Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MILLER ENERGY RESOURCES, INC. | a2015-03x198xkforpresentat.htm |

| EX-99.1 - EXHIBIT 99.1 - MILLER ENERGY RESOURCES, INC. | a2015-03x19exhibit991.htm |

Text Margin 4.00 MS Margin 4.70 MS Margin 4.00 MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 Investor Presentation March 2015

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 2 Forward Looking Statements Certain statements in this presentation and elsewhere by Miller Energy Resources¸ Inc. are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve the implied assessment that the resources described can be profitably produced in the future, based on certain estimates and assumptions. Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated by Miller Energy Resources, Inc. and described in the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, the potential for additional operating losses; material weaknesses in internal control over financial reporting and the need to enhance systems, accounting, controls and reporting performance; potential limitations imposed by debt covenants under the senior credit facilities on growth and the ability to meet business objectives; debt costs under existing senior credit facilities; the ability of the lenders to redetermine the borrowing base under the First Lien RBL; Miller's ability to meet the financial and production covenants contained in the First Lien RBL and/or Second Lien Credit Facility; whether Miller is able to complete or commence its drilling projects within its expected time frame or expected budget; the ability to recover proved undeveloped reserves; whether new productive assets can be successfully acquired, integrated and exploited in the future; whether production can be established on certain leases in a timely manner before expiration; whether the work commitments can be completed as required under the terms of the Susitna Basin Exploration Licenses; Miller's experience with horizontal drilling; risks associated with the hedging of commodity prices; dependence on third party transportation facilities; concentration risk in the market for the oil and natural gas produced in Alaska; the ability to perform under the terms of its oil and gas leases and exploration licenses with the Alaska DNR, including meeting the funding or work commitments of those agreements; uncertainties related to deficiencies identified by the SEC in our Form 10-K for 2011; the impact of natural disasters on Miller's Cook Inlet Basin operations; the effect of global market conditions on the ability to obtain reasonable financing and on the prices of Miller's publicly traded equity; limitations with respect to the issuance and/or designation of additional preferred stock; litigation risks; the imprecise nature of reserve estimates; risks related to drilling dry holes or wells without commercial quantities of hydrocarbons; fluctuating oil and gas prices and the impact on results from operations; the need to discover or acquire new reserves in the future to avoid declines in production; differences between the present value of cash flows from proved reserves and the market value of those reserves; industry risks that may be uninsurable; the potential for shortages or increases in costs of equipment, services and qualified personnel; strong industry competition; constraints on production and costs of compliance that may arise from current and future environmental, FERC and other statutes, rules and regulations at the state and federal level; the potential to incur substantial penalties and fines for noncompliance with applicable FERC administered statutes, rules, regulations and orders; new regulation on derivative instruments used to manage risk against fluctuating commodity prices; the potential impact of proposed federal, state, or local regulation regarding hydraulic fracturing; the effect that future environmental legislation could have on various costs; the impact of certain provisions included in the FY2015 U.S. federal budget on certain tax incentives and deductions Miller currently uses; that no dividends may be paid on our common stock for some time; cashless exercise provisions of outstanding warrants; market overhang related to outstanding options and warrants; the impact of non- cash gains and losses from derivative accounting on future financial results; risks to non-affiliate shareholders arising from the substantial ownership positions of affiliates; the effects of the change of control conversion features of the Series C and Series D Preferred Stock on a potential change of control; the junior ranking of the Series C and Series D Preferred Stock to the Series B Preferred Stock and all indebtedness; the ability to pay dividends on the Series C or Series D Preferred Stock; whether the Series C or Series D Preferred Stock is rated; the ability of the Series C or Series D Preferred Stockholders to exercise conversion rights upon a change of control; fluctuations in the market price of our Series C or Series D Preferred Stock; whether additional shares of Series C or Series D Preferred Stock or additional series of preferred stock that rank on parity with the Series C and Series D Preferred Stock are issued; the very limited voting rights held by the Series C and Series D Preferred Stockholders; the newness of the Series D Preferred Stock and the limited trading market of the Series C and Series D Preferred Stock; and risks related to the continued listing of the Series C and Series D Preferred Stock on the NYSE. Additional information on these and other factors, which could affect Miller's operations or financial results, are included in Miller Energy Resources, Inc.'s reports on file with United States Securities and Exchange Commission including its Annual Report on Form 10-K, as amended, for the fiscal year ended April 30, 2014. Capitalized terms used above but not defined above are defined in Miller's Annual Report. Miller Energy Resources, Inc.'s actual results could differ materially from those anticipated in these forward- looking statements as a result of a variety of factors, including those discussed in its periodic reports that are filed with the Securities and Exchange Commission and available on its Web site (www.sec.gov). All forward-looking statements attributable to Miller Energy Resources or to persons acting on its behalf are expressly qualified in their entirety by these factors. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We assume no obligation to update forward-looking statements should circumstances or management's estimates or opinions change unless otherwise required under securities law.

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 3 Investment Highlights Ability to Meaningfully Lower Drilling Risk Profile and CapEx No near-term lease expirations allows Company to develop resources methodically Reduction of CapEx for remainder of CY2015 to ~$40 million gross or less Given oil prices, primary focus of drilling will be at North Fork gas field Drilling at Redoubt has been reduced; depending on oil prices, we will potentially sidetrack RU-7B 11.7 MMBoe of 1P reserves, 1P PV-10 of $447(1) million and net daily production of ~4.0(2) MBoepd Long term growth potential; total 3P reserves of 32.2 MMBoe(1) and significant contingent resources Owned-infrastructure in each field with 3rd party appraisal value of ~$315 million(3) Significant Reserve, Resource, and Infrastructure Asset Base ~ 90% of net oil production hedged at ~$96/barrel through April 2016 At FQ3 2015 end, oil hedge book had market value of ~$44 million Unhedged oil production sells at ANS (Brent) less ~$4 Company sells gas under term contracts for $6.50+ per Mcf Favorable Hedge Position and Attractive Commodity Pricing Under State law, Alaska funds ~35-65% of D&C costs per well via its State cash tax rebate programs Received more than ~95% of the credits applied for to-date within an average of ~5 months of application Recently received $21.2 million in February 2015; expect to receive $20.6 million in March 2015; expect to receive another ~$33 million in early summer State of Alaska Incentives Recognizing an increased need for cost and capital discipline, the Board made changes to Miller Energy’s senior management in FQ2 2014 New management focused on reducing leverage, ensuring adequate liquidity, driving cost efficiencies, and ensuring appropriate cash-on-cash returns New Disciplined Management Team (1) Ryder Scott reserve report dated 07/31/14 (WTI Spot at $98.23 and Brent Spot at $104.94) (2) Average current production in March 2015 (3) Based upon 3rd party appraisals conducted in 2013 and 2014 using fair market value. Does not include North Fork infrastructure assets, Rig 36 or Rig 37

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 4 Name Title Carl Giesler, Jr. CEO & Director David Hall COO Jeff McInturff CAO & Interim CFO Kurt Yost General Counsel Management Board Members Focused and Accountable Management and Board Name Title Scott Boruff Executive Chairman Carl Giesler, Jr. CEO and Director Bob Gower Director Gerald Hannahs Director Gov. Bill Richardson Director A. Haag Sherman Director Charles Stivers Director Represents Management and Board Members who joined the Company in 2014

Text Margin 4.00 MS Margin 4.70 MS Margin 4.00 MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 Company Overview

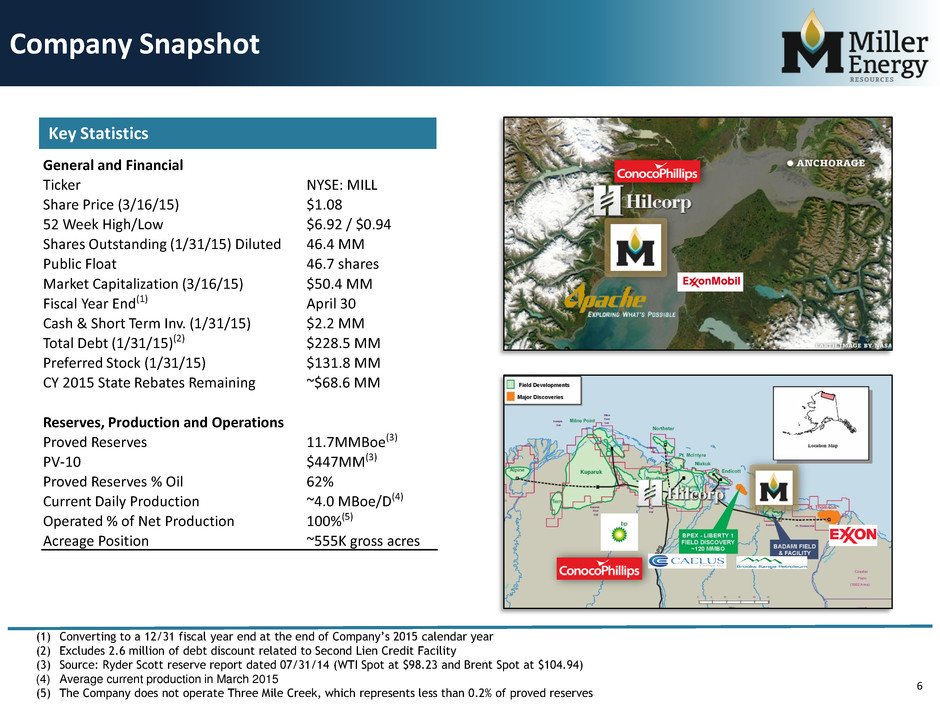

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 6 Cook Inlet – North Fork Cook Inlet – WMRU & Redoubt North Slope – Badami Key Statistics Company Snapshot (1) Converting to a 12/31 fiscal year end at the end of Company’s 2015 calendar year (2) Excludes 2.6 million of debt discount related to Second Lien Credit Facility (3) Source: Ryder Scott reserve report dated 07/31/14 (WTI Spot at $98.23 and Brent Spot at $104.94) (4) Average current production in March 2015 (5) The Company does not operate Three Mile Creek, which represents less than 0.2% of proved reserves General and Financial Ticker NYSE: MILL Share Price (3/16/15) $1.08 52 Week High/Low $6.92 / $0.94 Shares Outstanding (1/31/15) Diluted 46.4 MM Public Float 46.7 shares Market Capitalization (3/16/15) $50.4 MM Fiscal Year End(1) April 30 Cash & Short Term Inv. (1/31/15) $2.2 MM Total Debt (1/31/15)(2) $228.5 MM Preferred Stock (1/31/15) $131.8 MM CY 2015 State Rebates Remaining ~$68.6 MM Reserves, Production and Operations Proved Reserves 11.7MMBoe(3) PV-10 $447MM(3) Proved Reserves % Oil 62% Current Daily Production ~4.0 MBoe/D(4) Operated % of Net Production 100%(5) Acreage Position ~555K gross acres

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 7 Focusing on cost and capital discipline Prioritizing cash-on- cash returns vs. NAV growth Increasing transparency Increasing government independence Focusing on lower cost / lower risk capital projects Given current oil prices, pivoting to gas ($6.50+ Mcf) Employing State cash tax credits to reduce leverage Management Liquidity / Cash Management Miller Energy’s New Approach Prioritizing lower risk capital projects, such as workovers and sidetracks Working to mitigate mechanical and geological risk Supplementing technical team Drilling Discipline Pursuing deliberate growth through lower risk and lower cost projects At North Fork focusing on low-risk wells; at Redoubt focusing on sidetracks Pursuing scale and growth economies at Badami with capital enhancements Drilling Growth and Exploration Remove lines Focused on cost of capital discpline Prioritizing cash- on-cash, returns vs. NAV growth, improving transaparency, increased independence of governance Remove sub-bulllet Employing state cash credits to reduce leverage Drilling Disc: prioritizing lower risk capital projects such as work-over and sidetracks

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 8 Cook Inlet North Slope Company Field Locations Cook Inlet North Slope

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 9 Cook Inlet, AK North Slope, AK Total North Fork W. McArthur River Redoubt Badami (Savant) Commodity Type Gas Oil Oil Oil Production ~1.2 MBoepd(1) ~1.4 MBoepd(1) ~0.8 MBoepd(1) ~0.6 Boepd(1) ~4.0 MBoepd % Net Boed 30% 35% 20% 15% 100% 1P MMBoe 4.0 MMBoe(2) 4.9 MMBoe(2) 2.8 MMBoe(2) NA 11.7 MMBoe % 1P 34% 42% 24% NA 100% Total 3P MMBoe 19.7 MMBoe(2) 8.5 MMBoe(2) 4.0 MMBoe(2) NA 32.2 MMBoe % 3P 61% 26% 12% NA 100% CY 2015 Drilling Plans 2 new, 3 work-overs None RU-7B sidetrack Well Enhancements Infrastructure Two 7.4 mi. pipelines with ~22MMcfd capacity ~12 Mbpd of storage and processing capacity at the West McArthur River Osprey platform has 13 vacant well slots, 3 pipelines to onshore facility rated for ~25 Mbpd built by FST ~38.5 Mbpd processing and 50 mi. of pipelines; built by BP (1) Average current production in March 2015 (2) Ryder Scott reserve report dated 07/31/14 (WTI Spot at $98.23 and Brent Spot at $104.94) Four Consolidated Areas of Operation

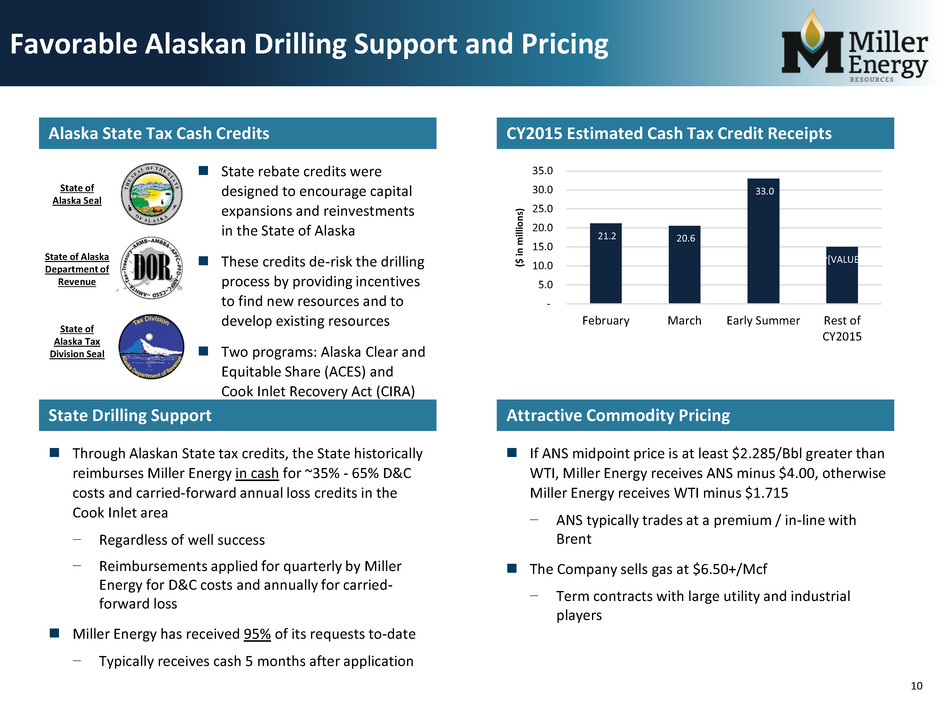

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 10 State rebate credits were designed to encourage capital expansions and reinvestments in the State of Alaska These credits de-risk the drilling process by providing incentives to find new resources and to develop existing resources Two programs: Alaska Clear and Equitable Share (ACES) and Cook Inlet Recovery Act (CIRA) Alaska State Tax Cash Credits CY2015 Estimated Cash Tax Credit Receipts Through Alaskan State tax credits, the State historically reimburses Miller Energy in cash for ~35% - 65% D&C costs and carried-forward annual loss credits in the Cook Inlet area − Regardless of well success − Reimbursements applied for quarterly by Miller Energy for D&C costs and annually for carried- forward loss Miller Energy has received 95% of its requests to-date − Typically receives cash 5 months after application If ANS midpoint price is at least $2.285/Bbl greater than WTI, Miller Energy receives ANS minus $4.00, otherwise Miller Energy receives WTI minus $1.715 − ANS typically trades at a premium / in-line with Brent The Company sells gas at $6.50+/Mcf − Term contracts with large utility and industrial players State Drilling Support Attractive Commodity Pricing Favorable Alaskan Drilling Support and Pricing State of Alaska Seal State of Alaska Tax Division Seal State of Alaska Department of Revenue 21.2 20.6 33.0 ~[VALUE] - 5.0 10.0 15.0 20.0 25.0 30.0 35.0 February March Early Summer Rest of CY2015 ($ in m ill ion s)

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 11 Net Proved Reserves as of July 31, 2014 Oil (MMbbls) Gas (Bcf) Total (MMBoe) PV-10 PDP 3.9 5.2 4.7 215.2$ PDNP 0.3 8.2 1.6 56.2 Total Proved Developed 4.1 13.3 6.4 271.5 PUD 3.1 13.2 5.3 176.1 Total Proved 7.3 26.6 11.7 447.6 Probable Reserves 2.3 37.1 8.4 183.6 Total Proved + Probable Reserves (2P) 9.5 63.6 20.1 631.2 Possible Reserves 2.3 58.8 12.1 198.0 Total Proved + Probable (2P) + Possible (3P) Reserves 11.8 122.5 32.2 829.3$ Reserves Summary(1) 1P Reserves By Category 1P Reserves By Commodity Reserves 1P PV-10 By Category PDP 40% PDNP 14% PUD 46% Total: 11.7 MMBoe Oil 62% Gas 38% PDP 48% PDNP 13% PUD 39% Total: 11.7 MMBoe Total: $447.6 M (1) Ryder Scott reserve report dated 07/31/14 (WTI Spot at $98.23 and Brent Spot at $104.94)

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 12 Current CapEx focus given high contracted gas prices Proved, producing field with ~11.34K acres − Lower risk, on-shore drilling ~24 Bcf+ in Proved reserves − Good quality 3D seismic 5 incumbent wells − Currently producing ~8.3 MMcfd − Average Initial Production: > 3.5MMcfd − Additional infield targets, multiple PUD locations 2 initial grass-roots wells producing and improving 100% WI, ~80% NRI Gas sold under term contracts at $6.50+/Mcf − LOE of ~$0.25/Mcf Company-owned Rig 37 on-location and drilling Highlights North Fork Unit

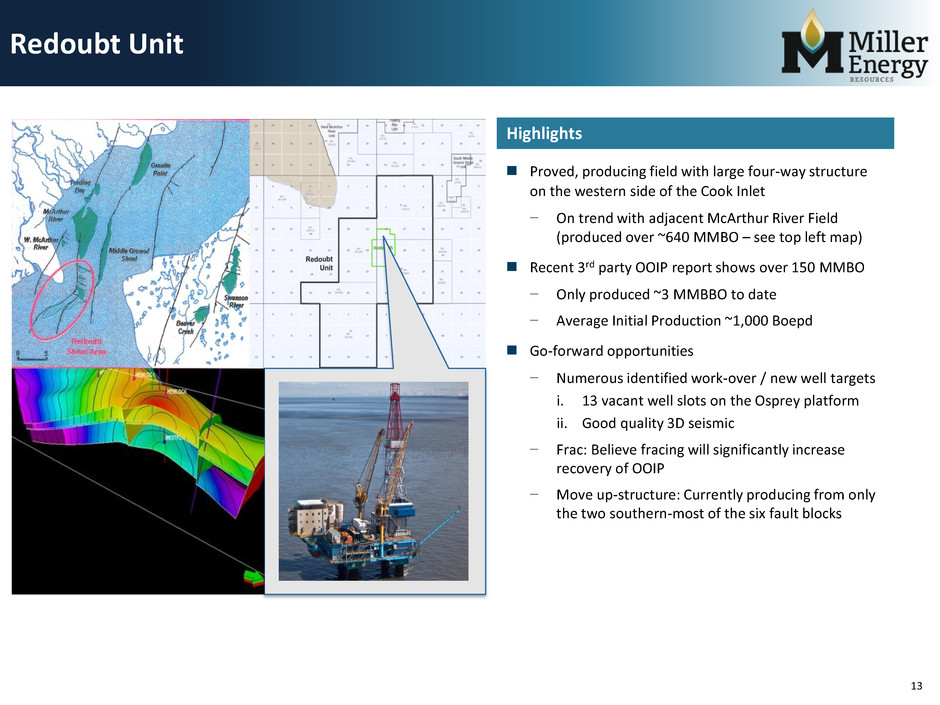

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 13 Proved, producing field with large four-way structure on the western side of the Cook Inlet − On trend with adjacent McArthur River Field (produced over ~640 MMBO – see top left map) Recent 3rd party OOIP report shows over 150 MMBO − Only produced ~3 MMBBO to date − Average Initial Production ~1,000 Boepd Go-forward opportunities − Numerous identified work-over / new well targets i. 13 vacant well slots on the Osprey platform ii. Good quality 3D seismic − Frac: Believe fracing will significantly increase recovery of OOIP − Move up-structure: Currently producing from only the two southern-most of the six fault blocks Highlights Redoubt Unit

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 14 Proved, producing field ~6 mi. north of Redoubt Unit − Like Redoubt, on trend with adjacent McArthur River Field (produced over ~640 MMBO) ~13.3 MMBBO recovered from WMRU to date − OOIP estimated at ~45+ MMBBO (excluding Sword and Sabre) − Implies > 20% recovery − Initial production range ~650-2,000 Boepd 100% WI, ~83% NRI Go-forward opportunities − Additional infield targets at WMRU & Sword i. Good Quality 3D seismic − Large adjacent Sabre prospect i. Estimated to hold over 40 MMBBO OOIP with significant gas potential ii. Prime JV candidate Highlights West McArthur River Unit

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 15 Proved, producing field (Badami) east of Prudhoe Bay on North Slope with ~18.5K acres − Most easterly-located active production facility with capacity Explore value accretive JV / sale of WI Currently producing ~1,000 Bopd gross (~600 net) 67.5% WI, ~57% NRI − Partner with ASRC, one of AK’s largest employers Many additional infield targets identified − Two new wells identified for future development − ~Initial Production range: ~600-900 Bopd − Good quality 3D seismic 100% WI in Yukon Gold exploration prospect estimated to hold ~100 MMBO just south of Pt. Thompson Highlights North Slope

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 16 Osprey Platform − Modern state-of-the-art facility − Designed for 21 wells producing 25 MBoed − Transfers crude oil via sub-sea pipeline to Kustatan Production Facility Kustatan Production Facility − State-of-the-art, fully computerized facility –newest in the Cook Inlet − 25 MBPD processing and storage capacity (expandable to 50 MBpd) − Processing crude oil and natural gas from Osprey platform − Provides electrical power for Osprey platform and West McArthur River Unit West McArthur River Unit − 12 MBpd storage and processing capacity North Fork Unit − Two 7.4 mi. pipelines with ~22 MMcfd capacity Badami (Savant) − 38.5 MBpd processing / storage facility − Two ~25 mi. pipelines − Near significant 3rd party exploration acreage Highlights Infrastructure Kustatan Production Facility Badami (Savant) Processing / Storage Facility

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 17 Drilling Rigs Rig 35 on Osprey Rig 36 Rig 37 Rig Terms Size/Type Location Status Future Plans Mgmt. Est. Value Rig-34 Company Owned ~750Hp, land based, ~6,000' depth Nikiski Stacked Being moved to L48 for sale ~$3 million Rig-35 Company Owned ~2,000Hp, platform based, ~21,000' depth Osprey Transitioning to RU-7B sidetrack Redoubt “horse” ~$25 million Rig-36 Company Owned ~2,400Hp, platform based, ~24,000' depth Nikiski Undergoing modifications to drill extended reach wells Badami / Sabre ~$15 + million Rig-37 Company Owned ~1,000Hp, land based, ~11,000' depth Homer/North Fork Located in North Fork fields North Fork “horse” ~$10 million

Text Margin 4.00 MS Margin 4.70 MS Margin 4.00 MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 Business Strategy

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 19 Business Strategy Overview Grow Production in a Capital Efficient Manner Methodically Develop Our Resource Base Leverage Our Owned Infrastructure Pursue Opportunistic Acquisitions Improve Cash Efficiency

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 20 4.8 5.4 5.4 4.6 4.0 5.5 4.8 0.7 2.2 1.4 4.9 1.8 - 2 4 6 8 10 12 2014 FQ1 2014 FQ2 2014 FQ3 2014 FQ4 2015 FQ1 2015 FQ2 2015 FQ3 ($ in m ill io n s) Recurring Cash G&A Other non-recurring 45 27 20 18 22 30 21 7 - 10 20 30 40 50 2014 FQ1 2014 FQ2 2014 FQ3 2014 FQ4 2015 FQ1 2015 FQ2 2015 FQ3 ($ p e r B o e ) LOE Savant Impact Cash G&A LOE / Boe Produced CapEx Improve Cash Efficiency 28 6.6 10.4 5.4 6.8 6.1 5.4 4.8 (1) (1) As of March 15, 2015, estimated CapEx spent to date in FQ4 16.0 51.1 28.3 43.9 46.3 48.2 32.7 5.0 - 10 20 30 40 50 60 2014 FQ1 2014 FQ2 2014 FQ3 2014 FQ4 2015 FQ1 2015 FQ2 2015 FQ3 2015 FQ4 ($ in m ill io n s)

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 21 1.4 2.1 2.5 3.1 3.3 3.3 3.4 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 2014 FQ1 2014 FQ2 2014 FQ3 2014 FQ4 2015 FQ1 2015 FQ2 2015 FQ3 (M b o e /d ) Production Grow Production in a Capital Efficient Manner Focused on developing lower risk opportunities while deploying capital as efficiently as possible − Prioritizing production growth and cash flow generation over reserve growth − Grading opportunities by risk-adjusted cash-on-cash returns Currently focused on drilling wells in the North Fork and Redoubt regions with approximately $40 million in expected gross CapEx through the remainder of CY2015, at least 35% of which we expect to recover through tax cash credits; in particular, we expect to: − Drill 2 new wells and work-over 3 wells in the North Fork area − Drill RU-7B sidetrack (1) Savant acquisition did not close until December 2014 (1)

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 22 Given oil prices, “pivot” to gas − Sell gas at $6.50+/Mcf under gas sales contracts Given balance sheet, reduce risk- profile/expense of targets − Production/cash flow growth more important than reserve growth Improve operating reliability − Initial grass-roots North Fork wells producing and improving − Supplement technical team Create “structural tension” in capital allocation Mitigate mechanical-and geological-risk Immediate Methodically Develop Our Resource Base Remainder CY 2015 $40 million remaining gross CapEx for CY2015 Maintain conservative drilling program − Continued gas focus at North Fork i. 2 additional new wells ii. 3 work-overs − Sidetracks and less risky drilling opportunities at Redoubt i. RU-7B sidetrack − Badami on hold for current drilling season, looking at well enhancements opportunities in the interim Redoubt − Hydraulic fracturing − Work North fault blocks Sabre / Sword / Susitna / Iniskin − JV / develop on-own Badami − JV / Farm-out / Sell-down Long-term

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 23 Company-owned infrastructure provides both near-term and long-term advantages to the Company − Near term advantages i. Provides capacity to grow ii. Vertical integration and wholly-owned infrastructure allows control of cost of CapEx Maintain low operating and incremental lifting costs iii. Production and processing capacity, and takeaway capacity exceed internal needs Ability to sell excess electricity and capacity to other oil and gas companies in the region and supplement our cash flow iv. Use access to our infrastructure to attract farm-in capital v. Able to continue to operate at lower costs in current environment than peers − Long Term i. Explore MLP-related options and other ways to optimize the ownership of our infrastructure ii. Mid-stream assets undervalued Evaluate mid-stream infrastructure disposal/spin-out opportunities iii. MLP-related options include: Sell to existing MLP / infrastructure fund Create own MLP Create Alaskan MLP Estimated appraisal value of $315 million(1) Leverage Our Owned Infrastructure (1) Based upon 3rd party appraisals conducted in 2013 and 2014 using fair market value. Does not include North Fork infrastructure assets, Rig 36 or Rig 37

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 24 Continue to seek acquisition opportunities to complement our existing assets Expect a number of attractive targets will become available Cook Inlet bolt-ons − Currently producing oil or gas − Must be credit and cash flow accretive − Must entail operatorship to achieve economies of scale North Slope bolt-ons − Must increase flow through Badami plant − Needs to be proximate to Badami unit − Operatorship preferred Pacific Energy Assets (12/10/09) − Acquired for ~$5.0 million Anchor Point Energy (8/14/14) − Acquired for $5.0 million Rig 37 (8/14/14) − Acquired for $7.0 million Savant Alaska (Badami Unit) (5/14/14) − 67.5% working interest in the Badami Unit with approximately 600 Bopd in net production, ~$6.0 million in PDP PV-10, and significant infrastructure − Acquired for $9.0 million North Fork (2/5/14) − Producing ~7.0 MMcfd (1,167 Boepd) at close, contracted at a fixed price of $7.00 per Mcf, and $334.7 million of PV-10 as of October 1, 2013 − Acquired for $56.6 million Go-Forward Approach History of Opportunistic Acquisitions Pursue Opportunistic Acquisitions

Text Margin 4.00 MS Margin 4.70 MS Margin 4.00 MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 Financial Overview

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 26 Revenues(1) Adjusted EBITDA Average Net Daily Production CapEx Financial Overview (1) Excludes hedge settlements 1.4 2.1 2.5 3.1 3.3 3.3 3.4 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 2014 FQ1 2014 FQ2 2014 FQ3 2014 FQ4 2015 FQ1 2015 FQ2 2015 FQ3 (M b o e /d ) 13.0 18.8 16.6 22.1 25.4 24.2 20.3 - 5.0 10.0 15.0 20.0 25.0 30.0 2014 FQ1 2014 FQ2 2014 FQ3 2014 FQ4 2015 FQ1 2015 FQ2 2015 FQ3 ($ in m ill io n s) - - - 16.3 - - 21.5 1.2 5.9 4.3 10.2 14.0 9.4 11.7 - 5.0 10.0 15.0 20.0 25.0 30.0 35.0 2014 FQ1 2014 FQ2 2014 FQ3 2014 FQ4 2015 FQ1 2015 FQ2 2015 FQ3 ($ in m ill io n s) NOL Adj. EBITDA (in millions) 16.0 51.1 28.3 43.9 46.3 48.2 32.7 5.0 - 10 20 30 40 50 60 2014 FQ1 2014 FQ2 2014 FQ3 2014 FQ4 2015 FQ1 2015 FQ2 2015 FQ3 2015 FQ4 ($ in m ill io n s)

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 27 Capital Structure (1) Excludes $2.6 million of debt discount related to Second Lien Credit Facility (2) The Company’s Second Lien Loans bear 2.00% in PIK interest in addition to the Cash pay rate noted above As of 1/31/2015 Capitalization ($ in millions) Actual Coupon Maturity Cash and Cash Equivalents 2.2$ Debt First Lien RBL 44.0 L+300 - 400 Jun-17 Second Lien Term Loan(1) 175.0 13.75% (2) Feb-18 Other Debt 7.1 Various Various Series B Preferred Stock 2.4 12.00% Sep-17 Total Debt 228.5 Series C Preferred Stock 71.7 10.75% Perpetual Series D Preferred Stock 60.1 10.50% Perpetual Common Equity (76.2) Total Capitalization 284.1$

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 28 ~ 90% of net oil production hedged at ~$96/barrel through April 2016, outstanding hedges have a MTM value of ~$44.0 MM at FQ3 2015 end North Fork Unit has the vast majority of its gas production effectively hedged through ENSTAR and an industrial customer gas delivery contract − ENSTAR at ~$7.08/Mcf with 1.5 Bcf remaining as of Jan. ’15 − Industrial at ~$6.85 Hedging Summary Current Oil Hedging Schedule Oil Hedge Summary Hedging 88 90 92 94 96 98 100 102 104 0 500 1,000 1,500 2,000 2,500 Hedge Volumes Bpd Ave Hedged Price Crude Oil (Brent Swaps) Contract Volumes Wtd. Avg. Period Type (Mbbls) Swap Price Jan '15 - April '15 Swap 258.0 97.18$ FY 2016 Swap 787.6 95.36$ May '16 - Dec. '16 Swap 232.6 93.97$

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 29 Conclusion Significant Reserve, Resource, and Infrastructure Asset Base Ability to Meaningfully Lower Drilling Risk Profile and Lower CapEx Favorable Hedge Position and Attractive Commodity Pricing State of Alaska Incentives New Disciplined Management Team

Text Margin 4.00 MS Margin 4.70 MS Margin 4.00 MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 Appendix

MILL Colors Text #1 0 0 0 Color #1 16 37 63 Color #2 41 121 154 Color #3 79 79 79 Color #4 150 150 150 Color #5 0 59 96 Other 255 255 255 31 Reconciliation of Adjusted EBITDA The table below represents a reconciliation of Adjusted EBITDA to the Company’s net loss, which is the most directly comparable financial measure calculated in accordance with generally accepted accounting principles in the United States of America. To supplement the Company's condensed consolidated financial statements, which statements are prepared and presented in accordance with GAAP, we use non-GAAP adjusted EBITDA, or adjusted Earnings Before Income Taxes, Depreciation and Amortization, as a measure to evaluate earnings by excluding certain non-cash expenses as set forth in the table below. The Company uses this non-GAAP financial measure for financial and operational decision making and as a means to evaluate period-to-period comparisons. Management believes that this non-GAAP financial measure provides meaningful supplemental information regarding the Company's performance and liquidity. The Company believes that both management and investors benefit from referring to this non-GAAP financial measure in assessing performance and when planning, forecasting and analyzing future periods. This non-GAAP financial measure also facilitates management's internal comparisons to historical performance and liquidity as well as comparisons to competitors' operating results. The Company believes this non-GAAP financial measure is useful to investors both because (1) it allows for greater transparency with respect to key metrics used by management in its financial and operational decision making and (2) it is used by our institutional investors and the analyst community to help them analyze the health of the business. Reconciliations to Non-GAAP Measures Nine Months Ended January 31, Twelve Months Ended April 30, 2015 2014 2014 2013 (in thousands) (in thousands) Net before income taxes $ (460,134) $ (26,658) $ (43,453) $ (30,203) Adjusted by: Interest expense, net 8,896 4,051 7,470 4,276 Depreciation, depletion and amortization expense 56,601 22,352 33,528 13,170 Impairment of proved properties and other long-lived assets 230,771 - 890 - Asset disposals 47 - - - Accretion of asset retirement obligation 1,067 903 1,239 900 Non-Cash exploration cost 244,848 786 2,009 1,458 Loss on debt extinguishment - - 15,145 - Stock-based compensation 10,857 5,120 9,034 10,459 Non-cash employee bonuses 1,586 - - - Non-recurring litigation settlement and related matters 7,441 1,998 4,215 - Non-recurring severance payments 1,489 - - - Non-recurring North Fork properties gas transportation costs 1,813 - 1,403 - Derivative contracts: (gain)loss on derivatives, net (55,516) 5,589 10,179 (6,751) Cash settlements (paid) received 6,769 (2,765) (3,815) 1,516 Adjusted EBITDA $ 56,535 $ 11,376 $ 37,844 $ (5,175)