Attached files

Exhibit 10.7

ASSIGNMENT, ASSUMPTION, AMENDMENT AND CONSENT

75 Kneeland Street, Lease of 6th Floor

This Assignment, Assumption, Amendment and Consent (this “Agreement”) is made as of September 1, 2001, by and among the TRUSTEES OF TUFTS COLLEGE, a Massachusetts not-for-profit corporation (the “Assignor”), PARATEK PHARMACEUTICALS, INC., a Delaware corporation (“Assignee”) and KING REAL ESTATE CORPORATION, AS TRUSTEE OF KNEELAND STREET REAL ESTATE TRUST (“Landlord”).

Assignor is the tenant under a certain lease dated November 10, 1993, as amended by amendment to lease dated March 31, 1998 (the “Lease”), entered into between Assignor and Landlord consisting of all of the rentable space on the 6th floor of the building located at 75 Kneeland Street in Boston, Massachusetts, containing approximately 15,088 rentable square feet of space (the “Premises”). A copy of the Lease is attached hereto as Exhibit A.

Assignor desires to assign its interest as tenant in the Lease to Assignee, and Assignee desires to accept the assignment thereof.

In accordance with the provisions of the Lease, Landlord’s consent to such assignment is required and Landlord is willing to give such consent subject to the terms and conditions of this agreement.

Now, therefore, in consideration of the promises and conditions contained herein, the parties hereby agree as follows:

1. Assignment. Assignor hereby assigns to Assignee all of its right, title and interest in and to the Lease, and Assignee hereby accepts the assignment, transfer and conveyance of such right, title and interest from the Assignor, at the rentals and upon all the other terms and conditions set forth in the Lease for the unexpired term of the Lease.

2. Assumption. Assignee agrees with Assignor and with Landlord to assume and does hereby assume all of tenant’s obligations under the Lease arising from and after the date hereof, including the payment of all rent, additional rent and other financial obligations of the tenant as set forth in the Lease and further assumes liability and responsibility for the due punctual performance of all the covenants, terms, conditions and provisions to be kept, observed and performed by the tenant as set forth in the Lease arising from and after the date hereof.

3. Assignor’s Obligations. Notwithstanding any other provisions of this Agreement, Assignor affirms and agrees that it shall remain fully and primarily liable to Landlord for the payment and performance of all obligations of the tenant under the Lease and that this Agreement shall not relieve Assignor of such liability; provided, however, that Assignor shall not be bound by any modifications to the Lease which are made without Assignor’s prior written consent and Assignor shall not be bound by the amendment to Article 35 of the Lease set forth in Section 8 of this Assignment (“Revised Article 35”).

4. Indemnity. Assignor hereby agrees to indemnify and hold Assignee harmless from and against all claims, demands, losses, damages, expenses and costs including, but not limited to,

- 1 -

reasonable attorneys’ fees and expenses actually incurred, arising out of or in connection with Assignor’s failure, prior to the date of this Assignment, to observe, perform and discharge each and every one of the covenants, obligations and liabilities of the tenant under the Lease, to be observed, performed or discharged on, or relating to, or accruing with respect to the period prior to the date of this Assignment.

Assignee hereby agrees to indemnify and hold Assignor harmless from and against all claims, demands, losses, damages, expenses and costs including, but not limited to, reasonable attorneys’ fees and expenses actually incurred, arising out of or in connection with Assignee’s failure, from and after the date of this Assignment, to observe, perform and discharge each and every one of the covenants, obligations and liabilities of the tenant under the Lease, to be observed, performed, or discharged on, or relating to, or accruing with respect to, the period from and after, but not before, the date of this Assignment, including, without limitation, all such covenants, obligations and liabilities under Revised Article 35. In addition, Assignee hereby agrees that its indemnity of Landlord under Section 35.11.1 of Revised Article 35 shall also run in favor of Assignor, substituting “Assignee” for “Tenant” and “Assignor” for “Landlord,” where applicable, including in the definitions of capitalized terms used in said Section 35A 1.1.

5. Certification. Landlord and Assignor hereby certify that: the Lease is in full force and effect; the copy of the Lease attached hereto is true, accurate and complete; there have been no modifications or amendments thereto; Assignor has fulfilled all of its obligations under the Lease and there exist no defaults under the Lease by Assignor; and Landlord has fulfilled all of its obligations under the Lease and there exist no defaults under the Lease by Landlord.

6. Notice. The tenant’s notice address under the Lease shall, from and after this date, be:

Paratek Pharmaceuticals, Inc.

75 Kneeland Street

Boston, MA 02110

7. Landlord’s Costs. Assignee shall pay all of Landlord’s $1,000 fee for its review and approval of this Agreement and shall also reimburse Assignor for reasonable attorneys’ fees and costs actually incurred (not to exceed $1,000) for the review and final execution of this Assignment and obtaining Landlord’s consent to the same.

8. Amendment to Lease. Assignor, Assignee and Landlord hereby agree that the Lease shall be amended, effective as of the date of this Agreement, by deleting the provisions of Article 35 in its entirety (however, such Article 35 shall be in full force and effect with respect to the obligations of the tenant thereunder arising prior to the date hereof), and the following shall be substituted in place thereof:

35. ENVIRONMENTAL HAZARDS

| 35.1. | TENANTS USE OF HAZARDOUS MATERIAL. |

Tenant and Tenant’s Agents, shall not use, maintain, generate, allow or bring on the Premises or Landlord’s Property or transport or dispose of, on or from the Premises or Landlord’s Property (whether into the ground, into any sewer or septic system, into the

- 2 -

air, by removal off-site or otherwise) any Hazardous Matter (as hereinafter defined), except only for Hazardous Matter of types and in quantities as are used in connection with the chemical, medical or biological research occurring in the laboratories located within the Premises, provided such use and storage is in strict compliance with all Environmental Requirements (as hereinafter defined) and with the provisions of this Article.

| 35.2 | GENERAL STANDARDS OF COMPLIANCE. |

Tenant shall inspect, use, store, generate, and dispose of all Hazardous Matter in compliance with all Environmental Requirements and shall cause its agents to so comply. Tenant shall take all reasonable measures to prevent any third party from releasing Hazardous Matter on or in the Premises. Tenant shall not release, or permit to be released, on, in or from the Premises or Property or in connection with Tenant’s use of the Premises any Hazardous Matter in violation of the Environmental Requirements.

| 35.3. | SPECIFIC STANDARDS OF COMPLIANCE. |

Without limiting Tenant’s obligations under Section 35.2, Tenant shall comply, and cause Tenant’s Agents to comply, with the specific requirements set forth in this Section 35.3.

35.3.1. New Chemicals. Tenant shall provide advance, premanufacture notice to the federal Environmental Protection Agency of the distribution of new chemicals as required under the Toxic Substances Control Act, 15 U.S.C. §21.01 et seq. and 40 CFR Part 700 to 799, and shall also notify Landlord in writing of same.

35.3.2. Laboratories. Tenant shall comply with 29 CFR Part 910 promulgated under the OSHA pertaining to occupational exposure to hazardous chemicals in laboratories.

35.3.3. Discharges to Sanitary Sewer. Tenant shall obtain an industrial use permit from the Massachusetts Water Resource Authority (“MWRA”) if required to do so by law or regulation and a state sewer permit from the state Division of Water Pollution Control and shall comply with the discharge regulations contained in 314 CMR Part 12 and 360 CMR Part 10 and any pretreatment conditions contained in the applicable sewer permit and shall cause its agents to so comply.

35.3.4. Handling Hazardous Wastes. Tenant shall comply, and shall cause its Agents to comply, with 310 CMR Part 30 and 105 CMR Part 480 relating to the handling, storage, generation, transportation, and disposal of hazardous waste and infectious waste. As soon as Tenant or its agents generates hazardous waste, Tenant shall provide Tenant’s generator number and copies of permits required under 310 CMR Part 30 to Landlord, and shall make available upon oral or written request of Landlord within seven (7) days of the date of such request, copies of all manifests used for the transportation and disposal of hazardous waste.

35.3.5. Inventories of Hazardous Material. Tenant shall comply with all notification, filing, reporting and inventory requirements with respect to Hazardous

- 3 -

Matter at the Premises, and Tenant shall make available to Landlord within seven days of the date of oral or written request: (a) copies of all inventories of Hazardous Matter and safety plans filed with the Fire Department under the Emergency Planning and Community Right-To-Know Act, 42 U.S.C. Section 11001 et seq. and applicable Massachusetts laws, (b) copies of material safety data sheets (“MSDS”) that accompany any product used or stored at the Premises, pursuant to the hazard communications standard under the Occupational Safety and Health Act (“OSHA”) and evidence that the MSDSs have been made available to Tenant employees, (c) reports related to radioactive and biological materials at the Premises, and (d) all other plans and reports required to be prepared pursuant to the Environmental Requirements.

Promptly following the request of Landlord, if Tenant or Tenant’s Agents generate hazardous or infectious waste, Tenant shall provide Tenant’s generator number and copies of permits required under 310 CMR Part 30 and 105 CMR Part 480 to Landlord, and shall make available upon oral or written request of Landlord within 7 days of the date of such request, copies of all manifests used for the transportation and disposal of hazardous and infectious waste.

Promptly following the request of Landlord, if Tenant or Tenant’s Agents generates, treats, stores or transports radioactive material, Tenant shall provide to Landlord all applicable licenses under 42 U.S.C. §2011 et seq. and M.G.L. c.11111, §§1 to 48. Tenant shall handle and dispose of radioactive materials in accordance with 10 CFR Parts 0 to 17, and 105 CMR Parts 120 to 122.

| 35.4. | NOTICES. |

Landlord and Tenant shall promptly deliver to the other any notices, orders or similar documents received from any governmental agency or official affecting the Premises and concerning the alleged violation of the Environmental Requirements. Tenant shall give prompt notice to the Landlord of any violation or potential violation of the Environmental Requirements.

| 35.5. | TENANT’S OBLIGATION TO PAY COSTS AND FINES |

Tenant shall bear the full cost of, and be solely responsible for, carrying out its obligations under this Article. Tenant shall pay forthwith any fine assessed in connection with any violation by Tenant or its agents of the Environmental Requirements.

Any cost or fine required under this Article to be borne by Tenant not promptly paid by Tenant that Landlord elects to pay shall be reimbursed by Tenant to Landlord within 30 days of written demand therefor and may at Landlord’s election be treated as additional rent hereunder; and Landlord shall have the same rights and remedies for the nonpayment thereof as for the nonpayment of rent.

During the investigation and cleanup of any release and during any restoration, maintenance, or repair work that is the responsibility of Tenant under this Article, Tenant shall continue to pay rent even though part or all of the Premises may be unusable.

- 4 -

| 35.6. | TENANTS RESPONSIBILITY TO CLEAN UP ANY RELEASE. |

Upon demand by Landlord (whether oral or written), if Hazardous Matter has been released by Tenant or Tenant’s Agents at or from the Premises, in connection with their use of the Premises or otherwise, Tenant shall take all actions which are necessary to attain cleanup levels in accordance with the Environmental Requirements, to mitigate Environmental Damages, and to allow full economic use of the Premises and Property. These actions shall include, without limitation, investigation and cleanup as may be required under CERCLA, Chapter 21E, RCRA, or Chapter 21C, whichever is applicable. All such investigation and remedial work shall be performed by contractors reasonably acceptable to Landlord in accordance with the Environmental Requirements. Any such action shall be performed in good, safe and workmanlike manner and shall minimize any impact on other tenants occupying the Property and the businesses conducted thereon. Tenant shall promptly provide to Landlord copies of testing results and all other reports.

Following such cleanup, Tenant shall promptly take all actions as are necessary to return the Premises, Property and any areas outside the Premises and Property to the condition existing prior to the presence or introduction of any such hazardous material or oil including the repair of any damage caused by the investigation or remediation.

| 35.7. | REMOVAL. |

Tenant shall remove all Hazardous Matter and the containers in which such substances were ever packaged or stored from the Premises prior to the termination of this Lease and prior to vacating; and such removal and disposal of such substances and containers shall be performed in accordance with 310 CMR Part 30.

| 35.8. | INSPECTION. |

Three months prior to the termination of this Lease, and if this Lease terminates other than by expiration of the term, within 30 days after the termination, and in all events not later than 30 days after the Tenant vacates the Premises, and at any other time that Landlord reasonably deems appropriate, Tenant shall retain an environmental site assessment firm acceptable to Landlord in its sole discretion who shall complete the following no later than 30 days after the firm is retained: (a) inspect the Premises for storage of hazardous waste, or release of Hazardous Matter in violation this Article; and (b) provide a report on the results of such inspection reasonably satisfactory to Landlord. No testing or sampling of soil, groundwater or building materials shall be performed without Landlord’s prior written approval.

Tenant, through a duly authorized officer if Tenant is a corporation and if Tenant is not a corporation, through a person empowered to bind Tenant, and any employee responsible for the proper handling and disposal of Hazardous Matter, shall give an annual certification, and a certification prior to the termination of this Lease and prior to vacating, to the effect that the requirements of this Article, and any other of the Environmental Requirements for which Landlord has requested a certification, have been satisfied.

- 5 -

Tenant grants Landlord, upon reasonable written notice, the right to inspect the Premises throughout the term of this Lease to determine whether Tenant is in compliance with the provisions in this Article; and Tenant shall provide Landlord with all information deemed by Landlord necessary for Landlord to ascertain whether Tenant so complies.

| 35.9. | INTENTIONALLY OMITTED. |

| 35.10. | SELF HELP. |

If Landlord reasonably determines that Tenant has not proceeded diligently to cure any default under this Article within a reasonable time period, as determined by Landlord in its sole, but reasonable, discretion, or in the event of an emergency as determined by Landlord in its sole, but reasonable, judgment, Landlord, in addition to any other remedy under this lease, shall have the right, but not the obligation, to enter upon the Premises and to perform Tenant’s obligations hereunder, including the payment of money and the performance of any other act. All reasonable sums so paid by Landlord and all incidental costs and expenses in connection therewith shall be reimbursed by Tenant to Landlord, promptly following demand therefor, as additional rent. Not-withstanding any such performances by Landlord, Tenant shall remain liable for any violation of the provisions in this Article.

| 35.11. | INDEMNIFICATION. |

35.11.1. Tenant’s Indemnification. Tenant and its successors, assigns and guarantors shall release, defend (with an attorney reasonably acceptable to Landlord), indemnify and hold harmless Landlord and its successors and assigns and the officers, directors, stockholders, partners, beneficial owners, trustees, employees, agents, contractors, attorneys, and mortgagees of Landlord or of its successors and assigns or of any of the foregoing from and against all Environmental Damages which may be asserted by Tenant, any other person or entity, or government agency on account of the presence or release of any Hazardous Matter upon, in or from the Premises or Property related to the activities conducted by Tenant or its agents, or to other action by Tenant or its agents in violation of the Environmental Requirements or on account of breach of any of Tenant’s obligations under this Article.

35.11.2. Landlord’s Indemnification. Landlord shall indemnify and hold Tenant harmless from and against all injury, loss, claim or damage relating to the cost of cleanup (including reasonable attorneys’ fees but exclusive of any indirect or consequential damages) arising during or after the Term of this Lease in connection with any release of Hazardous Matter upon, in or from the Premises or Landlord’s Property or other action in violation of Environmental Requirements, where such release or action occurred prior to the Term Commencement Date (or, if earlier, the date of Tenant’s initial entry onto the Premises) or was caused by the Landlord, its agents, employees or contractors after the Term Commencement Date; provided, however, that this indemnification by Landlord expressly excludes any release, action or violation caused in whole or in part by any prior, current or future tenant of the Building or any contractor, agent, employee or invitee of any of same.

- 6 -

| 35.12. | DEFINITIONS. |

The following terms as used herein shall have the meanings set forth below:

“Hazardous Matter” shall mean any substance (i) which is toxic, explosive, corrosive, flammable, infectious, radioactive, carcinogenic, mutagenic, biological or otherwise hazardous substance which is or becomes regulated by any governmental authority, agency, commission or instrumentality of the United States, the Commonwealth of Massachusetts or any political subdivision thereof including city or town in which the Premises are located; or (ii) which is or becomes defined as a “hazardous substance” pursuant to Section 101 of the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. Section 9601 et seq. (“CERCLA”); as well as any material or substance which is or becomes defined as hazardous material or oil under M.G.L. Ch. 21E (“Chapter 21E”), Section 2 and the Massachusetts Contingency Plan, 310 CMR Part 40; or (iii) which is or becomes a pollutant regulated under the Clean Air Act, 42 U.S.C. Section 7401 et seq. and 40 CFR Parts 50 to 85 or the Massachusetts Clean Air Act, M.G.L. c. 111, Section 142 et seq. and 310 CMR Parts 6 to 8; or (iv) which is or becomes defined as “hazardous waste” below; or (v) the presence of which requires investigation or remediation under any present or future federal, state or local statute, regulation, ordinance, by-law, order, action, policy or common law; or (vi) which contains gasoline, diesel fuel, oil or other petroleum hydrocarbons; or (vii) the presence of which causes or threatens to cause a nuisance or poses or threatens to pose a hazard to the health or safety of persons on or about or adjacent to the Premises or Property.

“Environmental Damages” shall mean all liabilities, injuries, losses, claims, damages (whether special, consequential or otherwise), settlements, attorneys’ and consultants’ fees, fines and penalties, interest and expenses, and costs of environmental site investigations, reports and cleanup, including without limitation costs incurred in connection with: any investigation or assessment of site conditions or of health of persons using the Building or Landlord’s Property; risk assessment and monitoring; any cleanup, remedial, removal or restoration work required by any governmental agency or recommended by Landlord’s environmental consultant; any decrease in value of Landlord’s Property; any damage caused by loss or restriction of rentable or usable space in Landlord’s Property; or any damage caused by adverse impact on marketing or financing of Landlord’s Property.

“Environmental Requirements” shall mean all Applicable Laws (including without limitation the laws and regulations referenced in this Article), common law principles pertaining to nuisance, tort, and strict liability, the provisions of any and all Approvals, all recommendations by manufacturers, trade associations and governmental bodies, and the terms of this lease; in so far as such laws and regulations, orders, permits and approvals, recommendations, and terms relate to the release, maintenance, use, keeping in place, or disposal of Hazardous Matter, including those pertaining to reporting, licensing, permitting, housekeeping, upgrading of equipment, health and safety of tenant’s agents and other persons, investigation, remediation, and disposal; and shall include both present and future laws and regulations, orders, permits and approvals, recommendations, and rules and regulations.

- 7 -

| 35.13. | OTHER |

35.13.1. The provisions of this Article shall be in addition to any other obligations and liabilities Tenant may have to Landlord under this lease or at law or in equity.

35.13.2. In the case of conflict between this Article and other provisions of this Lease, the provisions imposing the most stringent requirement as to Tenant shall control.

35.13.3. The obligations of Tenant under this Article shall survive the expiration or termination of this Lease and the transfer of title to the Property.

9. Utility Closet. Assignee agrees that Assignor may, at reasonable times and upon reasonable notice, (except that advanced notice shall not be required in event of an emergency) access the utility closet located in the Premises currently housing Assignor’s telephone center (the “Utility Closet”) at any time during the remaining term of the Lease and to continue to maintain voice and/or data communications equipment in the Utility Closet. Assignor shall maintain a comprehensive general liability policy in reasonable amounts as well as a policy covering Assignor’s fixtures, property and equipment installed in the Utility Closet, which policies shall name Assignee as an additional insured. Assignor hereby consents to Assignee’s relocation of the Utility Closet within the Premises, at Assignee’s sole cost and expense, subject to prior approval by Landlord, as required by the Lease. Notwithstanding any provisions in the Lease or this Assignment to the contrary, Assignor shall, at its sole cost and expense, at the end of the remaining term of the Lease, remove its property from the Utility Closet in accordance with the terms of the Lease. The foregoing arrangement is between Assignor and Assignee and does not affect in any way the Lease or the obligations of Assignee to Landlord under the Lease.

10. Landlord’s Consent. Landlord hereby consents to the foregoing assignment of the Lease by Assignor to Assignee.

11. Ratification. The Lease, as amended by this Agreement, is hereby ratified and confirmed by the parties.

12. Binding. This Agreement shall be binding upon and inure to the benefit of the parties hereto, their heirs, executors, administrators, successors, in interest and assigns.

[signatures on next following page]

- 8 -

In witness whereof, the undersigned have duly executed this Agreement as of the day and year first above written.

| ASSIGNOR; | ASSIGNEE: | |||||||

| TRUSTEES OF TUFTS COLLEGE | PARATEK PHARMCEUTICALS, INC. | |||||||

| By: | /s/ Steven S. Manos |

By: | /s/ George Hillman | |||||

| Name: Steven S. Manos | Name: George C. Hillman | |||||||

| Title: Executive V.P | Title: Executive Vice President | |||||||

| Duly authorized | Duly authorized | |||||||

| LANDLORD: | ||||||||

| KING REAL ESTATE CORPORATION, As Trustee of KNEELAND STREET REAL ESTATE TRUST and Not Individually |

||||||||

| By: | /s/ Karl Greenman |

|||||||

| Name: Karl Greenman | ||||||||

| Title: President and Treasurer | ||||||||

| Duly authorized | ||||||||

- 9 -

EXHIBIT A

Lease

LEASE

of

6th Floor, 75 Kneeland Street, Boston, MA

This lease (hereinafter “Lease”), entered into by and between:

KING REAL ESTATE CORPORATION, a Massachusetts corporation, Trustee of KNEELAND STREET REAL ESTATE TRUST under Declaration of Trust dated April 1, 1980, filed with Registry District of Suffolk County as Document No. 351241 and noted on Certificate of Title No. 92936 (hereinafter “Landlord”),

and

TRUSTEES OF TUFTS COLLEGE, a Massachusetts nonprofit corporation with a present mailing address of Ballou Hall, Medford, Massachusetts 02155, Attention: Executive Vice President (hereinafter “Tenant”).

In consideration of the rents, covenants and agreements hereinafter reserved and contained on the part of Tenant to be observed and performed, Landlord demises and leases to Tenant and Tenant leases from Landlord the following premises upon the following terms, covenants and conditions.

| 1. | DEMISED PREMISES |

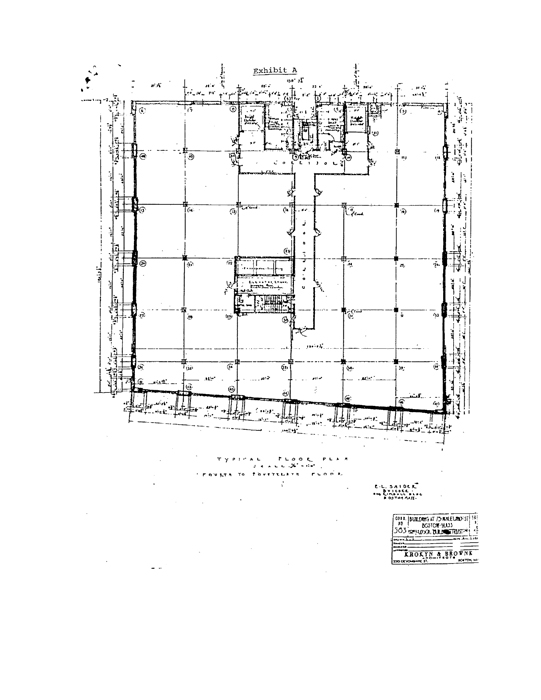

The demised premises consisting of the entire sixth floor of the building (hereinafter “Building”) located at 75 Kneeland Street, Boston, Massachusetts, which demised premises are shown on Exhibit A attached hereto, containing 15,088 square feet of rentable floor area (hereinafter the “Premises”). Said Building contains an aggregate total rentable area of 211,232 square feet.

Tenant shall have, as appurtenant to the Premises, the non-exclusive right and easement to use in common with others entitled thereto (a) common facilities (hereinafter “Common Facilities”) in the Building and on the land on which it is located (said Building and land are hereinafter “Landlord’s Property”) including without limitation, sidewalks, lobbies, hallways, stairways, entranceways, exterior spaces, common washrooms and such other facilities available to all tenants of the Building as may be designated from time to time by the Landlord (subject to the last sentence of this paragraph), and (b) the pipes, ducts, conduits, utility lines, wires, sewerage system and appurtenant equipment serving the Premises. Tenant’s rights hereunder shall always be subject to the reasonable rules and regulations from time to time established by Landlord, as provided in Section 23B hereof, provided such rules and regulations shall not materially interfere with Tenant’s Permitted Use (hereinafter defined) of the Premises. Landlord reserves and shall have the unrestricted right to change the location, size or character of any of the Common Facilities, provided such changes do not materially decrease the size of the Premises or materially adversely affect Tenant’s use of the Premises for the Permitted Use.

EXCEPTED AND EXCLUDED from the Premises are the exterior walls and any space currently or (if same does not materially decrease the size of the Premises or materially adversely affect Tenant’s use of the Premises for the Permitted Use) in the future necessary to install,

maintain and operate, by means of pipes, ducts, wires, meters, vents, flues, conduits, utility lines, fan rooms, shafts, stacks, utility closets, janitor closets, stairways or otherwise those utilities and services required for Landlord’s Property, Common Facilities thereof and tenant premises (including the Premises). Landlord, its agents, contractors and employees shall have the right of access to and entry on the Premises for the purposes of such installation, maintenance or operation or for the purposes of making repairs, alterations or additions to the Premises or to the Building if Landlord so elects. Except in cases of emergency, Landlord shall exercise the foregoing rights upon reasonable notice to the Tenant and in such a manner as not to interfere unreasonably with Tenant’s use of the Premises between the hours of 8:00 a.m. and 6:00 p.m. Monday through Friday and between the hours of 8:00 a.m. and 1:00 p.m. on Saturday, excluding all legal holidays (hereinafter “Business Hours”). Landlord further reserves the right to change the street address and the name of the Building at any time and from time to time upon sixty (60) days prior notice to Tenant, without liability to Tenant.

| 2. | TERM |

2.1 Term. Subject to the conditions herein stated, Tenant shall hold the Premises for a term of approximately five (5) years (hereinafter the “Term” or the “original Term”) commencing on the later of (i) the Substantial Completion Date (as defined in Article 3) or (ii) January 1, 1994 (the later of such dates being hereinafter referred to as the “Term Commencement Date”) and terminating December 31, 1998. The Term may be extended by Tenant upon and subject to the terms of Article 41 hereof, in which event the “Term”, as used herein, shall include the original Term together with the extension period.

| 3. | CONSTRUCTION AND CONDITION OF THE PREMISES |

3.1 Condition of Premises. Except for the construction of the Initial Tenant Improvements as provided herein, the Tenant accepts the Premises and the Building in their present “as is” condition, without representation or warranty, express or implied, in fact or in law, by Landlord and without recourse to Landlord as to the nature, condition or usability thereof and agrees that Landlord has no work to perform in or on the Premises; and Tenant agrees further that any and all work to be done in or on the Premises (except as provided herein with respect to the construction of the Initial Tenant Improvements and for those items of repair and other work which are expressly the responsibility of Landlord hereunder) will be at Tenant’s sole cost and expense.

3.2 The Initial Tenant Improvements.

(a) Tenant has provided Landlord with preliminary plans, and based upon such plans Landlord has caused its architect to prepare final plans and specifications (the “Plans”) for the layout of Tenant’s leasehold improvements to a portion of the Premises (the “Initial Premises”) as depicted on such Plans (the “Initial Tenant Improvements”). The Plans have been approved by the Tenant and are attached hereto as Exhibit B. The Initial Tenant Improvements shall not include Tenant’s furniture, trade fixtures, equipment and property and are limited to normal fit-up construction as depicted on the Plans. It is agreed that the Initial Tenant Improvements shall not include, and Landlord shall not be responsible for, any construction or build-out except within the Initial Premises, and (except only for the work described in clause 3 below) the

- 2 -

balance of the Premises (the “Balance of the Premises”) shall be delivered to the Tenant in its current “as is” condition. As part of the Initial Tenant Improvements, Landlord shall also perform the following work on the sixth floor of the Building:

1. The refinishing of the common restrooms, including making accessibility improvements thereto;

2. The refinishing of the common hallway; and

3. The installation of new thermopane windows in both the Initial Premises and in the Balance of the Premises.

Landlord agrees to remove, encapsulate or abate any asbestos in concentrations greater than one percent (1%) found in the Initial Premises during the process of the construction of the Initial Tenant Improvements; however, the foregoing shall not require Landlord to test the Premises or any portion thereof for the presence of asbestos and shall be limited to the removal, encapsulation or abatement of materials actually known by Landlord to contain such concentrations of asbestos.

Landlord agrees, in constructing the Initial Tenant Improvements, to reasonably cooperate with Tenant in coordinating its work with fit-up work to be performed in the Initial Premises by Tenant, such as telephone and communications cabling and the delivery and set-up of furniture and fixtures, provided such cooperation and coordination does not increase the cost of constructing, or time for completing, the Initial Tenant Improvements.

(b) Based upon the approved Plans, the Landlord shall proceed, promptly upon the execution hereof, using reasonable efforts, to obtain all necessary permits and approvals for the construction of the Initial Tenant Improvements, to engage a contractor to perform the construction and to proceed to complete the construction of the Initial Tenant Improvements in substantial conformance with the Plans. The Initial Tenant Improvements shall be performed in a good and workmanlike fashion using new materials and in a first-class manner; and the Initial Tenant Improvements shall be performed in accordance with, and when completed shall in all respects comply with all Applicable Law (as defined in Article 23) and the terms and conditions of all permits and approvals. Landlord reserves the right to make minor changes and substitutions to the Plans in connection with the construction of the Initial Tenant Improvements, provided same do not materially adversely modify the Plans. Landlord agrees to use all reasonable efforts to substantially complete the Initial Tenant Improvements by December 31, 1993. Landlord agrees to schedule bi-weekly meetings with Tenant during the construction period for the Initial Tenant Improvements in order to update Tenant as to the progress of construction and the estimated time of substantial completion of the work. If the Substantial Completion Date (as defined in subsection (c) below) has not occurred by January 15, 1994, Tenant shall be entitled to a credit against its rent obligations hereunder in the amount of one month’s rent (meaning in such event Tenant’s obligation to pay rent hereunder shall begin on the date one month following the Term Commencement Date). If the Substantial Completion Date has not occurred by June I, 1994, the Tenant shall have the option to terminate this Lease by giving written notice thereof to Landlord at any time thereafter but prior to the Substantial Completion Date occurring, and this Lease shall thereupon be terminated and of no force and effect.

- 3 -

(c) The Initial Tenant Improvements shall be deemed substantially complete on the date as of which a certificate of occupancy has been received from the City of Boston and delivered to Tenant and a certificate of Landlord’s architect has been delivered to Tenant stating that the Initial Tenant Improvements have been substantially completed in accordance with subsection (b) above, and only punch-list type items remain to be completed, which punch-list items are to be completed by Landlord as soon as reasonably practicable thereafter (the “Substantial Completion Date”). Notwithstanding the foregoing, if any delay in the substantial completion of the Initial Tenant Improvements by Landlord is due to: (i) any change in the Plans requested by Tenant; (ii) any request by Tenant for a delay in the commencement or completion of the Initial Tenant Improvements for any reason; or (iii) any other act or omission of Tenant or its employees, agents or contractors; then; for the purposes of establishing the Term Commencement Date only, the Substantial Completion Date shall be deemed to be the date the Initial Tenant Improvements would have been substantially completed, if not for the foregoing. Landlord agrees to provide Tenant with the benefit of any manufacturer’s warranties for equipment and fixtures in the Premises, the maintenance and repair of which are Tenant’s responsibility hereunder.

(d) Tenant shall give Landlord specific written notice of any defects or incomplete remaining items of work with respect to the Initial Tenant Improvements, such notice to be given to Landlord not later than the date ten (10) days after the Term Commencement Date. Except with respect to the items contained in such notice, Tenant shall be deemed satisfied with the Initial Tenant Improvements, Landlord shall be deemed to have completed all of its obligations under this Article 3 and Tenant shall have no claim that Landlord has failed to perform in full its obligations hereunder. Landlord agrees to use all reasonable efforts to correct or complete such items of work as soon as reasonably practicable after the Term Commencement Date. Landlord agrees to provide Tenant with the benefit of any warranty or guaranty received by Landlord from the contractor performing the construction of the Initial Tenant Improvements, Landlord agreeing to obtain customary construction warranties from its general contractor. Landlord agrees that if such construction warranties from its general contractor do not include a one year warranty regarding HVAC balancing and adjusting, Landlord shall be responsible, at its expense, for having any necessary balancing and adjusting performed during such one-year period.

(e) This lease is subject to the Landlord obtaining all permits, licenses and approvals necessary to allow Landlord to construct the Initial Tenant Improvements and obtain a certificate of occupancy with respect thereto; and if Landlord shall be unable to obtain same, and is therefore unable to commence or complete the Initial Tenant Improvements, then this lease may be terminated by Landlord by written notice to Tenant.

3.3 The Additional Tenant Improvements.

(a) Tenant shall be responsible, at its sole cost and expense, for the performance of all work, if any, necessary in Tenant’s discretion to prepare the Balance of the Premises for Tenant’s occupancy (the “Additional Tenant Improvements”). If Tenant desires to perform such work, Tenant shall complete the Additional Tenant Improvements in accordance with the

- 4 -

Additional Plans, as defined below, and in accordance with the requirements of Article 9 and Article 23 hereof; and the Additional Tenant Improvements shall only be performed by contractors and subcontractors who have been approved in writing by Landlord, such approval not to be unreasonably withheld or delayed.

(b) Tenant shall be solely responsible for the preparation and submission to Landlord for approval, of all architectural, electrical and mechanical drawings, plans and specifications necessary for the construction of the Additional Tenant Improvements, should Tenant desire to construct the same; and all such plans and specifications shall be subject to Landlord’s prior written approval, which shall not be unreasonably withheld or delayed (such plans and specifications, when approved by Landlord, are hereinafter referred to as the “Additional Plans”). Landlord shall not be deemed unreasonable in not approving matters therein which, among other things, in Landlord’s reasonable judgment, would cause additional delay or any expense or unreasonable inconvenience to Landlord in the construction, operation or maintenance of or insurance upon the Premises or Building or any related machinery, equipment or other property, or which are aesthetically inappropriate to the Building, or which would conflict with the design or function of the balance of the Building.

(c) Intentionally Deleted.

(d) All work to be done hereunder by Tenant in connection with the Additional Tenant Improvements shall be done in a good and workmanlike fashion using new materials and in a first-class manner; and the Additional Tenant Improvements shall be performed in accordance with, and when completed shall in all respects comply with, all Applicable Law (as defined in Article 23), including the applicable provisions of the Americans With Disabilities Act, the terms and conditions of all permits and approvals, and with all insurance requirements which may be then applicable.

(e) Tenant understands that certain tenant fit-up work is to be performed in the Building with respect to premises leased to New England Medical Center Hospitals, Inc. (the “NEMC Work”). Tenant agrees that, until the NEMC Work has been completed, but not later than July 1, 1994, Tenant shall use labor compatible with that being employed for the NEMC Work and shall not employ or permit the use of any labor or otherwise take any action which might result in a labor dispute involving personnel providing work or services in connection with the NEMC Work. If Tenant believes that compliance with the preceding sentence during such period will require Tenant to expend extra funds or pay a premium for labor and materials in connection with the Additional Tenant Improvements or any other Alterations, Landlord shall reimburse Tenant for the reasonable additional cost, if any, in complying with the preceding sentence, provided the following procedure shall apply and be followed:

(1) Before proceeding with any such construction work (the “Work”), Tenant shall notify Landlord and provide Landlord with plans and specifications for such work prepared by an architect and sufficient to bid, permit and construct the Work (the “Bid Plans”). The Bid Plans shall be subject to Landlord’s approval, as provided in subsection (b) above, and the Work as depicted on the Bid Plans shall in all respects comply with all Applicable Law, including the applicable provisions of the Americans with Disabilities Act (which compliance shall be and remain the responsibility of Tenant).

- 5 -

(2) Tenant shall promptly obtain from an appropriate and reputable contractor a bid for the construction of the Work as depicted on the Bid Plans (the “Bid Amount”), and the contractor’s reasonable charge for providing such bid shall be borne by the Landlord.

(3) Based upon the Bid Plans, the Landlord shall thereafter proceed using reasonable efforts to obtain all necessary permits and approvals for the construction of the Work, and shall cause the construction of the Work to be performed under its direction with contractors of Landlord’s choosing (which may involve construction activity occurring during night hours and on weekends only), and such work shall be completed by Landlord’s contractor in substantial conformance with the Bid Plans, and shall be performed in a good and workmanlike fashion using new materials and in a first-class manner and within the time provided for completion specified in Tenant’s contractor’s bid. Landlord reserves the right to make minor changes and substitutions to the Bid Plans, provided same do not materially adversely modify the Bid Plans. The Work shall be deemed substantially complete on the date as of which a certificate of occupancy has been received from the City of Boston and delivered to Tenant for the Work and the Work has been substantially completed in accordance with this paragraph, with only punch-list type items remaining to be completed, which punch-list items are to be completed by Landlord’s contractor as soon as reasonably practicable thereafter. Tenant shall give Landlord specific written notice of any defects or incomplete remaining items of work with respect to the Work within ten (10) days of the substantial completion of the Work; and except with respect to the items contained in such notice, Tenant shall be deemed satisfied with the Work and Landlord shall be deemed to have completed all of its obligations under this subsection (e) and Tenant shall have no claim that Landlord has failed to perform in full its obligations hereunder. Landlord agrees to provide Tenant with the-benefit of any warranty or guaranty received by Landlord from the contractor performing the Work, Landlord agreeing to use reasonable efforts to obtain customary construction warranties from its contractor, including the balancing and adjusting of the HVAC system for a period of one year

(4) Tenant shall pay to Landlord, promptly upon the presentation of bills or invoices from time to time for work performed or materials supplied pursuant to the construction contract (which shall be certified by Landlord as due under the construction contract), the cost of construction of the Work, provided the aggregate of Tenant’s payments to Landlord shall not exceed the Bid Amount (so that if the total cost of construction of the Work is less than the Bid Amount, Tenant shall only have paid such lesser amount), and any costs over the Bid Amount (subject to the following sentence) shall be borne by the Landlord. The Tenant shall remain responsible, and shall promptly pay or reimburse Landlord, for all permit and approval costs and other costs of the Work not included in the Bid Amount, and for any costs and expenses of construction due to: (i) any change in the Bid Plans requested by Tenant; (ii) any request by Tenant for a delay in the commencement or completion of the Work for any reason; or (iii) any other act or omission of Tenant or its employees, agents or contractors. Landlord’s construction obligations hereunder shall be conditioned upon prompt payment by Tenant of the costs of construction, as provided herein, and such payments shall be deemed additional rent hereunder and, in case of any nonpayment thereof, Landlord shall have in addition to any other rights and remedies, all of the rights and remedies provided by law or provided for in the Lease for the nonpayment of Fixed Rent

- 6 -

| 4. | RENT |

The fixed rent (hereinafter “Fixed Rent”) payable by the Tenant during the original Term shall be the annual rent of Two Hundred Eleven Thousand Eight Hundred Thirty Five and 52/100 ($211,835.52) Dollars ($14.04 per square foot of rentable floor area) payable in equal monthly installments of $17,652.96. Tenant’s obligations to pay Fixed Rent shall begin on the Term Commencement Date. Tenant shall deposit the first month’s rent with Landlord upon execution hereof, to be held as advance rental and security to be forfeited, without limitation or other remedies, for any default by Tenant occurring prior to the Term Commencement Date. If no default occurs, the payment shall be applied to the first monthly installment due hereunder.

Tenant shall also pay as additional rent without notice, except as required under this Lease, and without any abatement, deduction or setoff, all sums, impositions, costs, expenses and other payments which Tenant in any of the provisions of this Lease assume or agrees to pay, and, in case of any nonpayment thereof, Landlord shall have in addition to any other rights and remedies, all of the rights and remedies provided by law or provided for in the Lease for the nonpayment of Fixed Rent.

All Fixed Rent payments are due in advance without demand, deduction or set-off on the first day of each and every month during the Term and any extension or renewal thereof. Fixed Rent for any partial month shall be prorated.

In the event any Fixed Rent, additional rent or any other payments are not paid within ten (10) days of the due date thereof, Tenant shall be charged a late fee of 1.5% of such late payment for each late payment for each month or portion thereof that said payment remains outstanding. Said late fee shall be payable in addition to and not in exclusion of additional remedies herein provided to Landlord.

| 5. | PLACE OF PAYMENT OF RENT |

All payments of rent shall be made by Tenant to Landlord without notice or demand at such place as Landlord may from time to time designate in writing. The initial place for payment of rent shall be Whittier Partners, 155 Federal Street, Boston, Massachusetts 02110. Any extension of time for the payment of any installment of rent, or the acceptance of rent after the time at which it is due and payable shall not be a waiver of the rights of Landlord to insist on having all other payments made in the manner and at the times herein specified.

| 6. | OPERATING EXPENSES AND REAL ESTATE TAXES |

6.1 Operating Expenses Payment.

In the event that the total Operating Expenses (hereinafter defined) for any calendar year (beginning with calendar year 1994) increase above the Operating Expenses for calendar year 1993 (hereinafter “Operating Expenses Base”), Tenant shall pay to Landlord, as additional rent hereunder, 7.143% of any such increase (hereinafter “Proportionate Share”), in the manner hereinafter set forth. The Operating Expenses and the Operating Expenses Base shall be pro-rated for any partial calendar year within the Term hereof.

- 7 -

Landlord shall deliver to Tenant approximately ninety (90) days after the close of each calendar year in which any portion of the Term may fall, an itemized statement certified by the Landlord’s managing agent and allocating expense items in reasonable detail, setting forth:

a. The Operating Expenses for the preceding calendar year;

b. The total amount of Tenant’s Proportionate Share of the increase in Operating Expenses for the preceding calendar year; and

c. The balance, if any, due from or overpaid by Tenant for the preceding calendar year.

Tenant shall pay to Landlord the balance due from Tenant within thirty (30) days of the receipt of such statement. In the event such statement shows an overpayment by Tenant, Landlord shall refund the amount of such overpayment to Tenant within 30 days of the delivery of such statement or shall credit same against future additional rent payments, provided Tenant is not then in default in the performance of any of its obligations under-this Lease.

In addition, commencing January 1, 1994 or at any time thereafter designated by Landlord, on the first day of each month throughout the Term, Tenant shall pay to Landlord, on account towards Tenant’s share of anticipated increases in Operating Expenses, one-twelfth of the total amount reasonably estimated by Landlord to be Tenant’s share thereof for the current calendar year.

The Tenant shall also pay to the Landlord, within thirty (30) days of receipt of any invoice therefor, as additional rent hereunder, 100% of any Operating Expenses which are incurred by Landlord and either caused by any act or negligence by the Tenant or Tenant’s Agents or are performed as special services to Tenant beyond those normally provided by Landlord, including without limitation additional after-hours security, facilities and personnel (“Special Services”).

6.2 Operating Expenses Definition.

The term Operating Expenses shall mean only those costs reasonably incurred with respect to the operation, administration, cleaning, repair, management, maintenance, protection and upkeep (hereinafter “Operation”) of Landlord’s Property that are consistent with those provided at comparable buildings located in Boston, Massachusetts, including without limitation expenses for the following:

A. Compensation and all fringe benefits, workmen’s compensation, unemployment insurance, insurance premiums, wages and taxes paid to, for, or with respect to all persons engaged in the Operation of Landlord’s Property;

B. All utilities and services furnished and supplied to the Common Facilities;

C. All utilities and services furnished and supplied generally to tenants in the Building utilizing the Building’s common systems;

- 8 -

D. Cost of services, materials, supplies and equipment furnished or used in the Operation of Landlord’s Property;

E. Cost of maintenance, cleaning and repairs to Landlord’s Property;

F. All legal, accounting and other professional fees and charges directly related to the Operation of Landlord’s Property;

G. Expenses for or on account of the upkeep and maintenance of equipment, including payments under service contracts for maintenance of equipment such as, but not limited to, security, air-conditioning, heat or elevator equipment;

H. Premiums for any insurance carried by Landlord covering Landlord’s Property, including but not limited to fire, casualty, boiler, sprinkler, machinery, rental interruption and general liability insurance to the extent carried by Landlord, in its sole discretion;

I. Personal property sales and use taxes on material, equipment, supplies and services, the cost of all permits and licenses and all fees for fire, security and police protection;

J. Customary and reasonable management fees, which shall not exceed five (5%) percent of the gross rents for the Building per year; and

The net amount of any insurance proceeds received by Landlord on account of any items included as a part of the Operating Expenses shall be included as a credit against the Operating Expenses in the year in which such proceeds are received by Landlord.

Operating Expenses shall not include the following: leasing commissions and costs incurred in preparing leasable space in the Building for the occupancy of other tenants; interest, principal or other payments under any mortgage or other financing of the Building or Landlord’s Property; any inheritance, estate, succession, transfer, gift, franchise, income or earnings, profit, corporate or similar tax to the extent applicable to Landlord’s general or net income; and any fines or penalties payable by Landlord as a result of its violations of law.

Depreciation and costs incurred for the exclusive benefit of a specific tenant shall not be included in Operating Expenses. Expenditures which are not properly chargeable against income shall not be included in Operating Expenses, except that the annual charge off (hereinafter defined) of the following shall be included: (a) those capital improvements required to be made by federal, state or local regulation or ordinance not in effect as of the Term Commencement Date and (b) those capital items acquired by Landlord which, in Landlord’s reasonable judgment, should reduce the Operating Expenses whether or not such reduction occurs. There shall be included in Operating Expenses for the calendar year in which such capital expenditure is made and each succeeding calendar year, the amount of the annual charge-off of such capital expenditure together with interest at an annual rate equal to 2% over the prime rate of the Bank of Boston in effect at the time of making such capital expenditure (less insurance or other proceeds, if any, collected by Landlord by reason of damage to, or destruction of, any capital item so replaced). Annual charge-off shall be determined by dividing the original cost of the capital expenditure made during the Term of this Lease by the number of years of useful life of the item acquired. The useful life shall be determined by Landlord’s accountants in accordance with generally accepted accounting principles and practices in effect at the time of the capital expenditure.

- 9 -

6.3 Real Estate Taxes Payment.

In the event that the Real Estate Taxes (hereinafter defined) for any tax year increase above $336,995.73, (hereinafter “Tax Base”), Tenant shall pay to Landlord as additional rent hereunder, its Proportionate Share of any such increase. Such payments shall be made in monthly installments on the first day of each month, in an amount reasonably estimated by Landlord to be Tenant’s share thereof.

Landlord shall deliver to Tenant approximately ninety (90) days after the close of each tax year in which any portion of the Term may fall, an itemized statement setting forth:

a. The Real Estate Taxes for the preceding tax year;

b. The total amount of Tenant’s Proportionate Share of the increase in Real Estate Taxes for the preceding tax year; and

c. The balance, if any, due from or overpaid by Tenant for the preceding tax year.

Tenant shall pay to Landlord the balance due from Tenant within thirty (30) days of the receipt of such statement. In the event such statement shows an overpayment by Tenant, Landlord shall refund the amount of such overpayment to Tenant within 30 days of the delivery of such statement or shall credit same against future additional rent payments, provided Tenant is not then in default in the performance of any of its obligations under this Lease.

In the event that Landlord obtains an abatement, reduction or refund of any Real Estate Taxes for a tax period during which Tenant was obligated to pay a share of the increase in Real Estate Taxes, then Tenant shall receive its Proportionate Share of the net proceeds of such abatement, reduction or refund, and any interest paid to the Landlord on account of such abatement, reduction or refund, (after deduction of all reasonable costs, including legal and appraisal fees, incurred by Landlord in obtaining the same) but only to the extent and not in excess of any payments made by Tenant for such increase as required under this Article 6. Landlord shall be under no obligation to seek such an abatement, reduction or refund. Tenant shall not contest—by any proceedings the assessed valuation of Landlord’s Property or any part thereof for purposes of obtaining a reduction of its assessment or of any taxes.

6.4 Real Estate Taxes Definition.

The term “Real Estate Taxes” shall mean the sum of all taxes, rates and assessments, general and special, levied or imposed against the Landlord’s Property and any improvements constructed thereon (including the Building), including all taxes, rates and assessments, general and special, foreseen and unforeseen, levied or imposed for school, public betterment, general or local improvements. If the system of real estate taxation shall be altered or varied and any new tax shall be levied or imposed in the jurisdiction wherein Landlord’s Property is located, then any such new tax or levy shall be included within the term “Real Estate Taxes”. The amount of

- 10 -

the Real Estate Taxes which shall be deemed to have been levied or imposed with respect to Landlord’s Property and improvements shall be such amount as the legal authority imposing Real Estate Taxes shall have attributed thereto. In the absence of such attribution or if such legal authority shall include immovables other than Landlord’s Property and improvements in imposing such Real Estate Taxes, then such amount shall be established by Landlord in Landlord’s reasonable judgment. The term “Real Estate Taxes” shall not include any inheritance, estate, succession, transfer, gift, franchise, income or earnings, profit, corporate or similar tax to the extent applicable to Landlord’s general or net income.

Tenant shall pay prior to delinquency, all municipal, county, state or federal taxes which shall be levied, assessed or due and unpaid on any leasehold interest, on any investment of Tenant in the Premises, or on any personal property owned, installed or used by Tenant, or on Tenant’s right to occupy the Premises. Notwithstanding anything to the contrary, Tenant shall have the right at its sole cost and expense to contest the validity of and to seek an abatement of any of the foregoing taxes, excluding Real Estate Taxes.

6.5 Miscellaneous.

Any payment due under this Article for any portion of a tax year shall be appropriately prorated. Landlord shall have the same rights and remedies for the non-payment by Tenant of any amounts due hereunder as Landlord has for the failure of Tenant to pay rent.

| 7. | QUIET ENJOYMENT |

Tenant, upon payment of the rent herein reserved and upon the performance of all the terms and conditions of this Lease, shall at all times during the Term and during any extension or renewal term, peaceably and quietly enjoy the Premises without any disturbance from Landlord or from any other person claiming through Landlord, subject, nevertheless, to the terms and conditions of this Lease and to the mortgages hereinafter mentioned.

| 8. | USE OF THE PREMISES |

A. The Premises may be used solely by Tenant for the purposes of general office purposes including educational research and training and associated office uses, and for no other purpose (hereinafter “Permitted Use”).

B. Tenant shall not at any time use or occupy the Premises in violation of the certificate of occupancy or building permit issued for the Building or any applicable zoning ordinance. The statements in the Lease of the nature of the business to be conducted by Tenant in the Premises does not constitute a representation or guaranty by Landlord that such business may be conducted on the Premises or is lawful under the certificate of occupancy or building permit or is otherwise permitted by law; however, Landlord shall deliver to Tenant a Certificate of Occupancy for the Premises, as provided in Article 3 hereof.

C. Notwithstanding the foregoing, if Tenant is using the Premises for the Permitted Use and the City of Boston or its zoning authority notifies the Tenant that such use is in violation of the applicable provisions of the zoning ordinance, and, as a result, Tenant is duly ordered to cease its operations at the Premises, the Tenant shall have the option to terminate this Lease by

- 11 -

giving written notice thereof to Landlord prior to such order to cease operations being lifted or vacated, and this Lease shall thereupon be terminated and of no force and effect; provided, however, such termination shall only be effective if Tenant timely makes the Termination Payment (as defined below). The Termination Payment shall be made within 30 days of the date of Tenant’s notice of termination. The “Termination Payment” shall mean an amount equal to unamortized portion (as of the date of such termination) of the costs and expenses incurred by Landlord in constructing the Initial Tenant Improvements, which costs are to be amortized on a straight line basis evenly over the original Term. The parties agree that, for the purposes of the calculation of the Termination Payment, the costs and expenses of constructing the Initial Tenant Improvements shall be deemed to be $240,000, which amount shall amortize over the original term, commencing on the Term Commencement Date, at the rate of $4,000 per month.

| 9. | ALTERATIONS |

Except for those items specified elsewhere herein, no alterations, additions or improvements (hereinafter “Alterations”) to the Premises shall be made by Tenant without the prior written consent of Landlord, which shall not be unreasonably withheld. Landlord shall not be deemed unreasonable for withholding its consent to any Alteration which may affect the structural, mechanical, exterior or common facilities of the Building, nor for making its approval conditional upon Tenant’s agreement to restore the Premises at the expiration or earlier termination of the Term to its condition prior to such Alteration.

All work done in connection with any Alteration shall be done in a good and workmanlike manner employing materials of good quality and in compliance with laws, rules, orders and regulations of governmental authorities having jurisdiction thereof, by contractors approved by Landlord. Tenant shall be responsible that its contractors abide by all reasonable procedures, rules and regulations as promulgated by Landlord. All Alterations shall be performed in such a manner so as to maintain harmonious labor relations and not to damage the Building or unreasonably interfere with the construction or operation of the Building. Tenant shall indemnify and hold Landlord harmless from additional costs incurred in supplying service or repairing damage caused by Tenant’s contractors. Tenant shall cause each contractor to carry workmen’s compensation insurance in statutory amounts covering the employees of all contractors and subcontractors, and comprehensive general liability insurance with such limits as Landlord may reasonably require from time to time during the Term of this Lease, but in no event less than the minimum amount of comprehensive general liability insurance Tenant is required to maintain as set forth in Article 11 hereof (all such insurance to be written in companies reasonably approved by Landlord and insuring Landlord, Landlord’s mortgagee and Tenant as well as the contractors) and to deliver to Landlord certificates of all such insurance prior to commencement of any work. Any Alteration made by Tenant after such consent shall have been given, and any fixtures installed as part thereof shall, at Landlord’s option, become the property of Landlord upon the expiration or other sooner termination of this Lease. If Landlord shall fail to exercise such option, Tenant shall remove such Alterations at Tenant’s cost upon expiration or termination of this Lease. Tenant shall yield up the Premises in good order and repair, reasonable wear and tear and damage by fire or casualty excepted.

- 12 -

| 10. | MAINTENANCE AND REPAIR |

Except as otherwise provided in this Article and Articles 12 and 13, Landlord shall keep and maintain in good order and repair (in accordance with standards of office buildings of similar age, condition and character in Boston, Massachusetts) the Common Facilities and structural portions of the Building including but not limited to the roof, exterior walls, floor slabs, columns, elevators, public stairways and corridors, lavatories and common utility systems and equipment external to the Premises (specifically excluding any such equipment installed by or on behalf of Tenant). Landlord’s obligations hereunder shall exclude reasonable wear and tear and damage by fire or other casualty.

Tenant shall make all other repairs necessary to maintain the Premises in good order and repair, including, without limitation, all glass, doors and all utility systems and equipment serving the Premises exclusively and Tenant shall return the Premises to Landlord at the end of the Term in good condition, reasonable wear and tear and damage by fire or other casualty excepted. Tenant shall also be responsible for the cost of any repairs to the Premises or the Building (to the extent not reimbursed by insurance proceeds), which repairs may be structural or non-structural in nature, necessitated as the result of the negligence or fault of Tenant or Tenant’s subtenants, licensees, concessionaires, employees, agents, contractors or anyone else claiming by, through or under Tenant (hereinafter “Tenant’s Agents”) Tenant shall keep the interior of the Premises neat and in good order, repair and condition, shall keep all interior glass in good condition and shall replace any exterior glass broken by Tenant or Tenant’s Agents with glass of the same quality.

All repairs made by either Landlord or Tenant shall be done in a good and workmanlike manner in accordance with all applicable laws.

| 11. | INSURANCE |

11.1 Tenant’s Insurance. Tenant shall save Landlord harmless and indemnified from and against all injury, loss, claim or damage to any person or property while (a) on the Premises or (b), if arising out of the use or occupancy of the Premises by Tenant or Tenant’s Agents, on Landlord’s Property (unless caused by the act, neglect or default of Landlord, its employees, agents, licensees or contractors), and from and against all injury, loss, claim or damage to any person or property anywhere on the Premises or Landlord’s Property occasioned by any act, neglect or default of Tenant or Tenant’s Agents. Tenant shall maintain with respect to the Premises and Landlord’s Property liability insurance equivalent to comprehensive general liability and property damage insurance including the broad form comprehensive general liability endorsement and a contractual liability coverage endorsement in amounts not less than $3,000,000.00 combined single limit and an annual aggregate of at least $5,000,000.00. Landlord shall have the right, from time to time, to increase said insurance amounts to amounts customarily required of tenants in comparable buildings in the greater Boston area. Such insurance shall insure Landlord and Landlord’s mortgagees as additional insureds (with respect to their respective interests in the Premises) as well as Tenant against injury to persons or damage to property as herein provided, and shall contain a provision that the Landlord and Landlord’s mortgagees, although named as additional insureds, shall nevertheless be entitled to recovery under said policy for any loss occasioned to them, their servants, agents and employees by reason of the negligence of the Tenant or Tenant’s Agents.

- 13 -

Tenant shall maintain, at its sole cost and expense, fire and extended coverage insurance for all of its contents, furniture, furnishings, equipment, improvements, funds, personal property, floor coverings and fixtures located within or about the Premises, providing protection in an amount equal to One Hundred (100%) percent of the insurable value of said items.

All of Tenant’s insurance shall be with companies qualified to do business in Massachusetts, and shall be issued by insurance companies with a general policyholder’s rating of not less than A- and a financial rating of not less than Class X as rated in the most current “Best’s” Insurance Reports. Such insurance may be maintained by Tenant under a blanket policy or policies so-called, provided the coverage afforded Landlord is not reduced or diminished by reason of the use of such blanket insurance policy, and provided further that the requirements set forth herein are otherwise satisfied.

Tenant shall deposit with Landlord certificates of insurance that it is required to maintain under this Lease, at or prior to the Term Commencement Date, and thereafter, within thirty (30) days prior to the expiration of each such policy. Such policies shall provide that the policies may not be changed or cancelled without at least thirty (30) days’ prior written notice to Landlord.

Tenant covenants that in the event it violates Article 35 hereof or in the event it keeps upon the Premises or Landlord’s Property any substance of dangerous, inflammable or explosive character or makes any use of the Premises which increases the rate of insurance on the Premises or Landlord’s Property, Tenant shall promptly pay to Landlord upon demand any such increase resulting therefrom, which shall be due and payable as additional rent hereunder.

11.2 Landlord’s Insurance. Landlord shall maintain general liability insurance with respect to the Common Areas and fire and extended coverage insurance on the Building providing protection In an amount reasonably determined by Landlord to be adequate. Landlord shall not be responsible for any damage to Tenant’s contents, furniture, furnishings, equipment, improvements, funds, personal property or fixtures.

11.3 Waiver of Subrogation. Any insurance carried by either party with respect to the Premises or property therein or occurrences thereon shall, if it can be so written without additional premium or with an additional premium which the other party agrees to pay, include a clause or endorsement denying to the insurer rights of subrogation against the other party. Neither Landlord nor Tenant shall be liable to the other or to any insurance company (by way of subrogation or otherwise) insuring the other party for any loss or damage to any building, structure or other tangible property, or any resulting loss of income, or losses under worker’s compensation laws and benefits, even though such loss or damage might have been occasioned by the negligence of such party, its agents or employees if any such loss or damage is covered by insurance benefiting the party suffering such loss or damage or which is customarily covered by any insurance required to be carried hereunder, to the extent of such coverage.

| 12. | DAMAGE TO THE PREMISES |

12.1 Landlord’s Right to Terminate. If a portion of the Premises or the Building is substantially damaged by fire or other casualty, Landlord may terminate this Lease as of the date of such damage by giving Tenant written notice of such termination within sixty (60) days of such fire or casualty.

- 14 -

12.2 Landlord’s Obligation to Repair. In the event that Landlord elects not to terminate this Lease as aforesaid, then this Lease shall continue in full force and effect and Landlord shall promptly repair the damage and restore the Premises, excluding Tenant’s personal property, fixtures, furniture, equipment and floor coverings, to substantially the condition thereof immediately prior to such damage. Landlord’s obligation to repair such damage and restore the Premises shall be limited to the extent of the insurance proceeds made available to Landlord and allocated for the Premises. Landlord shall not be liable for any inconvenience or annoyance to Tenant or injury to the business of Tenant resulting from delays in repairing such damage.

12.3 Rent Abatement. For so long as such damage renders the Premises or a portion thereof unsuitable for Tenant’s use thereof immediately prior to the occurrence of such fire or casualty, a just and proportionate abatement of Fixed Rent shall be made, provided that such damage is not due to the fault or neglect of Tenant or Tenant’s Agents.

12.4 Tenant’s Option to Terminate. If damage to the Premises or to the Building renders the Premises substantially unsuitable for Tenant’s use thereof immediately prior to the occurrence of such fire or casualty, and provided that the damage was not due to the fault or neglect of Tenant or Tenant’s Agents, then Tenant may elect to terminate this Lease prior to the time such damage is repaired if and only if either:

a. Landlord fails to give written notice within sixty (60) days of said fire or casualty of its intention to restore the Premises; or

b. Landlord fails to restore the Premises to a condition suitable for the Permitted Use within one hundred eighty (180) days of said fire or casualty, provided such failure is not due to the action or inaction of Tenant, Tenant’s Agents, or causes beyond the reasonable control of Landlord.

Tenant shall exercise its option to terminate by giving written notice to Landlord within thirty days after Landlord’s failure to notify or failure to restore, as specified above.

12.5 Definitions. The term “substantial damage” as used herein shall refer to damage of such character that the same cannot in the ordinary course be reasonably expected to be repaired, within one hundred twenty (120) days from the time that such work would commence.

| 13. | EMINENT DOMAIN |

In the event that the whole of the Premises or Landlord’s Property shall be lawfully condemned or taken in any manner for public or quasi-public use, this Lease shall forthwith terminate as of the date of divesting of Landlord’s title.

In the event that only a part of the Premises or Landlord’s Property shall be so condemned or taken, then, if such condemnation or taking is results in any of the following, either Landlord or Tenant may by delivery of notice in writing to the other within sixty (60) days following the date on which Landlord’s title has been divested by such authority, terminate this Lease:

- 15 -

a. Results in the loss of reasonable access to the Premises, or renders the Premises substantially unsuitable for Tenant’s use thereof immediately prior to the occurrence of such taking;

b. Results in the loss to Tenant of twenty-five (25%) percent or more of the floor area of the Premises; or

c. Results in loss of facilities in the Building that supply heat, air conditioning, water, drainage, plumbing, electricity or other utilities to Premises.

In the event that only a part of the Premises or Landlord’s Property shall be so condemned or taken, then, if such condemnation or taking is substantial as hereinafter defined, Landlord may, in addition, by delivery of notice in writing within sixty (60) days following the date on which Landlord’s title has been divested by such authority, terminate this Lease. “Substantial” shall mean any condemnation or taking which:

a. Results in the loss of reasonable access to the Building, or renders the Building substantially unsuitable for its then uses;

b. Results in the loss to Landlord of more than twenty-five (25%) percent of the floor area of the Building or more than fifteen (15%) percent of the total area of the land; or

c. Results in loss of facilities in the Building that supply heat, air conditioning, water, drainage, plumbing, electricity or other utilities to Building.

If this Lease is not terminated as aforesaid or if such condemnation or taking is not substantial, then this Lease shall continue in full force and effect except that the Fixed Rent shall be equitably abated as of the date of divesting of title. Landlord shall, with reasonable diligence and at its expense, restore the remaining portion of the Premises as nearly as practicable to the same condition as it was prior to such condemnation or taking. Landlord’s obligation to restore the remaining portion of the Premises shall be limited to the extent of the condemnation proceeds made available therefor to Landlord.

In the event of any condemnation or taking, Landlord shall be entitled to receive the entire award in the condemnation proceedings, including any award made for the value of the estate vested by this Lease in Tenant, and Tenant hereby expressly assigns to Landlord any and all right, title and interest of Tenant now or hereafter arising in or to any such award or any part thereof. Notwithstanding the foregoing, Tenant shall have the right to bring a separate condemnation proceeding for relocation expenses and trade fixtures, or to bring other claims, payable in the manner and extent as, and if, provided by law, provided such awards do not reduce the awards to Landlord on account of such condemnation or taking.

- 16 -

| 14. | Intentionally Deleted |

| 15. | LANDLORD’S SERVICES |

15.1 Electric Current.

a. Landlord shall install and maintain at its cost separate electric meters for measuring electricity furnished to the Premises. Tenant shall contract with the company supplying electrical current for the purchase and obtaining of electrical current directly from such company, which shall be billed directly to and paid for by Tenant. This shall include all current used in the Premises, including but not limited to all electricity used for heating, air conditioning and ventilation, lighting, office equipment and machines.