Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Global Eagle Entertainment Inc. | v404846_8k.htm |

Exhibit 99.1

INVESTOR & ANALYST DAY MARCH 2015

We make forward - looking statements in this presentation within the meaning of the Securities Litigation Reform Act of 1995 . These forward - looking statements relate to expectations or forecasts for future events, including without limitation our earnings, revenues, expenses or other future financial or business performance or strategies, or the impact of legal or regulatory matters on our business, results of operations or financial condition . These statements may be preceded by, followed by or include the words “may,” “might,” “will,” “will likely result,” “should,” “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,” “target” or similar expressions . These forward - looking statements are based on information available to us as of the date they were made, and should not be relied upon as representing our views as of any subsequent date . These forward - looking statements are subject to a number of risks and uncertainties, including without limitation those risks and uncertainties described in our most recent annual report on Form 10 - K and subsequently filed reports on Form 10 - Q . As a result, our actual results or performance may be materially different from those expressed or implied by these forward - looking statements . We do not undertake any obligation to update forward - looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws . SAFE HARBOR STATEMENT 2

3 GLOBAL EAGLE ANALYST DAY AGENDA Time Description Time Description 8:30 am Registration & Breakfast 10:40 am Q&A/Break 9:00 am Dave Davis, CEO Strategic Outlook 11:00 am Customer/Partner Panel Boris Bubresko, Norwegian Air Shuttle Alfy Veretto , Virgin America Asi Tricha, SES 9:20 am Wale Adepoju, CCO Market Opportunity and Future Outlook 11:45 am Box Lunch 9:35 am Amir Samnani, SVP Content Services 12:00 pm Mike Zemetra, CFO Financial Overview 9:50 am Alexis Steinman, SVP Robin Cole, VP Digital Media Solutions 12:15 pm Q&A and Closing Remarks 10:10 am Aditya Chatterjee, CTO Connectivity Systems and Ops Data 12:45 pm Conclusion

STRATEGIC OUTLOOK 4

The leading global, full - service platform providing Content to ~ 150 airlines and Connectivity to 640+ aircraft (1) GEE has 750+ employees with headquarters in Los Angeles and offices worldwide Targeting the connected aircraft with integrated product suite - Content Services - Connectivity Systems - Digital Media Solutions - Operations Data Solutions 2014 Revenue : $388 MM 2014 Adjusted EBITDA*: $31 MM Cash: $275 MM (1) GEE: WORLD LEADER IN INFLIGHT CONTENT, CONNECTIVITY, DIGITAL MEDIA AND OPERATIONS DATA SOLUTIONS 5 Content Connectivity Digital Media (1) As of March 2015 Operations Data * See Appendix A and Appendix B for the definition of Adjusted EBITDA and a reconciliation to Net Income

6 MARKET LEADERSHIP DRIVING VALUE CREATION Business Model • Integrated product offering to optimize the passenger experience • Scalability and critical mass • Leading technology and strong industry partnerships • Expanding into adjacent markets Opportunity • $10+ Billion market • 13,000 aircraft growing at 1,500 per year, increasing penetration of onboard IFE, higher capacity systems • Increasing investment in passenger experience • Creating new revenue streams Market Position • No. 1 Provider: Inflight Satellite Connectivity (Ku - band) • No. 1 Provider: Inflight Entertainment • No. 1 Provider: Inflight Digital Advertising/Sponsorship • Fully integrated across all 3 lines of business Value Creation • Growing customer relationships with new products and services • Entering new markets • Organic • M&A • Expanding margins • Rapidly growing EBITDA * See Appendix A and Appendix B for the definition of Adjusted EBITDA and a reconciliation to Net Income

7 GEE’S FOUR AREAS OF FOCUS Operations Data Solutions Capturing, processing and delivering aircraft operational, administrative and crew - related data and analytics Curation, delivery and monetization of content, connectivity and transaction services on mobile devices Creation, acquisition, processing and delivery of video, audio and interactive entertainment to embedded inflight entertainment systems Design, operation and support of the platforms and networks that provide connectivity for aircraft Content Services Connectivity Systems Digital Media Solutions

Content Connectivity Ops. Services Digital Media Ads/Sponsors Sponsorships , Partnerships & Advertising Operations Data Internet Access Instant Messaging Gate - to - Gate Live Television Wireless Content Music Games Destination Deals / Info Shopping Flight Tracker BROAD PRODUCT SUITE INTEGRATES INFLIGHT ENTERTAINMENT AND CONNECTIVITY 8 VoD, Classics Hollywood / Bollywood / World Cinema Ku and Ku HTS Music

GLOBAL PRESENCE IN KEY MARKETS 9 India Canada Los Angeles, CA Corporate Headquarters Chicago, IL United Kingdom China Hong Kong Singapore Dubai

MANAGEMENT TEAM* AND BOARD OF DIRECTORS ▪ Former Chief Accounting Officer and Controller at GEE ▪ Former SVP and CAO of Demand Media, Inc. Mike Zemetra Chief Financial Officer ▪ Former CFO / COO at GEE ▪ Former CFO of US Airways and Northwest Airlines Dave Davis Chief Executive Officer ▪ Former VP at Power - One and Mindspeed Technologies ▪ Former VP & Equity Analyst at Bank of America Kevin Trosian VP Corporate Development and IR ▪ Former COO of AIA ▪ Executive at Spafax and Royal Brunei Airways Wale Adepoju Chief Commercial Officer Ed Shapiro Chairman Management Team Board of Directors Harry Sloan Jeff Sagansky Louis Belanger - Martin Jeff Epstein Jeff Leddy Bob Reding ▪ Former CTO and VP of Engineering for Spacenet Aditya Chatterjee CTO and SVP of Engineering 10 ▪ Former VP at DTI Games ▪ Former VP at AIA Alexis Steinman SVP Digital Media, Products ▪ Business Development, Sales & Marketing ▪ Apple, Sony and Microsoft Robin Cole VP Digital Media, Commercial ▪ President at: ▪ 20th Century Fox; Metro Goldwyn Mayer; Playboy Entertainment Jim Griffiths SVP Content Purchasing & Distribution ▪ Former Co - founder and Owner of Post Modern Group Amir Samnani SVP Content Solutions * Presenting today

STRONG REVENUE GROWTH AND EXPANDING MARGINS 11 * See Appendix A and Appendix B for the definition of Adjusted EBITDA and a reconciliation to Net Income $260 $388 $415 $ 435 $200 $250 $300 $350 $400 $450 2013 2014 2015 $ in MM $12 $31 $45 $ 55 $0 $15 $30 $45 $60 2013 2014 2015 REVENUE ADJUSTED EBITDA* $ in MM

• Expand Connectivity Service gross margin to 50+%, driven by: • Critical mass • Bandwidth efficiencies • Rapidly grow higher margin Digital Media and Operations D ata businesses • Expand Content gross margin through improved operational efficiencies and scale • Leverage infrastructure efficiencies • Expand Adjusted EBITDA margin to 20+% • Grow commercial connected aircraft by 2.5 - 3x vs FY14: New wins, linefit, new technologies • Expand revenue per aircraft with: • Take - rate increase driven by fleet - wide rollout, bandwidth performance • Digital products: IPTV, “Air Series” • Operations Data Solutions • Continued growth of advertising/ sponsorships • Grow Content Services: • In - line or faster than industry • Grow adjacent markets: • Maritime • Business aviation • M&A 3 - 4 YEAR CORPORATE GOALS 12 Revenue Margin * See Appendix A and Appendix B for the definition of Adjusted EBITDA and a reconciliation to Net Income

MARKET OUTLOOK AND GEE POSITION 13

- 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2013 2014 2015 2016 2017 2018 2019 Regional Single Aisle Twin Aisle Ultra-large MARKET DRIVERS FOR GEE’S BUSINESS 14 Passenger Growth • Annualized passenger growth ~5% since 2011 and is expected to reach over 6 billion by 2030 Airline Industry Growth • Aviation is a growing market – but with constrained yields Sources: Forecast International and ICAO

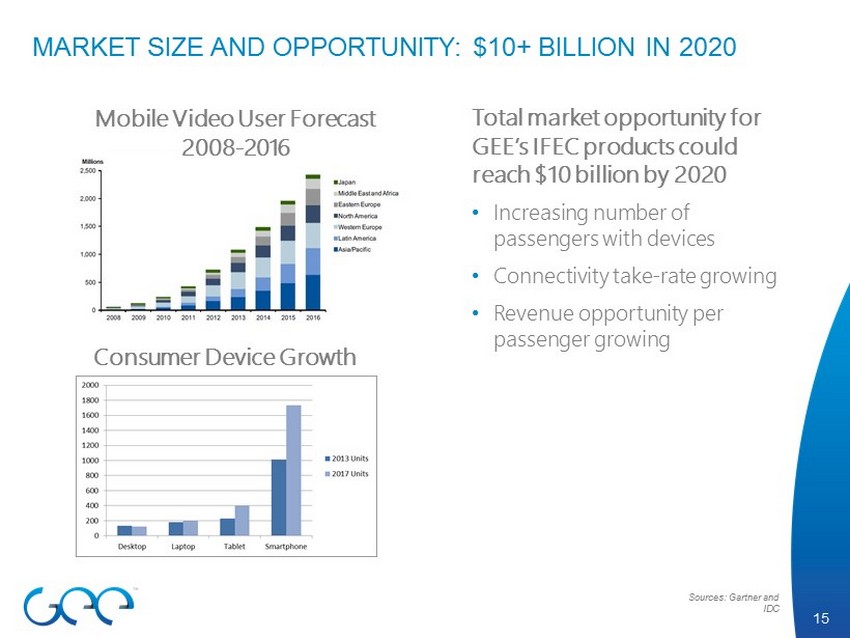

MARKET SIZE AND OPPORTUNITY: $10+ BILLION IN 2020 15 Total market opportunity for GEE’s IFEC products could reach $10 billion by 2020 • Increasing number of passengers with devices • C onnectivity take - rate growing • Revenue opportunity per passenger growing Consumer Device Growth Mobile Video User Forecast 2008 - 2016 Sources: Gartner and IDC

16 HOW THESE TRENDS SHAPE OUR STRATEGY Airlines can ‘monetize’ their customers and create an engaging customer experience with personalization. AUDIENCE • Connectivity enables us to tap in to data and enhance our connectivity offering • Improved customer data means improved advertising and sponsorship yields MONETIZATION CONTENT

17 DRIVING MORE VALUE TO AIRLINES 0 5 10 15 20 25 30 35 40 45 50 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95 100 Illustrative Willingness to Pay Dollars Traditional “pay to play” connectivity solutions do not even scratch the surface in capturing the financial opportunities from the billions of “captive” customers the airlines serve each year ; There is a relatively small group of passengers that value and will pay for connectivity ; Connectivity is fast becoming a competitive norm ; Customers unwilling to pay for full connectivity, are willing to pay for alternative products - Lower price points - Different value propositions Monetize the Tail B Percent of Customers A B C ; Offering new ‘mass - customized’ options to customers provides a differentiated product and raises customer interest - Better access to information - Customized flight experience - Monetize a new media platform Create New Value C Provide Connectivity A 100 Source: LEK Consulting

18 DIGITAL MEDIA SOLUTIONS ‘AIR’ SERIES ADJACENT MARKETS Entertainment solution for cruise, merchant and private ships In development Cloud - based VOD streaming service for institutions across the US & Canada Broadband connectivity and wireless IFE solution Wireless IFE solution App for pre - flight content downloads for secure inflight viewing Modular IFEC solutions: w - IFE software, live TV, near - live content and more Wireless IFE software and content services for OEMs and MROs

Large Addressable Market Source: Boeing, IMDC and IATA Active Commercial Aircraft 25,515 Exclude props Aircraft >16 years old 20,057 – 79% Exclude connected (narrowband, broadband) 15,986 – 63% Exclude Backlog Aircraft with Connectivity as % of Total Addressable Market Connectivity Market: Huge Revenue Opportunity ( Unit: Number of Aircraft ) OUR IMMEDIATE PRIORITES 19 ~13,000 Aircraft 53.0% 7.0% North America ROW Approximately 1,500 new aircraft are added to the global fleet each year • Using our existing global sales force to win connectivity customers • Build an audience for digital media Capture greater share in the connectivity market – especially internationally. Deliver rich media experience which adds value for the carrier and potential sponsors.

20 • Successful track record of integrating prior transactions • Achieved $10 MM annual run - rate cost savings within Content Services • Ability to win major airlines like Etihad and Garuda • Continued integration efforts across GEE for further savings • M&A Opportunities • Market adjacencies • Technology and operational synergies • Metrics • Accretion/dilution analysis • ROIC • FCF M&A STRATEGY AND OPPORTUNITIES

21 GEE’S FOUR AREAS OF FOCUS Operations Data Solutions Content Services Connectivity Systems Digital Media Solutions

22 CONTENT SERVICES

• Delivering product in 47 languages across 150 countries • ~ 60% share of IFE content market (1) • Distributor of Hollywood, Asian , Bollywood, European & Middle Eastern content to aviation, maritime & other non - theatrical markets • Exclusive airline distributor of: • Lionsgate / Summit f ilms • Select independent movie products & international content • Exclusive technical lab for Lionsgate , Warner Bros, Disney & Paramount LEADING PROVIDER OF CONTENT SERVICES TO GLOBAL IFE&C MARKET 23 (1) Source : IMDC

FULLY INTEGRATED CONTENT SUPPLIER 24 • Global capabilities in acquisition, technical services and distribution • Advanced state - of - the - art technical facilities • Investment in emerging technologies • MPAA - certified throughout technical operations • Highest ranking on performance and quality in OEM reports STUDIOS CONTENT ACQUISITION LAB OPS OEM AVIONICS AIRLINES

25 ADDING CAPABILITIES ORGANICALLY AND THROUGH M&A • 2014: Revenue grew 53% to $277 MM vs. $182 MM in 2013 • Acquired Post Modern Group in July 2013 • Strong technical operation which processes 80% of media for IFE market • Exclusive technical contracts with major Hollywood studios • Acquired IFE Services in October 2013 • High growth CSP with 48 airline clients across every continent • Strong portfolio of services including safety videos, IFE Magazines, etc. • Acquired Purple Media in October 2014 • Provides access to Indian content • Annual contracts range from low $100,000’s to double digit millions

26 RECENT HIGHLIGHTS • Expanding services within existing clients and winning over new customers • Key client wins: Etihad, Garuda Indonesia, WestJet , Royal Air Maroc , Hong Kong Airlines • Key client renewals: United Airlines and 2 large international carriers • Key lab services renewals: Disney, Warner Bros • Restructuring improvements: • Management • Integration • Single Operating Platform

27 CONTENT SUPPLIER TO LEADING AIRLINES LAB SERVICES FOR MAJOR STUDIOS

0 4000 8000 12000 2014A 2015E 2016E 2017E 2018E 0 5000 10000 Regional Single-aisle Twin-aisle A380 Not Fitted Overhead In-seat IFE Systems continue strong growth trajectory IFE Installs (1 ) (# of Aircraft) IFE by Aircraft Type CAGR ~10 % Source: IMDC IFE HARDWARE DRIVING CONTENT SERVICES Airlines migrating toward “individual experience” with their passengers 28 Over last 5 years, single - aisle aircraft delivered with in - seat IFE grew by 20 % to 30%

Con tent Services 29 EMBEDDED AND WIRELESS CONTENT PRODUCT LINE Content for embedded and wireless systems Movies Hollywood blockbusters, classics, regionals, independents TV Shows comedies, documentaries, cartoons, news, sports, dramas, non - verbal, local shows Audio all music genres; audio books; comedy, business, religious and news programs Games puzzle, casino, hidden object, kids, action & arcade, board & strategy, puzzle, trivia & words

Con tent Services 30 CREATIVE SERVICES Creative services for embedded and wireless systems Apps entertainment listings of IFE onboard on mobile devices Videos safety, advertising, destination, welcome onboard, immigration, crew training GUIs interactive seat back interface to all entertainment onboard Printwork entertainment guides, duty - free guides, safety cards, brochures, flyers, ads Branding reinforcing brands via the IFE system and other channels Content GUI Shopping GUI

31 CONTENT RIGHTS Western Asian Indian

32 BARRIERS TO ENTRY • Global supplier network needed to provide tailored content • Specialized knowledge and equipment needed to edit content • Gaining security clearance from movie distributors • Complexity of numerous hardware systems from Panasonic, Thales, Zodiac, Lumexis , etc. • Global operations needed to reliably onboard content accurately and on time • Entrenched, long - standing relationships with clients • Broad licensing capabilities, including international content, for video, audio and games

33 GROWTH WITHIN EXISTING CUSTOMER BASE • World’s third - largest airline by revenues and passengers carried (639 aircraft) • Account won in 2011 • Services provided: movies, TV shows, audio, games, digital publications, advertising • Systems : mix of 10 different embedded and wireless platforms • Major content synergies following merger with Continental Airlines in 2012 • Renewal secured in 2015 • World’s largest airline by revenue and passengers carried (967 aircraft) • Account won in 2012 • Services provided: movies, TV shows, audio, games, AIRRead , advertising, safety videos, arrival videos • Systems : mix of 10 different embedded and wireless systems • Enhancements since contract won: • Revenue generation support through the introduction of advertising • High quality creative services provided including safety and arrival videos

34 DIGITAL MEDIA SOLUTIONS

35 DIGITAL MEDIA SOLUTIONS – CURRENT , CURATED, CUSTOMIZED PARTNERSHIPS • GEE connects airlines and advertisers in a meaningful way to drive brand value, product awareness, create engaging compelling user scenarios, new business models and revenue streams PERSONAL EXPERIENCES • The proliferation of BYOD enables delivery of timely, curated, content and personalized experiences that inform the passenger journey from the cabin and beyond the terminal DIGITAL MEDIA SOLUTIONS • GEE integrates content and connectivity to deliver rich, dynamic digital media solutions including IPTV, streaming music, ecommerce, advertising and sponsorships

36 DIGITAL MEDIA PRODUCTS - AIR SERIES Connectivity and wireless IFE solution Wireless IFE solution Mobile app allowing pre - flight content downloads for secure inflight viewing Suite of modular IFEC solutions: software, live television, near - live content, content handling and more Wireless IFE software and content solutions for OEMs and MROs

37 Status: AVAILABLE & DEPLOYED • World’s leading connectivity and wireless IFE solution • Features movies, TV shows, music, live TV, messaging, e - pubs, deals, and more • Tried & tested: over 640 aircraft; several million users and over 100 million ad impressions/month What it is • Advertising and sponsorships: incremental revenue and product elevation • Gate - to - gate service • Customizable Benefits MUSIC GAMES DRM PROTECTED MOVIES & TV INTERNET ACCESS LIVE TELEVISION eBOOKS & MAGAZINES INSTANT MESSAGING DESTINATION DEALS MOVING MAP WITH OR WITHOUT CONNECTIVITY GEE CONNECTIVITY SOLUTION

38 Status : NEW – LAUNCHING SOON • W ireless IFE solution • World class entertainment, fresh digital media and offline transaction services • Near - live content can be updated multiple times daily through cellular (3G/4G) What it is • Fresh news and sports • In - portal advertising and sponsorship opportunities • Reduced weight & fuel burn MUSIC GAMES DRM PROTECTED MOVIES & TV eBOOKS & MAGAZINES MOVING MAP SURVEY PAYMENT DATA MANAGEMENT NEWS NEAR LIVE CONTENT Benefits GEE W - IFE SOLUTION

39 Status : AVAILABLE & DEPLOYED • Wireless In - flight Services and Entertainment (WISE) • An end - to - end software and content solution for wireless IFE • Sold to OEMs/MROs, not airlines • Supports mobile devices and airline seat - back tablets What it is • Allows aeronautics players to offer bundled wireless IFE solutions without in - house software or content expertise Benefits MUSIC GAMES DRM PROTECTED MOVIES & TV eBOOKS & MAGAZINES MOVING MAP SURVEY PAYMENT DATA MANAGEMENT WITH OR WITHOUT CONNECTIVITY NEWS OEM & MRO SOLUTIONS

40 • iOS /Android app allowing pre - flight (ground ) download of IFE content to passengers’ mobile devices • Content is unlocked for viewing while inflight or ‘airside’, based on passengers’ booking PNR code • Pay - per - use or free - to - PAX What it is • Superior value vs. consumer pay - per - view services • Cost effective for airline • Quick roll - out, scalable • No onboard equipment • Everything is handled on the passenger mobile device and in the “cloud” Benefits CONTENT DOWLOADED PRIOR TO FLIGHT MOVIES & TV CONTENT OFFERING COST EFFECTIVE SOLUTION FOR SHORT HAUL ANDROID / IOS TABLETS & SMARTPHONES Status: NEW – LAUNCHING SOON ULTRA LOW COST IFE SOLUTION

41 MARITIME SOLUTION Status : NEW – UNDER DEVELOPMENT • Wireless entertainment and connectivity - enabled services for cruise and other ships • World class entertainment, fresh digital media and offline transaction services • Supplements GEE’s maritime content distribution rights What it is • Leverages GEE’s airline market technology for another constrained environment • Turn - key service: VoD & movies , eBooks , magazines and newspapers, music • In - portal advertising and sponsorship opportunities MUSIC GAMES DRM PROTECTED MOVIES & TV eBOOKS & MAGAZINES MOVING MAP SURVEY PAYMENT DATA MANAGEMENT NEWS NEAR LIVE CONTENT Benefits

42 OPS DATA: CABIN CREW SOLUTION Status: AVAILABLE & IN TRIAL AT AIRLINE • Tablet app and back - end system enabling cabin crews’ digital workflow • Key electronic modules: • Reporting • Manuals • Airline - to - crew messaging • Buy - on - board • EPIL (Electronic Passenger Information List) What it is Paperless cabin Buy On Board ePIL • Enables a paperless cabin • Airline customizable • Each module can be turned on/off • Tracks & reports compliance, reduces admin burden Benefits

43 OPS DATA: SYSTEM REPORTING SOLUTION Status: COMMERCIALLY AVAILABLE • Data management and reporting tool for GEE services • Performance management: • System health monitoring • Aircraft position & avionic signals tracking • Take rates, usage, etc. • Ad/sponsor. Campaigns • 3GB of data per AC/mo. • Orders and inventory levels What it is PRODUCT COMMERCIAL PERFORMANCE SYSTEM HEALTH • Optimize offerings and campaigns • Appealing, intuitive for airline executives • Automated weekly reports tailored to airline’s needs Benefits

44 DIGITAL MEDIA SOLUTIONS - COMMERCIAL

DELIVERING IPTV TO AIRLINES 45 • GEE was the first to deliver IPTV to airlines • GEE licenses all the content, acquires the signal, processes the media to deliver live IPTV to each aircraft Ku SATELLITE GEE CONNECTIVITY EQUIPPED AIRCRAFT TCPIP , UDP & LIVE TV TCP IP, UDP & Live TV IPoS LINK Video Downlink TELEPORT/ MEDIA PROCESSING

IPTV VIEWING STATS 46 • IPTV viewing is a differentiator for airlines both in that they offer it and what they can provide • GEE enables a programmable IPTV line up that can change based on seasonal viewing habits • Sports channel viewing is seasonal • Easy to follow channels like HGTV, Discovery and Bravo do well throughout the year • Traditional broadcast channels CBS, Fox and NBC perform consistently throughout the year 45% 16% 15% 25% Entertainment News Sports Broadcast

ADS & SPONSORSHIPS DRIVING NEW REVENUE OPPORTUNITIES 47 • Advertisers and sponsors are growing sources of revenue • Live television • Music • Shopping / Retail • eBooks • Messaging • Portal experience enables various types of advertising: digital ads, video ads and “virtual live channels ”

48 SPONSORSHIP ON SOUTHWEST – LIVE TV AND MUSIC

NAS – FEATURED ARTIST 49 • NAS worked with local artist, Tini , to promote her music as part of a featured music section • NAS passengers can enjoy Tini’s music free of charge and download her songs for free from supported app stores

GEE Case Study SOUTHWEST’S TV FLIES FREE In July 2013, Southwest and GEE unveiled a partnership whereby DISH sponsored Southwest’s inflight TV service On January 1, 2015, Chase, Visa and Southwest Airlines Rapid Rewards – branded credit card becomes the principle sponsor of “TV Flies Free” Through the sponsorship , Southwest is the only airline in the world operating a live television service inflight streamed to passenger personal WiFi devices Sponsors are reaching a captive and targeted audience of 137 million annual passengers 50

CASE STUDY Beats - Music Service In conjunction with SWA, GEE launched the Beats In - Flight Music Service in Q4 2014. Beats Music is a subscription - based online music streaming service owned by Apple Through its partnership with GEE, Beats Music creates specially curated playlists stored on an aircraft’s wireless server for airline passengers to stream using their personal electronic devices during their flight Passengers accessing the Beats In - Flight Music service can access a wide range of programming, from pop, rock, country, to fresh new artists and the hottest songs, all handpicked by Beats Music’s experts All Beats Music songs are encoded and encrypted to protect the content and ensure a seamless and superior quality playback 51

GEE Case Study Norwegian Air Shuttle (NAS) was looking for a fun way to differentiate their IFE offering and partnered with Super Cell on the very popular Clash of Clans game • User engagement model • Users download from local onboard server, minimizing bandwidth usage, and register for a free version of the game • Leads generated as part of the download experience • R evenue was generated as part of an “upsell” experience • Benefits for NAS • Engaging, fun casual game for passengers • NAS generated revenue from the ad placement and rev share model for upsell to the full version of the game • Super Cell reached a new audience and generated leads for future marketing and sales engagement CASE STUDY Super Cell Clash of Clans - Gaming 52

CONNECTIVITY 53

• 643 aircraft installed with GEE connectivity solution as of 3/01/2015 • First global deployed fleet with Ku - band in - flight connectivity • Global partnership with SES provides worldwide Ku - band coverage • Ku High Throughput Satellite (HTS) compatibility, when available • New global Ku antenna under development provides highly efficient operability at all latitudes, including equatorial • World - class network operations center (NOC) • B2B business model with airlines, providing them with greater control over the in - flight passenger experience IN - FLIGHT CONNECTIVITY SYSTEM 54

55 CONNECTIVITY MILESTONES NAS launch 500 aircraft installations IPTV launched SES global partnership (Ku, Ku - HTS) 2011 2013 2015 SWA fleet installation SWA begins Trials begin Row 44 founded 2010 2008 2003 200 aircraft installations 2012 2014 Seamless transatlantic coverage Boeing provisions offerable Global antenna program launched Boeing linefit available (2015) Global antenna available (2016) 2016

Single Aisle Driving Growth Source: Boeing and Company Estimates Growth in Aircraft Shipments Connectivity Market: Huge Revenue Opportunity RAPID MARKET GROWTH OPPORTUNITY 56 79% 76% 73% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2010-2013 Deliveries Order Backlog since 2010 Future Demand • Market focus on B737 and A320 • GEE has most 737’s deployed with broadband satellite connectivity system • Estimated total deliveries from 2014 - 2033 of 37,000 aircraft • Estimated 26,000 single aisle deliveries from 2014 - 2033 0 10,000 20,000 30,000 40,000 50,000 2014 2033 Annual revenue per aircraft could grow from low $100,000’s to over $300,000

IN - FLIGHT CONNECTIVITY LEADER 57 • 3 years running “Best in I n - flight Connectivity & Communications ”* • First to deliver live television to passengers’ mobile devices • First to deliver connectivity services to passengers’ mobile devices gate - to - gate • First to deliver portal updates and content to the aircraft over satellite • First to develop major commercial sponsorship models for airlines to deliver services free of charge • State of the art and innovative network management systems * APEX Award with Norwegian Air Shuttle At any given moment, a GEE - equipped aircraft is in flight somewhere in the world 24 / 7 / 365

SUPERIOR CONNECTIVITY PRODUCT AND TECHNOLOGY PLATFORM Global partnership with SES for worldwide connectivity Ku - band technology provides high speed broadband internet via flexible and scalable satellite platform A leading provider of in - flight Internet connectivity that can cover both land and sea 58 EQUIPPED AIRCRAFT TCP IP & UDP IPoS LINK TCP IP & UDP IPoS LINK Ku SATELLITE INTERNET GROUND STATIONS Customer Service Aircraft Maintenance/ IFE Management Billing System Network Management Center - Chicago, Il

GLOBAL PARTNERSHIP WITH SES • Provides high speed Ku and Ku HTS coverage worldwide • Driving significant satellite bandwidth savings • Working closely together to drive new customer relationships 59 Ku and Ku HTS provide the optimal solution for coverage, speed and reliability

GEE’S CONNECTIVITY ANTENNA SYSTEMS - DEPLOYED - - DEVELOPMENT - 60 • The world’s largest installed base of Ku - band satellite connected aircraft • Marketed and supported by GEE and TECOM; aperture developed by QEST • STC’s for Boeing 737, 757 & 777 • Other STC certifications underway • “Provisions offerable” today on B737 • Linefit expected in 2015 for B737 • Linefit program for B787 underway • Developing new in - flight connectivity antenna with QEST; i nstallations expected in mid 2016 • Operable at all latitudes, including equatorial, based on breakthrough steerable pointing system • Speeds over 100 MBPS when utilizing Ku HTS satellite systems • Lower fuel - burn penalty than competitive low - profile antennas • Compatible with Global Eagle’s current certifications and future linefit installations

61 GEE ANTENNA DESIGN Available Q2 2016 Azimuth: 0 - 360 ° Elevation: 0 - 90 ° Tilt: - 15 ° … + 15 °

OPTIMIZED FOR ALL LATITUDES 62 - Current Antenna - - New Global Antenna - • Some limitations in equatorial regions Skew (degrees) 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 Good Poor Z ero Elevation degrees) EQUATORIAL CONUS CENTRAL AMERICA • Benefits in high latitude and equatorial regions 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 EQUATORIAL CONUS CENTRAL AMERICA Skew (degrees) Aircraft banking • New and existing antennas are ARINC 791 compatible • Excellent performance at the equator, high latitudes and during banking • New and existing designs meet Boeing radome specifications

NEW GLOBAL ANTENNA VS. FLAT PANEL DESIGNS 63 - New Global Antenna - • Benefits in high latitude and equatorial regions Good Poor Z ero Elevation degrees) • Issues with high latitudes, banking and at equator 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 EQUATORIAL CONUS CENTRAL AMERICA Skew (degrees) Aircraft banking - Competitive Antennas - 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 EQUATORIAL CONUS CENTRAL AMERICA Skew (degrees)

Boeing 737/NG/MAX ▪ GEE system approved for installation ▪ GEE antenna installs under GEE/Boeing Radome ▪ Provisions deliveries: Nov 2015 ▪ Linefit installation deliveries: Nov 2016 Boeing 787 ▪ GEE system in development ▪ ARINC 791 compatible ▪ Approval expected Q2 2015 ▪ Target 787 deliveries in late 2016 BOEING LINEFIT STATUS 64 Eliminates down time, costs and complexity versus retrofitting aircraft

NETWORK MANAGEMENT 65

TECHNOLOGY AND EXPERIENCE DRIVING WINS • Leading technology • Satellite expertise • Global, high - speed coverage • Largest deployed fleet • Longest history • Flexible business model • Network management expertise • Performance & analysis software • Integrated product suite 66

FINANCIAL OVERVIEW 67

KEY FACTORS DRIVING FINANCIAL SUCCESS 68 * As of March 5, 2015 Attractive Financial Model Significant Organic Growth & M&A Opportunities Successful Integration and Value Extraction Strong Balance Sheet • Connectivity market in early stages of rapid growth • E xpand current product offerings • Near term M&A to generate revenue and compliment existing business segments • Meaningful operating leverage • Growing airline, content and maritime markets • Low CapEx • Cash of approximately $275 million * • Low debt

Licensing • Seatback IFE: Sale or license of media content, video and music programming, applications and video games • N/M Services • Technical services such as encoding and editing of media content • Connectivity : Internet Access/ WiFi • Digital Media Products : IPTV , “Air” Series of products: VoD , Music, eBooks and Messaging • Digital Media Commercial : Advertising, sponsorship , shopping and travel - related revenue • Operations Data Equipment • N/M • Sale of satellite - based connectivity equipment CONTENT AND CONNECTIVITY BUSINESS SEGMENTS CONTENT SOURCE $ CONNECTIVITY 69

STRONG REVENUE GROWTH AND EXPANDING MARGINS 70 * See Appendix A and Appendix B for the definition of Adjusted EBITDA and a reconciliation to Net Income $260 $388 $415 $ 435 $200 $250 $300 $350 $400 $450 2013 2014 2015 $ in MM $12 $31 $45 $ 55 $0 $15 $30 $45 $60 2013 2014 2015 REVENUE ADJUSTED EBITDA* $ in MM

$3 $11 $51 $75 $0 $15 $30 $45 $60 $75 2011 2012 2013 2014 RAPID CONNECTIVITY SERVICE REVENUE GROWTH 71 $ in MM

- 153% - 96% 17% 27% -160% -120% -80% -40% 0% 40% 2011 2012 2013 2014 CONNECTIVITY SERVICE MARGIN COULD EXCEED 50+% 72

STRONG BALANCE SHEET AND CAPITAL STRUCTURE* 73 • Strong cash position • Approximately $275 MM of cash today • $3.60/share • Raised capital in convertible note offering in February 2015 • $83 MM Convertible note • Conversion price: $18.55 • Exchanged 12.7 MM warrants for 4.2 MM shares in September 2014 • Warrants outstanding: ~11.6 • Average conversion price: $ 11.20 • 76.6 MM shares outstanding today * As of March 5, 2015

COMPENSATION PHILOSOPHY – LONG - TERM GROWTH AND PROFITABILITY 74 Element Objective Basis Base Salary • Performance of job responsibilities • Attract and retain executives • Market rates Annual Short - Term Incentive Cash Compensation • Near - term corporate objectives and individual contributions • Weighted across: - Total revenue - Adjusted EBITDA - Strategic goals - Individual performance Long - term Equity Incentive Compensation • Promote long - term growth and align management interests with stockholders • Option and RSU grants • Performance grants (EBITDA - based)

• Expand Connectivity Service gross margin to 50+%, driven by: • Improved bandwidth costs • Critical mass • Rapidly grow higher margin Digital Media and Operations D ata businesses • Expand Content gross margin through improved operational efficiencies and scale • Leverage infrastructure efficiencies • Expand Adjusted EBITDA margin to 20+% • Grow commercial connected aircraft by 2.5 - 3x vs FY14: New wins, linefit, Global Ku Antenna • Expand revenue per aircraft with: • Take - rate increase, driven by fleet - wide rollout, bandwidth availability • Digital products: IPTV, “Air Series” • Operations Data Solutions • Continued growth of advertising/ sponsorships • Grow Content Services: • In - line or faster than industry • Grow adjacent markets: • Maritime • Business aviation • M&A 3 - 4 YEAR CORPORATE GOALS 75 Revenue Margin * See Appendix A and Appendix B for the definition of Adjusted EBITDA and a reconciliation to Net Income

Q&A SESSION

APPENDIX A: RECONCILIATION OF ADJUSTED EBITDA ($MM ) 77 1Q13 2Q13 3Q13 4Q13 Net Income (27.0) (13.1) (5.6) (69.2) Net Inc. Attributable to Non - Controlling Interests - 0.1 0.2 - Income Tax - 0.6 1.2 - Other Income (Expense) 4.8 5.0 (1.7) 60.1 Depreciation and Amortization 4.7 7.0 8.7 11.0 Stock - based Compensation 1.6 0.9 (0.6) 1.1 Acquisition and Realignment Costs 12.2 1.4 3.2 5.5 Restructuring Charges - - - - F/X Gain (Loss) on Intercompany Loan 1.4 (0.5) (0.8) - Adjusted EBITDA $(0.5)* $1.2 $4.5 $8.6 Note: Numbers may not add due to rounding *Pro Forma adjusted EBITDA

APPENDIX A: RECONCILIATION OF ADJUSTED EBITDA ($MM ) (CONT’D) 78 1Q14 2Q14 3Q14 4Q14 Net Income (26.3) 12.0 (15.5) (25.0) Net Inc. Attributable to Non - Controlling Interests 0.2 - - - Income Tax 1.3 0.8 1.5 4.6 Other Income (Expense) 15.9 (20.3) 7.1 11.2 Depreciation and Amortization 9.4 8.3 8.3 8.4 Stock - based Compensation 2.6 2.0 1.9 1.6 Acquisition and Realignment Costs 2.1 3.6 3.0 8.0 Restructuring Charges - - 2.6 1.6 F/X Gain (Loss) on Intercompany Loan - - - - Adjusted EBITDA $5.1 $6.5 $8.8 $10.4 Note: Numbers may not add due to rounding

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we present Adjusted EBITDA, which is a non - GAAP financial measure, as a measure of our performance. The presentation of Adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, net income (loss), operating loss befor e i ncome taxes or any other performance measures derived in accordance with GAAP or as an alternative to net cash provided by operatin g activities or any other measures of our cash flow or liquidity. For more information on this non - GAAP financial measure, please see the reconciliation table and notes on the previous pages. Adjusted EBITDA is the primary measure used by our management and board of directors to understand and evaluate our financial performance and operating trends, including period to period comparisons, to prepare and approve our annual budget and to develop short and long term operational plans. Additionally, Adjusted EBITDA is the primary measure used by the compensation committee of our board of directors to establish the funding targets for and fund the annual bonus pool for our employees and executives. We believe our presentation of Adjusted EBITDA is useful to investors both because it allows for greater transpar enc y with respect to key metrics used by management in its financial and operational decision - making and our management frequently uses it in discussions with investors, commercial bankers, securities analysts and other users of our financial statements . We define Adjusted EBITDA as operating loss before income taxes before, when applicable, other income(expense ), interest expense (income), depreciation and amortization, as further adjusted to eliminate their impact of, when applicable, stock - based compensation, acquisition and realignment costs, restructuring charges , F/X gain (loss) on intercompany loans and any gains or losses on certain asset sales or dispositions. Other income (expense), acquisition and realignment costs and restructuring charges include such items, when applicable, as (a) non - cash GAAP purchase accounting adjustments for certain deferred revenue and costs, (b) legal, accounting and other professional fees directly attributable to acquisition activity , (c) employee severance payments and third party professional fees directly attributable to acquisition or corporate realignment activities, (d) certain non - recurring expenses associated with our expansion into China that did not generate associated revenue in 2014, (e) legal settlements or reserves for legal settlements in the period that pertain to historical matters that existed at acquired companies prior to their purchase date, (f) impairment of a portion of certain receivables directly attributable to a customer undergoing economic hardships from recent trade sanctions imposed by the European Union and the United States on Russia, (g) changes in the fair value of our derivative financial instruments and (h ) any restructuring charges in the period pursuant to our integration plan announced on September 23, 2014 . Management does not consider these costs to be indicative of our core operating results. APPENDIX B: DEFINITION OF ADJUSTED EBITDA 79