Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ORIGINCLEAR, INC. | Financial_Report.xls |

| EX-31 - EXHIBIT 31.1 - ORIGINCLEAR, INC. | f10k2014ex31i_originoil.htm |

| EX-32 - EXHIBIT 32.1 - ORIGINCLEAR, INC. | f10k2014ex32i_originoil.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 333-147980

ORIGINOIL, INC.

(Exact name of registrant as specified in charter)

| Nevada | 26-0287664 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

5645 West Adams Blvd, Los Angeles, CA 90016

(Address of principal executive offices) (Zip Code)

Registrant's telephone Number: (323) 939-6645

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, “non-accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ¨ | Accelerated Filer ¨ |

| Non-accelerated Filer ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $17,280,503 based upon the closing sales price of the registrant’s common stock on June 30, 2014 of $0.21 per share.

At March 30, 2015, 117,792,485 shares of the registrant’s common stock were outstanding

DOCUMENTS INCORPORATED BY REFERENCE: NONE

| 1 |

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | Business | 3 |

| Item 1A | Risk Factors | 16 |

| Item 1B | Unresolved Staff Comments | 23 |

| Item 2. | Properties | 23 |

| Item 3. | Legal Proceedings | 23 |

| Item 4. | Mine Safety Disclosures | 23 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 23 |

| Item 6 | Selected Financial Data | 24 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 24 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 27 |

| Item 8. | Financial Statements and Supplementary Data | 27 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 27 |

| Item 9A. | Controls and Procedures | 28 |

| Item 9B. | Other Information | 28 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 29 |

| Item 11. | Executive Compensation | 31 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | |

| and Related Stockholder Matters | 34 | |

| Item 13. | Certain Relationship and Related Transactions, and Director Independence | 37 |

| Item 14. | Principal Accountant Fees and Services | 37 |

| Item 15. | Exhibits, Financial Statement Schedules | 37 |

| SIGNATURES | 38 | |

| 2 |

PART I

This Form 10-K contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about our:

| ● | business strategy; | |

| ● | financial strategy; | |

| ● | intellectual property; | |

| ● | production; | |

| ● | future operating results; and | |

| ● | plans, objectives, expectations and intentions contained in this report that are not historical. |

All statements, other than statements of historical fact included in this report, regarding our strategy, intellectual property, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. All forward-looking statements speak only as of the date of this report. You should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this report are reasonable, we can give no assurance that these plans, intentions or expectations will be achieved. These statements may be found under “Management's Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” “Properties,” as well as in this report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur.

ITEM 1. BUSINESS.

Organizational History

OriginOil, Inc. (“we”, “us”, “our”, the “Company” or “OriginOil”) was incorporated on June 1, 2007 under the laws of the State of Nevada. We have been engaged in business operations since June 2007. We recently moved into the commercialization phase of our business plan having been primarily involved in research, development and licensing activities. Our principal offices are located at 5645 West Adams Blvd., Los Angeles, California 90016, with a satellite office at 3300 S. Gessner, Suite 268, Houston, TX 77063. Our main telephone number is (323) 939-6645. Our website address is www.originoil.com.

In addition to announcing material financial information through our investor relations website, press releases, SEC filings and webcasts, we also intend to use the following social media channels as a means of disclosing information about our products, our planned financial and other announcements, our attendance at upcoming investor and industry conferences, and other matters and for complying with our disclosure obligations under Regulation FD:

| • | OriginOil’s Twitter Account (https://twitter.com/originoil) |

| • | OriginOil’s Facebook Page (https://www.facebook.com/OriginOil) |

The information we post through these social media channels may be deemed material. Accordingly, investors should monitor these accounts, in addition to following the company’s press releases, SEC filings, public conference calls and webcasts. This list may be updated from time to time.

We have not incorporated by reference into this report the information in, or that can be accessed through, our website or social media channels, and you should not consider it to be a part of this report.

Overview of Business

OriginOil is the proprietary developer of Electro Water Separation™ (EWS), the high-speed, primarily chemical-free technology to clean up large quantities of water. It removes oils, suspended solids, certain dissolved solids, and pathogens, in a continuous and energy-efficient process.

The company originally developed this technology to solve the challenge of removing microalgae from a highly dilute state. The electro-chemical process was then extended, first to cleaning up oil and gas waste water and most recently, to industrial, agricultural and urban waste. EWS is entirely electrical in nature and does not rely on algae for its cleaning capabilities.

EWS is designed to be an early step in removal of oils, solids and pathogens; reducing the work that more expensive, downstream processes must do, therefore enabling more cost-efficient and high-volume water cleanup overall.

OriginOil is a technology company. Our technology integrates easily with other industry processes. We have begun to embed our technology into larger systems through licensing and joint ventures.

While our long-term business model is based on licensing our technology to original equipment manufacturers (OEMs), distributors, resellers, service providers and other licensees, we also assemble and sell complete solutions based on EWS. These are named Smart Algae Harvester™ for algae harvesting and OriginClear™ Petro (previously CLEAN-FRAC™) for oil and gas water cleanup. A waste system is also in development and is to be named OriginClear Waste.

Recent Developments

We have been engaged in our business operations since June 2007, and to date, we have been primarily involved in research and development activities, with licensing to OEMs, and sales of pilot and demonstration equipment beginning in June of 2010. Commercial sales by both OriginOil and its licensees began in 2014.

| 3 |

In October of 2012, we announced that we signed our first OEM agreement with oil and gas water treatment firm Pearl H20, LLC (Pearl), a Pacific Advanced Civil Engineering, Inc. (PACE) spinoff whose product, PearlBlue, integrates EWS. Beginning in 2014, Pearl H2O was the first licensee to integrate EWS technology in a scaled-up system, which operates on a demonstration basis in California today.

Our first OEM licensing agreement in algae was in January 2014, with Orca Vision Inc., a new East Asian urban farming venture, which also purchased three demonstration systems.

In February 2014, we announced the opening of a Houston, Texas office for the oil and gas division of our business.

The first commercial sale by an OEM licensee occurred in September 2014, when Delta, Colorado based Industrial Systems Inc. (ISI) sold four industrial systems, powered by OriginOil’s EWS, to Synergy Resources, for produced water and oily waste treatment in Trinidad and Tobago (T&T). In addition to receiving a royalty on these sales, OriginOil fabricates core components such as an intelligent power supply and anode assemblies for sale to the licensee. OriginOil expects that such licensing hybrid revenue streams of royalties plus core component sales will become the norm.

In October of 2014, Gulf Energy SAOC of Oman agreed to purchase a CLEAN-FRAC (now OriginClear Petro) 5000 system from us for about $1.4 million. Currently, we are in discussions to modify that system for additional effluent specifications, potentially resulting in a higher sale price, and in the meantime to sell Gulf a smaller demonstration unit with the same capabilities.

In algae, we significantly upgraded the capacities of the early Model A12 unit (also known as the Algae Appliance™) to the new Smart Algae Harvester Model A25 (rated for 12 liters per minute of raw algae water processing), previewed at the Algae Biomass Summit in San Diego in September 2014 and launched officially in January 2015.

We are a joint venture partner in Ennesys, a system integrator focused on algae production to meet the European Union’s environmental regulations. In mid-2013, we installed a prototype EWS Waste unit at the Ennesys demonstration site which can process liquid waste, generating clean, nitrate-rich water to feed algae grown on the building’s roof as an energy source. In late 2013, we transferred three of our non-core patent applications to Ennesys. We continue to support Ennesys with technology and public communications.

In December 2014, OriginOil announced that it will launch a subsidiary in Hong Kong and grant it a master license for the People’s Republic of China. In turn, the subsidiary is expected to license regional joint ventures for frack and waste water treatment. A research and a manufacturing center are also planned.

As a result of discussions in 2014, on January 27, 2015, OriginOil announced collaboration with the Idaho National Laboratory (INL) of the U.S. Department of Energy. OriginOil and INL have submitted a proposal in response to a Funding Opportunity Announcement (FOA) titled Targeted Algal Biofuels and Bioproducts (TABB). The TABB FOA seeks alternative pathways to overcome two of the key barriers to commercializing algal biofuels: the high cost of producing algal biomass and the low yield of target biofuel and bioproduct feedstocks produced from algae.

OriginOil’s Technology Platform: Electro Water Separation™

OriginOil’s breakthrough water cleanup technology, called Electro Water Separation™ (EWS), is a high-speed, primarily chemical free process that efficiently extracts organic contaminants from very large quantities of water. Because of its capabilities, we believe EWS is valuable in water-intensive industries such as algae, oil & gas, and waste water treatment.

| 4 |

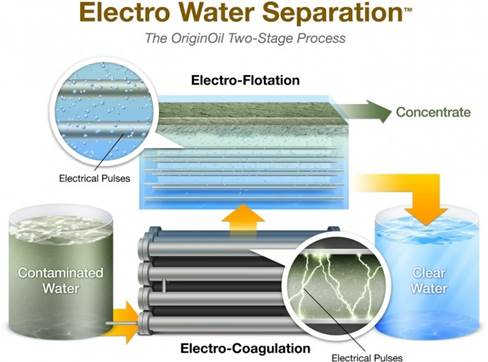

EWS is a two-stage process with an important third function.

EWS works in two stages:

Stage 1- Electro-Coagulation: contaminated water enters the first stage, which is a proprietary electro-coagulation process. In this stage, mild electrical impulses are applied in long tubes, causing the organic contaminants to coagulate, or “clump” together.

Stage 2 - Electro-Flotation: the coagulated material travels into a second stage where low power electrical pulses generate a cloud of micro-bubbles that gently lifts the concentrate to the surface for harvesting.

Together, these stages accomplish an important third function, electro-oxidation, which is effective in removing pathogens, for example.

The harvested concentrate can be made up of waste, recoverable hydrocarbons, or useful algae feedstock.

For the emerging algae industry, EWS can reduce bacterial contamination, and concentrate algae without chemicals, making large-scale harvest possible for end-uses such as nutritional products, animal feed, fertilizer, chemicals and fuel.

For the oil & gas industry, EWS can help clean up produced water and recycle fracking water to reduce harm to the environment and lower costs.

EWS has also been shown to help clean up contaminated industrial, agricultural and urban waste water quickly and cheaply without the primary use of chemicals for reuse and further purification.

Our Strategy

We are currently marketing our EWS systems at the demonstration scale as a way to penetrate markets and prove the technology for these markets, and to create future customers. This process is intended to lead to wide distribution of our technology through OEM (Original Equipment Manufacturer) “Powered by OriginOil” agreements with distributors, manufacturers, engineering service firms, and operators.

We believe our OEM/licensing model offers a host of potential advantages, including:

| · | Limited capital requirements; |

| · | Avoidance of capital cost for volume manufacturing; |

| · | Avoidance of time or expense in building distribution channels; |

| · | Collaborating with major players instead of competing with them; |

| · | Opportunity to make the core EWS technology a de facto standard in the multiple industries where it has applications. |

| 5 |

Given the number of potential industries in which EWS can be applied, we believe it is impractical for us to enter into each market and exploit them all effectively at once. Therefore, we seek OEMs, who will embed the technology in their own end-to-end systems, and ultimately, master licensees for each industry of application.

While our long-term business model is based on licensing our technology to original equipment manufacturers (OEMs), distributors, resellers, service providers and other licensees, we also assemble and sell complete solutions based on EWS. These are named Smart Algae Harvester™ for algae harvesting, and OriginClear™ Petro (previously CLEAN-FRAC™) for oil and gas water cleanup, and OriginClear Waste for waste water cleanup.

We currently manufacture our demonstration and commercial equipment in-house, with engineering support from a variety of vendors, sub-assembly manufacturers, and engineering firms.

The reason for selling complete solutions is to:

| · | Demonstrate the effectiveness of EWS and OriginClear in real-world field situations, as we did in 2014 for the petroleum industry in Colorado, Texas and now California; |

| · | Get EWS into use in commerce ahead of the lengthier licensee adoption rate; |

| · | Generate short-term revenues; |

| · | Enable licensees to buy “built” systems ahead of waiting for lengthy manufacturing timelines. |

Our Product Offerings

The Algae Industry

Much of the petroleum that powers our world comes from ancient algae that decomposed hundreds of millions of years ago. Like petroleum, algae can be turned into transportation fuels, chemicals, pharmaceuticals and plastics; but unlike petroleum, algae is a food as well; and absorbs CO2 in the growth process, about two tons of CO2 for every ton of algae produced.

Algae is one of nature′s most efficient and versatile photosynthetic factories. It has a short growing cycle and does not require arable land or fresh water, which makes it very attractive as an energy feedstock, or as a healthy and natural feed or fertilizer.

But a major barrier to commercialization is the difficulty in extracting small amounts of algae biomass from very large quantities of water at a reasonable cost and without using more energy than can be created. And the quantities of water required can be very large indeed: algae-to-water ratio can be as high as 1-to-1000.

Conventional water separation technologies such as centrifuges and membranes may work on a limited basis, but can be too expensive for large-scale use. Additionally, centrifuges are typically a batch process.

Early Harvesting Technology: Single Step Extraction™

OriginOil’s early algae harvesting technology was Single Step Extraction™ (SSE). Today, SSE is the first stage in EWS and it powers our sanitation and growth optimizing applications.

Current Offering: EWS Algae™

Today, EWS Algae™ is our standardized, low energy, primarily chemical-free, algae processing technology which is available for licensing.

While EWS Algae is available for licensing and integration into other vendor systems, we have also integrated EWS Algae into our own product line, called Smart Algae Harvester launched in January, 2015.

Smart Algae Harvesters are rated by their maximum capacity to process algae dilute continuously, labeled in liters per minute.

The first model in the new line is the A25, a workhorse algae harvester designed for scale-up testing and initial production. It can process up to 25 liters per minute or up to 36,000 liters (about 10,000 gallons) of algae cultivation water every day, producing a viable concentrate with extended shelf life, for a wide variety of applications, including nutritionals.

Later in 2015, OriginOil plans to launch a smaller, lab-scale algae model for researchers, with the full participation of the researcher community. In initial surveys, 67% of industry insiders surveyed said that a lab-scale harvester would be “Very” or “Extremely” useful.

| 6 |

OriginOil also plans to re-release the Model A12 as an R&D tool for ongoing monitoring and development of strains and growth methodologies, and higher capacity systems for distributed pond or bioreactor architectures, and ultimately, full-scale production.

A Model 120 was built and demonstrated at a public event in December, 2013 and is available commercially. Larger sizes are available on request.

OriginOil plans to make the entire Smart Algae Harvester product line available with bundled elements designed to increase the density of the feedstock for various applications. These product bundles, and their application, are subject to change.

Smart Algae Harvester Product Line

| · | The base system, Smart Algae Harvester, is a complete, integrated system to achieve ~5% solids concentrate (dry weight). |

| · | Density Plus System adds an integrated, external drying belt system to double concentration to ~10% solids (dry weight) or better |

| · | Max Density features a Smart Algae Harvester integrated with a best-in-class centrifuge for up to 20-30% solids content (dry weight) |

Algae For Feed

In 2013, OriginOil developed demonstration systems for the aquaculture industry and showed these at a public event on December 18, 2013 at Aqua Farming Tech, a working fish farm in Thermal, California. Aqua Farming Tech remains a testing site for OriginOil’s aquaculture activities.

In 2014, OriginOil assigned its aquaculture initiative to the algae division to focus on the growing opportunities in the Algae For Feed marketplace.

In April 2014, OriginOil announced that it had agreed to a collaborative exchange of equipment and information with the Catalina Sea Ranch, the first offshore shellfish ranch in U.S. Federal waters. OriginOil provided a demonstration-scale Model 12 system to Catalina Sea Ranch, which has used it to treat incoming seawater and harvest algae to feed its shellfish nursery and selective breeding program. Catalina Sea Ranch provides independent data on the efficiency and use of the machine, and gives OriginOil access to its nursery for field research.

In September 2014, OriginOil announced that it will provide algae harvesting technology for the low-cost algae growth system from Algasol Renewables. The integrated system is planned to launch at Algasol’s new facilities in Bangladesh, a unique, large-scale demonstration of micro-algae production for fish feed.

| 7 |

This new project is an expansion of the early marketing partnership announced in May 2012, under which Algasol, collaborating with NASA and Lawrence Berkley National Laboratory, agreed to bundle its offering with the OriginOil technology.

OriginOil aims to continue to support the growing algae industry in the fast-growing animal and fish feed sector.

Algae Sanitization and Growth Optimization

OriginOil’s Algae Screen™ technology implements the first, or both, stages of EWS for pond and bioreactor sanitization and growth optimization. It is currently offered only for licensing.

We intend to deploy Algae Screen technology for collaboration with the Idaho National Laboratory (INL) of the U.S. Department of Energy, and to commercialize it further thereafter.

The Oil and Gas Industry

The oil and gas industry is one of the most water-intensive industries in the world. It is both a large consumer of fresh water and producer of contaminated water, which is also a potential asset for drought-affected regions.

Water is produced and used in large quantities in oil and gas operations. According to the U.S. Department of Energy, an average of 3 barrels of contaminated water is generated for each 1 barrel of oil produced. In the United States, the average is 7 barrels of water. Greentech Media reports that energy companies pay between $3 to $12 to dispose of each barrel of produced water, implying a potential world market value between $300 billion and $1 trillion per year.

We believe OriginOil’s high speed, low energy and primarily chemical-free Electro Water Separation™ technology is ideally suited to help clean up the large quantities of water used in oil and gas operations.

A 2009 report on modern shale gas by the Groundwater Protection Council, "Modern Shale Gas Development in the United States: A Primer," stated that “the amount of water needed to drill and fracture a horizontal shale gas well generally ranges from about 2 million to 4 million gallons, depending on the basin and formation characteristics.” While fracking technology promises to unleash an abundant supply of inexpensive natural gas to power the modern world, water is quickly becoming a serious limiting factor. Additionally, the water returns as “frack flowback” laced with petroleum and contaminants that require rapid and efficient removal for disposal and recycling.

Oil and Gas Water Cleanup Solutions

In addition to licensing EWS, we also assemble and sell complete solutions based on EWS. In oil and gas, the solution is called OriginClear™ Petro (previously CLEAN-FRAC™). We currently manufacture our demonstration and commercial equipment in-house, with engineering support from a variety of vendors, sub-assembly manufacturers, and engineering firms.

Recently, OriginOil refined its Oil & Gas offering by launching CLEAN-FRAC™ PRIME (now known simply as OriginClear Petro), a standalone product designed to provide core water treatment for frack flowback and produced water applications in the oil and gas industry.

The launch followed successful trials in Bakersfield processing produced water from heavy oil in California’s Monterey Shale Formation.

OriginClear Petro removes up to 99.9% of all free and emulsified oil, and 99.5% of suspended solids from oil & gas wastewater, while also removing certain dissolved contaminants that will co-precipitate, and continuously disinfecting bacteria.

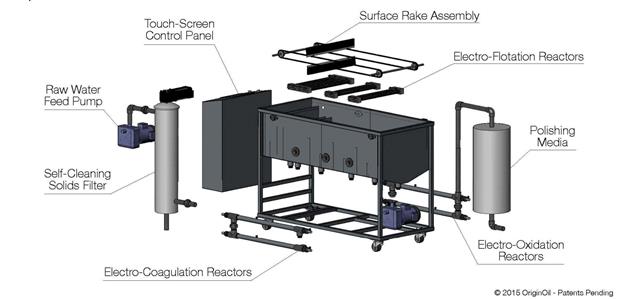

Available in capacities of 250, 1000 and 5000 barrels per day and beyond, OriginClear Petro bundles OriginOil’s core EWS technology with ‘heavies’ removal on the front end, intelligent controls, and a final post-polishing system, all in a single product.

| 8 |

All OriginClear Petro systems bundle OriginOil’s core EWS technology with intelligent controls, ‘heavies’ removal on the front end, and a post-polishing system, all in a single product.

OriginClear Petro is a turnkey single-skid system that includes an intelligent power supply, a self- cleaning filter for heavy solids removal on the front end, electro-oxidation reactors, and a polishing system on the back end.

All systems include a common SCADA control system with touch screen which will allow automatic control of the process as well as remote monitoring and alarms.

OriginOil and its regional partners are making OriginClear Petro available to customers such as: E&P operators, service companies, disposal well operators and water treatment companies.

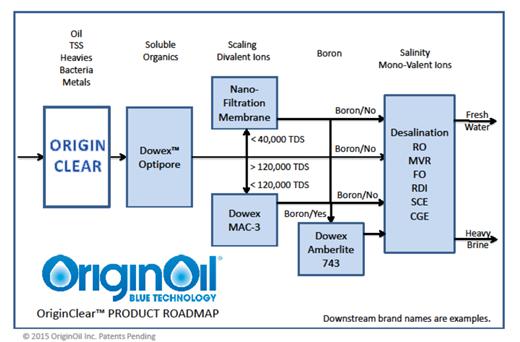

An OriginClear Petro system could be as simple as a standalone system or could include any combination of the downstream processes shown in the following diagram:

OriginOil's core system can be combined with downstream processes that remove other contaminants, to achieve any water quality level needed.

Downstream Integration

While OriginClear Petro is designed to deliver essentially “clear” water, additional processing is often needed to meet the requirements of specific applications.

| 9 |

In such cases, OriginOil works with the manufacturers of downstream solutions, such as TriSep, Dow Chemical or their OEMs, and other manufacturers, to integrate processes such as Ultra- or Nano-Membrane Filtration, to achieve, for example, flowback water treatment to a standard acceptable for “new” frack water.

Therefore, OriginOil is able to specify a complete water treatment solution for licensees, service companies and operators, as was done for the Gulf Energy application.

Waste Industry

Perhaps the largest of all opportunities for EWS is in cleaning up industrial, agricultural and urban waste. Our breakthrough EWS technology is a high-speed, high volume, and primarily chemical-free process that can efficiently remove contaminants and pathogens from incoming or outgoing water supplies. EWS Waste is available for licensing and we plan to launch our own integrated systems under the OriginClear Waste brand.

A prototype EWS Waste unit processes liquid human waste at the Ennesys urban algae demonstration site near Paris, generating clean, nitrate-rich water to feed algae. The algae is then converted onsite into energy for the building’s use. In this instance, EWS Waste is turning liquid sewage into nutrition for algae that, in turn, can help make commercial buildings self-sufficient for energy.

However, algae typically is not part of the process. EWS is an electrically-based technology that can target any application in waste water treatment, with a focus on the “clarity” stage of removing oils, suspended solids and bacteria.

EWS technology has been shown to effectively clean organics such as petroleum, achieving up to 99.9% reduction in free oil and a 99.5% reduction in suspended solids, and reduction of up to 99% of bacteria and other invaders, for clean and sanitized effluents.

Competitors

The Algae Industry

Companies in the new algae fuels industry tend to organize themselves as integrated producers and to keep their intellectual property to themselves. Our strategy, on the other hand, is to share our technology widely through licensing and private labeling.

With respect to our algae harvesting and sanitizing applications, we are aware that Alfa Laval, Algix, Aurora Algae, Cavitation Technologies, Evodos, New Oil Resources, Open Algae LLC, Perlemax, Valicor, Smartflow Technologies, Westfalia and World Water Works, among others, offer competing technologies.

OriginOil believes there is synergy between its process and many of these competing technologies, where EWS Algae can do the “heavy lifting” as the first, high-speed concentration stage, with other processes offering further concentration. In fact, OriginOil plans to select certain of these technologies for product bundles as part of the Smart Algae Harvester™ product line.

The Oil and Gas Industry

Market and Trends

The oil and gas industry is a major source of waste water. In the US, it generates about seven barrels of produced water for each barrel of oil. More recently the flowback water from fracking operations is a short term, but intensive, source of waste water as well.

Historically the solution to the treatment of produced and frack flowback water has primarily been to dispose it in permitted injection wells. Many technologies have existed for the “filtering” of these waters prior to injection, but with limited ability to remove contaminants. More recently, because of the cost of water management, environmental concerns and regulatory requirements, these “filtering” technologies are being reviewed and new technologies are being developed; the goal being to reduce water management costs and to dramatically reduce the volume of disposal. Not only can the oil and gas industry look forward to reduced water management costs, but environmental impacts will have been reduced; a win-win for all concerned.

Accordingly, the industry is increasingly recycling its produced and frack flowback waters for use in water flooding, cyclic steam stimulation, enhanced oil recovery, new hydraulic fracturing operations, irrigation and even drinking water. Recycling is becoming the economic choice as technologies have advanced and the cost of water treatment has decreased; while at the same time, the cost of disposal has risen (according to Shale Play Water Management magazine, costing between $1.75 and $26.75 per barrel of water). In addition, intense lobbying by environmental groups in front-line regions like California and New York is driving treatment and reuse as a way to make fracking and drilling in general more acceptable, especially in the midst of California’s historic drought.

| 10 |

Markets-and-markets reports that the global produced water treatment market size is estimated to exceed $8.0 billion by 2019. The major factors responsible driving the growth of this market include the energy sector growth in Africa and the Middle East, along with increasing strictness of environmental policies.

According to Bluefield Research, wastewater treatment spending for hydraulic fracturing is expected to grow almost three-fold, from $138 million in 2014 to $357 million in 2020 in the U.S. Bluefield cites water supplies increasingly at risk, tighter regulations emerging in key states, and costs of disposal on the rise as factors contributing to the substantial rise in water treatment and reuse, which is expected to account for 27 percent of total produced and flowback water by 2020, about double current levels.

Competing Technologies

These “filtering” technologies range from simple decanting to distillation. They are typically implemented as a multi-stage process to attain water quality standards for the planned reuse.

EWS can act as a pre-treatment stage for any of these multi-stage processes. While EWS can remove the emulsified and free oil, suspended solids and bacteria from the water stream, these subsequent stages can remove the heavy metals, scaling chemicals, salts and other natural and introduced chemicals. EWS can reduce fouling of these filters and membranes, making subsequent or downstream processes complementary to EWS and creating a strategic opportunity to collaborate.

Direct competitors using some form of electro-coagulation technologies include: Halliburton, Watertectonics, Bosque, Ecolotron, Quantum-ionics, Kaselco, Baker Hughes, RecylClean and Ecosphere.

Other companies also compete with EWS, but use other technologies that can involve chemical coagulants, batch operation or a high level of consumables. These include: Aqua-Tech, Aqua-Pure, CTI, Purifics, HydroZonics, Myclex, Osmonics, Filterboxx, MECO, Layne, 212 Resources, Veolia, Fountain Quail, Pall and Altela.

The Waste Industry

As our potential offering is in prototype stage, the Waste industry does not figure in our competitive planning.

In general, we believe that OriginOil has one or more advantages over some of the potential competitors, in that our process does not primarily use chemicals, is highly scalable on a continuous flow process, and may be significantly lower in energy consumption. We believe our technology may, in some cases, complement these companies’ offerings, however there is no guarantee that our technology will produce more efficiently or cost-effectively than these other technologies.

Government and Environmental Regulation

We are not aware of any existing or probable government regulations that would negatively impact on our operations. As a licensor and/or provider of water treatment equipment, we are not subject to government regulations for the removal of oils, solids and pathogens from water, other than normal safety standards and certifications (such as UL or CE) for goods that we manufacture for demonstrations and joint ventures, and our product lines. However, our prospective customers are subject to local, state and federal laws and regulations governing environmental quality and pollution control. To date, our compliance with government regulations has had no material effect on our operations, capital, earnings, or competitive position, and the cost of such compliance has not been material. We are unable to assess or predict at this time what effect additional regulations or legislation could have on our activities.

Intellectual Property

Our business is also based on developing a strong intellectual property portfolio and establishing a network of OEM distributors and core technology licensees. We have filed the following patent and trademark applications:

| · | On July 28, 2007 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Algae Growth System for Oil Production”. The inventors listed on the patent application are Nicholas Eckelberry and Riggs Eckelberry, our founders. We are listed as the assignee. On January 29, 2009 the application published with the publication number US 2009-0029445 A1. |

| · | On May 23, 2008 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Apparatus And Method For Optimizing Photosynthetic Growth In a Photo Bioreactor”. The inventors listed on the patent application are Steven Shigematsu and Nicholas Eckelberry. We are listed as the assignee. On November 26, 2009 the application published with the publication number US 2009-0291485 A1. |

| · | On July 26, 2009 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Procedure For Extraction Of Lipids From Algae Without Cell Sacrifice”. The inventors listed on the patent application are Paul Reep and Michael Green. We are listed as the assignee. This application was re-filed as a provisional application on August 13, 2010. |

| 11 |

| · | On April 20, 2010 we filed a PCT application with the USPTO to protect the intellectual property rights for “Systems, Apparatus and Methods for Obtaining Intracellular Products and Cellular Mass and Debris from Algae and Derivative Products and Process Use Thereof”. The inventors are Nicholas Eckelberry, Michael Green, and Scott Fraser. We are listed as the assignee. On October 10, 2010 the application published with the publication number WO/2010/123903. |

| · | On June 18, 2010 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Bio-Energy Reactor”. The inventors listed on the patent application are Michael Green, and Nicholas Eckelberry. On December 22, 2011, the application was published with the publication number US 2011-0308962 A1. We are listed as the assignee. |

| · | On October 17, 2010 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Methods and Apparatus for Dewatering, Flocculation and Harvesting of Algae Cells”. The inventors listed on the patent application are Michael Green, Nicholas Eckelberry, Scott Fraser and Brian Goodall. We are listed as the assignee. On May 24, 2012, the application was published with the publication number US 2012-0129244 A1. The application was converted to a utility application on October 14, 2011. |

| · | On October 19, 2010 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Methods and Apparatus for Dewatering, Flocculation and Harvesting Algae Cells”. The inventors listed on the patent application are Michael Green, Nicholas Eckelberry, Scott Fraser, and Brian Goodall. We are listed as the assignee. The application was converted to a utility application on October 18, 2011. On April 28, 2011, the application was published with the publication number US 2011-0095225 A1. |

| · | On October 19, 2010 we filed a PCT application with the Korean Receiving Office to protect the intellectual property rights for “Systems and Methods for Extracting Non-Polar Lipids from an Aqueous Algae Slurry and Lipids Produced There from”. The inventors are Nicholas Eckelberry, Michael Green, and Scott Fraser. We are listed as the assignee. On April 28, 2011, the application published with the publication number WO/2011/133181. |

| · | On March 18, 2011 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Enhancing Algae Growth by Reducing Competing Microorganisms in a Growth Medium”. The inventors listed on the patent application are Michael Green, Scott Fraser, Nicholas Eckelberry, and Jose Sanchez Pina. We are listed as the assignee. |

| · | On May 20, 2011 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Systems and Methods for Monitoring and Controlling Process Chemistry Associated with Biomass Growth, Oil Product and Oil Separation in Aqueous Mediums”. The inventors listed on the patent application are Paul Reep and Gavin Grey. We are listed as the assignee. |

| · | On June 16, 2011 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Bio-Energy Reactor”. The inventors listed on the patent application are Michael Green and Nicholas Eckelberry. On April 28, 2011 the application published with the publication number US 2011-0095225 A1. We are listed as the assignee. |

| · | On August 10, 2011 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Procedure for Extracting of Lipids from Algae without Cell Sacrifice”. The inventors listed on the patent application are Michael Green and Paul Reep. We are listed as the assignee. |

| · | On August 12, 2011 we filed a PCT application with the Korean Receiving Office to protect the intellectual property rights for “Procedure for Extracting of Lipids from Algae Without Cell Sacrifice”. The inventors listed on the patent application are Michael Green and Paul Reep. On February 16, 2012 the application published with the publication number WO/2012/021831. We are listed as the assignee. |

| · | On September 7, 2011 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Apparatuses, Systems and Methods for Increasing Contact Between Solutes and Solvents in an Aqueous Medium”. The inventors listed on the patent application are Nicholas Eckelberry, Gavin Gray, Jose L Sanchez Pina and Maxwell Roth. We are listed as the assignee. |

| · | On October 10, 2011 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Systems and Methods For Increasing Growth Of Biomass Feedstocks”. The inventors listed on the patent application are Nicholas Eckelberry, Jose L Sanchez Pina and Michael Green. We are listed as the assignee. |

| · | On October 14, 2011 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Systems and Methods For Developing Terrestrial and Algal Biomass Feedstocks and Bio-Refining the Same”. The inventor listed on the patent application was Paul Reep. We are listed as the assignee. |

| 12 |

| · | On October 14, 2011 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Systems, Methods And Apparatuses For Dewatering, Flocculating And Harvesting Algae Cells”. The inventors listed on the patent application are Michael Green, Scott Frasier, Brian Goodall and Nickolas Eckelberry. On May 24, 2012 the application published with the publication number US 2012/0129244 A1. We are listed as the assignee. |

| · | On October 18, 2011 we filed a PCT application with the Korean Receiving Office to protect the intellectual property rights for “Systems, Methods and Apparatuses For Dewatering, Flocculating and Harvesting Algae Cells”. The inventors listed on the patent application are Michael Green, Scott Frasier, Brian Goodall and Nickolas Eckelberry. On April 26, 2012 the application published with the publication number WO/2012/054404. We are listed as the assignee. |

| · | On November 11, 2011 we filed a trademark application with the USPTO to protect the intellectual property rights for our company logo “O”. On February 11, 2013 the trademark was issued with Certificate Number 4,284,801. |

| · | On November 11, 2011 we filed a trademark application with the USPTO to protect the intellectual property rights for our company logo “OriginOil”. On February 11, 2013 the trademark was issued with Certificate Number 4,284,800. |

| · | On January 30, 2012 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Systems and Methods for Harvesting and Dewatering Algae”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On March 12, 2012 we filed a utility patent application and PCT applications with the Korean Receiving Office to protect the intellectual property rights for “Enhancing Algae Growth by Reducing Competing Microorganisms in a Growth Medium”. The inventors listed on the patent application are Michael Green, Scott Fraser, Nicholas Eckelberry, and Jose Sanchez Pina. We are listed as the assignee. On November 27, 2012, the application published with the publication number WO/2012/129031. |

| · | On April 17, 2012 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Solute Extraction From an Aqueous Medium Using a Modular Device”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On May 18, 2012 we filed a provisional patent application with the USPTO to protect the intellectual property rights for “Modular Systems and Methods for Extracting a Contaminant from a Solution”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On May 18, 2012 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Monitoring Systems for Biomass Processing Systems”. The inventors listed on the patent application are Paul Reep and Gavin Grey. We are listed as the assignee. |

| · | On May 21, 2012 we filed a PCT application with the Korean Receiving Office to protect the intellectual property rights for “Monitoring Systems for Biomass Processing Systems”. The inventors listed on the patent application are Paul Reep and Gavin Grey. We are listed as the assignee. |

| · | On September 6, 2012 the Australian Patent Office issued patent 2010239380 titled “Systems, Apparatus and Methods for Obtaining Intracellular Products and Cellular Mass and Debris from Algae and Derivative Products and Process of Use Thereof”. This application was nationalized from PCT application PCT/US2010/031756. |

| · | On September 7, 2012 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Increasing Contact Between Solutes and Solvents in an Aqueous Medium”. The inventors listed on the patent application are Nicholas Eckelberry, Gavin Grey, Jose Sanchez Pina, and Maxwell Roth. We are listed as the assignee. |

| · | On September 9, 2012 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Systems and Methods for Increasing Growth of Biomass Feedstocks”. The inventors listed on the patent application are Nicholas Eckelberry, Mike Green, and Jose Sanchez Pina. We are listed as the assignee. |

| · | On October 10, 2012 we filed a PCT application with the Korean Receiving Office to protect the intellectual property rights for “Systems and Methods for Increasing Growth of Biomass Feedstocks”. The inventors listed on the patent application are Nicholas Eckelberry, Mike Green, and Jose Sanchez Pina. We are listed as the assignee. |

| · | On October 15, 2012 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Systems and methods for Developing Terrestrial and Algal Biomass Feedstocks and Bio-refining the Same”. The inventor listed on the patent application is Paul Reep. We are listed as the assignee. |

| 13 |

| · | On October 18, 2012 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Systems and methods for Extracting Non-polar Lipids from an Aqueous Algae Slurry and Lipids Produced There from”. The inventors listed on the patent application are Nicholas Eckelberry, Michael Green and Scott Fraser. We are listed as the assignee. |

| · | On October 19, 2012 we filed national stage application with the EPO to protect the intellectual property rights for “Systems and methods for Extracting Non-polar Lipids from an Aqueous Algae Slurry and Lipids Produced There from”. The inventors listed on the patent application are Nicholas Eckelberry, Michael Green and Scott Fraser. We are listed as the assignee. |

| · | On January 29, 2013 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Systems and Methods for Harvesting and Dewatering Algae”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On January 30, 2013 we filed a PCT application with the Korean Receiving Office to protect the intellectual property rights for “Systems and Methods for Harvesting and Dewatering Algae”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · |

On April 17, 2013 we filed a patent application with the USPTO to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventors listed on the patent application are Nicholas Eckelberry and Jose L. Sanchez Pina. We are listed as the assignee.

|

| · | On April 17, 2013 we filed a PCT application with the USPTO to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventors listed on the patent application are Nicholas Eckelberry and Jose L. Sanchez Pina. We are listed as the assignee. |

| · | On April 26, 2013 we filed a patent application with the USPTO to protect the intellectual property rights for “Producing Algae Biomass Having Reduced Concentration of Contaminants”. The inventor listed on the patent application is Jose L. Sanchez Pina. We are listed as the assignee. |

| · | On July 15, 2013 we filed a patent application with the USPTO to protect the intellectual property rights for “Removing Ammonia from Water”. The inventors listed on the patent application are Nicholas Eckelberry, Jose L. Sanchez Pina and Andrew Davies. We are listed as the assignee. |

| · | On September 9, 2013 we filed a patent application with the EPO, to protect the intellectual property rights for “Removing Compounds from Water Using a Series of Reactor Tubes Containing Cathodes Comprised of a Mixed Metal Oxide”. The inventors listed on the patent application are Nicholas Eckelberry, Jose L. Sanchez Pina and Scott Alexander Fraser. We are listed as the assignee. |

| · | On December 17, 2013 we filed a patent application with the USPTO to protect the intellectual property rights for “Removing Compounds from Water Using a Series of Reactor Tubes Containing Cathodes Comprised of a Mixed Metal Oxide”. The inventors listed on the patent application are Nicholas Eckelberry, and Jose L. Sanchez Pina. We are listed as the assignee. |

| · | On February 27, 2014 we filed a patent application with the USPTO to protect the intellectual property rights for “Electro Catalytic Process for Coalescing and Skimming Pollutants in Bodies of Water Prior to Filtration”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · |

On April 17, 2014 we filed a PCT application with the USPTO to protect the intellectual property rights for “Removing Ammonia from Water”. The inventors listed on the patent application are Nicholas Eckelberry, Jose L. Sanchez Pina and Andrew Davies. We are listed as the assignee . |

| · | On April 17, 2014 we filed a PCT application with the USPTO, to protect the intellectual property rights for “Removing Compounds from Water Using a Series of Reactor Tubes Containing Cathodes Comprised of a Mixed Metal Oxide”. The inventors listed on the patent application are Nicholas Eckelberry and Jose L. Sanchez Pina. We are listed as the assignee. |

| · | On April 17, 2014 we filed a PCT application with the USPTO to protect the intellectual property rights for “Producing Algae Biomass Having Reduced Concentration of Contaminants”. The inventors listed on the patent application are Nicholas Eckelberry and Jose L. Sanchez Pina. We are listed as the assignee. |

| · | On June 24, 2014 we filed a patent application with the Australian Patent Office to protect the intellectual property rights for “Systems and Methods for Harvesting and Dewatering Algae”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On June 24, 2014 we filed a patent application with the European Patent Office to protect the intellectual property rights for “Systems and Methods for Harvesting and Dewatering Algae”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| 14 |

| · | On July 23, 2014 we filed a patent application with the Chinese Patent Office to protect the intellectual property rights for “Systems and Methods for Harvesting and Dewatering Algae”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On July 25, 2014 we filed a patent application with the Korean Patent Office to protect the intellectual property rights for “Systems and Methods for Harvesting and Dewatering Algae”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On July 28, 2014 we filed a patent application with the Japanese Patent Office to protect the intellectual property rights for “Systems and Methods for Harvesting and Dewatering Algae”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On October 13, 2014 we filed a patent application with the EPO to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee.

|

| · | On October 15, 2014 we filed a patent application with the Malaysian Patent Office to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On October 16, 2014 we filed a patent application with the Japanese Patent Office to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On October 16, 2014 we filed a patent application with the Indian Patent Office to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On October 17, 2014 we filed a patent application with the Mexican Patent Office to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On October 17, 2014 we filed a patent application with the Chinese Patent Office to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On November 12, 2014 we filed a patent application with the Korean Patent Office to protect the intellectual property rights for “Harvesting and Dewatering Algae Using a Two-Stage Process”. The inventor listed on the patent application is Nicholas Eckelberry. We are listed as the assignee. |

| · | On November 17, 2014 we filed a utility patent application with the USPTO to protect the intellectual property rights for “System for removal of suspended solids and disinfection of water”. The inventors listed on the patent application are William Charneski, Nicholas Eckelberry and Dave Anderson. We are listed as the assignee. |

| · | On December 11, 2014 we filed a utility patent application with the USPTO to protect the intellectual property rights for “Method for Treating Wastewater”. The inventors listed on the patent application are Nicholas Eckelberry and Andrew Davies. We are listed as the assignee. |

| · | On December 10, 2014 the Chinese Patent Office issued patent ZL201080023861.1 titled “Systems, Apparatus and Method for Obtaining Intracellular Products and Cellular Mass and Debris from Algae and Derivative Products and Process of Use Thereof”. |

| · | On December 16, 2014 we filed a CIP application with the USPTO to protect the intellectual property rights for “Systems and Methods for Treating Wastewater”. The inventors listed on the patent application are Nicholas Eckelberry, William Charneski and Andrew Davies. We are listed as the assignee. |

| 15 |

In 2008 we abandoned the pursuit of two provisional patent filings filed in relating to “In-Line Lysing And Extraction System for Microorganisms” and “Renewable Carbon Sequestering Method of Producing Pollution Free Electricity”.

In 2009 we abandoned the pursuit of a provisional patent related to “Modular Portable Photobioreactor System”.

In 2010 we abandoned the pursuit of utility patent application related to “Device and Method for Separation, Cell Lysing and Flocculation of Algae from Water” and provisional patent application “Methods and Apparatus for Growing Algae on a Solid Surface”.

In 2011 we abandoned the pursuit of provisional patent application related to “Algae Growth Lighting and Control System”.

In 2012 we abandoned the pursuit of provisional patent filings related to “Multi-Plane Growth Apparatus and Method”, “Systems and Methods for Monitoring and Controlling Algae Growth and Harvesting Cellular Mass and Intracellular Products”, “Method for Extracting Intracellular Products from Microorganisms Using Gas Embolism”, “Algae Harvest Appliance”, “A System, Method And Apparatus To Produce Dewatered And Densified Algae Biomass” and foreign rights for “Bio-Energy Reactor”.

In 2013, we transferred the rights to the patents related to "Bio Energy Reactor", "Algae Growth System for Oil Production" and "Apparatus and Method for Optimizing Photosynthetic Growth in a Photo Bioreactor " to our partner Ennesys in France.

None of these abandoned or transferred patents are required for our business or products and we are focusing our efforts on the patent applications listed above.

Research and Development

During the years ended December 31, 2014 and 2013, we invested $1,284,611 and $1,072,548, respectively, on research and development of our technologies. Research and development costs include activities related to development and innovations in the core Electro Water Separation™ (EWS) technology, fabrication and scale-up of products based on this technology, development of firmware and process automation, development of new applications in industries such as aquaculture, technical support of customers, agents, joint venture partners and licensees, on-site consulting and training activities, and miscellaneous research.

Employees

As of March 30, 2015, we have 11 full-time employees. We have not experienced any work stoppages and we consider relations with our employees to be good.

ITEM 1A. RISK FACTORS

Risks Relating to Our Business

We have a limited operating history which makes it difficult to evaluate our business and prospects.

We were formed in June 2007 and are currently developing a new technology that has not yet gained market acceptance. As such, we have a limited operating history upon which you can base an evaluation of our business and prospects. Since we have not been profitable, there are substantial risks, uncertainties, expenses and difficulties that we are subject to. To address these risks and uncertainties, we must do among the following:

| ● | Successfully execute our business strategy; | |

| ● | Respond to competitive developments; and | |

| ● | Attract, integrate, retain and motivate qualified personnel; |

There can be no assurance that at this time we will operate profitably or that we will have adequate working capital to meet our obligations as they become due. Investors must consider the risks and difficulties frequently encountered by early stage companies, particularly in rapidly evolving markets. We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition, and results of operations could be materially and adversely affected.

We have a history of losses and can provide no assurance of our future operating results.

We currently have limited product revenues, and may not succeed in commercializing any products which will generate product or licensing revenues. Until recently, our primary activity has been research and development. We have experienced net losses and negative cash flows from operating activities since inception and we expect such losses and negative cash flows to continue in the foreseeable future. As of December 31, 2014 and 2013, we had working capital (deficit) of $(7,330,957) and $(1,535,766), respectively, and shareholders' equity (deficit) of $(7,200,317) and $(1,513,199), respectively. For the years ended December 31, 2014 and 2013, we incurred net losses of $(11,138,608) and $(8,762,991). As of December 31, 2014, we had an aggregate accumulated deficit of $(47,468,711). We may never achieve profitability. The opinion of our independent registered public accountants on our audited financial statements as of and for the year ended December 31, 2014 contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon raising capital from financing transactions and future sales.

| 16 |

We will need significant additional capital, which we may be unable to obtain.

Revenues generated from our operations are not presently sufficient to sustain our operations. Therefore, we will need to raise additional capital to continue our operations. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. We may be required to pursue sources of additional capital through various means, including debt or equity financings. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition. Our ability to obtain needed financing may be impaired by such factors as the capital markets and our history of losses, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

We have incurred substantial indebtedness.

As of March 30, 2015, we have convertible notes with outstanding principal and accrued but unpaid interest of approximately $3,325,623. All such debt is payable within the following twelve months and is convertible at a significant discount to our market price of stock. Our level of indebtedness increases the possibility that we may be unable to generate cash sufficient to pay, when due, the principal of, interest on or other amounts due in respect of the indebtedness. Our indebtedness, combined with other financial obligations and contractual commitments, could:

·in the case of convertible debt that is converted into equity, result in a reduction in the overall percentage holdings of our stockholders, put downward pressure on the market price of our common stock, result in adjustments to conversion and exercise prices of outstanding notes and warrants and obligate us to issue additional shares of common stock to certain of our stockholders;

·make it more difficult for us to satisfy our obligations with respect to the indebtedness and any failure to comply with the obligations under any of our debt instruments, including restrictive covenants, could result in events of default under the loan agreements and instruments governing the indebtedness;

·require us to dedicate a substantial portion of our cash flow from operations to payments on indebtedness, thereby reducing funds available for working capital, capital expenditures, acquisitions, research and development and other corporate purposes;

·increase our vulnerability to adverse economic and industry conditions, which could place us at a competitive disadvantage compared to competitors that have relatively less indebtedness;

·limit our flexibility in planning for, or reacting to, changes in business and the industry in which we operate; and

·limit our ability to borrow additional funds, or to dispose of assets to raise funds, if needed, for working capital, capital expenditures, acquisitions, research and development and other corporate purposes.

We may incur significant additional indebtedness in the future. If we incur a substantial amount of additional indebtedness, the related risks that we face could become more significant. Additionally, the terms of any future debt that we may incur may impose requirements or restrictions that further affect our financial and operating flexibility or subject us to other events of default.

Our revenues are dependent upon acceptance of our technology and products by the market; the failure of which would cause us to curtail or cease operations.

We believe that most of our future revenues will come from the sale or license of our technology and systems. As a result, we will continue to incur substantial operating losses until such time as we are able to generate revenues from the sale or license of our technology and systems. There can be no assurance that businesses and prospective customers will adopt our technology and systems, or that businesses and prospective customers will agree to pay for or license our technology and systems. In the event that we are not able to develop a customer base that purchases or licenses our technology and systems, or if we are unable to charge the necessary prices or license fees, our financial condition and results of operations will be materially and adversely affected.

| 17 |

We will need to increase the size of our organization, and may experience difficulties in managing growth.

We are a small company with a minimal number of employees. With the start of our planned principal activities, we expect to experience a period of significant expansion in headcount, facilities, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate managers. Our future financial performance and our ability to compete effectively will depend, in part, on our ability to manage any future growth effectively.

We may not be able to successfully develop and commercialize our technology and systems which would result in continued losses and may require us to curtail or cease operations.

We are currently commercializing our technology. We are unable to project when we will achieve profitability, if at all. As is the case with any new technology, we expect the research and development process to continue. We cannot assure that our engineering resources will be able to develop our technology and systems fast enough to meet market requirements. We can also not assure that our technology and systems will gain market acceptance and that we will be able to successfully commercialize the technologies. The failure to successfully develop and commercialize the technologies would result in continued losses and may require us to curtail or cease operations.

Our ability to produce and distribute commercially viable bio-fuel, clean-up oil and gas and waste water and aqua-feed on a commercially viable basis is unproven, which could have a detrimental effect on our ability to generate or sustain revenues.

The technologies we use to harvest algae, clean up oil and gas water, and waste water, have never been utilized on a full-scale commercial basis. Our Electro Water Separation (EWS) technology was only recently developed. All of the tests conducted to date by us with respect to the technology have been performed in a limited scale or small commercial scale environment and the same or similar results may not be obtainable at competitive costs on a large-scale commercial basis. We have never employed our technology under the conditions or in the volumes that will be required for us to be profitable and cannot predict all of the difficulties that may arise. Accordingly, our technology may not perform successfully on a commercial basis and may never generate any revenues or be profitable.

If a competitor were to achieve a technological breakthrough, our operations and business could be negatively impacted.

There currently exist a number of businesses that are pursuing novel processes to harvest algae, clean up oil and gas water, and waste water. Should a competitor achieve a research and development, technological or biological breakthrough where process costs are significantly reduced, efficiency greatly increased over ours, or if the costs of similar competing products were to fall substantially, we may have difficulty attracting customer licensees or sales. In addition, competition from other technologies considered “green” (environmental) or “blue” (water technology) could lessen the demand for the end-products produced by our technology. Furthermore, competitors may have access to larger resources (capital or otherwise) that provide them with an advantage in the marketplace, which could result in a negative impact on our business.

Any competing technology that harvests algae, cleans up oil and gas water, and waste water, at a superior scale and more cost efficient than ours, could render our technology obsolete. In addition, because we do not have any issued patents for all but one of our patent applications, we may not be able to preclude development of even directly competing technologies using the same methods, materials and procedures as we use to achieve our results. Any of these competitive forces may inhibit or materially adversely affect our ability to attract customer licensees, or to obtain royalties or other fees from our customer licensees. This could have a material adverse effect on our business, prospects, results of operation and financial condition.

Our long-term success depends on future royalties paid to us by licensees, and we face the risks inherent in a royalty-based business model.

We intend to generate revenue through the licensing of our technology and systems, and our long-term success depends on future royalties paid to us by prospective customer licensees. The amount of royalty payments we may receive is expected to be based upon the revenues generated by our prospective customer licensees’ operations, and so we will be dependent on the successful operations of our prospective customer licensees for a significant portion of our revenues. We face risks inherent in a royalty-based business model, many of which are outside of our control, including those arising from our reliance on the management and operating capabilities of our customer licensees and the cyclicality of supply and demand for end-products produced using our technology. Should our prospective customer licensees fail to achieve sufficient profitability in their operations, our royalty payments would be diminished and our results of operations, cash flows and financial condition could be adversely affected, and any such effects could be material.

| 18 |

We rely on strategic partners.

We rely on strategic partners to aid in the development and marketing of our technology and processes. Should our strategic partners not regard us as significant to their own businesses, they could reduce their commitment to us or terminate their relationship with us, pursue competing relationships or attempt to develop or acquire processes that compete with ours. Any such action could materially adversely affect our business.

A lack of government subsidies may hinder the usefulness of our technology.

While our long-term business model is based on licensing our technology to original equipment manufacturers (OEMs), distributors, resellers, service providers and other licensees, we also assemble and sell complete solutions based on EWS. Subsidies of any of the industries vary and may be reduced or eliminated, which could have a material adverse effect on our business. Likewise, regulations may become more onerous which also could have a material adverse effect on our business.

The industries in which we operate may endure deflationary cycles, affecting our ability to sell and license our systems.

If the current low cost of crude persists, it may become difficult or impossible to sell or license systems to the oil and gas industry, and the field of biofuels may become economically unviable. Such events and other deflationary events may impact our business materially.

If we lose key employees and consultants or are unable to attract or retain qualified personnel, our business could suffer.

Our success is highly dependent on our ability to attract and retain qualified scientific, engineering and management personnel. We are highly dependent on our management, including T. Riggs Eckelberry, who has been critical to the development of our technology and business. The loss of the services of Mr. Eckelberry would have a material adverse effect on our operations. We do not have an employment agreement with Mr. Eckelberry. Accordingly, there can be no assurance that he will remain associated with us. His efforts will be critical to us as we continue to develop our technology and as we attempt to transition to a company with profitable company commercialized products and services. If we were to lose Mr. Eckelberry, or any other key employees or consultants, we may experience difficulties in competing effectively, developing our technology and implementing our business strategies.

Competition from other companies in our market may affect the market for our technology.

New companies are constantly entering the market, thus increasing the competition. This could also have a negative impact on us or our customers’ ability to obtain additional capital from investors. Larger foreign owned and domestic companies which have been engaged in water cleanup and algae harvesting for substantially longer periods of time may have access to greater financial and other resources. These companies may have greater success in the recruitment and retention of qualified employees, as well as in conducting their own fuel manufacturing and marketing operations, which may give them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. If we or our customers are unable to compete effectively or adequately respond to competitive pressures, this may materially adversely affect our results of operation and financial condition.

Risks Related to Our Intellectual Property

If we fail to establish, maintain and enforce intellectual property rights with respect to our technology, our financial condition, results of operations and business could be negatively impacted.

Our ability to establish, maintain and enforce intellectual property rights with respect to the technology that we intend to license will be a significant factor in determining our future financial and operating performance. We seek to protect our intellectual property rights by relying on a combination of patent, trade secret and copyright laws. We also use confidentiality and other provisions in our agreements that restrict access to and disclosure of our confidential know-how and trade secrets.

We have filed patent applications with respect to many aspects of our technologies. However, we cannot provide any assurances that any of these applications will ultimately result in issued patents or, if patents are issued, that they will provide sufficient protections for our technology against competitors. Although we have filed various patent applications for some of our core technologies, we currently hold only two issued patents, one in Australia and one in Japan, and we may face delays and difficulties in obtaining our other filed patents, or we may not be able to obtain such patents at all.