Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Medisun Precision Medicine Ltd. | Financial_Report.xls |

| EX-32.2 - EXHIBIT 32.2 - Medisun Precision Medicine Ltd. | ex32_2apg.htm |

| EX-32.1 - EXHIBIT 32.1 - Medisun Precision Medicine Ltd. | ex32_1apg.htm |

| EX-31.2 - EXHIBIT 31.2 - Medisun Precision Medicine Ltd. | ex31_2apg.htm |

| EX-31.1 - EXHIBIT 31.1 - Medisun Precision Medicine Ltd. | ex31_1apg.htm |

| EX-10.13 - EXHIBIT 10.13 - Medisun Precision Medicine Ltd. | ex10_13apg.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal years ended December 31, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to ______

Commission File Number: 000-54907

ACCUREXA INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

47-2999657 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

113 Barksdale Newark, DE 19711 (Address of principal executive offices, including Zip Code)

| |

|

(415) 494-7850 (Registrant’s telephone number, including area code) | |

Securities registered under Section 12 (b) of the Exchange Act: None

Securities registered under Section 12 (g) of the Exchange Act: Common stock, $0.0001 par value (the “Common Stock”)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] (Do not check if a smaller reporting company) Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

[ ] Yes [X] No

There were a total of 5,993,816 shares of the registrant’s common stock outstanding as of March 25, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

Table of Contents

|

|

|

Page | ||||

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

|

5 | ||||

|

|

|

|

|

| ||

|

PART I |

|

|

|

6 | ||

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

Business |

|

6 |

|

|

|

|

|

|

|

|

|

|

|

Item 1A. |

|

Risk Factors |

|

13 |

|

|

|

|

|

|

|

|

|

|

|

Item 1B. |

|

Unresolved Staff comments |

|

28 |

|

|

|

|

|

|

|

|

|

|

|

Item 2. |

|

Properties |

|

28 |

|

|

|

|

|

|

|

|

|

|

|

Item 3. |

|

Legal Proceedings |

|

28 |

|

|

|

|

|

|

|

|

|

|

|

Item 4. |

|

Mine Safety Disclosures |

|

28 |

|

|

|

|

|

|

|

|

|

PART II |

|

|

|

29 | ||

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

29 |

|

|

|

|

|

|

|

|

|

|

|

Item 6. |

|

Selected Financial Data |

|

31 |

|

|

|

|

|

|

|

|

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

32 |

|

|

|

|

|

|

|

|

|

|

|

Item 7A. |

|

Quantitative and Qualitative Disclosures About Market Risk |

|

35 |

|

|

|

|

|

|

|

|

|

|

|

Item 8. |

|

Financial Statements and Supplementary Data |

|

36 |

|

|

|

|

|

|

|

|

|

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

37 |

|

|

|

|

|

|

|

|

|

|

|

Item 9A. |

|

Controls and Procedures |

|

37 |

|

|

|

|

|

|

|

|

|

|

|

Item 9B. |

|

Other Information |

|

39 |

|

|

|

|

|

|

|

|

|

PART III |

|

|

|

39 | ||

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

Directors, Executive Officers of the Registrant |

|

39 |

|

|

|

|

|

|

|

|

|

|

|

Item 11. |

|

Executive Compensation |

|

41 |

|

|

|

|

|

|

|

|

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

42 |

|

|

|

|

|

|

|

|

|

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

43 |

|

|

|

|

|

|

|

|

|

|

|

Item 14. |

|

Principal Accountant Fees and Services |

|

43 |

|

|

|

|

|

|

|

|

|

PART IV |

|

|

|

44 | ||

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

Exhibits and Financial Statement Schedules |

|

44 |

|

|

|

|

|

|

|

|

|

SIGNATURES |

|

|

|

45 | ||

3

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This annual report on Form 10-K and other reports that we file with the SEC contain statements that are considered forward-looking statements. These forward-looking statements are not historical facts and can be identified by use of terminology such as believe, hope, may, anticipate, should, intend, plan, will, expect, estimate, project, positioned, strategy and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire annual report on Form 10-K carefully, especially the risks discussed under Risk Factors. The assumptions underlying the forward looking statements included in this annual report on Form 10-K do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this annual report on Form 10-K will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

We are an "emerging growth company" under applicable Securities and Exchange Commission rules and are subject to reduced public company reporting requirements. See "Implications of Being an Emerging Growth Company" and "Risk Factors".

4

PART I

ITEM 1. BUSINESS

Introduction

We are a development stage company. We were incorporated in Delaware on August 29, 2012. We are focused on developing and commercializing novel neurological therapies based on our proprietary BranchPoint device delivering therapeutics directly into specific regions of the brain. The BranchPoint device can deliver therapeutics through the radial deployment of a flexible delivery catheter to large and anatomically complex brain targets through a single initial brain penetration. The BranchPoint device was developed at the University of California, San Francisco (UCSF) with $1.8 million in funding from the California Institute for Regenerative Medicine (CIRM). It is based on a neurosurgical delivery platform that we have exclusively licensed from UCSF. It may enable new approaches to neurological therapy and be modified for the delivery of a broad range of novel therapeutics, such as stem cells to treat neurodegenerative diseases, chemotherapeutics to brain tumors and gene therapy vectors.

Furthermore, we have licensed a photoacoustic technology platform from the University of Arkansas for Medical Sciences (UAMS) that may allow the detection, capturing and targeted destruction of metastatic circulating tumor cells (CTCs). We have completed a proof-of-concept clinical trial and are seeking a strategic partner for further clinical development

We cannot assure you that we will be successful with our development activities. We have an office at 113 Barksdale, Newark, Delaware 19711 and our telephone number is (415) 494-7850.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue, we qualify as an "emerging growth company" as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

·

exemption from the auditor attestation requirement on the effectiveness of our internal controls over financial reporting;

·

reduced disclosure about the company's executive compensation arrangements; and

·

no requirements for non-binding advisory votes on executive compensation or golden parachute arrangements.

We may take advantage of these provisions until December 31, 2017 or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our capital stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. To the extent that we take advantage of these reduced burdens, the information that we provide stockholders may be different than you might get from other public companies in which you hold equity interests.

Section 107(b) of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other companies.

Our BranchPoint Device

Our BranchPoint device can deliver therapeutics through the radial deployment of a flexible delivery catheter to large and anatomically complex brain targets through a single initial brain penetration. Clinicians can "tailor" therapeutic delivery to individual patient anatomy and specific disease targets, which may enhance the efficacy of therapies. The BranchPoint device also gives surgeons more precise control of the volume of therapeutics delivered and may ensure that the therapeutics delivered into the brain stay in the brain, avoiding the problem of reflux out to the brain surface. This modern and "easy to use" platform technology allows "real-time" monitoring of therapeutic delivery under interventional MRI guidance (iMRI), which can improve the accuracy of delivery, reduce the risk of complications, and increase patient safety. Currently available neurosurgical devices can deliver a straight, rigid needle to single brain locations. However, this basic strategy limits the size and "shape" of the brain treatment area. In order to deliver to larger and more complex brain targets, the surgeon needs to penetrate the brain multiple

5

times with such straight needles, which may increase the risk of bleeding and stroke, and may reduce the efficacy of therapeutics due to reflux, whereby therapeutics injected using straight needles can flow back out to the brain surface along the needle's path. The BranchPoint device was originally developed at UCSF with $1.8 million in funding from the California Institute for Regenerative Medicine (CIRM). It is based on a neurosurgical delivery platform that can enable new approaches to neurological therapy and be modified for the delivery of a broad range of novel therapeutics, such as stem cells to treat neurodegenerative diseases, chemotherapeutics to brain tumors and gene therapy vectors.

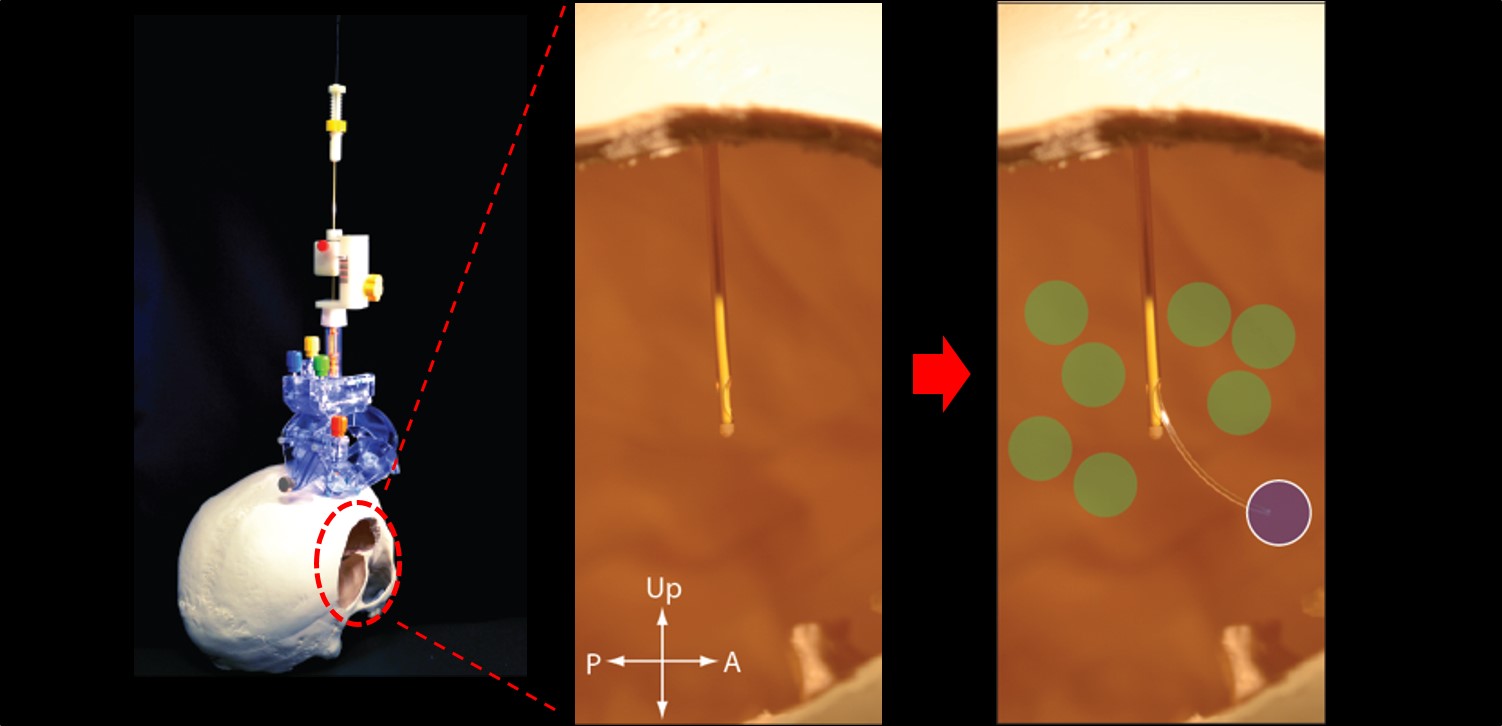

Fig. 1: The BranchPoint device delivers to large, complex targets through single penetration

Development Pipeline

Effective and safe delivery of therapeutics to the brain is often limited by the blood-brain barrier and lack of accurate, anatomic targeting of the intended site in the brain. Our BranchPoint device is a single platform that allows the delivery of multiple novel therapeutics under "real-time" MRI guidance (Fig. 2).

We are currently developing two programs in our pipeline.

1.

BranchPoint device for the delivery of therapeutics, such as stem cells or gene therapy vectors:

·

We plan to file a 510(k) submission of our BranchPoint device to the FDA (US Food and Drug Administration) in 2015.

·

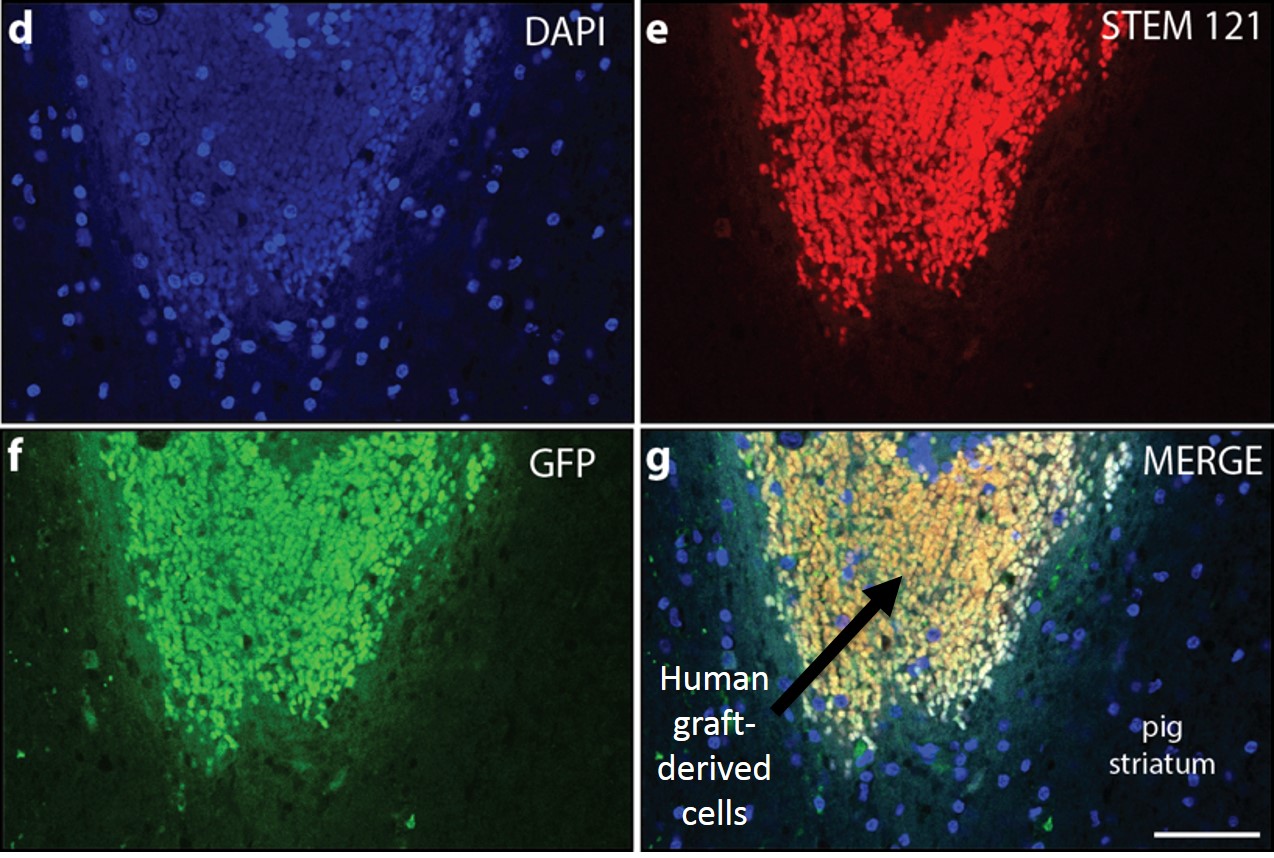

The feasibility of delivering human dopaminergic neural stem cells for the treatment of Parkinson's Disease has been demonstrated in animal studies (Fig. 3).

2.

ACX-31:

·

ACX-31 could deliver temozolomide, a chemotherapy drug, directly to the tumor site with our BranchPoint device. ACX-31 is contingent on BranchPoint's 510(k) approval.

·

temozolomide is a generic, approved chemotherapy drug that is indicated for the treatment of adult patients with newly diagnosed glioblastoma multiforme concomitantly with radiotherapy and then as maintenance treatment. Before temozolomide became generic, it generated US sales of $420 million and global sales of $910 million under its brand name Temodar in 2012.

·

Glioblastoma multiforme (GBM) is the most common and most aggressive malignant primary brain tumor in humans. Approximately 16,000 new patients are diagnosed with GBM in the US each year. Median survival without treatment is 4.5 months. With treatment, concomitant and adjuvant temozolomide chemotherapy with radiation significantly improves, from 12.1 months to 14.6 months, progression free survival and overall survival in GBM patients, as demonstrated in recent randomized clinical trials.

6

Fig. 2: The BranchPoint device may allow delivery of multiple therapeutics

|

Fig. 3: Immunohistochemistry analysis of dopaminergic neural stem cells grafted to the pig striatum: (d) 4'-6-diamidino-2-phenylindole nuclear stain (e) STEM 121-positive cells at the graft site (f) Green Fluorescent Protein-positive cells at the graft site (g) Merged images showing the border between graft-derived cells and pig striatum |

7

UCSF License Agreement

On September 16, 2014 (“Effective Date”), we entered into an exclusive license agreement (“UCSF License”) with the Regents of the University of California acting through its Office of Innovation, Technology, and Alliances, University of California San Francisco (“UCSF”) in regards to the exclusive licensing of a medical stereotactic device for the delivery of therapeutics to the human brain, characterized as “Microinjection Brain Catheter”, a.k.a. BranchPoint device ("Invention"). The invention was made in the course of research at UCSF by Drs. Daniel A. Lim, Matthew Silvestrini, and Tejal A. Desai, (collectively, the “Inventors”) and claimed in U.S. Patent Application No. PCT/US2013/052301, Microinjection Catheter; UC Case No. SF2012-063 (“Patent Rights”). The Invention was developed under funding from the California Institute for Regenerative Medicine ("CIRM") and sponsored in part by the National Institutes of Health. The UCSF License remains in effect from the Effective Date until expiration or abandonment of the Patent Rights.

Under the UCSF License, we are obligated to develop, manufacture, market and sell the invention, and have been granted the right to sublicense to third parties. Specifically, the UCSF License requires us to: (i) market the Invention for research use within three (3) months from the Effective Date; (ii) sell the Invention for research use within 12 months of the Effective Date; (iii) file and finalize any necessary regulatory documentation for FDA 510(k) approval within 6 months after the 510(k) application has been filed; (iv) market the Invention for clinical use within 6 months of receiving market approval from FDA or equivalent foreign regulatory agency; (v) sell the Invention for clinical use within 12 months of receiving market approval from FDA or equivalent foreign regulatory agency; (vi) within 1 year of the Effective Date, raise at least $750,000 in funding or revenue; (vii) market the Invention in the United States within 6 months of receiving approval from the FDA; and (viii) use commercially reasonable efforts to fill the market demand for the Invention following commencement of marketing. We are also required to pay UCSF 35% of our net sales or any sublicense royalty as defined therein, and a non-refundable license issue fee of $50,000. For a full description of further payment obligations and the UCSF License itself, the license agreement was filed as exhibit 10.1 to the Form 8-K as of September 17, 2014.

UCSF Patent

Our UCSF License includes U.S. Patent Application No. PCT/US2013/052301, Microinjection Catheter; UC Case No. SF2012-063 which is summarized as follows. The patent application can be accessed under the following link: http://www.google.com/patents/WO2014018871A1?cl=en

Background of the Invention:

Cell therapy has shown great promise in the treatment of a wide range of neurological diseases, including Parkinson's disease (PD), Huntington's disease, and stroke. To date, cell therapies have been delivered to the human brain with a stereotactically inserted straight cannula. While effective for small animal experimental models, straight cannula transplantation strategies present significant challenges when scaled-up for human therapy. The human brain is 800 to 2300 times larger than that of rodents used for preclinical research. With a straight cannula, cell delivery to the larger target volumes of human brain requires several independent brain penetrations. Some patients with PD have received up to 16 separate penetrations for transplantation to the putamen. Every transcortical brain penetration injures normal brain tissue and threatens hemorrhagic stroke.

In one approach to translational scale -up, very large numbers of cells can be delivered to a single location or along a short segment of the cannula tract. Unfortunately, the implantation of a large mass of cells within a confined location can severely impair graft viability, resulting in necrosis at the center of the transplant.

Another approach has been to insert a large host catheter, which is comprised of a number of internal passages, or lumens for the advancement of micro-catheters. These internal passages within the host catheter exit at specified distal orifice locations around the distal end to allow the delivery of a media to a desired target area. Using this approach, the host catheter is inserted into the center of the desired target, or delivery area in the patient. Then, the micro-catheters are inserted into the various lumens, where multiple doses can be delivered to each of the distal orifice locations along the elongate member. This method allows a larger target area to be covered without the need for multiple cranial penetrations. The introduction of a relatively large host catheter displaces a larger amount of tissue and the use of multiple micro catheters makes the ability to deliver a metered injection more difficult due to their variable lengths. A problem with at least some prior systems is that the delivered media may not stay at the desired delivery site. In a phenomenon called reflux, a portion of the media may flow back up the penetration shaft, significantly reducing the amount of media that remains at the treatment site. Larger injection volumes worsen the reflux of infused materials along the penetration tract making cell dosing unpredictable in terms of numbers as well as final graft location.

8

In most clinical trials, a syringe is used to deliver cells through the inserted cannula. Unless the syringe is kept in constant motion, the cells naturally sediment to the most dependent location, usually the end attached to cannula. Thus, the first partial injection volume from a syringe may contain far more cells than those dispensed later, further contributing to unpredictable variability of cell dosing. The use of a syringe having a larger diameter than the catheter main lumen may make it difficult to control the volume of each dose, and may subject the cells to shear and other mechanical forces that result in the decrease of cell viability for cell transplantation.

Brief Summary of the Invention:

An insertion device for delivering media inside a patient includes an outer guide tube having a closed end configured for insertion into patient tissue. The outer guide tube defines a side port in a wall of the guide tube near the closed end. The insertion device also includes an inner guide tube nested within the outer guide tube and movable axially within the outer guide tube. The inner guide tube includes a deflector at an end within the outer guide tube. The device also includes a catheter nested within the inner guide tube and movable axially within the inner guide tube. The catheter has a dispensing end that defines one more dispensing holes for dispensing the media. The deflector of the inner guide tube is positionable in relation to the opening of the outer guide tube such that it deflects the dispensing end of the catheter outward through the opening in the outer guide tube when the catheter is advanced axially within the inner guide tube.

UAMS License

On December 15, 2012 (“Effective Date”), we executed an Exclusive License Agreement (“UAMS License”) with the Board of Trustees of the University of Arkansas (“UofA”) acting on behalf of the University of Arkansas for Medical Sciences (“UAMS”) to commercially develop certain patents and patent applications owned by UAMS throughout the world for the life of the patents. Our UAMS License includes three patents (i) U.S. Patent Application Serial No. 12/334,217, Device and Method for In Vivo Flow Cytometry Using the Detection of Photoacoustic Waves; UAMS ID No. 2008-16; (ii) U.S. Patent Application Ser. No.: 12/945,576 Device and Method for In Vivo Noninvasive Magnetic Manipulation of Circulating Objects in BioFlows; UAMS ID No. 2008-16 CIP; (iii) U.S. Patent Application Ser. No.: 13/253,767 Device and Method for In Vivo Detection of Clots Within Circulatory Vessels; UAMS ID No. 2008-16 CIP2. Our three licensed patents cover a method for in vivo flow cytometry using the detection of photoacoustic waves by which targeted objects moving in the bloodstream absorb the energy level of a pulsed laser, and then either emit an acoustic wave that can be detected by an ultrasound transducer, or can be destroyed if a sufficient laser energy level is absorbed. The license agreement was filed as exhibit 10.2 to the Form 10 as of February 27, 2013.

As previously disclosed in our filing on Form 8-K on February 24, 2014, in the normal course of events, we confirmed, on or about February 3, 2014, that a portion of one of the three licensed patent applications, U.S. Patent Application Serial No. 12/334,217, Device and Method for In Vivo Flow Cytometry Using the Detection of Photoacoustic Waves; UAMS ID No. 2008-16, had been rejected by the United States Patent and Trademark Office and U.S. Patent Application Serial No. 12/334,217 was then abandoned prior to the date of our UAMS License. The basis for the rejection was primarily that the rejected portion of the application had previously been published in a scientific journal by the inventor Prof. Vladimir Zharov, an employee of the UAMS, prior to the filing of the application and therefore was not patentable.

We completed a proof-of-concept clinical trial, titled “In vivo real-time detection of circulating melanoma cells” which was conducted at UAMS under the direction of Prof. Laura Hutchins, Director, Division of Hematology/Oncology as the principal investigator and Prof. Vladimir Zharov, Director of the Philips Classic Laser and Nanomedicine Laboratories as sub-investigator, both of whom are employees of UAMS. The clinical trial examined 10 healthy control subjects in order to characterize the photoacoustic baseline signals and validated the sensitivity of CTC (circulating tumor cells) detection in 10 patients who had melanoma. We are currently seeking a strategic partner for further clinical development.

Device Approval Process

Our contemplated products will be regulated as medical devices and will be subject to extensive regulation by the FDA and other regulatory authorities in the US. The Food, Drug, and Cosmetic Act (“FD&C Act”) and other federal and state statutes and regulations govern the research, design, development, preclinical and clinical testing, manufacturing, safety, approval or clearance, labeling, packaging, storage, record keeping, servicing, promotion, import and export, and distribution of medical devices.

Unless an exemption applies, each medical device we wish to commercially distribute in the U.S. will require either prior premarket notification, or 510(k) clearance, or premarket approval (PMA) from the FDA. The FDA classifies medical devices

9

into one of three classes. Devices requiring fewer controls because they are deemed to pose lower risk are placed in Class I or II. Class I devices are subject to general controls such as labeling, premarket notification, and adherence to the FDA’s Quality System Regulation (a set of current good manufacturing practice requirements put forth by the FDA which govern the methods used in, and the facilities and controls used for, the design, manufacture, packaging, labeling, storage, installation and servicing of finished devices) (“QSR”). Class II devices are subject to special controls such as performance standards, post-market surveillance, FDA guidelines, as well as general controls. Some Class I and Class II devices are exempted by regulation from the premarket notification, or 510(k), clearance requirement or the requirement of compliance with certain provisions of the QSR. Devices are placed in Class III, which requires approval of a PMA application, if insufficient information exists to determine that the application of general controls or special controls are sufficient to provide reasonable assurance of safety and effectiveness, or they are life-sustaining, life-supporting or implantable devices, or the FDA deems these devices to be “not substantially equivalent” either to a previously 510(k) cleared device or to a “pre-amendment” Class III device in commercial distribution before May 28, 1976, for which PMA applications have not been required. A PMA application must be supported by valid scientific evidence, which typically requires extensive data, including technical, pre-clinical, clinical, manufacturing and labeling data, to demonstrate to the FDA’s satisfaction the safety and effectiveness of the device. A PMA application must include, among other things, a complete description of the device and its components, a detailed description of the methods, facilities and controls used to manufacture the device, and proposed labeling. A PMA application also must be accompanied by a user fee, unless exempt. For example, the FDA does not require the submission of a user fee for a small business’s first PMA. After a PMA application is submitted and found to be sufficiently complete, the FDA begins an in-depth review of the submitted information. During this review period, the FDA may request additional information, or clarification of information already provided. Also during the review period, an advisory panel of experts from outside the FDA maybe convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. In addition, the FDA generally will conduct a pre-approval inspection of the manufacturing facility to ensure compliance with the QSR, which requires manufacturers to follow design, testing, control, documentation, and other quality assurance procedures.

The FDA can delay, limit, or deny approval of a PMA application for many reasons, including:

·

the product may not be safe or effective to the FDA’s satisfaction;

·

the data from our pre-clinical studies and clinical trials may be insufficient to support approval;

·

the manufacturing process or facilities we use may not meet applicable requirements; and

·

changes in FDA approval policies or adoption of new regulations may require additional data.

If the FDA evaluations of both the PMA application and the manufacturing facilities are favorable, the FDA will either issue an approval letter, or approvable letter, which usually contains a number of conditions which must be met in order to secure final approval of the PMA. When and if those conditions have been fulfilled to the satisfaction of the FDA, the agency will issue a PMA approval letter authorizing commercial marketing of the device for certain indications. If the FDA’s evaluation of the PMA or manufacturing facilities is not favorable, the FDA will deny approval of the PMA or issue a not approvable letter. The FDA may also determine that additional clinical trials are necessary, in which case the PMA approval may be delayed while the trials are conducted and the data acquired is submitted in an amendment to the PMA. Even with additional trials, the FDA may not approve the PMA application. The PMA process can be expensive, uncertain, and lengthy and a number of devices for which FDA approval has been sought by other companies have never been approved for marketing.

New PMA applications or PMA supplements may be required for modifications to the manufacturing process, labeling and device specifications, materials or design of a device that is approved through the PMA process. PMA supplements often require submission of the same type of information as an initial PMA application, except that the supplement is limited to information needed to support any changes from the device covered by the original PMA application, and may not require as extensive clinical data or the convening of an advisory panel.

Clinical trials are almost always required to support a PMA application, and are sometimes required for a 510(k) clearance. These trials generally require submission of an application for an Investigational Device Exemption (“IDE”) to the FDA. If a trial is considered a “Non-Significant Risk” (“NSR”) study subject to abbreviated IDE regulations, a formal IDE submission is not required by the FDA. An IDE application must be supported by appropriate data, such as animal and laboratory testing results, showing that it is safe to test the device in humans and that the testing protocol is scientifically sound. The IDE application must be approved in advance by the FDA for a specified number of patients, unless the product is deemed a non-significant risk device and eligible for more abbreviated IDE requirements. Generally, clinical trials for a significant risk device may begin once the IDE application is approved by the FDA and the study protocol and informed consent form are approved by appropriate institutional review boards (“IRBs”) at the clinical trial sites. The FDA’s approval of an IDE allows clinical testing to go forward, but does not bind the FDA to accept the results of the trial as sufficient to prove the product’s safety and effectiveness, even if the

10

trial meets its intended success criteria. All clinical trials must be conducted in accordance with the FDA’s IDE regulations that govern investigational device labeling, prohibit promotion of the investigational device, and specify an array of recordkeeping, reporting and monitoring responsibilities of study sponsors and study investigators. . Required records and reports are subject to inspection by the FDA. The results of clinical testing may be unfavorable or, even if the intended safety and effectiveness success criteria are achieved, may not be considered sufficient for the FDA to grant approval or clearance of a product.

Although we believe our clinical trials will provide favorable data to support our PMA application, upon evaluation the FDA may conclude differently. Delays in receipt of or failure to receive FDA approval, the withdrawal of previously received approvals, or failure to comply with existing or future regulatory requirements would have a material adverse effect on our business, financial condition, and results of operations. Even if granted, the approvals may include significant limitations on the intended use and indications for use for which our products may be marketed.

After a device is approved or cleared and placed in commercial distribution, numerous regulatory requirements apply. These include:

·

establishing registration and device listing;

·

implementing QSR, which requires manufacturers to follow design, testing, control, documentation and other quality assurance procedures;

·

labeling regulations, which prohibit the promotion of products for unapproved or “off-label” uses and impose other restrictions on labeling;

·

medical device reporting regulations, which require that manufacturers report to the FDA if a device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur; and

·

corrections and removal reporting regulations, which require that manufacturers report to the FDA field corrections and product recalls or removals if undertaken to reduce a risk to health posed by the device or to remedy a violation of the FD&C Act that may present a risk to health.

Also, the FDA may require us to conduct post market studies or order us to establish and maintain a system for tracking our products through the chain of distribution to the patient level. The FDA enforces regulatory requirements by conducting periodic, unannounced inspections and market surveillance.

Failure to comply with applicable regulatory requirements, including those applicable to the conduct of our clinical trials, can result in enforcement action by the FDA, which may lead to any of the following sanctions:

·

warning letters;

·

fines and civil penalties;

·

unanticipated expenditures;

·

delays in approving or refusal to approve our applications, including supplements;

·

withdrawal of FDA approval;

·

product recall or seizure;

·

interruption of production;

·

operating restrictions;

·

injunctions; and

·

criminal prosecution.

Our products will need to be manufactured in compliance with current Good Manufacturing Practices (“cGMP”) requirements set forth in the QSR. The QSR requires a quality system for the design, manufacture, packaging, labeling, storage, installation and servicing of marketed devices, and includes extensive requirements with respect to quality management and organization, device design, equipment, purchase and handling of components, production and process controls, packaging and labeling controls, device evaluation, distribution, installation, complaint handling, servicing, and record keeping. The FDA enforces the QSR through periodic unannounced inspections If the FDA believes that we are not in compliance with QSR, it can shut down the manufacturing operations, require recall of our products, refuse to approve new marketing applications, institute legal proceedings to detain or seize products, enjoin future violations, or assess civil and criminal penalties against us or our officers or other employees. Any such action by the FDA would have a material adverse effect on our business. We cannot assure you that we will be able to comply with all applicable FDA regulations.

11

Non-FDA Government Regulation

The advertising of our products will be subject to both FDA and Federal Trade Commission regulations. In addition, the sale and marketing of our products will be subject to a complex system of federal and state laws and regulations intended to deter, detect, and respond to fraud and abuse in the healthcare system. These laws and regulations restrict and may prohibit pricing, discounting, commissions and other commercial practices that may be typical outside of the healthcare business. In particular, anti-kickback and self-referral laws and regulations will limit our flexibility in crafting promotional programs and other financial arrangements in connection with the sale of our products and related services, especially with respect to physicians seeking reimbursement through Medicare or Medicaid. These federal laws include, by way of example, the following:

·

the anti-kickback statute prohibits certain business practices and relationships that might affect the provision and cost of healthcare services reimbursable under Medicare, Medicaid and other federal healthcare programs, including the payment or receipt of remuneration for the referral of patients whose care will be paid by Medicare or other federal healthcare programs;

·

the physician self-referral prohibition, commonly referred to as the Stark Law, which prohibits referrals by physicians of Medicare or Medicaid patients to providers of a broad range of designated healthcare services in which the physicians or their immediate family members have ownership interests or with which they have certain other financial arrangements;

·

the anti-inducement law, which prohibits providers from offering anything to a Medicare or Medicaid beneficiary to induce that beneficiary to use items or services covered by either program;

·

the Civil False Claims Act, which prohibits any person from knowingly presenting or causing to be presented false or fraudulent claims for payment by the federal government, including the Medicare and Medicaid programs; and

·

the Civil Monetary Penalties Law, which authorizes the US Department of Health and Human Services (“HHS”) to impose civil penalties administratively for fraudulent or abusive acts.

Sanctions for violating these federal laws include criminal and civil penalties that range from punitive sanctions, damage assessments, money penalties, imprisonment, denial of Medicare and Medicaid payments, or exclusion from the Medicare and Medicaid programs, or both. These laws also impose an affirmative duty on those receiving Medicare or Medicaid funding to ensure that they do not employ or contract with persons excluded from the Medicare and other government programs.

Many states have adopted or are considering legislative proposals similar to the federal fraud and abuse laws, some of which extend beyond the Medicare and Medicaid programs to prohibit the payment or receipt of remuneration for the referral of patients and physician self-referrals regardless of whether the service was reimbursed by Medicare or Medicaid. Many states have also adopted or are considering legislative proposals to increase patient protections, such as limiting the use and disclosure of patient-specific health information. These state laws typically impose criminal and civil penalties similar to the federal laws.

In the ordinary course of their business, medical device manufacturers and suppliers have been and are subject regularly to inquiries, investigations and audits by federal and state agencies that oversee these laws and regulations. Recent federal and state legislation has greatly increased funding for investigations and enforcement actions, which have increased dramatically over the past several years. This trend is expected to continue. Private enforcement of healthcare fraud also has increased, due in large part to amendments to the Civil False Claims Act in 1986 that were designed to encourage private persons to sue on behalf of the government. These whistleblower suits by private persons, known as qui tam relaters, may be filed by almost anyone, including physicians and their employees and patients, our employees, and even competitors. The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), in addition to its privacy provisions, created a series of new healthcare-related crimes.

Competition

The business for delivery of therapeutics to the human brain is highly competitive. Our products must gain acceptance by the medical community and show clinically meaningful advantages in performance. There are several groups and companies working on competitive technologies although in various stages. Ivar Mendez, a neurosurgeon at Dalhousie University in Halifax, Canada, has created the Halifax Injector, which delivers cells by tiny computer-controlled motors. Researchers at Vanderbilt University, headed up by Prof. Robert J. Webster III and Asst. Prof. of Neurological Surgery Kyle Weaver, are developing a robotic steerable needle, which they call the 'Active Cannula' system. This is focused primarily on removing blood clots and not for stem cell deployment although future uses could include it. Renishaw's neuroinspire software system is a software base guidance system that builds a map of the brain via MRI scans and produces a 3D image for deciding on a path for needle based biopsies. The Renishaw system incorporates the use of traditional straight needles and used for biopsies. Many researchers working on regenerative medicine and stem cell deployment to the brain will continue to use straight needles.

12

We believe that our BranchPoint device is unique. Additionally, the projected low cost of our BranchPoint device compared to robotic or steerable needles utilizing micro-motors could be a significant advantage and create a more cost-effective solution for the delivery of therapeutics to the brain.

Backlog

We are in a development stage and do not have any backlog.

Proposed Sales, Marketing and Advertising

We will seek commercial partners to market the products upon approval by the FDA.

Environmental Matters

Laws and regulations relating to protection of the environment have not had and should not have a material impact on our business.

Proprietary Rights

In addition to our patent application we have entered into an employment agreement with our CEO and intend to enter into similar agreements with other key employees that require them to keep all of our proprietary information confidential. We cannot assure that such protections will prove adequate should they be challenged in litigation.

Research and Development

We anticipate that our expenses in 2015 will include product development, trial and contractor expenses, and professional fees.

Employees

Our CEO is employed by us on a part time basis. We believe that our business can be carried forward by consultants and independent contractors in 2015.

Seasonality

We do not anticipate that our business will be seasonal to any material extent.

ITEM 1A. RISK FACTORS

Risks Relating To Our Business

You should carefully consider the risks described below before investing in our publicly traded securities. The risks described below are not the only ones facing us. Our business is also subject to the risks that affect many other companies, such as competition, technological obsolescence, labor relations, general economic conditions, geopolitical events, climate change and international operations. Additional risks not currently known to us or that we currently believe are immaterial also may impair our business operations and our liquidity.

We are in an early development stage and have limited resources and are dependent on conducting successful clinical trials and raising additional capital.

To date our activities have involved obtaining and executing license agreements with UAMS and UCSF, and raising sufficient funds for a clinical trial and product development. As of December 31, 2014, we had $555,506 cash and cash equivalents on hand. This is not sufficient to complete our product development as a standalone company, which we estimate will cost approximately $5 to $7 million over the next four to five years. We do not have any commitments for the additional capital we require and management believes that our ability to raise additional capital is highly dependent on successful product development. We will be able to fund the current stage of product development with cash on hand, but if any stage of our product

13

development produces ambiguous or unfavorable results, it is unlikely that we will be able to raise additional funds for subsequent stages and our business will fail and our stock will become virtually worthless.

Our auditors have qualified their opinion based on our ability to continue as a going concern.

Our auditors qualified their report that we will continue as a going concern because we have no revenues, have incurred recurring losses and recurring negative cash flow from operating activities, and have an accumulated deficit. If we are unable to raise additional funds and continue as a going concern, investors in our stock will lose their money.

Even if our product development is successful and we raise additional capital, our shareholders may suffer substantial dilution.

We will require $5 to $7 million in additional capital to complete our clinical trials as a standalone company. We do not have any commitments for those funds, but are dependent on conducting successful product development and seeking additional investors. The terms of investment of any additional investors may result in substantial dilution to the holders of our common stock.

Our limited ability to protect our intellectual property, and the possibility that our technology could inadvertently infringe technology owned by others, may adversely affect our ability to compete.

We rely on a patent application obtained from UCSF under our UCSF License to protect our intellectual property rights. A successful challenge to the ownership of our technology could materially damage our business prospects. Our competitors may assert that our technologies or products infringe on their patents or proprietary rights. We may be required to obtain from others licenses that may not be available on commercially reasonable terms, if at all. Problems with intellectual property rights could increase the cost of our proposed products or delay or preclude our new product development and commercialization. If infringement claims against us are deemed valid, we may not be able to obtain appropriate licenses on acceptable terms or at all. Litigation could be costly and time-consuming but may be necessary to protect our technology license positions or to defend against infringement claims. UCSF has applied for a United States patent which is the subject of our UCSF License. No assurance can be given that this patent will be granted, that, if granted, this patent will provide us with meaningful protection from infringement by others or that any patent that we may be granted will not be held by a court to infringe on the rights of others. The loss of patent protection could materially adversely affect our business.

The patent applications that we licensed from the University of California, San Francisco (UCSF) under our UCSF License could become not patentable and impact the viability of our UCSF License.

A portion of one of the three licensed patent applications, U.S. Patent Application Serial No. 12/334,217, Device and Method for In Vivo Flow Cytometry Using the Detection of Photoacoustic Waves; UAMS ID No. 2008-16, had been rejected by the United States Patent and Trademark Office and U.S. Patent Application Serial No. 12/334,217 was then abandoned prior to the date of our UAMS License. The basis for the rejection was primarily that the rejected portion of the application had previously been published in a scientific journal by the inventor Prof. Vladimir Zharov, an employee of the UAMS, prior to the filing of the application and therefore was not patentable. U.S. Patent Application No. PCT/US2013/052301, Microinjection Catheter; UC Case No. SF2012-063 which we licensed under our UCSF License could also be rejected by the Unites States Patent and Trademark Office and become not patentable.

The Federal government has “March-in Rights” to grant additional licenses to the patents that we licensed from UCSF under our UCSF License.

The work resulting in the invention of the device described in the patent applications that we licensed was generated with the assistance of Federal grant funding. Therefore, the Federal government has the rights established and described in 35 U.S.C. §§ 200-212. Of particular relevance is 35 U.S.C. § 202(c)(4), which in respect to any invention in which we elect rights, provides the Federal agency that gave the grant funding a nonexclusive, nontransferrable, irrevocable, paid-up license to practice or have practiced for or on behalf of the United States any subject invention throughout the world: Provided, that the funding agreement may provide for such additional rights, including the right to assign or have assigned foreign patent rights in the subject invention, as are determined by the agency as necessary for meeting the obligations of the United States under any treaty, international agreement, arrangement of cooperation, memorandum of understanding, or similar arrangement, including military agreement relating to weapons development and production. Also of particular relevance is 35 U.S.C. § 203, which establishes the “March-in Rights” granted to the government. In summary, the statute provides the power for the Federal agency that gave the grant funding to bestow on a third-party applicant an additional license to the patents if that Federal agency determines that (1) we have not

14

taken sufficient steps to achieve practical application of the technology; (2) action is necessary to alleviate health or safety needs not currently being addressed by us; (3) public use requirements specified by Federal regulations are not being met by us; or (4) the technology is not being manufactured substantially in the United States. To date, despite multiple applications requesting such action, a Federal agency such as the NIH (National Institutes of Health) has never exercised the powers provided for in 35 U.S.C. § 203.

Our BranchPoint device may not be able to deliver therapeutics to brain targets, improve accuracy, reduce risk of complications or increase patient safety.

We demonstrated the ability of our BranchPoint device to deliver therapeutics to brain targets and improve accuracy of therapeutic delivery under interventional MRI guidance (iMRI) in animal and human cadaver studies. The ability of our BranchPoint device to reduce risk of complications or increase patient safety, however, needs to be demonstrated in either pre-approval or post-approval clinical trials which could be requested by the FDA upon 510(k) submission. If we conduct a clinical trial, such a trial could fail to demonstrate the ability of our BranchPoint device to perform as expected.

We are subject to the periodic reporting requirements of the Securities Exchange Act of 1934 that requires us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs could reduce or eliminate our ability to earn a profit.

We are required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 and the rules and regulations promulgated thereunder. In order to comply with these requirements, our independent registered public accounting firm has to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel has to review and assist in the preparation of such reports. The costs charged by these professionals for such services cannot be accurately predicted because factors such as the number and type of transactions that we engage in and the complexity of our reports cannot be determined at this time and have a major effect on the amount of time to be spent by our auditors and attorneys. However, our incurring these costs obviously is an expense to our operations and thus has a negative effect on our ability to meet our overhead requirements and earn a profit. We may be exposed to potential risks resulting from new requirements under Section 404 of the Sarbanes-Oxley Act of 2002. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

Since approximately a quarter of our current assets are in overseas accounts, it may prove difficult for U.S. investors to reach those assets to satisfy any claims.

We maintain approximately a quarter of our current assets in overseas accounts for strategic reasons that management believes are beneficial to the Company and its shareholders. However, in the event U.S. investors obtained a judgment or award against the Company for claims under federal or state securities laws, enforcement of such judgment or award would become more difficult as to those assets that are overseas.

We currently do not have, and may never develop, any commercialized products.

We are a development stage company and currently do not have any commercialized products or any significant source of revenue. We have invested substantially all of our time and resources since inception in developing our products. Our development products may require additional development and clinical evaluation and they will require regulatory approval, significant marketing efforts and substantial additional investment before they can provide us with any revenue. Commercialization of each of our products remains subject to certain significant risks. Our efforts may not lead to commercially successful products for a number of reasons, including:

·

we may not be able to obtain regulatory approvals for our development products, or the approved indication may be narrower than we seek;

·

any of our development products may not prove to be safe and effective in clinical trials to the FDA’s satisfaction;

·

physicians may not receive any reimbursement from third-party payers, or the level of reimbursement may be insufficient to support widespread adoption of our development products;

·

we may experience delays in our continuing development program;

15

·

any products that are approved by regulators may not be accepted in the marketplace by physicians or patients;

·

we may not have adequate financial or other resources to complete the continued development or to commence the commercialization of our products and we may not have adequate financial or other resources to achieve significant commercialization of our products;

·

we may not be able to manufacture our products in commercial quantities or at an acceptable cost; and

·

rapid technological change may make our technology and products obsolete.

If we are unable to obtain regulatory approval for or successfully commercialize our products, we will be unable to generate revenue.

We have not received, and may never receive, FDA approval to market any of our products.

We do not have the necessary regulatory approvals to market any of our products in the U.S. or in any foreign market. We plan initially to launch our products, once approved, in the U.S. The regulatory approval may process involve, among other things, successfully completing clinical trials. The FDA may requires us to prove the safety and effectiveness of our products to the FDA’s satisfaction. This process can be expensive and uncertain, and requires detailed and comprehensive scientific and human clinical data. FDA review may take years after an application is filed. The FDA may never grant approval. The FDA can delay, limit, or deny approval of an application for many reasons, including:

·

any of our products may not be safe or effective to the FDA’s satisfaction;

·

the data we may obtain from our pre-clinical studies and clinical trials may be insufficient to support approval;

·

the manufacturing process or facilities we use may not meet applicable requirements; and

·

changes in FDA approval policies or adoption of new regulations may require additional data.

The FDA may not consider the data we may gather in clinical trials sufficient to support approval of our products. The FDA may determine that additional clinical trials or data are necessary, in which case regulatory approval may be delayed for several months or even years while the trials are conducted and the data acquired are submitted in an amendment to initial application. The occurrence of unexpected findings in connection with any clinical trial may prevent or delay obtaining regulatory approval, and may adversely affect coverage or reimbursement determinations. If we are unable to complete our clinical trials necessary to successfully support our intended applications, our ability to commercialize our products, and our business, financial condition, and results of operations would be materially adversely affected, thereby threatening our ability to continue operations.

If any of our products are approved by the FDA, they may be approved only for narrow indications.

Even if approved, our products may not be approved for the indications that are necessary or desirable for successful commercialization. If the use of our products is restricted, then the size of the market for our products and the rate of acceptance of our products by physicians may be adversely affected.

If we wish to modify any of our products after receiving FDA approval, including changes in indications or other modifications that could affect safety and effectiveness, additional approvals could be required from the FDA, we may be required to submit extensive pre-clinical and clinical data, depending on the nature of the changes. Any request by the FDA for additional data, or any requirement by the FDA that we conduct additional clinical studies, could delay the commercialization of our devices and require us to make substantial additional research, development and other expenditures. We may not obtain the necessary regulatory approvals to market our products in the U.S. or anywhere else. Any delay in, or failure to receive or maintain, approval for our products could prevent us from generating revenue or achieving profitability, and our business, financial condition, and results of operations would be materially adversely affected.

Any of our products may not be commercially viable if we fail to obtain an adequate level of reimbursement by Medicare and other third party payers. The markets for our products may also be limited by the indications for which its use may be reimbursed.

16

The availability of medical insurance coverage and reimbursement for newly approved products is uncertain. In the U.S., physicians and other healthcare providers are generally reimbursed for all or part of the cost of patient treatment by Medicare, Medicaid, or other third-party payers.

The commercial success of our products in both domestic and international markets will significantly depend on whether third-party coverage and reimbursement are available for services involving our products. Medicare, Medicaid, health maintenance organizations and other third-party payers are increasingly attempting to contain healthcare costs by limiting both the scope of coverage and the level of reimbursement of new products, and as a result, they may not cover or provide adequate payment for the use of our products. In order to obtain satisfactory reimbursement arrangements, we may have to agree to a fee or sales price lower than the fee or sales price we might otherwise charge. Even if Medicare and other third-party payers decide to cover procedures involving our products, we cannot be certain that the reimbursement levels will be adequate. Accordingly, even if our products or future products we develop are approved for commercial sale, unless government and other third-party payers provide adequate coverage and reimbursement for our products, some physicians may be discouraged from using them, and our sales would suffer.

Medicare reimburses for use of medical products in a variety of ways, depending on where and how a product is used. However, Medicare only provides reimbursement if the Centers for Medicare and Medicaid Services (“CMS”) determines that a certain product should be covered and that the use of the product is consistent with the coverage criteria. A coverage determination can be made at the local level by the Medicare administrative contractor (formerly called carriers and fiscal intermediaries), a private contractor that processes and pays claims on behalf of CMS for the geographic area where the services were rendered, or at the national level by CMS through a national coverage determination. There are new statutory provisions intended to facilitate coverage determinations for new products, but it is unclear how these new provisions will be implemented. Coverage presupposes that the product has been cleared or approved by the FDA and further, that the coverage will be no broader than the indication as approved or cleared by the FDA, but coverage can be narrower. A coverage determination may be so limited that relatively few patients will qualify for a covered use of a product. Should a very narrow coverage determination be made for our products, it may undermine the commercial viability of our products.

Obtaining a coverage determination, whether local or national, is a time-consuming, expensive and highly uncertain proposition, especially for new products, and inconsistent local determinations are possible. On average, according to an industry report, Medicare coverage determinations for medical products lag 15 months to five years or more behind FDA approval for a product. The Medicare statutory framework is also subject to administrative rulings, interpretations and discretion that affect the amount and timing of reimbursement made under Medicare. Medicaid coverage determinations and reimbursement levels are determined on a state by state basis, because Medicaid, unlike Medicare, is administered by the states under a state plan filed with the Secretary of the U.S. Department of Health and Human Services (“HHS”). Medicaid generally reimburses at lower levels than Medicare. Moreover, Medicaid programs and private insurers are frequently influenced by Medicare coverage determinations.

The FDA may require additional clinical trials and any adverse results in such clinical trials, or difficulties in conducting such clinical trials, could have a material adverse effect on our business.

The FDA may require us to conduct additional clinical studies upon evaluation of our regulatory submission. The occurrence of unexpected findings in connection with any initial or subsequent clinical trial required by the FDA may prevent or delay obtaining regulatory approval. In addition subsequent clinical studies would require the expenditure of additional company resources and could be a long and expensive process subject to unexpected delays. Any adverse results in such clinical trials, or difficulties in conducting such clinical trials, could have a material adverse effect on our business.

We expect to operate in a highly competitive market, we may face competition from large, well-established pharmaceutical or medical device companies with significant resources, and we may not be able to compete effectively.

Our products must gain acceptance by the medical community and show clinically meaningful advantages in performance. However, our present and future competitors may enjoy

·

significantly greater name recognition;

·

established relations with healthcare professionals, customers and third-party payers;

·

established distribution networks;

17

·

additional lines of products, and the ability to offer rebates, higher discounts or incentives to gain a competitive advantage;

·

greater experience in conducting research and development, manufacturing, clinical trials, obtaining regulatory approval for products, and marketing approved products; and

·

greater financial and human resources for product development, sales and marketing, and patent litigation.

As a result, we may not be able to compete effectively against these companies or their products.

Technological breakthroughs could render our products obsolete.

The medical field is subject to rapid technological change and product innovation. Our products are based on our proprietary technology, but a number of companies and medical researchers are pursuing new technologies. Companies in the medical field with significantly greater financial, technical, research, marketing, sales and distribution and other resources have expertise and interest in the delivery of therapeutics to the human brain targets. Some of these companies are working on potentially competing products or therapies.

In addition, the National Institutes of Health and other supporters of medical research are presumptively seeking ways to improve patient diagnosis and treatment by sponsoring corporate and academic research. There can be no assurance that one or more of these companies will not succeed in developing or marketing technologies and products or services that demonstrate better safety or effectiveness, superior clinical results, greater ease of use or lower cost than our products, or that such competitors will not succeed in obtaining regulatory approval for introducing or commercializing any such products or services prior to us.

FDA approval of a commercially viable alternative to our products produced by a competitor could significantly reduce market acceptance of our products. Any of the above competitive developments could have a material adverse effect on our business, financial condition, and results of operations. There is no assurance that products, services, or technologies introduced prior to or subsequent to the commercialization of our products will not render our products less marketable or obsolete.

For initial or additional clinical trials required for our products by the FDA or with respect to clinical trials relating to the development of our technology for other applications, we depend on clinical investigators and clinical sites and other third parties to manage the trials and to perform related data collection and analysis, and, as a result, we may face costs and delays that are outside of our control.

With respect to any additional clinical studies for our products which may required by the FDA or with respect to clinical trials relating to the development of our core technology for other applications, we rely on clinical investigators and clinical sites, some of which are private practices, and some of which are research university- or government-affiliated, to enroll patients in our clinical trials. We may rely on: pathologists and pathology laboratories; a contract research organization to assist in monitoring, collection of data, and ensuring FDA Good Clinical Practices (“GCP”) are observed at our sites; a consultant biostatistician; and other third parties to manage the trial and to perform related data collection and analysis.

However, we may not be able to control the amount and timing of resources that clinical sites and other third parties may devote to our clinical trials. If these clinical investigators and clinical sites fail to enroll a sufficient number of patients in our clinical trials, or if the clinical sites fail to comply adequately with the clinical protocols, we will be unable to complete these trials, which could prevent us from obtaining regulatory approvals for our products or other products developed from our technology. Our agreements with clinical investigators and clinical sites for clinical testing place substantial responsibilities on these parties and, if these parties fail to perform as expected, our trials could be delayed or terminated.

If these clinical investigators, clinical sites or other third parties do not carry out their contractual duties or obligations or fail to meet expected deadlines, or if the quality or accuracy of the clinical data they obtain are compromised due to their failure to adhere to our clinical protocols or for other reasons, our clinical trials may be extended, delayed or terminated, and we may be unable to obtain regulatory approval for, or successfully commercialize, our products or other products developed from our technology.

18

In addition to the foregoing, any initial or additional clinical studies for any of our products which may required by the FDA and any clinical trials relating to the development of our technology for other applications may be delayed or halted, or be inadequate to support regulatory approval, for numerous other reasons, including, but not limited to, the following:

·

the FDA, an Institutional Review Board (“IRB”) or other regulatory authorities place our clinical trial on hold;

·

patients do not enroll in clinical trials at the rate we expect;

·

patient follow-up is not at the rate we expect;

·

IRBs and third-party clinical investigators delay or reject our trial protocol;

·

third-party organizations do not perform data collection and analysis in a timely or accurate manner;

·

regulatory inspections of our clinical trials or manufacturing facilities, among other things, require us to undertake corrective action or suspend or terminate our clinical trials, or invalidate our clinical trials;

·

changes in governmental regulations or administrative actions; and

·

the interim or final results of the clinical trial are inconclusive or unfavorable as to safety or effectiveness.

If our products are approved for reimbursement, we anticipate experiencing significant pressures on pricing.

Even if Medicare covers a product for certain uses, that does not mean that the level of reimbursement will be sufficient for commercial success.

We expect to experience pricing pressures in connection with the commercialization of our products and our future products due to efforts by private and government-funded payers to reduce or limit the growth of healthcare costs, the increasing influence of health maintenance organizations, and additional legislative proposals to reduce or limit increases in public funding for healthcare services. Private payers, including managed care payers, increasingly are demanding discounted fee structures and the assumption by healthcare providers of all or a portion of the financial risk. Efforts to impose greater discounts and more stringent cost controls upon healthcare providers by private and public payers are expected to continue. Payers frequently review their coverage policies for existing and new diagnostic tools and can, sometimes without advance notice, deny or change their coverage policies. Significant limits on the scope of services covered or on reimbursement rates and fees on those services that are covered could have a material adverse effect on our ability to commercialize our products and therefore, on our liquidity and our business, financial condition, and results of operations.

Our products may never achieve market acceptance even if we obtain regulatory approvals.

Even if we obtain regulatory approval, patients and physicians may not endorse our products. Physicians tend to be slow to change their diagnostic and medical treatment practices because of perceived liability risks arising from the use of new products and the uncertainty of third party reimbursement. Physicians may not utilize any of our products until there is long-term clinical evidence to convince them to alter their existing methods of diagnosing or evaluating suspicious lesions or other conditions addressed by our products and there are recommendations from prominent physicians that our products are effective. We cannot predict the speed at which physicians may adopt the use of any of our products. If our products receive the appropriate regulatory approvals but do not achieve an adequate level of acceptance by patients, physicians and healthcare payers, we may not generate significant product revenue and we may not become profitable. The degree of market acceptance of our products will depend on a number of factors, including:

·

perceived effectiveness of our products;

·

convenience of use;

·

cost of use of our products;

·

availability and adequacy of third-party coverage or reimbursement;

19

·

approved indications and product labeling;

·

publicity concerning our products or competitive products;

·

potential advantages over alternative diagnostic methodologies;

·

introduction and acceptance of competing products or technologies; and

·

extent and success of our sales, marketing and distribution efforts.

The success of our products will depend upon the acceptance by physicians and hospitals. We will be subject to intense scrutiny before physicians will be comfortable incorporating our products in their treatment approaches. We believe that recommendations by respected physicians and marketing by established licensees will be essential for the development and successful marketing of our products; however, there can be no assurance that any such recommendations will be obtained. To date, the medical community has had little exposure to us and our products.

Because the medical community is often skeptical of new companies and new technologies, we may be unable to gain access to potential customers in order to demonstrate the operational effectiveness of our products. Even if we gain access to potential customers, no assurance can be given that physicians will perceive a need for or accept our products, even after we receive approval from the FDA for marketing the product.

We intend to contract with third parties in order to commercialize our products.