Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BOSTON PRIVATE FINANCIAL HOLDINGS INC | d896135d8k.htm |

Exhibit 99.1

ANNUL REPORT

OF FINANCIAL CONDITION AS OF DECEMBER

31, 2014

“Our acquisition of Banyan Partners was an important milestone in our vision to become a premier wealth management and private

banking company in our markets across the country.”

Dear Friend,

I am

pleased to tell you that 2014 was a signi?cant year of growth and increased ?nancial strength for Boston Private Bank & Trust.

Our acquisition of Banyan

Partners in October was an important milestone in our overall vision to become a premier wealth management and private banking company in our markets across the country. On February 17, 2015, we unveiled Boston Private Wealth LLC, our new SEC

registered investment adviser that combines Boston Private Bank’s wealth management services with those of Banyan Partners. The combination is both compelling and distinctive, as it allows us to offer even deeper investment expertise, deliver a

more comprehensive range of wealth management services, and continue our tradition of providing superior private banking and trust services.

The Bank’s 2014

net income of $62.5 million represents a 7% increase over last year, excluding the one-time after-tax gain of $6.2 million from the sale of our Pacific Northwest offices in May 2013. Driven by continued growth in investments and loans, the

Bank’s balance sheet ended the year at $6.6 billion, up 6% from last year. Deposits increased by 7%, to $5.5 billion. Assets under management more than doubled, ending the year with a balance of $9.3 billion. This was primarily due to our

recent acquisition of Banyan Partners.

Another noteworthy event in 2014 was our 1st annual Private Partnership CFO Conference. We attracted CFOs from across the

country, and our planning is well underway for the 2015 conference on Cape Cod in June.

The Bank also remained strongly committed to the communities we serve,

providing ?nancing for a?ordable housing, ?rst-time homebuyers, economic development, social services, community revitalization and small businesses.

The year

ahead will be an exciting time indeed for Boston Private as we seek to bring our exceptional level of personal attention, expertise, and custom solutions to clients around the country. On behalf of everyone at Boston Private, I thank you for your

trust and relationship, and welcome your comments and suggestions.

Sincerely,Mark D. Thompson CEO & President

2014 FINANCIAL HIGHLIGHTS

ASSETS UNDER MANAGEMENT

NET INCOME ENDED AT

GREW TO $62.5 MILLION

$9.3 BILLION an increase of 7% over

last year. primarily due to the acquisition of Banyan Partners.

BALANCE SHEET CAPITAL REMAINED

ASSETS TOTALED STRONG

$6.6 BILLION with the Bank’s Tier 1 Leverage Ratio ending the year at 8.55%. an increase of 6% compared to last year.

DEPOSITS GREW TO LOANS TOTALED

$5.5 BILLION $5.3 BILLION

up 7% compared to last year. compared to $5.1 billion last year.

BOARD OF DIRECTORS Mark D. Thompson Nicholas A. R. Hofer Anne L. Randall

Herbert S. Alexander CEO & President Senior Vice President Executive Vice President Founder and Chairman Boston Private Bank & Trust Company West Coast Market

Leader Chief Financial and

Alexander, Aronson, Finning & Company Administrative Ocer Stephen M. Waters Gisela A. LoPiano

Margaret W. Chambers Founding and Managing Partner Senior Vice President Esther Schlorholtz Executive Vice President and General Counsel Compass Advisers Chief Lending O?cer, East

Coast Senior Vice President

Boston Private Financial Holdings, Inc. Chairman of the Board Director of Community Investment

Boston Private Bank & Trust Company W. Timothy MacDonald

Clayton G. Deutsch Executive

Vice President George G. Schwartz

CEO & President Donna C. Wells Chief Risk O?cer Executive Vice President

Boston Private Financial Holdings, Inc. President & CEO Chief Operating O?cer Mind?ash Technologies, Inc. Robert J. Nentwig Lynn Thompson Ho?man Senior Vice President Lynn

M. Swenson

Private Investor Chief Lending Ocer, West Coast Senior Vice President POLICY GROUP Chief Fiduciary Ocer

Christopher J. O’Connell

David J. Kaye Thomas K. Anderson Managing Director Neal

Tandowsky

Executive Vice President Executive Managing Director Boston Private Wealth Senior Vice President and Chief Financial O?cer Boston Private Wealth Director

of West Coast

Boston Private Financial Holdings, Inc. Alejandro Arteaga William T. Oberlies Residential Lending Senior Vice President Deborah F. Kuenstner Senior

Vice President National Director of Trust Howard M. Tarlow Chief Investment O?cer Director of Risk Analytics and Fiduciary Services Senior Vice President

Wellesley

College James C. Brown Chief Commercial Real Estate O?cer

Jeremy Parker

John

Morton III Executive Vice President Senior Vice President Mark D. Thompson Private Investor Director of Commercial Banking Treasurer CEO & President and Credit Management

Daniel P. Nolan Philip A. Powers Jennifer M. Willis

President and CEO Robert C. Buum Senior

Vice President Senior Vice President Hugh Johnson Advisors, LLC Senior Vice President Commercial Lending Team Leader Director of Marketing Chief Credit Ocer

George

G. Schwartz Pilar Pueyo Elizabeth W. Worrick

Executive Vice President Torrance Childs Senior Vice President Senior Vice President and Chief Operating O?cer Senior

Vice President Senior Human Resources Director National Director of Boston Private Bank & Trust Company National Director of Deposit Management Residential Lending

Peter J. Raimondi Brian G. Shapiro Gary L. Garber Chief Executive O?cer

Managing Partner

Senior Vice President Boston Private Wealth The Shapiro Group Chief Information O?cer

EXECUTIVE LEADERSHIP TEA M

James C. Brown, Anne L. Randall, Peter J. Raimondi, W. Timothy MacDonald, Mark D. Thompson, George G. Schwartz

ANNUAL REPORT OF 2014FINANCIAL

CONDITION

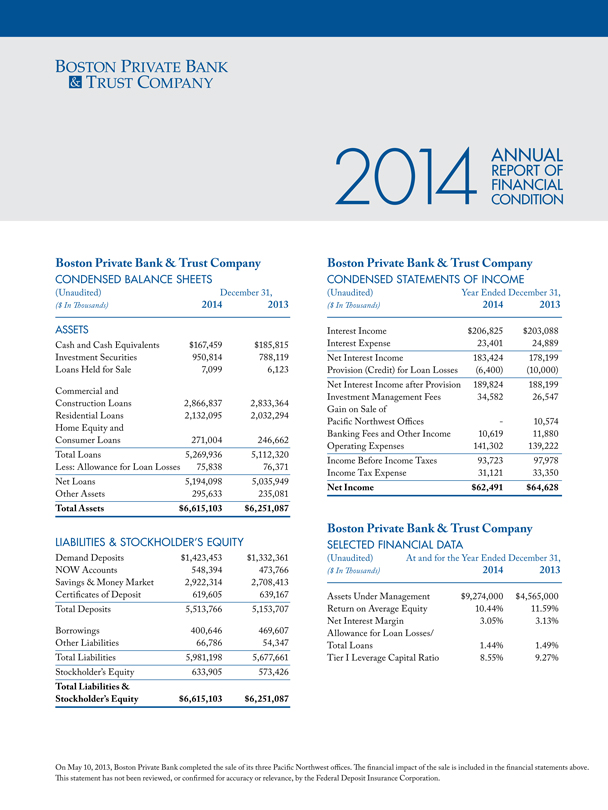

Boston Private Bank & Trust Company Boston Private Bank & Trust Company

CONDENSED BALANCE SHEETS CONDENSED STATEMENTS OF INCOME

(Unaudited) December 31,

(Unaudited) Year Ended December 31,

($ In Thousands) 2014 2013 ($ In Thousands) 2014 2013

ASSETS Interest Income $206,825 $203,088 Cash and Cash Equivalents $167,459 $185,815 Interest Expense 23,401 24,889 Investment Securities 950,814 788,119 Net Interest Income

183,424 178,199 Loans Held for Sale 7,099 6,123 Provision (Credit) for Loan Losses (6,400) (10,000) Net Interest Income after Provision 189,824 188,199 Commercial and Investment Management Fees 34,582 26,547 Construction Loans 2,866,837

2,833,364 Gain on Sale of Residential Loans 2,132,095 2,032,294 Paci?c Northwest O?ces—10,574 Home Equity and Banking Fees and Other Income 10,619 11,880 Consumer Loans 271,004 246,662 Operating Expenses 141,302 139,222 Total Loans 5,269,936

5,112,320 Income Before Income Taxes 93,723 97,978 Less: Allowance for Loan Losses 75,838 76,371 Income Tax Expense 31,121 33,350 Net Loans 5,194,098 5,035,949

Net

Income $62,491 $64,628

Other Assets 295,633 235,081

Total Assets $6,615,103

$6,251,087

Boston Private Bank & Trust Company

LIABILITIES & STOCKHOLDER’S EQUITY SELECTED FINANCIAL DATA

Demand Deposits $1,423,453 $1,332,361 (Unaudited) At and for the Year Ended December 31, NOW Accounts 548,394 473,766 ($ In Thousands) 2014 2013 Savings & Money Market 2,922,314 2,708,413 Certi?cates of Deposit 619,605 639,167 Assets Under Management $9,274,000 $4,565,000 Total Deposits 5,513,766 5,153,707 Return on Average Equity 10.44% 11.59% Borrowings 400,646 469,607 Net Interest Margin 3.05% 3.13% Other Liabilities 66,786 54,347 Allowance for Loan Losses/ Total Loans 1.44% 1.49% Total Liabilities 5,981,198 5,677,661 Tier I Leverage Capital Ratio 8.55% 9.27% Stockholder’s Equity 633,905 573,426

Total

Liabilities &

Stockholder’s Equity $6,615,103 $6,251,087

On

May 10, 2013, Boston Private Bank completed the sale of its three Paci?c Northwest o?ces. The ?nancial impact of the sale is included in the ?nancial statements above. This statement has not been reviewed, or con?rmed for accuracy or relevance,

by the Federal Deposit Insurance Corporation.

BOSTON PRIVATE OFFICES

Beverly Boston Boston

Brookline Burlingame Cambridge Los Altos Area Hingham Palo Alto Madison Jamaica Plain San Francisco Lexington San Jose San Francisco Bay Area Newton San Mateo Wellesley Beverly Hills Burbank Los Angeles Area Encino Atlanta

Granada Hills

Pasadena Dallas Coral Gables Santa Monica Ft. Lauderdale Westlake Village Naples

Florida Area Palm Beach Gardens

BOSTON PRIVATE BANK & TRUST OFFICES BOSTON PRIVATE WEALTH OFFICES

Ten Post O?ce Square 1440 Chapin Avenue Ten Post O?ce Square 100 First Street, 14th Floor Boston, MA Burlingame, CA Boston, MA San Francisco, CA 500 Boylston Street 345 S. San

Antonio Road 255 State Street, 6th Floor 160 Bovet Road Boston, MA Los Altos, CA Boston, MA San Mateo, CA 800 Boylston Street 420 Cowper Street 121 Alhambra Plaza, Suite 1202 144 South Beverly Drive, Suite 402 Boston, MA Palo Alto, CA Coral Gables,

FL Beverly Hills, CA

157 Seaport Boulevard 433 California Street 1845 Cordova Road, Suite 206 16000 Ventura Boulevard Boston, MA San Francisco, CA Fort Lauderdale,

FL Encino, CA

57 Enon Street, Route 1A 60 South Market, Suite 100 999 Vanderbilt Beach Road, Suite 200 1 Glenlake Parkway, Suite 700 Beverly, MA San Jose, CA

Naples, FL Atlanta, GA

1295A Beacon Street 160 Bovet Road 11376 N. Jog Road, Suite 101 5201 East Terrace Drive, Suite 380 Brookline, MA San Mateo, CA Palm Beach

Gardens, FL Madison, WI

265 Main Street 333 N. Glenoaks Boulevard 4965 Preston Park Blvd, Suite 350E Cambridge, MA Burbank, CA Plano, TX

| 7 | Central Street 16000 Ventura Boulevard Hingham, MA Encino, CA |

401c Centre Street 10820 Zelzah Avenue Jamaica Plain, MA (Loan Center) Granada Hills, CA 1666 Massachusetts Avenue 345 East Colorado

Boulevard Lexington, MA Pasadena, CA

1223 Centre Street 520 Broadway Newton, MA Santa Monica, CA

336 Washington Street 971 South Westlake Boulevard Wellesley, MA Westlake Village, CA

BostonPrivateBank.com

Wealth Management services are provided by Boston

Private Wealth LLC, an SEC registered investment adviser and a wholly owned subsidiary of Boston Private Bank & Trust Company. Investments are not FDIC insured, are not a deposit, are not guaranteed by Boston Private Bank & Trust

Company or any of its affiliates, and may lose value.