Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED MARCH 23, 2015 - DAKOTA PLAINS HOLDINGS, INC. | dakota151108_8k.htm |

WWW.DAKOTAPLAINS.COM WWW.DAKOTAPLAINS.COM NYSE MKT: DAKP NYSE MKT: DAKP CORPORATE PRESENTATION MARCH 23, 2015 CORPORATE PRESENTATION MARCH 23, 2015

Statements made by representatives of Dakota Plains Holdings, Inc. (“Dakota Plains”or the “Company”) during the course of this presentation that are not historical f acts, are forward-looking statements. These statements are based on certain assumptions and expectatio ns made by the Company which reflect management’s experience, estimates and perception of historical trends, cur rent conditions, anticipated future developments and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, man y of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to global economics or politics, our ability to obtain additional capital needed to implement our business pl an, minimal operating history, loss of key personnel, lack of business diversification, reliance on str ategic, third-party relationships, financial performance and results, prices and demand for oil, our ability to make acquisitions on economically acceptable terms, and other factors described from time to time in the Company’s periodic reports filed with the SEC that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Dakota Plains undertakes no obligation to p ublicly update any forward- looking statements, whether as a result of new information or future events. 2 FORWARD LOOKING

»Corporate Overview: □ Operate the Pioneer Terminal in New Town, ND transloading outbound crude and inbound frac sand »Current Environment □ Evaluating demand for crude-by-rail vs. pipeline in lower commodity price environment »December 2014 Buyout of JV Partner: □ Created value in earnings per share, EBITDA and operating cash flow per share □ Fully financed with low cost debt and cash on hand □ Simplified capital structure and financial reporting □ Expedites further growth □ Effectively mitigated exposure to the Lac Megantic incident »Future Growth: □ Expanding capacity with addition of 3 rd storage tank-fully funded and on schedule for summer 2015 □ Developing phased expansions toward goal of 160k bopd; timing will be dictated by demand »FY 2015 adjusted EBITDA guidance of $23.4M 3 OVERVIEW

Dakota Plains Holdings, Inc. is an integrated midstream energy company operating the Pioneer Terminal with services that include outbound crude oil storage, logistics, and rail transportation and inbound frac sand logistics. The Pioneer Terminal is located in Mountrail County, North Dakota, where it is uniquely positioned to exploit opportunities in the heart of theBakken and Three Forks plays of the Williston Basin. »NYSE-MKT: DAKP; »Recent closing price: $2.02 on March 18, 2015 »Headquarters: Wayzata, MN »FD Shares Outstanding: 57.8mm as of December 31, 2014 »Long Term and Current Debt: $48.5m; $9m of available credit as of December 31, 2014 »Auditor: BDO USA, LLP »Transfer Agent: Interwest Transfer Co, Inc. »Investor Inquiries: Dan Gagnier, Sard Verbinnen & Co, (212) 687-8080 4 INFORMATION

5 Bakken Heat Map – November 14, 2014 publication Crude By Rail Terminals □One of 3 rail terminals not on BNSF □Only non-BNSF terminal that accepts third party volumes □Capacity for 5 inbound pipelines; two connected □Access to only Missouri River bridge crossing for 70 miles Location Highlights: LOCATION

6 BUSINESS Frac Sand Storage & Transloading Crude Oil Storage & Transloading Crude Oil Logistics & Transport Oil Outbound Oil Outbound Sand Inbound Sand Inbound

TRANSFORMATIO N 2 Years Ago 2015 indirect investment in 350/50 JVs 0 operating control 26k b/d average throughput 4ladder tracks 0 crude oil storage $28m in debt at 12% 100%ownership and operating control >50k b/d average throughput 2loop tracks and 8ladder tracks 180k bbls crude oil storage; 270k bbls by summer 97.5k tons per quarter of frac sand $48m debt at ≈5.5% 7

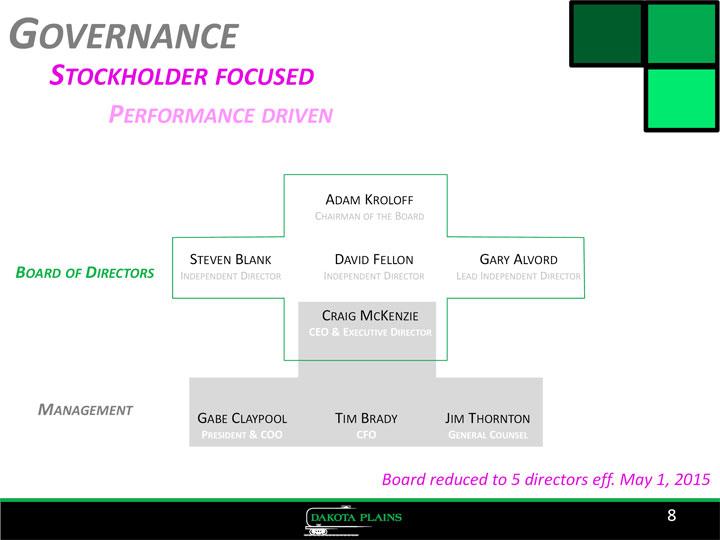

8 GOVERNANCE ADAM KROLOFF CHAIRMAN OF THE BOARD GARY ALVORD LEAD INDEPENDENT DIRECTOR STEVEN BLANK INDEPENDENT DIRECTOR DAVID FELLON INDEPENDENT DIRECTOR CRAIG MCKENZIE CEO & EXECUTIVE DIRECTOR BOARD OF DIRECTORS GABE CLAYPOOL PRESIDENT & COO TIM BRADY CFO JIM THORNTON GENERAL COUNSEL MANAGEMENT Board reduced to 5 directors eff. May 1, 2015 STOCKHOLDER FOCUSED PERFORMANCE DRIVEN

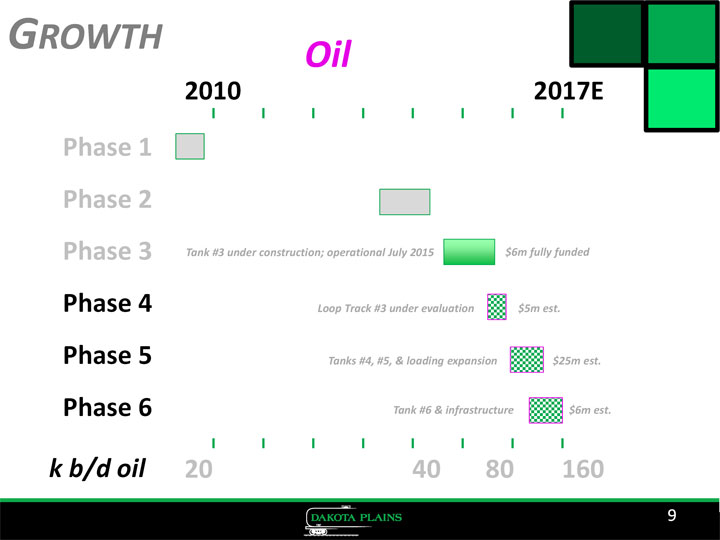

99 GROWTH Phase 4 Phase 5 Phase 6 Phase 1 Phase 2 Phase 3 2010 2017E Tank #3 under construction; operational July 2015 $6m fully funded Loop Track #3 under evaluation $5m est. Tanks #4, #5, & loading expansion $25m est. Tank #6 & infrastructure $6m est. k b/d oil 20 40 80 160 Oil

STRATEGIC ALTERNATIVES Combination Acquisition Recapitalization Sale with other company or MLP of strategic & accretive assets (or company) of debt/equity/structure to buyer pending level of interest Phased expansions based on demand Oil Sand 2015 – 2017 Plan Opportunity Set Destination terminals Origination terminals MLP qualified assets Debt syndication Stock buyback program Strategic merger targets Potential buyers 10

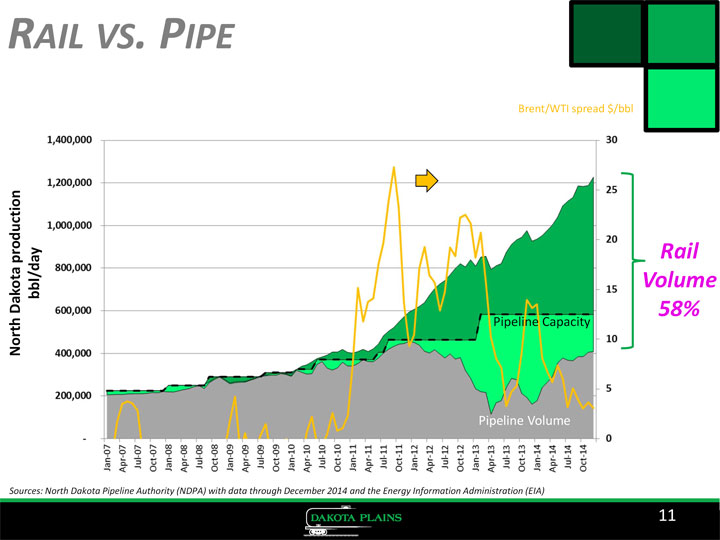

11 RAIL VS. PIPE Sources: North Dakota Pipeline Authority (NDPA) with data through December 2014 and the Energy Information Administration (EIA) Brent/WTI spread $/bbl Brent/WTI spread $/bbl North Dakota production bbl/day Rail Volume 58% Pipeline Volume Pipeline Capacity

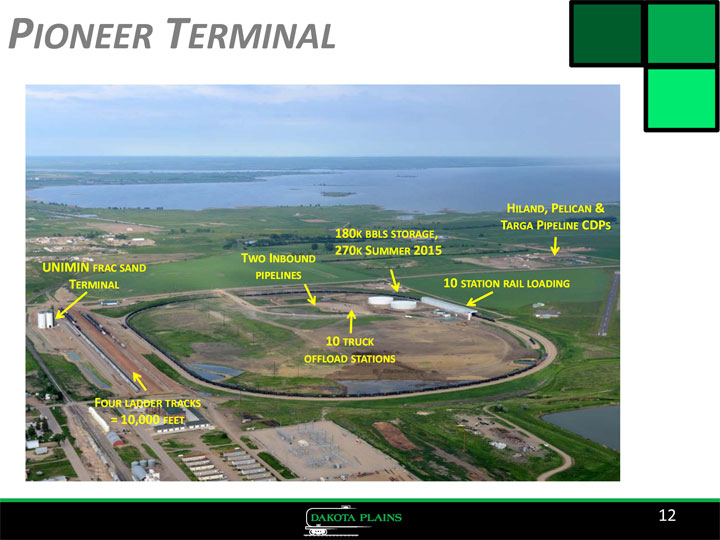

12 FOUR LADDER TRACKS = 10,000 FEET FOUR LADDER FOUR LADDER TRACKS = 10,000 TRACKS = 10,000 FEET FEET UNIMIN FRAC SAND TERMINAL UNIMIN FRAC SAND UNIMIN FRAC SAND TERMINAL TERMINAL 10 STATION RAIL LOADING 10 STATION RAIL LOADING 10 STATION RAIL LOADING 10 TRUCK OFFLOAD STATIONS 10 TRUCK 10 TRUCK OFFLOAD STATIONS OFFLOAD STATIONS 180K BBLS STORAGE, 270K SUMMER 2015 180K BBLS STORAGE, 180K BBLS STORAGE, 270K SUMMER 2015 270K SUMMER 2015 TWO INBOUND PIPELINES TWO INBOUND TWO INBOUND PIPELINES PIPELINES HILAND, PELICAN & TARGA PIPELINE CDPS HILAND, PELICAN & HILAND, PELICAN & TARGA PIPELINE TARGA PIPELINE CDPS CDPS PIONEER TERMINAL

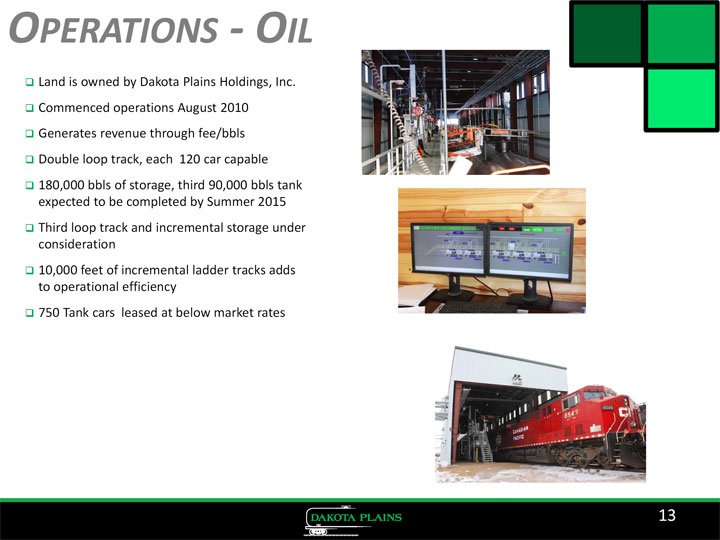

13 □Land is owned by Dakota Plains Holdings, Inc. □Commenced operations August 2010 □Generates revenue through fee/bbls □Double loop track, each 120 car capable □180,000 bbls of storage, third 90,000 bbls tank expected to be completed by Summer 2015 □Third loop track and incremental storage under consideration □10,000 feet of incremental ladder tracks adds to operational efficiency □750 Tank cars leased at below market rates OPERATIONS - OIL

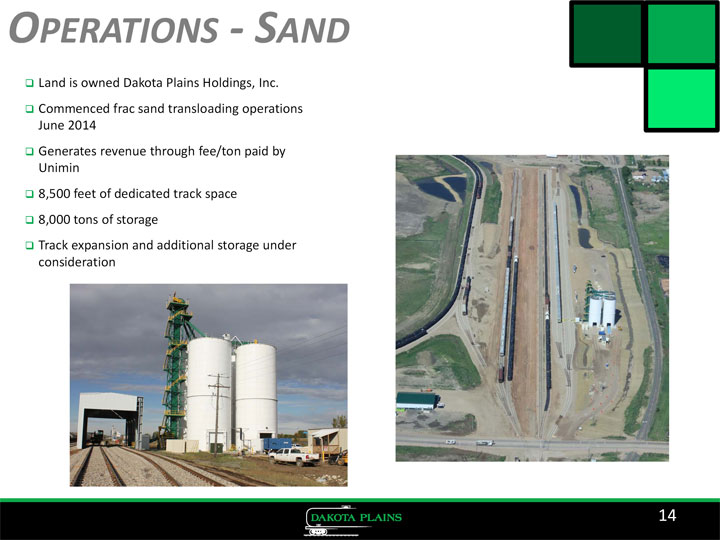

14 □Land is owned Dakota Plains Holdings, Inc. □Commenced frac sand transloading operations June 2014 □Generates revenue through fee/ton paid by Unimin □8,500 feet of dedicated track space □8,000 tons of storage □Track expansion and additional storage under consideration OPERATIONS - SAND

15 k tons per month of frac sand Actual k b/d of crude oil 2014 2015 PIONEER TRANSLOADING PLAN ToP vol = 49.1 kbpd

PRIORITIES Guidance Delivery Tank #3 Construction Operations Efficiency Throughput Contracts Debt Syndication Strategic Alternatives new customers and renewals with current customers bring outsourced operations in-house 57.5 k b/d oil; 97.5 k tons/q sand; $23.4 m EBITDA commission by July 2015 Strategy Committee process on behalf of Board SunTrust Robinson Humphrey as advisors $22.5 million due December 2015 2015 16

17 APPENDIX

18 CRUDE BY RAIL TERMINALS –END OF 2014 Dakota Plains Dakota Plains New Town -CP c. 80k bpd 3 rd Party OK Storage = 180k BOE Midstream Dickinson -BNSF c. 200k bpd Belle Fourche Pipe Storage ≈650k Global/Basin Zap -BNSF c. 60k bpd 3 rd Party OK Storage ≈ 140k Savage Trenton -BNSF c. 175K bpd 2-Gathering Lines Storage ≈300k Crestwood Partners Epping -BNSF c. 160k bpd Beaver Lodge Pipe Storage ≈1.1M Hess Tioga -BNSF c. 140k bpd Gathering 3 rd Party ? Storage ≈270k Global/Basin Stampede -CP c. 80k bpd No 3 rd Party Storage ≈200k Musket Corp. Dore -BNSF 60k bpd Banner Pipeline 3 rd Party OK Storage ≈90k Great Northern Power Development Fryburg -BNSF BakkenLink Pipeline c. 70k bpd Storage ≈450k Plains All American Van Hook -CP c. 65K bpd No 3 rd Party Storage ≈300k Plains All American Ross –BNSF c. 68k bpd Gathering Robinson Lake Pipe Storage ≈200k EOG Stanley -BNSF 75k bpd NO 3 rd Party Storage ≈240k Enbridge Berthold -BNSF c. 80k bpd Gathering Storage ≈300k Tesoro Logistics Refinery Mandan 68k bpd December 2014 Production ≈1.3M bpd Pipeline = 455k bpd Tesoro = 65k bpd Truck = 13k bpd Rail = 767k bpd Northstar Fairview –BNSF c. 100k bpd Q2 2015 Storage = 515k Phillips 66 Palermo – BNSF c. 80k bpd + Q4 2015 Storage = 300k

4Q 2014 RESULTS 19 all results in $mm 4q 2014 4q 2013 Consolidated Net Income $ (0.9) $ 0.3 EBITDA $ 1.9 $ 0.1 Oil Transloading JV Revenue $ 7.7 $ 4.6 Income $ 2.5 $ 0.9 Sand Transloading JV (a) Revenue $ 0.6 Income $ 0.2 Discontinued Operations Income from Marketing JV $ 0.4 $ 1.4 Income from Trucking JV $ 0.0 $ (0.1) (a) Commenced operations in June 2014

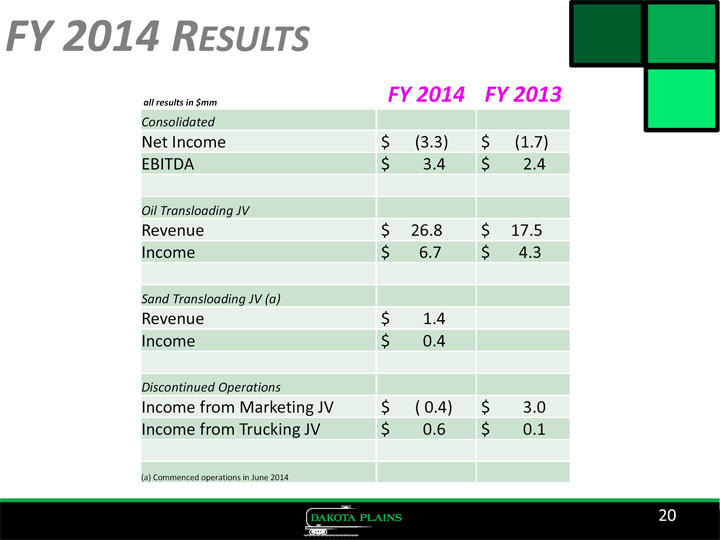

FY 2014 RESULTS 20 all results in $mm FY 2014 FY 2013 Consolidated Net Income $ (3.3) $ (1.7) EBITDA $ 3.4 $ 2.4 Oil Transloading JV Revenue $ 26.8 $ 17.5 Income $ 6.7 $ 4.3 Sand Transloading JV (a) Revenue $ 1.4 Income $ 0.4 Discontinued Operations Income from Marketing JV $ ( 0.4) $ 3.0 Income from Trucking JV $ 0.6 $ 0.1 (a) Commenced operations in June 2014

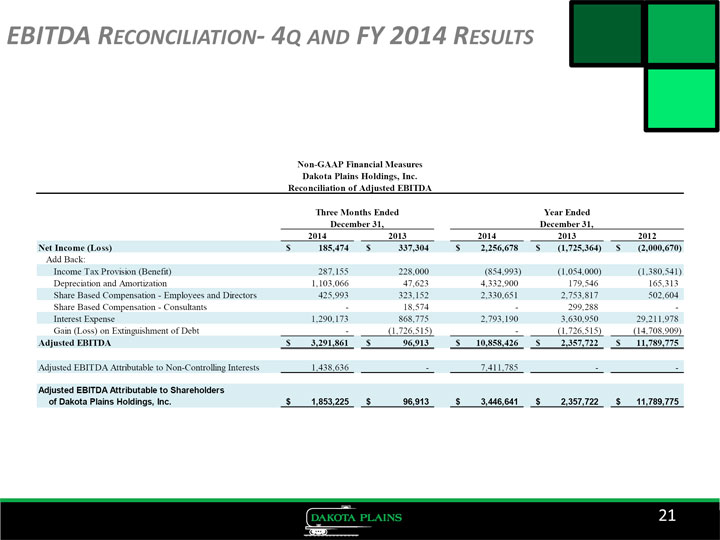

EBITDA RECONCILIATION-4Q AND FY 2014 RESULTS 21 2014 2013 2014 2013 2012 Net Income (Loss) 185,474$ 337,304$ 2,256,678$ (1,725,364)$ (2,000,670)$ Add Back: Income Tax Provision (Benefit) 287,155 228,000 (854,993) (1,054,000) (1,380,541) Depreciation and Amortization 1,103,066 47,623 4,332,900 179,546 165,313 Share Based Compensation - Employees and Directors 425,993 323,152 2,330,651 2,753,817 502,604 Share Based Compensation - Consultants - 18,574 - 299,288 - Interest Expense 1,290,173 868,775 2,793,190 3,630,950 29,211,978 Gain (Loss) on Extinguishment of Debt - (1,726,515) - (1,726,515) (14,708,909) Adjusted EBITDA 3,291,861$ 96,913$ 10,858,426$ 2,357,722$ 11,789,775$ Adjusted EBITDA Attributable to Non-Controlling Interests 1,438,636 - 7,411,785 - - Adjusted EBITDA Attributable to Shareholders of Dakota Plains Holdings, Inc. 1,853,225$ 96,913$ 3,446,641$ 2,357,722$ 11,789,775$ Non-GAAP Financial Measures Dakota Plains Holdings, Inc. Reconciliation of Adjusted EBITDA Three Months Ended Year Ended December 31, December 31,

EBITDA RECONCILIATION-2015 GUIDANCE 22 (expressed in USD millions, unless otherwise indicated) Twelve Months Ended December 31, 2015 Net Income 8.5$ Add back: Interest Expense 7.6$ o/w Contingent payment interest 4.2$ Term loan and revolver interest 3.1$ Fees / amortization associated with loans 0.4$ Tax Provision 1.6$ Depreciation and Amortization 4.5$ Share Based Compensation 1.2$ Adjusted EBITDA 23.4$