Attached files

| file | filename |

|---|---|

| EX-23.1 - Eco-Stim Energy Solutions, Inc. | ex23-1.htm |

| EX-32.1 - Eco-Stim Energy Solutions, Inc. | ex32-1.htm |

| EX-32.2 - Eco-Stim Energy Solutions, Inc. | ex32-2.htm |

| EX-31.2 - Eco-Stim Energy Solutions, Inc. | ex31-2.htm |

| EX-31.1 - Eco-Stim Energy Solutions, Inc. | ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Eco-Stim Energy Solutions, Inc. | Financial_Report.xls |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year ended December 31, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36273

ECO-STIM ENERGY SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 31104 | 20-8203420 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS

Employer Identification Number) |

| 2930 W. Sam Houston Pkwy N., Suite 275, Houston TX | 77043 | |

| (Address of principal executive offices) | (Zip Code) |

281-531-7200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer [ ] |

| Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

As of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, computed by reference to the closing price of that date, was $16,612,837. This aggregate value is computed at $6.50 per share, the last sale price of the common stock on June 30, 2014. All executive officers and directors of the registrant and all stockholders who owned 5 percent or more of the outstanding common stock at that time have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

The registrant had 6,785,899 shares of common stock outstanding at March 17, 2015.

Documents Incorporated by Reference: None

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Form 10-K”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1993, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, included in this Form 10-K that address activities, events or developments that we expect, project, believe or anticipate will or may occur in the future are forward-looking statements. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events. Forward-looking statements may include statements that relate to, among other things, our:

| ● | future financial and operating performance and results; | |

| ● | business strategy and budgets; | |

| ● | technology; | |

| ● | financial strategy; | |

| ● | amount, nature and timing of capital expenditures; | |

| ● | competition and government regulations; | |

| ● | operating costs and other expenses; | |

| ● | cash flow and anticipated liquidity; | |

| ● | property and equipment acquisitions and sales; and | |

| ● | plans, forecasts, objectives, expectations and intentions. |

All statements, other than statements of historical fact included in this Form 10-K, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this Form 10-K, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the anticipated future results or financial condition expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include but are not limited to:

| ● | the cyclical nature of the oil and natural gas industry; | |

| ● | the potential for our oil-company customers to backward-integrate by starting their own well service operations; | |

| ● | the potential for excess capacity in the oil and natural gas service industry; | |

| ● | dependence on the spending and drilling activity by the onshore oil and natural gas industry; | |

| ● | competition within the oil and natural gas service industry; | |

| ● | concentration of our customer base and fulfillment of existing customer contracts; |

| ● | our ability to maintain pricing and obtain contracts; | |

| ● | deterioration of the credit markets; | |

| ● | our ability to raise additional capital to fund future and committed capital expenditures; | |

| ● | increased vulnerability to adverse economic conditions due to indebtedness; | |

| ● | our limited operating history on which investors will evaluate our business and prospects; | |

| ● | our ability to obtain raw materials and specialized equipment; | |

| ● | technological developments or enhancements; | |

| ● | asset impairment and other charges; | |

| ● | our identifying, making and integrating acquisitions; | |

| ● | Albright Capital Management LLC and management control over stockholder voting; | |

| ● | loss of key executives; | |

| ● | the ability to employ skilled and qualified workers; | |

| ● | work stoppages and other labor matters; | |

| ● | hazards inherent to the oil and natural gas industry; | |

| ● | inadequacy of insurance coverage for certain losses or liabilities; | |

| ● | delays in obtaining required permits; | |

| ● | ability to import equipment or spare parts into Argentina on a timely basis; | |

| ● | regulations affecting the oil and natural gas industry; | |

| ● | legislation and regulatory initiatives relating to well stimulation; | |

| ● | future legislative and regulatory developments; | |

| ● | foreign currency exchange rate fluctuations; | |

| ● | effects of climate change; | |

| ● | volatility of economic conditions in Argentina; | |

| ● | market acceptance of turbine pressure pumping technology; | |

| ● | the profitability for our customers of shale oil and gas as commodity prices decrease; | |

| ● | risks of doing business in Argentina and the United States; and | |

| ● | costs and liabilities associated with environmental, health and safety laws, including any changes in the interpretation or enforcement thereof. |

We believe that it is important to communicate our expectations of future performance to our investors. However, events may occur in the future that we are unable to accurately predict, or over which we have no control. We caution you against putting undue reliance on forward-looking statements or projecting any future results based on such statements. When considering our forward-looking statements, you should keep in mind the cautionary statements in this Form 10-K, which provide examples of risks, uncertainties and events that may cause our actual results to differ materially from those contained in any forward-looking statement.

All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section and any other cautionary statements that may accompany such forward-looking statements. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Form 10-K.

You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement.

TABLE OF CONTENTS

| i |

Except when the context otherwise requires or where otherwise indicated, throughout this Annual Report on From 10-K, we use the terms “Eco-Stim,” “EcoStim,” “Company,” “we,” “us” and “our” to refer to Eco-Stim Energy Solutions, Inc.

Our Company

We are an early stage technology-driven independent oilfield services company providing well stimulation, coiled tubing and field management services to the upstream oil and gas industry. We are focused on reducing the ecological impact and improving the economic performance of the well stimulation process. We have assembled proven technologies and processes that have the ability to (1) reduce the surface footprint, (2) reduce emissions, and (3) conserve fuel and water during the stimulation process. We will focus on bringing these technologies and processes to the most active shale resource basins outside of the United States, using our technology to differentiate our service offerings. Our management team has extensive international industry experience. Our first operation is in Argentina, home to the Vaca Muerta, the world’s third-largest shale resource basin as measured by technically recoverable reserves. We also intend to pursue other markets that meet our investment criteria, which may include Mexico, Colombia and the United States as well as other markets where we believe we can offer clear strategic advantages and achieve acceptable financial returns. We may also explore opportunistic acquisitions and/or joint ventures with established companies in target markets.

Our management team has extensive experience in operating well stimulation fleets, coiled tubing units and other downhole completion equipment, as well as providing “sweet spot” analysis in shale resource basins using geophysical predictive modeling. We expect to leverage our management’s experience and historical local relationships in undersupplied markets to pursue profitable long-term contracts. We expect to compete for business with a limited number of other service companies based on technical capability, quality of equipment, local experience and existing relationships rather than solely on price. We also believe that we benefit from our association with our largest investor, ACM Emerging Markets Master Fund I, L.P., which is managed by Albright Capital Management LLC (collectively, “ACM”). ACM is an internationally recognized private equity firm dedicated to the emerging markets and has many established relationships in countries where the Company is evaluating opportunities.

Our first pressure pumping fleet commenced operations in the Neuquén province of Argentina in December 2014. This equipment consists of a 10,000 hydraulic horsepower (“HHP”) pressure pumping fleet and various pieces of complementary equipment. In October 2014, we placed an order with a local Argentine manufacturer to purchase our second pressure pumping fleet, which we also expect to deploy in Argentina during the fourth quarter of 2015. In addition, our coiled tubing unit commenced operations in the Neuquén province of Argentina in February 2015. Furthermore, we have successfully performed field management services for Yacimientos Petrolíferos Fiscales S.A. (“YPF”) in Argentina and expect to continue expanding this service offering. We believe these services, which have improved our customers’ understanding of their unconventional reservoir performance, have enhanced our established local relationships while differentiating us from our pressure pumping competitors. In February 2015, we performed our first pressure pumping job for YPF.

In line with our strategy to pursue technologies with ecological and economic benefits, we recently identified, evaluated and purchased 54,000 HHP of the latest generation turbine-powered pressure pumping units (“TPUs”). Management estimates this equipment was purchased at an 80% discount to its current replacement cost. Each of these TPUs consists of a high-pressure hydraulic pump, a turbine engine, a gearbox, electrical and hydraulic assemblies, and skids. The TPUs are compliant with the stringent Clean Air Non-road Diesel Tier 4 (“Tier 4”) emission standards of the U.S. Environmental Protection Agency (“EPA”) even when run on diesel fuel. We believe these TPUs provide numerous advantages over traditional diesel-powered pumping equipment, including: (1) the ability to operate on 100% natural gas, liquefied natural gas (“LNG”), compressed natural gas (“CNG”) or when necessary on diesel fuel; (2) significantly lower emissions; (3) a 50% smaller operating footprint; and (4) lower fuel and operating costs.

| 1 |

The TPUs were introduced to several North American unconventional shale resource basins in 2011 and established a proven track record with several large independent oil and gas companies, as well as at least one super-major oil and gas company. Using the recently purchased TPUs, management believes it can purchase new complementary equipment and assemble a full pressure pumping fleet at less than half the cost of a conventional pressure pumping fleet. The complementary equipment will consist of industry standard control systems, data vans and blenders. We expect the resulting TPU well stimulation fleet to generate attractive returns while demonstrating our operating capabilities to our prospective international customers. We are not expecting meaningful returns from the deployment of these assets before the third quarter of 2016 although management will be opportunistic if opportunities arise prior to that time.

Our Markets

The “shale revolution” has transformed the economics of oil and gas production in the United States, reversing 40 years of declining crude oil production and dramatically increasing natural gas supply, a trend with far-reaching implications. The United States’ extraordinary success with unconventional resources has prompted many to consider whether other countries with similar unconventional resources will also attain commercial success in developing said resources. According to the U.S. Energy Information Administration (the “EIA”) approximately 80% of global shale resources lie outside the United States. More than half of the shale oil outside the United States is concentrated in Russia, China, Argentina and Libya, while more than half of the shale gas outside the United States is concentrated in China, Argentina, Algeria, Canada and Mexico.

According to the EIA, Argentina was the largest natural gas producer and the fourth largest petroleum and other liquids producer in South America in 2012. As one of the top-five countries in the world with technically recoverable shale resources, we believe that Argentina is well-positioned to attract significant new investment in unconventional development. Furthermore, we believe Argentina is the international market most likely to replicate the success of U.S. shale basins utilizing proven advanced well stimulation techniques.

We believe the experience of the United States during the last ten years provides a model for what is likely to occur in emerging unconventional shale basins such as Argentina. According to Baker Hughes Incorporated (“Baker Hughes”) and management estimates, the drilling rig count in the Eagle Ford shale increased from four rigs and one well stimulation fleet in 2008 to approximately 265 drilling rigs and 87 well stimulation fleets in 2012, a ratio of one well stimulation fleet to every three drilling rigs. The increase in unconventional drilling in the United States has had a dramatic impact on domestic oil and natural gas production and has positioned the United States to significantly reduce its dependence on foreign energy sources.

By comparison, we expect the combination of excellent, high-quality liquid-rich shale (comparable to the Eagle Ford in the United States), manageable logistics/costs, and improving regulatory framework from a supportive, motivated government to drive a similar increase in Argentina’s shale production. According to Baker Hughes, there were 105 drilling rigs operating in Argentina in September 2014, 35 of which we believe are capable of drilling shale wells. Based on recent announcements from several major drilling contractors, there are in excess of 25 drilling rigs currently scheduled to arrive in Argentina in 2015 to participate in the development of shale resources. We are projecting the shale drilling rig count in Argentina to increase to approximately 135 drilling rigs by 2018 and approximately 220 drilling rigs by 2022, thus implying a significant increase in the related demand for well stimulation equipment.

The Eagle Ford experience in the United States would imply that by the end of 2015, 2018 and 2020, 20, 45 and 73 well stimulation fleets, respectively, will be required in Argentina to keep pace with the expected drilling activity. We believe that there are approximately seven unconventional well stimulations fleets currently in Argentina capable of completing large multi stage pressure-pumping jobs. If the experience in the Eagle Ford is indicative of what can be expected in Argentina, this would imply a significant increase in demand for the Company’s services in Argentina over the next several years.

| 2 |

Our Services

Pressure Pumping

Our customers utilize our pressure pumping services to enhance the production of oil and natural gas from formations with low permeability, which restricts the natural flow of hydrocarbons. The technique of well stimulation consists of pumping a fluid into a cased well at sufficient pressure to create new channels in the rock, which can increase the extraction rates and the ultimate recovery of the hydrocarbons. Our equipment is contracted by oil and gas producers to provide this pressure-pumping service, which is referred to as a well stimulation fleet. We offer a state-of-the-art pumping fleet, including well-stimulation pumps, nitrogen pumping units and cranes, in both trailer-mounted and skid-mounted configurations. We expect to have the capability of providing a variety of pressure-pumping services, including workover pumping, well injection, cementing, cased-hole testing, mud displacement, and wireline pump downs.

A portion of our pressure pumping equipment consists of our TPUs, which are powered by remanufactured turbine engines previously used in military applications. Each turbine engine generates in excess of 4,000 horsepower and therefore when operating at 2,000 HHP, the engine is running at less than 50% of its capacity. As a result, these turbine engines have a reputation for reliability and durability. They also weigh less than 1,200 pounds (as compared to a typical reciprocating engine of comparable horsepower which generally weighs approximately 12,000 pounds). The weight differential allows for better use of space on a trailer and more efficient operations. We believe the TPUs are more cost effective to operate and maintain than conventional diesel-powered equipment. Prior field operations with our current TPUs have demonstrated compliance with emission standards for nitrogen oxides (“NOx”) and carbon monoxide under the Tier 4 standards that regulate emissions from certain off-road diesel engines. Turbine engines also have significantly lower methane leakage compared to reciprocating engines.

The following table compares our TPUs to conventional diesel-powered pressure pumping equipment.

| Turbine-Powered | Conventional Diesel-Powered | |||

| Multi-Fuel Capability | Natural gas produced onsite (“Field Gas”), LNG, CNG, diesel, or a blend of diesel and natural gas (“Bi-fuel”) | Diesel or Bi-fuel | ||

| Emissions (using diesel) | Lower than typical diesel emissions: have met Tier 4 standards for NOx and carbon monoxide | Requires catalytic converter to meet Tier 4 standards (reduces HP, additional cost) | ||

| Horsepower (“HHP”) per trailer | 4,500 HHP (2 pumps) | 2,250 HHP (1 pump) | ||

| Major Engine Repair | Generally onsite repair or exchange | Shop |

Coiled Tubing

Our customers utilize our coiled tubing services to perform various functions associated with well-servicing operations and to facilitate completion of horizontal wells. Coiled tubing services involve the insertion of steel tubing into a well to convey materials and/or equipment to perform various applications as part of a new completion or the servicing of existing wells, including wellbore maintenance, nitrogen services, thru-tubing services, and formation stimulation using acid and other chemicals. Coiled tubing has become a preferred method of well completion, workover and maintenance projects due to speed, ability to handle heavy-duty jobs across a wide spectrum of pressure environments, safety and ability to perform services without having to shut-in a well. Our coiled tubing capabilities cover a wide range of applications for horizontal completion, workover and well-maintenance projects.

Field Management

We recognize that energy companies are under intense pressure to reduce finding costs while simultaneously coming under heightened environmental scrutiny. We have taken steps to create an innovative methodology for reducing costs, improving efficiencies and increasing resource recovery rates, which incorporates geophysics and various downhole diagnostics tools, including fiber optic acoustic and temperature measurements. Our suite of advanced but fully commercialized technologies can be combined to provide both highly efficient geophysical predictive models to our customers and downhole diagnostic measurements to confirm the accuracy of those predictions.

| 3 |

Our proprietary technologies are used to reduce the number of stages required to optimize production, which can result in a substantial reduction of the environmental footprint and costs of completing a well. Based on many predictive models executed in several of the U.S. shale basins, we believe that the best and most productive stages often occur in brittle and micro-fractured rock formations (“micro-fracture swarms”). These micro-fracture swarms are too small to detect with 3D seismic, but their location can be inferred using a proven attribute analysis combined with core analysis and well diagnostic information. We believe that stimulation efforts in these areas tend to be more effective and frequently result in a better stimulation effort, which in turn produces more hydrocarbons. We also have the capability to monitor the cementing and stimulation operation and the ongoing production results in real time over the life of the well, measuring the type and quantity of inflow from each stimulation stage. This data allows our customers to confirm and refine the predictability of our Geo-Predict® technology and related field services. Once the Geo-Predict® technology and our services are demonstrated to be accurate and reliable in a given area, it then offers compelling opportunities to lower production costs while simultaneously reducing the environmental impact as a result of completing fewer, better targeted stages with less horsepower. In cases where the fiber optic diagnostic system is permanently installed in a well, we believe the information provided allows for proactive management of the well’s performance over the life of the well, including the ability to actively shut off zones with unwanted water flow.

Growth Strategy

Our objective is to be one of the most effective, efficient, and environmentally responsible well stimulation and completions service providers in the world. We intend to prioritize risk management and specialize in the high-end well stimulation market, while seeking to achieve strong operating margins and increased market share generating long-term shareholder value. We intend to build upon our competitive strengths to grow our business and continuously increase our revenues and operating income by executing the following strategies:

Bring best practices and established technologies to capitalize on growth in development of international unconventional resource basins.

Our management team recognizes the importance of product and service differentiation and believes we have secured key technologies that will allow our service offerings to compete directly with larger and more established oilfield service companies currently operating in both the North American and international markets. These technologies include certain proprietary geophysical predictive tools and specialized down-hole tools, which we believe will ultimately allow for targeting of “sweet spots” and a reduction in the number of stimulation stages executed in each well without sacrificing production.

We believe our Company is positioned for growth based on a sound business plan, responsible corporate governance, experienced personnel and growing demand for environmental protection during oil and gas production. We recognize that well stimulation now faces intense environmental scrutiny and have taken steps to ensure that our well stimulation operations offer the most environmentally friendly solutions available in the industry. These techniques combine a number of processes and technologies in a manner that allows for a significant reduction in emissions, the use of water and horsepower while optimizing the number and placement of stimulation stages. In many well completion operations, we believe the following tools or process enhancements will improve the overall economics:

| ● | Predictive geophysical tools, which allow for the identification of “sweet spots” and efficient stimulation stage placement; | |

| ● | Sliding sleeve based perforating and well stimulation system (65% less HHP); | |

| ● | Temporary or permanent fiber optic recording system to measure performance of each stage over time, initial and ongoing well integrity, and to track the stimulation process as it occurs; and | |

| ● | Empirical diagnostic data gathered to improve and build confidence in the geophysical predictions (goal is fewer stages with same or better production). |

| 4 |

Leverage established local relationships in international markets.

We have assembled a team of industry professionals with significant international experience in oilfield services, including key executives with a particular emphasis on the well stimulation business. We are currently conducting operations in Argentina, where our management and operational team have long-standing relationships with customers and energy professionals. We also intend to pursue other markets where our management team has similar relationships so long as those markets meet our investment criteria.

Key ranking criteria for international shale market opportunities.

We evaluate six distinct characteristics in determining the viability of potential new markets for our services:

| ● | Regional geology. The quality and complexity of the rock, the presence of data about the resources it contains, and the ability to adapt existing technologies to local rock characteristics. | |

| ● | Pace of activity. Established energy activity with the prospect of growth in high-volume drilling and well stimulation operations. This may often include a consideration of conventional oil and gas development. | |

| ● | Demand for hydrocarbons. Sufficient local demand or, alternatively, established oil and gas distribution networks that can transport resources to consuming markets, either locally or through export. | |

| ● | Land access and operability. Developed infrastructure such as roads, rail, housing, fuel, pipelines, water availability, and a strong oil and gas workforce. | |

| ● | Local relationships. Established and long-standing relationships with local customers and energy professionals, as well as trusted advisors with an understanding of local laws, business process, tax issues and customary business practice. | |

| ● | Business environment. Positive and viable business environment. Manageable local regulations, taxes, security, culture and customary ethics practices. Positive views from the local community and activist organizations. |

We believe that it is important to consider each of these factors in addition to fiscal support and the estimated size of the resource base when assessing the viability of unconventional development. Markets that are promising in one category may pose obstacles to investment in other categories. The more factors that are favorable in each prospective location, the more likely that location will qualify as a viable investment opportunity. This process led to our decision to enter the Argentine market as our initial operations focus.

Proactively manage international risk.

Operating in international markets requires us to take on additional risk. We plan to conduct a formal risk assessment whenever considering our entry into new markets. As such, we have established internal controls intended to protect ourselves from foreign market risks, including but not limited to foreign currency exchange, tax, political and economic risks.

Our executive team’s assessment includes an understanding of local laws, regulations, cultures and ethics prior to entering any new market. Additionally, we may seek partners with local relationships and knowledge to reduce risk and to tailor our approach to the specific market. Because emerging markets inherently have rapidly changing risk profiles, we intend to conduct a thorough risk assessment not only prior to entering a new market, but also periodically while conducting operations to identify and address necessary changes.

In connection with these assessments, we believe that we benefit from our association with our largest investor, ACM, an internationally recognized private equity firm dedicated to the emerging markets, which currently has three representatives serving as members of our Board. Based on ACM’s significant ownership interest in us, we believe that they are incentivized to actively support our growth strategy and provide us with their extensive experience in pursuing successful investments in emerging markets.

| 5 |

Competitive Strengths

We believe our significant competitive strengths are as follows:

Ability to identify proven technologies that have high margin applications in international shale basins.

Our management team recognizes the importance of product and service differentiation. We believe that we have identified several key technologies (as well as securing partners with key technologies) that will allow emerging international shale basins to be developed in a cost effective and more ecological manner.

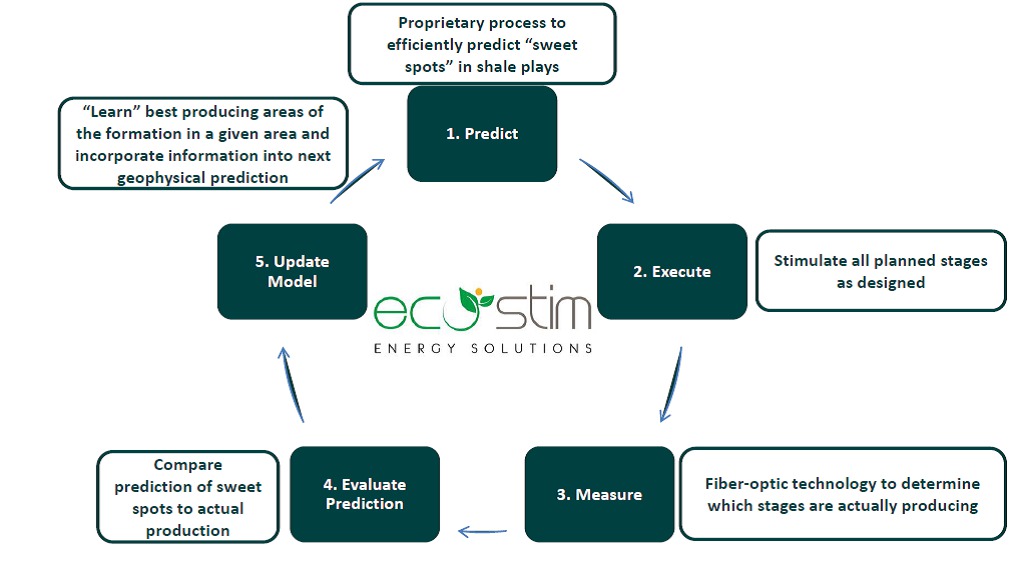

We have assembled a suite of technologies and methodologies designed to generate the empirical data needed to ultimately reduce stages and improve the estimated ultimate recovery. This process starts with our proprietary Geo-Predict® software and interpretation tools, which quickly and cost effectively predict both stimulation hazards and potential “sweet spots” using proven seismic processing and interpretation techniques (step 1 in the diagram below). This enables the operator to assess the locations of zones in the formation where well stimulation is most likely to be effective, potentially reducing the number of stages that must be stimulated, and the associated cost. The wells are then stimulated according to the customer’s plan (step 2 in the diagram below). Our advanced fiber optic acoustic measurement tools or, if more applicable, standard production logging tools can then measure the accuracy of each prediction, by identifying stage-by-stage flow properties on a real-time basis (in the case of fiber optics) (step 3 in the diagram below). The final step in the process involves using the stage-by-stage flow-property data to update the predictive model generated using Geo-Predict® (steps 4 and 5 in the diagram below). After developing sufficient data in a new area, and correlating the best production zones to identifiable markers in the sub-surface model, our Geo-Iteration® process allows our customers to target with confidence those zones which consistently yield strong production results.

The following diagram depicts an overview of our technology platform.

| 6 |

Further, we have secured strategic arrangements with some of the stronger unconventional technology companies currently participating in the development of unconventional shale basins in North America. These include specialized “green” chemical fluid providers, down-hole fiber optic acoustic recording systems, and down-hole sliding-sleeve completion tools. These technologies (both controlled by us and available to us through partnerships or alliances) allow us to present a broad consortium of products and services to our international customers. In addition, we can bring unique value through our turbine powered pumping equipment referred to below.

Differentiated turbine-powered equipment.

Our TPUs have multiple benefits over conventional diesel-powered well stimulation equipment, including:

| ● | Greater fuel flexibility. Our TPUs can operate on field gas, LNG, CNG, diesel or Bi-fuel, whereas conventional fracturing equipment can generally operate on only diesel or Bi-fuel. We believe our ability to operate our TPUs with various types of fuels, particularly natural gas, will provide significant value for our customers through, among other things, potential cost savings and ease of compliance with increasingly difficult emissions standards. Based on our extensive due diligence and field analysis, we believe that a gas-fired turbine powered pressure pumping crew operating in the U.S. market can save approximately $7 million per year in diesel cost in situations where natural gas is purchased at market prices and diesel costs remain at their five year average of $3.50 per gallon. With lower prices for diesel as a result of the current oil price decline, the savings are reduced proportionately. In other situations, where natural gas is otherwise being flared, the annual potential savings are much greater. In the international markets where diesel fuel can be 2-3 times more expensive than in the United States, we estimate that this equipment could potentially save a customer $14-21 million per year on fuel for a single pressure pumping fleet. | |

| ● | Lower emissions. Our TPUs, even when running on diesel fuel, produce lower emissions than conventional diesel-powered fracturing equipment and currently are 60% below the Tier 4 standards for NOx and carbon monoxide gas emissions. Also, the methane release from turbine powered engines is almost non-existent as compared to releases from even the best diesel or Bi-fuel engine. Finally, the opportunity to use field gas enables our customers to reduce their “flaring” of natural gas, a source of GHG’s and a waste of a valuable resource that is subject to increasing regulatory scrutiny in the United States and elsewhere. | |

| ● | Smaller footprint. Our TPUs are uniquely outfitted with twin triplex pumps capable of generating 4,500 total HHP from each trailer, whereas conventional configurations allow for only a single diesel-powered pump (1,800-2,500 total HHP) on a trailer, thus substantially reducing footprint. | |

| ● | Easier major engine repair or replacement. Because our turbine engines are much smaller and lighter than conventional diesel engines, we have the option to repair or replace turbine engines onsite, whereas a repair or replacement of a diesel engine generally requires transporting such engine to a repair shop. If we elect to deploy some or all of our TPUs in Argentina, we have identified an Argentina based maintenance company to provide repair and maintenance services. |

Highly experienced leadership team that have successfully built, operated, and sold other oilfield service companies.

Members of our executive leadership team bring an average of over 25 years of experience in the energy sector, and maintain long-standing relationships with many leading public and private exploration and production companies in the United States and in international markets.

Our management and operational team have extensive industry experience providing field management and well stimulation services to exploration and production companies in both international and domestic markets. We believe that we are well-staffed to execute our business plan in active shale and unconventional oil and natural gas basins located outside the United States. We plan to utilize our strategic relationships to develop oilfield service business opportunities initially in Latin America, with a particular focus in Argentina, Mexico and Colombia. Members of our management team have been involved with establishing oil-service businesses (including geophysical, offshore drilling, and well-stimulation) in Algeria, Argentina, Australia, Brazil, Cananda, China, Colombia, Egypt, Indonesia, Iraq, Kazakhstan, Malaysia, Mexico, Mozambique, Nigeria, Norway, Oman, Peru, Saudi Arabia, Turkey and the UAE, the UK and the United States.

| 7 |

Industry leading strategic partner with international experience.

ACM, an internationally recognized private equity firm dedicated to the emerging markets, currently has three representatives serving as members of our Board. Based on ACM’s significant ownership interest in us, we believe that they are incentivized to actively support our growth strategy and provide us with their extensive experience in pursuing successful investments in emerging markets.

Customers

Our customers consist primarily of international oil and gas exploration and production companies including national oil companies, local privately held exploration and production companies and, on occasion, other service companies that have contractual obligations to provide well stimulation and completion services. Demand for our services depends primarily upon the capital spending of oil and gas companies and the level of drilling activity in international markets. To date, substantially all our revenue generated is attributable to four customers, including YPF and three privately-held local exploration and production companies.

Competition

We operate in a highly competitive environment. Our competitors include Schlumberger, Halliburton, Weatherford, Baker Hughes, Calfrac, Pride San Antonio and other oilfield service companies. We compete with these companies in substantially all of our current markets. We believe that in the future we will face increased competition from these competitors as our Company and these competitors expand their operations. At this time, we believe that there are insufficient services being offered locally in Argentina to service a major unconventional field, but there can be no assurance that additional competitors will not enter markets served or proposed to be served by us. Most of the entities against which we compete, or may compete, are larger and have greater financial resources than our Company. No assurance can be given that increased competition will not have an adverse effect on our Company.

Suppliers and Raw Materials

We are acquiring well stimulation fleets from well-established manufacturers of such equipment in order to assure we operate reliable and high-performing fleets with the capability to meet the most demanding pressure and flow rate requirements in the field. We have purchased equipment from Stewart & Stevenson Manufacturing Technologies LLC, one of the most highly-regarded manufacturers of well stimulation equipment in the United States, and a local Argentine manufacturer, which we believe to be currently the only significant manufacturer of such equipment in Argentina. We have also purchased 12 trailers with 24 triplex pumps (TPUs) from a private company. This equipment was manufactured by Turbine Powered Technology, LLC located in Abbeville, Louisiana.

We intend to purchase or lease well stimulation equipment for our contracts outside the United States as contracts are secured. In addition, we have and may continue to pursue opportunities to acquire well stimulation and coiled tubing assets or businesses currently operating in the United States, with the goal of eventually relocating such assets to faster-growing or higher-margin international markets. We believe that well stimulation and coiled tubing equipment may be available from time to time at favorable prices given the volatility of commodity prices in the United States.

Environmental Regulation

Our operations and the operations of our customers are subject to increasingly stringent laws and regulations relating to importation and use of hazardous materials, radioactive materials and explosives and to environmental protection, including laws and regulations governing air emissions, well stimulation and pressure pumping, water discharges, wetlands or land use practices, waste management, and the release of hazardous substances into the environment. We incur, and expect to continue to incur, capital and operating costs to comply with environmental laws and regulations. The technical requirements of these laws and regulations are becoming increasingly complex, stringent and expensive to implement. In addition, these laws may provide for “strict liability” for remediation costs, damages to natural resources or threats to public health and safety. Strict liability can render a party liable for damages without regard to negligence or fault on the part of the party. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations and the issuance of orders enjoining some or all of our customers’ operations in affected areas.

| 8 |

Current or future legislation, regulations and enforcement initiatives may curtail production and demand for hydrocarbons such as oil and natural gas in areas of the world where our customers operate and thus adversely affect future demand for our services, which may in turn adversely affect future results of operations.

Well Stimulation

Many national, provincial, and local governments and agencies have adopted laws and regulations or are evaluating proposed legislation and regulations that are focused on the extraction of shale gas or oil using well stimulation, which is part of the well stimulation services we provide to our customers. Well stimulation is a stimulation treatment routinely performed on oil and gas wells in low-permeability reservoirs. Specially engineered fluids are pumped at high pressure and rate into the reservoir interval to be treated, causing cracks in the target formation. Proppant, such as sand of a particular size, is mixed with the treatment fluid to keep the cracks open when the treatment is complete. In response to concerns related to potential impacts to the environment and natural resources from well stimulation, governmental authorities have issued new rules and regulations governing the practice, and are also pursuing studies related to its potential effects. Also, some national, state, and local governments have adopted bans or other measures restricting well stimulation activities. For example, the Province of Neuquén in Argentina, where we operate, has approved a set of rules regarding the extraction of shale oil and gas. These rules require, amongst other things, that operators performing well stimulation obtain permits prior to commencing drilling activities and file reports with the provincial government regarding the chemicals used in the well stimulation process and an analysis of the flowback water returning to the surface. In addition, several other provinces and local governments have voted to ban well stimulation within their borders, and some groups continue to advocate for a national ban on well stimulation in Argentina.

Future well stimulation-related legislation or regulations that further restrict or prohibit such activities could lead to operational delays and increased costs for our operations or the operations of our customers. Any adverse impacts on the operations of our customers could in turn reduce demand for our services. If such additional legislation or regulations are enacted, it could adversely affect our financial condition, results of operations and cash flows.

Climate Change

International, national, and state governments and agencies are currently evaluating and promulgating legislation and regulations that are focused on restricting emissions commonly referred to as GHG emissions in response to concerns that GHGs contribute to climate change. For example, in the United States, the EPA has taken steps to regulate GHGs as pollutants under the federal Clean Air Act. The EPA’s “Mandatory Reporting of Greenhouse Gases” rule established in 2010 provided a comprehensive national scheme of regulations that require monitoring and reporting of GHG emissions, including emissions from the oil and gas industry.

International developments focused on restricting the emission of carbon dioxide and other gases include the Copenhagen Accord (an internationally applied protocol, which has been ratified by several countries in Latin America and is a continuation of the Kyoto Protocol) and the European Union’s Emission Trading System. Argentina, Brazil, and Mexico have all committed to reducing GHG emissions, either through the deployment of renewable energy sources or through the use of a cap and trade program. Such programs place a cap on GHG emissions at certain sources and require those sources to purchase allowances for emissions above their cap. The adoption of legislation or regulatory programs to reduce emissions of GHGs could require us or our customers to incur increased operating costs, such as costs to purchase and operate emissions control systems, to acquire emissions allowances or comply with new regulatory or reporting requirements. In addition, current or future legislation, regulations and developments may curtail production and demand for hydrocarbons such as oil and natural gas in areas of the world where our customers operate and thus adversely affect future demand for our services, which may in turn adversely affect future results of operations.

Finally, it should be noted that some scientists have concluded that increasing concentrations of GHGs in the Earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, floods and other climatic events; if any such effects were to occur, they could have an adverse effect on our operations and the operations of our customers.

| 9 |

Employees

As of today we have 54 employees, 52 of which are full-time employees, and 5 consultants. Thirty-four of our employees located in Argentina are covered by two collective bargaining agreements, one with Petroleros Privados – vigencia (Petroleum Skill workers union) and the other with Petroleros Jerárquicos – vigencia 31/12/2012 (Petroleum hierarchy workers union). Both collective bargaining agreements expire on March 31, 2015 and the new agreements are currently being negotiated by the unions.

Intellectual Property

We have registered or filed for registration with the United States Patent and Trademark Office for the following trademarks: Geo-Predict® and Geo-Iteration®. We have not filed any applications for the registration of our trademarks in foreign jurisdictions, but may do so in the future as we deem necessary to protect our business.

Operating Risk and Insurance

We maintain insurance coverage of types and amounts that we believe to be customary and reasonable for companies of our size and with similar operations. In accordance with industry practice, however, we do not maintain insurance coverage against all of the operating risks to which our business is exposed. Therefore, there is a risk our insurance program may not be sufficient to cover any particular loss or all losses. Currently, our insurance program includes, among other things, general liability, umbrella liability, sudden and accidental pollution, personal property, vehicle, workers’ compensation, and employer’s liability coverage. Our insurance includes various limits and deductibles or retentions, which must be met prior to or in conjunction with recovery.

Recent Developments

QM Purchase Order

On October 10, 2014, a subsidiary of ours entered into a purchase order with QM Equipment SA for the purchase of well stimulation equipment for a total purchase price of approximately $8,793,245, of which $6,155,271 will be due and payable when the equipment is delivered. The current estimated delivery date is December 2015.

GBCI Purchase Agreement

On October 10, 2014, we entered into an equipment purchase agreement with Gordon Brothers Commercial & Industrial, LLC for the purchase of the TPUs, certain spare parts and inventory for a total purchase price of approximately $6,500,000, of which $4,100,000 has been financed until April 1, 2015, upon which time the entire amount, including any accrued interest, will become due and payable. On March 12, 2015, we amended the agreement to add a blender, two data vans and a manifold at an increased cost of $400,000, to defer the due date of the final payment until March 31, 2016, and to provide for monthly installment payments of $50,000 beginning in May 2015.

ACM Convertible Note

On October 29, 2014, we elected to draw the remaining $10,136,115 under the Convertible Note issued to ACM as referenced in “Certain Relationships and Related Party Transactions and Director Independence” below. These funds will be used to supplement cash flow from operations and to finance various capital expenditures to be incurred over the next three quarters.

Revenue Milestone

On February 4, 2015, we announced that the Company has generated over one million dollars in oilfield service revenue since its equipment became operational in mid-December 2014.

| 10 |

Equity Offering

On February 19, 2015, the Company sold 1,051,376 registered securities of common stock at a price of $5.75 for gross proceeds to the Company of $6,045,412.

Corporate History

Vision Global Solutions, Inc.” (“Vision”), was formed as a Nevada corporation on January 7, 2005. On December 11, 2013, Vision acquired FracRock International, Inc., a privately held Delaware corporation (“FRI”), which resulted in a change of control of the Company. Pursuant to that certain Agreement and Plan of Reorganization dated as of September 18, 2013, by and among Vision, FRI Merger Sub, Inc., a newly formed wholly owned Delaware subsidiary of Eco-Stim (“MergerCo”), and FRI, MergerCo merged with and into FRI, with FRI surviving the merger as a wholly owned subsidiary of the Company, which was re-named Eco-Stim Energy Solutions, Inc (the “Merger”). On May 5, 2014, FRI merged with and into Eco-Stim, with Eco-Stim surviving the Merger.

Frac Rock International, Inc., a predecessor of our Company, was incorporated as a British Virgin Island company (“FRIBVI”) on December 30, 2011. On October 4, 2013, FRIBVI merged with and into FRI pursuant to an Amended and Restated Agreement and Plan of Merger.

Corporate Information

We are a Nevada corporation. Our principal executive offices are located at 2930 W. Sam Houston Pkwy N., Suite 275 Houston, Texas 77043 and our main telephone number at that address is (281) 531-7200. Our website is available at www.ecostim-es.com. Information contained on or available through our website is not part of or incorporated by reference into this Form 10-K or any other report we may file with the Securities and Exchange Commission (the “SEC”).

We file our reports, proxy statements and other information with the SEC. You can read and copy these reports, proxy statements and other information concerning Eco-Stim at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, on official business days during the hours of 10 a.m. to 3 p.m. Please call the SEC at 1-800-SEC-0330 for further information about the operation of the SEC’s Public Reference Room. The SEC also maintains an internet site that contains all reports, proxy statements and other information that we file electronically with the SEC. The address of that website is http://www.sec.gov.

INDUSTRY

Industry Overview

The pressure pumping industry provides well stimulation services to oil and natural gas companies. Well stimulation involves pumping a fluid down a perforated well casing, sliding sleeve or tubing under high pressure to cause the underground formation to crack, allowing the oil or natural gas to flow more freely. A propping agent is suspended in the fracturing fluid and props open the cracks caused by the well stimulation process in the underground formation. Proppants generally consist of sand, bauxite, resin-coated sand or ceramic particles.

We believe the two main factors influencing demand for well stimulation services are (1) the level of horizontal drilling activity by oil and natural gas companies, and (2) the stimulation requirements of the well being drilled, including the number of fracturing stages and the type and volume of fluids, chemicals and proppant pumped per stage. When drilling a horizontal well, the operator drills vertically into the formation and “steers” the drill string to create a horizontal section of the wellbore inside the target formation, which is referred to as a “lateral.” This lateral is divided into “stages,” which are isolated zones that focus the high-pressure fluid and proppant being pumped into the well into distinct portions of the wellbore and surrounding formation.

Over the last decade, technological advancements in horizontal drilling and multi-stage well stimulation have brought about a shift from the development of conventional oil and natural gas resources to the exploitation of the vast resource potential available across many of North America’s unconventional resource basins. These unconventional resources are characterized by shale formations spanning large areas, which in most cases require some form of stimulation to produce commercial amounts of hydrocarbons. These advanced completion techniques have allowed oil and natural gas producers to extract hydrocarbons from both conventional and unconventional resources that were previously thought to be uneconomic, resulting in significant increases in unconventional drilling activity. Moreover, operators are now also revisiting long-producing properties and redeveloping them using horizontal directed drilling that allows for longer horizontal laterals and more stages in stimulating the wells.

| 11 |

Longer laterals have resulted in operators increasing the number of stages per well, which has enhanced production rates while improving well economics. The total number of stages performed has been steadily rising over the last few years. According to PacWest Consulting Partners, the U.S. land market completed a record 375,000 stages in 2013, with demand for well stimulation services in the U.S. land market expected to increase by 5% in 2014 and an additional 3% in 2015.

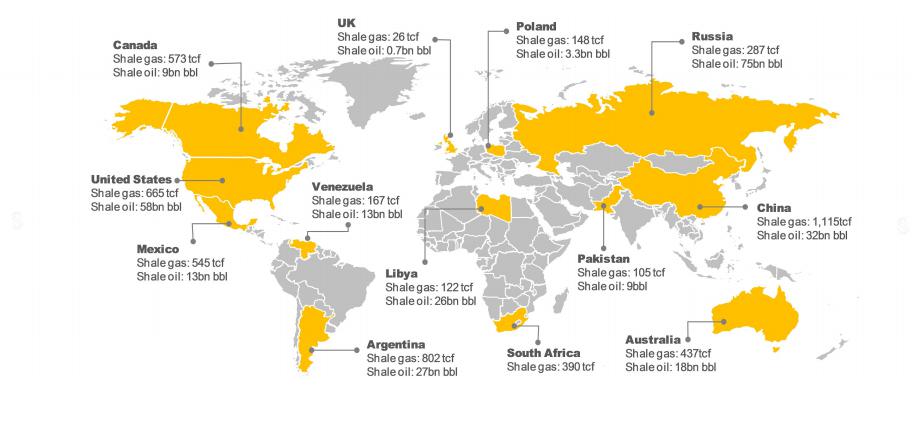

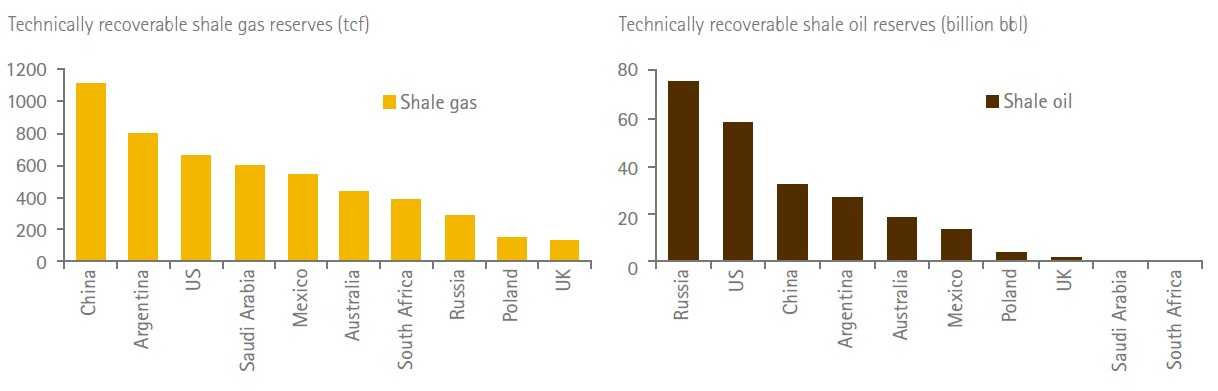

According to the EIA, approximately 80% of global shale resources lie outside the United States. More than half of the shale oil outside the United States is concentrated in Russia, China, Argentina and Libya, while more than half of the shale gas outside the United States is concentrated in China, Argentina, Algeria, Canada and Mexico.

Selected Estimated Technically Recoverable Shale Oil and Shale Gas Resources

Source: EIA

Shale development activity has progressed at a modest pace in many international regions due to several critical factors, including relatively poorly understood geology, prohibitive well costs, lack of government incentives and pipeline infrastructure, and various other environmental and social considerations. Given the variation across the world’s shale in both geology and above-ground conditions, the extent to which global resources will prove to be economically recoverable is not clear. The market impact of shale resources outside the United States will depend on their own production costs and volumes.

| 12 |

According to the EIA, Argentina ranks in the top tier of unconventional shale opportunities outside of the United States.

Size of Potential Resources

Source: EIA

Though many locations around the world that have both a wealth of unconventional resources and regimes that support investment, actual unconventional activity varies widely. To date, according to Morgan Stanley, significant commercial success outside the North American market has only been achieved in Argentina and China.

Of those countries with substantial shale potential, Argentina’s improving regulatory framework and favorable geological fundamentals has shown the most significant promise. In its most recent report, the EIA/Advanced Resources International, Inc. listed Argentina as possessing the world’s third-largest shale potential, with technically recoverable resources of 27 billion barrels of oil equivalent of shale oil and 802 trillion cubic feet of shale natural gas. Despite the challenging macro-political situation of the country, the attractiveness of below-ground fundamentals has been enough to spark a wave of investments. More specifically, the high-quality liquids-rich Vaca Muerta in the Neuquén Basin has been identified as one of the most promising areas in Argentina’s shale formations in terms of both size and hydrocarbon quality, including areas that are more “oily,” thus presenting better economics. By itself, Vaca Muerta represents approximately 40% of the country’s total estimated shale gas resources and approximately 60% of its total estimated shale oil.

The map below illustrates the identified shale basins within the country of Argentina.

Argentina’s Shale Basins

Source: YPF

Neuquén is an established basin with significant conventional oil and gas production and existing infrastructure, including roads, pipelines and railways. There is also an existing oil and gas workforce in Neuquén; however, the new technologies associated with developing unconventional resources will require new training of the workforce. In addition, the prevalence and power of unions across all aspects of the operation—from transport to fracturing services—are likely to contribute to the cost and complexity of developments.

| 13 |

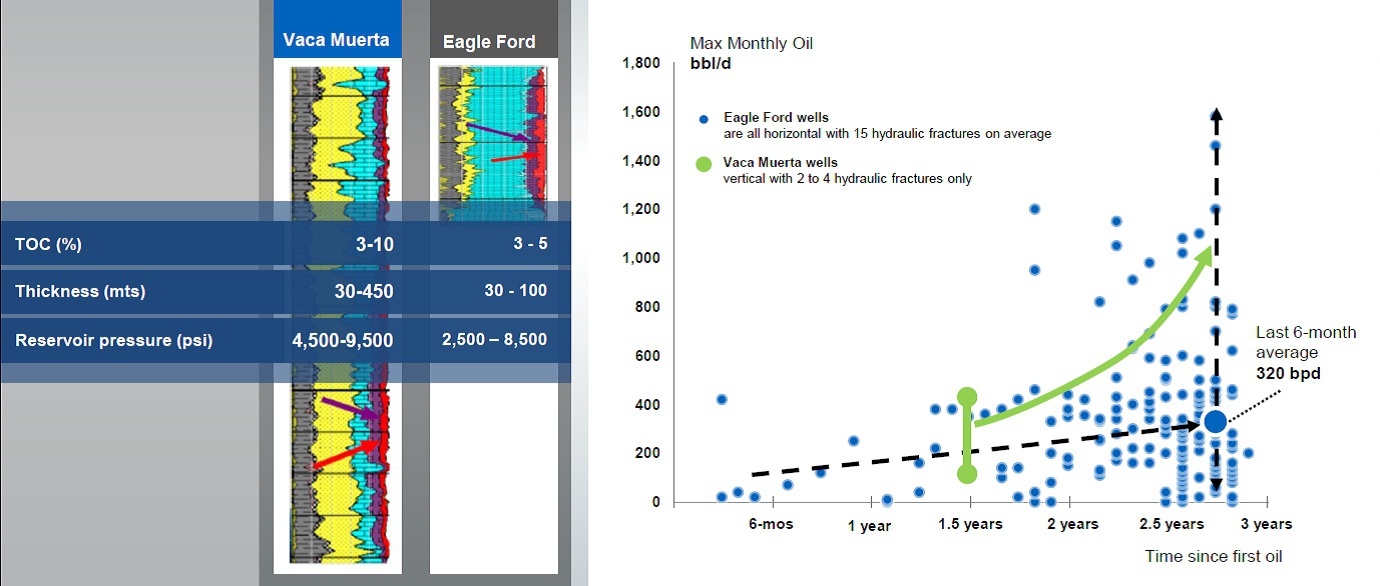

As illustrated in the charts below, the Vaca Muerta resource basin has similar characteristics to one of the richest drilling areas in the United States, the Eagle Ford basin in Texas. It is sufficiently thick and rich in liquid resources to foresee a consistent output.

Comparing the Vaca Muerta to the Eagle Ford

Source: YPF

Heavily regulated, Argentina has traditionally been a challenging environment for foreign investment. Energy sector policies have limited the industry’s attractiveness to private investors while shielding Argentina consumers from rising prices. Consequently, domestic demand for energy has grown rapidly while production of both petroleum and other liquids and natural gas has declined – leading Argentina to depend increasingly upon energy imports. In order to ensure that domestic demand is met, crude oil is subject to export taxes and restrictions on export volumes, which limit the profits that companies are able to generate from selling Argentine production abroad.

However, with production falling significantly and imports increasing over the last five years, the Argentine government is committed to developing its unconventional resources and has begun to offer attractive investment incentives in the energy sector. For example, Argentina initiated a new oil and gas promotion regime in 2013 that includes exemptions from the export tax for up to 20% of production after five years from the start of each project with a total five-year investment over $1 billion. In October 2014, the government passed a new hydrocarbon law which reduced the minimum five-year investment to $250 million. In addition, the maximum royalty due to the provincial government was capped at 12% while the holding period for concessions was extended to as much as 35 years. The government has also passed laws to eliminate the customs duties on drilling equipment under certain circumstances, which we believe is an effort to reduce obstacles to the development of the shale resources in the country.

As a result of these legal changes, there have been several announcements from major drilling contractors related to more than 25 drilling rigs which are currently scheduled to arrive in Argentina in 2015 to participate in the development of shale resources. In this early phase of exploration, understanding of the Vaca Muerta opportunity requires sound application of environmentally conscious principles, while focusing on appropriate shale play analogues to Argentine basins such as the Eagle Ford in the United States. As new data becomes available, close work between the different disciplines is paramount. Technological integration, as well as an understanding of local variability within an area of interest, will play a key role in the identification of the sweet spots and the cost-efficient de-risking of the play.

| 14 |

The support for the development of Argentina’s resource basins is now considered of national interest. Since 2009, Argentina has begun to import energy from outside the country. The need to purchase energy from outside the country has continued to accelerate for the past five years culminating with an import of over $10 billion in natural gas and LNG during 2013, according to Instituto Nacional de Estadística y Censos (INDEC). This situation has created a significant trade imbalance and has put pressure on the local currency as Argentina’s dollar reserves have dwindled from over $40 billion a few years ago to less than $28 billion today, according to the International Monetary Fund. We believe this situation is unsustainable and will further support the development of the Vaca Muerta shale resource as well as other resource basins in the country.

Recent Industry Trends

We believe the following principal trends are positively correlated to increasing demand for our services while facilitating implementation of our business strategy:

Ongoing, sustained development of existing and emerging unconventional resource basins.

We believe the continued development of unconventional resource basins will be in the national interest of the countries in which those basins are located. We expect the long-term capital for their development will be provided in part by the participation of large exploration and production companies that have made and continue to make significant capital commitments through joint ventures and direct investments in North American and international unconventional basins. The nationally owned oil and gas companies, in particular, are focused on growing oil and gas production in the local communities in which they operate. We believe that these companies are less likely to materially alter their drilling programs in response to short-term commodity price fluctuations given the focus on the national interests in securing long-term supply of oil and gas.

Increased focus on international development of unconventional resources.

Unconventional resources, specifically shale gas, tight gas, shale oil and tight oil, have revolutionized the energy landscape in the United States, using new technologies such as horizontal drilling and well stimulation to access previously unavailable resources. Oil and natural gas companies have begun to apply the knowledge gained through the extensive development of unconventional resource basins in the United States to international resource basins, including in Latin America. With an improving regulatory framework and favorable geological fundamentals, we believe Argentina is well-positioned to exploit its oil and natural gas resources. Favorable test results have subsequently led Chevron Corp., Royal Dutch Shell Plc, Total S.A., ExxonMobil Corporation and YPF among others to announce development plans in the region.

Constrained supply of well stimulation fleets in emerging markets.

The supply of well stimulation fleets, proppants, replacement and repair parts and other products has not kept up with the increased demand in many emerging international shale basins where horizontal drilling is expanding rapidly. Many established service companies lack a local presence in emerging markets, while some local service companies lack the requisite expertise. As a result, we believe there are insufficient oilfield services presently being offered on the necessary scale in Argentina and other emerging markets to meet anticipated growth in drilling activities, despite the vast unconventional resource potential that exists.

Increasing awareness for more efficient and economical solutions to develop shale resources.

Well stimulation now faces intense environmental scrutiny, particularly in international markets, that may require well stimulation operations to offer certain ecological protection during oil and gas production. As a result, there has been enhanced interest in technologies allowing for the use of natural gas as fuel, a significant reduction in surface footprint of operations, and overall reduction in the use of fuel, water and horsepower while optimizing the number and placement of stages.

| 15 |

An investment in our common stock involves a number of risks. You should carefully consider the risks described in “Risk Factors,” in addition to the other information contained in this Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before investing in our common stock. These risks could materially affect our business, financial condition and results of operations, and cause the trading price of our common stock to decline. You could lose part or all of your investment. You should bear in mind, in reviewing this Form 10-K, that past experience is no indication of future performance. You should read the section titled “Cautionary Note Regarding Forward-Looking Statements” for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this Form 10-K.

Risks Related to Our Business

We have limited operating history and only minimum revenues.

We have a limited operating history and, accordingly, we are subject to substantial risks inherent in the commencement of a new business enterprise. We are an early stage, technology-driven independent oilfield service company providing well stimulation, coiled tubing and field management services to the upstream oil and gas industry with a focus on improving the ecological and economic aspects of the process. Our Company’s primary focus will be on the most active shale and unconventional oil and natural gas basins outside the United States, commencing with Argentina. To date, we have only generated minimal revenue from our consulting and field management operations. There can be no assurance that we will be able to successfully generate additional revenues, or attain operating profitability. Additionally, we have a very limited business history that investors can analyze to aid them in making an informed judgment as to the merits of an investment in our Company. Any investment in our Company should be considered a high-risk investment because the investor will be placing funds at risk in our Company with unforeseen costs, expenses, competition, and other problems to which new ventures are often subjected. Investors should not invest in our Company unless they can afford to lose their entire investment. As we are early in the revenue-generation process, our prospects must be considered in light of the risks, expenses, and difficulties encountered in establishing a new business in a highly competitive industry.

We have limited sources of liquidity.

We require substantial capital to pursue our operating strategy. As we have limited internal sources of liquidity, we will continue to rely on external sources for liquidity for the foreseeable future.

We participate in a capital-intensive industry, and we may have capital needs for which our internally generated cash flows and other sources of liquidity may not be adequate.

We have substantial future capital requirements, including the need to fund growth through acquisition of additional equipment and assets, working capital and capital expenditures and debt service obligations. Since December 2013, our operation and growth has been funded primarily by proceeds from various equity and debt offerings and more recently by cash flows from operations. Our ability to fund operations, and to fund planned and committed 2015 capital expenditures will depend upon our future operating performance, and more broadly, on the availability of equity and debt financing, which will be affected by prevailing economic conditions, market conditions in the exploration and production industry and financial, business and other factors, many of which are beyond our control. Although we believe we are well-positioned to finance our future growth, if we are unable to generate sufficient cash flows or to obtain additional capital on favorable terms or at all, we may be unable to continue growing our business or to sustain or increase our current level of profitability. Our inability to grow our business may adversely impact our ability to sustain or improve our profits. Moreover, if we cannot generate sufficient cash flows or otherwise secure sufficient liquidity to support our capital requirements, we may not be able to meet our payment obligations which could have a material adverse effect on our results of operations or liquidity.

We may not be able to renew our existing agreements on attractive terms or at all, which could adversely impact the results of operations, financial condition and cash flows.

We can provide no assurance that we will be able to successfully fulfill, renew or replace our existing agreements with new agreements on or prior to their expiration on terms satisfactory to us or the operator or that we will be able to continue to provide services under those existing contracts without service interruption. If we are not able to either renew or enter into additional service contracts, the results of operations, financial condition and cash flows could be adversely impacted.

We are dependent on entering into additional service contracts to grow our business.

Our customers may choose to integrate their operations vertically by purchasing and operating their own well stimulation fleet, expanding the amount of well stimulation equipment they currently own or using alternative technologies for enhancing oil and gas production.

Our customers may choose to integrate their operations vertically by purchasing and operating their own well stimulation fleets in lieu of using our well stimulation services. Currently, the availability of attractive financing terms from financial institutions and equipment manufacturers facilitates this possibility by making the purchase of individual well stimulation equipment increasingly affordable to our customers. In addition, there are other technologies available for the artificial enhancement of oil and natural gas production and our customers may elect to use these alternative technologies instead of the well stimulation services we provide. Such vertical integration, increases in vertical integration or use of alternative technologies could result in decreased demand for our well stimulation services, which may have a material adverse effect on our business, results of operations and financial condition.

| 16 |

Our customer base is concentrated within the oil and natural gas production industry, and loss of a significant customer or the existing customer contracts could cause our revenue to decline substantially and adversely affect our business.

Our business is and will be highly dependent on existing agreements and the relationships with potential customers and technology partners. Revenues from these potential customers and revenues from joint ventures are expected to represent a substantial portion of our total future revenues. A reduction in business from any of these arrangements resulting from reduced demand for their own products and services, a work stoppage, sourcing of products from other suppliers or other factors could materially impact our business, financial condition and results of operations. In addition, the inability of suppliers to timely deliver the required equipment for the new well stimulation fleets could have a material adverse impact on our ability to perform under the existing agreements. We expect that we will continue to derive a significant portion of our revenue from a relatively small number of customers in the future. Our existing agreements do not obligate any of those prospective customers to use our products and services. In addition, the existing agreements contain provisions whereby the customers may terminate the agreement in the event we are unable to perform under the terms of the contract or make adjustments to service and/or materials fees payable thereunder based on changing market conditions. The existing agreements are also subject to termination by customers under certain circumstances, and any such termination could have a material adverse effect on our business.

We may have difficulty managing growth in our business, which could adversely affect the financial condition and results of operations.

We do not have highly sophisticated systems to forecast our future revenue or profitability and therefore could experience difficulty in managing our growth and associated working capital needs.

Our ability to operate successfully depends on the availability of water.

Well stimulation, and pressure pumping more generally, can require a significant supply of water, and water supply and quality are important requirements to our operations. We intend to meet our water requirements from sources on or near the well sites, but there is no assurance that we will be able to obtain a sufficient supply of water from sources in these areas, some of which are prone to drought.

We may be unable to maintain pricing on our core services.

Pressures stemming from fluctuating market conditions and oil and natural gas prices may make it increasingly difficult to maintain the pricing on our core services. We have faced, and will likely continue to face, pricing pressure from the competitors. If we are unable to maintain pricing on our core services, our financial results will be negatively impacted.

The activity level of our customers, spending for our products and services, and payment patterns may be impacted by any deterioration in the credit markets.

Many of our potential customers finance their activities through cash flow from operations, the incurrence of debt or the issuance of equity. In late 2008 and early 2009, there was a significant decline in the credit markets and the availability of credit, the effects of which may continue to be felt in 2015. Additionally, many of our potential customers’ equity values substantially declined. The combination of a reduction of cash flow resulting from declines in commodity prices, a reduction in borrowing bases under reserve-based credit facilities and the lack of availability of debt or equity financing may result in a significant reduction in our potential customers’ spending for our products and services.