Attached files

| file | filename |

|---|---|

| EX-10.18 - EX-10.18 - RAINDANCE TECHNOLOGIES INC | d705484dex1018.htm |

| EX-3.4 - EX-3.4 - RAINDANCE TECHNOLOGIES INC | d705484dex34.htm |

| EX-3.2 - EX-3.2 - RAINDANCE TECHNOLOGIES INC | d705484dex32.htm |

| EX-23.1 - EX-23.1 - RAINDANCE TECHNOLOGIES INC | d705484dex231.htm |

| EX-10.2 - EX-10.2 - RAINDANCE TECHNOLOGIES INC | d705484dex102.htm |

| EX-10.1 - EX-10.1 - RAINDANCE TECHNOLOGIES INC | d705484dex101.htm |

| EX-10.19 - EX-10.19 - RAINDANCE TECHNOLOGIES INC | d705484dex1019.htm |

Table of Contents

As filed with the U.S. Securities and Exchange Commission on March 30, 2015.

Registration No. 333-202391

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RainDance Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3826 | 20-1596384 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

749 Middlesex Turnpike

Billerica, MA 01821

(978) 495-3300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

S. Roopom Banerjee

President and Chief Executive Officer

RainDance Technologies, Inc.

749 Middlesex Turnpike

Billerica, MA 01821

(978) 495-3300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mitchell S. Bloom, Esq. Joseph C. Theis Jr., Esq. Goodwin Procter LLP Exchange Place 53 State Street Boston, MA 02109 (617) 570-1000 |

Alfred G. Merriweather Chief Financial Officer RainDance Technologies, Inc. 749 Middlesex Turnpike Billerica, MA 01821 (978) 495-3300 |

Joel L. Rubinstein, Esq. McDermott Will & Emery LLP 340 Madison Avenue New York, New York 10173 (212) 547-5400 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated March 30, 2015

PRELIMINARY PROSPECTUS

Shares

Common Stock

This is RainDance Technologies, Inc.’s initial public offering. We are selling shares of common stock.

We expect the initial offering price to be between $ and $ per share. Currently, no public market exists for the shares. We have applied to list our common stock on the NASDAQ Global Market under the symbol “RAIN.”

We are an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012 and may comply with certain reduced public company disclosure standards.

Investing in our common stock involves risks that are described in the “Risk Factors ” section beginning on page 13 of this prospectus.

| Per share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount (1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” beginning on page 134 of this prospectus for additional disclosure of compensation payable in connection with this offering. |

The underwriters may also exercise their option to purchase up to an additional shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2015.

| BofA Merrill Lynch |

Cowen and Company |

Evercore ISI |

The date of this prospectus is , 2015.

Table of Contents

Table of Contents

| Page |

||||

| 1 | ||||

| 9 | ||||

| 11 | ||||

| 13 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

| 49 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

51 | |||

| 73 | ||||

| 100 | ||||

| 109 | ||||

| 116 | ||||

| 120 | ||||

| 123 | ||||

| 128 | ||||

| Certain Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Common Stock |

131 | |||

| 135 | ||||

| 143 | ||||

| 143 | ||||

| 143 | ||||

You should rely only on the information contained in this prospectus or contained in any free writing prospectus we may authorize to be delivered to you. Neither we nor any of the underwriters have authorized anyone to provide any additional or different information. We take no responsibility for, and can provide no assurance as to the reliability of, any additional or different information that others may give you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since such date.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

We are the owner of various U.S. federal trademark registrations (®) and registration applications (TM), including the following marks referred to in this prospectus pursuant to applicable U.S. intellectual property laws: “RainDance Technologies®,” “ThunderStorm™,” “RainDrop™” and “ThunderBolts™.” All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and TM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections of this prospectus captioned “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes that are included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “RainDance Technologies,” “RainDance,” “the Company,” “we,” “us,” and “our” in this prospectus refer to RainDance Technologies, Inc.

RainDance Technologies, Inc.

Company Overview

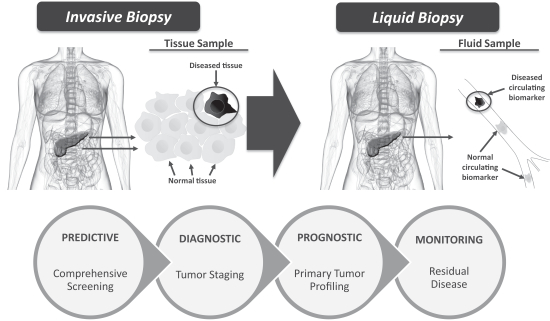

We are a commercial-stage company that develops, manufactures and sells proprietary systems, consumables and assays that enable ultra-sensitive detection and analysis of complex genetic diseases in tissue and “liquid biopsies” in life science and translational research settings. Our products enable researchers to enhance the sensitivity, specificity, range of gene content, sample type and workflow while lowering costs of Next Generation Sequencing content enrichment, or NGS, and Digital Polymerase Chain Reaction, or dPCR. We believe the market opportunity for our products is fast growing and will exceed $3 billion by 2018.

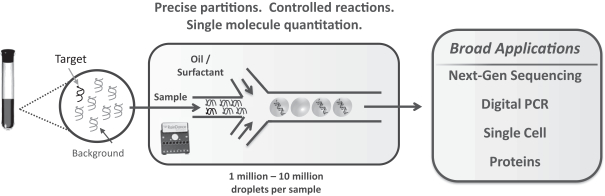

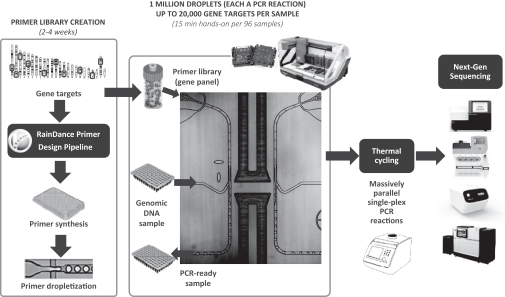

We have developed and commercialized a proprietary technology platform, which uses proprietary chemistries and sophisticated microfluidics, which are controlled volumes of miniscule fluids, to create for each sample millions of picoliter-scale droplets, each of which partitions and encapsulates a single molecule biological marker or reaction. Our customers are able to precisely create, control, manipulate, detect and quantitate millions of droplets in a single sample, and thereby enhance the sensitivity, specificity, sample range and workflow while lowering sample costs of NGS and dPCR. We refer to this platform as our digital droplet technology or digital droplet technology platform.

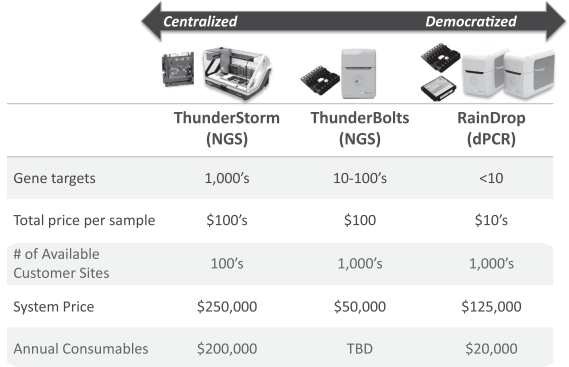

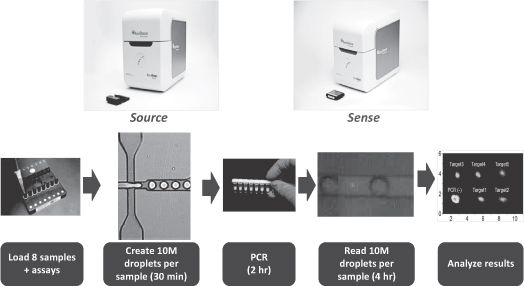

Our product portfolio includes three systems: ThunderStorm, ThunderBolts and RainDrop. Our ThunderStorm and ThunderBolts systems are used by researchers for NGS content enrichment, a method in which DNA is targeted and enriched to enable efficient sequencing. Our RainDrop system is used by researchers for dPCR, a technology approach to directly amplify and quantify nucleic acids. All three of these systems utilize our digital droplet technology and are marketed for research use only and not for use in diagnostic procedures. Our product portfolio also includes proprietary consumables that are used by our various systems and provide us with a significant, recurring revenue stream.

| • | ThunderStorm. Our ThunderStorm system, launched in December 2011, is an NGS content enrichment solution for high-volume customers to analyze any region of the genome with any commercially available NGS system through a highly automated, rapid, flexible and low cost process. Our ThunderStorm system is in current use for tissue analysis and liquid biopsy applications in high-volume laboratories for cancer and inherited disease research. Liquid biopsy enables non-invasive, highly accurate genetic analysis by detecting and measuring low levels of circulating genomic material such as DNA, RNA or microRNA in bodily fluids. |

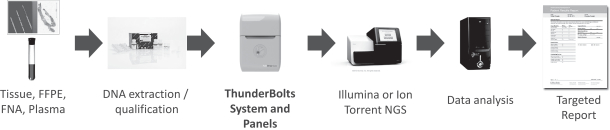

| • | ThunderBolts. Our ThunderBolts system, launched in February 2015, is an NGS content enrichment solution featuring the flexibility for user defined and predefined panels to target genetic regions of interest. Our ThunderBolts system utilizes elements of our RainDrop system’s architecture. Our ThunderBolts Cancer Panel, launched in April 2014, and our ThunderBolts Myeloid Panel, planned to be launched in April 2015, profile cancer mutations to enable researchers to analyze biopsy, plasma and formalin-fixed-paraffin-enabled, or FFPE, samples. Our predefined ThunderBolts panels are designed with the input of leading medical experts. For example, we assembled an exclusive consortium of hematologic oncology experts to advise us on the design and commercialization of the ThunderBolts Myeloid Panel. |

1

Table of Contents

| • | RainDrop. Our RainDrop system for dPCR, launched in March 2013, allows our customers to obtain what we believe, based on our industry knowledge of competing PCR and NGS products and technologies, is the industry’s highest sensitivity for genetic analysis of DNA, RNA or microRNA, across a broad range of sample types including tissue, plasma and bodily fluids. Our RainDrop system is used for monitoring of circulating genomic markers as well as for validation of mutations identified by other technologies such as NGS. |

Our products facilitate the research and discovery of cell-free genetic targets associated with inherited disease, pathology, and recurrence of cancer and infectious disease through genetic analysis of a broad range of sample types including tissue, plasma and bodily fluids. While the market for liquid biopsy is nascent and we have not yet generated significant revenue from our liquid biopsy applications, our products are currently used by researchers for liquid biopsies, and we believe there is growing demand for such products from translational researchers.

We sell our products to a broad range of customers at many leading institutions around the world. To date, a large portion of our revenue has been derived from our largest customers. For the years ended December 31, 2013 and 2014, our ten largest customers by revenue represented approximately 69% and 76%, respectively, of our total revenue, with one customer, Myriad Genetics, representing 29% of our total revenue in 2013 and 51% of our total revenue in 2014. We sell our products directly to customers through our dedicated sales force in North America and select European markets and through distributors in the rest of the world. As of December 31, 2014, we had an installed base of over 145 systems. Our customers include ten of the top thirty U.S. cancer research centers, such as the Mayo Clinic and Memorial Sloan Kettering Cancer Center and other leading global cancer centers. Our customers also include several of the leading medical genetic centers such as ARUP Laboratories and GeneDx. We also have multiple customers focused on infectious disease research including Johns Hopkins University and the U.S. Centers for Disease Control and Prevention. In addition, our products are used by leading pharmaceutical companies such as Novartis and Merck and large Clinical Laboratory Improvement Amendments of 1988, or CLIA, certified laboratories such as Myriad Genetics and Quest Diagnostics.

We have seen rapid adoption of our ThunderStorm and RainDrop systems, which retail in the U.S. for $250,000 and $125,000, respectively. Our recently launched ThunderBolts system retails in the U.S. for $50,000. We launched our ThunderStorm system in the fourth quarter of 2011 and have sold 57 systems to 22 customers as of December 31, 2014. We estimate that our ThunderStorm systems generate average annual consumable revenue per system of greater than $200,000. We launched our RainDrop system in the first quarter of 2013 and have sold 90 systems to 62 customers as of December 31, 2014. Our RainDrop system generates over $20,000 in average annual consumables revenue per system. For our ThunderStorm and RainDrop systems, we shipped consumable kits to customers corresponding to over 65,000 samples in 2013 and over 161,000 samples in 2014.

Our revenue grew from $17.2 million in 2013 to $30.6 million in 2014. In 2014, 53% of our sales were from consumables. Our gross margins were 51% in 2013 and increased to 58% in 2014. Our net loss was $14.3 million in 2013 and decreased to $8.8 million in 2014.

Company Strategy

Our mission is to ‘democratize’ genetic analysis research with products that enable our customers to detect and analyze complex genetic diseases by ultra-sensitive screening and monitoring of cell-free genomic targets. Our strategy to lead this market transformation is to:

| • | Enable Liquid Biopsy with Ultra-Sensitive NGS and dPCR for Translational Research Applications. We believe based on our knowledge of the market that our ThunderBolts and RainDrop systems represent the only platforms featuring both NGS and dPCR to perform ultra-sensitive tissue and |

2

Table of Contents

| liquid biopsy. We will continue to drive adoption and broaden awareness of our ThunderBolts and RainDrop systems for liquid biopsy assay and application developers. We will engage in sustained marketing and sales efforts to educate potential customers of the numerous advantages of our platforms and rapidly growing applications for liquid biopsy research as an alternative to traditional invasive biopsy procedures or imaging techniques that yield lower quality information. |

| • | Broaden our Assay Menu in Cancer and Infectious Disease to Increase Our Recurring Consumables Revenue. We plan to leverage our core ThunderBolts and RainDrop technology platforms to launch additional predefined disease-focused assays, in a similar manner to our ThunderBolts Cancer Panel and ThunderBolts Myeloid Panel. Beyond cancer research, our focus includes panels for research in infectious disease, immune monitoring and drug targets. In addition, our customers can build self-customizable panels that run on our systems for diverse research applications. We are collaborating with leading cancer centers, translational research institutes and assay development companies to expand the set of applications on our systems to drive consumables revenues. We intend to leverage our relationships with leading medical institutions to assemble consortiums of experts to advise us on the design and commercialization of predefined panels. |

| • | Establish the RainDrop System as the Gold Standard in Digital PCR. Based on our industry knowledge of competing products and technologies, we will highlight our RainDrop system’s superior capabilities to other PCR and dPCR instruments, as well as successful customer experiences to achieve our goal of making RainDrop the standard for dPCR research of genetic targets associated with cancer and other complex genetic diseases. We intend to collaborate with multiple medical research societies and standard and measurement agencies worldwide, such as the National Institute of Standards and Technology in the U.S., to establish RainDrop dPCR as a reference standard for genetic analysis. |

| • | Extend the Adoption of our ThunderStorm System in Major Commercial Laboratories. We currently promote our ThunderStorm system as the most powerful research-use platform for NGS content enrichment, and will reinforce our position as a trusted platform partner for high-volume customers. All of our products, including our ThunderStorm system, are currently labeled for research use only, or RUO, and are not for clinical diagnostic use. We plan to list our ThunderStorm system with the U.S. Food and Drug Administration, or the FDA, as a medical device to expand our potential markets for this product beyond research to clinical diagnostic use, although there can be no assurance regarding the timing of such listing. Prior to listing the product, the company has been in the process of establishing a quality system for the manufacturing facility and assuring that the design controls and production processes for the ThunderStorm will be in compliance with the FDA Quality System Regulations, or QSR. We believe that listing our ThunderStorm system with the FDA will provide increased regulatory certainty as the FDA’s policies concerning laboratory tests for analysis of complex genetic diseases continue to evolve as well as provide a competitive advantage compared to other products in the market which are labeled for research use only. |

| • | Drive Global Expansion. Our initial plan is to focus our direct sales force efforts on continued penetration within the United States, Canada and regions of Europe. We will continue to monitor and strategically pursue other geographic regions for opportunities to expand our direct sales and distribution presence. |

| • | Grow our Addressable Markets with New Technology Capabilities. We believe our technology is highly versatile and can be applied to address current technological limitations in several other large markets. We intend to continue investing in research for the development of innovative systems, assays and capabilities to expand our market opportunities within and beyond genomics. Leveraging our digital droplet technology platform, we are developing a pipeline of future products |

3

Table of Contents

| and applications for RNA sequencing, genomic structural variant analysis, single cell sequencing, novel approaches to enhance whole genome and exome sequencing, and multiplexed single molecule protein analysis. |

Target Markets

Newer technologies such as NGS and dPCR are accelerating the discovery of correlations between the human genome and diseases. We believe the total addressable market for our products will be over $3 billion by 2018. Our addressable market is comprised of existing NGS and PCR research markets, markets enabled by our technology, and markets created by the conversion of competing technologies to our products utilizing our digital droplet technology platform. The conversion of genetic analysis to NGS and dPCR is due to improvements in sensitivity, data density, workflow, and declining costs that enhance accessibility. The high growth in our markets and customers for NGS and dPCR reflects an industry transition from Sanger sequencing, Microarrays, which are a collection of microscopic DNA spots attached to a solid surface and used to measure genotypes or gene expression levels, and real-time PCR, or qPCR, a real-time polymerase chain reaction technique used to amplify and simultaneously quantify a targeted DNA molecule.

NGS Content Enrichment. We believe gene panels provide a targeted and efficient sequencing approach to research only relevant disease mutations. The workflow for targeted gene panels involves sample preparation, content enrichment, and library preparation, followed by NGS to analyze genes or genomic regions of interest. The 2013 Kalorama Report and the 2011 Takeda Pacific Report estimate the total addressable market for NGS content enrichment to be $800 million by 2017, growing at a compound annual growth rate, or CAGR, of approximately 20%. Specific applications and market segments for NGS content enrichment include:

| • | Basic Research: Researchers use targeted gene panels to discover and validate new mutations, analyze disease markers and genomic structural variations, assess methylation status, which denotes the addition of a methyl (CH3) group to another molecule, and gene regulation, which is a wide range of mechanisms that are used by cells to increase or decrease the production of specific gene products. The NGS content enrichment research market is expected to be $170 million by 2015, growing at a CAGR of approximately 16% (2011 Takeda Pacific Report). |

| • | Inherited Diseases Research: Commercial service laboratories and academic genetics centers use targeted gene panels for research into risk assessment of various inherited disorders and hereditary cancers. The NGS content enrichment market for inherited disease research is expected to be approximately $500 million by 2015, growing at a CAGR of approximately 22% (2011 Takeda Pacific Report). |

| • | Pathology Research: Cancer centers, bio-banks, and pathology laboratories are starting to adopt targeted gene panels to conduct cancer research. However, this research is in need of more sensitive tools to accurately and precisely analyze a multitude of small yet damaging genetic changes that evolve over time across multiple tissue types and organs. The NGS content enrichment market for cancer pathology is expected to be approximately $110 million by 2017, growing at a CAGR of approximately 17% (2013 Kalorama Report). |

Digital PCR. dPCR is one of the fastest growing technologies for genetic analysis. The 2013 Kalorama Report and the 2013 Global Industry Analysts Report estimate the global markets addressable by dPCR to be over $3 billion by 2018, growing at a CAGR of approximately 16%. Specific applications and market segments for dPCR include:

| • | Basic Research: Academic researchers use dPCR for highly precise analysis of genetic targets and this market is expected to be $400 million by 2018, growing at a CAGR of approximately 65% (2013 Global Industry Analysts Report). |

4

Table of Contents

| • | Cancer detection and mutation research: Researchers use dPCR to analyze predictive cancer markers and low-frequency mutation recurrence in circulating fluids, and this market is expected to be approximately $1.2 billion by 2017, growing at a CAGR of approximately 12% (2013 Kalorama Report). |

| • | Viral load research: Viral researchers, infectious disease agencies and commercial service laboratories use dPCR for highly accurate analysis of circulating virus in blood or lymph fluids for diseases such as Human Immunodeficiency Virus, or HIV, and Hepatitis C Virus, or HCV, and this market is expected to be $1.7 billion by 2017, growing at a CAGR of approximately 5% (2013 Kalorama Report). |

Limitations of Existing Technologies

Despite advances in genetic analysis, most technologies have struggled to break through the sensitivity and quantitation barriers for tissue or liquid biopsy, which require detection and quantitation of low-level yet important genetic targets such as circulating cell-free biomarkers in bodily fluids. These technologies do not provide the industry with simple tools that can accurately detect multiple mutations in a single assay with absolute precision, streamlined and scalable workflow, fast time-to-answer and low cost.

In particular, existing technologies for genetic analysis, including Sanger, Microarrays, PCR and NGS, face several limitations:

| • | Low sensitivity: Current approaches cannot achieve routine single molecule detection and quantitation across multiple markers in a single assay, which are needed for ultra-sensitive measurement of important, low-abundance genetic markers present in heterogeneous tissue and circulating fluids. |

| • | Lack of multiplexing capability: Most genetic analysis methods, with the exception of NGS and Microarrays, are limited to single genes or a limited number of gene targets in a single assay. Multiplexed genetic analysis solutions, such as our systems, are important because most diseases are demonstrated to be multi-genetic. |

| • | Limited content flexibility: While Sanger and NGS are designed for de novo sequencing, most other technologies, including Microarrays and PCR, employ “closed” assay designs, are limited to pre-designed content, or are limited to the availability of existing TaqMan assays, which consists of a TaqMan probe and primers to detect specific genetic regions of interest. |

| • | High sample input: To provide adequate analytical performance and sensitivity, most genetic analysis methods have a high threshold for sample input, which is prohibitive for many sample types such as FFPE. |

| • | Narrow application range: Many technologies in genetic laboratories are designed for a single use or small range of analysis types, which creates inefficiencies in use of lab space, workflow, technical training, consistency and economies of scale. |

| • | Time consuming complex workflow: Most genetic analysis technologies such as NGS, Sanger and Microarrays entail multiple time-consuming steps in workflow that are not readily automated. |

| • | Up-front and running costs: While the cost of genetic analysis continues to decline overall, sample economics for multi-gene panels are expensive at $100’s to $1,000’s per test. Sanger and PCR tests are less expensive, but both feature limited scalability. |

5

Table of Contents

The RainDance Solution and Advantage

Our proprietary digital droplet technology platform uses proprietary chemistries and sophisticated microfluidics to create for each sample millions of picoliter-scale droplets, each of which partitions and encapsulates a single molecule biological marker or reaction. Our technology platform enables researchers to precisely create, control, manipulate, detect, and quantitate millions of droplets. Our products lower the industry’s limit of detection compared to our competitors and increase the range of biological targets in a wide variety of sample types which we believe will unlock information previously inaccessible to researchers, while delivering simple workflow, fast turnaround time and lower cost results. Although we have only recently introduced our liquid biopsy applications, we believe it represents an initial and highly attractive application for our technology platform.

We offer several systems and related consumables for use by genetic researchers, all of which are based on our proprietary digital droplet technology platform, which we believe offers the following significant advantages:

| • | Ultra-sensitivity: Our technology enables true single molecule detection and analysis that we believe will unlock genetic information previously undetectable in complex and heterogeneous samples including circulating fluids and FFPE. Our technology can detect a single genetic target in a background of 250,000 other molecules, with a lower limit of detection of one in more than 1,000,000. Our technology platform delivers orders of magnitude increase in sensitivity per sample relative to existing technologies. |

| • | Multiplexing: Our technology enables our products to detect and analyze a broad range of targets in a single sample, from 10 genetic targets using our RainDrop system to hundreds of genetic targets using the ThunderBolts system, and to as many as 20,000 genetic targets using our ThunderStorm system. Higher multiplexing in a single sample, on a single platform, enhances research of complex diseases resulting in higher reproducibility and comparability of data, as well as lower cost per target. |

| • | Flexible open architecture: Our products are compatible with substantially all NGS systems and PCR chemistries, allowing researchers to leverage the industry’s 30 years and billions of dollars invested in innovation and commercialization of PCR and NGS technologies. As an ‘open source’ platform, our technology addresses pre-designed content limitations of TaqMan assays by allowing researchers to build flexible content and self-customizable panels. |

| • | Low sample input: Our single molecule detection capabilities allow our products to achieve ultra-sensitivity where the level or concentration of genetic targets is too low to detect with other existing technologies. With minimal starting sample requirements, our technology enables researchers to rapidly and cost-effectively analyze biopsy, plasma and FFPE samples. For NGS, our ThunderBolts and ThunderStorm systems require as little as 10 ng and 250 ng of DNA input, respectively, while our RainDrop dPCR system allows for as little as 3 pg of DNA input. |

| • | Broad application use: Our products currently enable researchers to perform a range of genetic analysis including sequencing enrichment, genotyping, gene expression, copy number variation, structural variations, and methylation in diseases such as cancer and infectious disease. In the future, we believe our digital droplet technology can be further leveraged to develop new products and applications for RNA sequencing, genome-wide structural variant analysis, single cell sequencing, novel approaches to enhance whole genome and exome sequencing, as well as multiplexed single molecule protein analysis. |

6

Table of Contents

| • | Simple rapid automated workflow: Our products feature simple, automated systems, software, assays, consumable chips and reagents. Our systems are designed to maximize performance while minimizing time-to-result, labor, and workflow complexity by integrating most steps of NGS and PCR directly into our systems. For example, our RainDrop system delivers results in as little as 7 hours and requires less than one hour of hands-on time. |

| • | Lower costs: Our products reduce all-in sample costs versus existing genetic analysis and invasive biopsy approaches. |

Risks Related to Our Business

Our business, financial condition, results of operations and prospects are subject to numerous risks, including those in the section of this prospectus captioned “Risk Factors” immediately following this prospectus summary. These risks include:

| • | We have incurred losses since we were formed and expect to incur losses in the future. We cannot be certain that we will achieve or sustain profitability. |

| • | Our financial results may vary significantly from quarter to quarter which may adversely affect our stock price. |

| • | If we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenue or achieve and sustain profitability. |

| • | Our customer base is highly concentrated, and the loss of one or more of our customers could harm our business, results of operations and financial condition. |

| • | We have limited experience in marketing and selling our products, and if we are unable to successfully commercialize our products, our business and operating results will be adversely affected. |

| • | We may experience development or manufacturing problems or delays that could limit the growth of our revenue or increase our losses. |

| • | We rely on a limited number of suppliers or, in some cases, one supplier, for our products, and may not be able to find replacements or immediately transition to alternative suppliers. |

| • | If the FDA determines that our products are intended for clinical use, or are marketed with express or implied clinical diagnostic claims, we may be required to obtain regulatory clearance(s) or approval(s) to commercialize our products, and may be required in the interim to cease or limit sales of our products or to recall products in the field, which could materially and adversely affect our business, financial condition and results of operations. |

| • | If we are unable to protect our intellectual property effectively, our business will be harmed. |

| • | We expect our stock price may fluctuate significantly and investors may not be able to sell their shares at or above the initial public offering price. |

7

Table of Contents

Corporate and Other Information

We were incorporated under the laws of the State of Delaware in 2004. Our principal executive offices are located at 749 Middlesex Turnpike, Billerica, Massachusetts 01821. Our telephone number is (978) 495-3300. We maintain a web site at www.raindancetech.com. The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our web site is not incorporated by reference into this prospectus, and should not be considered to be a part of this prospectus.

8

Table of Contents

| Common stock offered by us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Option to purchase additional shares from us |

We have granted the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to an additional shares from us. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million (or approximately $ million if the underwriters’ option to purchase additional shares in this offering is exercised in full), based upon an assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus. The principal reasons for undertaking this offering at this time are to create a public market for shares of our common stock and to facilitate our future access to public equity markets. We have no current specific plan for the proceeds, and thus, have not quantified or allocated any specific portion of the net proceeds or range of the net proceeds to any particular purpose. We anticipate that we will use the net proceeds we receive from this offering for general corporate purposes and working capital purposes, including the expansion of our commercial activities and team, continued development of our products and related applications, innovation in next-generation systems based on our digital droplet technology platform, strategic collaborations, enhancement of our manufacturing and administrative support capabilities, and regulatory clearance for our products as appropriate. See the section of this prospectus captioned “Use of Proceeds” for additional information. |

| Risk factors |

See the section of this prospectus captioned “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed NASDAQ Global Market trading symbol |

“RAIN” |

Except as otherwise indicated, the number of shares of common stock to be outstanding after this offering is based on 588,799,682 shares of common stock outstanding on an as-converted basis as of December 31, 2014 and excludes:

| • | 97,479,261 shares of common stock issuable upon the exercise of stock options outstanding as of December 31, 2014 with a weighted-average exercise price of $0.09 per share; |

9

Table of Contents

| • | 6,374,422 shares of common stock issuable upon the exercise of all outstanding warrants to purchase convertible preferred stock as of December 31, 2014 with an exercise price of $0.1808 per share, which will occur immediately prior to the closing of this offering if elected by the holders in some instances; |

| • | 36,000,000 shares of common stock issuable upon the exercise of common stock warrants outstanding as of December 31, 2014 with an exercise price of $0.05 per share, which will occur immediately prior to the closing of this offering; |

| • | 7,029,402 shares of common stock available for issuance under our RainDance Technologies, Inc. 2005 Employee, Director and Consultant Stock Plan, or the 2005 Plan, as of December 31, 2014. Upon completion of this offering there will be no future awards under the 2005 Plan; and |

| • | shares of common stock reserved for future issuance under our 2015 Stock Option and Incentive Plan, or the 2015 Plan, and shares of common stock reserved for issuance under our 2015 Employee Stock Purchase Plan, or the 2015 ESPP, each of which will become effective in connection with this offering and contain provisions that will automatically increase its respective shares reserved each year, as more fully described in “Executive Compensation—Employee Benefit Plans.” |

Except as otherwise indicated, the information in this prospectus:

| • | gives effect to our amended and restated certificate of incorporation, which will be in effect upon the closing of this offering; |

| • | reflects the 1-for- reverse stock split of our common stock effected on , 2015; |

| • | gives effect to the conversion of all of our outstanding convertible preferred stock as of December 31, 2014 into 578,934,840 shares of common stock, based on the conversion ratio applicable to each series of convertible preferred stock, immediately prior to this offering; |

| • | assumes no exercise of options or warrants outstanding as of December 31, 2014; |

| • | assumes the outstanding warrants to purchase convertible preferred stock will convert into warrants to purchase common stock, with the exception of the Company’s outstanding warrants that terminate upon completion of this offering unless previously exercised; and |

| • | assumes no exercise by the underwriters of their option to purchase up to an additional shares of our common stock in this offering. |

10

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

We have derived the following summary of consolidated statements of operations data for the years ended December 31, 2012, 2013 and 2014 from audited consolidated financial statements appearing elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected in the future. The summary consolidated financial data set forth below should be read together with the consolidated financial statements and the related notes appearing elsewhere in this prospectus, as well as the sections of this prospectus captioned “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| Year Ended December 31, |

||||||||||||

| ($ in thousands, except share and per share data) | 2012 |

2013 |

2014 |

|||||||||

| Revenue: |

||||||||||||

| Total revenue |

$ | 8,599 | $ | 17,174 | $ | 30,551 | ||||||

| Cost of sales |

5,059 | 8,395 | 12,840 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

3,540 | 8,779 | 17,711 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating expenses: |

||||||||||||

| Research and development |

10,644 | 8,512 | 8,455 | |||||||||

| Sales and marketing |

6,392 | 5,786 | 7,785 | |||||||||

| General and administrative |

4,774 | 5,493 | 7,600 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

21,810 | 19,791 | 23,840 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss from operations |

(18,270 | ) | (11,012 | ) | (6,129 | ) | ||||||

| Other income (expense): |

||||||||||||

| Interest income |

8 | 9 | 10 | |||||||||

| Interest expense |

(1,999 | ) | (2,990 | ) | (2,808 | ) | ||||||

| Other income (expense) |

111 | (341 | ) | 78 | ||||||||

|

|

|

|

|

|

|

|||||||

| Other (expense), net |

(1,880 | ) | (3,322 | ) | (2,720 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

$ | (20,150 | ) | $ | (14,334 | ) | $ | (8,849 | ) | |||

|

|

|

|

|

|

|

|||||||

| Net loss attributable to common stockholders—basic and diluted (1) |

$ | (20,150 | ) | $ | (14,334 | ) | $ | (8,849 | ) | |||

|

|

|

|

|

|

|

|||||||

| Net loss per share attributable to common stockholders—basic and diluted (1) |

$ | (5.05 | ) | $ | (3.53 | ) | $ | (1.21 | ) | |||

|

|

|

|

|

|

|

|||||||

| Weighted-average number of shares of common stock used in net loss per share attributable to common stockholders—basic and diluted (1) |

3,988,087 | 4,063,995 | 7,340,406 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pro forma net loss per share attributable to common stockholders—basic and diluted (unaudited) (2) |

$ | (0.02 | ) | |||||||||

|

|

|

|||||||||||

| Weighted-average number of shares of common stock used in pro forma net loss per share attributable to common stockholders—basic and diluted (unaudited) (2) |

576,496,997 | |||||||||||

|

|

|

|||||||||||

| (1) | See Note 2 to our consolidated financial statements for further details on the calculation of basic and diluted net loss per share attributable to common stockholders. |

| (2) | Weighted-average shares of common stock used in pro forma net loss per share attributable to common stockholders is computed using the weighted-average number of shares of common stock outstanding at the end of the period after giving effect to the conversion of all outstanding preferred stock into shares of common stock as if such conversion had occurred at the beginning of the period presented, or the date of issuance, if later. |

11

Table of Contents

| As of December 31, 2014 | ||||||||||

| Actual |

Pro Forma (1) |

Pro Forma As Adjusted (2) | ||||||||

| Cash and cash equivalents |

$ | 33,551 | $ | 33,551 | ||||||

| Working capital (3) |

28,127 | 28,127 | ||||||||

| Total assets |

50,174 | 50,174 | ||||||||

| Deferred revenue |

12,283 | 12,283 | ||||||||

| Long-term notes payable |

20,705 | 20,705 | ||||||||

| Accumulated deficit |

(132,958 | ) | (132,768 | ) | ||||||

| Stockholders’s (deficit) equity |

(111,734 | ) | 10,018 | |||||||

| (1) | The Pro Forma amounts included in this table reflect the assumed conversion of all outstanding shares of preferred stock into shares of common stock and the outstanding liability classified warrants to purchase convertible preferred stock will automatically convert into warrants to purchase common stock, with the exception of the Company’s outstanding liability classified warrants that terminate upon a deemed liquidation event or an IPO, upon the completion of the proposed offering, as if such event occurred as of December 31, 2014. |

| (2) | The Pro Forma As Adjusted amounts included in this table reflect the pro forma adjustments discussed above as further adjusted to reflect the net proceeds from the sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase (decrease) our cash, working capital (excluding deferred revenue), total assets and total stockholders’ (deficit) equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Working capital represents the excess of total current assets over total current liabilities. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks and uncertainties described below, which we believe are the material risks associated with our business and this offering. If any of the following risks were to materialize, our business, financial condition, results of operations, and future growth prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline, and you may lose all or part of your investment. In assessing these risks, you should also refer to all of the other information contained in this prospectus, including our financial statements and related notes.

Risks Related to our Business

We have incurred losses since we were formed and expect to incur losses in the future. We cannot be certain that we will achieve or sustain profitability.

We incurred net losses of $20.2 million, $14.3 million and $8.8 million for the years ended December 31, 2012, 2013 and 2014, respectively. As of December 31, 2012, 2013 and 2014, we had an accumulated deficit of $109.8 million, $124.1 million and $133.0 million, respectively. We cannot predict if we will achieve sustained profitability in the near future or at all. We expect that our losses will continue at least through December 31, 2016 as we plan to invest significant additional funds toward expansion of our commercial organization and the development of our products and related applications. In addition, as a public company, we will incur significant legal, accounting, and other expenses that we did not incur as a private company. These increased expenses will make it harder for us to achieve and sustain future profitability. We may incur significant losses in the future for a number of reasons, many of which are beyond our control, including the other risks described in this prospectus, the market acceptance of our products, future product development and our market penetration and margins.

Our quarterly and annual operating results and cash flows have fluctuated in the past and might continue to fluctuate, causing the value of our common stock to decline substantially.

Numerous factors, many of which are outside our control, may cause or contribute to significant fluctuations in our quarterly and annual operating results. These fluctuations may make financial planning and forecasting difficult. In addition, these fluctuations may result in unanticipated decreases in our available cash, which could negatively affect our business and prospects. In addition, one or more of such factors may cause our revenue or operating expenses in one period to be disproportionately higher or lower relative to the others. As a result, comparing our operating results on a period-to-period basis might not be meaningful. You should not rely on our past results as indicative of our future performance. Moreover, our stock price might be based on expectations of future performance that are unrealistic or that we might not meet and, if our revenue or operating results fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially.

Our operating results have varied in the past. In addition to other risk factors listed in this section, some of the important factors that may cause fluctuations in our quarterly and annual operating results include:

| • | the timing of receipt of new system orders from customers for our ThunderStorm, ThunderBolts and RainDrop systems; |

| • | adoption of our technology platform and products by customers; |

| • | the rate of utilization of consumable supplies by our customers; and |

| • | the utilization of our products by Myriad Genetics, Inc., or Myriad. |

13

Table of Contents

In addition, a significant portion of our operating expense is relatively fixed in nature, and planned expenditures are based in part on expectations regarding future revenue. Accordingly, unexpected revenue shortfalls might decrease our gross margins and could cause significant changes in our operating results from quarter to quarter. If this occurs, the trading price of our common stock could fall substantially, either suddenly or over time.

If we are unable to maintain adequate revenue growth or do not successfully manage such growth, our business and growth prospects will be harmed.

We have experienced significant revenue growth in a short period of time. We may not achieve similar growth rates in future periods. Investors should not rely on our operating results for any prior periods as an indication of our future operating performance. If we are unable to maintain adequate revenue growth, our financial results could suffer and our stock price could decline. To effectively manage this and our anticipated future growth, we must continue to maintain and enhance our financial, accounting, manufacturing, customer support and sales administration systems, processes and controls. Failure to effectively manage our growth could lead us to over-invest or under-invest in development, operational, and administrative infrastructure, result in weaknesses in our infrastructure, systems, or controls, give rise to operational mistakes, losses, loss of customers, productivity or business opportunities, and result in loss of employees and reduced productivity of remaining employees.

Our growth could require significant capital expenditures and might divert financial resources from other projects such as the development of new products and services. As additional products are commercialized, we may need to incorporate new equipment, implement new technology systems, or hire new personnel with different qualifications. Failure to manage this growth or transition could result in turnaround time delays, higher product costs, declining product quality, deteriorating customer service, and slower responses to competitive challenges. A failure in any one of these areas could make it difficult for us to meet market expectations for our products, and could damage our reputation and the prospects for our business.

If our management is unable to effectively manage our growth, our expenses might increase more than expected, our revenue could decline or might grow more slowly than expected and we might be unable to implement our business strategy. The quality of our products and services might suffer, which could negatively affect our reputation and harm our ability to retain and attract customers.

Our revenue is generated from a limited number of customers, and the loss of one or more of our clients or the failure to retain a significant amount of business from them could adversely affect our business, results of operations and financial condition.

Our customer base is highly concentrated. For the years ended December 31, 2012, 2013 and 2014, our ten largest customers by revenue represented approximately 70%, 69% and 76%, respectively, of our total revenue, with one customer, Myriad, representing 51% of our total revenue in 2014. We expect that a relatively small number of customers will continue to account for a significant portion of our revenue for the foreseeable future. The current term of the commercial supply agreement we have with Myriad ends April 2018; however, Myriad may terminate the agreement on twelve (12) months prior written notice. The loss of one or more of our customers, including the loss of Myriad or any of our larger customers, whether through expiration or termination of an agreement, acquisitions, consolidations, bankruptcies or otherwise, or the failure to retain a significant amount of business from our customers, could harm our business, results of operations and financial condition.

Our future success is dependent upon our ability to expand our customer base, to establish our technology platform and products as industry-standards and to introduce new applications and systems.

We introduced ThunderStorm in the fourth quarter of 2011, ThunderBolts in February 2015 and RainDrop commercially in the first quarter of 2013 and have achieved initial market penetration with leading

14

Table of Contents

cancer research centers, medical genetic centers, infectious disease research centers, pharmaceutical companies, and commercial service laboratories. Our success will depend, in part, upon our ability to increase our market penetration among these customers, to generate adoption of our technology platform by leading institutions and opinion leaders as the platform of choice for ultra-sensitive genetic analysis and content enrichment, and to expand our market by developing, and by fostering the development by our customers of, new applications, systems and applications for our products. These efforts require substantial time and expense. Any failure to expand our existing customer base, establish our technology platform and products or launch new applications, systems and applications, would adversely affect our ability to improve our operating results.

The liquid biopsy market and other emerging market opportunities may not develop as quickly as we expect, limiting our ability to successfully market and sell our products.

We intend to expand the application of our technologies to emerging market opportunities. For example, we have recently entered into the liquid biopsy market. Emerging market opportunities, such as the liquid biopsy market, could take several years to develop and mature, and we cannot be certain that these market opportunities will develop as we expect. The future growth of emerging markets for our products depends on many factors beyond our control, including recognition and acceptance of our applications by the scientific community and the growth, prevalence and costs of competing methods of genomic analysis. For example, the growth of the liquid biopsy market is dependent on acceptance of liquid biopsy as an alternative to traditional invasive or imaging techniques.

If these markets do not develop as we expect, our business may be adversely affected. Our success in these markets will also depend to a large extent on our ability to successfully market and sell products in these markets using our technologies. If we are not able to successfully market and sell our products or to achieve the revenue or margins we expect, our operating results may be harmed and we may not recover our product development and marketing expenditures.

Our sales cycle is lengthy and variable, which makes it difficult for us to forecast revenue and other operating results.

Our sales process involves numerous interactions with multiple individuals within an organization, and often includes in-depth analysis by potential customers of our products, preparation, writing and submitting of grants, processing of extensive documentation and a lengthy review process. Our customers’ evaluation process involves a number of factors, many of which are beyond our control. As a result of these factors, the large capital investment required to purchase our systems and the budget cycles of our customers, the time from initial contact with a customer to our receipt of a purchase order can vary significantly.

Our sales cycle also varies significantly by product. We believe that the current sales cycle for RainDrop is typically three to six months, and ThunderStorm is typically six to twelve months. While still early in our launch, we believe the sales cycle for our ThunderBolts system will be similar to that of our RainDrop system, though our existing RainDrop system installed base will have immediate access to predefined or user-defined ThunderBolts panels. Given the length and uncertainty of our sales cycle, we have in the past experienced, and likely will in the future experience, fluctuations in our system and consumables sales on a period-to-period basis. In addition, any failure to meet customer expectations could result in customers choosing to retain their existing systems, use existing assays not requiring capital equipment or to purchase systems other than ours.

The NGS content enrichment and dPCR markets are highly competitive. If we fail to effectively compete, our business, financial condition and operating results will suffer.

We face significant competition in the NGS content enrichment and dPCR markets. We currently compete with both established and early stage companies that design, manufacture and market systems and consumable supplies. We believe our principal competitors in the NGS content enrichment market are Agilent Technologies Inc., Illumina, Inc. and Qiagen N.V. and our principal competitor in the dPCR market is Bio-Rad

15

Table of Contents

Laboratories, Inc. In addition, there are a number of new market entrants in the process of developing novel technologies for the NGS content enrichment and dPCR markets.

Most of our current competitors are either publicly traded, or are divisions of publicly-traded companies, and enjoy a number of competitive advantages over us, including:

| • | greater name and brand recognition; |

| • | substantially greater financial and human resources; |

| • | broader product lines; |

| • | larger sales forces and more established distributor networks; |

| • | substantial intellectual property portfolios; |

| • | larger and more established customer bases and relationships; and |

| • | better established, larger scale, and lower cost manufacturing capabilities. |

We believe that the principal competitive factors in all of our target markets include:

| • | cost of capital equipment and supplies; |

| • | reputation among customers; |

| • | innovation in product offerings; |

| • | flexibility and ease of use; |

| • | accuracy and reproducibility of results; and |

| • | compatibility with existing laboratory processes, tools and methods. |

We cannot assure investors that our products will compete favorably or that we will be successful in the face of increasing competition from new products and technologies introduced by our existing competitors or new companies entering our markets. In addition, we cannot assure investors that our competitors do not have or will not develop products or technologies that currently or in the future will enable them to produce competitive products with greater capabilities or at lower costs than ours. Any failure to compete effectively could materially and adversely affect our business, financial condition and operating results.

Risks Related to the Development and Commercialization of our Products

We may not be able to develop new products or enhance the capabilities of our systems to keep pace with competition and rapidly changing technology and customer requirements, which could have a material adverse effect on our revenues, operating results and business.

Our success depends on our ability to develop new products and applications for our technology in existing and new markets, while improving the performance and cost-effectiveness of our systems. New technologies, techniques or products could emerge that might offer better combinations of price and performance than our current or future products. Existing markets for our products are characterized by rapid technological change and innovation. It is critical to our success that we anticipate changes in technology and customer requirements and successfully introduce new, enhanced and competitive technologies to meet our customers’ and prospective customers’ needs on a timely and cost-effective basis. At the same time, however, we must carefully manage the introduction by us of new products. If customers believe that such products will offer enhanced features or be sold for a more attractive price, they may delay purchases until such products are available. We

16

Table of Contents

may also have excess or obsolete inventory of older products as we transition to new products and our experience in managing product transitions is very limited. If we do not successfully innovate and introduce new technology into our product lines or manage the transitions to new product offerings, we may not remain competitive and our revenues, results of operations and business will be adversely impacted.

Competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. Some of our competitors have greater financial and personnel resources, a more established customer base, and more regulatory experience than we do. We anticipate that we will face increased competition in the future as existing companies and competitors develop new or improved products and as new companies enter the market with new technologies.

If we do not successfully manage the development and launch of new products, our financial results could be adversely affected.

We face risks associated with launching new products and with undertaking to comply with regulatory requirements for products that will be developed, manufactured, and tested as medical devices. If we encounter development or manufacturing challenges or discover errors during our product development cycle, the product launch date(s) may be delayed. The expenses or losses associated with unsuccessful product development or launch activities or lack of market acceptance of our new products could adversely affect our business or financial condition.

Undetected errors or defects in our products could harm our reputation, decrease market acceptance of our products or expose us to product liability claims.

Our products may contain undetected errors or defects when first introduced or as new versions are released. Disruptions or other performance problems with our products may damage our customers’ businesses and could harm their and our reputation. If that occurs, we may incur significant costs, the attention of our key personnel could be diverted, or other significant customer relations problems may arise. We may also be subject to warranty and liability claims for damages related to errors or defects in our products. In addition, if we do not meet applicable regulatory or quality standards, our products may be subject to recall. A material liability claim, recall or other occurrence that harms our reputation or decreases market acceptance of our products could harm our business and operating results.

The sale and use of products, or services based on our products, could lead to the filing of product liability claims if someone were to allege that one of our products contained a design or manufacturing defect which resulted in the failure to adequately perform the analysis for which it was designed or resulted in death or injury or failure to identify a condition leading to death or injury. A product liability claim could result in substantial damages and be costly and time consuming to defend, either of which could materially harm our business or financial condition. We cannot assure investors that our product liability insurance would adequately protect our assets from the financial impact of defending a product liability claim. Any product liability claim brought against us, with or without merit, could increase our product liability insurance rates or prevent us from securing insurance coverage in the future.

We expect to generate a substantial portion of our revenue internationally in the future and can become further subject to various risks relating to our international activities, which could adversely affect our business, operating results and financial condition.

During 2014, approximately 12% of our revenue was generated from sales to customers located outside of North America. We believe that a substantial percentage of our future revenue will come from international sources as we expand our overseas operations and develop opportunities in additional areas. Engaging in international business involves a number of difficulties and risks, including:

| • | required compliance with existing and changing foreign regulatory requirements and laws; |

17

Table of Contents

| • | difficulties and costs of staffing and managing foreign operations; |

| • | difficulties protecting or procuring intellectual property rights; |

| • | required compliance with anti-bribery laws, such as the U.S. Foreign Corrupt Practices Act, data privacy requirements, labor laws and anti-competition regulations; |

| • | export or import restrictions; |

| • | laws and business practices favoring local companies; |

| • | longer payment cycles and difficulties in enforcing agreements and collecting receivables through certain foreign legal systems; |

| • | political and economic instability; and |

| • | potentially adverse tax consequences, tariffs, customs charges, bureaucratic requirements and other trade barriers. |

Historically, most of our revenue has been denominated in U.S. dollars. In the future, we may sell our products and services in local currency outside of the United States. As our operations in countries outside of the United States grow, our results of operations and cash flows will be subject to fluctuations due to changes in foreign currency exchange rates, which could harm our business in the future. For example, if the value of the U.S. dollar increases relative to foreign currencies, in the absence of a corresponding change in local currency prices, our revenue could be adversely affected as we convert revenue from local currencies to U.S. dollars. If we dedicate significant resources to our international operations and are unable to manage these risks effectively, our business, operating results and financial condition will suffer.

If we are unable to recruit, train, retain and motivate key personnel, we may not achieve our goals.

Our future success depends on our ability to recruit, train, retain and motivate key personnel, including our senior management, research and development, manufacturing and sales and marketing personnel. Competition for qualified personnel is intense. Our growth depends, in particular, on attracting and retaining highly-trained sales personnel with the necessary scientific background and ability to understand our systems at a technical level to effectively identify and sell to potential new customers and develop new products. Because of the complex and technical nature of our products and the dynamic market in which we compete, any failure to attract, train, retain and motivate qualified personnel could materially harm our operating results and growth prospects.

Our business depends, in part, on levels of research and development spending by leading cancer research centers, medical genetic centers, infectious disease research centers, pharmaceutical companies, and commercial service laboratories, a reduction in which could limit demand for our products and adversely affect our business, operating results and financial condition.

In the near term, we expect that our revenue will be derived primarily from sales of RainDrop and ThunderStorm systems and related consumables to leading cancer research centers, medical genetic centers, infectious disease research centers, pharmaceutical companies, and commercial service laboratories for research and other applications. The demand for our products will depend, in part, upon the research and development budgets of these customers, which are impacted by factors beyond our control, such as:

| • | changes in government programs that provide funding to research institutions and companies; |

| • | macroeconomic conditions and the political climate; |

| • | changes in the regulatory environment; |

18

Table of Contents

| • | differences in budgetary cycles; |

| • | market-driven pressures to consolidate operations and reduce costs; and |

| • | market acceptance of relatively new technologies, such as ours. |

Our operating results may fluctuate substantially due to reductions and delays in research and development expenditures by these customers. Any decrease in our customers’ budgets or expenditures, or in the size, scope or frequency of capital or operating expenditures, could materially and adversely affect our business, operating results and financial condition.

We have limited experience in marketing and selling our products, and if we are unable to successfully commercialize our products, our business and operating results will be adversely affected.

We have limited experience marketing and selling our products. We sell all our products for research use only, through our own sales force in North America and through a combination of our own sales force and third-party distributors in additional major markets, such as the European Union and Asia, including China and Japan. In the future, we intend to establish distributor relationships in other parts of the world.

The future sales of our products will depend in large part on our ability to effectively market and sell our products, successfully manage and expand our sales force, and increase the scope of our marketing efforts. Because we have limited experience in marketing and selling our products, our ability to forecast demand, the infrastructure required to support such demand and the sales cycle to customers is unproven. If we do not build an efficient and effective sales force targeting the NGS content enrichment and dPCR markets, our business and operating results will be adversely affected.

We may experience development or manufacturing problems or delays that could limit the growth of our revenue or increase our losses.

We have been manufacturing and assembling our ThunderStorm system in commercial quantities since the fourth quarter of 2011, RainDrop since the first quarter of 2013 and ThunderBolts since February 2015. We outsource production of our RainDrop Source, RainDrop Sense and ThunderBolts systems to a third party. We may encounter unforeseen situations that would result in delays or shortfalls in our production as well as delays or shortfalls caused by an outsourced manufacturing supplier and by other third-party suppliers who manufacture consumable chips and components for our products. In addition, our production processes and assembly methods may have to change to accommodate any significant future expansion of our manufacturing capacity. If we are unable to keep up with demand for our products, our revenue could be impaired, market acceptance for our products could be adversely affected and our customers might instead purchase our competitors’ products. Our inability to successfully manufacture our products would have a material adverse effect on our operating results.

We rely on a limited number of suppliers or, in some cases, one supplier, for some of our materials and systems, and may not be able to find replacements or immediately transition to alternative suppliers, which could have a material adverse effect on our business, financial condition, results of operations and reputation.

We rely on certain sole suppliers, including Sony DADC Austria AG, for the consumable chips that are supplied with RainDrop, ThunderBolts and ThunderStorm, and we rely on Sigma-Aldrich for certain reagents that are used in the development of gene libraries for use with ThunderStorm. An interruption in our operations could occur if we encounter delays or difficulties in securing these materials, or if the quality of the products, components, or materials supplied do not meet our requirements, or if we cannot then obtain an acceptable substitute. The time and effort required to qualify a new supplier could result in additional costs. Any such interruption could significantly affect our business, financial condition, results of operations and reputation. We rely on Coghlin Companies, or Coghlin, as the sole outsourced manufacturer of the RainDrop Source, RainDrop

19

Table of Contents

Sense and ThunderBolts instruments. Any disruption in Coghlin’s operations or inability to maintain quality standards could impact the supply chain of our systems and our business, financial condition, results of operations and reputation could be adversely affected.

We believe that only a small number of suppliers are currently capable of supplying materials and servicing the systems necessary for our operations. The use of materials and systems furnished by these replacement suppliers would require us to alter our operations. Transitioning to a new supplier would be time consuming and expensive, may result in interruptions in our operations, could affect the performance specifications of our products or could require that we revalidate the materials and systems. There can be no assurance that we will be able to secure alternative materials and systems, and bring such materials and systems on line and revalidate them without experiencing interruptions in our workflow. If we should encounter delays or difficulties in securing, reconfiguring or revalidating the materials and systems we require for our products, our business, financial condition, results of operations and reputation could be adversely affected.

If we cannot provide quality technical and applications support, we could lose customers and our business and prospects will suffer.

The placement of our products at new customer sites, the introduction of our technology into our customers’ existing laboratory workflows and ongoing customer support can be complex. Accordingly, we need highly trained technical support personnel. Hiring technical support personnel is very competitive in our industry due to the limited number of people available with the necessary scientific and technical backgrounds and ability to understand our systems at a technical level. To effectively support potential new customers and the expanding needs of current customers, we will need to substantially expand our technical support staff. If we are unable to attract, train or retain the number of highly qualified technical services personnel that our business needs, our business and prospects will suffer.

Risks Related to Government Regulation and Product Reimbursement

If the FDA determines that our research use only products are intended for clinical use, or are marketed with express or implied clinical diagnostic claims, we may be required to obtain regulatory clearance(s) or approval(s) to commercialize our products, and may be required in the interim to cease or limit sales of our products or to recall products in the field, which could materially and adversely affect our business, financial condition and results of operations.