Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cytosorbents Corp | v406782_8k.htm |

| EX-99.3 - EXHIBIT 99.3 - Cytosorbents Corp | v406782_ex99-3.htm |

| EX-99.4 - EXHIBIT 99.4 - Cytosorbents Corp | v406782_ex99-4.htm |

| EX-99.1 - EXHIBIT 99.1 - Cytosorbents Corp | v406782_ex99-1.htm |

Exhibit 99.2

Cyto Sorbents Corporation NASDAQ CM: CTSO An Emerging Leader in Critical Care Immunotherapy Year 2014 Earnings Call March 31, 2015

Safe Harbor Statement Statements in this presentation regarding CytoSorbents Corporation and its operating subsidiaries CytoSorbents, Inc (now known as CytoSorbents Medical Inc) and CytoSorbents Europe GmbH that are not historical facts are forward - looking statements and are subject to risks and uncertainties that could cause actual future events or results to differ materially from such statements . Any such forward - looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . It is routine for our internal projections and expectations to change . Although these expectations may change, we are under no obligation to inform you if they do . Actual events or results may differ materially from those contained in the projections or forward - looking statements . The following factors, among others, could cause our actual results to differ materially from those described in a forward - looking statement : our history of losses ; potential fluctuations in our quarterly and annual results ; competition, inability to achieve regulatory approval for our device, technology systems beyond our control and technology - related defects that could affect the companies’ products or reputation ; risks related to adverse business conditions ; our dependence on key employees ; competition for qualified personnel ; the possible unavailability of financing as and if needed ; and risks related to protecting our intellectual property rights or potential infringement of the intellectual property rights of third parties . This list is intended to identify only certain of the principal factors that could cause actual results to differ from those discussed in the forward - looking statements . Readers are referred to a discussion of important risk factors detailed in the Company’s Form 10 - K filed with the Securities and Exchange Commission on March 31 , 2015 and other reports and documents filed from time to time by us, which are available online at www . sec . gov .

3 Cyto Sorbents is Well - Positioned as A Leader in Critical Care Immunotherapy Leading the Prevention or Treatment of Life - Threatening Inflammation in the ICU and Cardiac Surgery using CytoSorb ® Blood Purification

4 2014: A Strong Year of Growth

5 Driven by a growing combination of Direct Sales, Independent Distributor Sales, and Strategic Partner Sales WMC Intensiv Med LLC Achieved 2014 CytoSorb Sales of $3.1M

6 2 nd CytoSorb Germany User’s Meeting

7 1 st International CytoSorb User’s Meeting

8 ISICEM 2015

9 More Published Case Reports & Studies

10 Launched International CytoSorb Registry • The home of 40+ planned investigator initiated studies with many already enrolling

11 Launched New CytoSorb Website www.cytosorb.com

12 Partnered with Global Leaders

13 Expansion of Biocon Partnership • According to Biocon , hundreds of patients have benefited from CytoSorb ® therapy and orders continue to increase • Expanded agreement beyond sepsis to all critical care applications and cardiac surgery with a focus on the systemic inflammatory response syndrome (SIRS) in India and select emerging countries • Negotiated a co - development agreement where Biocon has committed to conduct and publish results from multiple Investigator Initiated studies and patient case studies • Biocon will continue to market CytoSorb ® with their critical care antibiotics as the “most comprehensive treatment” of sepsis • Biocon has also agreed to an increase in annual minimum sales targets which should result in significantly increased sales over the life of the agreement

14 Fresenius Medical Care • Entered into a 6 country partnership with Fresenius, the largest dialysis company in the world for exclusive distribution of CytoSorb® in critical care in France, Sweden, Norway, Finland, Denmark and Poland • Leveraging Fresenius’ #1 or #2 position in critical care in these territories and elsewhere in the world • CytoSorb® is a key part of Fresenius’ growth strategy in critical care • Strong sales force and distribution • CytoSorb has been used on the Fresenius multiFiltrate thousands of times • Potential for much broader synergy and expansion in the future

15 Cardiac Surgery Initial Partnership • Entered into an initial partnership with a top - four global medical device company in cardiac surgery to use CytoSorb ® intra - operatively during cardiac surgery in France • Initial evaluation phase expected to be complete in Q2 2015 • Following a successful evaluation, the two parties plan to jointly determine how to potentially expand upon both the size and geographic footprint of its partnership • France is the second largest medical device market and one of the highest volume cardiac surgery markets in the EU • Medtronic, Sorin , Maquet and Terumo are top firms in the cardiac surgery space worldwide

16 Focus on Generating Clinical Data

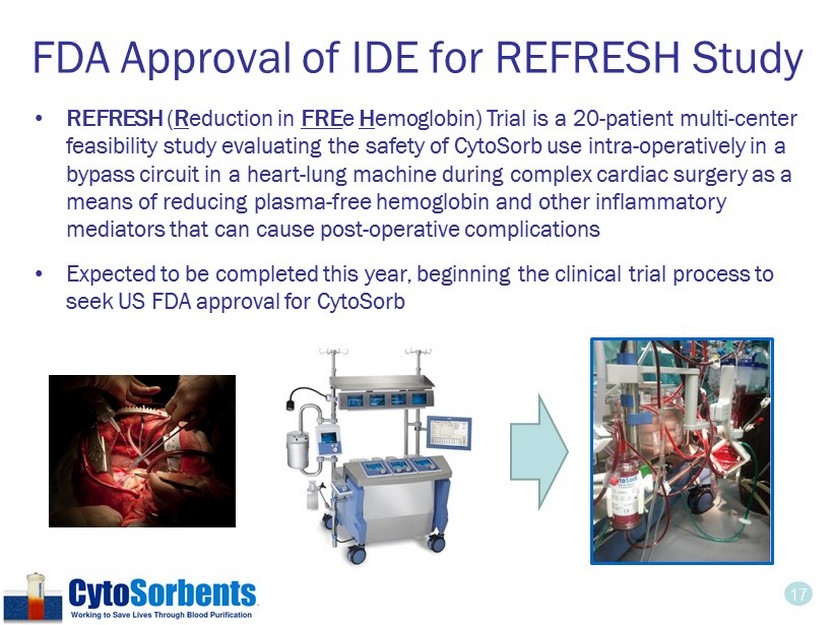

17 FDA Approval of IDE for REFRESH Study • REFRESH ( R eduction in FRE e H emoglobin) Trial is a 20 - patient multi - center feasibility study evaluating the safety of CytoSorb use intra - operatively in a bypass circuit in a heart - lung machine during complex cardiac surgery as a means of reducing plasma - free hemoglobin and other inflammatory mediators that can cause post - operative complications • Expected to be completed this year, beginning the clinical trial process to seek US FDA approval for CytoSorb

18 United States European Union Director of European Scientific Affairs 50+ Investigator Initiated Studies EU Sepsis Studies Pivotal Trial Cardiac Surgery European Registry US Air Force Funded Trauma Pilot Case Reports Germany Dosing Study Medical Director SVP of Clinical Development Trauma Advisory Board Sepsis Advisory Board Cardiac Surgery Advisory Board Chief Medical Officer Statistician Infrastructure to Drive Clinical Data Clinical Trial Manager United States Trials Sepsis Studies

19 Increased Investor Awareness

20 NASDAQ Capital Market Listed CytoSorbents (CTSO) Up - listed to NASDAQ in December 2014 • Average daily trading volume: 200K shares ($3M daily trading value) vs 30,000 prior to up - listing

21 #11 on Forbes Best Performing Stocks of 2014 CytoSorbents Achieved Strong Stock Performance in 2014 comparing favorably to peers

22 Continued Positive Analyst Coverage and Investor Outreach

23 Increased Media Coverage

24 Operating and Financial Highlights

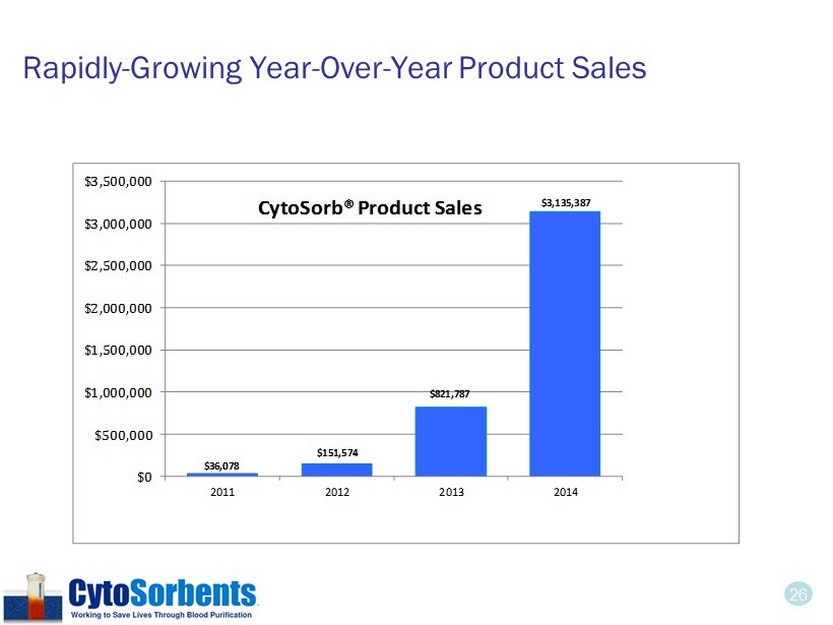

25 2014 Comparative Revenue Results • Achieved record CytoSorb® annual sales of $3.1 M, a 282% increase over $822K in 2013. • Grant and other income declined by 38% as a result of the conclusion of several significant grants. • Gross margin on product sales in 2014 were approximately 63%, as compared to 61% for 2013. 2014 2013 % Incr . Product revenue $ 3,135 ,387 $ 821,787 282% Grant and other income 987,438 1,600,880 (38)% Total revenue $ 4,122,825 $ 2,422,667 70%

26 Rapidly - Growing Year - Over - Year Product Sales $13,679 $87,960 $176,098 $127,969 $203,561 $314,159 $570,000 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 EST CytoSorb ® Product Sales Quarter over quarter growth rate has averaged 65% in the last three quarters $36,078 $151,574 $821,787 $3,135,387 $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 2011 2012 2013 2014 CytoSorb® Product Sales

27 Quarterly Product Sales $13,679 $87,960 $176,098 $127,969 $203,561 $314,159 $569,243 $663,233 $1,031,761 $871,150 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 CytoSorb® Product Sales • Q4 2014 Product Revenue were $871K, an increase of $557K or 177% over Q4 2013 product revenues of $314K. • Q4 2014 product revenues were approximately $161K lower than Q3 2014 revenues. Q3 2014 was the first quarter where distributor sales exceeded direct sales, and due to the bulk nature of distributor orders, sales can fluctuate from quarter to quarter.

28 Product Sales Trends Remain Strong $151,574 $310,779 $405,706 $595,588 $821,787 $1,214,932 $1,750,196 $2,578,396 $3,135,387 $- $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Trailing Twelve Month Product Sales Trend Line

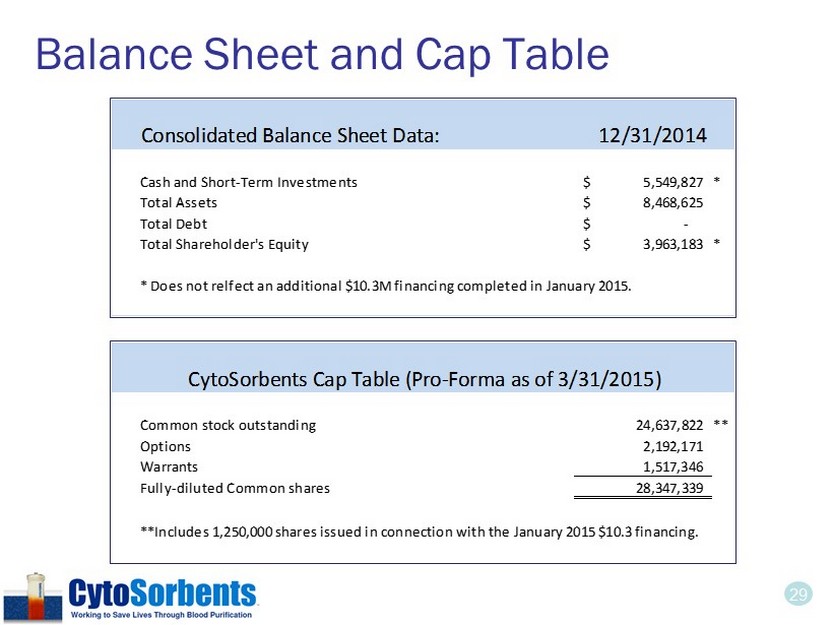

29 Balance Sheet and Cap Table Consolidated Balance Sheet Data: 12/31/2014 Cash and Short-Term Investments 5,549,827$ * Total Assets 8,468,625$ Total Debt -$ Total Shareholder's Equity 3,963,183$ * * Does not relfect an additional $10.3M financing completed in January 2015. Common stock outstanding 24,637,822 ** Options 2,192,171 Warrants 1,517,346 Fully-diluted Common shares 28,347,339 **Includes 1,250,000 shares issued in connection with the January 2015 $10.3 financing. CytoSorbents Cap Table (Pro-Forma as of 3/31/2015)

30 Outlook for 2015

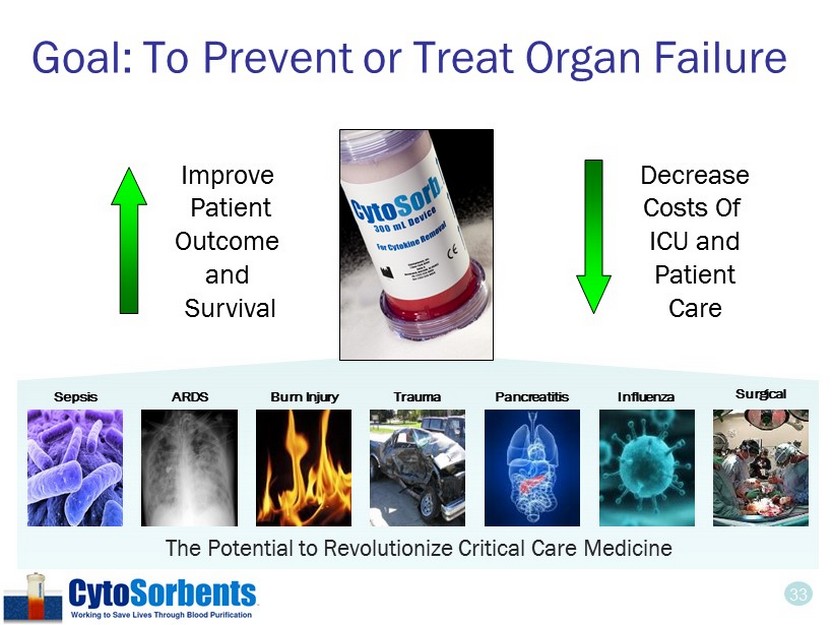

31 $20 Billion Opportunity in Critical Care Millions of people are admitted to the intensive care unit in hospitals in the U.S. and the European Union each year with deadly inflammatory conditions • In these conditions, massive inflammation driven by a “cytokine storm” causes cell death and organ failure. Nearly half of all deaths in the ICU is due to organ failure with no effective therapies • Because of the lack of effective therapies, approximately 1 in every 3 patients dies • The costs can be staggering: Lack of “active” therapies lead to patients lingering days to weeks in the ICU at $2,000 - 3,000 per day in the ICU* on average • Not surprising that we spend nearly 1% of our GDP on critical care** Sepsis ARDS Burn Injury Trauma Pancreatitis Influenza Surgical * Cooper, L, et al, Crit Care Med 2004, 32(11):2247 - 2253. ** Halpern, NA, et al., Crit Care Med 2010, 38(1):65 - 71.

32 Cyto Sorb ® Removes the Fuel to the Fire • CytoSorb ® represents a powerful immunotherapy to control inflammation • Approved in the European Union as the only specifically approved cytokine filter • Clinically proven to remove key cytokines in the blood of critically - ill patients • Approved for use in any situation where cytokines are elevated • Safe: ~5,500 human treatments, safe and well - tolerated

33 Goal: To Prevent or Treat Organ Failure Sepsis ARDS Burn Injury Trauma Pancreatitis Influenza Surgical The Potential to Revolutionize Critical Care Medicine Improve Patient Outcome and Survival Decrease Costs Of ICU and Patient Care

34 Cyto Sorb ® may help revolutionize critical care medicine, saving lives, and reducing costs • Massive untapped $20 billion unmet, medical need in critical care • CytoSorb® sales are generating significant growth with attractive 65% gross margins • Continued geographic expansion throughout the world • FDA approval to start U.S. cardiac surgery pilot study – the first phase to seek U.S. approval with CytoSorb® • Expansion of existing strategic partnerships and potential new ones • NASDAQ Capital Market up - listing and clean cap structure dramatically changes profile of company and ability for institutional and retail investors to invest Cyto Sorbents Has Tremendous Potential

35 Near Term Challenges

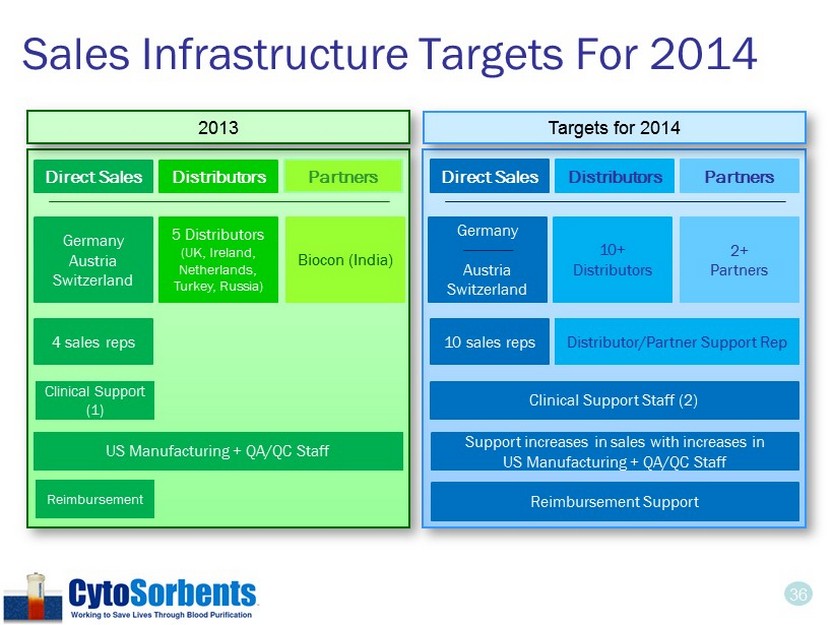

36 Sales Infrastructure Targets For 2014 Direct Sales Germany Austria Switzerland Direct Sales 5 Distributors (UK, Ireland, Netherlands, Turkey, Russia) 4 sales reps Distributor/Partner Support Rep Targets for 2014 2013 Distributors Partners Distributors Partners Biocon (India) Germany Austria Switzerland 10+ Distributors 2+ Partners 10 sales reps Clinical Support (1) Clinical Support Staff (2) Support increases in sales with increases in US Manufacturing + QA/QC Staff Reimbursement Support US Manufacturing + QA/QC Staff Reimbursement

37 Restructuring Targets For 2015 Direct Sales Germany ----------- Austria Switzerland Direct Sales 8 Distributors 4 sales reps International Sales Director + Export Business Manager Targets for 2015 Q1 2015 Distributors Partners Distributors Partners Biocon Fresenius Global Cardiac Surgery Co. Germany Austria Switzerland 12 or more Distributors total 5 or more Partners total 10 sales reps Clinical and Product Support ( 2 ) Medical Director, Head of Scientific Marketing (2) Clinical and Product Support (2) Medical Director, Head of Scientific Marketing (2) US Manufacturing + QA/QC Staff Reimbursement Support US Manufacturing + QA/QC Staff Reimbursement Support International Sales Director + Export Business Manager

38 Q1 2015 Revenue Guidance • In general, our product sales are too dependent on the timing and size of orders and cannot yet be accurately predicted • We have given guidance, however, when data from the full quarter is known • Expect that Q1 2015 CytoSorb product revenue will be in the range of $700,000 - $ 725,000 (unaudited). Adjusting for the impact in the change of the Euro, which has dropped 22% from a year ago, this is equivalent to an adjusted range of $800,000 - $850,000

39 Phillip P. Chan, MD, PhD - CEO 7 Deer Park Drive, Suite K Monmouth Junction, NJ 08852 pchan@cytosorbents.com Cyto Sorbents Corporation NASDAQ CM: CTSO An Emerging Leader in Critical Care Immunotherapy Q&A Session