Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - GoDaddy Inc. | d728713dex51.htm |

| EX-4.1 - EX-4.1 - GoDaddy Inc. | d728713dex41.htm |

| EX-23.1 - EX-23.1 - GoDaddy Inc. | d728713dex231.htm |

| EX-23.2 - EX-23.2 - GoDaddy Inc. | d728713dex232.htm |

| EX-10.28 - EX-10.28 - GoDaddy Inc. | d728713dex1028.htm |

| EX-10.13 - EX-10.13 - GoDaddy Inc. | d728713dex1013.htm |

| EX-10.24 - EX-10.24 - GoDaddy Inc. | d728713dex1024.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 19, 2015

Registration No. 333-196615

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT

NO. 7 TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

GoDaddy Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 7370 | 46-5769934 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

14455 N. Hayden Road

Scottsdale, Arizona 85260

(480) 505-8800

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Blake J. Irving

Chief Executive Officer

GoDaddy Inc.

14455 N. Hayden Road

Scottsdale, Arizona 85260

(480) 505-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jeffrey D. Saper, Esq. Allison B. Spinner, Esq. Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Nima Kelly, Esq. Executive Vice President & General Counsel Matthew Forkner, Esq. Deputy General Counsel GoDaddy Inc. 14455 N. Hayden Road Scottsdale, Arizona 85260 (480) 505-8800 |

Alan F. Denenberg, Esq. Sarah K. Solum, Esq. Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

CALCULATION OF REGISTRATION FEE

|

|

||||||||||||||||

| Title of each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||||||||||||

| Class A Common Stock, $0.001 par value per share |

25,300,000 | $ | 19.00 | $ | 480,700,000 | $ | 57,117.34 | |||||||||

|

|

||||||||||||||||

| (1) | Estimated pursuant to Rule 457(a) under the Securities Act of 1933, as amended. Includes an additional 3,300,000 shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Estimated solely for the purpose of calculating the registration fee. |

| (3) | The Registrant previously paid $12,880 of the registration fee in connection with the initial filing of this registration statement on June 9, 2014. |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued March 19, 2015

22,000,000 SHARES

CLASS A COMMON STOCK

GoDaddy Inc. is offering 22,000,000 shares of its Class A common stock. This is our initial public offering, and no public market exists for our Class A common stock. We anticipate that the initial public offering price will be between $17.00 and $19.00 per share.

We have been approved to list our Class A common stock on the New York Stock Exchange under the symbol “GDDY.”

GoDaddy Inc. has two classes of authorized common stock: the Class A common stock offered hereby and Class B common stock, each of which has one vote per share. Following this offering, affiliates of certain members of our board of directors will hold substantially all of our issued and outstanding Class B common stock and will control more than a majority of the combined voting power of our common stock. As a result of their ownership, they will be able to control any action requiring the general approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws and the approval of any merger or sale of substantially all of our assets. We will be a “controlled company” within the meaning of the corporate governance rules of the New York Stock Exchange. See “Organizational Structure” and “Management—Controlled Company.”

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 19.

PRICE $ A SHARE

| Price to Public |

Underwriting and |

Proceeds to |

||||||||||

| Per share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | See “Underwriters” for a description of the compensation payable to the underwriters. |

We have granted the underwriters the right to purchase up to an additional 3,300,000 shares of Class A common stock to cover over-allotments at the initial public offering price less the underwriting discount.

Certain entities affiliated with the principal beneficial holders of our Class A common stock, each an affiliate of a member of our board of directors, have indicated an interest in purchasing up to an aggregate of $50 million of shares of our Class A common stock (or an aggregate of 2,777,778 shares based on the midpoint of the estimated offering price range set forth above) offered pursuant to this prospectus directly from us at the initial public offering price. To the extent these affiliates purchase any such shares from us, the number of shares to be sold to the underwriters will accordingly be reduced. Because these indications of interest are not binding agreements or commitments to purchase, these affiliates may elect not to purchase shares in this offering. The underwriters will not receive any underwriting discounts or commissions from our sales of shares to these affiliates.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock to purchasers on , 2015.

| Morgan Stanley | J.P. Morgan | Citigroup |

| Barclays | Deutsche Bank Securities | RBC Capital Markets |

| KKR | Stifel | Piper Jaffray | Oppenheimer & Co. | JMP Securities |

, 2015

Table of Contents

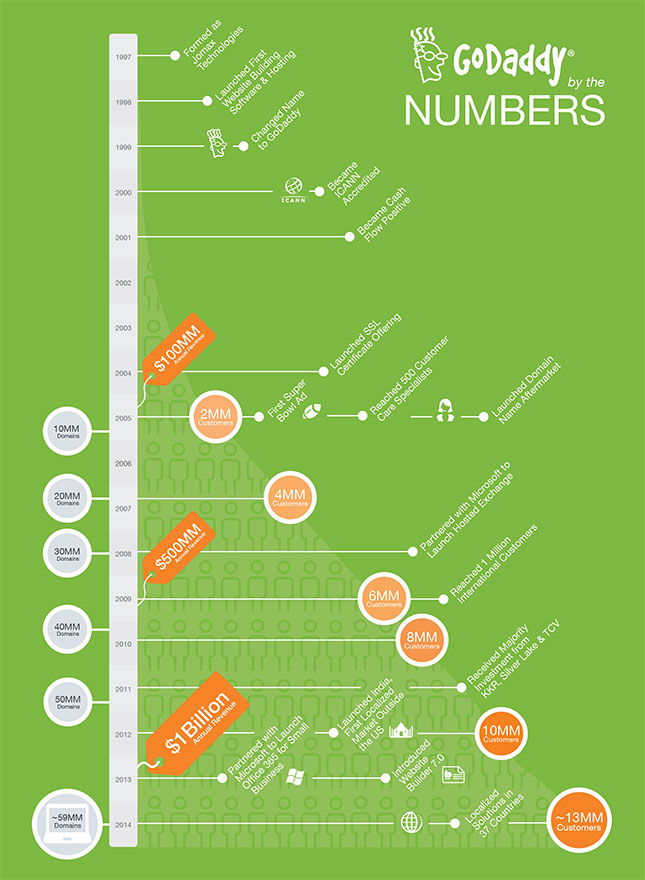

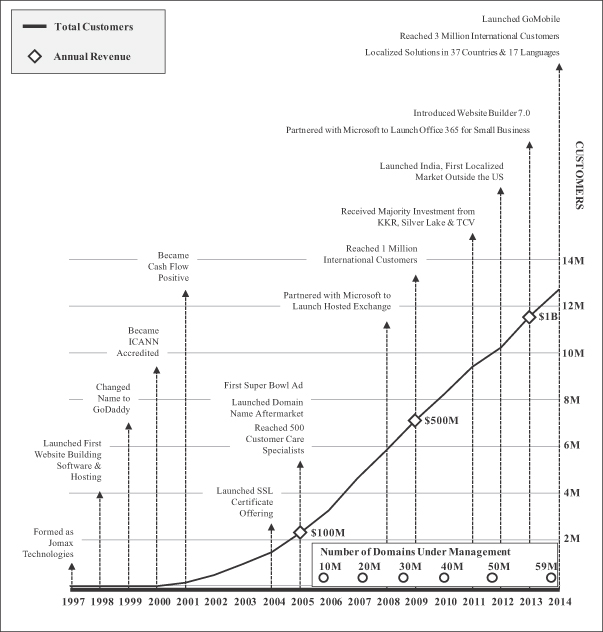

GoDaddy by the NUMBERS

1997 Formed as Jomax

Technologies

1998 Launched First Website Building Software & Hosting

1999

Changed Name to GoDaddy

2000 Became ICANN Accredited

2001 Became Cash Flow

Positive

2002

2003

2004 Launched SSL Certificate Offering $100MM Annual Revenue

2005 2MM Customers First Super

Bowl Ad Reached 500 Customer Care Specialists Launched Domain Name Aftermarket 10MM Domains

2006

2007 4MM Customers 20MM Domains

2008 6MM Customers Partnered with Microsoft to Launched Hosted

Exchange 30MM Domains

2009 Reached 1 Million International Customers $500MM Annual Revenue

2010 8MM Customers 40MM Domains

2011 Received Majority Investment from KKR, Silver Lake &

TCV 50MM Domains

2012 Launched India, First Localized Market Outside the US 10MM Customers $1 Billion Annual Revenue

2013 Partnered with Microsoft to Launch Office 365 for Small Business Introduced Website Builder 7.0

2014 Localized Solutions in 37 Countries ~13MM Customers ~58MM Domains

Table of Contents

GET STARTED CLAIM YOUR DIGITAL IDENTITY WITH A UNIQUE DOMAIN

NAME .shop .com .guru .uno GET ONLINE EASILY BUILD AN ELEGANT AND DYNAMIC WEB PRESENCE

“With GoDaddy’s help, my website is the last thing I worry

about”

Marc Rosenblum

Cruz Ale Works Santa Cruz, CA

“GoDaddy took my business to the next level”

Dave Cox

Digital Coconut

Toronto, Canada

GET CONNECTED MARKET YOUR VENTURE WITH SIMPLE YET POWERFULL CLOUD TOOLS AND SERVICES

GET HELP

24/7 CUSTOMER CARE WITH IN-REGION SUPPORT PROFESSIONALS THAT TALK WITH YOU AT YOUR LEVEL

GET FOUND MANAGE YOUR REPUTATION AND LISTINGS, ALL WHILE AMPLYFING YOUR

DISCOVERABILITY

GET PAID ACCEPT CREDIT CARDS, MANAGE YOUR BOOKS AND PREPARE FOR TAXES WITH EASE

GET SMART SINGLE PLATFORM FOR A SEAMLESS EXPERIENCE ACROSS ALL OF OUR PRODUCTS

“I’ve

got everything I could possibly need through GoDaddy”

Chelle Stafford

Recipe for Fitness

Scottsdale, AZ

FROM INSPIRATION TO SUCCESS

“GoDaddy is a global technology provider focused on helping

individuals easily start, confidently grow and successfully run their own ventures. Claiming a digital identity is the first step to operating a modern business today and GoDaddy’s leadership in domains makes us the natural onramp for extended

services over the lifecycle of a business – from brand and marketing services to pro email, bookkeeping and back office tools.”

It’s go Time GoDaddy

Table of Contents

Through and including , 2015 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

This prospectus contains statistical data, estimates and forecasts that are based on independent industry publications, other publicly available information and information based on our internal sources.

Neither we nor the underwriters have authorized anyone to provide you with information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

Unless expressly indicated or the context suggests otherwise, references in this prospectus to “GoDaddy,” the “Company,” “we,” “us” and “our” refer (i) prior to the consummation of the Reorganization Transactions described under “Organizational Structure—Reorganization Transactions,” to Desert Newco, LLC (“Desert Newco”) and its consolidated subsidiaries and (ii) after the Reorganization Transactions described under “Organizational Structure—Reorganization Transactions,” to GoDaddy Inc. and its consolidated subsidiaries, including Desert Newco. We refer to Kohlberg Kravis Roberts & Co. L.P. (together with its affiliates, “KKR”), Silver Lake Partners (together with its affiliates, “Silver Lake” and together with KKR, the “Sponsors”), Technology Crossover Ventures (together with its affiliates, “TCV”) and the other owners of Desert Newco prior to the Reorganization Transactions, collectively, as our “existing owners.”

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the following summary together with the more detailed information appearing in this prospectus, including “Risk Factors,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and our consolidated financial statements and related notes before deciding whether to purchase shares of our Class A common stock.

GODADDY INC.

Our customers have bold aspirations—the drive to be their own boss, write their own story and take a leap of faith to pursue their dreams. Launching that brewery, running that wedding planning service, organizing that fundraiser, expanding that web-design business or whatever sparks their passion. We are inspired by our customers and are dedicated to helping them turn their powerful ideas into meaningful action. Our vision is to radically shift the global economy toward small business by empowering passionate individuals to easily start, confidently grow and successfully run their own ventures.

Who We Are

Our approximately 13 million customers are people and organizations with vibrant ideas—businesses, both large and small, entrepreneurs, universities, charities and hobbyists. They are defined by their guts, grit and the determination to transform their ideas into something meaningful. They wear many hats and juggle many responsibilities, and they need to make the most of their time. Our customers need help navigating today’s dynamic Internet environment and want the benefits of the latest technology to help them compete. Since our founding in 1997, we have been a trusted partner and champion for organizations of all sizes in their quest to build successful online ventures.

We are a leading technology provider to small businesses, web design professionals and individuals, delivering simple, easy to use cloud-based products and outcome-driven, personalized Customer Care. We operate the world’s largest domain marketplace, where our customers can find that unique piece of digital real estate that perfectly matches their idea. We provide website building, hosting and security tools to help customers easily construct and protect their online presence and tackle the rapidly changing technology landscape. As our customers grow, we provide applications that help them connect to their customers, manage and grow their businesses and get found online.

Often technology companies force their customers to choose between technology and support, delivering one but not the other. At GoDaddy, we break that compromise and strive to deliver both great technology and great support to our customers. We believe engaging with our customers in a proactive, consultative way helps them knock down the technology hurdles they face. And, through the thousands of conversations we have with our customers every day, we receive valuable feedback that enables us to continually evolve our products and solutions.

Our people and unique culture have been integral to our success. We live by the same principles that enable new ventures to survive and thrive: hard work, perseverance, conviction, an obsession with customer satisfaction and a belief that no one can do it better. We take responsibility for driving successful outcomes and are accountable to our customers, which we believe has been a key factor in enabling our rapid customer and revenue growth. We have one of the most recognized brands in technology. Our tagline—“It’s Go Time”—captures the spirit and drive of our customers and links our brand to their experience.

1

Table of Contents

Our Opportunity

Our customers represent a large and diverse market which we believe is largely underserved. According to the U.S. Small Business Administration, there were approximately 28 million small businesses in 2012. Most small businesses have fewer than five employees, and most small business owners identify themselves as having little to no technology skills. According to the International Labor Organization Statistics Database, there were more than 200 million people outside the United States identified as self-employed in 2012. We believe our addressable market extends beyond small businesses and includes individuals and organizations, such as universities, charities and hobbyists.

Despite the ubiquity and importance of the Internet to individual consumers, many small businesses and organizations have remained offline given their limited resources and inadequate tools. As of January 2013, more than 50% of small businesses in the United States still did not have a website according to a study we commissioned from Beall Research. However, as proliferation of mobile devices blurs the online/offline distinction into an “always online” world, having an impactful online presence is becoming a “must have” for small businesses worldwide.

Our customers share common traits, such as tenacity and determination, yet their specific needs vary depending on the type and stage of their ventures. They range from individuals who are thinking about starting a business to established ventures that are up and running but need help attracting customers, growing their sales or expanding their operations. While our customers have differing degrees of resources and technical capabilities, they all share a universal need for simple and easy to use technology to build their online presence and grow their ventures. Although our customers’ needs change depending on where they are in their lifecycles, the most common customer needs we serve include:

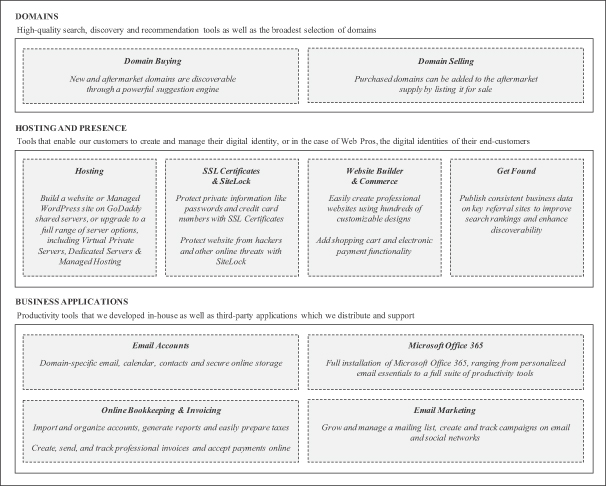

| • | Getting online and finding a great domain name. Every great idea needs a great name. Staking a claim with a domain name has become the de facto first step in establishing an idea online. Our customers want to find a name that perfectly identifies their business, hobby or passion. When inspiration strikes, we are there to provide our customers with high-quality search, discovery and recommendation tools as well as the broadest selection of domains to help them find the right name for their venture. |

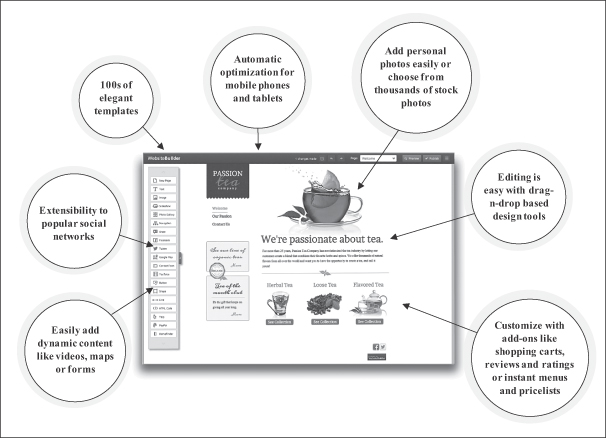

| • | Turn their domain into a dynamic online presence. Our products enable anyone to build an elegant website or online store—for both desktop and mobile—regardless of technical skill. Our products, powered by a unified cloud platform, enable our customers to get found online by extending their website and its content to where they need to be—from search engine results (e.g. Google) to social media (e.g. Facebook) to vertical marketplaces (e.g. Yelp and OpenTable)—all from one location. For more technically-sophisticated web designers, developers and customers, we provide high-performance, flexible hosting and security products that can be used with a variety of open source design tools. We design these solutions to be easy to use, effective, reliable, flexible and a great value. |

| • | Growing their business and running their operations. Our customers want to spend their time on what matters most to them—selling their products or services or helping their customers do the same. We provide our customers with productivity tools such as domain-specific email, online storage, invoicing, bookkeeping and payment solutions to help run their ventures as well as robust marketing products to attract and retain customers. In today’s online world, these activities are increasingly linked to a customer’s online presence. |

| • | Easy to use products with help from a real Customer Care specialist when needed. Our customers want products that are easy to use, and sometimes they need help from real people to set up their website, launch a new feature or try something new. We build products that are intuitive for beginners to use yet robust and feature-rich to address the needs of expert designers and power-users. Our Customer Care team consists of more than 3,400 specialists who are available 24/7/365 and are capable of providing care to customers with different levels of technical sophistication. Our specialists |

2

Table of Contents

| are measured on customer outcomes and the quality of the experience they provide, not other common measures like handle time and cost per call. We strive to provide high-quality, personalized care and deliver a distinctive experience that helps us create loyal customers who renew their subscriptions, purchase additional products and refer their family and friends to us. |

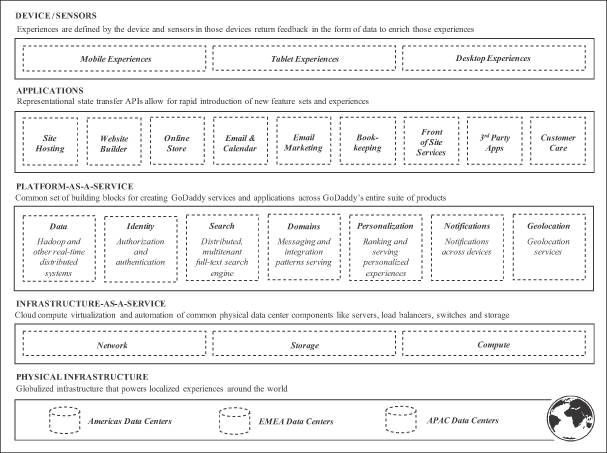

| • | Technology solutions that grow with them over time. Our customers need a simple platform and set of tools that enable their domain, website and other solutions to easily work together as their business grows and becomes more complex, and they need that platform to be simple to manage. Our API-driven technology platform is built on state-of-the-art, open source technologies like Hadoop, OpenStack and other large-scale, distributed systems. Simply put, we believe our products work well together and are more valuable and easier to use together than if our customers purchased these products individually from other companies and tried to integrate them. |

| • | Reliability, security and performance on a global technology platform. Our customers expect products that are reliable, and they want to be confident that their digital presence is secure. In 2014, we handled an average of over 11.6 billion domain name system, or DNS, queries per day and hosted approximately 9.3 million websites across more than 40,000 servers around the world. In addition, we have 35 petabytes in data storage capacity. We focus on online security, customer privacy and reliable infrastructure to address the evolving needs of our customers. |

| • | Affordable solutions. Our customers often have limited financial resources and are unable to make large, upfront investments in the latest technology. Our customers need affordable solutions that level the playing field and give them the tools to look and act like bigger businesses. We price most of our products at a few dollars per month while providing our customers with both robust features and functionality and personalized Customer Care. |

Our Competitive Advantages

We believe the following strengths provide us with competitive advantages in realizing the potential of our opportunity:

| • | We are the leading domain name marketplace, the key on-ramp in establishing a digital identity. We are the global market leader in domain name registration with approximately 59 million domains under management as of December 31, 2014, which represented approximately 21% of the world’s domains according to VeriSign’s Domain Name Industry Brief. |

| • | We combine an integrated cloud-technology platform with rich data science. At our core, we are a product and technology company. As of December 31, 2014, we had 794 engineers, 144 issued patents and 218 pending patent applications in the United States. Our investment in technology and development and our data science capabilities enable us to innovate and deliver a personalized experience to our customers. |

| • | We operate an industry-leading Customer Care team that also drives bookings. We give our customers much more than typical customer support. Our team is unique, blending personalized Customer Care with the ability to evaluate our customers’ needs, which allows us to help and advise them as well as drive incremental bookings for our business. Our Customer Care team contributed approximately 23% of our total bookings in 2014. Our customers respond to our personalized approach with high marks for customer satisfaction. Our proactive Customer Care model is a key component that helps create a long-term customer relationship which is reflected in our high retention rates. |

| • | Our brand and marketing efficiency. With a U.S. aided brand awareness score of 81% as of December 31, 2014 according to a survey we commissioned from BrandOutlook, GoDaddy ranks among the most recognized technology brands in the United States. Our tagline “It’s Go Time” reflects |

3

Table of Contents

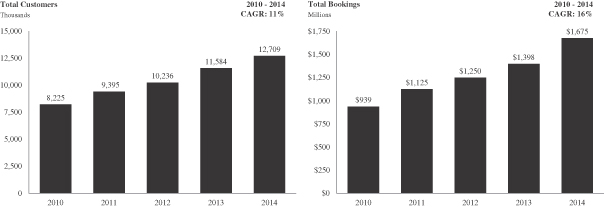

| the spirit and initiative of our customers and links our brand to their experience. Through a combination of cost-effective direct-marketing, brand advertising and customer referrals, we have increased our total customers from approximately 8 million as of December 31, 2010 to approximately 13 million as of December 31, 2014. |

| • | Our people and our culture. We are a company whose people embody the grit and determination of our customers. Our world-class engineers, scientists, designers, marketers and Customer Care specialists share a passion for technology and its ability to change our customers’ lives. We value hard work, extraordinary effort, living passionately, taking intelligent risks and working together toward successful customer outcomes. Our relentless pursuit of doing right for our customers has been a crucial ingredient to our growth. |

| • | Our financial model. We have developed a stable and predictable business model driven by efficient customer acquisition, high customer retention rates and increasing lifetime spend. In each of the five years ended December 31, 2014, our customer retention rate exceeded 85% and our retention rate for customers who had been with us for over three years was approximately 90%. We believe that the breadth and depth of our product offerings and the high quality and responsiveness of our Customer Care team build strong relationships with our customers and are key to our high level of customer retention. |

| • | Our scale. We have achieved significant scale in our business which enables us to efficiently acquire new customers, serve our existing customers and continue to invest to support our growth. |

| • | As of December 31, 2014, we had approximately 12.7 million customers, and in 2014, we added more than 1.1 million customers. |

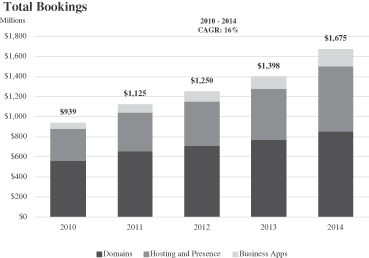

| • | In 2014, we generated $1.7 billion in total bookings up from $939 million in 2010, representing a compound annual growth rate, or CAGR, of 16%. |

| • | In 2014, we had $1.4 billion of revenue up from $741 million in 2010, representing a CAGR of 17%. |

| • | In the five years ended December 31, 2014, we invested to support our growth with $976 million and $656 million in technology and development expenses and marketing and advertising expenses, respectively. |

4

Table of Contents

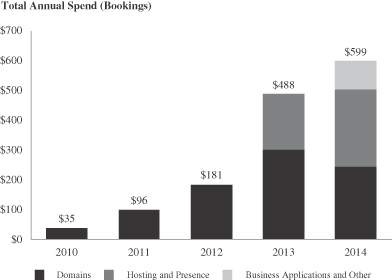

Our Key Metrics

We generate bookings and revenue from sales of product subscriptions, including domain products, hosting and presence offerings and business applications. We use total bookings as a performance measure, given that we typically collect payment at the time of sale and recognize revenue ratably over the term of our customer contracts. We believe total bookings is an indicator of the expected growth in our revenue and the operating performance of our business. We have two primary sales channels: our website and our Customer Care team. In 2014, we derived approximately 76% and 23% of our total bookings through our website and our Customer Care team, respectively. In 2014, 25% of our total bookings was attributable to customers outside of the United States.

Our Strategy

We are pursuing the following principal strategies to drive our business:

| • | Expand and innovate our product offerings. Our product innovation priorities include: |

| • | Deliver the next generation of naming. With over 280 million existing domains registered, it may be increasingly difficult for customers to find the name that best suits their needs. As a result, the Internet Corporation for Assigned Names and Numbers, or ICANN, has authorized the introduction of more than 1,300 new generic top-level domains, or gTLDs, over the next several years. These newly introduced gTLDs include names that are geared toward professions (e.g. .photography), personal interests (e.g. .guru), geographies (e.g. .london, .nyc and .vegas) and just plain fun (e.g. .ninja). Additionally, we believe there is great potential in the emerging secondary market to match buyers to sellers who already own the domains. We are continuing to invest in search, discovery and recommendation tools and transfer protocols for the combined markets of primary and secondary domains. |

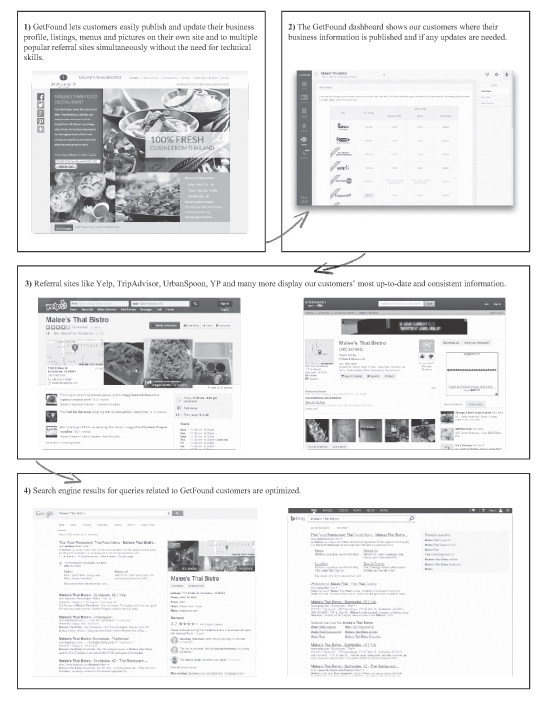

| • | Power elegant and effortless presence. We will continue to invest in tools, templates and technology to make the process of building a professional looking mobile or desktop website simple and easy. Additionally, we are investing in products that help our customers drive their customer acquisition efforts (e.g. Get Found) by managing their presence across search engines, social networks and vertical marketplaces. |

| • | Make the business of business easy. Our business applications range from domain-specific email to payment and bookkeeping tools and help our customers grow their ventures. We intend to continue investing in the breadth of our product offerings that help our customers connect with their customers and run their businesses. |

5

Table of Contents

| • | Win the Web Pros. We are investing in our end-to-end web professional offerings ranging from open application programming interfaces, or APIs, to our platform, delegation products and administrative tools as well as dedicated Customer Care resources. Our acquisition of Media Temple, Inc., or Media Temple, further expanded our web professional offerings, bolstered our dedicated Customer Care team and extended our reach into the web professional community. |

| • | Go global. As of December 31, 2014, approximately 28% of our customers were located in international markets, notably Canada, India and the United Kingdom. We began investing in the localization of our service offerings in markets outside of the United States in 2012 and, as of December 31, 2014, we offered localized products and Customer Care in 37 countries, 44 currencies and 17 languages. To support our international growth, we will continue investing to develop our local capabilities across products, marketing programs, data centers and Customer Care. |

| • | Partner up. Our flexible platform also enables us to acquire companies and quickly launch new products for our customers, including the launch of a series of partnerships ranging from Microsoft Office 365 for email to PayPal for payments. We also acquired companies and technologies in 2013 and 2014 that bolstered our product offerings. We intend to continue identifying technology acquisition targets and partnership opportunities that add value for our customers. |

| • | Make it personal. We are beginning to leverage data and insights to personalize the product and Customer Care experiences of our customers as well as tailor our solutions and marketing efforts to each of our customer groups. We are constantly seeking to improve our website, marketing programs and Customer Care to intelligently reflect where customers are in their lifecycle and identify their specific product needs. We intend to continue investing in our technology and data platforms to further enable our personalization efforts. |

| • | Wrap it with Care. We believe that our highly-rated Customer Care team is distinctive and essential to the lifetime value proposition we offer our customers. We are continuing to invest in improving the quality of our Customer Care resources as well as to introduce improved tools and processes across our expanding global footprint. |

Risks Affecting Us

Our business is subject to numerous risks and uncertainties, including those described in “Risk Factors” immediately following this prospectus summary and elsewhere in this prospectus. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. These risks include, but are not limited to, the following:

| • | our inability to attract and retain customers and increase sales to new and existing customers; |

| • | our inability to successfully develop and market products that respond promptly to the needs of our customers; |

| • | our failure to promote and maintain a strong brand; |

| • | the occurrence of service interruptions and security or privacy breaches; |

| • | system failures or capacity constraints; |

| • | evolving technologies and resulting changes in customer behavior or practices; |

| • | our failure to successfully or cost-effectively manage our marketing efforts and channels; |

| • | our failure to provide high-quality Customer Care; |

| • | significant competition; and |

| • | the business risks of international operations. |

6

Table of Contents

Summary of Offering Structure

As used in this prospectus, “existing owners” refers to the owners of Desert Newco, collectively, prior to the Reorganization Transactions, and “Continuing LLC Owners” refers to those existing owners who will retain their equity ownership in Desert Newco in the form of LLC Units after the Reorganization Transactions.

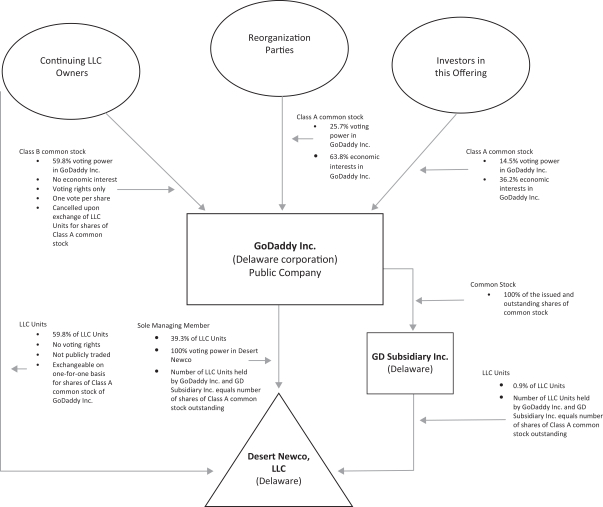

| • | This offering is being conducted through what is commonly referred to as an “Up-C” structure, which is often used by partnerships and limited liability companies when they decide to undertake an initial public offering. |

| • | The Up-C structure allows existing owners of a partnership or limited liability company to continue to realize the tax benefits associated with their ownership in an entity that is treated as a partnership for income tax purposes following an initial public offering, and provides tax benefits and associated cash flow to both the issuer corporation in the initial public offering and the existing owners of the partnership or limited liability company. |

| • | After the completion of this offering, we will operate and control the business affairs of Desert Newco as its sole managing member, conduct our business through Desert Newco and its subsidiaries and include Desert Newco in our consolidated financial statements. |

| • | Investors in this offering will purchase shares of our Class A common stock. |

| • | GoDaddy Inc. intends to use all of the proceeds from the sale of its Class A common stock in this offering to purchase, directly and indirectly through a wholly owned subsidiary, LLC Units from Desert Newco at a purchase price per unit equal to the initial public offering price per share of Class A common stock in this offering net of underwriting discounts and commissions. The aggregate number of LLC Units purchased will be equal to the number of shares of Class A common stock sold to the public in this offering. |

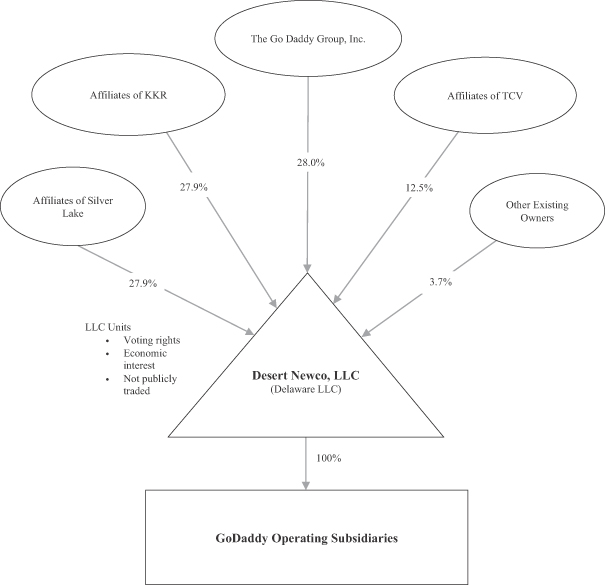

| • | Generally, the existing owners of Desert Newco, including affiliates of KKR, Silver Lake, TCV and Bob Parsons, will continue to hold units with economic, non-voting interests in Desert Newco, or LLC Units, and will be issued a number of shares of our Class B common stock equal to the number of LLC Units held by them upon completion of this offering. |

| • | As of December 31, 2014 and prior to the Reorganization Transactions, LLC Units were owned as follows: |

| • | affiliates of KKR owned 36,008,011 LLC Units, or approximately 27.9% of the outstanding LLC Units; |

| • | affiliates of Silver Lake owned 36,008,011 LLC Units, or approximately 27.9% of the outstanding LLC Units; |

| • | affiliates of TCV owned 16,148,992 LLC Units, or approximately 12.5% of the outstanding LLC Units; |

| • | affiliates of Mr. Parsons owned 36,058,011 LLC Units, or approximately 28.0% of the outstanding LLC Units; and |

| • | other existing owners owned 4,779,975 LLC Units, or approximately 3.7% of the outstanding LLC Units. |

| • | The Class A and Class B common stock will generally vote together as a single class on all matters submitted to a vote of stockholders, except as otherwise required by applicable law. |

| • | The Class B common stock will not be publicly traded and will not entitle its holders to receive dividends or distributions upon a liquidation, dissolution or winding up of GoDaddy Inc. |

7

Table of Contents

| • | Continuing LLC Owners will have the right to exchange their LLC Units, together with the corresponding shares of Class B common stock (which will be cancelled in connection with the exchange) for shares of our Class A common stock pursuant to the terms of an exchange agreement to be entered into in connection with this offering, or the Exchange Agreement. |

| • | In addition, LLC Units held by certain affiliates of KKR, Silver Lake and TCV will, prior to completion of this offering, be distributed to their affiliated corporate owners. These entities, which we refer to as the Blocker Companies, as described under “Organizational Structure,” will then merge separately with and into newly formed subsidiaries of GoDaddy Inc., and each of the surviving entities from such mergers will then merge with and into GoDaddy Inc. We refer to such transactions as the “Investor Corp Mergers.” Affiliates of the Blocker Companies, referred to as the Reorganization Parties, will receive a number of shares of our Class A common stock equal to the number of LLC Units held by the Blocker Companies prior to the Investor Corp Mergers. |

| • | As a result of these transactions and this offering (assuming certain of our affiliates do not purchase shares from us in this offering), upon completion of this offering: |

| • | Our Class A common stock will be held as follows: |

| • | 22,000,000 shares (or 25,300,000 shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock) by investors in this offering; and |

| • | 38,824,171 shares by the Reorganization Parties. |

| • | Our Class B common stock (together with the same amount of LLC Units) will be held as follows: |

| • | 90,397,599 shares and LLC Units by the Continuing LLC Owners. |

| • | The combined voting power in GoDaddy Inc. will be as follows: |

| • | 14.5% for investors in this offering (or 16.4% if the underwriters exercise in full their option to purchase additional shares of Class A common stock); |

| • | 25.7% for the Reorganization Parties (or 25.1% if the underwriters exercise in full their option to purchase additional shares of Class A common stock); and |

| • | 59.8% for the Continuing LLC Owners (or 58.5% if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

| • | Under various tax receivables agreements, or TRAs, to be entered into in connection with this offering, GoDaddy Inc. generally will retain approximately 15% of certain tax savings that are available to it under the tax rules applicable to the Up-C structure, and generally will be required to pay approximately 85% of such tax savings to the existing owners. |

| • | Our ability to make payments under the TRAs and to pay our own tax liabilities to taxing authorities will require that we receive distributions from Desert Newco. These tax distributions will include pro rata distributions to us and the other holders of LLC Units, including the Sponsors, calculated by reference to the taxable income of Desert Newco. Generally, these tax distributions will be computed based on an assumed income tax rate equal to the sum of (i) the maximum marginal federal income tax rate applicable to an individual (including, solely in the case of any current owner of The Go Daddy Group Inc., the 3.8% tax on net investment income to the extent such tax is applicable to Desert Newco income allocable to such owner) and (ii) 7%, which represents an assumed blended state income tax rate. As of December 31, 2014, this assumed income tax rate was 46.6% (which would increase to 50.4% with respect to a current owner of The Go Daddy Group Inc. if the tax on net investment income were to apply to all of its allocable share of income from Desert Newco). It is not expected that the tax on net investment income will apply to a significant portion of the income of Desert Newco allocable to current owners of The Go Daddy Group, Inc. Notwithstanding the potential differences, described above, in the assumed tax rate applicable in respect of different |

8

Table of Contents

| owners, Desert Newco will make tax distributions pro rata to LLC Unit ownership. In addition, under the tax rules, Desert Newco is required to allocate net taxable income disproportionately to its unit holders in certain circumstances. Because tax distributions will be determined based on the holder of LLC Units who is allocated the largest amount of taxable income on a per unit basis, but will be made pro rata based on ownership, Desert Newco will be required to make tax distributions that will likely exceed the actual tax liability incurred by many of the existing owners of Desert Newco in respect of their ownership of Desert Newco and that, in the aggregate, will likely exceed the amount of taxes that Desert Newco would have paid if it were taxed on its net income at the assumed rate applicable to current owners of The Go Daddy Group, Inc. |

See “Risk Factors—Risks Related to Our Company and Organizational Structure,” “Organizational Structure” and “Certain Relationships and Related Party Transactions.”

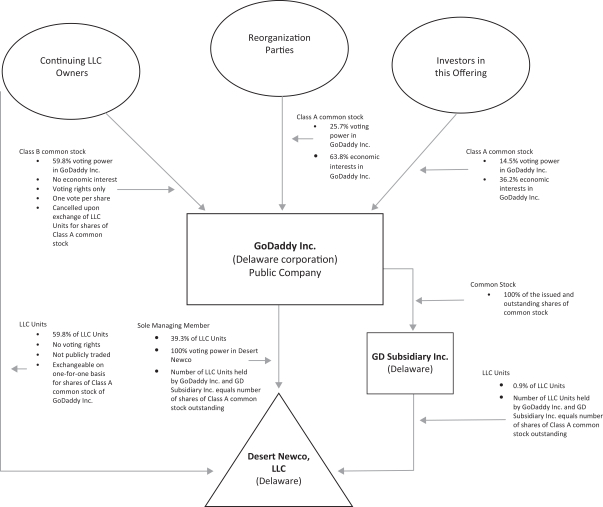

The diagram below depicts our organizational structure immediately following this offering assuming no exercise by the underwriters of their option to purchase additional shares of Class A common stock.

9

Table of Contents

Corporate Background and Information

We were incorporated in Delaware on May 28, 2014. We are a newly formed corporation, have no material assets and have not engaged in any business or other activities except in connection with the Reorganization Transactions described under “Organizational Structure.” Our principal executive offices are located at 14455 N. Hayden Road, Scottsdale, Arizona 85260 and our telephone number is (480) 505-8800. Our website is www.godaddy.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

GoDaddy, the GoDaddy design logo and other GoDaddy trademarks and service marks included in this prospectus are the property of GoDaddy Inc. This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

10

Table of Contents

THE OFFERING

| Class A common stock offered by us |

22,000,000 shares. | |

| Class A common stock to be outstanding after this offering |

60,824,171 shares (or 151,221,770 shares if all then outstanding exchangeable LLC Units were exchanged for newly-issued shares of Class A common stock on a one-for-one basis). | |

| Class B common stock to be outstanding after this offering |

90,397,599 shares. | |

| Voting power held by holders of Class A common stock after giving effect to this offering |

40.2% | |

| Voting power held by holders of Class B common stock after giving effect to this offering |

59.8% | |

| Option to purchase additional shares of Class A common stock |

We have granted the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to an additional 3,300,000 shares of Class A common stock. | |

| Use of proceeds |

We estimate that the gross proceeds from the sale of shares of our Class A common stock in this offering will be approximately $396 million (or approximately $455 million if the underwriters exercise in full their option to purchase additional shares of Class A common stock), based upon an assumed initial public offering price of $18.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus.

We intend to contribute approximately $25 million of these proceeds to GD Subsidiary Inc. and to use the remaining proceeds, and to cause GD Subsidiary Inc. to use the proceeds contributed to it, to purchase newly-issued LLC Units from Desert Newco, as described under “Organizational Structure—Reorganization Transactions.” We intend to cause Desert Newco to (i) pay the unpaid expenses of this offering payable by us, including the assumed underwriting discounts and commissions, which we estimate will be $33 million in the aggregate, (ii) make a final payment, which we estimate will be $26 million in the aggregate, to the Sponsors and TCV upon the termination of the transaction and monitoring fee agreement, in accordance with its terms, in connection with the completion of this offering, (iii) make a payment of $3 million to Bob Parsons upon the termination of the executive chairman services agreement, in accordance with its terms, in connection with the completion of this offering and (iv) make a payment of $315 million to repay the senior note (including related prepayment premiums and accrued interest). Any remaining proceeds will be used for general corporate purposes. Our intended uses for general corporate purposes may include working capital, sales and marketing activities, solution and platform development, general | |

11

Table of Contents

| and administrative matters, and capital expenditures, although we do not currently have any specific or preliminary plans with respect to the use of proceeds for such purposes. See “Use of Proceeds.” | ||

| Voting rights |

Following the Reorganization Transactions, unit holders of Desert Newco (other than GoDaddy Inc. and GD Subsidiary Inc.) will hold one share of Class B common stock for each LLC Unit held by them. The shares of Class B common stock have no economic rights.

Each share of Class A common stock and Class B common stock entitles its holder to one vote on all matters to be voted on by stockholders generally.

Holders of our Class A common stock and Class B common stock will vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law. See “Description of Capital Stock.”

When LLC Units and a corresponding number of shares of Class B common stock are exchanged for Class A common stock by a holder of LLC units pursuant to the Exchange Agreement described below, such shares of Class B common stock will be cancelled. | |

| Dividend policy |

We do not intend to pay dividends on our Class A common stock in the foreseeable future.

Immediately following this offering, GoDaddy Inc. will be a holding company, and either directly or through its wholly owned subsidiary GD Subsidiary Inc., its principal asset will be a controlling equity interest in Desert Newco. If GoDaddy Inc. decides to pay a dividend in the future, it would need to cause Desert Newco to make distributions to GoDaddy Inc. in an amount sufficient to cover such dividend. If Desert Newco makes such distributions to GoDaddy Inc., the other holders of LLC Units will be entitled to receive pro rata distributions.

Our ability to pay dividends on our Class A common stock is limited by our existing indebtedness, and may be further restricted by the terms of any future debt or preferred securities incurred or issued by us or our subsidiaries. See “Dividend Policy” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” | |

| Exchange agreement |

Prior to this offering, we will enter into the Exchange Agreement with Continuing LLC Owners so that they may, subject to the terms of the Exchange Agreement, exchange their LLC Units, together with the corresponding shares of Class B common stock, for shares of Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends, reclassifications and other similar transactions. When a LLC Unit, together with a share of our Class B common stock, is exchanged for a share of our Class A common stock, the corresponding share of our Class B common stock will be cancelled. | |

12

Table of Contents

| Tax receivable agreements |

Future exchanges of LLC Units, together with the corresponding shares of Class B common stock, for shares of our Class A common stock are expected to produce favorable tax attributes for us, as are the Investor Corp Mergers described under “Organizational Structure.” These tax attributes would not be available to us in the absence of those transactions. Upon the closing of this offering, we will be a party to five TRAs. Under these agreements, we generally expect to retain the benefit of approximately 15% of the applicable tax savings after our payment obligations below are taken into account.

Under the first of those agreements, we generally will be required to pay to Continuing LLC Owners approximately 85% of the applicable savings, if any, in income tax that we are deemed to realize (using the actual applicable U.S. federal income tax rate and an assumed combined state and local income tax rate) as a result of:

• certain tax attributes that are created as a result of the exchanges of their LLC Units, together with the corresponding shares of Class B common stock, for shares of our Class A common stock;

• any existing tax attributes associated with their LLC Units the benefit of which is allocable to us as a result of the exchanges of their LLC Units, together with the corresponding shares of Class B common stock, for shares of our Class A common stock (including the portion of Desert Newco’s existing tax basis in its assets that is allocable to the LLC Units, together with the corresponding shares of Class B common stock, that are exchanged);

• tax benefits related to imputed interest; and

• payments under such TRA.

Under the other TRAs, we generally will be required to pay to each Reorganization Party described under “Organizational Structure” approximately 85% of the amount of savings, if any, in U.S. federal, state and local income tax that we are deemed to realize (using the actual U.S. federal income tax rate and an assumed combined state and local income tax rate) as a result of:

• any existing tax attributes associated with LLC Units acquired in the applicable Investor Corp Merger the benefit of which is allocable to us as a result of such Investor Corp Merger (including the allocable share of Desert Newco’s existing tax basis in its assets);

• net operating losses available as a result of the applicable Investor Corp Merger; and

• tax benefits related to imputed interest.

For purposes of calculating the income tax savings we are deemed to realize under the TRAs, we will calculate the U.S. federal income tax savings using the actual applicable U.S. federal income tax rate and will calculate the state and local income tax savings using 5% for the assumed combined state |

13

Table of Contents

| and local tax rate, which represents an approximation of our combined state and local income tax rate, net of federal income tax benefits. See “Organizational Structure” and “Certain Relationships and Related Party Transactions—Tax Receivable Agreements.” | ||

| Controlled company |

Upon the completion of this offering, affiliates of KKR, Silver Lake, TCV and Bob Parsons, our founder, will control approximately 82.1% of the combined voting power of our outstanding common stock. As a result, we will be a “controlled company” under the New York Stock Exchange corporate governance standards. Under these standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance standards. See “Management—Controlled Company.” | |

| New York Stock Exchange trading symbol |

“GDDY” | |

| Risk factors |

See “Risk Factors” for a discussion of risks you should carefully consider before investing in our Class A common stock. | |

| Conflicts of interest |

KKR Capital Markets LLC, an underwriter of this offering, is an affiliate of KKR, the investment adviser to certain of our existing owners. Because these existing owners will own more than 10% of our outstanding capital stock, a “conflict of interest” is deemed to exist under Financial Industry Regulatory Authority, Inc., or FINRA, Rule 5121(f)(5)(B). Accordingly, this offering is being made in compliance with the requirements of Rule 5121(a)(1)(A). Pursuant to that rule, the appointment of a “qualified independent underwriter” is not required in connection with this offering as the member primarily responsible for managing the public offering does not have a conflict of interest, is not an affiliate of any member that has a conflict of interest and meets the requirements of paragraph (f)(12)(E) of Rule 5121. In accordance with Rule 5121, KKR Capital Markets LLC will not sell any of our securities to a discretionary account without receiving written approval from the account holder. | |

Certain entities affiliated with KKR, Silver Lake, TCV and Bob Parsons, each a beneficial owner of more than 5% of our capital stock and an affiliate of a member of our board of directors, have indicated an interest in purchasing up to an aggregate of $50 million of shares of our Class A common stock offered pursuant to this prospectus on a pro rata basis based on their existing ownership (assuming the midpoint of the estimated offering price range set forth on the cover page of this prospectus, 805,183, 805,183, 361,111 and 806,301 shares of our Class A common stock, respectively) directly from us at the initial public offering price. To the extent these affiliates purchase any such shares from us, the number of shares to be sold to the underwriters will accordingly be reduced. Because these indications of interest are not binding agreements or commitments to purchase, these affiliates may elect not to purchase shares in this offering. The underwriters will not receive any underwriting discounts or commissions from our sales of shares to these affiliates. Any shares purchased by such affiliates will be subject to lock-up restrictions described in the section entitled “Underwriters.”

14

Table of Contents

In this prospectus, unless otherwise indicated, the number of shares of our Class A common stock outstanding and the other information based thereon does not reflect:

| • | 26,647,614 shares of Class A common stock issuable upon the exercise of options to purchase LLC Units that were outstanding as of December 31, 2014, with a weighted-average exercise price of $8.27 per unit, that become exercisable for shares of our Class A common stock immediately following this offering; |

| • | 115,538 shares of Class A common stock issuable upon the exercise of warrants to purchase LLC Units that were outstanding as of December 31, 2014, with an exercise price of $7.44 per unit, that become exercisable for shares of our Class A common stock immediately following this offering; |

| • | 86,992 shares of Class A common stock issuable upon the vesting of restricted stock units, or RSUs, with respect to LLC Units that were outstanding as of December 31, 2014; |

| • | 6,048,871 additional shares of Class A common stock, subject to increase on an annual basis, reserved for future issuance under our 2015 Equity Incentive Plan, which will become effective in connection with the completion of this offering, plus 4,193,132 shares of Class A common stock reserved for future issuance under our 2011 Unit Incentive Plan, which shares will be added to the shares of Class A common stock to be reserved under our 2015 Equity Incentive Plan upon its effectiveness; |

| • | 2,000,000 additional shares of Class A common stock, subject to increase on an annual basis, reserved for future issuance under our 2015 Employee Stock Purchase Plan, or our ESPP, which will become effective in connection with the completion of this offering; and |

| • | 90,397,599 shares of Class A common stock issuable upon exchange of the same number of LLC Units (together with the same number of shares of our Class B common stock) that will be held by certain of our existing owners immediately following this offering. |

Except as otherwise indicated, all information in this prospectus assumes:

| • | a one-for-two reverse split of LLC Units, which became effective in March 2015; |

| • | no exercise by the underwriters of their option to purchase up to an additional 3,300,000 shares of Class A common stock from us in this offering; and |

| • | no purchase of shares of our Class A common stock by certain of our affiliates in this offering. See “Certain Relationships and Related Party Transactions—Participation in our Initial Public Offering.” |

15

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables present our summary consolidated financial data. The consolidated statements of operations data for the years ended December 31, 2012, 2013 and 2014 is derived from Desert Newco’s audited consolidated financial statements and the notes thereto included elsewhere in this prospectus. The summary consolidated financial data presented below is not necessarily indicative of the results to be expected for any future period. You should read the following summary consolidated financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes appearing elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| 2012 | 2013 | 2014 | ||||||||||

| (in thousands, except per share or per unit data) |

||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||

| Total revenue |

$ | 910,903 | $ | 1,130,845 | $ | 1,387,262 | ||||||

| Costs and operating expenses: |

||||||||||||

| Cost of revenue |

430,299 | 473,868 | 518,382 | |||||||||

| Technology and development |

175,406 | 207,941 | 254,440 | |||||||||

| Marketing and advertising |

130,123 | 145,482 | 164,671 | |||||||||

| Customer care |

132,582 | 150,932 | 190,503 | |||||||||

| General and administrative |

106,377 | 143,980 | 168,383 | |||||||||

| Depreciation and amortization |

138,620 | 140,567 | 152,759 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total costs and operating expenses |

1,113,407 | 1,262,770 | 1,449,138 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating loss |

(202,504 | ) | (131,925 | ) |

|

(61,876 |

) | |||||

| Interest expense |

(79,092 | ) | (70,978 | ) | (84,997 | ) | ||||||

| Other income (expense), net |

2,326 | 1,877 |

|

744 |

| |||||||

|

|

|

|

|

|

|

|||||||

| Loss before taxes |

(279,270 | ) | (201,026 | ) |

|

(146,129 |

) | |||||

| Benefit (provision) for taxes |

218 | 1,142 |

|

2,824 |

| |||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

$ | (279,052 | ) | $ | (199,884 | ) |

$ |

(143,305 |

) | |||

|

|

|

|

|

|

|

|||||||

| Basic and diluted net loss per share or per unit |

$ | (2.21 | ) | $ | (1.58 | ) |

$ |

(1.11 |

) | |||

|

|

|

|

|

|

|

|||||||

| Weighted-average common shares or units outstanding—basic and diluted |

126,098 | 126,663 |

|

128,567 |

| |||||||

|

|

|

|

|

|

|

|||||||

| Pro forma basic and diluted net loss per share (unaudited)(1) |

$ |

(0.82 |

) | |||||||||

|

|

|

|||||||||||

| Pro forma weighted-average common shares outstanding (unaudited)(2) |

56,303 | |||||||||||

|

|

|

|||||||||||

| (1) | Pro forma basic and diluted net loss per share have been adjusted to reflect $28,682 of lower interest expense related to the repayment of the senior note (including related prepayment premiums and accrued interest), using a portion of the proceeds of this offering as if such indebtedness had been repaid as of the beginning of the period. |

| (2) | Pro forma weighted-average shares includes approximately 17.5 million shares of common stock to be issued in this offering, representing only those shares whose proceeds will be used to repay the senior note (including related prepayment premiums and accrued interest), at an assumed initial public offering price of $18.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus. The issuance of such shares is assumed to have occurred as of the beginning of the period. |

16

Table of Contents

| As of December 31, 2014 | ||||||||

| Actual | Pro Forma As Adjusted(1)(2) |

|||||||

| (unaudited, in thousands, except per share data) |

||||||||

| Consolidated Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 138,968 | $ | 158,140 | ||||

| Prepaid domain name registry fees |

425,651 | 425,651 | ||||||

| Property and equipment, net |

220,905 | 220,905 | ||||||

| Total assets |

3,264,805 | 3,276,936 | ||||||

| Deferred revenue |

1,252,512 | 1,252,512 | ||||||

| Long-term debt, including current portion |

1,418,922 | 1,126,364 | ||||||

| Total liabilities |

2,854,414 | 2,723,717 | ||||||

| Total members’/stockholders’ equity |

410,391 | 553,219 | ||||||

| (1) | Pro forma as adjusted balance sheet data presents balance sheet data on a pro forma as adjusted basis for GoDaddy Inc. after giving effect to (i) the Reorganization Transactions described under “Organizational Structure,” (ii) the creation of certain tax assets in connection with this offering and the Reorganization Transactions, (iii) the creation of related liabilities in connection with entering into the TRAs with certain of our existing owners and (iv) the sale by us of 22.0 million shares of Class A common stock pursuant to this offering and the application of the proceeds from this offering as described in “Use of Proceeds,” based on an assumed initial public offering price of $18.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus. |

| (2) | A $1.00 increase or decrease in the assumed initial public offering price would increase or decrease, as applicable, cash and cash equivalents and total equity by approximately $20.7 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting assumed underwriting discounts and commissions. Similarly, an increase or decrease of one million shares of Class A common stock sold in this offering by us would increase or decrease, as applicable, cash and cash equivalents and total equity by approximately $16.9 million, based on an assumed initial public offering price of $18.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting assumed underwriting discounts and commissions. |

Key Metrics

We monitor the following key metrics to help us evaluate growth trends, establish budgets and assess operational performance. In addition to our results determined in accordance with U.S. generally accepted accounting principles, or GAAP, we believe the following non-GAAP and operational measures are useful in evaluating our business:

| Year Ended December 31, | ||||||||||||

| 2012 | 2013 | 2014 | ||||||||||

| (unaudited; in thousands, except ARPU) | ||||||||||||

| Total bookings |

$ | 1,249,565 | $ | 1,397,936 | $ | 1,675,198 | ||||||

| Total customers at period end |

10,236 | 11,584 | 12,709 | |||||||||

| Average revenue per user (ARPU) for the trailing 12 months ended |

$ | 93 | $ | 104 | $ | 114 | ||||||

| Adjusted EBITDA |

$ | 173,875 | $ | 196,323 | $ | 271,497 | ||||||

Total bookings. Total bookings represents gross cash receipts from the sale of products to customers in a given period before giving effect to certain adjustments, primarily net refunds granted in the period. Total bookings provides valuable insight into the sales of our products and the performance of our business given that we typically collect payment at the time of sale and recognize revenue ratably over the term of our customer contracts. We report total bookings without giving effect to refunds granted in the period. Refunds often occur in periods different from the period of sale for reasons unrelated to the marketing efforts leading to the initial sale. Accordingly, by excluding net refunds, we believe total bookings reflects the effectiveness of our sales efforts in a given period.

17

Table of Contents

Total customers. We define total customers as those that, as of the end of a period, have an active subscription. A single user may be counted as a customer more than once if the user maintains active subscriptions in multiple accounts. Total customers is an indicator of the scale of our business and is a critical factor in our ability to increase our revenue base.

Average revenue per user (ARPU). We calculate average revenue per user, or ARPU, as total revenue during the preceding 12 month period divided by the average of the number of total customers at the beginning and end of the period. ARPU provides insight into our ability to sell additional products to customers, though the impact to date has been muted due to our continued growth in total customers. The impact of purchase accounting adjustments makes comparisons of ARPU among historical periods less meaningful; however, in future periods, as the effects of purchase accounting decrease, ARPU will become a more meaningful metric. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Impact of Purchase Accounting.”

Adjusted EBITDA. Adjusted EBITDA is a measure of our performance that aligns our bookings and operating expenditures, and is the primary metric management uses to evaluate the profitability of our business. We calculate adjusted EBITDA as net loss excluding depreciation and amortization, interest expense (net), provision (benefit) for income taxes, equity-based compensation expense, change in deferred revenue, change in prepaid and accrued registry costs, acquisition and sponsor-related costs and a non-recurring reserve for sales taxes. Acquisition and sponsor-related costs include (i) retention and acquisition-specific employee costs, (ii) acquisition-related professional fees, (iii) adjustments to the fair value of contingent consideration, (iv) costs incurred under the transaction and monitoring fee agreement with the Sponsors and TCV, which will cease following a final payment in connection with the completion of this offering, (v) costs incurred under the executive chairman services agreement, which will cease following a payment in connection with the completion of this offering and (vi) costs associated with consulting services provided by KKR Capstone. As a result of our business model, we typically collect payment at the time of sale and generally recognize revenue ratably over the term of our customer contracts. At the time of a domain sale, we also incur the obligation for the domain name registry fees associated with the customer contract. As a result, sales to customers increase our deferred revenue and prepaid and accrued registry costs. We therefore adjust net loss for changes in deferred revenue and changes in the associated prepaid and accrued registry costs to facilitate a better comparison of our performance from period to period.

See “Selected Consolidated Financial Data—Key Metrics” for more information and reconciliations of our key metrics to the most directly comparable financial measures calculated and presented in accordance with GAAP.

18

Table of Contents

This offering and an investment in our Class A common stock involve a high degree of risk. You should consider carefully the risks described below and all other information contained in this prospectus, before you decide to buy our Class A common stock. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our Class A common stock would likely decline and you might lose all or part of your investment.

Risks Related to Our Business

If we are unable to attract and retain customers and increase sales to new and existing customers, our business and operating results would be harmed.

Our success depends on our ability to attract and retain customers and increase sales to new and existing customers. We derive a substantial portion of our revenue from domains and our hosting and presence products. The rate at which new and existing customers purchase and renew subscriptions to our products depends on a number of factors, including those outside of our control. Although our total customers and revenue have grown rapidly in recent periods, we cannot be assured that we will achieve similar growth rates in future periods. In future periods, our total customers and revenue could decline or grow more slowly than we expect. Our sales could fluctuate or decline as a result of lower demand for domain names, websites and related products, declines in our customers’ level of satisfaction with our products and our Customer Care, the timeliness and success of product enhancements and introductions by us and those of our competitors, the pricing offered by us and our competitors, the frequency and severity of any system outages, breaches and technological change. Our revenue has grown historically due in large part to sustained customer growth rates and strong renewal sales of subscriptions to our domain name registration and hosting and presence products. Our future success depends in part on maintaining strong renewal sales. Our costs associated with renewal sales are substantially lower than costs associated with generating revenue from new customers and costs associated with generating sales of additional products to existing customers. Therefore, a reduction in renewals, even if offset by an increase in other revenue, would reduce our operating margins in the near term. Any failure by us to continue to attract new customers or maintain strong renewal sales could have a material adverse effect on our business, growth prospects and operating results. In addition, we also offer business application products such as personalized email accounts and recently expanded our product offerings to include a wider array of these products. If we are unable to increase sales of these additional products to new and existing customers, our growth prospects may be harmed.

If we do not successfully develop and market products that anticipate or respond promptly to the needs of our customers, our business and operating results may suffer.

The markets in which we compete are characterized by constant change and innovation, and we expect them to continue to evolve rapidly. Our historical success has been based on our ability to identify and anticipate customer needs and design products that provide small businesses and ventures with the tools they need to create, manage and augment their digital identity. To the extent we are not able to continue to identify challenges faced by small businesses and ventures and provide products that respond in a timely and effective manner to their evolving needs, our business, operating results and financial condition will be adversely affected.

The process of developing new technology is complex and uncertain. If we fail to accurately predict customers’ changing needs or emerging technological trends, or if we fail to achieve the benefits expected from our investments in technology (including investments in our internal development efforts, acquisitions or partner programs), our business could be harmed. We must continue to commit significant resources to develop our technology in order to maintain our competitive position, and these commitments will be made without knowing whether such investments will result in products the market will accept. Our new products or product enhancements could fail to attain meaningful market acceptance for many reasons, including:

| • | delays in releasing new products or product enhancements, or those of companies we may acquire, to the market; |

19

Table of Contents

| • | our failure to accurately predict market demand or customer preferences; |

| • | defects, errors or failures in product design or performance; |

| • | negative publicity about product performance or effectiveness; |

| • | introduction of competing products (or the anticipation thereof) by other market participants; |

| • | poor business conditions for our customers or poor general macroeconomic conditions; |

| • | the perceived value of our products or product enhancements relative to their cost; and |

| • | changing regulatory requirements adversely affecting the products we offer. |

There is no assurance that we will successfully identify new opportunities, develop and bring new products to market on a timely basis, or that products and technologies developed by others will not render our products or technologies obsolete or noncompetitive, any of which could adversely affect our business and operating results. If our new products or enhancements do not achieve adequate acceptance in the market, or if our new products do not result in increased sales or subscriptions, our competitive position will be impaired, our anticipated revenue growth may not be achieved and the negative impact on our operating results may be particularly acute because of the upfront technology and development, marketing and advertising and other expenses we may incur in connection with the new product or enhancement.

Our brand is integral to our success. If we fail to effectively protect or promote our brand, our business and competitive position may be harmed.

Effectively protecting and maintaining awareness of our brand is important to our success, particularly as we seek to attract new customers globally. We have invested, and expect to continue to invest, substantial resources to increase our brand awareness, both generally and in specific geographies and to specific customer groups, such as web professionals, or Web Pros. There can be no assurance that our brand development strategies will enhance the recognition of our brand or lead to increased sales. Furthermore, our international branding efforts may prove unsuccessful due to language barriers and cultural differences. If our efforts to effectively protect and promote our brand are not successful, our operating results may be adversely affected. In addition, even if our brand recognition and loyalty increases, our revenue may not increase at a level that is commensurate with our marketing spend.

Our brand campaigns have historically included high-visibility events, such as the Super Bowl, and have involved celebrity endorsements or provocative themes. Some of our past advertisements have been controversial. During 2013 and 2014, we began re-orienting our brand position to focus more specifically on how we help individuals start, grow and run their own ventures. For example, one of our 2014 Super Bowl commercials featured one of our customers leaving her job as an operating engineer to pursue her dream of opening her own business. There can be no assurance that we will succeed in repositioning our brand, or that by doing so we will grow our total customers, increase our revenue or maintain our current high level of brand recognition. If we fail in these branding efforts, our business and operating results could be adversely affected.