 0.10 | |

| Quarter ended September 30, 2014 | $ | 0.055 | $ | 0.59 | |

| Quarter ended December 31, 2014 | $ | 0.09 | $ | 0.19 | |

| Fiscal 2013 | |||||

| Quarter ended March 31, 2013 | $ | 0.003 | $ | 0.050 | |

| Quarter ended June 30, 2013 | $ | 0.018 | $ | 0.101 | |

| Quarter ended September 30, 2013 | $ | 0.022 | $ | 0.070 | |

| Quarter ended December 31, 2013 | $ | 0.013 | $ | 0.044 |

Dividends

We have never paid a cash dividend on our common stock. The payment of dividends may be made at the discretion of our Board of Directors, and will depend upon, among other things, our operations, capital requirements, and overall financial condition. There are no contractual restrictions on our ability to declare and pay dividends.

Preferred Stock

On September 16, 2004, we filed with the Delaware Secretary of State a Certificate of Designation of the Rights and Preferences of Preferred Stock of Diversified Financial Resources Corporation, n/k/a China Fruits Corporation. This designation created 200,000,000 shares, no stated par value, of Series A and Series B Convertible Preferred Stock. On May 18, 2006, we filed with the Nevada Secretary of State and Articles of Exchange to redomicile from Delaware State to Nevada State, the designation regarding the Rights and Preferences of Preferred Stock remains unchanged except that the par value of Preferred Stock was changed to $.001. A Certificate of Designation was filed with the Nevada Secretary of State accordingly.

The Series A Convertible Preferred Stock has the following rights and privileges:

1. The shares are convertible at the option of the holder at any time into common shares, at a conversion rate of one share of Series A Convertible Preferred Stock for 100 shares of common stock for a period of 10 years from the issuance date

2. Requires two-thirds voting majority to authorize changes to equity.

3. Redemption provision at option of directors for $10 per share plus the greater of $3 per share or 50% of market capitalization divided by 2,000,000.

4. The holders of the shares are entitled to one hundred (100) votes for each share held.

5. Upon our liquidation, the holders of the shares will be entitled to receive $10 per share plus redemption provision before assets distributed to other shareholders.

6. The holders of the shares are entitled to dividends equal to common share dividends.

| (12) |

The Series B Convertible Preferred Stock has the following rights and privileges:

1. The shares are not convertible into any other class or series of stock.

2. The holders of the shares are entitled to five hundred (500) votes for each share held. Voting rights are not subject to adjustment for splits that increase or decrease the common shares outstanding.

3. Upon our liquidation, the holders of the shares will be entitled to receive $.001 per share plus redemption provision before assets distributed to other shareholders.

4. The holders of the shares are entitled to dividends equal to common share dividends.

5. Once any shares of Series B Convertible Preferred Stock are outstanding, at least two-thirds of the total number of shares of Series B Convertible Preferred Stock outstanding must approve the following transactions:

| a) | Alter or change the rights, preferences or privileges of the Series B Preferred Stock. | |

| b) | Create any new class of stock having preferences over the Series B Preferred Stock. | |

| c) | Repurchase any of our common stock. | |

| d) | Merge or consolidate with any other company, except our wholly-owned subsidiaries. | |

| e) | Sell, convey or otherwise dispose of, or create or incur any mortgage, lien, or charge or encumbrance or security interest in or pledge of, or sell and leaseback, in all or substantially all of our property or business. |

| f) | Incur, assume or guarantee any indebtedness maturing more than 18 months after the date on which it is incurred, assumed or guaranteed by us, except for operating leases and obligations assumed as part of the purchase price of property. |

Number of Holders

As of April 15, 2015, we had 3,624 common shareholders of record.

Securities Authorized for Issuance Under Equity Compensation Plans

As of the date of this Report, we have not authorized any equity compensation plan, nor has our Board of Directors authorized the reservation or issuance of any securities under any equity compensation plan.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

On January 12, 2015, the Board of Directors of the Company approved to issue 1,362,055 shares of the Company’s common stock to settle out a note payable currently due Mr. Quanlong Chen, President and Chief Executive Officer of the Company, in amount of $245,170, consisting of $233,978 in principal and $11,192 in accrued interests as of January 12, 2015.

On January 12, 2015, the Board of Directors of the Company approved to issue 428,082 shares of the Company’s common stock to partially settle a note payable currently due to 2 non-related parties, in principal amount of $62,500.

On February 27, 2015, the Board of Directors of the Company approved to issue 484,034 shares of the Company’s common stock to partially settle a note payable currently due to 2 non-related parties, in principal amount of $62,500 and accrued interest of $376.

Purchases of Equity Securities by the Small Business Issuer and Affiliated Purchasers

None.

Transfer Agent

Our transfer agent is ClearTrust LLC located at 16540 Pointe Village Dr., Ste. 210, Lutz, FL 33558.

| (13) |

ITEM 6. SELECTED FINANCIAL DATA

If the registrant qualifies as a smaller reporting company as defined by Rule 229.10(f)(1), it is not required to provide the information required by this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Forward Looking Statements

Certain statements in this report, including statements of our expectations, intentions, plans and beliefs, including those contained in or implied by "Management's Discussion and Analysis" and the Notes to Consolidated Financial Statements, are "forward-looking statements", within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that are subject to certain events, risks and uncertainties that may be outside our control. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “will”, and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements. These forward-looking statements include statements of management's plans and objectives for our future operations and statements of future economic performance, information regarding our expansion and possible results from expansion, our expected growth, our capital budget and future capital requirements, the availability of funds and our ability to meet future capital needs, the realization of our deferred tax assets, and the assumptions described in this report underlying such forward-looking statements. Actual results and developments could differ materially from those expressed in or implied by such statements due to a number of factors, including, without limitation, those described in the context of such forward-looking statements, our expansion strategy, our ability to achieve operating efficiencies, our dependence on distributors, capacity, suppliers, industry pricing and industry trends, evolving industry standards, domestic and international regulatory matters, general economic and business conditions, the strength and financial resources of our competitors, our ability to find and retain skilled personnel, the political and economic climate in which we conduct operations and the risk factors described from time to time in our other documents and reports filed with the Securities and Exchange Commission (the "Commission"). Additional factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to: 1) our ability to successfully develop and deliver our products on a timely basis and in the prescribed condition; 2) our ability to compete effectively with other companies in the same industry; 3) our ability to raise sufficient capital in order to effectuate our business plan; and 4) our ability to retain our key executives.

Critical Accounting Policies

Revenue recognition

The Company derives revenues from the resale of tangerines and other fresh fruits purchased from third parties, net of value added taxes (“VAT”). The Company is subject to VAT which is levied on the majority of the products of the Company at the rate of 17% on the invoiced value of sales. Output VAT is borne by customers in addition to the invoiced value of sales and input VAT is borne by the Company in addition to the invoiced value of purchases to the extent not refunded for export sales.

In accordance with guidance issued by the FASB, the Company recognizes revenue when persuasive evidence of an arrangement exists, transfer of title has occurred or services have been rendered, the selling price is fixed or determinable and collectability is reasonably assured. The Company’s sales arrangements are not subject to warranty.

The Company recognizes revenue from the sale of products upon delivery to the customers and the transfer of title and risk of loss. The Company did not record any product returns for the year ended December 31, 2014.

Inventory

Inventories consist of finished goods and are valued at lower of cost or market value, cost being determined on the first-in, first-out method. The Company periodically reviews historical sales activity to determine excess, slow moving items and potentially obsolete items and also evaluates the impact of any anticipated changes in future demand. The spoilage will be written-off directly to the profit and loss when it occurs.

| (14) |

Property, Plant, and Equipment

Plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

| Depreciable life | Residual value | ||

| Plant and machinery | 10-12 years | 5% | |

| Furniture, fixture and equipment | 5-6 years | 5% |

Expenditure for maintenance and repairs is expensed as incurred.

RESULTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

Revenues

Gross revenues were $32,635,446 and $9,369,901 for the years ended December 31, 2014 and 2013, respectively. We generate our revenues from sales of fresh fruits and related products, including our signature tangerine. The revenues are recognized when persuasive evidence of a sale exists, transfer of title has occurred, the selling price is fixed or determinable and collectability is reasonably assured. Our sales arrangements are not subject to warranty. We did not record any product returns during the year ended December 31, 2014.

The increase in revenues by $23,265,545, or approximately 248%, during the year ended December 31, 2014 was due primarily to the increase in numbers of our franchised retail stores. By the end of 2014, we had 64 franchised retail stores, increasing by approximately 814% compared to 7 stores in 2013. Our revenues generated from retail stores were approximately $8.5 million in 2014. Fresh fruits export was another key component of our revenues, which was approximately $22 million, or 67% of total revenues in 2014, including approximately $5 million from Thailand, approximately $4.6 million from Myanmar, approximately $4.5 million from Kyrgyzstan, approximately $3.2 million from Kazakhstan and approximately $1.6 million from Dubai. Since our e-commerce is still at the development stage, revenues from which was approximately $0.4 million in 2014.

We expect our sales to increase during in 2015 as our moves toward implementing our business plan, including the increase in franchise retail stores, the increase in marketing budgets. In 2015, we will pick Nanchang and Hangzhou as our next target markets to expand our franchised retail stores after Beijing area. Both cities have leading positions amongst Tier II cities in China with great potential to have a boom in local economy. As of December 31, 2014, there are 7 stores in Hangzhou area and 5 stores in Nanchang area. We estimate that the number of retail stores in 2015 will reach 20 and 10 in Hangzhou and Nanchang, respectively. The total number of retailed stores throughout China is expected to be 135 in 2015.

We will periodically evaluate the operations in the existing stores and replace those in poor performance with new stores. We believe we are able to expand our market shares through an effective and efficient franchise retail network. We expect more market shares via brand recognition in the near future.

Income / Loss

We had net income of $1,552,023 and $166,622 for the years ended December 31, 2014 and 2013, respectively. The increase in net income by $1,385,401, or approximately 831%, during the year ended December 31, 2014 was due primarily to the increase in sales revenues, resulting in gross profit of $5,789,972 and operating income of $1,914,657. The net income during the year of 2013 was due to the grants received from the local government in amount of $409,160, which was to encourage our efforts on modern agricultural development. Without the government grant, we suffered loss of $143,124 from operations.

There can be no assurance that we will achieve or maintain profitability, or that any revenue growth will take place in the future.

Expenses

Operating expenses for the years ended December 31, 2014 and 2013 were $3,875,315 and $2,114,426, respectively. The increase in operating expenses in 2014 was attributable to the increase in selling and marketing expenses, such as advertising, shipping and handling, and exhibition expenses, etc.

Cost of Goods Sold

Cost of goods sold included expenses directly related to the manufacturing and selling our products. Product delivery and direct labor would be examples of cost of goods sold items. During the year ended December 31, 2014, we had $26,845,474 in cost of goods sold, or 82.3% of sales revenue. During the year ended December 31, 2013, we had $7,286,184 in cost of goods sold, or 77.8% of sales revenue. The gross margin of fresh fruits products typically ranges between 5-10%.We expect to reduce the cost of goods sold through alliance with more non-related suppliers, which will also help us to reduce the risk of concentration.

| (15) |

Liquidity and Capital Resources

Cash flows used in operating activities were $2,610,557 and $599,157 for the years ended December 31, 2014 and 2013, respectively. Negative cash flows from operations in 2014 were due primarily to the increase in accounts receivable, inventories, prepaid expenses and related party receivable in the amount of $10,520,147, $523,240, $3,922,595 and $1,114,279, respectively, partially offset by the net income of $1,552,023, plus the increase in accounts payable, other payables and accrued liabilities in amount of $9,642,792 and $1,091,113, respectively. Negative cash flows from operations in 2013 were due primarily to the increase in accounts receivable by $3,589,453, the increase in inventories by $1,455,726, and the increase in prepaid expenses and other current assets by $814,225, partially offset by the net income of $166,622, plus the increase in accounts payable, other payables and accrued liabilities in amount of $4,151,415 and $479,903, respectively.

Cash flows used in investing activities were $679,031 and $396,195 during the years ended December 31, 2014 and 2013, respectively, due primarily to the purchase of property and equipment, which was $160,473 and $380,291 during the year of 2014 and 2013, respectively, cash outflow for construction in progress, which was $355,652 and $1,146 during the year of 2014 and 2013, respectively. In 2014, we also had investment of $162,906 in connection with the acquisition of three retail stores in Hangzhou, China.

Cash flows provided by financing activities were $4,055,571 and $904,041 for the years ended December 31, 2014 and 2013, respectively. Positive cash flows from financing activities in 2014 were due primarily to the proceeds of $5,911,868 from related parties’ loan, and proceeds from short-term loans in total of $5,937,933, bearing annual interest at a rate from 7.2% through 12% per annum, partially offset by the payments to short-term loans and related parties’ loan in amount of $3,091,961 and $5,183,677, respectively.

Positive cash flows from financing activities in 2013 were due primarily to the proceeds of $511,599 from related parties’ loan, and proceeds from notes payable in total of $1,963,864, bearing annual interest at a rate of 7.0% per annum, of which $981,932 is due on July 20, 2014, and the remaining balance is due on December 20, 2014, partially offset by the payments to notes payable in amount of $1,571,422.

We project that we will need additional capital to fund operations over the next 12 months. We anticipate we will need an additional $3,000,000 for the year of 2015.

Overall, we have funded our cash needs from inception through December 31, 2014 with a series of debt and equity transactions, primarily with related parties. If we are unable to receive additional cash from our related parties, we may need to rely on financing from outside sources through debt or equity transactions. Our related parties are under no legal obligation to provide us with capital infusions. Failure to obtain such financing could have a material adverse effect on operations and financial condition.