Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K - Behringer Harvard Short-Term Liquidating Trust | v404269_10k.htm |

| EX-10.7 - EXHIBIT 10.7 - Behringer Harvard Short-Term Liquidating Trust | v404269_ex10-7.htm |

| EX-31.1 - EXHIBIT 31.1 - Behringer Harvard Short-Term Liquidating Trust | v404269_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Behringer Harvard Short-Term Liquidating Trust | v404269_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Behringer Harvard Short-Term Liquidating Trust | v404269_ex31-2.htm |

| EX-21.1 - EXHIBIT 21.1 - Behringer Harvard Short-Term Liquidating Trust | v404269_ex21-1.htm |

Exhibit 10.6

PURCHASE AND SALE AGREEMENT

BY AND BETWEEN

BEHRINGER HARVARD MOCKINGBIRD COMMONS, LLC

AS SELLER

AND

THI VI DALLAS MOCKINGBIRD LLC

AS PURCHASER

Table of Contents

| Page | ||

| ARTICLE I Sale | 1 | |

| 1.1 | Real Property | 1 |

| 1.2 | Personal Property | 2 |

| 1.3 | Contracts and Leases | 2 |

| ARTICLE II Purchase Price | 3 | |

| 2.1 | Purchase Price | 3 |

| 2.2 | Allocation of Purchase Price | 3 |

| 2.3 | Deposit | 3 |

| 2.4 | Assumption of Existing Loan | 4 |

| ARTICLE III Seller's Representations, Warranties and Covenants | 5 | |

| 3.1 | Good Standing | 5 |

| 3.2 | Title | 5 |

| 3.3 | Due Authorization | 5 |

| 3.4 | No Violations or Defaults | 6 |

| 3.5 | Bankruptcy | 6 |

| 3.6 | Space Leases | 6 |

| 3.7 | Equipment Leases, Service Contracts and Rooms Agreements | 6 |

| 3.8 | Litigation | 6 |

| 3.9 | Compliance with Laws | 6 |

| 3.10 | Condemnation Actions | 6 |

| 3.11 | Hazardous Materials | 7 |

| 3.12 | Employees | 7 |

| 3.13 | Management and Franchise Agreements | 7 |

| 3.14 | Existing Loan | 8 |

| 3.15 | Terrorist Organizations List | 8 |

| 3.16 | Financial Information | 8 |

| 3.17 | Certain Limitations on Seller's Representations and Warranties | 8 |

| ARTICLE IV Purchaser's Representations, Warranties and Covenants | 9 | |

| 4.1 | Good Standing | 9 |

| 4.2 | Due Authorization | 9 |

| 4.3 | Litigation | 10 |

| 4.4 | Terrorist Organizations List | 10 |

| 4.5 | Bankruptcy | 10 |

| ARTICLE V Closing | 10 | |

| 5.1 | Closing | 10 |

| 5.2 | Costs | 10 |

| - i - |

Table of Contents

(continued)

| ARTICLE VI Actions Pending Closing | 11 | |

| 6.1 | Conduct of Business; Maintenance and Operation of Property | 11 |

| 6.2 | Title | 11 |

| 6.3 | Survey | 12 |

| 6.4 | Cooperation | 12 |

| 6.5 | Service Contracts; Equipment Leases; Space Leases | 13 |

| 6.6 | Liquor License | 13 |

| 6.7 | Inspection | 14 |

| 6.8 | Feasibility Period | 16 |

| 6.9 | Existing Loan | 17 |

| 6.10 | WARN Act | 17 |

| 6.11 | Tax Clearance Certificate | 18 |

| 6.12 | Termination of Manager | 18 |

| ARTICLE VII Purchaser's Conditions Precedent to Closing | 18 | |

| 7.1 | Representations and Warranties | 18 |

| 7.2 | Covenants of Seller | 18 |

| 7.3 | Termination of Existing Management Agreement | 19 |

| 7.4 | Title | 19 |

| 7.5 | Approval of Assumption of Existing Loan | 19 |

| 7.6 | Failure of Condition | 19 |

| ARTICLE VIII Seller's Conditions Precedent to Closing | 19 | |

| 8.1 | Representations and Warranties | 19 |

| 8.2 | Covenants of Purchaser | 19 |

| 8.3 | Purchase Price | 19 |

| 8.4 | Approval of Assumption of Existing Loan | 19 |

| 8.5 | Failure of Condition | 20 |

| ARTICLE IX Closing Deliveries | 20 | |

| 9.1 | Deed | 20 |

| 9.2 | Bill of Sale | 20 |

| 9.3 | Assignment of Permits and Licenses | 20 |

| 9.4 | Assignment of Service Contracts, Rooms Agreements and Equipment Leases | 20 |

| 9.5 | FIRPTA Certificate | 20 |

| 9.6 | Assignment of Space Leases and Brackets Lease | 20 |

| 9.7 | Assignment of Consulting Agreement | 20 |

| 9.8 | Closing Statement | 20 |

| 9.9 | Loan Assumption Documents | 21 |

| 9.10 | Termination of Excluded Contracts | 21 |

| 9.11 | Assignment of Declarant's Rights | 21 |

| 9.12 | Resignation of Directors | 21 |

| 9.13 | Estoppels | 21 |

| 9.14 | Termination of Existing Management Agreement | 21 |

| 9.15 | Consents | 21 |

| 9.16 | Original Documents | 21 |

| ii |

Table of Contents

(continued)

| 9.17 | Other Documents | 21 |

| 9.18 | Possession; Keys, Guest and Sales Information | 21 |

| 9.19 | Purchase Price | 21 |

| ARTICLE X Default | 22 | |

| 10.1 | Purchaser's Default | 22 |

| 10.2 | Seller's Default | 22 |

| ARTICLE XI RELEASE/Indemnification | 23 | |

| 11.1 | "AS-IS" CONVEYANCE | 23 |

| 11.2 | Agreement to Indemnify | 25 |

| 11.3 | Notice and Cooperation on Indemnification | 25 |

| ARTICLE XII Casualty or Condemnation | 26 | |

| ARTICLE XIII Apportionments | 26 | |

| 13.1 | Apportionments | 26 |

| 13.2 | Deposits | 27 |

| 13.3 | Room Revenue | 27 |

| 13.4 | Accounts Receivable; Accounts Payable | 27 |

| 13.5 | Food and Beverage Revenue; Vending Machine Revenue | 28 |

| 13.6 | Guests’ Property | 28 |

| 13.7 | Accounting | 28 |

| 13.8 | Employee Compensation | 28 |

| 13.9 | Existing Loan | 29 |

| 13.10 | Post-Closing True-Up | 29 |

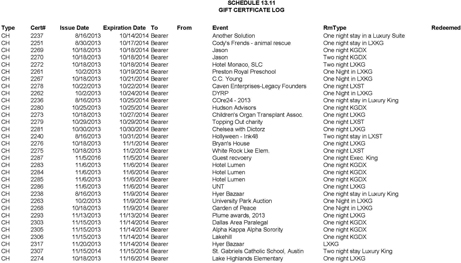

| 13.11 | Gift Certificates | 29 |

| ARTICLE XIV Miscellaneous | 30 | |

| 14.1 | Survival | 30 |

| 14.2 | Assignment | 30 |

| 14.3 | Consents | 30 |

| 14.4 | Applicable Law | 30 |

| 14.5 | Headings; Exhibits and Schedules | 30 |

| 14.6 | Notices | 30 |

| 14.7 | Limitation on Liability | 31 |

| 14.8 | Waiver | 32 |

| 14.9 | Partial Invalidity | 32 |

| 14.10 | Entire Agreement | 32 |

| 14.11 | Time is of the Essence | 32 |

| 14.12 | Waiver of Jury Trial | 32 |

| 14.13 | Counterparts | 32 |

| 14.14 | Brokerage | 32 |

| 14.15 | Time for Performance | 32 |

| 14.16 | No Public Disclosure | 33 |

| 14.17 | Recordation | 33 |

| iii |

Definitions

The following capitalized terms used in this Agreement are defined in the sections indicated below:

| Accountants | Section 13.7 | |

| Accounts Receivable | Section 1.2 | |

| Additional Deposit | Section 2.3 | |

| Affiliate | Section 3.14(a) | |

| Agreement | Introduction | |

| Apportionment Date | Section 13.1 | |

| Appurtenances | Section 1.1 | |

| Brackets Lease | Section 6.5 | |

| Brackets TI/LC Amount | Section 6.5 | |

| Closing | Section 5.1 | |

| Closing Date | Section 5.1 | |

| Closing Statement | Section 9.8 | |

| Confidential Information | Section 6.7(d) | |

| Consents | Section 6.8(a) | |

| Consent Notice | Section 6.8(a) | |

| Consent Notice Deadline | Section 6.8(a) | |

| Consent Termination Notice | Section 6.8(a) | |

| Consulting Agreement | Section 6.1(b) | |

| Continuing Employees | Section 6.10(a) | |

| Contract Date | Introduction | |

| Conversion Kitchen Equipment | Section 1.2 | |

| Cut-Off Time | Section 13.1 | |

| Deed | Section 9.1 | |

| Deposit | Section 2.3 | |

| Due Diligence Materials | Section 6.7(a) | |

| Equipment Leases | Section 1.3 | |

| Escrow Agent | Section 2.1 | |

| Escrow Instructions | Section 2.3 | |

| Encumbrances | Section 6.2(a) | |

| Environmental Laws | Section 3.11(a) | |

| Environmental Reports | Section 3.11(b) | |

| Excluded Contracts | Section 6.8(c) | |

| Excluded Personal Property | Section 1.2 | |

| Existing Lender | Section 2.4(a) | |

| Existing Loan | Section 2.4(a) | |

| Existing Loan Assumption Fees | Section 2.4(a) | |

| Existing Loan Documents | Section 3.14(a) | |

| Existing Management Agreement | Section 3.13 | |

| FF&E | Section 1.2 | |

| Feasibility Period | Section 6.8(b) | |

| Fixed Asset Supplies | Section 1.2 | |

| Gift Certificate Schedule | Section 13.11 |

| iv |

| Hazardous Materials | Section 3.11(a) | |

| Hotel Employees | Section 6.10(a) | |

| Improvements | Section 1.1 | |

| Initial Deposit | Section 2.3 | |

| Inventories | Section 1.2 | |

| Investigation Claims | Section 6.7(e) | |

| Land | Section 1.1 | |

| Lender | Section 2.4(a) | |

| Liquor Entity | Section 6.4 | |

| Loan Assumption Documents | Section 7.5 | |

| Loan Assumption Term Sheet | Section 2.4(a) | |

| Loan Prepayment | Section 2.4(c) | |

| Management Termination Fee | Section 6.12 | |

| Manager | Section 1.2 | |

| Manager Acknowledgment | Section 6.12 | |

| Permitted Exceptions | Section 6.2(b) | |

| Permitted Outside Parties | Section 6.7(d) | |

| Person | Section 3.15 | |

| Personal Property | Section 1.2 | |

| Pre-Closing Loan Default | Section 3.14(b) | |

| Property | Article I | |

| PTO Credit | Section 13.8 | |

| Purchase Price | Section 2.1 | |

| Purchaser | Introduction | |

| Purchaser Investigations | Section 6.7(a) | |

| Purchaser Reports | Section 6.7(a) | |

| Purchaser Representatives | Section 6.7(a) | |

| Real Property | Section 1.1 | |

| Restaurant Conversion | Section 6.1(b) | |

| Rooms Agreements | Section 1.3 | |

| Seller | Introduction | |

| Seller Investigation Indemnified Parties | Section 6.7(e) | |

| Service Contracts | Section 1.3 | |

| Space Leases | Section 1.3 | |

| Termination Notice | Section 6.8(b) | |

| Tesar Entity | Section 6.1(b) | |

| Title Commitment | Section 6.2(a) | |

| Title Company | Section 6.2(a) | |

| Title Objection Notice | Section 6.2(b) | |

| Title Policy | Section 6.2(a) | |

| True-Up | Section 13.10 | |

| Uniform System of Accounts | Section 1.2 | |

| WARN Act | Section 6.10(a) |

| v |

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (this "Agreement") is executed as of the 6th day of May, 2014 (the "Contract Date") by and between BEHRINGER HARVARD MOCKINGBIRD COMMONS, LLC, a Delaware limited liability company (the "Seller"), and THI VI DALLAS MOCKINGBIRD LLC, a Delaware limited liability company (the "Purchaser").

ARTICLE I

Sale

Subject to the terms and conditions set forth in this Agreement, Seller agrees to sell and convey to Purchaser, and Purchaser agrees to buy from Seller the following (collectively, the “Property”):

1.1 Real Property. That certain parcel of land situated in Dallas, Texas located at 5300 and 5330 East Mockingbird Lane, as described on Exhibit A attached hereto (the "Land"), including all right, title and interest of Seller, if any, in and to the land lying in the bed of any street or highway in front of or adjoining each such parcel to the center line thereof, all water and mineral rights, development rights and all easements, rights and other interests appurtenant thereto (the "Appurtenances"), and together with all buildings and other improvements that are located thereon currently operated as a hotel and retail facility, including, without limitation, all elevators, escalators, furnaces, heating, ventilating and air-conditioning systems and equipment, fixtures, electrical equipment, fire prevention and extinguishing apparatus located therein (the "Improvements"). The Land, the Appurtenances, the Improvements and Seller's development rights in connection with the foregoing collectively are referred to herein as the "Real Property."

| 1 |

1.2 Personal Property. All of Seller's right, title and interest, if any, in the following personalty: (a) all furniture, furnishings, fixtures (other than those which are part of the Improvements), machinery, signage, plans, drawings, works of art, rugs, mats, carpeting, appliances, devices, engines, telephone and other communications equipment, televisions and other video equipment, plumbing fixtures, kitchen equipment (including, without limitation, remaining equipment, if any, removed from the former Central 214 restaurant in connection with the Restaurant Conversion which Seller shall use reasonable efforts to deliver to Purchaser at Closing (the “Conversion Kitchen Equipment”)) and other equipment located in or related to the Real Property (collectively, the "FF&E"); (b) all computer equipment located in the Real Property and all computer software used at the Real Property, subject to the terms of any applicable license agreements, (c) all items included within the definition of "Property and Equipment" under the Uniform System of Accounts for the Lodging Industry, Tenth Revised Edition, as published by the Hotel Association of New York City, Inc. (the "Uniform System of Accounts"), including, without limitation, linen, china, glassware, tableware, uniforms and similar items, whether in use or held in stock for future use, in connection with the operation of the Real Property, subject to such depletion and including such resupplies prior to the Closing Date as shall occur in the ordinary course of business (the "Fixed Asset Supplies"); (d) all "Inventories" as defined in the Uniform System of Accounts, such as provisions in storerooms, refrigerators, pantries, and kitchens, all food and beverages (alcoholic and non-alcoholic) which are located at the Real Property, whether opened or unopened, other merchandise intended for sale or resale, fuel, mechanical supplies, stationery, guest supplies, maintenance and housekeeping supplies and other expensed supplies and similar items (the "Inventories"), provided that to the extent that any applicable law prohibits the transfer of alcoholic beverages from Seller to Purchaser, such beverages shall not be considered a part of Inventories; (e) the aggregate amount of any deposits received by Seller (whether paid in cash or by credit card) as a down payment for reservations made for rooms, banquets, meals or other services to be supplied from and/or after the Closing Date; (f) to the extent in Seller's (or its agents' or Affiliates’) possession, surveys, architectural, consulting and engineering blueprints, plans and specifications and drawings related to the Real Property, all telephone numbers, all non-proprietary customer and guest lists, databases and information and any goodwill of Seller; (g) all trade names used exclusively in connection with the operation of the Real Property, (h) subject to Section 13.4(a), the accounts receivable related to the Property (the “Accounts Receivable”), and (i) any and all other items of personalty located on, or used in connection with the operation of, the Real Property, (all of the foregoing, collectively, the "Personal Property"). The Personal Property specifically excludes (i) all property of guests; (ii) all items, except for Conversion Kitchen Equipment, if any, owned by Kimpton Hotel & Restaurant Group, LLC, a Delaware limited liability company ("Manager") or any affiliates of Manager, and tenants under the Space Leases; (iii) all tax deposits, utility deposits and other deposits held by parties other than Seller, except for any transferable deposits assigned to Purchaser, for which Seller is to be reimbursed as herein provided; (iv) any tax, insurance, FF&E, capital improvement and/or other escrows, impounds or reserves held by Manager or any other party, except to the extent such items are specifically assigned to Purchaser and for which Seller is reimbursed, and except for the Brackets TI/LC Amount which shall be assigned to Purchaser without reimbursement to Seller; (vi) all cash (including cash on hand) and cash equivalents, checks, drafts, notes and other evidence of indebtedness held at the Real Property on the Closing Date, and any balances on deposit with banking institutions relating to the Real Property (subject to the provisions of Section 13.9), including amounts held in "house banks"; and (vii) any right of Seller in and to any agreement with Manager or any Service Contracts or any other agreements that are not assignable without consent, for which Purchaser and Seller have not obtained consent prior to Closing (collectively, the "Excluded Personal Property").

1.3 Contracts and Leases. All of Seller's right, title and interest, if any, under (a) the leases of vehicles, equipment, furnishings or other personal property located at, and used in connection with, the operation of the Real Property, to the extent assignable (the "Equipment Leases"); (b) the service, maintenance and other agreements in connection with the operation of the Real Property identified in Exhibit B attached hereto, to the extent assignable (the "Service Contracts"); (c) the leases, licenses, concessions and other agreements granting any occupancy, possessory or entry rights in or to the Real Property, identified in Exhibit C attached hereto (the "Space Leases"), including any prepaid rents or deposits held by Seller (or Manager) thereunder; and (d) the corporate, airline, bus, tour operator, barter and similar agreements identified in Exhibit D attached hereto, pursuant to which third parties have been given certain rights to rooms or services at the Real Property from and/or after the Closing Date (the "Rooms Agreements"), but specifically excluding the Excluded Contracts.

| 2 |

ARTICLE II

Purchase Price

2.1 Purchase Price. In accordance with the terms of this Agreement, Seller shall sell and Purchaser shall buy the Property for a total purchase price of FORTY-EIGHT MILLION AND NO 100THS Dollars ($48,000,000.00), subject to Purchaser's assumption of the Existing Loan pursuant to Section 2.4 and adjustment as described in Article XIII below (the "Purchase Price"), payable to Seller on the Closing Date by wire transfer to First American Title Insurance Company, Attn: Jennifer D. Panciera, as agent for the Title Company (the "Escrow Agent").

2.2 Allocation of Purchase Price. The Purchase Price shall be allocated among the Real Property and various items of Personal Property as set forth on Exhibit E attached hereto. The parties agree that this allocation has been arrived at by a process of arm's-length negotiations, including, without limitation, the parties' best judgment as to the fair market value of each respective asset, and the parties specifically agree to the allocation as final and binding, and will consistently reflect those allocations on their respective federal, state and local tax returns, including any state, county and other local transfer or sales tax declarations or forms to be filed in connection with this transaction, which obligations shall survive the Closing.

2.3 Deposit. Within one (1) business day following the Contract Date, Purchaser shall deliver to Escrow Agent a deposit (together with any interest earned thereon, the "Initial Deposit") in the amount of One Million and No 100ths Dollars ($1,000,000.00), comprised of immediately available funds. In addition, unless Purchaser timely delivers a Termination Notice in accordance with Section 6.8(b), no later than one (1) day after the expiration of the Feasibility Period, Purchaser shall deliver to Escrow Agent, in immediately available funds, an additional amount of One Million and No 100ths Dollars ($1,000,000.00) (together with any interest earned thereon, the "Additional Deposit"). The Initial Deposit and the Additional Deposit (if posted) are referred to herein as the "Deposit". Escrow Agent shall hold the Deposit in accordance with the form of escrow instructions (the "Escrow Instructions") attached hereto as Exhibit F. Purchaser acknowledges and agrees that unless Purchaser timely delivers a Termination Notice in accordance with Section 6.8(b), then from and after the expiration of the Feasibility Period, the Deposit shall be deemed to be non-refundable to Purchaser except as otherwise provided in this Agreement. At Closing, the amount of the Deposit shall be applied to and credited against payment of the Purchase Price.

| 3 |

2.4 Assumption of Existing Loan.

(a) Unless Purchaser elects the Loan Prepayment, a portion of the Purchase Price shall be deemed paid by Purchaser acquiring title to the Property encumbered by, and Purchaser's assumption of, the mortgage loan in the initial principal amount of Thirty-One Million and No/100 Dollars ($31,000,000.00) made by Great American Life Insurance Company (the "Lender", and together with any servicer of the Existing Loan, collectively referred to herein as the "Existing Lender") to Seller on December 20, 2012 (the "Existing Loan"). At Closing, unless Purchaser elects the Loan Prepayment pursuant to Section 2.4(c) below, the amount of the then outstanding principal balance of the Existing Loan shall be applied and credited toward the payment of the Purchase Price. Promptly following the Contract Date, Seller shall (i) notify the Existing Lender of its desire to transfer the Property subject to the Existing Loan, (ii) introduce Purchaser to the Existing Lender and (iii) work in good faith with Purchaser and Existing Lender to obtain, prior to the Consent Notice Deadline, information from the Existing Lender regarding the terms upon which an assignment of the Existing Loan would be approved. After the Consent Notice Deadline, if this Agreement remains in effect, Purchaser shall commence the application process required by the Existing Lender for the assumption of the Existing Loan, together with the assumption and application fee(s), if any, required to process the Purchaser's proposed assumption of the Existing Loan, and Purchaser and Seller shall thereafter diligently pursue said assignment and assumption of the Existing Loan. Prior to the expiration of the Feasibility Period, Purchaser and Seller shall use good faith efforts to obtain a term sheet approved by Purchaser and Seller in their reasonable discretion or other written evidence provided by Existing Lender (A) confirming that Purchaser's assumption of the Existing Loan has been approved and will be consummated on or prior to the Closing Date, and (B) setting forth the material terms and conditions upon which Existing Lender has agreed to approve Purchaser's assumption of the Existing Loan and release all obligations of Seller and any guarantors of the Existing Loan, including, without limitation, the amount of any assumption and application fees and the identity of any guarantors and/or indemnitors which are to replace the current guarantors and/or indemnitors under the Existing Loan (the "Loan Assumption Term Sheet"). For the avoidance of doubt, Seller shall only have approval rights over that portion of the Loan Assumption Term Sheet that sets forth the terms and conditions of the aforementioned release of Seller and any guarantors of the Existing Loan. Purchaser shall provide Seller with copies of all material correspondence (omitting any information which is confidential or proprietary in nature) between Purchaser and Existing Lender relating to the status of the request to assume the Existing Loan. If Purchaser's assumption of the Existing Loan is approved by Existing Lender upon the terms and conditions set forth in the Loan Assumption Term Sheet, Purchaser shall be solely responsible for the payment of any and all assumption fees and other expenses (including legal fees) charged by the Existing Lender relating to the assumption of the Existing Loan (the "Existing Loan Assumption Fees").

(b) Notwithstanding anything to the contrary contained herein, unless Purchaser elects the Loan Prepayment pursuant to Section 2.4(c) below (in which case the termination right of Purchaser set forth in this paragraph shall not be applicable), Purchaser shall have the right to terminate this Agreement if (i) at any time, the Existing Lender has indicated in writing that it has disapproved or will not consent to the assumption of the Existing Loan by Purchaser (provided that Purchaser shall deliver such termination notice to Seller within five (5) business days of Purchaser's receipt of such written notice); or (ii) the Existing Lender fails to approve the assumption of the Existing Loan by Purchaser upon the terms and conditions agreed to by Purchaser, Seller and Existing Lender as set forth in the Loan Assumption Term Sheet. If Purchaser terminates this Agreement pursuant to this Section 2.4(b), then neither Seller nor Purchaser shall have any further obligation under this Agreement except for those obligations which expressly survive the termination of this Agreement, and the Deposit shall be promptly refunded to Purchaser. Purchaser shall provide to Seller a copy of any written notices or other correspondence received by Purchaser from Existing Lender which indicate that Existing Lender may not approve or consent to the assumption of the Existing Loan by Purchaser.

| 4 |

(c) Purchaser may elect not to assume the Existing Loan at Closing and remit to Seller cash in the full amount of the Purchase Price, in which case Seller will pay the Existing Loan in full at Closing (the "Loan Prepayment"); provided, however, Purchaser shall be solely responsible for the payment of any and all prepayment fees and other expenses (including legal fees) charged by the Existing Lender relating to the Loan Prepayment. Purchaser shall deliver written notice to Seller on or before the expiration of the Feasibility Period stating whether Purchaser has chosen to assume the Existing Loan or has chosen Loan Prepayment. If Purchaser does not provide such notice prior to the end of the Feasibility Period, Purchaser shall be deemed to have chosen (i) Loan Prepayment, if no Loan Assumption Term Sheet has been agreed upon and executed by Purchaser, Seller and Existing Lender prior to the end of the Feasibility Period, or (ii) assumption of the Existing Loan, if a Loan Assumption Term Sheet has been agreed upon and executed by Purchaser, Seller and Existing Lender prior to the end of the Feasibility Period. Promptly following Purchaser’s election or deemed election not to assume the Existing Loan, Seller shall give notice of prepayment to the Existing Lender and, subject to Purchaser's payment of the prepayment fees and other expenses relating to the Loan Prepayment as set forth herein, Seller shall deliver title to the Property at Closing free and clear of any Encumbrance relating to or securing the Existing Loan. Notwithstanding anything in this Agreement to the contrary, if the Existing Lender requires that the Closing occur on a particular date in order to allow Loan Prepayment or assumption of the Existing Loan, the Closing Date may be extended for up to thirty (30) days in order to accommodate such requirement.

ARTICLE

III

Seller's Representations, Warranties and Covenants

In order to induce Purchaser to enter into this Agreement and to consummate the transactions contemplated hereby, Seller represents and warrants to, and covenants with, Purchaser as follows, as of the Contract Date and as of the Closing Date:

3.1 Good Standing. Seller is a limited liability company organized, validly existing and in good standing under the laws of Delaware and is qualified to do business and in good standing in the State of Texas.

3.2 Title. Seller has good and marketable title to the FF&E, Fixed Asset Supplies, and Inventories, specifically excluding any Excluded Personal Property, which shall be subject only to the Permitted Exceptions as of the Closing Date. Seller has not previously assigned any interest in the Accounts Receivable that shall be assigned to Purchaser pursuant to Section 13.4(a).

3.3 Due Authorization. Subject to obtaining the Consents, the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby have been authorized by all requisite limited liability company actions of Seller (none of which actions have been modified or rescinded, and all of which actions are in full force and effect). Subject to obtaining the Consents, this Agreement constitutes a valid and binding obligation of Seller, enforceable against Seller in accordance with its terms.

| 5 |

3.4 No Violations or Defaults. Seller has received no written notice of an uncured violation or default under any agreement with any third party, or under any judgment, order, decree, rule or regulation of any court, arbitrator, administrative agency or other governmental authority to which it may be subject, which violation or default will, in any one case or in the aggregate, materially adversely affect the ownership or operation of the Property or Seller's ability to consummate the transactions contemplated hereby. Subject to obtaining the Consents, the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby will not (a) violate any law or any order of any court or governmental authority with proper jurisdiction; (b) result in a breach or default under any Space Lease or provision of the organizational documents of Seller; (c) require any consent, or approval or vote of any court or governmental authority or of any third person or entity that, as of the Closing Date, has not been given or taken, and does not remain effective; or (d) result in any Encumbrance, other than a Permitted Exception, against the Property.

3.5 Bankruptcy. Seller is not the subject debtor under any federal, state or local bankruptcy or insolvency proceeding, or any other proceeding for dissolution, liquidation or winding up of its assets.

3.6 Space Leases. There are no leases, licenses, concessions or any other agreements giving anyone other than Seller and transient hotel guests a right to use or occupy any Property or any part thereof, except for the Space Leases. To the actual knowledge of Seller, each of the Space Leases is in full force and effect and there are no presently existing defaults thereunder. Unaltered copies of each Space Lease identified on Exhibit C, to the extent in the possession or control of Seller, Seller’s Affiliates or Manager, have been made available to Purchaser.

3.7 Equipment Leases, Service Contracts and Rooms Agreements. Unaltered copies of each of the Equipment Leases, Service Contracts and Rooms Agreements identified on Exhibits H, B and D, respectively, to the extent in the possession or control of Seller, Seller’s Affiliates or Manager, have been made available to Purchaser. To the actual knowledge of Seller, each of the Equipment Leases, Service Contracts and Rooms Agreements are in full force and effect and there are no presently existing defaults thereunder.

3.8 Litigation. There are no actions, suits, arbitrations, governmental investigations or other proceedings pending, or to Seller's actual knowledge, threatened, against Seller or affecting the Property before any court or governmental authority which would have a material adverse effect on (a) the financial condition or operations of Seller or the Property or (b) Seller's ability to enter into or perform this Agreement.

3.9 Compliance with Laws. Seller has received no written notice which has not been cured stating that Seller and/or the Property are not in material compliance with any laws, rules, regulations, health and sanitation codes, zoning ordinances, environmental assessment and impact requirements or with the terms of any Permits applicable to the Property.

3.10 Condemnation Actions. To the actual knowledge of Seller, there are no pending or threatened condemnation actions or special assessments of any nature with respect to the Property or any part thereof.

| 6 |

3.1 Hazardous Materials.

(a) As used herein, "Environmental Laws" shall mean all federal state and local laws, statues, rules, codes, ordinances, regulations, orders, judgments, decrees, binding and enforceable guidelines, policies or common law now or hereafter in effect and in each case as amended, or any judicial or administrative interpretation thereof, including any judicial or administrative order, consent decree or judgment in each case, to the extent binding, relating to the environment, the protection of health or Hazardous Materials, including, without limitation, the Comprehensive Environmental Response Compensation and Liability Act, 42 USC §9601 et seq.; the Resource Conservation and Recovery Act, 42 USC §6901 et seq.; the Federal Water Pollution Control Act, 33 USC §1251 et seq.; the Toxic Substances Control Act, 15 USC §2601 et seq.; the Clean Air Act, 42 USC §7401 et seq.; the Safe Drinking Water act, 42 USC §3803 et seq.; the Oil Pollution Act of 1990, 33 USC §2701 et seq.; the Emergency Planning and Community Right-to-Know Act of 1986, 42 USC §11001 et seq.; the Hazardous Material Transportation Act, 49 USC §1801 et seq.; and the Occupational Safety and Health Act, 29 USC §651 et seq. (to the extent it regulates occupational exposure to Hazardous Materials); any state, local or foreign counterparts or equivalents, in each case as amended from time to time. As used herein, "Hazardous Materials" shall mean (i) substances that are defined or listed in, or otherwise classified pursuant to, any applicable law or regulations as "hazardous substances," hazardous materials," "hazardous wastes," "toxic substances," "pollutants," "contaminants" or other similar term intended to define, list or classify a substance by reason of such substance's ignitability, corrosivity, reactivity, carcinogenicity, reproductive toxicity or "EP toxicity", (ii) oil, petroleum or petroleum derive substances, natural gas, natural gas liquids, synthetic gas, drilling fluids, produced waters and other wastes associated with the exploration, development or production of crude oil, natural gas or geothermal resources, (iii) any flammable substances or explosives or any radioactive materials, (iv) asbestos in any form, (v) polychlorinated biphenyls, (vi) mold, mycotoxins or microbial matter (naturally occurring or otherwise) and (vii) infectious waste.

(b) Seller has delivered to Purchaser unaltered copies of all environmental reports for the Property in the possession or control of Seller or any of Seller’s Affiliates (collectively, the “Environmental Reports”). Except as set forth in the Environmental Reports, Seller has no knowledge of any violations of any Environmental Law and Seller has not received written notice of any uncured violation of any Environmental Law.

3.12 Employees.

(a) No employment contracts or collective bargaining agreements exist with respect to the Property that will subject Purchaser to a liability therefor. Seller is not now, and has not been in the past, an employer of any person employed at the Property.

(b) To the actual knowledge of Seller, there is no strike, work stoppage or other labor dispute relating to the operation on the Property or threatened by any union and no application is pending or threatened for certification of a collective bargaining agent.

3.13 Management and Franchise Agreements. There are no existing management contracts or franchise agreements relating to the Property other than the Hotel Operating Agreement, dated March 8, 2005, between Seller and the Manager, together with all amendments thereto (the "Existing Management Agreement"), to be terminated concurrently with the Closing.

| 7 |

3.14 Existing Loan.

(a) The documents described on Exhibit G attached hereto (the “Existing Loan Documents”) comprise all of the Existing Loan Documents to which Seller or any Affiliate of Seller is a party and each of such Existing Loan Documents is in full force and effect as of date hereof. None of the Existing Loan Documents have been modified, altered, or amended by Seller in any respect except as set forth in the Loan Assumption Documents and/or as necessary in connection with the transactions contemplated under this Agreement. True, complete and correct copies of all Existing Loan Documents have been delivered to Purchaser. "Affiliate" shall mean, with respect to a person or entity, all persons or entities that, directly or indirectly, control, are controlled by, or under common control with, such person or entity; or, with respect to a person or entity, all persons or entities that, directly or indirectly, own, are owned by or under common ownership with, such person or entity.

(b) Seller has not received written notice from Existing Lender of any uncured default by Seller of any obligation under the Existing Loan Documents. No event has occurred during Seller's ownership of the Property that constitutes, or after notice or the passage of time, or both, would constitute default by Seller of an obligation under any of the Existing Loan Documents (a "Pre-Closing Loan Default").

(c) The Existing Loan is not currently in special servicing, and Seller has not received notice from Existing Lender that the Existing Loan is to be transferred to a special servicer.

3.15 Terrorist Organizations List. Seller is not acting, directly or indirectly, for on or behalf of any Person named by the United States Treasury Department as a Specifically Designated National and Blocked Person, or for or on behalf of any Person designated in Executive Order 13224 as a Person who commits, threatens to commit, or supports terrorism. Seller is not engaged in the transaction contemplated by this Agreement directly or indirectly on behalf of, or facilitating such transaction directly or indirectly on behalf of, any such Person. "Person" shall mean any natural person, corporation, general or limited partnership, limited liability company, association, joint venture, trust, estate, governmental authority or other legal entity, in each case whether in its own or a representative capacity.

3.16 Financial Information. Seller has made available, or within five (5) days of Contract Date, shall make available to Purchaser unaltered copies of the year-to-date monthly financial statements and annual audited financial statements for calendar years 2011, 2012 and 2013 with respect to the Property, to the extent in the possession or control of Seller, Seller’s Affiliates or Manager; provided, however, that Seller makes no representation or warranty as to the accuracy or completeness of any such financial statements.

3.17 Certain Limitations on Seller's Representations and Warranties. The representations and warranties of Seller set forth in this Article III are subject to the following express limitations:

| 8 |

(a) The term "to Seller's actual knowledge," or "to the actual knowledge of Seller," or words of similar import shall mean the actual present knowledge of Mr. Jeff Burns, after due inquiry of the general manager of the Property.

(b) The expiration, amendment or termination of any Space Lease, Equipment Lease, Rooms Agreement or Service Contract by its terms or pursuant to Section 6.1 of this Agreement shall not affect the obligations of Purchaser hereunder or render any representation or warranty of Sellers untrue; and

(c) Seller's liability shall be limited as set forth in Section 14.7.

(d) With respect to Sections 3.6, 3.7 and 3.16, Seller shall request from Manager current copies of the Space Leases, Equipment Leases, Service Contracts, Rooms Agreements and Property financial statements. Seller shall deliver to Purchaser copies of any of the foregoing documents provided by Manager; provided, however, that Seller shall not be in default of this Agreement if any of the documents provided by Manager are incomplete or inaccurate and Seller has no knowledge of such incompleteness or inaccuracy.

ARTICLE IV

Purchaser's Representations, Warranties and Covenants

In order to induce Seller to enter into this Agreement and to consummate the transactions contemplated hereby, Purchaser represents and warrants to, and covenants with, Seller as follows, as of the Contract Date and as of the Closing Date:

4.1 Good Standing. Purchaser is a limited liability company organized, validly existing and in good standing under the laws of Delaware and is, or as of the Closing Date shall be, qualified to do business in Texas.

4.2 Due Authorization. Subject to obtaining approval of the Investment Committee of Thayer Hotel Investors VI LLC and Advisory Board of Thayer Hotel Investors VI Feeder LP, which Purchaser shall obtain, if at all, prior to the expiration of the Feasibility Period, the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby have been authorized by all requisite limited liability company actions of Purchaser (none of which actions have been modified or rescinded, and all of which actions are in full force and effect). Subject to obtaining approval of the Investment Committee of Thayer Hotel Investors VI LLC and Advisory Board of Thayer Hotel Investors VI Feeder LP, which Purchaser shall obtain, if at all, prior to the expiration of the Feasibility Period, this Agreement constitutes a valid and binding obligation of Purchaser, enforceable against Purchaser in accordance with its terms. Purchaser's failure to deliver a Termination Notice prior to the expiration of the Feasibility Period shall be deemed Purchaser's representation that Purchaser has obtained approval of the Investment Committee of Thayer Hotel Investors VI LLC and Advisory Board of Thayer Hotel Investors VI Feeder LP, and that the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby have been authorized by all requisite limited liability company actions of Purchaser (none of which actions have been modified or rescinded, and all of which actions are in force and effect).

| 9 |

4.3 Litigation. There are no actions, suits, arbitrations, proceedings, governmental investigations or other proceedings that are pending, or to Purchaser's knowledge, threatened, against Purchaser that would materially and adversely affect its ability to enter into, or perform its obligations under, this Agreement.

4.4 Terrorist Organizations List. Purchaser is not acting, directly or indirectly, for on or behalf of any Person named by the United States Treasury Department as a Specifically Designated National and Blocked Person, or for or on behalf of any Person designated in Executive Order 13224 as a Person who commits, threatens to commit, or supports terrorism. Purchaser is not engaged in the transaction contemplated by this Agreement directly or indirectly on behalf of, or facilitating such transaction directly or indirectly on behalf of, any such Person.

4.5 Bankruptcy. Purchaser is not the subject debtor under any federal, state or local bankruptcy or insolvency proceeding, or any other proceeding for dissolution, liquidation or winding up of its assets.

ARTICLE V

Closing

5.1 Closing. The consummation of the purchase and sale of the Property as contemplated by this Agreement (the "Closing") shall take place on the date that is thirty (30) days following the last day of the Feasibility Period (the "Closing Date"). The Closing shall be conducted as an "escrow closing" which shall take place at the office of the Escrow Agent without either party being present. The parties shall deliver to Escrow Agent, in escrow, on or before the Closing Date, all of Seller's and Purchaser's deliveries, the cash payment of the Purchase Price and sufficient additional cash necessary for the parties to pay the costs contemplated by Section 5.2 and there shall be no requirement that the parties attend a formal settlement. All transactions at the Closing shall be interdependent and are to be considered simultaneous, so that none are effective until all are effective.

5.2 Costs. Seller shall pay all transfer taxes and fees and any bulk sales taxes and other personal property taxes associated with the Closing. Purchaser shall pay for title insurance and the survey. Seller and Purchaser shall aggregate and split in accordance with local custom all recording taxes and fees and all fees of the Escrow Agent in connection with the Closing. Purchaser shall pay either (i) the Existing Loan Assumption Fees and all other fees associated with the assumption of the Existing Loan, including without limitation the Existing Lender's title insurance costs or (ii) all prepayment fees and other expenses (including the Existing Lender's legal fees) relating to the Loan Prepayment, as the case may be. Purchaser shall pay the amount of the Management Termination Fee, as described in Section 6.12. Each party shall pay its own attorneys' fees incurred in connection with this transaction.

| 10 |

ARTICLE VI

Actions Pending Closing

6.1 Conduct of Business; Maintenance and Operation of Property.

(a) Between the Contract Date and the Closing Date, Seller shall carry on the business of the Property as a full-service hotel in the ordinary course and in a good and diligent manner consistent with prior practice. Seller shall cause the Property to be maintained in its present order and condition, normal wear and tear excepted, and subject to any casualty, which shall be governed by Article XII, and shall cause the continuation of the normal operation thereof, including the purchase and replacement of supplies and equipment, the maintenance of its beneficial relations with guests, suppliers and others having business dealings with the Seller and the continuation of the normal practice with respect to maintenance and repairs so that the Property shall, except for normal wear and tear and subject to any casualty, be in substantially the same condition on the Closing Date as on the Contract Date. Seller shall not remove or permit to be removed any Personal Property except in the ordinary course of business or as necessary for repairs or replacements of worn out or obsolete items. Seller shall pay or shall cause to be paid all tax amounts due for the Property for the period prior to Closing.

(b) Notwithstanding the foregoing to the contrary, Purchaser acknowledges that Seller has been working with Chef John Tesar and his affiliated entity, J Tesar LLC dba Tesar Restaurant Group ("Tesar Entity") on a concept to convert the existing restaurant at the Real Property, Central 214, to a modern steakhouse concept to be known as Knife (the "Restaurant Conversion"). Seller shall be responsible for certain capital expenditures related to the Restaurant Conversion, which shall include (i) those items listed on Schedule 6.1(b) attached hereto, and (ii) such other items as agreed upon in writing by Purchaser and Seller during the Feasibility Period. At Closing, Purchaser shall assume the consulting agreement with Tesar Entity (which agreement shall be provided within five (5) days of the Contract Date, the "Consulting Agreement"), on terms mutually agreed upon by Seller and Purchaser.

6.2 Title.

(a) Purchaser shall obtain a binding commitment for an owner's policy of title insurance to be issued by First American Title Insurance Company or other nationally recognized, financially sound title insurance company acceptable to Purchaser and Seller (the "Title Company") to Purchaser on the Form T-1 Owner's Policy of Title Insurance (the "Title Commitment"), committing to insure Purchaser's good and indefeasible fee simple title to the Real Property. The title policy to be issued pursuant to the Title Commitment (the "Title Policy") shall be in an amount at least equal to the portion of the Purchase Price allocable to the value of the Real Property, as shown in Exhibit E. The Title Policy shall show no liens, mortgages, deeds of trust, security interests, pledges, charges, options, encroachments, easements, covenants, leases, reservations or restrictions of any kind (the "Encumbrances") other than: (i) if Purchaser elects to assume the Existing Loan, the lien(s) evidencing and securing the Existing Loan; (ii) applicable zoning regulations and ordinances; (iii) liens for taxes, assessments, and governmental charges not yet due and payable; and (iv) the Permitted Exceptions.

| 11 |

(b) Purchaser agrees to notify Seller in writing (the "Title Objection Notice") of any objections to exceptions appearing in the Title Commitment no later than ten (10) days prior to the expiration of the Feasibility Period. Within five (5) days following the Title Objection Notice, Seller shall notify Purchaser either that it will eliminate some or all exceptions to which Purchaser has objected prior to the Closing Date or stating that it will not eliminate any such exceptions. If Seller does not respond in such five (5) day period, Seller shall be deemed to have notified Purchaser that Seller will not eliminate any of the objections set forth on Purchaser's Title Objection Notice. If Seller elects not to remove all exceptions to title to which Purchaser has objected, Purchaser may terminate this Agreement in its sole discretion prior to the end of the Feasibility Period and receive a return of the Deposit. If Purchaser does not so terminate this Agreement, all exceptions shown on the Title Commitment other than those that Seller has affirmatively agreed to remove shall be deemed "Permitted Exceptions".

(c) In the event that any updated Title Commitment provided to Purchaser after the expiration of the Feasibility Period shows any material exceptions that were not included on the original Title Commitment, Purchaser shall have a period of five (5) days following receipt of such update to deliver to Seller a Title Objection Notice with respect to such update. Within five (5) days following such Title Objection Notice, Seller shall notify Purchaser either that it will eliminate some or all of the new exceptions to which Purchaser has objected prior to the Closing Date or stating that it will not eliminate any such exceptions. If Seller does not respond in such five (5) day period, Seller shall be deemed to have notified Purchaser that Seller will not eliminate any of the objections set forth on Purchaser's Title Objection Notice. If Seller elects not to remove all exceptions to title to which Purchaser has objected, Purchaser may terminate this Agreement in its sole discretion on or before the date that is five (5) days after Seller's response to Purchaser's Title Objection Notice (or if Seller does not respond, the date that is ten (10) days after delivery of Purchaser's Title Objection Notice), and receive a return of the Deposit. If Purchaser does not so terminate this Agreement, all exceptions shown on any update to the Title Commitment other than those that Seller has affirmatively agreed to remove shall also be deemed "Permitted Exceptions".

(d) The Title Policy may include such additional endorsements as Purchaser reasonably may request, including without limitation, Access, Contiguity, Minerals and Surface Damage, Restrictions, Encroachments and Minerals, and Deletion of Arbitration endorsements, to the extent the Title Company has agreed to issue such endorsements to Purchaser prior to the expiration of the Feasibility Period; provided, however, that obtaining any endorsements or extended coverage (including without limitation limiting the standard exception for "any discrepancies, conflicts or shortages in area or boundary lines, or any encroachments or protrusions, or any overlapping of improvements" to "shortages in area" only) shall not be a condition precedent to Purchaser's obligation to close.

6.3 Survey. Seller shall cooperate with Purchaser in obtaining an as-built survey of the Property, prepared in conformity with current American Land Title Association/American Congress on Surveying and Mapping standards for "Class-A" surveys and certified to Purchaser, the Existing Lender and the Title Company by a duly licensed land surveyor or professional engineer. Any objections to the survey shall be addressed in Purchaser's Title Objection Notice, and shall be deemed waived if Purchaser does not terminate this Agreement prior to the expiration of the Feasibility Period.

6.4 Cooperation. Seller shall cooperate reasonably, at no cost to Seller, with Purchaser in securing the transfer or issuance of any permits or licenses, including, without limitation, a liquor license which is held by KHRG Texas Holdings, Inc. an affiliate of Manager ("Liquor Entity"), necessary to permit the lawful, continuous operation of the Property by Purchaser immediately following the Closing Date.

| 12 |

6.5 Service Contracts; Equipment Leases; Space Leases. Between the Contract Date and the Closing Date, Seller shall not renew, extend or modify any Service Contract, Equipment Lease or Space Lease or enter into any new such agreements that would survive the Closing Date other than in the ordinary course of business, without Purchaser's prior written consent in each instance (which consent shall not be withheld or delayed unreasonably). Notwithstanding the foregoing, the parties acknowledge that Seller has entered into a letter of intent dated January 31, 2014, which has been previously reviewed by Purchaser, for the lease of the former Brackets space at the Real Property (the "Brackets Lease"). Seller shall (i) provide Purchaser with all material information in Seller's possession regarding the negotiation of the proposed Brackets Lease, (ii) within three (3) days after the Contract Date introduce Purchaser to the proposed tenant thereunder, and (iii) permit Purchaser to lead and initiate all subsequent discussions with said proposed tenant. Seller and Purchaser shall use commercially reasonable efforts to obtain the proposed tenant's signature, prior to Closing, on the Brackets Lease (in a commercially reasonable form acceptable to Purchaser, which lease document will provide that the Brackets Lease will only be effective upon the occurrence of the Closing). All of Seller's interest in and to the Brackets Lease shall be assigned to and assumed by Purchaser as of the Closing. The amount of Six Hundred Thousand and No/100ths Dollars ($600,000.00) (the "Brackets TI/LC Amount"), is currently held by Existing Lender in a reserve account pursuant to the Existing Loan. If the Existing Loan is assumed by Purchaser, the Brackets TI/LC Amount shall be assigned to Purchaser as of the Closing (to be disbursed by Existing Lender pursuant to the Existing Loan Documents, as amended by those loan documents executed in connection with the assignment and assumption of the Existing Loan), and if Purchaser chooses the Loan Prepayment, Purchaser shall instead be credited the amount of the Brackets TI/LC Amount at Closing.

6.6 Liquor License. Promptly following the expiration of the Feasibility Period, Purchaser shall make an application to the appropriate governmental authorities to have a new liquor license issued in the name of Purchaser or an entity designated by Purchaser in compliance with local law, and Seller shall reasonably cooperate with Purchaser in this regard, at Purchaser's sole cost and expense. Purchaser shall use all reasonable efforts, at its sole cost and expense, to obtain the approval of applicable authorities for the issuance of a new liquor license prior to, or contemporaneously with, the Closing. If such issuance has not been approved by the Closing Date, Seller agrees to use commercially reasonable efforts to cause Liquor Entity to execute such documents as are legal and customary to permit the continued sale of alcoholic beverages for up to ninety (90) days after the Closing pending such approval. In such event, Purchaser shall maintain liquor liability insurance in amounts currently maintained by Liquor Entity naming Liquor Entity and Seller as additional insureds, and Purchaser further agrees to indemnify, defend and hold Liquor Entity and Seller harmless from and against any liability, cost or expense arising out of Liquor Entity's cooperation with Purchaser during such interim period. The provisions of this Section 6.6 shall survive the Closing.

| 13 |

6.7 Inspection.

(a) Purchaser acknowledges that since April 10, 2014, Purchaser has been given certain access to the Property at its own risk, cost and expense and has been permitted to enter, or cause its representatives, engineers, contractors, consultants, agents, officers or employees ("Purchaser Representatives") to enter upon the Property for the purpose of making surveys or other tests, inspections, investigations and/or studies of the Property ("Purchaser Investigations"). Purchaser shall continue to have the right, upon no less than two full (2) business days' notice to Seller, at its own risk, cost and expense and at any date or dates prior to Closing, to enter, or cause its agents or representatives to enter, upon the Property for the Purchaser Investigations. Purchaser's written notice (which may be by email) shall specify the intended date of entry and shall provide a detailed description of the proposed Purchaser Investigations, including, without limitation, a list of contractors who will be performing the proposed Purchaser Investigation, a copy, if applicable, of the Purchaser’s testing plan and such other information as Seller reasonably requires in connection with such proposed Purchaser Investigation. Purchaser shall not conduct any test or investigation involving physical disturbance, sampling or invasive testing of any portion of the Property without Seller's prior written approval, which may be withheld or conditioned in Seller's sole and absolute discretion. Neither Purchaser nor any Purchaser Representatives shall enter the Property until Seller has given written approval (which may be by email) of both the request and any testing plan. In addition, and subject to this Section 6.7, Purchaser may conduct such architectural, environmental, engineering, economic and other non-invasive studies of the Property as Purchaser may, in its sole discretion, deem desirable. Purchaser shall not make any physical alterations to the Property, and all such entry shall be conducted during normal business hours of the Property and shall not unreasonably interfere with the use, occupation or operation of the Property, and Purchaser shall indemnify, defend and hold Seller harmless from any cost, claim, liability or expense incurred in connection therewith, except that Purchaser's obligations as set forth in this sentence shall not extend to previously existing conditions that are discovered by Purchaser to be present on, under or about the Property unless exacerbated by Purchaser's Investigations. Purchaser shall have reasonable access to all documentation, agreements and other information in the possession of Seller or Seller's agents related to the Property, all of which shall be without representation or warranty of any kind except as expressly set forth in this Agreement or in any of the Closing documents, and Purchaser shall have the right to make copies of same, including, without limitation, the Existing Loan Documents and those documents listed on Exhibit J attached hereto (the "Due Diligence Materials"), but specifically excluding any internal memoranda and attorney-client privileged documents. Unaltered copies of the Due Diligence Materials shall be delivered to Purchaser upon execution of this Agreement. A representative of Seller shall have the right, but not the obligation, to be present during any Purchaser Investigation. Purchaser shall, at its own expense, promptly fill and compact any holes, and otherwise restore any damage to the Property related to the Purchaser Investigations. Upon Purchaser’s completion of Purchaser Investigations, Purchaser shall be responsible for returning the Property to substantially the condition existing prior to Purchaser’s entry. Neither Purchaser nor any Purchaser Representative shall damage any part of the Property or any personal property owned or held by any tenant, occupant or guest of the Real Property. If Purchaser elects to terminate this Agreement pursuant to Section 6.8(b), Purchaser agrees to supply Seller with the results of any tests, studies or inspections of the Property performed pursuant to this Section 6.7 (the "Purchaser Reports"); provided, however, that Purchaser shall not be required to provide Seller with any Purchaser Reports to the extent the same (i) are legally privileged or constitute attorney work product, (ii) are subject to a confidentiality agreement or to applicable law prohibiting their disclosure by Purchaser, or (iii) constitute confidential internal assessments, reports, financial analysis, studies, memoranda, notes or other correspondence prepared by or on behalf of any officer, employee, lawyer or accountant of Purchaser in connection with Purchaser’s due diligence investigations. Seller acknowledges that the delivery of any such Purchaser Reports shall be without warranty or representation whatsoever other than that such materials have been fully paid for and may be delivered to Seller.

| 14 |

(b) Except as otherwise set forth in Section 6.10, Purchaser shall not purposefully contact any Property tenant, employee, guest, or invitee without Seller’s prior written consent, and Seller or its designated representative shall have the right to be present (whether telephonically or in person, as determined by Seller) during any conversations between Purchaser and any such person.

(c) Before and during Purchaser Investigations, Purchaser and each Purchaser Representative conducting any Purchaser Investigation shall maintain workers’ compensation insurance in accordance with applicable law, and Purchaser, or the applicable Purchaser Representative conducting any Purchaser Investigation, shall maintain commercial general liability insurance with limits of at least Two Million Dollars ($2,000,000.00) combined single limit for personal injury and property damage per occurrence. Purchaser shall deliver to Seller evidence of such workers’ compensation insurance and a certificate evidencing the commercial general liability and property damage insurance before conducting any Purchaser Investigation on the Property. Each such insurance policy shall be written by a reputable insurance company having a rating of at least "A+:VII" by Best’s Rating Guide (or a comparable rating by a successor rating service), and shall otherwise be subject to Seller’s prior reasonable approval. Such insurance policies shall name as additional insureds Seller, Manager, and such other parties holding insurable interests as Seller may designate.

(d) Purchaser agrees that information gathered in connection with this Agreement, including without limitation the results of the Purchaser Investigations (including those Purchaser Investigations undertaken prior to the Contract Date) and the Due Diligence Materials that is not generally known to the public (the "Confidential Information") shall be considered to be confidential, and such Confidential Information shall be used by Purchaser and Purchaser Representatives solely for the purpose of Purchaser’s evaluation of the physical and environmental condition of the Property and evaluation of the transaction. Purchaser shall use commercially reasonable efforts not to reveal, disclose, disseminate, publish or communicate to any other persons, parties or entities any Confidential Information, without the prior written consent of Seller, which shall be given or withheld in Seller’s sole, but reasonable, discretion, other than to Purchaser’s partners, employees, consultants, attorneys, engineers, prospective investors, and lenders involved in this transaction who are responsible for determining the feasibility of Purchaser’s acquisition of the Property and who have agreed to preserve the confidentiality of such information as required hereby (collectively, "Permitted Outside Parties"). Purchaser shall be responsible for ensuring that any and all Purchaser Representatives and Permitted Outside Parties (and any other person for whom Purchaser has responsibility hereunder) complies with the provisions of this Section 6.7(d) except in connection with a court order, other legal process or if necessary to comply with any reporting requirements mandated by law. In permitting Purchaser and the Permitted Outside Parties to review the Due Diligence Materials or any other Confidential Information, Seller has not waived any privilege or claim of confidentiality with respect thereto, and no third party benefits or relationships of any kind, either express or implied, have been offered, intended or created. The provisions of this Section 6.7(d) shall survive the termination of this Agreement in accordance with Section 14.1(a) below. Purchaser shall also promptly notify Seller in writing of requests for Confidential Information from any third party or regulatory agency.

| 15 |

(e) Purchaser shall indemnify, defend and hold Seller, Seller’s asset management company, Seller’s property management company, and their respective affiliates, partners, shareholders, officers, managers, members, directors, agents and employees (the "Seller Investigation Indemnified Parties") harmless from any and all losses, costs, liens, claims, causes of action, liability, damages, expenses and liability (including, without limitation, court costs and reasonable attorneys’ fees) (all of the foregoing, collectively, "Investigation Claims") incurred in connection with or arising in any way from (i) any Purchaser Investigation conducted by Purchaser and/or any Purchaser Representative, (ii) any entry onto the Real Property by Purchaser or any Purchaser Representative in connection with a Purchaser Investigation; or (iii) any breach by Purchaser and/or any Purchaser Representative of the terms of this Section 6.7, other than Investigation Claims resulting from the gross negligence or willful misconduct of any Seller Investigation Indemnified Party. This indemnity provision shall survive termination or expiration of this Agreement.

6.8 Feasibility Period.

(a) Seller has disclosed to Purchaser that the limited liability company operating agreement of Seller requires that the manager of Seller notify all members of the proposed sale, and permit any member that does not approve the sale an opportunity to purchase the interest in the Seller owned by the other member(s) and/or the Property. Seller shall commence the process of obtaining all members' consent to the sale (the "Consents") no later than one (1) business day following the Contract Date. If Seller has not delivered to Purchaser written notice that Seller has obtained all necessary Consents (the “Consent Notice”) by the date that is fifteen (15) business days following the Contract Date (the “Consent Notice Deadline”), then Seller may terminate this Agreement by delivering written notice to Purchaser and the Escrow Agent (the “Consent Termination Notice”) within one (1) business day following the Consent Notice Deadline. The Consent Notice, if any, shall contain evidence reasonably satisfactory to Purchaser and the Title Company that the Consents have been received. If Seller terminates this Agreement by delivering the Consent Termination Notice to Purchaser and the Escrow Agent in a timely manner, then the Deposit shall be returned immediately to Purchaser, and neither party shall have any obligations hereunder except for those which expressly survive termination. If Seller does not timely deliver the Consent Termination Notice, Seller’s right to terminate this Agreement pursuant to this Section 6.8(a) shall be deemed to have been waived, this Agreement shall remain in full force and effect, and Seller shall be obligated to deliver evidence reasonably satisfactory to Purchaser and the Title Company of the Consents prior to Closing.

| 16 |

(b) If, during the period between the Contract Date and the date that is 5:00 p.m. Dallas, Texas time on the date which is thirty (30) days after the date that the Consent Notice is delivered to Purchaser (the "Feasibility Period"), Purchaser gives Seller written notification (the "Termination Notice") that Purchaser elects not to consummate the purchase of the Property in accordance with the terms of this Agreement, this Agreement shall terminate, the Deposit shall be returned immediately to Purchaser and neither party shall have any obligations hereunder except for those which expressly survive termination. The Purchaser shall have the absolute right, in its sole discretion, to determine whether to give the Termination Notice. If Purchaser elects not to give the Termination Notice prior to the expiration of the Feasibility Period, Purchaser's right to terminate this Agreement pursuant to this Section 6.8(b) shall be deemed to have been waived, this Agreement shall remain in full force and effect, and the Deposit shall become non-refundable except as specifically set forth herein.

(c) Prior to the expiration of the Feasibility Period, Purchaser shall notify Seller of any Service Contracts, Space Leases, Equipment Leases and/or Rooms Agreements that Purchaser requests that Seller terminate, each of which shall be terminated at or prior to Closing (collectively, the "Excluded Contracts"). Purchaser shall be responsible for any fees or penalties in connection with the Excluded Contracts; provided, however, that Seller shall be obligated to terminate any Service Contract, Space Lease, Equipment Lease and/or Rooms Agreement that is not assignable by its terms and shall be responsible for any fees or penalties in connection therewith.

6.9 Existing Loan. Prior to Closing, Seller shall perform its obligations under the Existing Loan Documents (which shall include, without limitation, all monetary obligations). Except for any amendments or modifications to the Existing Loan Documents relating to Purchaser's assumption of the Existing Loan as contemplated hereunder, Seller shall not amend, modify or terminate any of the Existing Loan Documents without Purchaser's prior written consent, which consent may be withheld in Purchaser's sole and absolute discretion. Seller shall promptly deliver to Purchaser copies of any notices received by Seller from Existing Lender or delivered by Seller to Existing Lender under the Existing Loan Documents during the term of this Agreement, provided, that, the same do not include any confidential or proprietary information relating to Seller or any of Seller's Affiliates.

6.10 WARN Act.

(a) Neither Seller nor Manager shall give any termination notices under the Worker Adjustment and Retraining Notification Act (collectively with any similar applicable state or local laws, the "WARN Act") to any Hotel Employees or any governmental authorities. All employees of the Manager allocated to the Property (the "Hotel Employees") shall have their employment at the Property terminated as of the Closing Date and all wages, commissions, withholding, contributions and other employment benefits will have been properly paid and accounted for by Manager; provided, however, that Purchaser may hire the Hotel Employees (the "Continuing Employees"), on such terms and conditions as they may agree, following termination of their employment by Manager. Notwithstanding anything to the contrary contained herein, concurrently with the Closing, Purchaser shall cause its replacement manager to offer to hire a sufficient number of Hotel Employees on terms sufficient to avoid applicability of the WARN Act and shall continue to employ a sufficient number of Continuing Employees for a sufficient period of time to avoid application of the WARN Act. If Purchaser shall fail to comply with the provisions of this Section 6.10(a), Purchaser shall indemnify, defend and hold harmless the Seller Indemnitees from and against any and all liabilities, losses, costs, damages and expenses (including, without limitation, reasonable attorneys' fees) that may be incurred by, or asserted against, any such Seller Indemnitee arising out of or relating to the failure to give a termination notice under the WARN Act to the Hotel Employees or to any governmental authorities. This Section 6.10(a) shall survive the Closing.

| 17 |

(b) Seller hereby grants Purchaser the right, but not the obligation, to have its replacement manager begin interviewing employees of Seller at the Property following expiration of the Feasibility Period so that such replacement manager can determine which of the Hotel Employees Purchaser’s replacement manager intends to rehire. Notwithstanding the foregoing, if this Agreement is not terminated by Seller prior to the Consent Termination Deadline, Purchaser and/or its representative thereafter may interview the general manager, director of finance/controller, director of human resources, director of revenue management, director of sales and marketing and food and beverage general manager, provided that Seller is given at least two (2) business days' prior written notice (which may be by email) and the opportunity to have a representative present.

6.11 Tax Clearance Certificate. Purchaser may, at Purchaser's option, request a tax clearance certificate issued by the local taxing authority having jurisdiction over the Property, in order to determine whether all sales and use taxes for the Property have been paid to date. Seller shall reasonably cooperate with such request (which may be fulfilled by making a written request to Manager to cooperate with such request, if applicable) at no cost to Seller.

6.12 Termination of Manager. Seller shall obtain an acknowledgement from Manager (a) setting forth the amount of the termination fee required to be paid to Manager in connection with the termination of the Existing Management Agreement (the “Management Termination Fee”), (b) acknowledging that upon receipt of the Management Termination Fee, effective as of the Cut-Off Time, the Existing Management Agreement shall be terminated and Manager shall thereafter have no rights or claims against the Purchaser or the Property arising out of or relating to the Existing Management Agreement or its termination, and (c) agreeing to enter into, or cause Liquor Entity to enter into, an interim beverage agreement with Purchaser or Purchaser's designee necessary to permit the continued sale of alcoholic beverage at the Property in accordance with Section 10.3.3 of the Existing Management Agreement (the “Manager Acknowledgment”).

ARTICLE VII

Purchaser's Conditions Precedent to Closing

It shall be an express precondition to Purchaser's obligation to purchase the Property that each and every one of the following conditions shall have been satisfied as of the Closing Date (or waived by Purchaser).

7.1 Representations and Warranties. Each of Seller's representations and warranties shall be true and accurate in all material respects as if made on and as of the Closing Date.

7.2 Covenants of Seller. All actions Seller covenants herein to take shall have been completed.

| 18 |

7.3 Termination of Existing Management Agreement. The Management Agreement shall have been terminated; provided, however, that Seller shall receive a credit at Closing from Purchaser for the Management Termination Fee to the extent set forth in the Manager Acknowledgment. On the Closing Date, there shall be no contract or agreement in effect between Seller and any third party for management of the Property after the Closing Date. There shall be no fees, payments, commissions or other sums due and owing in connection with management of the Property under the Existing Management Agreement or any other management agreement for the period prior to the Closing Date, except to the extent to be paid by Seller following Closing in the ordinary course of business.

7.4 Title. Purchaser shall be able to obtain a policy of title insurance in conformance with the Title Commitment, subject only to the Permitted Exceptions.

7.5 Approval of Assumption of Existing Loan. Unless Purchaser has elected, in a timely manner, to prepay rather than assume the Existing Loan pursuant to Section 2.4(c), the Existing Lender shall have delivered loan assumption documents for Purchaser's proposed assumption of the Existing Loan consistent with the terms and conditions set forth in the Loan Assumption Term Sheet (the "Loan Assumption Documents").

7.6 Failure of Condition. In the event of the failure of any condition precedent set forth above, Purchaser, at its sole election, may (a) terminate this Agreement (and receive a return of the Deposit); (b) waive the condition and proceed to Closing; (c) with respect to a failure of the condition set forth in Section 7.5 only, extend the Closing Date for up to an additional ten (10) days; or (d) if such failure arises from Seller's breach of this Agreement, avail itself of any remedies provided in Section 10.2.

ARTICLE VIII

Seller's Conditions Precedent to Closing

It shall be an express precondition to Seller's obligation to convey the Property that each and every one of the following conditions shall have been satisfied as of the Closing Date (or waived by Seller).

8.1 Representations and Warranties. Each of Purchaser's representations and warranties shall be true and accurate in all material respects as if made on and as of the Closing Date.

8.2 Covenants of Purchaser. All actions Purchaser covenants herein to take shall have been completed.

8.3 Purchase Price. Purchaser shall be able to deliver the Purchase Price to the Escrow Agent.

8.4 Approval of Assumption of Existing Loan. If Purchaser is assuming the Existing Loan, the Existing Lender shall have delivered Loan Assumption Documents containing a release as approved by Seller pursuant to Section 2.4(a).

| 19 |

8.5 Failure of Condition. In the event of the failure of any condition precedent set forth above, Seller, at its sole election, may (a) terminate this Agreement (and the Deposit shall be returned to Purchaser); (b) waive the condition and proceed to Closing; (c) with respect to a failure of the condition set forth in Section 8.4 only, extend the Closing Date for up to an additional ten (10) days; or (d) if such failure arises from Purchaser's breach of this Agreement, avail itself of any remedies provided in Section 10.1.

ARTICLE IX

Closing Deliveries

9.1 Deed. Seller shall deliver a special warranty deed in recordable form in the form attached hereto as Exhibit K, conveying Seller's fee simple interest in the Real Property (the "Deed"), dated as of the Closing Date, free of all encumbrances other than the Permitted Exceptions conveying to Purchaser fee simple interest in the Real Property as required hereunder.

9.2 Bill of Sale. Seller and Purchaser shall deliver a bill of sale, dated as of the Closing Date, conveying to Purchaser the Personal Property, but specifically excluding the Excluded Personal Property, in the form attached hereto as Exhibit L.

9.3 Assignment of Permits and Licenses. Seller and Purchaser shall deliver an assignment of all existing permits and licenses relating to the Property if and to the extent assignable to Purchaser, in the form attached hereto as Exhibit M.