Attached files

| file | filename |

|---|---|

| EX-4.3 - EX-4.3 - Milacron Holdings Corp. | d896698dex43.htm |

| EX-4.2 - EX-4.2 - Milacron Holdings Corp. | d896698dex42.htm |

| EX-23.1 - EX-23.1 - Milacron Holdings Corp. | d896698dex231.htm |

| EX-10.5 - EX-10.5 - Milacron Holdings Corp. | d896698dex105.htm |

| EX-21.1 - EX-21.1 - Milacron Holdings Corp. | d896698dex211.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 3, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Milacron Holdings Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 3559 | 80-0798640 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3010 Disney Street

Cincinnati, OH 45209

(513) 487-5000 (Phone)

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Hugh C. O’Donnell

Vice President, General Counsel and Secretary

3010 Disney Street

Cincinnati, OH 45209

(513) 487-5000 (Phone)

(513) 487-5086 (Fax)

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Alexander D. Lynch, Esq. Heather L. Emmel, Esq. (212) 310-8007 (Fax) |

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022 (212) 906-1200 (Phone) (212) 751-4864 (Fax) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common Stock, $0.01 par value per share |

$100,000,000 | $11,620 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) promulgated under the Securities Act. |

| (2) | Includes shares of common stock that may be issuable upon exercise of an option to purchase additional shares granted to the underwriters. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated April 3, 2015

PROSPECTUS

Shares

Milacron Holdings Corp.

Common Stock

This is the initial public offering of our common stock. We are selling shares of our common stock.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. After pricing the offering, we expect that the shares will trade on the New York Stock Exchange (the “NYSE”) or Nasdaq Global Market (“Nasdaq”) under the symbol “MCRN.”

Investing in the common stock involves risks that are described in the “Risk Factors ” section beginning on page 18 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | We refer you to “Underwriting” beginning on page 146 of this prospectus for additional information regarding underwriting compensation |

The underwriters may also exercise their option to purchase up to an additional shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2015.

| BofA Merrill Lynch | Barclays | J.P. Morgan | ||

| Baird | Credit Suisse | Goldman, Sachs & Co. | ||

The date of this prospectus is , 2015.

Table of Contents

| Page |

||||

| 1 | ||||

| 18 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| 49 | ||||

| 54 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

56 | |||

| 81 | ||||

| 99 | ||||

| 103 | ||||

| 110 | ||||

| 126 | ||||

| 128 | ||||

| 130 | ||||

| 137 | ||||

| 141 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders |

143 | |||

| 146 | ||||

| 154 | ||||

| 154 | ||||

| 154 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free-writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the underwriters (or any of our or their respective affiliates) have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we, nor the underwriters (or any of our or their respective affiliates) take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters (or any of our or their respective affiliates) are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is only accurate as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospectus may have changed since that date.

Trademarks and Trade Names

We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business. In addition, our name, logo and website name and address are our service marks or trademarks. Some of the more important trade names and trademarks that we use include Cimcool, DME, Ferromatik Milacron, Milacron, Uniloy, TIRAD, Mold-Masters, M-PET, Kortec and E-Multi. Solely for convenience, we refer to trademarks, service marks and trade names in this prospectus without the ™, SM and ® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, trade names or service marks appearing in this prospectus are the property of their respective owners.

i

Table of Contents

Market and Industry Information

Market data used throughout this prospectus is based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys and publications and other publicly available information prepared by a number of sources, including the Freedonia Group, Inc. (“Freedonia”), Global Industry Analysts, Inc., a market research report publisher, Interconnection Consulting, Society of Indian Automobile Manufacturers and the U.S. Department of Commerce Bureau of Economic Analysis. We also purchased a hot runner market analysis report prepared by Interconnection Consulting in relation to the economic environment and regional landscape pertaining to that market. All Interconnection Consulting market share data presented in this prospectus is for the year ended December 31, 2013, as no additional study has been completed since that date. All of the market data used in this prospectus involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the estimated market position, market opportunity and market size information included in this prospectus is generally reliable, such information, which in part is derived from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates prepared by independent parties and by us.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto before making an investment decision. Unless otherwise stated in this prospectus, references to “we,” “our,” “us,” “Milacron” and the “Company” and similar terms refer to Milacron Holdings Corp. and its consolidated subsidiaries; references to “Milacron Holdings” refer to Milacron Holdings Corp.; references to “Milacron Intermediate Holdings” refer to Milacron Intermediate Holdings Inc., our wholly owned subsidiary; and references to “Milacron LLC” refer to Milacron LLC, our indirect wholly owned subsidiary.

Company Overview

We are a global leader in the manufacture, distribution and service of highly engineered and customized systems within the $27 billion plastic technology and processing industry. We are the only global company with a full-line product portfolio that includes hot runner systems, injection molding, blow molding and extrusion equipment. We maintain strong market positions across these products as well as leading positions in process control systems, mold bases and components, maintenance, repair and operating (“MRO”) supplies for plastic processing equipment and fluid technology. Our strategy is to deliver highly customized equipment, components and service to our customers throughout the lifecycle of their plastic processing technology systems.

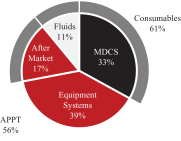

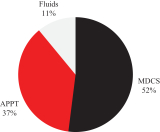

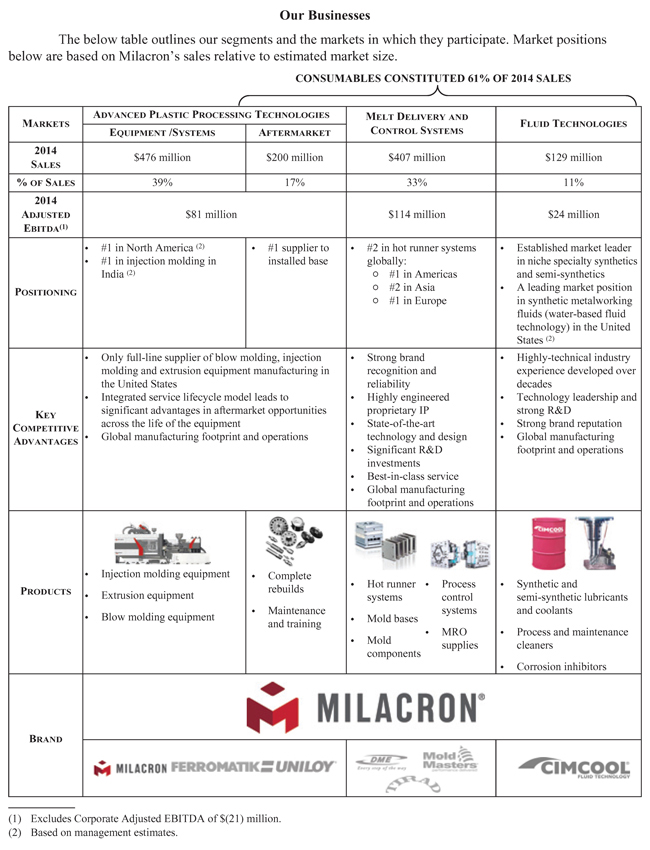

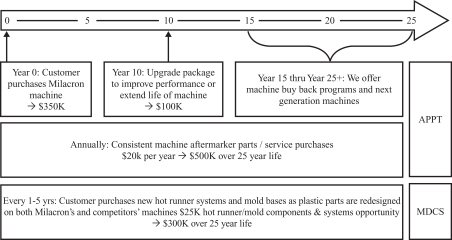

We serve the market through three segments: Advanced Plastic Processing Technologies, which we refer to as “APPT,” Melt Delivery and Control Systems, which we refer to as “MDCS,” and Fluid Technologies, which we refer to as “Fluids.” Our APPT segment designs, manufactures and sells injection, extrusion, and blow molding equipment, co-injection systems and related parts and services. Our MDCS segment designs, manufactures and sells hot runner and process control systems, mold bases and components, and sells MRO supplies. Hot runner systems are custom designed for each product a customer manufactures on an injection molding machine. Our Fluids segment is a global manufacturer of synthetic and semi-synthetic lubricants and coolants used in various industrial metalworking applications. Approximately 61% of our 2014 sales were from consumable products, which we define as products that are replaced and services provided throughout the life of the injection, extrusion, and blow molding systems and fluids used in the metalworking process. Our lifecycle sales include (1) machine aftermarket parts and service; (2) hot runner systems and mold bases, which are replaced each time new plastic parts are designed and existing parts are redesigned; and (3) upgrades and overhauls as customers decide to improve the performance or extend the life of equipment. We serve a diverse range of industries and have longstanding relationships with many of our over 27,000 customers. We have leading market shares in North America and in emerging markets, such as China and India.

The charts below illustrate Milacron’s diversification by principal business segment as a percentage of sales and Adjusted EBITDA for the year ended December 31, 2014.

| By Business (Sales) |

By Segment (Adjusted EBITDA)(1) | |

|

|

|

| (1) | Excludes Corporate Adjusted EBITDA of $(21) million. |

1

Table of Contents

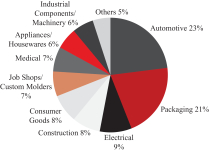

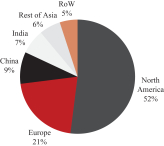

The charts below illustrate Milacron’s diversification by end market and geography as a percentage of sales for the year ended December 31, 2014.

| By End Market (Sales) |

By Geography (Sales) | |

|

|

| |

For the year ended December 31, 2014, we generated total sales, Adjusted EBITDA, Adjusted Net Income and net (loss) attributable to Milacron Holdings Corp. of $1,211 million, $199 million, $75 million, and $(15) million, respectively. Since early 2012, we have broadened our portfolio significantly through a series of strategic initiatives and value-enhancing acquisitions. We have made significant investments to upgrade our machining capabilities, expand capacity in China and India and pursue adjacent growth opportunities in our high-margin consumables businesses. Through our “One Milacron” initiative, we are leveraging our global capabilities, along with investing in new product development and improving manufacturing capabilities and engineering processes. We believe our recent and continuing investments in low cost manufacturing capabilities and our shared service center as well as the continued integration of prior acquisitions position us to drive significant margin improvement over the next three years.

| Significant Initiatives & Investments Since Early 2012 |

Milacron Today | |

| • Acquired Mold-Masters Luxembourg Holdings S.à r.l. (“Mold-Masters”), Kortec, Inc. (“Kortec”) and TIRAD, s.r.o. (“TIRAD”)

• Recruited high-caliber executive team

• Rolled out “One Milacron” initiative—integration and leveraging of our global footprint capabilities and customer relationships across all segments

• Developed new products, such as the E-Multi, M-PET and hybrid machine technologies

• Expanded production capabilities in certain high-growth and lower cost regions

• Employed manufacturing efficiency and low-cost sourcing initiatives

• Implemented an internal global back-office and engineering shared service center in India |

• Global growth platform with leading market positions in North America, China and India

• Plastic technology systems and solutions provider with a strong intellectual property portfolio

• 61% of 2014 sales from higher margin consumable products (recent acquisitions significantly enhanced historic percentages)

• Leading position in the high-growth and high-margin hot runner market

• Industry leading technology for shelf stable plastic packaging

• Upper teens Adjusted EBITDA margins

• Blue-chip customer relationships in all regions among original equipment manufacturers, molders and mold makers | |

2

Table of Contents

3

Table of Contents

Our Industry

We are a global leader in the manufacture, distribution and service of highly engineered and customized systems within the $27 billion plastic technology and processing industry.

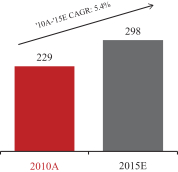

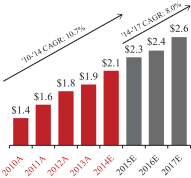

The following charts illustrate the growth in global plastic consumption, global plastic processing machinery demand and the global hot runner market for the periods set forth below.

| Global Plastic Consumption (in millions of tons)(1) |

Global Plastic Processing |

Global Hot Runner Market ($ in bn)(3) | ||

|

|

|

|

| (1) | Source: Global Industry Analysts, Inc. (January 2012). |

| (2) | Source: Global Industry Analysts, Inc. (May 2014). |

| (3) | Source: Interconnection Consulting (October 2014). |

We believe the following factors will contribute to demand growth for products in our APPT and MDCS segments:

Increasing Global Demand for Plastic Finished Products: We believe the growing demand for plastic products is supported by long term macroeconomic trends. Global population growth, coupled with continued urbanization, increased purchasing power and improved lifestyle in emerging markets have resulted in greater demand for a broad range of finished plastic products in many segments of the economy, including automotive, construction and consumer products. We believe that our strong global presence positions us well to benefit from this growth.

Technological Advancements, New Product Introductions and Continued Preference for Plastic Over Other Materials: Technological advancements in resin, product design and systems integration have increased the number and range of applications for which plastic products can be used. These advancements have led to increased adoption and penetration rates in both high growth industries, such as healthcare and electronics, as well as high volume industries, such as automotive and consumer packaging. For example, the use of plastic components assists automakers in reducing vehicle weight to meet federally mandated fuel economy standards. Consumers have continued to exhibit a preference for plastic packaging over available alternatives, particularly in food packaging. We believe our technology and track record for delivering efficient high speed systems for shelf stable plastic packaging will position us to take advantage of the continued materials conversion from metal and glass to plastic.

Hot Runner Market Demand Growth: Demand for hot runner systems (a custom designed product that channels molten plastic from an injection molding machine into a particular mold) is tied to new product design and product design changeover rather than broader capital investment trends. For instance, in certain large end markets, including electronics and consumer products where technology and preference are rapidly changing, product life cycles have significantly decreased in recent years. In certain emerging markets, such as Asia, hot

4

Table of Contents

runner systems are displacing legacy cold runner technology driven by an increased need for productivity, efficiency, automation and higher part quality. Although growing, hot runner systems penetration levels in emerging markets remain well below the penetration levels seen in developed economies.

Pent-up Equipment Demand: According to the U.S. Department of Commerce Bureau of Economic Analysis, the average age of plastic processing equipment in 2013 was 12 years compared to an average age of eight years in 1980. We believe much of the equipment purchased in the 1980s and 1990s is now nearing the end of its useful life, and the plastic processing industry will experience sustained growth as customers begin to make significant investments in machinery and equipment due to strong plastic demand, lower resin costs and a more robust manufacturing environment. We offer our customers several options to address this issue, including machine replacement, used machine purchases and retrofit services to upgrade their technology. Technological advances in our products have made it more compelling for our customers to purchase new equipment or engage us to retrofit their existing equipment before the end of their existing equipment’s useful life. Upgrading their equipment can provide our customers with several key advantages, including increased resin efficiency, energy efficiency and higher throughput capabilities.

Our Competitive Strengths

Leading Market Positions, Product Breadth and Highly Regarded Brands

Based on management estimates, we believe Milacron is the #1 manufacturer and supplier of plastic processing technologies in North America on a consolidated basis across the industry’s primary plastic processing machinery applications based on sales. We are also the #2 provider of hot runner systems worldwide based on sales. We continue to reinvest capital to establish and maintain our leading positions in emerging markets. We believe that the significant depth and breadth of our product portfolio provides us with a competitive advantage because it allows us to meet more of our customers’ demands as they expand their production capabilities. We believe Milacron has strong brand recognition with over 150 years of continuous operations. Our world class portfolio of brands, including Milacron, DME, Mold-Masters, TIRAD, Cimcool, Ferromatik and Uniloy, have long records of success selling products in over 100 countries across six continents.

Strategically Positioned to Benefit from Global Plastic Market Growth

Market growth is being driven by several fundamental dynamics including the re-tooling of an aging fleet in North America, continued conversion of metal and glass to plastic, and increased plastic consumption in emerging markets. We believe that our plastic processing technology combined with our customer driven sales approach positions us to add value to our customer base as they re-tool their aging fleets with aftermarket sales, retrofits and new equipment. Additionally, our strong technology offering across multiple applications positions us well to capitalize on the incremental growth from the continued materials conversion to plastic. Our international presence and our significant investments in manufacturing capacity in China and India provide a strong base on which we expect to capture emerging market growth.

Large Installed Base and Recurring Revenue Streams

We estimate that we have over 40,000 machines and over 140,000 hot runner systems installed globally. We have a significant opportunity to leverage our aftermarket business and contract services across our existing customer base. We believe we have a significant opportunity to further leverage our machine and hot runner customer base to drive sales and offer customized solutions combining the technology of Mold-Masters and Milacron. We believe we are the top global supplier of parts and service for our own equipment and have the opportunity to increase our share of this business for our installed base as well as that of our customers’ other equipment. The consumable products sold by our APPT aftermarket business, our MDCS business and our Fluids business provide recurring revenue streams. The acquisition of Mold-Masters in March 2013 significantly increased our sales of consumable products and services. We seek to add value to our customers through our lifecycle sales approach and capabilities, which allows us to capture more of our customers’ equipment spend on consumable products.

5

Table of Contents

Leading Technology and Extensive R&D Capabilities

Our products and systems are highly engineered and customized. We hold approximately 1,000 active and pending patents on a range of technologies across our businesses and employ over 750 engineers and designers. Recent innovations include (1) our E-Multi co-injection unit which enables cost effective retrofit of injection molding systems to produce multi-material parts; (2) multi-layer blow molding; (3) co-injection solutions; (4) hybrid machine technologies that blend hydraulic and electric movements; and (5) our M-PET series product line for polyethylene terephthalate (“PET”) preform molding. A number of our technologies are helping to drive the conversion from metal and glass to plastic. We maintain a global engineering and design center in India with over 140 associates to lower design and engineering costs and offer customers 24-hour access to our engineering capabilities.

Diverse End-Markets and Customer Base

Our products and systems serve a broad and diverse range of end markets and customers. For the year ended December 31, 2014, no end-market accounted for more than 23% of our sales and we have a balanced geographical exposure. Our MDCS leadership positions in the medical, teletronics and closures end-markets supplement our APPT strength in automotive and packaging end-markets and offer a platform from which we can expand the presence of each business in new markets and cross-sell our products and services to existing customers. As of December 31, 2014, our businesses maintained an estimated total of more than 27,000 customers. No single customer accounted for more than 1.6% of sales and our top 10 customers accounted for 8.9% of sales for the year ended December 31, 2014. Milacron is a preferred supplier to many key original equipment manufacturers (“OEMs”), end-users whose time to market and profitability depend on our ability to design and manufacture highly customized products with short lead times. As a result of working directly with end users including OEMs and brand owners, our systems are frequently specified by name by the end user and we gain visibility into new opportunities in the plastic technology value chain.

Efficient Cost Structure and Operating Flexibility

We are in the early stages of lean implementation and have undertaken a number of initiatives to improve our cost structure and operating flexibility which we believe will drive significant margin growth over the next three years. This includes consolidating manufacturing locations in North America and Europe and implementing lean initiatives to leverage our supply chain and increase low cost country sourcing. We are concurrently investing to expand capacity in higher growth markets in China and India, both for local market sales and for export to our global customer base and see continued opportunities to implement lean initiatives across our facilities. We are experiencing strong margin improvement momentum through continued operational excellence, further enhancing the attractive free cash flow characteristics of our business.

Track Record of Deploying Capital at Attractive Returns

Since early 2012, our management has identified and executed strategic capital deployment initiatives including accretive tuck-in acquisitions and manufacturing efficiency projects, which have improved our competitive position and financial profile. Our acquisition strategy is intended to broaden and deepen our portfolio and enhance our ability to service customers. These acquisitions have included our 2014 acquisitions of Kortec and TIRAD, each of which have been successfully integrated with our existing business and product development process. As part of our ongoing lean manufacturing initiatives, we have implemented several successful manufacturing footprint projects including our ongoing manufacturing footprint projects in Europe. We believe these projects allow us to expand margins and compete effectively across our global manufacturing base. We continue to see opportunity to execute accretive acquisitions and high payback efficiency projects.

6

Table of Contents

Experienced and Highly Skilled Management Team

Our senior management team consists of industry veterans with proven track records of operational excellence and strategic vision. Our team has successfully implemented both organic growth initiatives and strategic acquisitions. We have realigned our business segments and management structure to maintain and enhance our market leading position and executed effective strategies to focus on high growth and profitable markets. Our senior management team has an average of 30 years of plastic and industry experience, with much of this experience stemming from either our customers or other organizations within our value chain. This experience enables us to bring a customer’s perspective to our company and has influenced our strategy of providing value-enhancing lifecycle solutions to our customers.

Our Strategy

The key elements of our growth strategy include:

Grow Share Profitably

| • | Leverage our Installed Base and Technology to Continue to Drive Lifecycle Sales: Consumable sales are an attractive and recurring revenue opportunity. Our management estimates that the value of available consumable revenue across the life of a machine is one to four times its initial cost. Our lifecycle sales include (1) machine aftermarket parts and service; (2) hot runner systems and mold bases, which are replaced each time new plastic parts are designed and existing parts are redesigned; and (3) upgrades and overhauls as customers decide to improve the performance or extend the life of equipment. |

| • | Continue to Penetrate Emerging Markets: Over the last three years, we have invested in additional sales, service and manufacturing capacity in China and India, as well as maintaining a large and experienced local sales force in these and other emerging growth countries. Our businesses in emerging markets are growing and we believe we can further increase our penetration rate in emerging markets in Asia, Africa and Central America. |

| • | Customer Focused Market Approach: Our market approach is to provide a tailored solution addressing the needs of each customer. As a part of our lifecycle sales approach, we offer fleet assessments whereby we analyze the costs and benefits of upgrading or overhauling the customer’s fleet as opposed to outright replacement with new equipment. We believe we have a competitive advantage because we offer a broad set of repair services and upgrade technologies and do not limit our upgrades and overhauls to only Milacron equipment. |

| • | New Product and Technology Innovation: We have a pipeline of new product technical innovations that are designed to provide customer focused solutions. These technology solutions are expected to increase penetration in growth areas including co-injection systems for packaging and medical applications and next-generation hot runner systems design. We believe there is a large addressable market for high performance products, and we have a significant opportunity to gain additional market share. Our innovative solutions allow us to price our products at a premium to our competitors because of the differentiated technology and attractive value proposition that we offer. We recently launched new technology, including the Klear Can Co-injection Turn-Key Systems and the E-Multi All Electric Retrofit Solution. |

| • | Leverage the Capability and Reach of our Sales Force: We believe we have one of the largest direct sales forces in the industry, with over 400 sales professionals across our businesses. We have recently acquired or opened centers in Texas, California and Mexico to extend our sales reach in those markets. We have also created a Strategic Accounts Management sales leadership team to |

7

Table of Contents

| drive relationships with major plastic processors across our different product lines. We believe this will enhance our leadership position in the injection molding equipment market and continue to drive share gains for our overall business. |

Fund the Future by Driving Margin Improvements

We are in the early stages of implementing a number of initiatives which we anticipate will drive margin growth over the next three years. In addition to savings achieved to date through our ongoing lean initiatives, we expect our recent and continuing investment in facilities consolidation, administrative and sourcing cost savings and back office integration efforts to drive over $30.0 million of run-rate annual savings by the end of 2017.

| • | Facilities Consolidation Enabled by Recent Acquisitions: We continue to optimize our facility footprint by moving production to low cost countries. Our recent acquisitions of Mold-Masters in 2013 and Czech Republic-based TIRAD in 2014 provide the incremental scale to enable additional facility consolidation. While these initiatives are in early stages, currently announced facilities closures are expected to reduce annual operating expenses by approximately $2.2 million upon completion. We have also recently made substantial investments in China and India, both to meet growing domestic demand in those markets and to expand our low cost production capabilities for export. We will continue to seek opportunities to expand our low cost manufacturing footprint in growing markets and consolidate production to drive greater efficiencies. |

| • | Continued Back Office Integration and Operating Efficiencies: We are also in the process of transitioning certain engineering and administrative functions to a shared service center in India and have realized approximately $1.8 million of annual run-rate savings as a result of these initiatives. We expect these savings to increase as we continue to explore opportunities to maximize efficiencies and overhead savings by expanding the shared service center platform. |

| • | Continue to Implement Lean Initiatives: We are successfully improving operational efficiency and reducing costs through the implementation of lean initiatives which include low cost country sourcing. In 2014, we realized approximately $11 million in savings from improvements in global sourcing programs. We anticipate that our global sourcing leverage will improve, particularly due to overlapping spend in steel, electrical and other commodity purchases across our APPT and MDCS business segments. |

Make Possibilities a Reality by Continued Reinvestment

We continually invest in new product development in pursuit of our product vitality goal to achieve 15% of sales from products introduced in the last three years. We have made investments to improve efficiencies, develop new products and increase capacity across our three business segments. We plan to continue focusing on growing each business through efficient use of existing capacity and workforce. We have broadened our portfolio significantly through a series of strategic acquisitions as large as $1 billion and as small as $1 million in size and continue to see opportunity to execute accretive acquisitions.

Win Together as “One Milacron”

Our “One Milacron” initiative was designed to integrate and leverage our global footprint capabilities and customer relationships across all of our business segments with a “win together” culture. First, we are dedicated to providing best-in-class quality and safety for our customers and employees. We believe this approach will continue to allow us to build world-class leaders, account management and sales teams who deliver great service to every customer across Milacron’s businesses. We work closely with our customers throughout their design process and provide them with one-stop complete end-to-end plastic processing solutions that optimize their total cost of production rather than just focusing on selling new equipment. We believe this approach differentiates us from our competitors and helps us develop and maintain long-term customer loyalty.

8

Table of Contents

Risks Affecting Our Business

Investing in our common stock involves a high degree of risk. You should consider carefully the risks described in “Risk Factors” before making a decision to invest in our common stock. If any of these risks actually occur, our business, financial condition and results of operations would likely be materially adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose all or part of your investment. Below is a summary of some of the principal risks that we face.

| • | Demand for our products is affected by general economic conditions, including our customers’ industries and capital expenditures, consumer spending trends and other macroeconomic conditions. |

| • | If the use of plastic declines, it could materially adversely affect our business, financial condition or results of operations. |

| • | We operate in highly competitive industries, many of which are currently subject to intense price competition, and if we are unable to compete successfully, our results of operations could be materially adversely affected. |

| • | We may not be able to successfully implement strategic initiatives designed to increase our cost savings. |

| • | Increases in our cost structure or a disruption in our supply chain could have an adverse effect on our operating results and cash flows. |

| • | Our significant international operations subject us to risks such as unfavorable political, regulatory, labor and tax conditions. |

| • | We have a history of net losses and may not maintain profitability in the future. |

| • | We have a substantial amount of indebtedness, which could have a material adverse effect on our financial condition and our ability to obtain financing in the future and to react to changes in our business. |

| • | We will incur increased costs as a result of operating as a publicly traded company, and our management will be required to devote substantial time to new compliance initiatives. |

| • | CCMP will have a controlling interest in our company, and CCMP’s interests may be different from or conflict with those of our other stockholders. |

Our Principal Stockholder

We were acquired by affiliates of CCMP Capital Advisors, LLC (collectively referred to as “CCMP”) together with certain members of our management in April 2012 (the “CCMP Acquisition”). After this offering, affiliates of CCMP are expected to own approximately % of our common stock. As a result of this offering, CCMP will be able to exert significant voting influence of fundamental and significant corporate matters and transactions. See “Risk Factors—Risks Related to this Offering—CCMP will have a controlling interest in our company, and CCMP’s interests may be different from or conflict with those of our other stockholders.”

CCMP is a leading global private equity firm specializing in buyout and growth equity investments in companies ranging from $250 million to more than $2 billion in size. CCMP’s founders have invested over $16 billion since 1984, which includes their activities at J.P. Morgan Partners, LLC (a private equity division of

9

Table of Contents

JPMorgan Chase & Co.) and its predecessor firms. CCMP was formed in August 2006 when the buyout and growth equity investment professionals of J.P. Morgan Partners, LLC separated from JPMorgan Chase & Co. to commence operations as an independent firm. The foundation of CCMP’s investment approach is to leverage the combined strengths of its deep industry expertise and proprietary operating resources to create value by investing in four targeted industries—Industrials, Consumer/Retail, Energy and Healthcare.

Corporate Information

Milacron Holdings is a Delaware corporation. Milacron Holdings was incorporated on March 16, 2012. Our principal executive offices are located at 3010 Disney Street, Cincinnati, Ohio 45209. Our telephone number at our principal executive offices is 513-487-5000. Our corporate website is www.milacron.com. The information that appears on our website is not part of, and is not incorporated into, this prospectus.

10

Table of Contents

The Offering

| Common stock offered by us |

shares ( shares if the underwriters exercise their option to purchase additional shares in full). |

| Common stock to be outstanding after this offering |

shares ( shares if the underwriters exercise their option to purchase additional shares in full). |

| Option to purchase additional shares of common stock |

The underwriters also have the option to purchase up to an additional shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We estimate that the net proceeds to us from our sale of shares of common stock in this offering will be approximately $ million, after deducting underwriting discounts and commissions and estimated expenses payable by us in connection with this offering. This assumes a public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus. We expect to use net proceeds from this offering for general corporate purposes, including the repayment of outstanding indebtedness. See “Use of Proceeds.” |

| Dividend policy |

We do not anticipate paying any dividends on our common stock in the foreseeable future; however, we may change this policy in the future. Present and future agreements may also limit our ability to pay dividends. See “Dividend Policy” and “Description of Certain Indebtedness.” |

| Voting rights |

Each share of our common stock will entitle its holder to one vote on all matters to be voted on by stockholders generally. See “Description of Capital Stock.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 18 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

| Proposed NYSE or Nasdaq symbol |

“MCRN.” |

Unless otherwise indicated, the number of shares of common stock to be outstanding after this offering is based on shares outstanding as of 2015 and excludes:

| • | shares of our common stock issuable upon the exercise of options to purchase shares of our common stock, which have a weighted average exercise price of $ per share; and |

| • | shares of common stock reserved for future grant under our 2015 Equity Incentive Plan (the “2015 Equity Incentive Plan”). |

11

Table of Contents

Unless otherwise indicated, all information in this prospectus:

| • | gives effect to a -for-1 stock split of our common stock prior to the consummation of this offering; |

| • | gives effect to our amended and restated certificate of incorporation and our amended and restated bylaws, which will be in effect prior to the consummation of this offering; |

| • | assumes no exercise of the underwriters’ option to purchase up to additional shares of common stock from us; and |

| • | assumes an initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus. |

12

Table of Contents

SUMMARY HISTORICAL FINANCIAL AND OTHER DATA

The following table sets forth our summary historical financial and other data for the periods and as of the dates indicated. We derived our summary consolidated statements of operations data for the period from January 1, 2012 to April 30, 2012 (Predecessor) (“Predecessor Period 2012”), for the period from May 1, 2012 to December 31, 2012 (Successor) (“Successor Period 2012”) and for the years ended December 31, 2013 and 2014 (Successor) and our balance sheet data as of December 31, 2014 (Successor) from our audited consolidated financial statements included elsewhere in this prospectus.

The summary as adjusted balance sheet data as of December 31, 2014 has been prepared to give effect to the issuance of shares of our common stock in this offering at an assumed initial public offering price of $ , which is the midpoint of the range set forth on the cover of this prospectus, and the application of the net proceeds from this offering as described under “Use of Proceeds.” The following unaudited summary as adjusted financial information is presented for illustrative purposes only and is not necessarily indicative of the financial position that would have occurred if the relevant transactions had been consummated on the date indicated.

In April 2012, affiliates of CCMP, together with members of our management formed Milacron Holdings and, through Milacron Holdings, acquired all of the capital stock of Milacron Intermediate Holdings. Milacron in all periods prior to May 2012 is referred to as “Predecessor,” and in all periods including and after such date is referred to as “Successor.” As a result of acquisition accounting adjustments associated with the CCMP Acquisition, the consolidated financial statements for all Successor periods may not be comparable to those of the Predecessor period. In addition, our historical financial statements for the periods prior to the acquisition of Mold-Masters on March 28, 2013 may not be comparable to our financial statements for periods following such acquisition.

Our historical results are not necessarily indicative of future operating results. You should read the information set forth below in conjunction with “Selected Historical Financial Data of Milacron,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes thereto included elsewhere in this prospectus.

| Period from |

Period from May 1, |

Year ended |

Year ended |

|||||||||||||||

| (Dollars in millions, except share and per share data) | (Predecessor) | (Successor) | (Successor) | (Successor) | ||||||||||||||

| Statements of operations: |

||||||||||||||||||

| Sales |

$ | 260.7 | $ | 571.7 | $ | 1,028.8 | $ | 1,211.3 | ||||||||||

| Costs of sales |

181.5 | 423.3 | 689.1 | 792.3 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Manufacturing margins |

79.2 | 148.4 | 339.7 | 419.0 | ||||||||||||||

| Operating expenses: |

||||||||||||||||||

| Selling, general and administrative expenses |

55.6 | 104.9 | 223.4 | 266.9 | ||||||||||||||

| Business combination costs |

8.8 | 9.9 | 2.9 | 1.1 | ||||||||||||||

| Officer severance costs |

— | 6.2 | — | — | ||||||||||||||

| Amortization expense |

0.4 | 24.9 | 47.6 | 44.2 | ||||||||||||||

| (Gain) loss on currency translation |

(0.4 | ) | (0.1 | ) | 10.4 | 16.3 | ||||||||||||

| Other expense (income), net |

0.4 | (0.6 | ) | 1.1 | 8.8 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

64.8 | 145.2 | 285.4 | 337.3 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating earnings |

14.4 | 3.2 | 54.3 | 81.7 | ||||||||||||||

| Interest expense, net |

11.8 | 20.7 | 70.1 | 74.6 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (loss) before income taxes |

2.6 | (17.5 | ) | (15.8 | ) | 7.1 | ||||||||||||

| Income tax expense |

2.4 | 3.5 | 8.9 | 22.0 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings (loss) |

0.2 | (21.0 | ) | (24.7 | ) | (14.9 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

13

Table of Contents

| Period from |

Period from May 1, |

Year ended |

Year ended |

|||||||||||||||

| (Dollars in millions, except share and per share data) | (Predecessor) | (Successor) | (Successor) | (Successor) | ||||||||||||||

| Less: Net loss (earnings) attributable to the noncontrolling interest |

0.1 | (0.2 | ) | 0.1 | 0.1 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings (loss) attributable to Milacron Holdings Corp. |

$ | 0.3 | $ | (21.2 | ) | $ | (24.6 | ) | $ | (14.8 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings (loss) per share(1) |

$ | 4.36 | $ | (107.95 | ) | $ | (58.40 | ) | $ | (30.14 | ) | |||||||

| Diluted earnings (loss) per share(1) |

$ | 4.04 | $ | (107.95 | ) | $ | (58.40 | ) | $ | (30.14 | ) | |||||||

| Weighted average shares outstanding: |

||||||||||||||||||

| Basic |

68,877 | 196,387 | 421,200 | 490,965 | ||||||||||||||

| Diluted |

74,330 | 196,387 | 421,200 | 490,965 | ||||||||||||||

| Select segment and geographic data: |

||||||||||||||||||

| Sales by segment: |

||||||||||||||||||

| APPT |

$ | 177.9 | $ | 407.2 | $ | 580.1 | $ | 675.8 | ||||||||||

| MDCS |

38.9 | 76.1 | 320.5 | 406.7 | ||||||||||||||

| Fluids |

43.9 | 88.4 | 128.2 | 128.8 | ||||||||||||||

| Sales by geography: |

||||||||||||||||||

| North America |

$ | 148.0 | $ | 343.6 | $ | 526.4 | $ | 628.5 | ||||||||||

| Europe |

56.0 | 101.2 | 235.5 | 258.8 | ||||||||||||||

| Asia |

45.5 | 91.8 | 218.1 | 270.1 | ||||||||||||||

| Rest of World |

11.2 | 35.1 | 48.8 | 53.9 | ||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||

| Net cash provided by operating activities |

$ | 12.4 | $ | 8.1 | $ | 82.1 | $ | 37.6 | ||||||||||

| Net cash used in investing activities |

(4.9 | ) | (210.3 | ) | (993.4 | ) | (94.3 | ) | ||||||||||

| Net cash (used in) provided by financing activities |

(17.2 | ) | 55.2 | 964.8 | 41.2 | |||||||||||||

| Select supplemental data: |

||||||||||||||||||

| New orders(3) |

$ | 274.4 | $ | 522.7 | $ | 1,076.0 | $ | 1,230.4 | ||||||||||

| Backlog(4) |

119.6 | 201.1 | 227.9 | |||||||||||||||

| Adjusted EBITDA by segment(5): |

||||||||||||||||||

| APPT |

$ | 15.1 | $ | 47.3 | $ | 62.6 | $ | 81.0 | ||||||||||

| MDCS |

5.4 | 12.8 | 85.0 | 114.4 | ||||||||||||||

| Fluids |

6.9 | 18.7 | 23.5 | 23.8 | ||||||||||||||

| Corporate |

(2.9 | ) | (7.6 | ) | (9.5 | ) | (20.7 | ) | ||||||||||

| Adjusted EBITDA(5) |

24.5 | 71.2 | 161.6 | 198.5 | ||||||||||||||

| Adjusted Net Income(5) |

8.1 | 34.7 | 57.0 | 74.5 | ||||||||||||||

| Capital expenditures |

4.9 | 11.8 | 30.0 | 41.4 | ||||||||||||||

| Cash interest expense |

4.9 | 13.1 | 46.1 | 71.3 | ||||||||||||||

14

Table of Contents

| Year Ended December 31, 2014 |

||||||||

| Actual |

As Adjusted(2) |

|||||||

| Balance sheet data: |

||||||||

| Cash and cash equivalents |

$ | 81.5 | $ | |||||

| Accounts receivable |

183.3 | |||||||

| Inventories, net |

238.1 | |||||||

| Property and equipment, net |

216.9 | |||||||

| Total assets |

1,790.7 | |||||||

| Accounts payable |

89.9 | |||||||

| Advanced billings and deposits |

58.5 | |||||||

| Total debt and capital lease obligations, including current portion |

1,034.6 | |||||||

| (1) | Basic and diluted earnings (loss) per share is computed by dividing the net earnings (loss) available to common stockholders by the weighted-average number of shares of common stock outstanding during the period. |

| (2) | As adjusted information gives effect to the application of the net proceeds received by us from the offering as described under “Use of Proceeds.” |

| (3) | New orders represent the value of incoming purchase orders received for a period of time that may or may not have been shipped during the period. New orders are counted once we verify acceptance of price and terms and verify credit history and references. |

| (4) | Backlog represents the value of unfilled orders as of the applicable date. These unfilled orders are supported by a valid purchase order and price, terms and credit have been approved by us. All of our backlog is expected to be filled within the current fiscal year and there are no seasonal or other aspects of our backlog that would impact filling the orders. |

| (5) | We prepare our financial statements in conformity with U.S. GAAP. To supplement this information, we also use the following non-GAAP financial measures in this prospectus: Adjusted EBITDA and Adjusted Net Income. For a discussion of and important limitations on the usefulness of non-GAAP financial measures in this prospectus, see “Non-GAAP Financial Measures.” |

15

Table of Contents

The following table provides a reconciliation of net earnings (loss) attributable to Milacron Holdings Corp., the most comparable U.S. GAAP measure, to Adjusted Net Income and to Adjusted EBITDA for the periods presented.

| Period from |

Period from |

Year ended |

Year ended |

|||||||||||||||

| (Dollars in millions) | (Predecessor) | (Successor) | (Successor) | (Successor) | ||||||||||||||

| Net earnings (loss) attributable to Milacron Holdings Corp. |

$ | 0.3 | $ | (21.2 | ) | $ | (24.6 | ) | $ | (14.8 | ) | |||||||

| Amortization expense |

0.4 | 24.9 | 47.6 | 44.2 | ||||||||||||||

| Currency effect on intercompany advances(a) |

— | — | 10.0 | 13.8 | ||||||||||||||

| Organizational redesign costs(b) |

— | 6.5 | 4.4 | 12.9 | ||||||||||||||

| Long-term equity options and shareholder fees(c) |

0.7 | 2.3 | 5.0 | 5.5 | ||||||||||||||

| Debt costs(d) |

— | — | 0.2 | 4.1 | ||||||||||||||

| Acquisition integration costs(e) |

— | — | 2.0 | 4.0 | ||||||||||||||

| Professional services(f) |

— | 2.9 | 2.8 | 3.6 | ||||||||||||||

| Business combination costs(g) |

8.8 | 9.9 | 2.9 | 1.1 | ||||||||||||||

| Fair market value adjustments(h) |

(2.2 | ) | 9.4 | 4.8 | — | |||||||||||||

| Other(i) |

0.1 | — | 1.9 | 0.1 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Net Income |

8.1 | 34.7 | 57.0 | 74.5 | ||||||||||||||

| Income tax expense |

2.4 | 3.5 | 8.9 | 22.0 | ||||||||||||||

| Interest expense, net |

11.8 | 20.7 | 70.1 | 74.6 | ||||||||||||||

| Depreciation expense |

2.2 | 12.3 | 25.6 | 27.4 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 24.5 | $ | 71.2 | $ | 161.6 | $ | 198.5 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Non-cash currency effect on intercompany advances relates to advances in foreign currency exchange rates. The most significant exposure relates to the Canadian dollar pursuant to intercompany advances associated with the acquisition of Mold-Masters. |

| (b) | Organizational redesign costs in Successor Period 2012 primarily include restructuring expense related to CEO transition and severance costs of $6.2 million. Costs in 2013 and 2014 relate to salary and severance associated with a reduction of headcount as a result of company initiatives to transition processes to low-cost countries. Also included are facility shut down costs of $1.3 million and $1.9 million in 2013 and 2014, respectively. |

| (c) | Long-term equity options and shareholder’s fees include the non-cash charges associated with stock based compensation awards granted to certain executives and independent directors in the Predecessor Period 2012, the Successor Period 2012, 2013 and 2014 and a cash advisory fee paid to CCMP for all Successor periods. CCMP will not receive a cash advisory fee after this offering. |

| (d) | Debt costs in 2014 include a $2.9 million loss on the early extinguishment of a portion of our 8.375% senior secured notes. The loss consists of a $1.6 million premium paid for the early extinguishment and $1.3 million of previously deferred financing costs. We also incurred $0.7 million of fees to increase the term loan facility and expensed $0.5 million of previously deferred financing costs related to the term loan facility. |

| (e) | Acquisition integration costs incurred to fully integrate the acquisition of Mold-Masters, Kortec, TIRAD and certain other smaller acquisitions. Costs include travel, consulting services, restructuring associated with personnel changes and a branding study to integrate the acquired companies into Milacron. |

16

Table of Contents

| (f) | Professional fees in 2013 include consulting services associated with a manufacturing efficiency project and costs incurred on certain business development projects. Costs in 2014 relate to certain advisory services associated with readiness initiatives for this offering, and one-time business-related advisory services. |

| (g) | Business combination costs in the Predecessor Period 2012 include a $2.8 million non-cash charge related to the accelerated vesting of certain stock-based compensation associated with a change of control as a result of the CCMP Acquisition in April 2012 and $6.0 million of certain professional, audit, and other fees related to the transaction. Costs in the Successor Period 2012 include $9.9 million of certain professional, audit and other fees related to the CCMP Acquisition in April 2012. Costs in 2013 and 2014 relate to certain professional, audit and other fees related to the acquisitions of Mold-Masters, Kortec, TIRAD, and certain other smaller acquisitions. |

| (h) | Non-cash fair market value adjustments includes expenses related to acquisition accounting fair market value adjustments to inventory for the CCMP Acquisition in April 2012, and the acquisition of Mold-Masters in 2013. |

| (i) | Other costs in 2013 include a charge of $1.6 million related to environmental remediation required for the disposition of a building associated with a European facility. |

For a reconciliation of operating earnings, the most directly comparable U.S. GAAP measure, to Adjusted EBITDA for each of our segments, see “Selected Historical Financial Data of Milacron.”

17

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below and all of the other information included in this prospectus, including our consolidated financial statements and the related notes appearing elsewhere in this prospectus, before investing in our common stock. If any of the following risks actually occur, our business, financial condition, operating results and prospects could be materially adversely affected. As a result, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business and Industry

Demand for our products is affected by general economic conditions, including our customers’ industries and capital expenditures, consumer spending trends and other macroeconomic conditions.

Our business is affected by general economic conditions. Any uncertainty or adverse changes such as turmoil in global economic and political conditions, including through rising interest rates or inflation, commodity prices, high unemployment, increased volatility in global capital markets, international conflicts, sovereign debt concerns and/or other factors beyond our control, could lead to a significant decline in demand for our products. In addition, the success of our business depends on the profitability of our customers’ businesses. Many of our customers are in businesses that are cyclical in nature and sensitive to changes in general economic conditions, such as the packaging, automotive, industrial components and machinery, construction, consumer durables, electronics, medical and other industries. The performance of our business is directly related to the production levels of our customers. In particular, prices for plastic resins used to make plastic products and parts tend to fluctuate to a greater degree than our customers can adjust for in the pricing of their products. When resin prices increase, our customers’ profit margins decrease, which may result in lower demand for our products. Therefore, our business is affected by fluctuations in the price of resin, which could have an adverse effect on our business and ability to generate operating cash flows.

In addition, deterioration in the credit quality of our customers or the estimated residual value of our equipment could negatively impact the ability of our customers to obtain the resources they need to make purchases of our equipment. If our customers cannot access credit markets or do not utilize discretionary funds to purchase our products and services as a result of the economy or other factors, our business could suffer. Moreover, any prolonged periods of decline in our customers’ capital expenditures could have a material adverse effect on our business, financial condition or results of operations.

If the use of plastic declines, it could have a material adverse effect on our business, financial condition or results of operations.

Approximately 89% of our 2014 sales and profits were realized from the sale of equipment and services to the plastic processing market. A reduction in the usage of plastic would likely result in the reduction of our sales of equipment and services, which could have a material adverse effect on our business, financial condition, or results of operations. Factors that could result in a decline in the usage of plastic include:

| • | The relative cost of plastic compared with other materials, such as glass, metal and paper. The principal cost of plastic is petroleum-based resins and fluctuations in the price of crude oil and natural gas typically impact the price of these resins. If the price of plastic resins were to increase substantially or the cost associated with other competing materials such as glass, metal and paper, were to materially decrease, the plastic products of our customers may no longer be economically competitive relative to other alternatives. |

| • | The environmental impact of plastic may be perceived negatively by environmental groups, customers and government regulators. A number of governmental authorities and advocacy groups have lobbied for and considered, or are expected to consider, legislation aimed at addressing the environmental impacts of plastic. These proposals have included mandating certain rates of |

18

Table of Contents

| recycling and/or the use of recycled materials, imposing deposits or taxes on plastic packaging material, requiring retailers or manufacturers to develop a recycling infrastructure and increased scrutiny on the use of plastic. Legislative and other changes aimed at reducing the environmental impact of plastic may result in increased costs associated with plastic and/or reduced demand for plastic. |

Any of the foregoing factors and other factors, including those unknown to us, could result in a decline in the usage of plastic and could have a material adverse effect on our business, financial condition or results of operations.

We operate in highly competitive industries, many of which are currently subject to intense price competition, and if we are unable to compete successfully, it could have a material adverse effect on our business, financial condition and results of operations.

Many of the industries in which we operate are highly competitive. Our products may not compete successfully with those of our competitors. The markets for plastic processing equipment and related products, mold components and metalworking fluids are highly competitive and include a number of North American, European and Asian competitors. Principal competitive factors in the plastic processing industry include price, product features, technology, performance, reliability, quality, delivery and customer service. Principal competitive factors in the mold components industry include technology, price, quality, performance and delivery. Principal competitive factors in the metalworking industrial fluids industry include price, market coverage, technology, performance, delivery and customer service.

Our competitors may be positioned to offer more favorable pricing to customers, resulting in reduced profitability and a loss of market share for us. In certain cases we have lost business to competitors who offered prices lower than ours. Competition may also limit our ability to pass on the effects of increases in our cost structure. In addition, some of our competitors may have greater financial resources and less debt than we do, which may place us at a competitive disadvantage in the future. These competitors may be better able to withstand and respond to changes in conditions within our industry. Additionally, due to the recent strength of the U.S. dollar, some of our European competitors may be able to offer prices lower than ours.

Competition in any of these areas may reduce our sales and adversely affect our earnings and/or cash flow by resulting in decreased sales volumes, reduced prices and increased costs of manufacturing, distributing and selling our products.

Our results also depend on the successful implementation of several additional strategic initiatives. We may not be able to implement these strategies successfully, on a timely basis, or at all.

We have recently implemented or begun to implement several strategic initiatives that are designed to increase our cost savings and revenue, transform our business and improve our performance. These initiatives include expanding low cost production capabilities and consolidation of facilities, continued back-office integration to a shared service center and implementation of lean sourcing initiatives. The success of our recent initiatives is subject to both the risks affecting our business generally and the inherent difficulty associated with implementing these initiatives, and is largely dependent on the skills, experience, and efforts of our management and other employees. We face a number of uncertainties in connection with the successful implementation of these strategic initiatives. As a result, we may not be successful in implementing these initiatives nor realize anticipated cost savings and increases in revenue. If we are unsuccessful in implementing these initiatives, our financial condition, results of operations and cash flows could be adversely affected.

Increases in our cost structure or disruption in our supply chain could have a material adverse effect on our results of operations and cash flows.

Our costs are subject to fluctuations, particularly for raw materials and purchased components used in our business, including the cost of labor and steel and the cost of oil and chemicals used in the production of

19

Table of Contents

metalworking fluids. Our success is dependent, in part, upon our ability to manage these fluctuations through pricing actions, cost savings projects and global sourcing actions. While we have historically responded by reducing our cost structure and increasing the prices we charge our customers, these measures may not always be sufficient to offset the effects of the cost increases we experience. Accordingly, market changes in raw material and purchased component prices could have a material adverse effect on our results of operations and cash flows.

Additionally, we have developed a network of third-party vendors who supply certain parts and components for our products. While we currently believe that these third-party vendors represent a low-cost source of supply, their costs could rise in the future and we may not be able to effectively source or produce these components and parts. Significant disruptions to our supply chain could limit our ability to source parts and components on a cost effective basis, if at all, and could have a material adverse effect on our business, financial condition or results of operations.

Our significant international operations subject us to risks such as unfavorable political, regulatory, labor and tax conditions.

Our business is subject to risks related to the different legal, political, social and regulatory requirements and economic conditions of many jurisdictions. We have operations in many foreign countries, including, but not limited to, countries in Europe and Asia. For the year ended December 31, 2014, markets outside North America represented the following percentages of our sales: Asia 22%; Europe 21%; and the rest of the world 5%. In addition, as of December 31, 2014, approximately 68% of our workforce was located outside the United States.

Additional risks associated with our international operations include, but are not limited to the following:

| • | agreements may be difficult to enforce and receivables difficult to collect through a foreign country’s legal system; |

| • | foreign countries may impose additional withholding taxes or otherwise tax our foreign income, attempt to impose transfer taxes on past or future corporate level transactions, impose tariffs or adopt other restrictions on foreign trade or investment, including currency exchange controls; |

| • | general economic and political conditions or instability in the countries in which we operate could have an adverse effect on our earnings from operations in those countries; |

| • | restrictions on or costs relating to the repatriation of foreign profits to the United States, including possible taxes or withholding obligations; |

| • | differing, and possibly more stringent, labor regulations; |

| • | natural disasters, pandemics or international conflict, including terrorist acts, could interrupt the manufacturing of our products or performance of services, endanger our personnel or cause delays; |

| • | enforcement of anti-bribery laws, including the U.S. Foreign Corrupt Practices Act of 1977, as amended, (the “FCPA”), the U.K. Bribery Act (the “UKBA”) and similar laws, economic sanctions laws, regulations and regimes (including those administered by the Office of Foreign Assets Control (“OFAC”) of the U.S. Department of the Treasury), and other international laws and regulations; |

| • | the difficulties of staffing and managing dispersed international operations; |

| • | less protective foreign intellectual property laws; |

20

Table of Contents

| • | unexpected adverse changes in foreign laws or regulatory requirements may occur; |

| • | longer customer payment cycles; and |

| • | legal systems that may be less developed and less predictable than those in the United States. |

We are also subject to numerous regulations in the jurisdictions in which we operate, including customs and international trade laws, export control, antitrust laws and zoning and occupancy laws that regulate producers generally and/or govern the importation, exportation, promotion and sale of our products, the operation of facilities and our relationships with our customers, suppliers and competitors. If these regulations or laws were to change or were violated by our management, employees, suppliers, or agents, the costs of certain goods could increase, or we could experience delays in shipments of our goods, be subjected to fines or penalties, or suffer reputational harm, any of which could reduce demand for our products and negatively impact our business and results of operations. In addition, changes in national and local minimum wage laws and other laws relating to employee benefits could cause us to incur additional wage and benefits costs, which could negatively impact our profitability.

Our overall success as a global business depends, in part, upon our ability to succeed in differing and unpredictable legal, regulatory, economic, social and political conditions. We may not be able to continue to succeed in developing and implementing policies and strategies that will be effective in each foreign market where we do business. Any of the foregoing factors may have a material adverse effect on our ability to generate cash flow and grow our business.

Our operations partly depend on the rate of economic development and growth in the emerging markets of Asia, Africa, Central America and South America.

Our operations partly depend upon the economies of the Asian, African, Central American and South American markets. These markets include countries with economies in various stages of development or structural reform, some of which are subject to rapid fluctuations in terms of consumer prices, employment levels, gross domestic product, interest rates and foreign exchange rates. Our operations in these markets may also be subject to risks relating to weak legal systems which may affect our ability to enforce our intellectual property and contractual rights, exchange controls, unstable governments and privatization, changes in customs or tax regimes, or other government actions affect the flow of goods and currency. To the extent such fluctuations and risks have an effect on the ability of our consumers to pay for our products, the growth of sales of our products in such markets could be impacted negatively.

Our operations are conducted worldwide and our results of operations are subject to currency translation risk and currency transaction risk that could have a material adverse effect on our financial condition and results of operations.

Since significant sales are made in currencies other than the U.S. dollar, our financial results are affected by currency fluctuations. The financial condition and results of operations of each of our foreign operating subsidiaries are reported in the relevant local currency and then translated to U.S. dollars at the applicable currency exchange rate for inclusion in our financial statements. Exchange rates between these currencies, including the Canadian dollar, the Euro, Chinese yuan renminbi, Indian rupee and U.S. dollars in recent years have fluctuated significantly and may do so in the future.

For the year ended December 31, 2014, approximately 45% of our sales were in currency other than U.S. dollars. Significant changes in the value of the Euro, Chinese yuan renminbi and Indian rupee relative to the U.S. dollar could have an adverse effect on our financial condition and results of operations. If the Euro, Chinese yuan renminbi or Indian rupee should weaken against the U.S. dollar in the future, we will experience a negative effect in translating our new orders, sales and earnings when compared to historical results. In addition to

21

Table of Contents

currency translation risks, we incur currency transaction risk whenever one of our operating subsidiaries enters into either a purchase or a sales transaction using a different currency from the currency in which it records revenues. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosure about Market Risk—Foreign Currency Exchange Rate Risk.” Given the volatility of exchange rates, we may not be able to effectively manage our currency transaction and translation risks and any volatility in currency exchange rates may have a material adverse effect on our business, financial condition or results of operations.

We might not be able to timely develop, manufacture and gain market acceptance of new and enhanced products required to maintain or expand our business.

Our success in the future will depend in part upon our ability to maintain and enhance our technological capabilities, develop and market products and applications that meet changing customer needs and successfully anticipate or respond to technological changes of our competitors in a cost-effective and timely manner. Difficulties or delays in identifying viable new products, research, development or production of new products or failure to gain regulatory approval, intellectual property protection or market acceptance of new products and technologies may reduce future sales and adversely affect our competitive position. Our competitors may develop other patent technologies that are more effective or commercially attractive than our current or future technologies or render our technologies or services less competitive or obsolete. Our inability to anticipate, respond to or utilize changing technologies could cause us to lose customers.

Our business, financial condition and results of operations could be adversely impacted by business disruptions, security threats and security breaches.