Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - Las Vegas Resort Investment Company, LLC. | d885563dex32.htm |

| EX-31.1 - EX-31.1 - Las Vegas Resort Investment Company, LLC. | d885563dex311.htm |

| EX-10.16 - EX-10.16 - Las Vegas Resort Investment Company, LLC. | d885563dex1016.htm |

| EX-10.17 - EX-10.17 - Las Vegas Resort Investment Company, LLC. | d885563dex1017.htm |

| EX-10.18 - EX-10.18 - Las Vegas Resort Investment Company, LLC. | d885563dex1018.htm |

| EX-10.19 - EX-10.19 - Las Vegas Resort Investment Company, LLC. | d885563dex1019.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Las Vegas Resort Investment Company, LLC. | Financial_Report.xls |

| EX-31.2 - EX-31.2 - Las Vegas Resort Investment Company, LLC. | d885563dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-55258

Stockbridge/SBE Investment Company, LLC

(Exact name of registrant as specified in its charter)

| Delaware | 45-5141749 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 2535 Las Vegas Boulevard South Las Vegas, Nevada | 89109 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code): 415-658-3300

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Name of each exchange on which registered | |

| Not applicable | Not applicable |

Securities registered pursuant to section 12(g) of the Act:

Class A Membership Interests

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

At the close of business on June 30, 2014, the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant was $0.

The registrant’s Class A and Class B Membership Interests are not publicly traded. As of March 31, 2015, Stockbridge/SBE Voteco Company, LLC owns 100% of the Class A Membership Interests and Stockbridge/SBE Intermediate Company, LLC owns 100% of the Class B Membership Interests.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

Not Applicable

Table of Contents

Table of Contents

Overview

Stockbridge/SBE Investment Company, LLC (the “Company,” “we,” “us” or “our”) is a limited liability company organized in Delaware. We are a holding company, and our business is primarily conducted through our wholly-owned subsidiary Stockbridge/SBE Holdings, LLC, a limited liability company organized in Delaware (“Holdings”), and its wholly-owned subsidiary, SB Gaming, LLC, a limited liability company organized in Nevada (“SB Gaming”). Holdings currently owns the SLS Las Vegas and the real property on which it is located. SB Gaming will conduct the gaming operations at the SLS Las Vegas pursuant to a casino license agreement.

Holdings purchased the Sahara Hotel and Casino in Las Vegas (the “Sahara”) in 2007 for $345 million from Gordon Gaming Corporation. Nav-Strip, LLC (“Nav-Strip”), formerly a wholly-owned subsidiary of Navegante Gaming, LLC (“Navegante”), was the gaming operator for the Sahara pursuant to a casino operations lease between the Company and Nav-Strip (“Casino Operations Lease”). With the onset of the credit crisis shortly thereafter, plans for full-scale renovation were delayed and Holdings chose to operate the Sahara until its closing in May 2011 to focus on rescaling its redevelopment efforts, taking into account market conditions, and raising the capital needed to complete the planned renovation. Upon termination of the Casino Operations Lease in May 2011 and in accordance with its terms, Navegante transferred all of the equity interest in Nav-Strip to Holdings in December 2011. Since the transfer of Nav-Strip to Holdings, Nav-Strip has been an inactive subsidiary. Construction on the SLS Las Vegas began in February 2013 and opened to the public in the third quarter of 2014.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other Securities and Exchange Commission (“SEC”) filings, and any amendments to those reports and any other filings that we file with or furnish to the SEC under the Securities Exchange Act of 1934 are made available free of charge after they are electronically filed with, or furnished to, the SEC at the SEC’s internet site address at www.sec.gov or in the SEC’s Public Reference Room at 100 F Street, NE, Washington D.C., 20549. Information related to the operation of the SEC’s public reference room may be obtained by calling the SEC at 1-800-SEC-0330.

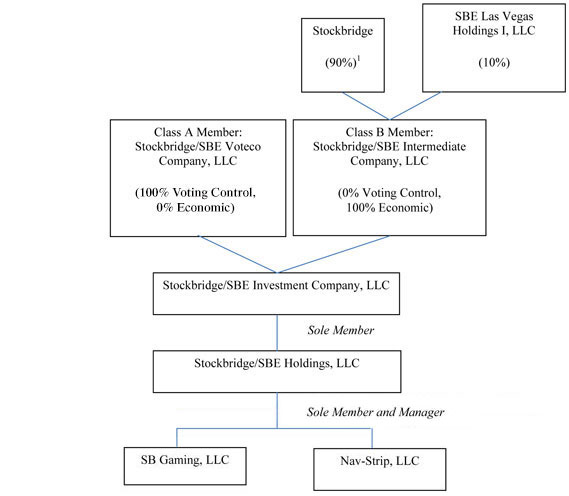

Corporate Structure

Stockbridge/SBE Voteco Company, LLC, a limited liability company organized in Delaware (“Voteco” or the “Class A Member”), holds 100% of the Company’s Class A Membership Interests, which have 100% of the voting rights, and Stockbridge/SBE Intermediate Company, LLC, a limited liability company organized in Delaware (“Intermediateco” or the “Class B Member”), holds 100% of the Company’s Class B Membership Interests (the “Class B Membership Interests”), which have 100% of the economic interests in the Company, but do not have any voting rights. Terrence E. Fancher is the sole member and manager of Voteco. Mr. Fancher is the founding principal of Stockbridge Capital Group, LLC (“Stockbridge”), a real estate investment management firm founded in 2003. Stockbridge real estate opportunity funds and related co-investment vehicles, together with affiliates of sbe Entertainment Group, LLC (“SBE”), own the Class B Member. Los Angeles-based SBE, founded in 2002, acquires, develops and manages hotel, restaurant and nightlife projects.

1

Table of Contents

Set forth below is a chart of our organizational structure.

| 1 | The interest held by Stockbridge is held by five Stockbridge affiliates. |

Overview of the SLS Las Vegas

The Company, through Holdings and SB Gaming, owns and operates the SLS Las Vegas, also referenced as (the “Property”), which we are positioning as a unique lifestyle-branded hotel-casino, with decor designed in an elegant, modern style. The SLS Las Vegas features the following:

| • | three hotel towers with a total of 1,612 rooms, including 1,361 rooms and 251 suites; |

| • | a casino, with an area of approximately 54,000 square feet, with approximately 792 slot machines, approximately 74 live table games and a sports book with an area of approximately 2,600 square feet; |

| • | approximately (i) 10 restaurants, bars and lounges with an area of approximately 40,000 square feet, (ii) three nightlife venues (including pool decks surrounding nightlife venues) with an area of approximately 60,000 square feet and (iii) retail locations with an area of approximately 9,000 square feet; |

| • | approximately 33,000 square feet of meeting and convention space; |

| • | a spa and fitness center, which is approximately 7,500 square feet; |

2

Table of Contents

| • | a pool and cabana area of approximately 35,000 square feet; and |

| • | approximately 2,100 parking spaces. |

Construction of the SLS Las Vegas began in February 2013, and the SLS Las Vegas opened to the public in the third quarter of 2014. In connection with the development of the SLS Las Vegas, the Company assembled an experienced development team. We retained PENTA Building Group, LLC (“PENTA”), an experienced general contractor, for preconstruction services in June 2011 and subsequently entered into a guaranteed maximum price contract in December 2011 for the construction of the Property. The project architect of record is Gensler. Philippe Starck, an internationally renowned designer, serves as Gensler’s design consultant. We funded the costs of the construction with equity contributions and proceeds from various debt facilities.

The principal executive offices of the SLS Las Vegas are located at 2535 Las Vegas Boulevard South, Las Vegas, Nevada 89109 and the telephone number is (702) 761-7000. The SLS Las Vegas internet web site is located at http://slslasvegas.com. The information found on our web site is not a part of this Annual Report on Form 10-K or any other report we file or furnish to the SEC.

Location of the SLS Las Vegas

The SLS Las Vegas is located at the northern end of Las Vegas Boulevard (often referred to as the “Las Vegas Strip”), at the southeast corner of Sahara Avenue and Las Vegas Boulevard. The intersection is one of the busiest intersections in Las Vegas. This location features not only convenient access from the I-15 freeway at the Sahara Boulevard exit, but also entrances to the SLS Las Vegas on both Paradise Road and Las Vegas Boulevard, a unique feature compared to other casinos on Las Vegas Boulevard. Our location has direct access to the Las Vegas monorail, including a monorail stop, and is within walking distance to the Las Vegas Convention Center. The SLS Las Vegas’ location is also within close proximity to McCarran International Airport. We believe our location is an attractive destination for leisure travelers, business travelers, group and convention business and Las Vegas local patrons due to its convenient access by road, direct access to the city’s monorail and its proximity to many of the amenities of Las Vegas, including the Las Vegas Convention Center.

Our Strategy

We believe that the SLS Las Vegas is positioned to be a unique destination on the Las Vegas Strip, in one of the most highly trafficked vacation and business travel destinations in the United States. The SLS Las Vegas offers distinct design elements, while also delivering a compelling guest experience created specifically for the needs of our target clientele. The Property, including food and beverage outlets, hotel rooms and the casino, is owned by Holdings. SB Gaming operates the casino and SBEHG Las Vegas I, LLC, an affiliate of SBE (the “Hotel Operator”), operates the balance of the facilities, except for the retail stores, the sports book, and the business center, which are leased to third parties.

Capitalize on the SBE Brand

The Company utilizes SBE’s strong and active customer following and social media presence in other major cities to build a customer base for the SLS Las Vegas. The marketing strategy for the SLS Las Vegas is to capitalize on SBE’s national brand platform to position itself as an approachable, affordable upscale hotel-casino and to attract, appeal and create loyalty in the local, leisure traveler, convention and group meetings, casino and wholesale market segments. We believe that SBE has developed successful hotel, restaurant and nightlife brands in Southern California. SBE has projects under construction or in the planning process for the expansion of certain of its brands in some of Las Vegas’ primary national feeder markets, such as Los Angeles, New York and Miami. SBE has brought a collection of its popular and recognizable brands to the SLS Las Vegas. We believe this differentiates the SLS Las Vegas from its competitors given that many of its brands are located in Southern California, which has been described by the Las Vegas Convention and Visitors Authority as the largest feeder market to Las Vegas.

3

Table of Contents

Target Clientele

Our marketing strategy targets both the visitor market (tourists, business travelers and convention attendees) and local patrons. The SLS Las Vegas provides a high-energy environment geared toward the lifestyle/boutique customer, who visits Las Vegas hotels and casinos for the wide range of restaurants, nightlife options and gambling. The SLS Las Vegas leverages SBE’s significant database for marketing purposes. In addition, we are leveraging other databases, such as the Property’s original gaming and hotel databases, as well as our relationship with Hilton Worldwide Holdings Inc. and Preferred Hotels Group, a hotel services organization that provides its members with marketing, sales and reservations services, to maximize our reach and marketing effectiveness.

Casino Strategy

The goal of the casino operations is to integrate table games and slot machines into the geographic core of the SLS Las Vegas, creating a casino floor space that is a part of the customer circulation within the Property. Both table games and slot machines are priced for both beginners and experienced gamblers. The casino strategy provides a product, service and marketing framework built around creating loyalty, longer play time and repeat visitation. We offer membership in the Hotel Operator’s newly launched loyalty program called THE CODE. Members of THE CODE are able to earn complimentary services, enjoy special prices on rooms, receive invitations to special events, access exclusive parties and concerts and benefit from personalized service. In addition, THE CODE offers members the opportunity to earn complimentary rewards, credits and slot play, while enjoying their favorite slot and table games.

Restaurants

The SLS Las Vegas incorporates a broad restaurant platform built around proven concepts serving a wide variety of offerings at various price points. The range of restaurant options has been developed to be attractive to lifestyle customers, business and leisure travelers, conventioneers, and locals. The SLS Las Vegas restaurants include Bazaar Meat by award-winning chef José Andrés, Umami Burger, Cleo and Katsuya. Other restaurant options at the SLS Las Vegas include Ku Noodle by José Andrés, 800° Degrees Neapolitan Pizzeria, The Northside Café, The Perq and a beer garden adjacent to the sports book.

Nightlife Venues

The SLS Las Vegas also offers a nightlife platform which leverages SBE’s knowledge and marketing relationships from successes at existing venues. LiFE is a nightclub that hosts live concerts as well as DJs. As an extension of LiFE nightclub, Beach LiFE pool offers an outdoor nightclub venue during the evenings and can also operate during the day as an additional pool area for hotel guests or as a daytime club. The Property’s poolside nightlife venue, Foxtail, has a dance floor, bar, lounge, outdoor terrace that opens onto the pool deck and table games. The Sayers Club offers live music experiences in an intimate setting.

Meeting Facilities and Ballroom

The SLS Las Vegas features approximately 33,000 square feet of meeting and ballroom space, which can be configured into multiple smaller spaces. Features include catering, banquets, a business center and full audio and visual capabilities.

Salon, Spa and Fitness Center

The SLS Las Vegas features approximately 7,500 square feet of spa and fitness amenities, including spa rooms and couples suites, a relaxation lounge, an herbal steam room and custom massage beds equipped with smartphone docks and music therapy. The salon occupies approximately 1,000 square feet.

4

Table of Contents

Retail

The SLS Las Vegas features approximately 9,000 square feet of retail space, including the following Fred Segal branded departments: jeans, men’s apparel, women’s apparel, shoes, home & gifts, intimates and jewelry.

Seasonality

The Las Vegas hotel, resort and casino industry is seasonal in nature. A variety of factors contribute to the seasonality of the Las Vegas market, including the timing of major Las Vegas conventions, major holidays such as New Year’s and Chinese New Year and major sporting events, particularly the Super Bowl, March Madness and premier boxing events. These factors can drive additional business to the Las Vegas market. Visitor volumes typically are lower during non-convention, mid-week periods and during the traditionally slower leisure period between Thanksgiving and New Year’s.

Competition

The SLS Las Vegas is located directly on the Las Vegas Strip and competes with other Las Vegas hotel-casinos, including those located on the Las Vegas Strip, on the basis of overall atmosphere, range of amenities, price, location, entertainment offered, theme and size. Currently, there are numerous upscale luxury gaming properties located on or near the Las Vegas Strip, and additional gaming properties located in other areas of Las Vegas. Many of the competing properties, such as Hard Rock Hotel & Casino, The Palms and The Cosmopolitan, have themes and attractions which draw a significant number of visitors and are expected to directly compete with our operations. Some of these facilities are operated by companies that have more than one operating facility, that have greater name recognition and financial and marketing resources than we do and market to the same target demographic group. Furthermore, additional hotel-casinos containing a significant number of hotel rooms may open in Las Vegas within the coming years.

To a lesser extent, we also face competition from hotels and hotel-casinos in areas other than Las Vegas. Our Property competes with hotel-casinos in the Mesquite, Laughlin, Reno and Lake Tahoe areas of Nevada, and in a growing number of other jurisdictions in which gaming is now permitted. The SLS Las Vegas also competes with state-sponsored lotteries, on-and off-track wagering, card parlors, riverboat and Native American gaming ventures, and other forms of legalized gaming in the United States, as well as with gaming on cruise ships, internet gaming ventures and international gaming operations. See “Item 1A. Risk Factors—Risks Related to Our Business—We face intense competition which could impact our operations and adversely affect our business and results of operations.”

Employees

The Company and Holdings have no employees. Currently, the Hotel Operator employs approximately 2,500 employees, some of whom are leased to SB Gaming, pursuant to an Employee Lease Agreement between the Hotel Operator and SB Gaming with respect to the gaming operations of the casino. Certain of the employees of the SLS Las Vegas are union members. Furthermore, non-union employees in various areas may be subject to union organization activities. The collective bargaining costs have been taken into account for the operation and construction of the SLS Las Vegas.

Nevada Gaming Regulation and Licensing

Introduction

The gaming industry is highly regulated. Gaming registrations, licenses and approvals, can be suspended or revoked for a variety of reasons. We cannot assure that the registrations, findings of suitability, licenses and approvals will not be suspended, conditioned, limited or revoked. The ownership and operation of casino gaming facilities in the State of Nevada are subject to the Nevada Gaming Control Act and the regulations made under such Act (collectively, the “Nevada Act”), as well as to various local ordinances. The SLS Las Vegas is subject to the licensing and regulatory control of the Nevada Gaming Commission (the “Nevada Commission”), the Nevada State Gaming Control Board (the “Nevada Board”), the Clark County Liquor and Gaming Licensing Board (the “Clark County Board”), and other local regulatory authorities (collectively, the “Nevada Gaming Authorities”).

5

Table of Contents

Holdings and SB Gaming Licensing Requirements

In order for SB Gaming to become the operator of the gaming-related activities at the SLS Las Vegas, it was required to apply for approval from, and be licensed by, the Nevada Gaming Authorities as a non-restricted licensee. SB Gaming has to pay periodic fees and taxes. The gaming licenses are not transferable. SB Gaming has received all necessary licenses from the Nevada Gaming Authorities. Holdings, the intermediary company that owns SB Gaming, was also required to be registered as an intermediary company and licensed to own SB Gaming by the Nevada Gaming Authorities.

Company Registration Requirements

For purposes of the Nevada Act, and in order for the Company to be registered to own Holdings, we are registered with the Nevada Commission as a “publicly traded corporation,” or registered company. Mr. Fancher, as a member of our board of directors (the “Board”) and the manager of Voteco, is required to be licensed or found suitable by the Nevada Commission. Further, the sole member of Voteco (the “Voteco Member”) is required to apply to, and be found suitable by, the Nevada Commission to own our voting securities.

We are required to submit detailed financial and operating reports to the Nevada Commission and provide any other information that the Nevada Commission may require. Substantially all of our material loans, leases, sales of securities and similar financing transactions must be reported to, or approved by, the Nevada Commission.

Individual Licensing Requirements

No person or entity may become a member of, or receive any percentage of the profits of, a registered intermediary company or company licensee without first obtaining licenses and approvals from the Nevada Gaming Authorities. The Nevada Gaming Authorities may investigate any individual who has a material relationship to or material involvement with us to determine whether the individual is suitable or should be licensed as a business associate of a gaming licensee. We, Terrence E. Fancher, as a member of our Board and Chief Executive Officer, the Voteco Member and certain of our key executives are required to file applications with the Nevada Gaming Authorities and are required to be licensed or found suitable by the Nevada Commission. The Nevada Gaming Authorities may deny an application for licensing for any cause. A finding of suitability is comparable to licensing, and both require submission of detailed personal and financial information followed by a thorough investigation. An applicant for licensing or an applicant for a finding of suitability must pay or must cause to be paid all the costs of the investigation. Changes in licensed positions must be reported to the Nevada Gaming Authorities and, in addition to their authority to deny an application for a finding of suitability or licensing, the Nevada Gaming Authorities have the jurisdiction to disapprove a change in a corporate position.

If the Nevada Commission were to find an officer, director or key employee unsuitable for licensing or unsuitable to continue having a relationship with us, we would have to sever all relationships with that person. In addition, the Nevada Commission may require us to terminate the employment of any person who refuses to file appropriate applications. Determinations of suitability or questions pertaining to licensing are not subject to judicial review in Nevada.

Consequences of Violating Gaming Laws

If the Nevada Commission determines that we have violated the Nevada Gaming Control Act or any of its regulations, it could limit, condition, suspend or revoke our applications, or registrations and gaming licenses, once obtained. In addition, we and the persons involved could be subject to substantial fines for each separate violation of the Nevada Gaming Control Act, or of the regulations of the Nevada Commission, at the discretion of the Nevada Commission. Further, the Nevada Commission could appoint a supervisor to operate the gaming-related activities at the SLS Las Vegas, and under specified circumstances, earnings generated during the supervisor’s appointment (except for the reasonable rental value of the premises) could be forfeited to the State of Nevada. Limitation, conditioning or suspension of any gaming licenses we may obtain and the appointment of a supervisor could, and revocation of any such gaming license would, have a significant negative effect on our gaming operations.

6

Table of Contents

Requirements for Voting Security Holders

Regardless of the number of membership interests or other interests held, any beneficial holder of the voting or non-voting securities of a registered company may be required to file an application, be investigated and have that person’s suitability as a beneficial holder of voting or non-voting securities determined if the Nevada Commission has reason to believe that the ownership would otherwise be inconsistent with the declared policies of the State of Nevada. If the beneficial holder of such securities who must be found suitable is a corporation, partnership, limited partnership, limited liability company or trust, it must submit detailed business and financial information including a list of its beneficial owners. The applicant must pay all costs of the investigation incurred by the Nevada Gaming Authorities in conducting any investigation.

The Nevada Act requires any person who acquires more than 5% of the voting securities of a registered company to report the acquisition to the Nevada Commission. The Nevada Act requires beneficial owners of more than 10% of a registered company’s voting securities to apply to the Nevada Commission for a finding of suitability within 30 days after the Chairman of the Nevada Board mails the written notice requiring such filing. However, an “institutional investor,” as defined in the Nevada Act, which beneficially owns more than 10% of the registered company’s voting securities as a result of a stock repurchase by the registered company may not be required to file such an application. Further, an institutional investor which acquires more than 10% but not more than 25% of a registered company’s voting securities may apply to the Nevada Commission for a waiver of a finding of suitability if the institutional investor holds the voting securities for investment purposes only. An institutional investor that has obtained a waiver may own more than 25% but not more than 29% of the voting securities of a registered company and maintain the waiver where the additional ownership results from a stock repurchase by the registered company. An institutional investor will not be deemed to hold voting securities for investment purposes unless the voting securities were acquired and are held in the ordinary course of business as an institutional investor and not for the purpose of causing, directly or indirectly, the election of a majority of the members of the board at directors of the registered company, a change in the corporate charter, bylaws, management, policies or operations of the registered company, or any of its gaming affiliates, or any other action which the Nevada Commission finds to be inconsistent with holding the registered company’s voting securities for investment purposes only. Activities which are not deemed to be inconsistent with holding voting securities for investment purposes only include:

| • | voting on all matters voted on by members or interest holders; |

| • | making financial and other inquiries of management of the type normally made by securities analysts for informational purposes and not to cause a change in its management, policies or operations; and |

| • | other activities that the Nevada Commission may determine to be consistent with such investment intent. |

Consequences of Being Found Unsuitable

Any person who fails or refuses to apply for a finding of suitability or a license within 30 days after being ordered to do so by the Nevada Commission or by the Chairman of the Nevada Board, or who refuses or fails to pay the investigative costs incurred by the Nevada Gaming Authorities in connection with the investigation of its application, may be found unsuitable. The same restrictions apply to a record owner if the record owner, after request, fails to identify the beneficial owner. Any person found unsuitable and who holds, directly or indirectly, any beneficial ownership of any voting security or debt security of a registered company beyond the period of time as may be prescribed by the Nevada Commission may be guilty of a criminal offense. We will be subject to disciplinary action if, after we receive notice that a person is unsuitable to hold an equity interest or to have any other relationship with, we:

| • | pay that person any dividend or interest upon any voting securities; |

| • | allow that person to exercise, directly or indirectly, any voting right held by that person relating to our Company; |

| • | pay remuneration in any form to that person for services rendered or otherwise; or |

| • | fail to pursue all lawful efforts to require the unsuitable person to relinquish such person’s voting securities including, if necessary, the immediate purchase of the voting securities for cash at fair market value. |

7

Table of Contents

Approval of Public Offerings

A registered company may not make a public offering of its securities without the prior approval of the Nevada Commission if it intends to use the proceeds from the offering to construct, acquire or finance gaming facilities in Nevada, or to retire or extend obligations incurred for those purposes or for similar transactions. Any approval that we might receive in the future relating to future offerings will not constitute a finding, recommendation or approval by any of the Nevada Board or the Nevada Commission as to the accuracy or adequacy of the offering memorandum or the investment merits of the securities. Any representation to the contrary is unlawful.

The regulations of the Nevada Commission also provide that any entity which is not an “affiliated company,” as that term is defined in the Nevada Act, or which is not otherwise subject to the provisions of the Nevada Act or regulations, such as our Company, that plans to make a public offering of securities intending to use such securities, or the proceeds from the sale thereof, for the construction or operation of gaming facilities in Nevada, or to retire or extend obligations incurred for such purposes, may apply to the Nevada Commission for prior approval of such offering. The Nevada Commission may find an applicant unsuitable based solely on the fact that it did not submit such an application, unless upon a written request for a ruling, referred to as a Ruling Request, the Chairman of the Nevada Board has ruled that it is not necessary to submit an application.

Approval of Changes in Control

As a registered company, we must also obtain prior approval of the Nevada Commission with respect to a change in control through:

| • | merger; |

| • | consolidation; |

| • | stock or asset acquisitions; |

| • | management or consulting agreements; or |

| • | any act or conduct by a person by which the person obtains control of us. |

Entities seeking to acquire control of a registered company must satisfy the Nevada Board and Nevada Commission with respect to a variety of stringent standards before assuming control of the registered company. The Nevada Commission may also require controlling stockholders, officers, directors and other persons having a material relationship or involvement with the entity proposing to acquire control to be investigated and licensed as part of the approval process relating to the transaction.

Approval of Defensive Tactics

The Nevada legislature has declared that some corporate acquisitions opposed by management, repurchases of voting securities and corporate defense tactics affecting Nevada gaming licenses or affecting registered companies that are affiliated with the operations permitted by Nevada gaming licenses may be harmful to stable and productive corporate gaming. The Nevada Commission has established a regulatory scheme to reduce the potentially adverse effects of these business practices upon Nevada’s gaming industry and to further Nevada’s policy to:

| • | assure the financial stability of corporate gaming operators and their affiliates; |

| • | preserve the beneficial aspects of conducting business in the corporate form; and |

| • | promote a neutral environment for the orderly governance of corporate affairs. |

Approvals may be required from the Nevada Commission before we can make exceptional repurchases of voting securities above their current market price and before a corporate acquisition opposed by management can be consummated. The Nevada Act also requires prior approval of a plan of recapitalization proposed by a registered company’s board of directors in response to a tender offer made directly to its stockholders for the purpose of acquiring control.

8

Table of Contents

Fees and Taxes

License fees and taxes, computed in various ways depending on the type of gaming or activity involved, are payable to the State of Nevada and to the counties and cities in which the licensed subsidiary’s respective operations are conducted. Depending upon the particular fee or tax involved, these fees and taxes are payable monthly, quarterly or annually and are based upon:

| • | a percentage of the gross gaming revenue received; |

| • | the number of gaming devices operated; or |

| • | the number of table games operated. |

A live entertainment tax is also payable when entertainment is provided in connection with admission fees, the selling or serving of food or refreshments, or the selling of merchandise.

Foreign Gaming Investigations

Any person who is licensed or registered, or required to be licensed or registered, or is under common control with those persons (collectively, “licensees”), and who proposes to become involved in a gaming venture outside of Nevada, is required to deposit with the Nevada Board, and thereafter maintain, a revolving fund in the amount of $10,000 to pay the expenses of investigation of the Nevada Board of the licensee’s or registrant’s participation in such foreign gaming. The revolving fund is subject to increase or decrease at the discretion of the Nevada Commission. Licensees and registrants are required to comply with the reporting requirements imposed by the Nevada Act. A licensee or registrant is also subject to disciplinary action by the Nevada Commission if it:

| • | knowingly violates any laws of the foreign jurisdiction pertaining to the foreign gaming operation; |

| • | fails to conduct the foreign gaming operation in accordance with the standards of honesty and integrity required of Nevada gaming operations; |

| • | engages in any activity or enters into any association that is unsuitable because it poses an unreasonable threat to the control of gaming in Nevada, reflects or tends to reflect, discredit or disrepute upon the State of Nevada or gaming in Nevada, or is contrary to the gaming policies of Nevada; |

| • | engages in activities or enters into associations that are harmful to the State of Nevada or its ability to collect gaming taxes and fees; or |

| • | employs, contracts with or associates with a person in the foreign operation who has been denied a license or finding of suitability in Nevada on the ground of unsuitability. |

License for Conduct of Gaming and Sale of Alcoholic Beverages

The conduct of gaming activities and the service and sale of alcoholic beverages at the SLS Las Vegas are subject to licensing, control and regulation by the Clark County Board. In addition to approving the licensee, the Clark County Board has the authority to approve all persons owning or controlling the membership interests of any business entity controlling a gaming or liquor license. All licenses are revocable and are not transferable. The Clark County Board has full power to limit, condition, suspend or revoke any license. Any disciplinary action could, and revocation would, have a substantial negative impact upon the operations of the SLS Las Vegas.

Agreements Governing the Operation of the SLS Las Vegas

Limited Liability Company Agreement

Our Limited Liability Company Agreement, as amended (the “Limited Liability Company Agreement”), governs our relationship with our members.

Classes of Membership Interests. We have two classes of membership interests: Class A Membership Interests and Class B Membership Interests. Holders of Class A Membership Interests are entitled to vote on any matter to be voted upon by our members. Holders of Class B Membership Interests have all the economic interests in the Company and, except as provided by law, do not have any right to vote. Stockbridge Fund II LV Investment LLC, Stockbridge Fund II D LV Investment LLC, Stockbridge Fund II E LV Investment LLC, Stockbridge Fund II Co-Investors LV Investment LLC and Stockbridge Fund III LV Investment, LLC (collectively, the “Stockbridge Funds”), SBE Las Vegas Holdings I, LLC and AREFIN Sahara Equity LLC (which holds no economic interest in Intermediateco) constitute the members of the Class B Member.

9

Table of Contents

The membership interests of the Company were bifurcated into voting and nonvoting membership interests for Nevada gaming regulatory and license purposes to accommodate the rule described under “Nevada Gaming Regulation and Licensing—Requirements for Voting Security Holders” that only the beneficial owners of more than 10% of any class of the voting equity interests of a publicly traded corporation are subject to being found suitable or licensed by the Nevada Commission. Each of the Stockbridge Funds, SBE Las Vegas Holdings I, LLC and AREFIN Sahara Equity LLC may be requested to file an application to have their suitability determined by the Nevada Commission.

Additional Capital Contributions. The Limited Liability Company Agreement provides that if we receive a request from Holdings stating that a determination has been made that cash receipts from the SLS Las Vegas are insufficient to pay specified necessary costs relating to the redevelopment, management, ownership and any leasing of spaces of the SLS Las Vegas in accordance with the operating and capital budget of Holdings, then the Class A Member will issue to the Class B Member a capital call notice requiring the Class B Member to fund the amounts specified by such notice.

Allocations and Distributions. The Limited Liability Company Agreement provides all profits and losses shall be allocated entirely to the holders of Class B Membership Interests. To the extent not prohibited by the terms of any financing agreement to which the Company is a party and subject to compliance with applicable law, including the Nevada Act, the Limited Liability Company Agreement provides that the Company shall make distributions to the extent it receives distributions from Holdings. Holders of Class A Membership Interests shall not be allocated any profits or losses or be entitled to receive any distributions of the Company.

Board. We are managed by our Board. Under the Limited Liability Company Agreement, the Board is comprised of four persons: the Stockbridge Executive Committee Member of Voteco, which under the Amended and Restated Limited Liability Company Agreement of Voteco, is defined as Terrence E. Fancher, as an initial member of Voteco that is affiliated with certain Stockbridge entities, an individual designated by the Executive Committee Member of Voteco, and two independent board members (determined in accordance with the Limited Liability Company Agreement). The Board has decision making authority in the management of the Company’s business, provided that the independent board members are entitled to vote only with respect to certain Material Actions, as defined in the Limited Liability Company Agreement. The following actions constitute Material Actions, upon which the Company’s two independent board members vote:

| • | Institution of proceedings to have the Company or Holdings be adjudicated bankrupt or insolvent; |

| • | Consent to the institution of bankruptcy or insolvency proceedings against the Company or Holdings; |

| • | Filing of a voluntary petition in bankruptcy or any other petition seeking reorganization or relief with respect to the Company or Holdings under any applicable federal or state law relating to bankruptcy, or consent to the same; |

| • | Consent to the appointment of a receiver, liquidator, assignee, trustee, sequestrator (or other similar official) of the Company or Holdings or a substantial part of the property of either the Company or Holdings; |

| • | Making of any assignment for the benefit of creditors of the Company and/or its subsidiaries; |

| • | Written admission of the Company’s inability to pay its debts generally as they become due; |

| • | Taking of action in furtherance of any action described above; or |

| • | To the fullest extent permitted by law, dissolution or liquidation of the Company or Holdings. |

10

Table of Contents

The Board members include Terrence E. Fancher (Stockbridge Executive Committee Member of Voteco), Sam Nazarian (designated by Mr. Fancher, removed January 12, 2015), Sam Bakhshandehpour (designated by Mr. Fancher, effective January 12, 2015) and Suzanne M. Hay and Julia A. McCullough, independent board members.

Officers. The Board may appoint or remove officers of the Company from time to time. The officers serve at the pleasure of the Board. All appointments of officers shall be subject to the Nevada Act, and if any officer is found to be unsuitable pursuant the Nevada Act, such officer shall be automatically removed from such position.

Restrictions on Transfer. Under the Limited Liability Company Agreement, members are prohibited from transferring any membership interests except as permitted under the Limited Liability Company Agreement and the Nevada Act.

Special Member. The Limited Liability Company Agreement provides that, upon the occurrence of any event that causes the last remaining member to cease to be a member (other than upon an assignment by such member of all of its limited liability company interest in the Company and the admission of the transferee or the resignation of such member and addition of an additional member), each person acting as an independent board member will automatically be admitted to the Company as a special member for the purpose of continuing the Company without its dissolution. Upon the admission to the Company of a substitute member, a special member will automatically cease to be a member of the Company. No special member may resign from the Company or transfer its rights as special member unless (i) a successor special member has been admitted to the Company as a special member, and (ii) such successor has also accepted appointment as an independent board member. The bankruptcy of a special member will not cause such special member to cease to be a member of the Company and upon the occurrence of such an event, the Company will continue without dissolution.

A special member will not have interest in profits, losses and capital of the Company and will have no right to receive any distribution of Company assets. Further, a special member will not be required to make any capital contributions to the Company and will not receive an interest in the Company. Additionally, a special member may not bind the Company to any arrangement, agreement or obligation and, except as required by applicable state law, each special member, solely in its capacity as special member, will have no right to vote on, approve or otherwise consent to any action by, or matter relating to, the Company, including, the merger, consolidation or conversion of the Company.

Casino License Agreement

Gaming Operations; Fees. SB Gaming will operate the gaming operations at the SLS Las Vegas pursuant to a Casino License Agreement, dated as of June 16, 2014, between Holdings, as licensor, and SB Gaming, as licensee, (the “Casino License Agreement”). Pursuant to the Casino License Agreement, Holdings, as licensor, will license to SB Gaming an exclusive right to use the approximately 54,000 square feet of casino floor space within the SLS Las Vegas for gaming operations and certain offices and rooms within the Property that will be used exclusively in support of gaming operations; an exclusive right to use certain licensed equipment, consisting of surveillance equipment and all information and systems related to THE CODE, together with any additions or replacements; and a nonexclusive license to use other premises such as employee areas and public areas of the hotel-casino. SB Gaming will pay Holdings a license fee monthly in arrears equal to total net cash flow, which means the gaming net cash flow for any period plus non-gaming cash flow for such period, for the immediately preceding month minus the amount SB Gaming must retain to meet its obligations during the present month under the agreement and other agreements relating to the SLS Las Vegas to which SB Gaming is a party. The amount of the license fee may be adjusted from time to time during the term upon the mutual agreement of Holdings and SB Gaming.

Term; Termination. The term of the Casino License Agreement commenced on June 16, 2014 and continues until either Holdings or SB Gaming terminates the agreement upon at least 180 days’ written notice to the other party. There is no termination fee payable in the event of termination.

11

Table of Contents

Second Amended and Restated Management Agreement

Hotel Operator; Fees. Holdings and the Hotel Operator entered into a Second Amended and Restated Management Agreement, as of June 16, 2014 (the “Hotel Management Agreement”), which provides for the management by the Hotel Operator of the hotel, food and beverage and retail operations at the SLS Las Vegas. The Hotel Operator will be the exclusive operator of and provide all employees for all non-gaming operations of the SLS Las Vegas.

Term; Termination. The Hotel Management Agreement provides for a 10-year term, which commences on the date on which the hotel opens to the general public. The Hotel Management Agreement may be terminated (i) by Holdings in connection with the sale of the hotel-casino, certain events of default by the Hotel Operator, certain non-permitted transfers by the Hotel Operator or the failure of the hotel-casino to meet a performance test and (ii) by the Hotel Operator upon the occurrence of certain events of default by Holdings, non-permitted transfers (including the transfer of the hotel-casino to a competitor), or a suspension (lasting 60 days or more), revocation or termination of a material approval required for the performance of the Hotel Operator’s obligations.

Employee Lease Agreement

Employees; Reimbursement. The Hotel Operator, SB Gaming and Holdings, solely as to certain provisions with respect to indemnification by Holdings and Holdings’ acknowledgment of the agreement, entered into an Employee Lease Agreement, as of June 16, 2014 (“Employee Lease Agreement”), which provides that the Hotel Operator will furnish employees to SB Gaming as necessary for the gaming operations of the casino (these employees are called the “assigned employees”). With respect to services performed by the assigned employees on behalf of SB Gaming, SB Gaming will reimburse the Hotel Operator for all of the actual wages, bonuses and other costs (including taxes, benefits, insurance, etc.) incurred by the Hotel Operator with respect to such assigned employees. Upon the Hotel Operator’s request, SB Gaming will report to the Hotel Operator all time worked by the assigned employees during each day and provide written verification of the same.

Term; Termination. The Employee Lease Agreement commenced on June 16, 2014 and will remain in effect so long as both the Hotel Management Agreement and the Casino License Agreement remain in effect. Any party to the Employee Lease Agreement may elect to terminate the agreement concurrently with any early termination of either the Hotel Management Agreement or the Casino License Agreement, so long as such termination allows reasonably sufficient time for each party to comply with all applicable laws. If either the Hotel Operator or SB Gaming is directed to cease business with the other party by any governmental authority or if one party determines in good faith, in its reasonable judgment, that the other party is or might be engaged in or was or is involved in any relationship that could jeopardize the first party’s business or licenses, then the first party will have the right to immediately terminate the Employee Lease Agreement, with or without notice and without further liability to the other party.

12

Table of Contents

Amended and Restated Development Management Agreement

Development Manager; Fees. Holdings and SBE Las Vegas Redevelopment I, LLC, an affiliate of SBE (the “Development Manager”), entered into an Amended and Restated Development Management Agreement (the “Development Agreement”), as of April 1, 2011, which provides for the management of designing, scheduling, budgeting, permitting, constructing and completing the redevelopment of the SLS Las Vegas by the Development Manager. The Development Agreement provides for a management fee of $10.9 million to be paid to the Development Manager for the services provided under the Agreement. See Note 8 to the Notes to Consolidated Financial Statements under the subheading “SBE Las Vegas Redevelopment I, LLC.” If Holdings revises the project program and project schedule to materially increase the scope for the redevelopment of the SLS Las Vegas, the management fee will be increased by an amount equal to two percent (2%) of the development costs incurred by Holdings by reason of changing the scope of the program.

Term; Termination. The Development Agreement provides that the agreement terminates upon the completion of the construction period, which is defined to mean the period commencing on the date the first project contractor commences construction until delivery to Holdings of specified evidence of completion. The Development Agreement may be terminated (i) by Holdings upon the disposition by the affiliate of the Development Manager of its interest in Holdings, the sale of the SLS Las Vegas, or the occurrence of certain cause or removal events enumerated in the Hotel Management Agreement and (ii) by the Development Manager upon a material breach of the Development Management Agreement (subject to cure) by Holdings, certain bankruptcy and insolvency events, or a suspension of the redevelopment project for a period longer than six months or occurring more than twice after April 1, 2011.

Intellectual Property

In April 2011, Holdings entered into a Non-Exclusive SLS Brand License Agreement (“SLS Brand License”) with SBE Hotel Licensing, LLC (“SBE Hotel Licensing”), which provides for a royalty-free, non-exclusive, non-sublicensable and non-transferable license by SBE Hotel Licensing of all right, title and interest in and to the trademarks and copyrights for the SLS Hotel brand, including trademarks and copyrights related to the SLS Brand (the “SLS Intellectual Property”) in connection with the development of the SLS Las Vegas. The SLS Brand License prohibits SBE Hotel Licensing from using the SLS Intellectual Property in connection with any restaurant, hotel, casino or nightclub located in Clark County without Holdings prior written approval, with certain exceptions described in the SLS Brand License.

Agreement Relating to Construction of the SLS Las Vegas

Guaranteed Maximum Price Construction Contract

PENTA; Fees. Holdings and PENTA entered into the Agreement Between Owner and Contractor, as of February 5, 2013 (the “GMP”), which provides for the construction of the SLS Las Vegas by PENTA. The GMP covers PENTA’s fee, contingency fees, insurance costs and certain costs of services and work provided, to the extent PENTA’s monthly application for payments of such amounts is approved by Holdings, and certain allowances and other costs. The GMP is subject to adjustment only by a written change order signed by Holdings.

Term; Termination. The final completion date of construction, pursuant to the Senior Construction Facility, is expected to occur in the second quarter of 2015. PENTA commenced construction on the SLS Las Vegas in February 2013.

13

Table of Contents

For the years ended December 31, 2014 and 2013 the Company and its subsidiaries paid costs totaling $154.6 million and $57.4 million, respectively, under the GMP and did not incur costs under the GMP for the year ended December 31, 2012.

The following risk factors are risks and uncertainties that we believe are material to the Company. Consider carefully the following risks and uncertainties, together with the other information contained in this Annual Report on Form 10-K, and the descriptions included in our consolidated financial statements and accompanying notes. Our actual results could differ materially from those contained in the forward-looking statements. The following risk factors set forth the risks that we believe are material to our business, financial condition, assets, operations and equity interests. If any of the following risks actually occur, our business, financial condition and results of operations could be materially and adversely affected. The risks and uncertainties described below are not the only risks facing our company. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or results of operations.

Risks Related to Our Business

We are entirely dependent on the SLS Las Vegas for all of our cash flow, which subjects us to greater risks than a hotel and casino operator with more operating properties, and accordingly, we could be disproportionately harmed by an economic downturn in this market or a disaster that reduced the willingness or ability of our customers to travel to Las Vegas.

We do not expect to have material assets or operations other than the SLS Las Vegas; thus, we are entirely dependent upon the SLS Las Vegas for all of our cash flow in the future. As a result, we are subject to a greater degree of risk than a more diversified hotel-casino operator with more operating properties. The risks to which we have a greater degree of exposure include the following:

| • | local economic and competitive conditions; |

| • | changes in local and state governmental laws and regulations, including gaming laws and regulations; |

| • | natural and other disasters; |

| • | an increase in the cost of utilities for the SLS Las Vegas as a result of, among other things, power shortages in California or other western states with which Nevada shares a single regional power grid, or a shortage of natural resources such as water; |

| • | a decline in the number of visitors to Las Vegas; |

| • | a decrease in gaming and non-gaming activities at the SLS Las Vegas; and |

| • | the outbreak of infectious diseases. |

Any of the factors outlined above could negatively affect our ability to generate sufficient cash flow to make payments or maintain our covenants with respect to our debt. The combination of the single location and the significant investment associated with the redevelopment of the SLS Las Vegas may cause our operating results to fluctuate significantly and may adversely affect our business.

Our business is particularly sensitive to reductions in discretionary consumer spending as a result of downturns in the economy.

Consumer demand for hotel-casino resorts, trade shows and conventions and for the type of amenities that we offer is particularly sensitive to downturns in the economy which adversely impact discretionary spending on leisure activities and, to a lesser extent, business activities. Changes in discretionary consumer spending or consumer preferences brought about by the factors such as perceived or actual general economic conditions, high unemployment, bank failures and the potential for additional bank failures, perceived or actual changes to disposable consumer income and wealth, the current global economic uncertainty and changes in consumer confidence in the economy, or fears of war and future acts of terrorism, could reduce customer demand for the amenities and leisure activities we offer, and may have a significant negative impact on our operating results.

14

Table of Contents

We face intense competition which could impact our operations and adversely affect our business and results of operations.

We compete mainly in the Las Vegas hotel, resort and casino industry. Specifically, our Property will compete with other high-quality Las Vegas hotel-casinos, especially those located on and near the Las Vegas Strip. Currently, various upscale, luxury and mid-priced gaming properties are located on or near the Las Vegas Strip. Upscale, luxury and mid-priced gaming properties are also located in the downtown Las Vegas area and additional gaming properties are located in other areas of Clark County. Many of the competing properties have market positions, amenities and attractions which draw a significant number of visitors and will directly compete with our operations.

Additional hotel-casinos containing a significant number of rooms may open, renovate or expand in Las Vegas over the next several years, which could also significantly increase competition. We believe that competition in the Las Vegas hotel, resort and casino industry is based on certain property-specific factors, including overall quality of service, types of amenities available to guests, price, location, entertainment attractions, theme and size. Our inability to generate and maintain the appropriate level of market awareness and penetration in relation to these property-specific factors could adversely affect our ability to compete effectively and could potentially impact our business and results of operations.

To some extent, we also compete with resorts, hotels and casinos in other parts of Nevada, throughout the United States and elsewhere in the world, such as Southeast Asia. In addition, the legalization of casino gaming in or near metropolitan areas from which we attract customers could have a negative effect on our business. We also compete with other types of gaming operations such as state-sponsored lotteries, on and off-track wagering, card parlors, riverboat gaming ventures, and other forms of legalized gaming in the United States, as well as with gaming on cruise ships, Internet gaming ventures and international gaming operations. Continued legalization and proliferation of gaming activities, including online gaming activities could significantly and adversely affect our business and results of operations.

Another area of competition is legalized gaming from casinos located on Native American tribal lands. Native American tribes in California are permitted to operate casinos with video slot machines, black jack and house-banked card games. The governor of California has entered into compacts with numerous tribes in California and has announced the execution of a number of compacts with no limits on the number of gaming machines (which had been limited under the prior compacts). While the competitive impact on our operations in Las Vegas from the continued growth of Native American gaming establishments in California remains uncertain, the proliferation of gaming in California and other areas located near the SLS Las Vegas could have an adverse effect on the Company’s business and results of operations.

In addition, certain states have legalized, and others may legalize, casino gaming in specific areas, including metropolitan areas from which we expect to attract customers, such as Los Angeles, New York, Philadelphia, San Francisco and Boston. Additionally, the current global trend toward liberalization of gaming restrictions and resulting proliferation of gaming venues, including those in Macau and Singapore, as well as potentially Japan and South Korea, could also result in a decrease in the number of visitors to the SLS Las Vegas by retaining international customers closer to home, which could adversely affect our business and results of operations.

Our business model involves high fixed costs, including property taxes and insurance costs, which we may be unable to adjust in a timely manner in response to a reduction in our revenues.

The costs associated with owning and operating hotel-casinos are significant, some of which may not be altered in a timely manner in response to changes in demand for services, and failure to adjust our expenses may adversely affect our business and results of operations. Property taxes and insurance costs are a significant part of our operating expenses. Our real property taxes may increase as property tax rates change and as the values of properties are assessed and reassessed by tax authorities. Our real estate taxes do not directly depend on our revenues, and generally we could not reduce them other than by disposing of our real estate assets or appealing a tax assessment using accepted valuation arguments, the latter not being a guarantee of a reduction.

15

Table of Contents

Property insurance premiums for the Las Vegas hotel, resort and casino industry have not changed significantly in recent years. However, an escalation in rates resulting from events beyond our control may increase insurance costs resulting in our inability to obtain adequate insurance at acceptable premium rates. A continuation of this trend could appreciably increase the operating expenses of our Property. If we do not obtain adequate insurance, to the extent that any of the events not covered by an insurance policy materialize, our financial condition may be materially adversely affected.

In the future, the SLS Las Vegas may be subject to increases in real estate and other tax rates, utility costs, certain operating expenses, and insurance costs, which could reduce our cash flow and adversely affect our financial performance. If our revenues decline and we are unable to reduce our expenses in a timely manner, our business and results of operations could be adversely affected.

Our success will depend on the value of our name, image and brand. If demand for, or the value of, our name, image or brand diminishes, our business and results of operations would be adversely affected.

Our success will depend on our ability to shape and stimulate consumer demands by maintaining our name, image and brand. We may not be successful in this regard and we may not be able to anticipate and react to changing consumer tastes and demands in a timely manner.

Our business would be adversely affected if our public image or reputation were to be diminished. Our brand names and trademarks are integral to our marketing efforts. If the value of our name, image or brands were diminished, our business and operations would be adversely affected.

We have substantial debt, and we may incur additional indebtedness, which may negatively affect our business and financial results.

We have substantial debt service obligations. As of December 31, 2014, our total debt was approximately $562 million, including undrawn proceeds under the Senior Construction Facility (as hereinafter defined). Our indebtedness and the covenants applicable to our indebtedness are described under Note 7 to the consolidated financial statements.

Our substantial debt may negatively affect our business and operations in several ways, including:

| • | requiring us to use a substantial portion of our funds from operations to make required payments on debt, which will reduce funds available for operations and capital expenditures, future business opportunities and other purposes; |

| • | making us more vulnerable to economic and industry downturns and reducing our flexibility in responding to changing business and economic conditions; |

| • | limiting the Company’s flexibility in planning for, or reacting to, changes in the business and the industry in which the Company operates; |

| • | placing the Company at a competitive disadvantage compared to its competitors that have less debt; |

| • | limiting our ability to borrow more money for operations over and above the current committed credit facility; |

| • | limiting our ability to borrow more money for capital or to finance acquisitions in the future; and |

| • | requiring us to dispose of portions of the Property in order to make required debt payments. |

Our working capital and liquidity reserves may not be adequate to cover all of our cash needs and we may have to obtain additional debt financing. Sufficient financing may not be available or, if available, may not be available on terms acceptable to us. Additional borrowings for working capital purposes or needed renovations or capital improvements will increase our interest expense, and, therefore, may harm our business and results of operations.

16

Table of Contents

If we increase our leverage, the resulting increase in debt service could adversely affect our ability to make payments on our indebtedness and harm our business and results of operations. Our primary source of liquidity is existing loans providing debt service and operating reserves.

We anticipate that we will refinance our indebtedness from time to time to repay our debt, and our inability to refinance on favorable terms, or at all, could harm our business and operations.

Our internally generated cash flow may be inadequate to repay our indebtedness prior to maturity; therefore, we may be required to repay debt from time to time through refinancing of our indebtedness and/or offerings of equity or debt. The amount and terms of our existing indebtedness may harm our ability to repay our debt through refinancing. If we are unable to refinance our indebtedness on acceptable terms, or at all, we might be forced to sell portions of our Property on disadvantageous terms, which might result in losses to us. If prevailing interest rates or other factors at the time of any refinancing result in higher interest rates on any refinancing, our interest expense would increase, which would harm our business and results of operations.

We are subject to taxation by various governments and agencies. The rate of taxation could change.

The casino entertainment industry represents a significant source of tax revenues to the various jurisdictions in which casinos operate. From time to time, various state and federal legislators and officials have proposed changes in tax laws, or in the administration of such laws, including increases in tax rates, which would affect the industry. If adopted, such changes could adversely impact our business, financial condition and results of operations.

Our insurance coverage may not be adequate to cover all possible losses that we could suffer, including terrorism, and our insurance costs may increase.

We have comprehensive property and liability insurance policies for the SLS Las Vegas with coverage features and insured limits that we believe are customary in their breadth and scope. Market forces beyond our control may nonetheless limit the scope of the insurance coverage we can obtain or our ability to obtain coverage at reasonable rates. Certain types of losses, generally of a catastrophic nature, such as earthquakes, floods, or terrorist acts, or certain liabilities may be uninsurable or too expensive to justify obtaining insurance. As a result, we may not be successful in obtaining insurance without increases in cost or decreases in coverage levels. In addition, in the event of a substantial loss, the insurance coverage we carry may not be sufficient to pay the full market value or replacement cost of our lost investment or in some cases could result in certain losses being totally uninsured. As a result, we could lose some or all of the capital we have invested in the Property, as well as the anticipated future revenue from the Property, and we could remain obligated for debt or other financial obligations related to the Property.

Our debt instruments and other material agreements require us to maintain a certain minimum level of insurance. Failure to satisfy these requirements could result in an event of default under these debt instruments or material agreements.

We may be subject to litigation in the ordinary course of our business. An adverse determination with respect to any such disputed matter could result in substantial losses.

We may be, from time to time, during the ordinary course of operating our businesses, subject to various litigation claims and legal disputes, including contract, lease, employment and regulatory claims as well as claims made by visitors to the SLS Las Vegas. In addition, there are litigation risks inherent in any construction or development project. Certain litigation claims may not be covered entirely or at all by our insurance policies, or our insurance carriers may seek to deny coverage. In addition, litigation claims can be expensive to defend and may divert our attention from the operations of our businesses. Further, litigation involving visitors to the SLS Las Vegas, even if without merit, can attract adverse media attention. As a result, litigation can have a material adverse effect on our business and, because we cannot predict the outcome of any action, it is possible that adverse judgments or settlements could significantly reduce our earnings or result in losses.

17

Table of Contents

Any failure to protect our trademarks could have a negative impact on the value of our brand names and adversely affect our business.

The licensing and/or development of intellectual property is part of our overall business strategy, and we regard intellectual property to be an important element of our success. Our business as a whole is dependent on a combination of several of our trademarks and other intellectual property. We, and our licensors, seek to establish and maintain our proprietary rights in our business operations and technology through the use of patents, copyrights, trademarks and trade secret laws. We, and our licensors, file applications for and obtain patents, copyrights and trademarks in the United States and in foreign countries where we believe filing for such protection is appropriate. We also seek to maintain our trade secrets and confidential information by nondisclosure policies and through the use of appropriate confidentiality agreements.

Despite our efforts and our licensors’ efforts to protect our respective proprietary rights, parties may infringe our trademarks and use information that we regard as proprietary, and our rights may be invalidated or unenforceable. The laws of some foreign countries do not protect proprietary rights to as great an extent as do the laws of the United States. Monitoring the unauthorized use of our intellectual property is difficult. Litigation may be necessary to enforce our intellectual property rights or to determine the validity and scope of the proprietary rights of others. Litigation of this type could result in substantial costs and diversion of resources. We cannot assure that all of the steps we and our licensors have taken to protect our respective trademarks in the United States and foreign countries will be adequate to prevent imitation of our trademarks by others. The unauthorized use or reproduction of our trademarks could diminish the value of our brand and our market acceptance, competitive advantages or goodwill, which could adversely affect our business.

If a third party asserts other forms of intellectual property claims against us or our licensors, our business or results of operations could be adversely affected.

Historically, trademarks and service marks have been the principal form of intellectual property rights relevant to the gaming industry. However, due to the increased use of technology in computerized gaming machines and in business operations generally, other forms of intellectual property rights (such as patents and copyrights) are becoming of increased relevance. It is possible that, in the future, third parties may assert superior intellectual property rights or allege that their intellectual property rights cover some aspect of our operations. The defense of such allegations may result in substantial expenses, and, if such claims are successfully prosecuted, may have a material impact on our business.

We will depend on our key personnel for the future success of our business and the loss of one or more of our key personnel could have an adverse effect on our ability to manage our business and operate successfully and competitively.

The leadership of our key personnel, Terrence E. Fancher, Scott Kreeger and Gabriel Frumusanu, is a critical element of our success. Our ability to manage our business and operate successfully and competitively is dependent, in part, upon the efforts and continued service of our key personnel. The death or disability of or other extended or permanent loss of services of our key personnel, or any negative market or industry perception with respect to key personnel or arising from loss of key personnel, could have a material adverse effect on our business. It could be difficult for us to find replacements for our key personnel, as competition for such personnel is intense. The departure of key personnel could have an adverse effect on our ability to manage our business and operate successfully and competitively.

One member of our Board and some of our key personnel are required to file applications with the Nevada Gaming Authorities to be licensed or found suitable by the Nevada Gaming Authorities. The Nevada Gaming Authorities may deny any application for any cause that they deem reasonable. In the event the Nevada Gaming Authorities were to find any person unsuitable for licensing or unsuitable to continue having a relationship with us, we would be required to sever all relationships with such person. We cannot assure that any such person will be able to obtain or maintain any requisite license or finding of suitability by the Nevada Gaming Authorities.

18

Table of Contents

Our business is particularly sensitive to energy prices and a rise in energy prices could harm our operating results.

We are a large consumer of electricity and other energy and, therefore, higher energy prices may have an adverse effect on our results of operations. Accordingly, increases in energy costs may have a negative impact on our operating results. Additionally, higher electricity and gasoline prices which affect our customers by reducing discretionary income and increasing travel costs may result in reduced visitation to the Property and a reduction in our revenues. We may be indirectly impacted by regulatory requirements aimed at reducing the impacts of climate change directed at up-stream utility providers, as we could experience potentially higher utility, fuel, and transportation costs.

Compromises of our information systems or unauthorized access to confidential information or our customers’ personal information could materially harm our reputation and business.

We face cybersecurity threats, which may range from uncoordinated individual attempts to sophisticated and targeted measures directed at us. Cyber-attacks and security breaches may include, but are not limited to, attempts to access information, including customer and company information, computer viruses, denial of service and other electronic security breaches. Our information systems may also be subject to operator error or inadvertence releases of data.