Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CARBO CERAMICS INC | d895538d8k.htm |

Production

Enhancement ....provides industry leading technology for:

Scotia Howard Weil 43

rd

Annual Energy Conference

March 25

th

, 2015

Higher

Production

& EUR

Exhibit 99.1 |

Forward Looking

Statements The Private Securities Litigation Reform Act of 1995 provides a "safe

harbor" for forward-looking statements. Any written or oral statements made by

the Company or on behalf of the Company in conjunction with this presentation may

include forward-looking statements which reflect the Company's current views with respect to

future events and financial performance. These forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to differ materially

from such statements. This document contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 concerning, among other

things, the Company's prospects, developments and business strategies for its operations, all of

which are subject to certain risks, uncertainties and assumptions. These risks and

uncertainties include, but are not limited to, changes in overall economic conditions,

changes in the cost of raw materials and natural gas used in manufacturing our

products, changes in demand and prices charged for our products, changes in the demand

for, or price of, oil and natural gas, risks of increased competition, technological,

manufacturing, distribution and product development risks, loss of key customers,

changes in government regulations, foreign and domestic political and legislative

risks, the risks of war and international and domestic terrorism, risks associated with

foreign operations and foreign currency exchange rates and controls, weather-related risks

and other risks and uncertainties described in our publicly available filings with the

Securities and Exchange Commission. The words "believe,”

"expect,” "anticipate,” "project" and similar expressions identify forward-looking statements.

Participants are cautioned not to place undue reliance on these forward-looking

statements, each of which speaks only as of the date the statement was made. The

Company undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise, except

as required by law.

2 |

•

Frac Conductivity &

Durability

•

Production Assurance

•

Flow Enhancement

•

Fracture Evaluation

•

Well Site Supervision

•

Frac Diagnostics & Optimization

•

Field Development Optimization

•

Reservoir & Formation Analysis

•

Frac Design

•

Economic Optimization

•

Reservoir Performance

•

Post Job Analysis

….a leading production enhancement company

Higher

Production &

EUR |

Managing Through

The Down-Cycle Actions |

In the near

term, we focus on being cash positive: –

–

CARBO Down-Cycle Actions and Focus

CARBO will manage through this down-cycle, and will continue with

its long term strategy

Reduce discretionary spending, and seek reduction in costs from our suppliers

Capex expenditures and dividend reductions implemented as part of cash

preservation

Reducing the workforce. First quarter will include severance costs.

Right-size the organization to the industry’s activity levels

Mothballing, idling and slowing down production at our manufacturing facilities.

This results in under-absorbed / period costs (depreciation, natural gas

commitments, fixed facility charges, etc.) that will burden the income statement.

Reduce inventory levels |

Managing The

Company For The Long Term Improving Well Production and EUR with Technology

|

Differentiate

with

Design-Build-Optimize

The

Frac

technology

strategy.

Our

multi-year effort to develop industry leading technology is starting to pay off.

–

KRYPTOSPHERE

is a “game-changer”

proppant, Offshore E&P orders are growing

–

SCALEGUARD, NRT, RPM, save

money

for

E&P

and

are

growing

in

client

base

–

Other platform technologies are currently in field test

–

StrataGen

leads as a “trusted advisor”

to E&P. Developing reputation as having

the best people to increase well Production and EUR by using technology.

–

Fracpro

continues to lead as the industry’s frac design software

Focus on growing ceramic proppant market share

Grow our sand business

Continue Falcon transition into products-based sales

Long Term Strategy and Focus

Longer term, we continue actions that keep us as the industry leader:

|

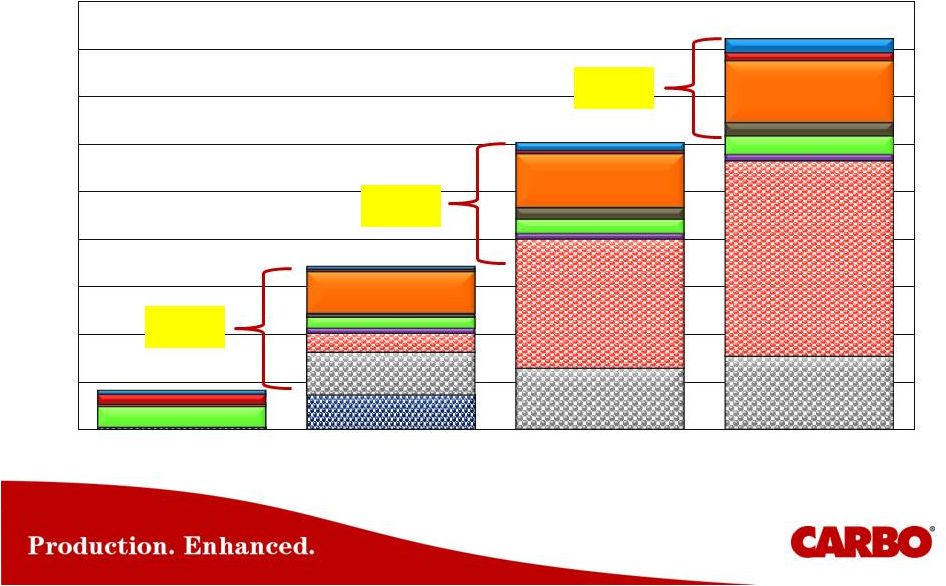

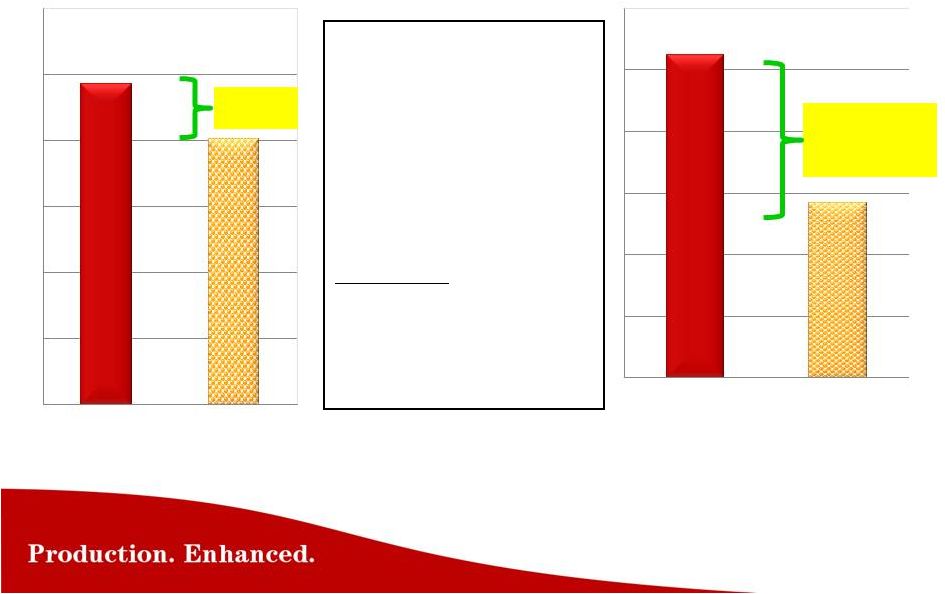

New Technology

Growth Targets Product Revenue

330%

75%

35%

2014

2015

2016

2017

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90 |

9

Our technology is 100% focused on improving

Production and EUR

•

Frac with the right technology the first time, to maximize ROI

–

Re-fracs are a costly example

of not doing it right the first time

•

Technology

developed

for

“life

of

the

well”

to

maximize

EUR

•

Technology developed for quick payback (months not years)

•

Proppant-delivered platforms greatly improve the effectiveness of

the technologies, and lowers the cost

•

Improves F&D costs $$/BOE……….and Lease Operating Expense (LOE)

|

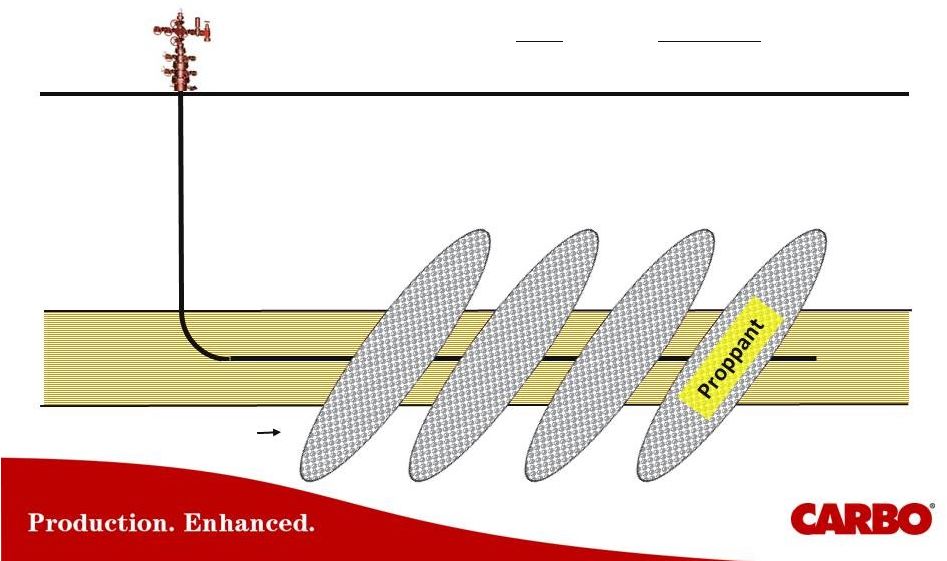

Oil &

Gas Multiple transverse fractures

Wellhead

“Built To Last The Life Of The Well”

…..when we are done, the only thing left

is the well

and the proppant, make sure

it has a long productive life.

Reservoir |

Proppant

Delivered

Technology

Platforms

Proppant

Delivered

Production

Assurance

Proppant

Delivered

Flow

Enhancement

Proppant

Delivered

Fracture

Evaluation

Higher

EUR

Production

R.O.I.

Infused Chemical

Delivery System

Resin Coated Products

CARBOBOND

Ceramics |

•

Chemically infused porous proppant with

controlled release of scale inhibitor, into

the production stream

•

Industry’s most effective scale inhibition

due to controlled release

•

Increases Production and EUR, and

lowers LOE

for E&P Operators

-

Provides production protection for

months/years

-

Reduces costly work-overs & pump

repairs

-

Prevent scaling damage from forming in

the frac

Production Assurance -

SCALEGUARD

Tubing with scale,

restricting production |

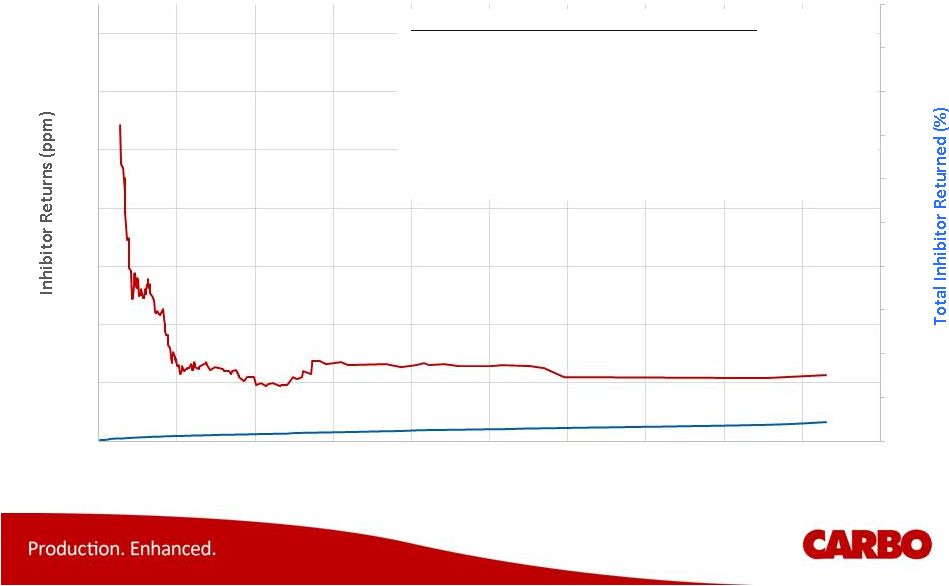

SCALEGUARD - Long Life

Protection •

No production loss due to scaling, and lowers LOE

•

Controlled release working as designed

•

After 8 months, no scaling problems

•

Maintain scale control above an engineered

minimum inhibitor concentration

•

Projecting several years of inhibition

Uinta Basin Scale Inhibition Success

0

10

20

30

40

50

60

70

80

90

100

0

20

40

60

80

100

120

140

0

2000

4000

6000

8000

10000

12000

14000

16000

18000

20000

Cumulative Water Produced (bbl) |

•

Reliable / controlled release of scale inhibitor from proppant pack

•

Remediate scale build up near perforations and wellbore

•

8 months without Scaling in tubulars / proppant pack

•

Eliminated workover operations @ $25,000 / quarter

•

Removed need for continuous chemical injection @ $2,500 / month

SCALEGUARD –

Lowers LOE |

Flow Enhancement

- CARBORPM

•

Increases Production and EUR

by

improving the permeability to

hydrocarbons in the propped fracture

•

Minimize capillary pressures in propped

fracture with neutral wettability

•

Increase effective fracture conductivity

–

Improve fracture clean-up

–

Reduce multiphase flow effects

•

Recent activity in Permian basin for several

operators has shown favorable results |

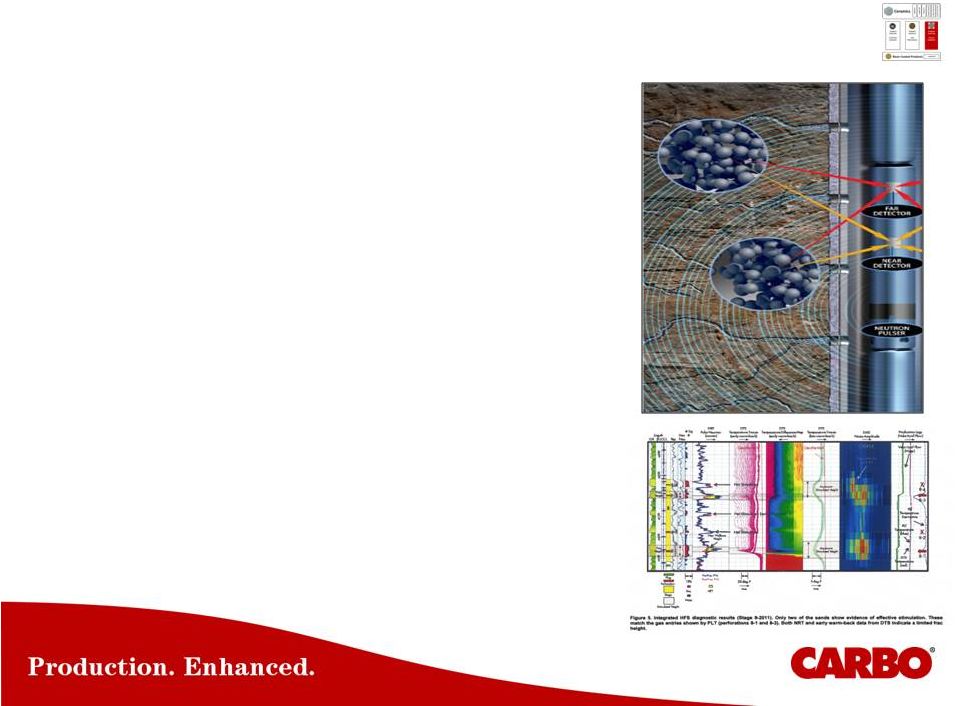

16

Fracture Evaluation -

CARBONRT

•

Identifying proppant placement, helps

identify production improvement

•

Non-radioactive tagged proppant

–

Environmentally friendly, manufactured into

proppant grains

–

Direct measurement of proppant placement

•

In vertical wells, measurement of

fracture height allows estimate of

fracture geometry

•

In horizontal wells, helps determine

stage spacing and coverage

•

Integrate with other measurements

–

Surface & downhole microseismic

–

Fiber optic temperature & acoustics

SPE 168603, Shell Pinedale |

Well Production

- Hierarchy of Proppant Value

Chart prepared by and

property of CARBO Ceramics Inc.

Highest Conductivity

Highest Production, EUR, ROI

Mono-sized

Spherical

Smooth surface

Low beta

Low steel erosivity

Quality Ceramic

Standard Ceramic

Chinese, Russian, Brazilian

Ultra-conductivity

More uniform flow path

More durability

Precision-engineered

Variable conductivity

Poor Quality

Conductivity

=

Permeability

of

the

frac

x

width

of

the

frac

=

K

frac

x

W

frac

Low density

Ultimate-high strength

Ultra-high strength

Very-high strength

High conductivity

Medium density

High density

Medium strength

Irregular size & shape

Medium conductivity

Resin-coated Sand

Low strength

Irregular size

& shape

Low conductivity

Sand

CARBOLITE |

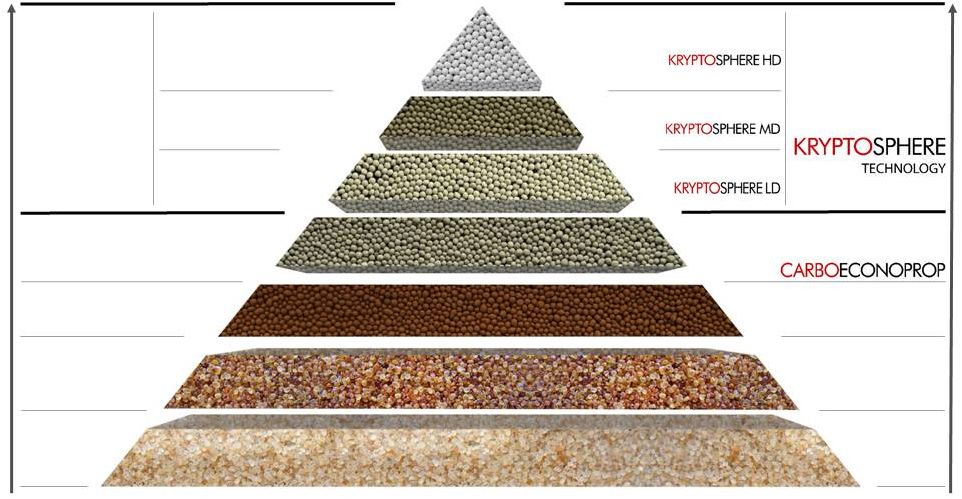

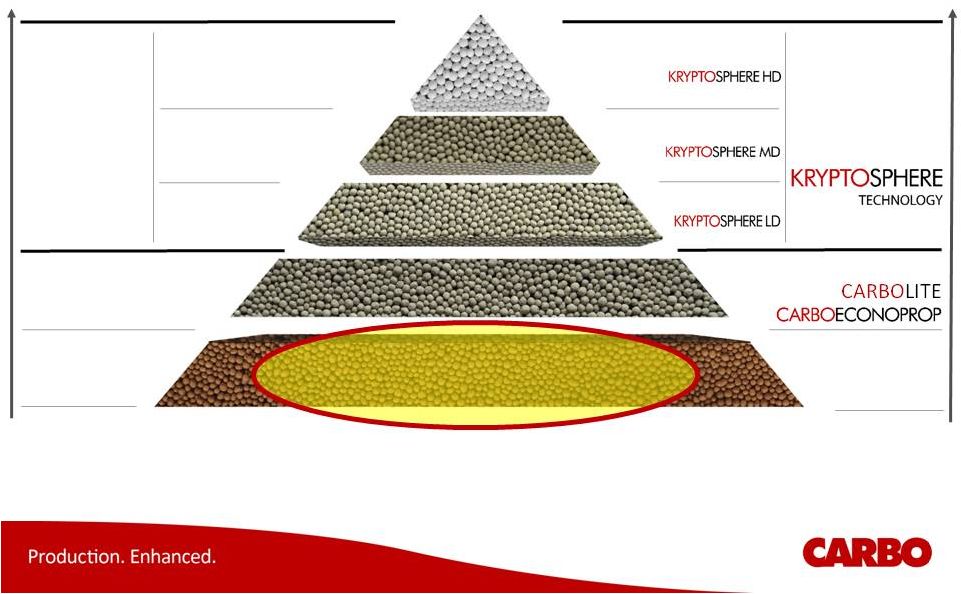

Originally

developed for deep water and ultra-high stress formations.

Have since developed it into a family of

products to address other reservoir

conditions.

Ultra-conductive ultra-high strength

proppant technology |

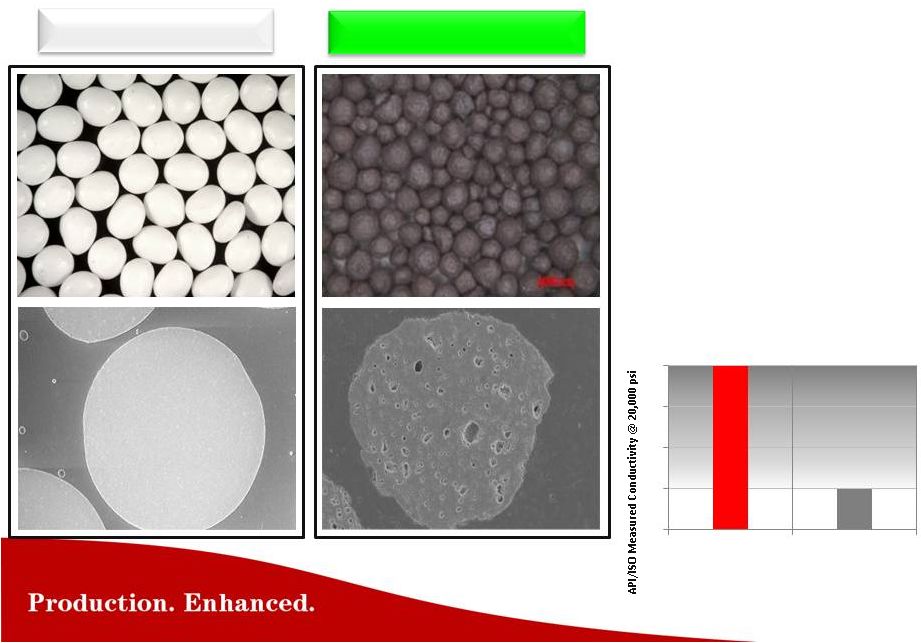

KRYPTOSPHERE HD KRYPTOSPHERE

is a paradigm shift in improved Conductivity

Competitors Bauxite

•

Superior Shape, Surface,

Microstructure, and Durability

•

KRYPTOSPHERE

HD

is the

strongest, highest conductivity

Proppant commercially available

today for the industry’s deepest,

highest stress wells

•

Tested successfully @30,000 psi

(industry API RP19C crush test)

•

KRYPTOSPHERE

HD

has 4 times

the conductivity of competitors

Bauxite Proppant @20,000 psi

4 times the

conductivity

after cyclic

loading

0

1

2

3

4

KRYPTOSPHERE

HD25

Competitors

Bauxite |

“Proppant

is one of the biggest factors in determining Production and EUR in fracture

stimulated wells. It is important that E&P

Operators know what proppant is being

used in their wells. Make sure you are

getting the Conductivity and Quality you are

paying for.” |

Do You Know What

Proppant Is Going In Your Well? Chart prepared by and

property of CARBO Ceramics Inc.

Highest Conductivity

Highest Production, EUR, ROI

Mono-sized

Spherical

Smooth surface

Low beta

Low erosivity

Quality Ceramic

Standard Ceramic

Chinese, Russian,

Brazilian

Ultra-conductivity

More uniform flow path

More durability

Precision-engineered

Variable conductivity

Poor quality

Conductivity

=

Permeability

of

the

frac

x

width

of

the

frac

=

K

frac

x

W

frac

Low density

Ultimate-high strength

Ultra-high strength

Very-high strength

High conductivity

Medium density

High density

Are you getting what you

paid for here? |

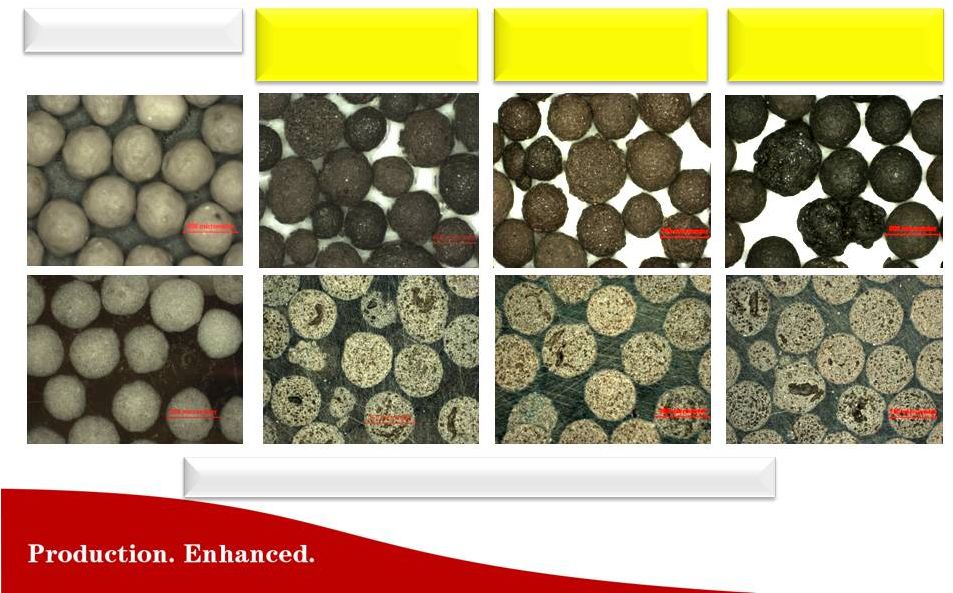

Production

&

EUR

is

sacrificed

using

low

quality

Chinese

ceramic

Three Bakken field samples of low quality Chinese ceramic:

IDC = Intermediate Density Ceramic

Production & EUR

Loss due to Poor

Quality:

•

Irregular Size &

Shape reducing

flowrates

•

Rough Surface

reducing flowrates

•

High Internal Porosity

leads to Low

Strength & Crushing

as Closure Stress

Increases

•

All lead to Reduced

Frac Conductivity

Bottom Row Represents Whole Pellet Cross Sections

Chinese 20/40 IDC

Supplier A

Chinese 20/40 IDC

Supplier B

Chinese 20/40 IDC

Supplier C |

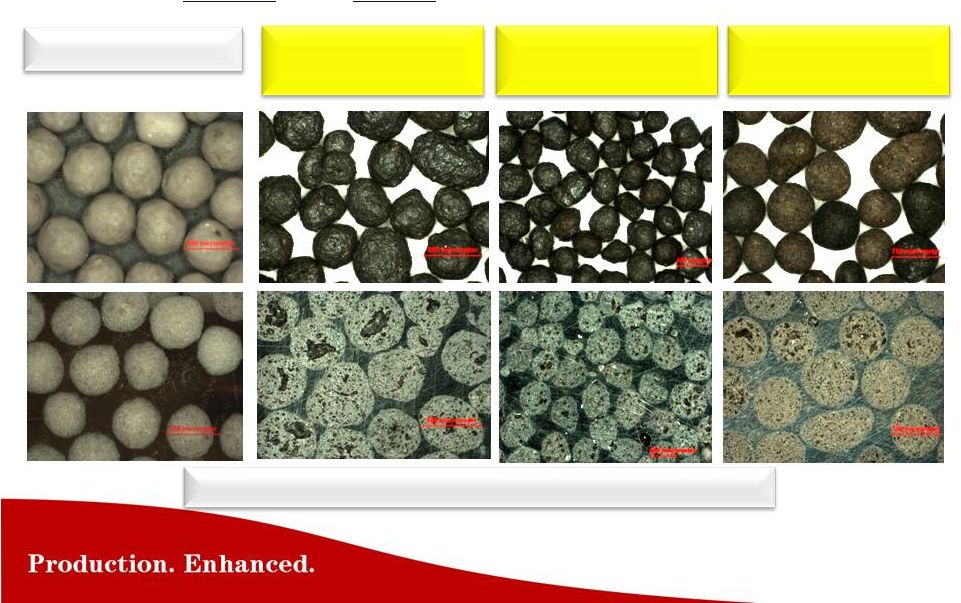

CARBOLITE versus Chinese Ceramic

Three Bakken field samples of low quality Chinese ceramic:

IDC = Intermediate Density Ceramic

Bottom Row Represents Whole Pellet Cross Sections

CARBOLITE

20/40

Chinese 20/40 IDC

Supplier A

Chinese 20/40 IDC

Supplier B

Chinese 20/40 IDC

Supplier C |

CARBOLITE versus Brazilian & Russian Ceramic

Two Brazilian

& one Russian

field samples of low quality ceramic proppant:

Field Samples #B1 taken in South Texas;

#B2, #R1 taken in North Dakota

LDC = Low Density Ceramic

Bottom Row Represents Whole Pellet Cross Sections

CARBOLITE

20/40

Brazilian 20/40 LDC

# B1

Brazilian 20/40 LDC

# B2

Russian 20/40 LDC

# R1 |

25

Bakken

Operator

CARBO

vs Chinese

30 Day Cum Oil

*EUR

6 wells with

CARBOECONOPROP

low

density ceramic (LDC)

4 wells with Chinese

intermediate density

ceramic (IDC)

Frac Design

(per well)

~ 24 stages

~ 3 million lbs

*Operator projected EUR

from early time data

+20%

+120,000

bbl Oil

ECONOPROP

Average

Chinese IDC

Average

Chinese IDC

Average

ECONOPROP

Average

0

2

4

6

8

10

12 |

Stakeholder

Value

Measurement

American Made

Ceramic Proppant

Low Quality Chinese

Ceramic Proppant

E&P Operators

Production & EUR

Higher

Lower

Less BOE produced,

due to poor quality

of proppant

E&P Operators

Natural Gas

Consumption

Higher

Zero

Due to being

manufactured in

China

USA

American Jobs

Higher

Made in AL, AR, GA, LA

Zero

Made in China

26

America’s Energy Renaissance …..“Made in America”

|

“Over 150

SPE papers have been written documenting the benefits of increased conductivity

on well Production and EUR. Generally, the payout

on the additional Proppant investment is less than

3 -

6 months, and increases Production and EUR in a

range of 20% to 100%.”

Case Histories |

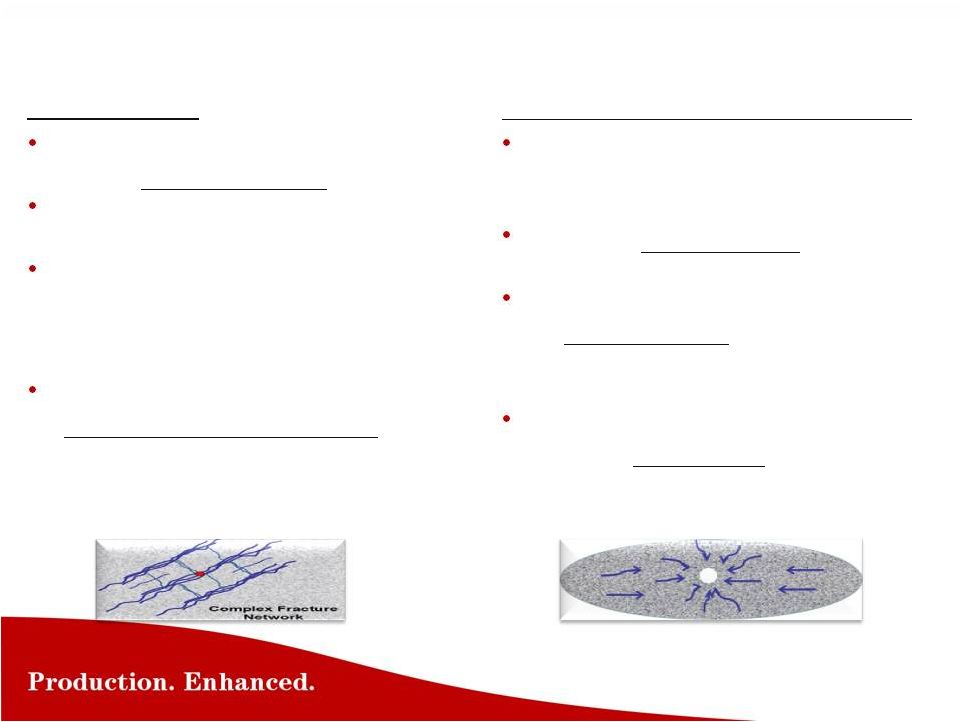

Contact

Area More Stimulated Reservoir Volume = Higher EUR

Convergent Flow, High Velocity & Delta P

To be economical, low perm reservoirs

require

large

contact

areas

to

drain

Create

many

transverse

fracs,

in

a

horizontal well

Create

complex

fractures

by

using

tech

niques such as slickwater, more stages,

& more perf density to enable more

frac initiation points

Complex

network

fracture

creation

is

dependent

on

formation

factors,

including brittleness

Convergent

Flow

from

Transverse

Fracs

creates enormous flow velocity near

wellbore, and choke points

Overcome

convergent

flow

issues

with

high

conductivity

tail-in

proppant

Overcome

the

reduced

flowrates

caused

by

multi-phase

flow

in

these

liquid

rich

reservoirs,

with

high

conductivity

proppant

The

proppant

needs

to

be

durable

to

with

stand

the

closure

stress

and

cyclic

loading

Conductivity

…for

“Life

of

Well” |

Is Your Well

Built On Sand Foundations? |

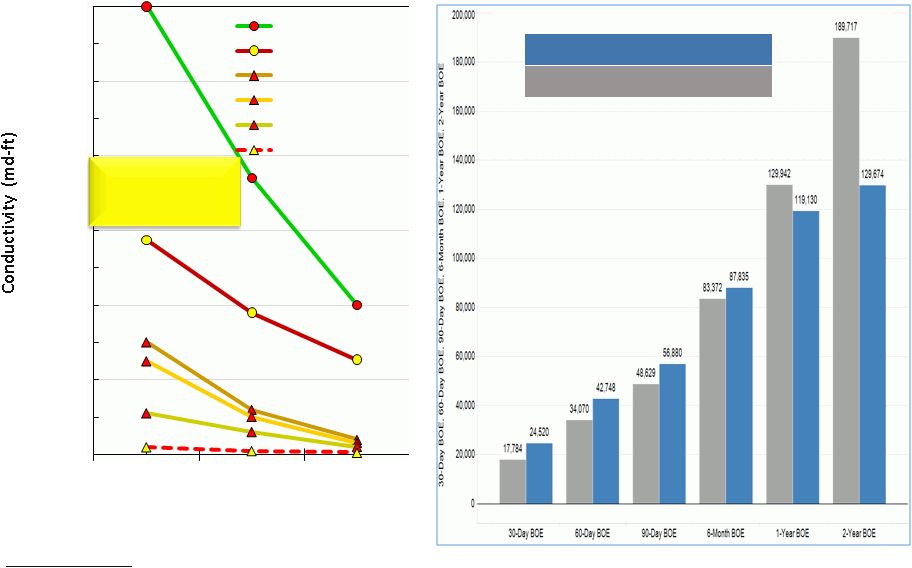

Closure

Stress (psi) Reference conductivity

-

does not include effects of non-darcy flow, multi-phase

flow, gel damage, etc.

Smaller mesh size

proppant, has much

lower Conductivity

Small-Mesh Operators

Other Operators

Eagle Ford –

Small Mesh Sand Evaluation

…..100 mesh sand can reduce EUR

Source: Public Production Database –

Eagle Ford Basin

0

1,000

2,000

3,000

4,000

5,000

6,000

6,000

8,000

10,000

CARBOLITE 20/40

CARBOLITE 30/50

White Sand 20/40

White Sand 30/50

White Sand 40/70

100 Mesh Sand |

Permian Basin

- Wolfcamp Operators, Ward County

Ceramic wells

out produce

offset RCS

wells by 45%

Note:

Production

Only –

1 yr

Ceramic

Production

Gains

Net $ Gain

@ $40 Oil,

$3 Gas

Ceramic vs

Sand

74,870 bbls

$2,560,000

Ceramic vs

RCS

56,610 bbls

$1,855,000

183,097

126,482

108,229

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

200,000

0

2

4

6

8

10

12

Time (months)

Low Density Ceramic -

7 Wells

RCS -

9 Wells

Sand -

21 Wells |

Permian Basin

- Bone Spring Operators, Lea County

Ceramic wells

out produce

offset Sand

wells by 42%

Note: Oil

Production

Only -

14 mo

Ceramic

Production

Gains

Net $ Gain

@ $75 Oil

Ceramic vs

Sand

21,980 bbls

$1,650,000

Ceramic vs

RCS

32,110 bbls

$2,410,000

74,682

42,571

52,702

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

0

2

4

6

8

10

12

14

Time (months)

CARBOLITE/CARBOECONOPROP (3 wells)

RCS (4 wells)

Sand (19 wells) |

Permian Basin

- Bone Spring Operators, Lea County

Ceramic wells

out produce

offset Sand

wells by 32%

Note:

Production

Only -

6 mo

Ceramic

Production

Gains

Net $ Gain

@ $40 Oil,

$3 Gas

Ceramic vs

Sand

18,391 bbls

$675,000

Ceramic vs

RCS

42,286 bbls

$1,560,000

76,522

34,236

58,131

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

0

1

2

3

4

5

6

7

Time (months)

Low Density Ceramic -

11 Wells

RCS -

6 Wells

Sand -

16 Wells |

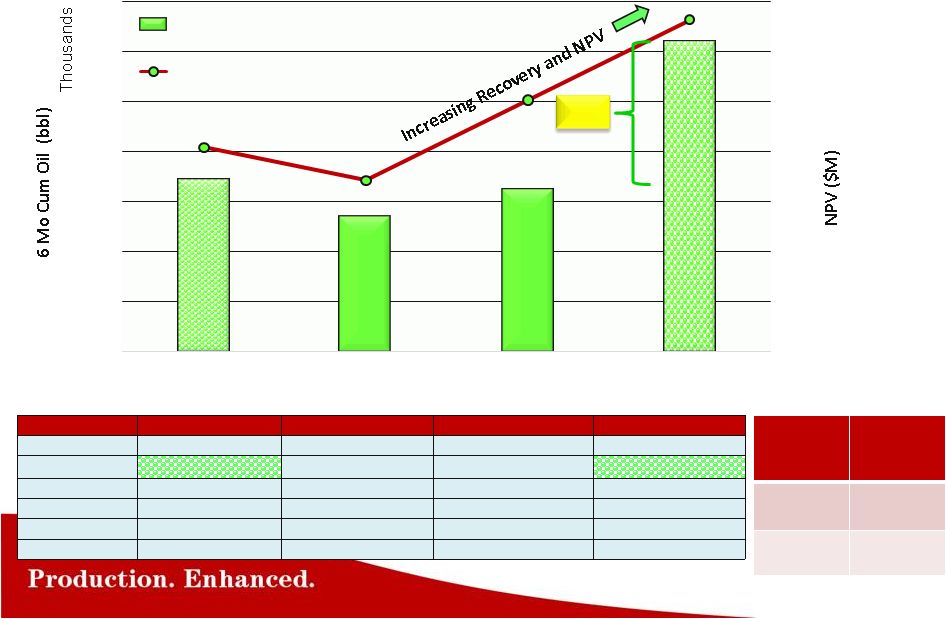

Initial

Wells Tested Sand

Tested More Stages

Today’s Design

Stages

20

20

30

30

Proppant Type

Ceramic

Sand

Sand

Ceramic

Well Cost

$5.5M

$5.0M

$5.4M

$6.7M

Model EUR

409 MBO

359 MBO

469 MBO

605 MBO

Pay Out

14.8 mo

15.5 mo

12.6 mo

12.5 mo

Well Count

5

63

42

8

Bakken Operator –

Optimizing Completion Design

6 Month

Production

Gain

~ 30,000

bbl oil per

well

Net $ Gain

@ $50 oil

$1,500,000

Payout on

Conductivity

~ 5 Months

92%

34

27

32

62

$0

$2

$4

$6

$8

$10

$12

$14

$16

0

10

20

30

40

50

60

70

Conductivity

Low Cost

Contact Area

Contact & Conductivity

6 Mo Cum Oil

NPV ($M) |

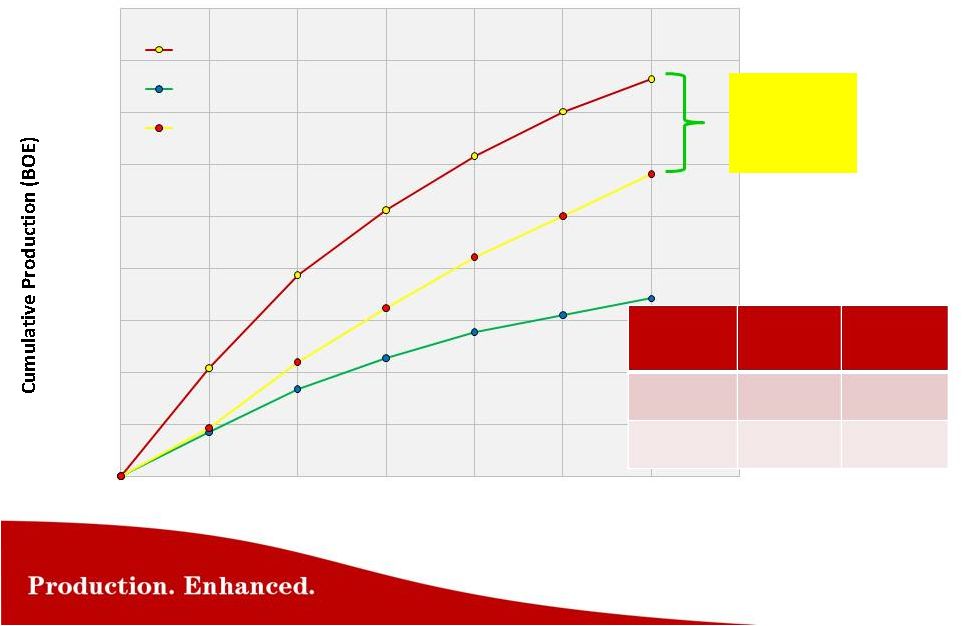

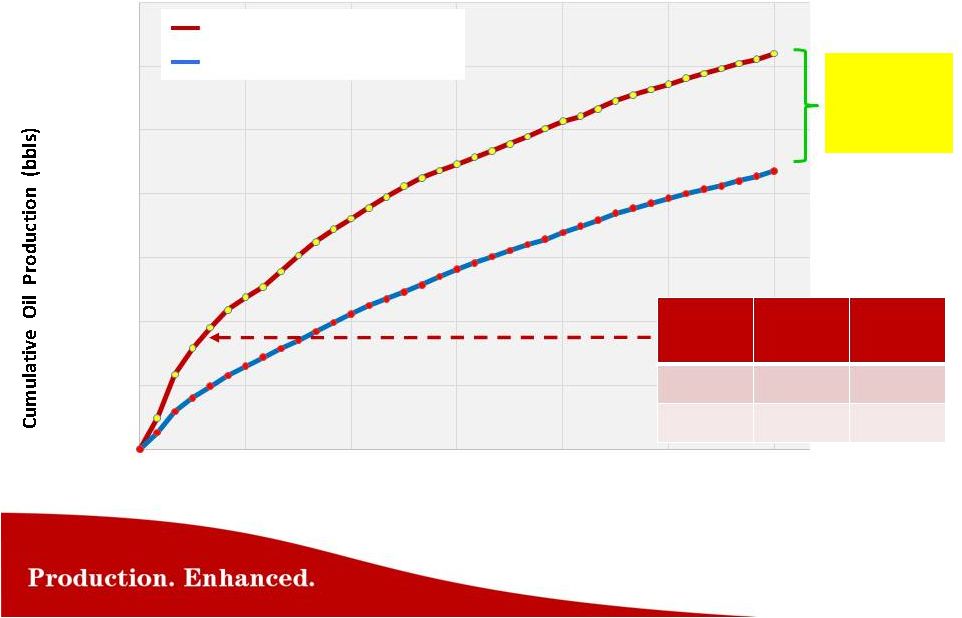

Bakken

-

Statoil

Mountrail County

Note: Oil

Production

Only

Production

Gains

Net $ Gain

@ $75 Oil

6 Months

54,000 bbls

$4,050,000

36 Months

92,000 bbls

$6,900,000

Ceramic wells

out produce

offset Sand

wells by 42%

SPE Paper

134595

&

146376

–

Brigham

Exp/Statoil

Conductivity investment payback < 4 mo

118,992

309,781

65,064

217,824

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

0

6

12

18

24

30

36

Months

White Sand (12 wells)

CARBO

ECONOPROP (7

wells) |

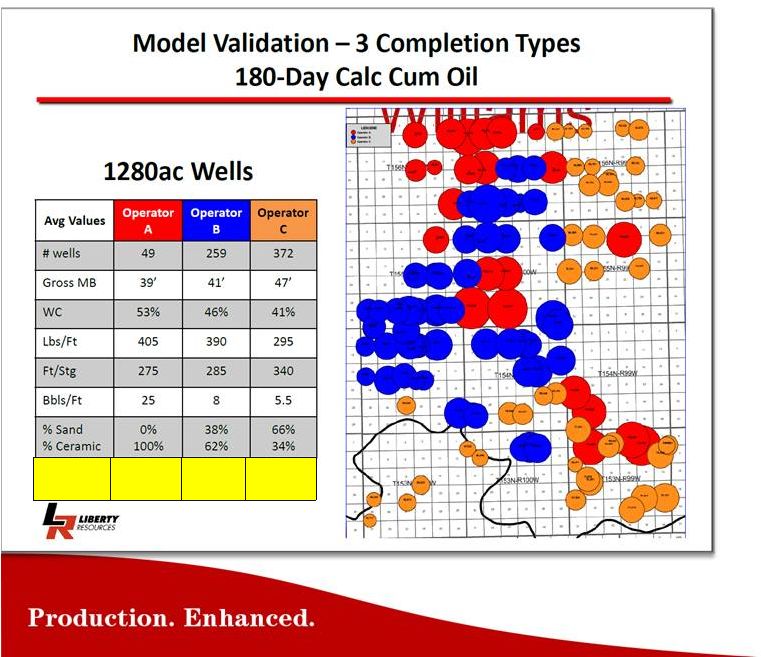

Bakken

- Liberty Resources

Williams County Source: Bakken/Three Forks American Business Conference

180 Day

Cum Oil

81,000

73,000

56,500

•

Liberty Resources has

lead the way in

increasing Contact

Area

and

Conductivity

•

Higher well

production results

compared to offset

wells, has verified the

technical success of

their completions |

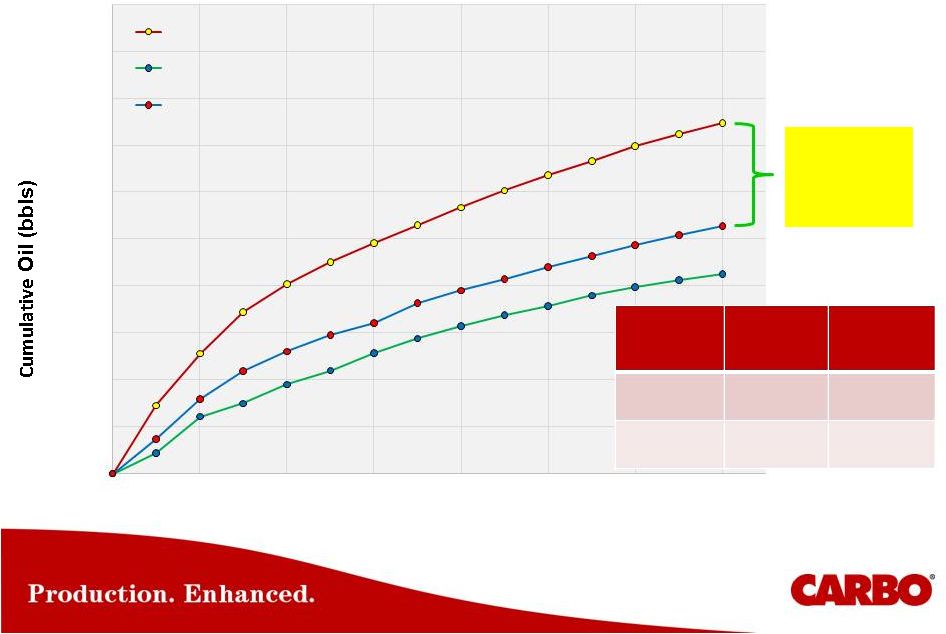

Eagle

Ford

Operator

–

Optimizing

Completion

Design

Original Design

Incr Length, Stages, Sand

Incr Length, Stages, Ceramic

Avg # Stages

19

25

29

Proppant Type

Ceramic

Sand

Ceramic

Lbs Prop/Feet of lateral

1,312

2,533

1,402

Well Count

13

3

2

* Public production data

28,860

35,100

66,300

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

Conductivity Design (Ceramic)

Increased Contact Design (Sand)

Increased Contact & Conductivity

(Ceramic)

90 Day Cum Oil

Significant uplift to optimizing

contact and conductivity |

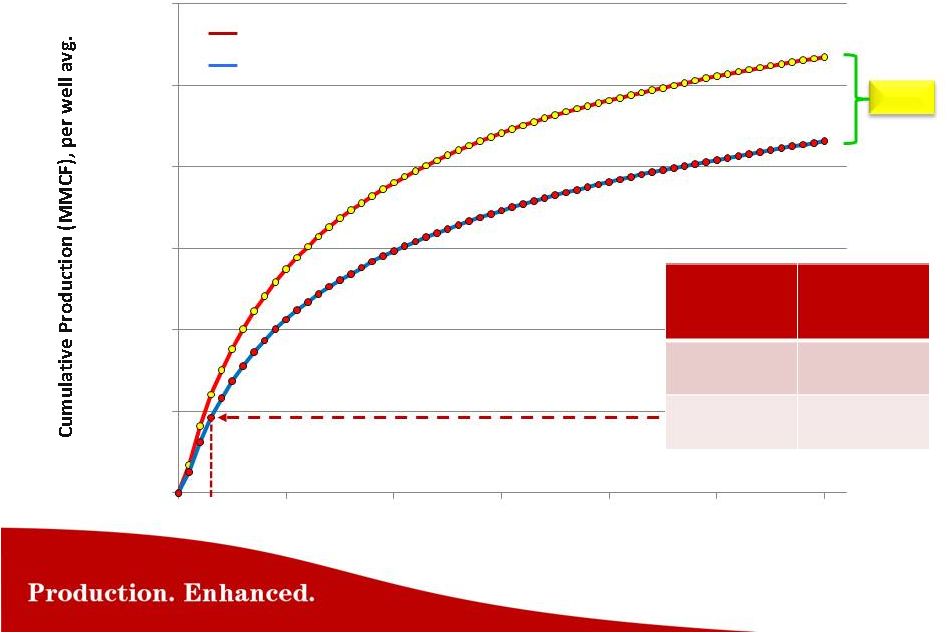

Haynesville

– High Stress Reservoirs Need Ceramic

SPE Paper 160206

3

CARBOHYDROPROP

40%

Tail-in

(20

wells)

Resin

Coated

Sand

40%

Tail-in

(33

wells)

* Public production data

48 Month

Production

Gain

0.52 BCF

per well

Net $ Gain @

$4.00 NG

$2,070,000

Payout on

Conductivity

< 3 Months

24%

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

0

10

20

30

40

50

60

603,445

2,672,809

462,783

2,155,748

Months After Initial Production |

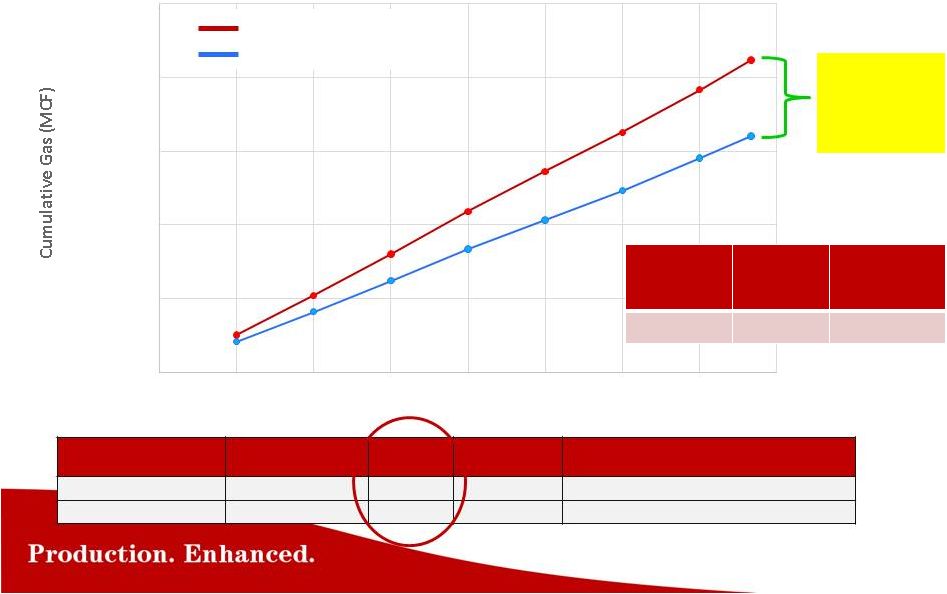

CARBOECONOPROP White Sand (Normalized)

2.4 x increase in sand/ft lateral yields 32% less Production

Ceramic well

out produces

offset Sand

well by 32%

Lateral Length

(feet)

Proppant

(Million lbs)

Frac Stages

Number

Cumulative Gas

Normalized on 6,800 Lateral

CARBOECONOPROP

6,800

5.5

27

2.12 BCF

White Sand

9,000

17.0

38

1.61 BCF

Cost Neutral Design….Ceramic outperforms Sand

NorthEast, Belmont County

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

0

1

2

3

4

5

6

7

8

Months

Gas

Production

Only

Production

Gains

Net $ Gain

@ $3/MCF

8 months

0.51 BCF

$1,530,000 |

The Industry

Down-Cycle Business Impacts Industry Impact On Our Results

|

Industry

Down-Cycle Business Impacts With oil price down ~50%, and natural gas pricing

expected to remain low: The decline in rig count has been very large, and very

fast. Lower 48 down ~ 50%

E&P

Operators

are

not

completing

(fracturing)

all

the

wells

they

are

drilling

–

Backlog of drilled but uncompleted wells growing

E&P

Operators

are

doing

every

thing

they

can

to

lower

well

cost.

Some

have

stopped using ceramic and are using sand for completions to lower cost,

regardless of the negative impact on well production.

With the over-supply of all proppant in the market, pricing is under pressure.

This includes ceramic, resin-coated sand, and sand.

Ceramic

sales

are

impacted

in

excess

of

the

decline

in

rig

count |

CARBO

Down-Cycle Actions and Focus In the near term, we focus on being cash positive:

Reduce inventory levels

–

Mothballing, idling and slowing down production at our manufacturing

facilities. This results in under-absorbed / period costs (depreciation, natural

gas commitments, fixed facility charges, etc.) that will burden the income

statement.

Right-size the organization to the industry’s activity levels

–

Reducing the workforce. First quarter will include severance costs.

Capex expenditures and dividend reductions implemented as part of cash

preservation

Reduce discretionary spending, and seek reduction in costs from our

suppliers

CARBO will manage through this down-cycle, and will continue with its long

term strategy |

“We are

building an enduring company that withstands the large industry

cycles, by focusing on improving well

Production and EUR through

continuous development of industry

leading technology.” |