Attached files

| file | filename |

|---|---|

| EX-5.1 - Edge Data Solutions, Inc. | ex51.txt |

| EX-23.2 - Edge Data Solutions, Inc. | ex232.txt |

As filed with the Securities and Exchange Commission on March 18, 2015 Registration No.333-198435

==============================================================================

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SAFE LANE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

COLORADO (State or jurisdiction of incorporation or organization) | 3714 (Primary Standard Industrial Classification Code Number) | 46-3892319 (I.R.S. Employer Identification No.) |

1624 Market Street, Suite #202, Denver, Colorado 80202/ Phone (949) 825-6512

(Address and telephone number of principal executive offices)

Paul D. Dickman, Chief Executive Officer, President and Chairman of the Board

1624 Market Street, Suite #202, Denver, Colorado 80202/ Phone (949) 825-6512

(Name, address and telephone number of agent for service)

COPIES OF ALL COMMUNICATIONS TO:

Michael A. Littman, Attorney at Law

7609 Ralston Road, Arvada, CO, 80002 phone 303-422-8127 / fax 303-431-1567

Approximate date of commencement of proposed sale to the public: As soon as possible after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | [___] |

| Accelerated filer | [___] |

Non-accelerated filer (Do not check if a smaller reporting company) | [___] |

| Smaller reporting company | [_X_] |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered | Amount To Be Registered | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee |

|

|

|

|

|

Common Stock for Distribution under Plan of Liquidation | 22,768,273 | $0.01 | $227,682.73 | $29.33 (2) |

|

|

|

|

|

Common Stock for resale from the Distributees of the Plan of Liquidation | 22,768,273 | $0.01 | $227,682.73 | $29.33 (2) |

(1)Estimated solely for the purpose of computing the registration fee pursuant to Rule 457(a) under the Securities Act.

(2) Previously paid with the prior registration statement filed on August 28, 2014.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

ii

(Subject to Completion)

PROSPECTUS

SAFE LANE SYSTEMS, INC.

22,768,273 shares of common stock underlying conversion rights of Class “B” Non-Voting for distribution to Distributees under the Plan of Liquidation, upon conversion of Class “B” Preferred Convertible Non-Voting Stock

and 22,768,273 shares of common stock for resale by Distributees of the Plan of Liquidation

We are registering:

(a)22,768,273 common shares to be distributed to Distributees under the Plan of Liquidation, upon conversion of Class “B” Preferred Convertible Non-Voting Stock.

(b)22,768,273 shares of common stock for resale by Distributees of the Plan of Liquidation

We will not receive any proceeds from sales of shares by selling shareholders. As used herein "Plan of Liquidation" refers only to liquidation of Class "B" Preferred Convertible Stock to the shareholders of Superior Traffic Controls, Inc. through Registration and Distribution.

Pursuant to the Master I.P. Agreement, we agreed to issue up to 22,768,273 shares of our Class “B” Preferred Convertible Non-Voting Stock on a one-for-one basis convertible up to 22,768,273 shares of our common stock to a Trustee for Superior Traffic Control, Inc.’s (“STC”) shareholders with the understanding and agreement that we would file an S-1 Registration Statement for a) the distribution of the common shares, pro-rata, to the shareholders of STC, and b) for resale of such converted common shares issued to STC shareholders in public market or private transactions. The terms of our Class “B” Preferred Convertible Non-Voting Stock and the terms of the Trust provide that there can be no conversion of our Class “B” Preferred Convertible Non-Voting Stock to common stock unless and until a Registration Statement on Form S-1 under the Securities Act of 1933 has been made effective.

Our selling shareholders plan to sell common shares at $0.01, until such time as a market develops for any of the securities and thereafter at such prices as the market may dictate from time to time. There is no market price for the stock and our pricing is arbitrary with no relation to market value, liquidation value, earnings or dividends. The price was arbitrarily set at $0.01 per share, based on a speculative concept unsupported by any other comparables. We have set the initial fixed price as follows:

Title | Price Per Share |

Common Stock | $0.01 |

At any time after a market develops, our security holders may sell their securities in a market, at market prices or at any price in privately negotiated transactions.

This offering involves a high degree of risk; see "RISK FACTORS" beginning on page 6 to read about factors you should consider before buying shares of the common stock.

These securities have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”) or any state or provincial securities commission, nor has the SEC or any state or provincial securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

We intend to obtain a quotation for our stock in the future, but cannot make any assurances that we will be approved for such quotation by FINRA. An application has not yet been filed, nor is there any selected broker/dealer to file for quotation on our behalf as of yet. Our common stock is presently not quoted on any national securities exchange or the NASDAQ Stock Market or any other venue.

This offering will be on a delayed and continuous basis only after the distribution upon conversion of Class “B” Preferred Convertible Non-Voting stock to common and for sales of selling shareholders (distributes) shares. The selling shareholders are not paying any of the offering expenses and we will not receive any of the proceeds from the sale of the shares by the selling shareholders. (See “Description of Securities – Shares”).

1

The information in this prospectus is not complete and may be changed. We may not sell these securities until the date that the registration statement relating to these securities, which has been filed with the Securities and Exchange Commission, becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this Prospectus is March 18, 2015.

2

TABLE OF CONTENTS

PART I - INFORMATION REQUIRED IN PROSPECTUS |

| Page No. |

ITEM 1. | Front of Registration Statement and Outside Front Cover Page of Prospectus |

|

ITEM 2. | Prospectus Cover Page |

|

ITEM 3. | Prospectus Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges | 4 |

ITEM 4. | Use of Proceeds | 19 |

ITEM 5. | Determination of Offering Price | 20 |

ITEM 6. | Dilution | 20 |

ITEM 7. | Selling Security Holders | 21 |

ITEM 8. | Plan of Distribution | 26 |

ITEM 9. | Description of Securities | 26 |

ITEM 10. | Interest of Named Experts and Counsel | 27 |

ITEM 11. | Information with Respect to the Registrant | 27 |

| a. Description of Business | 27 |

| b. Description of Property | 41 |

| c. Legal Proceedings | 41 |

| d. Market for Common Equity and Related Stockholder Matters | 41 |

| e. Financial Statements | 42 |

| f. Selected Financial Data | 43 |

| g. Supplementary Financial Information | 43 |

| h. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 43 |

| i. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | 49 |

| j. Quantitative and Qualitative Disclosures About Market Risk | 49 |

| k. Directors and Executive Officers | 50 |

| l. Executive and Directors Compensation | 52 |

| m. Security Ownership of Certain Beneficial Owners and Management | 55 |

| n. Certain Relationships, Related Transactions, Promoters And Control Persons | 56 |

ITEM 11 A. | Material Changes | 57 |

ITEM 12. | Incorporation of Certain Information by Reference | 58 |

ITEM 12 A. | Disclosure of Commission Position on Indemnification for Securities Act Liabilities | 58 |

PART II – INFORMATION NOT REQUIRED IN PROSPECTUS |

|

|

ITEM 13. | Other Expenses of Issuance and Distribution | 59 |

ITEM 14. | Indemnification of Directors and Officers | 59 |

ITEM 15. | Recent Sales of Unregistered Securities | 60 |

ITEM 16. | Exhibits and Financial Statement Schedules | 61 |

ITEM 17. | Undertakings | 62 |

| Signatures | 63 |

3

ITEM 3. PROSPECTUS SUMMARY INFORMATION, RISK FACTORS AND RATIO OF EARNINGS TO FIXED CHARGES

Our Company

Safe Lane Systems, Inc. (“Safe Lane Systems”, “Safe Lane Systems,” “We,” “Us,” “Our,” or “Company” hereafter), was incorporated in the State of Colorado on September 10, 2013. We were formed to engage in the sale of traffic safety equipment. We may also engage in any other business permitted by law, as designated by the Board of Directors of our Company.

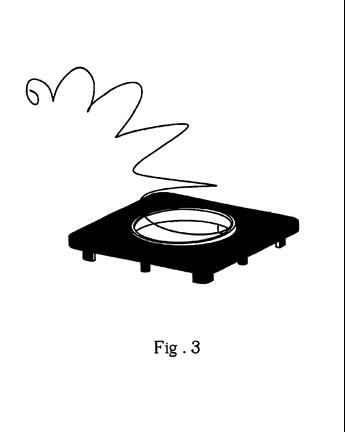

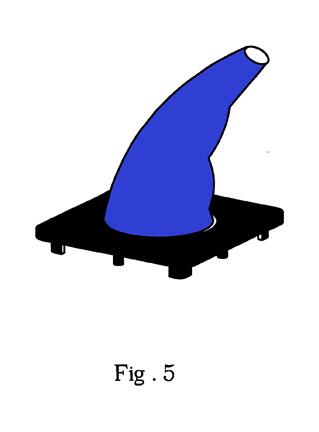

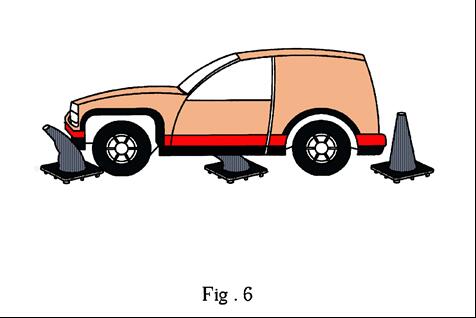

We have licensed and sub-licensed I.P. for a spring traffic cone dispenser designed to protect highway workers, first responders to vehicle collisions and highway incidents, law enforcement personnel, towing operators, private and public utility workers, as well as pedestrians and motorists. Our flagship product, The Kone General Automatic Safety Cone Deployment System, is the world’s first and only portable safety cone dispensing system. Safe D-Ploy Spring Cones are patented MUTCD (Manual on Uniform Traffic Control Devices) compliant highway safety cones. We must commence manufacture and sales by January 1, 2016. We cannot give any assurance that we will be able to comply with this requirement of the license.

We have begun initial minimal operations and are currently without revenue. We have one contract employee at the present time, our CEO. During the year ended December 31, 2013, the executive officers contributed their services and had not begun to be compensated. Upon formation, the founder, our CEO and Chairman, Paul D. Dickman, purchased 2,000,000 shares of the Company’s common stock as a price of $0.0005, per share for a total price of $1,000 and in addition he was granted 10,000,000 ($0.0001 par value) shares of Class “A” Super Majority Voting stock for organizational services.

We have engaged a marketing consultant to develop a marketing and sales plan for both the spring traffic cone and our automatic traffic cone dispenser. The consultant’s final marketing plan should be received and approved by the end of the year. We expect to incur an additional $15,000 in fees prior to the plan being finalized. We currently have sufficient capital to cover the expected expense.

We have engaged and are currently under agreement with a globally recognized manufacturer’s representation firm, The Johander Company of Minneapolis, to help guide us into retail markets, build a manufacturer’s representative network, and drive retail sales of our Spring Cone and Safe-D-ploy product accessories. Johander was founded in 1987 by Bill Johander and remains a family business operated by his daughter Jennifer who joined the company after a successful career at Target Stores. We will pursue under a ‘pay for success’ commission structure the following existing Johander retail relationships including; Target and Target.com, Bluestem Brands (Fingerhut), Meijer, Menard’s, Home Depot, Lowe’s, Advance Auto, Sam’s Club and Gander Mountain, Walmart, Costco, Dick's Sporting Goods, Sports Authority, Academy Amazon, NAPA, Auto Zone, O'Reillys, Pep Boys, AC Delco, ULine, Grainger, Gempler's, Toys R Us, and Streicher's. Through this relationship we expect to have a new manufacture in place by the end of the year at no additional costs until such time as manufacturing begins.

We plan to begin marketing our products in early 2015 based upon the recommendation of our marketing consultants. We expect we will need to raise an additional $1, 250,000 in equity financing prior to implementing our full marketing and sales plan. We owe a note payable of $210,000, which will need to be paid within the year 2015, as we have rewritten the note due March 31, 2015 to a due date of December 31, 2015. If we are unable to pay this note or refinance, the Company may have to cease operations .

We are in the developmental stage of our business. Since our incorporation September 2013, we have been engaged in securing both exclusive and non-exclusive license agreements for our key products, designing a marketing plan, and lining up suppliers and manufacturers for production.

During the 2015 fiscal year, we intend to focus our efforts on our product launch and marketing of the Kone General Automatic Safety Cone Deployment System. We must commence manufacture and sales by January 1, 2016 or our licenses will be in default.

4

Our Auditors have issued a going concern opinion and the reasons noted for issuing the opinion are our lack of revenues or business and very modest capital.

As of December 31, 2014, we had approximately $88,000 in cash on hand. Our current monthly cash burn rate is approximately $12,500, and it is expected that burn rate will continue until significant additional capital is raised and our marketing plan is executed. Once additional capital is raised to support our marketing efforts, we expect to increase our monthly general and administrative cash burn rate to approximately $25,000 per month until revenue is generated to offset this expense. Based upon our current burn rate, we will use all current cash within six months’ time. However, we will need to raise an additional approximately $1,250,000 to execute our plan of operations.

Implications of Being an Emerging Growth Company

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

•A requirement to have only two years of audited financial statements and only two years of related MD&A;

•Exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002;

•Reduced disclosure about the emerging growth company’s executive compensation arrangements; and

•No non-binding advisory votes on executive compensation or golden parachute arrangements.

We have already taken advantage of these reduced reporting burdens in this prospectus, which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)2(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. We have elected to use the extended transition period provided above and therefore our financial statements may not be comparable to companies that comply with public company effective dates.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

For more details regarding this exemption, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies.”

Factors that make this offering highly speculative or risky are:

There is no market for any securities;

We have no revenues or sales;

We are start up company;

We have minimal experience in the traffic safety business as a company;

We are undercapitalized.

5

Our principal executive offices are located at 1624 Market Street, Suite #202, Denver, Colorado 80202 and our telephone number is (949) 825-6512. We maintain a website at www.safelanes.com, such website is not incorporated into or a part of this filing.

Summary of Financial Information

The Summary Financial Information presented below is at December 31, 2014.

| As at December 31, 2014 |

Total Assets | $90,504 |

Current Liabilities | $212,764 |

Shareholders’ Deficit | $(122,260) |

| From September 10, 2013 (inception) to December 31, 2014 |

Revenues to December 31, 2013 and December 31, 2014 | $0 |

Net Loss at December 31, 2013 | $ (1,000) |

Net Loss at the year ended December 31, 2014 | $(125,538) |

As of December 31, 2013, the accumulated deficit was $(1,000). As of December 31, 2014, the accumulated deficit was $(126,538). We anticipate that we will operate in a deficit position and continue to sustain net losses for the foreseeable future.

The implied aggregate value of all common stock intended to be outstanding after the conversion, based on price of $0.01 and the 22,768,273 shares to be issued is $227,683.

The Offering

22,768,273 shares of common stock underlying conversion rights of Class “B” Preferred Convertible Non-Voting Stock for distribution to Distributees under the Plan of Liquidation

and

22,768,273 shares of common stock for resale by Distributees of the Plan of Liquidation

We are registering:

(a)22,768,273 common shares to be distributed to Distributees under Plan of Liquidation, upon conversion of Class “B” Preferred Convertible Non-Voting Stock

(b)22,768,273 shares of common stock for resale by Distributees of the Plan of Liquidation

We will not receive any proceeds from sales of shares by selling shareholders.

Pursuant to the Master I.P. Agreement, we agreed to issue up to 22,768,273 shares of our Class “B” Preferred Convertible Non-Voting Stock on a one-for-one basis convertible to 22,768,273 shares of our common stock to a Trustee for Superior Traffic Control, Inc.’s (“STC”) shareholders with the understanding and agreement that we would file an S-1 Registration Statement for a) the distribution of the common shares, pro-rata, to the shareholders of STC, and b) for resale of such converted common shares issued to STC shareholders in public market or private transactions. The terms of our Class “B” Preferred Convertible Non-Voting Stock and the terms of the Trust provide that there can be no conversion of our Class “B” Preferred Convertible Non-Voting Stock to common stock unless and until a Registration Statement on Form S-1 under the Securities Act of 1933 has been made effective.

Our common stock, only, will be transferable immediately after the closing of this offering. (See “Description of Securities”)

Common shares outstanding before this offering | 2,000,000 |

Maximum common shares being offered by our existing selling shareholders | 22,768,273 |

Maximum common shares outstanding after this offering | 24,768,273 |

6

We are authorized to issue 450,000,000 shares of common stock and 50,000,000 shares of preferred stock. Our current shareholders, officers and directors collectively own 2,000,000 shares of restricted common stock and 10,000,000 shares of Class “A” Preferred Super Majority Voting Stock as of December 31, 2014. These shares were issued in the following amounts and at the following prices:

Number of Shares | Consideration | Price Per Share |

2,000,000 common Stock | $1,000 | $0.0005 |

10,000,000 Class ”A” Preferred Super Majority Voting Stock | Founder Services | $0.0001 |

22,768,273 Class “B” Preferred Convertible Non-Voting Stock | Licenses | $0.0001 |

There is currently no public market for our shares as it is presently not traded on any market or securities exchange.

RISK FACTORS RELATED TO OUR COMPANY

Our securities, as offered hereby, are highly speculative and should be purchased only by persons who can afford to lose their entire investment in us. Each prospective investor should carefully consider the following risk factors, as well as all other information set forth elsewhere in this prospectus, before purchasing any of the shares of our common stock.

We have a lack of revenue history and investors cannot view our past performance since we are a start-up company.

We were formed on September 10, 2013 for the purpose of engaging in any lawful business and adopted a plan to engage in the traffic safety business. We have had no revenues since inception. We are not profitable and the business effort is considered to be in an early development stage. We must be regarded as a new or development venture with all of the unforeseen costs, expenses, problems, risks and difficulties to which such ventures are subject. We should be considered highly speculative.

We have limited working capital and limited cash funds.

Our capital needs are projected to be $1,250,000 during the next 12 months of operations. Such funds are not committed, at this time in any amount. Within the next six months additional financing requirements are projected to be $90,000. We have a note payable agreement in place with our current lender that will provide this funding need.

We will not receive any proceeds from the resale of the shares registered hereby. We are registering 22,768,273 shares of common stock on behalf of our shareholders for distribution and resale.

We have limited funds, and such funds may not be adequate to carry out the business plan. We have limited funds (as of January 30, 2015, we had $67,357 in cash on hand), and such funds may not be adequate to carry out the business plan. The ultimate success of our Company may depend upon our ability to raise additional capital. We have investigated the availability, source, or terms that might govern the acquisition of additional capital. If additional capital is needed, there is no assurance that funds will be available from any source or, if available, that they can be obtained on terms acceptable to us. If not available, our operations will be limited to those that can be financed with our modest capital.

The ultimate success of our Company may depend upon our ability to raise additional capital. Safe Lane Systems has investigated the availability, source, or terms that might govern the acquisition of additional capital. If additional capital is needed, there is no assurance that funds will be available from any source or, if available, that they can be obtained on terms acceptable to Safe Lane Systems. If not available, Safe Lane System’s operations will be limited to those that can be financed with its modest capital.

7

Our officers and directors may have conflicts of interest which may not be resolved favorably to us.

Certain conflicts of interest may exist between us and our officers and directors. Our Officers and Directors have other business interests to which they devote their attention and may be expected to continue to do so although management time should be devoted to our business. As a result, conflicts of interest may arise that can be resolved only through exercise of such judgment as is consistent with fiduciary duties to us. See “Directors and Executive Officers” (page 40), and “Conflicts of Interest" (page 42). Our officer is spending part-time in this business – up to 10 hours per week.

We may in the future issue more shares which could dilute current stockholders.

We may issue further shares as consideration for the cash or assets or services out of our authorized but unissued common stock that would, upon issuance, represent more equity of our Company. The result of such an issuance would be those new stockholders and management would control our Company, and persons unknown could replace our management at this time. Such an occurrence could result in a greatly reduced percentage of ownership of our Company by our current shareholders and distributes and their purchasers in the event of resale, which could present significant risks to investors.

We will incur significant costs to be a public company to ensure compliance with U.S.. corporate governance and accounting requirements and we may not be able to absorb such costs.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect these costs to be approximately $50,000-$75,000 per year. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

We are an “emerging growth company,” and any decision on our part to comply only with certain reduced disclosure requirements applicable to “emerging growth companies” could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we expect and fully intend to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)2(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt in to the extended transition period for complying with the revised accounting standards. We have elected to rely on these exemptions and reduced disclosure requirements applicable to “emerging growth companies” and expect to continue to do so.

8

We may not be able to meet the filing and internal control reporting requirements imposed by the SEC which may result in a decline in the price of our common shares and an inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No. 33-8934 on June 26, 2008, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm auditing a company’s financial statements may have to also attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting. We may be required to include a report of management on its internal control over financial reporting. The internal control report must include a statement

Of management’s responsibility for establishing and maintaining adequate internal control over its financial reporting;

Of management’s assessment of the effectiveness of its internal control over financial reporting as of year end; and

Of the framework used by management to evaluate the effectiveness of our internal control over financial reporting.

Furthermore, our independent registered public accounting firm may be required to file its attestation on whether it believes that we have maintained, in all material respects, effective internal control over financial reporting.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market price of our Common Stock and our ability to secure additional financing as needed.

The JOBS Act allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies.

Since, we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act, this election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Our common shares will not initially be registered under the exchange act and as a result we will have limited reporting duties which could make our common stock less attractive to investors.

Our common shares are not registered under the Exchange Act. As a result, we will not be subject to the federal proxy rules and our directors, executive officers and 10% beneficial holders will not be subject to Section 16 of the Exchange Act. In additional our reporting obligations under Section 15(d) of the Exchange Act may be suspended automatically if we have fewer than 300 shareholders of record on the first day of our fiscal year. Our common shares are not registered under the Securities Exchange Act of 1934, as amended, and we do not intend to register our common shares under the Exchange Act for the foreseeable future, provided that, we will register our common shares under the Exchange Act if we have, after the last day of our fiscal year, more than either (i) 2000 persons; or (ii) 500 shareholders of record who are not accredited investors, in accordance with Section 12(g) of the Exchange Act. As a

9

result, although, upon the effectiveness of the registration statement of which this prospectus forms a part, we will be required to file annual, quarterly, and current reports pursuant to Section 15(d) of the Exchange Act, as long as our common shares are not registered under the Exchange Act, we will not be subject to Section 14 of the Exchange Act, which, among other things, prohibits companies that have securities registered under the Exchange Act from soliciting proxies or consents from shareholders without furnishing to shareholders and filing with the Securities and Exchange Commission a proxy statement and form of proxy complying with the proxy rules. In addition, so long as our common shares are not registered under the Exchange Act, our directors and executive officers and beneficial holders of 10% or more of our outstanding common shares will not be subject to Section 16 of the Exchange Act. Section 16(a) of the Exchange Act requires executive officers and directs, and persons who beneficially own more than 10% of a registered class of equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of common shares and other equity securities, on Forms 3, 4 and 5, respectively. Such information about our directors, executive officers, and beneficial holders will only be available through this (and any subsequent) registration statement, and periodic reports we file thereunder. Furthermore, so long as our common shares are not registered under the Exchange Act, our obligation to file reports under Section 15(d) of the Exchange Act will be automatically suspended if, on the first day of any fiscal year (other than a fiscal year in which a registration statement under the Securities Act has gone effective), we have fewer than 300 shareholders of record. This suspension is automatic and does not require any filing with the SEC. In such an event, we may cease providing periodic reports and current or periodic information, including operational and financial information, may not be available with respect to our results of operations.

Because our common stock is not registered under the Securities Exchange Act of 1934, as amended, our reporting obligations under section 15(d) of the Securities Exchange Act of 1934, as amended, may be suspended automatically if we have fewer than 300 shareholders of record on the first day of our fiscal year.

Our common stock is not registered under the Exchange Act, and we do not intend to register our common stock under the Exchange Act for the foreseeable future (provided that, we will register our common stock under the Exchange Act if we have, after the last day of our fiscal year, $10,000,000 in total assets and either more than 2,000 shareholders of record or 500 shareholders of record who are not accredited investors (as such term is defined by the Securities and Exchange Commission), in accordance with Section 12(g) of the Exchange Act). As long as our common stock is not registered under the Exchange Act, our obligation to file reports under Section 15(d) of the Exchange Act will be automatically suspended if, on the first day of any fiscal year (other than a fiscal year in which a registration statement under the Securities Act has gone effective), we have fewer than 300 shareholders of record. This suspension is automatic and does not require any filing with the SEC. In such an event, we may cease providing periodic reports and current or periodic information, including operational and financial information, may not be available with respect to our results of operations.

Our articles of incorporation provide for indemnification of officers and directors at our expense and limit their liability which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our By-Laws include provisions that eliminate the personal liability of the directors of the Company for monetary damages to the fullest extent possible under the laws of the State of Colorado or other applicable law. These provisions eliminate the liability of directors to the Company and its stockholders for monetary damages arising out of any violation of a director of his fiduciary duty of due care. Under Colorado law, however, such provisions do not eliminate the personal liability of a director for (i) breach of the director’s duty of loyalty, (ii) acts or omissions not in good faith or involving intentional misconduct or knowing violation of law, (iii) payment of dividends or repurchases of stock other than from lawfully available funds, or (iv) any transaction from which the director derived an improper benefit. These provisions do not affect a director’s liabilities under the federal securities laws or the recovery of damages by third parties.

10

Reporting requirements under the Exchange Act and compliance with the Sarbanes-Oxley Act of 2002, including establishing and maintaining acceptable internal controls over financial reporting, are costly and may increase substantially.

The rules and regulations of the SEC require a public company to prepare and file periodic reports under the Exchange Act, which will require that the Company engage legal, accounting, auditing and other professional services. The engagement of such services is costly. Additionally, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) requires, among other things, that we design, implement and maintain adequate internal controls and procedures over financial reporting. The costs of complying with the Sarbanes-Oxley Act and the limited technically qualified personnel we have may make it difficult for us to design, implement and maintain adequate internal controls over financial reporting. In the event that we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls, we may not be able to produce reliable financial reports or report fraud, which may harm our overall financial condition and result in loss of investor confidence and a decline in our share price.

As a public company, we will be subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act of 2010 and other applicable securities rules and regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations will nonetheless increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires, among other things, that we file annual, quarterly, and current reports with respect to our business and operating results.

We are not diversified and we will be dependent on only one business.

Because of the limited financial resources that we have, it is unlikely that we will be able to diversify our operations. Our probable inability to diversify our activities into more than one area will subject us to economic fluctuations within the traffic safety industry and therefore increase the risks associated with our operations due to lack of diversification.

We will depend upon management but we will have limited participation of management (which could be detrimental to the business.).

We currently have two individuals who are serving as our officers and directors for up to 10 hours per week each on a part-time basis. Our directors are also acting as our officers. Our directors and officers are, or may become, in their individual capacities, officers, directors, controlling shareholder and/or partners of other entities engaged in a variety of businesses. We will be heavily dependent upon our officers skills, talents, and abilities, as well as several consultants to us, to implement our business plan, and may, from time to time, find that the inability of the officers, directors and consultants to devote their full-time attention to our business results in a delay in progress toward implementing our business plan. Once we achieve more funding – other consultants may be employed on a part-time basis under a contract to be determined. See "Management." Because investors will not be able to manage our business, they should critically assess all of the information concerning our officers and directors.

We may be unable to obtain and retain appropriate patent and trademark protection of our products and services.

We may seek to protect our intellectual property rights (if any) through patents, trademarks, trade names, trade secrets and a variety of other measures. However, these measures may be inadequate to protect our intellectual property (to the extent we have any) or other proprietary information.

Trade secrets may become known by third parties. Our trade secrets or proprietary technology may become known or be independently developed by competitors.

Rights to patents applications and trade secrets may be invalidated. Disputes may arise with third parties over the ownership of our intellectual property rights. Patents may be invalidated, circumvented or challenged, and the rights granted under the patent application that provide us with a competitive advantage may be nullified.

Problems with future patent applications. Pending or future patent applications may not be approved, or the scope of the granted patent may be less than the coverage sought.

11

Infringement claims by third parties. Infringement, invalidity, right to use or ownership claims by third parties or claims for indemnification may be asserted by third parties in the future. If any claims or actions are asserted against us, we can attempt to obtain a license for that third party's intellectual property rights. However, the third party may not provide a license under reasonable terms, or may not provide us with a license at all.

Litigation may be required to protect any intellectual property rights. Litigation may be necessary to protect our intellectual property rights and trade secrets, to determine the validity of and scope of the rights of third parties or to defend against claims of infringement or invalidity by third parties. Such litigation could be expensive, would divert resources and management's time from our sales and marketing efforts, and could have a materially adverse effect on our business, financial condition and results of operations.

We can give no assurance of success or profitability to our stockholders.

There is no assurance that we will ever operate profitably. There is no assurance that we will generate revenues or profits, or that the market price of our common stock will be increased thereby.

We have authorized and designated a Class “A” Preferred Super Majority Voting Stock, which having voting rights superior to our common stock.

Class “A” Preferred Super Majority Voting Stock (the “Class “A” Preferred Stock”) of which 10,000,000 shares of preferred stock have been authorized for the class and the shares have a deemed purchase price at $0.0001 per share. At the date of filing this Registration Statement, all 10,000,000 Class “A” Preferred shares have been issued to our CEO, Paul D. Dickman. The holder of the Class “A” Preferred Stock has the ability to vote equivalent of 60% of our common stock in any vote of the common stockholders. The Class “A” Preferred Stock would have a voting equivalent of 60%, if issued at this time.

We have authorized designated and issued a Class “B” Preferred Convertible Non-Voting Stock, which have no voting right until converted to common.

Class “B” Preferred Convertible Non-Voting Stock (the “Class ”B” Preferred Stock”) of which 30,000,000 shares of preferred stock have been authorized for the class and the shares have a deemed purchase price at $.0001 per share. The Class “B” Preferred Stock are to have voting rights equivalent to their conversion rate, one (1) share of Class “B” Preferred Stock equals one (1) share of common stock. At this time, 22,768,273 shares of the Class ”B” Preferred Stock have been issued.

Holders of the Class “B” Preferred Stock shall have no right to vote on any matter with holders of Common Stock and may not vote on any action, except an action which might change the rights and privileges of Class “B” Preferred Convertible Non-Voting Stock.

We have agreed to indemnification of officers and directors as is provided by Colorado Statutes.

Colorado Statutes provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s promise to repay us therefore if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we will be unable to recoup.

Our directors’ liability to us and stockholders is limited

Colorado Statutes exclude personal liability of our directors and our stockholders for monetary damages for breach of fiduciary duty except in certain specified circumstances. Accordingly, we will have a much more limited right of action against our directors that otherwise would be the case. This provision does not affect the liability of any director under federal or applicable state securities laws.

12

Burden to investors.

The financial risk of our activities will be borne primarily by existing shareholders, who will have contributed a significantly greater portion of our capital, than prior investors.

We will incur expenses in connection with SEC Filing Requirements and we may not be able to meet such costs, which could jeopardize our filing status with the SEC. Those costs are estimated to be $50,000 to 75,000 per year additional.

We will incur legal and accounting expenses as a result of being a public company in order to meet the filing requirements under the Securities and Exchange Act of 1934 (“34 Act”). We will see an increase in legal and accounting expenses as a result of such requirements. These costs can increase significantly if we are subject to comment from the SEC on its filings and/or is required to file supplemental filings for transactions and activities. If we are not compliant in meeting the filing requirements of the SEC, we could lose its status as a 1934 Act Company, which could compromise its ability to raise funds and to ever achieve trading status on the OTCBB.

RISK FACTORS RELATING TO OUR BUSINESS

Any person or entity contemplating an investment in the securities offered hereby should be aware of the high risks involved and the hazards inherent therein. Specifically, the investor should consider, among others, the following risks:

We have a limited operating history. If we fail to generate revenues and profits in the future, we may exhaust our capital resources and be forced to discontinue operations.

We were organized in 2013 and have a limited operating history. The potential for us to generate profits depends on many factors, including the following:

our ability to secure adequate funding to facilitate the anticipated business plan and goals of the Company;

the size and timing of future client contracts, milestone achievement, service delivery and client acceptance;

success in developing, maintaining and enhancing strategic relationships with potential business partners;

actions by competitors towards the development and marketing of technologies, products and services that will compete directly with ours;

the costs of maintaining and expanding operations; and

our ability to attract and retain a qualified work force.

We cannot assure you that we will achieve any of the foregoing factors or realize profitability in the immediate future or at any time.

We expect operating results to fluctuate significantly in the future as a result of a variety of factors, many of which are outside of our control. Factors that may adversely affect our operating results include, among others, demand of our products, the budgeting cycles of potential customers, lack of enforcement of or changes in governmental regulations or laws, the amount and timing of capital expenditures and other costs relating to the expansion of our operations, the introduction of new or enhanced products and services by us or our competitors, the timing and number of new hires, changes in our pricing policy or those of our competitors, the mix of products, increases in the cost of raw materials, technical difficulties, incurrence of costs relating to product design changes, general economic conditions, and market acceptance of our products. As a strategic response to changes in the competitive environment, we may from time to time make certain pricing, service or marketing decisions or business combinations that could have a material adverse effect on our business, results of operations and financial condition. Any seasonality is likely to cause quarterly fluctuations in our operating results, and there can be no assurance that such patterns will not have

13

a material adverse effect on our business, results of operations and financial condition. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall.

Because of the products and services we offer and will offer, we may become subject to significant product liability exposure.

We will be dependent on third party suppliers for various components used in our current technology and products. Some of the components that we procure from third party suppliers include engineering, manufacturing, and sales, some of which are the sole source of the components. The cost, quality and availability of components are essential to the successful production and sale of our products. Any significant disruption in the source of these components could seriously impact production of our products and seriously harm our ability to market these products.

If we are unable to compete effectively with existing or new competitors, our resulting loss of competitive position could result in price reductions, fewer customer orders, reduced margins and loss of market share.

There are numerous competitors in the market places in which we will be marketing our products and we expect competition to increase in the future. Many of our competitors may have significantly greater financial, technical and marketing resources than we do. These competitors may be able to respond more rapidly to new or emerging technologies or changes in customer requirements. They may also be able to devote greater resources to the development, promotion and sale of their products. Increased competition could result in price reductions, fewer customer orders, reduced margins and loss of market share. Our failure to compete successfully against current or future competitors could seriously harm our business, financial condition and results of operations.

We may not be able to manage future growth effectively, which could adversely affect our operations and financial performance.

The ability to manage and operate our business as we execute our development and growth strategy will require effective planning. Significant rapid growth could strain management and internal resources and cause other problems that could adversely affect our financial performance. We expect that our efforts to grow will place a significant strain on personnel, management systems, infrastructure and other resources. Our ability to manage future growth effectively will also require us to successfully attract, train, motivate, retain and manage new employees and continue to update and improve our operational, financial and management controls and procedures. Further, our ability to successfully offer our products and implement our business plan in a rapidly evolving market requires an effective planning and management process. We plan to increase the scope of our operations domestically and our anticipated growth in future operations will continue to place, a significant strain on our management systems and resources. If we do not manage our growth effectively, our operations could be adversely affected, resulting in slower growth and a failure to achieve or sustain profitability.

Changing Traffic Safety Standards could impact our product sales efforts.

The federal and state standards for traffic management are subject to ongoing changes and such changes may have an impact in the future on our products that cannot be determined.

We intend to rely on outside consultants, manufacturers and suppliers.

We intend to rely on the experience of outside consultants, manufacturers and suppliers. In the event that one or more of these consultants, manufacturers, or suppliers terminates with us, or becomes unavailable, suitable replacements will need to be obtained and there is no assurance that such replacement could be obtained under conditions favorable to us.

14

We may rely on strategic relationships to promote our product.

As a recently formed company, we intend to rely on strategic partnerships with outside companies and individuals to promote our products, thus making the future success of our business particularly contingent on the efforts of other parties. Our products are designed to serve several markets. An important part of our strategy is to promote acceptance of our products through product alliances with distributors who we feel could assist us with our promotion strategies. Our dependence on outside distributors, however, raises potential risks with respect to the future success of our business. Our success is dependent on the successful completion and commercial deployment of our products and on the future commitment of our distributors to our products and technology.

We will rely on suppliers, manufacturers and others.

We intend to rely on key vendors and suppliers to provide high quality products and services on a consistent basis. We must use outside facilities and contract manufacturers to produce and prove products which include manufacturing facilities, warehouses, shippers, testing companies and other critical vendor partners. Our future success will be contingent on the efforts and performance of these relationships. We may have difficulty in locating or using alternative resources should supply problems arise with any one supplier. An interruption or reduction in the source of supply of any of the component materials, or an unanticipated increase in vendor prices, could materially affect our operating results and damage customer relationships as well as our business.

We determined an arbitrary offering price.

The offering price of our shares under this Registration Statement was arbitrarily determined and does not necessarily bear any relationship to the assets, book value, earnings (loss) or our net worth and should not be considered to be an indication of the actual value of our Company.

Our common shareholders will not have any control of our Company.

The common stock registered hereby will represent a majority of our outstanding stock after its conversion but will remain limited in voting power due to the Class “A” Super Majority Voting Preferred stock held by management. Accordingly, it could be difficult for the investors hereunder to effectuate control over our affairs and it should be assumed that our officers, directors and Class “A” Super Majority Voting Preferred shareholders will be able, by virtue of their voting control and stock holdings, to control our affairs and policies permanently as they hold 60% voting power at all times while Class "A" is issued and outstanding. As a result, these stockholders will possess dominant influence over us, giving them the ability, among other things, to elect a majority of our Board of Directors and approve significant corporate transactions. Such share ownership and control may also have the effect of delaying or preventing a change in our control, impeding a merger, consolidation, takeover or other business combination involving us or discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us which could have a material adverse effect on the market price of our common stock.

Our shares will have limited transferability. Absence of Public Market: Non-Transferability and Non-Liquidity of Investment.

The shares distributed or resold pursuant to this Registration while registered for resale, may have extremely limited liquidity because our common shares are not approved for trading or quotation, and if we become approved brokerage houses have imposed severe restrictions upon penny stock trading. Until that time, there will be no market for the shares registered hereunder. An investor may be unable to liquidate an investment in the common stock and should be prepared to bear the economic risk of an investment in our stock for an indefinite period. In addition an investor should be able to withstand the total loss of their or its investment.

Our Management has broad discretion in Budget usage.

We expect to use our limited capital for general corporate purposes, including working funds, capital expenditures, promotional and marketing expenditures and to fund anticipated operating losses. In addition, we may use an unspecified portion of any future capital raised to acquire or invest in complementary products, IP and technologies if a favorable opportunity to make such an acquisition or investment arises. In the ordinary course of business, we

15

expect to evaluate potential acquisitions of products and technologies, which complement our business model. In addition, from time to time, we will evaluate the usage of cash to determine whether the then existing uses and apportionment should be changed. Accordingly, our management will have broad discretion in the application of our budgets. The failure of our management to apply funds effectively could have a material adverse effect on our business, results of operations and financial condition.

Our success depends upon compliance with our Master I.P. License Agreement.

In the second quarter of 2014, we entered into a Master I.P. License Agreement relating to the safety cone dispenser and flexible marker device with Superior Traffic Controls, Inc., a California corporation who is the owner of certain intellectual property relating to each of the aforesaid devices. Therefore, this agreement is exclusive as it relates to the safety cone dispensing device and non-exclusive as it relates to the flexible marker device. In the event that we do not meet certain conditions in the Master I.P. License Agreement, we could lose our right to manufacture and distribute the cone dispenser. Our success will depend significantly upon this license agreement and the proprietary technologies covered by said license agreement.

Our CEO has an incentive to generate revenues, but which may reduce our profitability.

Paul Dickman, our CEO is entitled to an 8% administrative fee on our total billings. This fee is substantial enough that it might be the difference between profitability on revenues and unprofitability, which could negatively impact our profitability, and therefore or investors.

Forward looking statements and associate risks.

This Prospectus contains certain forward-looking statements, including among others: (i) the projected time for commencing operations; (ii) anticipated trends in our financial condition and results of operations; (iii) our business strategy for its plan of operations; and (iv) our ability to distinguish itself from its current and future competitors. These forward-looking statements are based largely on our current expectations and are subject to a number of risks and uncertainties. Actual results could differ materially from these forward looking statements. In addition to other risks described elsewhere in this “Risk Factors” discussion, important factors to consider in evaluating such forward-looking statements include (i) changes to external competitive market factors or in our internal budgeting process which might impact trends in our results of operations; (ii) anticipated working capital or other cash requirements; (iii) changes in our business strategy or an inability to execute our strategy due to unanticipated changes in the industry in which we will operate; and (iv) various competitive factors that may prevent us form competing successfully in the marketplace. In light of these risks and uncertainties, many of which are described in greater detail elsewhere in this “Risk Factors” discussion, there can be no assurance that the events predicted in forward-looking statements contained in this Prospectus will in fact transpire.

Our continuation as a going concern is dependent on additional financing, as our operations are capital intensive and future capital expenditures are expected to be substantial.

Our future success is dependent on our ability to attract additional capital and ultimately, upon our ability to develop future profitable operations. There can be no assurance that we will be successful in obtaining such financing, or that it will attain positive cash flow from operations. Management believes that actions future actions to be taken to revise our operating and financial requirements may provide the opportunity for us to continue as a going concern.

RISK FACTORS RELATED TO OUR STOCK

No public market exists for our common stock at this time, and there is no assurance of a future market.

There is no public market for our common stock, and no assurance can be given that a market will develop or that a shareholder ever will be able to liquidate his investment without considerable delay, if at all. If a market should develop, the price may be highly volatile. Factors such as these discussed in the “Risk Factors” section may have a significant impact upon the market price of the shares offered hereby. Due to the low price of our securities, many brokerage firms may not be willing to effect transactions in our securities. Even if a purchaser finds a broker willing to effect a transaction in our shares, the combination of brokerage commissions, state transfer taxes, if any, and any

16

other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of our shares as collateral for any loans.

Our stock, if ever listed, will in all likelihood be thinly traded and as a result you may be unable to sell at or near ask prices or at all if you need to liquidate your shares.

The shares of our common stock, if ever listed, may be thinly-traded. We are a small company which is relatively unknown to stock analysts, stock brokers, institutional stockholders and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven, early stage company such as ours or purchase or recommend the purchase of any of our securities until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our securities is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on Securities price. We cannot give you any assurance that a broader or more active public trading market for our common Securities will develop or be sustained, or that any trading levels will be sustained. Due to these conditions, we can give stockholders no assurance that they will be able to sell their shares at or near ask prices or at all if they need money or otherwise desire to liquidate their securities.

Our common stock may be volatile, which substantially increases the risk that you may not be able to sell your securities at or above the price that you may pay for the security.

If we are able to obtain an exchange listing of our common stock in the future, because of the possible price volatility, you may not be able to sell your shares of common stock when you desire to do so. The inability to sell your securities in a rapidly declining market may substantially increase your risk of loss because of such illiquidity and because the price for our securities may suffer greater declines because of our price volatility.

The price of our common stock that will prevail in the market after this offering may be higher or lower than the price you may pay. Certain factors, some of which are beyond our control, that may cause our share price to fluctuate significantly include, but are not limited to the following:

Variations in our quarterly operating results;

Loss of a key relationship or failure to complete significant transactions;

Additions or departures of key personnel; and

Fluctuations in stock market price and volume.

Additionally, in recent years the stock market in general, has experienced extreme price and volume fluctuations. In some cases, these fluctuations are unrelated or disproportionate to the operating performance of the underlying company. These market and industry factors may materially and adversely affect our stock price, regardless of our operating performance. In the past, class action litigation often has been brought against companies following periods of volatility in the market price of those companies common stock. If we become involved in this type of litigation in the future, it could result in substantial costs and diversion of management attention and resources, which could have a further negative effect on your investment in our stock.

If we cannot pay the note payable for $ 250,000 it could subject us to a lawsuit and potential judgment

We owe a note for $250,000 which is due December 31, 2015 and if we do not pay the note, the holder could sue on the note and obtain a judgment and levy and execute on our assets, which could cause our business to fail.

The regulation of penny stocks by the SEC and FINRA will discourage the tradability of our securities.

We are a “penny stock” company, as our stock price is less than $5.00 per share. Even if we were able to obtain an exchange listing for our stock, we cannot make an assurance that we will be able to maintain a stock price greater than $5.00 per share and if the share price was to fall to such prices, that we wouldn’t be subject to the “Penny Stocks” rules. None of our securities currently trade in any market and, if ever available for trading, will be subject to a Securities and Exchange Commission rule that imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited stockholders. For purposes of the rule,

17

the phrase “accredited stockholders” means, in general terms, institutions with assets in excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000 (or that, when combined with a spouse’s income, exceeds $300,000). For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Effectively, this discourages broker-dealers from executing trades in penny stocks. Very few brokers now affect such trades. Consequently, the rule will affect the ability of purchasers in this offering to sell their securities in any market that might develop therefore because it imposes additional regulatory burdens on penny stock transactions.

In addition, the Securities and Exchange Commission has adopted a number of rules to regulate “penny stocks". Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities and Exchange Act of 1934, as amended. Because our securities constitute “penny stocks” within the meaning of the rules, the rules would apply to us and to our securities. The rules will further affect the ability of owners of shares to sell our securities in any market that might develop for them because it imposes additional regulatory burdens on penny stock transactions.

Investors should be aware that, according to Securities and Exchange Commission, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) “boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

Investors in penny stocks have limited remedies in the event of violations of penny stock rules. While the courts are always available to seek remedies for fraud against us, most, if not all, brokerages require their customers to sign mandatory arbitration agreements in conjunctions with opening trading accounts. Such arbitration may be through an independent arbiter. Stockholders may file a complaint with FINRA against the broker allegedly at fault, and FINRA may be the arbiter, under FINRA rules. Arbitration rules generally limit discovery and provide more expedient adjudication, but also provide limited remedies in damages usually only the actual economic loss in the account. Stockholders should understand that if a fraud case is filed an against a company in the courts it may be vigorously defended and may take years and great legal expenses and costs to pursue, which may not be economically feasible for small stockholders.

Without arbitration agreements, specific legal remedies available to stockholders of penny stocks include the following:

If a penny stock is sold to the investor in violation of the requirements listed above, or other federal or states securities laws, the investor may be able to cancel the purchase and receive a refund of the investment.

If a penny stock is sold to the investor in a fraudulent manner, the investor may be able to sue the persons and firms that committed the fraud for damages.

The fact that we are a penny stock company will cause many brokers to refuse to handle transactions in the stocks, and will discourage trading activity and volume, or result in wide disparities between bid and ask prices. These may cause stockholders significant illiquidity of the stock at a price at which they may wish to sell or in the opportunity to complete a sale. Stockholders will have no effective legal remedies for these illiquidity issues.

18

We will pay no foreseeable dividends in the future.

We have not paid dividends on our common stock and do not ever anticipate paying such dividends in the foreseeable future. Stockholders whose investment criteria are dependent on dividends should not invest in our common stock.

Rule 144 sales in the future may have a depressive effect on our stock price.

All of the outstanding shares of common stock are held by our present officers, and directors, stockholders as "restricted securities" within the meaning of Rule 144 under the Securities Act of 1933, as amended. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. Rule 144 provides in essence that a person who has held restricted securities for six months may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1.0% of a company's outstanding common stock or the average weekly trading volume during the four calendar weeks prior to the sale. There is no limit on the amount of restricted securities that may be sold by a non-affiliate after the owner has held the restricted securities for a period of six months. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to subsequent registration of shares of common stock of present stockholders, may have a depressive effect upon the price of the common stock in any market that may develop.

Our stockholders may suffer future dilution due to issuances of shares for various considerations in the future.

There may be substantial dilution to our stockholders as a result of future decisions of the Board to issue shares without shareholder approval for cash, services, or acquisitions.

Any sales of our common stock, if in significant amounts, are likely to depress the market price of our securities.

Assuming all of the shares of common stock under this Registration Statement are sold by the selling security holders registered hereby, we would have 22,768,273 shares that are freely tradable, and in the market float.

Unrestricted sales of 22,768,273 shares of stock by our selling stockholders could have a significant negative impact on our share price, and the market for our shares.

Any new potential investors in our stock may suffer a disproportionate risk and there may be immediate dilution of existing investor’s investments if the price is significantly lower than other investors basis.

Our present shareholders have acquired their securities at a cost significantly less than that which the investors purchasing after this Registration may pay for their stock in the market. Therefore, any new potential investors will bear significant risk of loss.

We have determined an arbitrary offering price of our shares.

The price of our shares has been determined arbitrarily by us with no established criteria of value. There is no direct relationship between these prices and our assets, book value, lack of earnings, shareholder’s equity, or any other recognized standard of value of our business. The offering price should not be considered an indication of the actual value of the shares or securities.

ITEM 4. USE OF PROCEEDS

We will not receive any proceeds from the sale of the shares being registered on behalf of our selling shareholders.

We may raise additional funds through a private placement of shares of our common stock. At this time there is no committed source for such funds and we cannot give any assurances of being able to raise such funds. We can assure that we will require additional funds to carry out our business plan. The availability and terms of any future financing will depend on market and other conditions.

19