Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NACCO INDUSTRIES INC | d892746d8k.htm |

Exhibit 99

NACCO Industries, Inc.

Strategic 2014 Annual Update Report

NACCO Industries, Inc. at a Glance

Principal Businesses

North Headquarters: American Dallas, Coal Texas (“NACoal”)

North American Coal mines and markets steam and metallurgical coal for use in power generation and steel production and provides selected value-added mining services for other natural resources companies. North American Coal operates eight surface coal mining operations and has two additional coal mines under development.

The company also provides dragline mining services operating under the name “North American Mining Company” for independently owned limerock quarries in Florida.

Financial Results

NACoal:

Revenues: $172.7 million Operating loss: $89.0 million Net loss: $51.0 million Adjusted income:(1) $15.5 million Equity: $103.1 million Return on Equity:(1) (36.5%) Return on Capital Employed:(1) (15.0%)

Market Positions

NACoal:

North American Coal is among the ten largest coal producers in the United States.

Coal is delivered from developed mines in North Dakota, Texas, Mississippi, Louisiana and Alabama, primarily to adjacent or nearby power plants.

Hamilton Headquarters: Beach Richmond, Brands Virginia (“HBB”)

HBB is a leading designer, marketer and distributor of small electric household and specialty housewares appliances, as well as commercial products for restaurants, bars and hotels.

HBB has a broad portfolio of some of the most recognized and respected brands in the small electric appliance industry, including Hamilton Beach®, Proctor Silex®, Hamilton Beach® Commercial and Weston®. HBB also sells products under licensed brands such as Jamba® and Wolf Gourmet®.

Headquarters: Kitchen Collection Chillicothe, Ohio

Kitchen Collection is a national specialty retailer of kitchenware in outlet and traditional malls throughout the United States.

HBB:

Revenues: $559.7 million Operating profit: $35.8 million Net income: $23.1 million Equity: $49.6 million Return on Equity:(1) 43.2% Return on Capital Employed:(1) 28.7%

Kitchen Collection:

Revenues: $168.5 million Operating loss: $7.1 million Net loss: $4.6 million Equity: $32.2 million Return on Equity:(1) (14.3%) Return on Capital Employed:(1) (11.4%)

HBB:

HBB is a leading company in retail and commercial small appliances, with strong share positions in many of the categories in which it competes. HBB products are primarily distributed through mass merchants, national department stores, wholesale distributors and other retail sales outlets.

Kitchen Collection:

Kitchen Collection is the nation’s leading specialty retailer of kitchen and related products in factory outlet malls with 248 stores throughout the United States at December 31, 2014.

(1) This Annual Report contains references to non-GAAP financial measures. Presentations of, and quantitative reconciliations to, the most directly comparable financial measures calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”) appear on page 14.

| * |

|

Jamba® is a registered trademark of the Jamba Juice Company. |

** Wolf Gourmet® is a registered trademark of the Sub-Zero Group, Inc.

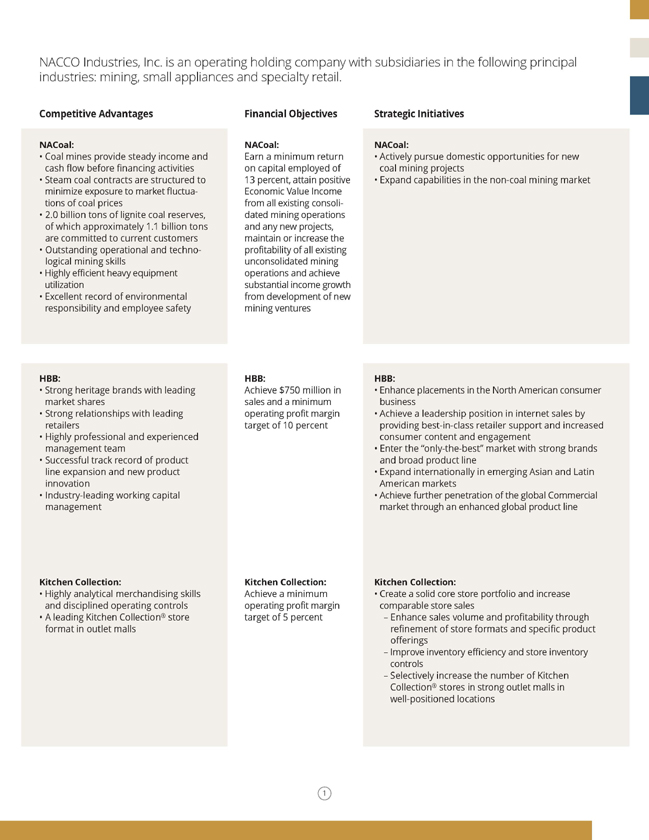

NACCO Industries, Inc. is an operating holding company with subsidiaries in the following principal industries: mining, small appliances and specialty retail.

Competitive Advantages NACoal: Coal mines provide steady income and cash flow before financing activities

Steam coal contracts are structured to minimize exposure to market fluctuations of coal prices

2.0 billion tons of lignite coal reserves, of which approximately 1.1 billion tons are committed to current customers

Outstanding operational and technological mining skills Highly efficient heavy equipment utilization

Excellent record of environmental responsibility and employee safety

Financial Objectives NACoal: Earn a minimum return on capital employed of 13 percent, attain positive Economic Value Income from all existing consolidated mining operations and any new projects, maintain or increase the profitability of all existing unconsolidated mining operations and achieve substantial income growth from development of new mining ventures

Strategic Initiatives NACoal: Actively pursue domestic opportunities for new coal mining projects

Expand capabilities in the non-coal mining market HBB: Strong heritage brands with leading market shares Strong relationships with leading retailers

Highly professional and experienced management team Successful track record of product line expansion and new product innovation

Industry-leading working capital management HBB: Achieve $750 million in sales and a minimum operating profit margin target of 10 percent HBB:

Enhance placements in the North American consumer business Achieve a leadership position in internet sales by providing best-in-class retailer support and increased consumer content and engagement Enter the “only-the-best” market with strong brands and broad product line

Expand internationally in emerging Asian and Latin American markets Achieve further penetration of the global Commercial market through an enhanced global product line

Kitchen Collection: Highly analytical merchandising skills and disciplined operating controls A leading Kitchen Collection® store format in outlet malls

Kitchen Collection: Achieve a minimum operating profit margin target of 5 percent Kitchen Collection: Create a solid core store portfolio and increase comparable store sales

– Enhance sales volume and profitability through refinement of store formats and specific product offerings

– Improve inventory efficiency and store inventory controls

– Selectively increase the number of Kitchen Collection® stores in strong outlet malls in well-positioned locations 1

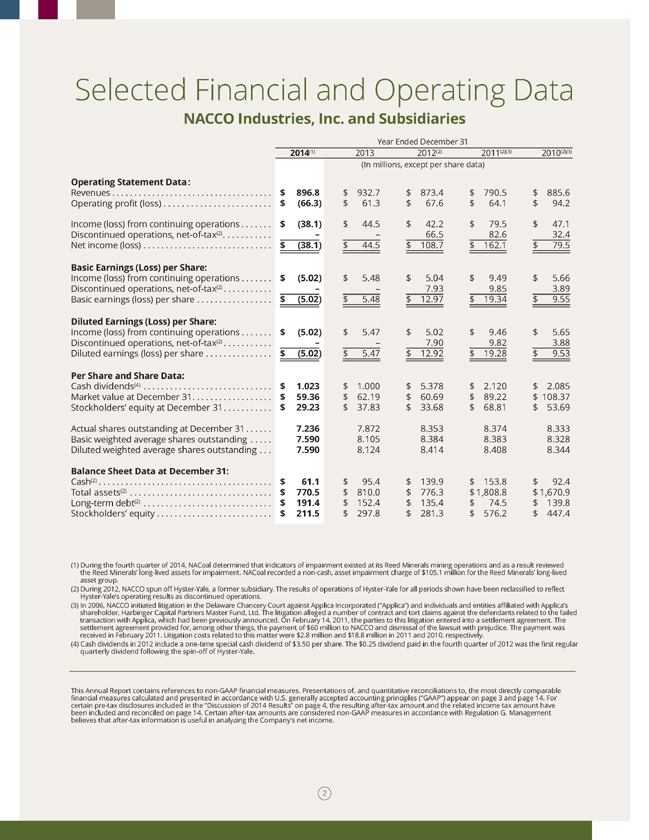

Selected Financial and Operating Data

NACCO Industries, Inc. and Subsidiaries

Year Ended December 31

2014(1) 2013 2012(2) 2011(2)(3) 2010(2)(3)

(In millions, except per share data)

Operating Statement Data:

Revenues $896.8 $932.7 $873.4 $790.5 $885.6

Operating profit (loss) $(66.3) $61.3 $67.6 $64.1 $94.2

Income (loss) from continuing operations $(38.1) $44.5 $42.2 $79.5 $47.1

Discontinued operations, net-of-tax(2) – – 66.5 82.6 32.4

Net income (loss) $(38.1) $44.5 $108.7 $162.1 $79.5

Basic Earnings (Loss) per Share:

Income (loss) from continuing operations $(5.02) $5.48 $5.04 $9.49 $5.66

Discontinued operations, net-of-tax(2) – – 7.93 9.85 3.89

Basic earnings (loss) per share $(5.02) $5.48 $12.97 $19.34 $9.55

Diluted Earnings (Loss) per Share:

Income (loss) from continuing operations $(5.02) $5.47 $5.02 $9.46 $5.65

Discontinued operations, net-of-tax(2) – – 7.90 9.82 3.88

Diluted earnings (loss) per share $(5.02) $5.47 $12.92 $19.28 $9.53

Per Share and Share Data:

Cash dividends(4) $1.023 $1.000 $5.378 $2.120 $2.085

Market value at December 31. $59.36 $62.19 $60.69 $89.22 $108.37

Stockholders’ equity at December 31 $29.23 $37.83 $33.68 $68.81 $53.69

Actual shares outstanding at December 31 7.236 7.872 8.353 8.374 8.333

Basic weighted average shares outstanding 7.590 8.105 8.384 8.383 8.328

Diluted weighted average shares outstanding 7.590 8.124 8.414 8.408 8.344

Balance Sheet Data at December 31:

Cash(2) $61.1 $95.4 $139.9 $153.8 $92.4

Total assets(2) $770.5 $810.0 $776.3 $1,808.8 $1,670.9

Long-term debt(2) $191.4 $152.4 $135.4 $74.5 $139.8

Stockholders’ equity $211.5 $297.8 $281.3 $576.2 $447.4

(1) During the fourth quarter of 2014, NACoal determined that indicators of impairment existed at its Reed Minerals mining operations and as a result reviewed the Reed Minerals’ long-lived assets for impairment. NACoal recorded a non-cash, asset impairment charge of $105.1 million for the Reed Minerals’ long-lived asset group.

(2) During 2012, NACCO spun off Hyster-Yale, a former subsidiary. The results of operations of Hyster-Yale for all periods shown have been reclassified to reflect Hyster-Yale’s operating results as discontinued operations.

(3) In 2006, NACCO initiated litigation in the Delaware Chancery Court against Applica Incorporated (“Applica”) and individuals and entities affiliated with Applica’s shareholder, Harbinger Capital Partners Master Fund, Ltd. The litigation alleged a number of contract and tort claims against the defendants related to the failed transaction with Applica, which had been previously announced. On February 14, 2011, the parties to this litigation entered into a settlement agreement. The settlement agreement provided for, among other things, the payment of $60 million to NACCO and dismissal of the lawsuit with prejudice. The payment was received in February 2011. Litigation costs related to this matter were $2.8 million and $18.8 million in 2011 and 2010, respectively.

(4) Cash dividends in 2012 include a one-time special cash dividend of $3.50 per share. The $0.25 dividend paid in the fourth quarter of 2012 was the first regular quarterly dividend following the spin-off of Hyster-Yale.

This Annual Report contains references to non-GAAP financial measures. Presentations of, and quantitative reconciliations to, the most directly comparable financial measures calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”) appear on page 3 and page 14. For certain pre-tax disclosures included in the “Discussion of 2014 Results” on page 4, the resulting after-tax amount and the related income tax amount have been included and reconciled on page 14. Certain after-tax amounts are considered non-GAAP measures in accordance with Regulation G. Management believes that after-tax information is useful in analyzing the Company’s net income.

| 2 |

|

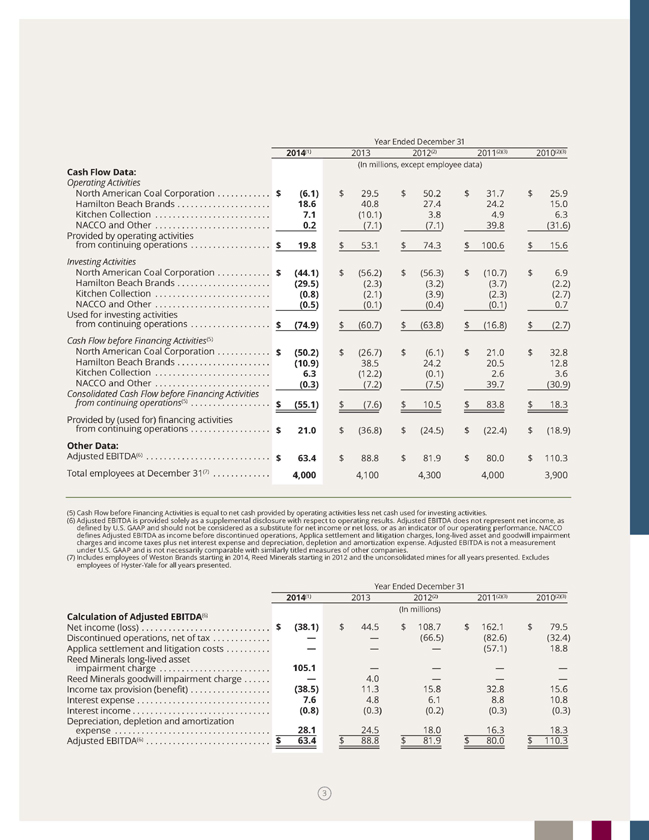

Year Ended December 31

2014(1) 2013 2012(2) 2011(2)(3) 2010(2)(3)

Cash Flow Data: (In millions, except employee data)

Operating Activities

North American Coal Corporation $(6.1) $29.5 $50.2 $31.7 $25.9

Hamilton Beach Brands 18.6 40.8 27.4 24.2 15.0

Kitchen Collection 7.1 (10.1) 3.8 4.9 6.3

NACCO and Other 0.2 (7.1) (7.1) 39.8 (31.6)

Provided from continuing by operating operations activities $19.8 $53.1 $74.3 $100.6 $15.6

Investing Activities

North American Coal Corporation $(44.1) $(56.2) $(56.3) $(10.7) $6.9

Hamilton Beach Brands (29.5) (2.3) (3.2) (3.7) (2.2)

Kitchen Collection (0.8) (2.1) (3.9) (2.3) (2.7)

NACCO and Other (0.5) (0.1) (0.4) (0.1) 0.7

Used from for continuing investing activities operations $(74.9) $(60.7) $(63.8) $(16.8) $(2.7)

Cash Flow before Financing Activities(5)

North American Coal Corporation $(50.2) $(26.7) $(6.1) $21.0 $32.8

Hamilton Beach Brands (10.9) 38.5 24.2 20.5 12.8

Kitchen Collection 6.3 (12.2) (0.1) 2.6 3.6

Consolidated NACCO and Cash Other Flow before Financing Activities (0.3) (7.2) (7.5) 39.7 (30.9)

from continuing operations(5) $(55.1) $(7.6) $10.5 $83.8 $18.3

Provided from continuing by (used for) operations financing activities $21.0 $(36.8) $(24.5) $(22.4) $(18.9)

Other Data:

Adjusted EBITDA(6) $63.4 $88.8 $81.9 $80.0 $110.3

Total employees at December 31(7) 4,000 4,100 4,300 4,000 3,900

(5) Cash Flow before Financing Activities is equal to net cash provided by operating activities less net cash used for investing activities.

(6) Adjusted EBITDA is provided solely as a supplemental disclosure with respect to operating results. Adjusted EBITDA does not represent net income, as defined by U.S. GAAP and should not be considered as a substitute for net income or net loss, or as an indicator of our operating performance. NACCO defines Adjusted EBITDA as income before discontinued operations, Applica settlement and litigation charges, long-lived asset and goodwill impairment charges and income taxes plus net interest expense and depreciation, depletion and amortization expense. Adjusted EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies.

(7) Includes employees of Weston Brands starting in 2014, Reed Minerals starting in 2012 and the unconsolidated mines for all years presented. Excludes employees of Hyster-Yale for all years presented.

2014(1) 2013 2012(2) 2011(2)(3) 2010(2)(3)

Calculation of Adjusted EBITDA(6) (In millions)

Net income (loss) $(38.1) $44.5 $108.7 $162.1 $79.5

Discontinued operations, net of tax — — (66.5) (82.6) (32.4)

Applica settlement and litigation costs — — — (57.1) 18.8

Reed impairment Minerals long-lived charge asset 105.1 — — — —

Reed Minerals goodwill impairment charge — 4.0 — — —

Income tax provision (benefit) (38.5) 11.3 15.8 32.8 15.6

Interest expense 7.6 4.8 6.1 8.8 10.8

Interest income (0.8) (0.3) (0.2) (0.3) (0.3)

Depreciation,expense depletion and amortization 28.1 24.5 18.0 16.3 18.3

Adjusted EBITDA(6) $63.4 $88.8 $81.9 $80.0 $110.3

| 3 |

|

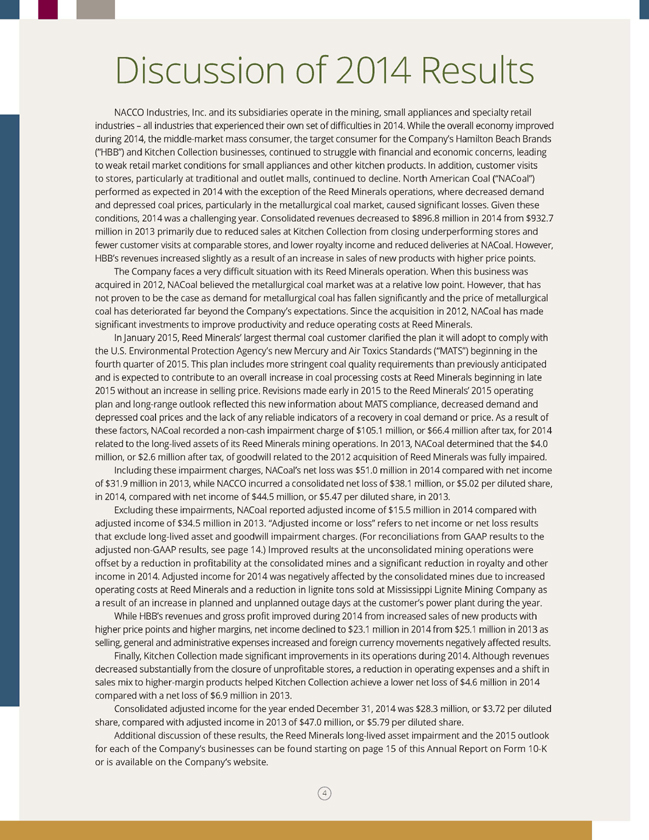

Discussion of 2014 Results

NACCO Industries, Inc. and its subsidiaries operate in the mining, small appliances and specialty retail industries – all industries that experienced their own set of di?culties in 2014. While the overall economy improved during 2014, the middle-market mass consumer, the target consumer for the Company’s Hamilton Beach Brands (“HBB”) and Kitchen Collection businesses, continued to struggle with ?nancial and economic concerns, leading to weak retail market conditions for small appliances and other kitchen products. In addition, customer visits to stores, particularly at traditional and outlet malls, continued to decline. North American Coal (“NACoal”) performed as expected in 2014 with the exception of the Reed Minerals operations, where decreased demand and depressed coal prices, particularly in the metallurgical coal market, caused signi?cant losses. Given these conditions, 2014 was a challenging year. Consolidated revenues decreased to $896.8 million in 2014 from $932.7 million in 2013 primarily due to reduced sales at Kitchen Collection from closing underperforming stores and fewer customer visits at comparable stores, and lower royalty income and reduced deliveries at NACoal. However, HBB’s revenues increased slightly as a result of an increase in sales of new products with higher price points.

The Company faces a very di?cult situation with its Reed Minerals operation. When this business was acquired in 2012, NACoal believed the metallurgical coal market was at a relative low point. However, that has not proven to be the case as demand for metallurgical coal has fallen signi?cantly and the price of metallurgical coal has deteriorated far beyond the Company’s expectations. Since the acquisition in 2012, NACoal has made signi?cant investments to improve productivity and reduce operating costs at Reed Minerals.

In January 2015, Reed Minerals’ largest thermal coal customer clari?ed the plan it will adopt to comply with the U.S. Environmental Protection Agency’s new Mercury and Air Toxics Standards (“MATS”) beginning in the fourth quarter of 2015. This plan includes more stringent coal quality requirements than previously anticipated and is expected to contribute to an overall increase in coal processing costs at Reed Minerals beginning in late 2015 without an increase in selling price. Revisions made early in 2015 to the Reed Minerals’ 2015 operating plan and long-range outlook re?ected this new information about MATS compliance, decreased demand and depressed coal prices and the lack of any reliable indicators of a recovery in coal demand or price. As a result of these factors, NACoal recorded a non-cash impairment charge of $105.1 million, or $66.4 million after tax, for 2014 related to the long-lived assets of its Reed Minerals mining operations. In 2013, NACoal determined that the $4.0 million, or $2.6 million after tax, of goodwill related to the 2012 acquisition of Reed Minerals was fully impaired.

Including these impairment charges, NACoal’s net loss was $51.0 million in 2014 compared with net income of $31.9 million in 2013, while NACCO incurred a consolidated net loss of $38.1 million, or $5.02 per diluted share, in 2014, compared with net income of $44.5 million, or $5.47 per diluted share, in 2013.

Excluding these impairments, NACoal reported adjusted income of $15.5 million in 2014 compared with adjusted income of $34.5 million in 2013. “Adjusted income or loss” refers to net income or net loss results that exclude long-lived asset and goodwill impairment charges. (For reconciliations from GAAP results to the adjusted non-GAAP results, see page 14.) Improved results at the unconsolidated mining operations were o?set by a reduction in pro?tability at the consolidated mines and a signi?cant reduction in royalty and other income in 2014. Adjusted income for 2014 was negatively a?ected by the consolidated mines due to increased operating costs at Reed Minerals and a reduction in lignite tons sold at Mississippi Lignite Mining Company as a result of an increase in planned and unplanned outage days at the customer’s power plant during the year.

While HBB’s revenues and gross pro?t improved during 2014 from increased sales of new products with higher price points and higher margins, net income declined to $23.1 million in 2014 from $25.1 million in 2013 as selling, general and administrative expenses increased and foreign currency movements negatively a?ected results.

Finally, Kitchen Collection made signi?cant improvements in its operations during 2014. Although revenues decreased substantially from the closure of unpro?table stores, a reduction in operating expenses and a shift in sales mix to higher-margin products helped Kitchen Collection achieve a lower net loss of $4.6 million in 2014 compared with a net loss of $6.9 million in 2013.

Consolidated adjusted income for the year ended December 31, 2014 was $28.3 million, or $3.72 per diluted share, compared with adjusted income in 2013 of $47.0 million, or $5.79 per diluted share.

Additional discussion of these results, the Reed Minerals long-lived asset impairment and the 2015 outlook for each of the Company’s businesses can be found starting on page 15 of this Annual Report on Form 10-K or is available on the Company’s website.

| 4 |

|

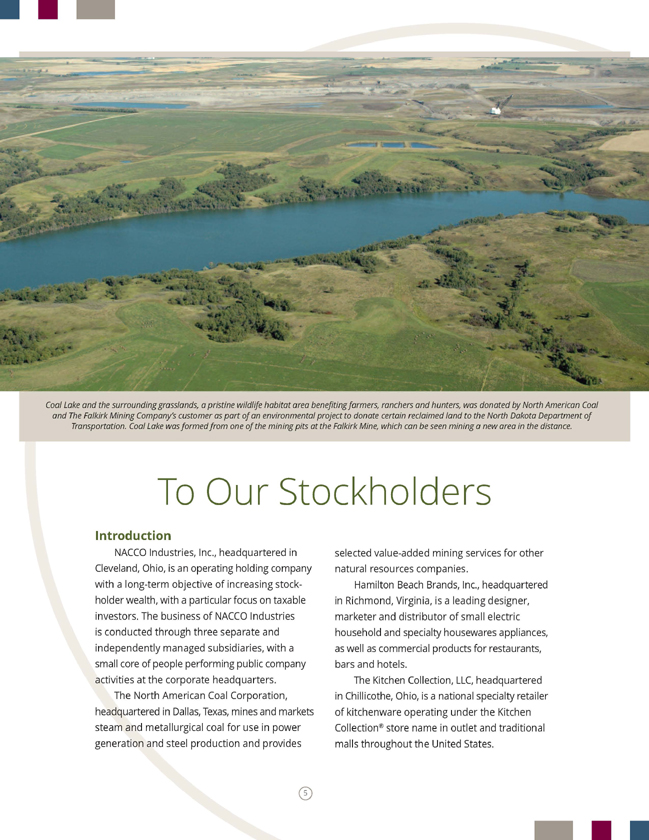

Coal Lake and the surrounding grasslands, a pristine wildlife habitat area benefiting farmers, ranchers and hunters, was donated by North American Coal and The Falkirk Mining Company’s customer as part of an environmental project to donate certain reclaimed land to the North Dakota Department of Transportation. Coal Lake was formed from one of the mining pits at the Falkirk Mine, which can be seen mining a new area in the distance.

To Our Stockholders

Introduction

NACCO Industries, Inc., headquartered in Cleveland, Ohio, is an operating holding company with a long-term objective of increasing stockholder wealth, with a particular focus on taxable investors. The business of NACCO Industries is conducted through three separate and independently managed subsidiaries, with a small core of people performing public company activities at the corporate headquarters.

The North American Coal Corporation, headquartered in Dallas, Texas, mines and markets steam and metallurgical coal for use in power generation and steel production and provides selected value-added mining services for other natural resources companies.

Hamilton Beach Brands, Inc., headquartered in Richmond, Virginia, is a leading designer, marketer and distributor of small electric household and specialty housewares appliances, as well as commercial products for restaurants, bars and hotels.

The Kitchen Collection, LLC, headquartered in Chillicothe, Ohio, is a national specialty retailer of kitchenware operating under the Kitchen Collection® store name in outlet and traditional malls throughout the United States.

| 5 |

|

North American Coal

Unconsolidated Mines

North American Coal (“NACoal”) employs a different business model than most other coal industry participants. A large majority of NACoal’s mines operate under contracts to supply coal to an individual customer’s power plant for a long period of time, often for decades. The mines and the customer facilities are in close proximity, often adjacent to one another. These contracts include “cost-plus” pricing terms under which NACoal’s compensation includes all operating costs, plus a comparatively small but consistent amount of agreed profit on tons or heating units (btu) delivered. All but two of NACoal’s coal mining operations operate pursuant to cost-plus contracts. This contractual approach also applies to NACoal’s value-added service operations, such as its Florida dragline mining operations, where NACoal personnel operate and maintain draglines for extraction of limerock at customer-owned limerock mines.

While the pre-tax profits generated from these mines are included in NACoal’s income statement, these mines, which are referred to as the “unconsolidated mines,” are not consolidated in the Company’s financial statements. Financing for these mines is supported by, or in some instances, actually provided by customers to minimize costs. NACoal and its customers believe strongly that these long-term contracts fully align the long-term interests of the mine and the customer facility in a way that assures low costs for the customer over the long term. NACoal’s analysis of historical data supports that conclusion.

Consolidated Mines

Two of NACoal’s coal mines, one in Mississippi and one in Alabama, operate pursuant to a more traditional business model, where NACoal provides the capital for the mine and sells coal produced to customers. These mines are referred to as the “consolidated mines” because they are consolidated in the Company’s financial statements. At Mississippi Lignite Mining Company (“MLMC”), coal is delivered to a single power plant which is adjacent to the mine. MLMC’s coal prices are fixed, but they escalate pursuant to established indices over time and are not subject to spot coal market fluctuations. MLMC’s contract expires in 2032.

The Centennial Natural Resources coal mining business in Alabama, formerly known as Reed Minerals until the beginning of 2015, was acquired in August 2012 as the foundation of what was expected to become a metallurgical coal platform for NACoal. Key to this acquisition was an existing multi-year contract to sell a majority of the coal produced as steam coal for use by a significant U.S.-based public utility. NACoal viewed this contract as providing stability against the recognized volatility in the market for metallurgical coal, which accounted for the balance of Centennial’s coal production. Centennial is the only part of NACoal’s business that has any exposure to fluctuations in spot coal prices.

When this business was acquired in 2012, the Company believed the metallurgical coal market was at a relative low point. Market analysis at the time of the acquisition indicated that the metallurgical coal market was close to bottom and suggested that improvements in both price and demand were on the horizon. That analysis was proven to be incorrect as global demand for metallurgical coal has fallen significantly, including in important export markets such as China, and the price for metallurgical coal has deteriorated far beyond what NACoal expected. Customer

| 6 |

|

A new dragline and surface miner were put into service in 2014 at North American Coal’s newest mine, Caddo Creek Resources Company, which commenced delivering coal in late 2014.

demand and pricing for all types of coal in the Alabama market have declined and remain weak. Clearly this result is very disappointing to us and to our stockholders. In addition, we now believe regulatory changes on the immediate horizon, including the Environmental Protection Agency’s costly and controversial Mercury and Air Toxics Standards regulation, which requires significant reductions in mercury emissions from power plants, will increase Centennial’s operating costs without corresponding increases in coal selling prices. These pricing, demand and regulatory pressures led to recognition of a very substantial non-cash impairment charge related to the Centennial mining operations’ long-lived assets

for the fourth quarter of 2014. This non-cash accounting charge does not impact the Company’s cash flow from operations.

NACoal faces a very difficult situation with the Centennial operation. Until markets improve, the Centennial business will be managed based on cash generation. The management team is right-sizing operations in line with conservative volume estimates, altering mining plans, investigating less costly coal processing methods, managing production volumes to optimize cash flow, evaluating capital employed and considering sales of non-core assets if appropriate. The Company believes that efforts to manage the business around conservative volume expectations and manage for cash will help position this business to take advantage of any rebound in the coal market that may occur over time.

Safety and Environmental Excellence

NACoal consistently ranks among the safest and most environmentally responsible coal mining companies in the country. In 2014, the Mine Safety and Health Administration (MSHA) listed NACoal as the safest large coal mining company in the country. Safety is at the very core of NACoal’s culture, embedded deeply in employee training programs, operating procedures and best practices shared among all of NACoal’s operations.

NACoal’s permitting, mining and reclamation activities utilize state-of-the-art technology and a commitment to excellence to ensure that activities comply with, or exceed, legal requirements. Work on the mine site is performed with the greatest degree of care to ensure that land is returned to a productive natural state. Frequently, NACoal employees and their families are farmers, ranchers and outdoorsmen who live near mining areas.

| 7 |

|

They care deeply about the land, water and wildlife where they live and are excellent stewards. As representative evidence of this corporate and individual commitment to the environment, MLMC received one of only three 2014 Excellence in Surface Coal Mining Reclamation Awards from the U.S. Department of the Interior’s Office of Surface Mining and Reclamation.

Strategic Initiatives and Long-Term View

NACoal’s unconsolidated operations, which constitute a large majority of its earnings and cash flow capabilities, provide a strong core to NACoal’s business model. NACoal has been very fortunate to enter into six new agreements over the last several years to develop new mines or provide services to customers. Generally, the power plants served by NACoal are among the lower-cost producers of electricity on their respective grids. NACoal expects to continue to be a low-cost miner of coal at existing mines and its mines in development, in support of customer needs. Over the longer term, NACoal’s goal is to increase earnings of its unconsolidated operations by approximately 50 percent by 2017 over 2012 results through the development and maturation of its new mines in development and normal escalation of contractual compensation at its existing unconsolidated mines. NACoal continues to anticipate it will achieve this goal.

NACoal also has had a goal of at least doubling the earnings contribution of its consolidated mining operations by 2017 from 2012 levels due to benefits from anticipated continued operational improvements at MLMC’s customer’s power plant and from the company’s execution of its long-term plan at the Centennial operations. While NACoal continues to expect meaningful improvements of financial results at the MLMC mine compared

to 2012, the outlook at Centennial is poor at this time due to low coal prices, low demand and the aforementioned regulatory challenges. We currently are not prepared to forecast significant GAAP earnings at Centennial, and will not until these price and demand conditions improve.

NACoal expects to continue its record of operational excellence in safety, environmental stewardship and production at each of its mining operations and, over time, to deliver profitability that exceeds its financial objectives, with the exception of the Centennial operations.

Given the current unsupportive regulatory environment for developing new traditional coal-fired power plants, and based on lessons learned at Centennial, NACoal is taking a very disciplined approach with respect to growth. Opportunities may exist, although limited, to provide coal to customers for use other than as a power-generation fuel, or to serve as a cost-plus contract miner for non-coal operations, such as aggregates or other minerals. Also, strategic growth could possibly come from projects based on new technologies that utilize coal, such as integrated gasification combined-cycle power generation, and production of alternative fuels made from coal, as well as other clean coal technologies and non-traditional products derived from coal. NACoal is working with a range of technical experts and potential partners who could help develop projects based on these advanced technologies. However, any significant growth in domestic opportunities is largely dependent on the United States adopting a more balanced energy policy in which coal continues to play a key role, including through new coal technologies.

NACoal believes that a large majority of consumers in the United States will benefit

| 8 |

|

from a domestic energy policy that balances affordability, energy needs and environmental responsibility. The company believes that, for the foreseeable future, coal must remain an integral part of the nation’s total energy mix for the United States to continue to be competitive in a global economy. NACoal will continue to monitor pending regulations and legislation and will take a leadership role to help encourage reasonable regulation by the government. Importantly, NACoal expects to address currently anticipated changes to domestic environmental regulatory requirements by working collaboratively with its customers, trade associations, representatives of regulatory bodies, and government officials.

Hamilton Beach Brands’ new Wolf Gourmet®

Blender, just one appliance in a line of luxury countertop appliances created through a licensing agreement with Sub-Zero Group, Inc. to enter the “only-the-best” market segment.

Overall, NACoal’s focus on safety and environmental compliance and its unusual but attractive business model, based largely on long-term cost reimbursable contracts, provide a solid foundation for all of the company’s coal and limerock mining operations, as well as stable cash flow before financing activities with minimal capital investment, other than at MLMC, which will continue to require ongoing replacement capital. NACoal will continue to pursue growth over the next few years mainly as the company’s new mines currently in development reach full production and by reaching its five-year targets for its consolidated and unconsolidated mines, other than Centennial.

Hamilton Beach Brands Overview

Hamilton Beach Brands’ (“HBB”) vision is to be a leading designer, marketer and distributor of small electric household, specialty housewares and commercial appliances sold worldwide under strong brand names and to achieve profitable growth from innovative solutions that improve everyday living.

HBB develops and invests in several core competencies that are critical to achieving that vision. Most importantly HBB has a culture based on a foundation of Good Thinking™. Whether developing innovation to address consumers’ unmet needs, solving a challenge in the supply chain or partnering with a retail customer, HBB’s Good Thinking™ culture provides a competitive advantage. The only way to achieve that culture is by hiring and retaining talented and dedicated employees globally. In addition, HBB believes it is best in class at sourcing and logistics as well as support systems to meet the needs of retail and commercial customers. HBB pursues market and

9

product development expertise to help ensure products delight consumers across the most desirable market opportunities. Finally, HBB maintains and invests in a strong brand portfolio to increase customer and consumer confidence that HBB’s family of products is right for them.

Strategic Initiatives and Long-Term View

HBB’s vision includes delivering growth above historic rates to reach sales of approximately $750 million over the next four to five years. As the company moves toward this target sales level, HBB expects to take advantage of increasing economies of scale to improve return on sales by focusing on its five key strategic initiatives.

First, HBB is focused on enhancing placements in the North American consumer business through consumer-driven innovative products and strong sales and marketing support. The company’s product and placement track record is strong due to innovation processes centered on understanding and meeting end-user needs and focusing on quality and best-in-class customer service. In the North American consumer market, HBB believes it has a stronger and deeper portfolio of new products than its competitors. HBB expects its product pipeline in 2015 and beyond to be at or above 2014 levels, leveraging strong brands and best-in-class products.

In pursuit of growing placements, HBB acquired the Weston Products business (now called Weston Brands) near the end of 2014. Weston Brands markets and distributes appliances and accessories under the proprietary Weston® brand and private label brands for consumers who are hunters, gardeners and food enthusiasts who have a passion for Farm-to-Table and Field-to-Table foods, and for knowing the origin of their food. The U.S. population participating in the Field-to-

Products available from Hamilton Beach Brands’ new acquisition Weston Brands, include, clockwise from® top: Weston® Fruit & Wine Press, Weston® Pro Series Meat Grinder, Weston® Professional Advantage Vacuum Sealer, Weston® Electric Pasta Machine and Weston® Cabbage Shredder

Table segment has grown almost 10 percent over the past decade. In the Farm-to-Table segment, about one-third of the U.S. population participates in gardening or home harvesting. As interest in home harvesting, farmers’ markets and more wholesome food choices continues to expand, this acquisition is expected to deliver growth at a rate at or above HBB’s core kitchen appliance business.

A second area of growth opportunity is through the enhancement of online sales and

10

communications. In the past few years, online sales of small kitchen appliances have grown significantly. During 2014, approximately 17 percent of small kitchen appliances were purchased online. Retailers are looking for partners that can provide not only products, but also the capabilities and support for promotion, marketing and distribution programs appropriate for that channel. As consumers’ shopping habits evolve to rely more on the Internet, HBB is focused on providing best-in-class retailer support, increasing engagement with end users, including maintaining a website that is appropriate for mobile devices, and enhancing its programs designed to make HBB the preferred source for small appliances.

Third, in 2014 HBB announced its entry into the “only-the-best” high-end small kitchen appliance market segment through multi-year licensing agreements with the Sub-Zero Group, Inc. and the Jamba Juice Company. HBB and Sub–Zero Group will be launching a full line of Wolf Gourmet® branded small kitchen appliances and cooking tools in 2015 for sale in high-end retail channels, in Sub-Zero and Wolf showrooms and on the Internet. This “only-the-best” segment is a strong growth opportunity area in which HBB has not previously participated. This segment accounts for approximately one-third of the U.S. small kitchen appliance market, and its target consumer is financially strong. The company also is currently working with the Jamba Juice Company to create a product line focused on blending and juicing under the Jamba® brand. HBB will introduce the first Jamba® branded products in 2015. HBB is pursuing other opportunities to create additional product lines that can be distributed in high-end or specialty stores and on the Internet.

Fourth, HBB is focused on expanding its retail presence internationally in the emerging growth markets of Asia and Latin America by increasing product offerings designed specifically for those market needs and by expanding distribution channels and sales and marketing capabilities. HBB’s historical strength has been in the North American consumer goods market, with approximately 20 percent of its total sales occurring outside the United States in 2014. HBB’s objective is to increase international sales to 35 to 45 percent of total sales by concentrating on key markets. HBB’s efforts will focus on continuing to expand its positions in Mexico, Canada, Central America and South America, as well as in the emerging markets of China, India and Brazil. To achieve this growth, HBB is working to enhance its understanding of local consumers’ needs, increasing sales and marketing resources allocated to these markets and developing products to meet those needs, especially in the mid- to high-end segments of these markets. HBB began selling retail products in China in 2013, and in Brazil and India in 2014. HBB expects to increase sales in these areas in 2015.

Fifth, while HBB has a solid position in the commercial market, it continues to focus on achieving further penetration of the global commercial market through a commitment to an enhanced global product line for chains and distributors serving the global food service and hospitality markets. HBB is enhancing its global commercial product line, particularly with new innovative blending and mixing platforms, and strengthening its food service and hospitality offerings in order to achieve further market penetration in this segment. Over the near term, HBB anticipates continuing to build distribution capabilities and resources in the international food service market, where products and services will be directed at global food service chains.

11

HBB is optimistic that it will be able to build on the momentum achieved in 2014 by focusing on these five strategic initiatives as a solid set of strategies for profitable growth. HBB believes it is well-positioned to continue its leadership position in the small kitchen appliances industry. Achieving its $750 million sales objective will help move the company toward achieving its near-term financial objective of 8 percent operating profit margin and its long-term financial objective of a minimum 10 percent operating profit margin in the years ahead. It also expects to continue to be a substantial generator of cash flow before financing activities, with a continued low level of capital expenditures required.

Kitchen Collection

Kitchen Collection’s vision is to be a leading specialty retailer of kitchenware in outlet malls and to a lesser degree traditional malls throughout the United States. However, to achieve this vision, Kitchen Collection must increase the number of customers coming into its stores, which is difficult in an environment in which many of its target consumers are financially stressed. High unemployment or underemployment, fewer two-income families and lower rates of household formation have resulted in fewer visits to many of the malls and outlets where Kitchen Collection has store locations. In addition, intense competitive pressure for value has resulted in additional discounting and brought margins under pressure. In this environment, not all malls where Kitchen Collection maintains stores are doing well. In the strong malls in which Kitchen Collection has a good store position, its stores do well, but stores in struggling malls with poor store locations are not doing well, despite improvements to the Kitchen Collection® store format over the past few years.

During 2014, Kitchen Collection closed a significant number of stores early in the year and opened a smaller number of stores toward the end of the year. By the end of 2014, essentially most of the stores with recurring poor results were closed or were scheduled for closure in early 2015. As part of this process, the remaining Le Gourmet Chef® outlet stores will be evaluated, and some may be converted to Kitchen Collection® stores. The company will also continue to evaluate and, as lease contracts permit, close or restructure leases for underperforming stores.

Kitchen Collection has a strong core in its Kitchen Collection® store format in outlet malls. In the near term, Kitchen Collection expects to add stores cautiously and focus its growth on its Kitchen Collection® store format, with new stores expected to be located in sound positions in strong outlet malls. As the company reaches a solid core store portfolio, focus will shift to comparable store sales growth. Kitchen Collection expects to accomplish this by enhancing sales volume and profitability through continued refinement of its format and ongoing review of specific product offerings, merchandise mix, store displays and appearance, while continuing to improve inventory efficiency and store inventory controls. A particular focus will be on increasing sales of higher-margin products. Nonetheless, at current mall and store traffic levels, reaching the company’s 5 percent operating profit margin target will be challenging.

Overall, Kitchen Collection is dealing with a difficult environment and evolving aggressively in a constructive manner. Capital expenditures are expected to be modest, with generation of positive cash flow before financing activities expected.

12

Conclusion and NACCO Outlook

NACCO is a strong, multi-industry company with leading businesses in the mining and small appliances industries. The Company continues to believe HBB’s growth opportunities are significant. While growth opportunities also are significant at NACoal, they are largely based on growth at existing mines and those in development. Both HBB and NACoal will be prudent in pursuing any new opportunities. NACCO is confident that NACoal and HBB have the right strategic initiatives in place to move them closer to achieving their long-term growth and financial objectives. Kitchen Collection’s long-term prospects at this time are uncertain, but its near-term prospects are positive and should improve significantly. NACCO is well positioned to support its individual businesses in the years ahead. Each subsidiary is benefitting from programs previously put in place which, when combined with the initiatives now being implemented, should improve income and return on total capital employed at each business over the next few years. In addition, the Company expects each business to generate significant cash flow before financing over time, which it expects to use mainly to pay dividends, repurchase stock when that is an attractive investment for its stockholders, and reduce debt.

As of December 31, 2014, NACCO had repurchased 680,013 shares of its Class A common stock for an aggregate purchase price of $36.0 million, including $35.1 million of stock purchased during 2014. These purchases were made under

the stock repurchase program the Company announced in November 2013, which permits the repurchase of up to $60 million of the Company’s outstanding Class A common stock. Under a previous stock repurchase program which ran from November 2011 to November 2013, the Company repurchased approximately 624,000 shares of Class A common stock for an aggregate purchase price of $35.6 million.

We would like to recognize Jack Turben, who chose to retire from the NACCO and subsidiary Boards this past May, after serving for 17 years. He also served as chair of our Finance Committee. Jack brought unique and valuable perspectives to the Board from his experiences as a real pioneer and leader in the private equity arena. We appreciate his many contributions and wish him well in retirement.

In closing, we would like to thank all of our subsidiaries’ customers, retailers and suppliers, and all of NACCO’s stockholders, for their continued support. Most importantly, we would also like to thank all employees of NACCO and its subsidiary companies for their continued hard work. We continue to have great confidence in the management teams leading each of our subsidiaries and the parent company, and we are confident these teams can successfully implement their respective strategic initiatives to enhance the Company’s sales and profits over the next few years.

Alfred M. Rankin, Jr.

Chairman, NACCO Industries, President Inc. and Chief Executive Officer

Robert L. Benson

President The North and American Chief Executive Coal Corporation Officer

Gregory H. Trepp

President Hamilton Chief Executive Beach and Chief Officer Brands, Executive Inc. Officer The Kitchen Collection, LLC

13

Supplemental Data

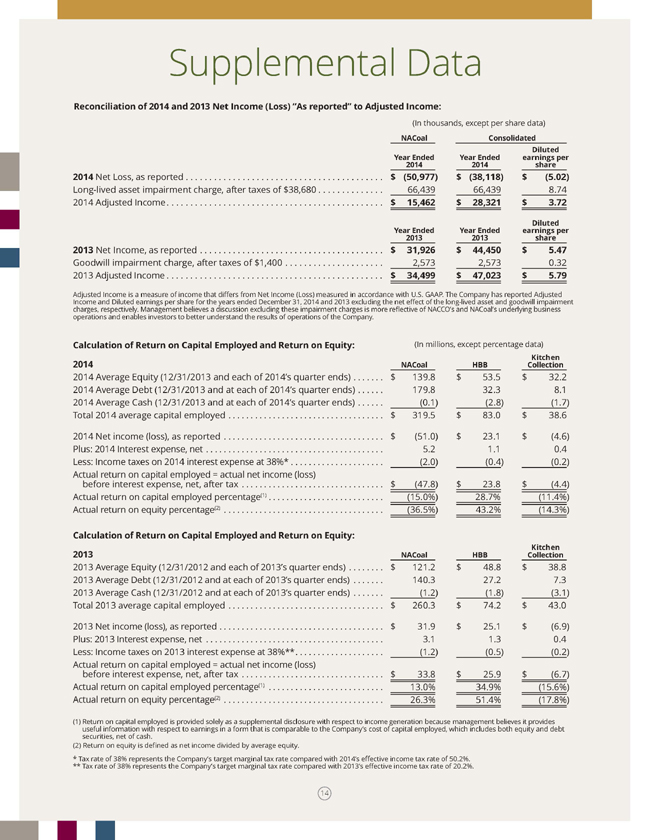

Reconciliation of 2014 and 2013 Net Income (Loss) “As reported” to Adjusted Income:

(In thousands, except per share data)

NACoal Consolidated

Year Ended Year Ended earningsDiluted per

2014 2014 share

2014 Net Loss, as reported $(50,977) $(38,118) $(5.02)

Long-lived asset impairment charge, after taxes of $38,680 66,439 66,439 8.74

2014 Adjusted Income $15,462 $28,321 $3.72

Year Ended Year Ended Earnings Diluted per

2013 Net Income, as reported $2013 31,926 $2013 44,450 $share 5.47

Goodwill impairment charge, after taxes of $1,400 2,573 2,573 0.32

2013 Adjusted Income $34,499 $47,023 $5.79

Adjusted Income is a measure of income that differs from Net Income (Loss) measured in accordance with U.S. GAAP. The Company has reported Adjusted

Income and Diluted earnings per share for the years ended December 31, 2014 and 2013 excluding the net e?ect of the long-lived asset and goodwill impairment charges, respectively. Management believes a discussion excluding these impairment charges is more re?ective of NACCO’s and NACoal’s underlying business operations and enables investors to better understand the results of operations of the Company.

Calculation of Return on Capital Employed and Return on Equity: (In millions, except percentage data)

2014 NACoal HBB Collection Kitchen

2014 Average Equity (12/31/2013 and each of 2014’s quarter ends) $139.8 $53.5 $32.2

2014 Average Debt (12/31/2013 and at each of 2014’s quarter ends) 179.8 32.3 8.1

2014 Average Cash (12/31/2013 and at each of 2014’s quarter ends) (0.1) (2.8) (1.7)

Total 2014 average capital employed $319.5 $83.0 $38.6

2014 Net income (loss), as reported $(51.0) $23.1 $(4.6)

Plus: 2014 Interest expense, net 5.2 1.1 0.4

Less: Income taxes on 2014 interest expense at 38%* (2.0) (0.4) (0.2)

Actual before return interest on capital expense, employed net, after = actual tax net income (loss) $(47.8) $23.8 $(4.4)

Actual return on capital employed percentage(1) (15.0%) 28.7% (11.4%)

Actual return on equity percentage(2) (36.5%) 43.2% (14.3%)

Calculation of Return on Capital Employed and Return on Equity:

2013 NACoal HBB Collection Kitchen

2013 Average Equity (12/31/2012 and each of 2013’s quarter ends) $121.2 $48.8 $38.8

2013 Average Debt (12/31/2012 and at each of 2013’s quarter ends) 140.3 27.2 7.3

2013 Average Cash (12/31/2012 and at each of 2013’s quarter ends) (1.2) (1.8) (3.1)

Total 2013 average capital employed $260.3 $74.2 $43.0

2013 Net income (loss), as reported $31.9 $25.1 $(6.9)

Plus: 2013 Interest expense, net 3.1 1.3 0.4

Less: Income taxes on 2013 interest expense at 38%** (1.2) (0.5) (0.2)

Actual before return interest on capital expense, employed net, after = actual tax net income (loss) $33.8 $25.9 $(6.7)

Actual return on capital employed percentage(1) 13.0% 34.9% (15.6%)

Actual return on equity percentage(2) 26.3% 51.4% (17.8%)

(1) Return on capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital employed, which includes both equity and debt securities, net of cash.

| (2) |

|

Return on equity is de?ned as net income divided by average equity. |

* Tax rate of 38% represents the Company’s target marginal tax rate compared with 2014’s e?ective income tax rate of 50.2%.

** Tax rate of 38% represents the Company’s target marginal tax rate compared with 2013’s e?ective income tax rate of 20.2%.

14

Directors and Officers

NACCO Industries, Inc. Directors Scott S. Cowen

President Emeritus, Tulane University Former Professor and Dean of Weatherhead School of Management at Case Western Reserve University John P. Jumper

Chairman of the Board of Leidos Holdings, Inc. Retired Chief of Staff, United States Air Force

Dennis W. LaBarre Retired Partner, Jones Day Richard de J. Osborne Retired Chairman and Chief Executive Officer, ASARCO Incorporated Alfred M. Rankin, Jr. Chairman, President and Chief Executive Officer, NACCO Industries, Inc. Chairman, President and Chief Executive Officer,

Hyster-Yale Materials Handling, Inc. James A. Ratner Executive Vice President of Forest City Enterprises, Inc. and Chairman and Chief Executive Officer of Forest City Commercial Group Britton T. Taplin Self employed (personal investments) David F. Taplin Self employed (tree farming)

David B. H. Williams Partner of Williams, Bax & Saltzman, P.C. Officers: Alfred M. Rankin, Jr. Chairman, President and Chief Executive Officer J.C. Butler, Jr. Senior Vice President–Finance, Treasurer and Chief Administrative Officer Elizabeth I. Loveman Vice President and Controller John D. Neumann Vice President, General Counsel and Secretary Miles B. Haberer

Associate General Counsel and Assistant Secretary Mary D. Maloney

Associate General Counsel, Assistant Secretary and Senior Director-Benefits & Human Resources Robert L. Benson President and Chief Executive Officer – The North American Coal Corporation Gregory H. Trepp President and Chief Executive Officer – Hamilton Beach Brands, Inc. Jesse L. Adkins Associate Counsel and Assistant Secretary Officers of Subsidiaries Corporation The North American Coal Alfred M. Rankin, Jr. Chairman Robert L. Benson President and Chief Executive Officer J.C. Butler, Jr.

Senior Vice President-Project Development, Administration and Mississippi Operations Carroll L. Dewing

Vice President-North Dakota, Texas and Florida Operations, Human Resources and External Affairs, President, The Coteau Properties Company Michael J. Gregory Vice President-Marketing and Special Projects Miles B. Haberer Associate General Counsel, Assistant Secretary and Director-Land Mary D. Maloney Associate General Counsel, Assistant Secretary and Senior Director-Benefits & Compensation John D. Neumann Vice President, General Counsel and Secretary

J. Patrick Sullivan, Jr. Vice President and Chief Financial Officer Harry B. Tipton III

Vice President-Engineering, and Alabama and Louisiana Operations Jesse L. Adkins Associate Counsel and Assistant Secretary K. Donald Grischow Treasurer, Director-Compensation and Benefits and Global Risk Management

John R. Pokorny Controller Hamilton Beach Brands, Inc. Alfred M. Rankin, Jr. Chairman Gregory H. Trepp President and Chief Executive Officer Gregory E. Salyers

Senior Vice President, Global Operations

R. Scott Tidey Senior Vice President, North America Sales and Marketing Keith B. Burns Vice President, Engineering and Information Technology Kathleen L. Diller Vice President, General Counsel and Secretary Dana B. Sykes Associate General Counsel, Assistant Secretary and Senior Director, Human Resources James H. Taylor Vice President and Chief Financial Officer Richard E. Moss Senior Director, Finance & Treasurer J.C. Butler, Jr. Assistant Secretary John D. Neumann Assistant Secretary The Kitchen Collection, LLC Alfred M. Rankin, Jr. Chairman Gregory H. Trepp Chief Executive Officer Robert O. Strenski

President Randy L. Sklenar Vice President-Field Operations and Human Resources

Karen E. Cavender Controller L.J. Kennedy

Secretary and Treasurer J.C. Butler, Jr. Assistant Secretary

John D. Neumann Assistant Secretary

Corporate Information

Annual Meeting The Annual Meeting of Stockholders of NACCO Industries, Inc. will be held on May 14, 2015, at 9:30 a.m. at the corporate office located at: 5875 Landerbrook Drive, Cleveland, Ohio 44124 Form 10-K

Additional copies of the Company’s Form 10-K filed with the Securities and Exchange Commission are available free of charge through NACCO Industries’ website (www.nacco.com) or by request to: Investor Relations NACCO Industries, Inc. 5875 Landerbrook Drive, Suite 220 Cleveland, Ohio 44124 (440) 229-5130 Stock Transfer Agent and Registrar Stockholder Correspondence: Computershare P.O. Box 30170 College Station, TX 77842-3170 Overnight Correspondence: Computershare

211 Quality Circle, Suite 210 College Station, TX 77845 (800) 622-6757 (U.S., Canada and Puerto Rico) (781) 575-4735 (International) Legal Counsel McDermott Will & Emery LLP 227 West Monroe Street Chicago, Illinois 60606

Independent Registered Public Accounting Firm

Ernst & Young LLP 950 Main Ave., Suite 1800 Cleveland, Ohio 44113

Stock Exchange Listing

The New York Stock Exchange Symbol: NC

Investor Relations Contact

Investor questions may be addressed to: Investor Relations NACCO Industries, Inc.

5875 Landerbrook Drive, Suite 220 Cleveland, Ohio 44124 (440) 229-5130 E-mail: ir@naccoind.com

NACCO Industries Website

Additional information on NACCO Industries may be found at the corporate website, www.nacco.com. The Company considers this website to be one of the primary sources of information for investors and other interested

Subsidiary parties. Company Websites The websites for NACCO’s subsidiaries are as follows:

Hamilton www.hamiltonbeach. Beach Brands–U. com S. : www. www.commercial. proctorsilex.hamiltonbeach. com com Hamilton www.hamiltonbeach. Beach Brands–Mexico: com.mx Weston www. westonproducts. Brands: com Kitchen www. kitchencollection. Collection: com www.legourmetchef.com North www. American nacoal.com Coal:

Environmental Benefits

This Annual Report on Form 10-K is printed using post-consumer waste recycled paper and vegetable-based inks. served 29 trees for pre- the future 83 borne lbs. water- waste not created wastewater 12,260 gal. flow saved solid 1,356 waste lbs. not generated 2,671 greenhouse lbs. net gases prevented BTUs 20,442,500 energy not consumed

The FSC Trademark identifies wood fibers coming from forests which have been certified in accordance with the rules of the Forest Stewardship Council.

FSC is not responsible for these calculations. Calculations per Mohawk Environmental calculator.

5875 Landerbrook Drive, Suite 220 • Cleveland, Ohio 44124

An Equal Opportunity Employer