Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - PFSWEB INC | pfsw-ex21_201412319.htm |

| EX-31.1 - EX-31.1 - PFSWEB INC | pfsw-ex311_201412318.htm |

| EX-31.2 - EX-31.2 - PFSWEB INC | pfsw-ex312_201412316.htm |

| EX-23.1 - EX-23.1 - PFSWEB INC | pfsw-ex231_2014123110.htm |

| EXCEL - IDEA: XBRL DOCUMENT - PFSWEB INC | Financial_Report.xls |

| EX-32.1 - EX-32.1 - PFSWEB INC | pfsw-ex321_201412317.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended December 31, 2014 |

or

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the transition period from to |

Commission file number 000-28275

PFSWEB, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

75-2837058 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

|

505 Millennium Drive, Allen, Texas |

|

75013 |

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code:

972-881-2900

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

¨ (Do not check if a Smaller reporting company) |

|

Smaller reporting company |

|

x |

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2014 (based on the closing price as reported by the National Association of Securities Dealers Automated Quotation System) was $107,165,218.

At March 11, 2015, there were 17,230,628 shares of the registrant’s Common Stock issued, $.001 par value.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the annual meeting of shareholders, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Annual Report relates.

INDEX

|

|

|

|

Page |

|

|

|

|

|

|

|

|

Item 1. |

|

1 |

||

|

Item 1A. |

|

14 |

||

|

Item 1B. |

|

24 |

||

|

Item 2. |

|

24 |

||

|

Item 3. |

|

24 |

||

|

Item 4. |

|

24 |

||

|

|

|

|

|

|

|

Item 5. |

|

25 |

||

|

Item 6. |

|

25 |

||

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 |

|

|

Item 7A. |

|

37 |

||

|

Item 8. |

|

38 |

||

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

66 |

|

|

Item 9A. |

|

66 |

||

|

Item 9B. |

|

67 |

||

|

|

|

|

|

|

|

Item 10. |

|

67 |

||

|

Item 11. |

|

67 |

||

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

67 |

|

|

Item 13. |

|

Certain Relationships and Related Transactions and Director Independence |

67 |

|

|

Item 14. |

|

67 |

||

|

|

|

|

|

|

|

Item 15. |

|

68 |

||

|

79 |

||||

Unless otherwise indicated, all references to “PFSweb,” “the Company,” “we,” “us” and “our” refer to PFSweb, Inc., a Delaware corporation, and its subsidiaries; references to “PFS” refer to our wholly-owned subsidiaries, Priority Fulfillment Services, Inc., Priority Fulfillment Services of Canada, PFSweb BV (Belgium), REV Solutions, Inc., REVTECH Solutions India Private Limited and LiveAreaLabs, Inc.; references to “Supplies Distributors” refer to our wholly-owned subsidiary Supplies Distributors, Inc. and its subsidiaries; and references to “Retail Connect” refers to our wholly-owned subsidiary PFSweb Retail Connect, Inc.

General

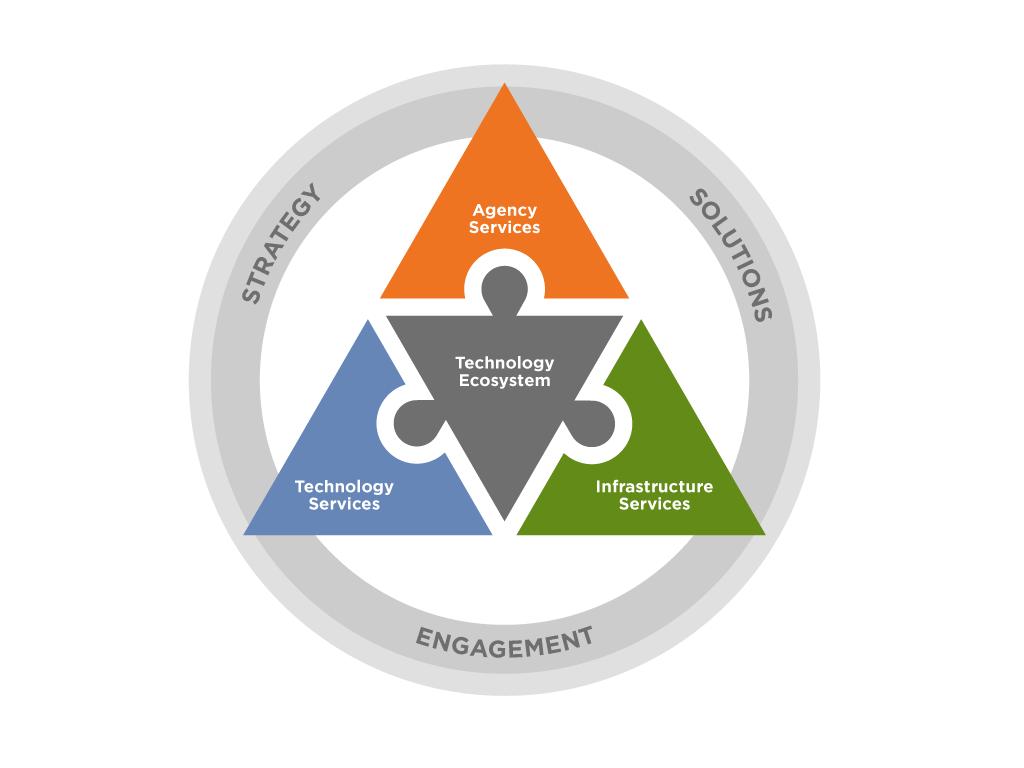

PFSweb is a global provider of omni-channel commerce solutions supporting major brands and other companies seeking to optimize and enhance their online and traditional business channels. Comprised of technology, critical infrastructure, and professional services, we provide our clients with best-of-breed capabilities offered as a complete end-to-end solution or on an à la carte basis. Marketed as PFSweb’s End2End eCommerce® solution and PFSweb Infinite Commerce®, or iCommerceSM, the services we offer are organized into the following categories:

|

● |

Digital Agency Services |

|

● |

Technology Services |

|

● |

Infrastructure Services |

|

● |

Technology Ecosystem |

Our solutions support direct-to-consumer (“DTC”), business-to-business (“B2B”), and retail sales channels. The majority of our clients are the merchants of record for the orders we process through our infrastructure on their behalf. For these clients, we do not own the inventory or the resulting accounts receivable, but provide ecommerce solutions and other services for these client-owned assets.

For some of our clients, we are the merchant of record for the orders we process through our infrastructure. Depending on the terms under these arrangements, we record either product revenue or service fee revenue, may own the accounts receivable and inventory and we may be compensated for all or a portion of our services through the resulting profit margin. In some of these client relationships, we purchase the inventory as the product is delivered to our facility. In other of these client relationships, the client retains ownership of inventory in our facility and we purchase the inventory immediately prior to each individual customer sales transaction. In all of these cases, we seek inventory financing from our clients in the form of extended terms, working capital programs or marketing funds to help offset the working capital requirements that follow accounts receivable and inventory ownership.

1

We are headquartered in Allen, Texas where our executive and administrative offices and our primary technology operations and hosting facilities are located, and certain professional services including digital agency and technology services are performed. We operate state-of-the-art call centers from our U.S. facility located in Dallas, Texas and from our international facilities located in Richmond Hill, Ontario, Canada and Liège, Belgium. We lease or manage warehouse facilities of approximately 1.6 million square feet, many containing highly automated and state of the art material handling and communications equipment in Memphis, Tennessee, Southaven, Mississippi, Grapevine, Texas, Richmond Hill and Markham, Ontario, Canada and Liège, Belgium, allowing us to provide global distribution solutions. Additionally, we engage in business development activities and provide additional digital agency services and/or technology services from our offices in Minneapolis, New York City, Seattle, London, Munich, and Bangalore.

PFSWEB’S END2END ECOMMERCE® SOLUTIONS

PFSweb serves as the “brand behind the brand” for companies seeking to increase efficiencies, enter new markets or launch optimized sales channels. As an eCommerce development firm, digital agency and business process outsourcer, we offer scalable and cost-effective solutions for brand manufacturers, online retailers, and distributors across a wide range of industry segments. We provide our clients with seamless and transparent solutions to support their business strategies, allowing them to focus on their core competencies. Leveraging PFSweb’s technology, expertise and proven methodologies, we enable clients to develop and deploy new products and implement new business strategies or address new distribution channels rapidly and efficiently through our optimized solutions. Our clients engage us both as a consulting partner to assist them in the design of a business solution as well as a virtual and physical infrastructure partner to provide the mission critical operations required to build and manage their business solution. Together, we not only help our clients define new ways of doing business, but also provide them the technology, physical infrastructure and professional resources necessary to quickly implement their business model. We allow our clients to quickly and dramatically change how they “go-to-market.”

Each client has a unique business model and unique strategic objectives that often require highly customized solutions. PFSweb can support clients in a wide array of industries, including fashion apparel and accessories, fragrance and beauty products, consumer packaged goods, home furnishings and housewares, collectibles and toys, consumer electronics, office technology and network connectivity products and aviation spare parts. These clients turn to PFSweb for help in addressing a variety of business needs that include eCommerce creative design and development, customer satisfaction and retention, time-definite logistics, vendor managed inventory and integration, supply chain compression, cost model realignments, transportation management and international expansion, among others. We also act as a constructive agent of change, providing clients the ability to alter their current distribution model, establish direct relationships with end-customers, and reduce the overall time and costs associated with existing distribution channel strategies. Our clients are seeking solutions that will provide them with dynamic supply chain and multi-channel marketing efficiencies, while ultimately delivering a world-class customer service experience.

Our value proposition is to become a seamless, well integrated extension of our clients’ enterprises by delivering superior solutions that drive optimal customer experiences. On behalf of the brands we serve, we strive to increase and enhance sales and market growth, bolster customer satisfaction and customer retention, and drive costs out of the business through operations and technology related efficiencies. As both a virtual and a physical infrastructure for our clients’ businesses, we embrace their brand values and strategic objectives. By utilizing our services, our clients are able to:

Quickly Capitalize on Market Opportunities. Our solutions empower clients to rapidly implement their supply chain and eCommerce strategies and take advantage of opportunities without lengthy integration and implementation efforts. We have readily available advanced technology and physical infrastructure that is flexible in its design, which facilitates quick integration and implementation. The PFSweb solution is designed to allow our clients to deliver consistent quality service as transaction volumes grow and also to handle daily and seasonal peak periods. Through our international locations, our clients can sell their products broadly throughout the world.

Improve the Customer Experience. We enable our clients to provide their customers with a high-touch, positive buying experience thereby maintaining and promoting brand loyalty. Through our use of advanced technology, we can respond directly to customer inquiries by e-mail, voice or data communication and assist them with online ordering and product information. We believe we offer our clients a “world-class” level of service, including Web-enabled customer care service centers, detailed Customer Relationship Management (“CRM”) reporting and exceptional order accuracy. We have significant experience in the development of eCommerce storefronts that allows us to recommend features and functions easily navigated and understood by our clients’ customers. Our technology platform is designed to ensure high levels of reliability and fast response times for our clients’ customers. Because of our technology, our clients benefit from being able to offer the latest in customer communication and response conveniences to their customers.

2

Minimize Investment and Improve Operating Efficiencies. One of the most significant benefits outsourcing provides is the ability to transform fixed costs into variable costs. By eliminating the need to invest in a fixed capital infrastructure, our clients’ costs typically become more directly correlated with volume increases or declines. Further, as volume increases drive the demand for greater infrastructure or capacity, we are able to quickly deploy additional resources. We provide services to multiple clients, which enables us to offer our clients economies of scale, and resulting cost efficiency, that they may not have been able to obtain on their own. Additionally, because of the large number of daily transactions we process, we have been able to justify investments in levels of automation, security surveillance, quality control processes and transportation carrier interfaces that are typically outside the scale of investment that our clients might be able to cost justify on their own. These additional capabilities can provide our clients the benefits of enhanced operating performance and efficiency, reduced inventory shrinkage, and expanded customer service options.

Access a Sophisticated Technology Ecosystem. We provide our clients with access to a Technology Ecosystem featuring best-of-breed eCommerce technologies together in a single, integrated, PCI certified offering. Powered by leading enterprise-class software solutions, our platform is seamlessly integrated into PFSweb's back-end operations to provide an end-to-end eCommerce solution. Built to accelerate the implementation process, the Technology Ecosystem allows for flexible integrations with other technology providers and client systems.

Our Technology Ecosystem also extends beyond the digital world and into physical commerce channels. Brands and retailers today require flexible technology to control customer shopping experiences regardless of where they shop. Deploying ship from store, in-store pick up, or mobile point of sale capabilities are just a few examples of how PFSweb can enable brands to create a dynamic and unique omni-channel shopping experience.

We believe our highest value proposition is achieved when our clients engage our full suite of services from all of the categories included in PFSweb’s End2End eCommerce® solutions. However, we provide our clients with the opportunity to customize their solution by selecting only certain services from our offering in à la carte fashion if they prefer. We believe this flexibility and willingness to create a customized solution for each client differentiates us from our competition.

Digital Agency Services

Our Digital Agency Services provide the key strategy, design, and digital marketing expertise required by leading brands with high expectations. We utilize proven business strategies, agency-based innovation, usability expertise, and eCommerce best practices to harmonize and produce visual ingenuity and tangible results.

We help brands succeed in the digital space by using a comprehensive set of strategy and services, including targeted campaigns and personalized communications, that are designed to attract customers, convert browsers to buyers, and nurture the customer relationship. With various degrees of client engagement, we bring industry expertise to every solution. Our experience in providing end-to-end solutions gives us a 360 degree view of the entire customer experience. These services can be bundled together in unique packages that help drive results through all shopping channels.

Creative Services. Powered by our subsidiary LiveAreaLabs, Inc., a digital creative agency and eCommerce systems integrator acquired in 2014, we collaborate with our clients and partner with other key stakeholders to create online experiences that engage our clients’ customers, drive conversion, and maximize revenue. We focus on user-centered design methodologies to incorporate powerful emotional and visual components.

User Experience. Regardless of device, we understand how our clients’ customers interact with the client brand and how to deploy the best on-site practices to increase conversion rates.

Digital Strategy. We gain an understanding of our clients’ goals, their brand, and their customers to develop digital marketing strategies that deliver results. We specialize in understanding the changing market, emerging digital technologies, and developing comprehensive marketing plans that engage at every touch point.

Search Engine Optimization (SEO) and Paid Search. We use sophisticated and current search engine optimization best practices to drive organic traffic along with expert-driven paid search and retargeting campaigns.

Affiliate Marketing. We build powerful relationships with the influencers promoting our clients’ sites and drive incremental sales for our clients through alternate channels attributing revenue appropriately and tracking and reporting commissions.

Product Merchandising. We create engaging and personalized on-site shopping experiences through dynamic product merchandising. Promotion set-up, on-site search optimization, and A/B testing help convert shoppers into buyers.

3

Comparison Shopping Engines. We have experience creating and managing comparison shopping feeds that will increase brand visibility in a competitive landscape while driving sales for our clients. We use the comparison shopping engine channel to enhance the search engine marketing initiatives and power mobile applications.

Conversion Optimization. We combine industry expertise with best-in-breed technology to increase conversion and increase customers’ average order size. Our team of experts offers services in on-site merchandising, recommendations, personalization, on-site search, and promotion management and support.

Digital Analytics. Through powerful reporting techniques and expert analysis, we provide the key insights and actionable recommendations needed to aid in the growth of our clients’ brands online.

Email Marketing. Our data focused approach to email marketing seeks to increase our clients’ ROI. We test and design emails for custom segments to get the right message to our clients’ customers.

Social Engagement. Our social tactics help facilitate discussions and pull key learnings from social chatter to support and evaluate brand initiatives.

Learning Lab. Our methodology is to plan, execute, and learn while capturing valuable insights. Using our unique learning lab experience, brands can understand meaningful consumer interactions that drive revenue growth. By building a personalized and optimized experience through all customer touch points, brands can improve customer loyalty and brand engagement.

Technology Services

PFSweb's Technology Services build world-class eCommerce websites that are designed to maximize revenue opportunities. Built by a seasoned group of professionals, we combine strategy and technology to create innovative user experiences. From high-fashion apparel to consumer packaged goods, our portfolio consists of brands that accept only the highest quality shopping websites.

We use a proven methodology to deliver quality implementations to meet some of the strictest brand requirements in the industry. Our project teams are comprised of industry-leading professionals that bring eCommerce and web development best practices to our clients’ custom solutions. Once live, our team applies the same level of excellence to ongoing development, site maintenance, and solutions support.

Direct-to-Consumer eCommerce (“DTC”). PFSweb’s End2End eCommerce® solution for the DTC online channel features Demandware eCommerce, a leading third party Software-as-a-Service (“SaaS”) eCommerce platform. As a Demandware Strategic Solution and End-to-End Partner, we are one of the premier Demandware development organizations. Following the establishment of our Demandware partnership in 2008, we have become one of the largest international Demandware development teams in the world and maintain a talented team of Demandware certified developers who create world-class user experiences for some of the world's leading brands. We have fully integrated Demandware with the rest of our world-class technology platform, including other best-of-breed technology partners to create a PFSweb reference application that provides our clients with a very high-function DTC online store out-of-the-box. We are able to use the PFSweb reference application as a starting point to quickly create a completely customized online store for our DTC clients. Designed specifically for DTC brands, our comprehensive offering redefines end-to-end eCommerce by enabling retailers and branded consumer goods manufacturers with the ability to employ a total outsourcing solution customized to their particular eCommerce strategy, without the loss of site or brand control associated with earlier end-to-end outsourcing solutions.

Through the 2014 acquisition of REV Solutions, Inc., an eCommerce systems integrator, we enhanced our Demandware practice and broadened the portfolio of technology services with the addition of Oracle ATG. As an Oracle Gold Partner, we launch commerce initiatives for major brands. Oracle Commerce (which now includes ATG Commerce) is a leading platform consisting of commerce applications to provide seamless customer experiences across multiple touch points. We continue to innovate with Oracle Commerce to drive sales, reduce cycle times, decrease costs, and improve service levels for our clients.

eCommerce Development. With one of the most experienced teams of Demandware and Oracle developers, our staff is ready to build custom eCommerce solutions for our clients. We employ a proven development methodology, led by a highly-qualified team of solutions architects, web developers, project managers, and Quality Assurance (“QA”) testers. When paired with our Agency Services, we can provide an entire suite of services that spans strategy, creative, project management, web development, and quality assurance.

Platform Support. Our work doesn't stop when we launch an eCommerce site. Our Platform Support team provides real-time management and monitoring to ensure our clients’ sites are always operating at peak performance. We provide Level 1/2/3 technical, business, and solutions support for optimal issue management.

4

Quality Assurance. Whether it's a new site build or ongoing development, our team of QA experts employ a full-service test suite that includes quality assurance scripting and testing, regression, load testing, and automation.

Training. We provide on-site, personalized platform training from experienced subject-matter experts. Our training team empowers our clients’ business and merchandising staff with the knowledge they need to operate and optimize their eCommerce sites. Core training includes platform essentials, advanced merchandising, front-end design, and developer training.

Business-to-Business eCommerce (“B2B”). PFSweb’s End2End eCommerce® solution for the B2B online channel features our GlobalMerchant Commerceware service that provides a complete eCommerce website solution for our B2B clients. We engage collaboratively with our clients to design, build, host, and manage fully branded, fully customized and fully integrated eCommerce web applications for B2B channels. We offer a broad range of hosting and support plans that can be tailored to fit the needs of each client. Utilizing Microsoft’s .NET Technologies and our proprietary GlobalMerchant Commerceware platform, we maintain a robust hosting environment for our hosted client B2B web sites.

Omni-Channel Order Management

Order Management Interfaces. Our order management system (OMS), based on the Oracle JD Edwards ERP suite, is a scalable solution built for DTC and B2B order processing. We also offer a distributed order management solution utilizing the Shopatron Retailer software that is tightly integrated with our internal OMS. This solution provides retailers with a complete technology solution for integrating both online and offline channels. Our order management technology solutions provide interfaces that allow for real-time information retrieval, including information on inventory, sales orders, shipments, delivery, purchase orders, warehouse receipts, customer history, accounts receivable and credit lines. These solutions are seamlessly integrated with our web-enabled customer contact centers, allowing for the processing of orders through shopping cart, phone, fax, mail, email, web chat, and other order receipt methods. As the information backbone for our total supply chain solution, order management services can be used on a stand-alone basis or in conjunction with our other business infrastructure offerings, including customer contact, financial or distribution services. In addition, for the B2B market, our technology platform provides a variety of order receipt methods that facilitate commerce within various stages of the supply chain. Our systems provide the ability for both our clients and their customers to track the status of orders at any time. Our services are transparent to our clients’ customers and are seamlessly integrated with our clients’ internal system platforms and web sites. By synchronizing these activities, we can capture and provide critical customer information, including:

|

● |

Statistical measurements critical to creating a quality customer experience, containing real-time order status, order exceptions, back order tracking, allocation of product based on timing of online purchase and business rules, the ratio of customer inquiries to purchases, average order sizes and order response time; |

|

● |

B2B supply chain management information critical to evaluating inventory positioning, for the purpose of improving inventory turns, and assessing product flow-through and end-user demand; |

|

● |

Reverse logistics information, including customer response and reason for the return or rotation of product and desired customer action; |

|

● |

Detailed marketing information about what was sold and to whom it was sold, by location and preference; and |

|

● |

Web traffic reporting showing the number of visits (“hits”) received, areas visited, and products and information requested. |

Product Content Management. PFSweb's iCommerce PCM solution provides a comprehensive set of tools for creating, integrating, mastering, and syndicating product content efficiently across an entire organization. Leveraging enterprise-class product information management (PIM) software powered by Riversand Technologies, we provide a SaaS-based solution that enables brands to maximize the selling value of their product content across all commerce channels.

Technology Collaboration. We have created a suite of technology services that enable buyers and suppliers to fully automate their business transactions within their supply chain using the order management interfaces. Our collaboration technologies operate in an open systems environment and feature the use of industry-standard XML and SOA web services, enabling customized eCommerce solutions with minimal changes to a client’s systems or our Enterprise Resource Planning (“ERP”) systems. The result is a faster implementation process. We also support information exchange methods such as AS2, FTP, SFTP, EDI, MQ Series, ALE, HTTP, and HTTPS.

5

Information Management. We have the ability to communicate with and transfer information to and from our clients through a wide variety of technology services, including real-time web service enabled data interfaces, file transfer methods and electronic data interchange. Our systems are designed to capture, store and electronically forward to our clients critical information regarding customer inquiries and orders, product shipments, inventory status (for example, levels of inventory on hand, on backorder, on purchase order and inventory due dates to our warehouse), product returns and other information. Our systems are capable of providing our clients with customer inventory and order information for use in analyzing sales and marketing trends and introducing new products. We also offer customized reports and data analyses based upon specific client needs to assist them in their budgeting and business decision process. We are managing this information while securing data and complying with various privacy regulations.

Infrastructure Services

Our infrastructure services provide the operational activities required and expected of the world's leading brands. We have DTC and B2B experience in customizing solutions to meet the unique nuances of our clients’ internal finance, customer care, and supply chain operations. With more than 1.6 million square feet of leased or managed distribution space and approximately 1,000 call center seats across two continents, we have the global infrastructure to meet the operational needs of our eCommerce and traditional B2B clients.

As the operational backbone of the online and B2B shopping experience, we focus on three core actions: to deliver, to communicate, and to fulfill the promise behind each brand we support.

Order Fulfillment

We design advanced pick-pack-ship operations that streamline our clients’ supply chain process and offer a flexible fulfillment distribution model. Our fulfillment team understands the value of the delivery experience by specializing in creating branded solutions with gift wrap and other branded services. Our distribution centers are located in the Memphis area, Toronto, and Belgium to provide centrally located fulfillment throughout North America and Europe.

Advanced Distribution Facilities and Infrastructure. An integral part of our solution is the warehousing and distribution of our clients’ inventory. We currently have more than 1.6 million square feet of leased or managed warehouse distribution space domestically and internationally to store and process our own and our clients’ inventory. We receive inventory in our distribution centers, verify shipment accuracy, unpack and audit packages (a process that includes spot-checking a percentage of the inventory to validate piece counts and check for damages that may have occurred during shipping, loading and unloading). Upon request, we inspect for other damages or defects, which may include checking fabric, stitching and zippers for soft goods, or ‘testing’ power-up capabilities for electronic items as well as product specifications. We generally stock for sale within one business day of unloading. We pick, pack and ship customer orders and can provide customized packaging, customized monogramming, personalized laser engraving, capabilities of high volume shrink packaging, inserts and promotional literature for distribution with customer orders. For many clients, we provide gift-wrapping services including line level gifting, customized gift-wrapping paper, ribbon, gift-box and gift-messaging.

Our distribution facilities contain computerized sortation equipment, flexible mobile pick-to-light carts, powered material handling equipment, scanning and bar-coding systems and automated conveyors and in-line scales. Our distribution facilities include several advanced technology enhancements, such as radio frequency technology in product receiving processing to ensure accuracy, as well as an automated package routing and a pick-to-light paperless order fulfillment system. Our advanced distribution systems provide us with the capability to warehouse an extensive number of stock keeping units (SKUs), ranging from large high-end electronics to small cosmetic compacts. Our facilities are flexibly configured to process B2B and DTC orders from the same central location.

In addition to our advanced distribution systems, our pick-to-light carts, stationary pick-to-light areas and conveyor system controls provide real time productivity reporting, thereby providing our management team with the tools to implement productivity standards. This combination of computer-controlled equipment provides the seamless integration of our pick-to-light systems and mass sortation capabilities. This unique combination of technologies ensures high order accuracy for each and every customer order.

We are able to take advantage of a variety of shipping and delivery options, which range from next day service to zone skipping, to optimize transportation costs. Our facilities and systems are equipped with multi-carrier functionality, allowing us to integrate with all leading package carriers and provide a comprehensive freight and transportation management offering.

We offer reverse logistics management services, including issuing return authorizations, return carrier shipping labels, receipt of product, crediting customer accounts and disposition of returned product. We also leverage strategic partnerships to provide our

6

clients with access to distributed returns centers that collect, consolidate, report on and forward to our central facilities returned product allowing us to accelerate credits to our clients’ customers, reduce freight costs for our client, improve customer service and reduce complexity and cost in our facilities from handling inbound returns.

Our domestic facilities provide trained security professionals from our security headquarters in Memphis, Tennessee and Southaven, Mississippi. Continual validation and the use of current and retired law enforcement professionals ensures that we employ the latest in security processes and procedures to further enhance our surveillance and detection capabilities.

Facility Operations and Management. Our facilities management service offering includes distribution facility design and optimization, business process reengineering and ongoing staffing and management. Along with our multi-brand operations in Mississippi and Tennessee, we also manage dedicated client-owned/leased facilities on behalf of two of our clients: an aircraft parts distribution center in Grapevine, Texas and a DTC facility in Memphis, Tennessee for a major retailer. Our expertise in supply chain management, logistics and customer-centric fulfillment operations extends through our management of client-owned/leased facilities, resulting in cost reductions, process improvements and technology-driven efficiencies.

Kitting and Assembly Services. Our expanded kitting and assembly services enable our clients to reduce the time and costs associated with managing multiple suppliers, warehousing hubs, and light manufacturing partners. As a single source provider, we provide the advantage of convenience, accountability and speed. Our kitting and assembly services include light assembly, specialized kitting and supplier-consigned inventory hub either in our distribution facilities or co-located elsewhere. We also offer customized light manufacturing and supplier relationship management (“SRM”).

We work with clients to re-sequence certain supply chain activities to aid in an inventory postponement strategy. We can provide kitting and assembly services and build-to-stock thousands of units daily to stock in a Just-in-Time (“JIT”) environment. This service, for example, can entail the procurement of packaging materials including retail boxes, foam inserts and anti-static bags. These raw material components may be shipped to us from domestic or overseas manufacturers, and we will build the finished SKUs to stock for the client. Also included is the custom configuration of high-end printers and servers. This strategy allows manufacturers to make a smaller investment in base unit inventory while meeting changing customer demand for highly customizable products.

Our standard capabilities include: build-to-order, build-to-stock, expedited orders, passive and active electrostatic discharge (“ESD”) controls, product labeling, serial number generation, marking and/or capture, lot number generation, asset tagging, bill of materials (“BOM”) or computer automated design (“CAD”) engineering change processing, SKU-level pricing and billing, manufacturing and metrics reporting, first article approval processes, and comprehensive quality controls.

Kitting and inventory hub services enable clients to collapse supply chains into the minimal steps necessary to prepare product for distribution to any channel, including wholesale, mass merchant retail, or direct to consumer. Clients no longer have to employ multiple providers or require suppliers to consign multiple inventory caches for each channel. We offer our clients the opportunity to consolidate operations from a channel standpoint, as well as from a geographic perspective. Our integrated, global information systems and international locations support business needs worldwide.

Product Management and Inspection Services. We also operate a coupon management system and product management program. Coupons are managed and activated by a unique serial number, thus significantly reducing fraudulent activity. Our capabilities also extend into salvage operations, allowing our clients to reclaim valuable raw materials and components from discontinued or obsolete inventory.

We operate a test and repair center where we visually inspect items for cosmetic defects. These items are put through rigorous testing that includes: functionality, durability, accessory inspection and packaging. Items that pass the testing are repackaged and resold with a noted exception of “open-box” merchandise. Items that fail the inspection are disassembled and working spare parts are saved for future use in repairs.

7

High Compliance Distribution Related to Food and Cosmetic Products. We also operate a Food and Drug Administration (“FDA”) compliant facility, which meets the Consolidated Standards for Inspection along with regulatory developments required by the FDA under the Food Safety Modernization Act and other industry best practices.

Customer Care

Our internal call center operations are focused on providing essential services such as order entry, returns authorization, and order tracking. These operations also include our iCommerce Agent (“iCA”), a customizable web-based application featuring powerful customer service tools for accessing all required customer information. Our unique multi-lingual capabilities are possible through our strategically placed locations in Dallas, Belgium, Toronto, and our partner location in Hungary.

Customer Relationship Management. Through our web enabled CRM platform, iCA, our unique technology leverages the client’s website investment by wrapping CRM capabilities around the existing website. Through iCA, agents provide customer service functions, such as placing orders, checking order status, facilitating returns, gathering “voice of the customer” information, initiating upsell and cross sell, and managing escalations. iCA is fully integrated into the client’s website front end and our data analytics platform and order processing system, allowing full visibility into customer history and customer trends. Through each of our customer touch-points, information can be analyzed and processed for current or future use in business evaluation, product effectiveness and positioning, and supply chain planning. Through this fully integrated system, we are able to provide a complete customer care solution in a PFSweb customer care center or on a license basis to our clients’ owned or outsourced customer care centers.

Customer Assistance. An important feature of evolving commerce is the ability for the customer to speak with a live customer service representative. Our experience has been that many consumers tell us they visited the web location for information, but not all of those consumers chose to place their order online. Our customer care services utilize features that integrate voice, e-mail, standard mail, fax, data and Internet chat communications to respond to and handle customer inquiries. Our customer care representatives answer various questions, acting as virtual representatives of our clients’ organization, regarding order status, shipping, billing, returns and product information and availability as well as a variety of other questions. Our web-enabled customer care technology identifies each customer contact automatically and routes it to the appropriate customer care representative who is individually trained in the clients’ business and products.

Our web-enabled customer care centers are flexibly designed so that our customer care representatives can handle either several different clients and products in a shared agent environment, thereby creating economy of scale benefits for our clients, or through a highly customized dedicated agent support model that provides the ultimate customer experience and brand reinforcement.

Quality Monitoring. Quality is essential in our client solutions. As representatives of our clients, our customer care representatives must adhere to the unique quality standards of each client. We continually monitor the quality of our customer care representatives against each client quality standard and use the results to provide agent-level feedback to continually improve the customer care experience. Clients may participate in the quality process by remotely listening to calls, assisting in the grading of recorded calls, and providing ongoing direction to improve quality standards.

Customer Self-Help. With the need for efficiency and cost optimization for many of our clients, we have integrated interactive voice response (“IVR”) as another option for customer contacts. IVR creates an “electronic workforce” with virtual agents that can assist customers with vital information at any time of the day or night. IVR allows for our clients’ customers to deal interactively with our system to handle basic customer inquiries, such as account balance, order status, shipment status, catalog requests, product and price inquiries, and routine order entry for established customers. The inclusion of IVR in our service offering allows us to offer a cost effective way to handle high volume, low complexity calls.

Financial Services

Protecting our clients’ brand with secure payment processing and fraud management services is critical to a successful operation. We also provide flexible global payment options as well as gift cards, B2B invoicing, and VAT services.

Our financial services are divided into two major areas: 1) billing, credit, collection and cash application services for B2B clients and 2) fraud review, chargeback management and processing and settlement of credit card services for DTC clients.

Business-to-Business Financial Management. For B2B clients, we offer full-service accounts receivable management and collection capabilities, including the ability to generate customized computer-generated invoices in our clients’ names. We assist clients in reducing accounts receivable and days sales outstanding, while minimizing costs associated with maintaining an in-house

8

collections staff. We offer electronic credit services in the format of EDI and XML communications direct from our clients to their vendors, suppliers and retailers.

Direct-to-Consumer Financial Management. For DTC clients, we offer secure credit card processing related services for orders made via a client web site or through our customer contact center. We offer manual credit card order review as an additional level of fraud protection. We also calculate sales taxes, goods and services taxes or value added taxes, if applicable, for numerous taxing authorities and on a variety of products. Using third-party leading-edge fraud protection services and risk management systems, we can offer high levels of security and reduce the level of risk for client transactions.

Professional Consulting Services

As part of the tailored solution for our clients, we offer a full team of experts specifically designated to focus on our clients’ businesses. Team members play a consultative role, providing constructive evaluation, analysis and recommendations for the client’s business. This team creates customized solutions and devises plans that will increase efficiencies and produce benefits for the client when implemented.

Comprised of industry experts from top-tier consulting firms and industry market leaders, our team of professional consultants provides client service focus and eCommerce, customer care, logistics and distribution expertise. They have built solutions for Fortune 1000 and Global 2000 market leaders in a wide range of industries, including multi-channel retailers, apparel, technology, telecommunications, cosmetics, aviation, housewares, high-value collectibles, sporting goods, pharmaceuticals and several more. Focusing on the evolving infrastructure needs of major corporations and their business initiatives, our team has a solid track record providing consulting services in the areas of interactive marketing eCommerce, supply chain management, distribution and fulfillment, technology interfacing, logistics and customer support.

SELLER SERVICES FINANCIAL MODELS

Service Fee Model

We refer to the standard PFS seller services financial model as the “Service Fee” model. In this model, our clients own the inventory and are the merchants of record and engage us to provide various business outsourcing services in support of their business operations. We provide ecommerce website services, inventory and order management, customer service, payment processing, and operations reports such as product sales, sales tax, and inventory management reports. In this model, we provide infrastructure and services and the clients are responsible for all financial operations and reporting related to the sales transactions.

The Service Fee model is designed to generate margins for our clients consistent with other retailers in our clients’ product category and provide bottom line financial results for our clients similar to other retailers in their space. We report service fee revenues from clients in this model in our traditional PFSweb service fee segment.

Agent (Flash) Financial Model

As an additional service, we offer an “Agent”, or “Flash” model, in which our clients maintain ownership of the product inventory stored at our locations. When a customer orders the product from our clients, a “flash” sale transaction passes product ownership to us for each order and we in turn immediately re-sell the product to the customer. The “flash” ownership exchange establishes us as the merchant of record, which enables us to use our existing merchant infrastructure to process sales to end customers, removing the need for clients to establish these business processes internally, but permitting them to control the sales process to end customers. In this model, based on the terms of our current client arrangements, we record product revenue net of cost of product revenue as a component of service fee revenue in our consolidated statement of operations.

Retail Financial Model

In addition to the Service Fee and the Agent models, we also offer a “Retail” model. Under the Retail model, a PFSweb subsidiary purchases inventory from the client. In the Retail model, we place the initial and replenishment purchase orders with the client and take ownership of the product upon delivery to our facility.

Because we are the product owner as well as the merchant of record, we work closely with the client to plan sales and promotional activities. Under the Retail model, depending upon the product category and sales characteristics, we may require the client to provide product price protection as well as product purchase payment terms, right of return, and obsolescence protection appropriate to the product sales profile as well as potential reimbursement for uncollectible customer accounts receivable balances. Since we purchase and own the inventory and accounts receivable, this business model may require significant working capital requirements for which we have credit available either through credit terms provided by our clients or under senior credit facilities.

9

Depending on the terms of our client arrangements in the Retail model, we record either: 1) gross revenue - product revenue or 2) net revenue - product revenue net of cost of product revenue as a component of service fee revenue in our consolidated statement of operations.

The costs of all standard PFSweb services normally billed on a transaction basis under the Service Fee model, as well as certain credit risks, may be covered by the selling margin under the Retail model arrangement. The bottom line financial results for our client should be similar to the financial benefits from the retail channel, although unlike the traditional retail channel, our clients generally control the presentation and branding of the web site and own all the customer data from the eCommerce activities.

In general, we seek to structure client relationships in our Retail model under the net revenue approach, although we have one client still utilizing the gross revenue approach. We use our Retail model to enable our Supplies Distributors subsidiary to serve as a global distributor of printer supplies for Ricoh Infoprint Solutions Company (“IPS”), a wholly-owned subsidiary of Ricoh Company Ltd. (“Ricoh”). In this model, the product revenues are reported in our Business and Retail Connect segment.

INDUSTRY INFORMATION AND COMPETITIVE LANDSCAPE

Industry Overview

Business activities in the public and private sectors continue to operate in an environment of rapid technological advancement, increasing competition and continuous pressure to improve operating and supply chain efficiency while decreasing costs. We currently see the following trends within the industry:

|

● |

Manufacturers strive to restructure their supply chains to maximize efficiency and reduce costs in both B2B and DTC markets, and to create a variable-cost supply chain able to support the multiple, unique needs of each of their initiatives, including traditional and electronic commerce. |

|

● |

Companies in a variety of industries seek outsourcing as a method to address one or more business functions that are not within their core business competencies, to reduce operating costs or to improve the speed or cost of implementation. |

|

● |

Retailers, both traditional and e-commerce only, partner with end to end providers to provide a turnkey solution to support their e-commerce channels. Providers with a global presence provide additional value to companies pursuing an international expansion strategy. |

Supply Chain Management Trend

As companies maintain focus on improving their businesses and balance sheet financial ratios, significant efforts and investments continue to be made identifying ways to maximize supply chain efficiency and extend supply chain processes. Working capital financing, vendor managed inventory, supply chain visibility software solutions, distribution channel skipping, direct to consumer eCommerce sales initiatives, and complex upstream supply chain collaborative technology are products that manufacturers seek to help them achieve greater supply chain efficiency.

A key business challenge facing many manufacturers and retailers as they evaluate their supply chain efficiency is in determining how the trend toward increased DTC business activity will impact their traditional B2B and DTC commerce business models. Order management and small package fulfillment and distribution capabilities are becoming increasingly important processes as this trend evolves. We believe manufacturers will look to outsource their non-core competency functions to support this modified business model. We believe companies will continue to strategically plan for the impact that eCommerce and other new technology advancements will have on their traditional commerce business models and their existing technology and infrastructure capabilities.

Manufacturers, as buyers of materials, are also imposing new business practices and policies on their supplier partners to shift the normal supply chain costs and risks associated with inventory ownership away from their own balance sheets. Through techniques like Vendor Managed Inventory or Consigned Inventory Programs (“CIP”), manufacturers are asking their suppliers, as a part of the supplier selection process, to provide capabilities where the manufacturer need not own, or even possess, inventory prior to the exact moment that unit of inventory is required as a raw material component or for shipping to a customer. To be successful for all parties, business models such as these often require a sophisticated collection of technological capabilities that allow for complete integration and collaboration of the information technology environments of both the buyer and supplier. For example, for an inventory unit to arrive at the precise required moment in the manufacturing facility, it is necessary for the Manufacturing Resource Planning systems of the manufacturer to integrate with the CRM systems of the supplier. When hundreds of supplier partners are involved, this process can become quite complex and technologically challenging. Buyers and suppliers are seeking solutions that utilize XML based protocols and traditional EDI standards to ensure an open systems platform that promote easier technology integration in these collaborative solutions.

10

Outsourcing Trend

In response to growing competitive pressures and technological innovations, we believe many companies, both large and small, are focusing their critical resources on the core competencies of their business and utilizing eCommerce and infrastructure services to accelerate their business plans in a cost-effective manner and perform non-core business functions. Outsourcing can provide many key benefits, including the ability to:

|

● |

Enter new business markets or geographic areas rapidly; |

|

● |

Increase flexibility to meet changing business conditions and demand for products and services; |

|

● |

Enhance customer satisfaction and gain competitive advantage; |

|

● |

Reduce capital and personnel investments and convert fixed investments to variable costs; |

|

● |

Improve operating performance and efficiency; and |

|

● |

Capitalize on skills, expertise and technology infrastructure that would otherwise be unavailable or expensive given the scale of the business. |

Typically, many outsourcing service providers are focused on a single function, such as information technology, call center management, credit card processing, warehousing or package delivery. This focus creates several challenges for companies looking to outsource more than one of these functions, including the need to manage multiple outsourcing service providers, to share information with service providers and to integrate that information into their internal systems. Additionally, the delivery of these multiple services must be transparent to the customer and enable the client to maintain brand recognition and customer loyalty. Furthermore, traditional commerce outsourcers are frequently providers of domestic-only services versus international solutions. As a result, companies requiring global solutions must establish additional relationships with other outsourcing parties.

Another vital point for major brand name companies seeking to outsource is the protection of their brand. When looking for an outsourcing partner to provide infrastructure solutions, brand name companies must find a company that can provide the same quality performance and superior experience their customers expect from their brands. Working with an outsourcing partner requires finding a partner that can maintain the consistency of their brand image, which is one of the most valuable intangible assets that recognized brand name companies possess.

Competition

We face competition from many different sources depending upon the type and range of services requested by a potential client. Many other companies offer one or more of the same services we provide on an individual basis. Our competitors include vertical outsourcers, which are companies that offer a single function solution. We compete with transportation logistics providers, known in the industry as 3PL’s and 4PL’s (third or fourth party logistics providers), who offer product management functions as an ancillary service to their primary transportation services. We also compete against other eCommerce and infrastructure service providers, who perform various services similar to our solution offerings. Additionally, we see competition from agencies providing creative, commerce strategy and system integration services.

In many instances, we compete with the in-house operations of our potential clients themselves. Occasionally, the operations departments of potential clients believe they can perform the same services we do, at similar quality levels and costs, while others are reluctant to outsource business functions that involve direct customer contact. We cannot be certain we will be able to compete successfully against these or other competitors in the future.

Although many of our competitors offer one or more of our services, we believe our primary competitive advantage is our ability to offer a full array of customized services marketed as PFSweb’s End2End eCommerce® solutions, thereby eliminating any need for our clients to coordinate these services from many different providers. We believe we can differentiate ourselves by offering our clients a very broad range of eCommerce and business process services that address, in many cases, the entire value chain, from demand to delivery.

11

We also compete on the basis of many other important additional factors, including:

|

● |

experience supporting a specific product vertically; |

|

● |

operating performance and reliability; |

|

● |

ease of implementation and integration; |

|

● |

experience of the people required to successfully and efficiently design and implement solutions; |

|

● |

experience operating similar solutions dynamically; |

|

● |

leading edge technology capabilities; |

|

● |

global reach; and |

|

● |

price. |

We believe we can compete favorably with respect to many of these factors. However, the market for our services is competitive and continually evolving, and we may not be able to compete successfully against current and future competitors.

Competitive Landscape

End-to-end Commerce. In North America, we compete with full service commerce providers such as eBay Enterprise, Trade Global and OneStop, as well as other providers such as Speed Commerce and Newgistics. In the European market, we compete with companies such as Yoox and other geographically focused providers in Western Europe.

Agency Services and Technology Services. We compete with a wide range of digital agency and system integration firms, each with varying degrees of experience with Demandware or Oracle ATG, including SapientNitro, OSF, Accenture (Acquity), and Lyons Consulting Group.

Infrastructure Services. Our infrastructure business competes with eCommerce focused order fulfillment providers such as Innotrac and OHL, as well as, depending on the client’s retail and/or supply chain strategy, Excel Logistics, UPS Logistics, and other “pure-play” fulfillment or call center providers.

COMPANY INFORMATION

Clients and Marketing

Our target clients include traditional retailers, online retailers and leading technology and consumer goods brands looking to quickly and efficiently implement or enhance business initiatives, adapt their go-to-market strategies, or introduce new products, programs or geographies, without the burden of modifying or expanding their technology, customer care, supply chain and logistics infrastructure. Our solutions are applicable to a multitude of industries and company types and we have provided solutions for such companies as:

Procter & Gamble (consumer packaged goods), L’Oréal (health & beauty), LEGO Brand Retail (toys), T.J. Maxx (apparel and home fashion), Columbia Sportswear (active outdoor apparel), Diageo (premium beverages), Roots Canada Ltd. (apparel), BCBGMAXAZRIA (high fashion), Ricoh (printer supplies), Xerox (printers and printer supplies) and Hawker Beechcraft Corp. (facilities management and time-definite logistics supporting parts distribution) among many others.

We target potential clients through an extensive integrated marketing program comprised of a variety of direct marketing techniques, email marketing initiatives, trade event participation, search engine marketing, public relations, social media and a sophisticated outbound tele-sales lead generation model. We have also developed global business development methodology which allows us to effectively showcase our various eCommerce and infrastructure service solutions and products. We also pursue strategic marketing alliances with consulting firms, software manufacturers and other logistics providers to increase market awareness and generate referrals and customer leads.

Because of the highly complex nature of the solutions we provide, our clients demand significant competence and experience from a variety of different business disciplines during the sales cycle. As such, we often utilize a member of our executive team to lead the design and proposal development of each potential new client we choose to pursue. The executive is supported by a select group of highly experienced individuals from our professional services group with specific industry knowledge of, or experience with, the solutions development process. We employ a team of highly trained implementation managers whose responsibilities include the oversight and supervision of client projects and maintaining high levels of client satisfaction during the transition process between the various stages of the sales cycle and steady state operations.

12

Technology

We maintain advanced management information systems and have automated key business functions using online, real-time or batch systems. These systems enable us to provide information concerning sales, inventory status, customer payments and other operations essential for us and our clients to efficiently manage electronic commerce and supply chain business programs. Our systems are designed to scale rapidly to handle the transaction processing demands of our clients and our growth.

Many internal infrastructures are not sufficient to support the explosive growth in e-business, e-marketplaces, supply chain compression, distribution channel realignment and the corresponding demand for real-time information necessary for strategic decision-making and product fulfillment. To address this need, we have created PFSweb’s End2End eCommerce® platform to enable companies with little or no eCommerce infrastructure to speed their time to market and minimize resource investment and risk, and to allow all companies involved to improve the efficiency of their supply chain.

Using the various components of our collaboration technology suite, we can assist our clients in easily integrating their web sites or ERP systems to our systems for real-time web service enabled transaction processing without regard for their hardware platform or operating system. This high-level of systems integration allows our clients to automatically process orders, customer data and other eCommerce information. We also can track information sent to us by the client as it moves through our systems in the same manner a carrier would track a package throughout the delivery process. Our systems enable us to track, at a detailed level, information received, transmission timing, any errors or special processing required and information sent back to the client.

We have invested in advanced telecommunications, computer telephony, electronic mail and messaging, automated fax technology, IVR technology, barcode scanning, wireless technology, fiber optic network communications and automated inventory management systems. We have also developed and utilize telecommunications technology that provides for automatic customer call recognition and customer profile recall for inbound customer service representatives.

The primary responsibility of our systems development team of IT professionals is directed at implementing custom solutions for new clients and maintaining existing client relationships. Our development team can also produce proprietary systems infrastructure to expand our capabilities in circumstances where we cannot purchase standard solutions from commercial providers. We also utilize temporary and/or contract resources when needed for additional capacity.

Our information technology operations and infrastructure are built on the premise of reliability and scalability. We maintain diesel generators and un-interruptible power supply equipment to provide constant availability to computer rooms, call centers and warehouses. Multiple internet service providers and redundant web servers provide for a high degree of availability to web sites that interface with our systems. Capacity planning and upgrading is performed regularly to allow for quick implementation of new clients and avoid time-consuming infrastructure upgrades that could slow growth rates. In the event of a disastrous situation, we also have a disaster recovery plan that provides geographically separated and comparably equipped data centers that are able to recover stored data in a reasonable and effective manner.

Employees

As of December 31, 2014, we had approximately 1,700 employees, of which approximately 1,100 were located in the United States. We have never suffered an interruption of business as a result of a labor dispute. We consider our relationship with our employees to be good. In the U.S., Canada and India, we are not a party to any collective bargaining agreements and while our European subsidiaries are not a party to a collective-bargaining agreement, they are required to comply with certain rules agreed upon by their employee Works Councils.

Our success in recruiting, hiring and training large numbers of skilled employees and obtaining large numbers of hourly employees and temporary staff during peak periods for distribution and call center operations is critical to our ability to provide high quality distribution and support services. Call center representatives and distribution personnel receive feedback on their performance on a regular basis and, as appropriate, are recognized for superior performance or given additional training. Generally, our clients provide specific product training for our customer service representatives and, in certain instances, on-site client personnel to provide specific technical support. To maintain good employee relations and to minimize employee turnover, we strive to offer competitive pay, hire primarily full-time employees who are eligible to receive a full range of employee benefits, and provide employees with clear, visible career paths.

13

Internet Access to Reports

We maintain an Internet website, www.pfsweb.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K (and amendments, if any, to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934) are made available, free of charge, through the investor relations section of this website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. The information on this website is not incorporated in this report.

Government Regulation

We are subject to federal, state, local and foreign consumer protection laws, including laws protecting the privacy of our customers’ personally identifiable information and other non-public information and regulations prohibiting unfair and deceptive trade practices. Furthermore, the growth and demand for online commerce has and may continue to result in more stringent consumer protection laws that impose additional compliance burdens and greater penalties on online companies. Moreover, there is a trend toward regulations requiring companies to provide consumers with greater information regarding, and greater control over, how their personal data is used, and requiring notification when unauthorized access to such data occurs. For example, many states currently require us to notify each of our customers who are affected by any data security breach in which an unauthorized person, such as a computer hacker, obtains such customer’s name and one or more of the customer’s social security number, driver’s license number, credit or debit card number or other similar personal information. In addition, several jurisdictions, including foreign countries, have adopted privacy-related laws that restrict or prohibit unsolicited email promotions, commonly known as “spam,” and that impose significant monetary and other penalties for violations. One such law, the CAN-SPAM Act of 2003 and the recent anti-spam legislation passed in Canada impose complex, burdensome and often ambiguous requirements in connection with our sending commercial email to our customers and potential customers. Moreover, in an effort to comply with these laws, Internet service providers may increasingly block legitimate marketing emails. These consumer protection laws may become more stringent in the future and could result in substantial compliance costs and could interfere with the conduct of our business.

Our business, financial condition and operating results could be adversely affected by any or all of the following factors, in which event the trading price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business

We operate with significant levels of indebtedness and are required to comply with certain financial and non-financial covenants; we are required to maintain a minimum level of subordinated loans to our subsidiary Supplies Distributors; and we have guaranteed certain indebtedness and obligations of our subsidiaries.

As of December 31, 2014, our total credit facilities outstanding, including debt, capital lease obligations and our vendor accounts payable related to financing of Ricoh product inventory, was approximately $19 million. Certain of the credit facilities have maturity dates in calendar year 2016 or beyond, but are classified as current liabilities in our consolidated financial statements given the underlying nature of the credit facility. We cannot provide assurance that our credit facilities will be renewed by the lending parties. Additionally, these credit facilities include both financial and non-financial covenants, many of which also include cross default provisions applicable to other agreements. These covenants also restrict our ability to transfer funds among our various subsidiaries, which may adversely affect the ability of our subsidiaries to operate their businesses or comply with their respective loan covenants. We cannot provide assurance that we will be able to maintain compliance with these covenants. A non-renewal, default under or acceleration of any of our credit facilities could have a material adverse impact upon our business and financial condition. In addition, we have provided $2.5 million of subordinated indebtedness to Supplies Distributors as of December 31, 2014. The maximum level of this subordinated indebtedness to Supplies Distributors that may be provided without approval from our lenders is $5.0 million. The restrictions on increasing this amount without lender approval may limit our ability to comply with certain loan covenants or further grow and develop Supplies Distributors’ business. We have guaranteed most of the indebtedness of Supplies Distributors. Furthermore, we are obligated to repay any over-advance made to Supplies Distributors by its lenders to the extent Supplies Distributors is unable to do so.

14

Our business and future growth depend on our continued access to bank and commercial financing.

Our business and future growth currently depend on our ability to access bank, vendor and commercial lines of credit. We currently depend on line of credit facilities provided by various banks and commercial lenders that provided for an aggregate of up to approximately $58 million in available financing as of December 31, 2014. These lines of credit currently mature at various dates through April 2016 and are secured by substantially all our assets. Our ability to renew our lines of credit depends upon various factors, including the availability of bank loans and commercial credit in general, as well as our financial condition and prospects. Therefore, we cannot guarantee that these credit facilities will continue to be available beyond their current maturities on reasonable terms or at all. Our inability to renew or replace our credit facilities or find alternative financing would materially adversely affect our business, financial condition, operating results and cash flow.

We are uncertain about the availability of additional capital.

We may require additional capital to take advantage of opportunities, including strategic alliances and acquisitions, and to fund capital expenditures, or to respond to changing business conditions and unanticipated competitive pressures. We may also require additional funds to finance operating losses. Should these circumstances arise, our existing cash balance and credit facilities may be insufficient and we may need to raise additional funds either by borrowing money or issuing additional equity or both. We cannot assure you that such resources will be adequate or available for all of our future financing needs. Our inability to finance our growth, either internally or externally, may limit our growth potential and our ability to execute our business strategy. If we are successful in completing an additional equity financing, this could result in further dilution to our shareholders’ ownership or reduce the market value of our common stock.

We anticipate incurring significant expenses in the foreseeable future, which may reduce our ability to achieve or maintain profitability.

To reach our business growth objectives, we currently expect to increase our operating and marketing expenses, as well as capital expenditures. To offset these expenses, we will need to generate additional profitable business. If our revenue declines or grows slower than either we anticipate or our clients’ projections indicate, or if our operating and marketing expenses exceed our expectations or cannot be reduced to an appropriate level, we may not generate sufficient revenue to be profitable or be able to sustain or increase profitability on a quarterly or annual basis in the future. Additionally, if our revenue grows slower than either we anticipate or our clients’ projections indicate, we may incur unnecessary or redundant costs and our operating results could be adversely affected.

Our service fee revenue and gross margin are dependent upon our clients’ business and transaction volumes and our costs. A reduction in our clients’ ecommerce business or our inability to grow our business or increase service fee revenue from new or existing clients could negatively impact our operating results.