Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Northern Power Systems Corp. | d898568d8k.htm |

| EX-99.1 - EX-99.1 - Northern Power Systems Corp. | d898568dex991.htm |

Troy

Patton – CEO

Ciel Caldwell -

CFO

31March2015

YE –

Q4 2014 Earnings Presentation

Northern Power Systems

Exhibit 99.2 |

2

All

statements

and

other

information

contained

in

this

document

related

to

anticipated

future

events

or

results

constitute

forward-looking

statements.

Forward-looking

statements

often,

but

not

always,

are

identified

by

the

use

of

words

such

as

“seek”,

“anticipate”,

“believe”,

“plan”,

“estimate”,

“expect”,

“intend”,

“forecast”,

“project”,

“likely”,

“potential”,

“targeted”

and

“possible”

and

statements

that

an

event

or

result

“may”,

“will”,

“would”,

“should”,

“could”

or

“might”

occur

or

be

achieved

and

other

similar

expressions.

Forward-looking

statements

are

subject

to

known

and

unknown

business

and

economic

risks

and

uncertainties

and

other

factors

that

could

cause

actual

results

of

operations

to

differ

materially

from

those

expressed

or

implied

by

the

forward-looking

statements.

Forward-

looking

statements

are

based

on

estimates

and

opinions

of

management

at

the

date

the

statements

are

made.

Northern

Power

Systems

does

not

undertake

any

obligation

to

update

forward-looking

statements

even

if

circumstances

or

management’s

estimates

or

opinions

should

change,

except

as

required

by

law.

For

the

reasons

set

forth

above,

investors

should

not

place

undue

reliance

on

forward-looking

statements.

This

presentation

references

non-GAAP

financial

measures

with

the

required

reconciliation

referenced

in

the

table

captioned

“Non-GAAP

Reconciliations”

to

the

most

comparable

GAAP

financial

measures. |

Presentation Organization and Call Details

3

Q&A Session:

Immediately following this call

Link from IR webpage at

http://www.ir.northernpower.com/events-

and-presentations.aspx

Troy Patton

President and CEO

Ciel Caldwell

CFO

Presentation Organization:

Q4 2014 business update

Q4 2014 operational and financial results

review

GAAP to Non-GAAP reconciliations

Basis of Presentation:

Q4 2014 = Northern Power Systems Corp.

YTD 2014 = Q1 Wind Power Holdings, Inc.

+ Q2 -

Q4 Northern Power Systems Corp.

2013 periods = Wind Power Holdings, Inc.

Hosted by: |

NPS’

Business Lines

Fully developed strategic

partnership approach

Successfully deployed in

China and Brazil to date

4

High-margin Development

Expansion of IP portfolio

NPS 2MW

turbine

platform

Converter and

Controls

Systems

NPS

60/100kW

Technology Licensing

Product Sales & Service

Technology Development |

Business Expansion Trends

5

5

Non-GAAP EBITDA (Loss)/Income

Bridge to Net Loss |

Q4

2014: Product Sales and Service Update Strong long-term European

demand Near term delays in Italy market as

customers awaited government decree

Strong demand in UK

Asia business development expanding

Follow-on installations complete

Private ownership of small generation

assets now permitted with KEPCO offering

20 year PPAs

US –

project pipeline growing

First installation complete in New York City

Sales hiring in new regions commenced

6

NPS 2MW

turbine

platform

Converter and

Controls

Systems

NPS

60/100kW

Product Sales & Service |

Blade

Production Ramped third generation blade production with

US based producer in anticipation of Italian

market demand

Accelerated transition to dual sourcing

Two new suppliers being put in place to support

future sales

Located in prime shipping lanes

Strong track record

Impacted 4Q sales and will impact first half of

2015

$4 –

6 million revenue impact in 2015

7

Provides more stable and reliable foundation for future growth

|

Q4

2014: Technology Licensing Update WEG 2.1MW turbines production has

achieved a steady 8 units per month

Healthy and increasing order backlog at

over 500MW

Revenue comes from WEG licensing and

commenced royalty payments

Actively exploring other regions

8

Fully developed strategic

partnership approach

Successfully deployed in

China and Brazil to date

Technology Licensing |

Q4

2014: Technology Development WEG 3.3MW development progressing as

scheduled:

Expecting design completion in 2016

Backbone of planned development activity for

next twelve months

Laboratory R&D commenced on power

converter business applications

Initial full converter focus on distributed energy

markets and special applications

Inverter product optimized for energy storage

market, technology-agnostic

Anchor customer deployment in 2015, top and

bottom line impact in 2016

9

High-margin Development

Expansion of IP portfolio

Technology Development |

YE

2014: Key Financial Metrics 10

FY 2014

Q4 2014

Revenue

•

$56M

•

174% y/y growth

•

$14M

•

56% y/y growth

Backlog

•

$41M

•

9% y/y reduction

Gross Margin

•

20%

•

Up from 6% in FY 2013

•

20%

•

PY at 8%

Net Loss

•

($7.9M)

•

44% y/y loss reduction

•

($.40/share)

•

($2.4M)

•

51% y/y loss reduction

•

($.11/share)

Non-GAAP

EBITDA Loss

•

($4.8M)

•

57% y/y loss reduction

•

($1.6M)

•

48% y/y loss reduction |

Revenue and Gross Margin Trends

11

Q1 ‘13

Q2 ‘13

Q4 ‘13

Q2 ‘14

Q1 ‘14

Q3 ‘13

High-wind Regimes

Non-turbine Revenue

Low-wind Regimes

Q3 ‘14

Q4 ‘14 |

YE

2014: Other Financial Metrics Cash Flow Statement

FY 2014

FY 2013

Cash used in operations

($14.8M)

•

Change in operating

assets / liab. ($9.1M)

($6.1M)

•

Change in operating

assets / liab. ($5.5M)

Cash (used in) provided by

investing activities

$0.2M

•

Cap-Ex ($1.0M)

•

Facility Sale $1.2M

($0.4M)

•

Cap-Ex ($0.4M)

Cash provided by financing

activities

$23.3M

$6.5M

12

Balance Sheet Metrics

December 31, 2014

December 31, 2013

Cash and cash equivalents

$13.1M

$4.5M

Debt

-

$12.5M

Working capital line

$4.0M*

-

* Comerica working capital line of credit available through 6/30/15 for up to

$6M |

Full Year

Revenue for first half of 2015 lower than first half of 2014

Growth to resume in back half of year

Core business focus (utility through partnerships)

First Half

Second Half

Transitioning blade production

Reach full production

Delay in Italian market

Resume growth in Italy

Euro decrease

Continued negative impact

Gross margin pressure

Return to target gross margins of

low-mid 20s

13

2015 Expectations |

14 |

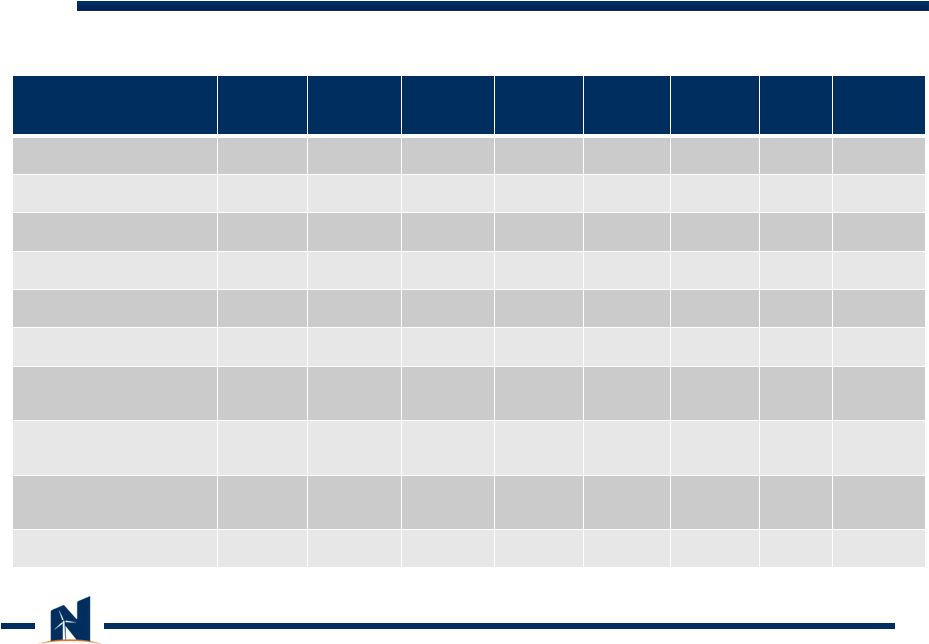

Non-GAAP Reconciliations Non-GAAP adjusted EBITDA

15

Q1

2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Q3

2014

Q4

2014

Net Loss

$(3,384)

$(2,753)

$(3,122)

$(4,869)

$(3,124)

$(2,064)

$(289)

$(2,417)

Interest

18

111

101

284

240

37

40

26

Taxes

26

3

(16)

22

14

15

412

454

Depreciation

227

310

234

214

178

391

194

179

Stock compensation

122

57

85

437

148

454

144

141

Fair value warrants

63

(724)

488

1

-

-

-

-

Non-cash

restructuring

50

(31)

4

47

-

-

-

-

Asset impairment

and loss on disposal

-

-

-

-

-

-

-

4

Loss on asset held

for sale

-

-

-

768

-

-

-

-

Adjusted EBITDA

$(2,878)

$(3,027)

$(2,226)

$(3,096)

$(2,544)

$(1,167)

$501

$(1,613)

(All amounts in thousands) |