Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 2014 EARNINGS CALL PRESENTATION - Federal Home Loan Bank of Seattle | a8-k2014earningscall.htm |

Federal Home Loan Bank of Seattle Exhibit 99.1 2014 Earnings Call Michael L Wilson President and Chief Executive Officer Federal Home Loan Bank of Seattle March 25, 2015

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including information regarding the proposed merger of the Federal Home Loan Bank of Seattle (Seattle Bank) with the Federal Home Loan Bank of Des Moines (Des Moines Bank). These statements may be identified by the use of forward- looking terminology, such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plan,” “could,” “should,” “would,” “may,” and “will,” or their negatives, or other variations on those or other terms. Forward-looking statements are subject to known and unknown risks and uncertainties. For example, the Seattle Bank’s actual financial performance and condition prior to the proposed merger or actions or transactions related to the proposed merger, including its completion, the Amended Consent Arrangement, and payments of dividends and repurchases of capital stock may differ materially from those expected or implied in forward-looking statements because of many factors. Such factors may include, but are not limited to, the continued ability or desire of a party to pursue the proposed merger, the occurrence of any event, change, or other circumstance that could give rise to the termination of the merger agreement related to the proposed merger, regulatory and legislative actions and approvals (including those of the Federal Housing Finance Agency relating to the stock repurchases and dividends and acceptance of final merger documentation), potential benefits, costs, liabilities, and delays related to the proposed merger, changes in general economic and market conditions (including effects on, among other things, U.S. debt obligations and mortgage-related securities), demand for advances, changes in the bank's membership profile or the withdrawal of one or more large members, shifts in demand for the bank's products and consolidated obligations, business and capital plan and policy adjustments and amendments, competitive pressure from other Federal Home Loan Banks and alternative funding sources, the Seattle Bank's ability to meet adequate capital levels, accounting adjustments or requirements (including changes in assumptions and estimates used in the bank's financial models), interest-rate volatility, changes in projected business volumes, the bank's ability to appropriately manage its cost of funds, changes in the bank's management and Board of Directors, and hedging and asset-liability management activities. Additional factors are discussed in the Seattle Bank's most recent annual report on Form 10-K. The Seattle Bank does not undertake to update any forward- looking statements made in this presentation. Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 2

2014 Financial Results Our Merger with the Federal Home Loan Bank of Des Moines Agenda 3

2014 Financial Results 4

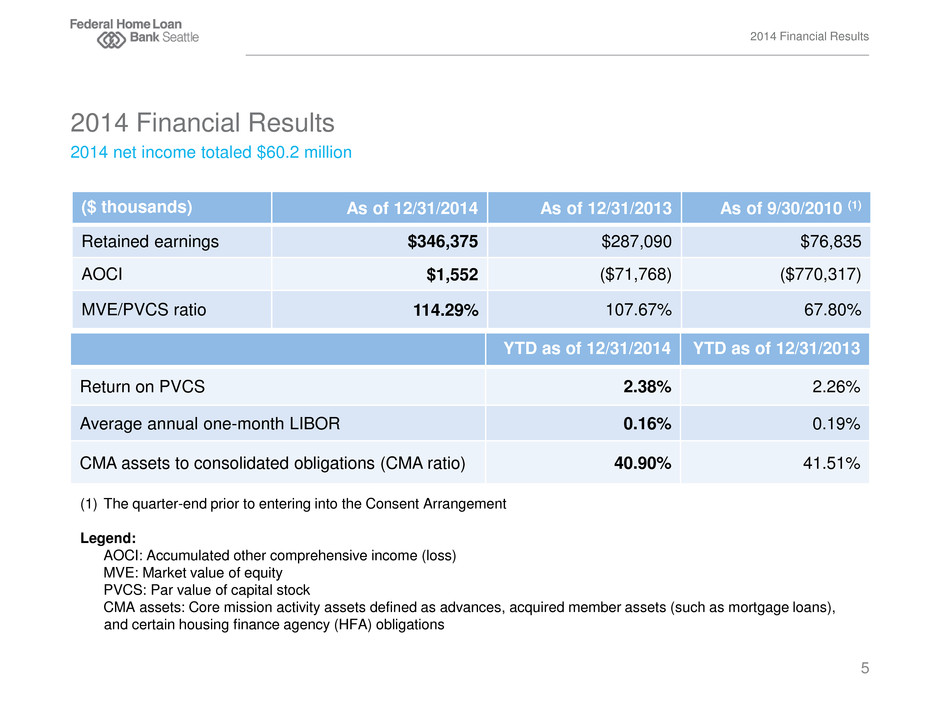

2014 net income totaled $60.2 million 2014 Financial Results 2014 Financial Results 5 ($ thousands) As of 12/31/2014 As of 12/31/2013 As of 9/30/2010 (1) Retained earnings $346,375 $287,090 $76,835 AOCI $1,552 ($71,768) ($770,317) MVE/PVCS ratio 114.29% 107.67% 67.80% YTD as of 12/31/2014 YTD as of 12/31/2013 Return on PVCS 2.38% 2.26% Average annual one-month LIBOR 0.16% 0.19% CMA assets to consolidated obligations (CMA ratio) 40.90% 41.51% (1) The quarter-end prior to entering into the Consent Arrangement Legend: AOCI: Accumulated other comprehensive income (loss) MVE: Market value of equity PVCS: Par value of capital stock CMA assets: Core mission activity assets defined as advances, acquired member assets (such as mortgage loans), and certain housing finance agency (HFA) obligations

Regulatory approval of dividend payments and stock repurchases* 2014 Financial Results Continued Progress in Our Return to Normal Operations 6 Paying Dividends • Paid dividends and interest on mandatorily redeemable capital stock (MRCS) totaling $2.6 million in 2014, compared to $1.4 million in 2013. • Board of Directors approved $0.025 per share dividend based on fourth quarter 2014 financial results: — Paid on February 23, 2015 — Amount based on average Class A and Class B stock outstanding during fourth quarter 2014 Repurchasing Stock • Repurchased $396.9 million of excess capital stock, compared to $98.5 million in 2013 • Q1 2015 stock repurchases include: — $25 million of excess capital stock from across the bank’s shareholder base, repurchased on March 9, 2015 — $75 million of excess capital stock from shareholders whose redemption requests have satisfied the redemption waiting period, repurchased on March 23, 2015 *The Federal Housing Finance Agency (FHFA) reviews the bank’s requests to repurchase and pay dividends on its capital stock on a quarterly basis.

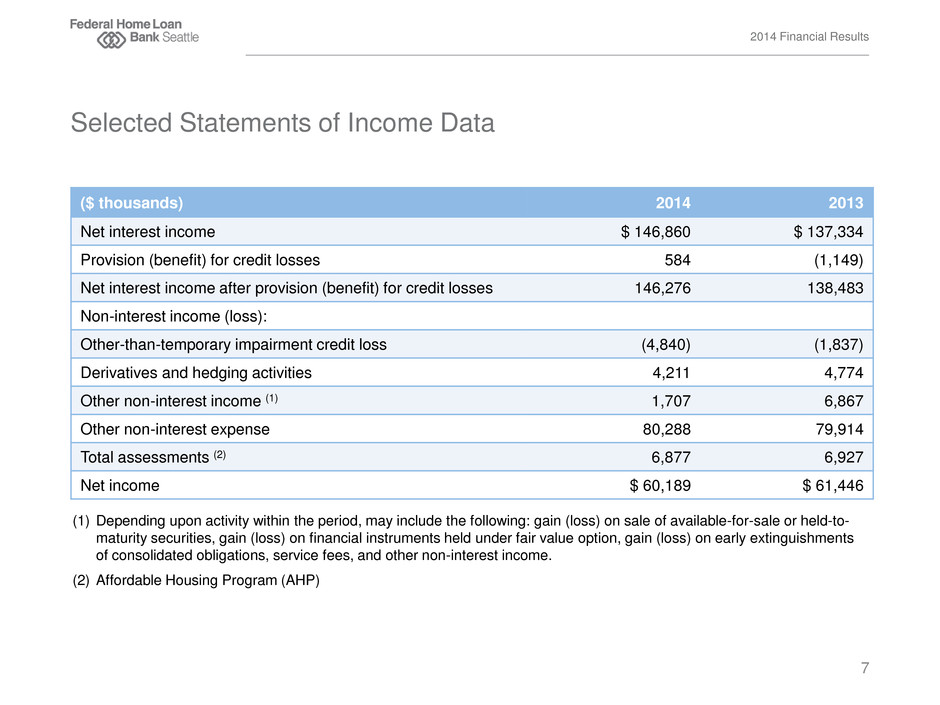

2014 Financial Results Selected Statements of Income Data 7 ($ thousands) 2014 2013 Net interest income $ 146,860 $ 137,334 Provision (benefit) for credit losses 584 (1,149) Net interest income after provision (benefit) for credit losses 146,276 138,483 Non-interest income (loss): Other-than-temporary impairment credit loss (4,840) (1,837) Derivatives and hedging activities 4,211 4,774 Other non-interest income (1) 1,707 6,867 Other non-interest expense 80,288 79,914 Total assessments (2) 6,877 6,927 Net income $ 60,189 $ 61,446 (1) Depending upon activity within the period, may include the following: gain (loss) on sale of available-for-sale or held-to- maturity securities, gain (loss) on financial instruments held under fair value option, gain (loss) on early extinguishments of consolidated obligations, service fees, and other non-interest income. (2) Affordable Housing Program (AHP)

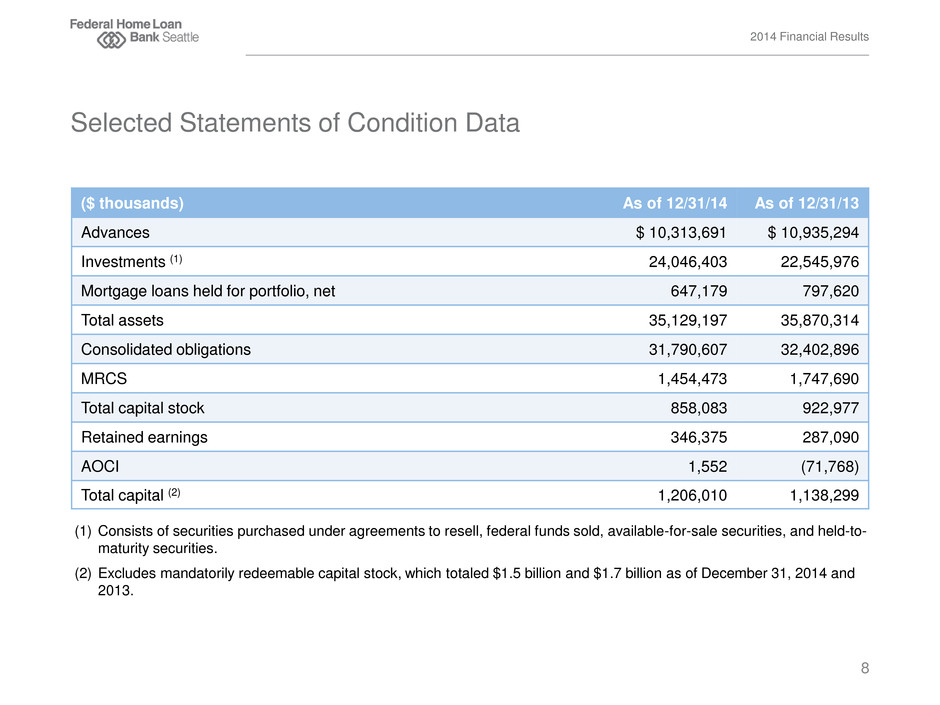

2014 Financial Results Selected Statements of Condition Data 8 ($ thousands) As of 12/31/14 As of 12/31/13 Advances $ 10,313,691 $ 10,935,294 Investments (1) 24,046,403 22,545,976 Mortgage loans held for portfolio, net 647,179 797,620 Total assets 35,129,197 35,870,314 Consolidated obligations 31,790,607 32,402,896 MRCS 1,454,473 1,747,690 Total capital stock 858,083 922,977 Retained earnings 346,375 287,090 AOCI 1,552 (71,768) Total capital (2) 1,206,010 1,138,299 (1) Consists of securities purchased under agreements to resell, federal funds sold, available-for-sale securities, and held-to- maturity securities. (2) Excludes mandatorily redeemable capital stock, which totaled $1.5 billion and $1.7 billion as of December 31, 2014 and 2013.

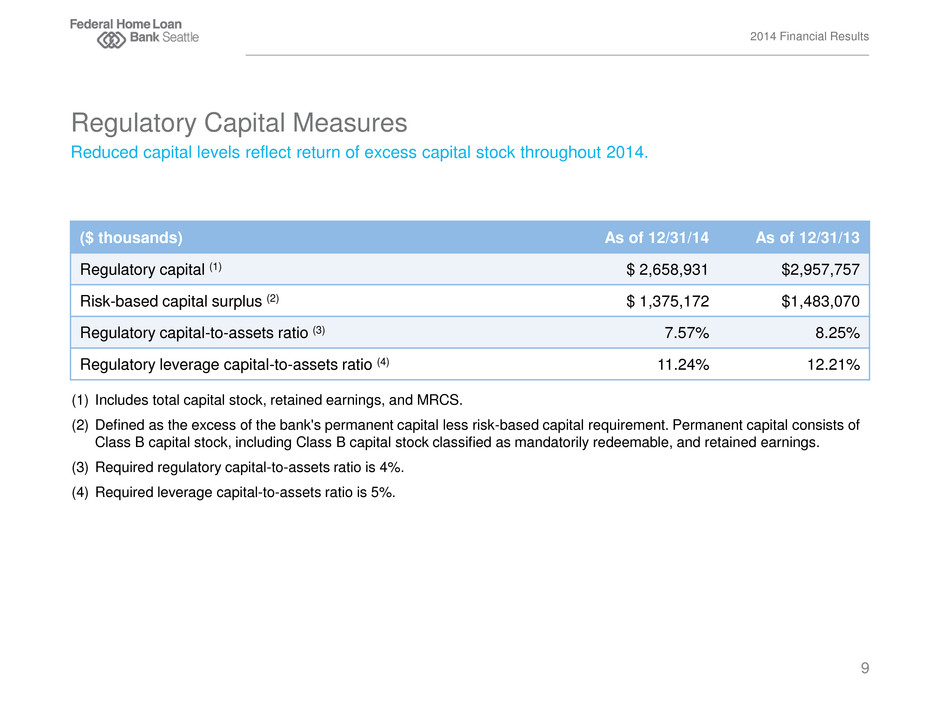

Reduced capital levels reflect return of excess capital stock throughout 2014. 2014 Financial Results Regulatory Capital Measures 9 ($ thousands) As of 12/31/14 As of 12/31/13 Regulatory capital (1) $ 2,658,931 $2,957,757 Risk-based capital surplus (2) $ 1,375,172 $1,483,070 Regulatory capital-to-assets ratio (3) 7.57% 8.25% Regulatory leverage capital-to-assets ratio (4) 11.24% 12.21% (1) Includes total capital stock, retained earnings, and MRCS. (2) Defined as the excess of the bank's permanent capital less risk-based capital requirement. Permanent capital consists of Class B capital stock, including Class B capital stock classified as mandatorily redeemable, and retained earnings. (3) Required regulatory capital-to-assets ratio is 4%. (4) Required leverage capital-to-assets ratio is 5%.

Our Merger with the Federal Home Loan Bank of Des Moines 10

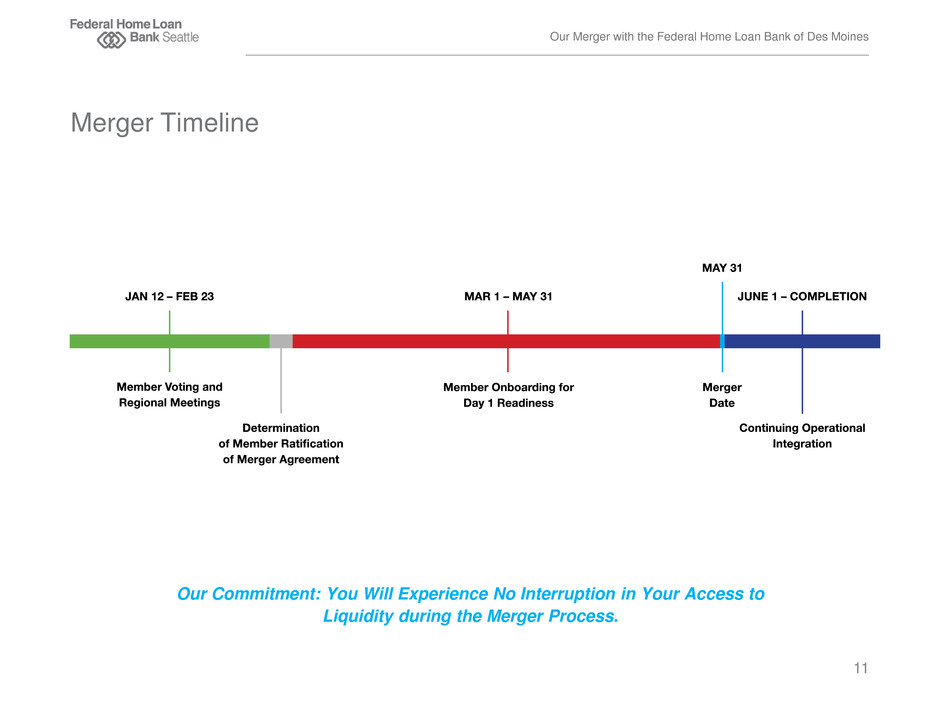

Our Merger with the Federal Home Loan Bank of Des Moines Our Commitment: You Will Experience No Interruption in Your Access to Liquidity during the Merger Process. Merger Timeline 11

Our Merger with the Federal Home Loan Bank of Des Moines The banks are making good progress in preparing to serve you on June 1, 2015. • Operations are being integrated, data is being converted, cross-training is ongoing. • Relationship managers are hosting orientation sessions with Seattle Bank members; shareholders’ estimated capital stock requirements to be provided in mid-April. As members, you must also do your part: • Review the “onboarding” materials you received from the Des Moines Bank. • Complete the necessary forms and agreements to preserve your access to funding and related services and return them to the Des Moines Bank by May 1. • Ensure your staffs participate in the online training sessions on new tools (e.g., eAdvantage) and new processes (e.g., wire transfer). • If you haven’t done so already, visit the welcome page on the Des Moines Bank’s website: www.fhlbdmwelcome.com. It includes an abundance of materials and links to resources to help you prepare. Merger Progress 12

Fulfilling the FHLBanks’ Value Proposition . Our Merger with the Federal Home Loan Bank of Des Moines Our Continuing Commitment to You 13 Your FHLBank exists to provide members with funding and liquidity. • Advances are our core business. Reliability is crucial. • We must be available at all points in an economic cycle and during a member’s lifecycle. We want to be innovative to help members thrive in a challenging environment. • We work to anticipate member needs, and value our members’ input. We have an obligation to safeguard the capital our members have entrusted to us. • We must be able to redeem/repurchase stock at par. Any dividend must be reasonable. • We strive to optimize value to our members.

Our Merger with the Federal Home Loan Bank of Des Moines Regardless of our name, our location, or how we describe our mission, we are here … to provide you – our members – with reliable and cost-effective liquidity, funding, and services that enhance your success and that of the communities you serve. Our Mission 14

Questions? 15