Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Delek Logistics Partners, LP | dkl-8kxdropdowntylercrudet.htm |

| EX-10.2 - EXHIBIT 10.2 - THROUGHPUT AGREEMENT - Delek Logistics Partners, LP | dkl-8kexhibitx102throughpu.htm |

| EX-10.3 - EXHIBIT 10.3 - THIRD AMENDED & RESTATED OMNIBUS AGREEMENT - Delek Logistics Partners, LP | dkl-8kexhibitx103thirdamen.htm |

Exhibit 10.1

ASSET PURCHASE AGREEMENT

(El Dorado Rail Offloading Facility)

among

LION OIL COMPANY

and

LION OIL TRADING & TRANSPORTATION, LLC

as Sellers

and

DELEK LOGISTICS OPERATING, LLC

as Buyer

and, solely for purposes of Article VIII and Section 9.2,

DELEK US HOLDINGS, INC.

as Guarantor

Dated as of March 31, 2015

TABLE OF CONTENTS

ARTICLE I DEFINED TERMS | |||||

1.1 | Defined Terms | ||||

ARTICLE II TRANSFER OF ASSETS AND AGGREGATE CONSIDERATION | |||||

2.1 | Sale of Assets | ||||

2.2 | Transferred Assets | ||||

2.3 | Excluded Assets | ||||

2.4 | No Assumption of Liabilities | ||||

2.5 | Consideration | ||||

ARTICLE III CLOSING | |||||

3.1 | Closing | ||||

3.2 | Deliveries by the Sellers | ||||

3.3 | Deliveries by the Buyer | ||||

3.4 | Prorations | ||||

3.5 | Reimbursement | ||||

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE SELLERS | |||||

4.1 | Organization | ||||

4.2 | Authorization | ||||

4.3 | No Conflicts or Violations; No Consents or Approvals Required | ||||

4.4 | Absence of Litigation | ||||

4.5 | Bankruptcy | ||||

4.6 | Brokers and Finders | ||||

4.7 | Title to Transferred Assets | ||||

4.8 | Permits | ||||

4.9 | Condition of Transferred Assets; Sufficiency of Transferred Assets | ||||

4.10 | Compliance with Applicable Law | ||||

4.11 | Compliance with Environmental Law | ||||

4.12 | Conflicts Committee Matters | ||||

4.13 | WAIVERS AND DISCLAIMERS | ||||

ARTICLE V REPRESENTATIONS AND WARRANTIES OF THE BUYER | |||||

5.1 | Organization | ||||

5.2 | Authorization | ||||

5.3 | No Conflicts or Violations; No Consents or Approvals Required | ||||

5.4 | Absence of Litigation | ||||

5.5 | Brokers and Finders | ||||

5.6 | Environmental Consent Decree | ||||

ARTICLE VI COVENANTS | |||||

6.1 | Additional Agreements | ||||

6.2 | Further Assurances | ||||

6.3 | Cooperation on Tax Matters | ||||

6.4 | Cooperation for Litigation and Other Actions | ||||

[Signature Page to Asset Purchase Agreement]

6.5 | Retention of and Access to Books and Records. | ||||

6.6 | Permits; Certain Real Property | ||||

6.7 | Environmental Consent Decree | ||||

6.8 | Delayed Assets | ||||

ARTICLE VII INDEMNIFICATION | |||||

7.1 | Indemnification of Buyer and Sellers | ||||

7.2 | Defense of Third-Party Claims | ||||

7.3 | Direct Claims | ||||

7.4 | Limitations | ||||

7.5 | Tax Related Adjustments | ||||

ARTICLE VIII LIMITED GUARANTY | |||||

8.1 | Limited Guaranty by Delek US | ||||

ARTICLE IX MISCELLANEOUS | |||||

9.1 | Expenses | ||||

9.2 | Notices | ||||

9.3 | Severability | ||||

9.4 | Governing Law | ||||

9.5 | Arbitration Provision | ||||

9.6 | Confidentiality | ||||

9.7 | Parties in Interest | ||||

9.8 | Assignment of Agreement | ||||

9.9 | Captions | ||||

9.10 | Counterparts | ||||

9.11 | Integration | ||||

9.12 | Amendment; Waiver | ||||

9.13 | Survival of Representations and Warranties and Covenants | ||||

ARTICLE X INTERPRETATION | |||||

10.1 | Interpretation | ||||

10.2 | References, Gender, Number | ||||

Schedules:

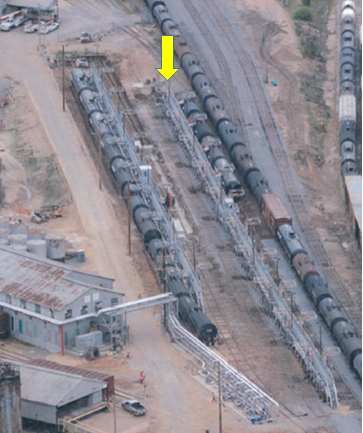

Schedule 2.2(a) — Rail Offloading Facility

Schedule 2.2(d) — Third Party Claims

[Signature Page to Asset Purchase Agreement]

ASSET PURCHASE AGREEMENT

(El Dorado Rail Offloading Facility)

THIS ASSET PURCHASE AGREEMENT (this “Agreement”) dated as of March 31, 2015, is made and entered into by and among Lion Oil Company, an Arkansas corporation “Lion”), Lion Oil Trading & Transportation, LLC, a Texas limited liability company (“LOTT”), Delek Logistics Operating, LLC, a Delaware limited liability company (the “Buyer”) and, solely for purposes of Article VIII and Section 9.2, Delek US Holdings, Inc., a Delaware corporation (“Delek US”). LOTT and Lion are each sometimes referred to in this Agreement as a “Seller” and collectively the “Sellers.”) Each of the Sellers and the Buyer are sometimes referred to in this Agreement as a “Party” and collectively as the “Parties.”

WHEREAS, Lion is the owner of a refinery and other related assets near El Dorado, Arkansas (the “El Dorado Refinery”);

WHEREAS, Buyer wishes to purchase certain assets associated with and adjacent to the El Dorado Refinery; and

WHEREAS, the Parties wish to amend certain provisions of the Omnibus Agreement.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants set forth herein and in the Restated Omnibus Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

ARTICLE I

DEFINED TERMS

DEFINED TERMS

1.1 Defined Terms. Unless the context expressly requires otherwise, the respective terms defined in this Section 1.1 shall, when used in this Agreement, have the respective meanings herein specified, with each such definition to be equally applicable both to the singular and the plural forms of the term so defined.

“Action” means any claim, action, suit, investigation, inquiry, proceeding, condemnation or audit by or before any court or other Governmental Authority or any arbitration proceeding.

“Affiliate” means, with to respect to а specified Person, any other Person controlling, controlled by or under common control with that first Person. As used in this definition, the term “control” includes (i) with respect to any Person having voting securities or the equivalent and elected directors, managers or Persons performing similar functions, the ownership of or power to vote, directly or indirectly, voting securities or the equivalent representing 50% or more of the power to vote in the election of directors, managers or Persons performing similar functions, (ii) ownership of 50% or more of the equity or equivalent interest in any Person and (iii) the ability to direct the business and affairs of any Person by acting as a general partner, manager or otherwise. Notwithstanding the foregoing, for purposes of this Agreement, Delek US and its subsidiaries (other than the General Partner and the Partnership and its subsidiaries), including the Sellers, on the one

1

hand, and the General Partner and the Partnership and its subsidiaries, including the Buyer, on the other hand, shall not be considered Affiliates of each other.

“Agreement” has the meaning set forth in the preamble.

“Amended and Restated Secondment Agreement” has the meaning set forth in Section 3.2(g).

“Ancillary Documents” means, collectively, the Buyer Ancillary Documents and the Seller Ancillary Documents.

“Applicable Law” means any applicable statute, law, regulation, ordinance, rule, judgment, rule of law, decree, Permit, requirement, or other governmental restriction or any similar form of decision of, or any provision or condition issued under any of the foregoing by, or any determination by any Governmental Authority having or asserting jurisdiction over the matter or matters in question, whether now or hereafter in effect and in each case as amended (including, without limitation, all of the terms and provisions of the common law of such Governmental Authority), as interpreted and enforced at the time in question, including Environmental Law.

“Bill of Sale” has the meaning set forth in Section 3.2(b).

“Books and Records” has the meaning set forth in Section 2.2(b).

“Business Day” means any day, other than Saturday or Sunday, on which banks are open for business in Nashville, Tennessee.

“Buyer” has the meaning set forth in the preamble.

“Buyer Ancillary Documents” means each agreement, document, instrument or certificate to be delivered by the Buyer, or its Affiliates, at the Closing pursuant to Section 3.3 hereof and each other document or Contract entered into by the Buyer, or its Affiliates, in connection with this Agreement or the Closing.

“Buyer Indemnified Costs” means (a) any and all damages, losses, Claims, liabilities, demands, charges, suits, penalties, costs, and expenses (including court costs and reasonable attorneys’ fees and expenses incurred in investigating and preparing for any litigation or proceeding) that the Buyer Indemnified Parties incur and that arise out of or relate to (x) any breach of a representation, warranty or covenant of either of the Sellers under this Agreement, (y) any Specified Title Matters or (z) any Excluded Liability, and (b) any and all Actions, Claims, assessments, judgments, costs, and expenses, including reasonable legal fees and expenses, incident to any of the foregoing. Notwithstanding anything in the foregoing to the contrary, Buyer Indemnified Costs shall exclude any and all Special Damages (other than (1) those that are a result of (x) a third-party claim for Special Damages, (y) the gross negligence or willful misconduct of either of the Sellers or (z) the failure of either of the Sellers to perform its obligations under Section 6.6 and (2) Special Damages (excluding punitive damages) arising out of any Specified Title Matter not otherwise provided for in clause (1)(x) above).

[Signature Page to Asset Purchase Agreement]

“Buyer Indemnified Parties” means Buyer and its Affiliates, including the Partnership, and their respective officers, directors, partners, managers, employees, consultants and Affiliated equity holders.

“Claim” means any existing or threatened future claim, demand, suit, action, investigation, proceeding, governmental action, condemnation, audit or cause of action of any kind or character (in each case, whether civil, criminal, investigative or administrative), known or unknown, under any theory, including those based on theories of contract, tort, statutory liability, strict liability, employer liability, premises liability, products liability, breach of warranty or malpractice.

“Claimant” has the meaning set forth in Section 9.5.

“Closing” has the meaning set forth in Section 3.1.

“Closing Date” has the meaning set forth in Section 3.1.

“Confidential Information” means all information, documents, records and data that a Party furnishes or otherwise discloses to the other Party (including any such items furnished prior to the execution of this Agreement), together with all analyses, compilations, studies, memoranda, notes or other documents, records or data (in whatever form maintained, whether documentary, computer or other electronic storage or otherwise) prepared by the receiving Party which contain or otherwise reflect or are generated from such information, documents, records and data; provided, however, that the term “Confidential Information” does not include any information that (a) at the time of disclosure or thereafter is or becomes generally available to or known by the public (other than as a result of a disclosure by the receiving Party), (b) is developed by the receiving Party without reliance on any Confidential Information or (c) is or was available to the receiving Party on a nonconfidential basis from a source other than the disclosing Party that, insofar as is known to the receiving Party after reasonable inquiry, is not prohibited from transmitting the information to the recipient by a contractual, legal or fiduciary obligation to the disclosing Party.

“Consents” means all notices to, authorizations, consents, Orders or approvals of, or registrations, declarations or filings with, or expiration of waiting periods imposed by, any Governmental Authority, and any notices to, consents or approvals of any other third party, in each case that are required by Applicable Law or by Contract in order to consummate the transactions contemplated by this Agreement and the Ancillary Documents.

“Contract” means any written contract, agreement, indenture, instrument, note, bond, loan, lease, mortgage, franchise, license agreement, purchase order, binding bid or offer, binding term sheet or letter of intent or memorandum, commitment, letter of credit or any other legally binding arrangement, including any amendments or modifications thereof and waivers relating thereto.

“Delayed Asset” has the meaning set forth in Section 6.8(a).

“Delek US” has the meaning set forth in the preamble.

[Signature Page to Asset Purchase Agreement]

“Dispute” means any and all disputes, Claims, controversies and other matters in question between any Seller, on the one hand, and the Buyer, on the other hand, arising out of or relating to this Agreement or the alleged breach hereof, or in any way relating to the subject matter of this Agreement regardless of whether (a) allegedly extra-contractual in nature, (b) sounding in contract, tort or otherwise, (c) provided for by Applicable Law or otherwise or (d) seeking damages or any other relief, whether at law, in equity or otherwise.

“Effective Time” has the meaning set forth in Section 3.1.

“El Dorado Refinery” has the meaning set forth in the recitals.

“Encumbrance” means any mortgage, pledge, charge, hypothecation, claim, easement, right of purchase, security interest, deed of trust, conditional sales agreement, encumbrance, interest, option, lien, right of first refusal, right of way, defect in title, encroachments or other restriction, whether or not imposed by operation of Applicable Law, any voting trust or voting agreement, stockholder agreement or proxy.

“Environmental Consent Decree” has the meaning set forth in Section 5.6.

“Environmental Law” means all federal, state, and local laws, statutes, rules, regulations, orders, judgments, ordinances, codes, injunctions, decrees, Environmental Permits and other legally enforceable requirements and rules of common law now or hereafter in effect, relating to pollution or protection of human health and the environment including, without limitation, the federal Comprehensive Environmental Response, Compensation, and Liability Act, the Superfund Amendments Reauthorization Act, the Resource Conservation and Recovery Act, the Clean Air Act, the Federal Water Pollution Control Act, the Toxic Substances Control Act, the Oil Pollution Act, the Safe Drinking Water Act, the Hazardous Materials Transportation Act, and other similar federal, state or local environmental conservation and protection laws, each as amended from time to time.

“Environmental Permit” means any Permit, approval, identification number, license, registration, consent, exemption, variance or other authorization required under or issued pursuant to any applicable Environmental Law.

“Excluded Assets” has the meaning set forth in Section 2.3.

“Excluded Liabilities” has the meaning set forth in Section 2.4.

“Fundamental Representations” has the meaning set forth in Section 7.4(a).

“General Partner” means Delek Logistics GP, LLC, a Delaware limited liability company.

“Governmental Authority” means any federal, state, local or foreign government or any provincial, departmental or other political subdivision thereof, or any entity, body or authority exercising executive, legislative, judicial, regulatory, administrative or other governmental functions or any court, department, commission, board, bureau, agency, instrumentality or administrative body of any of the foregoing.

[Signature Page to Asset Purchase Agreement]

“Indemnified Costs” means the Buyer Indemnified Costs and the Seller Indemnified Costs, as applicable.

“Indemnified Party” means the Buyer Indemnified Parties and the Seller Indemnified Parties.

“Indemnifying Party” has the meaning set forth in Section 7.2.

“Lease and Access Agreement” has the meaning set forth in Section 3.2(a).

“Lion” has the meaning set forth in the preamble.

“LOTT” has the meaning set forth in the preamble.

“Material Adverse Effect” means any material adverse change, circumstance, effect or condition in or relating to the Transferred Assets or the assets, financial condition, results of operations, or business of any Person or that materially impedes the ability of any Person to consummate the transactions contemplated hereby, other than any change, circumstance, effect or condition in the refining or pipelines industries generally (including any change in the prices of crude oil, natural gas, natural gas liquids, feedstocks or refined products or other hydrocarbon products, industry margins or any regulatory changes or changes in Applicable Law) or in United States or global economic conditions or financial markets in general. Any determination as to whether any change, circumstance, effect or condition has a Material Adverse Effect shall be made only after taking into account all effective insurance coverages and effective third-party indemnifications with respect to such change, circumstance, effect or condition.

“North Rack Parcel” means that portion of the Premises (as such term is defined in the Lease and Access Agreement) upon which the crude oil offloading rack identified on Exhibit A-1 attached hereto and such other property utilized in connection with the operation therewith is situated.

“Omnibus Agreement” means that certain Third Amended and Restated Omnibus Agreement entered into and effective as of March 31, 2015, by and among Delek US, Delek Refining, Ltd., Lion, the Partnership, Paline Pipeline Company, LLC, SALA Gathering Systems, LLC, Magnolia Pipeline Company, LLC, El Dorado Pipeline Company, LLC, Delek Crude Logistics, LLC, Delek Marketing-Big Sandy, LLC, Delek Marketing & Supply, LP, DKL Transportation, LLC, the Buyer and the General Partner.

“Order” means any order, writ, injunction, decree, compliance or consent order or decree, settlement agreement, schedule and similar binding legal agreement issued by or entered into with a Governmental Authority.

“Partnership” means Delek Logistics Partners, LP, a Delaware limited partnership.

“Party” and “Parties” have the meanings set forth in the preamble.

[Signature Page to Asset Purchase Agreement]

“Permits” means all permits, licenses, sublicenses, certificates, approvals, consents, notices, waivers, variances, franchises, registrations, orders, filings, accreditations, or other similar authorizations, including pending applications or filings therefor and renewals thereof, required by any Applicable Law or Governmental Authority or granted by any Governmental Authority that are related to the Transferred Asset.

“Permitted Encumbrances” means (a) liens for taxes not yet due and payable; (b) liens of mechanics, laborers, suppliers, workers and materialmen incurred in the ordinary course of business for sums not yet due or being diligently contested in good faith; (c) liens securing rental, storage, throughput, handling or other fees or charges owing from time to time to common carriers, solely to the extent of such fees or charges; and (d) any easement, right-of-way or right of access with respect to the rail lines serving the Rail Offloading Facility or the operation of locomotives and rail cars on such rail lines.

“Person” means an individual or a corporation, limited liability company, partnership, joint venture, trust, unincorporated organization, association, Governmental Authority or other entity.

“Purchase Price” has the meaning set forth in Section 2.5(a).

“Rail Offloading Agreement” has the meaning set forth in Section 3.2(c).

“Rail Offloading Facility” has the meaning set forth in Section 2.2(a).

“Receiving Party Personnel” has the meaning set forth in Section 9.6(d).

“Respondent” has the meaning set forth in Section 9.5.

“Restated Omnibus Agreement” means the Omnibus Agreement, as amended by the Restated Omnibus Agreement Schedules, as further amended, supplemented or restated from time to time.

“Restated Omnibus Agreement Schedules” has the meaning set forth in Section 3.2(d).

“Right of Way Agreement” has the meaning set forth in Section 3.2(f).

“Seller” and “Sellers” have the meaning set forth in the preamble.

“Seller Ancillary Documents” means each agreement, document, instrument or certificate to be delivered by any of the Sellers, or their Affiliates, at the Closing pursuant to Section 3.2 hereof and each other document or Contract entered into by any of the Sellers, or their Affiliates, in connection with this Agreement or the Closing.

“Seller Indemnified Costs” means (a) any and all damages, losses, Claims, liabilities, demands, charges, suits, penalties, costs, and expenses (including court costs and reasonable attorneys’ fees and expenses incurred in investigating and preparing for any litigation or proceeding) that the Seller Indemnified Parties incur and that arise out of or relate to any breach of a representation, warranty or covenant of Buyer under this Agreement, and (b) any and all Actions,

[Signature Page to Asset Purchase Agreement]

Claims, assessments, judgments, costs, and expenses, including reasonable legal fees and expenses, incident to any of the foregoing. Notwithstanding anything in the foregoing to the contrary, Seller Indemnified Costs shall exclude any and all Special Damages (other than those that are a result of (x) a third-party claim for Special Damages or (y) the gross negligence or willful misconduct of Buyer).

“Seller Indemnified Parties” means the Sellers and their Affiliates, including Delek US, and their respective officers, directors, partners, managers, employees, consultants and Affiliated equity holders.

“Site Services Agreement” has the meaning set forth in Section 3.2(e).

“South Rack Parcel” means that portion of the Premises (as such term is defined in the Lease and Access Agreement) upon which the crude oil offloading rack identified on Exhibit A-2 attached hereto and such other property utilized in connection with the operation therewith is situated.

“Special Damages” means any consequential, punitive, special, incidental or exemplary damages, or for loss of profits or revenues.

“Specified Title Matters” means (i) any defect in the Sellers’ actual right, whether by contract, easement or common law, to occupy, use and possess the North Rack Parcel or the South Rack Parcel in connection with the Rail Offloading Facility as contemplated by the Lease and Access Agreement or the Rail Offloading Agreement, (ii) any liability for non-performance of any obligation under any lien or access agreement with respect to the North Rack Parcel or the South Rack Parcel to the extent written notice of such obligation was not previously provided to the Buyer by the Sellers and (iii) any amounts payable in connection with the continued use of the North Rack Parcel or the South Rack Parcel before or after the Closing.

“third-party action” has the meaning set forth in Section 7.2.

“Transferred Assets” has the meaning set forth in Section 2.2.

ARTICLE II

TRANSFER OF ASSETS AND AGGREGATE CONSIDERATION

TRANSFER OF ASSETS AND AGGREGATE CONSIDERATION

2.1 Sale of Assets. Subject to all of the terms and conditions of this Agreement, each Seller hereby sells, assigns, transfers and conveys to the Buyer, and the Buyer hereby purchases and acquires from the Sellers, the Transferred Assets, free and clear of all Encumbrances, other than Permitted Encumbrances.

2.2 Transferred Assets. For purposes of this Agreement, the term “Transferred Assets” shall mean the following assets, properties and rights of the Sellers, other than the Excluded Assets:

(a) all of the right, title and interest of the Sellers to the rail offloading facility, including two crude oil offloading racks at the El Dorado Refinery, which racks are designed to receive up to 25,000 bpd of light crude oil or 12,000 bpd of heavy crude oil delivered by rail to the

[Signature Page to Asset Purchase Agreement]

El Dorado Refinery (together with all pumps, piping and other ancillary equipment owned by the Sellers necessary to allow for the direct offloading of crude oil, and gates and fencing associated with the facility, as well as certain other related assets and properties that are either located on the same parcels of real estate as those assets and properties or used in connection therewith, including the rights of the Sellers under any lease, right-of-way agreement, easement or similar agreement with respect to the North Rack Parcel or the South Rack Parcel in existence on the date hereof, and used in connection with the ownership and operation of any of the other assets and properties described above), which assets include the assets listed in detail on Schedule 2.2(a) to this Agreement, the “Rail Offloading Facility”);

(b) all of the records and files related to the operation of the Transferred Assets, including, plans, drawings, instruction manuals, operating and technical data and records, whether computerized or hard copy, tax files, books, records, tax returns and tax work papers, supplier lists, reference catalogs, surveys, engineering statements, maintenance records and studies, environmental records, environmental reporting information, emission data, testing and sampling data and procedures, data related to the Rail Offloading Facility associated with construction, inspection and operating records, any and all information necessary to meet compliance obligations with respect to Environmental Laws and any other Applicable Laws, in each case related to the Transferred Assets and existing as of the Closing Date (the “Books and Records”);

(c) all of the right, title and interest of the Sellers, if any, in and to unexpired warranties and guarantees from third parties that are not Affiliates of the Sellers to the extent related to the Transferred Assets, including warranties set forth in any equipment purchase agreement, construction agreement, lease agreement, consulting agreement or agreement for architectural or engineering services, it being understood that nothing in this paragraph shall be construed as a representation by any Seller that any such warranty remains in effect or is enforceable; and

(d) all Claims and similar rights against third parties that are not Affiliates of any Seller (including indemnification and contribution) to the extent related to (i) the ownership or operation of the Transferred Assets after the Effective Time or (ii) any damage to the Transferred Assets not repaired prior to the Effective Time, or any portion thereof, if any, including those set forth on Schedule 2.2(d) and including any claims for refunds, prepayments, offsets, recoupment, condemnation awards, judgments and the like, whether received as payment or credit against future liabilities, in each case to the extent related to the matters covered by clauses (i) or (ii) above.

2.3 Excluded Assets. The Transferred Assets shall not include, and the Sellers reserve and retain all right, title and interest in and to the following (collectively, the “Excluded Assets”):

(a) all real property, including all real property subject to the Lease and Access Agreement;

(b) all rail tracks owned by the Sellers, if any;

(c) all inventory, including raw materials, intermediates, products, byproducts and wastes that is located at the Rail Offloading Facility at or prior to the Effective Time;

[Signature Page to Asset Purchase Agreement]

(d) other than as provided in the Restated Omnibus Agreement, the rights of the Sellers to the name “Delek,” “Lion,” “LOTT” or any related or similar trade names, trademarks, service marks, corporate names or logos, or any part, derivative or combination thereof;

(e) all of the Sellers’ and any of their Affiliates’ right, title and interest in and to all accounts receivable and all notes, bonds, and other evidences of indebtedness of and rights to receive payments arising out of sales, services, rentals and other activities occurring in connection with and attributable to the ownership or operation of the Transferred Assets prior to the Effective Time and the security arrangements, if any, related thereto, including any rights with respect to any third party collection procedures or any other actions or proceedings in connection therewith;

(f) all rights, titles, claims and interests of the Sellers or any of their Affiliates (i) under any policy or agreement of insurance, (ii) under any bond, (iii) to or under any condemnation damages or awards in regard to any taking or (iv) to any insurance or bond proceeds; and

(g) all Claims and similar rights in favor of any Seller or any of their Affiliates of any kind to the extent relating to (i) the Excluded Assets or (ii) the ownership of the Transferred Assets prior to the Effective Time (other than any damage to the Transferred Assets not repaired prior to the Effective Time).

2.4 No Assumption of Liabilities. Except as expressly set forth herein, or in the Ancillary Documents, the Buyer shall not assume or become obligated with respect to any obligation or liability of any Seller and their Affiliates of any nature whatsoever as a result of the transactions contemplated by this Agreement, including any payment obligations of the Sellers due in respect of Permitted Encumbrances (all such obligations or liabilities of any Seller and their Affiliates not expressly so assumed by the Buyer, collectively, the “Excluded Liabilities”).

2.5 Consideration.

(a) The aggregate consideration to be paid by the Buyer for the Transferred Assets shall be $42,478,029 (the “Purchase Price”).

(b) The Purchase Price shall be paid at the Closing by wire transfer of immediately available funds to the accounts specified by the Sellers.

ARTICLE III

CLOSING

CLOSING

3.1 Closing. The closing of the transactions contemplated hereby (the “Closing”) shall take place simultaneously with the execution of this Agreement. The date of the Closing is referred to herein as the “Closing Date” and the Closing is deemed to be effective as of 12:01 a.m., Nashville, Tennessee time, on the Closing Date (the “Effective Time”).

3.2 Deliveries by the Sellers. At the Closing, the Sellers shall deliver, or cause to be delivered, to the Buyer the following:

[Signature Page to Asset Purchase Agreement]

(a) A counterpart to a lease and access agreement in the form mutually agreed upon by Lion and the Buyer (the “Lease and Access Agreement”), duly executed by Lion.

(b) A bill of sale and assignment in the form mutually agreed upon by the Parties (the “Bill of Sale”), duly executed by the Sellers.

(c) A counterpart of a rail offloading agreement in the form mutually agreed upon by the Parties (the “Rail Offloading Agreement”), duly executed by the Sellers.

(d) A counterpart of an amended and restated set of schedules to the Omnibus Agreement in the form mutually agreed upon by the Parties (the “Restated Omnibus Agreement Schedules”), duly executed by Delek US and each applicable subsidiary of Delek US (excluding the General Partner, the Buyer and the Partnership and its subsidiaries).

(e) A counterpart of an amended and restated site services agreement in the form mutually agreed upon by Lion and the Buyer (the “Site Services Agreement”), duly executed by Lion.

(f) A counterpart to a right of way agreement in the form mutually agreed upon by the Parties (the “Right of Way Agreement”), duly executed by Lion.

(g) A counterpart to a secondment agreement in the form mutually agreed upon by the Parties (the “Amended and Restated Secondment Agreement”), duly executed by Lion.

(h) Evidence in form and substance reasonably satisfactory to the Buyer of the release and termination of all Encumbrances on the Transferred Assets, other than Permitted Encumbrances.

3.3 Deliveries by the Buyer. At the Closing, the Buyer shall deliver, or cause to be delivered, to the Sellers the following:

(a) The Purchase Price as provided in Section 2.5(a).

(b) A counterpart to the Lease and Access Agreement, duly executed by the Buyer.

(c) A counterpart to the Rail Offloading Agreement, duly executed by the Buyer.

(d) A counterpart of the Restated Omnibus Agreement Schedules, duly executed by the General Partner, the Buyer and the Partnership and its subsidiaries.

(e) A counterpart to the Site Services Agreement, duly executed by the Buyer.

(f) A counterpart to the Right of Way Agreement, duly executed by the Buyer.

(g) A counterpart to the Bill of Sale, duly executed by the Buyer.

[Signature Page to Asset Purchase Agreement]

(h) A counterpart to the Amended and Restated Secondment Agreement, duly executed by the General Partner.

3.4 Prorations. On the Closing Date, or as promptly as practicable following the Closing Date, but in no event later than 60 calendar days thereafter, the personal property taxes with respect to the Transferred Assets shall be prorated between the Buyer, on the one hand, and the Sellers, on the other hand, effective as of the Effective Time with the Sellers being responsible for amounts related to the period prior to but excluding the Effective Time and the Buyer being responsible for amounts related to the period at and after the Effective Time. If the final property tax rate or final assessed value for the current tax year is not established by the Closing Date, the prorations shall be made on the basis of the rate or assessed value in effect for the preceding tax year and shall be adjusted when the exact amounts are determined. All such prorations shall be based upon the most recent available assessed value available prior to the Closing Date.

3.5 Reimbursement. If the Buyer, on the one hand, or the Sellers, on the other hand, pays any tax agreed to be borne by the other Party under this Agreement, such other Party shall promptly reimburse the paying Party for the amounts so paid. If any Party receives any tax refund or credit applicable to a tax paid by another Party hereunder, the receiving Party shall promptly pay such amounts to the Party entitled thereto.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE SELLERS

REPRESENTATIONS AND WARRANTIES OF THE SELLERS

The Sellers, jointly and severally, hereby represent and warrant to the Buyer that as of the date of this Agreement:

4.1 Organization. Lion is a corporation duly organized and validly existing, under the Applicable Laws of the State of Arkansas. LOTT is a limited liability company, validly existing and in good standing under the Applicable Laws of the State of Texas. Each Seller is duly authorized to conduct business and is in good standing under the Applicable Laws of each jurisdiction where such qualification is required, except where the lack of such qualification would not have a Material Adverse Effect. Each Seller has the requisite corporate or limited liability company power, as applicable, and authority necessary to carry on its business and to own and use the Transferred Assets owned or operated by it.

4.2 Authorization. The Sellers have full corporate or limited liability company power, as applicable, and authority to execute, deliver, and perform this Agreement and any Seller Ancillary Documents to which it is a party. The execution, delivery, and performance by each Seller of this Agreement and the Seller Ancillary Documents and the consummation by each Seller of the transactions contemplated hereby and thereby, have been duly authorized by all necessary corporate or limited liability company action, as applicable, of the Sellers. This Agreement has been duly executed and delivered by the Sellers and constitutes, and each Seller Ancillary Document executed or to be executed by any Seller has been, or when executed will be, duly executed and delivered by such Seller and constitutes, or when executed and delivered will constitute, a valid and legally binding obligation of such Seller, enforceable against it in accordance with their terms, except to the extent that such enforceability may be limited by (a) applicable bankruptcy, insolvency,

[Signature Page to Asset Purchase Agreement]

reorganization, moratorium, fraudulent conveyance or other similar laws affecting creditors’ rights and remedies generally and (b) equitable principles which may limit the availability of certain equitable remedies (such as specific performance) in certain instances.

4.3 No Conflicts or Violations; No Consents or Approvals Required. The execution, delivery and performance by the Sellers of this Agreement and the Seller Ancillary Documents to which it is a party does not, and the consummation of the transactions contemplated hereby and thereby will not, (a) violate, conflict with, or result in any breach of any provision of such Seller’s certificate of incorporation, bylaws, certificate of formation, limited liability company agreement or similar governing documents, (b) violate in any material respect any Applicable Law to which any Seller is subject or to which any Transferred Asset is subject or (c) result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify, or cancel, or require any notice or trigger any rights to payment or other compensation under any Contract (oral or written) to which any Seller is a party or by which it is bound that relates to the Transferred Assets, or that could prevent or materially delay the consummation of the transactions contemplated by this Agreement. No Consents are required in connection with the execution, delivery and performance by any Seller of this Agreement and the Seller Ancillary Documents to which any Seller is a party or the consummation of the transactions contemplated hereby or thereby.

4.4 Absence of Litigation. There is no Action pending or, to the knowledge of any Seller, threatened against the Sellers or any of their Affiliates relating to the transactions contemplated by this Agreement or the Ancillary Documents or the Transferred Assets or which, if adversely determined, would reasonably be expected to materially impair the ability of the Sellers to perform their obligations and agreements under this Agreement or the Seller Ancillary Documents and to consummate the transactions contemplated hereby and thereby.

4.5 Bankruptcy. There are no bankruptcy, reorganization or rearrangement proceedings under any bankruptcy, insolvency, reorganization, moratorium or other similar laws with respect to creditors pending against, being contemplated by, or, to the knowledge of any Seller, threatened, against the Sellers.

4.6 Brokers and Finders. No investment banker, broker, finder, financial advisor or other intermediary has been retained by or is authorized to act on behalf of the Sellers or their Affiliates who is entitled to receive from the Buyer any fee or commission in connection with the transactions contemplated by this Agreement.

4.7 Title to Transferred Assets.

(a) The Sellers have good and valid title to the Transferred Assets, free and clear of all Encumbrances, other than Permitted Encumbrances.

(b) There has not been granted to any Person, and no Person possesses, any right of first refusal to purchase any of the Transferred Assets, except pursuant to this Agreement and the Restated Omnibus Agreement.

[Signature Page to Asset Purchase Agreement]

4.8 Permits. The Sellers have all material Permits necessary for the operation of the Transferred Assets at the location and in the manner operated as of the date hereof. The Sellers are in material compliance with all Permits, all such Permits are in full force and effect, and there is no Action pending or, to the knowledge of the Sellers, threatened before any Governmental Authority that seeks the revocation, cancellation, suspension or adverse modification thereof.

4.9 Condition of Transferred Assets; Sufficiency of Transferred Assets. The Transferred Assets are in good operating condition and repair (normal wear and tear excepted), are free from material defects (patent and latent), are suitable for the purposes for which they are currently used and are not in need of material maintenance or repairs except for ordinary routine maintenance and repairs. The Transferred Assets, together with the rights granted to Buyer pursuant to the Ancillary Documents, constitute all of the assets and rights necessary to conduct the business of the Transferred Assets in a manner consistent with past practice.

4.10 Compliance with Applicable Law. Except where the failure to be in compliance would not have a Material Adverse Effect, with respect to the Transferred Assets, including their operation, the Sellers are and have been in compliance with all, and, to the knowledge of the Sellers, is not under investigation with respect to and has not been threatened to be charged with or given notice of any violation of any, Applicable Laws (other than Environmental Laws). To the knowledge of the Sellers, the Sellers have disclosed to the Buyer in writing prior to the execution hereof all investigations or notices of any material violations of any Applicable Laws (other than Environmental Laws) received by the Sellers or their Affiliates related to the Transferred Assets within the last five years.

4.11 Compliance with Environmental Law. Except where the failure to be in compliance would not have a Material Adverse Effect, with respect to the Transferred Assets, including their operation, the Sellers are and have been in compliance with all, and, to the knowledge of the Sellers, is not under investigation with respect to and has not been threatened to be charged with or given notice of any violation of any, applicable Environmental Laws. To the knowledge of the Sellers, the Sellers have disclosed to the Buyer in writing prior to the execution hereof all investigations or notices of any material violations of any Environmental Laws received by the Sellers or their Affiliates related to the Transferred Assets within the last five years.

4.12 Conflicts Committee Matters. The projections and budgets provided to the conflicts committee of the board of directors of the General Partner (including those provided to the financial advisor to the conflicts committee) as part of its review in connection with this Agreement and the transactions contemplated hereby were prepared and delivered in good faith and have a reasonable basis and are consistent with the current expectations of the Sellers’ management regarding the Transferred Assets.

4.13 WAIVERS AND DISCLAIMERS. NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED IN THIS AGREEMENT, EXCEPT FOR THE EXPRESS REPRESENTATIONS AND WARRANTIES AND OTHER COVENANTS AND AGREEMENTS MADE BY THE PARTIES IN THIS AGREEMENT, THE ANCILLARY DOCUMENTS AND THE RESTATED OMNIBUS AGREEMENT, THE PARTIES HERETO ACKNOWLEDGE AND AGREE THAT NONE OF THE PARTIES HAS MADE, DOES NOT MAKE, AND EACH SUCH

[Signature Page to Asset Purchase Agreement]

PARTY SPECIFICALLY NEGATES AND DISCLAIMS, ANY REPRESENTATIONS, WARRANTIES, PROMISES, COVENANTS, AGREEMENTS OR GUARANTIES OF ANY KIND OR CHARACTER WHATSOEVER, WHETHER EXPRESS, IMPLIED OR STATUTORY, ORAL OR WRITTEN, PAST OR PRESENT, REGARDING (I) THE VALUE, NATURE, QUALITY OR CONDITION OF THE TRANSFERRED ASSETS INCLUDING, WITHOUT LIMITATION, THE WATER, SOIL, GEOLOGY OR ENVIRONMENTAL CONDITION OF THE TRANSFERRED ASSETS GENERALLY, INCLUDING THE PRESENCE OR LACK OF HAZARDOUS SUBSTANCES OR OTHER MATTERS ON THE TRANSFERRED ASSETS, (II) THE INCOME TO BE DERIVED FROM THE TRANSFERRED ASSETS, (III) THE SUITABILITY OF THE TRANSFERRED ASSETS FOR ANY AND ALL ACTIVITIES AND USES THAT MAY BE CONDUCTED THEREON, (IV) THE COMPLIANCE OF OR BY THE TRANSFERRED ASSETS OR THEIR OPERATION WITH ANY APPLICABLE LAWS (INCLUDING WITHOUT LIMITATION ANY ZONING, ENVIRONMENTAL PROTECTION, POLLUTION OR LAND USE LAWS, RULES, REGULATIONS, ORDERS OR REQUIREMENTS), OR (V) THE HABITABILITY, MERCHANTABILITY, MARKETABILITY, PROFITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OF THE TRANSFERRED ASSETS. EXCEPT TO THE EXTENT PROVIDED IN THIS AGREEMENT, THE ANCILLARY DOCUMENTS OR THE RESTATED OMNIBUS AGREEMENT, NONE OF THE PARTIES IS LIABLE OR BOUND IN ANY MANNER BY ANY ORAL OR WRITTEN STATEMENTS, REPRESENTATIONS OR INFORMATION PERTAINING TO THE TRANSFERRED ASSETS FURNISHED BY ANY AGENT, EMPLOYEE, SERVANT OR THIRD PARTY. EXCEPT TO THE EXTENT PROVIDED IN THIS AGREEMENT, THE ANCILLARY DOCUMENTS OR THE RESTATED OMNIBUS AGREEMENT, EACH OF THE PARTIES HERETO ACKNOWLEDGES THAT TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, THE TRANSFER AND CONVEYANCE OF THE TRANSFERRED ASSETS SHALL BE MADE IN AN “AS IS,” “WHERE IS” CONDITION WITH ALL FAULTS, AND THE TRANSFERRED ASSETS ARE TRANSFERRED AND CONVEYED SUBJECT TO ALL OF THE MATTERS CONTAINED IN THIS SECTION 4.13. THIS SECTION 4.13 SHALL SURVIVE THE TRANSFER AND CONVEYANCE OF THE TRANSFERRED ASSETS OR THE TERMINATION OF THIS AGREEMENT. THE PROVISIONS OF THIS SECTION 4.13 HAVE BEEN NEGOTIATED BY THE PARTIES AFTER DUE CONSIDERATION AND ARE INTENDED TO BE A COMPLETE EXCLUSION AND NEGATION OF ANY REPRESENTATIONS OR WARRANTIES, WHETHER EXPRESS, IMPLIED OR STATUTORY, WITH RESPECT TO THE TRANSFERRED ASSETS THAT MAY ARISE PURSUANT TO APPLICABLE LAW NOW OR HEREAFTER IN EFFECT, OR OTHERWISE, EXCEPT AS SET FORTH IN THIS AGREEMENT, THE ANCILLARY DOCUMENTS OR THE RESTATED OMNIBUS AGREEMENT.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF THE BUYER

REPRESENTATIONS AND WARRANTIES OF THE BUYER

The Buyer hereby represents and warrants to the Sellers that as of the date of this Agreement:

5.1 Organization. The Buyer is a limited liability company, validly existing and in good standing under the Applicable Laws of the State of Delaware.

[Signature Page to Asset Purchase Agreement]

5.2 Authorization. The Buyer has full limited liability company power and authority to execute, deliver, and perform this Agreement and any Buyer Ancillary Documents to which it is a party. The execution, delivery, and performance by the Buyer of this Agreement and the Buyer Ancillary Documents and the consummation by the Buyer of the transactions contemplated hereby and thereby, have been duly authorized by all necessary limited liability company action of the Buyer. This Agreement has been duly executed and delivered by the Buyer and constitutes, and each Buyer Ancillary Document executed or to be executed the Buyer has been, or when executed will be, duly executed and delivered by the Buyer and constitutes, or when executed and delivered will constitute, a valid and legally binding obligation of the Buyer, enforceable against it in accordance with their terms, except to the extent that such enforceability may be limited by (a) applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar laws affecting creditors’ rights and remedies generally and (b) equitable principles which may limit the availability of certain equitable remedies (such as specific performance) in certain instances.

5.3 No Conflicts or Violations; No Consents or Approvals Required. The execution, delivery and performance by the Buyer of this Agreement and the Buyer Ancillary Documents to which it is a party does not, and consummation of the transactions contemplated hereby and thereby will not, (a) violate, conflict with, or result in any breach of any provisions of the Buyer’s certificate of formation or limited liability company agreement, (b) violate in any material respect any Applicable Law to which the Buyer is subject or (c) result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify, or cancel, or require any notice or trigger any rights to payment or other compensation under any Contract to which the Buyer is a party or by which it is bound that could prevent or materially delay the consummation of the transactions contemplated by this Agreement. No Consents are required in connection with the execution, delivery and performance by the Buyer of this Agreement and the Buyer Ancillary Documents to which the Buyer is a party or the consummation of the transactions contemplated hereby or thereby.

5.4 Absence of Litigation. There is no Action pending or, to the knowledge of the Buyer, threatened against the Buyer or any of its Affiliates relating to the transactions contemplated by this Agreement or the Ancillary Documents or which, if adversely determined, would reasonably be expected to materially impair the ability of the Buyer to perform its obligations and agreements under this Agreement or the Buyer Ancillary Documents and to consummate the transactions contemplated hereby and thereby.

5.5 Brokers and Finders. No investment banker, broker, finder, financial advisor or other intermediary has been retained by or is authorized to act on behalf of the Buyer or its Affiliates who is entitled to receive from the Seller any fee or commission in connection with the transactions contemplated by this Agreement.

5.6 Environmental Consent Decree. The Buyer acknowledges that it has received notice and a copy of the consent decree entered in United States and State of Arkansas v. Lion Oil Company, Civ. No. 03-1028 (Western District of Arkansas) (the “Environmental Consent Decree”). The

[Signature Page to Asset Purchase Agreement]

Buyer further acknowledges that the Sellers have made no representation as to whether any Transferred Assets are subject to the Environmental Consent Decree.

ARTICLE VI

COVENANTS

COVENANTS

6.1 Additional Agreements. Subject to the terms and conditions of this Agreement, the Ancillary Documents and the Restated Omnibus Agreement, each of the Parties shall use its commercially reasonable efforts to do, or cause to be taken all action and to do, or cause to be done, all things necessary, proper, or advisable under Applicable Laws to consummate and make effective the transactions contemplated by this Agreement. If at any time after the Closing Date any further action is necessary or desirable to carry out the purposes of this Agreement, the Parties and their duly authorized representatives shall use commercially reasonable efforts to take all such action.

6.2 Further Assurances. After the Closing, each Party shall take such further actions, including obtaining consents to assignment from third parties, and execute such further documents as may be necessary or reasonably requested by the other Party in order to effectuate the intent of this Agreement and the Ancillary Documents and to provide such other Party with the intended benefits of this Agreement and the Ancillary Documents. Following the Closing, the Buyer and the Sellers agree to remit to the other Party or its Affiliates, as applicable, with reasonable promptness, any payments, rebates, bills or other correspondence received on or in respect of, or otherwise relevant to the other Party or its Affiliates including, with respect to the Buyer, the Transferred Assets or, with respect to the Sellers, the Excluded Assets.

6.3 Cooperation on Tax Matters. Following the Closing Date, the Parties shall cooperate fully with each other and shall make available to the other, as reasonably requested and at the expense of the requesting Party, and to any Governmental Authority responsible for the administration of any tax, all information, records or documents relating to tax liabilities or potential tax liabilities of the Sellers for all periods at or prior to the Effective Time and any information which may be relevant to determining the amount payable under this Agreement, and shall preserve all such information, records and documents at least until the expiration of any applicable statute of limitations or extensions thereof.

6.4 Cooperation for Litigation and Other Actions. Each Party shall cooperate reasonably with the other Party, at the requesting Party’s expense (but including only out-of-pocket expenses to unaffiliated third parties, photocopying and delivery costs and not the costs incurred by any Party for the wages or other benefits paid to its officers, directors or employees), in furnishing reasonably available information, testimony and other assistance in connection with any proceedings, tax audits or other Disputes involving any of the Parties hereto (other than in connection with Disputes between the Parties).

6.5 Retention of and Access to Books and Records.

(a) As promptly as practicable and in any event before 30 days after the Closing Date, the Sellers will deliver or cause to be delivered to the Buyer, the Books and Records that are in the possession or control of the Sellers or their Affiliates.

[Signature Page to Asset Purchase Agreement]

(b) The Buyer agrees to afford the Sellers and their Affiliates and their respective accountants, counsel and other designated individuals, during normal business hours, upon reasonable request, at a mutually agreeable time, full access to and the right to make copies of the Books and Records at no cost to the Sellers or their Affiliates (other than for reasonable out-of-pocket expenses); provided that such access will not be construed to require the disclosure of Books and Records that would cause the waiver of any attorney-client, work product or like privilege; provided, further, that in the event of any litigation, nothing herein shall limit any Party’s rights of discovery under Applicable Law. Without limiting the generality of the preceding sentences, the Buyer agrees to provide the Sellers and their Affiliates reasonable access to and the right to make copies of the Books and Records after the Closing for the purposes of assisting the Sellers and their Affiliates (a) in complying with the Sellers’ obligations under this Agreement, (b) in preparing and delivering any accounting statements provided for under this Agreement and adjusting, prorating and settling the charges and credits provided for in this Agreement, (c) in owning or operating the Excluded Assets, (d) in preparing tax returns, (e) in responding to or disputing any tax audit, (f) in asserting, defending or otherwise dealing with any claim or dispute, known or unknown, under this Agreement or with respect to Excluded Assets or (g) in asserting, defending or otherwise dealing with any third party claim or dispute by or against the Sellers or their Affiliates relating to the Transferred Assets.

6.6 Permits; Certain Real Property.

(a) During the term of the Rail Offloading Agreement, (i) the Sellers shall maintain all Permits necessary for the operation of the Transferred Assets, and (ii) if the Buyer reasonably determines that it is necessary to transfer any such Permits to the Buyer or its designee, the Sellers shall, at their own expense, take such actions as are necessary to transfer such Permits.

(b) The Sellers shall use commercially reasonable efforts to obtain, at their own expense, any lease, right-of-way or other agreement, including those with the owner of the South Rack Parcel and those with the owner of the North Rack Parcel, reasonably necessary to permit the Buyer to own and operate (i) the portion of the Rail Offloading Facility located on the South Rack Parcel and any improvement or replacement thereof and (ii) the portion of the Rail Offloading Facility located on the North Rack Parcel, in each case through at least the Term (as defined in the Rail Offloading Agreement).

6.7 Environmental Consent Decree. Upon the Sellers’ request and solely to the extent that any Transferred Asset is subject to the Environmental Consent Decree, the Buyer will execute a modification to the Environmental Consent Decree that makes the Buyer responsible for complying with the terms and conditions of the Environmental Consent Decree as may be required by the United States Environmental Protection Agency with respect to such Transferred Assets. The Parties acknowledge that the prior sentence does not affect the indemnity in Section 3.1(a) of the Restated Omnibus Agreement.

6.8 Delayed Assets.

(a) Notwithstanding anything herein to the contrary, any Transferred Asset, the assignment, transfer, conveyance or delivery of which to the Buyer without a Consent would

[Signature Page to Asset Purchase Agreement]

constitute a breach or other contravention of law or the terms of such Transferred Asset (a “Delayed Asset”), shall not be assigned, transferred, conveyed or delivered to the Buyer until such time as such Consent is obtained, at which time such Delayed Asset shall be automatically assigned, transferred, conveyed or delivered without further action on the part of the Buyer or the Sellers.

(b) Until such time as such Consent is obtained, (i) each Party (and its applicable subsidiaries and Affiliates) shall use its commercially reasonable efforts to obtain the relevant Consent; provided, that no Party shall be required to pay any monies or give any other consideration in order to obtain any such Consents, (ii) the Sellers shall endeavor to provide the Buyer with the benefits under each Delayed Asset as if such Delayed Asset had been assigned to the Buyer (including by means of any subcontracting, sublicensing or subleasing arrangement), to the extent such is permitted under the applicable Delayed Assets, (iii) the Sellers shall promptly pay over to the Buyer or its subsidiaries payments received by the Sellers after the Closing in respect of all Delayed Assets, and (iv) the Buyer shall be responsible for the liabilities of the Sellers with respect to such Delayed Asset. Notwithstanding any other provision in this Agreement to the contrary, following the assignment, transfer, conveyance and delivery of any Delayed Asset, the applicable Delayed Asset shall be treated for all purposes of this Agreement as a Transferred Asset.

(c) Buyer hereby agrees that the failure to obtain any such Consent referred to in this Section 6.8 or the failure of any such Delayed Asset to constitute a Transferred Asset or any circumstances resulting therefrom shall not constitute a breach by the Sellers of any representation, warranty, covenant or agreement under this Agreement; provided, however, that any breach by the Sellers of its covenants in this Section 6.8 may constitute a breach under this Agreement. Nothing in this Section 6.8 shall be deemed to constitute an agreement to exclude from the Transferred Assets any such Delayed Asset.

ARTICLE VII

INDEMNIFICATION

7.1 Indemnification of Buyer and Sellers. From and after the Closing and subject to the provisions of this Article VII, (i) the Sellers, jointly and severally, agree to indemnify and hold harmless the Buyer Indemnified Parties from and against any and all Buyer Indemnified Costs and (ii) Buyer agrees to indemnify and hold harmless the Seller Indemnified Parties from and against any and all Seller Indemnified Costs; provided, that for purposes of this Section 7.1, any breach of Sellers’ or Buyer’s representations and warranties or failure to comply with any covenant or agreement and the amount of any Buyer Indemnified Costs or Seller Indemnified Costs, as applicable, arising from a breach thereof shall be determined without giving effect to any qualification as to materiality or Material Adverse Effect. For the avoidance of doubt, the foregoing indemnification is intended to be in addition to and not in limitation of any indemnification to which the Parties may be entitled under the Ancillary Documents.

7.2 Defense of Third-Party Claims. An Indemnified Party shall give prompt written notice to Sellers or Buyer, as applicable (the “Indemnifying Party”), of the commencement or assertion of any action, proceeding, demand, or claim by a third party (collectively, a “third-party action”) in respect of which such Indemnified Party seeks indemnification hereunder. Any failure so to notify the Indemnifying Party shall not relieve the Indemnifying Party from any liability that

[Signature Page to Asset Purchase Agreement]

it, he, or she may have to such Indemnified Party under this Article VII unless the failure to give such notice materially and adversely prejudices the Indemnifying Party. The Indemnifying Party shall have the right to assume control of the defense of, settle, or otherwise dispose of such third-party action on such terms as it deems appropriate; provided, however, that:

(a) The Indemnified Party shall be entitled, at its own expense, to participate in the defense of such third-party action (provided, however, that the Indemnifying Party shall pay the attorneys’ fees of the Indemnified Party if (i) the employment of separate counsel shall have been authorized in writing by any the Indemnifying Party in connection with the defense of such third-party action, (ii) the Indemnifying Party shall not have employed counsel reasonably satisfactory to the Indemnified Party to have charge of such third-party action, (iii) the Indemnified Party shall have reasonably concluded that there may be defenses available to such Indemnified Party that are different from or additional to those available to the Indemnifying Party, or (iv) the Indemnified Party’s counsel shall have advised the Indemnified Party in writing, with a copy delivered to the Indemnifying Party, that there is a material conflict of interest that could violate applicable standards of professional conduct to have common counsel);

(b) The Indemnifying Party shall obtain the prior written approval of the Indemnified Party before entering into or making any settlement, compromise, admission, or acknowledgment of the validity of such third-party action or any liability in respect thereof if, pursuant to or as a result of such settlement, compromise, admission, or acknowledgment, injunctive or other equitable relief would be imposed against the Indemnified Party or if, in the opinion of the Indemnified Party, such settlement, compromise, admission, or acknowledgment could have a material adverse effect on its business;

(c) The Indemnifying Party shall not consent to the entry of any judgment or enter into any settlement that does not include as an unconditional term thereof the giving by each claimant or plaintiff to each Indemnified Party of a release from all liability in respect of such third-party action; and

(d) The Indemnifying Party shall not be entitled to control (but shall be entitled to participate at its own expense in the defense of), and the Indemnified Party shall be entitled to have sole control over, the defense or settlement, compromise, admission, or acknowledgment of any third-party action (i) as to which the Indemnifying Party fails to assume the defense within a reasonable length of time or (ii) to the extent the third-party action seeks an order, injunction, or other equitable relief against the Indemnified Party which, if successful, would materially adversely affect the business, operations, assets, or financial condition of the Indemnified Party; provided, however, that the Indemnified Party shall make no settlement, compromise, admission, or acknowledgment that would give rise to liability on the part of any Indemnifying Party without the prior written consent of such Indemnifying Party.

The Parties shall extend reasonable cooperation in connection with the defense of any third-party action pursuant to this Article VII and, in connection therewith, shall furnish such records, information, and testimony and attend such conferences, discovery proceedings, hearings, trials, and appeals as may be reasonably requested.

[Signature Page to Asset Purchase Agreement]

7.3 Direct Claims. In any case in which an Indemnified Party seeks indemnification hereunder which is not subject to Section 7.2 because no third-party action is involved, the Indemnified Party shall notify the Indemnifying Party in writing of any Indemnified Costs which such Indemnified Party claims are subject to indemnification under the terms hereof. Subject to the limitations set forth in Section 7.4(a), the failure of the Indemnified Party to exercise promptness in such notification shall not amount to a waiver of such claim unless the resulting delay materially prejudices the position of the Indemnifying Party with respect to such claim.

7.4 Limitations. The following provisions of this Section 7.4 shall limit the indemnification obligations hereunder:

(a) The Indemnifying Party shall not be liable for any Indemnified Costs pursuant to this Article VII unless a written claim for indemnification in accordance with Section 7.2 or Section 7.3 is given by the Indemnified Party to the Indemnifying Party with respect thereto on or before 5:00 p.m., Nashville, Tennessee time, on or prior to the first anniversary of the Closing Date; provided, however, that written claims for indemnification (i) for Indemnified Costs arising out of (x) a breach of any representation or warranty contained in Sections 4.1, 4.2, 4.3, 4.6, 4.7, 5.1, 5.2, 5.3 and 5.5 (the “Fundamental Representations”) or (y) an Excluded Liability may be made at any time, (ii) the Specified Title Matters related to the South Rack Parcel may be made at any time prior to effectiveness of any lease, right-of-way or other agreement contemplated by Section 6.6(b); (iii) the Specified Title Matters related to the North Rack Parcel may be made at any time prior to the later of (1) the date on which the Sellers provide the Buyer with a survey showing that all of the North Rack Parcel is on real estate owned by the Sellers and (2) the date of the effectiveness of any lease, right-of-way or other agreement contemplated by Section 6.6(b), in the case of (1) and (2), provided that the Sellers have provided evidence reasonably satisfactory to the Buyer that the North Rack Parcel is free and clear of all Encumbrances (other than Permitted Encumbrances) that would materially and adversely affect Logistics’ rights with regard to the North Rack Parcel under the Lease and Access Agreement or its ability to perform its obligations under the Rail Offloading Agreement and (iii) for Indemnified Costs arising out of a breach of any covenant may be made at any time prior to the expiration of such covenant according to its terms; provided, however, that with respect to clauses (ii) and (iii)(2) above, any lease, right-of-way or other agreement obtained pursuant to Section 6.6(b) shall include a complete release of the Buyer from any and all Claims related to the South Rack Parcel or the North Rack Parcel, as applicable, arising out of or related to time periods prior to the effectiveness of the applicable lease, right-of-way or other agreement.

(b) An Indemnifying Party shall not be obligated to pay for any Indemnified Costs under this Article VII until the amount of all such Indemnified Costs exceeds, in the aggregate, $225,000, in which event Indemnifying Party shall pay or be liable for all such Indemnified Costs from the first dollar. The aggregate liability of an Indemnifying Party under this Article VII shall not exceed $6,500,000. The limitations in the previous two sentences shall not apply to Indemnified Costs to the extent such costs arise out of (i) a breach of any Fundamental Representations, (ii) a Specified Title Matter or (iii) an Excluded Liability.

(c) Each Party acknowledges and agrees that, after the Closing Date, notwithstanding any other provision of this Agreement to the contrary, the Buyer’s and the other

[Signature Page to Asset Purchase Agreement]

Buyer Indemnified Parties’ and the Sellers’ and the other Seller Indemnified Parties’ sole and exclusive remedy with respect to the Indemnified Costs shall be in accordance with, and limited by, the provisions set forth in this Article VII. The Parties further acknowledge and agree that the foregoing is not the remedy for and does not limit the Parties’ remedies for matters covered by the indemnification provisions contained in the Ancillary Documents. Any indemnification obligation of the Sellers to the Buyer Indemnified Parties on the one hand, or the Buyer to the Seller Indemnified Parties on the other hand, pursuant to this Article VII shall be reduced by an amount equal to any indemnification recovery by such Indemnified Parties pursuant to the other Ancillary Documents between the Parties to the extent that such other indemnification recovery arises out of the same event or circumstance giving rise to the indemnification obligation of the Sellers or the Buyer, respectively, hereunder.

7.5 Tax Related Adjustments. The Sellers and the Buyer agree that any payment of Indemnified Costs made hereunder will be treated by the Parties on their tax returns as an adjustment to the Purchase Price.

ARTICLE VIII

LIMITED GUARANTY

8.1 Limited Guaranty by Delek US. Delek US hereby unconditionally and irrevocably guarantees to the Buyer the due and punctual payment of all payment obligations of the Sellers insofar as such payment obligations relate to the indemnification under Article VII in respect of Specified Title Matters. In the case of the failure of the Sellers to make any such payment as and when due, Delek US hereby agrees to make such payment or cause such payment to be made, promptly upon written demand by the Buyer to Delek US, but any delay in providing such notice shall not under any circumstances reduce the liability of Delek US or operate as a waiver of the Buyer’s right to demand payment.

ARTICLE IX

MISCELLANEOUS

9.1 Expenses. Except as provided in Section 3.4 of this Agreement, or as provided in the Ancillary Documents or the Restated Omnibus Agreement, all costs and expenses incurred by the Parties in connection with the consummation of the transactions contemplated hereby shall be borne solely and entirely by the Party which has incurred such expense. For the avoidance of doubt, the Buyer shall be responsible for all costs and expenses (including attorneys’ fees and expenses) incurred by the conflicts committee of the General Partner in connection with this Agreement and the transactions contemplated herein. Except as this Agreement otherwise provides, the Sellers, on the one hand, and the Buyer, on the other, shall each be responsible for 50% of the payment of the aggregate costs associated with obtaining the consents, approvals or authorizations necessary to effect the transfer of the Transferred Assets to the Buyer as contemplated herein.

9.2 Notices. All notices, requests, demands, and other communications hereunder will be in writing and will be deemed to have been duly given upon confirmation of actual delivery thereof: (a) by transmission by facsimile or hand delivery; (b) mailed via the official governmental mail system, sent first class, postage pre-paid, via certified or registered mail, with a return receipt

[Signature Page to Asset Purchase Agreement]

requested; (c) mailed by an internationally recognized overnight express mail service such as FedEx, UPS, or DHL Worldwide; or (d) by e-mail. All notices will be addressed to the Parties at the respective addresses as follows:

if to the Sellers:

Lion Oil Company

c/o Delek US Holdings, Inc.

7102 Commerce Way

Brentwood, TN 37027

Attn: General Counsel

Telecopy No: (615) 435-1271

c/o Delek US Holdings, Inc.

7102 Commerce Way

Brentwood, TN 37027

Attn: General Counsel

Telecopy No: (615) 435-1271

and

Lion Oil Trading & Transportation, LLC

c/o Delek US Holdings, Inc.

7102 Commerce Way

Brentwood, TN 37027

Attn: General Counsel

Telecopy No: (615) 435-1271

c/o Delek US Holdings, Inc.

7102 Commerce Way

Brentwood, TN 37027

Attn: General Counsel

Telecopy No: (615) 435-1271

with a copy, which shall not constitute notice, to:

Lion Oil Company

c/o Delek US Holdings, Inc.

7102 Commerce Way

Brentwood, TN 37027

Attn: President

Telecopy No: (615) 435-1271

c/o Delek US Holdings, Inc.

7102 Commerce Way

Brentwood, TN 37027

Attn: President

Telecopy No: (615) 435-1271

if to the Buyer:

Delek Logistics Operating, LLC

c/o Delek Logistics GP, LLC

7102 Commerce Way

Brentwood, TN 37027

Attn: General Counsel

Telecopy No: (615) 435-1271

c/o Delek Logistics GP, LLC

7102 Commerce Way

Brentwood, TN 37027

Attn: General Counsel

Telecopy No: (615) 435-1271

with a copy, which shall not constitute notice, to:

Delek Logistics Operating, LLC

c/o Delek Logistics GP, LLC

7102 Commerce Way

c/o Delek Logistics GP, LLC

7102 Commerce Way

[Signature Page to Asset Purchase Agreement]

Brentwood, TN 37027

Attn: Chief Executive Officer

Telecopy No: (615) 435-1271

Attn: Chief Executive Officer

Telecopy No: (615) 435-1271

if to the Guarantor:

Delek US Holdings, Inc.

7102 Commerce Way

Brentwood, TN 37027

Attn: General Counsel

Telecopy No: (615) 435-1271

7102 Commerce Way

Brentwood, TN 37027

Attn: General Counsel

Telecopy No: (615) 435-1271

with a copy, which shall not constitute notice, to:

Delek US Holdings, Inc.

7102 Commerce Way

Brentwood, TN 37027

Attn: President

Telecopy No: (615) 435-1271

7102 Commerce Way

Brentwood, TN 37027

Attn: President

Telecopy No: (615) 435-1271

or to such other address or to such other person as either Party will have last designated by notice to the other Party.

9.3 Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be valid and effective under Applicable Law, but if any provision of this Agreement or the application of any such provision to any person or circumstance will be held invalid, illegal or unenforceable in any respect by a court of competent jurisdiction, such invalidity, illegality or unenforceability will not affect any other provision hereof, and the Parties will negotiate in good faith with a view to substitute for such provision a suitable and equitable solution in order to carry out, so far as may be valid and enforceable, the intent and purpose of such invalid, illegal or unenforceable provision.

9.4 Governing Law. This Agreement shall be subject to and governed by the laws of the State of Texas, excluding any conflicts-of-law rule or principle that might refer the construction or interpretation of this Agreement to the laws of another state.

9.5 Arbitration Provision. Any and all Disputes shall be resolved through the use of binding arbitration using three arbitrators, in accordance with the Commercial Arbitration Rules of the American Arbitration Association, as supplemented to the extent necessary to determine any procedural appeal questions by the Federal Arbitration Act (Title 9 of the United States Code). If there is any inconsistency between this Section 9.5 and the Commercial Arbitration Rules or the Federal Arbitration Act, the terms of this Section 9.5 will control the rights and obligations of the Parties. Arbitration must be initiated within the time limits set forth in this Agreement, or if no such limits apply, then within a reasonable time or the time period allowed by the applicable statute of limitations. Arbitration may be initiated by а Party (“Claimant”) serving written notice on the other Party (“Respondent”) that the Claimant elects to refer the Dispute to binding arbitration. Claimant’s

[Signature Page to Asset Purchase Agreement]

notice initiating binding arbitration must identify the arbitrator Claimant has appointed. The Respondent shall respond to Claimant within 30 days after receipt of Claimant’s notice, identifying the arbitrator Respondent has appointed. If the Respondent fails for any reason to name an arbitrator within the 30-day period, Claimant shall petition the American Arbitration Association for appointment of an arbitrator for Respondent’s account. The two arbitrators so chosen shall select а third arbitrator within 30 days after the second arbitrator has been appointed. The Claimant will pay the compensation and expenses of the arbitrator named by or for it, and the Respondent will pay the compensation and expenses of the arbitrator named by or for it. The costs of petitioning for the appointment of an arbitrator, if any, shall be paid by Respondent. The Claimant and Respondent will each pay one-half of the compensation and expenses of the third arbitrator. All arbitrators must (i) be neutral parties who have never been officers, directors or employees of the Sellers, the Buyer or any of their Affiliates and (ii) have not less than seven years’ experience of in the energy industry. The hearing will be conducted in Houston, Texas and commence within 30 days after the selection of the third arbitrator. The Sellers, the Buyer and the arbitrators shall proceed diligently and in good faith in order that the award may be made as promptly as possible. Except as provided in the Federal Arbitration Act, the decision of the arbitrators will be binding on and non-appealable by the Parties hereto. The arbitrators shall have no right to grant or award Special Damages in favor of Sellers, on one hand (except to the extent such Special Damages (a) are awarded to a third-party or (b) are the result of the gross negligence or willful misconduct of the Buyer), or Buyer, on the other hand (except to the extent such Special Damages (1) (x) are awarded to a third-party, (y) are the result of the gross negligence or willful misconduct of the Sellers, or (z) the failure of the Sellers to perform their obligations under Section 6.6 and (2) are Special Damages (excluding punitive damages) arising out of any Specified Title Matters not otherwise provided for in clause (1)(x) above).

9.6 Confidentiality.

(a) Obligations. Each Party shall use commercially reasonable efforts to retain the other Party’s Confidential Information in confidence and not disclose the same to any third party nor use the same, except as authorized by the disclosing Party in writing or as expressly permitted in this Section 9.6. Each Party further agrees to take the same care with the other Party’s Confidential Information as it does with its own, but in no event less than a reasonable degree of care.