Attached files

| file | filename |

|---|---|

| EX-99.1 - China Electronics Holdings, Inc. | e613498_ex99-1.htm |

| EX-99.2 - China Electronics Holdings, Inc. | e613498_ex99-2.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

April 2, 2015

CHINA ELECTRONICS HOLDINGS, INC.

___________________

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

333-152535

|

98- 0550385

|

|

State of

|

Commission

|

IRS Employer

|

|

Incorporation

|

File Number

|

I.D. Number

|

Building G-08, Guangcai Market, Foziling West Road, Lu’an City,

Anhui Province, China

Address of principal executive offices

Registrant's telephone number: 011-86-564-3224888

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. Forward-looking statements are based on the Company’s current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. The Company’s actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. The Company cautions you therefore against relying on any of these forward-looking statements. These statements are subject to uncertainties and risks. including, but not limited to (i) securing capital for general working purposes, and (ii) other risks and in statements filed from time to time with the Securities and Exchange Commission (the “SEC”). In addition, the Company disclaims any obligation to, and will not, except as required by applicable law, update any forward-looking statements to reflect events or circumstances after the date hereof.

|

Item 7.01

|

Regulation FD Disclosure.

|

| Item 8.01 | Other Events. |

On December 18, 2014, Lu'AnGuoying Electronic Sales Co., Ltd. (“Guoying”), a wholly-owned subsidiary of China Electronics Holdings, Inc. (the “Company” or "CEHD"), entered into a Letter of Intent (the “LOI”) with An Hui Da Yun Heng Tong E-Commerce Company, Ltd.("Anhui Glory E-Commerce"), the owner of China Crazy Buy (www.fkgou.com), an e-commerce platform provider of online direct sales and online marketplace business of locally produced and national known agriculture foods and by products (raw, packed or cooked food,, meat, beverage, fresh fruits and vegetables, etc), supermarket and grocery products and consumer electronic appliances, in Anhui Province of China,. Anhui Glory E-Commerce is an affiliated business under common control of the CEO of the Company.

Pursuant to the LOI, the Company plans to raise capital to consummate an acquisition of Anhui Glory E-Commerce by March 31, 2015. The consideration for the acquisition is portion of cash from offering proceeds and issuance of shares of China Electronics Holdings in exchange for shares owned by the owner of Anhui Glory E-Commerce. Most of the offering proceeds will be used as working capital to upgrade our proprietary technology platform, develop direct business with local farms and production bases, marketing and promotions, establish our logistics and delivery system, purchase inventory under Online Direct Sale business model, and expansion of our employees. On March 31, 2015, the CEO of CEHD and the general manager of Anhui Glory E-Commerce entered into an extension agreement to extend the closing date from March 31, 2015 to June 30, 2015, due to failure to obtain financing by March 31, 2015.

A copy of the press release is attached hereto as Exhibit 99.1. China Electronics also announced that it will host a conference call on Friday, April 10, 2015 at 10:00 a.m.

DESCRIPTION OF BUSINESS

OF

ANHUI GLORY E-COMMERCE

Overview

Anhui Glory E-Commerce Company (the “Company” or “We”), the owner of China Crazy Buy which is a platform provider of online direct sales and online business marketplace, was founded in January of 2014. The Company is the first and largest online to offline and business to customer online sales platform, focused on the sale of locally produced and national known agricultural food and by products (such as raw, packaged and cooked food, meat, beverage, fresh fruits and vegetables), supermarket and grocery products, and electronic appliances in the Anhui Province of China. We have made significant investments in proprietary technologies and infrastructure in order to support and help businesses leverage the power of the internet to establish an online presence and conduct commerce with consumers and other businesses. The platform we have developed consists of suppliers including manufacturers, production base and farms, and third-party sellers such as retailers and wholesalers. As of today, our proprietary technology platform has supported approximately 275 merchant clients and has approximately over 500,000 registered online users. We target online buyers in a population of approximately 900,000 populations(approximately 300,000 families) in Lu An City and plan to expand our logistics capacity to reach other cities in An Hui province with a population of 67,822,700 people and high-income buyers in Jiangsu, Zhejiang, and Shanghai province with a total population of 157,431,200 people.

We launched our online direct sales business model concurrently with our online marketplace business model in October 2014. In our Online Marketplace business model, third-party sellers offer products to customers over our online marketplace and pay us commission on their sales. In our online direct sales business model, we acquire products for suppliers and sell them directly to customers.

Our featured products are agricultural foods, its byproducts, snacks and groceries. Our offerings are organized into five product categories on our website: Supermarket, Wine and Liquor Store, Snacks Street, Grocery Store, and Electronics Malls. We adopt flash sales, discount sales and group buy as an integral part of our sales strategy.

|

|

·

|

Supermarket: Our Online Supermarket mainly sells fresh and locally produced agricultural foods and nutritional supplements, such as rice, meat, seafood, vegetables and fruit baskets. Our customers can pick and order different kinds of foods from different suppliers and place them in one purchase order through our marketplace.

|

|

|

·

|

Wine and Liquor Store: Through our online Wine and Liquor Store, we sell juices, milkshakes, white liquors, yellow liquors, beer, wines, teas, and coffees with discount rate.

|

|

|

·

|

Snacks Street: Our Snack Streets segment sells snacks such as cooked flower seeds, seasoned tofu, candy, chips, biscuits, chocolates, baked goods, meat jelly, pudding, etc.

|

|

|

·

|

Grocery Store: We sell general merchandise products, such as household goods, clothing, accessories, cosmetics, and personal care products.

|

|

|

·

|

Electronics Mall: Through our Electronics Malls, we sell electronics appliances, such as computer products, autoparts accessories, smart phones, mobile handsets and other mobile digital products, home appliances, and office equipments.

|

Our website not only offers a broad selection of authentic products at competitive prices but also provides easy site navigation, basic search functions, comprehensive product information and customer reviews and ratings.

Our revenue segments are composed of the following:

|

|

·

|

Transaction Commission: We charge commissions on transactions through our marketplace depending on different types of goods and sales models;

|

|

|

·

|

Online Advertising and Marketing Fees: We plan to charge different levels of fees based on the number of browsers and clicks, length of time and location where the ads are placed on our market place.

|

|

|

·

|

Logistic Service Fees: We currently take a platform approach to shipping and deliver by working with third-party logistics service providers.

|

|

|

·

|

Payment and Settlement Service: We outsource our payment and settlement system to third parties, such as China Unionpay and alipay, and charge additional service fees.

|

|

|

·

|

Membership Fees: We charge an annual membership fee for users to subscribe to our platform. We offer a one year waiver of membership fee for promotional purposes.

|

Industry Analysis

We believe e-commerce business in third tier cities, towns, counties and rural areas in China has huge potential, in the agricultural industry. Although national e-commerce platform providers, such as Taobao and Jing Dong, have emerged online stores opened by small business in villages and counties of third and fourth tier cities and have started logistic delivery plans in the rural areas, we believe it is an area that national e-commerce providers in China have not aggressively penetrated yet.

Overall, according to CNNIC, as of December 31, 2013, China had the world’s largest Internet population with 618 million users with 302 million online shoppers in 2013. We believe the number of online shoppers will increase, due to the continuous increase in the number of Internet users, as well as by the higher percentage of Internet users making purchases online. We believe that consumers are expanding the categories of products and services they are purchasing online, which will further increase online and mobile commerce activity. Online shopping, which represented 8.0% of total consumption in China in 2013, is projected to grow at a compound annual growth rate, or CAGR, of 36.1% from 2013 to 2016, according to iResearch, as more consumers shop online and e-commerce spending per consumer increases. According to CNNIC, China has the world’s largest mobile Internet user base with 500 million users as of December 31, 2013, and mobile usage is expected to increase, driven by the growing adoption of mobile devices.

China’s offline retail market faces significant challenges due to few nationwide brick and mortar retailers, an underdeveloped physical retail infrastructure, limited product selection and inconsistent product quality. These challenges in China’s retail infrastructure, which we believe are particularly acute outside of tier 1 and 2 cities, are causing consumers to leapfrog the offline retail market in favor of online and mobile commerce.

Currently, the market value of agricultural products in China is approximately 2.5 trillion RMB. However, the sale of agriculture products through online e-commerce only reaches 50 billion RMB, which leaves huge potential for growth and profit margin. With E-commerce business model and consumer data collected through transactions on e-commerce, farmers can decide what type and amount of agriculture products they may grow annually based on market need; farmers have the ability to start planting and growing the products after purchaser orders are in place, thus avoiding the overproduction of agriculture products that are in less demand. The emergence of e-commerce business for agriculture food also accelerates the development of production, processing, storage, logistics and other related services.

80% of China population lives in towns, counties and rural areas. The highest demand for E-commerce in third tier cities, towns, counties and rural areas is coming from the younger population. Among online users in rural areas, 75.9% are between the ages of 20 and 29 years old and 18.6% of whom are between the ages of 30-39 years old. In total 95% of online users in rural areas are within these age groups. According to Rural E-Commerce Consumer Report issued by Ali Research Institute and reports issued by China E-Commerce Research Center in December 2014, the market value of rural e-commerce in China is approximately RMB 180 billion in 2014 and expects to reach RMB 460 billion in 2016. The online users from rural areas reached the population of 1,770,000,000 in 2013, representing 28.6% of the total online users. The Internet coverage rate in rural areas reached 27.5%, increased 4% compared to last year, which demonstrates a huge potential growth between rural and urban areas. Approximately 84.41% of rural population would like to accept e-commerce to purchase products online according to a survey.

Along the ongoing urbanization progress of rural areas in China, the developing economies of inland China has brought back young generations from first and second tier cities back to their hometowns to establish family ties and obtain employments. Compared to first and second tier big cities, smaller towns, counties and rural markets under fast development provide much more affordable living cost and much less competition in terms of employments for young generations. For example the population of Lu An City, a well-developed third tier city in Anhui Province, has increased from approximately 400,000 in 2005 to approximately 900,000 in 2014 with annual growth rate of approximately 13%. In 2008, 80% of the population of Lu An City consisted of people born in 60s and 70s, while now 80% population of Lu An City consist of people born in 70s, 80s and 90s. According to Lu An Economic News issued in end of 2014, when compared with other online promotional sales offered by e-commerce providers in terms of transaction amount and volume on November 11,2014, we estimate An Hui Province ranked top 12 among all provinces in China, while Lu An City of AnHui Province ranked top 5 cities in AnHui Province.

Our Business Model

We have launched three types of business models:

Online Marketplace

In our Online Marketplace Business Model, third-party sellers offer products to customers over our online marketplace and pay us commission on their sales. We apply our online marketplace business model to larger local businesses (such as restaurants, KTV, and tea houses, etc) and fresh food providers that have higher standards for storage and delivery need in Lu An City, and a selection of large consumer electronics appliances under Guoying distribution that are available for sale in Guoying's exclusive and non-exclusive franchise stores. Under our online marketplace business model, we provide a third party online transaction platform to local businesses that register online accounts with us ("Users"). We provide Users with trading platform, payment logistics and settlement system services. For services rendered, we charge transaction commission, payment and settlement fees, logistic service fees and membership fees. By using our platform, the Users can adjust their pricing strategy online, implement promotion plans (i.e. buy 1 get 1 free or gift in exceed of certain amount of purchase orders), execute purchase orders and settle payments. Users can arrange logistics and delivery services themselves or contact us for logistics and delivery services by paying additional fees. We do not take inventory from such Users in our warehouse. In addition, our platform does not support "payment upon delivery" method for online marketplace, which means the buyers need to pay in advance when they place purchase orders online. However by trading in our marketplace, users are entitled to take advantage of the convenience of our over 300 self-pick stations scattered throughout hundreds of residential neighborhoods in Lu An City, which helps our Users increase their customer base. Our third-party platform model allows us not to engage in competition with our merchant clients, not to hold inventory, and allows us to scale rapidly without the risks and capital requirements of sourcing. For example, we have launched our sale program of "one stop fresh fruit baskets", "bring hotpot back home", "Lu An local smocked duck" and “Cowboy One-Stop Purchase of Fruits, Vegetables, Meat and Tofu” for restaurants and farms under this business model. The online marketplace business model is provided to larger and sophisticated businesses that have an established pricing strategy, customer base and logistics capacity. Larger and more sophisticated businesses are able to leverage the growth of their business by using our platform and marketplace.

Online Direct Sales

In our online direct sales business model, we acquire products for suppliers and sell them directly to customers. We developed online direct sales business models for sale of supermarket and grocery products, and small electronic appliances under Guoying distribution. We require users to pay in advance to purchase their inventory and store them in our warehouse. Because buyers purchase various kinds of groceries and supermarket goods in one purchase order at a relatively cheap unit price, the Online Direct Sales model allows us to meet buyers’ various purchase orders in relatively short period of time and enables us to provide free delivery service for any purchase order of more than $6. For excess inventory, we have adopted an exchange policy with manufacturers where we can exchange goods for more popular goods ordered by our buyers.

Online Joint Sales

We provided an Online Joint Sales business model mostly to unsophisticated small retail sellers and a selection of small electronic appliances under Guoying distribution that are not available for sale in Guoying exclusive and non-exclusive franchise stores that require our assistance for delivery, installation and maintenance through Little Bee, our logistic channels. We provide the lowest purchase price to sellers to assist them in listing their goods on our marketplace, which provides us with the discretion to decide listing sales prices and the pricing strategy for such goods, and storage of such goods in our warehouse in order to achieve fast delivery, however, we do not take inventory from sellers. We are responsible for our own expense in providing logistics and delivery services. By utilizing our logistics system "Little Bee," our logistics costs are covered under our sales profit. Our payment and settlement system supports "payment upon delivery" method for goods sold under this business model.

This business model is invented and initiated to assist small business or retail sellers who are not yet familiar or lack experience with e-commerce business management by providing training and services to such sellers, while leaving us the discretion to decide the listing and sale price to increase our profit margin. This model is initiated for the purpose of brand marketing and to enroll more small business to our marketplace. We collect membership fees, commissions on transactions, online advertising and marketing, logistics service fees, and payment and escrow service fees from our clients under this model. In the future, for Supermarket and Grocery Store sales, we will transform to an“ Online Direct Sales” model.

As of today, with approximately 275 merchant sellers on our platform, we plan to develop an Online Direct Sales model with grocery and supermarket owners due the reason described above. We will continue developing and growing our business with direct production base, villages, and large farms by using Online Joint Sale business model, which provides us with higher gross profit margins.

Our Delivery and Logistics, Little Bee

Under Online Marketplace business model, we do not take inventory and the Seller is responsible for determining the sales price, printing sales label through our system and arranging package, logistics and delivery services for online purchase orders. This reduces the potential risk of holding perishable inventory that could go bad.

Under Online Joint Sales business model, the Seller is responsible for delivering goods to our warehouse in Lu An City. We are responsible for sorting, packaging, deciding sales price and printing sales labels. Our logistics personnel called "Little Bees" are responsible for delivering packaged purchase orders to our exclusive franchise stations, called "Honeycombs" (the "Exclusive Franchise Station" or "Honeycomb") located in Lu An City. We plan to establish forty Honeycombs in Lu An City. Our Honeycombs are logistics and transfer stations operated under "Crazy Buy" ("FengKuangGou") brand name. We also plan to set up desktop computers at those Stations to assist customers who are not familiar or experienced with online shopping to place purchase orders through our platform. We plan to establish approximately 40 "Little Bee" delivery personnel and place at least one Little Bee at every Honeycomb. Our "Little Bee" will then deliver the packaged purchase to our to be established 300 self-pickup stations (the "Self-Pickup Station") in Lu An City by three wheel motorcycle. Self-Pickup Station refers to a light-box with our brand name that we set up at convenience stores located at residential neighborhoods and communities. Self-Pickup Stations are used to store purchased orders delivered by our Little Bees in case the buyers are not at home when goods are delivered, or to provide convenience to buyers who place grocery orders in the morning before leaving for work and want to pick up on their way home that the same day.

Within Lu An City, we can deliver fresh food within 45 minutes (the "Flash Delivery") after customers place and purchase orders above a minimum purchase price during certain flash sale period for certain products. We are able to deliver orders to neighborhoods, towns, and counties outside Lu An City within 12 hours. For orders delivered directly from farms and the production base, we estimate the delivery of goods within 3 days after the sale date. Compared to other fresh direct business, we have cheaper labor cost, operate our logistics and delivery services more cost efficiently, and use various forms of transportations such as trucks, three-wheel motorcycles and bikes, etc. to achieve our goal of same-day delivery for a minimum amount of purchase within the same city.

Currently, we outsource our logistics services to third party companies which pay salaries for our Little Bee personnel and allow them to use their trucks under the supervision of our logistics and delivery department. We engage another logistics company for delivery outside Lu An City. Our customers can also choose to pick up purchase orders at our to be established 300 self-pick up stations and 40 Honeycombs throughout Lu An City. We provide customers with notification of delivery via text message.

Our Marketing and Promotions

We adopted the following marketing strategies to grow our customer base and enhance our brand recognition:

|

|

·

|

For certain selected goods, with a minimum purchase price, our Little Bees deliver purchase orders to customers free of charge;

|

|

|

·

|

Within Lu An City, we deliver to our customers or to the nearby self-pickup stations within 45 minutes;

|

|

|

·

|

We recommend "Hot Sale" deals to our customers from time to time to sell out our access inventory;

|

|

|

·

|

We offer "Flash Sales" with discounted prices to our customers from time to time to sell out our access inventory. Our “Flash Sales” attracts new customers primarily through word-of-mouth referrals. We offer new sales events daily with a curated selection of popular branded products at deeply discounted prices in limited quantities during limited time periods.

|

|

|

·

|

Customers can accumulate coupons by purchasing points in exchange for free gifts on our marketplace;

|

|

|

·

|

For purchased products, our customers can leave comments and rate scores for such goods on online community;

|

|

|

·

|

Sellers, by using our platform, can list product information, package method and photos, goods photo in kind, formula analysis, and competitive strength analysis compared against other similar products online, together with information regarding inventory, delivery, payment, guarantee, return policy, and whether gift coupon is applicable.

|

|

|

·

|

In 2015, we plan to host marketing events at approximately 20 schools and colleges in Lu An City to students born in 1970s, -80s and -90s, whom we believe are the largest e-commerce user population, and through those students, our brand will be marketed to over 100, 000 families.

|

|

|

·

|

At our to be established 40 Honeycombs, our Little Bee personnel teach and assist our customers to place online purchase orders on www.fkgou.com, or place purchase orders by scanning the bar code printed on picture advertisements placed at our Honeycombs.

|

|

|

·

|

We advertise our brand name, China Crazy Buy ("Fengkuanggou") on LED Advertising Boards along express highways from airport to Lu An City, main streets and most prestigious shopping malls in Lu An City.

|

From Jan 24 to Feb 1, 2015, we sponsored a major marketing event, China Lu An First Offline to Online Chinese New Year Fair (Advance Purchase)(the "Fair") lasting nine days right before Chinese new year to promote our platform brand name, China Crazy Buy ("Fengkuanggou"). The leading organizations that held the event include Lu An City People's Government, E-Commerce Association of An Hui Province, Lu An Business Bureau, Lu An Agriculture Bureau, and Lu An E-Commerce Association. The attendants to the Fair include the mayor and general secretary of Lu An City government, chairman of E-Commerce Associations and executive officials from various government bureaus. We sponsored buses from all areas of Lu An city to travel to the Fair every 20 minutes free of charge to provide convenience to the public to attend the fair. Over 200 sellers from Yun Nan, Xi Zang, Fujian, He Fei, Fu Yang, etc. exhibit their show booths at the fair. Sellers who opened stores on Tmall and Taobao also opened stores on China Crazy Buy. Over 96,700 people of the general public attended the Fair during its nine days exhibition.

In addition, we have started and will continue to develop a mobile app that enables certain classified buyers to market our platform or forwarding sales information of goods sold on our market place through a smart-phone app, such as our business account opened on Wechat, to promote our sales to their friends and followers affiliated with their online account. We classify such buyers and name them by different groups, such as Crazy Man (Bee Man), Crazy Soldier (Bee Soldier), Crazy General (Bee General), Crazy God (Bee God). The classification is based on the number of their affiliated friends and followers within their online account. Our app will be able to track the sales promoted and generated from followers and friends of such classified buyers. The app gives such classified buyers incentive and accumulative points exchangeable into currency to purchase goods on our marketplace for the sales generated by such buyers from their friends and followers.

Payment, Fulfillment and Return

Payment

Our customers can choose to either make payments upon placing purchase orders online or make payments upon arrival of the delivery.

For online payments, we support Alipay, China UnionPay Card, and Fuyou Pay Card. For payments made upon door delivery, our customers can choose to pay in cash, POS with the China UnionPay Card, or Fuyou Pay Card.

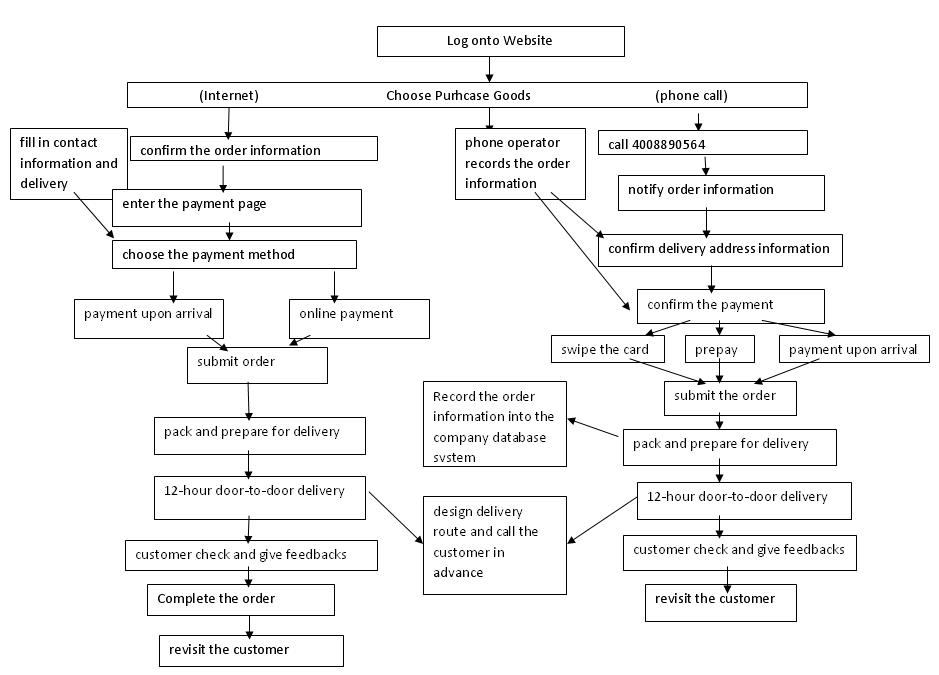

Customers can place purchase orders either through the internet or by calling our customer services. Our online purchase procedure is listed in the chart below:

Return

We offer 7-day return and 15-day exchange policy when certain criteria are met.

Under the "Online Joint Sales" and the "Online Marketplace" business models, we adopted the following return policies: Fresh and cooked foods are returnable within 15 days if due to the fault of the seller, and become non-returnable if tasted upon delivery and not due to the fault of the seller. Non-food daily use products are returnable within 7 days upon delivery if the package is not opened. Under the "Online Joint Sales" business model, we are responsible to arrange logistics for returned goods and products first to our Warehouse and then to sellers respectively. Under Online Direct Sale business model, while we took inventory and storage products in our warehouse, we adopt a return policy if customers cancel purchase orders online before packaging and delivery they are entitled to exchange .

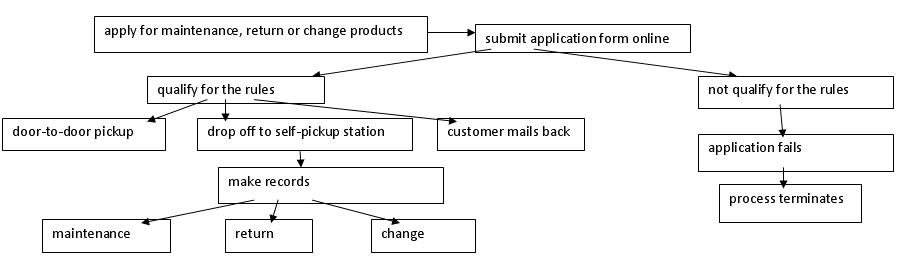

Our return policy and working process is listed in the chart below:

Employees

We currently have 95 employees including an operations department, marketing department, technology department, financial management, customer service, and logistics department, but will need to ramp up when the company expands.

Competitive Strength

|

l

|

Not only do we operate our online transaction technology platform, we are also dedicated to providing training and education, regarding how to use e-commerce platform to conduct businesses, to local businesses in Lu An City, specifically companies and enterprises in the agriculture industry,. We serve as the general secretary of Lu An E-Commerce Association. The Association has sub-divisions in five counties and four districts surrounding Lu An City . Our Chairman, Mr. Hailong Liu, born and raised from rural areas of Lu An City, is dedicated to training local sellers and farms on how to use electronic marketplace to transition their traditional business into e-commerce. The Association has held several seminars to hundreds of local business in Lu An City and surrounding areas as of today. Most of the members of the Association joined membership and opened stores on China Crazy Buy.

|

|

l

|

We obtained strong local government support because we assisted agriculture companies and small businesses to transition from traditional businesses to e-commerce by providing our platform, China Crazy Buy. During 2014 Chinese New Year in February 2015, we sponsored a major marketing event, China Lu An First Offline to Online Chinese New Year Fair (Advance Purchase) (the "Fair") lasting nine days beginning right before the Chinese new year to promote our brand name, China Crazy Buy ("Fengkuanggou"). Five authorities, including Lu An City People's Government, E-Commerce Association of An Hui Province, Lu An Business Bureau, Lu An Agriculture Bureau, and Lu An E-Commerce Association participated in the fair as leading organizations. The attendants to that fair include the mayor and general secretary of Lu An City government, the chairman of E-Commerce Associations and executive officials from various government bureaus.

|

We are entitled to government beneficial policy, including tax benefit, to support local e-commerce business. According to the “Guidance on Expediting Development and Implementation of E-commerce in Lu An city” provided by Lu An City government, online sales and the marketplace for agricultural products is an important component to e-commerce business in Lu An City. Local agricultural large to small businesses that start to open online stores and transit into e-commerce business model will be entitled to a tax reduction under the policy.

|

l

|

We perform background checks on suppliers and third-party sellers as well as the products they provide. We examine their business licenses and their qualification certificates, and check their brand recognition and make inquiries about the market acceptance of their products among players in the same industry. We also conduct on-site visits to assess and verify their location, scale of business, production capacity, property and equipment, human resources, research and development capability, quality control system and fulfillment capability. Third-party sellers will be subject to penalties or be asked to end their operations on our online marketplace if they violate the marketplace rules, for example by selling counterfeit products. We also conduct regular reviews on the performance of third-party sellers, twice a year, and have the right to terminate the operations of third-party sellers that remain inactive on our online marketplace for three consecutive months or have an overall ranking below a certain threshold.

|

The online retail industry in China is intensively competitive. Our current competitors include (i) major online retailers in China that offer a wide range of general merchandise product categories, such as Alibaba Group, which operates taobao.com and tmall.com, and (ii) major traditional retailers in China that are moving into online retailing, such as SuningAppliance Company Limited, which operates suning.com, and Walmart which holds a majority interest in yihaodian.com. In October 2014, Alibaba initiated “Thousand Towns and Ten Thousand Counties Plan” to expand Taobao e-commerce businesses to rural markets in China. Suning has expanded its sales to towns and counties in Yun Nan province. Jing Dong (JD.com) has started its logistic delivery plan to the rural areas. However, compared to other national e-commerce providers, we have the following competitive strengths:

|

l

|

Strong local competitive strength: We have very strong local competitive strength in Lu An City and in An Hui province by obtaining local government incentive supports, providing lower membership and transaction fees, more convenient logistics and faster delivery compared to our national competitors.

|

|

l

|

We have a regulated operation system. All the third party sellers on our platform are enterprises (either direct sale from manufactures, suppliers, farms and production bases, or indirect sale through agents) with reasonable priced goods and protection for their brand names.

|

|

l

|

We provide VIP service for online third party sellers. Our operation professionals will provide advice to third party sellers on arrangement of products online, price decisions and strategic marketing.

|

Use of Proceeds

and

Growth Strategies

We plan to raise capital to consummate an acquisition of Anhui Glory E-Commerce by June 30, 2015. The consideration for the acquisition is portion of cash from offering proceeds and issuance of shares of China Electronics Holdings in exchange for shares owned by the owner of Anhui Glory E-Commerce. Most of the offering proceeds will be used as working capital to upgrade our proprietary technology platform, develop direct business with local farms and production bases, marketing and promotions, establish our logistics and delivery system, purchase inventory under Online Direct Sale business model, and expansion of our employees. On March 31, 2015, the CEO of CEHD and the general manager of Anhui Glory E-Commerce entered into an extension agreement to extend the closing date to June 30, 2015, due to failure to obtain financing by March 31, 2015.

Upgrade Proprietary Technology Platform

Currently our platform provides an interactive user community that discusses, rates and reviews of our products and services. We plan to raise capital to upgrade our proprietary technology platform, including:

|

|

a)

|

Develop and gather data on consumer behavior and transactions completed on our marketplaces and interactions among participants on our platform which will provide us and our sellers with valuable insights on ways to improve the buyer experience, operate more efficiently and create innovative products and services.

|

|

|

b)

|

Develop a sophisticated business intelligence system that enables us to refine our merchandise sourcing strategy to manage our inventory turnover and control costs and to leverage our customer database to create customized product recommendations and cost-effective and targeted advertising. We also plan to leverage our large customer database to produce our sales forecast.

|

|

|

c)

|

Improve our inventory management system for third party sellers so that we can assist the third party sellers to manage their sales and profits data.

|

|

|

d)

|

Continue developing a mobile app that enables certain classified buyers to market our platform or forwarding sales information of goods sold on our market place through internet or social media, such as Wechat, to promote our sales to their friends and followers affiliated with their online account. We classify such buyers and name them by different groups, such as Crazy Man (Bee Man), Crazy Soldier (Bee Soldier), Crazy General (Bee General), Crazy God (Bee God). The classification is based on the number of their affiliated friends and followers within their online account. Our app will be able to track the sales promoted and generated from followers and friends of such classified buyers. The app gives such classified buyers incentive and accumulative points exchangeable into currency to purchase goods on our marketplace for the sales generated by such buyers from their friends and followers.

|

|

|

e)

|

As we grow and develop a larger number of suppliers and third-party sellers on our platform, by leveraging our extensive network of suppliers and our insights into their business operations, we plan to develop various financial products, including supply chain financing as a value-added service we provide to our suppliers.

|

Expand Scalable Logistics Platform

We target online buyers in a population of approximately 900,000 population(approximately 300,000 families) in Lu An City and plan to expand our logistics capability to reach all 16 counties in An Hui province with a population of 67,822,700 people and high-income buyers in Jiangsu, Zhejiang, and Shanghai province with a total population of 157,431,200 people. We plan to set up 300 self-pickup stations in 2015, 600 self-pickup stations in 2016 and 1,000 self-pickup stations in 2017. Our long term goal is to establish a subsidiary company with approximately 40 Honeycombs (the "Exclusive Franchise Store") and 600 self-pickup stations in each of 16 counties in An Hui Province.

Develop Direct Business with Local Farms and Production Base

We plan to apply an "Online Joint Sales" business model to C2B (customer to business) transactions. We have contracted large wholesalers of agricultural products such as farms and production base directly and allow individual buyers to place purchase orders in advance by taking advantage of our proprietary technology and data insights. We plan to work with rural cooperative corporations, village committees and large farms in rural markets throughout 16 counties and towns in An Hui Province to collect data regarding oversupply, inventory available, as well as the growing and feeding schedule of breeding stock (chicken, duck, pig, and fish, etc.), fruits and vegetables. We plan to analyze and publish such data within our database, which will be used as guidance for online customers looking to place purchase orders for families and friends several months in advance, in particular, in accordance with their celebration plans at big festivals in China, such as Spring Festival (Chinese new year), mid-autumn festival and Duan Wu festival. The orders are placed several months in advance with a scheduled sale date (the "Sale Date") in the future. Online customers can order in advance vegetable and fruit baskets, or pick breeding stock from chosen farms and even designated individual farmers in order to trace the origin of production in the future. For logistics and delivery services, as farms are located remotely in rural areas, we will be able to deliver the goods to buyers within three days after the Sale Date. Buyers are entitled to cancel purchase orders from the Order Date until three days before the Sale Date. However, buyers are not entitled to cancel orders within three days before Sale Date when we start process and execute the orders. For example, we have launched our advance sales program of "Grandpa's Pumpkin" and "Winter Palm" by contracting farms and production base with us directly to sell on our online marketplace.

In addition, the Company makes efforts to initiate e-commerce process of grocery basket project for convenience of local consumers by delivering agriculture food and its by-products from production base to customers directly. The Company plans to enter into contracts with over 100 production bases and farms in 2015, and enter into contracts with over 2,000 production bases and farms in An Hui Province in 2017.

Duplicate Our Business Model to Other 16 Counties in AnHui Province

Our e-commerce platform business model is duplicative. Our long term goal is, within two years, we plan to raise capital to expand scalability of our technology platform to provide online direct sale and marketplace services to large, medium and small businesses in all 16 counties of Anhui province. In two years, we plan to raise capital to develop the scalability of our logistics platform by setting up warehouse and data exchange center in each of the 16 counties in An Hui Province. We plan to raise capital to establish a subsidiary company with approximately 40 Honeycombs (the "Exclusive Franchise Store") and 600 self-pickup stations in each of 16 counties in An Hui Province.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(d)

|

Exhibits.

|

|

Exhibit

Number

|

|

Description

|

|

99.1

99.2

|

|

Extension of Letter of Intent

Text of press release issued by China Electronics Holdings regarding information of acquisition target

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: April 2, 2015

|

CHINA ELECTRONICS HOLDINGS, INC.

|

|||

|

By:

|

/s/ Hailong Liu

|

||

|

Hailong LIU

|

|||

|

President and Chief Executive Officer

|

|||