Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Aspect Software Parent, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 CERTIFICATION - Aspect Software Parent, Inc. | ex321123114.htm |

| EX-31.2 - EXHIBIT 31.2 CERTIFICATION - Aspect Software Parent, Inc. | ex312123114.htm |

| EX-21.1 - EXHIBIT 21.1 LIST OF SUBS - Aspect Software Parent, Inc. | ex211listofsubs2014.htm |

| EX-10.42 - EXHIBIT 10.42 JOSEPH GAGNON EMPLOYMENT - Aspect Software Parent, Inc. | ex1042employementagreement.htm |

| EX-12.1 - EXHIBIT 12.1 EARNINGS OF FIXED CHARGES - Aspect Software Parent, Inc. | ex121ratioofearningstofixe.htm |

| EX-31.1 - EXHIBIT 31.1 CERTIFICATION - Aspect Software Parent, Inc. | ex311123114.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2014

OR

¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 333-170936

ASPECT SOFTWARE PARENT INC.

(Exact name of registrant as specified in its charter)

Delaware | 20-3503231 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2325 East Camelback Road, Suite 700

Phoenix, Arizona 85016

(Address of principal executive offices) (Zip code)

Telephone Number: Telephone: (978) 250-7900

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2014, the last business day of the registrant's most recently completed second fiscal quarter, was zero as there is currently no established public trading market for the registrant's equity securities.

The registrant had one ordinary share outstanding as of February 28, 2015.

TABLE OF CONTENTS

Part I | ||

Item 1 | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Part III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Part IV | ||

Item 15. | ||

1

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the “Management's Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933 (the “Securities Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”). All statements other than statements of historical facts are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified below, under “Item 1A. Risk Factors” and elsewhere herein. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

PART I

Item 1. Business

Company Overview

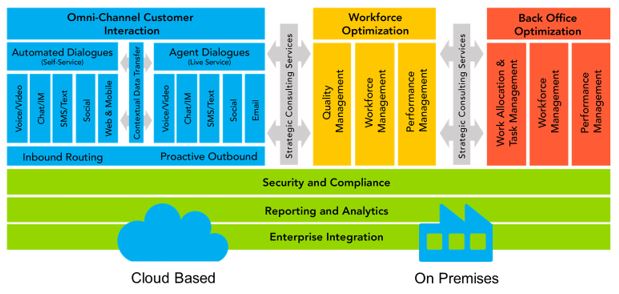

Aspect Software Parent Inc. ("Aspect, "we", "our", "us") is a global provider of a fully-integrated solution that unifies the three most important facets of modern consumer engagement strategy: customer interaction management, workforce optimization and back-office. Aspect Software Group Holdings Ltd. ("Holdings") is Aspect Software Parent Inc.'s sole shareholder. Through a full suite of cloud, hosted and hybrid deployment options, we help the world’s most demanding contact centers and back offices seamlessly align their people, processes and touch points to map and deliver remarkable customer experiences.

Through seamless, two-way communications across phone, chat, email, instant message ("IM"), short message service ("SMS") and social channels, Aspect equips companies with the tools and technologies needed to design customer experiences that engage and serve today's demanding customers across multiple channels of communication. Whether delivered through Aspect's cloud infrastructure or as software deployed on the customers’ premises, our solutions enable organizations to integrate customer self-service, contact center operations, workforce optimization and back office workflow solutions into existing enterprise technology investments for companies looking to remove communication and workflow barriers or create more productive business processes. We believe that this flexible, forward-focused design approach drives enhanced business efficiencies, fosters loyalty and increases customer value.

2

We operate in one reportable segment. Please see Note 24, “Segment Reporting,” of Item 8 of this Annual Report on Form 10-K for more information. For the year ended December 31, 2014, our total net revenues, net loss and earnings before interest, taxes, depreciation and amortization, as adjusted ("Adjusted EBITDA") were $444.9 million, $33.8 million and $106.7 million, respectively. See “Key Financial Measures” in “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” in Part II of this Annual Report on Form 10-K for a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to income from operations, the most directly comparable generally accepted accounting policies ("GAAP") financial performance measure.

Industry Overview

The contact center continues to evolve. Standard call centers consist of agents handling inbound and outbound calls using a collection of telephones. These single channel call centers still require multipoint systems consisting of a PBX, an automatic call distributor (“ACD”), and an automated attendant to handle voice-based interactions, along with optional enhancements such as an interactive voice response (“IVR”) system, a predictive outbound dialer and a call logger. As communication channels have evolved, many of these call centers transformed to multichannel contact centers by adding SMS texting, mobile applications, e-mails, web interaction, messaging capabilities, and social media. As cloud service availability has grown, call centers are increasingly opting for alternative software deployment models. This approach enables organizations to automate processes to improve organizational effectiveness, and the cloud-based deployments in particular help reduce total cost of ownership. Cloud-based deployments offer increased flexibility, faster deployment, minimal up front capital expense and reduced internal information technology staff costs to handle upgrades, maintenance and disaster recovery.

Widespread smartphone and tablet adoption has resulted in consumers expecting always-available omnichannel client software services and applications, which work uniformly on various mobile devices and operating systems. Companies will need to continue to increase their focus on omnichannel client development and the ability to deliver a consistent brand experience across all channels used by mobile consumers.

Additionally, the onslaught of the internet of things has made content management increasingly important and challenging for organizations, especially industries such as insurance, financial services, and healthcare that circulate large amounts of information internally and externally. This trend has driven the demand for analytics that can provide meaningful data about the increasingly large variety of interactions enterprises have with the customer and prioritize this disparate data as actionable information.

In a market where everything is changing at a higher degree and rate than ever before, our comprehensive product portfolio with flexible deployment capabilities positions Aspect as a key strategic partner to address customers' evolving needs.

Competitive Strengths

We believe that we benefit from the following competitive strengths:

Leading Market Positions, Differentiating Vision and Global Deployment Capabilities. Aspect is an innovator of various core contact center technologies such as intelligent automatic call distribution, predictive dialing and workforce management. Over the years, we have continued to maintain our leading position in these segments of the contact center market. We continue to innovate and develop our applications and expand our global footprint in support of our cloud deployment options.

3

Large and Diversified Installed Base of Blue-Chip Customers. We are a major contact center solution provider with a comprehensive portfolio. We provide our solutions and services worldwide, with 72% of our revenues generated from the Americas, 19% from Europe and Africa and 9% from Asia Pacific for the year ended December 31, 2014, and we view our market opportunities on a global basis. We deliver our solutions to more than 2,300 customers in more than 80 countries and our products currently support approximately 1.5 million contact center agent seats managing over 100 million customer interactions daily. No one customer accounted for more than 10% of our revenues for the year ended December 31, 2014. We believe that this geographic diversity and lack of customer concentration helps us to mitigate the effects of isolated regional downturns. It also provides us with a broad range of relationships that we can leverage to implement our new technologies in our customers' contact centers and also on an enterprise-wide basis.

Recurring Revenue with High Renewal Rates. During the year ended December 31, 2014 our recurring revenues comprised 66% of our total revenues. Recurring revenue includes maintenance, hosting and managed services revenue. We believe that contact center operations have become critical business functions for many of our customers, positioning us as a key strategic supplier. Additionally, customers view switching contact center systems as a complex, risky and an expensive undertaking, given the considerable upfront license costs, lengthy implementations and potential for disruptions of critical operations. Renewal rates are positively impacted by the inclusion of investment protection features for those who are under maintenance of premise products as it includes software updates, upgrades and customer care support on a 24x7x365 coverage with customer care provided globally.

Our People and Management. We have a strong executive management team with considerable leadership and software industry experience and proven execution skills in growing companies organically and through acquisitions. This collection of talent includes many individuals who have experience transforming businesses. Our executive management team has an average of more than twenty years of technology experience.

Business Strategy

The following components are key to our strategy and achieving our growth objectives:

Expand our Global Presence. Aspect receives the majority of its revenue today from mature markets like North America and Western Europe. We are investing in emerging markets such as Brazil, Mexico, China and India, through both organic growth in personnel and partner channel development. We expect to generate more new customer wins from the emerging markets.

Develop Best-In-Class Solutions. During the past four decades, we have been a market leader in key segments of the contact center market, largely due to our ability to develop innovative products that meet the needs of our customers. In recognition of the contact center's business transformation from isolated phone-based, outbound communications to inbound and outbound multi-channel communications that are highly integrated into a company's operations, we believe we have developed and matured one of the industry's first truly integrated unified contact center offerings. With our flagship product Aspect Unified IP,

4

we can provide both an effective and innovative platform that meets the evolving market needs for new customers, while offering a new set of capabilities to sell to our current customers who are upgrading their existing legacy contact center systems. Our workforce optimization capabilities have grown through organic developments and acquisitions to be an integrated full-featured workforce optimization platform leveraging both Microsoft Unified Communications ("UC") and other leading industry platform technologies. We have a unique advantage as the only recognized contact center infrastructure leader that offers truly integrated interaction management and workforce optimization technologies. The combined interaction management and workforce optimization solution takes full advantage of UC, allowing Aspect to lead the contact center transformation. We plan to continue to invest and develop new products and solutions ahead of changing contact center and enterprise needs and continually take advantage of the developing UC marketplace.

2014 was a year of material accomplishment and forward momentum for Aspect's solution portfolio, especially with regard to cloud offerings.

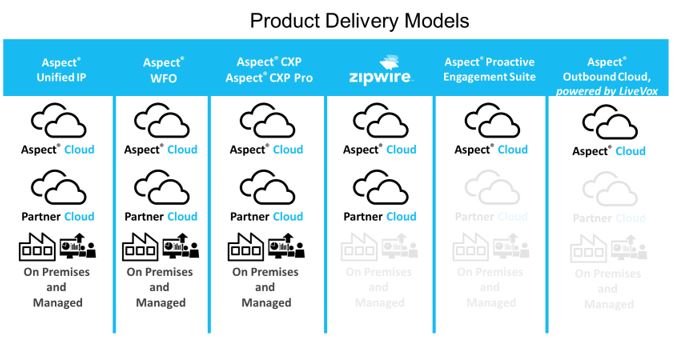

Become a Premier Cloud Solutions Provider. Aspect’s goal is to become a premier cloud solutions provider. We have increased our internal investments in cloud solution development activities and have had major releases of Unified IP, WFO, WFM, and our Proactive Engagement Suite offerings in the cloud. Our acquisition of Voxeo Corporation ("Voxeo") and Voxeo's wholly-owned subsidiary Qivox and the licensing of new Software as a Service ("SaaS") technology advanced our cloud infrastructure and product portfolio. We have leveraged the Voxeo product portfolio and cloud infrastructure, licensed technology and our contact center experience to develop Zipwire, our pure SaaS contact center offering. Zipwire, a true cloud contact center solution delivers superior functionality and ease of use. Unlike many smaller hosted solutions built on traditional on-premises platforms, Zipwire's scalability and multi-tenant capabilities offer on-demand flexibility without sacrificing performance or reliability. Additionally, we have released Aspect Outbound powered by LiveVox, which is a compliant, multi-tenant outbound cloud contact center solution that scales easily and provides advanced disaster recovery capabilities.

Migrate and Further Penetrate Our Installed Customer Base. We have a large installed customer base on our legacy telephony-based Signature predictive dialer and automatic call distribution products. As our customer base migrates to software-based platforms, we are using our relationships with these customers to market our Aspect Unified IP platform product and related unified communications applications. Migrations from Signature dialers to the Aspect Unified IP-based applications are essentially complete, and most of our customers have chosen to use Aspect Unified IP. As customers migrate to new solutions, we are marketing our workforce optimization solutions as well as additional capabilities and services to our customers.

Leverage Aspect Professional Services to Drive Customer Contact Deployments. Aspect’s deep technology expertise paired with our dedication to innovate is the driving force behind delivering meaningful business results to our clients spanning the contact center and beyond. Whether organizations require implementation, project planning, strategy and governance planning, application development, custom development or resources to augment their information technology ("IT") staff, Aspect’s Professional Services is uniquely positioned to help our customer get the most value from their software investment at every stage. Aspect’s Professional Services has three dedicated service areas: Implementation and Optimization Services, Interaction Enablement Services, and Performance Improvement Services. Through integration with leading customer relationship management ("CRM") applications, Aspect's Professional Services helps customers design and implement a seamless integrated system that unites communication functionality with usable customer data in a single location. The result is an integrated agent desktop solution that successfully empowers contact center with the data required to meet today’s growing demand for remarkable customer experiences.

Our Solutions

We generate revenues by selling and licensing our software and hardware products, selling maintenance contracts and services to support our products and providing professional services that help customers identify and implement the appropriate contact center and interaction management solutions.

5

Contact Center Products and Applications

We offer a “one-stop-shop” for contact center solutions, delivering key components either in integrated suites or separate modules, tailored to suit customer preferences and requirements. Our applications for the contact center are internet protocol ("IP") based solutions that offer new ways to address particular customer interactions by delivering a specific combination of capabilities to improve contact center performance. Our primary platform products are categorized into four main product groups: Contact Center (Aspect Unified IP, Aspect Zipwire, and Aspect CXP), Workforce Optimization, Back Office Optimization and Signature. We offer deployment flexibility to suit our customer needs; from the convenience of the cloud to the familiarity of on-premise or somewhere in between.

Aspect Unified IP

Built to scale from 10-agent to several-thousand-agent contact centers, our flagship contact center platform, Aspect Unified IP, is a Microsoft web services platform contact center solution that unites inbound, outbound, interactive voice response and internet contact capabilities like email and web chat while delivering robust queuing, routing, reporting and agent empowerment capabilities in a single solution. The unified platform requires less professional services to implement than alternative solutions as less computer telephony integration is required and provides customers with a lower total cost of ownership. Aspect Unified IP generated approximately $192 million of revenue (43% of our total revenue) for the year ended December 31, 2014.

Aspect Zipwire

Zipwire, is a pure cloud, SaaS contact center solution. Zipwire’s highly competitive feature set offers simplicity in provisioning, support and on-going operations. Designed to get a contact center up and running in hours or days as opposed to traditional software solutions that can take months to deploy, Zipwire rapidly accelerates time-to-value for customers. Zipwire can be delivered through Aspect’s proven cloud and telecommunications infrastructure attained through our acquisition of Voxeo in July 2013 and can also be deployed within an enterprise’s private cloud network. Qivox, acquired through the Voxeo purchase, is a hosted omni-channel communications platform for providing SaaS-based solutions for customer engagement management. Aspect has branded the Qivox product portfolio as Aspect Proactive Engagement Suite. Aspect Zipwire products generated approximately $11 million of revenue (3% of our total revenue) for the year ended December 31, 2014.

Aspect Customer Experience Platform ("CXP")

The Aspect Customer Experience Platform ("CXP") makes it easy to design, implement and deploy IVR and self-service customer contact applications across multiple communications channels, like voice, text (IM, SMS, USSD), mobile web, social networks like Twitter and smartphone applications. With CXP, it’s easy to implement personalized self-service that gets customers a first-contact resolution - freeing up your contact center agents to address more complex problems. CXP products generated approximately $42 million of revenue (9% of our total revenue) for the year ended December 31, 2014.

6

Workforce Optimization

Built on a Microsoft standards-based platform, our workforce optimization solutions improve the management and efficiency of contact center customer contact activities. Examples of specific customer needs our workforce optimization products can support include more efficient coordination of customer self-service with live contact center agent assisted service; greater visibility, control and staffing efficiency in a multichannel, distributed customer contact environment; automation of early stage contact and a more effective past due customer account targeted collections strategy; and tools and processes to optimize resource utilization and foster a continuous improvement culture. In 2014, we released version 8 of our Workforce Optimization Suite, which dramatically improves agent and supervisor efficiency via our simple widget-based user interfaces. Workforce Optimization products generated approximately $102 million of revenue (23% of our total revenue) for the year ended December 31, 2014.

Back Office Optimization

Aspect Back Office Optimizer provides the ability to distribute and redistribute work items (tasks) based on predicted task outcomes and real-time resource availability. The solution captures work from multiple sources and ensures work is allocated to the right individual, team, department and/or location based on resource availability, backlog and desired service level outcome. Back Office Optimization products generated approximately $2 million of revenue (less than 1% of our total revenue) for the year ended December 31, 2014.

Signature Products

Our Signature products, which generated approximately $98 million of revenue (22% of our total revenue) in the year ended December 31, 2014, include all of the core technologies needed to operate a modern call center, including ACD, predictive dialer, computer telephony integration and IVR.

Managed Services

Aspect’s Managed Services provides customers management and operational assistance for Aspect solutions. There are three distinct services offered:

Operation. Provides client services designed to help operate and manage a technology environment by reducing staffing costs and technology maintenance costs. This could include hosted or premise-based solutions or remotely through the cloud.

Optimization. Provides services designed to improve technology adoption with the goal of increasing the business value by optimizing the technology in place.

Hosting. Hosting the technology and/or owning the technology for the customer which helps reduce the customer’s capital costs.

7

Consulting and Customer Care Services

We offer our consulting and customer care services and systems integration skills to help our customers plan, implement and support our solutions in the contact centers and across their entire enterprise. Our global professional and customer care services team is comprised of business professionals and Microsoft certified experts and consisted of approximately 800 employees worldwide as of December 31, 2014. Our worldwide delivery capability helps customers with their critical business communications needs and is supported by management tools and technical customer care centers around the world. The services we offer include:

• | installation and implementation of contact center solutions; |

• | consulting services to help customers design and optimize their communications investments; |

• | management services that provide customers with an alternative to owning and operating communications applications and infrastructure; and |

• | on-site and remote customer care and managed services. |

We believe the global market for these services is fragmented. Companies serving these markets range from local firms to large multi-national companies with global footprints to other vendors, including communications businesses, value-added resellers, distributors and system integrators. Our interaction management consultants help organizations identify the right opportunities, navigate implementation obstacles and get the right results from unified communications by offering services and support from strategy and design to implementation. From improving individual and group productivity and enhancing collaboration to implementing communications-enabled business processes and transforming enterprise communications, we provide experienced guidance and support organizations as they adopt unified communications solutions.

The major areas of our services include:

Aspect Professional Services delivers unified communications capabilities in the contact center and throughout the enterprise. Our consultants help organizations identify the right opportunities, navigate implementation obstacles and get the right results from unified communications with services that span conception through completion. From improving individual productivity and heightening collaboration to communications-enabling business processes and transforming enterprise communications, we provide experienced guidance at every step of an organization's unified communications journey.

Aspect Customer Care. Aspect Customer Care helps ensure optimal operations and continuous system uptime by providing support services throughout the entire lifecycle of our relationship with our customers. Our engineers provide 24x7x365 follow-the-sun service via the telephone, internet-based self-service, email consultation, remote computer access and on-site service. Nearly 90% of new customers that purchase contact center solutions from us also purchase maintenance contracts. Through our maintenance relationships, we provide upgrades to installed software for customers under a maintenance contract and provide support to help ensure optimal operations.

Microsoft Consulting Services. Leveraging our pool of Microsoft experts, this group provides strategic consulting and implementation for a wide variety of Microsoft products and solutions such as SharePoint, Lync, Microsoft Dynamics, and Business Intelligence. In addition to technical consultation and implementation, this group includes a Healthcare and an Education practice that provides targeted solutions for high-growth industries. With the introduction of next generation customer contact applications, that take advantage of both Aspect contact center technologies as well as Microsoft technology, this group is expanding its efforts to broaden Microsoft's utilization within the contact center.

Aspect Education Services. Aspect Education Services offers a variety of courses designed to provide contact center supervisors and administrators with the skills and knowledge needed to enhance productivity and improve customer satisfaction. Courses are offered online, at our worldwide training facilities and onsite at customer facilities.

Customers

Our customer base is diverse, ranging in size from small businesses employing a few employees to large government agencies and multinational companies with over 100,000 employees. Our products are used in many verticals and industries in businesses around the world that have a significant amount of interaction with their customers, including financial services, telecommunications, technology, business process outsourcers, transportation, utilities, health care and government.

Our customers include: American Airlines, American Express, British Airways, British Gas, Citigroup, Computer Sciences Corp., Discover Financial Services, FedEx, General Electric, Hilton Reservations Worldwide, JC Penney, Lands' End, Lloyds TSB, Southwest Airlines, The Royal Bank of Scotland, Verizon Wireless, U.S. Airways, VW Credit, and Wipro. No one customer represented more than 10% of our total revenue for the years ended December 31, 2014, 2013 and 2012. For customer geographic information, please see Note 24, “Segment Reporting,” to our audited consolidated financial statements in Item 8 of this Form 10-K.

8

We are a market leader in all core contact center technologies:

• | A Visionairy in Gartner's Contact Center infrastructure magic quadrant (Source: Gartner, May 2014 “Magic Quadrant for Contact Center Infrastructure”) |

• | #1 in Work Force Management (Source: Pelorus Associates, March 2014 “2014 World Contact Center Workforce Management Systems Market”) |

• | #1 in Outbound Dialer (Source: Frost and Sullivan, September 2014 “Global Rollup-Contact Center Systems Market”) |

Sales and Marketing

We have 318 sales personnel worldwide. We sell and market our products primarily through our direct sales force. In addition to our direct sales, we sell our products through referral providers, resellers and distributors. Referral providers identify and engage with sales leads and transfer the relationship with the potential customer to our sales force in exchange for a finder's fee. Resellers sell our products but do not provide related services to the customers. Distributors sell our products and provide services and support related to our products. We have formed a single global sales force that is cross-trained across our full product offerings and is in a position to understand the solutions required to address our customers' needs. The sales force is supported by a pre-sales group of solutions consultants that have an in-depth knowledge of all our products. In addition, we maintain a formal sales process that includes CRM software based tools and structured account development methodology. This allows us to track every opportunity by geography in real time and thus helps us forecast early in the quarter if any weakness is predicted.

Product Development

We employ over 340 employees involved in product development and follow a strict product lifecycle to ensure stringent process control. Our product lifecycle is a process that our cross-functional program teams use in the management of products and product releases. The process is followed from new program concept through introduction and provides a repeatable, predictable method that we believe enhances product quality and provides for predictable product delivery.

For research and development costs for the past three fiscal years, please see our audited consolidated financial statements located in Item 8 of this Form 10-K.

Intellectual Property

We own a significant number of commercially important patents in the contact center industry and have nearly 1,000 patents and patents pending worldwide that are applicable across our entire platform of products for the contact center industry. We expect to continue to file new applications to protect our research and development investments in new technology and products and receive numerous patents each year. The duration of our patents is determined by the laws of the country of issuance and for U.S. patents may be 17 years from the date of issuance of the patent or 20 years from the date of its filing depending upon when the patent application was filed. In addition, we hold numerous trademarks, both in the U.S. and in foreign countries.

We will obtain patents and other intellectual property rights used in connection with our business when practicable and appropriate. Our intellectual property policy is to protect our products, technology and processes by asserting our intellectual property rights where appropriate and prudent. From time to time, assertions of infringement of certain patents or other intellectual property rights of others have been made against us. In addition, a pending claim is in an early stage of litigation. Based on industry practice and our prior experience, we believe that any licenses or other rights that might be necessary for us to continue with our current business could be obtained on commercially reasonable terms. However, we cannot assure you that any of those licenses or other rights will always be available on acceptable terms or that litigation will not occur. The failure to obtain necessary licenses or other rights, or litigation arising out of such claims, could adversely affect our business.

Competition

We offer a wide range of applications and services and as result have a broad range of competitors. We compete against traditional enterprise voice communications providers, such as Avaya, Siemens Enterprise Communications, and data networking companies, such as Cisco. We also face competition from other competitors, including Genesys Laboratories, Interactive Intelligence, Altitude Software and Noble Systems. We face competition in certain geographies with companies that have a particular strength and focus in these regions, such as Huawei in China. In addition, Verint Systems and NICE Systems Ltd. compete with us in the workforce management and quality monitoring product areas. Aspect Global Professional Services also competes with the above mentioned companies and others offering services with respect to their own product offerings, as well as many value added resellers, consulting and systems integration firms and network service providers.

9

Several of these existing competitors have, and many of our future competitors may have, greater financial, personnel, research and development and other resources, more well-established brands or reputations and broader customer bases than we do and, as a result, these competitors may be better positioned to respond quickly to potential acquisitions and other market opportunities, new or emerging technologies and changes in customer requirements. Some of these competitors may have customer bases that are more geographically balanced than ours and, therefore, may be less affected by an economic downturn in a particular region. Competitors with greater resources also may be able to offer lower prices, additional products or services or other incentives that we cannot match or do not offer. Industry consolidations may also create competitors with broader and more geographic coverage and the ability to reach enterprises through communications service providers.

Technological developments and consolidation within the communications industry result in frequent changes to our group of competitors. The principal competitive factors applicable to our products include:

• | product features, performance and reliability; |

• | customer service and technical support; |

• | relationships with distributors, value-added resellers and systems integrators; |

• | an installed base of similar or related products; |

• | relationships with buyers and decision makers; |

• | price; |

• | the financial condition of the competitor; |

• | brand recognition; |

• | the ability to integrate various products into a customer's existing networks, including the ability of a provider's products to interoperate with other providers' communications products; and |

• | the ability to be among the first to introduce new products. |

In addition, existing customers of data networking companies that compete against us may be inclined to purchase enterprise communications solutions from their current data networking vendor rather than from us. Also, as communications and data networks converge, we may face competition from systems integrators that have traditionally focused on data network integration. We cannot predict with precision which competitors may enter our markets in the future, what form such competition may take or whether we will be able to respond effectively to the entry of new competitors into our markets or the rapid evolution in technology and product development that has characterized our markets. In addition, in order to effectively compete with any new market entrant, we may need to make additional investments in our business or use more capital resources than our business currently requires or reduce prices, which may adversely affect our profitability.

Item 1A. Risk Factors

Our business depends on our ability to keep pace with rapid technological changes that impact our industry.

The market in which we operate is characterized by rapid, and sometimes disruptive, technological developments, evolving industry standards, frequent new product introductions and enhancements, changes in customer requirements and a limited ability to accurately forecast future customer orders. Our future success depends in part on our ability to continue to develop technology solutions that keep pace with evolving industry standards and changing customer demands. The process of developing new technology is complex and uncertain, and if we fail to accurately predict customers’ changing needs and emerging technological trends our business could be harmed. We are required to commit significant resources to developing new products before knowing whether our investments will result in products the market will accept. If the industry does not evolve as we believe it will, or if our strategy for addressing this evolution is not successful, many of our strategic initiatives and investments may be of no or limited value. Furthermore, we may not execute successfully on our strategic plan because of errors in product planning or timing, technical hurdles that we fail to overcome in a timely fashion, or a lack of appropriate resources. This could result in competitors providing those solutions before we do, in which case we could lose market share and our net revenues and earnings would decrease.

A key component of our strategy is our focus on the development and sale of enterprise communications products and services, and this strategy may not be successful.

Contact center technology is undergoing a change in which previously separate voice and data networks are converging onto IP based platforms with software driven unified communications applications. Both traditional and new competitors are investing heavily in this market and competing for customers.

Our initial approach to this convergence has been to provide software permitting the integration of existing telephony environments with networks in which voice traffic is routed through data networks. Ultimately, the strategy is to have customers migrate over time to our unified communications applications. This integration and migration strategy requires enterprise-level selling and deployment of enterprise-wide solutions that reach further into customers’ information technology

10

organizations, rather than selling and deployment efforts focused primarily on contact center managers and traditional telephone networks.

In order to execute our strategy successfully, we must:

• | expand our customer base by selling to enterprises that previously have not purchased from us; |

• | expand our presence with existing customers by adding value with our products and services; |

• | continue research and development investment, including investment in new software and platform development; |

• | train our sales staff and distribution partners to sell new products and services; |

• | improve our marketing of existing and new products and services; |

• | acquire key technologies through licensing, development contracts, alliances and acquisitions; |

• | train our professional services and support employees and channel partners to service new or enhanced products and applications and take other measures to ensure we can deliver consistent levels of service globally to our multinational customers; |

• | enhance our professional services and customer care organizations’ ability to service complex, multi-vendor IP networks; |

• | recruit and retain qualified personnel, particularly in research and development, professional services, customer care and sales; |

• | develop relationships with new types of channel partners who are capable of both selling our products and extending our reach into new and existing markets; and |

• | establish or expand our presence in key geographic markets. |

We may or may not be able to successfully accomplish any or all of the foregoing, which may adversely impact our operating results. The success of our unified communications products strategy depends on several factors, including proper new product definition, timely completion and introduction of these products, differentiation of new products from those of our competitors, and market acceptance of these products. There can be no assurance that we will successfully achieve market acceptance of our products, or any other products that we may introduce in the future, or that products and technologies developed by others will not render our products or technologies obsolete or noncompetitive. If we do not successfully execute our strategy, our operating results may be materially and adversely affected.

Recent global economic trends could adversely affect our business, results of operations and financial condition, primarily through disrupting our customers’ businesses.

Recent global economic conditions, including disruption of financial markets, could adversely affect our business, results of operations and financial condition, primarily through disrupting our customers’ businesses. Higher rates of unemployment and lower levels of business activity generally adversely affect the level of demand for certain of our products and services. In addition, continuation or worsening of general market conditions in the U.S. economy or other national economies important to our businesses may adversely affect our customers’ level of spending, ability to obtain financing for purchases and ability to make timely payments to us for our products and services, which could require us to increase our allowance for doubtful accounts, negatively impact our days sales outstanding and adversely affect our results of operations. Consumer hesitancy or limited availability of credit may constrict the business operations of our end user customers and our channel, development, and implementation partners, and consequently impede our own operations. The consequences may include restrained or delayed investments, late payments, bad debts, and even insolvency among our customers and business partners. These have had an effect on our revenue growth and incoming payments, and the impact may continue. In addition, our prices could come under more pressure due to more intense competition or deflation. If current economic conditions persist or worsen, we expect that our revenue growth and results of operations will continue to be negatively impacted. Finally, an extended period of further economic deterioration could exacerbate the other risks we describe herein. If these or other conditions limit our ability to grow revenue or cause our revenue to decline and we cannot reduce costs on a timely basis or at all, our operating results may be materially and adversely affected.

If our products do not remain compatible with ever-changing operating environments, we could lose customers and the demand for our products and services could decrease, which could materially adversely affect our business, financial condition, operating results and cash flow.

The largest suppliers of systems and computing software are, in most cases, the manufacturers of the computer hardware and software systems used by most of our customers. Historically, these companies have from time to time modified or introduced new operating systems, systems software and computer hardware. In the future, such new products could require substantial modification of our products to maintain compatibility with these companies’ hardware or software. Failure to adapt our products in a timely manner to such changes or customer decisions to forgo the use of our products in favor of those with

11

comparable functionality contained either in their hardware or software systems could have a material adverse effect on our business, financial condition, operating results and cash flow.

Our future revenue is dependent in large part upon our installed customer base continuing to license additional products, renew recurring subscription agreements and purchase additional professional services, and any migration of our customers away from our products and services would adversely impact our operating results.

Our large installed customer base traditionally has generated a very substantial portion of our revenue. Our support, hosting and managed services strategies are under constant review and development to assist us in addressing our customers’ broad range of requirements. Success in achieving our business goals depends significantly on the success of our maintenance, hosting and managed services models and on our ability to deliver high-quality services. It is possible that existing customers will decide not to renew or reduce their contracts with us or not to purchase more of our products or services in the future, which could have a material adverse effect on our business and results of operations.

Our gross margins may decrease due to competitive pressures or otherwise, which could negatively impact our profitability.

Gross margins may decrease in the future in response to competitive pricing pressures, new product introductions by us or our competitors, changes in the costs of components, increases in manufacturing costs, royalties we need to pay to use certain intellectual property, or other factors. If we experience decreased gross margins and we are unable to respond in a timely manner by introducing and selling new, higher-margin solutions successfully and continually reducing our costs, our gross margins may decline, which will harm our business and results of operations.

The decision-making process for purchasing our products and related services can be lengthy and unpredictable, which may make it difficult to forecast sales and budget expenses.

Because of the significant investment and executive-level decision-making typically involved in our customers’ decisions to license our products and purchase related services, the sales cycle for our products and related services typically ranges from six to twelve months, or longer for large enterprises. We use sales force automation applications, a common practice in our industry, to forecast sales and trends in our business. Our sales personnel monitor the status of all proposals and estimate when a customer will make a purchase decision and the dollar amount of the sale. These estimates are aggregated periodically to generate a sales pipeline. Because the success of our product sales process is subject to many factors, some of which we have little or no control over, our pipeline estimates can prove to be unreliable both in a particular quarter and over a longer period of time, in part because the “conversion rate” or “closure rate” of the pipeline into contracts can be very difficult to estimate. A contraction in the conversion rate, or in the pipeline itself, could cause us to plan or budget incorrectly and adversely affect our business or results of operations. In particular, a slowdown in information technology spending or economic conditions generally can unexpectedly reduce the conversion rate in particular periods as purchasing decisions are delayed, reduced in amount or canceled. The conversion rate can also be affected by the tendency of some of our customers to wait until the end of a fiscal period in the hope of obtaining more favorable terms, which can also impede our ability to negotiate and execute these contracts in a timely manner. In addition, if we acquire new companies or enter into related businesses, we will have limited ability to predict how their pipelines will convert into sales or revenues for one or more quarters following the acquisition, and their conversion rate post-acquisition may be quite different from their historical conversion rate.

Accordingly, our sales are difficult to forecast and can fluctuate substantially and we may expend substantial time, effort and money educating our current and prospective enterprise customers as to the value of, and benefits delivered by, our products, yet ultimately fail to produce a sale. If we are unsuccessful in closing sales after expending significant resources, our operating results will be adversely affected. As a result, if sales forecasted for a particular period do not occur in such period, our operating results for that period could be substantially lower than anticipated.

Many of our sales are made by competitive bid processes, which often requires us to expend significant resources, which we may not recoup.

Many of our sales, particularly in larger installations, are made by competitive bid processes. Successfully competing in competitive bidding situations subjects us to risks associated with the frequent need to bid on programs in advance of the completion of their design, which may result in unforeseen technological difficulties and cost overruns, as well as making substantial investments of time and money in research and development and marketing activities for contracts that may not be awarded to us. If we do not ultimately win a bid, we may obtain little or no benefit from these expenditures and may not be able to recoup these costs on future projects.

Even where we are not involved in a competitive bidding process, due to the intense competition in our markets and increasing customer demand for shorter delivery periods, we must in some cases begin the implementation of a project before the

12

corresponding order has been finalized, increasing the risk that we will incur expenses associated with potential orders that do not come to fruition.

Disruption of or changes in our sales channels could harm our sales and gross margins.

If we fail to manage distribution of our products and services properly, or if our distributors’ financial condition or operations weaken, our revenue and gross margins could be adversely affected.

An important element of our market strategy involves developing our indirect sales, implementation and support channels, which includes our global network of alliance partners, distributors, dealers, value-added resellers (“VARs”), telecommunications service providers and system integrators. Systems integrators sell and promote our products and perform custom integration of systems and applications. VARs market, sell, service, install and deploy our products. The remainder of our products and services is sold through direct sales.

Our relationships with channel partners are important elements of our marketing, sales and support efforts. If these relationships fail, we will have to devote substantially more resources to the sales and marketing, implementation and support of our products than we would have had to otherwise. Some factors which could adversely affect our relationships with our channel partners include the following:

• | we compete with some of our channel partners, including through our direct sales, which may lead these channel partners to use other suppliers that do not directly sell their own products or otherwise compete with them; |

• | some of our channel partners may demand that we absorb a greater share of the risks that their customers may ask them to bear; and |

• | some of our channel partners may have insufficient financial resources and may not be able to withstand changes and challenges in business conditions. |

In addition, we depend on our channel partners globally to comply with applicable regulatory requirements. To the extent that they fail to do so, that could have a material adverse effect on our business, operating results, and financial condition.

Our financial results could be adversely affected if our contracts with channel partners were terminated, if our relationships with channel partners were to deteriorate, if any of our competitors were to enter into strategic relationships with or acquire a significant channel partner or if the financial condition of our channel partners were to weaken. In addition, we may expend time, money and other resources on developing and maintaining channel relationships that are ultimately unsuccessful. There can be no assurance that we will be successful in maintaining, expanding or developing relationships with channel partners. If we are not successful, we may lose sales opportunities, customers and market share. In addition, there could be channel conflict among our varied sales channels, which could harm our business, financial condition and results of operations.

Moreover, the gross margin on our products and services may differ depending upon the channel through which they are sold and we may have greater difficulty in forecasting the mix of our products and the timing of orders from our customers for sales derived from our indirect sales channels. Changes in the balance of our distribution model in future periods therefore may have an adverse effect on our gross margins and profitability.

Customer implementation and installation of our products involves significant resources and is subject to significant risks.

Implementation of our software is a process that often involves a significant commitment of resources by our customers and is subject to a number of significant risks over which we may have little or no control. These risks include in particular:

• | shortages of our trained consultants available to assist customers in the implementation of our products; |

• | system requirements and integrations to our customer’s databases and other software applications that do not meet customer expectations; |

• | software that conflicts with the customer’s business processes; |

• | third-party consultants who do not have the know-how or resources to successfully implement the software; |

• | implementation of the software that is destabilized by custom specific software development or other anomalies in the customer’s environment; and |

• | safeguarding measures recommended or offered by us are not properly implemented by customers and partners. |

Due to these risks, some of our customers have experienced protracted implementation times in connection with the purchase and installation of our software products. In addition, the success of new software products introduced by us may be adversely

13

impacted by the perceived or actual time and cost to implement the software products. We cannot guarantee that we can reduce or eliminate protracted installation times, that shortages of our trained consultants will not occur, or that our costs to perform installation projects will not exceed the fees we receive when fixed fees are charged by us. Accordingly, unsuccessful customer implementation projects could result in increased expenses and claims from customers, harm our reputation, and cause a loss of future revenues.

The migration of our installed base to our newer software-based products involves significant resources and is subject to significant risks.

The majority of maintenance revenue from our installed base is attributable to customers using our legacy contact center products. While we have begun to migrate those customers to our newer software based products, the process will continue for a number of years. Customers who are very satisfied with their current products may be concerned about the risk of disrupting their businesses during a migration. In addition, most migrations require customers to invest in new hardware systems on which our newer products will be installed. Even if our newer products provide additional functionality or are more efficient, certain customers may delay migrations for fear of disruption and/or an unwillingness to invest their internal and financial resources.

Engaging in a migration discussion with customers also carries the risk that such customers will consider replacing our installed products with competitive products. While we try to minimize the potential migration costs and disruptions for customers, some may decide to turn the migration process into a competitive bid process. In these cases, there can be no assurance that we will be able to retain these customers, which could adversely affect our operating results.

Even after a customer decides to undertake a migration to our newer software based products, there are additional execution risks. We may fail to properly scope the project or the customer’s requirements. Our newer products may not be fully compatible with other systems in the customer environment. We may not have trained consultants available on a timely basis to assist the customer with the migration. Any of these risks could delay the migration and disrupt the customer’s business. Accordingly, they could result in increased expenses and claims from customers, harm our reputation, and cause a loss of future revenues.

Our sales to government customers subject us to risks, including early termination, audits, investigations, sanctions and penalties.

These contracts are generally subject to annual fiscal funding approval, may be terminated at the convenience of the government, or both. Termination of a contract or reduced or eliminated funding for a contract could adversely

affect our sales, revenue and reputation. Additionally, government contracts are generally subject to audits and investigations, which could result in various civil and criminal penalties and administrative sanctions, including termination of contracts, refund of a portion of fees received, forfeiture of profits, suspension of payments, fines and suspensions or debarment from doing business with the government.

Consolidation in the software industry may result in unstable and/or decreased demand for our software.

The entire IT sector, including the software industry, has in recent years experienced a period of consolidation through mergers and acquisitions. We expect this trend to continue for the foreseeable future. Although consolidations in the software industry may create market opportunities for remaining entities, any consolidation could create uncertainty among existing and potential customers regarding future IT investment plans. In turn, this could diminish customer demand for our products and services and could result in longer sales cycles as customers determine which company best addresses their needs, which would adversely affect our operating results.

We face intense competition from numerous competitors and, as the enterprise communications and information technology businesses evolve, we may face increased competition from companies that do not currently compete directly against us.

Because we focus on the development and marketing to enterprises of enterprise communications solutions, such as unified communications and contact center solutions, we compete against traditional enterprise voice communications providers, such as Avaya, Siemens, Genesys Labratories, Alcatel-Lucent and data networking companies, such as Cisco Systems, Inc., and software based competitors such as Interactive Intelligence, NICE, Verint, Altitude Software and Noble Corporation. We also face competition in the small and medium enterprise market from many competitors, including Cisco, Alcatel-Lucent, Mitel Networks Corp, and Shoretel, Inc., although the market for these products is more fragmented. We face competition in certain geographies with companies that have a particular strength and focus in these regions, such as Huawei in China. Our services division competes with companies like those above in offering services with respect to their own product offerings, as well as with many value added resellers, consulting and systems integration firms and network service providers.

14

Because the market for our products is subject to rapid technological change, as the market evolves we may face competition in the future from companies that do not currently compete in the enterprise communications market, but whose current business activities may bring them into competition with us in the future. In particular, as the convergence of enterprise voice and data networks becomes more widely deployed by enterprises, the business, information technology and communication applications deployed on converged networks become more integrated. We may face increased competition from current leaders in information technology infrastructure, information technology, personal and business applications and the software that connects the network infrastructure to those applications. We may also face competition from companies that seek to sell remotely hosted services or software as a service directly to the end customer that are moving into the enterprise market. Competition from these potential market entrants may take many forms, including offering products and applications similar to those we offer as part of another product offering. In addition, these technologies continue to move from a proprietary environment to an open standards-based environment.

The principal competitive factors affecting the market for our professional services include responsiveness to customer needs, breadth and depth of technical skills offered, availability and productivity of personnel, ability to demonstrate achievement of results and price. There is no assurance that we will be able to compete successfully in the future.

Several of our existing competitors have, and many of our future competitors may have, greater financial, personnel, research and development and other resources, more well-established brands or reputations and broader customer

bases than we do and, as a result, these competitors may be in a stronger position to respond quickly to potential acquisitions and other market opportunities, new or emerging technologies and changes in customer requirements. Some of these competitors may have customer bases that are more geographically balanced than ours and, therefore, may be less affected by an economic downturn in a particular region. Competitors with greater resources also may be able to offer lower prices, additional products or services or other incentives that we cannot match or do not offer. Industry consolidations may also create competitors with broader and more geographic coverage and the ability to reach enterprises through more channels.

Existing customers of data networking companies that compete against us may be inclined to purchase enterprise communications solutions from their current data networking or software vendors rather than from us. Also, as communications and data networks converge, we may face competition from systems integrators that traditionally have been focused on data network integration. We cannot predict which competitors may enter our markets in the future, what form such competition may take or whether we will be able to respond effectively to the entry of new competitors into competition with us or the rapid evolution in technology and product development that has characterized our businesses. In addition, in order to effectively compete with any new market entrant, we may need to make additional investments in our business, use more capital resources than our business currently requires or reduce prices, any of which may materially and adversely affect our profitability.

Our Cloud-Based Applications Present Execution and Competitive Risks

We are devoting significant resources to extend our cloud-based alternative to our traditional, on-premises offerings. Certain competitors offer alternative cloud-based services. While we believe our expertise, investments in infrastructure, and the breadth of our cloud-based services provide us with a solid foundation to compete, it is uncertain whether our strategies will attract the users or generate the revenue required to be successful. In addition to certain software development costs, we may incur costs to build and maintain infrastructure to support cloud-based services. These costs could negatively impact our operating margins. Whether we are successful in this new business model depends on our execution in a number of areas, including:

• | continuing to innovate and bring to market compelling cloud-based experiences that generate increasing traffic, |

• | improving the performance of our cloud-based services, and |

• | continuing to enhance the attractiveness of our cloud-based platforms to partners. |

The occurrence of cyber incidents, or a deficiency in our cybersecurity, could negatively impact our business by causing a disruption to our operations, a compromise or corruption of our confidential information, and/or damage to our brand image, all of which could negatively impact our financial results.

A cyber incident is considered to be any adverse event that threatens the confidentiality, integrity, or availability of our information resources. More specifically, a cyber incident is an intentional attack or an unintentional event that can include gaining unauthorized access to systems to disrupt operations, corrupt data, or steal confidential information. As our reliance on technology has increased, so have the risks posed to our systems, both internal and those we have outsourced. Our three primary risks that could directly result from the occurrence of a cyber incident include operational interruption, damage to our brand image, and private data exposure. We have implemented solutions, processes, and procedures to help mitigate this risk, such as creating a proactive internal oversight function to evaluate and address our risks related to cybersecurity, but these measures, as well as our organization’s increased awareness of our risk of a cyber incident, do not guarantee that our financial results will not be negatively impacted by such an incident.

15

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control, and any failure to meet our debt service obligations could harm our business, financial condition and results of operations.

Our ability to make payments on and to refinance our indebtedness, and to fund working capital needs and planned capital expenditures will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, business, legislative, regulatory and other factors that are beyond our control.

If our business does not generate sufficient cash flow from operations or if future borrowings are not available to us in an amount sufficient to enable us to pay our indebtedness or to fund our other liquidity needs, we may need to refinance all or a portion of our indebtedness, on or before the maturity thereof, sell assets, reduce or delay capital investments or seek to raise additional capital, any of which could have a material adverse effect on our operations. In addition, we may not be able to affect any of these actions, if necessary, on commercially reasonable terms or at all. Our ability to restructure or refinance our indebtedness will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. The terms of existing or future debt instruments may limit or prevent us from taking any of these actions. In addition, any failure to make scheduled payments of interest and principal on our outstanding indebtedness would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness on commercially reasonable terms or at all. Our inability to generate sufficient cash flow to satisfy our debt service obligations, or to refinance or restructure our obligations on commercially reasonable terms or at all, would have an adverse effect, which could be material, on our business, financial condition and results of operations, as well as on our ability to satisfy our debt obligations.

In addition, if we are unable to meet our debt service obligations, the holders would have the right following a cure period to cause the entire principal amount to become immediately due and payable. If the amounts outstanding under these instruments are accelerated, we cannot assure you that our assets will be sufficient to repay in full the money owed to our debt holders.

The agreements governing our outstanding indebtedness impose significant operating and financial restrictions on our company and our subsidiaries, which may prevent us from capitalizing on business opportunities.

The agreements governing our outstanding indebtedness impose significant operating and financial restrictions on us. These restrictions limit our ability, among other things, to:

• | incur additional indebtedness; |

• | pay certain dividends or make certain distributions on our capital stock or repurchase our capital stock; |

• | make certain capital expenditures; |

• | make certain investments or other restricted payments; |

• | place restrictions on the ability of subsidiaries to pay dividends or make other payments to us; |

• | engage in transactions with affiliates; |

• | sell certain assets or merge with or into other companies; |

• | guarantee indebtedness; and |

• | create liens. |

As a result of these covenants and restrictions, we are and will be limited in how we conduct our business, and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. The terms of any future indebtedness we may incur could include more restrictive covenants. We cannot assure you that we will be able to maintain compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the lenders and/or amend the covenants.

Our failure to comply with the restrictive covenants described above as well as others contained in our revolving credit facility from time to time could result in an event of default, which, if not cured or waived, could result in our being required to repay these borrowings before their due date. If we are forced to refinance these borrowings on less favorable terms, our results of operations and financial condition could be adversely affected.

16

Our failure to comply with the agreements relating to our outstanding indebtedness, including as a result of events beyond our control, could result in an event of default that could materially and adversely affect our results of operations and our financial condition.

If there were an event of default under any of the agreements relating to our outstanding indebtedness, the holders of the defaulted debt could cause all amounts outstanding with respect to that debt to be due and payable immediately. We cannot assure you that our assets or cash flow would be sufficient to fully repay borrowings under our outstanding debt instruments if accelerated upon an event of default. Further, if we are unable to repay, refinance or restructure our indebtedness under our secured debt, the holders of such debt could proceed against the collateral securing that indebtedness. In addition, any event of default or declaration of acceleration under one debt instrument could also result in an event of default under one or more of our other debt instruments. In addition, counterparties to some of our long-term customer contracts may have the right to amend or terminate those contracts if we have an event of default or a declaration of acceleration under certain of our indebtedness, which could adversely affect our business, financial condition or results of operations. Last, we could be forced into bankruptcy or liquidation. As a result, any default by us on our indebtedness could have a material adverse effect on our business and could impact our ability to make payments.

We may have exposure to additional tax liabilities.

As a multinational corporation, we are subject to income taxes in the U.S. and various foreign jurisdictions. Significant judgment is required in determining our global provision for income taxes and other tax liabilities. In the ordinary course of a global business, there are many intercompany transactions and calculations where the ultimate tax determination is uncertain. Our income tax returns are routinely subject to audits by tax authorities. Although we regularly assess the likelihood of adverse outcomes resulting from these examinations to determine our tax estimates, a final determination of tax audits or tax disputes could have an adverse effect on our results of operations and financial condition.

We are also subject to non-income taxes, such as payroll, sales, use, value-added, net worth, property and goods and services taxes in the U.S. and various foreign jurisdictions. We are regularly under audit by tax authorities with respect to these non-income taxes and may have exposure to additional non-income tax liabilities which could have an adverse effect on our results of operations and financial condition.

In addition, our future effective tax rates could be favorably or unfavorably affected by changes in tax rates, changes in the valuation of our deferred tax assets or liabilities, or changes in tax laws or their interpretation. Such changes could have a material adverse impact on our financial results.

We may experience significant errors or security flaws in our products and services.

Despite testing prior to their release, software products frequently contain errors or security flaws, especially when first introduced or when new versions are released. The detection and correction of any security flaws can be time consuming and costly. Errors in our software products could affect the ability of our products to work with other hardware or software products, could delay the development or release of new products or new versions of products and could adversely affect market acceptance of our products. If we experience errors or delays in releasing new products or new versions of products, we could lose revenues. In addition, we run our own business operations and support and professional services on our products and networks and any security flaws, if exploited, could affect our ability to conduct internal business operations. End users, who rely on our products and services for applications that are critical to their businesses, may have a greater sensitivity to product errors and security vulnerabilities than customers for software products generally. Software product errors and security flaws in our products or services could expose us to product liability, performance and/or warranty claims as well as harm our reputation, which could impact our future sales of products and services. In addition, recent and future developments in information security laws and regulations may require us to publicly report security breaches of our products or services, which could adversely impact future business prospects for those products or services.

We depend on technology licensed to us by third parties, and the loss of this technology could delay implementation of our products or force us to pay higher license fees.