Attached files

| file | filename |

|---|---|

| 8-K - 8-K - McGraw-Hill Global Education Intermediate Holdings, LLC | mhgeih8-kxq4callpresentati.htm |

McGraw-Hill Global Education Holdings Q4 and FY 2014 Investor Update March 31, 2015 Final

All statements in this presentation and the oral remarks made in connection herewith that are not statements of historical fact are “forward-looking statements” within the meaning of securities laws. Forward-looking statements include any statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, and objectives of management. The words ‘‘anticipate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘intend,’’ ‘‘may,’’ ‘‘plan,’’ ‘‘predict,’’ ‘‘project,’’ ‘‘target,’’ ‘‘potential,’’ ‘‘will,’’ ‘‘would,’’ ‘‘could,’’ ‘‘should,’’ ‘‘continue,’’ and similar expressions commonly indicate a forward-looking statement, although not all forward-looking statements may contain these words. You should not put undue reliance on forward-looking statements. All forward-looking statements are subject to certain risks and uncertainties, and actual results or events could differ materially from the plans, intentions and expectations described therein. We undertake no obligation to revise forward-looking statements to reflect events or circumstances that arise after the statements are made. Important Notice Regarding Forward Looking Statements 2

Meeting Participants 3 Patrick Milano Executive Vice President, Chief Financial Officer & Chief Administrative Officer David Levin President & Chief Executive Officer David Kraut Treasurer, Vice President – Investor Relations

4 Introduction and Business Review

Highlights: Strong Company Performance and Market Share Increases in 2014 driven by Digital Growth • Solid 2014 financial results in line with expectations • Digital cash revenue exceeded traditional print cash revenue in Higher Ed business for first year in company’s history – Digital Cash Revenues up 18% to $412 million • 2014 Higher Ed market share increased by 30 bps - driven by digital growth – Higher Ed has taken 140 bps of market share since 2012 (1) • Proprietary e-commerce platform achieved $105 million in 2014 cash revenues – Cash revenues up 57%; now represents third largest Higher Ed distribution channel • Strong, sustained user growth across flagship digital platforms – Rapid market penetration and deeper engagement demonstrated by 51% growth in instructor assignments and 32% growth in student assignments 5 (1) Source: Management Practice Inc.

Highlights: Company Positioned for Continued Success • Continued to make significant investment in digital platform and capabilities to maintain and expand our leadership position – significant development accomplishments include: – Version 8 of Connect – Connect Insight – Powered Data Driven Learning – SmartBook – Bringing Adaptive Learning to the "reading experience" – New eCommerce capability – Many new feature releases for ALEKS and LearnSmart • Peter Cohen appointed as President of K-20 following successful turnaround of School Education business • Successfully completed separation from former parent company – Will result in substantially lower one-time investment requirements in 2015 – Eliminates one of the more significant risks from the original LBO transaction 6

• Sales of digital solutions more than offset expected traditional print volume declines • Continued strong leadership in adaptive technology offerings with ALEKS, LearnSmart and SmartBook usage all increasing rapidly - Since its introduction in May 2013, more than 450 SmartBook titles have been developed for the Higher Education market • New mobile-first version of Connect Platform introduced at SXSWedu 2015 – Powering Anywhere, Anytime Learning Strong Digital Adoption Growth Continues 7 Business Mix Moving to Digital Rapid Growth in Digital Subscribers

8 Financial Update

$87 $90 $354 $359 24% 25% 27% 28% Q413 Q414 2013 2014 $357 $360 $1,291 $1,301 Q413 Q414 2013 2014 $99 $113 $351 $412 28% 32% 27% 32% Q413 Q414 2013 2014 MHGE Financial Performance Summary 9 Continued strong growth of digital cash revenues in Q4 and the full year 2014 Growth in digital offsetting decline in traditional print volume Significant continuing investment in our Digital Platform Group being funded by cost savings Higher Education full year growth of 18% driven by increasing sales of Connect and ALEKS Professional full year growth of 11% driven by Access subscription sales International full year growth of 26% driven by increasing sales of Connect and ALEKS Growth in digital and custom channels more than offset expected traditional print decline Traditional print declined $21 million in Q414 and $65 million in FY 2014; declined 11% and 9%, respectively Actioned $78 million of run-rate cost savings since 2013 with $91 million total planned through 2015 Digital Platform Group (DPG) non- capitalized investment increased $35 million during 2014 Adjusted operating expenses flat year-over-year - Excluding increase in DPG investment Total MHGE % Change / % of total Cash Revenue Total Cash Revenue Digital Cash Revenue Post Plate Adjusted Cash EBITDA +2% +1% +1% +3% +18% +15% ($ in Millions)

$14 $9 $42 $38 15% 10% 12% 11% Q413 Q414 2013 2014 $10 $16 $32 $38 27% 39% 26% 30% Q413 Q414 2013 2014 $227 $226 $811 $838 Q413 Q414 2013 2014 Business Unit Financial Performance Summary ($ in Millions) 10 Total Cash Revenues % Change Post Plate Adjusted Cash EBITDA % Change / Margin % 18% y-o-y growth in digital cash revenues for 2014 and 16% for Q4 Digital growth driven by increased sales of Connect/LearnSmart/ ALEKS and custom print Traditional print sales declined 11% in 2014 11% y-o-y growth in digital cash revenues for 2014 and 26% for Q4 Digital cash revenue growth driven by increased sales of Access subscription platforms Traditional print sales down 5% in 2014 26% y-o-y growth in digital cash revenues for 2014 and slight decline for Q4 on a USD basis due to foreign exchange rate movements Full year digital growth driven by sales of Connect and ALEKS which grew in excess of 50%. Higher Education Professional International $36 $40 $125 $127 Q413 Q414 2013 2014 $94 $94 $355 $336 Q413 Q414 2013 2014 Notes: 1 Post Plate Adjusted Cash EBITDA will not sum to total MHGE due to the ‘Other’ reporting segment. See Appendix for reconciliation. 0% +17% +56% +2% +11% +7% +20% +3% 0% (10%) (36%) (5%) $63 $75 $275 $293 28% 33% 34% 35% Q413 Q414 2013 2014

$150 $200 $250 $300 $350 $400 2012 2013 2014 Trad. Print Custom Print Digital Revenue Mix by Business Unit ($ in Millions) 11 Digital Cash Revenues % Change / % of total Cash Revenue Custom Cash Revenues % Change / % of total Cash Revenue Traditional Print Cash Revenues % Change / % of total Cash Revenue Higher Education Cash Revenue Trend Higher Education Professional International $780 $811 $838 Digital Cash Revenue is Growing at a CAGR of 18.7% since 2012 Digital now exceeds Traditional Print Total Cash Revenue $72 $84 $274 $322 32% 37% 34% 38% +16% +18% Q413 Q414 2013 2014 $17 $21 $52 $58 7% 9% 6% 7% +26% +11% Q413 Q414 2013 2014 $10 $9 $25 $31 4% 4% 3% 4% (11%) +26% Q413 Q414 2013 2014 $81 $60 $311 $276 36% 26% 38% 33% (26%) (11%) Q413 Q414 2013 2014 $74 $83 $227 $240 32% 37% 28% 29% 12% 6% Q413 Q414 2013 2014 $20 $19 $73 $69 9% 8% 9% 8% (5%) (5%) Q413 Q414 2013 2014 $84 $86 $330 $304 37% 38% 41% 36% +1% (8%) Q413 Q414 2013 2014

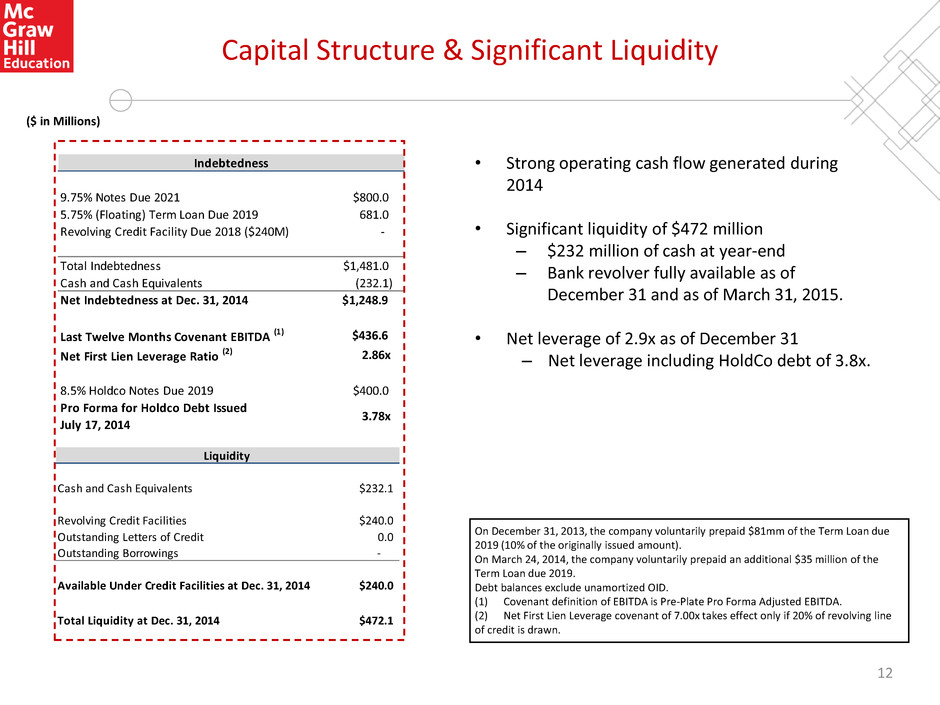

9.75% Notes Due 2021 $800.0 5.75% (Floating) Term Loan Due 2019 681.0 Revolving Credit Facility Due 2018 ($240M) - Total Indebtedness $1,481.0 Cash and Cash Equivalents (232.1) Net Indebtedness at Dec. 31, 2014 $1,248.9 Last Twelve Months Covenant EBITDA (1) $436.6 Net First Lien Leverage Ratio (2) 2.86x 8.5% Holdco Notes Due 2019 $400.0 Pro Forma for Holdco Debt Issued July 17, 2014 3.78x Indebtedness Capital Structure & Significant Liquidity 12 • Strong operating cash flow generated during 2014 • Significant liquidity of $472 million – $232 million of cash at year-end – Bank revolver fully available as of December 31 and as of March 31, 2015. • Net leverage of 2.9x as of December 31 – Net leverage including HoldCo debt of 3.8x. On December 31, 2013, the company voluntarily prepaid $81mm of the Term Loan due 2019 (10% of the originally issued amount). On March 24, 2014, the company voluntarily prepaid an additional $35 million of the Term Loan due 2019. Debt balances exclude unamortized OID. (1) Covenant definition of EBITDA is Pre-Plate Pro Forma Adjusted EBITDA. (2) Net First Lien Leverage covenant of 7.00x takes effect only if 20% of revolving line of credit is drawn. ($ in Millions) Cash and Cash Equival nts $232.1 Revolving Credit Facilities $240.0 Outstanding Letters of Credit 0.0 Outstanding Borrowings - Available Under Cr dit Facil ties t Dec. 31, 2014 $240.0 Total Liquidity at Dec. 31, 2014 $472.1 Liquidity

13 Appendix: Financial Detail

Glossary McGraw-Hill Global Education Holdings, LLC (MHGE) McGraw-Hill Education’s Higher Education, Professional and International businesses Connect Mobile-first learning platform for students and instructors in the higher education market SmartBook Adaptive reading product designed to help students understand and retain course material by guiding each student through a highly personal study experience LearnSmart Adaptive learning program which personalizes learning and designs targeted study paths for students ALEKS Adaptive learning technology for the K-12 and higher education markets MH Campus Integrates all digital products from McGraw-Hill Education into a school’s Learning Management System (LMS) Financial Terminology Cash Revenue GAAP revenue plus the change in total deferred revenue during the period presented Deferred Revenue Advance payments or unearned revenue recorded until services have been rendered or products have been delivered Adjusted Cash EBITDA Adjusted EBITDA is defined as EBITDA adjusted to exclude unusual items and other adjustments required or permitted in calculating covenant compliance under the indenture governing our senior secured notes and/or our new senior secured credit facilities. Post-Plate Adjusted Cash EBITDA EBITDA adjusted to exclude unusual items and other adjustments required or permitted in calculating covenant compliance including the cash spent for plate investment Plate Investment Costs Plate investment costs, reflecting the cost of developing education content, are capitalized and amortized. These costs are capitalized when the title is expected to generate probable future economic benefits and are amortized upon publication of the title over its estimated useful life of up to six years. 14

Cash Revenue Bridge and Operating Segment Detail 15 ($ in Millions) Dec 31, 2013 Dec 31, 2014 Dec 31, 2013 Dec 31, 2014 Reported Revenue 359$ 372$ 1,242$ 1,290$ Eliminate Impact of Purchase Accounting 4 - 29 (1) Total 362 372 1,271 1,289 Change in Deferred Revenues (5) (12) 20 12 Total Cash Revenues 357$ 360$ 1,291$ 1,301$ Cash Revenue by Segment Higher Ed 227$ 226$ 811$ 838$ Professional 36 40 125 127 International 94 94 355 336 Other - - - - Total Cash Revenue 357$ 360$ 1,291$ 1,301$ Cash EBITDA by Segment Higher Ed 63$ 75$ 275$ 293$ Professional 10 16 32 38 International 14 9 42 38 Other 1 (9) 4 (9) Total Cash EBITDA 87$ 90$ 354$ 359$ Three Months Ended Year Ended Amounts above may not sum due to rounding.

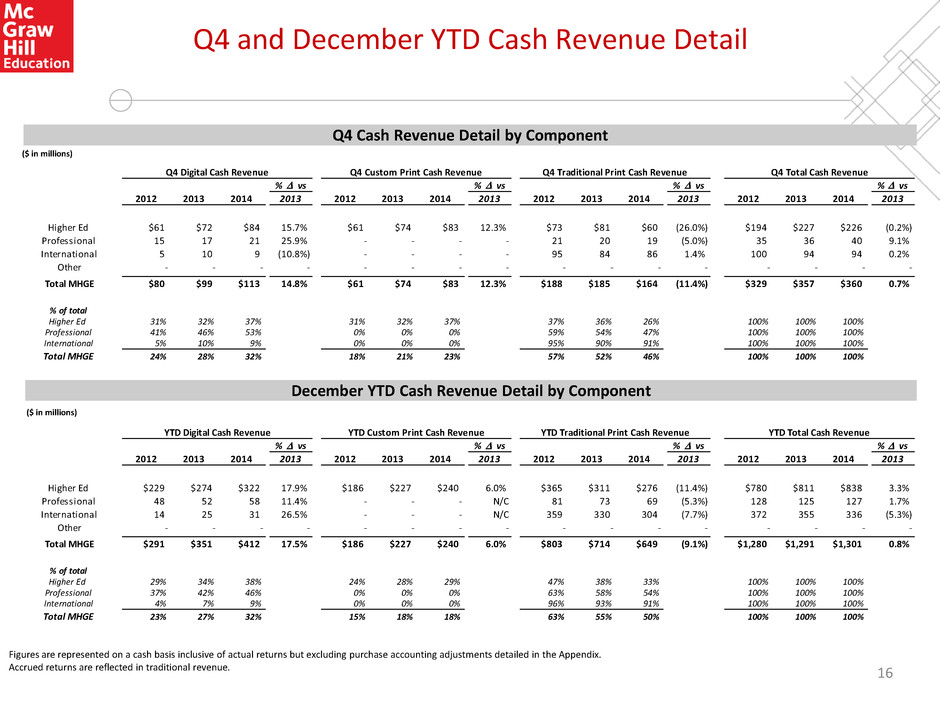

($ in millions) Q4 and December YTD Cash Revenue Detail Figures are represented on a cash basis inclusive of actual returns but excluding purchase accounting adjustments detailed in the Appendix. Accrued returns are reflected in traditional revenue. ($ in millions) Q4 Cash Revenue Detail by Component December YTD Cash Revenue Detail by Component 16 Q4 Digital Cash Revenue Q4 Custom Print Cash Revenue Q4 Traditional Print Cash Revenue Q4 Total Cash Revenue 2012 2013 2014 2013 2012 2013 2014 2013 2012 2013 2014 2013 2012 2013 2014 2013 Higher Ed $61 $72 $84 15.7% $61 $74 $83 12.3% $73 $81 $60 (26.0%) $194 $227 $226 (0.2%) Profession l 15 17 21 25.9% - - - - 21 20 19 (5.0%) 35 36 40 9.1% International 5 10 9 (10.8%) - - - - 95 84 86 1.4% 100 94 94 0.2% Other - - - - - - - - - - - - - - - - Total MHGE $80 $99 $113 14.8% $61 $74 $83 12.3% $188 $185 $164 (11.4%) $329 $357 $360 0.7% % of total Higher Ed 31% 32% 37% 31% 32% 37% 37% 36% 26% 100% 100% 100% Professional 41% 46% 53% 0% 0% 0% 59% 54% 47% 100% 100% 100% International 5% 10% 9% 0% 0% 0% 95% 90% 91% 100% 100% 100% Total MHGE 24% 28% 32% 18% 21% 23% 57% 52% 46% 100% 100% 100% % D vs % D vs % D vs % D vs YTD Digital Cash Revenue YTD Custom Print Cash Revenue YTD Traditional Print Cash Revenue YTD Total Cash Revenue 2012 2013 2014 2013 2012 2013 2014 2013 2012 2013 2014 2013 2012 2013 2014 2013 i r Ed $229 $274 $ 22 17.9% $186 $2 7 $240 6.0% $ 65 $ 11 $ 6 (11.4%) $780 $811 $838 3.3% Pr f ssi l 48 52 58 11.4% - - - N/C 81 73 69 (5.3%) 128 125 127 1.7% International 14 25 31 26.5% - - - N/C 359 330 304 (7.7%) 372 355 336 (5.3%) Other - - - - - - - - - - - - - - - - Total MHGE $291 $351 $412 17.5% $186 $227 $240 6.0% $803 $714 $649 (9.1%) $1,280 $1,291 $1,301 0.8% % of total Higher Ed 29% 34% 38% 24% 28% 29% 47% 38% 33% 100% 100% 100% Professional 37% 42% 46% 0% 0% 0% 63% 58% 54% 100% 100% 100% International 4% 7% 9% 0% 0% 0% 96% 93% 91% 100% 100% 100% Total MHGE 23% 27% 32% 15% 18% 18% 63% 55% 50% 100% 100% 100% % D vs % D vs % D vs % D vs

Q4 Income Statement Excluding Impact of Transaction 17 ($ in Millions) 2013 2014 2013 2014 2013 2014 Revenue 359$ 372$ 4$ -$ 362$ 372$ Cost of goods sold 117 107 (12) - 105 107 Gross profit 242 265 15 - 257 265 Operating expenses Operating & administration expenses 188 195 - - 188 195 Depreciation 7 4 - - 7 4 Amortization of intangibles 23 24 (21) (22) 2 2 Transaction costs 4 - (4) - - - Total operating expenses 222 224 (25) (22) 197 201 (Loss) income from operations 20 41 40 22 60 64 Interest (income) expense, net 45 31 (45) (31) - - Other (income) (1) (1) 1 1 - - (Loss) income from operations before taxes on income (23) 12 83 52 60 64 Income tax (benefit) provision (9) (6) 32 20 23 14 Net (loss) income (14) 18 51 32 37 49 Less: Net loss attributable to noncontrolling interests (1) - - - (1) - Net loss (income) attributable to McGraw-Hill Global Education Intermediate Holdings, LLC (15)$ 18$ 51$ 32$ 36$ 49$ Post-Plate Adjusted Cash EBITDA 87$ 90$ 87$ 90$ Cash Revenue Bridge Revenue per above 362 372 Change in deferred revenue per Cash Revenue schedule (5) (12) Cash Revenue 357 360 Operating Expense Bridge Total Operating Expenses Per Above 197 201 Less: Depreciation & Amortization of intangibles (9) (6) Less: Acquisition costs (2) - Less: Amortization of prepublication costs (23) (18) Less: Restructuring and cost savings implementation charges (13) (13) Less: Physical separation costs (3) (5) Less: Other adjustments (7) (10) Adjusted Operating Expenses 139 148 Reported Transaction Impact Excluding Impact From Transaction Three Months Ended Dec 31, Three Months Ended Dec 31, Three Months Ended Dec 31,

($ in Millions) 2013 2014 2013 2014 2013 2014 Revenue 1,242$ 1,290$ 29$ (1)$ 1,271$ 1,289$ Cost of goods sold 517 359 (141) 3 376 361 Gross profit 725 932 170 (4) 895 928 Operating expenses Operating & administration expenses 624 683 - - 624 683 Depreciation 20 15 - - 20 15 Amortization of intangibles 71 103 (63) (96) 8 8 Transaction costs 28 4 (28) (4) - - Total operating expenses 743 806 (91) (100) 652 706 (Loss) income from operations (18) 126 261 96 243 221 Interest (income) expense, net 136 146 (136) (146) - - Other (income) (2) (12) 2 12 - - (Loss) income from operations before taxes on income (151) (8) 394 229 243 221 Income tax (benefit) provision (63) (11) 153 89 90 77 Net (loss) income (88) 3 241 141 154 144 Less: Net loss attributable to noncontrolling interests (2) 0 - - (2) 0 Net loss (income) attributable to McGraw-Hill Global Education Intermediate Holdings, LLC (90)$ 4$ 241$ 141$ 152$ 144$ Post-Plate Adjusted Cash EBITDA 354$ 359$ 354$ 359$ Cash Revenue Bridge Revenue per above 1,271 1,289 Change in deferred revenue per Cash Revenue schedule 20 12 Cash Revenue 1,291 1,301 Operating Expense Bridge Total Operating Expenses Per Above 652 706 Less: Depreciation & Amortization of intangibles (28) (23) Less: Acquisition costs (4) (3) Less: Amortization of prepublication costs (76) (64) Less: Restructuring and cost savings implementation charges (25) (31) Less: Physical separation costs (4) (24) Less: Other adjustments (20) (31) Adjusted Operating Expenses 495 530 Reported Transaction Impact Excluding Impact From Transaction Year Ended Dec 31, Year Ended Dec 31, Year Ended Dec 31, Dec YTD Income Statement Excluding Impact of Transaction 18

EBITDA and Adjusted EBITDA 19 EBITDA, a measure used by management to assess operating performance, is defined as income from continuing operations plus interest, income taxes, depreciation and amortization, including amortization of prepublication costs (“plate investment”). Adjusted EBITDA is defined as EBITDA adjusted to exclude unusual items and other adjustments required or permitted in calculating covenant compliance under the indenture governing our senior secured notes and/or our new senior secured credit facilities. Post-Plate Adjusted Cash EBITDA reflects the impact of cash spent for plate investment. Plate investment costs, reflecting the cost of developing education content, are capitalized and amortized. These costs are capitalized when the title is expected to generate probable future economic benefits and are amortized upon publication of the title over its estimated useful life of up to six years. Post-Plate Adjusted Cash EBITDA reflects EBITDA as defined in the First Lien Credit Agreement and the Bond Indenture. Each of the above described EBITDA-based measures is not a recognized term under U.S. GAAP and does not purport to be an alternative to income from continuing operations as a measure of operating performance or to cash flows from operations as a measure of liquidity. Additionally, each such measure is not intended to be a measure of free cash flows available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Such measures have limitations as analytical tools, and you should not consider any of such measures in isolation or as substitutes for our results as reported under U.S. GAAP. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement U.S. GAAP results to provide a more complete understanding of the factors and trends affecting the business than U.S. GAAP results alone. Because not all companies use identical calculations, these EBITDA-based measures may not be comparable to other similarly titled measures of other companies. Management believes EBITDA is helpful in highlighting trends because EBITDA excludes the results of decisions that are outside the control of operating management and can differ significantly from company to company depending on long- term strategic decisions regarding capital structure, the tax rules in the jurisdictions in which companies operate, and capital investments. In addition, EBITDA provides more comparability between the historical operating results and operating results that reflect purchase accounting and the new capital structure. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA and Post-Plate Adjusted Cash EBITDA are appropriate to provide additional information to investors about certain material non-cash items and about unusual items that we do not expect to continue at the same level in the future.

Q4 Adjusted Cash EBITDA 20 ($ in Millions) Dec 31, 2013 Dec 31, 2014 Net Income (14)$ 17$ Interest (income) expense, net 44 31 Provision for (benefit from) taxes on income (9) (6) Depreciation, amortization and plate investment amortization 53 47 EBITDA 74$ 89$ Deferred revenue (a) (2) (12) Restructuring and cost savings implementation charges (b) 13 13 Sponsor fees (c) 0 1 Purchase accounting (d) 12 - Transaction costs (e) 4 0 Acquisition costs (f) 2 (0) Physical separation costs (g) 3 5 Other (h) 6 8 Adjusted EBITDA 112$ 105$ Plate investment cash costs (i) (25) (15) Post-Plate Adjusted Cash EBITDA prior to annualized cost savings and pre acquisition ALEKS 87$ 90$ Three Months Ended

December YTD Adjusted Cash EBITDA 21 ($ in Millions) Dec 31, 2013 Dec 31, 2014 Net Income (88)$ 4$ Interest (income) expense, net 136 146 Provision for (benefit from) taxes on income (63) (11) Depreciation, amortization and plate investment amortization 167 183 EBITDA 152$ 321$ Deferred revenue (a) 49 11 Restructuring and cost savings implementation charges (b) 25 31 Sponsor fees (c) 1 4 Purchase accounting (d) 141 (3) Transaction costs (e) 28 4 Acquisition costs (f) 4 3 Physical seperation costs (g) 4 24 Other (h) 17 15 Adjusted EBITDA 420$ 410$ Plate investment cash costs (i) (67) (50) Post-Plate Adjusted Cash EBITDA prior to annualized cost savings and pre acquisition ALEKS 354$ 359$ Annualized cost savings for initiatives implemented or that will be implemented (j) 42 27 Pre-acquisition ALEKS Post-Plate Adjusted EBITDA (k) 5 - Post-Plate Adjusted Cash EBITDA after annualized cost savings and pre-acquisition ALEKS 401$ 386$ Year Ended

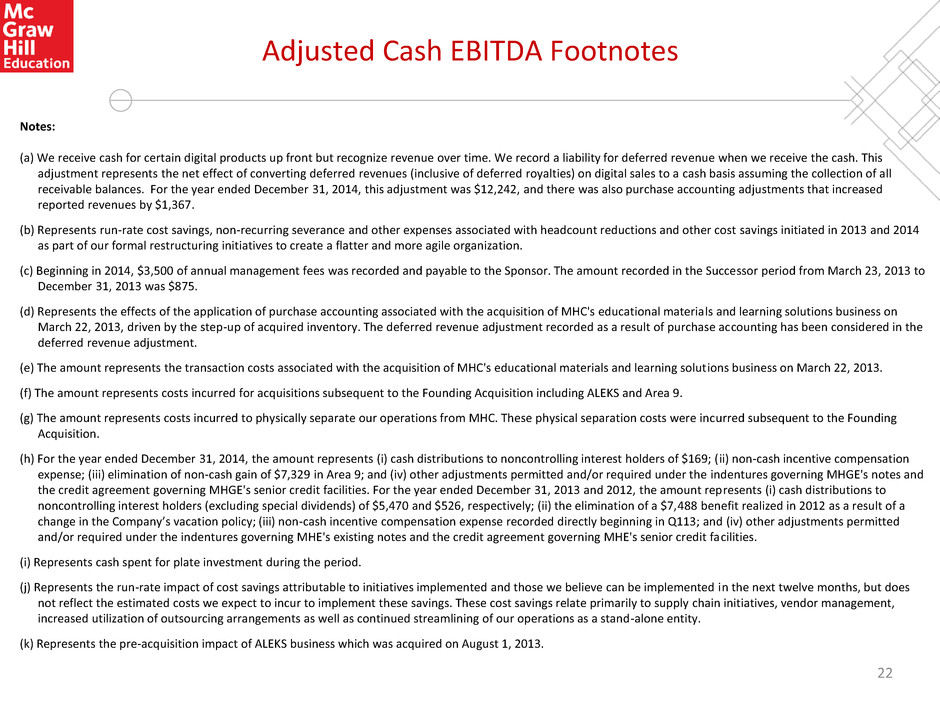

Adjusted Cash EBITDA Footnotes 22 Notes: (a) We receive cash for certain digital products up front but recognize revenue over time. We record a liability for deferred revenue when we receive the cash. This adjustment represents the net effect of converting deferred revenues (inclusive of deferred royalties) on digital sales to a cash basis assuming the collection of all receivable balances. For the year ended December 31, 2014, this adjustment was $12,242, and there was also purchase accounting adjustments that increased reported revenues by $1,367. (b) Represents run-rate cost savings, non-recurring severance and other expenses associated with headcount reductions and other cost savings initiated in 2013 and 2014 as part of our formal restructuring initiatives to create a flatter and more agile organization. (c) Beginning in 2014, $3,500 of annual management fees was recorded and payable to the Sponsor. The amount recorded in the Successor period from March 23, 2013 to December 31, 2013 was $875. (d) Represents the effects of the application of purchase accounting associated with the acquisition of MHC's educational materials and learning solutions business on March 22, 2013, driven by the step-up of acquired inventory. The deferred revenue adjustment recorded as a result of purchase accounting has been considered in the deferred revenue adjustment. (e) The amount represents the transaction costs associated with the acquisition of MHC's educational materials and learning solutions business on March 22, 2013. (f) The amount represents costs incurred for acquisitions subsequent to the Founding Acquisition including ALEKS and Area 9. (g) The amount represents costs incurred to physically separate our operations from MHC. These physical separation costs were incurred subsequent to the Founding Acquisition. (h) For the year ended December 31, 2014, the amount represents (i) cash distributions to noncontrolling interest holders of $169; (ii) non-cash incentive compensation expense; (iii) elimination of non-cash gain of $7,329 in Area 9; and (iv) other adjustments permitted and/or required under the indentures governing MHGE's notes and the credit agreement governing MHGE's senior credit facilities. For the year ended December 31, 2013 and 2012, the amount represents (i) cash distributions to noncontrolling interest holders (excluding special dividends) of $5,470 and $526, respectively; (ii) the elimination of a $7,488 benefit realized in 2012 as a result of a change in the Company’s vacation policy; (iii) non-cash incentive compensation expense recorded directly beginning in Q113; and (iv) other adjustments permitted and/or required under the indentures governing MHE's existing notes and the credit agreement governing MHE's senior credit facilities. (i) Represents cash spent for plate investment during the period. (j) Represents the run-rate impact of cost savings attributable to initiatives implemented and those we believe can be implemented in the next twelve months, but does not reflect the estimated costs we expect to incur to implement these savings. These cost savings relate primarily to supply chain initiatives, vendor management, increased utilization of outsourcing arrangements as well as continued streamlining of our operations as a stand-alone entity. (k) Represents the pre-acquisition impact of ALEKS business which was acquired on August 1, 2013.