Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Green Innovations Ltd. | gnin_ex322.htm |

| EX-31.1 - CERTIFICATION - Green Innovations Ltd. | gnin_ex311.htm |

| EX-32.1 - CERTIFICATION - Green Innovations Ltd. | gnin_ex321.htm |

| EX-10.14 - EMPLOYMENT AGREEMENT - Green Innovations Ltd. | gnin_ex1014.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Green Innovations Ltd. | Financial_Report.xls |

| EX-31.2 - CERTIFICATION - Green Innovations Ltd. | gnin_ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 10-K

________________________________________

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________.

Commission File Number: 000-54221

________________________________________

|

GREEN INNOVATIONS LTD. |

|

(Exact name of registrant as specified in its charter) |

________________________________________

|

Nevada |

26-2944840 |

|

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

|

3208 Chiquita Blvd. S., Suite 216 Cape Coral, FL |

33914 |

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (239) 829-4372

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.0001 Par Value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

¨ |

Accelerated Filer |

¨ |

|

Non-Accelerated Filer |

¨ |

Smaller Reporting Company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

On June 30, 2014, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $7,099,640, based upon the closing price on that date of the common stock of the registrant on the OTC Bulletin Board system of $0.062. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its Common Stock are deemed affiliates of the registrant.

As of April 1, 2015, the registrant had 105,190,906 shares of its common stock, $0.0001 par value, outstanding, and 27,649,430,616 shares of its common stock, $0.0001 par value, issuable.

TABLE OF CONTENTS

| Page | |||||

|

PART I. |

|||||

|

Item 1. |

Business |

4 |

|||

|

Item 1A. |

Risk Factors |

25 |

|||

|

Item 1B. |

Unresolved Staff Comments |

31 |

|||

|

Item 2. |

Properties |

31 |

|||

|

Item 3. |

Legal Proceedings |

31 |

|||

|

Item 4. |

Mine Safety Disclosures |

33 |

|||

|

PART II. |

|||||

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

34 |

|||

|

Item 6. |

Selected Financial Data |

35 |

|||

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operation |

35 |

|||

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

39 |

|||

|

Item 8. |

Financial Statements and Supplementary Data |

F-1 |

|||

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

40 |

|||

|

Item 9A. |

Controls and Procedures |

40 |

|||

|

Item 9B. |

Other Information |

42 |

|||

|

PART III. |

|||||

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

43 |

|||

|

Item 11. |

Executive Compensation |

45 |

|||

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

46 |

|||

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

47 |

|||

|

Item 14. |

Principal Accounting Fees and Services |

48 |

|||

|

PART IV. |

|||||

|

Item 15. |

Exhibits, Financial Statement Schedules |

49 |

|||

|

Signatures |

50 |

||||

|

Exhibits |

|||||

|

2

|

FORWARD LOOKING STATEMENTS

This report on Form 10-K contains forward-looking statements within the meaning of Rule 175 of the Securities Act of 1933, as amended, and Rule 3b-6 of the Securities Act of 1934, as amended, that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “anticipate,” “expects,” “intends,” “plans,” “believes,” “seeks” and “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 10-K. Investors should carefully consider all of such risks before making an investment decision with respect to the Company’s stock. The following discussion and analysis should be read in conjunction with our consolidated financial statements for Green Innovations Ltd. Such discussion represents only the best present assessment from our Management.

|

3

|

PART I

Item 1. Business.

General Overview

We were incorporated in the State of Nevada on July 1, 2008 as Winecom, Inc. (“Winecom”). We were a development stage company focused from September of 2009 to August of 2012 on the development and operation of our website, www.winecom.com, a social networking website that catered to wine lovers. We did not generate any revenues under the Winecom operations. On September 20, 2012, we changed our name to Green Innovations Ltd. (“Green Innovations,” the “Company,” “we,” “us,” “our,” or “GNIN”), and on September 26, 2012, we acquired Green Hygienics, Inc. (“Green Hygienics”), a Florida corporation formed on August 1, 2012, that imports, sells and distributes bamboo-based hygienic products and other paper products . Consequently, we discontinued our business plan related to www.winecom.com and have since pursued the business of Green Hygienics.

Green Hygienics is in the business of importing and distributing bamboo-based hygienic products and other paper products in North America through a licensing agreement with American Hygienics Corporation (“AHC”), a privately-owned corporation in the People's Republic of China. Green Hygienics entered into a contract on August 1, 2012, to license AHC's proprietary bamboo-based products, which the Company is marketing to retail establishments in the United States and Canada.

The consolidated financial statements in this report include the accounts of Green Innovations and its wholly-owned subsidiary, Green Hygienics. All inter-company accounts and transactions have been eliminated in consolidation.

Green Innovations Ltd.

Green Innovations was the parent company of two wholly-owned subsidiaries: Green Hygienics, Inc. (“Green Hygienics”), a Florida corporation, and Sensational Brands, Inc. (“Sensational Brands”), a Florida corporation, which was dissolved in September 2013. Green Innovations provides the management, administrative, marketing and other pertinent focuses for its subsidiaries.

Green Hygienics, Inc.

Our wholly-owned subsidiary, Green Hygienics, is focused on the importation, sale, and distribution of hygienic and household products made of bamboo-based paper and other green products. On August 1, 2012, Green Hygienics entered into a Licensing Agreement with AHC, a corporation domiciled in the People's Republic of China, pursuant to which we acquired the exclusive right for a period of 5 years to import and distribute AHC's proprietary bamboo pulp-based hygiene products. AHC is a leading manufacturer of bamboo-based wet wipes, is internationally certified (ISO 9001:2008, BRC-CP, EPA, Nordic swan, cGMP and GMP) and is a member of the world Private Label Manufacturers Association. Exporting to over 45 countries, AHC supplies a number of Multi-National brands and retailers on all continents including customers such as 3M, Carrefour, Tesco, Walmart, and Goodyear. The Licensing Agreement contemplates the distribution of generic, private label, and Green Hygienics branded products, described below. Subject to the below-described sales targets being met, the exclusive distribution license will be renewable for an additional period of 5 years.

|

4

|

Sensational Brands, Inc.

Our wholly-owned subsidiary, Sensational Brands, Inc., a Florida corporation (“Sensational Brands”), was formed for the acquisition of certain assets, via an asset purchase agreement, from Sensational Brands, Inc., a Texas corporation (“SBI-TX”). SBI-TX, a company owned by W. Ray (“Tray”) Harrison, Jr., the former National Sales Manager for Green Hygienics, had developed products and the brand name “Sensational.” On November 19, 2012, Sensational Brands entered into an Asset Purchase Agreement with SBI-TX pursuant to which it acquired certain assets of SBI-TX, including the trademark “SENSATIONAL” for the use in commercial sales of bathroom tissue and paper napkins. In exchange for the trademark, we issued to SBI-TX and Tray Harrison 500,000 warrants for common stock of the Company. The warrants were for a period of five years and had an exercise price of $0.01 per share. Sensational Brands was dissolved in September of 2013. The trademark, which was the only asset, was assigned to Green Hygienics.

The Company reports its business under the following SIC Codes:

|

SIC Code |

Description |

|

|

322291 |

Sanitary Paper Product Manufacturing |

|

|

322121 |

Paper (except Newsprint) Mills |

|

|

424130 |

Industrial and Personal Service Paper Merchant Wholesalers |

Our corporate headquarters are located at 3208 Chiquita Boulevard, Suite 216, Cape Coral, Florida 33914. The Company’s primary web sites are www.greeninnovationsltd.com and www.greenhygienics.com. The web sites are not incorporated in this Form 10-K.

The Industry

Billions of dollars are spent annually on disposable products, even with the shift to recyclable products, thousands of tons of non-biodegradable consumer goods still end up in local landfills; never degrading and causing further environmental damage. Green Hygienics is an environmentally friendly company whose intention is to help change the way paper products are developed and used, using 100% tree-free bamboo-based products in our bamboo line of paper products.

Our green products are innovative, not merely in the sense of “green” products, but in the sense of offering smarter consumer-relevant solutions that link product quality to the shared responsibility of producers and consumers. The environmental footprint of the product in terms of production and disposal and, in many cases even more importantly, the proper use of the product with respect to its environmental impact will be decisive. To address this, we must work more closely with consumers, communicating top performance, the added value of sustainable products and enabling behavioral changes.

Green Hygienics’ focus is to connect sustainable production with sustainable consumption. This means understanding current and future consumption patterns, then harnessing innovation to develop more sustainable products, services and behavior change initiatives. This will help us learn in leading the way in identifying opportunities for sustainable value creation for consumers, businesses and society as a whole.

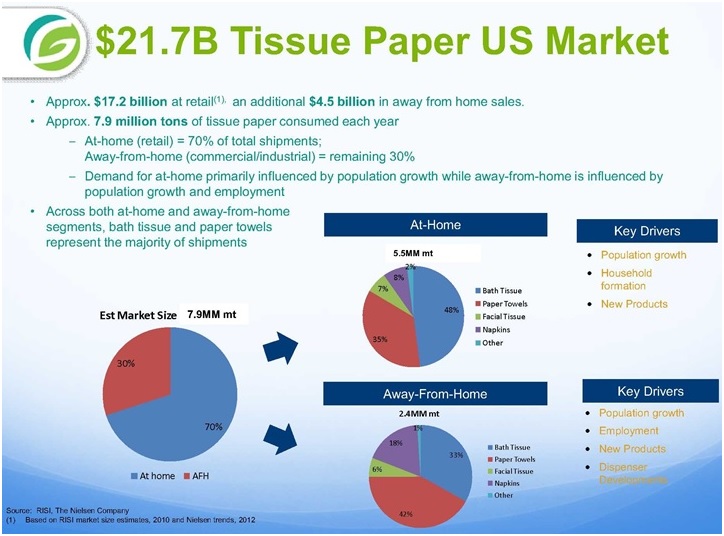

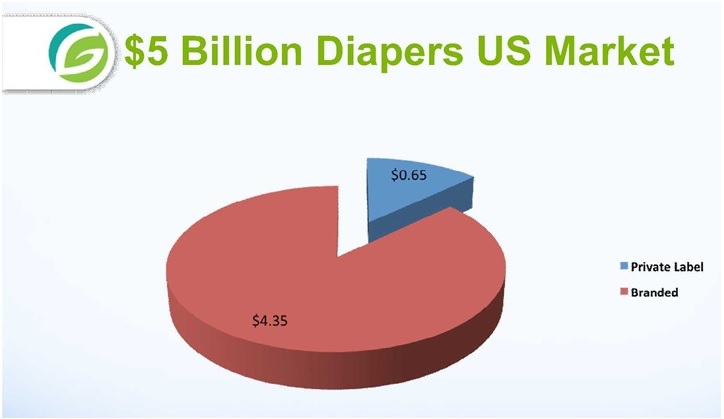

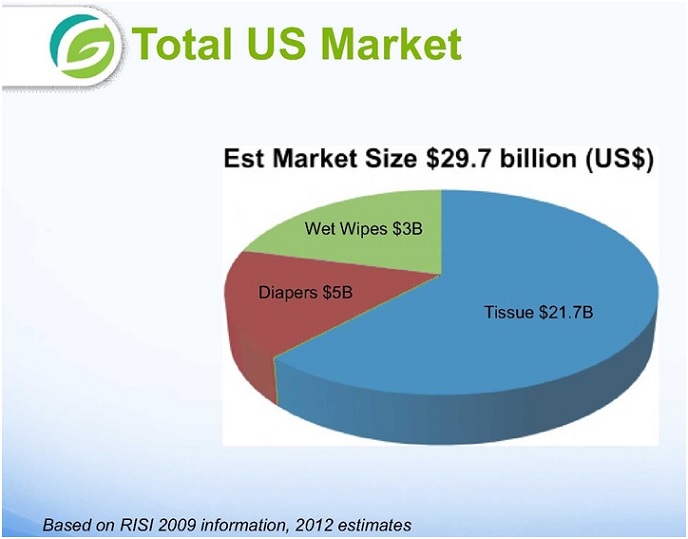

Prudently, Green Hygienics markets other paper products to complement the growing green product line as management has ascertained that while the industry evolves in the green market, the market continues to be primarily non-green products. The tissue market in the U.S. alone is approximately $21.7 billion. The total U.S. market for the products of Green Hygienics is approximately $29.7 billion.

|

5

|

Industry Statistics

|

6

|

|

7

|

|

8

|

|

9

|

Customers

Retailers

The marketing plan is for the introduction of a range of products into each retailer, increasing the product offering carried over time. For certain retailers, the opening order is anticipated to be products under the Sensational® Bamboo, Noov® or Clearly Herbal® brand. Green products, such as our bamboo tree-free line, are increasingly being ordered by buyers as the conscientious consumer demands more green products. The Noov and Clearly Herbal brand, in certain circumstances, provides the open door for the introduction of our full line, especially our bamboo tree-free line.

Currently, the Company’s products are located in the following stores, as well as others, as listed below and at http://greenhygienics.com/products/where-to-buy/:

(Note: The above logos are the property of each respective company.)

The products of Green Hygienics, as of the date of this report, are in the following stores (listed alphabetically): Affordable Leasing & Distribution, Al’s, Albertsons Intermountain, Albertsons Northwest, Albertsons Southwest, Albertsons SoCal, Amazon.com, Anacortes Food Pavilion, Archbold SuperValu, Archie’s IGA, Arlington Food Pavilion, Associated Food Stores, Baker’s Foods IGA, Big Saver Foods, Bill’s SuperValu Plus, Blaine Cost Cutter, Bob’s Produce Ranch, Bromley’s Market, C&S, Camano Island Plaza IGA, Cardenas, Country Market, Dan’s, Darold’s SuperValu Foods, Dick’s Fresh Market, Dissmore Food Mart IGA, Dodson’s IGA, Driskill Foods, E. Wenatchee Food Pavilion, Ellis SuperValu, Erdman’s County Market, Ferndale Cost Cutter, Festival Foods, Fiesta Foods, FoodMaxx Supermarket, Forth’s Foodfair, Gelson’s, Geyer’s Fresh Foods, Gordy’s County Market, Great Lakes Foods, Hart’s SuperValu Auth, Hornbachers, Howser’s Supermarket IGA, Hy-Vee, Ingles Foods, Island Fresh, Jerry’s Foods, Jim’s SuperValu, Juba’s SuperValu, Jubilee Foods, Ken’s Market, Kessler’s, Knowlan’s Super Market, Kowalski’s, Larry’s Foodland Auth, Libby Empire, Linns, Lucky, Lynden Food Pavilion, MacKenthun’s Fine Food, Martin’s SuperValu Foods, McNallys SuperValu Foods, Menards, Metro Foodland, Millers New Market, New Market, New Markets, Palace Supermarket, Paulbeck’s County Market, Payless Foods, PD Distributors, Pequot Lakes SuperValu, Pete’s County Market, Pontiac Foodland, Prosser Food Depot, Rite Choice Foods, Save Mart, Sedro-Woolley Food Pavilion, Service Food Market, Shopko, Silver Lake Foods, Stan’s Market, Starvin’ Sam’s, Super One, SuperValu Foods, SuperValu East Region, SuperValu West Region, Sutton’s SuperValu, Swansons Food Inc., The Marketplace, Tom’s Market, Town & Country Mark – IT, Walgreens, Walker Super One Foods, Willie’s SuperValu, Woodman’s, Wyatt’s SuperValu, Yardbirds Shop’ n Kart, and 99 Cents Only Stores.

United States

The primary national retailers are Target, Walmart, Whole Foods, Kroger, Rite Aid, Club, CVS, dollar stores, grocery chains, drug store chains, mass merchandisers, and away from home distributors. As of December 31, 2014, with the sales and marketing efforts of Green Hygienics has supplied various outlets. Green Hygienics is engaged in ongoing marketing efforts and negotiations to secure purchase orders from larger national retailers, however, no definitive orders have been secured as of the date of this report.

|

10

|

Canada

Green Hygienics has a distribution agreement with Avanti Distribution, Inc. (“Avanti”), a Canadian company, for exclusive distribution rights for Canada. Avanti’s target merchants are Big Lots, Walmart, Loblaws, Katz Group Canada, Jean Coutu, Uniprix, McKesson, Costco Wholesale, IGA Sobeys, Brunet, Metro, Le Naturist, and others. As of December 31, 2014, through Avanti, the Company has already begun fulfilling orders to Dollarama and Dollar Tree.

Consumers

The consumers of our products are individuals, companies and institutions. Our product line includes products, such as bath tissue, paper towels, facial tissue, napkins, wet wipes, biodegradable diapers, feminine care, office paper, and other products that are used frequently or daily by most consumers in developed countries and by a large and increasing number of consumers in developing countries. Therefore, the potential end consumers for our products is infinite.

Our Products

Summary

|

11

|

Bamboo is redefining itself as an alternative crop with expansive uses and benefits. Originally being viewed as a plant material in landscape nurseries, zoos and botanical gardens, the spectrum of bamboo use has been seen in construction materials, musical instruments, furniture and crafts, perhaps its greatest attribute is arising in its important contribution to conservation. Not only has bamboo been an important factor in agroforestry, constructed wetlands and wildlife habitat, it is now being viewed for its biodegradable aspects in replacing landfill mainstays such as diapers and napkins, which take many decades to degrade.

Currently, an estimated 27.4 billion disposable diapers are used each year, resulting in an estimated 3.4 million tons of used diapers adding to landfills each year in the United States alone, not factoring in other countries around the world.

Green Hygienics seeks to become one of the premier suppliers of high quality tree-free bamboo-based products ranging from feminine care to biodegradable diapers. Incorporating a proprietary bamboo manufacturing strategy by its third party manufacturer, Green Hygienics is able to provide a viable option to a vast array of products that were otherwise known as ecologically “unfriendly” products that took years, decades, even centuries to decompose into its natural surroundings.

Disposal of used sanitary products by flushing out into the oceans of the world, incinerating, or depositing in landfill, creates various pollutants including dioxins deposited in the sea through sewage waste and air pollution from incinerators.

Green Hygienics holds the exclusive North American distribution rights for this proprietary bamboo manufacturing currently being manufactured in China under American Hygienics Corporation (“AHC”) in regards to wet wipes, diapers, feminine care, and others. AHC currently supplies other paper products to Walmart China, Tessco, Revlon, 3M, Walgreens, Honest Company, Woolworth, Coles, Foodstuff, Dollarama, Dollar General, Carrefour, Ramson Group, Pigeon, Tall Joy, and more. Green Hygienics will be utilizing the relationship with AHC’s current clients to embed itself within the North American market. With the relationship already in place with Walmart China, Green Hygienics will pursue a cross over to the Walmart and Walmart Canada in the North American market, amongst various other retailers through its distribution representatives such as Distribution GSP, Inc., which supplies over 90% of all of the pharmacies in Canada as well as Brooks and Eckerd’s in the United States.

There are various benefits and advantages to the products offered by Green Hygienics. The most important being that Green Hygienics offers products that are 100% totally chlorine-free (“TCF”) bamboo pulp, unlike many companies that claim their base sheet to be bamboo, however, in actuality, are rayon based. Green Hygienics prides itself on the quality of product it will be delivering to reputable companies and in doing so have an increased level of quality control entailing:

|

· |

ISO 9002 Compliance |

|

|

· |

FDA Approval |

|

|

· |

SGS Testing - the world’s leading inspection, verification, testing and certification company. Recognized as the global benchmark for quality and integrity, employing 59,000 people and operating a network of more than 1,000 offices and laboratories around the world. |

|

|

· |

Fully documented and monitored quality control system |

|

12

|

The Bamboo Alternative

Green Hygienics will introduce the first “tree-free diaper,” made from highly sustainable, environmentally-friendly bamboo-based resources. Traditional diapers are made from wood pulp, petroleum-based products, and man-made chemicals. It is estimated that we use more than 27 billion disposable diapers each year, and according to the Environmental Protection Agency, diapers such as these account for approximately 3.5 million tons of yearly waste. This diaper waste often ends up in landfills where it can take hundreds of years to fully decompose. In contrast, our baby diaper is made from 100% biodegradable bamboo pulp, which grows quickly, without the need for pesticides, is highly renewable, and can be regrown and harvested again in a matter of years.

The bamboo plant is not just for diapers. For centuries, bamboo has been a symbol of luck and longevity in the Chinese culture, and bamboo paper, while produced on a relatively small scale, is considered to be among the most beautiful and durable types of paper in existence. In addition to its quality, our Eco Choice Range paper offers the following savings (per Metric ton) when compared to usual industrial methods:

|

· |

17 trees spared |

|

|

· |

7,000 gallons of water saved |

|

|

· |

4,200 kw/h less electricity used |

|

|

· |

20 pounds CO2 emission reduction |

|

13

|

The Company prudently markets non-green paper products to complement its marketing strategy for the green products as the industry evolves to green products.

Our Products

Bamboo Pulp-Based Hygiene and Household Products

Current and Future Products - Bamboo

(Not pictured: Bamboo Copy Paper and Clearly Herbal Bamboo Baby Wipes – coming soon)

Clearly Herbal Baby Wipes

(Not pictured: Clearly Herbal Flushable Moist Wipes – coming soon)

|

14

|

Current Products – Virgin from tree Paper

Current and Future Products – Premium Formulations (PF)

Current Products – Recycled

Our agreement with AHC also gives us the exclusive North American distribution rights (for retail and institutional distribution) for AHC conventional products.

Manufacturing by Third Parties

Currently, all production of Green Hygienics products are being manufactured in China through the contractual relationships with American Hygienics Corporation (“AHC”) and Xiamen ITG Group Corp Ltd. (“ITG”).

American Hygienics Corporation

|

15

|

AHC (www.amhygienics.com ) is an international company that is one of the largest private label manufacturers of wet wipes in Asia. AHC produces absorbent hygiene products in excess of $75 million annually. AHC is the largest manufacturer of bamboo-based wet wipes in the world. They are a member of the World Private Label Manufacturers Association. Currently, AHC exports to more than 45 countries.

Through our exclusive licensed manufacturer, American Hygienics Corporation, we are able to offer class 100,000 ISO 8 critical environment standard (first “Class 100,000 ISO 8 Clean Room” in the world), a standard required for products designed for the medical industry. This new state-of-the-art facility is the only facility to offer such a high quality standard in the wet wipe industry. It will allow us to accommodate many of our customers with medical wipes and devices which will provide a ‘one stop shop’ in the wet wipe industry.

AHC is ISO 9001:2008, BRC-CP, Nordic Swan, cGMP & GMPc certified.

AHC manufactures multi-national brands and retail customers on six continents. Customers include, but are not limited to, 3M®, Carrefour®, Tesco®, Walmart®, Goodyear®, and more.

Xiamen ITG Group Corp Ltd.

ITG (www.itg.com.cn) is a comprehensive enterprise founded in 1980 and listed on the Shanghai Stock Exchange in 1996. Since 1991, ITG has been consecutively listed among the China Top 500 Import and Export Enterprises, and ranked No. 5 on the China International-Domestic Wholesale and Retail listing. The Company is also a National AAA Grade Credit Foreign Trade Enterprise. (Source: www.itg.com.cn)

|

16

|

ITG is the largest bamboo paper supplier in the world exporting to North America, South America, Australia, Europe, Africa, the Middle East and Latin America. ITG has the capacity of 120,000 metric tons per month which calculates to 16 million cases per month.

Other

One of Green Hygienics’ keys to success will be to set up its own proprietary production facility within the domestic United States that will process bulk bamboo pulp into a fibrous material that can be engineered to create these same hygiene products in-house.

Sales Targets

In order to renew our Licensing Agreement with AHC for an additional 5 year term, we must achieve the following sales targets during the initial 5 year term:

|

· |

$150,000 in sales of absorbent pad based products, including diapers, panty liners and sanitary pads during the first year followed by a 25% increase during each subsequent year; |

|

|

|

|

|

|

· |

$100,000 in sales of plates and cups, produce platters, dryer sheets, and stationary during the first year followed by a 25% increase during each subsequent year; and |

|

|

|

|

|

|

· |

$150,000 in sales of miscellaneous branded products, followed by a 25% increase during each subsequent year. Branded products include products marketed under the Green Hygienics brand and related marks, including "Premium Formulation," Clearly Herbal and Green & Soft. |

Market Strategy

The development of new markets or business models that deliver consumer value in more eco-efficient or socially beneficial ways, there are several ways in which our strategies can be built around our products that deliver social benefits. Green Hygienics’ strategies center on differentiation, aiming to offer a superior product with a distinctive brand made in more sustainable ways than the current product set. Green Hygienics’ objective is to offer better value products. We seek to win by pre-emptive moves, gaining first mover advantage such as customer loyalty and focus our products on a specific segment or geography, and look for synergies, enhancing the value to the customer while reducing costs.

Marketing has a vital role to play in decoupling material consumption from consumer value. It has the ability to facilitate both innovation and choice influencing for sustainable consumption, because it allows products and information to flow between producers and consumers. It can help consumers to find, choose and use sustainable products, by providing information, ensuring availability and affordability, and setting the appropriate tone through marketing communications. Sales data and market research provide insights about consumer attitudes, beliefs and behaviors that can then be fed into the planning process, driving innovation and guiding key business decisions, including pricing, packaging and distribution.

|

17

|

Marketing also has a vital role to play in leveraging the company’s sustainability credentials to build brand equity. In order to do so, it is vital to ensure consistency with our corporate sustainability strategy; any claims made must be authentic, credible and responsible. As solutions shift from technical to social, marketing also has an increased role in driving innovation. Brand values are communicated to consumers through all sales and marketing channels, from lead generation and customer support to advertising, sponsorship and point-of-sale activities. These messages will provide signals to consumers about social and behavioral norms, and are believed by some to have behavioral effects beyond the product or brand from which they emanate.

Green Hygienics has segmented their efforts into four distinct customer markets:

|

1. |

Health & Natural product stores: These customers are purchasing. Their establishments serve a wide variety of eco-friendly products to thousands of customers each day. |

|

|

|

||

|

2. |

Drugstores: These are buying more eco-friendly products to satisfy their eco-friendly clientele. |

|

|

|

||

|

3. |

Supermarkets: These are buying more eco-friendly products to satisfy their eco-friendly clientele and to improve their green print. |

|

|

|

||

|

4. |

Superstores: These are large buyers of eco-friendly products increasing demand from their customers with green initiative programs. |

Target Market

Increasing numbers of consumers are realizing that their purchasing behavior directly affects many ecological problems. We seek to provide a profile of consumers who are likely to seek out environmentally friendly products, and to put forward marketing strategies to attract them. The research shows that consumers for environmentally friendly products are more likely to be female married, with at least one child living at home. This group seems more likely to put the welfare of others before their own. They are perhaps more likely to think of how a ruined environment may affect their partner and their children’s future. Consumers who are educated about and seeking out green products report that today’s ecological problems are severe, that corporations do not act responsibly towards the environment and that behaving in an ecologically favorable way is important. They place a high importance on security and warm relationships with others, and often consider ecological issues when buying something. They do not believe that it is inconvenient to, for example, do without single-serve aseptically packaged juices or puddings, in the interests of protecting the environment.

Competitive Edge

|

· |

Increasing the availability of more sustainable products through integrating sustainability and life cycle processes into product design innovation that doesn’t compromise on quality, price or performance in the market. |

|

|

· |

Creating a market for sustainable products and business models by working in partnership with consumers and other key stakeholders to demonstrate that sustainable products and lifestyles deliver superior performance at the best prices. Using marketing communications to influence consumer choice and behavior. |

|

|

· |

Editing out unsustainable products, product components, processes and business models in partnership with other actors in society and retailers. |

Retailers understand their unique opportunities and responsibilities in the area of sustainable consumption, but differ in their approaches. For example, some take a choice editing approach, eliminating products considered to be unsustainable and, where possible, offering only sustainable choices. Others offer a range of both sustainable and unsustainable choices at a range of prices, in order not to exclude consumers with more limited budgets. Some large global retailers are starting to create minimum sustainability standards for the products that they offer and from their supply chains, but are not yet ready to engage consumers in discussions about impacts across the full product life cycle. Retailers will seek more product contents disclosure from product suppliers in the future in order to determine the sustainability of the product and we will supply them with the tool’s necessary to simplify their task.

Strategy and Implementation

Marketers should advertise why it is convenient to purchase “green” products. The Body Shop, for example, uses information cards, window displays and videos throughout its stores to inform people about the environmental and social effects of their purchasing decisions. This information educates the consumer about The Body Shop’s natural product ingredients, earth-friendly manufacturing, and policy of purchasing from developing countries. Marketers should also communicate to the target audience that buying green products can have a significant impact on the welfare of the environment. Marketers should persuade consumers that environmental protection is not the sole responsibility of business and that each individual can also make a difference. Marketers should regularly provide feedback to show consumers that they are making a difference.

Our research reveals that 80% of consumers who seek out green products say they refuse to buy products from companies accused of being polluters. Companies which do not follow environmental regulations or which try to exploit the green movement to increase sales are therefore exposed to consumer boycott. For example, Procter & Gamble and Walmart were publicly criticized for putting a “green” label on a brand of paper towels made of chlorine-bleached, unrecycled paper and packaged in plastic, simply because the inner tube for the towels was made of recycled paper.

|

18

|

Consumer attitudes and behaviors:

|

· |

Consumers are increasingly concerned about environmental, social and economic issues, and increasingly willing to act on those concerns |

|

|

· |

Consumer willingness often does not translate into sustainable consumer behavior because of a variety of factors – such as availability, affordability, convenience, product performance, conflicting priorities, skepticism and force of habit |

How GHI will capitalize on these know consumers behaviors:

|

· |

Making it easy and affordable for the consumer to make sustainable purchasing decisions, as they increasingly report a willingness to do so |

|

|

· |

Making sustainable products available and comparable – without compromising on performance and at no extra costs |

|

|

· |

Leveraging the unprecedented power of consumers to share information about our Company, products via social networks, to promote sustainable products, usage, consumption and lifestyles |

Competition Overview

We are a company engaged in the sale and distribution of hygienic and household bamboo-based paper products. Currently, our target market is limited to North America. We intend to compete with other manufacturers and distributors of hygienic and household paper products, including products made of traditional wood-pulp based paper, bamboo-pulp based paper, or other recycled or novel paper materials. We will also compete with traditional manufactures of non-paper based diapers.

Many of the companies with whom we intend to compete have greater financial resources, production capabilities, and distribution networks than we do. These competitors may be able to benefit from greater economies of scale than our Company. In addition, they may be able to afford more expertise in design and manufacturing of their products. This competition could result in competitors having products of greater quality and interest to prospective customers and investors. This competition could adversely impact our ability to finance further development and to achieve the financing necessary for us to develop our business.

We believe that Green Hygienics is currently one of the few distributors of 100% tree-free products in the U.S. marketplace. There are other companies that manufacture products in a similar scope; however, they have up to 30% tree-based ingredients in their products. Green Hygienics is the exclusive supplier for AHC in North America bamboo-based products. AHC is the world’s largest manufacturer of bamboo-based wet wipes, internationally certified: ISO 9001:2008, BRC-CP, EPA, Nordic swan, cGMP and GMP and member of the world Private Label Manufacturers Association. AHC suppliers multi-national brands and retailers on all continents including customers such as 3M, Carrefour, Tesco, Walmart, Goodyear and export to over 45 countries.

AHC’s research and development facility with laboratory for micro-biological/bio-burden testing currently houses over 200 dedicated employees. Management believes that innovation is an essential driver of more sustainable consumption. The goal of sustainable innovation is to deliver high levels of global and functional value, while minimizing resource use and environmental impacts. Innovation is a well-known core business function. Business innovation responds to the challenge of sustainable consumption through: eco-efficiency measures, product innovation and design, production & supply chain management, and business model innovation.

Our research and development of new products, product features, and technologies are driven by the quest for the best performance at the best price that also improves eco-efficiency and societal value.

Competition

Competitors: Bamtastic™ and Bambooee®

Bamtastic™ (Green Paq Solutions, Inc.) is a bamboo paper towel brand made in China and sold in the U.S. market. Its primary targets are commercial, retail and online customers, with a general price point of $9.99 for a 12-roll pack of bamboo bath tissue.

Bambooee® (CM National, Inc.) is a brand made in China and the U.S with similar targeted customers. Bambooee® was the first bamboo paper towel brand to be introduced to the U.S. market. Bambooee® is generally priced at a premium: $18 for a 12-roll pack.

|

19

|

Intellectual Property

Website

We assert common law copyright in the contents of our website, greeninnovationsltd.com, greenhygienics.com, clearlyherbal.us, and gogreenest.com, and common law trademark rights in our business name and related product labels, including "Clearly Herbal," “Sensational,” and "Green & Soft." We have not registered for the protection of all of our copyrights, trademarks, patents or designs, although we may do so in the future as we deem necessary to protect our business. We have registered for protection of our domain name, www.greenhygienics.com.

Trademarks

We have registered or filed for registration in the United States for the following copyrights and trademarks:

Noov is also registered in Canada. Avanti is used through a relationship with Avanti Distribution, a Canadian company.

The Company has registered Flora® but will not be using it.

Other

Through our Licensing Agreement dated August 1, 2012 with AHC, we hold the exclusive North American distribution rights to certain proprietary products of American Hygienics for the manufacture of bamboo pulp-based paper products, described elsewhere in this report. Our exclusive rights are enforceable for a minimum term of 5 years from August 1, 2012, and are subject to an additional 5 year renewal provided we meet certain sales quotas during the initial terms. The terms of the agreement with Green Hygienics are discussed in the section of this report entitled "Description of Business."

Green Hygienics has been granted an Intellectual Passport CB, through its authors Kalpesh Parmar and Yogesh Parmar, owners of AHC, which will own the worldwide Intellectual Passport for the manufacturing of the bamboo pulp. The Intellectual Passport CB is a private system of intellectual property registration that aims to enhance the protection of intellectual property rights conferred by existing legal frameworks.

Accreditations

|

|

FDA - Food and Drug Administration

The FDA is an executive department agency of the United States Department of Health and Human Services. The FDA is established to be responsible for protecting and promoting public health through regulation of consumer products. The FDA is one of the most recognized certifications in the world.

|

|

EPA - Environmental Protection Agency

An agency of the United States federal government which has been established for the purpose of protecting human health and the environment. The EPA's purpose is to protect consumers from significant risk from human health and the environment on which they live learn and work.

|

|

|

20

|

Nordic Environmental Label

The Nordic Ecolabel is a comprehensive evaluation through the lifecycle of the product. This means that, in developing criteria, we look at the whole life cycle of the product and all its related environmental issues. Climate considerations are thus a key element of the assessment. Some criteria contain requirements linked directly to the climate, such as those concerning use of fossil fuels or energy consumption during the manufacturing process. The more important we judge the climate issue to be for a particular product group, the stricter and more extensive the requirements become in that area.

|

|

British Retail Consortium

The British Retail Consortium (“BRC”) is the lead trade association in the UK representing the whole range of retailers, from the large multiples and department stores through to independents, selling a wide selection of products through all levels of wholesale and retail. The BRC is a highly sought after certification in the UK as it is the authoritative voice of retail, recognized for its powerful campaigning and influence within government and as a provider of excellent retail information. The majority of UK, and many European and global retailers, and brand owners will only consider doing business with suppliers who have gained certification against the appropriate BRC Global Standard.

|

|

ISO 9001:2000 – International Organization for Standardization

ISO International Standards ensure that products and services are safe, reliable and of good quality, they are strategic tools that reduce costs by minimizing waste and errors and increasing productivity. They help companies to access new markets, level the playing field for developing countries and facilitate free and fair global trade.

|

|

GMP – Good Manufacturing Practice

GMP is a production and testing practice that maintains and ensures quality control of a manufactured goods. Many countries have created uniform GMP guidelines to correspond with their own legislation. These GMP guidelines safeguard the consumer and ensuring the goods produced are of the highest quality.

GMP is enforced in the United States by the FDA.

The World Health Organization (“WHO”) version of GMP is used by pharmaceutical regulators and the pharmaceutical industry in over one hundred countries worldwide, primarily in the developing world. The European Union's GMP (“EU-GMP”) enforces similar requirements to WHO GMP, as does the FDA's version in the US. Similar GMPs are used in other countries, with Canada, Japan, Singapore, Philippines and others having highly developed/sophisticated GMP requirements.

Research and Development

We have incurred research and development expenses since our collaboration with Laboratoire M2, Inc. (“M2 Labs”), a Canada-based research and development company that has a technology of an all-natural EPA approved disinfectant. We are in the development and additional EPA approval for the world’s first all-natural biodegradable disinfectant wipe. The resultant product will have projected claims of a 99.9% kill claim with kill times under 3 minutes which would ultimately, as projected by management and M2 Labs, make the product “hospital grade.”

|

21

|

We do anticipate that we will spend significant resources on research and development during the next 12 months.

Green Hygienics will continue to innovate with new products in the versatile bamboo supply chain. Bamboo produces thousands of products which makes Green Hygienics a valuable research and development entity focused on sustainable bamboo products.

Reports to Security Holders

We intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. We file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company's operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

As distributors and importers of hygienic and household paper products, including products used for food packaging and storage, we are regulated by the U.S. Food and Drug Administration. We believe that the products we intend to distribute are in compliance, in all material respects, with the laws and regulations administered by the U.S. Food and Drug Administration.

We believe that we are and will continue to be in compliance in all material respects with applicable statutes and the regulations passed in the United States. There are no current orders or directions relating to our company with respect to the foregoing laws and regulations.

Environmental Regulations

We do not believe that we are or will become subject to any environmental laws or regulations of the United States. While our products and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our products or potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of December 31, 2014, we had a total of four full time employees, four full time consultants and various hourly leased employees. Our employees are not parties to any collective bargaining agreement. We believe our relationships with our employees are good.

Property

We lease approximately 1,542 square feet of office space in Cape Coral, Florida, pursuant to a lease that will expire on February 28, 2019. This facility serves as our corporate headquarters. Prior to March 1, 2014, we leased approximately 1,000 square feet of office space in Cape Coral, Florida which served as our corporate headquarters. Due to a change in ownership of the building, the Company took on opt-out option to extinguish its current lease, effective February 28, 2014. The Company leases a warehouse in Ontario, California with approximately 50,000 square feet. The warehouse lease began on November 1, 2013, and expires on October 31, 2016.

|

22

|

|

23

|

Warehouse – Ontario, California

Available Information

All reports of the Company filed with the SEC are available free of charge through the SEC’s website at www.sec.gov. In addition, the public may read and copy materials filed by the Company at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. The public may also obtain additional information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

|

24

|

Item 1A. Risk Factors

The following important factors among others, could cause our actual operating results to differ materially from those indicated or suggested by forward-looking statements made in this Form 10-K or presented elsewhere by management from time to time.

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

Risks Related to Our Business

We have limited operating history and our foreseeable future is uncertain.

We were formed in 2008 and did not have any operations until the fourth quarter of 2012 due to the acquisition of Green Hygienics. We have only nominal assets, and have generated limited revenues since our inception. The Green Hygienics acquisition in September 2012 discontinued the prior operations. For our year ended December 31, 2014, we experienced net losses of $7,796,339. We used cash in operating activities of $1,358,934 in 2014. As of December 31, 2014, we had an accumulated deficit of $17,336,999. In addition, we could incur additional losses in the foreseeable future, and there can be no assurance that we will ever achieve profitability. Our future viability, profitability and growth depend upon our ability to successfully operate, expand our operations and obtain additional capital. There can be no assurance that any of our efforts will prove successful or that we will not continue to incur operating losses in the future.

We do not have substantial cash resources and if we cannot raise additional funds or generate more revenues, we will not be able to pay our vendors and will probably not be able to continue as a going concern.

As of December 31, 2014, our available cash balance was $49,157. We will need to raise additional funds to pay outstanding vendor invoices and execute our business plan. Our future cash flows depend on our ability to wholesale our products to major retail and grocery chains. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us.

We may be required to pursue sources of additional capital through various means, including joint-venture projects and debt or equity financings. Future financings through equity investments will be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly-issued securities may include preferences, superior voting rights, the issuance of warrants or other convertible securities, which will have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations.

Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets and the fact that we have not been profitable, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

We have a limited operating history, and it may be difficult for potential investors to evaluate our business.

We began current operations in September 2012. Our limited operating history makes it difficult for potential investors to evaluate our business or prospective operations. Since our formation, we have generated only limited revenues. Our revenues were $4,159,562 and $1,867,788 for the years ended December 31, 2014, and 2013, respectively. As an early-stage company, we are subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays inherent in a relatively new business. Investors should evaluate an investment in us in light of the uncertainties encountered by such companies in a competitive environment. Our business is dependent upon the implementation of our business plan, as well as the ability of our merchants to enter into agreements with consumers for their respective products and/or services. There can be no assurance that our efforts will be successful or that we will be able to attain profitability.

We may not be able to secure additional financing to meet our future capital needs.

We anticipate needing significant capital to establish our operations, distribution network and customer base. We may use capital more rapidly than anticipated and incur higher operating expenses than expected, and will be depend on external financing to satisfy our operating and capital needs. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. We may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

|

25

|

Our business and operating results could be harmed if we fail to manage our growth or change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must locate and retain skilled sales people, marketers, management, and other personnel, and solicit and obtain adequate funds in a timely manner. If we fail to effectively manage our human or financial resources during the growth of our business, our business may fail which would cause you to lose your investment.

We may not have access to the product supply necessary to support our business, which could cause delays or suspension of our operations.

Competitive demands for supply of products could result in the disruption of planned sales and distribution activities. Because we will rely on third party manufacturers to produce the products that we intend to sell, we may experience difficulty in securing a reliable supply of quality products at a competitive price. Although we believe that we have secured a suitable supplier of quality products at a competitive price, if our product supply is compromised for any reason, we may have to suspend some or all of our operations, which could significantly harm our business.

We depend on the products of American Hygienics Corporation.

The Company has a Licensing Agreement with AHC and the stability of AHC, along with its ability to continue to supply its products to the Company at a price that will afford the Company to meet its goals and objectives, is imperative to the stability and viability of the Company.

We depend on the production facility of American Hygienics Corporation.

The production of a portion of the Company’s products are dependent on the manufacturing performed by AHC, and their ability to continue to supply products to the Company at a price that will afford the Company to meet its goals and objectives is imperative to the stability and viability of the Company.

Our profitability depends, in part, on our success and brand recognition, and we could lose our competitive advantage if we are not able to protect our trademarks against infringement, and any related litigation could be time-consuming and costly.

We believe our brand will gain substantial recognition by consumers and merchants in North America. We have registered the “Sensational” trademark with the United States Patent and Trademark Office. We also have other copyrights and trademarks that we use. Use of our trademarks or similar trademarks by competitors in geographic areas in which we have not yet operated could adversely affect our ability to use or gain protection for our brand in those markets, which could weaken our brand and harm our business and competitive position. In addition, any litigation relating to protecting our intellectual property against infringement could be time-consuming and costly.

Our profitability depends, in part, on our licensed products from American Hygienics Corporation, and we could lose our competitive advantage if they are not able to protect their trademarks and intellectual properties against infringement, and any related litigation could be time-consuming and costly.

Green Hygienics is the exclusive supplier for AHC in North America of its 100% bamboo-based products. Use of AHC’s intellectual property and proprietary manufacturing processes by competitors could adversely affect our pricing structure, harm our business and competitive position. In addition, any litigation relating to protecting AHC’s intellectual property against infringement could involve the Company and be time-consuming and costly.

Attraction and retention of qualified personnel is necessary to implement and conduct our sales and marketing efforts.

Our future success will depend largely upon the continued services of our Board members, executive officers, sales personnel, and other key personnel. Our success will also depend on our ability to continue to attract and retain qualified personnel with sales, marketing and distribution experience. Key personnel represent a significant asset for us, and the competition for qualified personnel is intense in the paper product industry.

We may have particular difficulty attracting and retaining key personnel in regards to the sales and marketing aspect of the Company. We do not have key-person life insurance coverage on any of our personnel. The loss of one or more of our key people or our inability to attract, retain and motivate other qualified personnel could negatively impact our ability to develop or to sustain our operations.

We are exposed to risks associated with the ongoing financial crisis and weakening global economy, which increase the uncertainty of consumers purchasing products.

The recent severe tightening of the credit markets, turmoil in the financial markets, and weakening global economy are contributing to a decrease in consumer confidence. If these economic conditions are prolonged or deteriorate further, the market for our products will decrease accordingly.

|

26

|

RISKS ASSOCIATED WITH OUR INDUSTRY

We face significant competition in the hygienic and household paper product industry.

We intend to compete with other manufacturers and distributors of hygienic and household paper products, including products made of traditional wood-pulp based paper, bamboo-pulp based paper, or other recycled or novel paper materials. We will also compete with traditional manufactures of non-paper based diapers, female sanitary pads, disposable plates and cups, and produce platters. Many of the companies with whom we intend to compete have greater financial resources, production capabilities, and distribution capacity than we do. These competitors may be able to benefit from greater economies of scale than our Company. In addition, they may be able to afford more expertise in design and manufacturing of their products. This competition could result in competitors having products of greater quality and interest to prospective customers and investors, which could adversely impact on our ability to develop or sustain our operations.

Existing regulations, and changes to such regulations, may present technical, regulatory and economic barriers to the use of our products, which may significantly reduce demand for our products.

Our products are subject to various regulatory and economic barriers which could have an adverse effect on the Company.

Our business depends on the products of our suppliers, American Hygienics Corporation and Xiamen ITG Group Corp Ltd.

AHC and ITG are both considered to be stable companies with many years of experience in the industry. Its stability, or lack thereof, could create various issues related to our products. Other suppliers are viable alternatives but, without the special products of AHC, the product line that the Company offers could be adversely affected.

Our company is projected to experience rapid growth in operations, which will place significant demands on its management, operational and financial infrastructure.

If the Company does not effectively manage its growth, the quality of its products could suffer, which could negatively affect the Company's brand and operating results. To effectively manage this growth, the Company will need to continue to improve its operational, financial and management controls and its reporting systems and procedures. Failure to implement these improvements could hurt the Company's ability to manage its growth and financial position.

The Company treats its proprietary information as confidential and relies on internal nondisclosure safeguards and on laws protecting trade secrets, all to protect its proprietary information.

There can be no assurance that these measures will adequately protect the confidentiality of the Company's proprietary information or that others will not independently develop products or technology that are equivalent or superior to those of the Company. The Company's patents, trademarks, trade secrets, copyrights and/or other intellectual property rights are important assets to the Company. Various events outside of the Company's control pose a threat to its intellectual property rights as well as to the Company's products and services. Although the Company seeks to obtain patent protection for its systems, it is possible that the Company may not be able to protect some of these innovations. There is always the possibility, despite the Company's efforts, that the scope of the protection gained will be insufficient or that an issued patent may be deemed invalid or unenforceable.

RISKS RELATED TO OUR ORGANIZATION AND THE MARKET FOR OUR STOCK

We are subject to the reporting requirements of federal securities laws, which can be expensive and may divert resources from other projects, thus impairing our ability to grow.

We are a public reporting company and, accordingly, subject to the information and reporting requirements of the Exchange Act and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC (including reporting of the Merger) and furnishing audited reports to stockholders will cause our expenses to be higher than they would be if we remained privately held.

|

27

|

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures. Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. In addition, if we are unable to comply with the internal controls requirements of the Sarbanes-Oxley Act, then we may not be able to obtain the independent accountant certifications required by such act, which may preclude us from keeping our filings with the SEC current and may adversely affect any market for, and the liquidity of, our common stock.

Public company compliance may make it more difficult for us to attract and retain officers and directors.

The Sarbanes-Oxley Act and new rules subsequently implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these new rules and regulations to increase our compliance costs and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers.

Because we became public by means of a merger, we may not be able to attract the attention of major brokerage firms.

There may be risks associated with us becoming public through a merger. Securities analysts of major brokerage firms may not provide coverage of us since there is no incentive to brokerage firms to recommend the purchase of our common stock. No assurance can be given that brokerage firms will, in the future, want to conduct any secondary offerings on behalf of our post-Merger company.

Our stock price may be volatile.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

|

● |

changes in our industry; |

|

● |

competitive pricing pressures; |

|

● |

Our ability to obtain working capital financing; |

|

● |

additions or departures of key personnel; |

|

● |

limited “public float” in the hands of a small number of persons whose sales or lack of sales could result in positive or negative pricing pressure on the market price for our common stock; |

|

|

● |

sales of our common stock; |

|

● |

our ability to execute our business plan; |

|

● |

operating results that fall below expectations; |

|

● |

loss of any strategic relationship; |

|

● |

regulatory developments; |

|

● |

economic and other external factors; and |

|

● |

period-to-period fluctuations in our financial results. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

|

28

|

We may not pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

We cannot ensure that a liquid trading market for our common stock will be sustained.

Our stock is currently quoted on the OTC Bulletin Board, but is traded sporadically. We cannot predict how liquid the market for our common stock might become. As soon as is practicable after becoming eligible, we anticipate applying for listing of our common stock on either the NYSE Amex Equities, The NASDAQ Capital Market or other national securities exchange, assuming that we can satisfy the initial listing standards for such exchange. We currently do not satisfy the initial listing standards for any of these exchanges, and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock is otherwise rejected for listing and remains quoted on the OTC Bulletin Board or is suspended from the OTC Bulletin Board, the trading price of our common stock could suffer and the trading market for our common stock may be less liquid, and our common stock price may be subject to increased volatility.

Furthermore, for companies whose securities are quoted on the OTC Bulletin Board, it is more difficult (i) to obtain accurate quotations, (ii) to obtain coverage for significant news events because major wire services generally do not publish press releases about such companies, and (iii) to obtain needed capital.

The market price of our common stock can become volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings.

The market price of our common stock can become volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include: our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; changes in financial estimates by us or by any securities analysts who might cover our stock; speculation about our business in the press or the investment community; significant developments relating to our relationships with our customers or suppliers; stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry; customer demand for our products; investor perceptions of our industry in general and our Company in particular; the operating and stock performance of comparable companies; general economic conditions and trends; announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; changes in accounting standards, policies, guidance, interpretation or principles; loss of external funding sources; sales of our common stock, including sales by our directors, officers or significant stockholders; and additions or departures of key personnel. Securities class action litigation is often instituted against companies following periods of volatility in their stock price. Should this type of litigation be instituted against us, it could result in substantial costs to us and divert our management's attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to the operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our Company at a time when you want to sell your interest in us. We do not intend to pay dividends on shares of our common stock for the foreseeable future.

|

29

|

Our common stock is currently considered a “penny stock,” which may make it more difficult for our investors to sell their shares.

Our common stock is currently considered a “penny stock” and may continue in the future to be subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on The NASDAQ Stock Market or other national securities exchange and trades at less than $5.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. Since our securities are subject to the penny stock rules, investors may find it more difficult to dispose of our securities.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market, or upon the expiration of any statutory holding period under Rule 144, or issued upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Bruce Harmon, our interim chief financial officer and chairman of our board of directors, beneficially owns a substantial portion of our outstanding common stock and preferred stock, which enables him to influence many significant corporate actions and in certain circumstances may prevent a change in control that would otherwise be beneficial to our stockholders.

Bruce Harmon, as of December 31, 2014, beneficially owns 8.9% of our outstanding shares of common stock and 100% of our outstanding shares of preferred stock. As the preferred stock has super voting rights, Mr. Harmon beneficially controls approximately 66.2% of the votes for all of our stock. As such, he has a substantial impact on matters requiring the vote of the stockholders, including the election of our directors and most of our corporate actions. This control could delay, defer, or prevent others from initiating a potential merger, takeover or other change in our control, even if these actions would benefit our stockholders and us. This control could adversely affect the voting and other rights of our other stockholders and could depress the market price of our common stock.

Public company compliance may make it more difficult for us to attract and retain officers and directors.